I am starting this post off with a news article because it explains why JODI has U.S. production numbers wrong for July.

No, U.S. Oil Production Probably Didn’t Rise in July

The Joint Organizations Data Initiative (JODI) releases monthly oil supply-and-demand data for about 80 countries, which it gathers by directly surveying the countries. It is widely cited by analysts, especially for its figures on demand, imports and exports.

The latest JODI data released Sunday showed that U.S. crude-oil production rose from 9.3 million barrels a day in June to 9.5 million barrels in July.

But the EIA’s latest forecast called for July production to fall to 9.2 million barrels a day in July, continuing the trend of declining U.S. production as companies cut spending in the face of low prices.

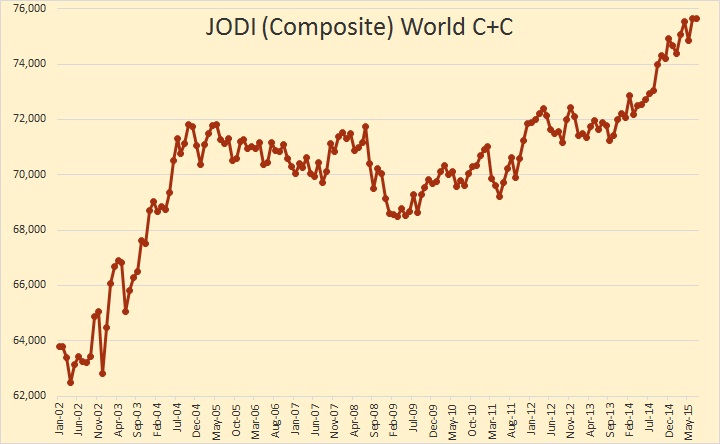

For the charts below I have used JODI data for all Non-OPEC nations except those that do not report to JODI. For them I use the EIA data and carry forward the same data that the EIA reported, (April). For the USA, since the JODI data is obviously wrong for July, I simply carried forward the June data which also came directly from the EIA. And for OPEC I use the OPEC MOMR’s “secondary sources”. JODI also uses the MOMR for their data but uses the “direct communication” data instead of the secondary sources data.

The data below is through July 2015 and is in thousand barrels per day.

In July we remained at or near the world’s all time peak at 75,631,000 barrels per day, down just 15,000 bpd from June.