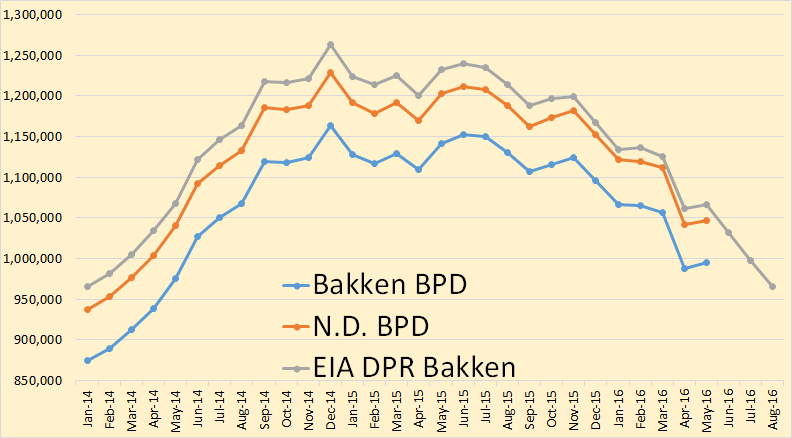

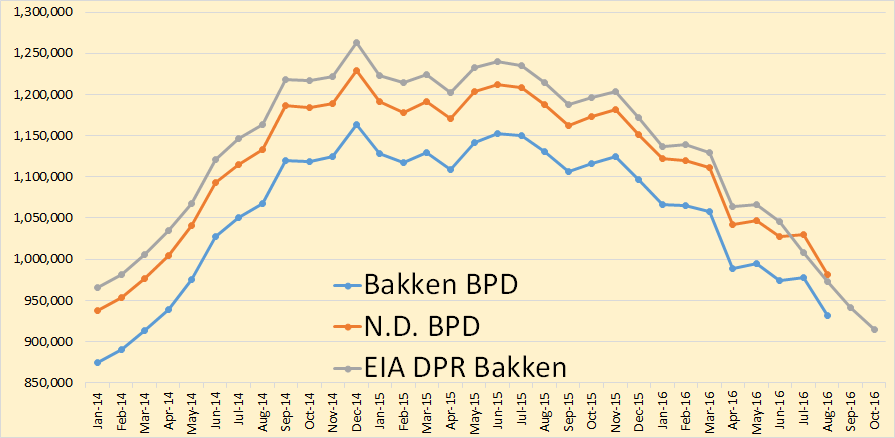

North Dakota has released August production data for the Bakken and also for all North Dakota.

Bakken production was down 46,433 barrels per day to 930,931 bod, All North Dakota was down 48,695 bpd to 981,039 bpd. This is first time North Dakota has been below 1 million barrels per day since March of 2014.