A Guest Post by George Kaplan

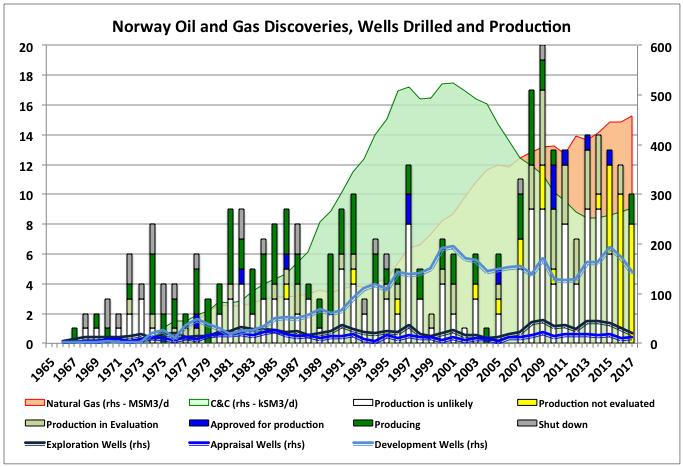

Short-term trends for UK oil and gas production and, to a lesser extent, Norway can be rendered a bit meaningless by seasonal impacts from summer maintenance turn-arounds and cyclic gas demand. Overall, though, both are at or approaching the tail end of the production curve, but with slight upticks in the nearer term. Barring several large and unlikely new discoveries over the coming years the industry will continue winding down in both countries, with the UK ahead of Norway, and exploration and development leading operations and finally decommissioning. However some Norwegian gas production still has a multi-decade plateau to come and there are a couple of large oil projects due on-line in each country which will run for twenty to thirty years.