The Post Carbon Institute has just released a critique of the EIA’s Light Tight Oil projections. It is titled DRILLING DEEPER. The report is highly critical of the EIA’s projections and should be read by everyone interested in Peak Oil.

All data on all charts is in million barrels per day unless otherwise specified.

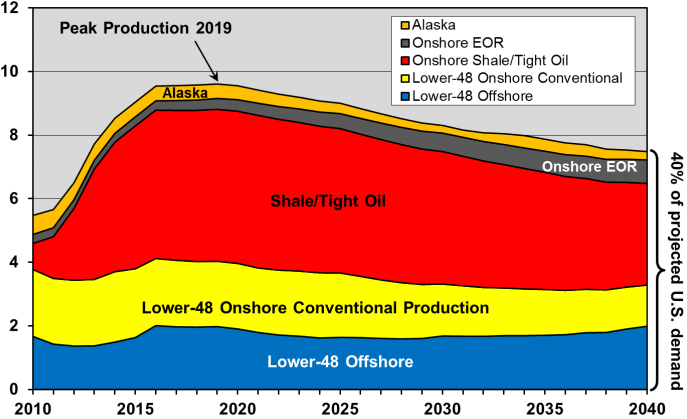

First a look at the EIA oil projections for US production from all sources. They expect offshore to increase to 2 million barrels per day by 2016, an increase of almost 600,000 bpd from current production. Also note that the EIA has US almost peaking in 2016 and increasing only slightly until the peak in 2019.

The EIA has several projections, covering all bases. However the reference, or most likely, will be the only one covered in this post.

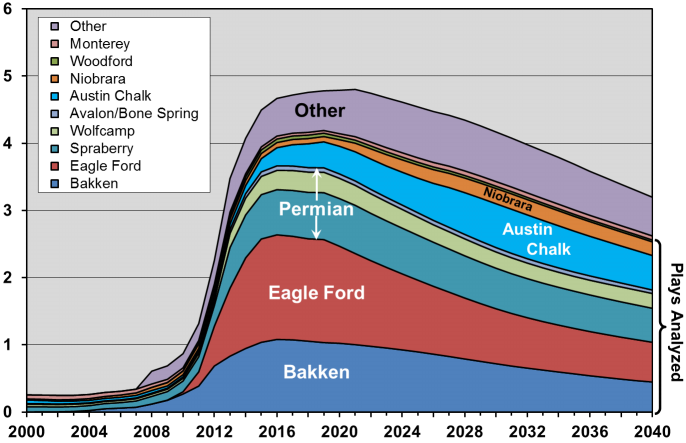

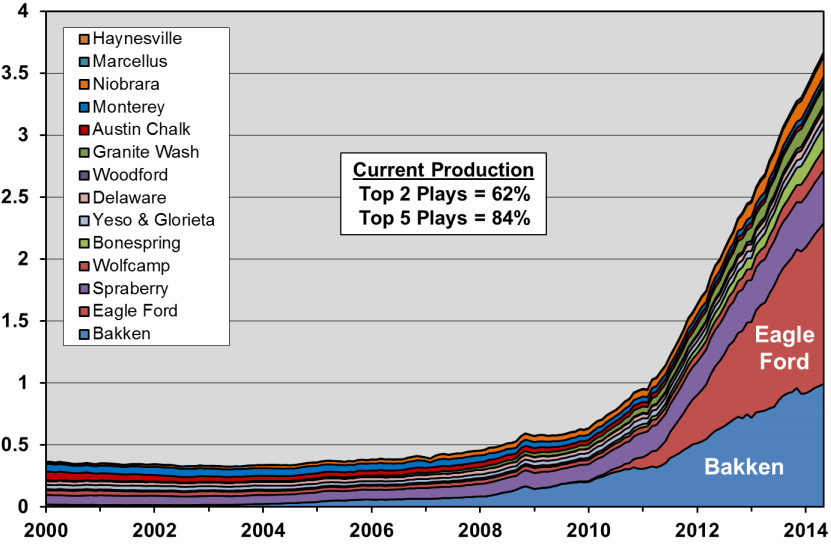

Here is where all the Light Tight Oil will be coming from. They have the Bakken peaking in 2016 at 1.1 million bpd and Eagle Ford peaking at about the same time at 1.5 to 1.6 million bpd.

While they have the Bakken and Eagle Ford peaking in 2016 all the rest continues to increase and peaks much later. And they have the rest declining faster than the Bakken and Eagle Ford.

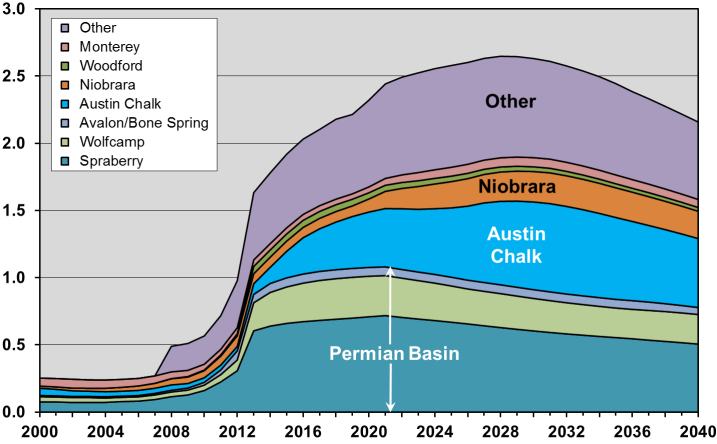

They have all other tight oil plays peaking in 2028 at about 2.65 million bpd with the Austin Chalk and “Other” growing the most.

62% of all Shale oil is currently coming from the Bakken and Eagle Ford. But by 2028 the EIA says that will be reversed with over 60% coming from outside those two plays.

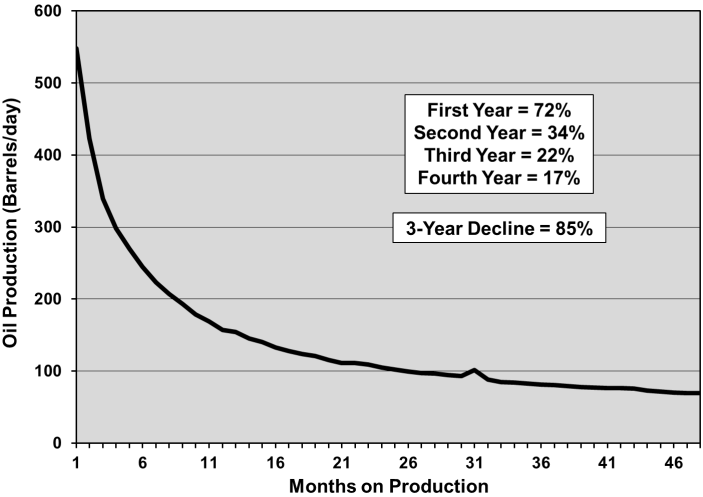

We now have a much better handle on the decline rate. It is far worse than we thought, declining 72% the first year.

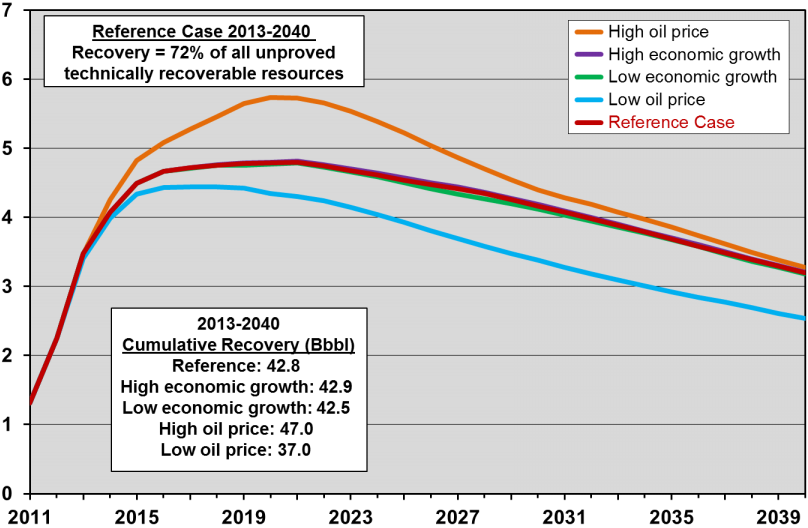

The Post Carbon Institute’s take on things are a little different. They have the initial production a little higher than the EIA but dropping off much faster.

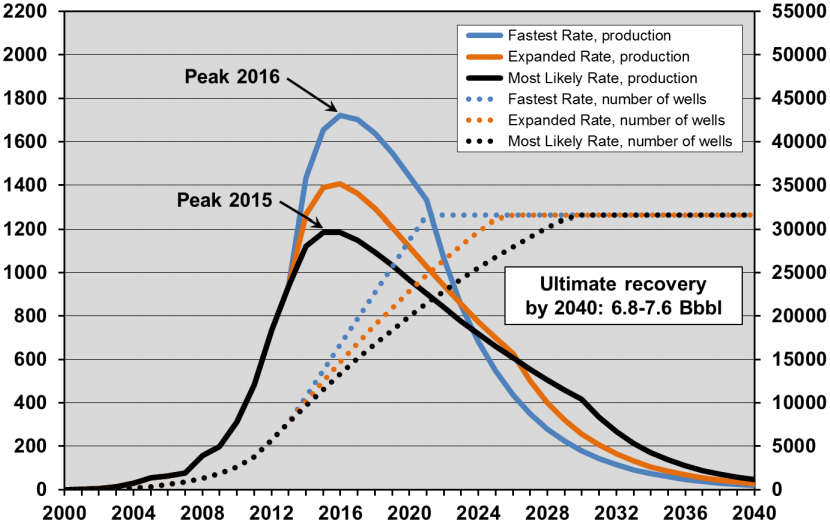

The Post Carbon Institute produced three cases, a Low Well Density Case, and Optimistic Case and a Realistic Case. And all three cases have three rates. In all cases the higher the initial production rate the faster the decline rate. I have posted here the Realistic Case.

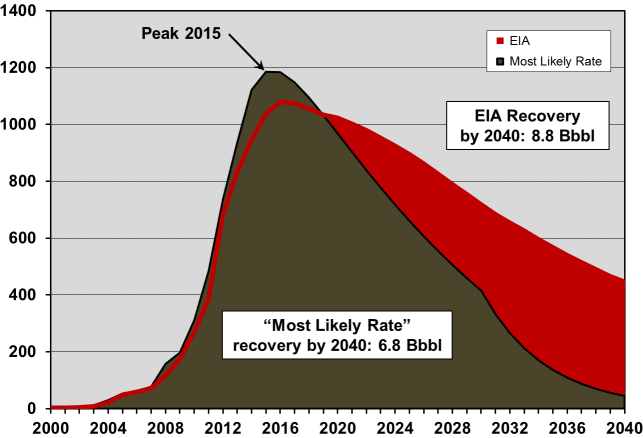

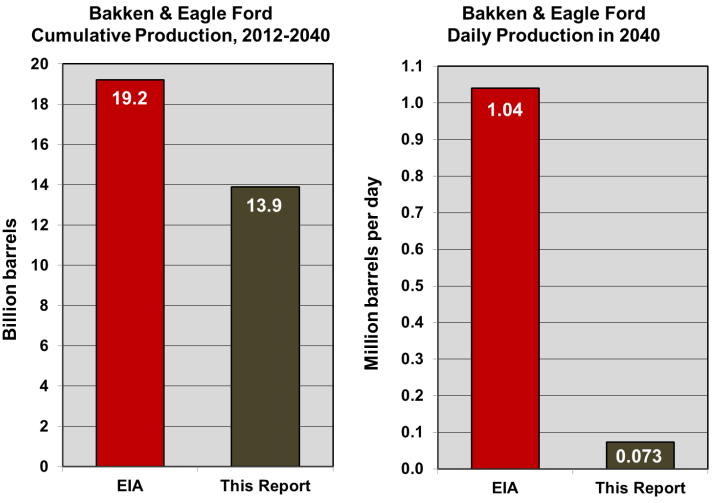

Here we can see the difference in what the EIA predits and what the PCI predicts. The EIA has production still going relatively strong by 2040 while PCI has both the Bakken and Eagle Ford petering out.

That difference is made more clear in this chart.

Bakken Conclusions

1. High well- and field-decline rates mean a continued high rate of drilling is required to maintain, let alone increase, production. The observed 45% per year field decline rate requires the drilling of 1,470 wells per year just to maintain current production levels.

2. The production profile is most dependent on drilling rate and to a lesser extent the number of drilling locations (i.e., greatly increasing the number of drilling locations would not change the production profile nearly as much as changing the drilling rate). Drilling rate is determined by capital input, which currently is about $16 billion per year to drill 2,000 wells, not including leasing and other ancillary costs.

3. Peak production is highly likely to occur in the 2015 to 2017 timeframe and will occur at between 1.15 and 1.77 MMbbl/d. The most likely peak is between 1.15 and 1.22 MMbbl/d in the 2015 to 2016 timeframe.

4. Increased drilling rates will raise the level of peak production and move it forward a few months but do not appreciably increase cumulative oil recovery through 2040. Increased drilling rates effectively recover the oil sooner, making the supply situation worse later.

5. The projected recovery of 6.8 billion barrels by 2040 in the “Most Likely Rate” scenario (2,000 wells/year declining to 1,000 wells/year) of the “Realistic” case (80% of play drillable, at 3 wells per square mile), agrees fairly well with the mean estimate of latest USGS assessment of the Bakken (including the Three Forks) of 7.4 billion barrels.

6. These projections are optimistic in that they assume the capital will be available for the drilling “treadmill” that must be maintained (roughly $188 billion is needed to drill more than 23,500 wells, exclusive of leasing and ancillary costs). This is not a sure thing as drilling in the poorer-quality parts of the play will require much higher oil prices to be economic. Failure to maintain drilling rates will result in a steeper drop-off in production.

7. Nearly four times the current number of wells will be required to recover 6.8 billion barrels by 2040 in the “Realistic” case.

8. Projections that the Bakken will continue to grow and then maintain a plateau followed by a gentle decline for the foreseeable future51 are unlikely to be realized.

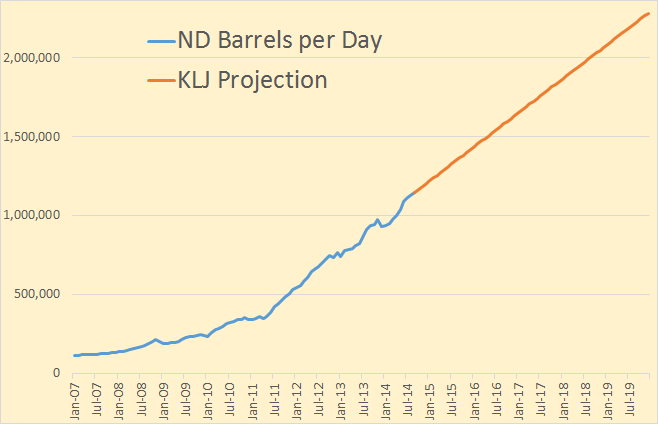

I have to add this. Five-Year Outlook: North Dakota Oil Production to Grow Steadily

On average, North Dakota oil production, which surged past the 1 million b/d mark earlier this year, will continue to grow steadily at a rate of about 18,000 b/d each month through 2019, according to a study completed in September for the state legislature.

Commissioned last year by state lawmakers, Bismarck-based engineering/planning firm Kadrmas, Lee & Jackson (KLJ) completed the work in partnership with North Dakota State University, concluding that daily production could hit the 2 million b/d level during the period.

KLJ and the university used three approaches to forecast the sustainability of oil and gas production: economic analysis of the Bakken/Three Forks shale formation; projections on population, employment and housing needs; and potential for enhanced oil recovery (EOR).

Got that, Bakken production will increase by an average of 18,000 barrels per day for the next 5+ years. 18,000 bpd increase just happens to be almost exactly what the Bakken has been averaging for the last 3 years. Here is what that chart will look like if they are correct.

So how do they plan on keeping production increasing at 18,000 bpd every month? Easy EOR! From that report:

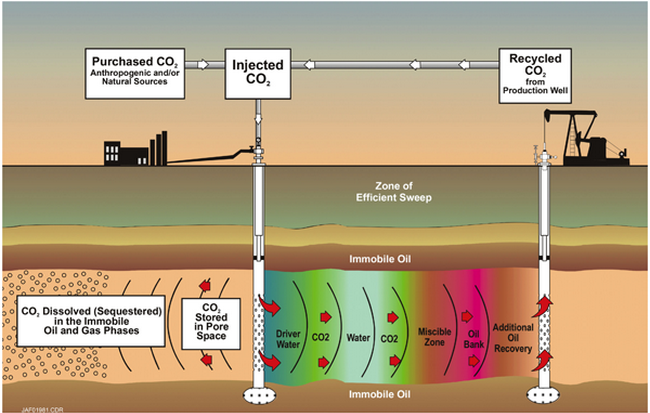

EOR using carbon dioxide (CO2) injections to get extra production out of mature wells has the potential to increase overall production in North Dakota, the study pointed out. “In conjunction with other non-traditional technologies, such as horizontal drilling and hydraulic fracturing, CO2 EOR should be recognized as part of a long-term production strategy for North Dakota oilfields. Modeling and analysis proves there is significant opportunity.”

The primary challenges to EOR during the next five years, the study said, are the need to acquire sufficient volumes of CO2 and the oil/gas companies willingness to invest in EOR.

The study fails to mention that CO2 EOR has never been done on fractured non-porous reservoir rock. Here is how CO2 EOR works.

From an injection well you push CO2 into the reservoir. The pressurized CO2 combines with the oil and water and sweeps through the porous rock toward the well bore. But you can’t do that in a light tight oil reservoir. There are no injection wells in the LTO reservoir. And if there were it still wouldn’t work. The CO2 would hit one of the fractures in the rock and just channel all the CO2 right to the well bore and you would recover nothing but the CO2.

I did a little research and they tell me that the way they hope to do CO2 injection in a LTO field is just to push it down the original oil well bore under a lot of pressure, then let it come right back out. Okay but that sounds like it would be very inefficient. From what I read CO2 injection is already on the verge of being uneconomical.

But… there may be other ways of doing it. If you are in Atlanta from November 16th through the 21st then you can attend a seminar discussing just how it may be done. And you may be lucky. If they are looking for investors you may get in on the ground floor.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com

Hi Ron,

It is the Spraberry that grows the most (excluding Bakken and Eagle Ford).

That is in your fifth figure.

Sorry Ron. I was looking at the wrong chart.

My own gut feeling is that oil prices will be higher than most folks think and that the oil production both annually or daily and cumulatively from the tight oil fields will thus be at the high end of estimates simply because depletion of legacy conventional field will restrict supply enough to keep the price up.

I believe this although I also believe we are going to adapt to higher oil prices faster and more successfully than most folks believe. This train of thought leads me to the conclusion that while there may well be a very deep recession associated with peak oil it may not be as so deep and disruptive as to totally destroy the business as usual economy.

The consequences of peak oil are going to be determined to a very large extent by the shape of the production curve and the slope of the downside.If the peak turns out to be relatively flat and prolonged, a plateau rather than a spike, and production falls off slowly, there will be time to adapt to a substantial extent and we might be so lucky as to continue to live ” life (more or less) as we know it” after peak oil.

Predicting as Yogi said is tough especially when it comes to the future.

This link is about the change in attitudes about cars and car ownership among millennials.

It is well worth the time needed to read it.

http://www.theatlantic.com/magazine/archive/2012/09/the-cheapest-generation/309060/?single_page=true

Just because you have access to a shared ownership car does not mean you are going to drive it nearly as far or as often as you would a car of your own.If the cost of ownership of cars continues to go up and wages and salaries continue to stagnate then driving per capita will peak within the fairly near future. Total miles driven may peak as well.For what it is worth I expect both of these trends to continue uninterrupted.

Shared ownership of automobiles may turn out to be one of the big mostly unanticipated changes in future lifestyles.

If a younger homeowner decides to put just most of what he can save by avoiding the cost of owning a new car into upgrading his house in a decade or so he may well be the proud owner of a net zero energy house.

Fifty grand will be enough to do the job in a lot of cases as the cost of renewables comes down and fifty grand is less than the price of one nice car and taxes and insurance and maintenance on it for a decade.

As far as the rise of auto ownership in places such as India and China continuing to grow at the curent blistering place is concerned- I do not believe this is going to last. Peak oil will put a stop to it unless these markets are dominated by battery powered cars.

Peak oil will also pretty much put an end to happy motoring even in the US..but we just might squeak thru peak oil without the country going entirely to hell in a hand basket.

Volts and Leafs and fore and aft two seater super compact cars will be the norm eventually assuming peak oil arrives at a leisurely pace.If the peak is sharp and there is a shark fin decline in available oil …… Well in that case I recommend investing in survival gear and bomb shelters.

I have a spot picked out to dig mine and the machinery and building materials on hand needed to construct it.If I ever hear anything out of Washington about embargoing oil shipments headed to Asia from Canada or Venezuela I am going to drop every thing else and fire up the backhoe and start digging that shelter.

There is probably a ten percent per decade chance of a really bad disease such as ebola breaking out into the general population and quarantine measures failing to control it before it kills millions of people.

The odds of a very hot oil war may not be any less and may be greater.

When do you suppose we will start seeing the oil industry itself facing the reality of peak oil? I suppose we have seen it a bit in that the major oil companies don’t seem to be sinking money into new projects.

Companies working the Bakken and Eagle Ford must be aware of a projected peak in a couple of years even if they don’t want to tell investors that.

As some companies are backing out of tar sand projects, that would suggest that maybe the Keystone pipeline might lose financial support.

Are the companies still involved with high cost projects going to keep going if the price of oil is high enough? Or are more companies going to rethink projects? Of course, that implies companies think in terms of mid and long term, and we have seen that many companies only think in the short term even if that turns out to lead to a dead end that they could predict if they thought beyond the next quarter.

When? How about March 20th, 2014, “age of austerity” seems pretty telling.

http://www.rigzone.com/news/article.asp?a_id=132190

On long-term thinking, some DOT do finally seem to be coming around, and now project less endless exponential growth and more flatlined demand (p. 27):

http://www.ofm.wa.gov/budget/info/Sept14transpovol4.pdf

which is probably bad news for debt service and road maintenance, and it’s not like they’ve really been maintaining the roads over the last, oh, two decades or so in Seattle, some arterial funds from bridging the gap taxes aside. Can’t wait to see the sticker shock when maintenance comes due on I-5 through the Seattle core… will the car drivers bluff, fold, or pay their money down?

I haven’t been able to post any comments for several days. I keep posting and nothing shows up. (Since I’m not particularly controversial, I am assuming I haven’t been banned here.) So I’m trying a different name and a different email address.

___________________

A few years ago I read that some counties were converting some roads back to gravel to avoid maintenance. I thought that was actually a good thing because it encourages people to stop planning for an ever expanding system of roads, cars, and trucks.

The lack of funding for roads has less to do with Peak Oil or the Great Recession, and more to do with Republicans attempting to defund government – in this case, local government. Governments have a perfectly good tax based, but they’re being prevented from levying the taxes needed.

In this case, oil companies don’t want gas taxes, even though the gas tax hasn’t been raised in many years. After inflation, gas taxes have declined quite a bit.

It’s not surprising that roads are in bad shape.

The lack of funding for roads has less to do with Peak Oil or the Great Recession, and more to do with Republicans attempting to defund government – in this case, local government.

Yes, I know. But by not providing money to fix roads and bridges, the anti-government folks push us closer to making driving an unpleasant experience. Also, in some areas, privatization of roads is happening again. You pay a toll to a private company in order to use “its” road.

As government money disappears, and as income inequality increases, overall consumption goes down. It’s essentially preparing the country for the peak oil days to come.

The idea that government will be called in to subsidize oil to keep the drilling going to avoid global collapse has its limits if the number of consumers who can afford oil, afford a car, and afford to go anyplace keeps going down.

If your policies destroy everyone below the very wealthy, there’s less and less reason to have a society built on oil.

That’s the upside of extreme income inequality. If all the wealth is in just a few hands, global consumption goes down.

As we can already see, passing laws that enrich corporations doesn’t necessarily lead to more jobs. It just makes corporations richer.

I suppose you could look at it that way. OTOH, it’s a terrible way to prepare, given the heavy costs of vehicle damage, congestion, etc. It would be far, far better to tax oil heavily, and push EVs, hybrids, etc.

It would be far, far better to tax oil heavily, and push EVs, hybrids, etc.

What would be better and what will actually happen politically aren’t likely to be the same things.

At some point, I expect that the wealthy will see more money in green technology than in oil, but that critical mass in politics hasn’t hit yet. Can we hope that the Kochs become green tech champions?

There already is a great deal of money to be made in green tech. Tesla for instance.

The terrible thing is that the Kochs don’t care. They’re committed to making money from extractive industries, like oil and lumber. They appear ready to fight to the death to protect their industry. At the expense of democracy, the climate, and our national security.

The introduction of electric, hybrid electric, and other high mileage vehicles (Fiat 500 etc.), is no doubt taking it’s toll on gas tax revenues.

In the future, some revenue method other than the gas tax will have to be implemented, in order to maintain the nation’s highways.

Yes, but not anytime soon. The level of gas tax needed to properly account for the various external costs of oil is significantly higher than the level needed to fund road repair.

Actually, the revenues have been falling since 2004. Some States are taking action already.

http://www.bloomberg.com/news/2013-06-04/losing-revenue-from-hybrids-prompts-states-to-hit-owners.html

The gas tax hasn’t been raised in many years. If we just indexed for inflation, that would make up for all the losses.

Gas taxes are far too low. This is an incredibly easy problem to fix.

Unless you’re an oil company, of course, in which case you desperately object to raising gas taxes.

Mr. Burnsian Republican plots, and the gas tax is easy to fix? Mm, well, I’ve heard a lot of talk about raising that tax, but that purportedly easy action has been AWOL for decades now. Perhaps quite a few Americans are critically dependent on cars, and measures to mend that problem would run afoul deep cultural and built environment gotchas?

Meanwhile, on your purported Republican tax plot front, it was the Democratic-controlled Washington House that passed in 2013 a $10 billion transportation package titled rather heavily towards new roads. Thankfully, that went about as far as Big Bertha has.

Meanwhile, the roads still do crumble, the crush-load 7x series buses are a sad sight to behold, and I routinely bicycle past car drivers stuck in traffic. If they all switched to EV, as you claim is somehow possible, they would still be stuck in traffic, and the buses would still be crush-loaded, and there would still be a need to maintain the roads, somehow, in the face of higher energy prices.

Research shows that taxpayers support taxes that they believe are funding useful expenditures. If they’re told by the Kochs and their “think tanks” that tax increases will only increase waste, then they won’t.

If Democrats are supporting road work, isn’t that consistent with the argument that Republicans are blocking things?

And, yes, if higher energy costs are accompanied by lower gas taxes (reduced by inflation over many years) to fund road work, then yes, roads will crumble. But that doesn’t seem to *caused* by the higher energy costs…

Finally, I should say that I like bikes and mass transit. I use electric trains every day. I think bikes and rail are great. My point: PO isn’t going to force people to use bikes and trains – EVs (and hybrids, EREVs, etc) will work just fine for anyone who wants them.

Republicans attempting to defund government

True, but it also has to do with the fact that the US infrastructure is overextended. A lot of suburban and rural infrastructure was originally funded with a one off injection of Federal money. There is no money for the upkeep of the sprawl it created, and the sprfawl undermined local government tax base. Retrenchment is inevitable.

Have you seen anything that quantifies this?

I’ve heard this before, and I’d be very curious to see real information. As best I can tell, suburban overall cost of living is lower than urban: I suspect suburbanites and exurbanites can afford a small increase in local taxes to fund infrastructure.

And, of course, the country’s GDP is about 4x higher than it was when suburban sprawl started in the 50’s, when this stuff was expanded. If we could build it then, I can’t imagine we can’t afford to maintain it now.

FYI – VMT (actual and per capita) have already peaked; vehicle ownership trends are the same, but the link below doesn’t show that graph. I don’t expect any of these to reach their previous highs, although we may level off for the next few years with the increased domestic production, a stronger dollar, and weaker international demand.

http://www.ssti.us/2013/02/per-capita-vmt-ticks-down-for-eighth-straight-year/

Whichever forecast one uses to estimate when accepted and observable overall decline sets in, the key point to make is: 5 YEARS!! Maybe 2018, and maybe 2020. Regardless, it might as well be tomorrow for all the difference it makes. It is a blink of an eye.

I suppose if the economy tanks there will be so much ‘noise’ it won’t matter for awhile.

I would really be interested to hear what preps folks are making, (or not). It would be interesting to understand other outlooks re preps with regard to age, occupation, location, family, etc.

This post is pretty huge as far as I’m concerned.

Paulo

I graduated from the University of MN in 2010, and took my Biology degree down to FL. Using money I made trading stocks using the lens of peak oil I purchased a house and am now in my 4th year of turning my yard into a food forest. I live in St. Petersburg, FL, 7 minutes from the heart of downtown.

You can make a killing trading with the lens of peak oil. Not blindly so, but with it used as a major factor. For instance, markets will likely be taken by surprise that data is more optimistic than expected the next few months. Many markets have already rallied, but there is more rally to go before year end. 2015, however, will have a rough first half. Elections in Greece in March, a potentially rancorous Republican Congress, and rising oil prices (due to Russia, higher demand, low point of LTO seasonality, etc) will create strong negative pressure on stocks, and volatility will spike.

Call me out on it in the future. As much as I hate predictions because they are by nature limited in scope and in assessing possibilities I will still predict a bullish 4Q 2014 (although, still range bound), and a 1Q and 2Q 2015 that really freak people out. There are a number of ETFs that can profit off this. Namely, triple inverse European markets, and triple value volatility ETFs. Later on this will set up for some significant rallies because the fundamental problem – growing energy supplies for global growth – will not yet have unfolded.

Minus reasonably predictable political crises there will be upward market movements until we hit that elusive 2016-2018 peak. Early 2015 will present some political crises internationally that can be positioned for. They will inevitably reside, followed by a strong rally. Constant updates on trends in LTO and global production allow me to adjust my long term trading strategy. Portfolio management based on thermodynamics as the tide, and human psychology as the waves allows for predicting both underlying trends and superficial trends.

I don’t want to ramble on too much, but using peak oil to invest pretty much saved my life and my future, so it has become a strong component of my prep suggestions. If it is real, and it is based on physical laws, then it by definition will effect human markets. Most political, financial, and Central Bank moves end up being predictable as a natural human reaction to the effects peak oil manifests.

The only reason it is so easy to make money is because no one in the markets sees this. The general populations complete ignorance about the subject, including the investing classes, allows for the information and signals to be misinterpreted (usually as human errors instead of thermodynamic trends i.e. housing crisis, global recession = poor regulation/ greedy bankers, not limited energy supplies). Markets perfectly price assets according to how they interpret the information given. Wild market moves are times not where new information is necessarily presented, but when the same information is often being re-interpreted. With peak oil we are lucky – time and time again it accurately predicts and explains economic information, but no one sees that so it’s not “already priced in”.

Brian,

You obviously have a unique knowledge base and skill set that has served you well. I am impressed having always distrusted the Market and the folks floating the offerings. It is simply a different world from the one I have known. Good on you.

So, I assume you have some bucks in the bank as well as a yard in process of becoming a ‘food forest’. In your opinion, as PO begins to bite and considering your proximity to population…..what’s next? Would you stay in Fla? Would you move? Do you like it there? Is there a reason why you live in Fla as opposed to other places? I am curious, that’s all.

Ron, delete if this is too off topic.

Ron, thanks for this site. I know I have said it before but your data and articles are far and away the Peak as per PO. It has really filled the hole left after TOD folded. In fact, except for the fact that postings only arrive every few days, the info and comments are a real treat to read.

regards…paulo

My view is that peak oil will force people into, not out of, urban areas. Job availability will decline outside metropolitan areas, and grow inside of them. On a relative basis this will make property close to metros more valuable while also ensuring a strong market for permaculture produce.

There is tremendous potential for permacultural techniques to command higher prices even than organic produce. Permaculture takes organic to the next level – you literally build an ecosystem where animal and plant diversity increases. Living minutes from the heart of St. Petersburg I’ve had hawks, otters, turtles, crayfish, owls, snakes, bees, and various butterflies move into my yard. A bee hive set up shop late into my 2nd year – year round they have plentiful pollen to harvest due to my diversity of fruit trees and ornamental flowers.

From putting in gutters, removing a 40 ft silk oak, buying and installing rainwater catchment tanks and dripline, purchasing plants, tools, etc it cost ~$4,500. I purchased young fruit trees though.

In my standard urban lot I have Jujube, 3 Mango cultivars (early, mid, late season), 2 low chill hour apple varieties (early and mid season), 2 low chill hour peaches (early and mid season), type A Avocado, type B avocado, Blueberry, Pineapple, Raspberry, Blackberry, White Sapote, Pomegranate, Mulberry, Jaboticaba, Cherry of the Rio Grande, Grumichama, 2 Fig varieties, 3 Persimmon varieties, Guava, 6 Macademia trees, Lychee, Grapefruit, Tangelo, Blood Orange, Mandarin Orange, Strawberry Guava, Miracle Fruit, Ice Cream Java Banana, Pitomba, Blue Grape, Strawberries, Natal Plum, Longan, Muscadine Grape, Sugar Apple, and Passion Fruit. Then, there’s the standard annual veggies any old organic garden has.

This is only possible because Florida has such solar intensity. Where I located myself you NEED a canopy layer, sub-canopy, bush, vining, and ground cover layer to not fry your plants. This means you can overlap many plants. Especially if you intentionally plant fruit trees near each other that fruit at opposite times of year – that way they don’t steal each others nutrient requirements. Also, plant shallow rooted fruit trees like Avocado next to deep taproot trees like Mangoes. By planting diverse species knowledgeably you do not sacrifice yield by planting close. Have 5 gas stations next to each other and they all suffer; have a gas station next to a barber shop, grocery store, e-cig shop, and a hotel and the effect is synergistic – each benefits by having the other near by. This is the fundamental principle of Permaculture.

If things get to the point of complete collapse, like we almost had in 2008, then I think police and military enforcement will keep highly populated areas relatively safe in the U.S. By 2016 I will have solar panels, an EV, house fully paid off, and zero grocery bill if I must, so my monthly expenses will be small enough that any storm can be financially born indefinitely.

I do have $3,500 of freeze dried food and the ability to filter/boil my lake water if the worst of worst scenarios unfolds. Even though I have spend capital preparing for that scenario I do not find it likely.

If peak happened in 2008 we’d have been screwed. Total collapse of financial, monetary, and societal cohesion; the full doomer outcome. I had held that perspective from 2006-2011. My 2009 thesis for Advanced Writing for the Sciences hypothesized that oil sands and other unconventional production would not live up to expectations on the idea that the expensive market prices needed to maintain unconventional production created recessions. The conclusion was that high prices would create recession, causing severe price swings and preventing investment in unconventional production due to extreme oil price volatility.

I was wrong. I was dead wrong, and between mid-2010 and late-2011 it cost me. I lost… a lot because no matter how much I looked at it I couldn’t fathom the world economy living with $100 barrel oil. I thought $100 meant another crisis. My view was validated by the EU Financial Crisis, or so I thought. I bet my all that the Eurozone Crisis was the next leg down, just as bad as 2008. How could it not? Oil was so damn pricey!

I learn every day, and I learned a costly lesson in 2011 – no matter how confident you are ALWAYS have a hedge. Once the Euro crisis was “resolved” by the bazooka the ECB pledged markets rallied, which I thought temporary.

It took until mid-2012 for me to accept reality and see my folly. High oil prices were inhibiting growth, but were clearly being tolerated, resulting in strong Central Bank action that guaranteed stock returns (returns even in excess of “normal” times due to how it influences asset allocation), AND liquid fuel production was increasing.

My premise that high oil prices = recession = price volatility = no unconventional production was flat wrong. Turned out that most of the inefficient oil use was destroyed in the 2003-2008 runup; as a consequence, the price point society could handle was higher than it had been. Where $100 oil had before created recession, it now created marginal, low growth (efficiency gains mostly).

Anyway, going on too long again…

I think things got distorted by all the financial tomfoolery. The picture isn’t at all clear whether the bazookas worked, at least in the long run. The withdrawal of U.S QE over the past year has coincided with a significant downturn in the world economy – China, Europe and Japan are still pumping money in to the system.

It’s hard to say whether their actions have put the economy back on to the straight and narrow and growth (low as it may be) will continue or whether it was simply a reprieve and we’ve got more fun left to play out.

I’m not taking any financial gambles like you but a lot of my life choices have been made based on my negative outlook of future conditions. I’m trying to balance things, continue engaging in society whilst trying to reduce my dependency on it so that disengaging won’t be too painful.

I should specify, my views compared to the average person are extremely pessimistic. My perspective is always changing as I learn (I accept that I am often wrong, and this will continue until the day I die).

I only see upward market movement, barring various temporary political crises, until the date of peak liquid fuel production. I see this site as the best place that exists for discussing and hardening that very important date, which seems to generally fall between 2015-2018 given current trends. In my mind this will precipitate another 2008 type crisis, likely centered this time on Europe, Japan, or China. My bet being on Europe.

If a permanent, sustained decline follows, without an equivalent ability to produce EV and renewable energy capacity, then we will face a complete system breakdown.

I’m more optimistic than I was 5 years ago, but I put this chance at 50/50 currently. In other words, I have no clue whatsoever, but I do see the previously unfathomable progress in solar, wind, and EV continuing until parity. If peak oil happens 7-10 years before cost parity then I’d bet on complete financial breakdown. If cost parity happens about the same time as peak I’d bet on a near repeat of the 2008-2014 cycle. Again, political realities could have made 2008 the real collapse, and next time around it is entirely possible that collapse will happen not because it has to, but because something like TARP isn’t passed, leading to complete collapse.

Wind and EV are already at parity in the US, and PV is there in a few places.

I always find it strange that the attitude is always so Western / Developed world centric. I think that green technologies have the possibility to be a saving grace for the developed world but what about the developing?

Peak oil and other crises will have a disproportionately high effect on the developing world, we’re already seeing failed states popping up left right and center and they’re a little close for comfort. These failed states will have 2 main effects, firstly you’ll have increased emigration from them (with the final destination being the developed world if possible) which will put both economic and social pressure on those societies. Secondly these failed states will begin exporting their failed nature to their neighbours, it will be hard to contain the chaos emanating from them. The most prominent example right now is the Middle East and North Africa. It isn’t off the cards that countries such as Pakistan, Iran and Turkey will start to see fallout from the conflicts in the region. I think there is a slight chance that the fallout could reach as far as places like the Balkans within the next 10-20 years. On the other side of the world I believe there is a good chance that Latin America could become a bit of a basketcase. Mexico is struggling to contain it’s problems, again within 10-20 years they will be having a harder job and areas of the country could be lost to government control.

As the developing world suffers so will the developed as many of the raw materials used are sourced from them. It’s certainly not an end game scenario but the developed world will suffer – as OFM has mentioned before the logical outcome of these events will be governments taking a more authoritarian role and countries going in to lockdown to hold back the problems, this will also stifle economies but will be a small price to pay for stability.

As you can see I also have a penchant for negative predictions. I don’t think such events are avoidable, there are too many external stresses beyond our control that are pushing people to take extreme stances. I think the most notable symptom of these pressures is manifesting in politics i.e. Europes growth of the far right and the political divisions / intransigence in the U.S.

El Ukuku,

I completely agree with your sharp assessment in every way.

The next oil price spike or a bad year for global food production will almost assuredly precipitate multiple crises in developing countries that will have ramifications felt in the developed world.

Although such events can happen at any time their statistical likelihood increases rapidly as global food or energy prices increase.

My view is that peak oil will force people into, not out of, urban areas.

I agree entirely.

But why would that happen? PO isn’t going to raise the cost of commuting for anyone who has the sense to buy a more efficient vehicle. A Nissan Leaf is already cheaper than any other car on the road to own and operate, and it’s cost won’t go up if gas prices rise.

Hi Nick,

It depends on how urban is defined. Many people live beyond the commuting distance for a Leaf and do not have good access to public transportation. So if one defines “Urban” as a metropolitan area with a radius of about 45 miles. The Round trip commute for someone with a leaf would be a problem outside 45 miles.

At present most people do not have access to a place to recharge their vehicle at work. This might change in the future.

Excellent! I also follow your ideas. But I do it with literary criticism instead of stocks. It has also saved me in many ways.

Brian, would you care to share some actual trades you have made money on, or are currently investing in, that would show this play between short term vs medium term trends?

Since the 400 point intrady drop in the Dow I invested in UDOW and UMDD; that is short-term (offload 1/3 in November, 1/3 in December, 1/3 during earnings season in January).

Medium term – UWTI is something I will continue to strengthen my position in. Multiple factors, from seasonality to global demand, are causing prices to be much lower than they will be. I will begin offloading this position from February through April.

I never unload everything, or buy everything, at once. Emotion and conviction must be put aside. Don’t go all in on a single idea, but if a bet goes bad don’t unload out of fear – if your analysis was correct, and data still empirically supports that then ADD to your position. Otherwise, just hold on. Selling after significant loses, or buying after missing significant gains is… well… there’s Warren Buffet quotes for this type of thing, but I’ll refer to the statistical concept of Reversion to the Mean (but in economics the mean itself is always changing, so it’s complicated!).

The Greek elections could be a real doozy, so I cannot possibly think of what lies beyond March. Either an incredible rally, or a period of sustained volatility and turbulence; if Syriza wins big and keeps up its rhetoric, then we would very rapidly be in a bear market.

I can verify this; as you can see UWTI is a losing position right now. I plan on purchasing more this week as opposed to offloading this losing bet:

In my view UTWI could go down further one leg. This is due to the disintegration of the oil market. Due to the high oil price over the last five years, oil is priced out from the space heating and electricity generating market. The residual fuel market stands at 10 mill bbd and the home heating oil market around 5 mill bbd and is currently replaced by coal, natural gas and biomass with an economic advantage of 50%. This will go on for a few years and will free up some 15 mill bbd additional supply. I follow the shrinkage of the oil market through FRO which is one of the leading oil carriers. Until 2008 this stock has been a high performer outpacing the oil price manyfold. However from 2009 this stock has underperfomed the oil price consistently despite rising oil price. This can only mean that the volume of oil shipped shrank considerably.

Recently FRO fell once again indicating lower volume and presumably lower oil prices the days ahead.

Heinrich Leopold,

Very interesting! I will keep FRO in my radar from now on. Most recent production gains are consumed without shipping. The U.S. obviously being the shining star that is using domestic increases simply to reduce imports. Thus both higher production and higher prices would not benefit FRO. This seems to match what has occurred in its value since the financial crisis.

Using the Export Land Model as an indicator it would seem FRO may continue to suffer as exports continue to decline indefinitely, at least on average over the long term.

UWTI was my example of a medium to long term play I’m dedicated to. I completely agree it has room to fall, in which case I will purchase more. Even if it falls another 15% it won’t effect me as I’m intentionally holding it for an extended period.

I always purchase in increments because trying to time a precise top or bottom is a fools errand. That way my average purchase price is always at a level that reaps high returns. Often times I will only have purchased 50-80% of my intended total. I leave an extra 20-30% in case another drop happens, so I can scoop stocks up cheap, and maximize returns further.

Statistically, that last drop that would allow me to purchase 100% of what I have in cash waiting for that opportunity is several standard deviation removed, and is an outlier on the normal curve. All the cash I have leftover after an upward move begins is simply pooled together for the next thing on my radar. Especially because once a move begins to happen it is time for me to slowly begin edging in to the next position that will take advantage of the market consequences of whatever is moving.

For instance, UMDD has had such strong gains that I will begin offloading far sooner than expected. The consequences of strong gains in Midcap U.S stocks is that they will soon drop. I will begin investing in shorting Midcaps (even though I’m invested in a bullish ETF right now) in Mid-December, and will slowly increase my bear position through February.

Brian,

Agree with your invetment strategy. However my way is to look deeper behind a trend. Markets are seldom logic and do not follow common sense. The majority is always wrong. Take a look at the oil market. Production costs are high and companies outside shale do not invest very much. Production is going down worldwide and I think as well that peak oil is real. Therefore the oil price has only way and that is up – right? However the steep increase of oil over the last years does also provoque a response from market demand – as it always does when the price of a product rises. If the price is up the market shrinks, if the price is down the market grows bigger. Sometimes it takes time as compnies have to close facilities and invest in new capacities. If you look at the numbers of the oil market there has been a stampede out of the residual fuel market in the US, Europe and Japan (-14%,-10%,-21% respectively) last year. Asia (-5%) has been a laggard, yet the trend is here already starting. This year the stampede has turned out to be a tsunami (over -70% in the US). The residual fuel market in the US is now extinct. Europe and Asia are close behind the US. So there are millions of barrels per day coming out of the market searching for a new home. So this should be enough for a short term oil crash. The oil market does not understand peak oil, he understands just how much oil is on the market. UWTI has reached 18,61 and knocked three times on the important resistance of 18. By next week we know which direction the market takes. I think it will be down – and midcap400 higher.

Brian,

1) You wrote: There are a number of ETFs that can profit off this. Namely, triple inverse European markets, and triple value volatility ETFs. Later on this will set up for some significant rallies because the fundamental problem – a growing energy supplies for global growth….

Triple inverse…. for a growing energy supplies for global growth?

What are you thinking?

2) Central Bank moves end up being predictable as a natural human reaction to the effects peak oil

What are you smoking?

3) The only reason it is so easy to make money is because no one in the markets sees this.

Brian, there’s NO market. It’s all a Ponzi scheme.

4) With peak oil we are lucky – it’s not “already priced in”.

How about collapse? Would care to price that for us?

Keyser Soze,

I’m obviously just some guy on the internet. Perhaps I have complicated defense mechanisms and protect my ego by pretending to be some market maker; that is, by far, the most likely scenario.

If we assume the markets are just a giant Ponzi scheme, then we’re simply adopting defeatism, which is itself a defense mechanism for not trying. Ultimately, we then blame the world for our situation instead of focusing on what pragmatic steps we can take to create a more secure future for ourselves.

I’ll play devils advocate here. OK, so you know it’s all a Ponzi scheme. Doesn’t this actually make the market MORE predictable? Some secret cabal has plans and will implement them in this scenario. Do you not have any idea what this plan is? If it’s to always catch people at their weakest wouldn’t even that give you statistically significant clues as to how to take advantage of their rigging?

One can look at the data another way:

In 30 years there will be over 3.0 Mbbl/day of Shale Oil, which is about the same as 2013.

3-4 Mbbl/day for 30+ years.

One can see this as an unexpected bonus on top of the conventional oil.

Luck pure and simple has resulted in my personally being in a place and situation that is probably as good as I could hope for in respect to peak oil.

Hence there is very little I feel a need to do personally (given that I am already old and won’t be around forever) that I would not be doing anyway for other reasons. It is said that if you collect coins a quarter will never be worth less than a quarter no matter what. A few barrels of diesel and a couple of tons of fertilizer and a truck load of lime and so forth are not bad investments at all since the price of these things tends to go up with the price of oil and while oil is down for the moment … it is not going to stay down.

The downside risks of getting a small farm such as mine in shape for peak oil are minor and the upside benefits are going to be huge if I live long enough to see them realized.I expect that if things turn really bad to be able to raise plenty of food for myself and a few close friends and that sort of thing easily enough with some help …. even if I cannot buy fertilizers and insecticides.There is gravity flow potable water, there is timber for building and firewood ,there is a small bandsaw mill to mill it, there are masonry barns with metal roofs that will last a century easily if the roofs are kept painted. There is tightly fenced cropland.. …tight enough to keep deer out for the most part and if one gets in that deer will be an opportunity rather than a problem insofar as food is concerned.

We used to raise a few cows and within a year I expect to be properly set up again to raise a few grass fed cows for beef…. and a milk cow can live right in there with the beef cows if she is needed.

Above all there are neighbors who are going to be willing to work with me because our families have known each other and intermarried for generations and all our old folks are buried side by side in the same cemetery on the hill next to the church where I still go for an occasional service even though I am not a believer.

(Covering your bets is a good policy and keeping up relations with the neighbors is a very prudent thing to do.)

If things get really bad .. and there is of course a very real possibility that they will.. ….we are mostly red neck conservative violence prone southern mountain hillbillies with more than a few firearms in just about every house and at least one or two older people in every family who knows something about hard times and hard work.

It may seem strange to some people but the sort of people around here who pack both Bibles and pistols are quite as ready to give you the shirt off their backs as they are to quote the Old Testament and shoot you…. but they hardly ever do actually shoot any body who is not in real need of it. Home invasions , armed robbery, and forcible rape are virtually unheard of in this community since the people who might be interested in that sort of career know better than to practice it locally.

We won’t starve or die of thirst or exposure because this is small farm country lightly populated with a broad agricultural base. We can and do grow almost everything here (often in small quantities it is true ) you can imagine except tropical crops. There are plenty of streams heading up in this area – no towns above us polluting our water. It never gets so cold for so long that survival is an issue.

We do not have a large population of unassimilated immigrants or enough racial minorities in the immediate area to worry about the sort of problems some larger communities and cities may experience due to cultural diversity.

There are local doctors and dentists and a good hospital within a twenty minute drive.Twenty minutes to a Walmart superstore and a Lowes big box store.

There are good highways and railroads but we are a long way from any really big city and thus hopefully insulated from any mad exodus from a city with failing water and sewer services and that sort of thing.

All in all this sort of place is probably as good as can be found if somebody is seriously thinking about actually moving.

The only real problem is earning as good a living as most people are used to in more prosperous areas. Wages and salaries are modest in the extreme compared to a lot of places .. but then so are taxes and the prices of many goods and services.The taxes on my farm and home combined are much less than the taxes on the little house I used to own in the city of Richmond.And since I have a well and septic system ( plus gravity fed spring water ) there is no water and sewer bill.

What I have done to prepare is dig up all the ancient knowledge of natural local economies which used human labour and local materials, put it on line for all to know. The ultimate step would be to go to the countryside and work and live there. I learned and practice alternative medicine, knitting, hand washing of clothes, walking, haybox cooking, solar water heating etc. as part of the preparation for peak oil. But the real challenge will be when doing agriculture, I cannot prepare for that properly in the city.

Hello Rita,

I went to your site. What language was it written in?

Peter

Looks like Albanian — “shqiptare” is Albanian for Albanian or Albania, I think.

Yep, Google does a fair job of translating. First Albanian web site I’ve visited or even known about.

NAOM

Ron,

The method that you refer to, with injection of CO2 and production of hydrocarbons out of the same wellbore, is called “huff and puff” production (SPE paper on a Bakken study: https://www.onepetro.org/conference-paper/SPE-168979-MS). Some of the more carbonate prone unconventional reservoirs, like those in the Permian Basin, have the possibility of normal CO2 flood since the carbonates have better permeability then the clastics of the other unconventional plays. Though even with huff and puff, you still have the possibility of moving what would otherwise be immobile oil. The goal for either type of CO2 flood is having the reservoir above minimum miscibility pressure, which I assume the Bakken is at its average depth.

Will they get enough extra oil from this huff and puff procedure to cover the cost of doing it? What is your opinion on that?

I would say that depends less on the geology and more on the infrastructure cost associated with a CO2 flood. A place like the Permian Basin has a well developed CO2 pipeline system, that is the largest in the world, and thus has a relatively low cost to develop additional CO2 floods. On the flip side, a place like the Bakken would be more expensive since I don’t know of any CO2 domes that are piped to North Dakota (these are the sources for the CO2 that go to the Permian, like the Bravo Dome). One option is capturing CO2 from power plants and piping it to where it is needed, but that has not happened with any large volume yet.

I don’t think any power plant is set up for carbon capture in the Upper Midwest.

Whole idea smells like a bill of goods that the consultants, oil reps and legislature are getting into a circle jerk over.

Anon – you may be right about both items you mention, but…

The source is/would be a coal gasification plant near Beulah ND, that already sends CO2 to Canada via pipeline, which seems like it’d run thru the Bakken on its way to Weyburn Saskatchewan.

http://www.dakotagas.com/CO2_Capture_and_Storage/

This article notes 2 tests of CO2 in the Bakken, both not economic, but they learned from them…

http://www.bakkentoday.com/event/article/id/34431/

But note this caution:

“Scientists don’t have time on their side.

For CO2 injection to work, the pressure in the oil reservoirs can’t get depleted too much before the gas is injected, Harju said.

“Because of the peculiar and unique nature of these rocks and the gargantuan size of the resource, the timelines are going to be diminished greatly,” Harju said. “Things that took us 20, 30, 40 years to arrive at previously, we need to do in two and three and four years now.

“

I just don’t see pressure drawdown as that big of an issue, for MMP CO2 injection, in unconventional reservoirs. By definition, these reservoirs have poor permeability, and each wellbore is generally considered separate and not connected to the porosity of nearby wellbores (infill drilling might connect some frac’d porosity). The exact opposite is true in conventional fields, where pressure drawdown can impact a large area because of a higher permeability. BHP data might show otherwise, but I would not consider pressure drawdown the limiting factor in unconventional CO2 floods.

From sunnnv’s link:

CO2 injections = More Bakken Oil

Harju said he knows of two field tests of CO2 injection into Bakken rocks – one in Mountrail County and one in Montana. Neither was economically successful, but they will help researchers with their laboratory experiments.

I just don’t see how the “huff and puff” method can be very successful. I can understand how CO2 sweeping through a conventional field could be very successful and economical. But just blowing it in then letting it back out again the same way it went in and hoping to get enough extra oil to make it economical… that just sounds like a lot of wishful thinking.

DOE Funded Centralized generation poster child black hole. Co2 pumped into Nat Gas Fields.

https://en.wikipedia.org/wiki/Kemper_Project

>>>>

http://www.greentechmedia.com/articles/read/We-Must-Forget-Everything-We-Know-About-Rate-Structures

Yep, few large new things get built without subsidies and boondoggles (transcontinental railroad, etc.).

http://www.basinelectric.com/Miscellaneous/pdf/Fact_Sheets/DGCtalkingpoints%2011-2012.pdf

The local electric company bought it off the DOE after the original owners defaulted on a loan guarantee.

I just re-went thru the CLR September investors presentation and searched for the word “enhanced” in the Bakken section, and it occurs several times.

But none of those occurrences refer to any sort of CO2 injection project, pilot or otherwise.

If CLR isn’t doing it, it’s not going to happen anytime soon by anyone.

The rule of thumb is that an unconventional well will produce maybe 8%-10% of the OOIP of the reservoir. In conventional reservoirs CO2 flooding can move as much as 15% of the previously immovable OOIP. If a CO2 flood is only one third as effective in unconventional reservoirs as it is in conventional reservoirs, then an additional 63% can be produced from an unconventional well. That is why EOR is such a big deal in unconventional play. There is just such a large percent of the OOIP that is not moved if only a small additional amount is movable it has a large economic upside.

I don’t have time to research this now, but my take would be that in an unconventional field, where one HAS TO “huff and puff”, that CO2 will only work when one has a single phase (i.e. it’s still all liquid with all the natural gas still dissolved in the oil). And even then, it will be a slow process – each cycle will only get a little bit of oil.

Once the downhole pressure is reduced so the natural gas exists in bubbles, even if one compresses everything back into all liquid with the injection of CO2, when the pressure is released, the CO2 will preferentially go with the natural gas (both light/small molecules), and the oil (the more valuable stuff) will mostly stay in place.

Kinda like the difference from washing your clothes in a tub of water/solvent with a rinse cycle (conventional sweep Enhanced Oil Recovery) vs. (trying to) blot them clean (“huff and puff” in single well micro oil fields).

n.b. CO2 under pressure is a replacement for conventional dry cleaning solvents.

http://en.wikipedia.org/wiki/Supercritical_carbon_dioxide

So I think “huff and puff” in fracked wells technically works (how economically is an open question), but ONLY while the downhole pressure during withdrawal is enough to maintain a single phase. Once the bubbles start coming out, it’s all over for all but the lightest oil components (i.e. natural gas condensate – which will mostly come out with the gas anyway). Note the study abstract ManBearPig linked to says soak times up to a year.

That is in contrast to sweep EOR with CO2, in which even gaseous CO2 (non polar – like dissolves like) will dissolve in the oil and reduce its viscosity and even gas flow will sweep things toward the production wells. And you can (more likely) pump CO2 in at enough pressure to maintain CO2 as a supercritical fluid, where the oil will dissolve in the CO2, and a single phase will flow to the production well, which is choked down to maintain field pressure.

That last thing just CANNOT happen in a single hole fracked micro oil field when downhole pressure drops below critical levels.

Perhaps they’d try to drill between two old holes, and frac into both, and sweep that way. But getting into both of the old holes, in any uniform/high coverage sort of way seems like a very long shot.

And if the time frame closes in only a few years, with low oil prices discouraging investment, then CO2 EOR in the Bakken may never happen.

In every conventional CO2 flood that I know of the reservoir pressure dropped below bubble point prior to injection. I have not seen where this has created a situation where only the light hydrocarbons are mobile during CO2 injection. On a side note, this presentation has an image with CO2 pipelines/fields:

http://www.energyxxi.org/sites/default/files/020174_EI21_EnhancedOilRecovery_final.pdf (page 6)

I was under the impression “huff and puff” referred to steamflooding, too. Cyclic Steam Stimulation, isn’t that the formal name?

Yes, that is correct. Huff and puff is just the term used to describe injection (of some fluid) and producing out of the same wellbore.

I truly wonder if geological or financial constraints will cause the peak in LTO. With WTI hovering near $80.00 pb and some analysts calling for lows in the low to mid seventies…or worse will investors and other types of credit be found to continue to fund a project that was not particularly profitable at $100.00 pb? How long can these companies operate at how much loss? The still willfully ignorant public is rejoicing at the lowered prices and though math trumps magic every tine, the public prefers it’s comforting delusions no natter how short lived to economic and finite resource realities in the not too distant future. Sane as it ever was.

Only the best individual shale wells can make money at $80 WTI, ideally if their operator has low overhead. Any “bust” well that starts <200b/day will cause loss of shirt if not head.

A whole bunch of new, marginal projects will be killed at current prices.

You may well be right. I’m going to take the liberty of repeating Dennis Coyne’s comment from yesterday here. According to Dennis:

“The average Bakken well produces about 87,500 barrels in its 1st year or about 240 b/d average output for year 1. The first month’s output is about 477 b/d. Don’t forget OPEX of 4$/b in your calculations and I use 24.5% for royalties and taxes so I get 3.6 million of net revenue for the first year.

It is better to discount by 7% to find the net present value of future output. Most of these wells have never paid off the drilling costs with one year of output even at $100/b the net revenue is only $5.7 million for the first year of an average well. Breakeven comes a few years later.”

I expect I haven’t broken any “rules” or offended Dennis in any way by doing this. To me, his is a succinct, clear and valuable analysis of Bakken well economics: Not that I know screw all about economics or Bakken wells of course!

As we discussed, 240 is probably lethal at $60. This means . . . assuming average and median are close, that fully 1/2 of wells are throat cutters for the industry, given that 1/2 will be below 240.

Whoever spiked the dollar will be facing some counter manipulation soon. Or bombing strikes in Libya.

Watcher,

Note that $60/b at the wellhead is equivalent to about $75 at the refinery gate if we assume transport costs of $15/b. For east coast refineries they pay Brent prices if they don’t get the oil from North Dakota so I usually use Brent as my benchmark. Under these assumptions (I am unsure about actual rail costs I have found estimates of $10 to $15/b so I am using $15/b), breakeven is currently about $75/b at the refinery gate for the average Bakken well.

Your $60/b guess looks spot on. The EIA has Brent spot prices at $84/b as of Oct 20 and currently the Dec futures contract is at $86/b.

For now the average Bakken well makes money and remember that when an oil company drills a well the expectation is that it is always better than average (its only the guys at the other company that drill a below average well 🙂 . The reality is that some of these wells will lose money and others will make money, but the average well(until the new well EUR starts to decrease) will be profitable at a Brent price as low as $75/b.

In the Oct 15 NDIC Directors cut Bakken oil prices were $66/b which would be equivalent to Brent at $81/b, however according to the EIA Brent prices were $84/b on that date (10/15/2014). I don’t know if maybe transport costs are $18/b and I am not sure what has happened to Bakken prices since mid October.

The discount is not all transport costs. The oil has high metal content variance and is light on diesel. It’s barely oil. The metal variance causes refineries to have to change procedures from rail car to rail car. Mountrail has API average of 43. Don’t lean on transportation for the discount and thus Brent and east coast refineries are not a legit metric. A definitive measure would be Midwest refineries and what they pay for the rail cars. Besides which, do you know any other rail shipped product that pays 25% of retail for transport? Cars don’t.

Oct 13, 14 and 15 saw a $2+ drop of WTI . . . between 14th and 15th. $81.xx on the 15th, but the Director’s Cut likely didn’t wait til the close of trading on the 15th to release the document, so one presumes the text was prepared the day or two before at $84ish.

Hi Watcher,

In an ideal world we could account for minute to minute variations in every variable. We could just as easily call it $15/b for rail transport (which would be 18% of the refinery gate price, call it the retail price) and $3/b discount for inferior quality crude (I will just assume you are correct though in the past you indicated Bakken oil was similar to WTI). It affects the bottom line the same way either way. Note that an East coast refinery tends to get Brent Crude from New York Harbor, the Crude pipelines mainly go to Texas and Louisiana from Cushing and not to the East Coast refineries, so Brent prices are what is paid if North Dakota oil is not used and it is the proper metric.

I was unaware of the discounting of Bakken crude do you have any links to confirm this? Thanks for the info.

Here:

http://www.hydrocarbonprocessing.com/Article/3250397/Processing-shale-oils-in-FCC-Challenges-and-opportunities.html

That’s fairly hard work. You won’t absorb all of it, but will in a general way make clear what is going on.

WTI has recently had its definition changed. I posted a Bloomberg link when I saw the announcement. Don’t think I bookmarked it. If search works, it’s out there.

The issue overall is a comprehensive description of oil and the degree to which it is NOT described by “API 39”. This was usually not an issue with conventional oil because variance wasn’t huge. But early Eagleford days threw a hand grenade into the matter because of their condensate definition.

Bakken gets quoted as “API 39”, same as WTI. Well, there are probably a few wells flowing API 39, but Mountrail county in particular averages 42ish.

NoDak would LOVE to have samples taken that show 39. And samples NOT taken that would show 47. A recent controversy over the explosion of railcars had an initial assay quote a substantially large number for volatility (gas content of the liquid) and then a recent sample they were sent as Congress was looking into regulations showed a huge difference from their first assay publications.

These numbers are entirely unreliable.

Just realized I said Brent prices above where I meant to say I don’t know what has happened to Bakken oil prices since mid November.

Dennis, fixed it but I think you had October right, not November. I thought you had editing privelages?

Yes Ron I do thanks. It was Oct my reading is terrible.

Hi Doug,

I take it as a complement that you quoted me and didn’t follow up with “that is hogwash” (which is usually not too far off). In this case it is mostly based on NDIC data with very little modelling ridiculously far into the future so it is a little more tolerable than my speculative scenarios of output to 2030.

In short no offense and feel free to quote me and please continue to call me on stuff that you disagree with.

Hi Doug,

In a comment in another thread (which I just read), you asked about net present value(NPV) of future output.

Despite Watcher’s comments to the contrary, this is how a business evaluates an investment, and he is correct that it is never exactly correct because future income is unknown.

If I am deciding whether to invest $9 million in a new well I consider how much money I will make on the investment. In order to do that I have to make a guess about how much money I will get from the oil produced by the well in the future and deduct from this gross revenue any expenses such as operating costs, interest costs, royalties and taxes.

The net in NPV refers to the deduction of expenses, thus net revenue is gross revenue minus expenses. The present value accounts for the fact that there might be alternative ways I could invest the money which I could earn a return on.

In my calculations I do things in real dollars so inflation can be ignored and I use a real discount rate of 7%. This discount rate is assumed to be the real rate of return (which is also figured in inflation adjusted dollars) which I could earn by investing in something different from a new well (maybe large cap stocks).

Clear as mud. Most of this you probably know, I am trying to do the explanation so any high school student could understand it.

As a numerical example for an average Bakken new well with the refinery gate piece at $80/b, transport costs at $15/b, OPEX at $4/b, royalties and taxes at 24%, and financial costs at $4/b and 23 year EUR at 320 kb each barrel, each barrel nets us $41.4/b after expenses in real dollars so over 23 years the net revenue is 320,000 b times $41.4 or $13.25 million dollars. The problem with the previous calculation is that we need to account for the future dollars being worth less than current dollars (because I could have put the money in a mutual fund and earned a 7% real rate of return.)

When the calculation is done by discounting at a 7% annual rate on a monthly basis out to when the well is shut in at 23.5 years the NPV of future output is $10.39 million. If the initial cost of the well will be $9 million and the expenses and output over the next 23.5 years match what has been assumed in the calculation then my profit over 23.5 years in present dollars will be $1.39 million on my $9 million investment (on top of the 7% return assumed in the NPV calculation.)

This would be about a 15% real rate of return, when the 7% is added in the total return is 22%.

Hi Doug,

Some corrections

“As a numerical example for an average Bakken new well with the refinery gate piece at $80/b” piece should be price.

“23 year EUR at 320 kb each barrel, each barrel” should be “24 year EUR at 320 kb, each barrel”

I say “23 years” several times, in every case it should have been “24 years”, the average well is shut in after 23.5 years when output falls to 7 b/d.

“assumed in the calculation” should have been “assumed in the NPV calculation”

Sorry I should read more carefully before posting my comments.

Thanks Dennis but I think I’ll just stick to quantum field theory and superfluid decoupling in pulsars: and avoiding making ill informed comments about anything to do with economics. However, I really do enjoy your and Watcher’s discussions of oil economics mostly because they highlight the complexities involved. Besides, as I said to Watcher, my (scientific) calculator lacks an NPV button. [smiling yellow face].

Hi Doug,

Just wanted to get that out there, it can be done very simply using a spreadsheet, but is not all that interesting. It is much less math heavy than quantum field theory, though to be honest I really have never gone beyond introductory Quantum mechanics (and have forgotten most of that).

When I do the Bakken or Eagle Ford scenarios I initially ignore NPV and just assume some number of wells will be drilled given the area of the play and the likely well density and estimates of technically recoverable resources (which drives you nuts, but this is just the starting point). I also make assumptions about when new well EUR will start to decrease (because the sweet spots are fully drilled) and how quickly this EUR decrease will proceed (we can only guess at both of these, I always say what I am doing, everyone says its no good, but I can easily run any scenario that someone suggests that is more realistic, nobody has ever made specific suggestions).

Then based on the TRR scenario (without considering NPV) I begin to look at NPV in order to develop the Economically recoverable resources (ERR) scenario. Using very similar assumptions to my comment above, I require that the NPV is greater than the well cost. In order to accomplish this fewer new wells are drilled which decreases the rate that new well EUR decreases.

For example if a drilling rate of 150 new wells per month caused new well EUR to decrease by 1% per month, a decrease in the drilling rate to 135 new wells per month (10% fewer new wells) would cause the decrease in new well EUR to also be 10% less, so the rate of decrease would fall to 0.9%.

Over time the oil price increases in these scenarios usually similar to one of the EIA oil price scenarios (I usually use the reference scenario), in most scenarios I assume well costs remain fixed at $9 million (2013$) and hold all economic assumptions fixed over the scenario (except oil prices which rise to about $140/b by 2040).

Note that in Hughes analysis he assumes that the number of new wells added (he calls it the drilling rate) gradually declines in his most likely scenarios, these look somewhat similar to the scenarios I have done with explicit economic assumptions, but usually the drilling rate decreases more rapidly in my scenarios than in the Hughes analysis.

Dennis knows what he is doing and I agree with him that it is not that complicated and something that can be done on a spreadsheet.

Yet, I still lament the fact that there is not a “convolution” function in Excel. It would make these computations very slick.

The oil industry probably paid off Microsoft not to include a convolution fxn 🙂

Hi paul,

Thanks for the vote of confidence.

It is your analysis and that of Rune Likvern that I have built on.

Dennis, if you’re interested, Excel does have a Fourier analysis tool as a part of the “Analysis ToolPak” that could, I suppose, be used by you to analyze periodic data via the Fast Fourier Transform. The tool also supports inverse transformations. Access by clicking “Tools, Data Analysis, Fourier Analysis” on toolbar. Note Excel’s Fourier transform assumes periodic data starts at x = 0 and data corresponding to negative x-values are in the second half of range. This confused me at the first get-go.

Since convolution involves integration, however, I highly recommend that any Fourier analysis would best be done by a program other than Excel. My wife and I regularly use Mathematica and/or MatLab for that sort of thing but I confess these are pretty expensive for personal use. If you work in (for) the petroleum industry naturally there is always cool proprietary stuff available to play with: The heart and soul of the exploration geophysicist. I have no doubt you already know all this.

I can’t pursue this now because my wife and I are off to Norway shortly. In fact, if I linger for one additional second at this computer my decapitation if guaranteed.

Hi Doug,

I must admit that I have never really used fourier transforms. Convolution can be done brute force by simple summation rather than integration (numerical integration of sorts).

As we do not have the functional form of either the well profile or the rate of well additions, the integration is hard to do.

Convolution can be done by simply setting up the spreadsheet properly, but it would probably be better to write a macro routine to do it.

Paul Pukite (aka Webhubbletelescope) is correct that a convolution function should be built into Excel.

I tried searching for macros on the web, but no luck. I can write code in fortran, C and basic, but I have never learned visual basic.

Factoid. About 52 gallons of oil are required to make a truck tire. Of so says a source. Yeah, yeah, not interested in orange oil blather. Interested in the numbers reality.

Another factoid, 300 million passenger car tires are tossed each year and each tire holds 10 gallons of oil (they ARE a lot lighter than truck tires). Sooooo, looks like 3 billion gallons of oil used up in tread loss and that’s 71ish million barrels/year or 194K bpd, which is definitely hilarious.

We should check bike tire burn in China.

Replacing the oil in tires with biomass wouldn’t be hard. Here’s detailed info:

“About 250 million tires are sold yearly in the United States. Each one is roughly one-fourth synthetic rubber (the rest consists of natural rubber, steel, nylon, polyester, assorted reinforcing chemicals, waxes, pigments and oils). Synthetic rubber production dates back to the early 1900s and mushroomed into an industry during World War II. Today it takes about seven gallons of oil to make a standard tire—five gallons as feedstock for chemicals that make up synthetic rubber, plus two for the energy required to power the manufacturing process.

Many types of plants, including poplars, oak trees and kudzu, produce isoprene, a volatile hydrocarbon liquid that’s a building block of natural rubber. (Isoprene emissions from trees on hot days are a component of smog.) Chemical companies also refine isoprene from petroleum and use it to make synthetic polyisoprene rubber, which has good strength, flexibility and resistance to cold. Synthetic polyisoprene is widely used in tires, as well as other goods like hoses, rubber bands and pipe gaskets.

Working with Goodyear Tire & Rubber, Genencor has developed a way to make isoprene by starting with plant material instead of oil. The company uses E. coli bacteria to break down cellulose-based sugars derived from plant materials like corn, corn cobs or switchgrass, generating natural isoprene as a byproduct.

It’s cleaner to make than the oil version. “Some of the microbe cell mass is left over after the microbes catalyze the reaction,” says Genencor vice president Carl Sanford, “but that can be recycled, used as fertilizer or burned for energy. There are no highly toxic waste products.”

Genencor’s business case relies on making BioIsoprene cost-competitive with isoprene from petroleum, so its prospects hinge partly on world oil prices over the next five years. Global rubber supplies will also be a factor. BioIsoprene could sub in for a portion of the natural rubber already in tires, Sanford says. “And sometimes companies can’t get enough petro-derived isoprene, so we may be able to fill the void.”

While federal agencies have estimated that the U.S. could produce as much as a billion tons of biomass crops per year within the next several decades, enough to satisfy the renewable fuel mandate with materials left over, not all experts agree on that number.

It’s worth noting, however, that although the global isoprene market isn’t trivial—about 1.7 billion pounds per year—replacing that entire amount with plant-based isoprene is a much smaller undertaking than meeting federal biofuel targets. Sanford estimates that every ton of BioIsoprene requires about four tons of feedstock, so it would take only about 3.4 million tons of cellulosic materials to make enough plant-based isoprene for all global applications. ”

http://www.popularmechanics.com/cars/alternative-fuel/news/bioengineers-turn-trees-into-tires

Interesting article, thanks for the link.

Hi Ron,

The link to the conference abstract on EOR had an extra %22 on it,

This works:

https://aiche.confex.com/aiche/2014/webprogram/Paper356067.html

Thanks Sunny, I fixed the link. I thought I checked that before I posted but apparently I did not.

Shale Oil should be viewed as a gift of time to transfer to a renewable transportation infrastructure. Others might see it as a gift from god.

Think Fossil Free New Cars by 2030 ( Tesla, Volt E 85, Leaf, Solar Panels ). We should accept no less from no one. If you disagree, stock up on your burners now.

Green means Peace in the MidEast

haha

Global EV sales 2013 about 243000 (from a shill site so maybe bogus high)

Global 2013 vehicle sales 83ish million. 0.003 3 tenths of 1 percent.

Oh btw that was 17,600 in China. China total vehicle 2013 sales 21.98 million.

Yes Sally, that’s 0.0008 8 hundredths of 1%

Your flowers and unicorn world is NEVER going to happen.

Green means you need to clean that rifle barrel.

The bad news is you’ll be shooting Americans with it. Unless you’re willing to kill Chinese with something bigger.