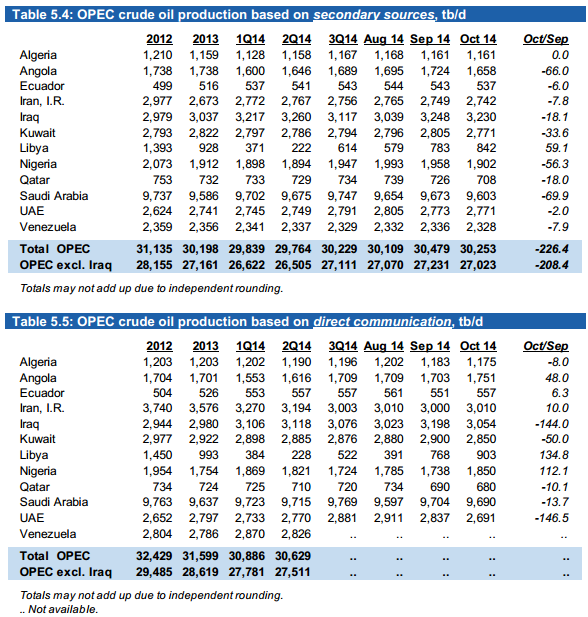

OPEC just published their November Monthly Oil Market Report which contains crude only production data for all OPEC nations. The only big surprise was that everyone had declining production except Libya and Algeria, that is according to “secondary sources”.

I find it interesting that Venezuela has, for the last several months, refused to give OPEC their production data.

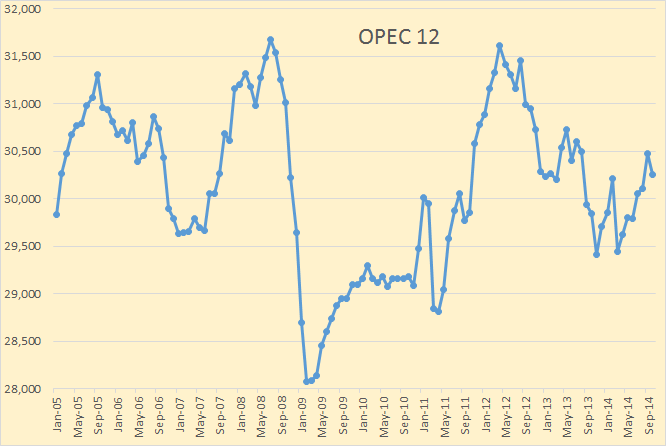

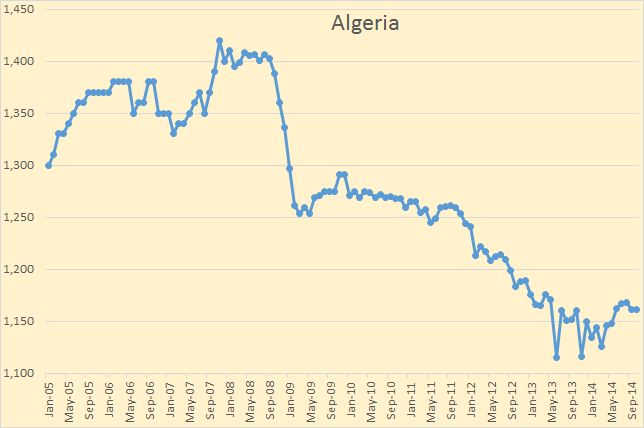

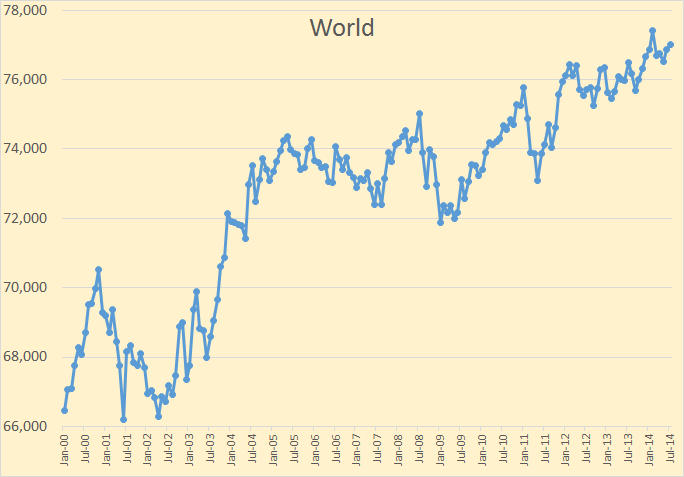

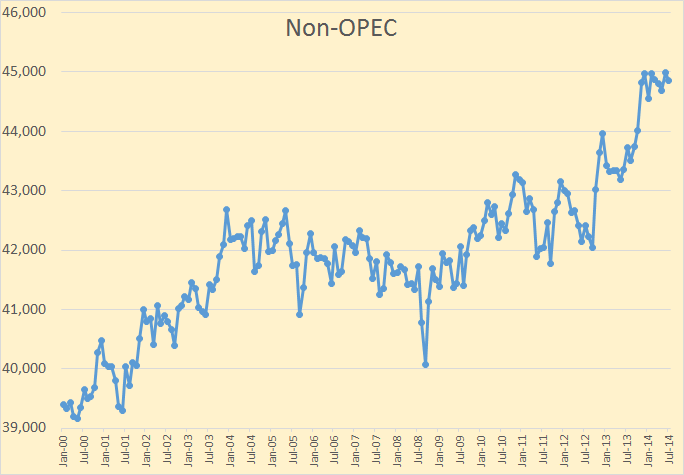

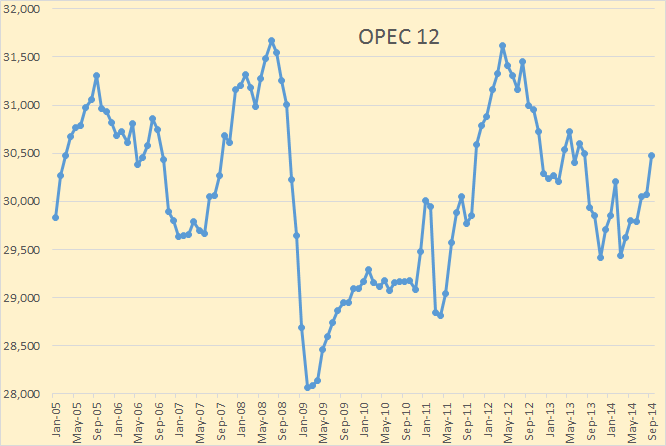

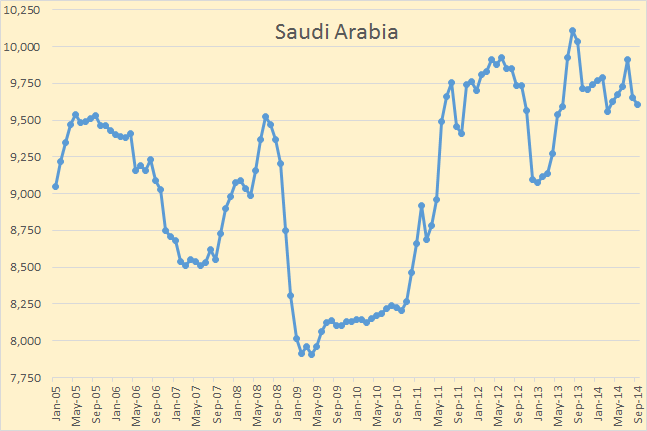

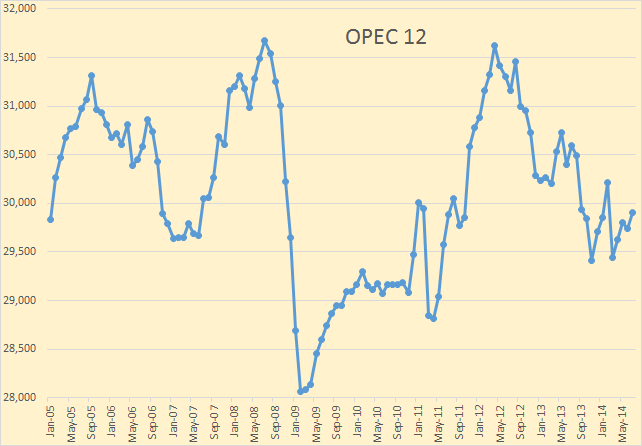

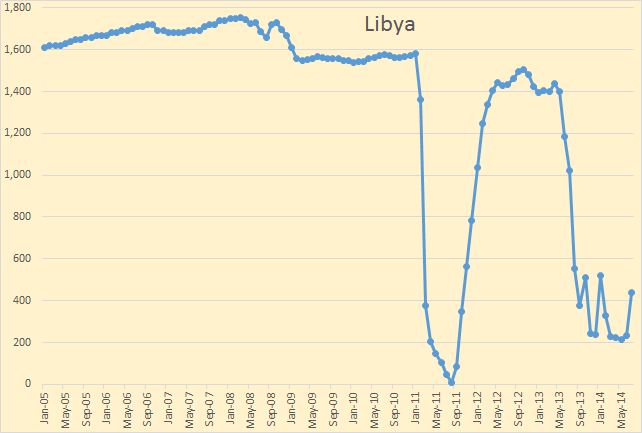

All charts below are in the charts below are in thousand barrels per day with the last data point October 2014 and is based on OPEC’s “secondary sources”. I have decided to post all OPEC charts in this post.

OPEC production declined 226,000 bpd. September production was revised only slightly, up 5,000 bpd.

Algeria has stopped their decline, temporally at least.