This is a guest post by Steve St. Angelo of SRSroccoReport.Com. All opinions expressed in this post are his and do not necessarily reflect those of Ron Patterson.

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin.

Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

The Great U.S. Shale Gas Boom Is Likely Over For Good

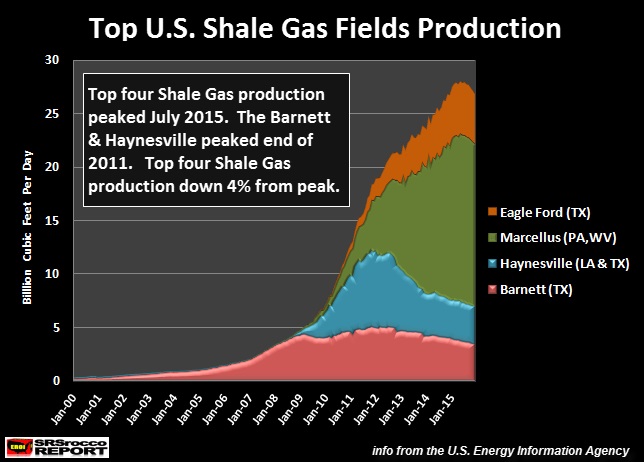

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

As we can see from the chart, the Barnett and Haynesville peaked four years ago at the end of 2011. Here are the production profiles for each shale gas field: