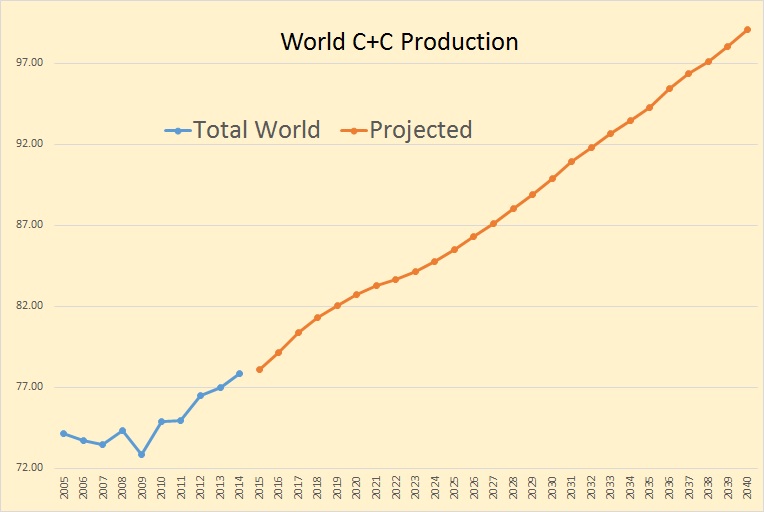

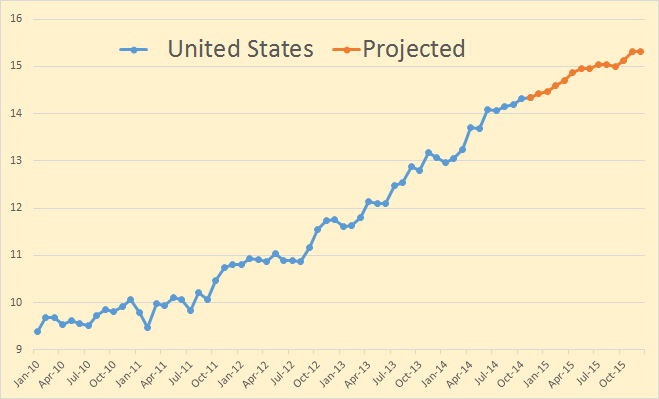

Last year I posted a lot of data published in the EIA’s Annual Energy Outlook 2014 published in May of last year, and the next one is due out Tuesday April 14. We are looking forward to that. But the EIA’s International Energy Outlook 2014, published last September, completely slipped by me. How did I miss that? But I looked at their predictions for world Crude plus Condensate production I found it very interesting.

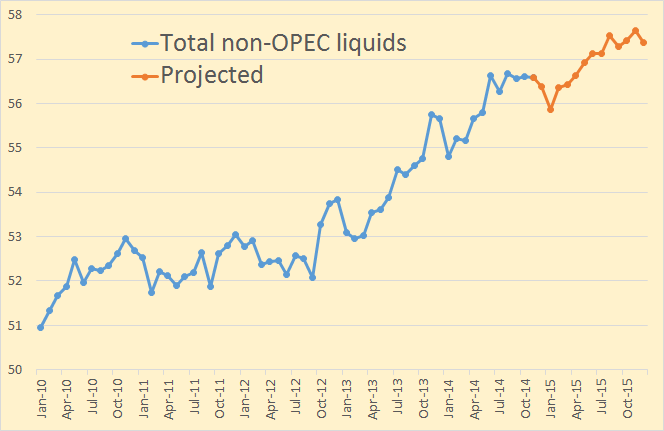

In the below, though the data was posted in September, I have assumed the 2014 data was complete. Though it may be a little off it is close enough for, as the saying goes, “government work”‘. The data is in million barrels per day with the last data point 2040.

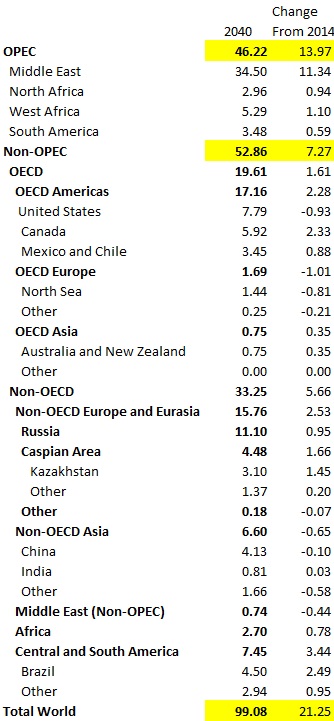

The EIA is expecting World C+C to reach just over 99 million barrels per day in 2040. That will be up 21.25 million bpd from 2014.

This chart shows just which countries, they believe, will be responsible for that 21.25 million bpd increase. That is except for OPEC. They do not break out OPEC production by country.