Notice: Please limit your comments below to the subject matter of this post only. There is a petroleum post above this one for all petroleum and natural gas posts and a non-petroleum post below this one for comments on all other matters.

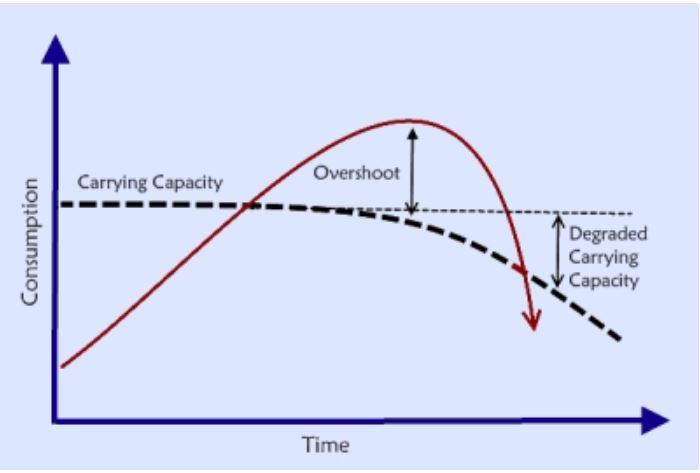

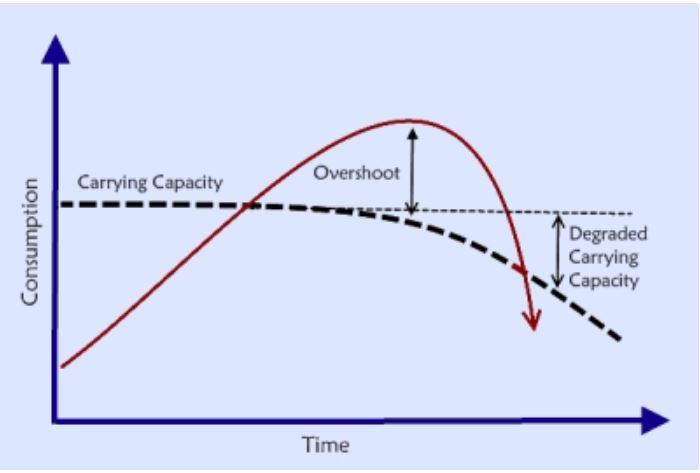

First, let us define carrying capacity and overshoot. And none has done that better than Paul Chefurka.

Carrying Capacity: Carrying capacity is a well-known ecological term that has an obvious and fairly intuitive meaning: “the maximum population size of a species that the environment can sustain indefinitely, given the food, habitat, water and other necessities available in the environment”. Unfortunately, that definition becomes more nebulous the closer you look at it – especially when we start talking about the planetary carrying capacity for humans. Ecologists claim that our numbers have already surpassed the carrying capacity of the planet, while others (notably economists and politicians…) claim we are nowhere near it yet!

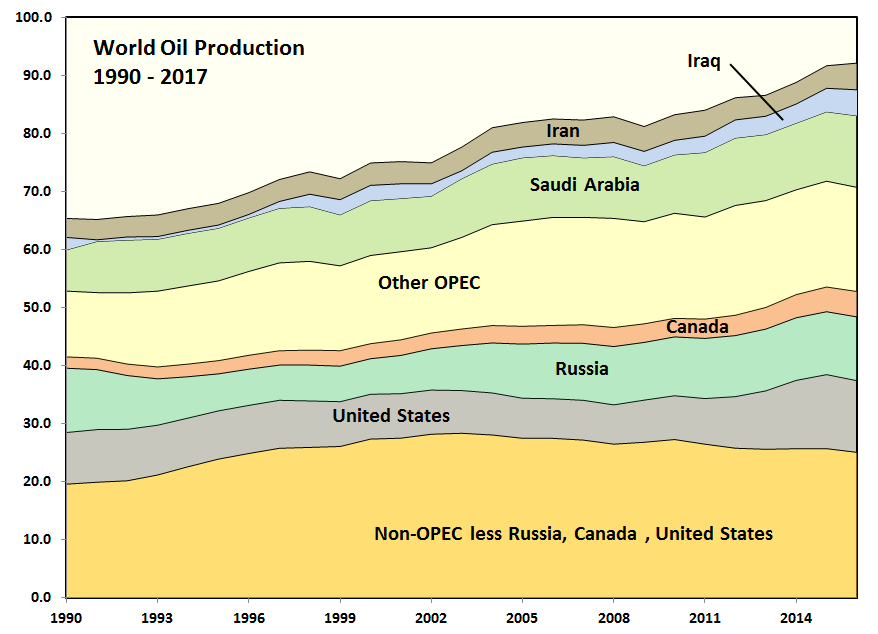

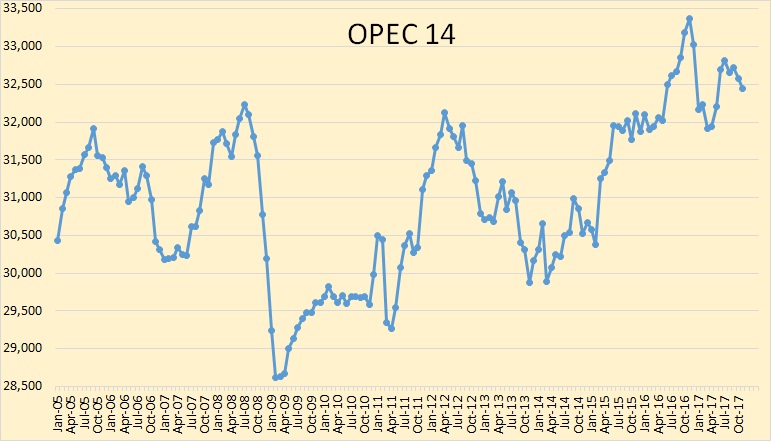

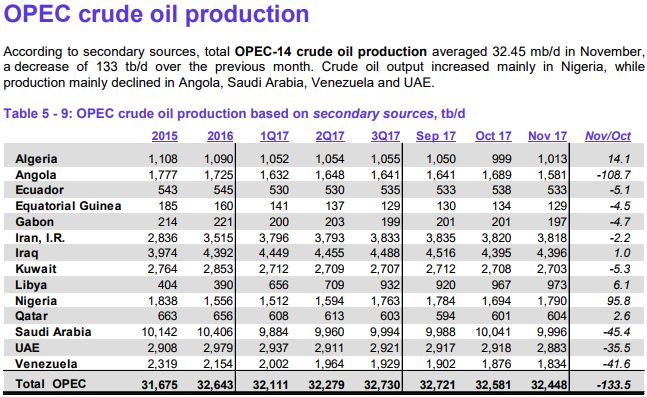

Overshoot: When a population surpasses its carrying capacity it enters a condition known as overshoot. Because carrying capacity is defined as the maximum population that an environment can maintain indefinitely, overshoot must by definition be temporary. Populations always decline to (or below) the carrying capacity. How long they stay in overshoot depends on how many stored resources there are to support their inflated numbers. Resources may be food, but they may also be any resource that helps maintain their numbers. For humans one of the primary resources is energy, whether it is tapped as flows (sunlight, wind, biomass) or stocks (coal, oil, gas, uranium etc.). A species usually enters overshoot when it taps a particularly rich but exhaustible stock of a resource. Like oil, for instance…

Read More