A Guest Post by George Kaplan

Part I Discoveries and Reserves

The following are a few charts and observations concerning the US Gulf of Mexico production, with data mostly taken from BOEM for the OCS and a bit from EIA. The BOEM data site has been updated and makes it easy to get the raw data, but not in a very easily discerned way. This post is intended to make it a bit easier to follow and come to your own conclusions concerning the likely future of GoM production.

I’m sure I’ve made a few mistakes in getting and downloading the data, but the relative trends are probably more informative than absolute values so there will need to be follow up revisions as new data is available and hopefully any issues will get smoothed out. Reserve data is available for 2015. New data for 2016 is likely not available until the end of the year, but when it is it will be interesting to see what changes there are. The main focus here is on oil but gas data is also presented. Production data is issued twice monthly but some, such as for BP, is up to six months late so I’ve just assumed daily flow stays constant to fill in any gaps.

Every year BOEM issues a report for the previous year’s reserves (i.e. December 2016 covers 2015): ”https://www.boem.gov/Reserves-Inventory-Program-Gulf-of-Mexico-OCS-Region/”

The reserves given are 2P, with the description:

“Reserves in this report are proved plus probable (2P) reserves estimates. The reserves must be discovered, recoverable, commercial and remaining. Reserves, starting with the 2011 report, now include Reserves Justified for Development. “

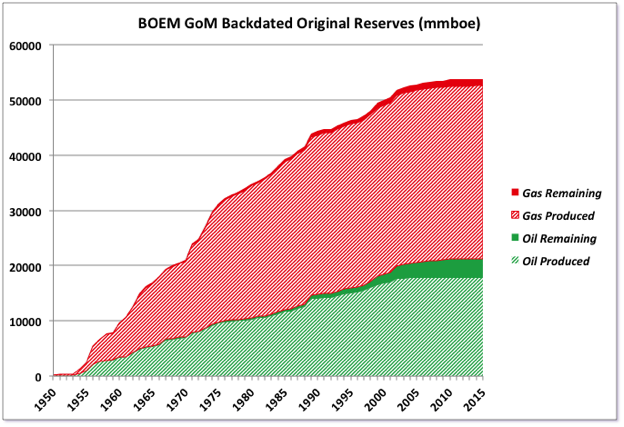

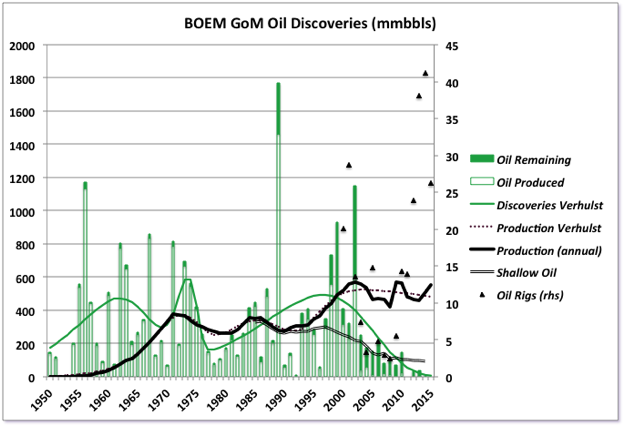

The first figure below shows cumulative backdated oil and gas reserves by discovery year (shown as produced and remaining, and stacked to give total discovery). Finding new oil and especially gas is now a struggle. However one problem with the chart may come from the way BOEM record production against lease but reserves against fields. Lease and fields and fields are associated with exploration blocks, but also split by ownership. One field may cover several leases, and that is easy to accommodate but equally one lease may contain several fields and then, as far as I can tell, but there may be arcane knowledge to which I am not privileged, the reserves are logged against a common field number. Hence later discoveries might be recorded against older fields. For example recent tie-ins for South Deimos and West Boreas to the Olympus Spar are not shown as separate fields but rather against Mars-Ursa, and would show as reserve growth on the older discovery. A bigger impact is that there are discovered fields, mostly since 2010, which do not have confirmed development plans yet, and so do not get counted as reserves by the SPE methods that BOEM uses. Therefore the flattening in new discoveries is not really as severe as shown, at least for oil. However, as discussed later, discoveries currently are declining towards zero.

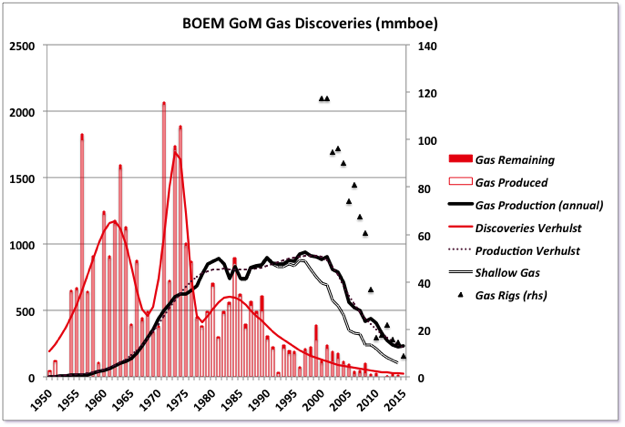

Condensate is included in the oil numbers and associated gas from oil fields with the gas reserves. NGLs are also included with the gas. The GoM is, or has been, particularly gas prone so these represent significant proportions of the total reserves, so it will only increase as a result of newly sanctioned projects, while there are some available.

Note this chart shows the situation in 2016 – i.e. the backdated reserves discovered and remaining for all the years up to the one shown; it isn’t a record of cumulative production to that year. Total discoveries for oil so far total 23.1 Gb and for gas 34.5 Gb (based on conversion rate of 5600 mcf / bbl). The curves above are really made up of a series of similar shaped asymptotic growth curves for shallow, deep, deeper – Jean Laherrere shows and discusses them well in his work.

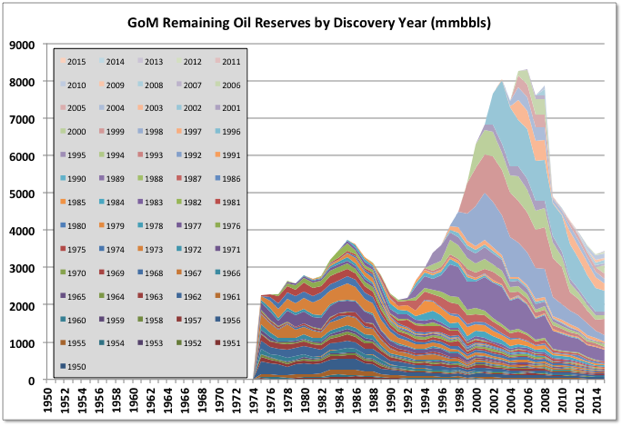

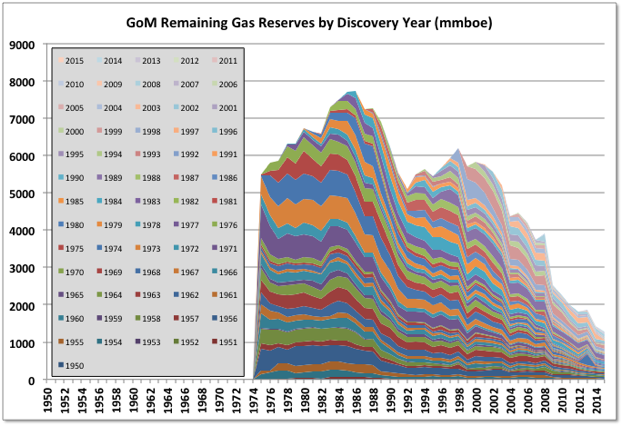

The following charts show how the remaining reserves have evolved historically. The start in 1974 is because of the recording and reporting methods, not because that’s is when production suddenly started. Similarly the jump down at 2008 /2009 is, I think, because of changes in SPE reporting methods for reserves introduced in 2007.

Produced and remaining reserves and production history are given in the following two figures: as of December 2015 oil reserves remaining are 3.5 Gb and gas 1.3 Gb. Note the reserves are reported according to SEC rules so they can be developed or undeveloped provided there is a development plan that will allow production within five years. There is a relatively large volume of resources that will be developed but are not included yet (see further below).

Most of the remaining oil is in fairly recent discoveries. Annual production and active drilling rigs are shown for recent years where break out GoM data has been available. I fitted three cycle Verhulst equations to both the oil and gas for discoveries and production. The fits are pretty good except for oil discoveries, which I think are heavily skewed by a couple of really high years. Hubbert logistics curves are symmetric versions of Verhulst equation. To some extent they are just convenient curves that start low have a hump in the middle and then tail off – like production and discovery profiles, But there is some mathematical basis in that they are derived from population growth, so that the production (or discovery) irate is a function of the oil remaining to be produced (or discovered) times that so far produced, which is a kind of proxy for the number of existing facilities or rigs, and that kind of makes sense. The three-cycle agreement matches the shallow, deep and deeper discovery cycles (not all that close though). I don’t know how the skewedness from the non-symmetric curves might be explained in actual physical things, but am looking into it. Hubbert curves from production are used to predict ultimate recovery and peaks, but here the peaks are obvious, and the discovery known.

The fits for production could be used to project the future, but I prefer a bottom up method as below, if data is available, and certainly for oil the Verhulst fit does not do a very good predictive job. Obviously the fit does not predict the sharp increase that occurred through 2016 and is just about peaking now (it is declining while actual production is sharply rising). It would suggest there would have been a peak around 2010 or before if there hadn’t been the drop from the 2008 recession and then drilling hiatus caused by the Deep Water Horizon explosion, which might be true, but isn’t much use for prediction. Short term boom-and-bust upsets like that make curve fitting quite difficult, it would probable need another two or three cycles to get a good match, at which point any pretense that there is some physical basis to the fitting has gone.

The remaining gas is looking pretty sparse, mostly associated gas, which is therefore controlled by oil production and development. Only Hadrian South and Otis are significant recent gas fields. I haven’t seen news of offshore pipelines and onshore gas treatment plants being decommissioned but presumably something like that must be happening or on the cards.

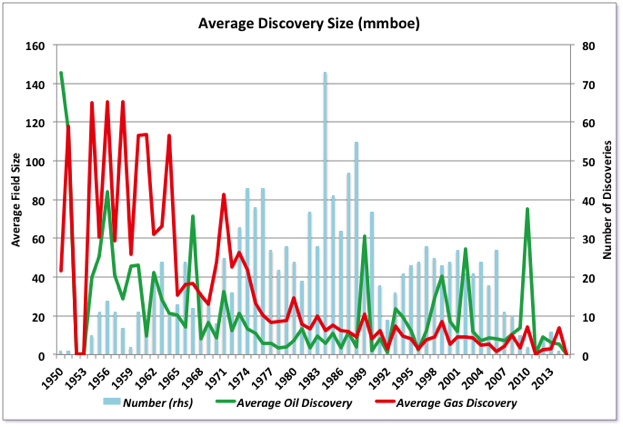

As well as the number dropping the average discovery size has been falling slightly after jumps for oil when deep and ultra-deep fields were first explored. The distribution of discoveries recently has been for few larger discoveries and a number of smaller ones, so a rising proportion of recent developments have been tie-backs. Sometimes these are to new “hub-and-spoke” facilities that just collect several small fields (e.g. Delta House, Na Kika, maybe Chevron’s Tigris in the future), but often the tie-backs are to mature facilities and don’t add to overall production, rather they just extend an existing facility’s plateau production period or reduce the decline rate. However even the smaller discoveries have been drying up over the last couple of years.

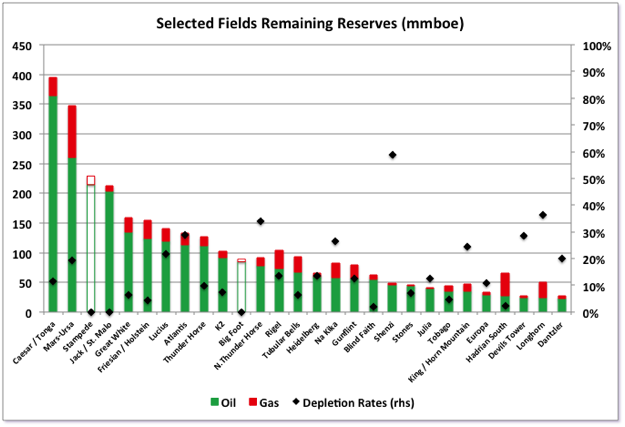

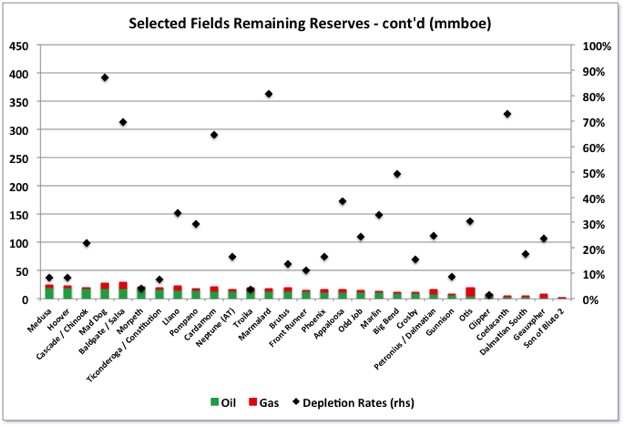

The next two figures show the remaining reserves and depletion rates (i.e. percent remaining removed per year at the expected production rate) for the larger or more recently developed fields and for which production data is given later. The rate used in the calculation is taken as the oil production average for the last six months for which there is data. This is therefore a bit out of step with the reserve data – i.e. the production is about 6 to 9 months later than the reserve data, but it’s OK for a rough indication. Note the open bars are used for Stampede and Big Foot as they are not in production but due next year.

Some fields are predominantly gas and the depletion rate counted against oil is not meaningful and probably changes significantly: i.e. Otis, Longhorn, Hadrian South, Mad Dog, Baldpate and Salsa, and partly Na Kika. Some other high depletion rates may be because not all the reserves have been included. For instance Baldpate includes Salsa, Cougar, Deep Penn State and Enchilada, but the last three of those fields do not have reserves listed. Deep Penn State came on line this year, but doesn’t appear anywhere in BOEM numbers (the production is against a combined Baldpate and Salsa lease number). Devil’s Tower numbers may be similar in that Kodiak was bought on line as a new lease but may not show in earlier reserve numbers.

Coelacanth and Son of Bluto 2 have ridiculously low reserves for the size of development, I don’t know if they have been written down from early production data, or maybe the operator was initially very conservative (however early production for Son of Bluto 2 wasn’t very good). Marmalard may reflect missing reserve data. Cardamom doesn’t look to have performed well with high water cut, which might have knocked down the recoverable estimate. Blind Faith has very low production for the available reserves: one lease has been offline for several years and the other is declining fast; the reserves may be overestimated. Overall the depletion numbers should be taken with large error bars; hopefully the next release of 2016 data may sort out a few of these issues.

For all the effort needed to get these fields on line some of the reserves are pretty low – e.g. for Julia and Stones, but it might be there are phase 2 projects planned which are more than five years out and therefore wouldn’t be included – Julia certainly has one such.

Now we should consider EIA reserve figures. They have “proved” reserves from the end of 2015 (C&C) of 4.27 Gb, with change over the year of 10 mmbbls for revisions and adjustments, 108 acquisitions and discoveries, and a drop of 557 for production. They define proved as “… reserves are estimated volumes of hydrocarbon resources that analysis of geologic and engineering data demonstrates with reasonable certainty [defined as 90%] are recoverable under existing economic and operating conditions.” So they would likely include discoveries that might be developed more than five years out. They don’t give field-by-field data so it’s difficult to go much further than that, but see below for further discussion. Over the last two years have been some big potential fields written off (Logan, Kaskida, Hadrian North, Moccasin) and others downgraded (Hopkins, Shenandoah), it will be interesting to see if these have been included in the EIA numbers as their annual update is released; as well as what impact oil price might have had in reserve revisions.

Part II Current Production

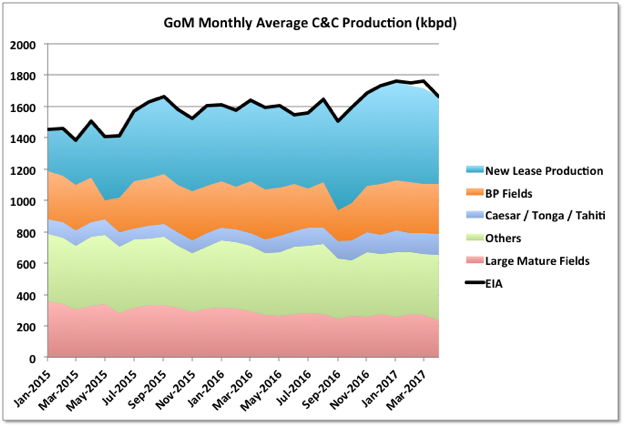

The following figures present the BOEM production data for the fields that are shown in depletion estimates above. Some fields have been quite unsteady, which may contribute to some of the anomalies above (though it might be expected that the depletion rates would be shown as quite low if the wells are offline). The results are through April though a few numbers are missing and have been estimated (just by assuming constant daily flow from the previously known month).

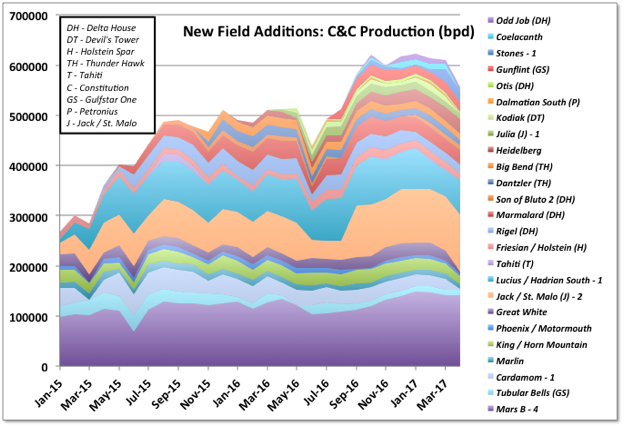

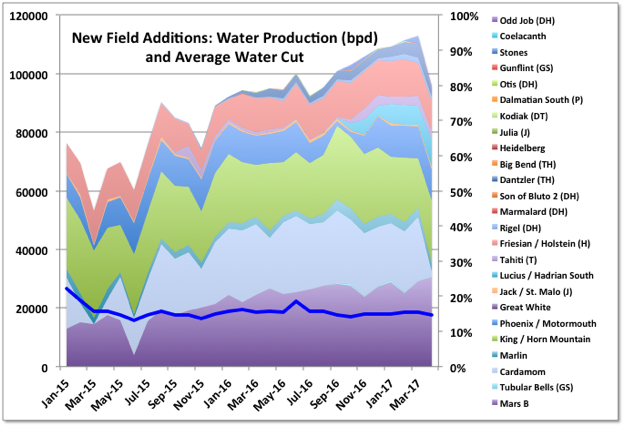

The first chart shows oil from fields with leases that have started up since late 2014, followed by their water production. Strictly speaking Mars-Ursa started in the 1990’s but with a second development to the Olympus spar starting early 2014. However it took a bit of time to ramp up and has had a couple of new tie-backs added since, so I’ve included it here.

The average water cut has held steady as more fields have been added, but it would be reasonable to expect it now to increase, as there are few new fields now due. This would usually be accompanied by declining oil production. Some of the fields look to be declining without water support (either from injection or an aquifer), presumably these have solution gas and/or compaction drive, and just go into continuous decline. I do not have the data to be able to identify the drive strategy for each field, though it probably can be found with a bit of searching. The recently announced Kaikias tie-back will go to the Olympus Spar with Mars-Ursa, so some decline must be expected there to make room. Heidelberg, Julia and Stones are still not at their design capacity. Stones has been slow to ramp up and has about 10,000 bpd still to go to meet design. Julia and Heidelberg may have another 40,000 combined but this may wait for later, second phase developments, possibly dependent on initial production results. There has been a phase II development for Jack that will show up in the next few reports through June. Coelacanth is about 25,000 bpd below capacity, but was designed to allow for future tie-backs, so it’s not clear how much of the spare can be filled from current on-line fields. Dalmatian South looks like a waste of money, but there are plans to add multiphase pumping on the Dalmatian fields next year that may have an impact.

Note that a numbers after the name shows how many drilling rigs are currently active on the field.

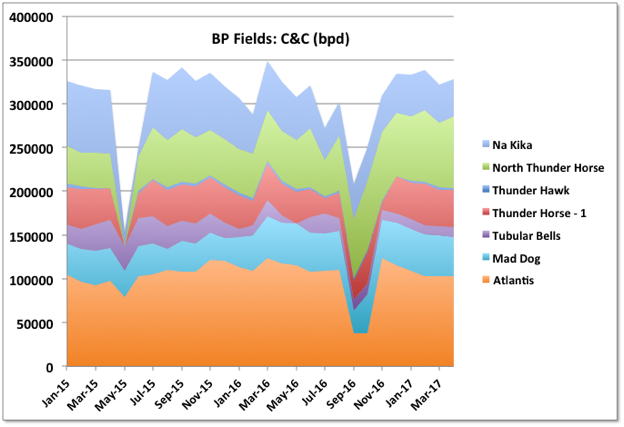

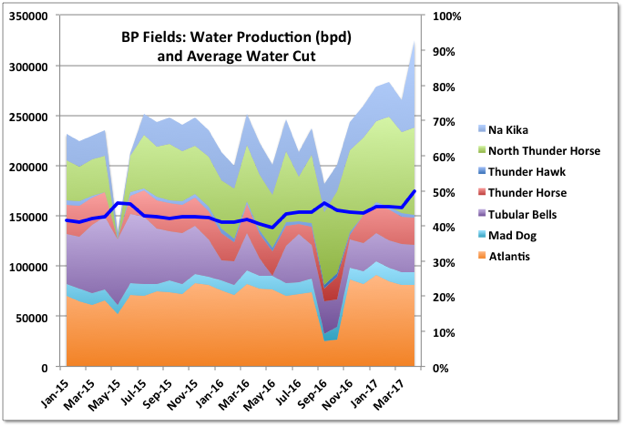

The next two charts show oil and water for BP operated fields. Note Tubular Bells is a new field included in the chart above. Na Kika is a collection of production of many small and dispersed oil and gas fields (hence the name which refers to an octopus god who created the land out of the sea). Although I’ve collected fields together elsewhere this is the only place I’ve used the facility name for the aggregate as the list of all the fields, e.g. with separators, is too long.

Thunder Horse South came on line early in 2017 and should show in the results for February and March, which have not yet been reported (BP is generally slower than other’s, except sometimes Chevron, with their numbers). I don’t know in which lease it would appear.

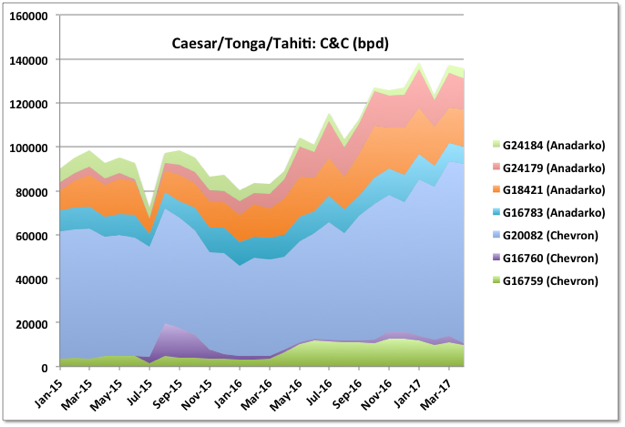

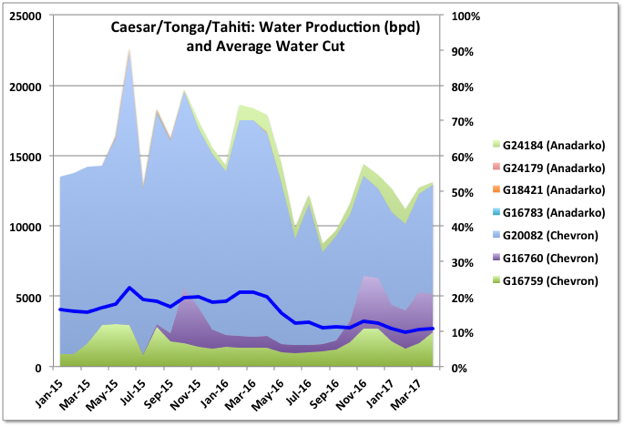

The next two figures show oil and water production for Caesar/Tonga/Tahiti, which are blocks in Green Canyon. Three leases are operated by Chevron and go to Tahiti, which was Chevron’s flagship before Jack. Anadarko operates the other four, and its production goes through the Constitution spar, which also processes the Ticonderoga and Constitution fields. It has nameplate capacity of 40,000 bpd and currently looks to be at or slightly over this. There have been two recent fires with shut down and muster on the spar in late March and late April, which might impact production figures. Next year the Constellation field (which was Hopkins when BP operated it) is due to be tied in, so either they expect some decline on existing fields or have done some significant brownfield debottlenecking. For both operators production has been fairly flat and even slightly increasing overall, it looks like gas handling might be the main concern there rather than water – maybe something to look into after the next issue of production numbers.

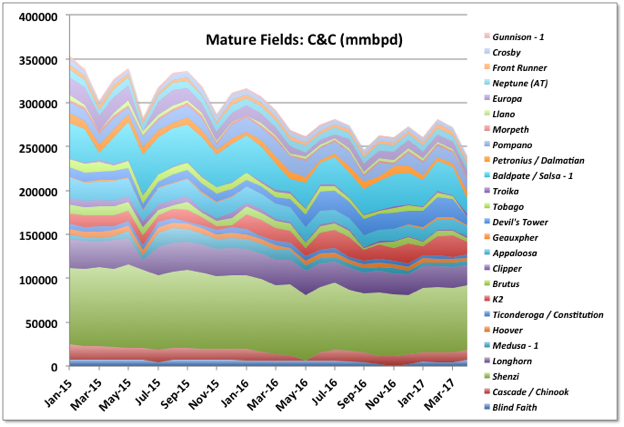

The final production numbers are for the remaining fields with stated oil reserves above 10 mmbbls. There was a general, and fairly high, decline through 2015 and early 2016, which was arrested after the 2016 hurricane dip. New production came into Shenzi, K2, Baldpate and Devil’s Tower. The Devil’s Tower increase came from a new lease, Kodiak, also shown in the first production chart above. Baldpate tied in Deep Penn South – there is no individual data for this that I can find – and added one other production well. For Shenzi it looks like development wells were added in May 2016 and January 2017, the latter added about 8,000bpd. I think I’m missing something for Shenzi as it has much higher flow than warranted by its stated reserves. BHP, which operates Shenzi, announced neighbouring discoveries at Shenzi North in 2015 and Caicos in 2016, so maybe they just tied them in immediately. K2 added about 12,000 bpd in June 2016, as two leases came back on line and the third increase flow significantly due to the addition of gas lift at the subsea templates.

Tobago includes the Silvertip field. I think there was a plan for a subsea tieback from there in 2016, but the general decline in production suggests maybe not. They are both processed with the Great White field on the Perdido Spar (Shell operator, start-up in 2010). Great White (shown in the chart for new leases) has been increasing, but development drilling was planned to be complete in 2016, so it may now join Tobago in decline.

Of particular note in April: overall there was a big production drop, mainly from Cardamom, Great White and Kodiak going offline; there was a large (five fold) increase in reported water on one Na Kika lease. This may be a reporting revision rather than reality; most lease reports are up to date except Coelacanth, Tubular Bells, Atlantis, the Thunder Horse complex seems to be missing February and March data but have April numbers, it’s not evident that Thunder Horse South start-up has yet added much production yet; Stones ramp up isn’t going well; some of the other small recent new fields aren’t looking great either (Dalmatian, Otis, and Odd Job, which has just started cutting water); Lucius reversed recent declines but the water cut is still increasing rapidly; Julia and Heidelberg are steady but well off their nameplate capacity. Julia and Stones have active drilling rigs, Heidelberg doesn’t. Cardamom goes to the Augur platform, which is well over twenty years old. I don’t know if that might reduce their availability through equipment failures or the need for more planned maintenance – usually older platforms are at low flow and have plenty of on-line redundancy, but Cardamom is a significant proportion of the facility’s nameplate value.

Of the 40 rigs listed by BSEE in the GoM for the past week, thirteen are running tools (some may be exploration wells), four are drilling exploration wells, two are appraisal wells (Phobos and North Platte), two are pre-drilling on Stampede, one each are pre-drilling on Appomattox and Mad Dog (or might be further appraisal) and the others are working on development wells. Eleven rigs are for Shell, five Chevron, four Anadarko, two BP, three Hess and three ExxonMobil.

Altogether the four oil production charts here cover about 90% of total deep water production. There are a large number of other smaller producers in deep plus over 200,000 bpd still from shallow fields. Production from these other fields has actually been holding up pretty well over the last couple of years.

Overall there has been a recent plateau in production from the large mature fields: without the added production to arrest the decline in these fields the GoM would not now be exceeding previous production rates, even with all the new fields that came on line in 2015 and 2016. Some of this will be due to continuous development drilling within a field and other to new tie-backs; facility bottlenecking may also be involved (e.g. K2). Much of this is likely due to investment decisions made in high price era of 2013 and 2014.

With high depletion and low discoveries, and the current investment hiatus, then at some time decline has to start again, and will likely look like 2015 in the chart above. If planned maintenance has been cut back then future decline may actually be worse. The oldest fields are obviously limited by well and reservoir performance, but for some of the middle aged ones, especially those with throughput close to nameplate capacity, the surface facilities may be or are becoming limits. Typically facilities are designed for maximum total liquids at around 50% water cut after that either the oil production falls naturally as the wells water out, or they have to be cut back to allow the production facilities to function correctly (i.e. to stay on line and produce on-spec oil and water), but that’s not hard and fast. Sometimes gas compression will present a lower limit.

The biggest operators in the GoM, and therefore those most likely to influence production in near and medium future, with their average production from January to May in kbpd, are as follows:

| Shell Offshore Inc. | 232 |

| BP Exploration & Production Inc. | 189 |

| Anadarko Petroleum Corporation | 159 |

| LLOG Exploration Offshore, L.L.C. | 77 |

| Union Oil Company of California | 57 |

| Chevron U.S.A. Inc | 50 |

| BHP Billiton Petroleum (GOM) Inc. | 48 |

(Union Oil is a subsidiary of Chevron.)

Part III Future Scenarios

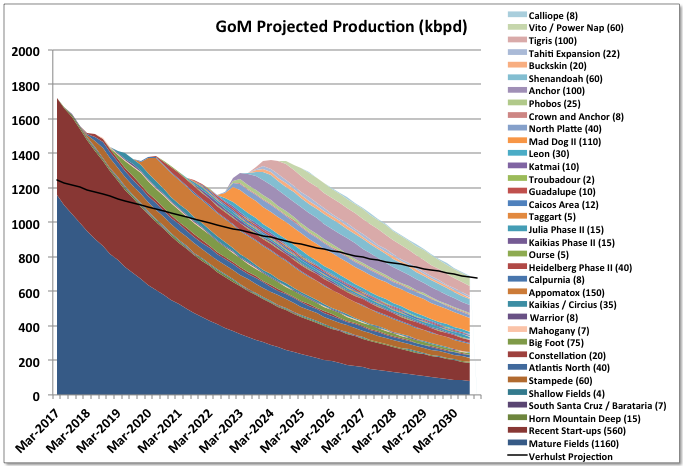

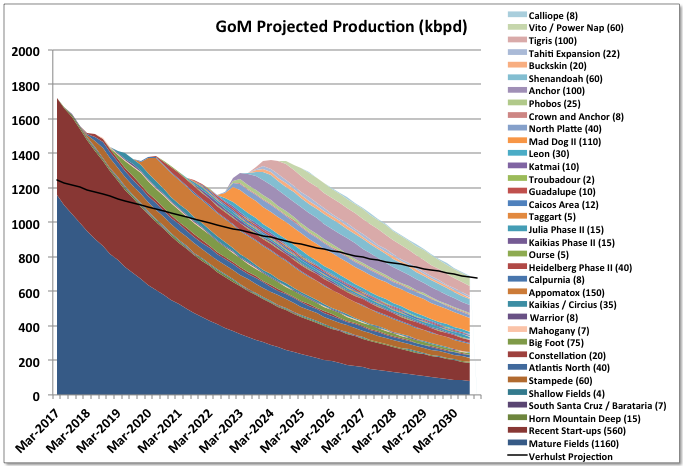

The following chart presents an educated guess at a scenario for future production, comprising all fields that are identified as probable developments plus estimated decline rates for existing fields based on their expected depletion rates. The total recovery from developed fields, excluding Stampede and Big Foot, is 4.4 Gb, with another 3.5 Gb from new fields. So, given there has been about 0.6 produced in 2016, it may be an overestimate, but equally there may be some additional near field developments that are not yet listed as reserve numbers, or straight reserve growth (e.g. BP recently added over 200 mmboe through improved seismic methods). Note that any of the putative 3.5 Gb additions is currently “undiscovered” it would get added to the cumulative discovery curve against the year of discovery (i.e. the first successful exploration well) when it is approved for development, there isn’t a sudden blip against, say, 2019, should oil prices increase and a number of projects suddenly get approved. However a lot of the recent discoveries are in deep water explored since 2010 so the third cycle in the three cycles of curves mentioned above would become more obvious. These projected recovery numbers are fairly well in line with the EIA reserve numbers, i.e. 7.3 2P compared with 4.3 Gb 1P from EIA, so maybe another 3 Gb of probable, which would reasonable. There are other, I think generally pretty small, ‘discoveries’ that could be added (Sicily, Winter, Samurai, Tortuga, Magellan), but equally some of the fields shown may prove non-commercial.

There may be additional discoveries but with recent discovery size around 10 to 20 mmbbls there’d need to be a lot to make much difference, and therefore a lot of looking, and that isn’t happening at the moment, or opening up a new frontier somewhere. The resources required to meet the start-up profile shown would be extensive, and might not be available in the period shown, especially as the profile implies a sudden price increase and hence completion from other areas to develop delayed projects.

The bracketed number against the field name is the nominal nameplate oil capacity for any development. I’ve also included the curve fit for data through 2015 (black line) – obviously it’s a poor prediction from the start as it misses the 2017 peak.

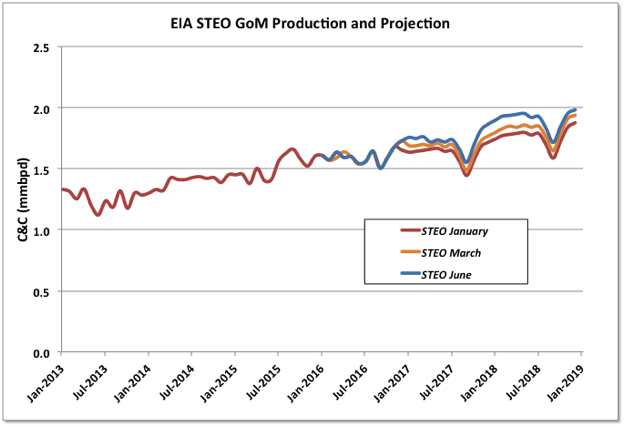

EIA also provide future projection. Recently these have pretty much consisted of extending the current month’s production for about six months, putting in a dip down for hurricane season if appropriate, and then adding a growth curve of about 300,000 bpd over eighteen months. They have never correctly explained where this extra production comes from – and change their theory with each release, and seem never to allow for any mature field declines. Any largish fields due to produce extra production in 2018 should show in current BOEM reserve data – and only Stamped and Big Foot (which is due for installation late in 2018 and unlikely to be on line) do. I think reality will be closer to my scenario: allowing for new discoveries and increased brownfield and in-fill activity it might be nearer a plateau than shown in the short term, but there will not be growth before, at minimum, 2021 and then only if there are major discoveries.

The GoM is a mature basin, the deep-water fields less so than shallow, but it looks currently that oil is in slow terminal decline and gas mostly exhausted. Many other offshore basins (and probably onshore) are in a similar state or soon will be: UK, Norway, Mexico, Azerbaijan, most Asian countries and Australia. Less so for Angola and Nigeria but the current hiatus in investment will hit their production soon – likely their final production profile will look like a two or three cycle Verhulst fit, a bit like the GoM oil, with a coming dip. It has good data availability, even if the basis using lease numbers can be confusing, therefore it is quite interesting as an indicator of what happening in other, less well documented, basins. I also find it amusing to follow the knots that the EIA, the industry media and the E&Ps tie themselves into in order not to openly admit there might ever be a peak.

268 responses to “GULF OF MEXICO DISCOVERIES, RESERVES AND PRODUCTION”

Awesome post George. Appreciate you sharing your work with us.

I agree. Thank you!

Thanks for putting this together George. It’s great.

So your estimate of GOM ultimate cumulative production would be about :

7.3 (current deepwater cum) + 4.4 (remaining deepwater production from existing fields and sanctioned projects) + 3.5 (future deepwater production from unsanctioned projects + future discoveries) = 15.2 Gb (deepwater total), + about 14 Gb (total shelf to date = ~ 13 Gb + ~1 Gb remaining) = 29.2 Gb.

Do I have that right?

If so, that is pretty much in line with the 30 Gb low estimate I came up with last September.

In my mid case and upside estimates (37 and 47 Gb), I included more exploration successes, and better recoveries from existing and future projects.

Note – I’ll have sketchy internet service for another week so I won’t be replying too promptly to comments.

SLG – sorry I missed this when you first posted it. Yes I think I’d agree with your lower case estimates. For the shelf I don’t really know – it has remained on a plateau or shallow decline for a few years, and I don’t know why, or if it will continue. Of course it’s all stochastic so higher cases are possible with new discoveries as well, it’s what makes following this stuff interesting – you geologist types have all the fun with that though. After the Atlantis improvement higher recoveries look like they might have an impact as well. But equally it looks to me like some of these developments just aren’t as good as they should be and wouldn’t have been developed unless there had been the really high oil prices in the 2011 to 2014 era (and might not be again with the lessons learned since) and/or they just haven’t lived up to expectations.

I put something together on Brazil that might come out next week – I’d be interested in what you think the possibilities there are as well.

The level of detail is overwhelming! Thank you. It extremely enlightening.

Thanks George!

Awesome–

GOM prompted me to go look for what happened to that drilling offshore Cuba. Repsol and two others drilled exploratory offshore Cuba. All three dry 2012. Initial talk that this would not be the end of it.

Was. No more drilling.

Oddly, Cuba does flow oil.

Oil production is from a large heavy oil field located near Varadero, and a few small scattered fields. Cuba is part of a small mini continent that drifted between north and South America, and broke up. A few chunks crashed against South America, for example the big rock in Paraguana, Vehezuela. The largest piece hit North America. Cuba also sells oil it essentially steals from Venezuela, its semicolony. This of course was ignored by Ben Rhodes, the 30 year old speech writer who developed Obama’s Cuba policy in secret, without consultation with the state department, or state intelligence agencies, once he decided to go into geopolitics.

Consumption and production numbers hard to get. 150K bpd floats around. Production apparently covers about half that.

China anted up $6B to expand their refinery up to 150K bpd PLUS an LNG import plant PLUS an electricity generation plant. Money flowed in 2011. Should have been done by now.

That’s all BS. These regimes thrive in secrecy and love to announce deals they never act upon.

What we do know is that production in Cuba AND Venezuela is dropping. Cuba’s production is heavy, and their main refinery at Cienfuegos is an old Soviet design, can’t process heavy molecules.

Venezuela sends medium crude to Cuba, which is used internally, and the Castro Mafia sells the heavy crude. Pdvsa makes a huge sacrifice when it sends thus crude to Cuba, because it imports lighter crudes to blend with the 8 degree faja crude. This happens because the Venezuelan dictatorship us now controlled in part by Raúl Castro and his son Alejandro Castro Espin, who appears to be in charge.

Alejandro Castro is a psychopath, in charge of all security and spy services, which explains why Maduro’s security services are so vicious. We are seeing scenes in Venezuela that appear to be something out of a horror movie, and some of it appears intentional. We know chavismo has now a wide open split, with important figures from the Chavez period calling openly for a rebellion.

I mention this because what happens in Venezuela impacts Cuba, and viceversa. Venezuela is Cuba’s prized colony, and they will try to hang on to it by brute force.

Meanwhile we see an odd alliance of red obamites and corporate interests trying to cover up the Cuban involvement and doing propaganda against Trump’s very smart shift in sanctions to target the Cuban military’s business empire, known as GAESA.

Bloomberg – 10 July 2017

Output at older fields from China to North America — making up a third of world supply — fell 5.7 percent last year, the most since 1992, according to Rystad Energy AS. It’ll drop about 6 percent in 2017 if oil stays at current prices, the consultant said.

Consultant Wood Mackenzie Ltd. estimates decline rates at older fields at about 5 percent in 2015 and 2016, compared with “just below” 4 percent from 2012 to 2014.

A decline this year at the pace predicted by Rystad would remove about 1.8 million barrels a day from the market.

https://www.bloomberg.com/news/articles/2017-07-09/oil-fields-pumping-third-of-world-supply-die-fastest-in-24-years

Perhaps investing in CO2 fill, water injection or infill drilling has stalled with the low oil prices. It’s not so cheap to squeeze out the last barrels of an old field – activity for sure will heaten up when oil prices climb again. It’s a little bit like shale oil – you can ramp up production with smaller and faster projects than bringing a new deep sea field online.

At least at the chinese old giant field they stated last year the reduced investing in recovery technic due to low prices.

Eulenspiegel,

Tertiary recovery suffers from the same ailment that the Gulf of Mexico does. It’s just too high-cost to be competitive with shale and OPEC conventional.

According to a study conducted by the Boston Consulting Group, there’s still plenty of “yet-to-find” potential in the Gulf of Mexico, almost 200 billion BOE.

http://gaffney-cline-focus.com/will-mexico-be-competitive

But who in the heck is going to invest in this high-cost, long lead time oil when oil prices are in the $50/ barrel range and so volatile?

Deep water Gulf of Mexico is one of the areas replete with projects that Goldman Sachs has identified as having become “so uneconomic, so stranded, that we almost don’t see any scenario under which they will be developed.”

“New shale production and OPEC are fighting for market share and the rest of the market, really, is fighting for relevance,” adds Goldman Sachs’ Michele Della Vigna.

Lower for Longer? The Impact of the New Oil Order: Goldman Sachs

https://www.youtube.com/watch?v=Zilqznc5LCc

Hi Glenn,

An estimate of barrels of oil equivalent yet to find tells us very little.

It is oil that may be scarce in the future (probably before natural gas), if most of these barrels of oil equivalent are natural gas it will not help the situation very much, and that study is quite old from 2012.

And who is the Boston Consulting Group?

The Boston Consulting Group is a global management consulting firm with over 80 offices around the world.

https://www.bcg.com/

Oil and Gas is not really this company’s area of expertise, so perhaps this “Yet to find” estimate is very speculative.

Gaffney Cline is an oil and gas consultant, perhaps they found the study credible.

Part two of the study gives a relatively negative outlook for Mexico, due to the nature of Mexican laws and the resulting lack of foreign investment.

http://gaffney-cline-focus.com/will-mexico-be-competitive-part-2-fiscal-balance-and-stability

Dennis,

Regarding Part 2 of the Gaffney Cline study, whether to implement a “regressive” fiscal regime or a more “progressive” fiscal regime is probably the least of Mexico’s worries when it comes to attracting foreign investment, given the current highly volatile, $50/barrel oil price environment.

The “yet to find” estimates are also not terribly relevant in the current price environment, since most of that “yet to find” oil and gas is high-cost and cannot compete with shale and OPEC.

Hi Glenn,

I agree low prices may eventually reduce output as fewer investments in oil sands, deepwater and other high cost barrels of output. In addition some “low cost” output from LTO plays might not be developed as the core areas of current LTO plays run out of space for new wells and EUR per foot of horizontal lateral completed starts to decrease. At some point there is a limit to how many frack stages and how much proppant can be stuffed down those wells and see a decent return on that marginal capital spending. That point is likely to be reached by 2020 for the Permian basin. Much of the apparent increase in Permian well productivity is a combination of increased lateral length, increased proppant volumes and an increased number of frack stages all of which leads to higher cost wells (where land cost should be included).

When this occurs is difficult to guess precisely, but I think by 2025 is pretty likely (greater than 50% probability).

How much of this expensive oil can be neglected?

Can the US expand shale oil production by 20 MB/d to replace all the aging oilfields and another 10 MB/d for all the deep sea oil?

Opec will be hard pressed to provide the growing demand alone.

Or do we only have a monentary oil price hole because everyone on the whole world started big projects during the high price enviroment, inclusive shale oil, which all complete these years and weight down on oil prices alltogether. And when they run out and get into decline alltogether, while consumption is growing, we’ll see the one or another supply hole.

And when oil price again is at 100$, we’ll see the same again – frackers will frack marginal rock which is nowadays seen as “dry hole”, GOM and all deep sea will be explored and drilled again, old fields will be nitro injected, and all this new supply will get online roughly the same time…

Hi Eulenspiegel,

It is doubtful that US output will rise above 11 Mb/d even in a high oil price environment, LTO output might rise to 6.5 Mb/d, but output from US onshore conventional is likely to decline by 4 to 6% per year especially at oil prices under $60/b. So over the next 3 years we might see about 400 kb/d decline in onshore conventional and another 400 kb/d decline in GOM output so that net US output would increase by about 1.2 Mb/d from April 2017 levels in 3 years (assuming LTO output increases by 2 Mb/d over those three years). Under this scenario US output is 10.9 Mb/d in 2020.

Whether OPEC, Russian, Canadian, Brazilian, and US output can offset declines elsewhere in the World remains to be seen. I think it will be a challenge for World C+C output to rise to more than 85 Mb/d for any 12 month period in the future. The highest World C+C output average over any consecutive 12 months to date has been 80.7 Mb/d (12 months ending March 2016 based on EIA data). The most recent 12 months ending March 2017 the trailing 12 month World C+C output average was 80.5 Mb/d. The 85 Mb/d is near my high estimate, the range is 82 to 86 Mb/d for the one sigma range (about a 70% probability the peak will fall in this range in my opinion somewhere between 2021 and 2028.)

Eulenspiegel,

Yours is a very old, but I believe legitimate, critique of free-market fundamentalism.

Simonde de Sismondi, who was for a time the only heretic among Adam Smith’s disciples, put it this way:

Hi Glenn,

Do you agree with Barzun’s assessment?

I ask because you often complain about government interference, which suggests you believe the market should rule.

Or is it that the market should rule unless it affects you negatively and in that case there should be government intervention?

Your position is not clear or perhaps even contradictory.

Dennis,

It is one thing to make a legitimate critique of a situation. It is quite another to propose a solution that is both 1) politically possible and 2) will work.

In the case of overproduction of oil, just what would you propose the federal

government do?

Any workable solution would have to be multilateral, because oil markets are global in nature these days and if the US government were to unilateraly mandate produciton limits on US producers, this would only hand more market share over to OPEC and Russia.

So what is your solution? Do you propose that the US join OPEC?

What do you believe would be the political possiblities of that happening?

Hi Glenn,

So is that a long winded way of saying you agree with Barzun?

A yes or no answer would suffice, rather than a dodge.

Is government intervention sometimes necessary or not?

It seems as long as the government is not interfering with the oil and gas industry, you are ok with government intervention.

And yes the US should join OPEC,Russia and others in controlling output as was done for the good of the oil and gas industry from 1935 to 1970 by the RRC of Texas and other state agencies (Oklahoma and Louisiana.)

Volatility in oil and gas prices leads to a poor allocation of capital resources.

Dennis Coyne said:

“And yes the US should join OPEC,Russia and others in controlling output as was done for the good of the oil and gas industry from 1935 to 1970 by the RRC of Texas and other state agencies (Oklahoma and Louisiana.)”

And just what do you believe to be the political possiblities of that happening?

Some folks are hopelessly idealistic. Others, like Reinhold Niebuhr, are more realistic.

Oil price volatility is damaging to the economy. Most developed countries recognized this in the 70s, and started heavily taxing consumption to limit the damage it caused. Trying to control production is a chump’s game.

By a simple geometric progression, say one third production is 10 Gb per year, at 5.7% continuing decline rate that would give 175 Gb to be recovered. However the rate looks like it’s accelerating so probably less. Note that an accelerating decline rate is exactly what would be expected if in fill drilling and brownfield expansion has been used extensively to maintain or accelerate production in response to high prices and limited alternative (‘cheap’) sources. With 175 Gb here, only about 75 Gb left of conventional discovered and undeveloped, discoveries falling (I think likely about the same this year as last for oil at current pace, maybe less for gas), and XH oil done for the time being at least, then the big question is how much is remaining in the other two thirds on line at the moment? And will it sometime (soon?) start to look like the older one third?

10 Gb/year? check numbers again, please.

Even 1.6Mb/day*365 is only ~1/2 Gb/year

Global production is 30 Gb per year (to one significant figure), one third of that is 10. The sum of an infinite geometric series declining at r per year is X0/r. Checked.

5.7 % is only achievable if there’s continuous investment in EOR, redrills, sidetracks, connection of small remote satellites, installation of beefier artificial lift systems….I’ve been there and eventually we hit the wall. In one offshore case the decline rate shot up to 38% per year.

Hi George,

It is not clear what you are talking about, World conventional C+C output (about 26.6 Gb per year)?

So one third would be about 10 Gb/year and at a 5.7% annual decline rate, I see the 175 Gb. The question would be what about the other 16.6 Gb of World output. If reported BP statistical review proved reserves are roughly equal to actual World 2P reserves and we deduct Canadian Oil Sands and Orinoco belt oil we have about 1300 Gb, in addition there has been about 1300 Gb of cumulative conventional C+C output (excluding LTO and extra heavy oil). This suggests about a 2600 Gb conventional URR if there were no more discoveries or reserve growth in the future.

Let’s assume no reserve growth or discoveries and that 1300 Gb is roughly World 2P reserves. That suggests the other 16.6 Gb would decline at about 1.33% per year.

Decline rates in this scenario start at 3%/year in 2017 and fall to 2%/year by 2044.

So if or when higher decline rates are seen in the newer production that would tend to further undermine the BP figures I guess.

Hi George,

I agree.

Also I realized that the BP figures include NGL, which Laherrere estimates at 300 Gb URR, so probably 2300 Gb for conventional C+C is a better estimate than 2600 Gb.

Hi George,

In addition Laherrere estimates that OPEC reserves are overstated by about 300 Gb, so a more conservative URR estimate would be 2000 Gb (with the assumption that there are zero discoveries and zero 2P reserve growth in the future).

To me the 2300 Gb estimate is more reasonable for conventional C+C World URR, but clearly such an estimate is speculative, it could be 2000 Gb or 2600 Gb and it’s possible the USGS estimate of about 3000 Gb may prove correct.

The lack of clarity on OPEC reserves makes accurate World URR estimates quite difficult to achieve.

Mike

Third update today on icewine 2 well in the HRZ shale north slope Alaska.

16% frac fluids now recovered.

Icewine#2 Operations Update

Flowback operations have continued, with fluid composition comprising 100% water. After analysing the performance of the well to date, and comparing to results from other plays, a decision has been made to shut the well in for six weeks to allow for pressure build up and imbibition to occur. Imbibition (or soaking) has proven to be effective in other plays by allowing frac fluid to be absorbed, displacing in-situ water that may be blocking hydrocarbon molecules from being able to flow through the reservoir.

Post the shut in period, the well may then be swabbed.

Further analyses are required to determine the impact, if any, of the performance of the Icewine#2 well on the probability of success for the HRZ play at the Franklin Bluffs location and over the wider acreage position.

Further updates will be made as and when appropriate throughout the testing program.

They could try running a jet pump, that’s fairly easy to rig up, they have to fly in a sliding sleeve, the pumps, and hook up with chiksan from the cementing unit. I assume the wellhead and casing can take a 5000 psi hydrotest. I’m surprised that’s not in their contingency planning. Swabbing in the north slope is very complicated by regulations.

World’s Top Oil Traders Bet American Shale Is Here to Stay

http://www.rigzone.com/news/oil_gas/a/150923/Worlds_Top_Oil_Traders_Bet_American_Shale_Is_Here_to_Stay

Hi Glenn,

We will see if these investments pay out at under $50/b. Eventually investors will become tired of losing money. This may be a matter of “irrational exuberance” on the part of these investors.

Dennis,

Traders profits aren’t based on the absolute price of oil. They are more interested in having a dependable future supply of oil that needs to be traded. They make their money on the juice, not the absolute price of oil.

Hi Glenn,

My mistake. Traders are more gamblers than investors, I am not much interested in what traders think, the investors in oil companies (either through equities or bonds or direct lines of credit) are far more important in my view.

Though traders do influence the oil price so may be important as well, I am just less focused on short term price movements.

Never met Lambert. I’m not sure those experts know what they talk about, but they sure wear expensive suits.

Whether it is a reality or just an illusion that the Permian can supply low cost oil for the foreseeable future, it works for me in that it kills interest in projects elsewhere, especially those in environmentally sensitive areas.

And if the net result is under-investment in oil and gas projects, and, as a result, much higher prices at some point in the future, those high prices might be an added incentive for societies to come to grips with needing to find more non-carbon ways to power the world.

It’s a two-step process. Very low prices, which kill projects, and then very high prices, which force new energy ideas.

Hi Boomer,

If it happens gradually (the increase in oil prices) at maybe 15% to 20% annual price increases over several years, your scenario is great. A fast spike in oil prices may create economic turmoil and a great deal of suffering for those that are less fortunate, so I hope that is not what occurs.

The scenario below has prices increasing by 17.5% per year from 2017 to 2023 and then by 5% per year from 2023 to 2028. A price increase like this might be gradual enough for the World economy to adjust without a depression.

Baker Hughes International Rig Count +3 in June from May = offshore still declining -5 but land +8

Baker Hughes link: http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsintl

George. I took a little time and looked at well by well production for Energy XXI, a company that specializes in shallow GOM production. Energy XXI went through BK and I lost track of them.

Surprising to me how many offshore wells in GOM are producing under 100 BOPD. I know little about operations offshore. However, when I do know that onshore deep wells begin to become tough in terms of economics once they fall below the 50 BOPD threshold, I begin to wonder how many GOM wells are being operated at a loss, and have been for 3 years now? I assume plugging these wells is very expensive, and therefore limping along at a slow burn may be preferable.

I’d appreciate your insights here. Have to wonder if maybe this story is playing out offshore in other parts of the world too, with most selling oil for $40 or less.

Platform removal can be a real hassle. If you want one you can have it free as is where is.

Unmanned, shallow water platforms might work at 100 bpd with a few wells, I can’t imagine deep water, manned platforms being economic at that sort of flow, if nothing else I’m not sure many deep wells would be easy to restart if that is all they are producing, at least in water flood reservoirs. I don’t know where else there would be the same sort of density of shallow production in mature fields as GoM – maybe parts of Brazil and Saudi, but I think their fields are much larger. The shallow gas in GoM is a few years ahead of the oil fields for maturity and I have seen almost nothing concerning how that infrastructure is being or has been decommissioned. In the UK decommissioning costs are huge, I think estimated over $80 billion and growing, and the costs are tax negative so, as of last year, the North Sea is a net cost to tax payers. I had thought the recent announcement of lower GoM lease costs was to benefit existing small producers but it looks like it is only for leases in the next round. In the UK lower royalties and taxes were introduced in recent years to keep the low producing fields on line, for higher recovery and to allow for future tie backs, but it hasn’t always worked – e.g. Brent is being decommissioned which means the Shell Penguins tie back now has to be shut down and a new FPSO sought to complete the field recovery.

Victor Davis Hanson: We Should Show A Little Gratitude For The Fracking Industry

http://www.investors.com/politics/columnists/victor-davis-hanson-we-should-show-a-little-gratitude-for-the-fracking-industry/

The USA has no energy independence. Sometimes I wonder whether these guys have a whole brain, or just a tape recorder, or whatever.

Today’s mentality. You see it on the internet, and you can assume it is true. Independent thought not required. Just regurgitate.

Consumption is 19.5 mbpd and grew last year. Production is less than 10 and declined last year. Not clear how that equates to independence.

Products supplied in EIA weekly last week 22.225 million BOPD. Highest since stat began to be tracked by EIA in 1990.

Will be interesting to see if this was just an outlier.

Here’s an eyebrow raiser:

Cruise ship industry, about 12,500 ships in the world.

They burn 140 tons of fuel per day. X 7 for barrels is 980 barrels.

12500 X 980 = 12.25 million bpd.

REALLY hard to believe, but those are the numbers. Maybe something wrong there. The X7 may be wrong because the fuel is much more dense than plain crude?

Regardless, 63% of all passengers originate in North America and 37% of trips are Carribean and GoM.

Most discussion is about envirowacko whining how 16 ships pollute the same as all cars in the world combined. Zero importance. Oil will be burned.

There aren’t 12500 big cruise ships, more like 250 to 350. There might be a lot of small boats that carry less than 10 people (e.g. sailing cruising) but they wouldn’t burn much oil.

http://www.answers.com/Q/How_many_cruise_ships_are_there_all_together_in_the_world?#slide=1

shrug

Hi Watcher,

See

https://en.wikipedia.org/wiki/List_of_largest_cruise_ships

If we use more than 100,000 Gross tonnes as a cutoff for a large cruise ship (the largest is over 200,000 Gross tonnes) there are 70 in the World with another 50 to be completed by 2025.

So George may have overestimated or may be including ships that are out of service.

Nah, 140 tons of fuel/day is average. Bigger ships is more.

Guys going to Antarctica use less. 140 – 150 tons is specified as avg. Water is viscous.

The literature has talk of LNG. Then it is all dismissed for safety. Too easy to ignite.

Over the past 30 or so years I have been on multiple ocean and river cruises, including one on the Yangtze. In my opinion there is no better vacation. Their demise will be a great loss. The cruise lines did bow to pressure to eliminate ocean skeet shooting.

Doing the numbers wiki lists about 320 cruise ships as operating – I was comparing ‘big’ cruise ships with ordinary boats like cabin cruisers or even river sightseeing vessels.

Hi Watcher,

What size ship burns 140 tons of fuel per day?

For some of the larger ships (154,000 gross tonnage) I get 228 tonnes of fuel used per day assuming 7 barrels per tonne from

http://cruises.lovetoknow.com/wiki/How_Much_Fuel_Does_a_Cruise_Ship_Use

Hi Watcher,

I think 140 tonnes per day might be the average for the big ships, but there are only 70 of those.

Where are you getting your data from?

I found this

Total number of 2014 cruise ships is 410 (including river cruise boats), total number of berths is 467,629. More than 300 of those are sea-going, with capacity to accommodate a total of over 300,000 passengers per day.

http://www.repositioncruises.com/cruise-industry/

The riverboat cruise ships are pretty small, so my guess is the 145 tonnes of fuel would be for the 300 oceangoing ships.

So 145*7*300=304 kb/d used by ocean going cruise ships. Though this may assume the boat travels continuously, which is usually not the case.

Hi Watcher and Shallowsand,

I think the more important metric is net crude inputs to refineries and blenders. I also don’t think the weekly numbers are very accurate.

The monthly data for net crude inputs to refineries and blenders was about 17 Mb/d in April 2017. The four week average for June 30 for net crude inputs to refineries was also about 17 Mb/d, US C+C production was about 9 Mb/d so if we cut our petroleum liquids consumption by 47% or raised output to 17 Mb/d, then we would indeed be crude independent.

I do not expect we will be independent of crude until we reduce consumption, maybe by 2040 or 2050. Of course output may fall faster than consumption, hard to guess for sure.

Hi Dennis,

Re: “hard to guess for sure”

Please clarify. Do you mean that it’s possible to guess for sure though difficult — but actually possible? And, how about “guess for sure”? What does that mean? For sure it’s a guess, I’d guess? 🙂

Hi Doug,

LOL. Yes poor wording no doubt. The meaning was supposed to be that even I am not going to make such a guess, for it is likely to be far from the mark.

Any future scenario is a guess, to be sure.

And it is not hard to guess, but it is difficult to be correct, about one in a billion (but that might be too optimistic).

In short, accurate guesses about the future are difficult to produce.

.

Hi Glenn,

We are talking about oil, that chart is for all energy.

Let’s compare apples to apples.

Chart below shows US net crude imports in the EIA’s AEO 2017.

No case has the US as a net exporter of crude by 2050.

So much for US oil independence.

Wake up, America !

http://www.msn.com/en-us/money/markets/how-energy-rich-australia-exported-its-way-into-an-energy-crisis/ar-BBE9o5j?li=BBnbfcN&ocid=DELLDHP

The USA isn’t that short sighted. Lol. Sarc.

Well, it depends who’s in charge and at the moment the entire head office is out to lunch, eating KFC and tweeting, and nobody is in charge. Example #331: I thought we might need these heavier crudes to blend with LTO here in America, but nooooooooo: http://oilprice.com/Latest-Energy-News/World-News/Worlds-Third-Largest-Oil-Importer-Secures-Deal-With-US.html

I know, lets IMPORT heavy oil from Columbia instead. Out one door, in the other. Its another Forrest Gump moment!

in that article they say they are getting Mars Blend Crude. It comes from GoM.

Assay is API 28.8. Yo, GoM guys, how do you get that thick stuff to flow from down there.

Interesting distillation yields:

Naptha and C1-C4 15%

Diesel and Kerosene 33% (!!)

50+% Atmos Residue (more processing to get heavy stuff)

Maybe India boils it with coal. They got coal.

28.8 API isn’t heavy – it’s the middle of the medium range. Neither is it likely to be thick, which describes viscosity. How well it flows depends much more on the reservoir properties, GOR and depth than on the stock tank oil. It looks like it’s a pretty good fit for the India refineries, and a good price. There currently isn’t a shortage of any sort of oil so everything is running on arbitrage.

A tad surprising so little gasoline?

The reporter called it heavy.

He didn’t go get the assay.

Ya you’re right. I remember seeing far lower API from Orinoco.

API 28.8 is actually a pretty good fit for lots of EF condensate and its close. In the mean time inventories of LTO continue to swell in America and the only reason they are not higher than ever is because of exports. You guys are missing the entire damn point and that point is we are full up with condensate right now, its coming out of our ears and the stupid US shale oil industry keeps adding to the pot. There is no gasoline demand this summer. We need to leave some of it in the ground as a savings account. The shale industry needs to be put on a short leash.

I’ve spent a lot of time in Australia, the comments here about that article also miss the point, entirely. Its always something else other than what the article says, unless of course you can use it to promote your agenda, then its a relevant article. Shale development in the Cooper has been an economic disaster. Gas in the Carnarvon is getting exported all away without any internal infrastructure to spread it around Australia. Big gas runs the show in Australia and it has left its own country behind in the name of money.

My x-box works so I am glad Mr. Stehle commented. It means he is not on his way to Washington to assume some role in implementing energy policy in the US. Its bad enough as it is.

Note the Prime Minister of Australia’s declaration that he would block some exports until local needs were met. But, I guess, he doesn’t know what the hell he is talking about with regards to his own country; some internet experts here on POB do, however. This Aussie thing, by the way, is a perfect example of Jeffrey Brown’s Land Export Model at work. And, by the way, Jeffrey estimates volumetric decline of gas in America at something like 17 BCFPD.

Exporting America’s last, limited remaining hydrocarbon resources, under the false narrative of shale abundance, is stupid.

Dennis Coyne: go ahead and cram all the TRR unconventional shale reserves you want into the mix (recovery of those reserves, in the absence of over 75-85 dollar oil prices, will all be a function of available capital and a favorable American monetary policy), please, HOW MANY MORE BBLS. OF UNCONVENTIONAL SHALE RESOURCES ARE AVAILABLE IN THE U.S., AT CURRENT SHALE OIL PRODUCTION RATES, HOW MANY YEARS DO WE HAVE LEFT, and DO YOU BELIEVE WE WILL HAVE ENOUGH TO GET US, OUR KIDS, TO THE END, ENOUGH TO BE EXPORTING IT AT THE MOMENT ALL AROUND THE GLOBE AT $40 DOLLARS A BARREL? Thank you.

Watcher,

Here’s a graph form the EIA that shows where some of the various crudes, including Mars, fit in the scheme of things.

As the EIA goes on to explain:

“Crude oils that are light (higher degrees of API gravity, or lower density) and sweet (low sulfur content) are usually priced higher than heavy, sour crude oils. This is partly because gasoline and diesel fuel, which typically sell at a significant premium to residual fuel oil and other “bottom of the barrel” products, can usually be more easily and cheaply produced using light, sweet crude oil. The light sweet grades are desirable because they can be processed with far less sophisticated and energy-intensive processes/refineries.”

https://www.eia.gov/todayinenergy/detail.php?id=7110

Watcher,

And as this graph from the Colorado School of Mines shows, Bakken and Eagle Ford LTO have almost the same yields as WTI and Brent.

LTO, despite what the shale bashers say, is a light sweet crude and is one of the most valuable and desirable crudes in the world.

Mike

I posted another update on the HRZ well near the top of the comments. Fernando has already replied.

Howdy from a hot S. Texas, Lights; I read the report. Its not good. If they are now shutting the well in for BHP buildup tests it is pretty much a dead duck, IMO. Trying to now artificially unload frac fluid in that area of Alaska will cost a fortune. I would say the pilot test failed and it will be interesting now to see if they even drill a HZ test. Thanks much.

Mike

Thanks for the reply Mike.

I agree it looks like a dud they claimed in presentations it would flow at such a prolific rate it would offset the extra costs associated with Alaska.

Mike,

It depends on refinery design.

Some refineries are designed to refine light sweet. Other refineries are designed to refine heavy sour.

We export light sweet becaue that’s what most foreign refinerares are set up to refine.

We import heavy sour because that’s what US refineries are set up to refine.

It’s all totally logical for anyone who understands the refining business.

What you have just said makes no sense because the US didnt build gazillion new refineries since the export ban lifted. So they are designed to do higher API liquids as well as heavier since until recently only condensate could export and thus LTO and heavy both had to refine here.

As for Colorodo School of Mines chart, pls post a date. I posted a link a few weeks ago of a WTI assay, which after decades of quoting API 39.5, now quotes 40.7. It has changed because LTO flow into Cushing has dragged the number up. The yardstick changed so don’t compare to it.

Look for Statoil’s or Marathon’s Capline or BP’s assay page to get up to date stuff.

Oh and repeat to yourself often “This Is Not An Investment Blog. It is a Peakoil blog.”. Oil’s value is not measured in money.

The wholesale price of electricity in South Australia is A$188/Mwh this moment, down from about A$350/Mwh a few minutes ago.

This entire Australian situation can provide an enormous education to everyone with an interest in learning about these crucial issues.

As the above referenced article clearly, repetitively states, the restrictions on additional gas development, as well as the premature terminating of existing, carbon based generation. (“… as other steady power sources are shutting down”) play a significant role in the current crisis.

There are MANY other factors that have prioritized wind and solar adoption in the Aussie power generating industry, along with stifling more hydrocarbon output.

An objective accounting of the myriad factors involved could be enlightening to all, most especially, perhaps, to the staunch advocates of renewable power generation.

As an aside, Saint Musk’s 100 Mw battery can provide only a few minutes juice to the SA grid which currently needs 1,600 Mwh as these words are typed.

4 months out, SA hits its peak summertime power consumption for which the grid operator, AEMO, projects there is simply insufficient supply … at any price.

Hi Coffeeguyzz,

See islandboy’s comments on Open Thread.

http://peakoilbarrel.com/open-thread-non-petroleum-july-9-2017/#comment-608191

He has a different take on this than you, perhaps you guys could learn something from each other.

Dennis

Thanks for the opportunity to engage with Island Boys sources.

Battery about to run out and I’m not particularly enthralled to spend time researching, but I most assuredly will.

The tone, verbiage of IB’s snippet seems to convey a slanted perspective to the max, but I will gladly engage ‘the Other’ and let the facts/data determine the right and wrong of these issues.

Meantime, checking in on Aussie’s RET, RECs, Hazelwood and Northern shutdowns might give you a ‘bigger’ view of the current situation down in Oz.

projects there is simply insufficient supply … at any price.

The future in a phrase.

Dennis

Just spent more time than I readily have closely going over the 23 page pdf right from the AEMO describing the Feb. 10, 2017 overload incident in New South Wales for about 90 minutes from 5:00 PM to about 6:30 PM.

I sure wish someone WAY more knowledgeable than I could weigh in because there seems a ‘lot more’ to the story than the MSM (Guardian – Feb. 22, 2017) accounts would have one think.

Couple of points …

Super hot day, 43C or so for 4 hours.

One gas plant, Torrawa (sp?) 440Mw tripped offline for 2 hours.

4 natgas plants called in as emergency had no natgas supply.

One other plant seemed down for maintenance.

Wind generated 500Mw at 1:00 PM. Dropped off to 284 at 5:00.

Here’s an interesting item …

Rooftop solar generated almost 900 Mw at 1:00PM and dropped to 271 at crunch time (5:00 PM).

All of which leaves me with wondering how much economic impact the Ra and Zephyr boys are/have been exerting on the coal/gas burners.

I don’t know, but to claim that the hydrocarbon outfits dropped the ball may be a skewed evaluation.

It doesn’t make economic sense, and is impossible, to make a complex system 100% infallible. Electrical supply systems are usually better than most – and this was a controlled event where they just cut off some of the big users for a relatively short time, from what I can see. The USA, or at least Texas which I think is separate, uses rolling brownouts regularly during high demands, it is also the least reliable system I have ever experienced due to outages from storm damage. But would it make sense to pay the huge costs needed to make it more reliable?

The issue with the Australia outage that I got is that the heatwave contributed. As things heat up we are going from 3 and 5 sigma high temperature or drought or flood events being rare to never, to them being monthly and yearly, so all the legacy plant will turn out to have the wrong design envelope, and eventually we’ll get longterm, uncontrolled and/or unrecoverable failures. And that will be news worth reading.

100% is not possible, but nearly 100% should be tried in an industry country.

There are lots of productions that don’t “like” being browned out – they need lots of time to get them running again, and produce lots of wastage during this process.

Or it’s a security thing – it’s possible but not recommended to brown out high speed trains, airports etc.

And it’s not economic,too, for everyone to have a backup electricity generation besides very critical installations like hospitals or big IT centers.

In a rural area with only small commercial districts it is normal to have electricity interruptions. Most of them due to severe weather conditions.

Don’t wanna beat this SA power situation into the ground, but the unfolding situation may prove highly instructive.

Right now, 02:30 on Saturday, wintertime, spot SA wholesale juice costs A$105/Mwh.

This is ‘down’ from A$250 just a few hours ago.

These costs are wildly unsustainable in maintaining any sort of modern industrial society.

The Hazelwood and Northern coal burners recently shut down.

Meanwhile, as described in the NY Times the other day, 1,600 coal burners, worldwide, are in some stage of being built.

If anyone can justify this turn of events, I’m all ears to learn.

Quick edit …

Using the 5 minute metric rather than the default 30 minute on the AEMO Data Dasboard page, spot price pegged at A$338/Mwh.

Insane.

Mike,

Right, the blackouts which have occured, despite some of the highest electricity prices in the world, are all the fault of those evil fossil fuel producers.

Banning fracking, $0.60 cent feed-in tarriffs for solar, huge up-front subsidies for solar and wind instalations, grid problems caused by a surfeit of intermittent wind and solar, none of that had anything to do with causing the problems.

Unless the government gets a brain and starts taxing gas at the pump hard enough to cut consumption. But I’m not holding my breath.

Dennis,

If you will follow the threading, I was responding to Fernando Leanme, who claimed “The USA has no energy independence.”

Leanme, in turn, I assume was responding to the original article, which said “fracking has given America virtual energy independence.”

You, however, changed the subject from energy independence to oil independence.

This manipulaiton of content is a rhetological fallacy that actually has a name: It is called moving the goal posts.

The above guy doesn’t seem to understand that crude oil is but one line in a set of dominoes. Non-renewable, finite resources such as crude oil have interesting properties, some of which include being non-renewable in supply and finite in extent. Thus, the rationale for this blog — to get a handle on these intrinsic properties. Too bad that you think the act of doing this analysis is somehow evil.

Hi Glenn,

The opinion piece you quoted was mostly talking about the increase in LTO output, any objective person would read it as such.

Yes you moved the goal posts, by changing the subject to all energy rather than oil output which was clearly the focus of the opinion piece.

I am used to that, and I will counter your charts with a chart that shows that the US will not be oil independent.

Here is the quote:

Fracking has given America virtual energy independence, freeing it from the leverage of unstable and often hostile Middle East regimes. The result is less need to interfere in the chronic squabbling in the oil-rich but unstable Persian Gulf.

Does it not seem that “energy” in this quote refers to oil.

If not why the focus on the middle east which exports very little natural gas to the US, but is very influential in the World Oil market?

Dennis Coyne says:

Nah. The article talks equally about oil and natural gas.

From the article:

While many of the folks who follow this site observe oil related matters primarily, specifically the actual or potential amounts in existence, it may behoove readers to step back a bit and observe a few ‘downstream’ effects of shale-inspired production.

At about $200 billion investment, the biggest expansion by FAR in the US petrochemical industry is underway.

Multi billion dollar facilities are being built with continual downstream manufacturing plants being announced to take advantage of the world’s lowest cost feedstock and electricity.

This is why companies like Samsung, LG, Foxconn (!), Haribo, BMW are expanding or creating plants making white goods, cars, candy, and on and on.

A single power plant in Ohio, the Guernsey Power Station – one of dozens being built in the Appalachian Basin – will produce enough electricity (1,600 Mw) to power virtually all of South Australia’s baseload.

Juice in SA is A$97 at midnight, now, whereas it is US$22 in Ohio 8:00 AM.

This is why manufacturers are locating here.

The 16 trade Western Pennsylvania Building Council is actively seeking 20,000 apprentices for their paid 3 to 5 year programs so as to ensure sufficient skilled workers for what is described the biggest, long term build out of commercial projects in that area’s history.

Brand new, ultra modern schools and hospitals have been built in tiny western North Dakota towns due to oil sourced revenue.

The impact of vast, vast amount of hydrocarbons is widespread over a broad range of activities, and is barely getting underway.

maybe those allocating the $$$ have a bit more insight than the “experts” that post here, just a thought ?

then again it is easier sit in front of a computor telling others they don’t know what they are doing and making excuses than to get out of the chair and start being productive.

TT

To me, simply staggering.

Minute, but highly instructive point … the creation, from SCRATCH, of an entirely new industry – bulk, ocean borne transportation of liquid ethane.

Never even existed before.

So, you have executives with decades of experience, pondering countless variables, and deciding to invest tens of billions of dollars to design, build, and operate what is now a fleet of several dozen huge ships.

The infrastructure at Morgan’s Point and Marcus Hook is not even completed yet the ‘virtual pipeline’ out of MP to the new cracker in India is underway.

Running out soon?

Uneconomic?

Puhleeze.

Hi Glenn,

But as I showed, the part of the quote after “energy independence” (that you leave out for some reason) clearly points towards the Middle East which exports very little coal or natural gas to the US.

Yes fracking has produced both oil and natural gas and more natural gas has helped to reduce electricity prices. The US is natural gas independent and may remain so for some time.

The US will only become independent of imported oil (which has always been the focus of “energy independence”) if we reduce out consumption to 10 Mb/d or less.

How do you propose we do that?

>How do you propose we do that?

Taxing gas at the pump would be an excellent start. Infill development instead of sprawl would help a lot as well.

Hi Glenn,

Also the chart you posted includes coal.

So if you want to interpret the piece as oil and gas, then post a chart on that.

The quote on energy independence referred to the middle east which is much more important in oil markets but affects the US natural gas market very little.

Oil is the appropriate chart. All energy much less relevant, a red herring.

Dennis,

So if we’re talking about energy independence, a chart about oil indpendence “is the appropriate chart”?

I don’t think so.

Good luck trying to convince anyone in America of that.

It funny these guys have two modes they switch between. Sometimes its the heroic frackers that caused low oil prices, and sometimes it those sneaky dirty Arabs trying to destroy America.

What Oil Bulls Don’t Know About Global Inventories | OilPrice.com: “The problem is that, as has been the case over the past year, stockpiles aren’t coming down because the oil is being used, it’s just being moved overseas. And nowhere is this more visible than in the record amount of oil exported overseas.”

“U.S. demand did hit a record in the last week of June, but more than half of the week-on-week increase came from the volatile ‘other oil products’ category, not core fuels like gasoline, diesel or jet fuel. In fact, Lee writes that gasoline demand has lagged last year’s level all year and still shows little sign of exceeding it. Over the weekend, we presented BofA’s amazement at the failure of gasoline demand to rise during the peak of driving season, prompting the bank’s energy analyst to ask ‘Where Is Driving Season?’, more specifically, ‘is this year’s driving season over before it began?’”

BoA’s only evidence of falling consumption is a lower price. Once you reject that silliness, things become more clear.

The numbers are right there in the bible. US consumption last year up. US production last year down.

Watcher,

It depends on what one means by consumption, if we focus on gasoline diesel and jet fuel, you are correct at least for April consumption is up YOY. I don’t trust the weekly data, it is not very good. The 4 week average for the end of June also shows consumption is up YOY by 1% for gasoline, distillate and jet fuel combined.

https://wattsupwiththat.com/2017/07/10/the-world-keeps-not-running-out-of-oil/

Hi Texas Tea,

Nobody expects the World will run out of oil, simply that there will be a peak in crude plus condensate output between 2020 and 2030, though some believe this may happen sooner or has already occurred.

Yes oil output has been resilient, but this is not likely to continue beyond 2030. As the cheap oil becomes scarce an oil prices rise, oil use may get replaced more and more by other energy sources providing electricity to battery powered vehicles. Personal transport will be replaced first, then society will move on to freight moved by electrified rail and battery powered trucks (from rail terminal to factory or store). Personal transport by 2050, land freight by 2070. After that there will be little need for oil except maybe ships and planes and these uses may be replaced by 2090.

Another example of an “oil industry geophysicist” posting at WUWT misrepresenting the facts. So often it turns out that people like Middleton that deny that oil is a finite resource also deny that AGW can occur. Middleton spends most of his time on WUWT writing anti-AGW posts. There is something about the oil industry that indoctrinates their workers.

The Eugene Island case shows rapidly diminishing returns regardless of the fact that secondary production peaks occur. Middleton says that “Most of the growth comes from well performance, field extensions and economic revisions.”

The main revision being that somehow, some way, the oil industry will redefine renewable energy as oil, lol.

So the goal is to put more oil on the market, thus lowering the price for everyone? A spiral to the bottom?

Trump’s First Step To Boost Gulf Of Mexico Drilling | OilPrice.com

Solo una pregunta ¿A quien pertenece esos yacimientos? ¿Pertenecen a México o a Estados Unidos?

Creo es EU en el parte de golfo norte.

NAOM

THERE’S STILL A MAJOR REASON WHY OIL COULD JUMP BACK TO $120, EXPERTS SAY

http://www.cnbc.com/2017/07/07/theres-still-a-major-reason-why-oil-could-jump-back-to-110-experts-say.html

With Libya and Nigeria not being impacted by internal conflict I think we have almost no oil off production for non oil industry reasons, (unless you count the lack of maintenance in Venezuela) – I’m not sure when last that happened, if ever. So all the risks are likely to be on supply upsets now.

BLOG: NEW PROJECT SANCTIONS ON THE RISE

https://www.woodmac.com/ts/tech-services/2017/06/22/blog-new-project-sanctions-on-the-rise/

I missed this a couple of weeks back. Didn’t see it posted here. 2.5 Gb would only support about 400 kbpd, but as most of it is brownfield or tieback it wouldn’t necessarily be added production but either extending a plateau or ameliorating decline rates. Overall this just means any oil supply shortfall after 2018/2019 will be longer and sharper.

2.5 billion _BOE_ liquids.

BTW. thank you for a very interesting and well researched article/post.

Thanks – I’m not sure what you are saying concerning the BOE number. I use Gb which is confusing probably, but so are most things to do with units in the oil industry.

From the Aramco CEO speech yesterday:

https://www.bloomberg.com/news/articles/2017-07-10/aramco-to-spend-300-billion-as-ceo-frets-about-world-oil-supply

Saudi Aramco, which plans what could be the world’s biggest initial public offering, will invest more than $300 billion over the next decade to maintain its spare oil-production capacity and explore for more natural gas, President and Chief Executive Officer Amin Nasser said.

I still don’t get why he thinks it’s his job to tell the ret of the industry how much they should be investing, but reading the above I’d say they have no more oil to find. $30 billion per year is about $8 per barrel production, which is a pretty good operating cost for mature fields, I don’t see that number representing too much new, greenfield development.