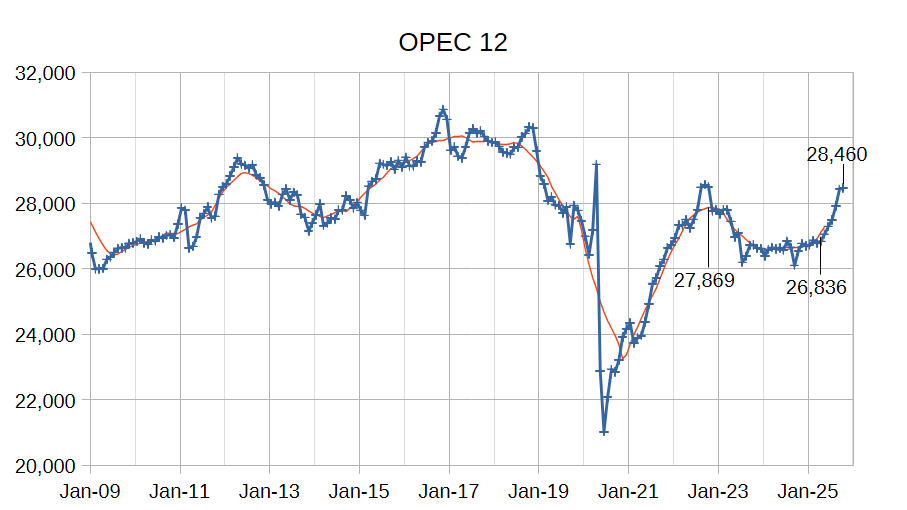

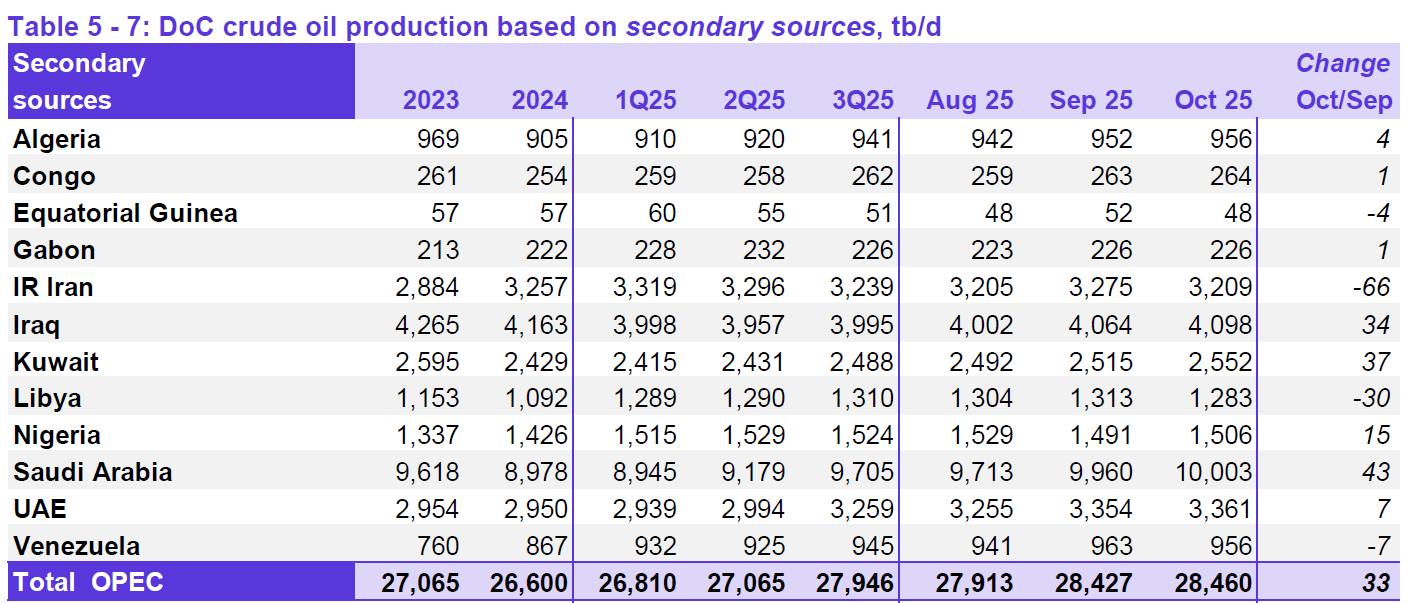

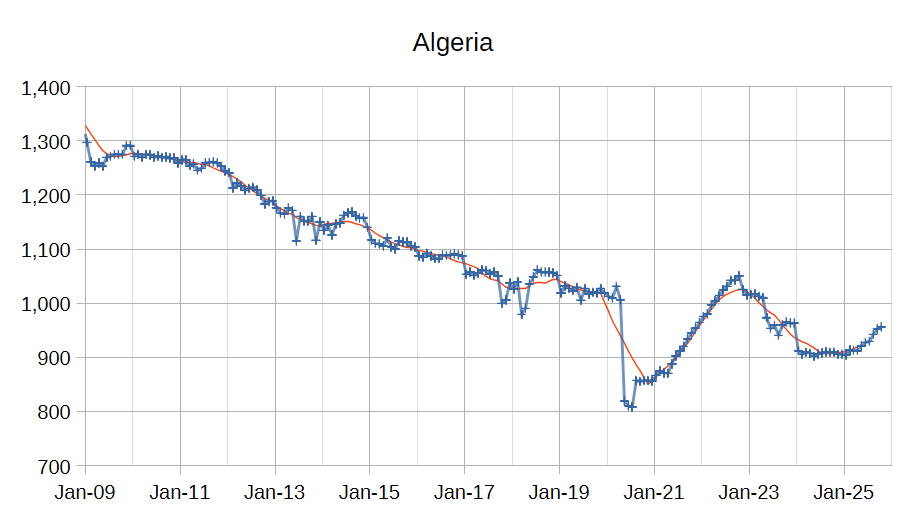

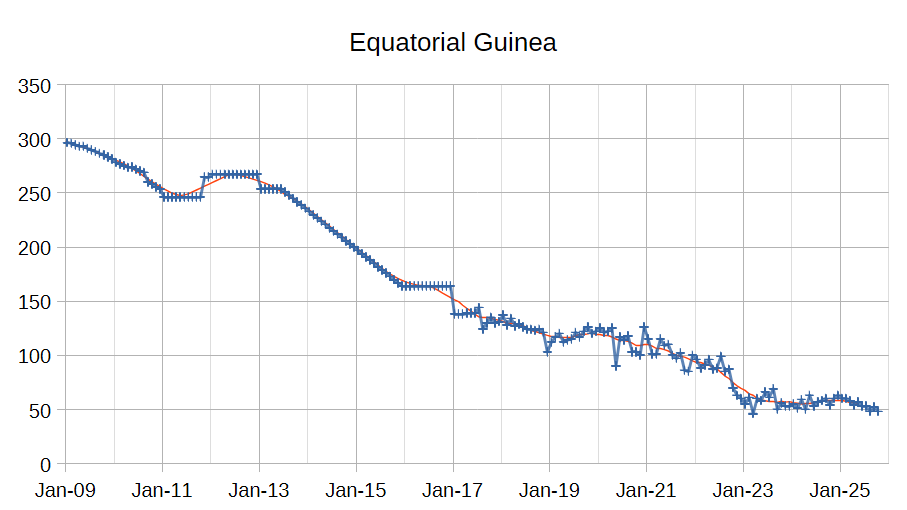

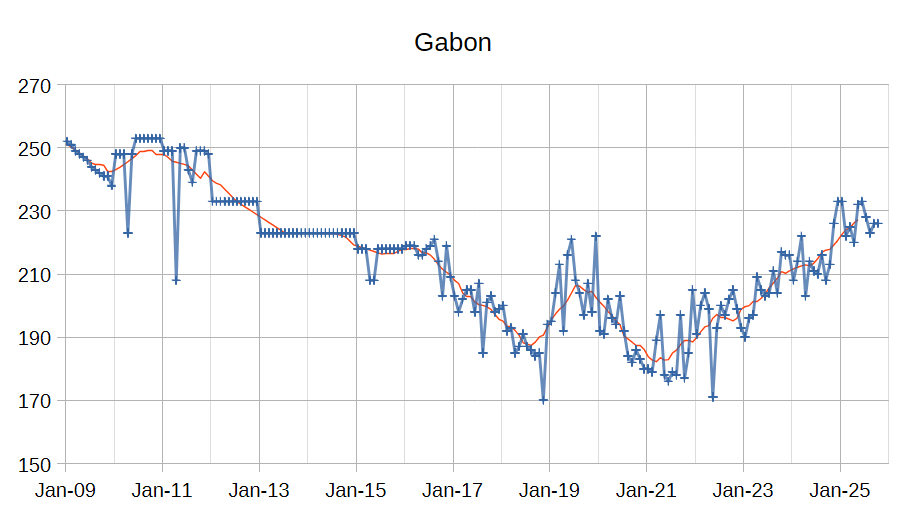

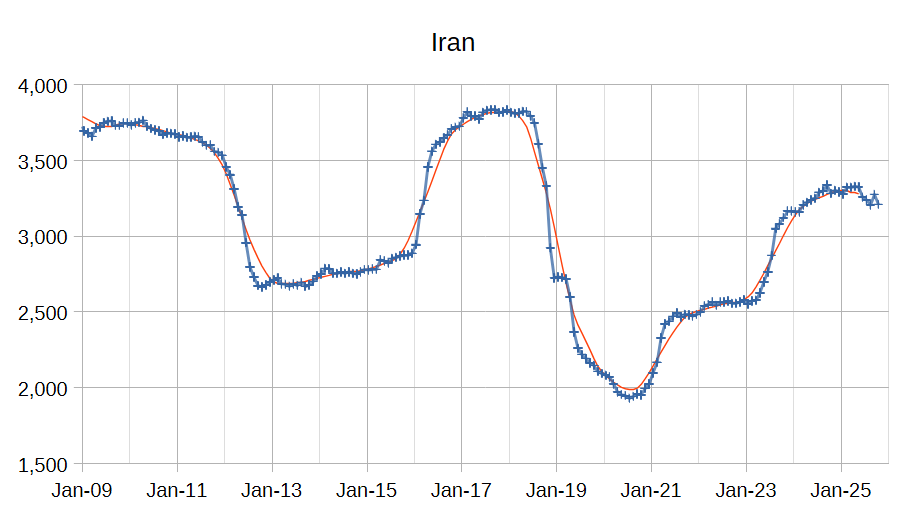

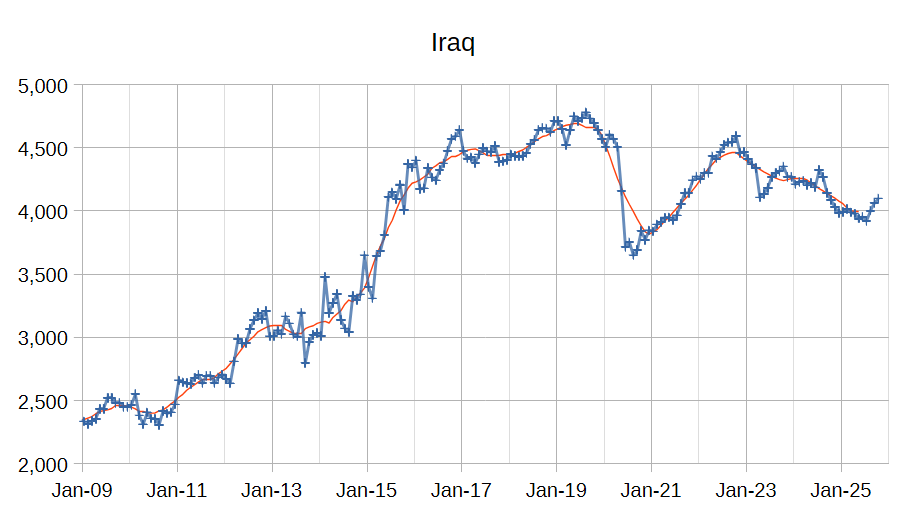

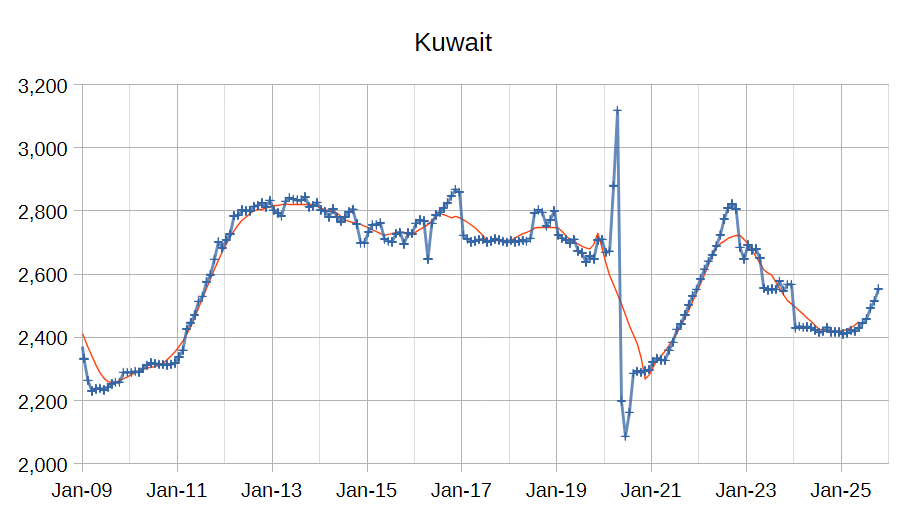

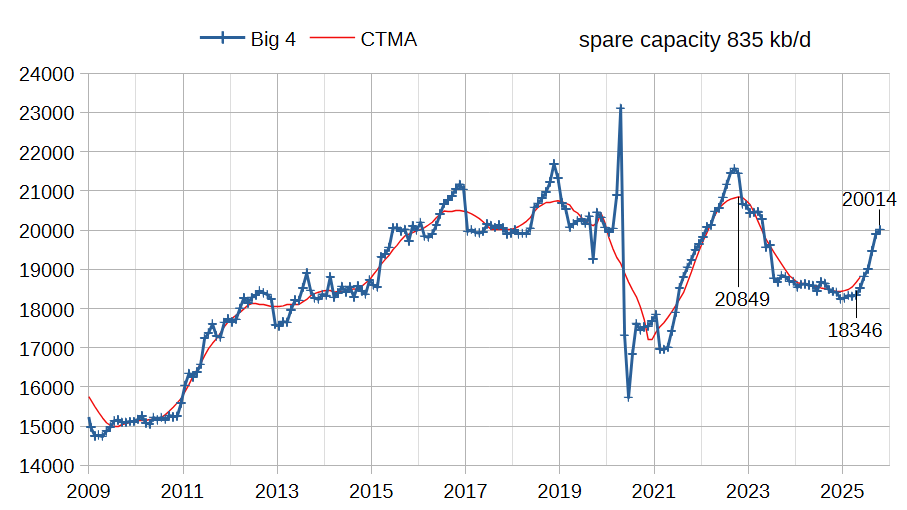

The OPEC Monthly Oil Market Report (MOMR) for November 2025 was published recently. The last month reported in most of the OPEC charts that follow is October 2025 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

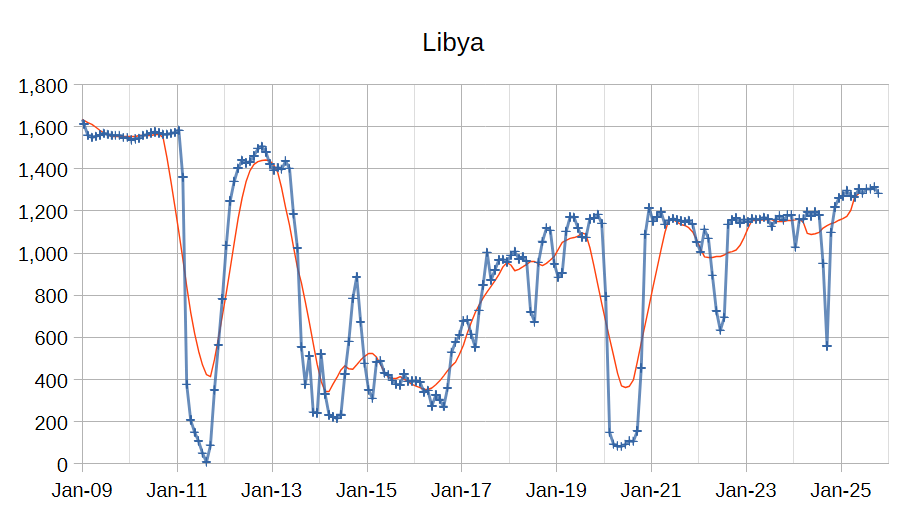

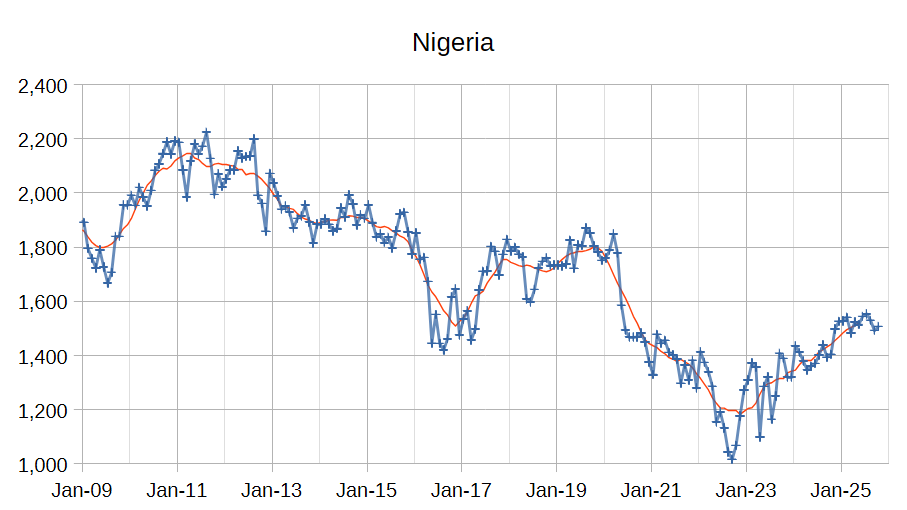

OPEC 12 output for September 2025 was revised lower by 13 kb/d and August 2025 output was revised lower by 3 kb/d compared to last month’s report. OPEC 12 output increased by 33 kb/d with the largest increases from Saudi Arabia (43 kb/d), Kuwait (37 kb/d), Iraq (34 kb/d) and Nigeria (15 kb/d). Iran (-66 kb/d) and Libya (-30 kb/d) saw decreased crude output. All other OPEC members had small increases or decreases of 7 kb/d or less. Combined output from the other 6 members increased by 2 kb/d in October from the September level.

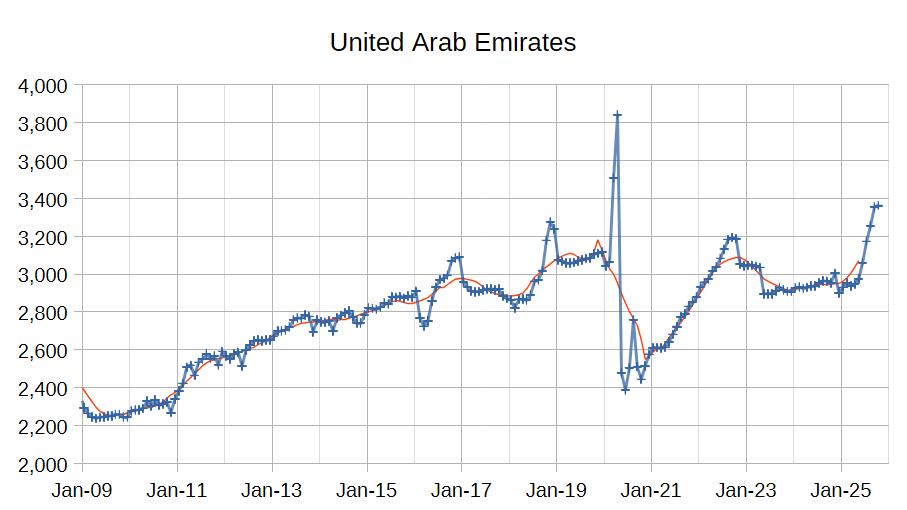

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas and where most of OPEC spare capacity currently exists (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 835 kb/d relative to the 2022 CTMA peak to 20014 kb/d in October 2025. The Big 4 may have about 835 kb/d of spare capacity when World demand calls for an increase in output. Since April 2025 the OPEC Big 4 have increased output from 18346 kb/d to 20014 kb/d, an increase of 1668 kb/d in just 6 months (an average monthly increase of 278 kb/d.) If the rate of increase of last month for the Big 4 (121 kb/d) continues in the future, OPEC spare capacity would run out in about 7 months. Perhaps this is part of the reason that future increases after December 2025 have been put on hold as spare capacity will be down to about 595 kb/d by the end of 2025 (assuming a 240 kb/d increase in output by the Big 4 over the next 2 months.)

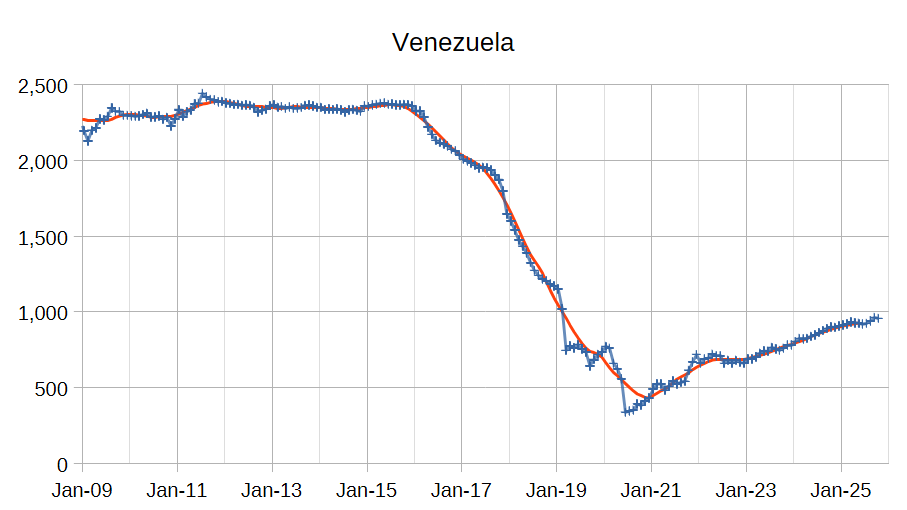

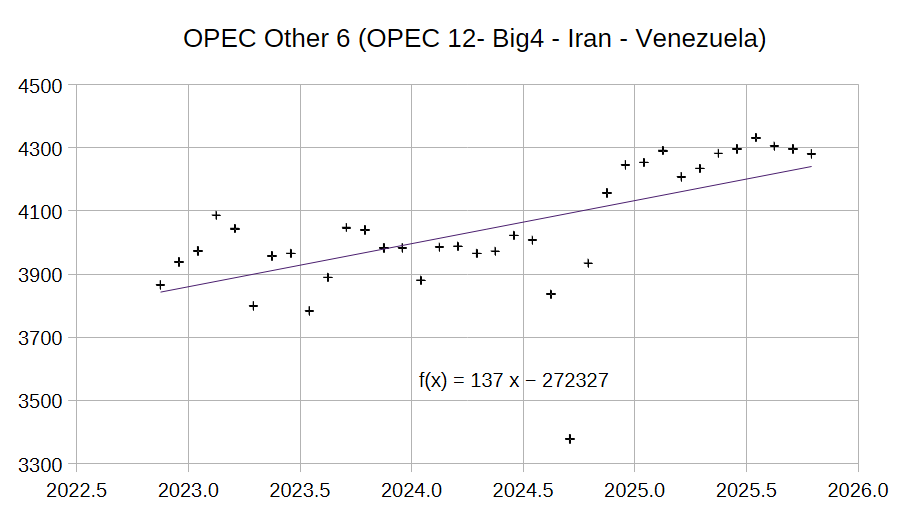

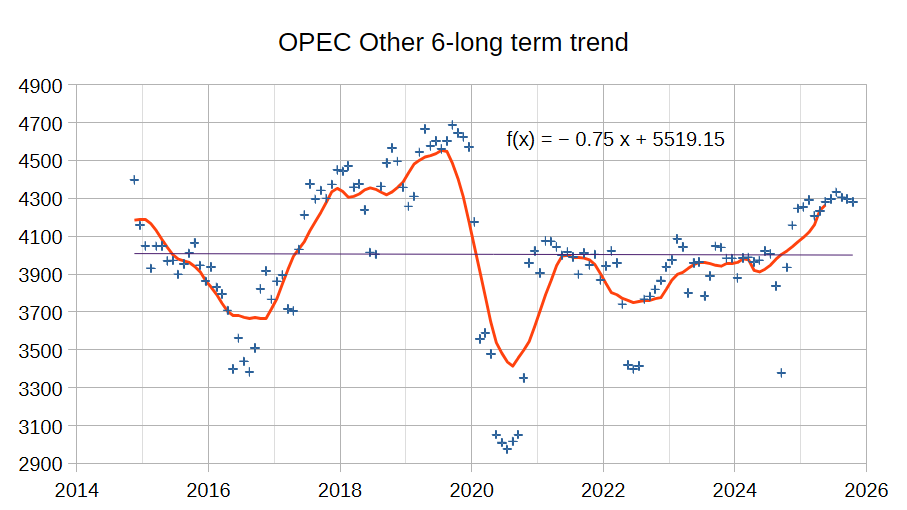

The chart above shows the most recent 36 month average annual increase of 137 kb/d for the Other 6 OPEC group which excludes the Big 4 and Iran and Venezuela. Iran and Venezuela have seen their output rise over the past 3 years at an annual rate of 364 kb/d which I believe will fall to zero in the near future. The chart below shows the long term trend for the OPEC Other 6 which is roughly flat (a small average annual rate of decrease of 0.75 kb/d) over the past 11 years. I expect the Other 6 will see their output return to this flat trend in the next few years.

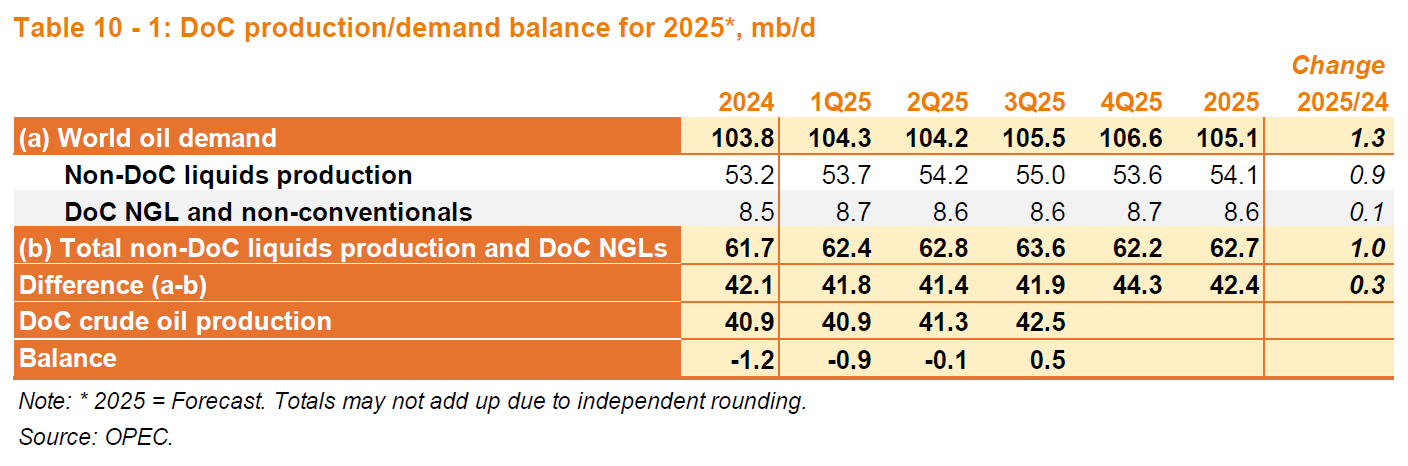

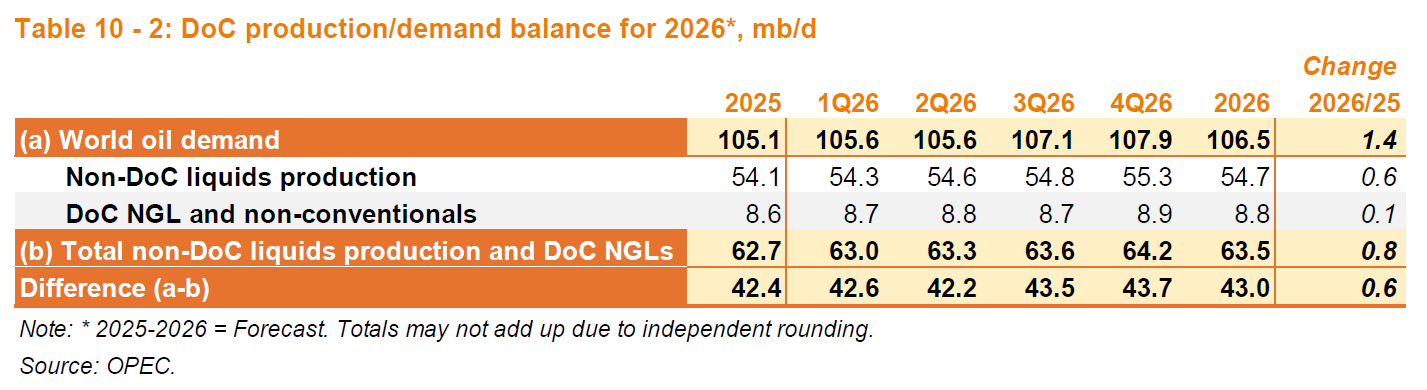

The only change in the production/demand balance from last month’s MOMR is a 100 kb/d increase in the forecast for Non-DOC liquids production in 2025, this reduces the increase in the call on OPEC by the same amount because the demand forecast is unchanged from last month’s report.

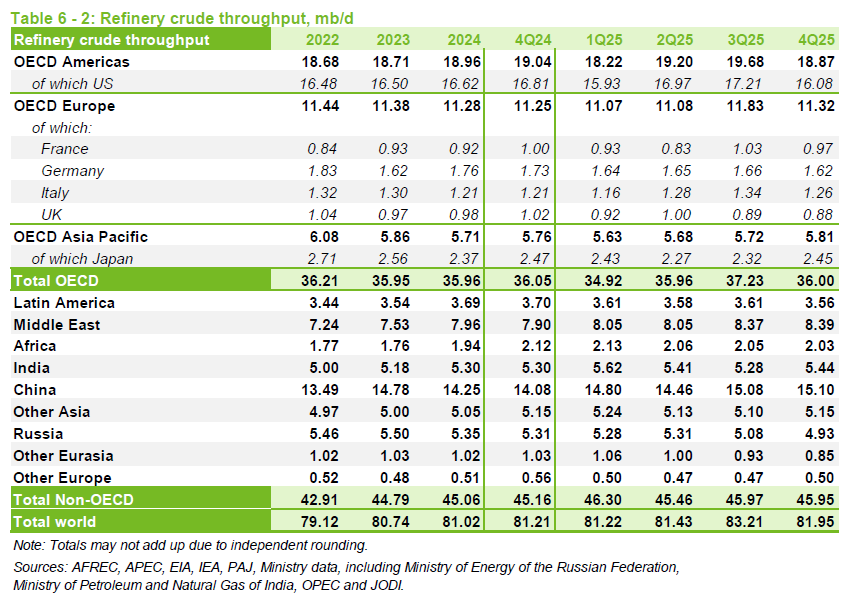

Refinery crude throughput is a measure of World demand for C+C (though imperfect because some crude is burned directly in power plants in the Middle East.) OPEC data shows the previous peak was 81.68 Mb/d in 2018. For the most recent 4 quarters (ending 2025Q3) the average World refinery throughput was 81.77 Mb/d, a new annual average peak and a significant revision from last month’s report at 81.34 Mb/d for the same 4 quarters.

From the November MOMR:

Preliminary September 2025 data show that OECD commercial inventories rose by 6.0 Mb, m-o-m, to stand at 2,845 Mb. At this level, OECD commercial stocks were 37.7 Mb higher than at the same time last year, but 22.4 Mb lower than the latest five-year average, and 122.3 Mb below the 2015–2019 average.

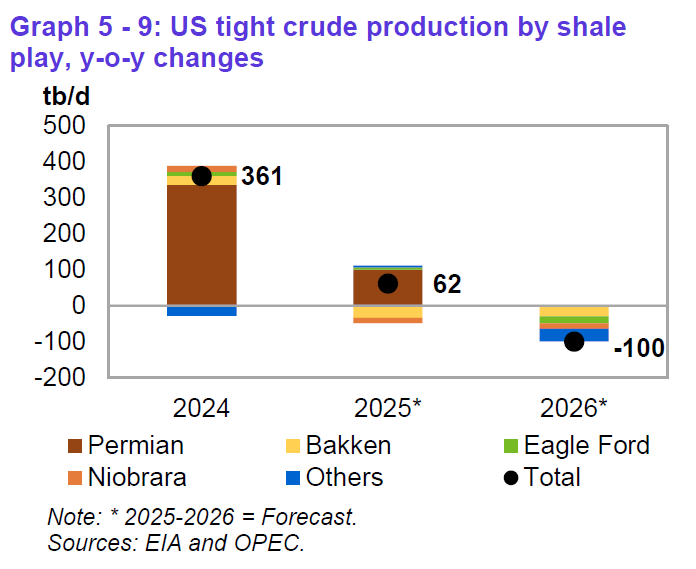

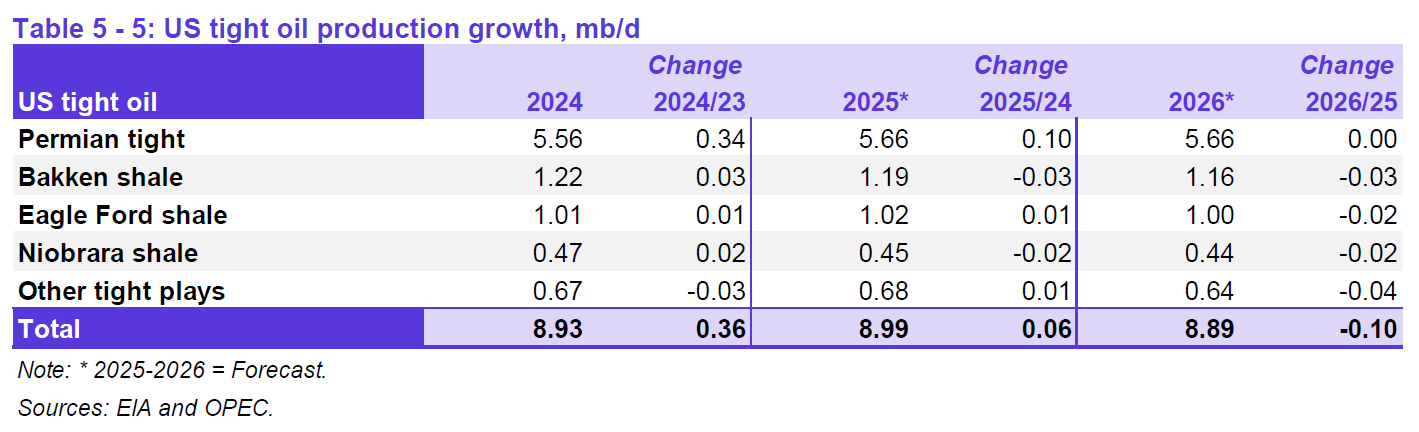

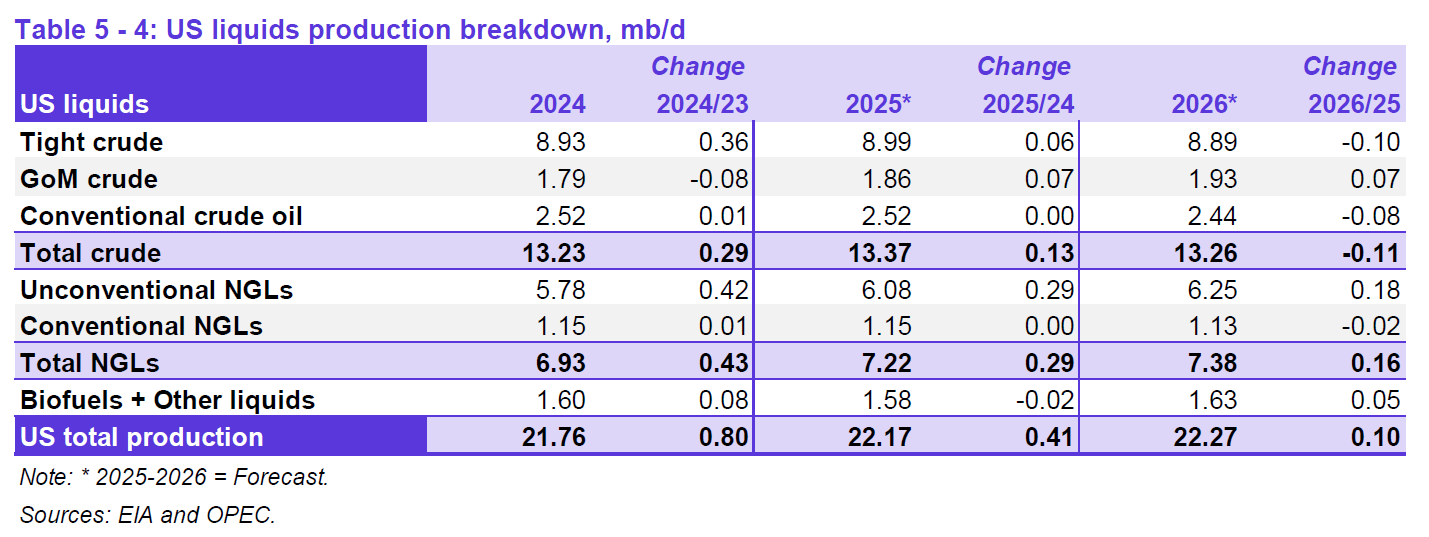

OPEC has reduced its estimate of US tight oil output in 2025 and 2026 compared to last month’s report by 10 kb/d for both years. Also the estimate for 2024 increased by 10 kb/d compared to last month’s report (in line with data from the EIA), so the increase in tight oil output from 2024 to 2025 is 20 kb/d lower than last month’s report while the decrease in tight oil forecast from 2025 to 2026 is unchanged from last month’s report.

OPEC forecasts US C+C output to increase by 130 kb/d to 13.37 Mb/d and to decrease by 110 kb/d in 2026 to 13.26 Mb/d. The latest STEO from the EIA forecasts 13.59 Mb/d in 2025, 220 kb/d higher than the OPEC forecast, in 2026 the EIA expects US C+C to fall by only 10 kb/d compared to the 2025 annual average. For 2026 the difference between the two forecasts is 320 kb/d. If we assume these two forecasts are equally likely, the average of the two is 13.48 Mb/d in 2025 and 13.42 Mb/d in 2026. My guess is the OPEC forecast will be closer to correct.

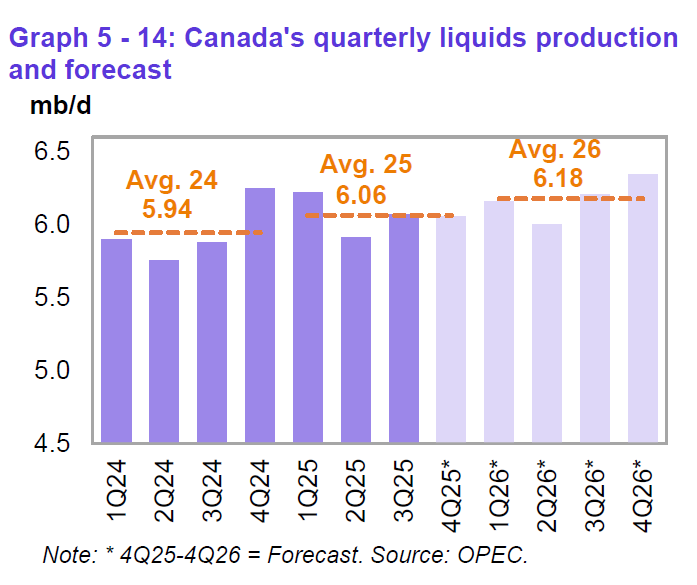

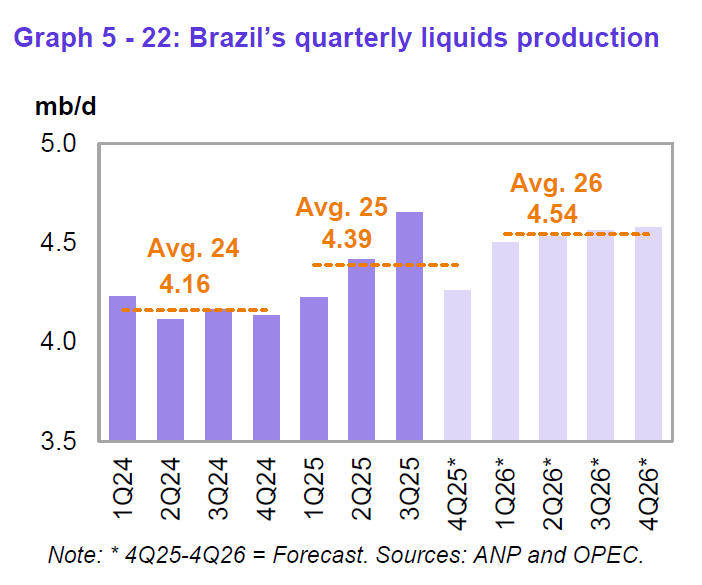

Above are two forecasts for output from non-OPEC+ nations from the November MOMR. OPEC forecasts Latin America non-OPEC output to increase by 300 kb/d in 2025 and by 500 kb/d in 2026. By deducting Brazil’s output and assuming the rest of the increase comes from Argentina and Guyana we get an increase of 70 kb/d in 2025 and 350 kb/d in 2026 for combined Argentina and Guyana output of liquids.

Leave a Reply