Please place all comments not related to gas or oil here.

Category: Uncategorized

Open Thread, June 28, 2018

General discussion here.

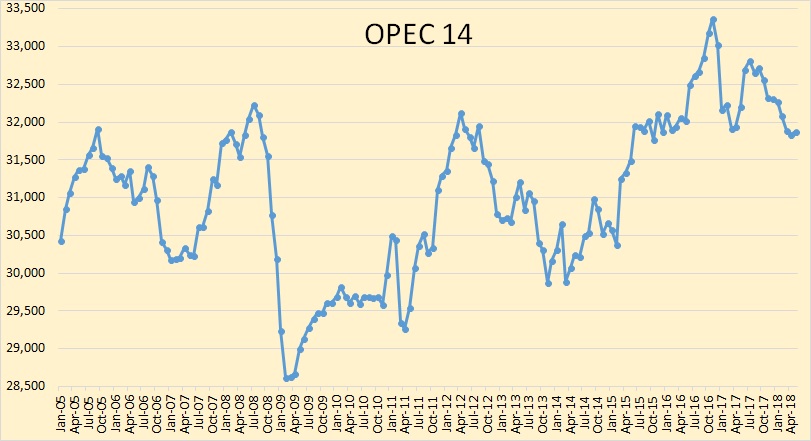

OPEC May Oil Production

All OPEC data below is from the OPEC Monthly Oil Market Report. All OPEC data is in thousand barrels per day and is through May 2018.

OPEC 14 Crude oil production was up 35,000 barrels per day but that was after March production had been revised down by 32,000 bpd and April production was revised down by 89,000 bpd.

Open Thread Non-Petroleum, June 12, 2018

Comments not related to oil and gas go in this thread please.

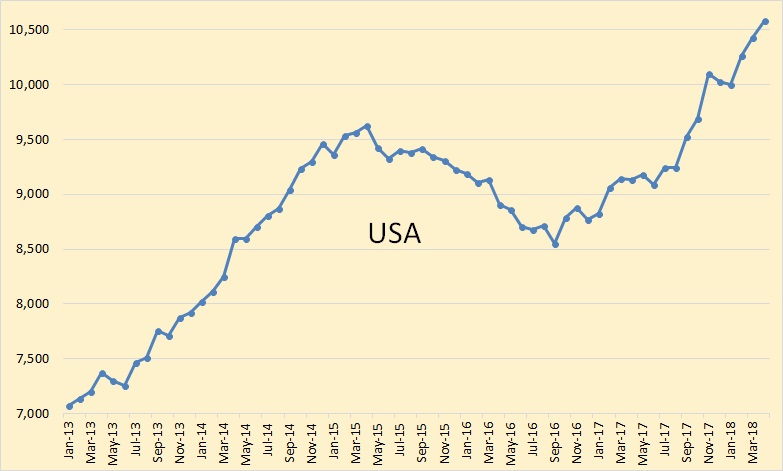

USA and World Oil Production

All data below is from various sources. All US data is from the EIA. Unless otherwise noted is in thousand barrels per day.

US C+C production through April, 2018. For the last 8 months, the average increase in US production has been 168,000 bpd. Most of this has come from the Permian.