A guest post by George Kaplan

Norwegian oil production peaked in 2000 to 2001; gas production may be peaking about now. Oil hit a low in 2013 and then recovered towards a new local peak, probably concurrent with the gas.

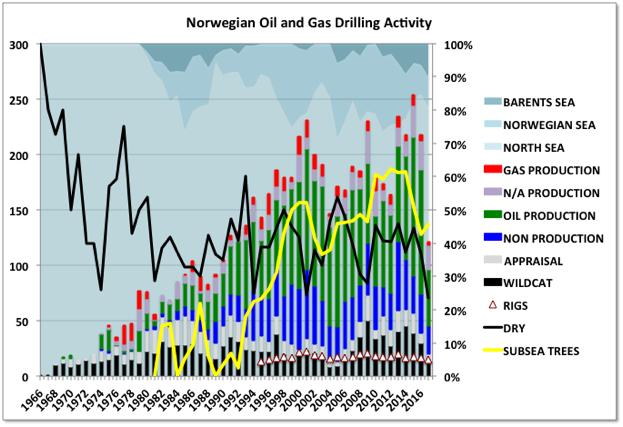

Drilling and Development

The most surprising thing I find with their industry is that the drop in oil price made almost no difference the drilling activity shown here (all data here and below taken from the NPD – Norwegian Petroleum Directorate – which provides more data than just about any other such organisation).

The chart shows numbers of wells drilled, as stacked bars, and number of operating rigs (unstacked) against the left hand axis, other curves are ratios of total against the right axis. Read More