Open Thread for petroleum (oil and natural gas) discussion and news.

The Energy Transition

by Dennis Coyne

(note that an Open Thread has recently been published for Petroleum)

I expect World Fossil fuel output to peak in 2025. If the World economy continues to grow in the future, a gap between Energy produced from all sources (including non-fossil fuels) and the demand for Energy will grow over time. If the gap between energy demand and energy supply is not filled by growth in non-fossil fuel energy sources there must be lower demand for energy due to reduced economic growth rates.

Texas Petroleum Report – July 2016 and LTO scenarios

by Dennis Coyne

I have attempted to correct the reported Texas output using the methodology provided by Dean. Usually Dean provides the spreadsheets and I simply reproduce his charts with a few comments. This month Dean may be on vacation or busy and I have not yet received his input. If I get his charts I will post them.

Dean uses the average of the correction factors from Jan 2014 to the present in order to reduce the month to month volatility of the correction factors. I tried several averaging methods (all data, 12 month average, 6 month average, and 3 month average) where for the x month average the most recent x months of correction factors were averaged.

The only method with a significant difference was the 3 month average, so I present the “corrected” output using Dean’s usual method and an “Alt (3 month)” alternative. The RRC data and the EIA estimate are also included for reference.

Open Thread Non-Petroleum

A new post on Texas output will be up soon. This thread is for non-Petroleum discussions and news.

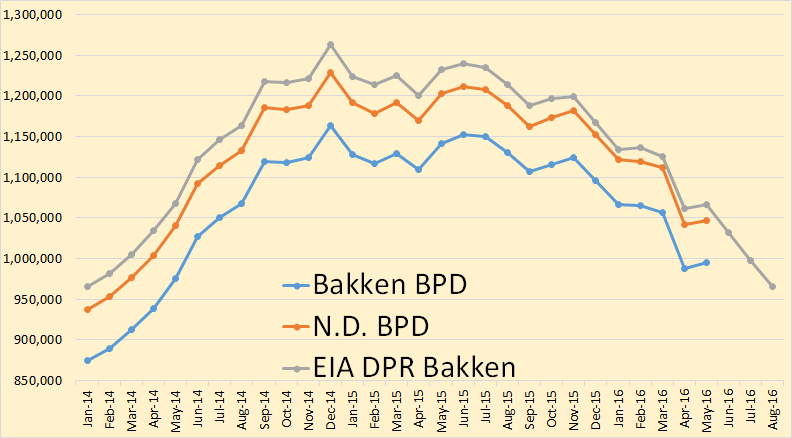

North Dakota Production and STEO

The Bakken and North Dakota production data is out.

Bakken production was up 6,540 barrels per day while all North Dakota production was up 5,383 bpd. This was not posted as a correction to last months data though it looks that is exactly what it is. Last months data was twice as much as it should have been so now it is correct. Notice the data from the Drilling Productivity Report. It appears to have June data exactly correct, or very nearly so. Of course that is all the Bakken, including the Montana Bakken.