Dean Fantazzini has provided his latest estimates for Texas Oil and Natural Gas output.

Comments not related to oil or natural gas in this thread please.

Comments not related to oil or natural gas in this thread please.

Non-Petroleum comments in this thread please.

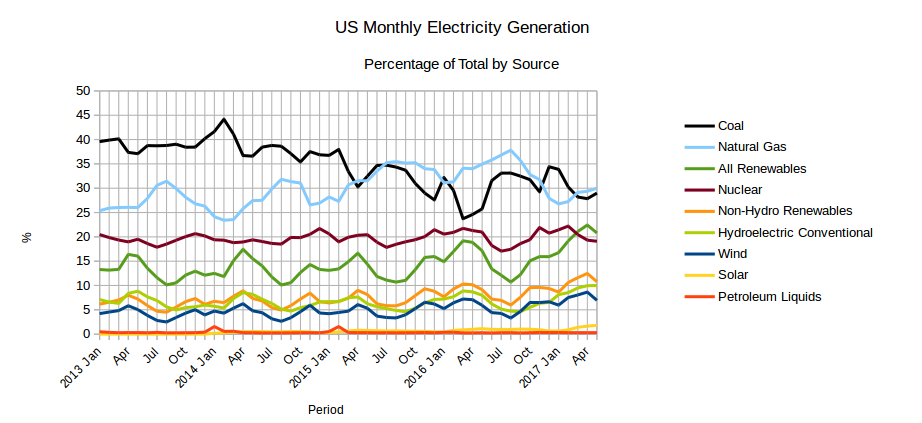

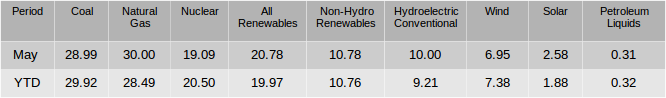

The EIA released the latest edition of their Electric Power Monthly on July 25th, with data for May 2017. The April data was revised and re-released after the last report was prepared so some figures from this report may not be consistent with those from the previous report. Read More

Comments not related to oil and natural gas in this thread please.