This update reports data from the Monthly Oil Market Report (MOMR) published by OPEC on December 14, 2020. The latest data point in each chart presented is November 2020 and output is thousands of barrels per day (kb/d).

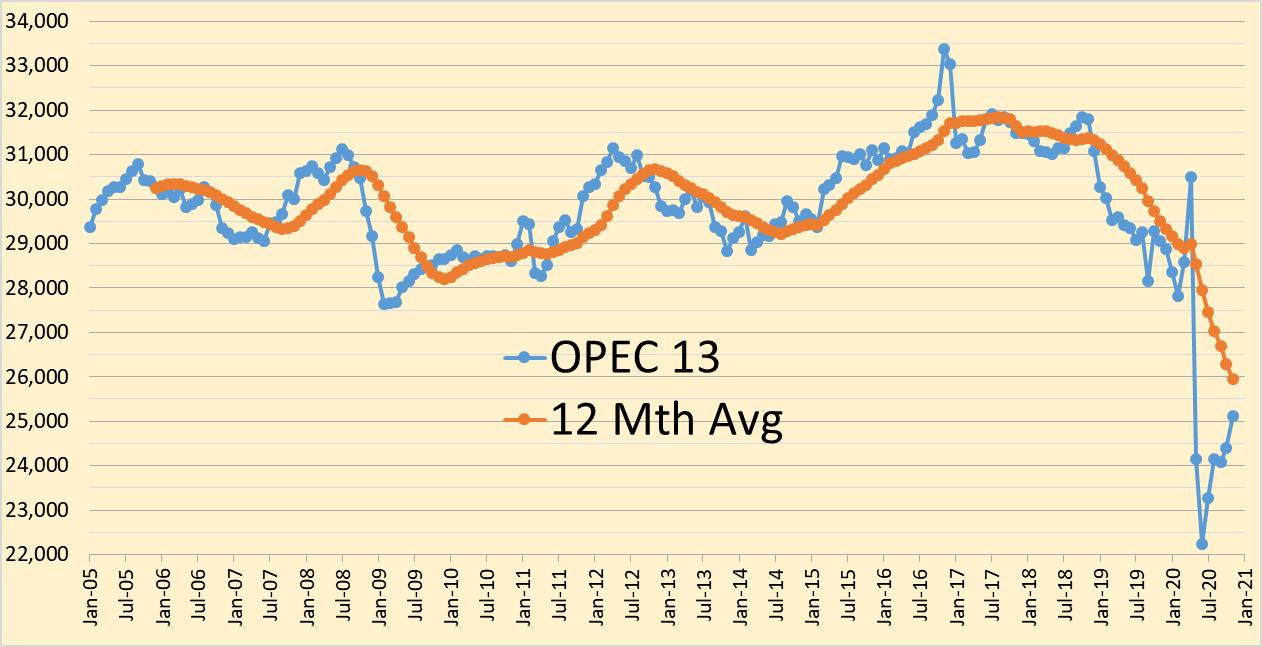

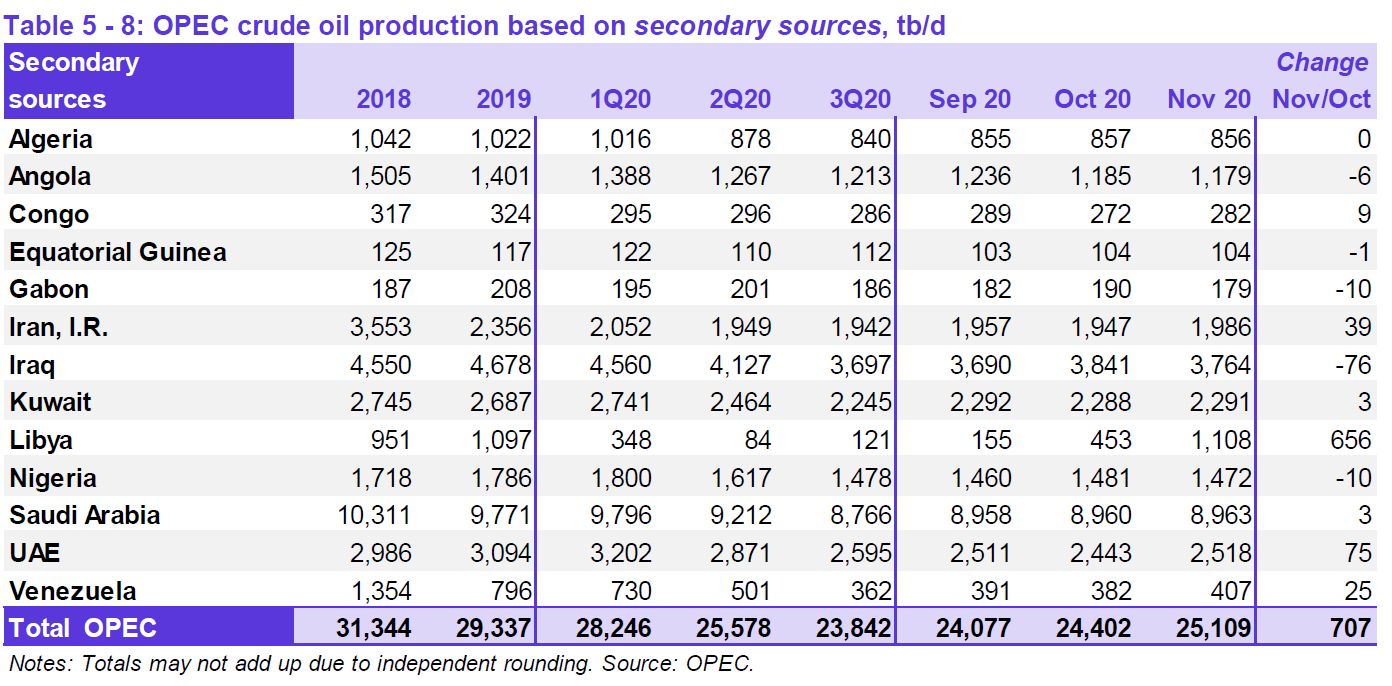

OPEC output in October was revised 14 kb/d higher than reported in the October MOMR to 24,402 kb/d. November 2020 OPEC output increased by 707 kb/d to 25,109 kb/d.

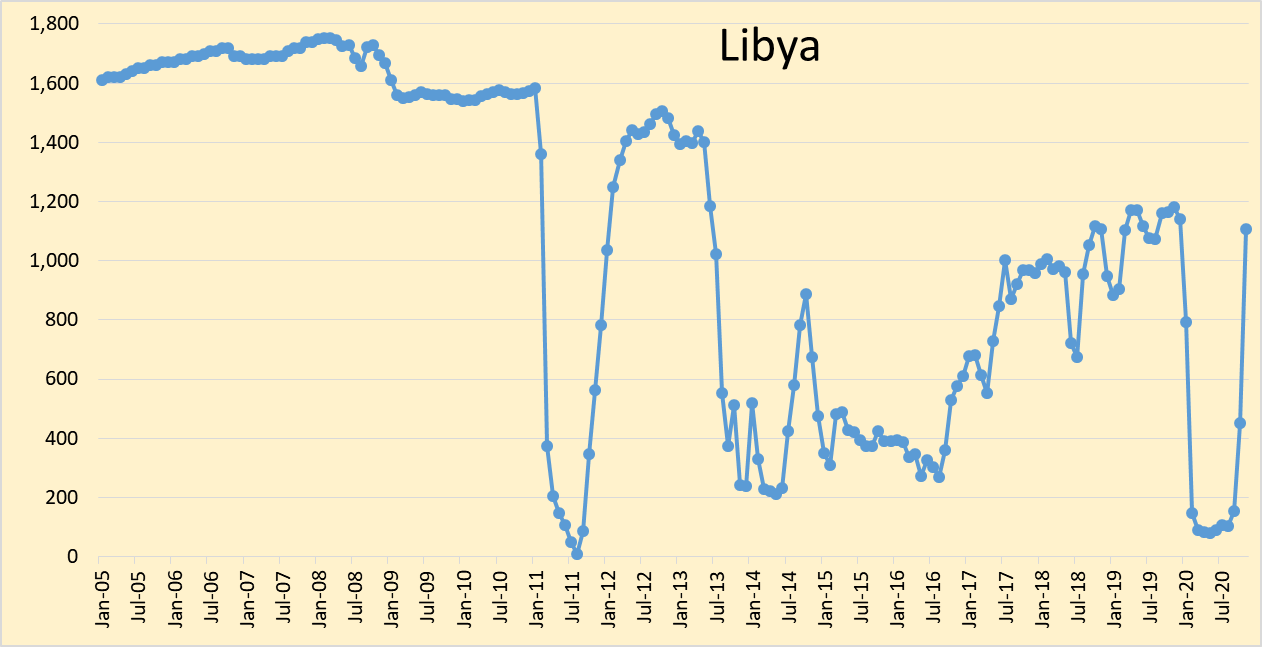

As can be seen in the chart above most of the increased output in October was from Libya with an increase in November of 656 kb/d.

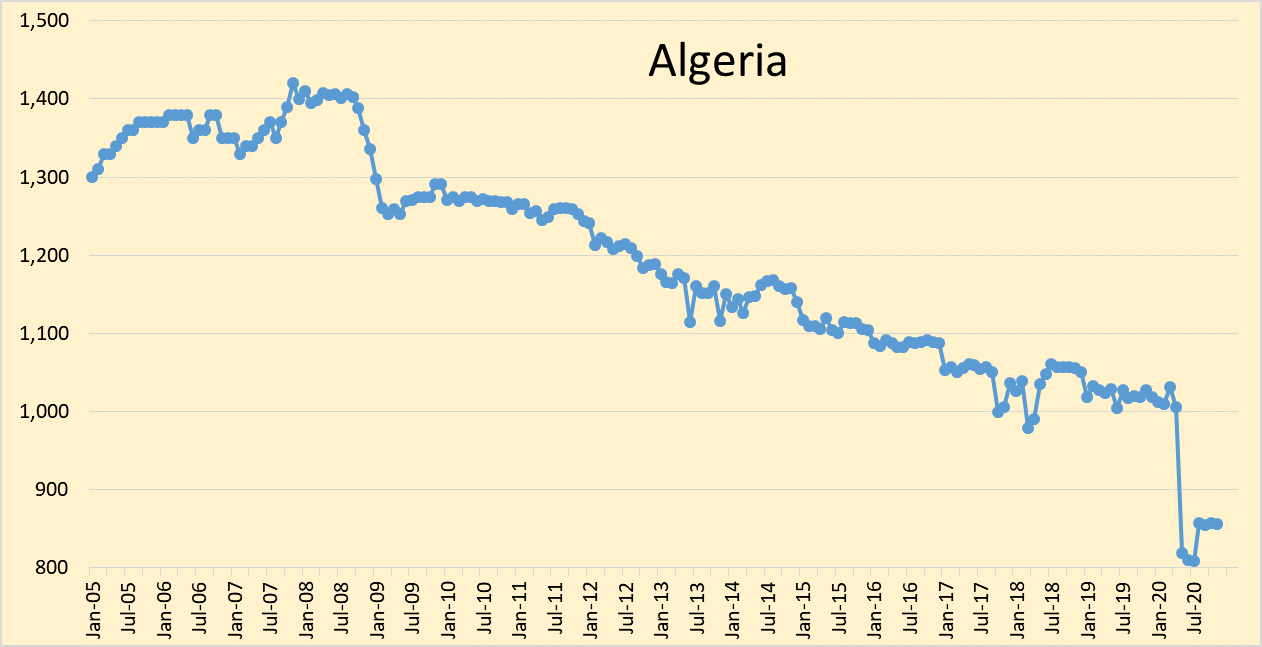

Algeria output flat since August, Nov output 856 kb/d.

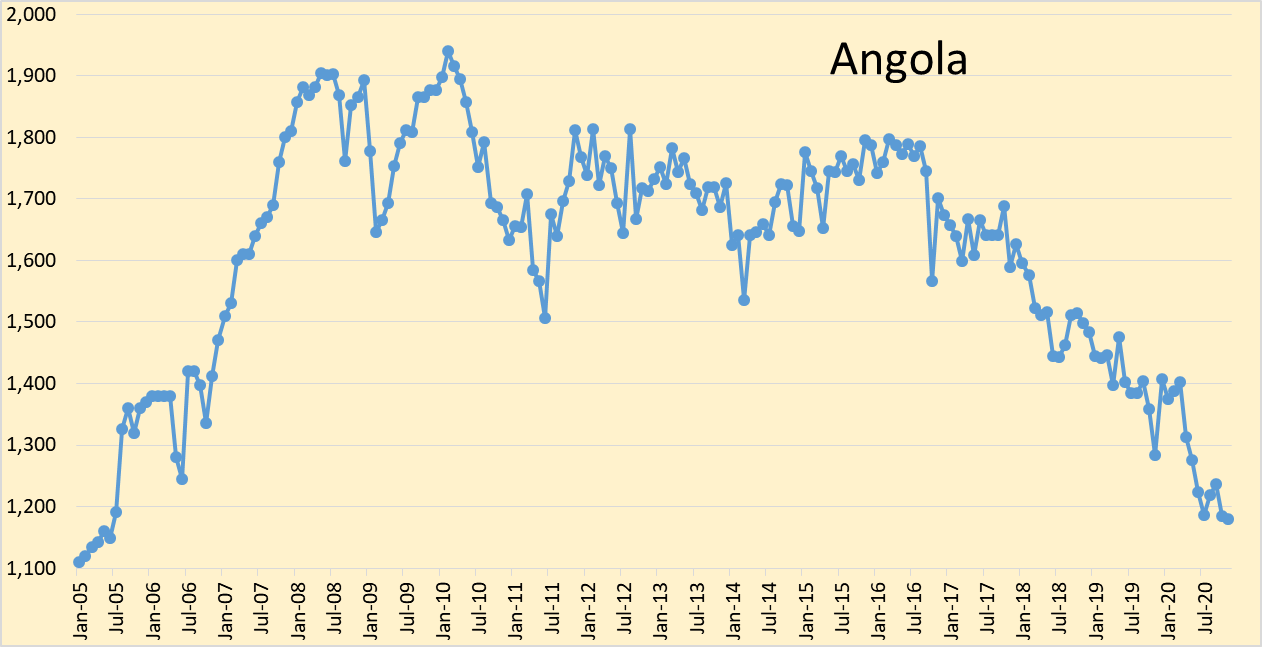

Angola’s output has been declining at about 11.5% per year since Nov 2016, In November 2020 output was down by 6 kb/d to 1179 kb/d.

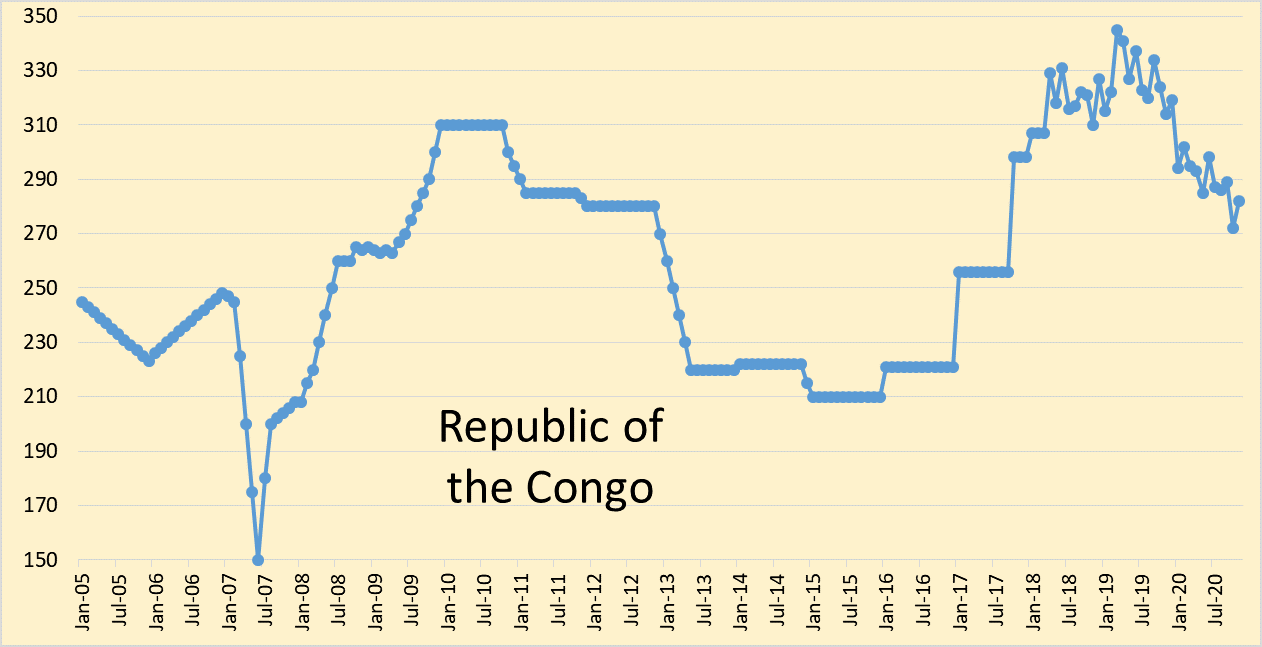

Republic of Congo had an increase of 10 kb/d in November to 282 kb/d.

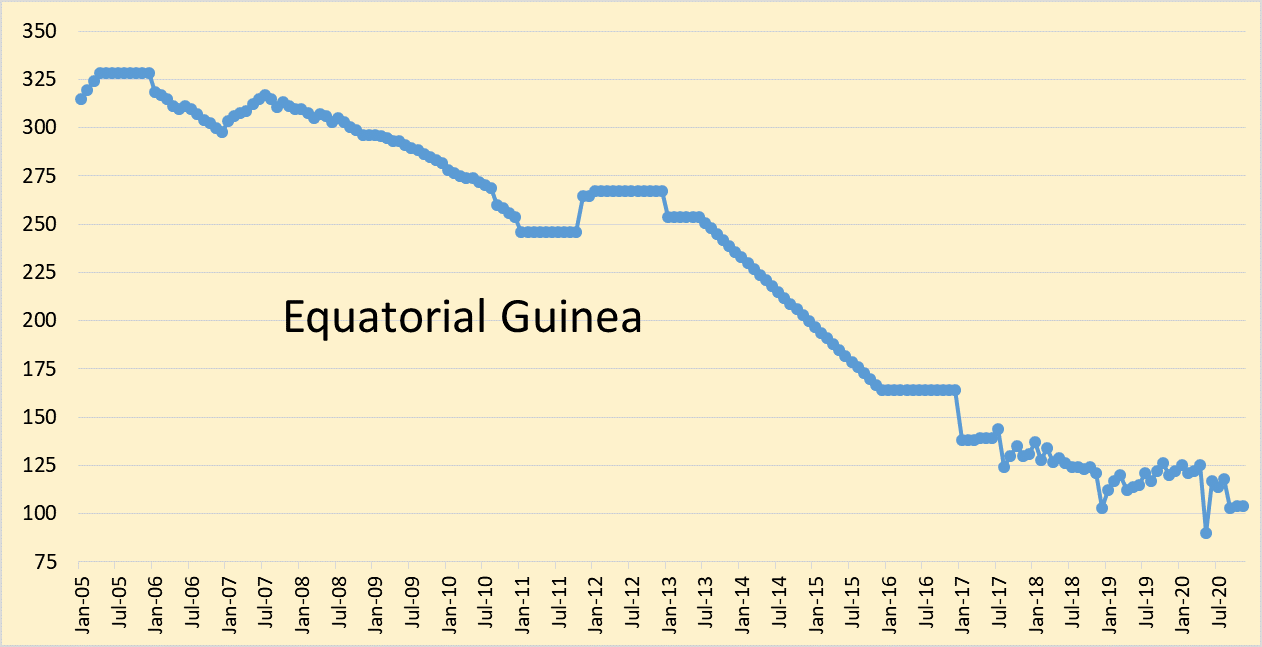

No change, November output 104 kb/d same as October.

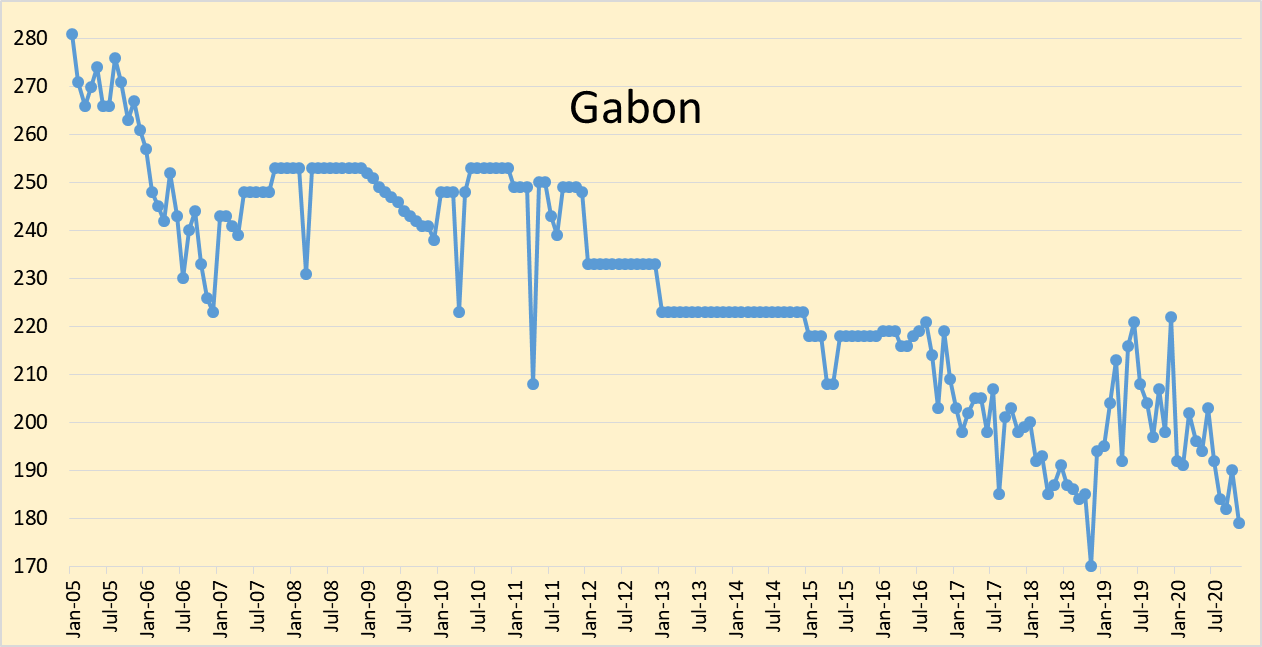

Gabon down by 11 kb/d to 179 kb/d.

Note that combined output of Republic of Congo, Equatorial Guinea, and Gabon in November was only 565 kb/d, if we add Venezuela the 4 nations produced 972 kb/d in November 2020, about 3.9% of OPEC output.

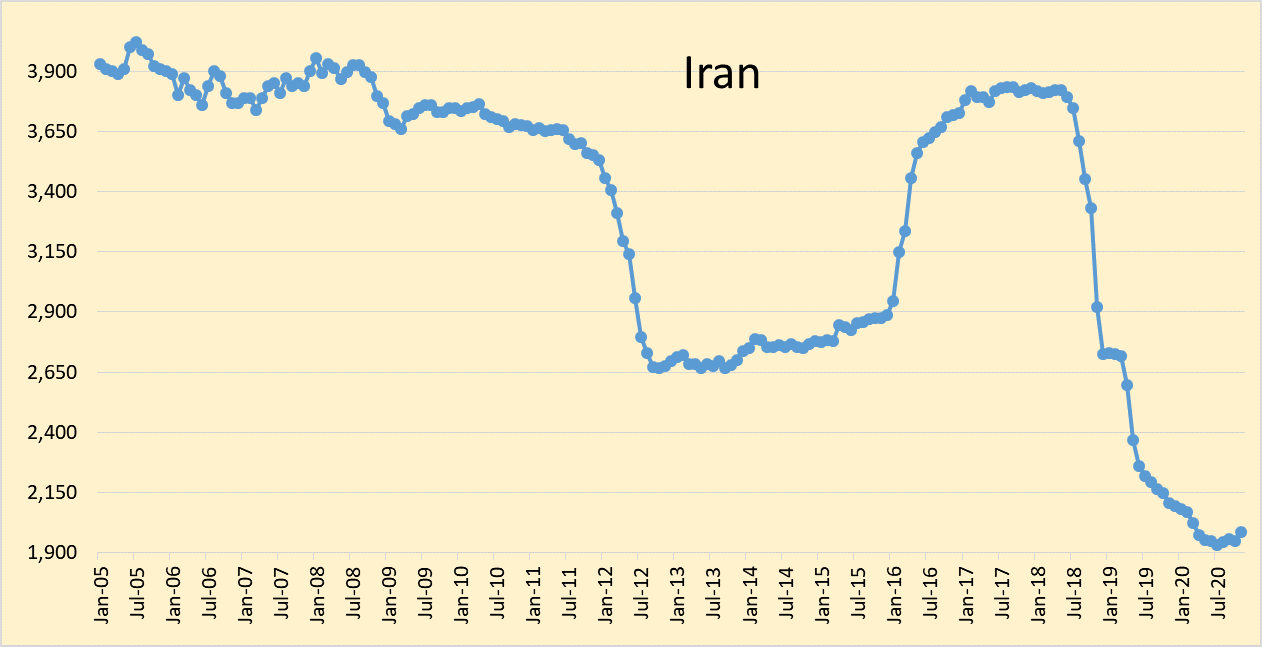

Iran produced 1986 kb/d in November, up 39 kb/d.

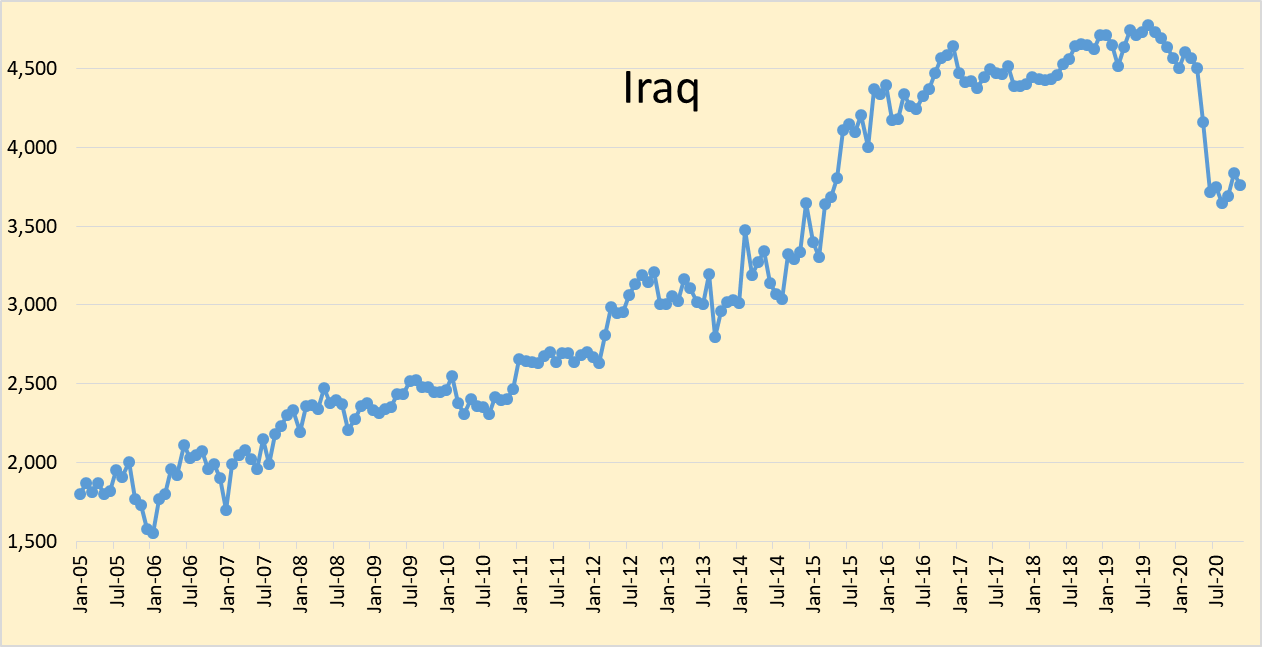

Iraq’s output was 3764 kb/d, 77 kb/d lower than October.

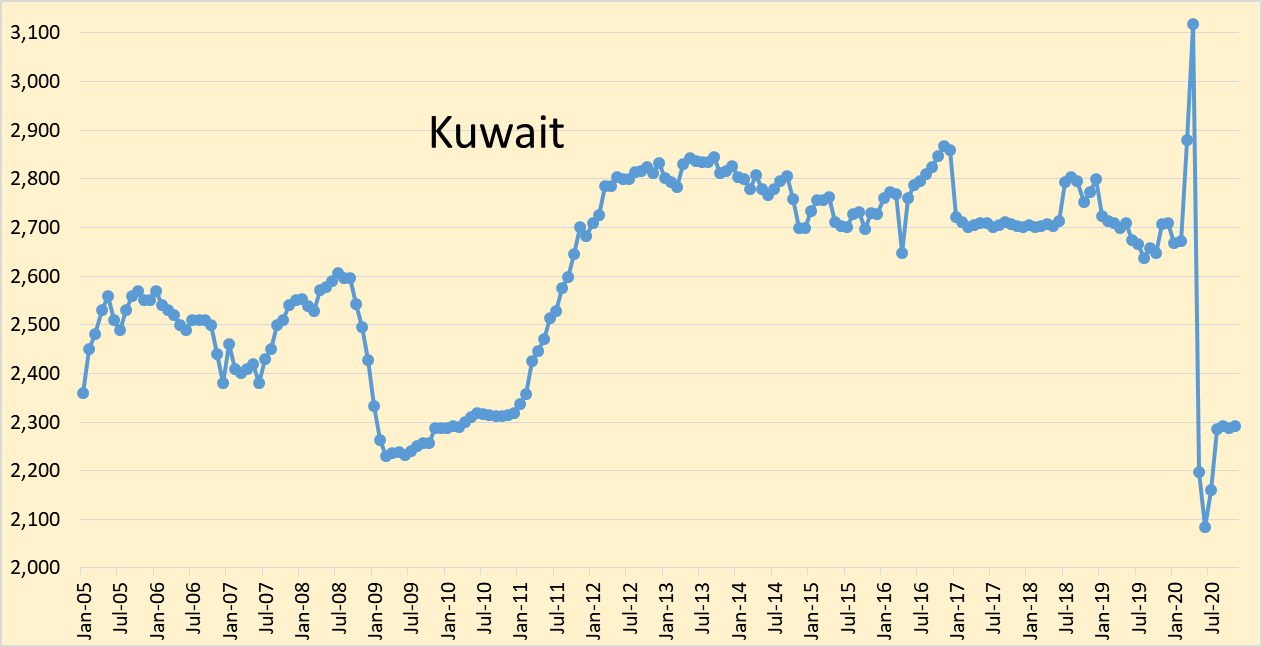

Little change for Kuwait, output 2291 kb/d in November.

Big increase in Libya for November of 656 kb/d, accounting for 93% of the OPEC increase in output this month (707 kb/d). Output was 1108 kb/d, approaching the near term peak of 1183 kb/d from 12 months earlier.

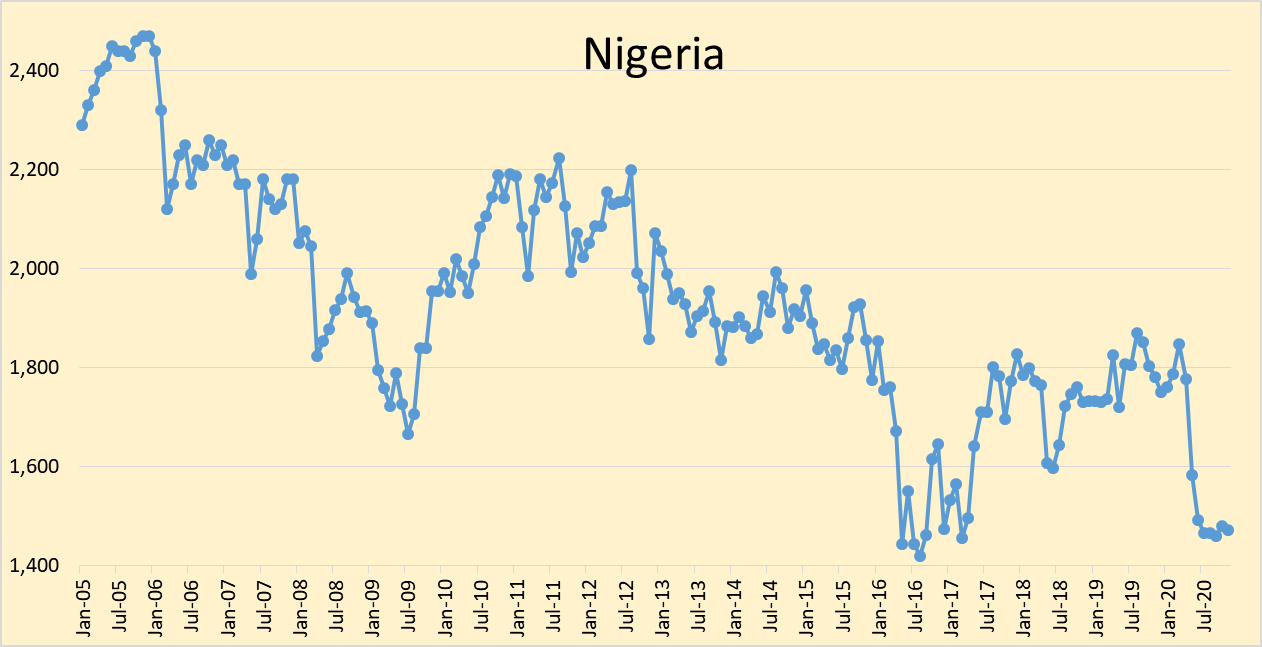

Nigerian output has been flat since July 2020, Nov output 1472 kb/d.

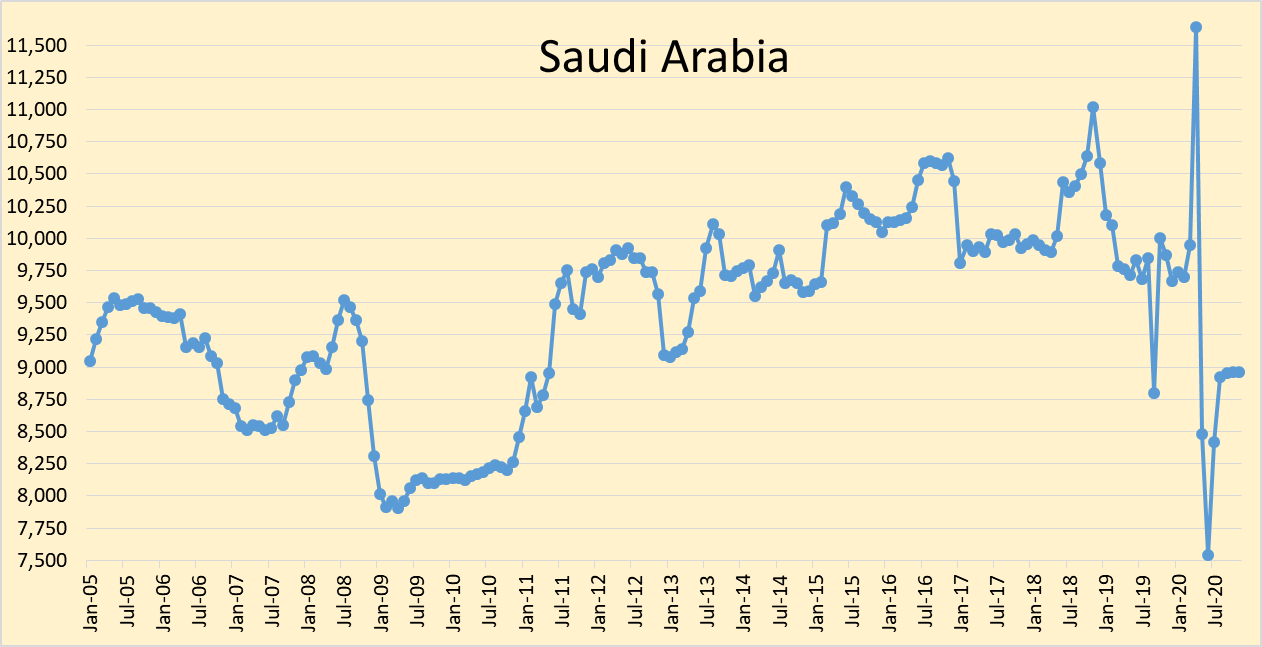

Saudi output has also been flat since Sept 2020, 8963 kb/d in November.

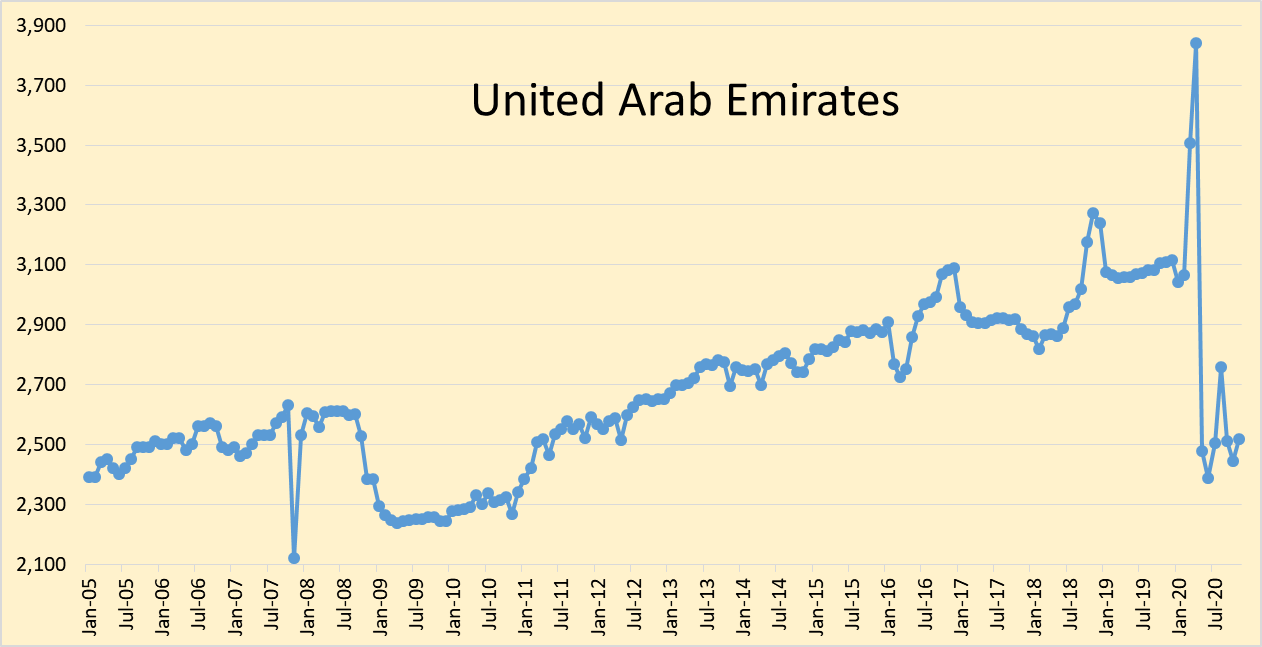

UAE up 75 kb/d in November to 2518 kb/d.

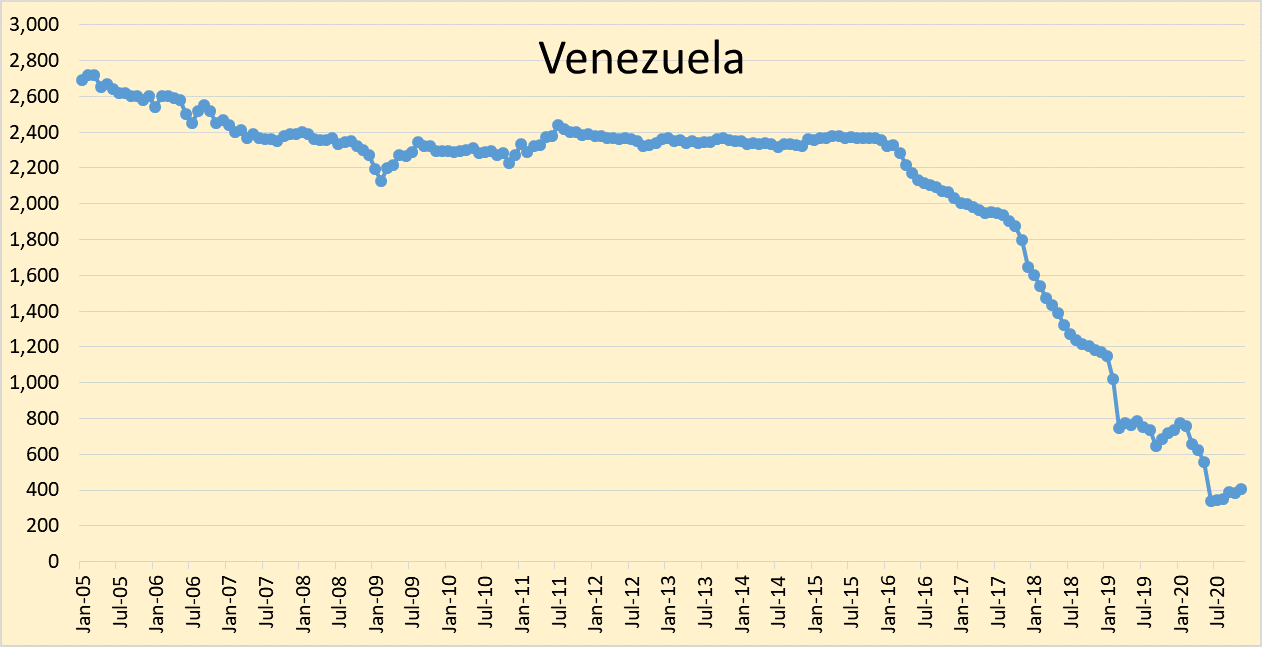

Venezuela’s output was 407 kb/d, up by 25 kb/d.

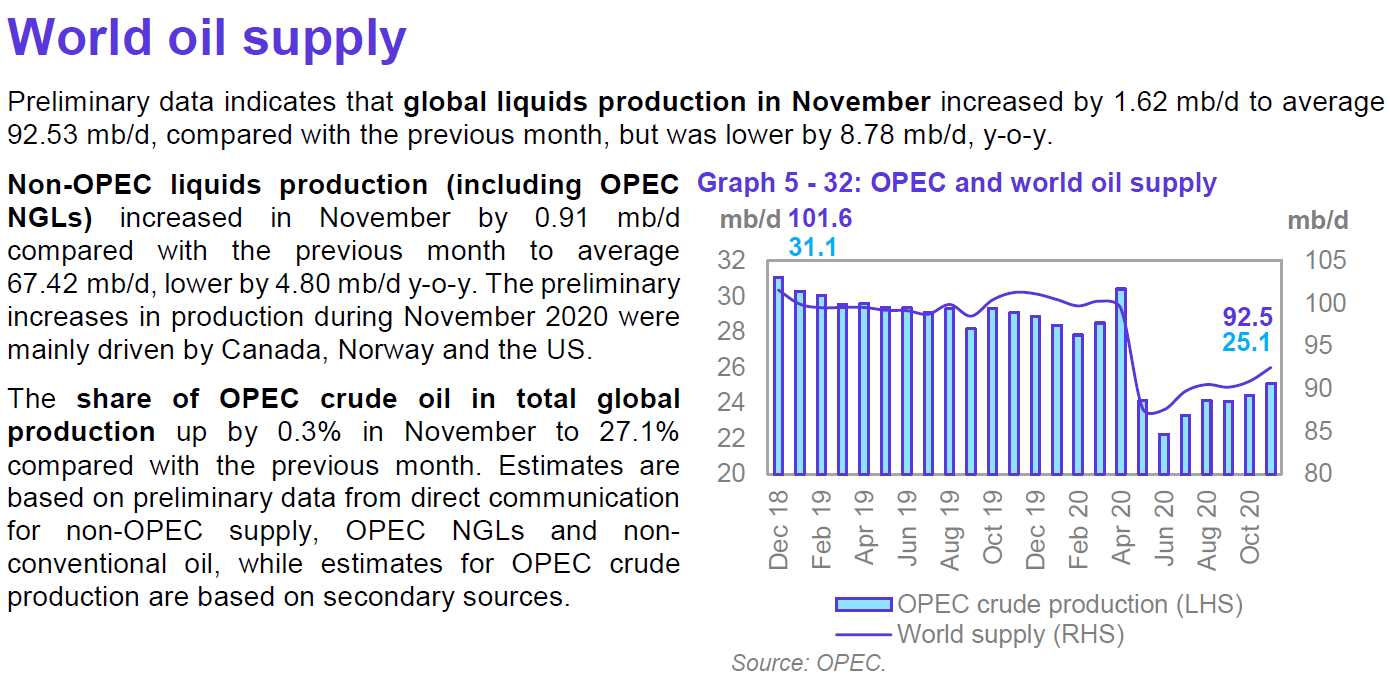

World total liquids output was 92,530 kb/d in November an increase of 1620 kb/d.

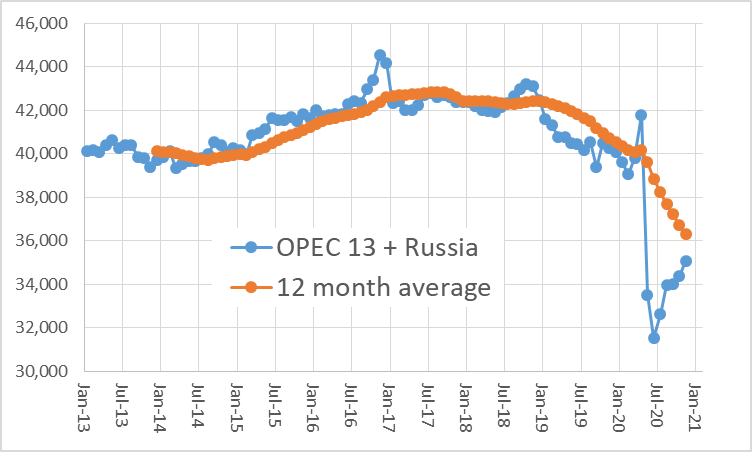

OPEC 13 and Russian output for November was 35,076 kb/d, up by

716.5 kb/d. The 12 month trailing average for Russia+OPEC was 36,291 kb/d in November down 4438 kb/d from 12 months earlier. Russian output increased by 10 kb/d in November to 9967 kb/d which is 1244 kb/d less than the Nov 2019 level of output.

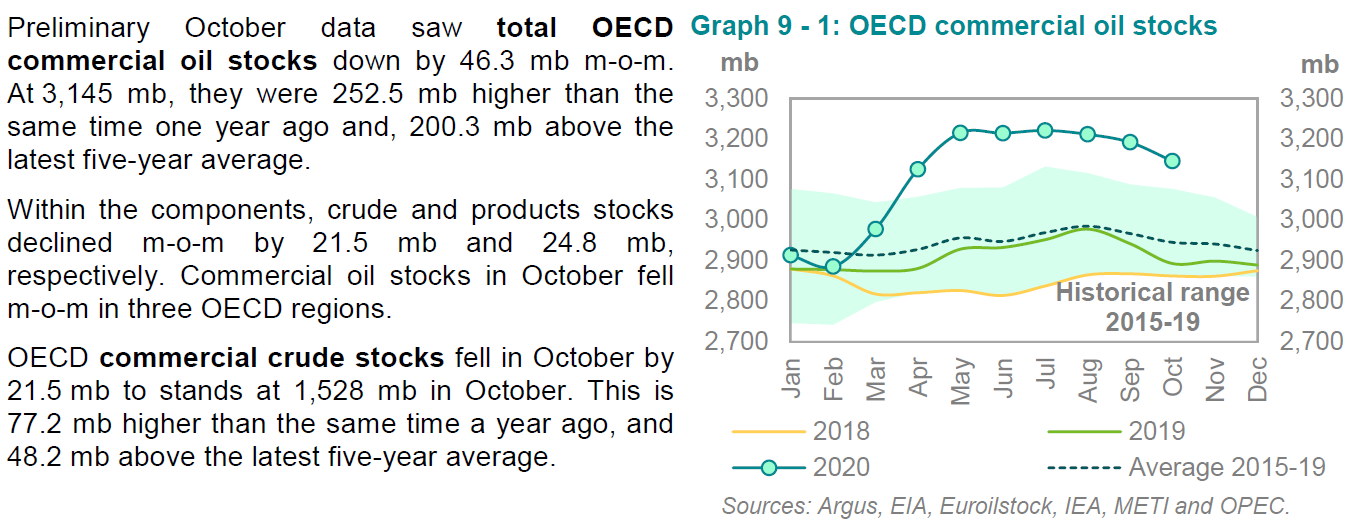

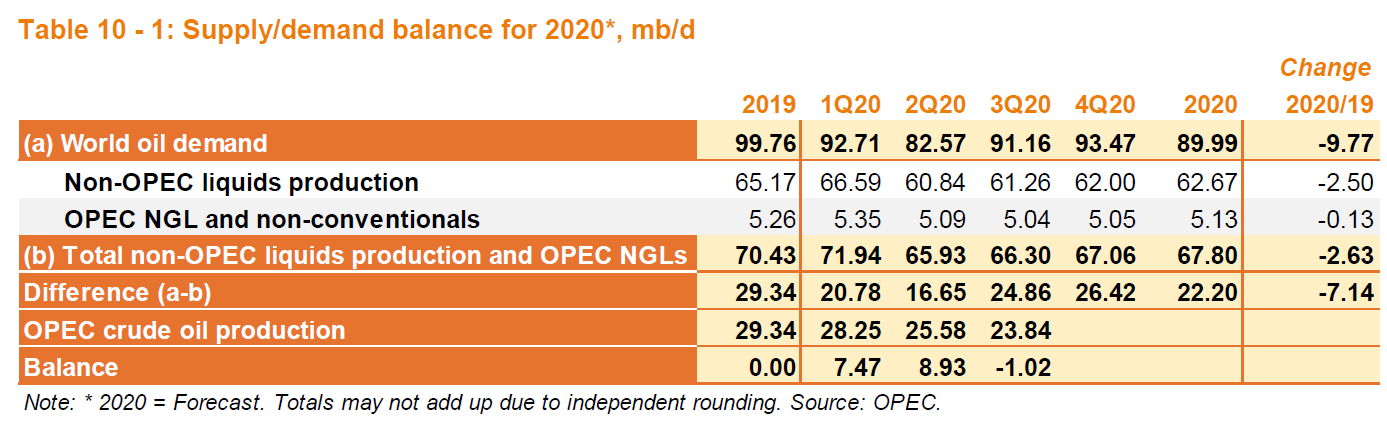

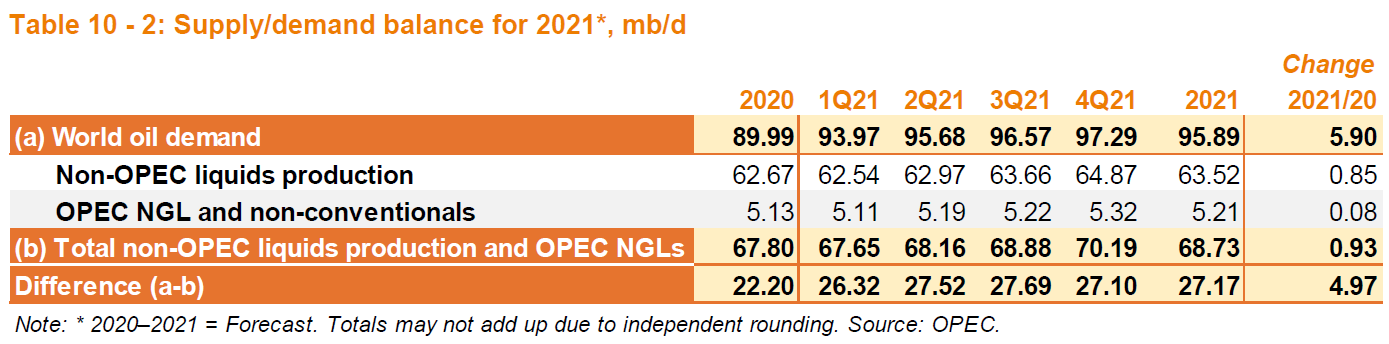

OPEC expects demand for OPEC crude to be 26 Mb/d for 2021Q1, if they are able to maintain an output level of 25 Mb/d for the quarter and their demand estimate is correct, then petroleum stocks will be reduced by about 90 Mb. If November and December stock draws are about 30 Mb each month, then OECD stock levels fall almost to the 5 year average (roughly 50 Mb above) at the end of 2020Q1. The wild cards are how much Libya is able to increase output above the current level and whether Biden is able to reach a deal with Iraq Iran (thanks for the correction, Chris) and then remove sanctions. I think the Iran negotiation is likely to take 6 to 12 months to accomplish, (at minimum) it will be interesting to watch.

126 responses to “OPEC MOMR, November 2020”

Dennis

Great job. ??

Thanks Ovi. Happy holidays to all. Stay safe, keep your distance, wear your mask, and wash your hands.

Dennis , really a very good job done . Simple ,well bifurcated and easy even for a non oilman like me to understand . Dank je wel . Keep up the good work .

Hole in head,

Thank you, I just tried to follow the format Ron had laid out so well.

If you have concern about oil demand, then the recovery in world economy is the paramount variable.

While many here like to express their opinion on the prospects, the OECD has more credibility than anyone here does.

Their projections are well presented here-

https://www.visualcapitalist.com/global-recession-2020-recovery/

As of now, the projection is recovery to pre-Covid global GDP levels in roughly one year.

Hicks , OECD just like IMF and World Bank is full of crap. Let us do a real analysis .

South America : Dead

North America : USA and Canada . Dead . $3.5 trillion wasn’t enough , so now another $ 940 billion and still a couple of millions will be evicted .

UK ; Dead . Wait for a ^No deal Brexit^ .

EU : The 4 largest economies are dead . Extreme lockdown till 15th January .

Middle East ; Dead . Low oil prices are causing pain even to the sheikhs . Anyway most of MENA is nothing but endless wars .

India : Dead . I have posted several times .

China : Limping , but in no position this time to pull the world out of the mess .

Japan : It has been in a recession since I forget when .

Australia : Stupid and suicidal . Picked up a fight with China which takes 43% of it’s exports . China slapped a 200% duty on wine, beef ,barley . Banned imports of wool and several products (except iron ore) on frivolous grounds .

New Zealand : Nothing there . They succeeded in the battle against Covid but lost the economy . Anyway too small an economy . More sheep than humans .

So from where is the growth going to come from Mali ,Chad , Somalia , Nigeria etc .Maybe OECD can ask the penguins and polar bears in Arctic and Antarctic for assistance . 🙂

Excellent and to the point article.

My son works in the Alberta oil patch and was worried about layoff. He works in maintenance as an industrial electrician. He recently informed me his company has lots of work and is going flat out. He is doing well.

Articles in Cdn news the past few weeks have stated that our oil companies are planning modest production increases, and are budgeting for maintenance and capital improvements. This is a much better outlook for workers than it was 6 months ago. Meanwhile, work is continuing on the Trans Mtn pipeline expansion to avoid the US bottleneck and politics. A workplace injury shut down the lower mainland work sites the other day, but it is still going ahead. Furthermore, so is the Kitimat NG export plant and Site C BC Hydro dam project.

I think, (if I had to hazard a guess because I don’t know), is that a lot of the protests about these mega projects are abating because of so many Covid job losses in other sectors. It is a hard argument to make these days to crash everything. Although, there is apparently firm plans underfoot for transitioning away from fossil fuels in Canada, but for the time being, it is paying a lot of the bills. GW is accepted here and citizens expect firm reductions in CO2 emissions. (Usually the other guy goes first kind of thing. 🙂

regards and stay safe.

Paulo,

I agree the article posted by Hickory was excellent. My guess is the envelope for the high and low scenarios in the chart following “Fragile Recovery” has about a 3 in 4 chance of the actual path for World GDP falling between those two cases.

Despite the insistence by some that economists should predict the future accurately, they never have in the past and are not likely (roughly a 100% probability) to do so in the future.

The statistics are very basic, number of possible futures is equal to infinity, choose one future from that infinite set. Odds of choosing correctly are exactly 1 divided by infinity or

zero.

A 2015 paper on reserve growth from the USGS estimates 3300 Gb technically recoverable conventional oil resources (TRR) outside the US, for the US the TRR is roughly 300 Gb for a World TRR of about 3600 Gb. Link to paper below.

https://pubs.er.usgs.gov/publication/sir20155091

Jean Laherrere estimated about 2800 Gb of conventional resources in 2018. The average of these two estimates is about 3200 Gb. I generally find the USGS estimates to be too optimistic and the estimates by Mr. Laherrere have historically proven too pessimistic.

An updated oil shock model using the 3200 Gb conventional oil resource estimate and an unconventional oil (tight oil and oil sands from Canada and Venezuela) URR estimate of about 200 Gb (80 Gb of tight oil and 120 Gb of oil sands) for a World URR of 3400 Gb.

Peak year for this scenario is 2033, but output is on a plateau between 86.5 and 87.3 from 2028 to 2035. Peak is 2032 and 2033 at 87.3 Mb/d and the 2018 peak is surpassed in 2024.

and the 2018 peak is surpassed in 2024.

We shall see-

(hopefully, I’m getting on in my years)

Hightrekker, I posted this at the fag end of the last post . Maybe you missed it .

“Low demand ESG investment only = No new oil production will come online . The oil now underground will remain underground . Discovered oil is important but more important is FID to bring this discovered oil online . No more . We have crossed peak whenever it was and whatever parameter we may choose .”

https://oilprice.com/Energy/Energy-General/Big-Oil-Slammed-With-A-7-Trillion-Reality-Check.html

Hole in head,

As Hightrekker said, we will see.

Hightrekker,

Yes the future is always a guess, World C+C consumption grew at an average annual rate of about 800 kb/d each year from 1982 to 2019. I expect 2020 average World C plus C output will be about 76500 kb/d, if the rate of growth seen from 1982 to 2019 is what we see from 2021 to 2033 (800 kb/d increase each year), then we would not surpass the 2018 level of World C+C output (82867 kb/d) until 2028 and would not reach the level of World C+C output projected in my scenario until 2034.

I did not account for this lack of demand when creating the scenario, note that many major agencies (IMF, OPEC, EIA, IEA, World Bank) expect the World to return to the 2019 level of World real GDP by 2022. Demand for oil may return more quickly than the average rate seen from 1982 to 2019.

For example oil output from Jan 2009 to Dec 2010 the average annual rate of increase for World C plus C output was 1717 kb/d and that economic crisis was much less severe than what we face today. In 2009 World C+C output was 1171 kb/d less than 2008, in 2020 I project World C plus C output will be 5847 kb/d less than 2019 (so more than 5 times more of an affect on the oil market compared to GFC).

In any case, projections by major agencies (and certainly my projections as well) are wrong nearly 100% of the time.

So you are correct, we will have to wait to see what the future brings.

You are the pros with this–

I’m just an observer

Do you think this model is realistic? That’s not the picture given, for example, by the analysis of Rystad Energy neither the IEA…

Mr. Fleury,

My model compared with at Rystad projection in chart below, the light purple (or violet) is condensate, the shades of green are crude, from Rystad scenario. The Oil shock model is the black dashed line, it is not much different from the Rystad C plus C projection.

I think that we are not speaking of the same thing. I am speaking of oil crude which is the main stuf for passengers transport and haulage. IEA is very skeptical about the ability of oil companies for commissioning new hypothetical reserves (see the post of Georges Kaplan below) which are not going to be enough to supply market. Joël Couse did say during a webinard about evolution of Europe future oil supply : ‘‘Compte tenu de la part persistante du pétrole et du gaz dans notre consommation énergétique dans les années à venir, le maintien de l’offre pétrolière et gazière nécessitera un effort d’investissements continu. L’AIE a chiffré, en 2019, cet effort à environ 650 à 750 milliards de dollars par an, en moyenne, dans les décennies à venir, dont 40% pour la production de capacités existantes, c’est-à-dire, il faudra compenser des années de baisse d’investissements, comme 2020, par des périodes d’investissements plus intenses.’’

Given the drop in oil consumption and the current oil prices, with what money are the oil companies going to be able to bring the funds necessary, according to IEA, to supply the oil demand ?

In the summary for decision makers of the World Energy Outlook of 2018, IEA did specify that current oil production was not enought to offset a supply crunch to 2025. ‘‘Todays flow of new upstream projects appears to be geared to the possibility of an imminent slowdown in fossil fuel demand, but in the New Policies Scenario this could well lead to a shortfall in supply and further escalation in prices. The risk of supply crunch looms largest in oil. The average level of new conventional crude oil project approvals over the last three years is only half the amount necessary to balance the market out to 2025, given the demand outlook in the New Policies Scenario. US tight oil is unlikely to pick up the slack on its own. Our projections already incorporate a doubling [already unlikely] in US tight oil from today to 2025, but it would need to more than triple [very unlikely] in order to offset a continued absence of new conventional projects.’’

Art Berman has a different view.

https://www.artberman.com/2020/09/03/stop-expecting-oil-and-the-economy-to-recover/#

Oh, lord, another follower of Nate Hagens and his completely unrealistic dismissal of substitutes for oil.

Such as?

Primarily electrification (EVs, heat pumps, etc), with the power provided by solar, wind, hydro,

Secondarily efficiency, as in the Passive House approach.

Thirdly synthetic hydrocarbons or other liquids: hydrogen, synthetic diesel, ethanol, methanol, ammonia, again powered by renewables.

So… not substitutes for oil. Okay.

The primary use, bar none, for oil is energy. While, yes, you can indeed make synfuel from components readily available, such as ammonia fuel, these do not substitute for the innate energy content of a ridiculously cheap resource.

And given how utterly negligible solar and wind is in the energy mix, they will not be doing this anyway.

Your other points on heat pumps replacing gas and Passivhaus standards are totally valid, and things we should have been doing decades ago in Europe, let alone the US. However, efficiency savings will not get us out of the predicament we are in. There will have to be radical changes to consumption (MUCH less of it) and how the economy is ordered. As we can see, even with a pandemic hitting economies hard, it barely made a dent in the case for endless growth at all cost and impacts on the environment.

Hume,

Note that my scenario has oil output recovering to the 2018 level after 7 years, as to supply never returning to 2018 levels, this is doubtful. Here is a look at what happened to World consumption of refined oil products (excluding ethane and LPG), data from BP statistical review of world energy.

sorry forgot chart

Dennis,

What do you make of the OPEC announcement of the requirement of $10.6 trillion to meet demand by 2040?

https://www.aa.com.tr/en/economy/oil-industry-needs-106-trillion-investment-up-to-2040/1636026#:~:text=Nearly $10.6 trillion of investment,Outlook 2040 published on Tuesday.

Which more or less confirms the Rystad report. In your scenario do you expect resources to be diverted for oil and gas exploration to match the supply numbers of 2018 in 7 years time? At what oil price do you consider this to be feasible?

Hume,

I use the oil price scenario below.

I believe that peak demand might occur before peak supply (around 2040), but the future is difficult to predict. Oil prices will adjust to whatever balances supply and demand for oil.

Also 10.6 trillion over 20 years is 0.53 trillion per year. World GDP is about 142 trillion, so today this would be 0.37% of World GDP. As the World economy grows over the next 20 years in constant dollars probably at about 2%/year, the share of investment needed for oil falls to 0.25% of World GDP in 2040.

Seems this will not be a problem.

“Oil prices will adjust to whatever balances supply and demand for oil.”

On that we agree.

“ I believe that peak demand might occur before peak supply (around 2040)”

Yep, demand will keep growing … as far as one can see. On that we also agree.

However, peak supply occurred in 2018.

Time will enlighten.

Roger,

If extraction rates for conventional oil remain very low, then the World C+C peak will be 2018. That is only likely if demand for oil remains low, we both seem to agree that this last assumption is not a good one. So I assert that the probability that the 2018 peak in World output of C plus C will not be surpassed by 2035 to be less than 5%.

Dennis,

The trouble with peak demand is it can’t exist while one of two outcomes is true. Either there is an alternative energy source of terawatt capacity available or the global birth rate becomes negative.

Global GDP can be expressed in terms of global energy supply. Without it there is no growth.

Hume,

Replacing declining fossil fuel energy with alternatives should be discussed in Open thread, Non-Petrol. Petroleum people don’t really like to discuss what might replace petroleum in the future.

Dennis,

I was responding to your post which mentioned peak fossil fuel demand. To my mind peak demand is a fallacy for the reasons I stated.

I don’t believe I went off topic nor did I intend such.

Hi Denis, might be a typo. In your next to last sentence, do you really mean Iraq, or Iran?

Thank you for the correction. Yes my mistake, it should be Iran.

Now corrected.

From the graph above, it seem Saudi Arabia is on the declining side of the overall production curve. What do you think?

Same observation for OPEC and OPEC + Russia.

That does not mean, they could reach temporarily higher production levels,

Chris,

Yes I expect OPEC+ may be able to increase output when demand supports this, I think OPEC plus will return to 40 to 42 Mb/d, probably by 2024 or 2025. Much depends on the economic recovery, some believe oil demand will never return to the 2019 level (demand peaked in 2019, supply peaked in 2018, there was a stock draw in 2019 that accounts for the difference). I am doubtful about that, my guess is about a 90% probability that the 2019 demand peak will be surpassed.

Oil prices have rallied within $2.50 of the average price for February, 2020.

Interesting that upstream oil equities are lagging the price of oil’s rebound by a significant amount.

Maybe there won’t be enough investor money for shale CAPEX?

Shallow Sand,

Is the market waiting for the price to consolidate before jumping in? $60 a barrel is where shale oil turns a profit. Maybe we won’t see much activity until then.

I think the industry is very out of favor. It may stay that way.

I’m looking for oil stocks to go the way of tobacco stocks. They need to stop focusing on growth and instead focus on yield.

These names can be cash cows at $75+ oil if they maintain CAPEX discipline. Drill from cash flow AFTER a decent dividend is paid.

SS , I agree with you . I feel sad for individuals like you and Mike S who wear pants worn at the butt , however , reality is reality . We will witness the decline and end of the oil industry not because it was not ” available ” but because it was not ” affordable ” . Horrible times for you stripper guys , but I say

” To prepare ,you must be aware ” . I am sure that you and Mike S and all others in your field know this and are taking preventive action . I am not an oilman but I understand what guys like you do so that I can eat eat strawberries 24/7/ 365 . Be well .

The oil industry isn’t out of favour with the powers that be. One way or the other the industry will get it’s way.

I’m banking on it.

p.s. ExxonMobil’s annual dividend was 7.9%. EPD’s (ticket symbol) was 8.26%. Not too shabby I would have thought.

Exxon has been borrowing money to pay its dividend. With interest rates so low, it makes sense, I guess, but it doesn’t have anything to do with money from operations. It’s just a trick to make the CEO richer.

The industry is not out of favor by a long shot. It is more a period of time where the globalists can expand their agenda (which can be necessary). Reduction of “carbon emissions” by 8% this year is right on target according to agenda 2030. The situation with expanding consumption of fossil fuels everywhere is not sustainable; not now or in the future. So the the party of living beyond our means had to be stopped one way or another. At one point not long into the future consumers will have to feel the pain of fossil fuel consumption converted to it being costly (as opposed to now, dirt cheap).

The scale of fossil fuel consumption has to be scaled back, even China admits that with their 2060 “net zero co2” target. In reality I think we are looking at a significantly reduced energy consumption per capita in future. What can be sustained, I have no idea. The indirect message from UN and the WEC when they talk about 8% annual reduction target of co2 until 2030 implies concerns to put it mildly.

In Norway we are at the forefront of any environmental target simply because it can be done. It has been a lot of pressure for us to pursue wind power, even though we have enough hydro power already. The compromise was to expand electricity cables to UK and Germany, in addition to the ones we have to Denmark and Sweden. The idea is that wind power inregularity can be mitigated by turning hydro power on/off (difficult) or differences between countries (wind strength; also difficult). Hydrogen power is an expensive solution, but is pursued because it solves inconsistency problems with wind solar power.

In Norway, we are pursuing more resources in the Barents sea (way north) to ensure a backup plan beyond 2030. It is possible to have an oil export economy until that point; what happens beyond that depends on what the 180 blocks for exploration in that area will yield in actual results.

Shallow sand,

If there is not adequate CAPEX, tight oil supply will fall and oil prices may continue to increase. At low levels of well completion they may be able to fund new wells from cash flow at $50/bo.

In discussions elsewhere (at peakoil.com) some have suggested well cost will tend to move up and down with the price of oil. I found using some well cost data from the EIA that when real oil prices rise slowly (about 5% increases annually, as we saw from 1994 to 2004) that lifting costs rise by approximately 1.5% per year, I assume we might see something similar as oil prices fall. Does this match your real world experience?

For example we saw prices drop from 2014 to 2016, then rise from 2016 to 2018, then fall again in 2019 with a big drop in 2020. Were your costs affected, going up and down with oil prices and in percentage terms was the change in costs about a third of the change in oil prices?

Thanks.

Edit.

A comment by NickG below made me realize that I failed to mention the lifting costs were in constant dollars (so-called real costs).

In nominal terms, assuming a 2.4% annual inflation rate, the nominal oil price would rise at 7.4% per year and nominal lifting costs by 3.9% per year in my scenario.

Dennis,

Intuitively it makes sense that higher end prices would give suppliers and service providers more pricing power. On the other hand, 1.5% per year is lower than the general rate of inflation: the rate from 1994 to 2004 was 2.4%.

NickG,

Sorry, I meant to say these lifting costs and oil prices are in constant dollars.

So the 1.5% annual rate of rise in real costs would be a 3.9% rise in nominal costs, if we assume a 2.4% annual rate of inflation. Also the 5% annual rate of increase in real oil price would be an 7.4% annual rate of increase in nominal oil prices under the same 2.4% inflation rate assumption.

IEO (pure exploration) beat S&P by about 9% over the past 3 months. Energy ETF XLE did in fact crush it – outperforming S&P by a 50% spread.

Bankruptcy Hit U.S. Oil Producers To Lose Quarter Of Production In 2021

Operated oil production from the recent Chapter 11 filings is heavily weighted in the Eagle Ford and Bakken regions, at almost 400,000 bpd. Permian-focused operators that are currently going through restructuring only produce 80,000 bpd in the basin.

Across the US onshore industry, about 800,000 bpd of production is operated by E&Ps that have filed for bankruptcy protection in 2019-2020. With limited capex and completion activity, we anticipate production from this group will decline further to 600,000 bpd by late-2021.

Frugal: Thanks for that link!

https://www.cnn.com/2020/12/18/investing/rockefeller-foundation-divest-fossil-fuels-oil/index.html

My personal opinion, for what it’s worth, is that anybody middle aged or older who’s working hands on, or keyboard on, in the oil biz is pretty well safe in terms of a job for another ten to twenty years.

Promotion prospects might not be so good, but older guys will likely retire faster than the industry shrinks. I wouldn’t advise any kid of mine to go into the oil biz though.

I can’t say anything for sure about the hands on oil guys who post here, but my impression, reading their comments, is that they aren’t exactly hard up. They aren’t likely to ever have to think of a twenty year old banged up pickup with 200 k miles on the odometer as their NEW truck……. which is a VERY common thing for small farmers like me.

( Fortunately being a world class jackass of all trades and Super Bowl quality rolling stone I’m not exactly broke, lol…… but I never made more than wages farming,on average, and changing times forced little guys like me out of the biz.

The thing is that if you own farmland in the right kind of place, you have a pretty decent retirement package, especially if you bought with long term appreciation in mind……. if you can bring yourself to sell. I won’t, not so long as I can get by with a new twenty year old truck, lol.

So I know what it’s like to have to give up a well loved primary career. )

Hi all,

I asked the Non-Petroleum side what they though about ending the Non Petroleum thread.

Would also like some input from Petroleum focused people.

See comment below and maybe check out comments from link below

http://peakoilbarrel.com/open-thread-non-petroleum-december-17-2020/#comment-712103

and I said this in the Non Petrol post

I am thinking about eliminating the Non-Petroleum thread, let me know in the comments below if you have an opinion on the matter. Rational arguments for or against will be considered.

Below is a comment I made in response to some of the feedback as I was not clear about what I had in mind.

Thanks for the feedback.

Sorry I was not clear. At the start of Peakoilbarrel, there was no Non-Petroleum thread. Ron wrote most of the posts and he was happy to let everyone post their thoughts on pretty much anything that was remotely related to oil (or whatever topic he was posting on.

As time went on, it seemed the oil focused people were getting annoyed with off topic stuff, so I (or someone, I don’t remember the details) suggested the Open Thread Non-Petroleum, in addition to the usual Petroleum focused thread. We tried it and it worked for a while, but with fewer comments these days I thought a single thread like back at the start might work better. Everyone can post what they want (hopefully at least energy related) to comment about. In the end everything is really related to everything, there is really are no hard and fast boundary (imo).

So Islandboy your posts would continue, but there might be both petroleum and non-petroleum comments in response to your post. Likewise, an OPEC post might see comments on both politics, climate, oil, EVs, etc.

It would be interesting to hear from the oil guys, I’ll see if I can get some input on the other side.

Note that nothing is set in stone, just seeing what people would prefer. People that write posts and comment a lot may have more influence, but I am willing to listen to ideas from everyone.

If you combined them, you would need to ban discussion of politics and climate change. That crap just clutters everything, causes division, and ultimately turns people away from visiting. Let Facebook be the place for those sorts of discussions.

I rarely read the non-Petroleum comments. I read the articles there some.

Dennis i don’t think its a secret but i think this is the opposite of what you should do.

The reason for fewer posts in off topic thread might be you allow everything in here aint no reason to even try to stay on topic, but then again the best oil poster has already left and aint coming back so perhaps from that point it won’t matter.

Personally i think the oil discussion was better a couple of years ago when every discussion wasnt highjacked with the intent to push the same tiresome narrative.

If you are looking to monetize the blog then i would totally understand quantity above quality and catering to solar, ev, environmental posts and arguments. But for a quality discussion on oil “solar is best at everything and magical” does add very little even though its posted over and over in every thread.

One idea would also be to try that delete button out for a change and se how that plays out but i think its probably to late now for that.

Solar isn’t “magical”, it’s just really, really cheap. Obviously not a popular topic of conversation among people who sell fuel for a living, and perhaps best discussed elsewhere so as not to hurt anyone’s feelings, but true nonetheless.

I don’t think there is any way i can reply to this in a constructive way so you actually get my point seeming you felt the urging need to answer with that.

Your reply and attitude is actually the perfect example , you just cant see it but elaborating on why is a waste of time, and yes it will also drag discussion further off topic. That small part got trough.

Dennis will choose the direction of this blogs future, you might all get what you wish for at least for a brief moment in time.

I feel sorry for the people actually contributing sometimes.

Baggen,

The value of solar power vs fossil fuel is a key question. Your comment suggested that you feel that solar (and wind, hydro, etc.,) is not valuable as a substitute for FF. You could actually have a constructive discussion: you could provide specific ideas or points of information that supported your view. If you’re concerned about being off-topic you could move the discussion to the non-oil post.

Am I correct in thinking that you are so confident that FF cannot be replaced that you feel that it’s not even worth discussion?

Nick,

I dont see it as value of solar vs fossil, i consider both having its place one is essential in current situation and one is a little bit of cream on the top.

You got me wrong on many instances i think, as i said i think they have their place especially hydro of those you mention since its base load. I basically think we are going about this in the wrong way, and preaching the magic of renewables like you do is not actually helping i believe if to many buys into that we are putting all our eggs in the same basket and we quit look for other solutions since we are so sure this will be the magic bullet that saves us. We need to make the transition, i just dont believe solar is going to be the viable solution but meanwhile our FF is running out and we are wasting it like flaring gas as the tight oil operators do its just irresponsible, bad business and it gives us less time to come up with a solution and transition into it.

“If you’re concerned about being off-topic you could move the discussion to the non-oil post.”

Yes i could if i would have that interest and believed it would be meaningful, now i choose to try to stay on topic and talk about oil in the oil thread of the oil blog.

“Am I correct in thinking that you are so confident that FF cannot be replaced that you feel that it’s not even worth discussion?”

I find the discussion very interesting and one that is very necessary for our future, im interested in such a discussion with people who actually wants to discuss it rather then preach and “win” an internet argument, i have no time or need to participate in that. But yes i dont think it can be replaced by solar and wind, but that is a discussion for another thread that is why i try to not post stuff like that here i wish you would do the same and not constantly try to drag every oil thread towards your favorite subject if you keep at it you might find yourself here with the only people left having the exact same opinion as you do makes for a poor discussion dont you think?

I was actually thinking about making a post on my own blog about my own solar installation and how it is looking economy wise after a full year of operation in Sweden, ill let you know if i do the post and you can explain to me what numbers i got wrong. 😀

Baggen,

You raised the topic of solar, and indicated fairly clearly your opinion about it’s value as an energy source. I think you can expect that people will respond to that. If you wish to only discuss oil, then…don’t give opinions about non-oil subjects, like solar.

I value and respect the oil industry. While I feel that consumers should move away from oil as quickly as possible, I don’t feel that oil producers should be disrespected in any way.

The only thing I would ask of oil producers is honesty: an acknowledgement that oil does have its downsides, which are now becoming much clearer than before and which require a new approach to energy. This is similar to, say, tobacco: I respect tobacco farmers and tobacco product manufacturers, and only ask that they be honest about the harm that tobacco can do to people’s health.

So. If people don’t want to talk about solar, etc., on the oily thread, that’s staying on topic. But if they “diss” them, they should expect pushback (and maybe a deletion from Dennis).

Hopefully respectful, thoughtful pushback: evidence based discussion which is intended to inform, rather than coerce anyone into thinking something or other. Hopefully an invitation to move over to the non-oily thread. But, one way or another I think a response is likely.

Because this stuff is important, and everyone will be better off if we’re all clear on what we’re dealing with.

If you want to reply, please go to the non-oil post, here:

http://peakoilbarrel.com/open-thread-non-petroleum-december-17-2020/#comment-712303

Nick,

“Baggen,

You raised the topic of solar, and indicated fairly clearly your opinion about it’s value as an energy source. I think you can expect that people will respond to that. If you wish to only discuss oil, then…don’t give opinions about non-oil subjects, like solar.”

I gave Dennis my opinion and feedback since he asked for it, and i have raised the same issue before he asked about it this time and stated my opinion (the same one) about the direction of the blog. And in my feedback yes the word “solar” existed yes, and i indicated the value i believe off topic posts about solar that add no value adds to the oil threads. It was no discussion, it was feedback to Dennis and as said it was about the low quality off topic posts with an agenda not a debate about the energy source.

Dennis now seems to have decided to try what i suggested some time ago, lets see if he follows trough and if it gets better. Perhaps its to late and then he will still have the option to mash everything together and see how that turns out.

Oh and as i said im not against that discussion i think its interesting if its done in the right spirit and ofc then also in another thread. For me its just as i have touched upon, will it be meaningful and interesting and if so do i have the time to spend on engaging in such a discussion.

Well, you were being obnoxious, insulting people whose opinions differ from yours, so it isn’t surprising you fail to find common ground.

The oil industry is in for a wild ride in the next couple of decades. “Same old same old” isn’t going to cut it.

You just cant see it,

You realized your post was off topic, you also realized it added no value at all. Yet you had had to post it, why is that you think? (retorical question)

Hi Dennis,

I remember why the Non-petroleum thread was created. There were many off-topic messages here.

I prefer having this thread focusing mainly on oil (and other fossil fuels), which is why this site has been created and why it is known and referred. The other thread could focus on let say discussions on other energies.

Note that it will be sometimes difficult to choose. For example, wind turbines increase the need for gas power plants. Or EV sales impact use of oil for transport.

To me, the comments should be somehow related to the initial post/article. As you mentioned, the best example is Islandboy posts.

Unless they impact the different energy sectors, Political or other discussions should not be part of this site.

Political or other discussions should not be part of this site.

Ah, if only that was possible. Unfortunately, regulation of “external” costs like pollution and national security can only be done by government: the private sector is captive to the pressures of competition, and has to work at the lowest common denominator. Voluntary efforts simply can’t work.

And, of course, Koch et al know this, and so have worked aggressively to cripple government. The current administration is doing it’s best to damage the professional bureaucracy, and cripple government and the basic functions of democracy.

Politics isn’t a “frill”, an optional thing to discuss in teahouses. It’s a basic, fundamental thing to our daily lives. Again, radical conservatives are trying to obscure that, and pretend that private wealth and power are the only things that matter. If we want a better world, we have to push back against that idea.

Dennis, Please keep it separate. The oil thread is about our predicament: sooner or later we will run out/short of oil. The other thread is about the would be/should be/could be/wanna be mitigations to that predicament. That is a discussion on another level.

I think that’s a reasonable perspective. In fact, one could think of the oily thread as about “supply”, and the non-oil thread as about “demand”.

The problem of course, is that the two things are related. If demand continues high, then oil prices will rise and production will be maximized (whatever that might turn out to be), while if demand is reduced by alternatives to oil then prices will be relatively lower and production will be lower than otherwise. So, it’s hard to separate discussions of supply from discussions of demand (and alternatives).

Still, one can try.

FWIW I find the current setup useful. I go to the petroleum threads to get facts and comment by oil folk on the true oil situation. In the non-petroleum thread I find the opinions expressed by oil folk help me get a broader understanding of where the oil folk are at, and to bounce thoughts off expert and non experts in oil matters alike. The two threads usefully compliment each other and allow the PeakOilBarrel community to function as the wonderful diverse thing it is.

The virus has reduced comments in all blogs. If you think the virus will remain a part of society for years to come then there will be fewer comments in all blogs for years to come. If the virus is going to disappear comment totals probably will return to what they were.

Dennis, I have earlier postulated that LTO production will fall drastically ( no ,not going to zero) because new drillings are not enough . Your response has been that there are DUC’s waiting in the wings to be fracked . Do you have any data or info on these DUC’s by Tier 1 , Tier2 and Tier 3 location ? In my opinion DUC’s are a narrative to keep the OPM flowing . Most will not be economical to pay for the fracking expenses involved .

Hole in head,

My understanding of your position was incorrect, I thought your expectation was that demand would never return to previous levels.

I do not have information on DUC locations, I imagine they are mostly in Tier one areas (say 80% or more of existing DUCs, but that’s a guess.) Even if we ignore DUCs (as Enno Peters does at shale profile for his supply projection and base future output on drilling rig count only we get tight oil falling from 6.5 Mb/d (Oct 2020) to 4.7 Mb/d fo Dec 2029 (assuming no future increase in rig count, this ignores DUCs) see link below from shaleprofile.com

https://public.tableau.com/shared/9BNQGC7QM?:display_count=y&:origin=viz_share_link&:embed=y

I imagine some DUCs will be completed (in tier one areas), some may never be completed (perhaps 20% of the DUC total).

My scenario assumes oil prices rise along with frac spreads and drilling rigs.

Frac spread count at link below

https://www.aogr.com/web-exclusives/us-frac-spread-count/2020

For week ending Dec 18 the count was 146, one year ago it was 333, and 6 months ago it was 78. My guess is that in 6 months (mid June 2021 the frac spread count will be between 200 and 300, and 550 to 600 tight wells will be competed for that frac spread level.

Tight oil scenario in chart

Dennis , no , you did not misunderstand my position . I repeat and confirm that we will never get to a demand level of pre Covid . Europe is FUBAR . Spain today executed a severe lockdown indefinitely . The communication said ” maybe extended to March 2021 ” . UK is “Alcatraz” . Channel trains ,trucks , flights ,ferries to and from Europe cancelled till further notice . This while Brexit talks are stuck . I have repeatedly said that the world is underestimating the economic damage Covid has done . Demand is gone . The new specter is stag inflation. As to LTO I am more in agreement with Art Berman who has given a much lower figure for total US production for June 2021 as compared to EIA .

I also stand by for my POV that DUC’s are now a narrative and have no real value . Currently the situation in LTO sector as I read is” merge not for size but to survive ” . The finances of the merged companies are not going to improve . 0+0=1 was never true . Time Warner+AOC+ CNN was a merger ” made in heaven” but turned crap . I can give you several other cases . You are terrific with data and with explaining it via graphs and tables but if the fundamental hypothesis is defective then the whole theorem and the conclusion thereof is defective . No offense intended .

Hole in head,

You are correct that if you are correct, you will be correct. I just think you are wrong. Just because things are bad now does not mean it will continue indefinitely, an assertion does not make it so.

In time we will see who is correct, my guess is that World real GDP will reach the 2019 level by 2022 (greater than 60% probability), perhaps 2023 at the latest (95 % probability) , I would put the probability that World real GDP is not above the 2019 level by 2025 at about 0.001%.

Earlier you seemed to be asserting that supply would remain low, that only occurs if oil prices fall as you have suggested (to $25/bo by 2025 for WTI as I recall, maybe in 2019$), that prediction will also be incorrect.

Yes, Dennis , these are forecasts . Tomorrow the sun will rise in the East and set in the West . Let all of us enjoy the good times till they last .

The new specter is stag inflation.

No sign of that so far. The general inflation rate is only 1.2%. Even if you subtract energy, the inflation rate is only 2.0%.

Nick , I have repeatedly said ” Just because it hasn’t happened to you ,does not mean it is not happening ” . In India the CPI is 7.5% , food price inflation is 11.8 % . Growth will be negative 10.8 % at the end of the year , unemployment figures are not being released by the govt because they are terrible . Low estimate is 400 million unemployed , high estimate is 600 million . As to US inflation figures they are calculated by BLS ( Bureau of Lies and S***) , I would not even take them with a pinch of salt , they are so manipulated and contaminated . BLS always underestimates inflation because it is linked with COLA (Cost Of Living Adjustment) whereby govt salaries and pensions increase if the inflation is high . The lesser said the better on how inflation is calculated in USA .

You forgot to mention that India GDP growth will be around 8% in this upcoming year.

Cheers.

Hickory , who said that ? The bums at IMF . Let us do simple arithmetic . 2020 will end at

negative 10.8 % so to grow at 8 % in 2021, India will have to grow by 18.8 % . No country in the world in human history has achieved this , not even China . QED .

H in H. thats not how it works. They won’t be back above pre-covid base until sometime in 2022.

Hicks , you know nothing about India . Do you know that 250 million went on a general strike on 15 th December shutting the country down . Are you aware that there are as of now 1.2 million farmers who have sieged New Delhi ? This has been billed the largest protest in the history of the world . Only food and essential services allowed in and out for a population of 12 million . They have threatened to cut off food supplies if there demands are not met . Who said this ” There are only nine meals between mankind and anarchy ” ? Do you know that government is now paying salaries by rotation , one month policemen, next month doctors and nurses , then the month after the garbage pickers . The federal govt is broke . The country is in deep DODO . Whosoever says 2022 is talking bullshit . My current POV is a collapse by June/July 2021 when the treasury runs out of cash .

P.S : On what I have stated you can google or go on Youtube .

Hole in Head,

What’s happening in India is the global monetary system starting to unravel. The 2016 demonetisation of the 500 and 1000 notes foreshadowed the current crisis.

The coup by the military in Mali earlier this year came about as the military were either on subsistence wages or weren’t being paid at all.

Chinese state owned companies are defaulting on their bonds. The dominoes are starting to fall. It won’t be long before it reaches our shores.

Some information on DUCS here: https://www.rystadenergy.com/newsevents/news/press-releases/duc-well-inventory-sufficient-to-support-us-fracking-deep-into-2021-280-300-rigs-needed-afterwards/.

Schinzy , many thanks . Rystad to me has now started to piss in the wind . Just writing for the sake of writing . Just picked this from the blog of Mike S ( he wears jeans worn at the knees and butt ) . Learning all the time .

https://www.oilystuffblog.com/single-post/us-proven-oil-reserves-to-production-ratio?postId=5fc3e2641e9c040017188dbd

Schinzy, the article confirms what I thought ,which is there is only smoke and mirrors . All hat no cattle ( I think it is a quote in Texas ).

Learning all the time for some laughs . The great Benny Hill .

https://www.youtube.com/watch?v=Yw2ADNb8T60&ab_channel=gsom7

Hole in Head,

Mike Shellman can’t seem to understand U.S. oil exports helps create the global market which underpins the value of the U.S. dollar.

If the numbers he cites are correct, world governments will soon announce an energy crisis.

Since the US has been the world’s biggest net importer of oil since the fifties, it’s a bit hard to see your point. Or maybe you mean since September 2019?

If the US wants to be a big exporter, it should tax fuel at the pump to reduce waste. This would cut imports, increasing net exports. but I’m not holding my breath.

Hume , most of the US public has the same misunderstanding . The US is an exporter of finished petroleum products but a net importer of crude oil . LTO exports are miniscule . The value of the dollar is underpinned by the US agreement with KSA to use the USD as the sole currency for crude oil sales and by military force .

The value of the dollar is underpinned by the US agreement with KSA to use the USD as the sole currency for crude oil sales

AFAIK, the real agreement in 1973 between Nixon and the KSA king was for KSA to invest it’s net earnings in US banks. Nixon was concerned that the sudden increase in oil earnings, and the resulting imbalance in trade between the two countries, would cause currency problems.

Right now KSA is drawing down it’s savings, and US oil imports are much lower, relatively. KSA pricing oil in dollars means little: it’s just a price – remember, you can accept any currency you want and turn around and exchange it for other currencies in the press of a keyboard.

Thanks Schinzy, good piece.

Thanks all for the feedback.

Again picked up from the blog of Mike S . OPM is drying up for LTO.

https://www.nasdaq.com/articles/debt-market-runs-dry-for-us-shale-revolution-2020-12-11

The music is playing but the party is over .

Hole in head,

The article says the money is drying up for the small players, the big names still have access to capital, the small well run oil companies finance out of cash flow. Those that rely on debt will fail and many of them are indeed filing bankruptcy paperwork. There are also a number of mergers between large and mid-size companies.

The world is swimming in capital currently. Any substantial businesses with good prospects can get funding, at very low rates.

The key part of that statement is -“good prospects”.

If the industry prospects become more favorable, money will flow to those with history of good management and assets.

DUC’s are red herrings .

https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/121420-total-us-shale-production-projected-to-fall-in-january-as-ducs-decline-eia

Tight oil data out for November 2020.

Output was 7031 kb/d down 61 kb/d from October and down 1266 kb/d from Nov 2019.

Output has been flat from July to November with output ranging from 7045 kb/d in July to a high of 7145 kb/d in September and then down to 7031 kb/d in Nov. The average output over the past 5 months has been 7072 kb/d. My latest tight oil scenario has output at 6969 kb/d in Nov 2020 and output falls to 6666 kb/d in June 2021, to 6660 kb/d for July 2021 and then output starts to increase.

Shale profile projection assuming rig count is unchanged from the Nov 2020 level, see link below

https://public.tableau.com/shared/SMNNBQS3C?:display_count=y&:origin=viz_share_link&:embed=y

Note that for Nov 2020 the shaleprofile tight oil supply projection has US tight oil at 6432 kb/d, EIA estimates 7031 kb/d for Nov 2020 US tight oil output. The shale profile model seems to be running low by about 600 kb/d as of Nov 2020, some of this may be due to a higher proportion of completions from DUCs relative to the model estimate.

Click on chart for larger view.

Another blow for the Gulf and super majors today:

‘SHELL RAISES IMPAIRMENT CHARGES BY UP TO $4.5bn … These included the partial impairment of its Appomattox project in the US Gulf of Mexico due to “subsurface updates”. Appomattox lies about 80 miles off the coast of Louisiana, extracting oil and gas from beneath the seabed in water depths of about 7,400 feet. The project started producing in May 2019 and is Shell’s largest floating platform in the Gulf of Mexico, due to produce the equivalent of 175,000 barrels of oil per day at peak. Biraj Borkhataria, of RBC Capital Markets, said: “Given this is set to be one of Shell’s largest producing deepwater assets, this is particularly disappointing.” ‘

From The Times, so behind a paywall.

Thanks George,

This is indeed disappointing. Appomattox is the first Norphlet oil production (Jurassic in age) in the GOM, and was expected to be a big long term producer. Not sure from above how severe the impairment from Appomattox is. Appomattox is the main field, with at least one other tieback planned, called Vicksburg. I’m sure low oil prices aren’t helping Shell out, but there is also a subsurface component here. I wonder what in the subsurface is driving this – from what I’ve seen, there is more reservoir variability than you might suspect from a first glance at the well logs. Also, I think water injection support is needed, and at these reservoir depths, temperatures and pressures, successful water injection is not a given.

The other Norphlet project that is being discussed is Chevron’s Ballymore, 30 or so miles to the south of Appomattox. Be interesting to see what Chevron does with this news.

Impairment sounds like a euphemism for something more dire.

The future of the oil industry is probably going to be as much influenced by politics and electrified transportation as by geology for the next decade or two.

Given that some of the people actually IN the oil biz don’t like political stuff in this thread, I’m just going to post a link I think they ought to read, and ask anybody and everybody to put any responses in the open topic thread.

https://getpocket.com/explore/item/how-venezuela-struck-it-poor?utm_source=pocket-newtab

Hi All,

I have decided to leave things as they are (that is the Non-petrol thread will continue), at some point I may start deleting comments that are off topic, keep in mind responses to off topic stuff will end up getting deleted automatically so just don’t respond to off topic posts. If it is worth responding to you can copy and paste the comment to the non-petroleum thread and maybe note that. I will not do that, I will simply delete along with all responses to the original off topic comment.

Subsurface impairment. Announced now, in a year when the virus has destroyed activity. So the question would be, with no activity going on how did they conduct whatever studies were conducted to declare that this impairment is called for?

Well performance,, the wells at Appomattox have been on line long enough for Shell to know whether they are performing as expected – reservoir pressures holding up as expected, achieving expected rates,, etc.

I’ve been following Appomattox’s monthly oil production, and it has not been as high as I would have expected,, but, I also know that often operators will slowly bring on fields/ramp up wells in order to get as much reservoir information as possible. I was thinking that was the case here, but, apparently not.

They will have already appraised the field enough to roughly know the footprint of the accumulation, so I don’t think the subsurface impairment is an original-oil-in-place thing, but I think it is a well performance thing. (A related common culprit is connectivity – the reservoir is not as connected as expected, so the drainage areas for the wells are smaller than expected, resulting more rapid pressure decline, less rate, and less EUR per well than expected. In this case, the reservoir is either more faulted, or more stratigraphically complex, than thought).

Sometimes this means they will still be able to achieve the expected field EUR, but will need to drill more wells – not sure if that is the case here or not.

As I suggested above a few comments, the impairment may also be due to ineffective water injection performance. From what I have seen regarding the Norphlet subsurface (not just Appomattox, but the entire play area), I would expect the need for water injection because of limited aquifer size. I would think, though, it is too early to tell whether poor water injection performance is the culprit.

Southlageo,

“Sometimes this means they will still be able to achieve the expected field EUR, but will need to drill more wells”

Not being an oil man please forgive what may be a naive query in advance. Does Shell or any other producer have to write down an oil field before they’ve had time to rectify the situation?

Hume,

That’s a good question, and an oil field finance or reserves person would be able to provide a better answer than me. I’ve never worked the nuts and bolts of a reserve write-down. But that won’t stop me from taking a stab at it.

To answer your second comment — there are “signposts” including field production performance and oil price forecasts a prudent operator will be looking for to see if a write-down is warranted.

Taking a big enough field wide reserve write-down to warrant a press release is a big deal (now Appomattox is a big deal, so it makes sense Shell would do this). That means that Shell not only thinks they will not achieve their “most-likely” EUR, but will not even economically achieve their P1 EUR ( In order to be classified as P1 reserves, a company has to be very confident they will produce those reserves,, like 90% confident). But, what complicates things is there is also an economic producibility component here. So, when Shell looks at their price forecasts, they may believe that some of their P1 reserves are not economic (again, not necessarily that they can not produce the reserves, but they cannot economically produce the reserves).

If the write-down has this economic component to it — if oil prices go above Shell’s forecasts, they could put these reserves back on their books. But,, if the write-down is due to solely to subsurface issues, then they likely will not put these reserves back on their books.

To address this comment – “Sometimes this means they will still be able to achieve the expected field EUR, but will need to drill more wells”.

If the subsurface component behind the write-down is because of more compartmentalization than expected, then, you may just need to drill more wells to got the expected EUR – for example, if you thought the field had 5 fault blocks that could be adequately drained by 5 wells, and, after well performance and new seismic, you convince yourself the field has 10 compartments, you can maybe achieve your expected EUR by drilling 5 more wells into the newly identified fault blocks.

Thanks SouthLaGeo for all the great info.

Thank you Mr. Kaplan for bringing up the subject.

SLG – I think the Appomattox wells are not performing very well. There may be a bit of recent effects from hurricanes but overall the two wells in black have been complete failures, the three in green have shown rapid decline (maybe from choking) and the two in red look to be no better than meh. Not my field but looks like sand is most likely to be the culprit. I remember BP pulled out of a couple of leases with large OIP estimates because of sand issues (inter alia). Could be something to do with oil chemistry, but they could probably fix that, or reservoir quality in some other way. It’s not water as none has shown. All leases have at least one well. There are some other possible small fields that could be tied in – Rydberg, Shiloh, Gettysburg, others? – but presumably they are all similar reservoirs.

Mr Kaplan and SLG thanks for your input on GOM . Terrific work as usual . Confirms my POV that oil will be left underground because it is not worthwhile the effort in money or otherwise to bring it online . Many such impairments will be coming in the near future .

This is good stuff, George.

A tedious question – The BSEE data I am familiar with shows both “monthly production per well”, and “days on production per well”,, so, when you plot as above the daily production per well, I assume you are dividing “monthly production per well” by “days on production per well”,, correct? You are not plotting “monthly production per well” divided by the number of days in the month? If so, then one cannot just add the monthly production per well for all the wells on your plot to get the field’s average daily production for the month,,,

I believe Thunderhorse is the BP field you are referring to above. BP has corrected that early sand production problem – I think with different well completion processes. I agree that sand could be part of the problem. Appomattox is the first deepwater Norphlet field, so there is a steep learning curve here for Shell.

Well, looking at year end stuff.

2020 will be our worst financial year in upstream oil production since 1998. The first two months of 2020 plus this uptick at the end was enough to overcome horrible March, April, May etc.

WTI is going to average the lowest since 2003 or 2004.

Thankfully grain prices have rocketed higher. Very strong basis too.

I’m thinking if the pandemic is taken care of by the vaccine, things could get better.

Hi shallow sand,

I asked a question earlier. Maybe you missed it.

http://peakoilbarrel.com/opec-momr-november-2020/#comment-712181

Basically the question is when oil prices rise over time (say at 7.5% annually), how much would you estimate that your lifting costs would rise (in annual percentage terms)?

Does roughly 4% per year (in nominal terms, not adjusted for inflation) sound about right?

I found data on US lifting costs at link below (excel spreadsheet)

https://www.eia.gov/finance/archive/frsdata/T-18.xlsx

I compared with real lifting with real annual oil prices from 1994 to 2004 (a period when real oil prices rose at about 5%/year and lifting costs rose by 1.5% per year) to convert to nominal prices and lifting costs I simply assumed an inflation rate of 2.5%/year.

looked more closely at the data and it may be that those costs are for combined oil and natural gas lifting costs so it might not give the correlation between costs and oil prices I had hoped for.

More data at page below

https://www.eia.gov/finance/data.php

WTI and Brent Crude were down as much as 4.5% yesterday on news of fresh global lockdowns. Today both are up, having regained most of their losses. Goldman Sachs sees $65 a barrel Brent in the third quarter of 2021.

Supply must be very tight for both indexes to rally so quickly.

Hume, nothing like that . On 22nd the price went down because of inventory buildup and new lockdowns Europe.

https://www.zerohedge.com/energy/wti-extends-losses-after-surprise-crude-build-0

and 0n 23rd price went up with the stimulus news and further trashing of the dollar . There is still a lot of surplus stocks around . Demand is still lackluster worldwide . Traders are known “to sell the news and buy the rumor”.

Hole in Head,

China and India are nearly back to pre-covid of energy demand. Some provinces in China are having to implement two and three day weeks since there’s no electricity as a result of China’s stance on importing Australian coal.

The oil futures market is backwardated. Meaning current prices are trading higher than the futures price. Global demand is forcing those prices higher.

Hume , posted on 16th Dec on the last post .

“Sales increased in Oct /Nov because of festive season and are again faltering . 15 days of December data is in .

https://energy.economictimes.indiatimes.com/news/oil-and-gas/indias-dec-1-15-diesel-sales-down-5-2-per-cent-shows-data/79757066

Some more info , petrol bounced because public transportation is subject to Covid 1.5 metre distancing . No alternative but to to use own car . Employers financed scooters and motorcycles for employees so that they turn up for work on time so no excuses and avoid crowded places . Airline fuel sales are down by 46% . As to diesel I have already clarified on that . No, India is not back .

As to China , the info I have is that China is stockpiling it’s SPR . Why ? China is engaged in a warlike situation on three fronts , the India-China border , South China sea and Taiwan . It has learnt from history what led to the defeat of Germany and Japan . US has announced China as enemy no ; 1 . China is not going to be caught flatfooted . As to coal , this is a political decision (more to hurt Australia) and not based on economics . However my POV is that China cannot continue production of goods when there is no demand worldwide . This gives the CCP a convenient way of explaining why GDP fell in this quarter .

“New Mexico’s State Land Office is putting an end to the commercial sale of freshwater for oil and gas developments to protect the state’s scarce freshwater resources. Effective Dec. 15, 2020, the State Land Office will not issue any new easements for commercial sales of fresh water for oil and gas development. It will no longer re-issue or renew existing easements for such use once they expire.”

Hume, upthread you included a statement on oil demand-

“…peak fossil fuel demand. To my mind peak demand is a fallacy for the reasons I stated.”

On this, we have an overlapping level of agreement.

I don’t see it quite the same as you however.

When we look at transportation (which accounts for about 70% of crude oil demand) I don’t think we are going to see peak mileage demand for many decades, until human population begins a very slow decline later in this century.

Yet, over this decade we will see the beginning of a technology shift where mileage can (and will) be traveled under petrol power- or electric power. The absolute ownership of this energy sector by oil will gradually shift to a shared scenario. By the end of this decade that energy source mix for transportation will be obvious to all, and it will no longer be ‘new’ news. Many people here seem to be unaware just how very strong this emerging economic/technologic transition wave is.

We may not be at peak crude oil demand yet ( I don’t think we are), but we are not far from the peak of it.

On the other hand, I don’t think we are anywhere close to peak natural gas demand/production.

Decades away from that peak.

Hicks , peak demand or peak supply ? What is the issue , I fail to understand ? Both are cheeks of the same bottom . — George Galloway British MP 🙂

P.S ; He used this in his testimony to the joint house for Republicans and Democrats when he was summoned for an Iraq war inquiry .

The point being discussed was not distinguishing between demand vs supply- it was about peak of energy levels that the global economy actually produces/consumes, and the sources that the energy comes from.

Hicks , we are now peak civilisation . You can fine tune all you want , peak demand , peak supply, peak consumption , peak production . It is a one way street .

Add me to the list Hole in Head.

Enjoy yourself.

Steve D Angelo has a post which is not behind the paywall . Interesting read .

https://srsroccoreport.com/the-collapse-of-u-s-shale-oil-production-has-now-begun/

Hole in Head,

Steve is more bearish on oil production than Art appears to be. I wonder if we could chart how energy intensive sectors of the economy would perform on lower oil supply. Which industries would cease to exist if U.S. production were 5 million barrels a day?

Hume . I wish I could give you an answer , but I am unable to . I am a great fan of David Korocwitz , Joseph Tainter, Naseem Taleb who have written a lot about the collapse of complex systems . That is what our lifestyle is now, two components, complexity + connectivity = Industrial civilisation . Both the components need nett surplus energy and that is where we have hit the wall . When did Shell discover that drilling and pumping in GOM was not worthwhile ? There is still oil there in GOM but they decide leave it there and take a hit of $4.5 billion . When did Exxon discover that $ 20 billion of their assets were crap ? So your question what sectors will cease to exist when US production goes down to 5 MOPD , my answer is” it is going to be a case of discovery” by natural means . On TOD was a poster whose write off line was ” Did you grab your bag of NPK ” . What he meant was did you grab your bag of fertiliser (Nitrogen, Phosphorus , Potash) . Why I bring this up is that he wrote that in relation to Liebig’s law of the minimum . Fertiliser is 80% Nitrogen , 15% phosphorus and 5 % Potash , but it is not possible to increase Nitrogen to 85 % or phosphorus to 20 % if you don’t have Potash . So, no Potash = no fertilser = no food . I have given this example earlier also ” The human body is 80% water . How much water do you have to loose to die ? Answer 20 % . Why ? Because at that level of dehydration your kidneys will fail and you will die . The hospital will list it as death by kidney failure and actually it was death by dehydration . ” This is from my personal experience when I had cholera . Covid has fired the first bombshell on industrial civilisation . The immediate fatalities are travel ,tourism and hospitality sectors . The collateral damage done by these fatalities is currently papered over by wild money printing , so what total damage has exactly been done to the full system is unknown . What will be the next sectors ( talking about US only ) to go down, my guess is education and healthcare . Two common quotes are ” The chain is as strong as it’s weakest link ” and ” A small hole can sink a big ship ” . I guess we are in the process of now discovering where the weakest link is and where the hole is . This is the best I can say .

Useful to note that US Government debt is at about 23.5 trillion right now. Stimulus did not seem to do much for tax revenue. Nor will it since stimulus checks of whatever magnitude are not taxable.

Rather a lot more significant than this, and make no mistake here, debt-to-gdp well over 100% is indeed significant, the federal reserve’s balance sheet has risen from less than 1 trillion in 2007 to about 7.5 trillion now, and almost half of that in 2020.

Inflation, which about 40 years ago everyone would have told us would be 30% per year with numbers like I just mentioned, is struggling to get to 2%. Oil is a pretty big part of that. It’s never focused on in discussions of inflation because the CPI is very well-designed. The CPI profiles what percentage of a typical consumers budget is represented by various categories and then measures the increase in price of those categories. Most of those categories have to be shipped, and if the price of shipping declines, then so will the price of that category. Oil and gasoline are categories in themselves, but their impact on other categories is generally neglected.

Regardless, prices ain’t going up. And as long as they do not, that debt does not inflate away.

My first thought after reading this comment is why was it posted on the oily side.

Second thought was why would anyone believe the expansion of the balance sheet be more significant than the expansion of debt.

Third, the supply of labor and resources versus demand is what drives inflation.