Evolution is all about a struggle for survival and reproduction. For predators it becomes an arms race. For hundreds of millions of years predatory animals have honed their offensive weapons while prey animals have evolved ever more effective defensive adaptations. Each animal, predator or prey, carved out their particular niche and occupied that niche until they were driven out, to another niche, or went extinct, or still occupy it today.

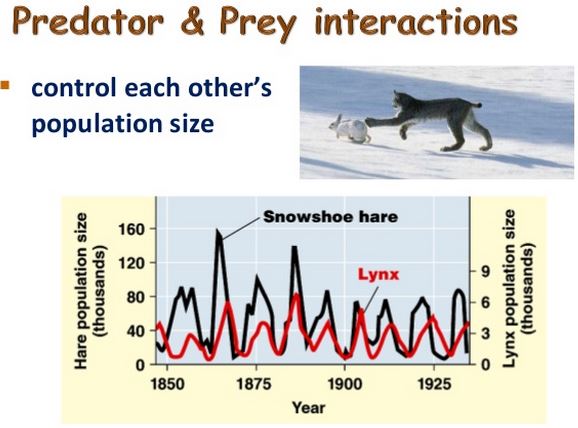

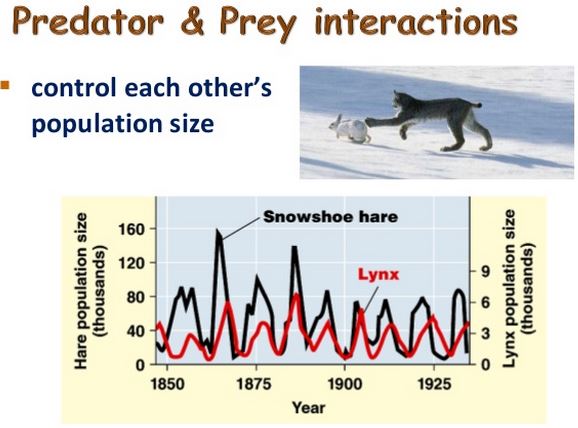

And that’s the way it went for hundreds of millions of years. Every species multiplying its numbers to the limit its niche or habit would support. Species waxed and waned, predator and prey maintaining a balance. When the prey numbers would expand the predator numbers would expand and when too many predators reduced prey numbers, then the predator numbers would also wane.

For millions of years nature kept every species in check. Population explosions of any species was soon met by either an corresponding explosion of predatory animals, or in cases were there were not enough predator animals, like rat or mice plagues, starvation would ultimately reduce their numbers to what the territory would support.

Read More