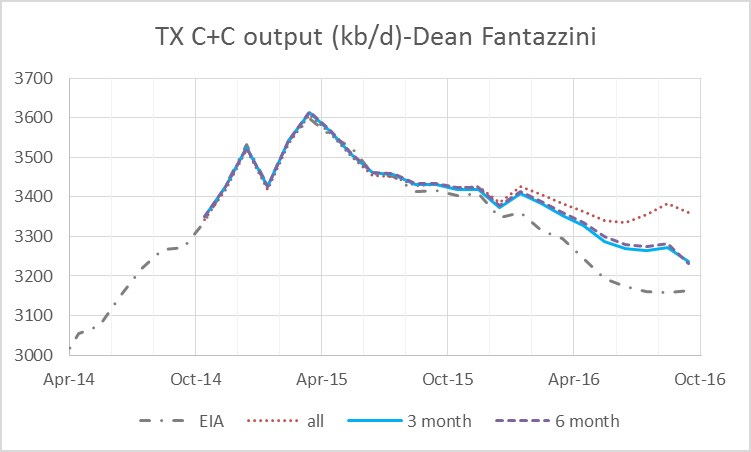

The labels in the chart above are for the “corrected (3 month)” estimate. This estimate (now preferred by Dean Fantazzini) is 35 kb/d lower than the EIA estimate for Sept 2016 (which is the most recent EIA estimate). Texas C+C output has fallen by about 500 kb/d from the April 2015 peak. Read More