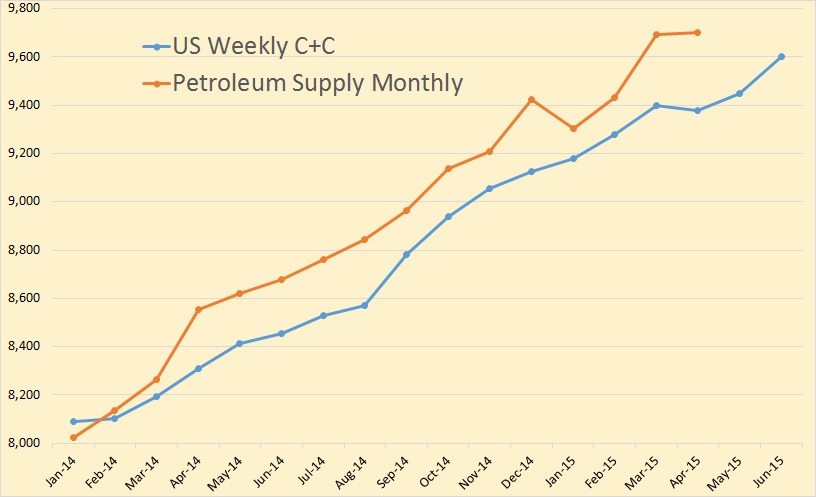

The EIA’s, on June 30th, published its Petroleum Supply Monthly. I Think their numbers are just way too high. I compared them with the EIA’s Weekly Petroleum Status Report. The chart below shows the Results.

I averaged the weekly numbers and converted them to monthly data. They were pretty close for the first three months of 2014 but then they begin to diverge. Of course they were much closer earlier but in the Petroleum Supply Monthly has, over several months, been revised upward. The Weekly Petroleum Status Report is never revised.

In April, the Petroleum Supply Monthly shows US C+C production 322,000 barrels per day above the weekly average of the Weekly Petroleum Status Report.