A guest post by George Kaplan

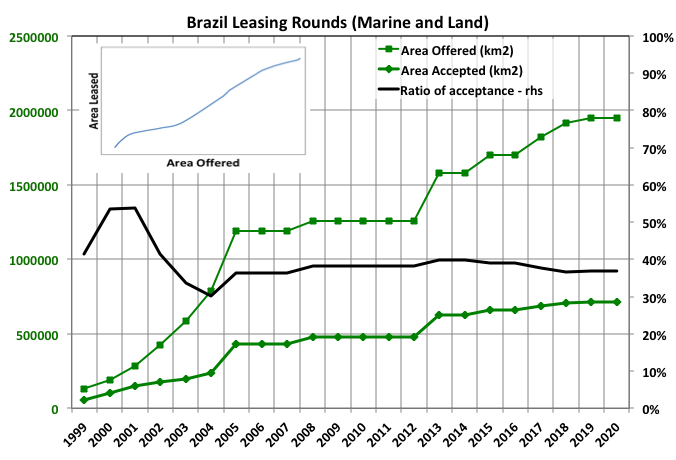

Leasing

The creaming curve for lease sales in Brazil looks like it is turning towards the asymptote overall. Unfortunately there is insufficient data provided to allow land and marine leasing to be separated but I expect that the curve for land is close to the limit but that for marine areas is barely half way. The average take up of offers has remained high, which suggests APB, the Brazilian authority in charge, is discerning about what it offers.