You can continue with relevant comments at “Carrying Capacity, Overshoot and Species Extinction” but all other comments not related to oil or natural gas on this thread please.

Category: Uncategorized

Non-OPEC Mid-size Oil Producers

A Guest Post by George Kaplan

This post covers recent C&C production and future prospects, with a bit on gas, for several mid-size non-OPEC producers. A few have been omitted (e.g. Canada, Kazakhstan, Egypt, UK) for no particular reasons other than lack of time or anything much to say, but may be covered in the future. Many of the countries here have held a bumpy plateau over the last twelve to eighteen months. For most this has come after a period of decline, and some are showing signs that decline might be starting again. Brazil has been on a plateau after a period of increase, and may be about to renew that growth. There is a general theme that oil discoveries and developments are drying up and most of the countries are looking more to gas, but with the current gas glut looking like it might end up worse than the 2014/15 oil glut that strategy may prove difficult in the near term.

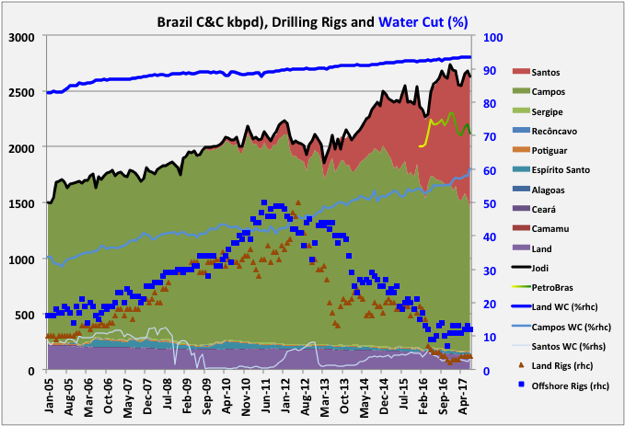

Brazil

Brazil production peaked in March and has been on a plateau since (data below is through July, there should have been an August update but ANP aren’t very consistent in release dates). They have had several large FPSOs offline for maintenance (generally their FPSOs don’t have the best availability and they have had recent common mode failure issues with the high pressure gas risers, though I don’t know if this is a direct cause of the recent turnarounds). The Campos fields’ average water cut seems to be accelerating, which might also be contributing to a plateau rather than allowing a new peak.

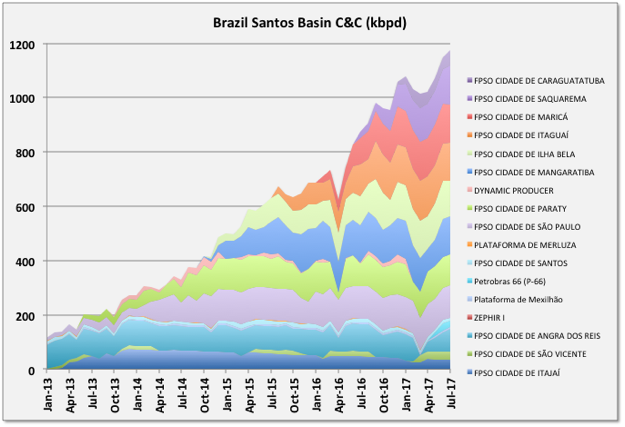

All the new production growth is coming from the Santos basin. PetroBras production contributes about 82% to the total, but gradually falling as the new Santos production is partly foreign owned, e.g. by Shell – one reason they bought BG, and may fall faster now as PetroBras are trying to divest older fields. Their figures come out quicker than ANP and they report a new record in August, but falling slightly in September and October. They have bought the Libra extended test production on-line this month which will add production, and give some indication of future expectations.

There are ten new, large FPSOs due through 2021, and a couple of others possible, which would altogether add about 1.5 mmbpd extra nameplate. However the overall decline rate now indicates they need about three major new projects per year just to maintain plateau, and if the Campos FPSOs’ performance is repeated then the earliest Santos facilities should start to decline this year or next, and can go quite quickly.

Carrying Capacity, Overshoot and Species Extinction

Notice: Please limit your comments below to the subject matter of this post only. There is a petroleum post above this one for all petroleum and natural gas posts and a non-petroleum post below this one for comments on all other matters.

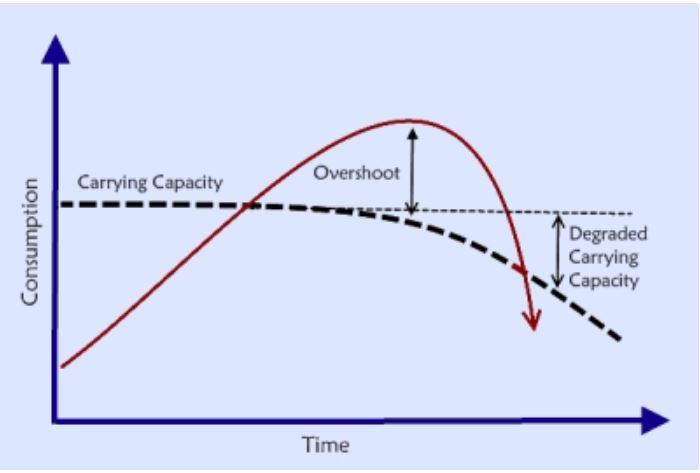

First, let us define carrying capacity and overshoot. And none has done that better than Paul Chefurka.

Carrying Capacity: Carrying capacity is a well-known ecological term that has an obvious and fairly intuitive meaning: “the maximum population size of a species that the environment can sustain indefinitely, given the food, habitat, water and other necessities available in the environment”. Unfortunately, that definition becomes more nebulous the closer you look at it – especially when we start talking about the planetary carrying capacity for humans. Ecologists claim that our numbers have already surpassed the carrying capacity of the planet, while others (notably economists and politicians…) claim we are nowhere near it yet!

Overshoot: When a population surpasses its carrying capacity it enters a condition known as overshoot. Because carrying capacity is defined as the maximum population that an environment can maintain indefinitely, overshoot must by definition be temporary. Populations always decline to (or below) the carrying capacity. How long they stay in overshoot depends on how many stored resources there are to support their inflated numbers. Resources may be food, but they may also be any resource that helps maintain their numbers. For humans one of the primary resources is energy, whether it is tapped as flows (sunlight, wind, biomass) or stocks (coal, oil, gas, uranium etc.). A species usually enters overshoot when it taps a particularly rich but exhaustible stock of a resource. Like oil, for instance…

Open Thread Non-Petroleum, November 29, 2017

Comment not related to Oil and/or Natural Gas in this thread please.

Thanks.

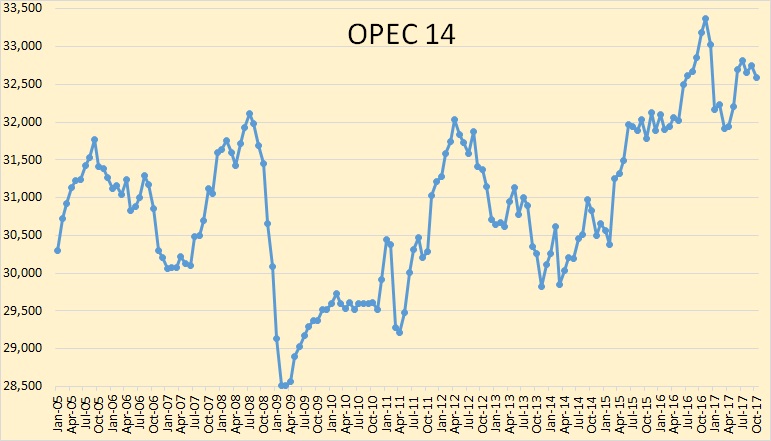

OPEC October Production Data

All data below is based on the latest OPEC Monthly Oil Market Report.

All data is through October 2017 and is in thousand barrels per day.

I have now included Equatorial Guneia although I only have data from January 2015 from OPEC’s secondary sources. The January 2015 E. Guneia data was extended back to January 2005. I know this is inaccurate but production from E. Guneia is so small it will make little difference.