The EIA has published International Energy Statistics with Crude + Condensate numbers for September 2014. As most of you know I only follow Crude + Condensate because I believe that biofuels and natural gas liquids should not be part of the peak oil equation.

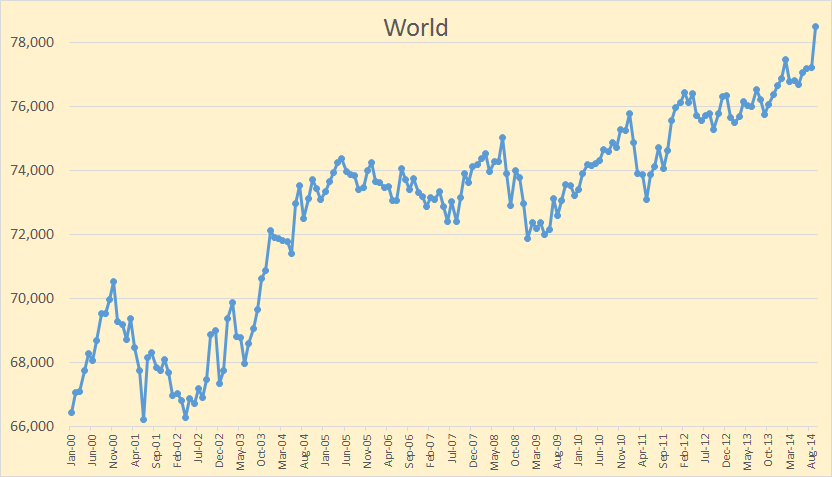

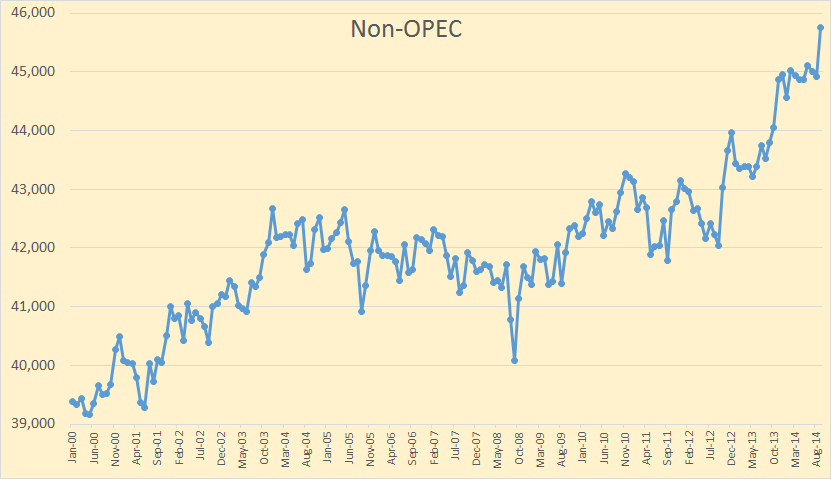

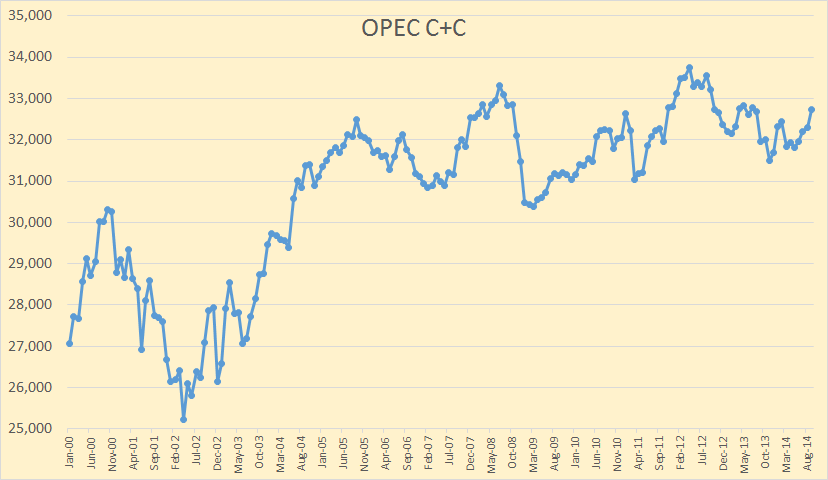

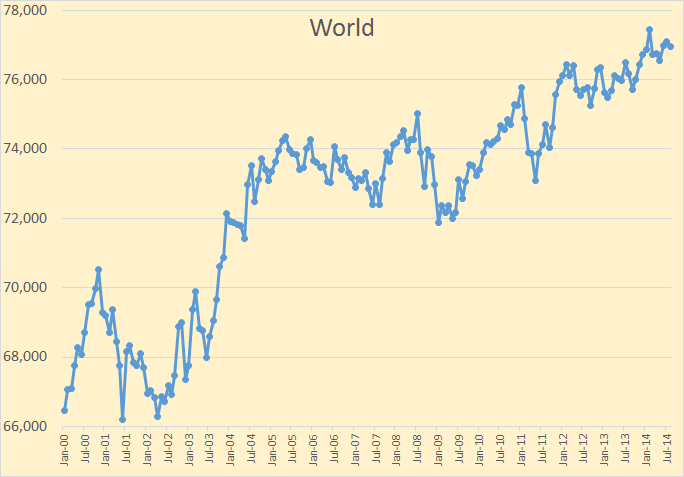

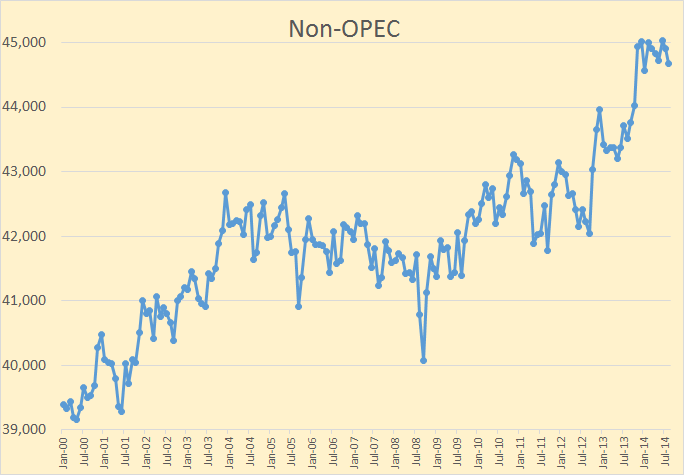

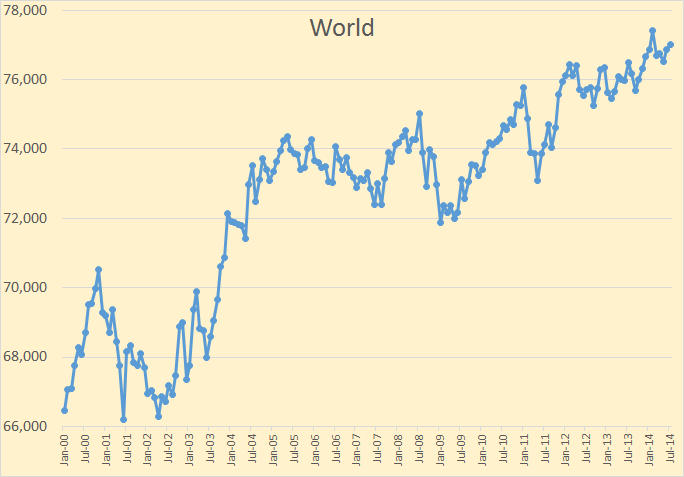

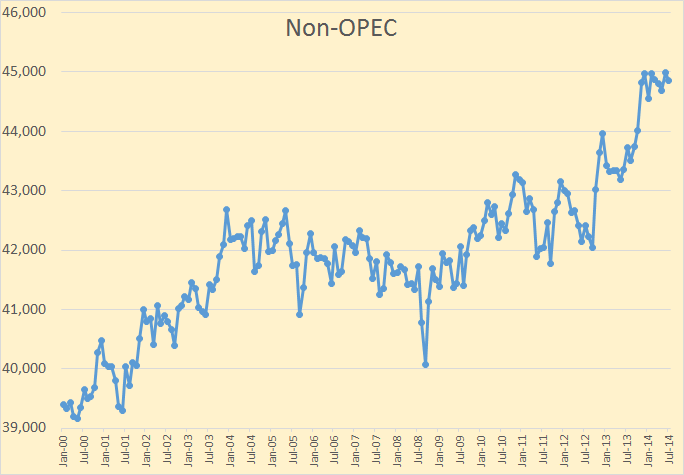

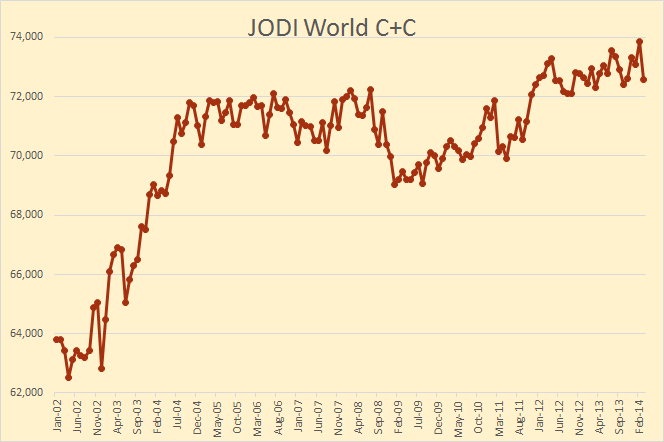

The data in all charts is thousand barrels per day with the last data point September 2014.

World oil production was up 1,270,000 barrels per day in September. This was somewhat of a shocker. I had expected production to be up about .9 mbd but not this much.

Non-OPEC nations accounted for 833,000 bp/d of the increase.

And OPEC nations accounted for 438,000 bpd of the increase. The EIA said OPEC produced 32,734,000 barrels per day of C+C in September. OPEC’s “secondary sources” said OPEC produced 30,560,000 barrels of Crude Only in September. OPEC’s crude only production had dropped to 30,053,000 bpd in November, or over half a million barrels per day lower.