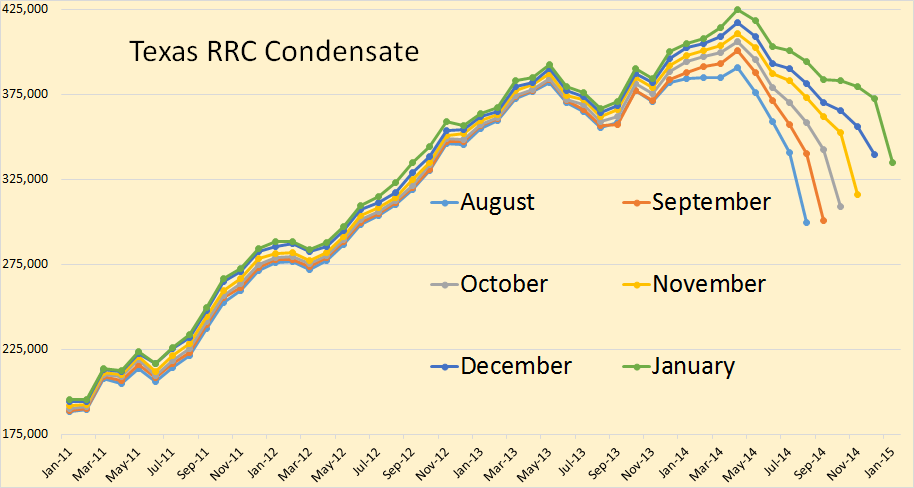

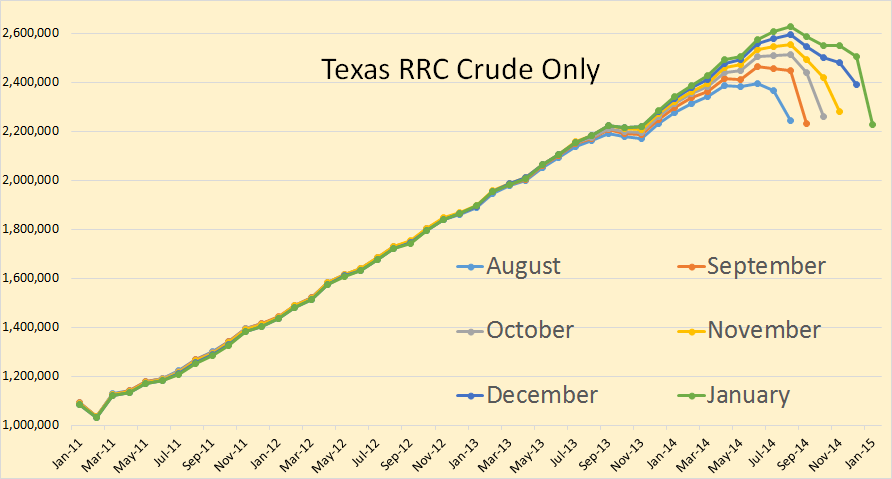

The Texas Rail Road Commission has released its latest stats with production numbers through January. There is always a delay in these numbers and that is why you see the production graph lines seem to droop toward the recent months. Because of this I post six months data so the data can be compared in order to gain a better insight into which way production is heading.

All Texas oil and gas data is through January. The Oil data is in barrels per day and the gas data is in MCF.

Texas condensate will likely show a small gain when the data is finally in. Either way it will not be enough to make much difference in the final C+C January production.

I believe Texas crude only will be down in January. This shows a huge decline from the December incomplete data. The EIA data is through December only.