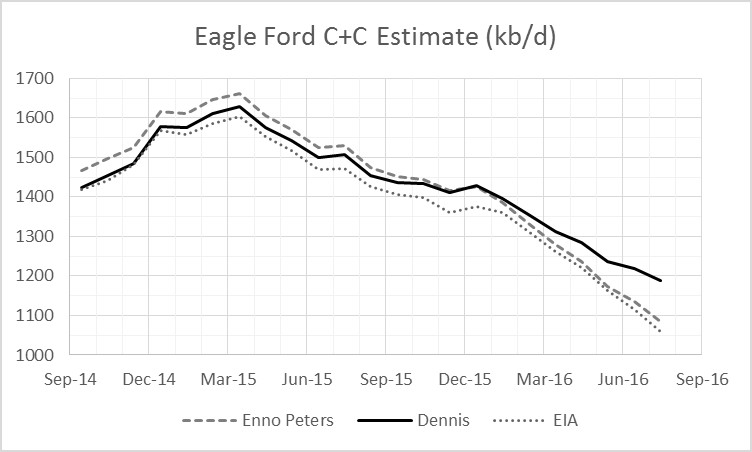

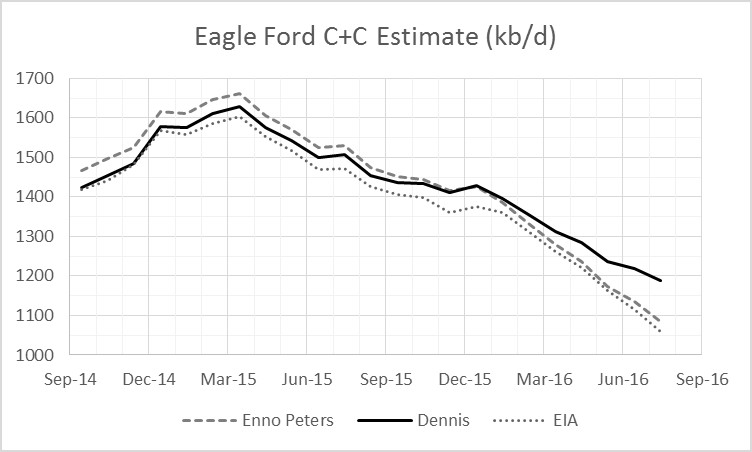

Enno Peters recently reported on Eagle Ford output at shaleprofile.com, so I have updated my estimate of Eagle Ford output by utilizing his data. Enno reports horizontal well output from the Eagle Ford region so some output from other formations is included (Austin chalk, etc). To compensate for this I compare the data from shaleprofile to the output reported from the EIA for the Eagle Ford.

For Sept 2014 through Nov 2015 Enno’s data is about 52 kb/d higher on average each month than the EIA estimate, so I deduct this amount from my preliminary estimate to arrive at my final estimate. Enno’s data for each month from Sept 2014 to July 2016 is divided by Texas (TX) statewide C+C output from the RRC to find the percentage of Eagle Ford region to TX statewide output. This percentage is multiplied by Dean Fantazzini’s 6 month corrected estimate of Texas C+C output and then 52 kb/d is subtracted to arrive at my final Eagle Ford estimate.

The Chart below has my estimate labelled as Dennis and Enno’s Eagle Ford region estimate (horizontal wells only) labelled as Enno Peters. The EIA estimate is shown as well.

Read More