An interesting analysis was recently published by BNP Paribas (one of the top 10 banks in the World by assets) entitled Wells, Wires, and Wheels… . In that analysis they argue that long term oil prices will fall to $20/b or less in order for oil used for personal land transport to compete with EVs powered by wind and solar at current cost levels.

I reworked my oil price assumptions, first with a simple scenario that follows the EIA’s AEO 2018 reference oil price scenario up to $70/b in 2017$ and then remains at that level long term. Second I noticed that a scenario with such an oil price assumption sees tight oil output fall in 2022 so the scenario was revised with oil prices rising from 70 to 80 per barrel from 2022 to 2024 and then remaining at that level until 2028. The BNP Paribus analysis suggests that EVs will have cut significantly into oil demand by 2022 to 2025 so I assume oil prices fall to $20/b over the next 10 years.

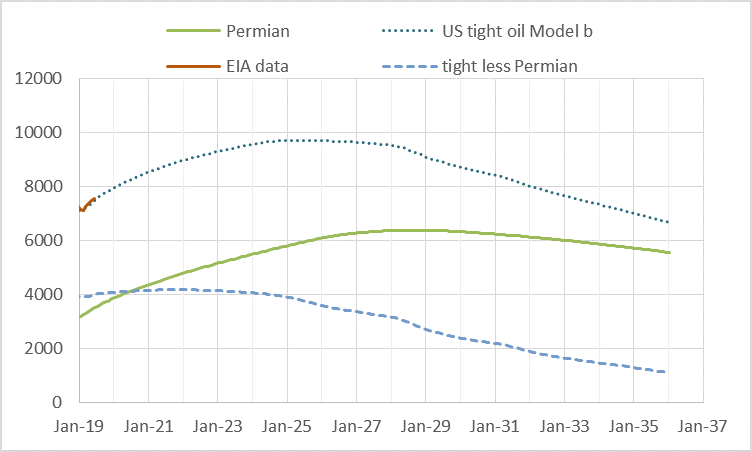

Scenarios below.

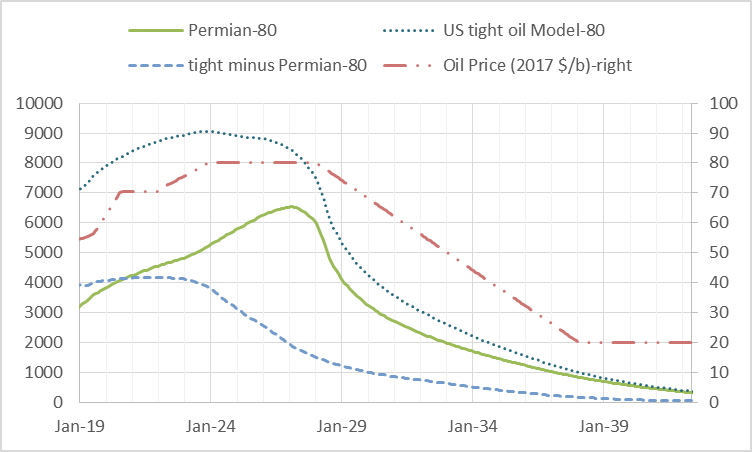

The chart shows US tight oil output as well as Permian output and US tight oil minus Permian tight oil, the oil price scenario with the maximum price of $80/b is shown on right hand vertical axis. URR for tight oil is about 53 Gb for this scenario from 2006 to 2052.

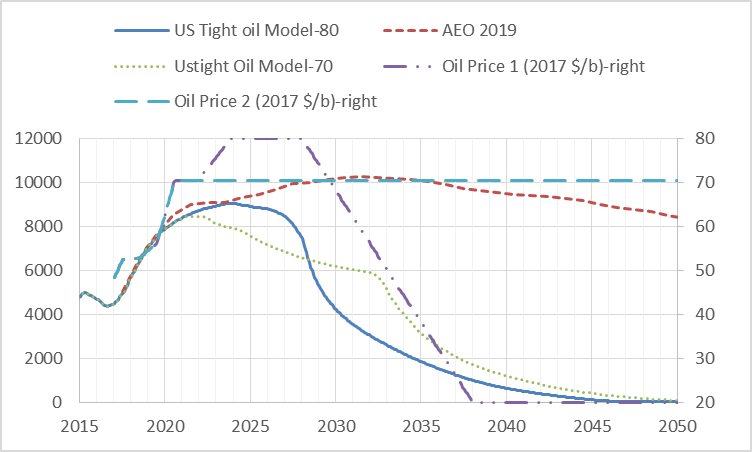

Chart above has EIA’s AEO 2019 scenario which assumes oil prices rise to $109/b by 2050, for such an oil price scenario the scenario is reasonable up to 2028, beyond 2030 it is highly unlikely that the scenario will be correct if the USGS mean TRR estimates for US tight oil are also correct. The scenario would be more in line with the USGS F5 TRR estimate which the professional geophysicists and geologists at the USGS believe has about a 5% probability of being realized. In short, the AEO 2019 tight oil reference scenario (especially after 2030), is highly unlikely.

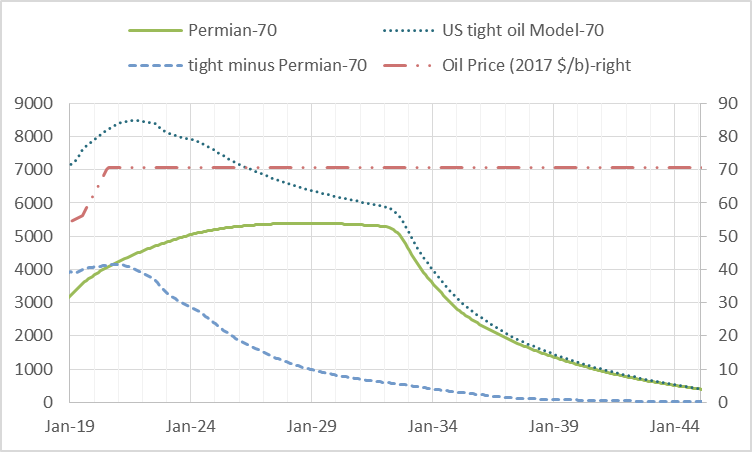

The scenario with a maximum oil price of $70/b in 2017$ is below, oil price on right axis.

It is unclear how quickly the transition to EVs might be accomplished, the scenario with prices falling to $20/b by 2038 assumes autonomous vehicles reach the approval stage by 2028 which may lead to a rapid increase in miles of vehicle travel by EVs and a precipitous fall in miles travelled in ICEVs. In fact, it is probable that the scenario presented may be too conservative under that assumption, we might see oil prices fall to $20/b by 2033 rather than 2038 which would lead to a steeper decline in tight oil output.

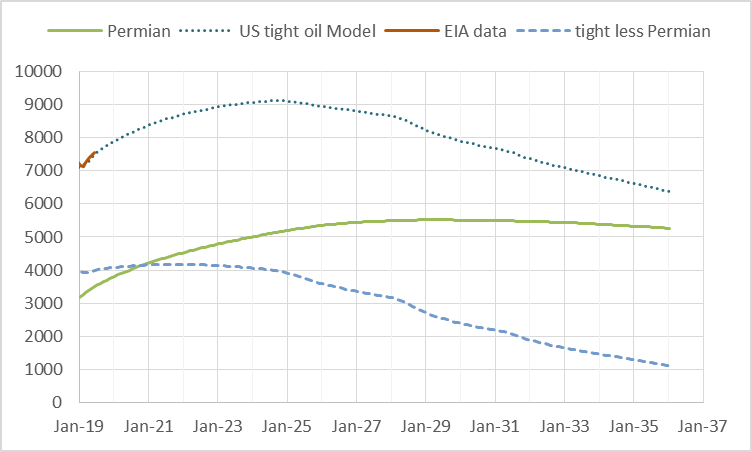

Earlier scenarios presented below (from a previous post).

The above scenario uses a scenario with oil prices rising to $100/b (following AEO 2018 reference scenario) in 2017$ and assumes the completion rate is unchanged from the average completion rate in the first half of 2019 up until 2025.

The scenario above uses the same oil price assumption as the previous scenario, but the completion rate rises by 15% over a 66 month period (from 478 to 550 from July 2019 to Dec 2025) in the Permian basin with other tight oil basins unchanged from the previous scenario (where the completion rate was unchanged over that 5.5 year period).

Dennis

I think that BNP Paribas is to optimistic on the penetration of BEVs. (See below). I still think the road to BEVs is first thru PHEVs since their initial cost can be lower. Mind you, these will also reduce gasoline demand. I just read a piece at green car report, I think, where their survey said that most consumers would be happy with a 75 mile range for an around town car.

Clip from J. D. Power report.

Mobility Confidence Index is 55 for battery-electric vehicles: With an overall score of 55, consumers have a neutral level of confidence about the future of battery-electric vehicles. Attributes scoring lowest include likelihood of purchasing an electric vehicle (39); reliability of electric compared to gas-powered vehicles (49); and ability to stay within budget compared to gas, diesel or hybrid vehicles (55). Most consumers, regardless of age, believe there are positive environmental effects of electric vehicles.

Full speed ahead—for small market share: Both consumers and industry experts recognize it will be well over a decade before electric vehicles equal gas-powered vehicles in sales volume. Experts also predict it will be at least five years until battery-electric vehicles’ market share reaches 10%.

Full report at:

https://www.jdpower.com/business/press-releases/2019-mobility-confidence-index-study-fueled-surveymonkey-audience

Hi Ovi,

Best selling electric vehicle is the Model 3, this will be surpassed by the Model Y. The Chevy Volt was probably the best PHEV and was discontinued, not a lot cheaper than the Model 3. As I have suggested in the past, a car with an ICE and Battery system is complex, far more complex than a simple BEV. As BEVs reach scale they will be far cheaper than ICEV. Read the report, it is pretty clear the advantage goes to BEVs powered by wind and solar, a problem for both the oil and the natural gas industry as natural gas also will have difficulty competing with solar and wind. Coal is already more expensive than natural gas.

JD Power is kind of an entrenched cheerleader for the status quo. Plugin vehicle sales have been growing quite rapidly, quite a bit of this growth has been BEVs. In 2018 Plugin sales growth was about 64%. A fairly conservative scenario (with decelerating sales growth to 20% by 2030 has World sales of Plugin vehicles at 74 million per year by 2032 and cumulative sales of 371 million by 2032. By 2033 all new car sales are plugins, but it takes another 15 years for the entire fleet to become plugin vehicles. That scenario ignores the possibility of autonomous vehicles(AV), that replaces passenger vehicle miles far more rapidly because an AV will probably drive an average of 50,000 miles per year rather than 10,000. So it accelerates the process of eliminating ICEVs (miles driven by ICEVs) by a factor of 5. My scenario is quite conservative as it ignores AVs.

You are mixing several things here.

First, EV market share is not the same as fuel consumption. Since electricity is much cheaper than liquid fuel, EV sales will skew towards heavy fuel consumers like taxis, which we have already seen with hybrids. In general, EVs have high initial costs and lower operating costs, than ICEVs. Most cars are parked 90% of the time, burning no fuel. For those cars purchase price matters. For heavily used vehicles, operating costs matter.

Second, you are mixing market share with profitability. The latter drives investment and business model viability. For example, in America online retail is only about 10% of retail, but it is hammering retail chains anyway. Shopping malls are not closing because they can’t sell enough physical stuff, they are closing because they can’t make a profit. The net result may be a decline is the amount of physical stuff Americans buy. If you don’t buy online and your local Sears closes, you may end up buying less.

In the same way, the oil business relies on the belief that oil is reasonably priced. If EVs show consumers there is a cheaper alternative, they may be motivated to cut oil consumption. People don’t like getting ripped off. They want a fair price, and what that means is based on their own judgement. That is a personal (or herd) choice. For example, German houses are smaller and more sturdily built than American houses. Germans consider American houses flimsy, and Americans consider German houses cramped. There is no right and wrong here. If EVs persuade consumers that oil is too expensive, demand will fall, whether it “makes economic sense” or not.

Third, you are confusing general market sentiment with buying potential. You quote 39% as a low value for consumers likely to buy EVs. 39% of the car market is not a low value. It is an order of magnitude more than the EV industry can produce. The market is switching as fast as the product can be produced.

Also you are muddled about the meaning of customer surveys. Market sentiment is driven by herd instinct and advertising. As the number of EVs sold increases, the number of interested buyers will also increase. Consumers don’t actually care what kind of drive train their cars contain. If the industry tells them to buy EVs, they will, just like they bought cars with fins in the 50s and buy bloated pickups today.

Another huge problem for the car industry (and the oil industry in the long run) is autonomy. It sounds like science fiction to most people, but car companies are all betting on it. Autonomy means sales of cars will fall in the next decade, eroding the buffer of the ICEV fleet that protects the oil industry.

But more important, autonomy accelerates the move to EVs because current car design is so terrible. Cars used to be mechanical wonders with a little electricity. Now they are multiple electronic systems wrapped around a mechanical core. The slow death of the carburetor and belt driven components shows how this core is being eroded. The much talked about switch to 48 volt systems is designed to clean up a lot of the mess cars currently are.

When my tank is low, there is a special trigger that alerts my navigation system and suggests to me I look for a gas station. But my navigation system has no idea if I am signalling a left or right turn. Also cars have miles of redundant wiring because individual systems are controlled independently. Tesla is now planning to build hub and spoke wiring to allow semi autonomous zones in the car to control all the components contained there based on a single wire for energy and a single data channel to a central processor. This should greatly reduce complexity, weight and assembly costs.

Autonomous cars need complete control over the entire car. By far the easiest way to do this is by making the car completely electric, a computer on wheels, and removing mechanical devices where ever possible. They also reduce demand for human driven vehicles, which are mostly ICEVs.

Another huge problem for the car industry (and the oil industry in the long run) is autonomy. It sounds like science fiction to most people, but car companies are all betting on it. Autonomy means sales of cars will fall in the next decade, eroding the buffer of the ICEV fleet that protects the oil industry.

This episode of Know You Know, specifically addresses the fact that the legacy automakers are literally stuck in the past with their business model and don’t get that much sooner than they could possibly anticipate, they will no longer be selling cars because nobody will want to own them.

https://www.youtube.com/watch?v=RMfdYMpXcTc

The ‘Soon” Fallacy | In Depth

Thanks for the price/production charts Dennis. I can think of plenty of economic reasons why low oil prices may occur and persist in the future, and it’s interesting to see the impacts that it might have. I anticipate a GFC2, or worse, and from what I remember about the last one, not everybody was running out to buy a new $45,000 vehicle. Maybe if they’re good for sleeping in I suppose.

Taxis have certainly been the ones embracing EVs from what I can see. Otherwise I see very few EVs around.

Survivalist,

In this case, the low oil prices are due to alternatives to oil being cheaper than oil.

Of course GFC2 would also lead to lower demand for all goods including EVs and oil, I doubt a GFC2 will be permanent, recovery will be quick if the World does not respond in the manner chosen by the EU in response to GFC, if most nations choose no fiscal stimulus in response to GFC2, it will quickly become Great Depression 2 and recovery will take a decade or more. Keynes will be spinning in his grave.

If EVs and renewables scale up quickly then GFC2 may not occur until 2069.

Sometimes these things happen far more quickly than I anticipate. I am the guy who thought iphones were a dumb idea when first saw them, they would never be a big thing, so I tend to underestimate the speed with which technology can catch on.

You have made this comment before, about a Keynesian response saving the day from GFC2. What are we experiencing now if not Keynesian stimulus, with $1 Trillion plus annual deficits in the USA and negative interest rates across the seas. It makes one wonder what could be done to level up.

You’re talking about government debt. Republicans have brainwashed Americans to thinking it is the end of the world (when there is a Democrat in the White House), but really, although it is high, it could be dealt with by simply raising taxes, not to mention going to the effort of collecting them. Check out the recent history of Greece. Austerity works.

America has a much more serious problem, which is foreign debt. Both problems could be dealt with by adding a dollar or two of tax to gas at the pump.

Alimbiquated,

I strongly disagree, austerity does not work. It is the reason Europe did so badly after GFC. I do agree taxes should be collected, Greeks are notorious for not paying taxes. Serious fines or prison time for the wealthy who don’t pay might be one solution.

Perhaps you forgot the smiley face next to “austerity works” I often miss sarcasm in a post unless indicated.

As you point out below, it depends on who you are being austere to. what america needs now is massive tax increases to the rich combined with massive consumption taxes, for example for gas. The former would reduce government debt and the latter would reduce consumer debt by shifting outlays from consumption to investment in cost reducing investment. Reducing consumer debt is key to reducing foreign debt.

Alimbiquated,

I am thinking of fiscal policy more on the spending side rather than the revenue side. Generally higher government spending helps both rich and poor as in all boats rising with the tide.

I do agree that more progressive tax policy would be a good thing, but the rich hold power in the US as evidenced by our current president who has fooled the middle class into believing that he has their best interests at heart, he only is interested in Donald Trump’s interests.

You’d need to make that about $6 and even that would not reduce the debt, just stop adding more – then you have the issue of reducing consumption that reduces tax collected.

NAOM

NAOM,

The wealthy do not consume all their income like poor folks and the middle class. Raise taxes on the wealthy and consumption falls very little.

I was referring to the point about tax on fuel and, given the annual fuel consumption, that would be the approximate level to raise around $1T. That would hit the poor hard and the rich would just moan and carry on. Just taxing fuel won’t fix the problem, it needs changes right across the board so to poor do not bear the brunt of the problem while the rich stuff their pockets.

NAOM

Notanoilman,

Sorry I get it now. I think carbon taxes make sense but prefer a fee and dividend plan where all carbon taxes collected are refunded to each citizen equally. So it is revenue neutral and progressive. The way to raise taxes to reduce debt is to raise tax rates on income over 300k to 40% and income over 600k to 60%. Basically raise taxes on the wealthy enough to reduce deficits. Also eliminate all loopholes and treat dividends and capital gains the same as wage income and interest.

NAOM,

Agree fuel taxes would hot the poor if not done correctly. A tax and dividend plan would be revenue neutral and would tend to be progressive. All taxes collected returned to all citizens equally regardless of income. The rich tend to use more fuel on average, those poor and middle class folks that are smart enough to cut their fuel use will come out ahead. This policy would be combined with a highly progressive income tax that eliminates special treatment of dividends and capital gains and other special perks for the rich. All income from every source would be treated equally (wages, interest, dividends, capital gains, tax refunds, rents, royalties, and anything I haven’t thought of).

Duanex,

Deficits are a fiscal stimulus, in the US taxes should be higher to reduce deficits, preferably a progressive tax. The negative interest rates are a monetary stimulus, a far less effective policy which leads to poor allocation of scarce capital. Also note that a 1 trillion dollar deficit for an economy of 21 trillion is not a huge deal.

I hear often, that we could raise the tax level to take care of a particular problem, such as in this case debt.

Very true, but the same argument is used for too many issues. Debt, SS, Medicare (for all), Discretionary projects like infrastructure or military.

One such project is doable, more than one questionable.

Dangerous game to play.

Would you do it your personal families finance?

Perhaps if your future prospects were incredible.

Lets remember, these are the ‘good’ times, when the past debts of crisis should be retired, not accumulated.

Hickory,

I am suggesting paying down debt during good times, we could also cut spending as well as raise taxes as a compromise (Republicans like cutting spending and Democrats don’t, positions reversed on taxes).

Republicans like cutting spending! Oh, I get it you are being funny today. HA.

dclonghorn,

They claim to want to cut spending by government, certainly moreso than the average Democrat in my view.

I am a comedian, but only inadvertently.

Interesting: Attributes scoring lowest include:

*Likelihood of purchasing an electric vehicle (39);

In Europe and China ALL vehicles produced soon will be electric. So the likelihood of purchasing an electric vehicle in those huge markets (and the markets they feed to) becomes 100%.

In markets where some poor fools are still trying to sell fossils, with thousands of acres of used ones as well as new ones, who would by a Ford over its tecnhnically and economically superior electric equivalent. Look out when decent utility EVs arrive – that will be the final straw. Not only the Tesla Ute, but Rivian, Great Wall and a swarm of others are starting to enter the market – inducing both the lads on the farms and the ladies on the high street to take up an EV.

*Reliability of electric compared to gas-powered vehicles (49);

The engineering simplicity and ability for on-line upgrades of EVs ensures very good reliability compared to fossils. That low score comes out of the ignorance of the consumer (which ignorance, the fossil industry nourishes, of course.)

*Ability to stay within budget compared to gas, diesel or hybrid vehicles (55).

Why would EVs be worse than a fossil clunker. Thrown a cam belt lately – bang goes any budget!

So all these are just ignorant (some willfully so) responses.

The facts are much clearer, as the paper notes: EVs now make economic sense in most constituencies. Fossils don’t. Game over.

Rethinking Renewable Mandates

Tesla car erupts in flames after ‘autopilot failure’ in Moscow

When using autopilot you are supposed to pay attention, the feature is not perfect. It is adaptive cruise control and lane keep assist, nothing more.

Agree no subsidies are needed. EVs will quickly take over market for cars. They will be cheaper to own and operate.

Civilization is a ‘technology’ that is currently ‘crashing and burning’, so to speak, and that encompasses your ‘markets’, which encompasses your ‘electric carriage’.

If there is some kind of human aspect that that kind of technology, despite itself, lulls people into not paying proper attention, then it may prove to be useless and, of course, worse than useless.

Since you seem to be tracking car fires. Here is a news station that did at bit of research on the 3000 or so Hyundai and Kia fires. I will save you watching the video, by saying it sounds like a fuel pump issue. There were injuries and one death. No lithium, just gasoline. Of course, this doesn’t include the many other car fires and recalls that I have heard about. I can run those down for you, if you wish.

https://www.abcactionnews.com/news/local-news/i-team-investigates/up-in-flames-an-abc-action-news-investigation-in-kia-and-hyundai-vehicle-fires

Ok, guys, now let’s go over, if only in our heads, all the problems with cars in general, and vis-a-vis the crony-capitalist plutarchy, nature and community. Go ahead, try it as a personal thought experiment. Try to leave as little out as possible.

I wonder if, in the final analysis, any relatively complex human technology actually ‘works’.

You know, y’all need to think in terms of per capita miles driven by state.

NY for example drives 6800 miles/yr per person. Texas 10,544. Point being, if city folk decide to not drive their gasoline car, well, they weren’t doing so much anyway. Texans do drive a lot, there are a lot of them, and they aren’t going to leave themselves stranded on the road when there’s a perfectly good gas station right across the street.

And so, you’re not saving much oil consumption. The growing pop states like North Carolina also have wide open spaces, they drive 11,120 miles/yr . Lots of people who drive long distance. Vs NYC.

Reduced environmental impacts is zero importance, of course, because no one will agree to starve to keep global warming slower.

Watcher,

I will probably drive about 20k for the first year owning my Model 3. I live in a very rural state, no problem with being stranded. Plenty of superchargers in Texas. In addition charging infrastructure will only get better with time. Plenty of coal, natural gas, hydro, wind, solar, nuclear, and geothermal to produce electricity to power EVs. The total cost is far cheaper, just read the report referenced. Not some green outfit, one of the top ten banks in the World. It’s real, oil is going down to $20/b, most of it will be left in the ground as it won’t be able to compete.

One can set the price at $8o/b, but not many buyers will be found. Unless you want to subsidize by calling the price $80 and then rebate $60 to customers so the real price is $20/b.

Watcher

Assume 300 driving days per year.

NY @ 6800 m/yr = 22.67 m/d avge.

Texas @ 10,554 = 35.2

NC @ 11,120 = 37.1

Dennis @ 20,000 = 66.7

So you can see a PHEV with between 50 or 75 mile battery range would probably cover close to 75% to 90% of most trips on battery. A little range extender engine picks up the odd longer trip.

As a point of interest, the original Volt was designed for a 38 mile range because it was the US average trip length. GM’s survey of their customers revealed that their biggest request was more miles on battery. So in Volt2, they went to 54 miles with a lighter battery and similar volume.

The Volt has been discontinued. A nice idea, but 35k vs 39 k for a Tesla Model 3 which is a far nicer car.

The Volt was an amazing piece of engineering for it’s time. Very complex but generally worked well. Now that EV’s have progressed in range, quality and ability the Volt can be quietly put aside over the next 10 years as they lose support and age.

Dennis

According the this article 40k buys a pretty stripped model 3. I am sure most pay for the extras.

The cheapest Tesla you can order online will now be the Standard Range with a software limit on battery capacity and it will cost $40,700 with a — euphemism alert — Partial Premium Interior, comprising power front seats, leatherette upholstery, an upgraded audio system, and navigation. This new Standard Range will have 10 percent less range — reduced by software — than the Standard Range Plus. That interpolates to 226 miles, close enough to the original-maybe-it-existed Standard Range’s 220. Software guardians of the pecking order will also block out the heated seats, navi, and online music streaming. They can pay a fee to upgrade to the Plus’ higher range, and features. Car and Driver said buyers of the Standard Range were getting calls from Tesla reps asking if the buyers didn’t maybe want to upgrade to the Plus after all.

Hi Ovi,

It is 40 k for the standard range plus with 240 miles of range.

The Volt was 35 k. I assure you the standard range plus for 40k is a far nicer car than the 35 k volt. It was an ok car, just far less of a car than the model 3.

Note that I have a Camry XLE hybrid, I used to think it was a nice car.

It is ok, but half the car of the Model 3. Performance, ride, handling, etc a completely different league. You would need to test drive one to appreciate the difference.

Ovi,

Probably 350 days driven per year, maybe 344 at minimum. The tesla is almost always the car of choice, though when leaving a car at an airport it is the Camry. So about 58 miles per day on average. Most days it is about 15 miles.

In the second half of this coming decade, miles driven by EV or PHEV will be considerably cheaper than for petrol miles. Most Texans (and other people) are price sensitive, and will opt for the better deal when they are ready for a new vehicle.

It already happened to me. I got a PHEV just over a year ago. My miles are much cheaper than they used to be. 3/4 of my miles have been electric, supplied by solar PV on my roof. 1/4 of the miles have been petrol. The money diverted from the petrol station is in effect more rapidly paying off the roof panels, which also provide all of our net annual electricity household consumption.

This kind of scenario will become more obvious to people all around. And very gradually the nations stock of on road vehicles will be electrified (either full EV or PHEV- same outcome).

It will take a long time to accomplish the shift. We’ll see which auto manufacturers can stay ahead of the curve. Its going to be a very rough road for those who aren’t out front. And there may come a time when battery supply becomes a limiting factor. Tesla has a big advantage on that front.

Note to watcher- no one is agreeing to starve, just to trying avoid being left without transport and and being subject to massive transport price increases when petrol goes through the coming depletion process. The country certainly needs to begin with deployment of an alternative to the dire scenario you seem to look forward to.

What was the full cost of your panels, charging gear, and installation? And how much do you reckon you are saving monthly or annually?

I keep running this idea around in my head, but I only spend $100 per month on gas and the electricity will still cost something. I reckon $20-40 range per month. Savings, yes. But only an $800 savings per year. That’s a long payoff on a $15K panel array turnkey install, which was last I was quoted (could have come down). Maybe 20 years to pay for itself, if no replacement and maintenance is required, which seems unlikely.

Those economics haven’t worked for me, but prices will keep dropping, I think, or I’ll just go ahead at some point.

My system total cost was $16,000.

Our electrical bill was much higher than yours.

The costs for a system have come down, we paid $2.40/kW in early 2018, and generated

11,000 kwhrs in the first 12 months.

We had excess production, and the utility has credited us $480 (even though they pay only 3 cents/kwhr for excess production, while charging up to 25 cents for consumption!)

We expect excess production to cease once we get a second EV in the coming decade. In fact, we might need to get some more panels. We have 20, might want 6 more.

With a low electrical bill that you have, it may not make sense at this point.

If you get a PHEV or EV at some point, the economics will shift strongly in favor of getting a PV system.

Watcher! Some perspective, purlease!

Texas average of 10,544 miles per year is just 29 miles per day. Even a 30 kWh Leaf can do that for three whole days before needing a wee charge from the wire hung out the kitchen window! And that charge may only cost you $3.00 (at 10 cents per unit) and away you go again for another three days. How much does it cost you to drive your Texas Tank for three days??

I think price ever getting back to $70-$80 depends a lot on how well things hold together. You really need calm markets instead of chaos to get oil there. I expect absolute chaos to continue as the pie starts to shrink for everybody. People assume that things are going to get calm and remain calm. That just not in the cards. Matter of fact the chaos is going to accelerate from here on out.

Anybody have a WAG about how much debt would be needed to build out renewables and EV’s for everybody? Your also going to have to put that debt on top of the current debt.

The renewable and EV economy will need to be able to service all the debts from the prior fossil fuel economy plus it’s own debts.

You couldn’t pay me any amount of money to own a bond be it government or corporate. All that paper will be worthless as we attempt a transition to a renewable and EV economy. Only way they get paid is with monopoly money.

HHH,

The cost is lower for EV, wind and solar, read the report. Cost lower by a factor of 4 to 5.

Dennis the cost doesn’t matter one fucking bit. Can a EV and solar economy generate enough profits to service the debt or not? It’s not a viable way forward if not. Can Shale oil generate profits at current price the answer is hell no and it’s not a viable way forward. Without profits all one can do is go further into debt to keep the farce going until they can’t anymore.

HHH,

Solar is quite profitable see

https://www.forbes.com/sites/greatspeculations/2019/01/30/nextera-energy-best-in-class-but-at-a-price/#5d1368414a2d

https://finance.yahoo.com/quote/NEE?p=NEE

Tight oil, not profitable at $60/b or lower for Brent Crude.

Financial engineering of stock price isn’t really a profit. Real profits are you borrowed money to create something like Tesla cars. Then you made a profit after all cost are deducted including taxes. There is either a profit there or there is not. Now companies can continue on not making a profit for a very long time though being able to borrow more money. Doesn’t mean any of it actually gets paid back. All it mean is companies expand their ability to take on more debt right up until they can’t anymore then they fold. The stock buybacks that are taking place at every major company in America are a form of company liquidation. When real profits and revenues can’t keep up with the debt servicing cost piled on them to do all those buyback and cost of daily business each and everyone of them will fold.

Hell the major oil companies can borrow cheaper than the rest of them. Doesn’t mean they are going to make dime on shale oil. Just means they are going into debt producing shitty oil.

You can have all the growth in the world and still not make a profit Dennis.

Banks have to be profitable too. Banks borrow money short-term and lend long-term. If your in Germany where the central banks benchmark rate is negative 0.40% and the entire yield curve all the way out to 30 year is negative. How do you make money lending within the borders of your own country? There is no profit to be made lending in Germany. And yes i understand there are loans with positive interest within the borders of Germany where money can be made lending but all those loans are not government backed loans. They are loans that depend solely on there being profits made in the real economy.

Without profits eventually governments no longer get funded because there is no profits to tax. Oh wait they can just issue more debt at a negative rate and have the central bank buy it. Anyone that believes that this can and will continue to go on until the end of time is fooling themselves.

People believe central banks can just buy up all the debt and cancel the debt. What is to stop them. Give all governments a clean slate to borrow. Ask yourself why haven’t they already done that? Facts are central banks around the world have bought up trillions in debt and none of it is getting canceled.

HHH,

Not all companies have no profits and just because a company borrows money does not mean they are not profitable. A company that is expanding operations will borrow to take advantage of existing opportunities, in some cases things won’t play out as they expect and they may borrow too much.

Amazon for years did not turn a profit, they are looking pretty good lately. My guess is the same will be true for Tesla, VW, some Chinese EV producers, and power companies that focus on solar and wind power as well as battery storage and HVDC transmission.

HHH – ” Can a EV and solar economy generate enough profits to service the debt or not?”

In my world, you service your debt with earnings. Then if you have leftover it may be considered profit.

Much more important question to ask, “if the country did not embark on a rapid development program and deployment of electric transportation, what would be the economic repercussions of declining oil supplies?”

Since you are a stock guy, you might enjoy riding these two solar equipment companies in to the higher layers of the atmosphere- SEDG, ENPH

I’d invest in the medals that are required to build batteries rather than pick any particular companies stock. No i’m not a stock fan.

Way i see it EV’s will revolve around battery storage. Forget about where and how the electricity is being produced. These can be coal, or natural gas, nuclear or hydro powered EV’s or solar and wind. They all need certain medals for batteries.

HHH,

Metal mot medal.

‘Not’ not ‘mot’ 🙂

Yes ‘Mot’ 😉

mot 1

/mō/

noun

noun: mot; plural noun: mots

short for bon mot.

bon mot

/ˌbän ˈmō/

noun

noun: bon mot; plural noun: bon mots; plural noun: bons mots

a witty remark.

synonyms: witticism, quip, pun, pleasantry, jest, joke, sally; More

Origin

mid 18th century: French, literally ‘good word’.

Dennis was right on the ‘Mot’! And I found it quite funny.

Cheers!

I am only funny unintentionally.

That’s a great kind of funny sometimes, Dennis.

That is funny! thanks for the correction Jay 🙂

HHH, that is what I think also. It won’t remain calm and a certain kind of chaos has appeared already (‘energy choice dillemas’, ‘effects of climate change’ to name two). The chance of a concerted transition to EV’s, etc in course of slowly rising oilprices in the next let’s say 10-20 years is not very big in my opinion. Simply because there are a number of reasons to imagine why oilprices are not going to behave that way. Think about for example a rapid increase and then a crash in price. We have seen that in the previous decade.

The fact that EV, etc costs are lower by a factor 4-5 far from completely erase the problems of the current debt economy (governments and consumers).

Ah, but what level of market penetration by the Renewable Electricity + Electric Vehicles combo (RE+EV) is required to knock out the players who are only surviving on (ignorant) shareholder sentiment that maybe oil will get above $70 and stay there? I would say you only need enough to ‘prove’ to investors in the fossil industry that the threat is real. A clear 1% penetration may be enough. I think 5% penetration by RE+EV would be a huge signal to the market. You don’t need 25% or 50%.

These investors will switch their money in a blink of an eye if the signals are clear. As they say: “You won’t need much. Just a tiny taste.”

I can’t say that I agree with Watcher about a whole lot, but one thing he does say is that when you MUST have something, you will get it, one way or another. Oil for now, and for quite some time to come, probably at least two or three decades at best, is something we simply MUST have.

If depletion and or political factors reduce the supply of oil faster than electrification of transportation reduces the need for it, the price WILL go thru the roof. If the user doesn’t pay at the pump, he will pay at tax time, collectively speaking. One way or another, we are all users, and one way or another, we are all de facto tax payers.

I can’t see that ANYTHING other than hard times and or oil becoming obsolete as transportation fuel can keep the price of it down very long, considering depletion.

One thing that always REALLY pisses me off is that so many people talk about the price of something being CHEAP, when it’s subsidized. It still costs the same, and somebody, in essence, EVERYBODY pays the subsidy. Even a little old lady who has never paid a dime in income taxes, because her husband supported her pays, de facto, because the subsidy any one person gets reduces the subsidy any other person COULD get, namely HER.

I’m not opposed to subsidies, in principle. I support subsidizing renewable energy, electric cars, etc. Bottom line, such subsidies are EXCELLENT deals for EVERYBODY, except those with skin in the current day bau ff industries. But it’s not good pr to talk about subsidized cars as if the subsidy is a miraculous gift . This sort of talk INFURIATES people by the tens of millions who CAN’T get any particular subsidy, and as often as not wouldn’t want to even if they could. And you can be sure they know about the subsidies for rewewable energy and electric cars, because their favorite talk show hosts, so called news organizations, and politicians remind them often enough that they CAN’T forget.

A FAIR way to subsidize an electric car would be to have a national lottery. Everybody gets an equal shot at a winning ticket. If I win, I can apply it to the purchase of an electric car. If I can’t afford a new car, or don’t want one, then I could sell it to somebody who DOES. End of discrimination on the basis of being well enough off to afford a new car.

Politically speaking, this could be a HUGE winner. Before long every little rural small town and county weekly paper would be running a picture of a farm laborer or the town drunk who has just won, and sold his subsidy check/ ticket, and used the proceeds to buy himself a well used F250. Half of his friends and acquaintances would rush out to register and vote D, because them there tree huggin’ whale lover soc’lis red commies Dimmerkrats are all at once COOL ’cause they’re running a ” FREE” lottery for them.

Is the Permian better then most think today ?

https://www.forbes.com/sites/davidblackmon/2019/08/08/heres-what-is-really-happening-in-the-permian-basin/

“What we’re seeing is that [Permian Basin] wells drilled this year are continuing the trend of being better than they were the year before, across the whole Permian – the New Mexico Permian and the Texas Permian. Average per-well peak rates for the New Mexico Permian since 2014 have gotten better every year, averaging about 20% better every year. But more importantly, on a cumulative basis, the same amount of time it used to take to produce a nominal break-even per well was five years [in 2014], and today it’s 9 months. – Allen Gilmer, Founder and Chairman of the Board of DrillingInfo”

“these producers are sitting on another Saudi Arabia and have years worth of locations that can be profitably drilled at $20-$30 prices. Most of it is economic at $40/bbl – you just need to be able to go out there and do it the right way.”

That doesn’t jive with the recent statements from the CEO of Pioneer.

I follow @allengilmer on Twitter to observe his cornucopianism and undying Trump allegiance. It’s comical stuff that I feel the urge to reply to but realize he would just block me and then I would miss out on where his lunacy is headed.

It has to be that his political agenda influences his forecasts. Does Gilmer have any charts to back up his claims? Or are these saved for his paid subscribers?

Envision,

People who actually know something about producing oil like Shallow Sand and Mike Shellman might tell you that the claim that most Permian basin oil is profitable at $40/b is a load of BS.

To earn a modest return of 10% for a highly risky endeavor (drilling a new well whose ultimate recovery is unknown) requires an oil price of at least $62/b at the well head (WTI=$66/b) over the 15 year life of the well at an average full cycle capital cost for well, land, and associated infrastructure of about $10 million for the average Permian well. Also note that the “typical” EUR touted in investor presentations is about 2 times too high (1.84 aactually) for barrels of oil produced. The natural gas is not very profitable, though I include it in the breakeven analysis (along with NGL) to offset some of the OPEX.

My scenarios use a relatively realistic analysis to arrive at US tight oil output, under an optimistic scenario for oil prices (rising to $100/b) and the mean USGS TRR scenario for US tight oil, there might be 75 Gb of URR for US tight oil. If oil prices are low due to an EV and renewables transition as envisioned by BP Paribas the URR will be about 50 Gb, with a steep drop in output around 2030, for the Brent oil price scenario that steeply drops from $80/b in 2028 to $20/b (both in 2017$) in 2038. As mentioned in the post a steeper drop over 5 years is possible if AVs reach regulatory approval by 2028, with oil prices reaching $20/b by 2033 or perhaps sooner.

Why faster with AVs? Let’s say the average EV owner drives her car 15k miles per year without AV, now her AV capable car is approved to drive itself and she chooses to use the car as a robotaxi to earn extra income with the car being driven 200 miles per day for 300 days per year that would be 60k miles. If we assume 50% of EV owners make this choice then miles per EV increases to 2.5 times what it was before approval of AV by regulators so oil demand from ICEVs would drop 2.5 times as fast so oil prices might actually fall to $20/b in 4 years rather than 5 years.

In any case when AVs are approved demand for oil from personal and commercial transport will drop like a rock.

Dennis

In order to guess the price of oil in 2030 you have to have a reasonable idea of when peak oil will happen and what the global decline rate will be.

If we assume global aviation and marine transport will continue to grow along with global GDP then you have to work out how many electric vehicles would have to be bought so that demand for oil falls faster than production decline plus increased consumption from aviation and marine.

Aviation is consuming 10 billion gallons more than 2 years ago.

https://www.statista.com/statistics/655057/fuel-consumption-of-airlines-worldwide/

https://edition.cnn.com/travel/article/china-new-airports/index.html

What year will peak oil be and what will the decline rate be are the big questions to answer.

Hugo,

I have presented that information in the past. The chart below is millions of barrels per day of World C+C output. The supply curve shows output with the assumption that demand is high enough that every barrel that can be produced at a profit can find a willing buyer, it is as high a supply is likely to be in a scenario with oil prices at up to $120/b and World URR is approximately 3200 Gb for C+C (including conventional oil, tight oil, and extra heavy oil from Canadian Oil sands and Orinoco belt). The demand scenario assumes that demand for crude other than for land transport increases by 280 kb/d each year, it is assumed about 35% of C+C demand is for non-land transport use.

Of course assumptions can be modified this an earlier analysis based on BP regional data, note that many analyses include NGL and biofuels as part of oil supply, I do not, my focus is on C+C output which is primarily used for light and middle distillate production with a small portion becoming residual fuel.

The gap between supply and demand that arises after 2028 leads to falling oil prices so that supply adjusts lower to match demand.

Note that this scenario is an older scenario that has not taken account of the tight oil scenario I presented In this post. Also it does not take account of falling oil prices which will lead to far lower extra heavy oil output than my previous scenarios. Will revise in the future.

Revised scenario, required adjustment of oil price scenario with oil prices remaining at $80/b until 2034, this reflects rising extraction rates through 2034. Tight oil scenario revised for consistency.

revised tight oil scenario used with scenario above.

shock model which matched the ev transition demand scenario, note rising extraction rate for conventional oil through 2034, this suggested that oil supply was matched pretty closely with demand up to 2034, which led me to adjust the oil price scenario. Note that the “supply scenario assumed constant extraction rate after 2034.

Dennis

I really do not understand your demand graph. How do you get demand falling faster than supply?

50% increase in demand is coming from other sectors.

https://www.iea.org/newsroom/news/2018/october/petrochemicals-set-to-be-the-largest-driver-of-world-oil-demand-latest-iea-analy.html

This year 140 million motorbikes will be sold and nearly 100 million cars, vans and trucks. Approximately half that number will be crushed. Of the new vehicles on the roads 48 million additional cars, vans and trucks will be burning oil. Sales of electric motorbikes are unfortunately tiny.

Obviously, for Oil demand to level off all additional cars etc would need to be fully electric. Then for oil demand to fall, even more electric vehicles would need to be sold to make up for aviation and marine transportation and the petrochemical industry. There is little chance global sales of electric vehicles will be anything like 70 million in 2027.

For instance BMW produce about 60 models, they only have 3 electric vehicles for sale and another 2 or 3 on the drawing board.

Hugo,

Read my comment.

Supply curve shown assumes no EV transition and oil prices high enough to balance market (so demand would equal supply as must always be true.

The “demand” curve is a demand constrained scenario where supply will be lower to match lower demand caused by EV and renewable transition.

I guess my previous explanation was not clear. Petrochemical demand is mostly natural gas and NGL, I said specifically that I exclude NGL from my analysis, the IEA does not.

As to how fast the transition to EVs will occur, plugin vehicle sales have been growing rapidly, note that new cars get driven more than old cars, so miles driven by electric can change fast. This is especially true when AVs are approved.

Generally I underestimate the speed of such transitions.

Dennis

I have read your comment several times.

Firstly looking at your graphs it is difficult to pinpoint the exact year. But somewhere around 2028 you have demand falling faster than supply decline. For that to happen the number of NEW vehicles that are electric must be more than the number of new vehicles that are petrol and diesel.

which would be around 50 million.

Also the number of electric motorbikes sold would have to exceed 70 million per year.

I really hope you are correct but considering most car companies are not even designing half their fleet to be electric tells me you are wrong.

Hugo,

See chart at comment linked below (revised scenario)

http://peakoilbarrel.com/us-tight-oil-scenario-based-on-bnp-paribas-study/#comment-684792

I think it is fairly clear in that scenario that the demand constrained scenario falls below the supply constrained scenario in roughly 2035. In the scenario about 83 million plugin vehicles are sold in 2035 and the total plugin fleet is 604 million vehicles in 2035, about half of the total. Growth rate of plugin sales at this point just matches sales growth (assumed to 1% per year). Note that in an AV approved scenario (quite likely by 2035 in my view) new car sales would be falling as TaaS will be the way forward for personal transport and commercial transport will quickly move to EVs (50% sales growth likely) once AVs are approved.

Also thank you for your initial comment which prompted the revision (and improvement in my view) of the initial model presented.

On the number of vehicles that are EVs, we will see more of them and it is number of vehicles sold that matters. That number is increasing rapidly and in my view that trend is likely to continue. I hope that my scenario proves to be incorrect because it is too conservative. 🙂

Also I am not too concerned with motorbikes they use a lot less fuel and like vehicles will be replaced by ebikes.

Hugo,

Also note that in my revised scenario the “demand contrained” scenario falls below the ” supply constrained scenario in 2035 (16 years in the future).

You do not think it is possible that EVs cannot ramp up to a level that cuts into oil demand in 16 years?

Have you ever seen the Tony Seba presentation that shows the slides with find the auto and find the horse in NYC about 10 years apart?

ICEVs are the horse, EVs are like the auto in that scenario, my scenario does not even tak into account the likely approval of autonomous vehicles by 2030 worldwide. Once that occurs EV use increases (miles driven per year) by a factor of 4 at minimum and ICEV miles driven drops to zero very quickly.

For that reason (the fact that autonomous vehicles are not even included in my scenario) I consider my EV transition scenario very conservative.

And as I mention often I was a late adopter of some technology such as cell phones and smart phones.

Dennis

I have little doubt EVs could be reducing oil demand by 2035.

The real concern is what happens between peak oil in 2025 and 2035.

At the moment about 50 million ICE vehicles are scrapped each year, to be replaced by 95 million new ICE vehicles. Along with aviation and maritime growth we have a demand increase of 0.6mmbl/d of CandC per year.

The is little chance sales of pure electric vehicles will be 50 million in 6 years.

Between 2025 and 2030 will prove very difficult. There will be 1.5 billion ICE vehicles in 2025 and they will all need fuel and there simply will not be enough.

Hugo,

Oil prices will adjust to a level that supply matches demand, more hybrids, plugin hybrids, and EVs will be sold over the ensuing period so that average fuel efficiency will increase, aging populations in advanced economies will result in fewer vehicle miles travelled (old people drive less).

The scenario I have created has annual sales growth of plugin vehicles decreasing to 50% in 2019 and decreasing each year by 5% through 2024 and then remaining at 25% growth for 2025 to 2030 and then gradually decreasing as 100% of personal vehicle (light duty vehicles less than 6000 pounds curb weight) sales become plugin vehicles by 2034.

The scenario does not account for autonomous vehicles which will accelerate the transition.

Hugo- “The real concern is what happens between peak oil in 2025 and 2035.”

Absolutely, although one could quibble with the exact timeframe, I agree wholeheartedly.

It is probable that in this period will be a very big rough patch (to say the least). Some places more than others.

Its why I see deployment of reneweables as

critical to help weather that transition.

We are all very late to the game on this.

And if you live in an area with solid electricity supply your going to want a PHEV at minimum. That way you’ve got options and flexibility. And incredible mileage for the short trips.

It’s my concern that the crony-capitalist plutarchy, or status-quo if you will, is unlikely to properly or adequately respond to our current and impending predicaments.

That’s why we have Extinction Rebellion, which wants what they call citizen assemblies and something closer to real democracy. This may be a step in the right direction of systemic change that can then perhaps begin to better respond. If or until then, I fear that much responses, such as that include so-called renewable technology, will be wasted.

https://seekingalpha.com/article/4284168-oil-picture-bullish-eia-realizes

Interesting take on EIA outlook. While they have looked at two subtractions which are not included in the projection, I have one more. Note, the EIA is constantly adjusting the US lower as we go, but it is no where near low enough for 2020 for production. 2019 is still a little high to me for an average, but, at least, within reason now. It’s absurdly high for 2020.

GuyM,

If oil prices remain where they are through the end of 2020 you may be right, I am skeptical that the expected glut in oil output will come to pass. For that reason I think we may see oil prices gradually rise to $70/b by mid 2020, my $70/b and $80/b scenarios only have US tight oil increasing by 500 kb/d in 2020 (from Dec 2019 to Dec 2020) and annual average tight oil output increases by 636 kb/d from 2019 to 2020, in 2019 the annual average US tight oil output increase by 1130 kb/d from the 2018 annual average, so 1768 kb/d increase in the 2020 annual average compare to the 2018 annual average tight oil output, for my $80/b scenario (first chart in the post). No doubt this is still too optimistic for some, my guess is that the future will prove that it was a pessimistic scenario, like many of my past scenarios.

I could be anything. Been following projections of supply/demand for more than a few years. No prediction by EIA, IEA or OPEC has been anywhere near close. Each year seems to differ by semantics, or timing. Lower by demand this year by .4 million. Shoot, it won’t happen later, it’s already happened. Three of Europe’s top GNP countries are in what resembles recession. Look at the OECD draws, they haven’t happened. Ain’t going to, much. On the supply side, US production growth is stunted, to say the least. So, what is happening NOW, on inventory draws, is only going to get worse. And, we can’t really tell what that is, because we can’t get a handle on all inventories. (So what’s new?)

So, your standard response is to guess that if prices improve, the walking dead can come to life again. From an accounting viewpoint, I have a hard time understanding that. Voodoo cures are not an option. They are walking dead, and will remain zombies. That is it, and that is close to 90%.

GuyM,

Generally higher prices result in higher profits. Also lower supply tends to increase prices, though certainly you are correct that if demand falls while supply falls there would be no change in price. I guess that is where you think things stand and that it will continue. My guess is different that is all. I agree both demand and supply at the World level will fall at current price level. Where I differ is that I expect supply will fall more than demand between now and 2020 and lead to higher oil prices which will lead to better profits. I also think the better companies will buy up the decent assets from the zombies. Then the tight oil industry will be better off with decent companies running the show.

I have $8000 in options that will cover if prices rise by Jan 2021. Yes, supply will fall more than demand. But, there won’t be much price movement this year. That will set up a long time before things can be geared up again, when prices do rise, which I also fully expect.

Guym,

Many of the forecasts are too high. On that we agree. I also agree most predictions are incorrect. The EIA prediction for the US through 2038 looks reasonable to me. Perhaps oil prices do not recover. Difficult to know, I agree it might be anywhere from 50 to 70, as to it being anything, I think less than 30 or more than 90 between now and 2022 are not very likely.

correction I said 2038 above and meant 2028 for EIA forecast (AEO 2019), sorry.

I bought a 2013 Nissan Leaf used in early 2015 for $10K. I have driven it as my primary car for over four years, including using it in my home inspection business and tooling my kid around town. At first I thought I would be needing a new battery around now, and I had budgeted to replace it after 8-10 years. But after six and a half years the battery is still over 90% capacity, and I now have no intention of ever replacing it. The costs to operate are negligible, maybe $10-15/month, putting on about 8K miles a year. There are no oil changes every 3 month, no radiator flushing, etc. The biggest cost is the tax my state NC puts on the car every year – this is roughly equivalent at $160 to the amount spent on fuel. Once the shop had to put some brake fluid in. I bought a new set of tires recently. It is not kept in a garage. It just turns on and goes when I need it, and never has any problems. It is limited in range as a first generation EV so I have to plug it in every day or two, but other than that, I plan on driving it for the next ten years and then handing it over to my son as his first car. And oh yeah, the best part – even in Eco mode when I am stopped at a stoplight next to a rumbling brand new Camaro or some other such nonsense, I leave em in the dust like they’re standing still, laughing all the way.

At some point, the government is going to have to find some way of replacing the road tax that is paid through gasoline. I think that eventually the electricity going into your car will come through it’s own meter so that it can be taxed at a different rate than home electricity. Also there is early talk of adding a mileage charge when you renew the license on a BEV. In the meantime, enjoy the free ride.

Ovi,

I agree, the logical choice is to tax based on miles on odometer and Gross vehicle weight as heavier vehicles do more damage to roads per mile, this tax can be paid when the car’s registration is renewed, for cars that are sold privately it might require a tax to be paid from most recent registration to miles on car when it is sold.

Note that this applies to PHEVs as well as most miles travelled probably are on electricity.

Dennis

I don’t think there is a good solution for this issue. Special meters are too expensive. Miles work for BEVs. It is not going to work perfectly for PHEVs, because of the different size batteries that will be used. For instance the Prius prime gets 25 miles on battery. The BMW I3 second generation gets 115 miles on battery. So if miles are used, maybe they will have to add some arbitrary factor based on battery range.

If the Prius does 10,000 miles, maybe 60% are done in EV mode and would pay the tax on 6000 miles. For the BMW, maybe 90% are done in EV mode and pay appropriately.

I am also thinking that this factor might be used by the govt to push larger batteries.

Maybe a battery range tax, in addition to the mileage charge could be used to encourage a bigger battery in a PHEV.

For example:

25 to 49 miles: $150/yr

50 to 74: $100

75 to 99: 50

>100: No battery tax

Ovi,

Battery range should not be a factor. Just eliminate road taxes based on fuel use for all vehicles. We could leave a carbon tax on fuel.

Ovi,

Solution is simple, eliminate fuel taxes on all vehicles, road tax paid at registration based on gross vehicle weight and miles on odometer.

That works.

The whole idea of using gas taxes to pay for roads is kinda dumb, and was abandoned decades ago, when Republicans started refusing to raise taxes in attempt to destroy the government. The Federal Highway Fund is broke, as is every state DOT. Governments across the country have been dipping into the general fund for years.

The solution to the problem is to stop building new road capacity. Most road expenditures in the US are to increase capacity, even though there isn’t enough money there to repair existing capacity. It’s the same problem as the shopping mall problem. There are simply too many around. Pounding more money down that rathole is not the solution.

Here is the background of the guy behind this scientific paper:

Mark Lewis joined in January 2019. Previously, he was Managing Director and Head of Research at the Carbon Tracker Initiative (April-December 2018), Managing Director and Head of European Utilities Research at Barclays (2015-18), Chief Energy Economist at Kepler Cheuvreux (2014-15), and Managing Director and Global Head of Energy Research at Deutsche Bank (2005-13). He has also been a member of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures since May 2016.

Mark is a UK and French Citizen and holds a BA (First-Class Hons) in Modern Languages and Economics from Sheffield University, an MPhil from Cambridge University, and an MA from London University.

https://investors-corner.bnpparibas-am.com/mark-lewis/

—————–

This guy is anti-oil through and through and I am not sure how his modern languages, philosophy and economics arts degree qualify him to do any credible EROCI calculations. Its mind boggling how guys like this get so much press in the media because they work for some bank.

Ivan, other than character assassination, do you have reality based issues with the assumptions or analysis presented in the study?

It’s deserved character assassination. There is agenda here. Agenda is pretty much all that matters in a world where data avalanches and can’t be screened for identity other than the dood’s background.

Why go and get data from a guy with this sort of radical extreme green background. There are zillions of other places to get data.

And btw, why all the talk about cars. They undersell SUVs and trucks by a huge amount.

Exactly right Watcher, the guy is selling “sustainability” investments for the bank clients. Is he going to produce a paper stating that EV’s are not competitive? That solar and wind are not as reliable as NG? Of course not. Producing papers with provocative headlines such as oil at $20 a barrel is great for business, it gets the sensualist media attention, it gets them virtue points with the climate change crowd, it gets them green investment banking, environmental government contracts. Going back to the paper, Lewis states:

“The reason why wind and solar energy pose such a threat to the energy system established over the past 100 years is simple: they have a short-run marginal cost of zero. In other words, when the wind blows and the sun shines, the energy itself arrives for free.”

Well just because the marginal cost of solar is zero at the panel doesn’t mean that it is zero to the user. The bit in between – transmission and storage – still has to be resolved. The cost and complexity of that bit will ensure that fossils are in business for some decades yet. The Manhattan Institute does a good job of disputing all this green magical thinking in this paper:

https://www.manhattan-institute.org/green-energy-revolution-near-impossible

Actually, even Micheal Moore seems to have figured the renewable scam, from ABC News:

What if alternative energy isn’t all it’s cracked up to be? That’s the provocative question explored in the documentary “Planet of the Humans,” which is backed and promoted by filmmaker Michael Moore and directed by one of his longtime collaborators. It premiered last week at his Traverse City Film Festival.

https://abcnews.go.com/Entertainment/wireStory/michael-moore-backed-doc-tackles-alternative-energy-64844048

The Manhattan Institute does a good job of disputing all this green magical thinking in this paper:

And by that statement I assume you do not include the possibility that the Manhattan Institute has an agenda and ideology of it’s own which they are defending?

https://www.manhattan-institute.org/?gclid=CjwKCAjw1rnqBRAAEiwAr29II9CIptrYAEK_zQy71QrKnmCy1xEGcmYTtPFJ-XA9Mv_uzbTTF4bOwhoC8SYQAvD_BwE

A leading free-market think tank focusing on Economic Growth, Education, Energy and Environment, Health Care, Legal Reform, Public Sector, Race, & Urban Policy

Lets see how these completely unbiased people without any agenda discuss issues such as Public Sector, Race and Education.

https://www.manhattan-institute.org/new-report-proves-trump-right-rescind-obama-era-school-discipline-policies

Uhuh! I see! I’ll bet they are just as unbiased and agenda free when they discuss energy and renewables.

Manhattan Institute was founded by William Casey, Reagan’s CIA boss, and funded by Charles Koch. It’s just a Republican propaganda outlet, like Fox News, plain and simple.

How about Micheal Moore is he the Koch brothers shill too?

You are making my point Fred, you can’t look at these papers without looking at who’s behind them.

Neither ad hominum or appeal to authority are useful.

Specific criticisms of the analysis are. Make an argument guys, so far there has been little.

We have a much more in depth discussion about this topic on the non petroleum thread. I don’t want to hijack this thread with political, ideological and non petroleum related topics. This comment of mine from that thread should clarify where I stand.

http://peakoilbarrel.com/open-thread-non-petroleum-august-9-2019/#comment-684800

Cheers!

In a free market, marginal costs set prices. We have no Soviet style Five Year Plan to worry about “total system costs” in capitalism. The problem is that you simply can’t win market share from renewables on price, no matter how cheap your fuel is.

Because we live in a free market, solar is set to kill all other energy sources. It will do so by stripping all the profit out of the fuel selling business. What happens afterwards is an interesting question, but it doesn’t solve the problem for the traditional energy industry.

This is hard to imagine because it is happening so quickly. In the 2020s an enormous flood of dirt cheap solar panels will hit the market. Production was up by 30% last year, and there is no end in sight. Installed capacity will double by 2024, and again by 2030 at latest.

Profits in the industry will continue to fall, making new investment less and less attractive. Meanwhile the existing fleet will continue to age and shut down.

Watcher,

The focus is on light vehicles including all vehicles weighing less than 6000 pounds, includes most SUVs including Ford expedition and all varieties of F150.

So cars suvs and pickup trucks included.

Ad hominum agrguments convince nobody.

Not really a scientific paper, it is investment research by an investment bank, I think it is pretty well done.

More information on Mark Lewis here

https://www.bnpparibas-am.com/en/author/mlewis/

It his experience as a chief energy economist which is important in my view.

In addition specific criticism’s of why you might think the analysis is incorrect are more useful than an ad hominem argument.

“An interesting analysis was recently published by BNP Paribas (one of the top 10 banks in the World by assets) entitled Wells, Wires, and Wheels… . In that analysis they argue that long term oil prices will fall to $20/b or less in order for oil used for personal land transport to compete with EVs powered by wind and solar at current cost levels.” – I am not an oilman but somehow this strikes me as being absurd.

You see . . . these green wackos said oil consumption was going to fall because of the magic of EVs (that only sell to other green wackos with a lot of money, and who don’t drive much, and when they do they don’t talk about the winter). They said that 3 yrs ago. 2 yrs ago. And last year.

But son of a gun, US 2018 oil consumption grew 2.5%. That ain’t a small number. Global consumption grew 1.5%.

There was an article the other day about the IEA getting headlines because they changed their global consumption estimate for 2019, and the change was downward. That essentially was the headline. Lots of exclamation points. IEA sees lower oil consumption in 2019 than their previous estimate!!!

Well, I went and looked for their estimate. It did decrease. By 50K bpd. Out of 95 million bpd. that’s 0.05%. Oh, and the estimate that decreased . . . it was a 1.5% global consumption growth number. They got headlines by reducing 1.5% by 0.05%.

Actually in their last OMR, the IEA upped their baseline demand estimates for 2017 and 2018 by 200K, thus while lowering YoY demand growth for 2019 by less than 200K, they actually increased their demand estimates for this year. The media never gets their story right, it is either stupidity or spinning some bias narrative.

Ivan,

Output of C+C has increased by about 811 kb/d per year on average from 1982 to 2019. The average rate of increase for World C+C output in percentage terms has been 1.2% per year. From 2010 to 2019 the rate of increase was 1.3% per year and from 2000 to 2019 the rate was 1% per year.

I expect the rate of growth will fall going forward.

see international energy statistics at EIA

https://www.eia.gov/beta/international/data/browser/#/?pa=00000000000000000000000000000000002&f=M&c=00000000000000000000000000000000000000000000000001&tl_id=5-M&vs=INTL.57-1-WORL-TBPD.M&cy=199401&vo=0&v=H&start=197301&end=201904

Also note that using BP Statistical Review of World Energy data for European oil consumption in millions of tonnes of oil equivalent from 2005 to 2015, the oil consumption decreased at an average rate of 2% per year over that period.

The rate of decrease was pretty steady over the entire 10 years, some may have been due to GFC, but we would expect if that were the case we would see a rate change.

Eventually the rest of the World will catch up with Europe, possibly North America and then Asia and South America.

Hi Watcher,

I talked about my Model 3 all last winter. Drove the car to the ski resort and back almost every weekend, charged car at resort and yes range is lower in winter as is true of all cars.

I do confess to caring about the environment (guess that would be a green whacko), guilty as charged. 🙂

Again ad hominem not really convincing.

Robert, without getting into the hardcore data analysis, consider several big factors here.

-Solar and wind electricity at utility scale in the favorable areas has become very inexpensive in just the past 2-3 years.

-While these forms of electricity do have transmission losses and a significant cost for storage (primarily batteries and pumped hydro), they do not require transport to centralized facilities, refining, and then dispersal to distribution locations (all as a liquid).

-the conversion of liquid fuel into kinetic in a ICEngine is an inefficient process compared to conversion of electrical energy into kinetic energy in an electric motor. One fellow on this post quoted-“An ICE motor has an energetic efficiency of less than 25% , an electric motor more than 80%.” This alone gives a huge cost advantage to the electric vehicle scenario.

Keep in mind that the study looked at “how much a given capital outlay on oil and renewables translates into useful or propulsive energy at the wheels: in other words, for a given capital outlay, how much mobility can you buy?”

Robert,

Read the paper, I see no problem with the analysis and so far I am still waiting for valid arguments.

Astonishment is not an argument.

Read and find specific flaws.

“Accordingly, we calculate that the long-term break-even oil price for gasoline to remain competitive as a source of mobility is $9-$10/bbl, and for diesel $17-19/ bbl.”

Again I claim no expertise but simply believe that it is highly improbable that we will ever see such prices. Incidentally Leisure Village in Camarillo CA has 2100 homes. One of the patrol officers recently told me that he recalls only seeing about 3 EV’s with outside wiring. My wife tells me that she has seen a Tesla that is garaged near us. I personally have not seen a Tesla in LV this year.

I am probably wrong but i think they are making an error on page 34 of the report.

It says $100 billion dollars of oil purchased at $60/barrel, refined to gasoline gives gross energy at the pump of 1347TWh. And they continue with their calculation based on this figure.

According to my quick calculation, 1 litre of gasoline gives an output energy of 15.66 kWh

This can be calculated a number of ways for those interested. But the simplest way is look at the reference website below. 12.06 kWh/kg [NOTE: I’ve taken the lower caloric value!]. Since the density of gasoline is ~ 0.77kg/L you get the 15.66kWh/litre.

reference: https://www.engineeringtoolbox.com/fuels-higher-calorific-values-d_169.html

Now 1 barrel of oil is 159 litres. So 15.66*159 ~ 2490kWh per barrel of gasoline.

$100 billion / $60 nets you 1.6*10^9 barrels of oil (rounded down). Or gasoline in this case.

Continuing 1.6*10^9 barrels * 2490 = 3.984 * 10^12 kWh. Now lets convert that to terrawatts hours.

~ 3984TWh. They report 1347TWh.

That’s close to a factor of 3 off, and i’ve taken the lowest test case, a higher rounding, caloric value and lower density would net a result more than 3 possibly even 4. So I think i must be wrong somewhere. Please correct me.

Have you considered that in the USA a barrel of oil yields about 20 gallons of gasoline from the refining process, or about 76 liters (rather than the 159 that you included in your calc’s)?

That is one issue to factor.

Ohh yes i see what you mean. If that is the case I still disagree with their calculation. Because if 1 barrel of oil yields ~ 76 litres of petrol, the rest of the barrel is not thrown away.

One barrel of crude oil can make about 19 US gallons of gasoline, 10 gallons of diesel, 4 gallons of jet fuel and another 9 gallons of other oil products such as liquid petroleum gas, plastics, lubricants or heating oil. So the calculation is not a fair one in my view.

ref: http://www.econtrader.com/economics/explain/how-much-gasoline-one-barrel-crude-oil.htm

And readjusting for the factor you pointed out you have:

~1904TWh which is the figure they should use for gasoline. And diesel should be slightly less. But they have diesel at more. (The caloric value of gasoline is higher than diesel and 1 barrel of oil produces only 10 gallons of diesel). Seems to be an error there also.

Bear in mind i am half asleep when doing this lol

It’s barrels of oil, not barrels of gasoline 😉

There are 42 gallons (approximately 159 liters) in one barrel of oil. The energy contained in a barrel of oil is approximately 5.8 million British thermal units (MBtus) or 1,700 kilowatt-hours (kWh) of energy.

Oh, seems that Hickory already pointed that out…

Cheers!

An ICE car only gets about 20% of the energy contained in a litre of gasoline/diesel to the wheels. The rest is just heat. So you only use aroud 3kWh to move the car.

Yes so you get ~ 365TWh of useful energy. Compared to their figure of 270TWh.

I need independent sources to see whether their $100 billion dollars is reasonable to get them their respective TWhs of wind and solar.

Yes, an ICE vehicle is primarily a heater on wheels, from an energy point of view anyway. The mechanical energy it produces is more a footnote.

Iron mike

You have an error on your calculation . 1 liter of gasoline has 0.77 kg and corresponding, it has

0.77*1 2 kwh of energy , only 9.3 kwh

Beside this , 1 kwh in battery of a BEV is much more valuable than 1 kwh in gasoline of your ICE car, at least by a factor of 3. An ICE motor has an energetic efficiency of less than 25% , an electric motor more than 80%.

Yes thank you, you are correct.

Iron Mike,

They are looking at energy at the wheel. Basically in an ICEV 67 % of energy in the fuel is waste heat.

The calculation is spot on for energy at wheel, perhaps conservative as I would e pect a 4 to one ratio rather than 3 to 1.

This is what i was looking for.

Section 1.2 of their report:

REALITY CHECK: OIL HAS A MASSIVE INCUMBENCY ADVANTAGE

The oil industry today enjoys a massive scale advantage over wind and solar of several orders of

magnitude – oil supplied 33% of global energy in 2018 compared with only 3% from wind and solar.

Moreover, EVs are currently more expensive than ICE and diesel vehicles on a sticker-price basis, and

likely to remain so until 2023-25.

This scale advantage over wind and solar gives oil the further advantages of speed and convenience:

the oil industry is so massive that the amounts that can be purchased on the spot market can provide

very large and effectively instantaneous flows of energy. By contrast, new wind and solar projects will

only deliver their energy over a 25-year operating life. This underlines the point that the renewable energy industry needs to scale up massively over the coming decades since on an absolute unadjusted

basis wind and solar cannot deliver anything close to the energy that the global oil industry can deliver

today as an instantaneous flow.

So their calculations are done over a 25 year period of output for wind, and solar, $100 billion worth. Feeding the respective TWhs into EVs, vs $100 billion of oil at 60/barrel feeding the respective TWhs into gasoline and diesel transportation. I think probably a years worth of an oil field pumping at 1 million barrels/day.

I can’t see how wind and solar can ever scale up to what oil and nat gas are doing. I could be wrong though.

Hello Iron Mike,

Just think back over how fast cell phones took over from personal land line phones in places where the service was good, and how fast cell service has expanded into formerly unprofitable markets as the price of the phones and provision of the service has declined.

Wind and solar power are getting to be more economical from one month to the next. Within two or three more years the number of places where wind and solar farms can be built profitably will have grown substantially, and every time the price of oil and gas spike, people and governments are going to better understand that once a wind and solar farm IS built, it’s going to run for twenty plus years essentially fuel free.

And after that….. a complete overhaul, back to BETTER than new, will cost only peanuts, compared to starting from scratch.

Renewable electricity production is going to grow, globally, like an explosion of insects in a farm field.

Hardly any to be seen today, crop wiped out a couple of months later. The renewable electricity industry is going to wipe out the fossil fuel electricity industry, excepting whatever can’t be provided due to intermittent wind and solar production, in most parts of the world.