The recent price crash in crude oil, if it lasts for any length of time, will certainly affect oil production. The question is, just how great an effect will it have an how soon? But in this post I want to concentrate on what is, or was, happening to world oil production even before the price crash.

Russia, the largest producer of crude oil in the world, will peak in 2014. There are various estimates of how fast their production will decline but best case, for Russia, puts their decline at about 2% per year. They say they are depending on the Bazhenov Shale and Arctic offshore just to keep production flat in 2015. Well that is not going to happen, not in the next few years anyway. And if prices stay in the current range it is unlikely to ever happen.

OPEC is a wild card but there is little doubt that they are producing flat out right now. Only Iran has any real any real chance of increasing production very much and that only if sanctions are lifted. Libya has already increased production significantly and could increase more but very little. With the violence still going on in Libya, there is a greater chance that their production will decline.

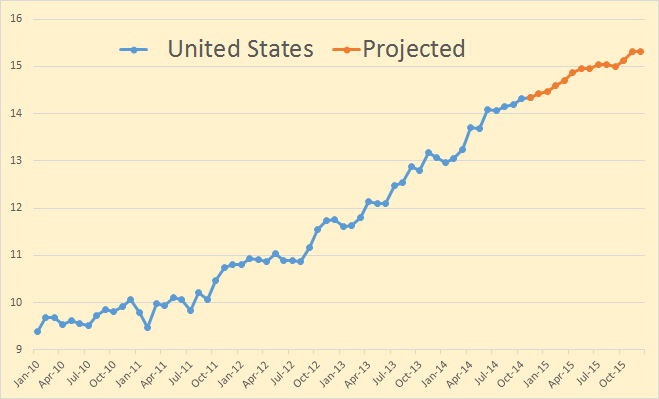

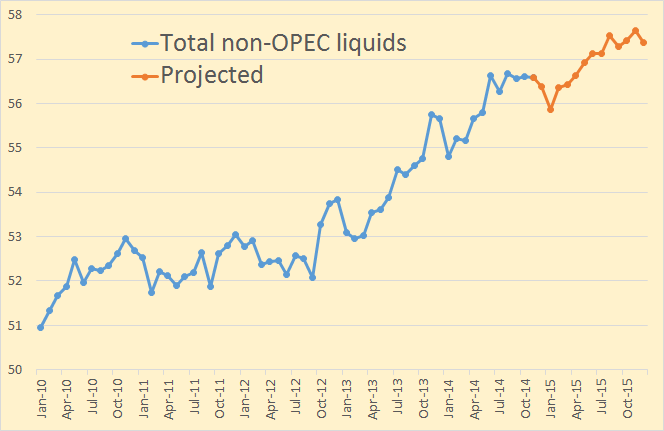

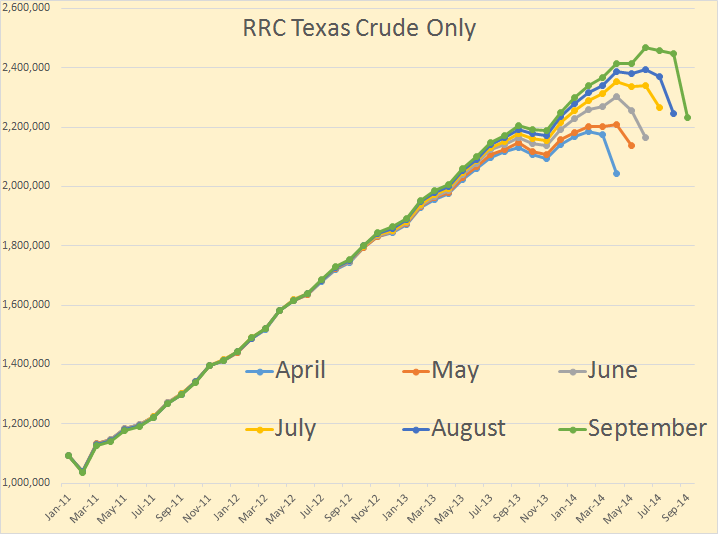

But before we go any further let’s look at what the EIA is predicting for 2015 for both the USA and the rest of non-OPEC? The below charts are from the EIA’s Short-Term Energy Outlook. Current data is through October 2014 and the projected data is through December 2015. All data is in million barrels per day. Also, very important, the data is Total Liquids which includes NGLs, bio fuels and refinery process gain. The EIA, for US production even counts refinery process gain on imported oil.

The EIA is predicting US average production total liquids will be up 1.49 million barrels per day in 2014 and up another 1.1 mbd in 2015. (I always use m for million and k for thousand.)

The EIA is predicting non-OPEC average total liquids will be up will be up 1.88 mbd in 2014 but only about half that, up .95 mbd, in 2015.