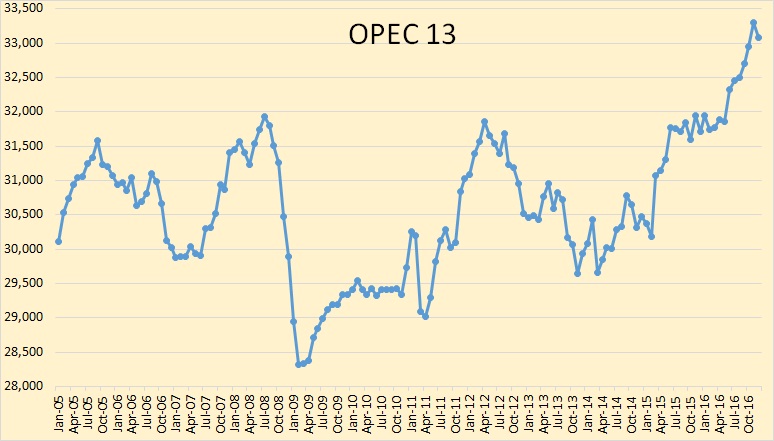

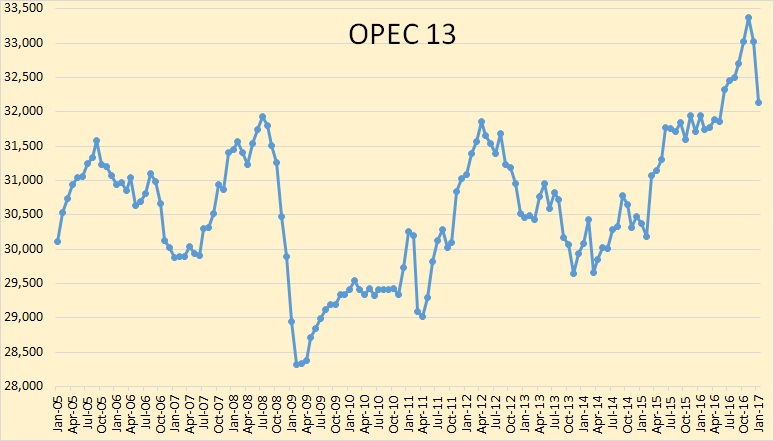

The new January OPEC Monthly Oil Market Report is out with crude only production numbers for January 2017. All charts are in thousand barrels per day.

OPEC crude oil production dropped to 32,139,000 bpd in January. November production was revised upward by 68,000 bpd while December production was revised downward by 56,000 bpd. So Peak OPEC production was in November 2016 instead of December as they had it last month.

Officially OPEC agreed to cut production by 1.2 million barrels per day beginning in January. So OPEC missed their mark by 310,000 barrels per day.