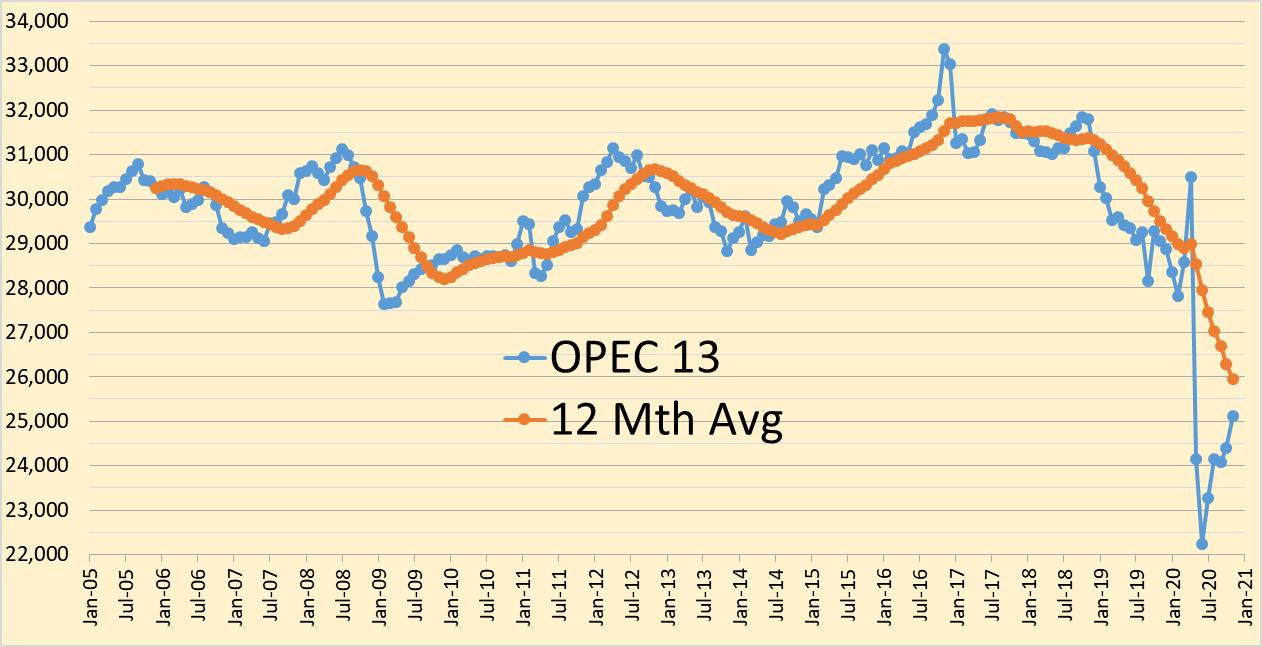

This update reports data from the Monthly Oil Market Report (MOMR) published by OPEC on December 14, 2020. The latest data point in each chart presented is November 2020 and output is thousands of barrels per day (kb/d).

OPEC output in October was revised 14 kb/d higher than reported in the October MOMR to 24,402 kb/d. November 2020 OPEC output increased by 707 kb/d to 25,109 kb/d.

Read More