There has been very little data to post about recently and as everyone should know by now, I post primarily about data. So if there is no data there is not much to post about. Also I have been very busy for the a week now and have checked in only a couple of times.

A few days ago a very racist post was posted on this blog. I completely overlooked it as I seldom scan the posts because I get an email for every post so I just read the posts in the emails. But when there is a guest post, as the one last week was, I get no emails, the guest poster gets them instead. Anyway I deleted the post and banned the poster. I also banned another poster because he accused me of deliberately letting the post stay up. That outraged me. It was the same thing as accusing me of such racism.

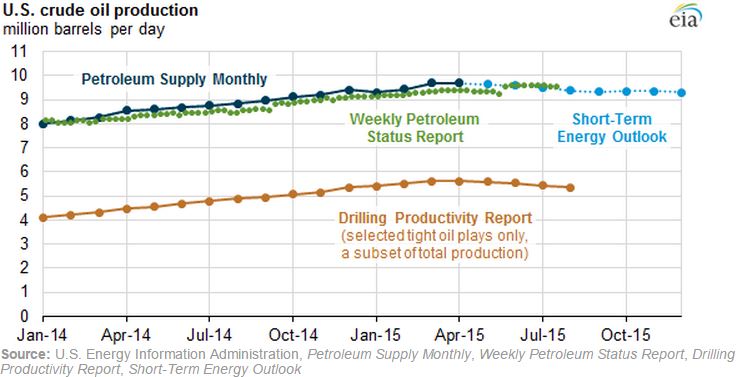

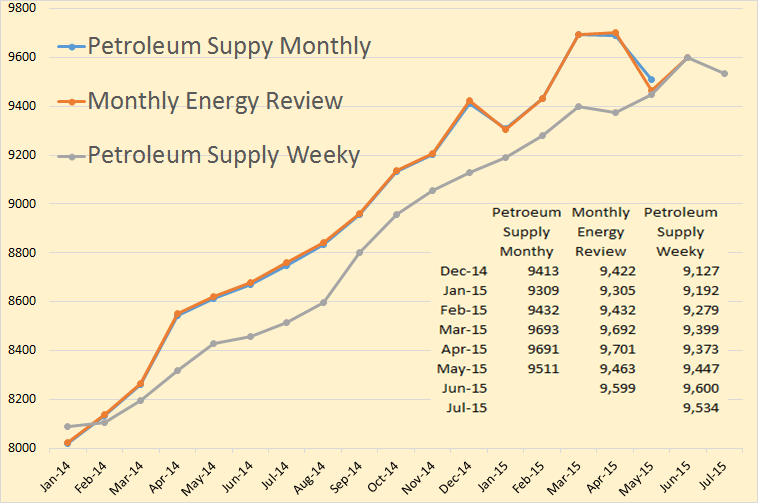

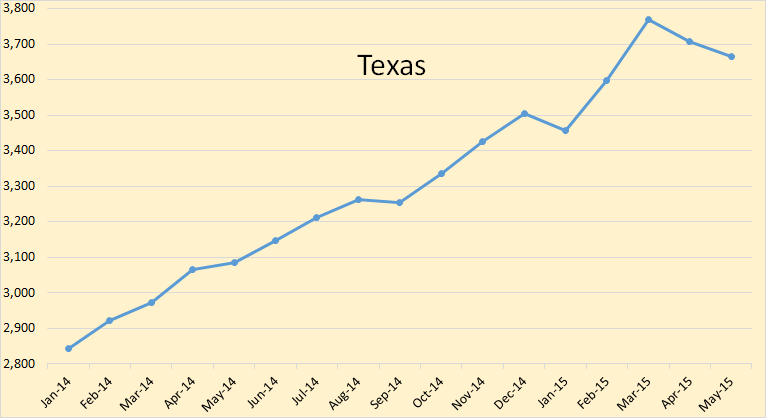

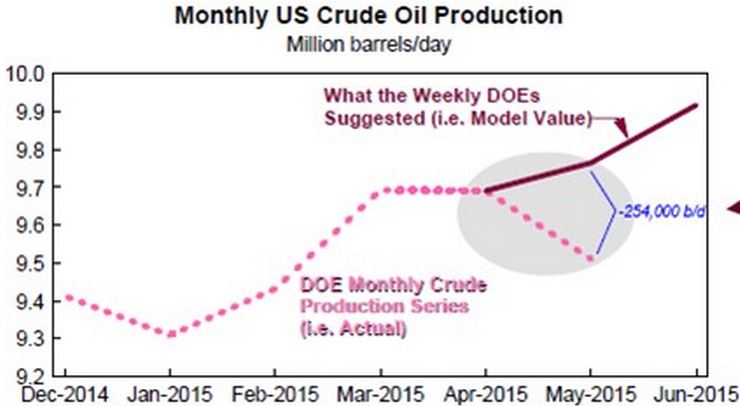

The Monthly Energy Review and the Petroleum Supply Monthly have US production peaking, so far, in March and April. The Petroleum Supply Weekly has US production peaking in June. In the chart above I have averaged the Petroleum Supply Weekly into monthly data. All data is in thousand barrels per day,

Here we have the weekly data from the Petroleum Supply Weekly. The last data point is July 24th. The huge jumps you see are basically just revisions. The huge jump you see for the week of May 22nd, was not really a jump. The EIA explained that their prior numbers were too low and the sudden increase that week was merely an adjustment.

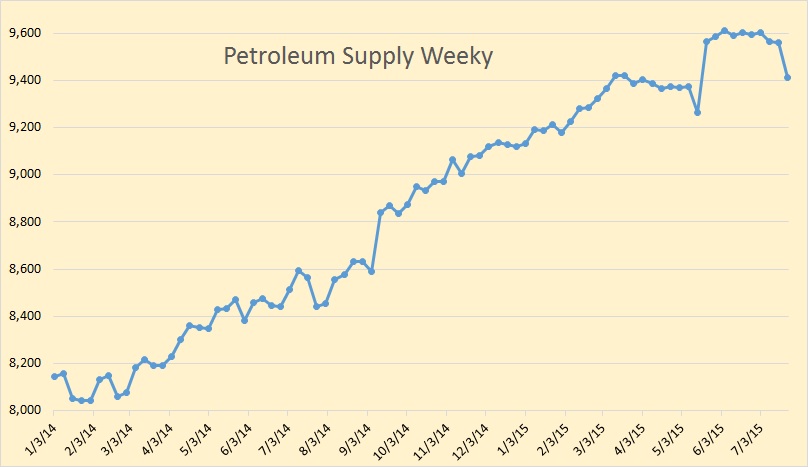

The EIA is finally getting its act together as to Texas C+C production. They have Texas peaking in March at 3,770,000 bpd and declining 106,000 bpd since then.

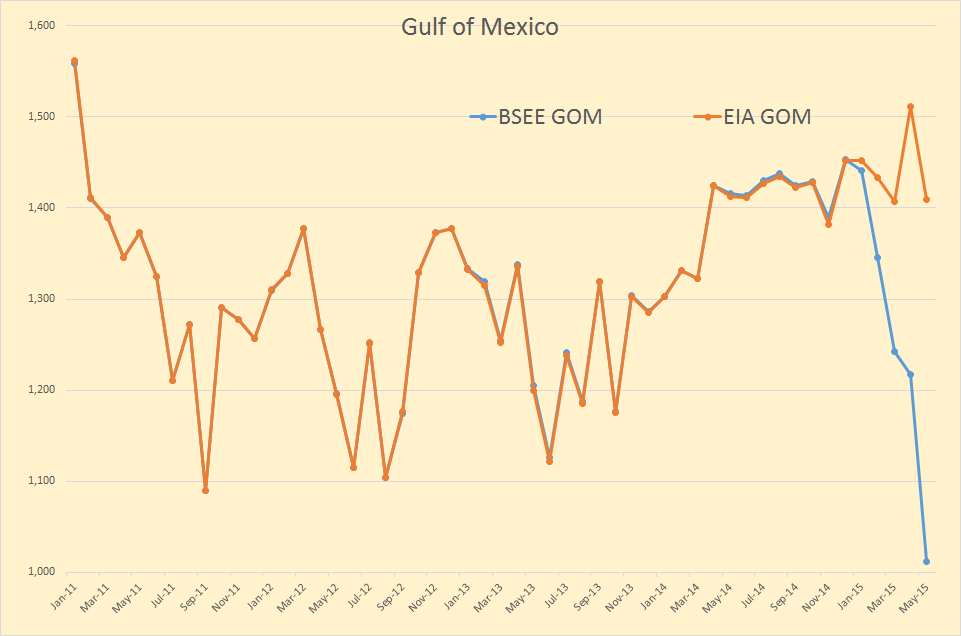

The EIA had the Gulf of Mexico spiking up in April but falling right back in May. The BSEE data, like Texas, is always delayed but only by about four months.

The EIA admits that they show different data but tries to explain it here:

EIA reports show different aspects of U.S. oil production statistics and trends

EIA publishes several reports covering current crude oil and natural gas production conditions and how recent trends may affect the near-term outlook for the oil and gas industry. Each EIA product is distinct in its purpose, methodology, timeframe, and regional coverage. Some reports are considered estimates of actual production volumes, while others focus on future production.

EIA publishes several reports covering current crude oil and natural gas production conditions and how recent trends may affect the near-term outlook for the oil and gas industry. Each EIA product is distinct in its purpose, methodology, timeframe, and regional coverage. Some reports are considered estimates of actual production volumes, while others focus on future production.

One analyst suggest the EIA has been fudging the data all along:

EIA Capitulates Under Cover Of Darkness

Many investors know that when a company wants to mitigate media coverage of bad news, they typically release data on a Friday after the close.

Well last Friday, that is exactly what the EIA did, admitting the very thing I and Cornerstone Analytics have been arguing all year: EIA was and still is overstating U.S. production. The amount that they admitted to so far, as of Friday afternoon, was 254,000 barrels per day (b/d) or 1,778,000 barrels per week, 7,112,000 per month or 14,224,000 for June and July alone.

This is the most incredible cover up I have ever witnessed in my decade-long investment career and I have not seen one major media outlet even mention it so far. Instead China demand & Iran output are front and center as per prior posts in an attempt to divert attention (I call it moving the goal posts) away from the fact that both U.S. production and inventories were about to fall. The chart below speaks for itself on what is occurring:

Rune goes large:

http://oilprice.com/Energy/Crude-Oil/US-Shale-How-Smoke-And-Mirrors-Could-Cost-Investors-Millions.html

Rune is a modest man. He should have said BILLIONS. 😉

Hi OFM and thanks!

The headline is something oilprice.com produced on their own, my original headline;

”Are the Light Tight Oil (LTO) Companies trying to outsmart Mother Nature with their Financial Balance Sheets?”

How my post originally and in full appears on my blog, link below

http://fractionalflow.com/2015/08/03/are-the-light-tight-oil-lto-companies-trying-to-outsmart-mother-nature-with-their-financial-balance-sheets/

And OFM you are right, it will become 10’s of billions and lots of people will become very familiar with the color….. red. 😉

Rune, QEP, who has best acreage, can increase Bakken production 9% with just two rigs running, seems to do things right, still burned through $714.5 million cash in first half of 2015. That is with benefit of $15.88 per barrel re hedges.

Do agree that QEP cannot make a go of it only further reinforces the theme of your most recent article.

The numbers are there for all to see. WTI at $45 or below. This is getting very ugly!!

Shallow,

QEP (all Grail which at some point will become saturated with wells) has wells with very good first year flow totals. As these ages (like those of 2014 vintage) their total actual EUR converges towards the average for all their wells. The EUR band for the average well by vintage for their wells is also very narrow as I documented for some companies in my recent post.

If QEPs average well follows the same pattern as others, that is midway point for EUR is reached after about 30 months of operation, the EUR for the average well will end up at around 400 kb (from actual data and apply some error bars to the figure).

WTI (fixed) at $45/b and a $8M well requires a EUR about 450 – 500 kb for a Bakken well to nominally pay out (that is cash flows discounted at 0%) and thus no profit.

There are not many wells that are that good.

It is getting uglier!

To me this is very serious and I believe few truly understand what this will set us up for further down the road.

We are reliant on financially healthy oil companies as the oil companies are the experts to extract oil and bring it to the market.

The oil companies with a lot of exposure to light tight oil are relatively minor players. I’m not impressed by their managements’ ability to allow them to survive long term, if they go bankrupt their properties will be in better hands, and all personnel will still be available.

In the medium term the oil price should bounce back and in a few years go above $100 per barrel, which should allow more wells to be drilled.

Fernando, ExxonMobil, ConocoPhillips, EOG, Marathon Oil, Apache, Anadarko Petroleum, Occidental Petroleum, Shell, Chevron, BHP Billion, etc. All have varying degrees of exposure to US shale.

I think you will find this is why there could be a ferocious oil price snap back. Many of these companies are abandoning world wide efforts to drill shale wells in US.

Given these companies cannot all be completely incompetent, it would appear that many non-US projects they were pursuing need an even higher oil price then shale. International rig count outside Middle East has plummeted.

Another thing, is there really any spare capacity left? When oil prices skyrocketed, dwindling spare capacity was a reason given. With KSA ramped up to 10.6, but how much higher can they go? No one else has any significant spare production capacity, at least based on my reading.

Euan Means has a good chart on this in his link above.

Mearns, and below, not above. Comment editor not working for some reason.

Shallow, the large companies don’t have “a lot” of exposure. Do any of them have exposed more than 20 % of their SMOG PV to light tight oil? Any companies with more than 20 % exposure have shaky management as far as I’m concerned.

I’d say COP, MRO and definitely EOG do.

I really think they feel shale has a better risk/return metric than most other conventional production.

For example, Marathon sold some pretty good Norway production to buy high priced shale production and acreage.

If they have overexposure to shale then indeed they must feel they lack other alternatives.

They were unable to find enough prospects other than tight light oil in a $100 per barrel price environment. But the answer isn’t to play poker with shareholder funds. The answer is to simply acknowledge there’s a lack of acceptable prospects, strengthen finances, and look for a merger candidate.

The other answer is to take oil price insurance in the futures market.

The other answer is to take oil price insurance in the futures market.

That’s the key. As ShallowSand said, many companies got complacent, and saved a few pennies by not hedging properly.

Yet, these shale companies keep touting 600k, 800k, 1MM barrel EUR’s. When will regulators do something about that? It is clear from the financials of these companies that EUR’s are way overstated.

Regulators accept reserve estimates signed by professionals. If I were signing off on inflated reserve estimates I would use a false identity, because shareholders could come after me.

WSJ: Oil-and-Gas Debt Deals Sting Investors

Funds face paper losses on substantial investments this year in exploration-and-production companies

http://www.wsj.com/articles/oil-and-gas-debt-deals-sting-investors-1438634208

“US-Shale-How-Smoke-And-Mirrors-Could-Cost-Investors-Millions”

Losses for those who don’t have the patience to wait.

”Losses for those who don’t have the patience to wait.”

Han, would you care to elaborate a little further on what you mean?

Rune, I guess for a lot of investors the solution is waiting for the oilprices to recover. However maybe a lot are forced to close their position taking the loss. They could try to recover the losses and even win when oil production is clearly starting to decline. I’m losing now with some UWTI shares, but I don’t panic.

Han, thanks for your reply.

The key here is the level of the oil price.

Simply stated there are two camps out there; one with those who believe the oil price will soon get higher.

The other; the oil price will stay suppressed (as in low) for some time.

FWIIW, I have flagged that I am in the second camp (bearish).

Mine is from a broad understanding of the present global oil supply/demand balances, which, with no political interference, like from some countries agreeing to hold back supplies to close/narrow the present gap between supply and demand and thus provide support for a higher oil price, could last for some time. How long is any ones’ guesses.

How things are in 2020 is in my opinion difficult to predict.

Further the drag from total global debt loads will slow economic activity and thus affect demand for oil.

Whatever happens in the near term, reality is that new supplies are costlier to develop and in general needs about $70/b for profitability.

As long oil prices remain low, it weakens the oil companies’ balance sheets and their abilities for investments in new supplies. I think this is serious and poorly understood by most.

A conventional oil reservoir has better resilience towards price swings due to its depletion profile.

Shales (LTO) not so, as these now produce a big portion of their EUR in a low price environment, thus requiring a much, much higher price for the fast declining remaining EUR to make a profit.

Rune, also thanks for your reply. Exactly because of your mentioned caracteristics of LTO, I think that oil price recovery will happen rather sooner than later. Maybe even before end of this year. And for OPEC countries current oilprices are far too low for fiscal breakeven, so I wonder how long ‘they’ are going to keep their stubborn policy.

Global debt loads could be a problem indeed. Oilprices could rebound considerably before falling below current levels.

I want patience and I want it now!

Patience is the euphemism for “I’m losing my shirt and am being skinned alive”.

Whiting is under 20 USD today and CLR is in the doldrums at less than 32 USD.

STO is 16.37. RIG is on sale for 12.40, looks like a brand new low. It’s nuclear winter for oil stocks.

”I want patience and I want it now!”

+ 2

Han,

The main reason for the low oil price is the high US dollar – and low current account deficit through high US oil production. As long as US production does not come down by at least two mb/d, the oil price will not move up. As high fixed costs producers the Saudis have to produce as much as they can – no matter how low the price goes. Saudi Arabia will very likely not bring up the oil price as this is too expensive for them. The natural swing producer is shale, because shale can reduce production at the lowest costs. You will get uwti much cheaper by next year.

Heinrich Leopold,

I disagree. The main reason for the low oil price is the mismatch between a weaker growing demand and a stronger growing production.

The high USD value is a byproduct of the worsening global economic conditions and its weakening demand growth on commodities and oil.

The oil price recovery requires a healthier oil demand growth. Cutting oil prices by half has not resulted in a surge in demand as it was predicted by many, and a lot of people are ignoring this important and worrying fact.

People are concentrating on the wrong side of the equation. A new global crisis, that is already past due according to post 60s statistics on recessions, will continue to depress prices for years, even as it destroys US shale production and reduces global oil production: i.e. peak oil.

The growing gap could turn ugly:

Javier,

It is exactly the strong dollar, who restricts global demand through lower monetary liquidity.

Heinrich Leopold,

Nope. A strong dollar is the result, not the cause of a reversal of the carry trade that is coming out of the developing world, the Eurozone and Japan, due to its poor performance as a result of a weakening global economy leaded by a weakening China.

Javier wrote:

“People are concentrating on the wrong side of the equation. A new global crisis, that is already past due according to post 60s statistics on recessions, will continue to depress prices for years, even as it destroys US shale production and reduces global oil production: i.e. peak oil.”

Well Said. The Dollar strength is a symptom of global financial problems, not the cause.

I do think that the collapse in oil prices is likely to trigger oil shocks in the future (perhaps in 3 to 5 years). Long term projects are getting canceled, and the Shale debt bubble is to leave a bad mark in future energy investments well after the dust settles. At some point it, will result is real shortages do to a lack of sufficient investment to offset declines.

My best guess is that Energy companies, LTO and non-LTO need prices above $110 to support depletion offsets, and I doubt we will get there in the next two or three years. which will delay development for that same period. Since it takes 3 to 7 years to develop a new field, we are talking 6 to 10 years before new oil (non-shale) become available to offset declines. By then it will very tough or impossible to prevent an economic collapse.

I also doubt the global economy can sustain prices above $100 for any considerable period. The economy was able to afford higher prices by loading up on Debt. Already the sovereign debt bubble is beginning to crack in Asia and the EU. A US debt crisis may begin on the Shale debt bubble, coupled with corporate debt (used to fuel stock buybacks) and problems with Muni (aka Puerto Rico default) and student loans.

Lots and lots of really tough economic problems and a lack of will to tackle them with any real commitment or long term solutions. Maybe the collective Central banks can delay with another big round of QE, but QE can’t solve real problems.

“As long as US production does not come down by at least two mb/d, the oil price will not move up. ”

Heinrich, Reading the comments from Rune and shallow sand among others, it probably won’t take many years before that is going to happen.

Han,

Maybe there is a fast change. However, it will be faster for natgas. Ratio of UWTI/UGAZ is very favourable for UGAZ. It may be a wise thing switching to UGAZ instead of sticking with UWTI.

Yeah EIA is right lol lol lol

Nothing about coal exports.

“The Clean Power Plan will reduce carbon pollution from power plants, the nation’s largest

source, while maintaining energy reliability and affordability. Also on August 3, EPA issued

final Carbon Pollution Standards for new, modified, and reconstructed power plants, and

proposed a Federal Plan and model rule to assist states in implementing the Clean Power

Plan.”

http://www.epa.gov/airquality/cpp/fs-cpp-overview.pdf

http://www2.epa.gov/cleanpowerplan/clean-power-plan-existing-power-plants

And last week there was this news release from a left wing socialist greenie weenie organization that apparently thinks anthropogenic climate change is real enough to be a threat. That group better known as the DoD… released this:

http://www.defense.gov/news/newsarticle.aspx?id=129366

DoD Releases Report on Security Implications of Climate Change

DoD News, Defense Media Activity

WASHINGTON, July 29, 2015 – Global climate change will aggravate problems such as poverty, social tensions, environmental degradation, ineffectual leadership and weak political institutions that threaten stability in a number of countries, according to a report the Defense Department sent to Congress yesterday.

Can’t wait for an update from the DoD on ‘Peak Oil’ and how that might aggravate those same conditions.

The DoD has a chief, who goes by the name President. When you get down to it they are a government bureaucracy. And they are quite skillful at laying out the BS. Overpopulation is a worse problem. But global warming is what the bureaucracy emphasizes because it pleases the top boss.

So you think this one is BS as well?

http://www.acq.osd.mil/dsb/reports/ADA477619.pdf

I don’t think the president really has much to do with the content of any of these reports.

Did you read what the German Bundeswehr said in their report on Peak Oil?

Do you think that is BS as well?

http://www.energybulletin.net/sites/default/files/Peak%20Oil_Study%20EN.pdf

Do you think Angela Merckle has much influence over what the Bundeswehr says about German national security issues? Well in a similar vein I don’t buy your argument that the US President influences the DoDs report on national security issues and if they think Climate Change is important enough to be on their radar it’s probably because where there is smoke there is also fire.

I believe I was the first person to post links to the Defense white papers known as JOE Reports ( Joint Operating Reports) at the TOD.

Anybody interested in where the Pentagon stands on climate as future issue is free to look them up.

They are chock full of rock solid historical information and what is commonly accepted as hard science at just about any university.

But just because I disagree with Fernando on SOME issues does not mean I disagree with him across the board.

He is hard nosed enough to tell it like he sees it on illegal immigration- and I see it more or less exactly the same way he does. The more people you allow in illegally , the more will show up – and the growth in numbers will be exponential with a very steep curve even in the very near future.

Some problems have to be dealt with by nipping them in the bud. Maybe I am a caveman or worse but I sincerely believe this is one of them. You just can’t ignore a crack in a leaky dam or a leaky roof without EXPECTING exponentially increasing troubles as a result.

For what it is worth I base this opinion on having read a hell of a lot of history books over the last fifty years plus while most people spent their evenings watching tv.

AND I DO fully recognize that my own refugee family arrived on these shores less than two centuries ago.

Hypocrisy has nothing to do with the facts. We Scots,Irish and some Germans took the land I live on TODAY from the local so called ”Indians” who took it in a series of wars from other,earlier ”Indians”.

My more distant ancestors took the land they occupied in Scotland and Ireland from people who got there sooner and I have good reason to believe that part of my family arrived here as the result of the English deliberately starving them out.

Life is a Darwinian affair and will remain so for the foreseeable future.

The people in Western Europe are already having quite a bit of trouble looking after their own. These troubles will grow worse as the climate worsens and non renewable resources continue to grow ever more expensive.

A million desperate refugees mostly uneducated and unable to speak the language and used to doing whatever is necessary to get by in a failing country where the rule of law means NOTHING —–Well, a million such refugees are enough to wreck any small country and enough to bring on a political backlash a LOT worse than than any policy designed to keep them out.

Now as far as the hard core left leaning liberals who will condemn me for these words are concerned, most likely by saying I am grossly exaggerating the problem–

Well to them I can only say ” You need to be thinking about the nature of the exponential function and the potential number of refugees.”

And thinking about the sort of politicians who will take over if the refugees are allowed to get thru in large numbers. They are not going to be the sort of politicians that modern decent people are proud of.

“The people in Western Europe are already having quite a bit of trouble looking after their own.”

Mac, a Dutch politician said last week that refugees wouldn’t be much of a problem for Europe, because the population is decreasing. I agree with you that it is dangerous because of the mentioned risk of exponential increase.

Hi Han,

For the most part the population is NOT YET decreasing and the governments in Western Europe are still looking at paying for getting the older generations safely thru old age on the economic backs of relatively few young people.

My cave man side again emerges and I for one do not believe that millions of uneducated and uncivilized ( by European standards) people used to living by ENTIRELY different rules can be easily integrated into a modern western welfare state.

Damned few of the many people I know of locally, personally, here in the states make a serious effort to better themselves once they get on welfare. They look at it as a sinecure position and do every thing they can to STAY on welfare. This not to say most of them do not hustle a little or a lot on the side, babysitting, cutting grass, doing a little carpentry or painting or dealing a little pot or fixing cars or whatever.

But the idea that all such people are determined to rise to the top of the heap via study and hard work is a joke.

So long as only a few get thru you will get a lot with real brains and ambition as a percentage of that few. ONCE they start getting thru by the tens of thousands you will unfortunately get the sort in large numbers that that jackass Trump is blathering about.

Hardly anybody is right about everything.

I have lots of Mexican neighbors these days – most of them the salt of the earth. But recently we are seeing the kind coming here -HERE- who have no work ethic other than to deal hard drugs and break into houses and that sort of behavior.

This sort of person is NOT to be BLAMED for possessing the ethics and values of the society he grew up in. If I had been born to Catholic or Buddhist parents I would be a Catholic or Buddhist etc. If my Daddy had been a successful professional crook there is every reason to believe I would have followed in his footsteps.

I do not believe any country is at present strong enough to risk taking in unscreened immigrants by the thousands and tens of thousands without risking a horrible political backlash at the minimum.

I hope Trump flames out and crashes but the level of support he is getting now makes my point for me.

Trump in office supported by people like him in control of congress means the end of any hope for any NEW environmental initiatives and the gutting of any already in place.

The REAL conservative position is to take care of the one home we have.

UNFORTUNATELY the large majority of people who think of themselves as conservatives are not well enough educated in the physical sciences to understand this fundamental fact.

Mac,

This reverses the reality of the problem.

The hard reality is that illegal immigration has been tolerated in the US, (and legal immigration in Europe) because it provided cheap labor for business.

If anyone really cared about stopping immigration they would do something to improve education and opportunities in the immigrants’ countries of origin. That would start, for the US, with Mexico. Mexicans would be delighted to stay in Mexico if things weren’t so bad for them there.

The US has collaborated with the Mexican elite to keep the status quo – that could change…if the business community really wanted it to.

I agree about the lack of opportunity in poor countries such as Mexico. But actually doing something about this lack of opportunity is a Herculean job and the American business community as you point out is not interested in fixing the problem. It is to the business community’s advantage to support the status quo.

The working classes of this country are desperate to do something about immigration but politically unorganized and thus powerless.

I know many such people personally, some of them kin to me. They hate immigrants guts with a passion because they contribute to the oversupply of cheap labor that keeps THEM poor.

The more fortunate middle classes are somewhat different. My old colleagues in education are mostly hard core liberals and yet perfectly happy to hire the CHEAPEST yard boys and baby sitters and house cleaners and nickel and dime construction workers they possibly can – nationality and citizenship be damned.

They can AFFORD to take the high and snooty moral ground because they work in fields that are just about totally insulated from competition from immigrants. The middle class business OWNERS are VERY happy to hire the cheapest labor they can get, no more questions asked than necessary to avoid going to jail.

Nurses are pretty well insulated from competition from immigrants but sometime back I read about a few hundred being allowed in from the Phillipines. The nurses I know personally ( some in the family ) are already retiring as early as possible because they are overworked and under paid. NOT a single one of them believes that the Phillipine nurses are being brought in except for ONE reason- to avoid paying higher wages and providing better working conditions.

A lot of computer programmers who used to think they were safe economy have seen THEIR jobs outsourced overseas as well. The most conservative of newly minted conservatives are liberals that have been recently mugged. The programmers were mugged by so called free trade.

My gut belief is that sooner rather than later the people who really matter at election time, the ”middle of the road more or less ” middle classes, are going to come to the conclusion that cheap labor is NOT a good thing.

I personally would rather pay a a couple more bucks for a shirt made by decently paid neighbors than one made in an overseas location- as well as supporting my neighbors on welfare and paying for an ever expanding police , courts, and prison system.

So far as I am concerned , pardon my language , only a fool who does not KNOW any poor working class people could possibly believe they can be successfully trained by the hundreds of thousands and the millions to do more sophisticated modern knowledge based work.

I have BEEN THERE and HELPED in the ATTEMPT to do that. Maybe one out of ten or twenty displaced manufacturing and service workers has the guts and potential to get the real training starting over with learning basic fxxking arithmetic and reading.

I used to make EXCELLENT money welding. Then I participated in shooting off my own welders toes by teaching a couple of hundred kids the fundamentals. Now welders are a dime a dozen compared to formerly.

The ONLY reason ANY trade or profession pays well is because there are few enough people capable of practicing it to keep wages and salaries high– UNLESS the people in it have a way of keeping outsiders permanently OUT.

I was able to get into some nuclear power plant work occasionally when the unions could not supply enough people. But as a general thing – not being able to get into the relevant unions – I was not even eligible to APPLY for most good welding jobs thru my working years.

The ONLY way the poor working people of this country will ever again enjoy reasonably well paid work is if by some means the competition for manufacturing and trades jobs is reduced sufficiently that the people doing the hiring must offer higher wages.

Moving the textile and furniture industries that used to provide modest but steady incomes to a million people in my area overseas is was one of the WORST mistakes possible. Half these people are now permanently on one sort or another of welfare and will STAY on it. A substantial portion of them have turned to less than legal ways of making ends meet.

I LIVE among these people, grew up among them, dress and talk like them , and mostly I live like them on a day to day basis.I am however MUCH better off than most of them since I own a good bit of property. I could dress and live more extravagantly if I so desired. I could drive a new car if I really wanted to.

They talk to me far more honestly than most people do to priests and lawyers. Some of this talk has taken place TODAY in the very room I am sitting in at this minute with a couple of folks who came to visit my Daddy.

I also know the other side. I lived for years in the city and hung around the university district taking grad classes and owned a business and made a lot of money at times. I was welcome at parties where everybody was living the American dream.

actually doing something about this lack of opportunity is a Herculean job

Not really. As you know, Mexicans are as hard working as anyone. My impression is that Mexican elites deliberately set things up to prevent entrepreneurship, good education, unionization, etc. It takes forever to get permits. There are effective monopolies everywhere. Why is Carlos Slim so rich??

The US actively supports this stuff. If the US pushed in the other direction against it, it would have enormous leverage. After all, if the US sneezes, Mexico catches a bad cold.

The ONLY reason ANY trade or profession pays well is because there are few enough people capable of practicing it to keep wages and salaries high

That helps, but the most important thing is collective action: unions. Which also need government support, or businesses will crush them.

Moving the textile and furniture industries that used to provide modest but steady incomes to a million people in my area overseas is was one of the WORST mistakes possible.

That’s not the primary problem. Automation is the primary problem. Automation would have eliminated 80% of those jobs by now, either way.

OFM

“I for one do not believe that millions of uneducated and uncivilized ( by European standards) people used to living by ENTIRELY different rules can be easily integrated into a modern western welfare state.”

Low skill immigrants cannot replace high skill workers (engineers, skilled laborers, etc). Its never been about the quantity of workers, but the skills of the workers needs to maintain complex systems. I am pretty sure the TPTB are only focusing in increasing the body count instead of matching skills sets. Of course political parties are gaming for the latino vote in the US. its probably not much different in the EU (with the difference of Middle East immigrants)

For Nick ,

in response to your eight o four seven o four pm response

SO -You think dislodging the entrenched Mexican elite is a piece of cake job?

Maybe you are right.

But I am VERY strongly of the opinion that dislodging that elite and rearranging the Mexican economy is going to be a Herculean job.

Mac,

That would greatly over simplify this discussion.

What I’m trying to say is that the United States has collaborated with the Mexican status quo. Think maquiladoras. If the US were to stop pulling in the wrong direction, and start rolling in the right direction, they could make a very large difference.

But, we haven’t really tried…

Wouldn’t it be a good idea to at least give it a try??

>The people in Western Europe are already having quite a bit of trouble looking after their own.

Europe is a massive exporter of food, and I haven’t heard about people starving.

Fernando has a point. If it wasn’t for population we would not have a problem. 🙂

So population with technology causes global warming which causes climate change. Climate change affects the hydrologic cycle which in turn causes food production to be reduced, which solves some of the population problem.

So if we can increase global warming fast enough, the population problem goes away. We can throw fossil fuel depletion into the mix just to give the population reduction an extra edge.

The downside is that OFM stopped immigration and there is no one to work the farm fields when the tractors stop. Bad plan OFM.

Wait a minute.

Or maybe a good plan as it cuts population even faster due to less food. Good plan OFM.

The price of field labor – to the extent it is necessary- is a big problem for the farmers who have to pay for it while competing in the most competitive industry around.

BUT if the cheap imported labor disappears then the price of it will go up substantially and some of the millions of people without jobs already – LOCAL people – will gladly take these jobs.

This increase in labor costs on the farm will drive up the costs of fresh veggies and fruits a little – not much- at retail.

The farmers will pass it thru and on to the wholesalers.

When I was a kid I got paid pretty good money to pick apples – fifty cents a bushel due to labor shortages. I made very close to a hundred bucks some days- awesome money for that place and time.

If I were still working I could pay two or even three bucks a bushel and a strong young man willing to HUSTLE all day could make over five hundred bucks. This would result in MY costs increasing maybe six or seven cents a POUND. Apples seldom sell AT RETAIL for less than a dollar a pound these days and usually closer to two bucks than one buck.

The cost of field labor being an issue is simply farm industry propaganda. The ONLY part of hands on farm work these days that really supposedly depends on dirt cheap help is harvesting.

You do NOT want incompetent help mixing chemicals that cost hundreds of bucks per pound or driving and maintaining tractors and combines that cost substantially more than Mercedes and Teslas.

Except for hand harvested fruits and veggies the industry is and has been thoroughly mechanized for decades. Labor is NOT a big deal. That is totally industry propaganda bullshit. Get rid of the immigrant help ( no reflection intended on the immigrants who pick veggies and fruits , they are awesomely hard working decent people) and the price of tomatoes and apples goes up a nickel or a dime at the most.

The price of chicken , beef and pork might go up a cent or two at the MOST.The operation of grain farms and feedlots is so highly mechanized that virtually NOTHING is done by hand anymore except repairs and maintenance work. The cost of a combine operator compared to the cost of a combine and the value of a hundred acres of corn or wheat is TRIVIAL. The operator will harvest into the thousands of dollars worth of crops per HOUR he works running a big modern machine.

And a million or two million local people are back at work at wages they are willing to accept.

This is NOT to say that occasionally farmers CANNOT find enough help mostly due to political considerations.

Restaurants and farmers hire the cheapest help they can get for competitive reasons. If the cost of labor goes up they pass it along. Certainly some fast food outfits will fail if they have to pay a couple of bucks MORE per hour. But the INDUSTRY will survive. The industry will shrink some but the people in it will make more and have more to spend to support other industries so the net effect will be more or less a wash.

No honest farmer will ever blame his failure on the cost of labor – so long as other farmers are paying the same labor costs as he is. If he fails it will be for OTHER reasons.

Decades ago I saw figures to the effect that modern American farmers have more horsepower per man at their disposal than any other industry. I expect that this still holds. Big trucks have more horsepower than big tractors but farmers have tractors , combines,insecticide sprayers, lots of electric motors etc etc at their disposal- multiple machines per man.

Thanks, OFM, for putting a proper scale on cost of farm labor. I would add that, as usual, one really good helper is worth many not so good ones, and lots less bother.

I just had to let go two ok but not great shop aides since their stress on me was more than I could take.

The one I kept, now admits that he too, found them more in the way than real help. We are now both happier and more effective.

When I was in business, I did what I could to bring in a few talented foreigners and they were indeed truly experts and a credit to all. And their offspring are now nationally recognized in this or that field. a great success!

That was a real few, less than 10. When it comes to thousands and millions, then of course we get the normal distribution of everything human, heavily weighted toward poverty, ignorance, poor health and all the other reasons one might feel pushed to make a desperate move.

Those reports are related to fuel and energy supply, have nothing to do with “climate change” as such. The first link refers to energy supply security, concludes they use too much fuel and says the energy grid may become more unreliable (probably caused by voltage instabilities caused by wind).

BTW, how does this jive with your Vencore link and the supposed resiliency of the Arctic Ice Sheet and its recent upward trend?

https://goo.gl/8HyLhL

Or do you think these guys are less professional than the good folks at Vencore?

At least on this site you can actually download the data.

Arctic sea ice maximum reaches lowest extent on record

Arctic sea ice extent for February 25, 2015 was 14.54 million square kilometers (5.61 million square miles). The orange line shows the 1981 to 2010 median extent for that day. The black cross indicates the geographic North Pole. Sea Ice Index data. About the data —Credit: National Snow and Ice Data Center

High-resolution image

The National Snow and Ice Data Center (NSIDC) is part of the Cooperative Institute for Research in Environmental Sciences at the University of Colorado Boulder. NSIDC scientists provide Arctic Sea Ice News & Analysis content, with partial support from NASA.

NSIDC has issued an update to Arctic Sea Ice News & Analysis describing winter sea ice conditions in the Arctic Ocean.

Arctic sea ice appears to have reached its maximum extent for the year on February 25 at 14.54 million square kilometers (5.61 million square miles). This year’s maximum ice extent is the lowest in the satellite record.

That’s a five month old report. The report I linked was written in late July.

You alarmists have a tendency to flagellate yourselves using cherry picked data. I think it’s some sort of masochistic tendency, to be honest. You would do better if you looked at the data, and relied less on the army of hysterical media and blog literature.

Like I say, this is uncannily similar to the Iraq WMD bullshit storm used by Bush, the Pentagon, and the media prior to the 2003 invasion.

Fernando, the subject of that article was about the sea ice maximum! That is the very latest sea ice maximum. It was, of course, written at the time of the year when the sea ice maximum occurs. It states that this year’s sea ice maximum was the lowest on record. That record will be current until the next sea ice maximum occurs,… next year!

That is current data. That is not cherry picking. Good god man, get a grip.

Yes Ron, nevertheless it was a cherry pick to pick the article. It proves nothing if the reader is educated in the subject (don’t forget I worked in real Arctic projects for several years and had to coordinate work done by ice experts). What counts is the over all trend, including the ice mass trend. The data in that particular link shows the trend was altered for a few weeks (the ice cover just happened to go very low at the max, which in the over all climate change is meaniingless). I like to look at the full data set. And the full data set does show a sea ice concentration, cover and volume recovery since 2012.

http://neven1.typepad.com/blog/2015/08/piomas-august-2015.html

What counts is the over all trend, including the ice mass trend.

Yep, I agree 100% with that statement!

To be clear the overall trend has clearly been heading down at least since the 1980s, so I’m not quite sure how you figure this is cherry picked data on my part.

Of course you are still entitled to your opinion.

Cheers!

It is cherry picked simply because you highlighted a single point in a longer trend.

My post, on the other hand, linked the Vencore site so it could be used by those who wish to have information from a USA government contractor who has less of a political agenda.

I also chose to quote the statement about the ice recovery from the 2012 low, which happens to be a 30 month trend (not a single point). The intent was to show that Vencore wasn’t just parroting the party line.

The ice recovery is important to those who try to project ice conditions for multiyear projects. For example, it could alter plans to explore for oil offshore Greenland, the Barents/Pechora, the Beaufort, etc.

We haven’t discussed the issue much, but the record sea ice extent around Antarctica is causing re supply problems for some bases. I understand the Australians may have to reduce activities because the ice is so thick they can’t access their base like they used to.

Fernando, now you are just making excuses, trying to cover your mistake of calling the very last current data cherry picking.

Highlighting the fact that the very last sea ice maximum was the very lowest sea ice maximum in history is, by no stretch of the imagination, cherry picking.

The original reason you said it was cherry picking was the fact that the data was five months old. But when I pointed out that the very last sea ice maximum was five months ago and therefore this was current data, then you changed your reason. You found another reason to call it cherry picking.

Is it that hard to say: “Hey, I misspoke.”

Sea ice cover plot by Danish institute. Shows the slight dip in February. The key is not to get misled by a statement focusing on a small segment, and instead look at the full data set.

http://ocean.dmi.dk/arctic/icecover.uk.php

Hi Fred.

Did you read the report a week or so ago describing sea-level change along the Atlantic coast of the US? The forebulge caused by the weight of the last ice sheet is still relaxing and the greatest rate of relaxation along the coast is centered at about the Chesapeake. Norfolk, Virginia, the throbbing heart of my old outfit the US Navy, is in that area. As the forebulge subsides the land sinks below sea level.

Mother Nav is not a skeptic about sea-level rise, for good reason.

No I didn’t see the report a week ago but I gather this is what you are talking about

view-source:http://www.geodesy.noaa.gov/GRD/GPS/Projects/CB/SEALEVEL/sealevel.html

A similar plot just for tide gauges along the east coast of North America.

Tide gauges on the Chesapeake Bay are again emphasized using a different color.

Note the similarity of all these plots.

Figure provided by Bruce Douglas (NODC) and John Lilibridge (GL)

The Table below shows the relative sea level rise in mm per year

for long-term tide gauges in the Chesapeake Bay region. Trends

for 1930-1990 and 1970-1990 are displayed. It is

obvious at a glance that there is a great difference between the

regional rate of sea level rise during the two periods.

The interval 1930-1990 is long enough at 60 years to establish

that the middle Atlantic region has a systematically higher rate

of sea level rise than the long term global average of nearly 2

mm per year. The approximately 1.5 mm/yr extra rise for the

region comes from a general sinking of the area into the ocean.

Postglacial rebound, that is, readjustment (sinking in this area)

of land elevations since the retreat of the glaciers at the end

of the last ice age, is the cause. The overall global rise of

sea level adds to the effect of land subsidence in the Chesapeake

area to produce an unusually high rate of long-term local sea

level rise relative to the global average.

The period 1970-1990 tells a very different story. The sinking

of the land from postglacial rebound is still going on, but the

regional ocean circulation and density structure has produced a

temporary fall of sea level in the zone that has entirely offset

the effect of the subsidence due to postglacial rebound. Thus

for now, the net change of sea level in the middle Atlantic area

is zero. Of course this situation will not last. The nearby

ocean will inevitably recover, and even overshoot, its long term

rate of sea level rise in the area, producing at some time in the

future (probably in the next few decades) a rate of rise that

exceeds the long term average rate for the region.

Isostatic rebound is rise of land mass that was depressed by the weight of ice during the last glacial period which should cause the apparent sea level to go down, not up. If you guys aren’t confused you’re certainly confusing me. True, sea levels from NY to Newfoundland did jump (approximately four inches in 2009 and 2010) — caused by ocean circulation changes.

Isostatic rebound is rise of land mass that was depressed by the weight of ice during the last glacial period which should cause the apparent sea level to go down, not up.

Yeah, that’s what I would have thought as well but you can argue with the guys who wrote that, not me 🙂

The approximately 1.5 mm/yr extra rise for the

region comes from a general sinking of the area into the ocean.

Postglacial rebound, that is, readjustment (sinking in this area)

of land elevations since the retreat of the glaciers at the end

of the last ice age, is the cause.

For reasons unbeknown to me, it seems the post glacial rebound in this particular region was causing the land to sink, not to rise during this time period…

This might help clarify the issue…

http://goo.gl/Nn5yJ0

Earth also returns to its original shape very slowly. In fact, postglacial rebound continues today, albeit at an exponentially-decaying rate. The land beneath the former ice sheets, e.g. around Hudson Bay and central Scandinavia, is still rising by over a centimetre a year [3, 4], while those regions which had bulged upwards around the ice sheet are subsiding – regions such as the Baltic states and much of the eastern seaboard of North America

Here’s a graphic that shows the rising and subsiding areas

“Recently, the term post-glacial rebound is gradually being replaced by the term glacial isostatic adjustment. This is in recognition that the response of the Earth to glacial loading and unloading is not limited to the upward rebound movement, but also involves downward land movement…………..”

Shit, and I’m a bloody geophysicist…. mind you it was 50 odd years ago we learned that stuff…. yeah, its a piss poor excuse. Thanks Fred.

A discussion on the factors in sea level rise including the forebulge.

http://www.eenews.net/stories/1059972339

I was about to search for a magazine article I read, but it turns out the article posted at your link contains the information I sought:

“When it comes to the East Coast, however, Greenland does have one particular twist in store. Its ice-loss legacy does not end with dumping fresh water. Afterward, geography kicks in. The island will rise, undergoing its own post-glacial rebound, just like Canada. (This could mitigate some melting.) But it will also lose something more ephemeral.

It will lose its gravity.

Currently, Greenland is home to so much ice that its huge mass pulls ocean water toward the island, its gravitational pull lifting local sea levels. Like a miniature moon, it creates a permanent tide. But melt enough ice and the ringing water will slough away, circulating back into the Atlantic.

“It’s the most counterintuitive effect one could imagine,” said Harvard’s Mitrovica. “The sea level close to the ice sheet will dramatically drop … if it’s melted enough.”

Even with the water it dumps into the ocean, this means that Greenland melt could lower sea levels in a halo some 1,200 miles around it. Newfoundland and Britain, for example, would see their sea levels quickly fall, he said. Few published models have accounted for these gravitational changes. Mitrovica published one himself, in 2010, looking at New York City. And by and large, Greenland’s gravity loss canceled out much of the rise that would have come from its meltwater.

The community is only beginning to grapple with the importance of gravity to sea levels. These gravitational changes also mean each ice source carries its own geographic signal, its own fingerprint, as Mitrovica calls it. Future sea-level rise will be a mix of thermal inflation, glacial legacies and these fingerprints. Each coastline, each port will be different.

“There’s no reason to believe that it should be even,” Mitrovica said.”

The magazine article I read had the feature of maps/graphics depicting Greenland’s icecap gravitational pull and resulting ocean level bulge around it…as that bulge relaxes away, sea level will rise at various shores around the World far from Greenland.

If the planet were smooth with no high elevation masses of mountains and ice, and stationary, no moon , etc , as a theoretical or thinking experiment , then there should be a nice quiet sea that levels itself out perfectly like standing water in a small lake.

So – if anybody in this forum knows, what are the maximum differences brought about in sea level from place to place on the globe by factors such as the Greenland ice sheet?

You mean by gravitational effects?

well at least the glacier melt is slowing down…oh wait….

Observations show that glaciers around the world are in retreat and losing mass. Internationally coordinated for over a century, glacier monitoring activities provide an unprecedented dataset of glacier observations from ground, air and space. Glacier studies generally select specific parts of these datasets to obtain optimal assessments of the mass-balance data relating to the impact that glaciers exercise on global sea-level fluctuations or on regional runoff. In this study we provide an overview and analysis of the main observational datasets compiled by the World Glacier Monitoring Service (WGMS). The dataset on glacier front variations (~42 000 since 1600) delivers clear evidence that centennial glacier retreat is a global phenomenon. Intermittent readvance periods at regional and decadal scale are normally restricted to a subsample of glaciers and have not come close to achieving the maximum positions of the Little Ice Age (or Holocene). Glaciological and geodetic observations (~5200 since 1850) show that the rates of early 21st-century mass loss are without precedent on a global scale, at least for the time period observed and probably also for recorded history, as indicated also in reconstructions from written and illustrated documents. This strong imbalance implies that glaciers in many regions will very likely suffer further ice loss, even if climate remains stable.

http://www.ingentaconnect.com/content/igsoc/jog/pre-prints/content-ings_jog_15j017

Melting is what the glaciers are supposed to be doing since the world came out of the Little Ice Age, that marked the maximum expansion of glaciers during the entire 11,000 years of the Holocene.

Glaciers have been smaller than now for most of the Holocene, when CO2 concentrations were much lower.

And most interestingly, percentage of Swiss glaciers retreating and advancing for the last 100 years correlates well with AMO (Atlantic Multidecadal Oscillation).

100‐year mass changes in the Swiss Alps linked to the Atlantic Multidecadal Oscillation

Since the AMO is about to turn again, this theory predicts that our suffering shrinking glaciers should get a respite during the next decades.

From Fig.3 in that paper:

Aug 3 (Reuters) – Alpha Natural Resources Inc, one of the largest U.S. coal companies, became the latest in the hard-hit industry to seek bankruptcy on Monday.

The company became the second-largest publicly traded U.S. coal producer when it bought Massey Energy Co in a $7.1 billion deal in 2011, when its stock was trading at more than $50.

http://www.reuters.com/article/2015/08/03/alpha-ntrl-resc-bankruptcy-idUSL3N10E4JP20150803

Yes, US coal company stocks are probably the only sector in worse shape than US oil and gas.

I guess we will have enough gas, etc? US coal production is tanking. Peak coal in US?

EIA says US imports of coal will drop, but then rise in 2016.

Will be a big issue in the 2016 election in WV, VA, KY, IN and PA?

I read a few years ago that a whopping 14,000 coal mining jobs were considered at risk from the ‘war on coal’.

Big hairy damn deal! Many of the same folks ideologically bleeding over that paltry number of jobs were champing at the bit to flush half to two thirds of the U.S. automobile industry (including parts suppliers) down the drain….many more jobs would have been lost…and many more auto industry U.S. jobs have been lost since the great outsourcing in autos and light trucks started decades ago. Same thing with cameras, televisions, and appliances…the numb-nuts bleating over the coal mining jobs cheered ‘Free Trade’ and the ‘Free Market’ for creating supposed corporate efficiencies from exploiting cheap labor and lax environmental regulations in various other countries around the World.

So…they can shove their concern about coal miners sideways…those folks are far better off without the danger and chronic health issues from underground coal mining..and we and the environment would be far better off when we stop explosively removing mountaintops and filling in the valleys with the spoil…fly ash, sludge ponds, heavy metals…Holy Zeus, bring on the NG, with appropriately regulated fracking…and I’d rather see valleys filled with water for pumped storage then overburden blasted from mountaintops. And…bring on the solar PV and (especially offshore) wind…I would even entertain advanced fission plants as long as there is a 3 order of magnitude increase in safety against core melt downs, and we implemented a sane strategy to deal with the waste.

Any chance you’d consider running for office? 🙂

Ron, one of my recent posts that has generated a fair bit of interest.

US Shale Oil: drilling productivity and decline rates

“With these declines and current rig count and productivity levels, production in the Bakken will stabilise at around 870,000 bpd, down 330,000 bpd on current levels. Production in the Eagle Ford will stabilise at around 1,140,000 bpd, down 560,000 on current levels. The lower decline in the Permian means that production there will continue to rise. It is estimated that the net effect will be an LTO production decline of the order 830,000 bpd spread over several months.”

This bound to be wrong, but the essence may be close to true.

Euan. That you for the link.

Thank you, I mean!

Euan,

You wrote about the Bakken production projection:

“This is calculated by taking recent production of 1,200,000 bpd and applying a 5.2% decline per month and observing that this will take production down to 871,000 bpd after month 6.”

I belief this method is flawed. The front-month decline rate declines itself rapidly as fewer fast-declining wells are being brought online than before. My projection tells me that even if 0 wells are brought online in the 7 months after May 2015, the December daily production is still higher than 871kbpd. This is based on applying well decline profiles to all individual wells, using separate profiles for >=2014 and <2014 wells. With about 100-120 wells being brought online on a monthly basis (consuming part of the fracklog) for the rest of the year, I project ND production will end around 1110 kbopd, plus or minus 40kbpod.

Enno, I’m quite sure my analysis is flawed and there is a better way of doing this. In the articles I write I try to find a way of reaching “quick and dirty” answers that pick up on some fundamental points and get us into the right ball park.

Some of the key observations are that less new wells = lower play decline rate. And that LTO production is not going to fall as far as many may expect or hope with current drilling and efficiencies. I think we are agreed on that. The devil then is in the detail.

If you had some links to your splendid work….

Hi Euan, I agree with you. When the new ND data is out, end of next week, I’ll create a short-term projection in a post here.

I am looking forward to it, Enno!

Told you Ron, the Gov now cooks most of the data they release to maintain their complete control of markets, perception, etc. The destruction in the oil patch will come back to bite us hard, but since the world is in a technocrat driven zero interest rate depression maybe we won’t need that much oil after all.

Mixed Signals on U.S. Oil Output

Government reports conflict on whether production is rising or falling, puzzling investors

July 29, 2015

http://www.wsj.com/articles/mixed-signals-on-u-s-oil-output-1438215062

The most important question in the oil market is whether American production is falling as prices drop. Official oil data aren’t giving a straight answer.

Investors, traders and executives who rely on federal data from the Energy Information Administration are tripping over conflicting images of U.S. production that have emerged from separate EIA reports in recent months.

If you’re pitching loan proposals, hard to see how reporting lower production helps you.

Relying on government data can lead to serious cases of data poisoning. Government agencies take the data, cook it unevenly, contaminate randomly, and package it. I see the possibility that they have a fairly well thought out process to drive prices down in an effort to lean on Iran and Russia.

Given the fact that Iran has agreed to the deal the big countries wanted, and that Russia isn’t about to fold but Saudi Arabia and the other Arabs are gasping for air, I expect to see these energy agencies change their tune in a few weeks or months and improve their projections, which in recent months looked like anal extractions.

QEP Resources, which has the best Bakken wells IMO, reported earnings that beat estimates. They earned .09 per share, before impairments. Including impairments resulted in a GAAP loss of .43 per share.

QEP did not add debt, because they had over one billion of cash on hand as of 1/1/15. Through 6/30/15 they burned through $714.5 million of that cash. They did achieve a production increase of 9% from the first quarter, and made no CAPEX adjustments for the year. Their oil guidance for full year increased 500K barrels, or about 1,400 bopd from prior quarter. No adjustment for forecast gas or NGLs was made, same forecast as prior quarter.

About 2/3 of forecast 140K BOEPD is gas in 2015. QEP was almost strictly a gas producer prior to the shale oil boom. Oil is where production growth is in 2015 v 2014, with Williston and Permian being location.

Long term debt is $2.2185 billion. Looks like they have good wells in both Permian and Williston basins. Believe they have over 400 locations yet to develop in Bakken, infill drilling on 400-600′ spacing and seeing strong results, 100 BOE in first 90 days. Well costs $7.3-$7.8 million in Bakken.

Stock closed at $13.04, but after hours up to $13.98 on earnings beat. 52 week high $35.91.

Closed Tulsa office, reduced workforce by 10%.

This company is probably the strongest in the Bakken due to very superior well locations. Able to keep increasing production with just two rigs running. Q2 production, 52,400 BOEPD 89% liquids in Bakken, so have large presence. Much smaller in Permian at $11,400 BOEPD 81% liquids. Noteworthy that they realized $61.74 or an extra $15.88 per barrel on oil and $3.22 or an extra $.53 per mcf on gas due to hedges.

Bottom line to me. QEP is a well run company with the best Bakken acreage. They had a substantial benefit from hedges, cut costs greatly and increased production in Bakken with just two rigs running off a very large base of production. However, they barely earned an operating profit and burned over $700 million in cash in six months, which is pretty hefty considering a market cap of $2.46 billion.

QEP will be in trouble when hedges roll off and they will run out of cash or will need to borrow/cut CAPEX.

Proof to me that $60s do not work. QEP could probably hold production flat and remain cash flow neutral at $75 per barrel in the field, with regard to Bakken and Permian, if gas remains in $3 range. For Bakken that is about $83 WTI.

shallow sand,

Why is the stock tanking? Just yesterday down 6% in one day. Is it the high proportion of unhedged NGL or is it the low hedge price for natural gas?

I think when oil sank to $45, pretty much all oil stocks fell to varying degrees.

The point, in part, of my above post, is that even the best acreage in the bakken will not work here or even at $60. QEP did raise Baskin production but burned through $714.5 million in 182 days to do so. That with hedges in place which gave them an effective oil price during the 182 days of over $61 at the well head.

So if Goldman Sachs is correct, and oil stays at $50 or below WTI till 2020, it would appear all bakken activity would necessarily cease. QEP cannot burn over $1.4 billion a year, the next five years, the company’s market Cap is not even twice that.

I have no clue why people still have not caught on. I could tell when I first looked at shale in 8/14 there would be a problem. I felt anything below $75 WTI would squeeze most. It just takes time.

What is so difficult to understand about the problem with perpetual cash flow negativity?

And don’t forget global production, especially high cost heavily depleted fields like the North Sea, where a lot of fields are still producing because the abandonment costs are so high, and companies are kicking the P&A costs down the road.

Net Cash Flow math is actually quite similar to Net Oil Export math, to-wit, given an ongoing decline in gross cash flow from production sales, unless total costs (lease operating expenses plus G&A overhead) fall at the same rate as, or at a faster rate than, the rate of decline in gross cash flow, the resulting rate of decline in net cash flow will exceed the rate of decline in gross cash flow and the rate of decline in net cash flow will accelerate with time.

As noted below, this has “Interesting” implications for the remaining cumulative net cash flow from developed producing properties. Of course, the gross cash flow from producing properties can decline when (not if) that production declines and/or if the price declines. This implies a tremendous mismatch between remaining cumulative net cash flow and debt levels.

On the following Six Country Case History chart, the cash flow analogues to Net Export data would be as follows:

Production = Gross Cash Flow From Production Sales

ECI Ratio = Ratio of Gross Cash Flow to Total Costs

Net Exports = Net Cash Flow (Gross Cash Flow Less Total Costs)

CNE = Cumulative Net Cash Flow

Link to chart:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps55d9efa7.jpg

Jeffery,

Your graph goes to 2002. Do you have an updated one? What has happened in the last 13 years?

They hit combined zero net exports in 2007, and as of 2011 they had combined net imports of 350,000 bpd. I haven’t updated the data base since then.

These were the six major net oil exporters, excluding China, that hit or approached zero net exports from 1980 to 2010.

Denial.

You and I are clearly bias toward the profitability and sustainability of the LTO business. A lot of that is related to relying on oil and gas production to feed our families and a hand’s-on knowledge of oilfield economics 101. The LTO industry’s out of control spending spree resulted in 4 million barrels of increased oil production in the US that the world did not need. Oil prices at 45 dollars makes that message loud and clear. The rest of worldwide oil industry is now reeling from this, as is a good many world economies. It has me working harder than I have ever had to work, at 65, just to stay even. I am pissed off at the shale oil industry.

I don’t know about you, Shallow, but I am also now very pissed off at the EIA. Apparently it can’t add even with its toes and fingers, and it grossly misrepresented production levels in the US and helped create, essentially, the illusion of a production “glut” that most certainly affected oil markets. Who will hold them accountable? Nobody. I can’t wait for the EIA to begin to ask me for monthly production data. I’ll say call the Texas Railroad Commission and while your at it, kiss my ass.

Mike

I used to invite my daughter and son-in law over for steaks. These days, I give them a choice of pinto beans and brown rice or black beans and brown rice (I’ve got some good beans and rice recipes if you want them).

In any case Dr. Thomas Watson, Sr. (founder of IBM) reportedly observed that companies set themselves up for failure during boom times. Arguably, the best time to expand is during a recession. I would think that this would be a great time to put together an equity group (with little or no debt financing) to buy conventional producing properties with relatively low decline rates.

Jeffery, your valuable perspective on global oil issues often cause me to forget that you too are a Texas boy with a very vested interest in oil production. The cost of pinto beans at the local HEB are sky high right now, always a leading indicator of oilfield related unemployment. That and Bud Light.

All of the best production acquisitions I ever made were in these kinds of downturns, with good W. Texas bankers standing behind me. I am not seeing any noteworthy production sales yet as I think people are still hoping for a miracle. I think when the reality of a prolonged price turndown sets in there will be some steals out there, you are correct, sir.

Mike

Funny, as I was replenishing my stock of dried beans, I noticed that pinto beans were almost sold out at the local HEB here.

Rockman over on the “other” PO forum, is sitting on a rig-beam like a hungry vulture, lots of cash in-hand and no debt, waiting, just waiting for just such petro-carrion deals:)

Mike, this is why I am in favor of EIA compiling runs from the crude oil purchasers. Not as many companies to collect data from. All should be automated already. They send the stuff to the paying companies like IHS and Drilling info, already. They could also easily report by gravity also, which would be very relevant info.

Ok for EIA to forecast or do whatever else, but the oil runs would be data we should be able to rely on. Should be able to get pretty timely too. Besides, what goes into the pipeline is what is the relevant number anyway. I’m not aware of crude being stored in the field.

I’m kind of resigned to low price for awhile, but also think that KSA cannot stand this for years, and demand will also grow by 1-1.5 million a year like it has, so overproduction will narrow.

Do think that price could rocket over $100 again due to zero world wide spare capacity. It took 3 years plus for the US shale ramp up, probably take at least that long to grow US like that again, if even possible.

Around here, when the price first ran up in 2005-2007, not a lot of drilling. Everyone happy to be making good money, not interested in going for broke. Just look at the data. Seems like that in other places also.

If the shale folks have half a brain, they would be a little more cautious and thankful when prices do rise. Not go on a borrowing spree. Maybe if enough creditors get burned, they won’t be able to.

Shallow, I don’t much care for the EIA but your idea would sure be beneficial to the folks who need to know everything about oil production. That would be fine with me.

I think we are going to have to find a way to survive the next 18 months with < 60 dollar oil. Having said that, who knows? Nobody in the world is much liking these oil prices, I don't think. I guess a VLCC turned upside down and sideways in the mouth of the Hormuz would help some, uh?

Shale folks got no brains, period.

Mike

Mike. My problem with EIA is they are estimating, come up with at least three different numbers for production, and yet those numbers are heavily traded on.

Oil runs in the pipeline would be pretty accurate. In 18 years I remember 2 tank errors, one in our favor and one against us (both times truck driver wrote down wrong number). Of course both of those were caught by everyone pretty much immediately and corrected.

As I am sure you do, we get statements about the 10th of the month and call if we find errors.

The report crude purchasers would email to EIA would be very simple. Report total barrels purchased and then break down same in some reasonable API gravity increments. No need to report who they bought from, just by state.

Its too easy!!

On your ME comment, funny KSA at war, yet apparently there is no risk? In the 12 years prior, if someone over there let one fly out their behind the oil price would go up.

Don’t feel as bad for our extended family as you might. We are heavy in oil, no doubt, but have other stuff going. One is grain farm, but rent that so more like owning RI given those prices are in the dumper. But overall income big time off where it was.

We know many people who are mostly just in oil. A lot of guys who maybe own some production and do service work. With most don’t ever talk much specifics about oil stuff right now, seems like would be in bad taste.

Do have a few real close friends in oil, we do talk. None of them have time to screw with the internet or looking at shale economics. I have educated them a little with the facts about cash flow and debt. Sure pisses them off a lot. So I don’t dwell on it too long.

Hang in there. We figure OPEC will cut, in 2009 price doubled, 1999 more than doubled, both within months of a cut. What you think happens if they announce a 2-3 million cut tomorrow to price?

But some more heads have to roll first, so 18 months will probably do it before a cut. Banks can do themselves a huge favor by saying drilling stops in October. Hate it for the guys and gals that need rigs running to work, though.

“The LTO industry’s out of control spending spree resulted in 4 million barrels of increased oil production in the US that the world did not need. ”

I would say, of these 4-4.5mb/d only 1.5-2mb/d are really excessive. With US LTO production at 2.5 mb/d in 2015, the oil market would have been perfectly balanced.

Alex,

Don’t forget LTO’s little high maintenance cousin “Oil Sand” with over 2mb/d 🙂

Also noteworthy, the two largest upstream MLP’s, LINE and BBEP are trading at just 10% of their year ago stock prices. These two companies have combined production of over 250K BOEPD. Also have combined debt of $14 billion. Each borrowed heavily to buy existing conventional land based production, and paid high prices for much of same, hence the large debt.

Look for declines in conventional US production due to stories such as these.

shallow sand,

Roughly how many of these LTO (public) companies are out there anyway? LINE and BBEP would appear to be basket cases.

Actually LINE and BBEP are not shale companies. They are companies which bought considerable conventional production over the past 10 or so years. Between the two, they operate over 20,000 wells. Most of their production meets the stripper classification of less than 15 BOE per well.

The business model requires them to pay distributions to unit holders (shareholders). The production they have is generally cash flow positive even now, but they paid very high prices for leases between 2005-2014, with mostly borrowed money. The debt service plus distributions are doing them in.

An untold story is that from about 2005 on, many small privately held US operators of conventional production sold some or all of their production to entities such as these. The MLP’s, flush with investors’ cash, paid high prices for this production. The idea was that the MLP’s would hedge almost all production, making these shares or units a safe investment, providing income in the form of quarterly distributions. Yields of 7-10% are very attractive in this era of financial repression.

The upstream MLP’s were first tested in 2008-2009. However, at that time, they were very well hedged. The downturn was short and they were able to maintain distributions during that period.

Of course they, like the rest of us, got complacent. Did not stay completely hedged and tried to use cheaper hedges, like three way collars. Oil won’t go below $70 WTI surely?

These companies are now slashing, or eliminating, distributions just to survive. As investors wanted to own for the distributions (income), they have dumped the shares completely. A year of sub $50 oil will pretty well put them into BK, IMO.

Probably up to half a million barrels per day of US conventional liquids production is held by these entities. Because they are not shale, no one talks about them. But it all adds up. This production is the stable low decline variety, hate to see it suffer too.

We are not in their position because we bought leases mostly pre-2005, before per flowing barrel sales shot up several fold. Thankfully we are too conservative, we tried to buy some but always out bid. Whew!!! We are hurting mightily at present levels. Throw major debt service on that, its lights out.

With that many wells, decommissioning liabilities are staggering, even though land based. Hopefully, vultures will swoop in and at least keep the production flowing.

There is a lot more than US shale getting hammered. Its just that shale gets all the press. Our county’s oil production is generally in great economic jeopardy. Canada too. No matter, surely our OPEC friends will fill the gap, just like last time US oil industry was decimated.

Thanks shallow, was totally unaware of all that.

shallow sand,

LINE also down 18,8% in one day, becoming a penny stock soon. There must be a reason for this.

Heinrich,

LINE eliminated its distribution. That plus oil price tanking I assume.

They have over $10 billion of debt.

I think almost all of the Master Limited Partnerships have had to eliminate or cut their quarterly distribution (dividend). Cutting this craters the stock price.

Note ConocoPhillips actually raised its dividend a penny and the CEO said they would defend the dividend at almost any cost. They borrowed the entire $1.8 billion to pay the dividend and likely will do so till they cannot. If they eliminated the dividend, stock maybe drops to 30s or 20s per share? Who knows for sure?

I note the MLP’s generally did not have to cut 2008-2009. Although price has not yet hit 2008-2009 lows, this crash is worse already and the companies will not be saved by OPEC this time, at least not as soon as in 2008-2009.

shallow sand,

I think many companies still think, that oil prices will go up soon. However it will take time. Most companies are very skilled in finding oil and producing it, yet are awful in assessing prices.

Heinrich, no one really is very good at it when it comes to oil forecasting.

When KSA first started hinting they would not cut, there was talk from there of needing $80 Brent for two years to balance the market. Then they said $60.

OPEC will cut at some point, just like in 1986, 1999 and 2009. Or maybe not, which mean US companies will trade like US coal companies soon.

Shallow you look at these reports more than I do, but I would guess the Canadians have been hurt even worse. PennWest has similar debt to QEP, right about 2.2B. PWE did not add debt and actually paid it down, due to – how many times have you heard this these days? – selling “non-core assets.”

Of course production dropped below 100,000 boepd (to 91K) because of those dispositions. Did not mention anything about staff reductions, but capex trimmed again. Still I’d think a flowing boe of conventional would be worth more than one of shale. So similar back of the envelope comparison but QEP was at $13? and PWE approaching $1?

DuaneX. I am far from being a person to know why one company’s stock trades for much more than another.