A Guest Post by George Kaplan

Production History and Reserves

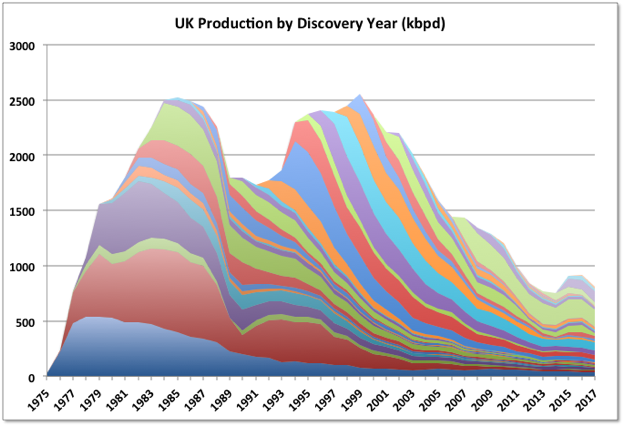

UK oil production peaked in 1999. The peak was probably pushed out a couple of years because of the major production interruptions following the Piper Alpha disaster. Production declined quickly until around 2011, then the high oil price allowed more brownfield and then greenfield developments that created a third local peak in 2016. Production is declining again this year but there are several large projects due that will create another peak in 2018 or 2019 (nearly equal to the 2016 one). After that terminal decline is likely. The chart below shows C&C production split according to the year of first production of the field.

Like all such all diagrams, this shows that the largest fields were developed first and declined the slowest. Read More