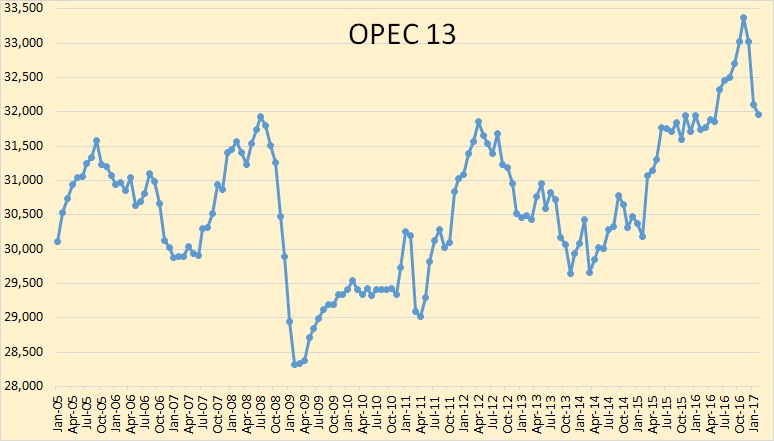

The new January OPEC Monthly Oil Market Report is out with crude only production numbers for February 2017. All charts are in thousand barrels per day.

All data below is in thousand barrels per day and is through February 2017.

OPEC crude oil production dropped to 31,958,000 bpd in January. That was a drop of 140,000 bpd. In January OPEC production dropped 930,000 bpd for a two month total of 1,070,000 bpd.

Officially OPEC agreed to cut production by 1.2 million barrels per day beginning in January. So they are getting close.

OPEC’s November production of 33,374,000 represented an all time high for the Cartel.