Non-Petroleum topics here please. Thanks.

Category: Uncategorized

Texas Oil and Natural Gas Update- Sept 2016

Dean has provided his monthly update for Texas Oil and Natural Gas. The most recent month’s estimate is often volatile and may be ignored, the June and May estimates are likely pretty good (within 1% and 2%), the April 2016 estimate is likely to be robust(within 1% of the final value). The June EIA estimate is 240 kb/d lower than Dean’s estimate (about 7% too low). Read More

Open Thread Non-Petroleum- Sept 26,2016

Please post topics not directly related to oil and natural gas here.

Mexico, China and Beyond

This is a guest post by David Archibald. The opinions expressed in this post do not necessarily represent those of Dennis Coyne or Ron Patterson

Mexico, China and Beyond

Ron Patterson’s post asking if China’s oil production has peaked reminded me of Mexico

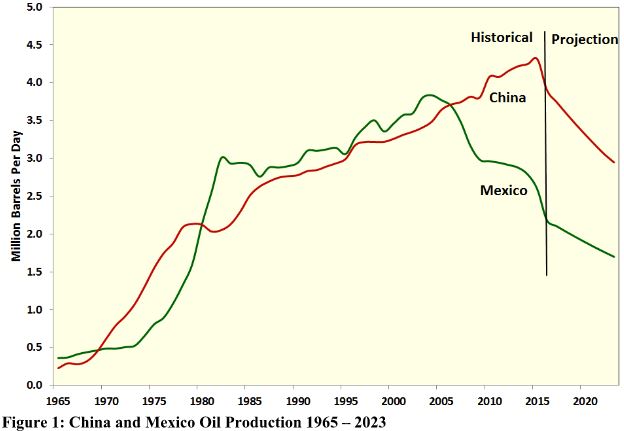

which also produces mainly from supergiant fields. Mexico’s oil production peaked in 2004 and has averaged a 3.5 percent per annum decline rate since, with a peak yearly decline rate of 9 percent in 2008. China’s oil production has fallen 10% from its peak in 2015. Part of that is oil price-related as the Daqing oil field has an operating cost of $46 per barrel and could reverse as the oil price rises. The comparison of China and Mexico with a projection to 2023 is shown in the following figure:

Open Thread- Non-Petroleum- Sept 20, 2016

Comments not related to Oil or natural gas should be posted here.