The OPEC Monthly Oil Market Report is out. OPEC took a hit in December, down 205,000 barrels per day. After examining the past and present production numbers, I believe that OPEC, except Iran, has peaked. That is, the combined production from all the other OPEC nations, has peaked. And any additional production from Libya is likely to be in tiny increments that won’t make much difference in the big picture. Other OPEC nations may show a slight increase from their current level. But the combined production from all the other 11 OPEC nations, 12 if you count Indonesia, has peaked.

Of course there will be some small increases from the other 11 OPEC countries from time to time but overall, in 2016 and beyond, I believe it will OPEC will be from flat to down, with a greater chance of being down. That is we are at, or near, the peak right now. There might be a slight uptick of their combined production in the coming months but not enough to get excited abut.

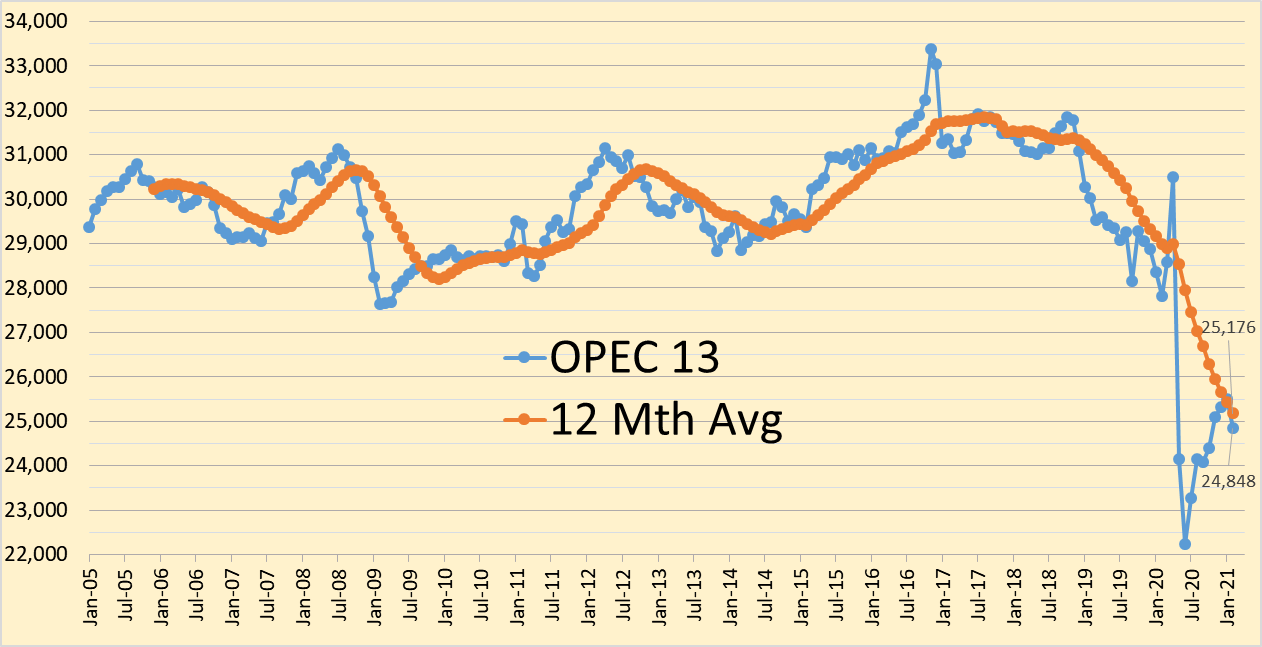

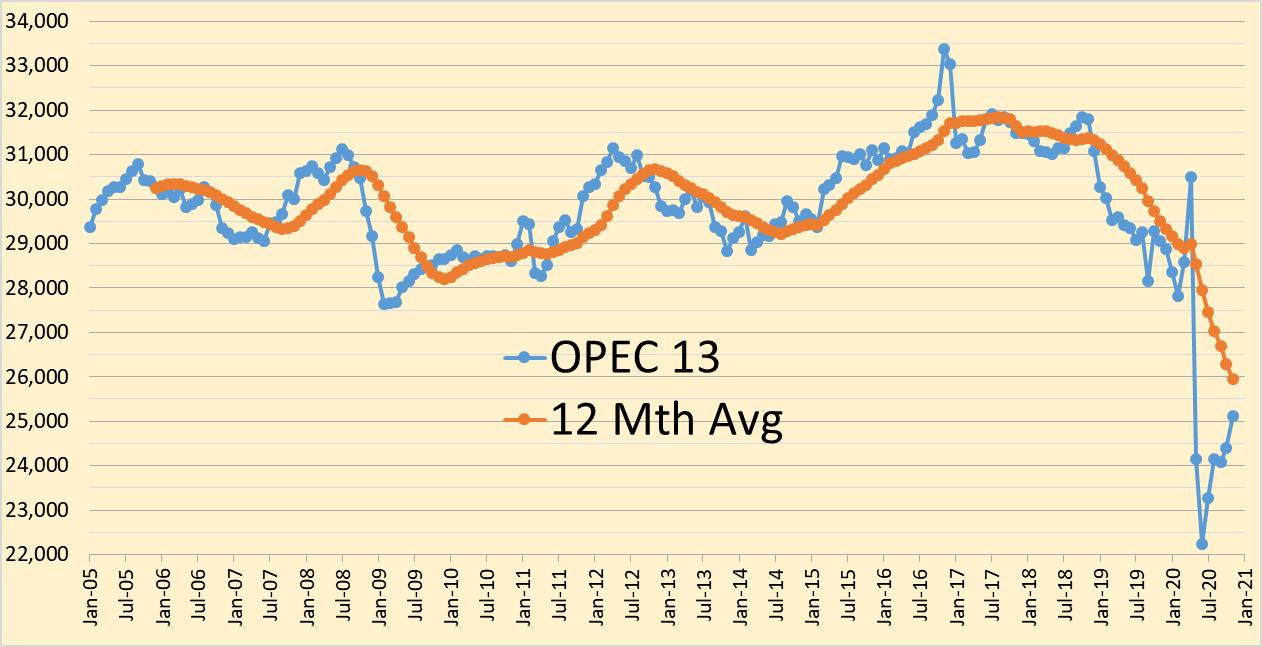

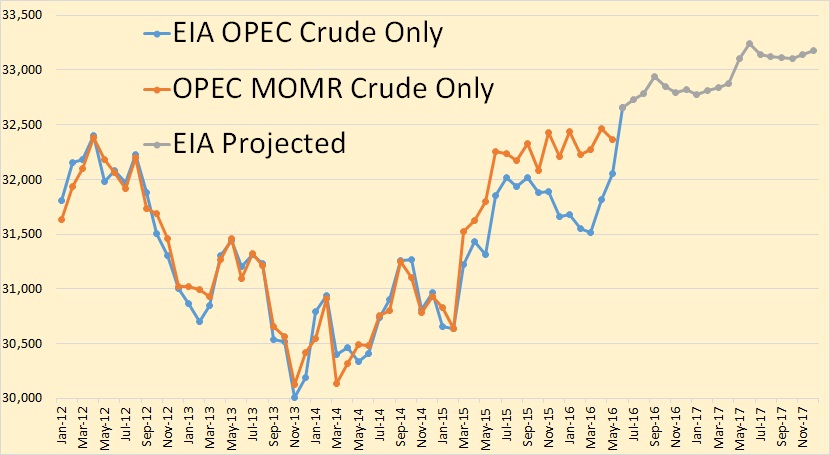

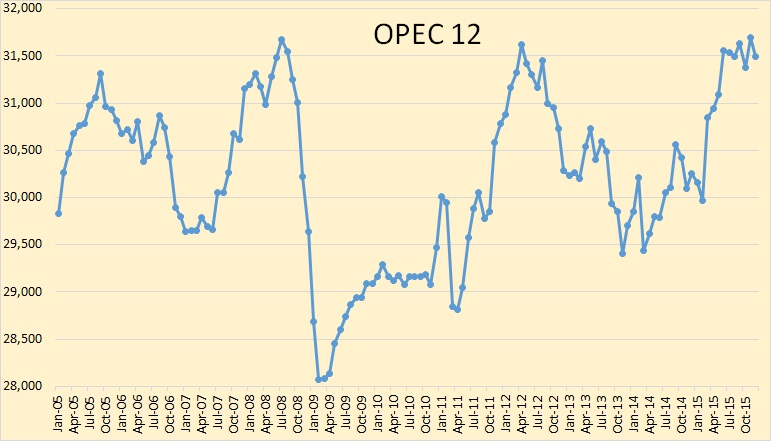

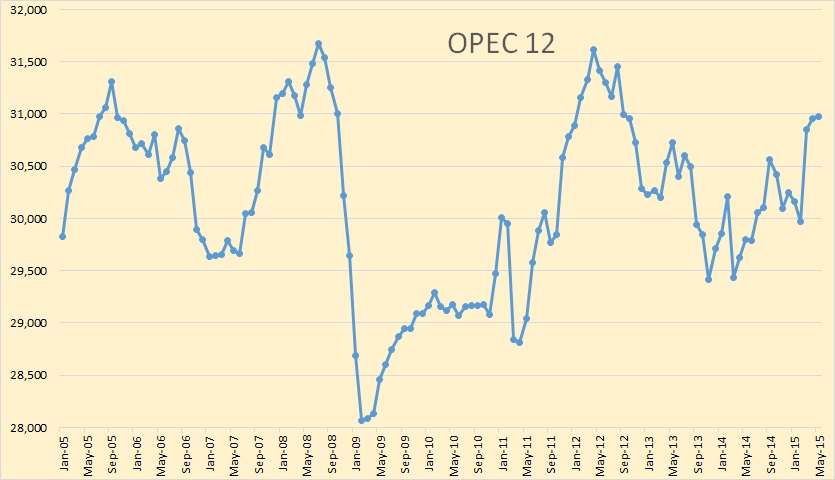

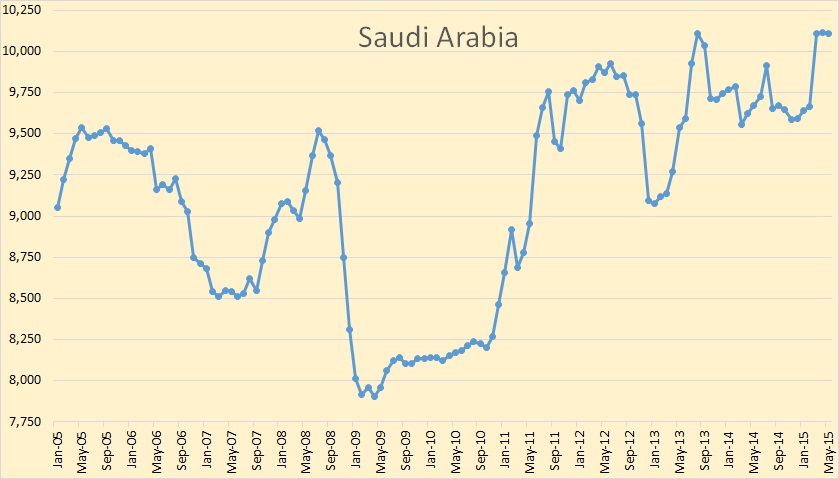

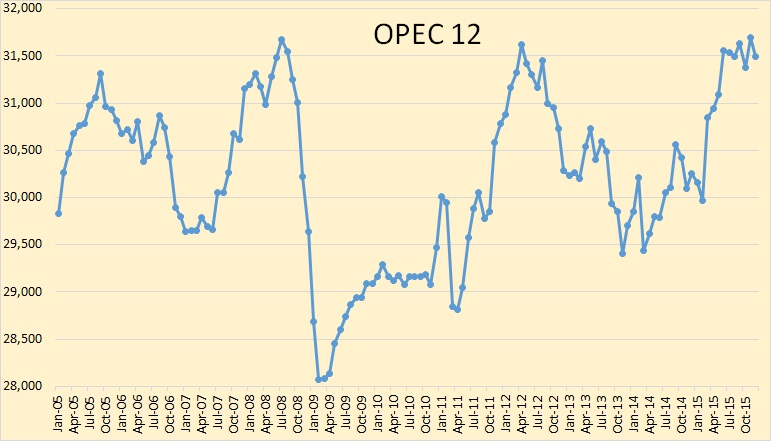

All Data in the charts below is through December and is in thousand barrels per day.

OPEC production, in the chart above does not include Indonesia. OPEC 12 was down 204,000 barrels per day.

Read More