Comments related to oil and natural gas production and closely related subjects in this thread. Thanks.

“Shale companies from Texas to North Dakota have been managing their wells to maximize short-term oil production. That has long-term consequences for the future of the American energy boom. By front-loading the wells to boost early oil output, many companies have been able to accelerate growth. But these newer wells peter out more quickly, so companies have to drill new ones sooner to sustain their production. In effect, frackers have jumped on a treadmill and ratcheted up the speed, becoming ever more dependent on new capital to keep oil production humming, even as Wall Street is becoming more skeptical of funding the industry.” Rebecca Elliot, The Wall Street Journal (4/8)

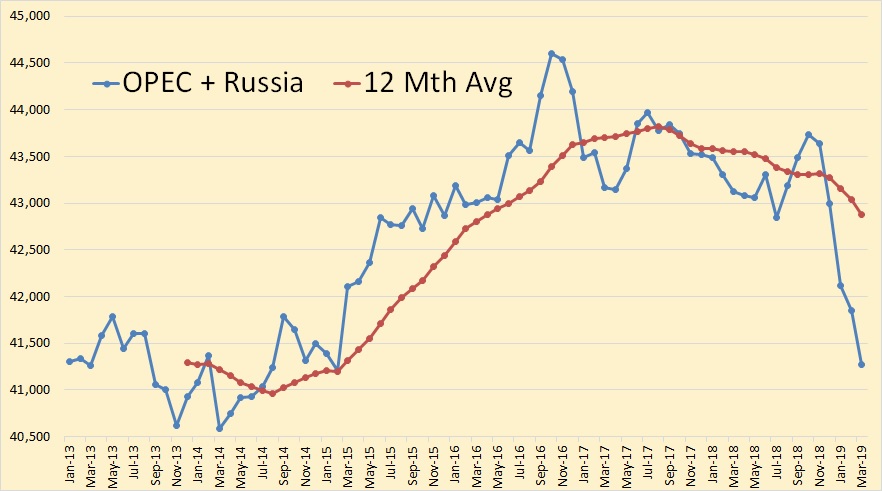

OPEC + Russia through March 2019, in thousand barrels per day.

The Largely Ignored Problem Of Global Peak Oil Will Seriously Hit In A Few Years

The era of oil is coming to an end, with global oil production set to halve in the next five to six years. To avoid a global economic slump, the transition to 100% renewables worldwide needs to be accelerated. It is feasible and cheaper than the current system, research shows.

2018 was a year of bold ambition and remarkable achievements for renewable energy, according to the International Renewable Energy Agency. Indeed, the production costs of renewables fell to record lows, undercutting the costs of existing coal-fired power plants. Investment in renewables kept rising, with most investment coming from emerging and developing countries. And even in places where politicians try to block the energy transition, for instance in the USA and Australia, numerous private actors, companies, and entire communities increasingly committed to go 100% renewable.

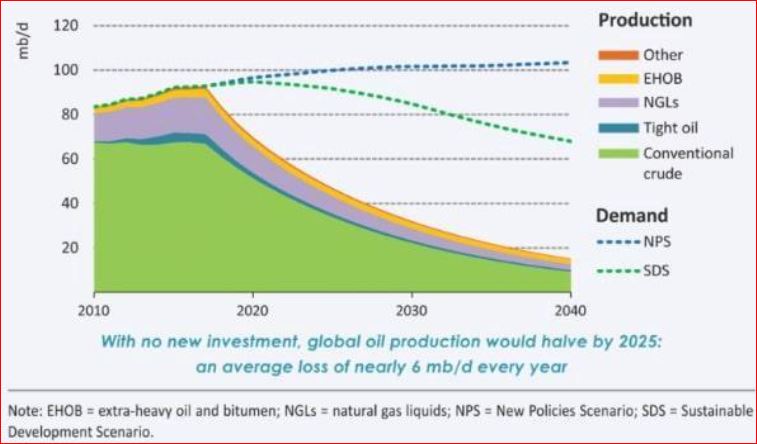

Yet, one important piece of news on the global energy transformation went unnoticed, despite the fact that it came from one of the most influential organizations, the International Energy Agency (IEA). The dramatic message was hidden in a graph on page 159 of the 2018 World Energy Outlook (WEO), the annual edition of the most significant report on global energy developments.

It shows that with no new investment, global oil production — including all unconventional sources — will drop by 50% by 2025 (Figure 1). That means that the global oil supply crunch is likely to happen already in the next five to six years and not in decades, as many fossil fuel companies hope. The global annual oil production is set to decline by approximately six million barrels per day starting in 2020. That means in the coming years the provision of energy related to oil will reduce annually by an amount equal to the total energy demand of Germany in 2014.

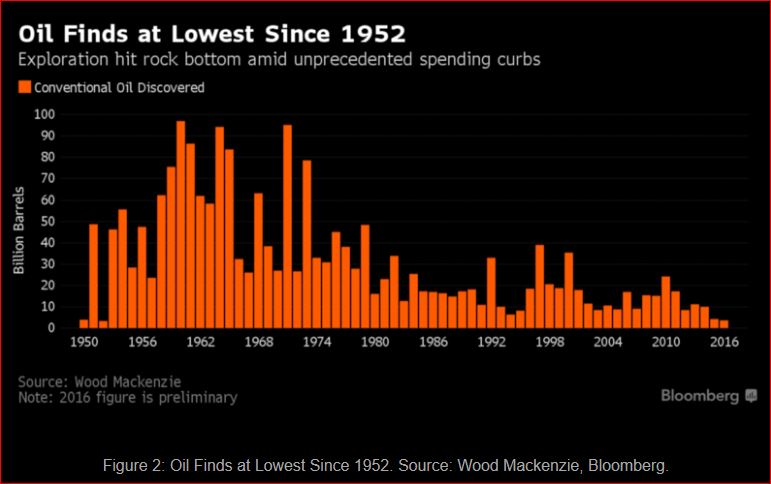

What most folks fail to realize is that there is lots of new investment. But outside the USA, and the shale boom, it’s all infill drilling. Hardly any new fields to be found.

There is a lot more to this article. Find it at the link above.

U.S. Petroleum Balance Sheet

PDF file http://ir.eia.gov/wpsr/overview.pdf

U.S. Gulf Coast crude oil imports at record low 1.4 million b/day

The US imported 71 kb/day of crude oil from Venezuela last week

US average retail price for gasoline was $2.828 last week, +0.081 cents higher than the same week last year

Oilytics chart summary https://pbs.twimg.com/media/D4XTlvTXsAAAatm.jpg

Products: https://pbs.twimg.com/media/D4XVdn8X4AA86nb.jpg

Twitter: https://twitter.com/OilyticsData

US inventories week/week change (1000 barrels)

Crude Oil: -1,396

7 oil products: -294

Total (crude oil + 7 products) -1,690

Propane & Natural Gas Plant Liquids: +4,949

SPR: flat

Chart: https://pbs.twimg.com/media/D4YHUrhWAAI_ZhM.png

Crude Oil & Distillates

https://pbs.twimg.com/media/D4YHayQX4AIma7l.png

Asia Pacific, annual oil production and oil consumption to 2017

$WTI isn’t inflation adjusted

Units: 1000 barrels per day

That chart looks really odd.

Oil price isn’t in constant dollars.

It does describe some good relative info. That area’s consumption is roughly double US consumption, and they produce a lot less of their consumption than the US does.

Just a repost from EN from an anterior thread – not exactly the same countries, but the production cliff of the last two years should be more or less the same. Consumption : production now at 36.000 : 7.000?

Thanks Energy News for the chart.

Very illustrative of the big problem they have.

They collectively are now importing just about all of OPEC production, and this does not take into account OPEC internal consumption.

Africa, annual oil production and oil consumption to 2017.

The big dip in 2011 was due to Libya

Africa crude oil production – EIA International Data

Chart https://pbs.twimg.com/media/D4YLdwdWwAAvDBJ.png

i dont get it. Traders run completely out of fingers and toes? US production increase was the big kahuna. It’s stuck at 11.9, and will probably stay around there for the next year. So, the 1.4 annual increase in the World is taken care of by WHAT? If OPEC gears up the last half, we will still be short.

Guym,

So far tight oil production continues to increase at roughly 80 kb/d each month (average of past 6 months). Perhaps the rate of increase will fall a bit in future.

My guess it will be cut in half to roughly 480 kb/d for the annual rate.

That would be true based upon past production. Independents are really pulling in their horns from the investor fallout. Jan total slipped lightly from Dec, and it is not increasing from Jan, either in completions or permits through today. the vast majority of those completions tend to be numerous in the “where did this company come from category”.

Note exports are no longer increasing, and WTI inventory in Okla is normalizing. If production is increasing, where the heck is it going? Marathon, Exxon, and Chevron take their little piggies to local market, and EIA says that is not increasing either.

As far as the Eagle Ford goes, I can be pretty sure we are on a decline. But, the parade of “who dat?” companies continue to proudly display their 200 bpd IP rates in both the EF and Permian.

And, really, 480 increase would be a drop in the bucket, should it happen. And, a substantial drop is not in my tarot cards.

Guym,

I agree the market is not likely to be ovesupplied. As oil prices continue to increase we might see more completions. Also possible that the 960 kb/d annual rate of increase of the most recent 6 months continues. World demand for C+C has increased at an a average annual rate of 800 kb/d from 1982 to 2018 so that may be all that is needed for the next few years.

https://oilprice.com/Energy/Energy-General/The-Undeniable-Signs-Of-A-Shale-Slowdown.html

schlumberger should know. My observations told me it probably was decreasing, but this is THE word. You can argue with them, but I don’t attack windmills.

The word is that investors are causing this. Probably not. My guess is new loan covenants. Not quick to dispel.

Guym,

We agree that the growth in tight oil output is likely to be lower than the past 12 months, it seems Schlumberger’s view is not very different than my view. The predict that future growth in North American land oil production will be lower than the recent past, they do not cite any specific growth prediction in annual change in output. I propose an annual rate of increase of 450+/-200 kb/d which is substantially below the annual rate of increase for the past 6 months (about 960 kb/d).

I also agree that Schlumberger would know better than me, but I basically agree with their assessment, there will be a tight oil slowdown.

I could go with 420/+_200. I personally tend towards flat. And I see it going higher next year. But, that one year lag is huge when you look at Ron’s IEA chart above. Depletion will be at a much higher rate.

My analysis is far from scientific as it relies on just a chart and some crayons, but 2018 looks like the high.

Guym,

My guess is that higher prices will result in higher completion rates on land everywhere, arctic and deepwater would have a 5 year lag at least, so that will help mostly with decline except in the case of projects that are already in development. Peak could be as early as 2022, low probability, less than one in 10 that it will occur before 2022, if Mr. Laherrere’s C+C URR estimate for the World is correct, it would require a Global Financial Crisis, major war in Middle east, or very low oil prices. My guess is that all of these are low probability before 2022.

I also thought it was low probability that Trump would be elected, so as I have been wrong before, history may repeat.

Dennis, a slowdown means falling behind. The Red Queen has to run fast just to stay ahead of legacy decline. That is legacy decline is at least four-fifths of what they are producing. So a slowdown of just one fifth their current production would mean no increase at all. It would all be absorbed by legacy decline.

Ron,

For Permian 400 wells per month completion rate resulted in about a 1000 kb/d rate of increase in total output, this is over and above the legacy decline. The model suggests 300 wells per month completion rate is enough to keep output growing. The model has matched actual output quite closely up to Feb 2019, so it may be accurate for future unless the average well profile changes. If it does not the completion rate would need to fall below 300 new wells per month for output to fall. That is for horizontal oil well completions. Impossible to predict future completion rate.

GuyM,

A new US LTO scenario with flat output in 2019 and then slowly rising output to 8.2 Mb/d by 2023, with a plateau from 2022 to 2025 before declining output. Under this scenario it is likely tight oil producers could operate without increasing debt (utilize any excess cash flow for new wells).

Yes, looks reasonable. Still a lot of unknowns that could affect that. We have no idea how much big oil will attempt to replace imports, or how much they can. M&A is still in the early stages.

Using the new lower LTO scenario combined with a World C+C scenario where Laherrere’s 2500 Gb scenario is combined with reserve growth of 1% per year from 2015 to 2070 (producing reserves grow at this rate). This results in an increase in conventional reserves by 100 Gb so the total C+C minus extra heavy oil minus tight oil URR is 2600 Gb.

Extra heavy oil URR is 200 Gb (same as Mr. Laherrere’s estimate) and tight oil URR is 95 Gb for a World C+C URR of 2900 Gb. The tight oil scenario is the one shown in my 4/24 comment above.

Peak is in 2021 at 84.5 Mb/d for this very conservative scenario vs my more optimistic scenario where tight oil output is 2.8 Mb/d higher with a later peak in 2025 instead of 2022, the more optimistic scenario peaks in 2024 at 87.3 Mb/d (using 2800 Gb of conventional oil and World C+C URR of 3100 Gb).

2021 vs Ron’s 2018. Er, not a clear cut winner, here. Probably won’t be until about 4 years. But, desired demand (funky GuyM coined word) will continue to increase. And, the projected increase in prices might be a tad flat in the beginning, but, of course you are aware of that. It is, as you say, conservative.

Eyeballing your chart, (I enlarged it in Paint to get a better picture), your last EIA data point seems to be 2017. 2018 is higher, it was, but 2019 is even higher? Then it levels out through 2022 then heads down.

According to that chart, we are on the peak plateau right now in 2019. Is that correct? I know, in your text you say the peak is 2021, but your chart puts it so close to 2019 that it is within the margin of error.

Well, I would not argue with your scenario…. very much. I just have peak oil one year before your peak plateau.

Our predictions are getting closer together Dennis. 😉

Yes see comment below which I put in the wrong place, click on chart for larger view.

The word is that investors are causing this. Probably not. My guess is new loan covenants. Not quick to dispel.

Well, that too, but I suspect that a lack of good sweet spots to drill also has a lot to do with it.

From your link:

Last month the EIA estimated that supply from the seven main shale regions had

increased by 282 thousand barrels per day (kb/d) from December to March,” Standard Chartered wrote in a report on April 16. “This month it has revised the December to March increase down to just 42kb/d. Total oil shale liquids supply was also revised down 213kb/d to 8.38mb/d in April, including downward revisions of 83kb/d for the Permian, 84kb/d for the Bakken and 20kb/d for Eagle Ford.”

When the Drilling Productivity Report starts to heavily downgrade their predictions, it’s time to take notice.

Ron the drilling productivity report is garbage, I ignore it.

Far better data at

https://www.eia.gov/petro

Ron,

The EIA tight oil production estimates have also been revised from last month. The biggest revisions were Jan 2019 and Feb 2019 at 91 kb/d and 162 kb/d respectively.

Data at

https://www.eia.gov/petroleum/data.php#crude

(see tight oil production estimates by play).

I used last month’s estimate through Feb 2019 to compare with current estimate in the chart below.

Annual rate of increase of tight oil production has slowed to 600 kb/d for the most recent 5 months of tight oil output compared to a 2300 kb/d annual rate of increase over the preceding 5 months. If we consider the past 12 months of production from April 2018 to March 2019, the annual rate of increase (using a least squares fit to determine the trendline) is 1500 kb/d for US tight oil output. One possible interpretation is that the annual rate of increase of US tight oil output is highly variable over short intervals of 5 months.

The rate of increase is more consistent over 12 month periods if we look at the absolute value, the percentage rate of annual increase has slowed from 29% to 22% when the previous 12 month rate of increase is compared with the most recent 12 month rate of increase. I expect an even bigger decrease in the rate of increase over the next 12 months.

I don’t argue that shale will increase, resulting in a US increase in production. I just don’t see it taking care of the rest of the world. And, I am not sure that even if it did, that the world could use extra 50+ API liquids to offset what they need. I expect a new category of oil to add to Brent and WTI, which might be: Brent, WTI and Unsalable.

That unsalable produces almost no diesel.

The planet runs on diesel.

Chart below has L48 data for % of C+C with API >50

Click on chart for larger image.

Thanks Dennis. I have posted a graph with that data down below to get greater width.

Maybe the slowdown is connected an oversupply of gas.

https://oilprice.com/Latest-Energy-News/World-News/Apache-Shuts-In-Permian-Gas-Production-As-Prices-Crash.html

Ron and GuyM,

Same scenario just blown up so 2010 to 2040 are easier to read.

There is indeed a plateau from 2019 to 2022 at 84.15 to 84.49 Mb/d, note that this is about as low as I believe is somewhat likely (more than 20% chance it might be correct). My best guess remains that a 2024 peak is the most likely scenario (with even odds it will be either before or after June 30, 2024.) We will know next March if 2018 was the peak.

Dennis,

Quick question. You estimate peak oil around 2024. But you don’t see a GFC 2.0 for quite some time. I assume for quite sometime means 10+ years maybe?

So is it fair to assume you don’t think peak oil will have any significant financial impact?

Iron Mike,

Note that I expect the initial period for the first five years after the peak will be gradual decline in output.

For an intermediate scenario (with LTO output the average of my low and high scenarios) and my standard 2800 Gb conventional oil scenario the peak is 2024 at about 86 Mb/d, by 2029 output falls to about 83 Mb/d. There will no doubt be a great deal of confusion as to what is happening as peak oil is not on most people’s radar some may think it is a lack of demand, others may see OPEC as trying to gather excess profit. In any case, the main effect will be an increase in the price of oil and many will assume that we need more investment in oil exploration and production.

In my analysis “some time” is about 5 years after the peak there is a potential for a GFC 2 as high oil prices and lack of oil supply may affect economic output negatively.

I say “potential GFC2” because there will be other powerful market forces at work. The increase in the price of oil, coupled with falling battery costs could lead to a rapid take off of BEV production worldwide and this will tend to create jobs and economic growth. On balance I don’t think this second effect will be enough to prevent GFC2 and expect around 2030 we might see such an event.

Difficult to say with much certainty because my crystal ball is in the shop. 🙂

As I am sure you are aware, predictions of the future are certain to be incorrect.

Dennis, you have World 2019 C+C production 1,140,000 barrels per day above 2018 production. OPEC March production is already 1,834,000 below the OPEC 2018 average. And OPEC says they will keep production low for the rest of the year. Russia has a bit more to cut. And Canada’s National Energy Board has Canadian 2019 production well below 2018 production. Don’t you think that 2019 prediction is just a tad too optimistic?

Ron,

There are 12 months in a year. The average output in 2018 was 82,853 kb/d, December output was 83,841 kb/d, so with no increase in World output from Dec 2018 output level we would have a 988 kb/d increase over the average 2018 C+C World output average. The numbers are of course subject to future revisions, the model is based on the information I have at present, new information causes me to adjust my thinking.

My guess is that higher oil prices might result in higher output, at least this year (by 2025 I expect this will no longer be true). Do I expect my guess for output this year will be exactly the number from my model? No, that would happen only by chance and the odds are very low indeed (approximately zero).

Do you think they are actually making money at this point or are they just near breaking even?

The peak, so far, in World C+C production was in October 2018. By December it had already dropped by over half a million barrels per day. By March it will be down by another million barrels per day.

It is just my opinion, and nothing more, but I don’t believe there is any way in hell we will hold those December 2018 production numbers thru December 2019. But even if the December 2019 numbers matched those of a year earlier, the average 2019 would still be a lot lower because of the very low production in the first half of the year.

I may be wrong in picking 2018 as the peak. But I believe 2019 production will be below 2018 production.

The average for 2018 was 82,850,000 barrels per day. March production will be below that level…. I think. 😉

But after looking at early 2018 production, I concede, it will be close.

Nobody can come close enough to count actual production, especially a time of production. It’s a peak plateau as of sometime 2018. It could get slightly higher or lower. There probably will not be any clear apex. Especially, if SA says they are increasing, because we can’t tell if they are producing, or pulling from inventory. In the US, we have majors hovering like vultures over the independents, who have pulled their heads into their shells. Canada is in a long tug of war contest, and Brazil and Argentina are dazed and confused. Venezuela will circle the drain for longer, making it impossible to come back for years. Iran will continue to play hide the oil, and Libya’s future is far from being clear. Meanwhile, World depletion keeps marching on. The big surge in production will come from? That’s right, it won’t come.

GuyM,

Everyone in financial newspapers “knows” thas US fracking industry can increase daily production by 2mbpd over night, so there will be no shortage anytime in the future. This is a cornupia.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

Seems US production fall from 12200 kbpd to 12100kbpd .

Still waiting for pipeline capacity..?

Baker Hughes weekly U.S. Rig Count:

Oil: -8 at 825

Natural Gas: -2 at 187

Permian -1

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

12/02 8,697 2016

To

12,100 now

3,400 in less than 2.5 years. Is it possible production is peaking?

Sean,

Probably not, tight oil output will continue to grow, just more slowly, there is often a slowdown in winter and spring, during summer and autumn we are likely to see a slight increase in the rate of output. I expect US tight oil output to increase to about 11 Mb/d by 2025.

Interesting new link to the Clean Technica article. So maybe the original peakers were off only ten years or so…? I feel chastened for having doubted them….

I’m aware of the hazards of apophenia & such (that is, seeing connections in probably unconnected events), but one has to wonder… Is this why the Repugs have gone insane? They know what’s cookin’?

Suddenly, the big exporters–Russia & Saudi Arabia–ain’t such bad actors after all. Putin’s a mensch, Trump’s all buddy/buddy w/ him. And so what if MBS saws up a few reporters? He’s a role model.

Maduro’s gotta go, sitting on all that flammable sludge.

Cantarell’s dead, so fuck Mexico. Build the wall!

And Canada? It’s just “air space.”

And those so-called “allies” of the US, importers of oil all? Fuck them, too.

Maybe The Big Grab is coming.

Oh, nevermind. I’ve been eating beans & burritos today.

Original peakers are more or less on target minus LTO, which wasn’t part of the peak calculations.

Exactly. And Peakers Ver. 2.0 (the ones that have now incorporated USA LTO into their calculations) appear to have it, more or less, right again, IMHO.

Link?

Ron has it up top, under the write-up. “The Largely Ignored Problem” etc.

He’s referring to this:

https://cleantechnica.com/2019/04/18/the-largely-ignored-problem-of-global-peak-oil-will-seriously-hit-in-a-few-years/

Gotcha, thanks guys – yes the Sisyphean task of maintaining global crude oil rates becomes more unmanageable every year as more of the total of extraction is from high depletion shale oil, old giants are depleted ever faster from secondary and tertiary extraction techniques done during high price years, and meaningful discoveries have all but disappeared or are mostly BOE – i.e. gas finds. The odds go up every year – I don’t like thinking of peak oil as likely to happen this year or that but rather what are the odds for any given year peak having occurred (cumulative). Here’s a wag for peak year:

2018: 10%

2019: 25%

2020: 45%

2021: 65%

2022: 80%

2023: 90%

2024: 95%

2025: 98%

2026+: 99%+

To elaborate, if we look at actuarial science, which deals with predicting the timing of the death (peak) of a complicated system (human life) – an actuary would never say, “This person is so sick they are definitely going to die this year,” or the converse, “This person is so healthy there is no way they would die this year.”

Instead, they give percentages based on the extent of their knowledge and the overlapping likelihood of events happening that might delay or speed up the arrival of death. Complicated systems like global oil production have numerous influencing factors. The first set is actually related to oil production: geology, oil prices, debt loads, past production, etc. But other external sets would be political (wars, failed states, carbon taxes, etc); technological (renewables, fracking); financial (recessions, debt bubbles, etc); etc.

So when I see Dennis’ charts, fine though they may be, I am not convinced as they take into account only the internal set of factors related directly to the ability to physically produce more oil. They always seem like a best case scenario if none of the external factors come into play. Possible, but not something I would bet my own money on.

Stephen,

Correct they are scenarios based on a set of assumptions, not all of these are best case assumptions. Things such as financial crises, major wars etc are not included as they are difficult to predict.

The shock model and related models for tight oil and extra heavy oil assume there will be adequate demand such that oil prices rise to a level where it is profitable to produce the oil.

Aside from a great financial crisis or world war, it is unlikely that demand for oil would be inadequate unless there is a rapid transition to electric, rail, light rail, car pooling, autonomous vehicles, better urban design enabling more walking, biking, and other small vehicle transport. This last scenario, though possible in theory, seems unlikely until perhaps 2040 at the earliest. Under that sort of scenario there would be lower oil output because prices were low due to lack of demand.

Note that your table is giving cumulative probability that peak oil happens by year x or earlier.

In my view there is roughly a 50% probability that the peak will happen between 2022 and 2026, and about a 25% probability it will occur before 2022 and a 25 % probability it will occur after 2026. I would also put the probability that the peak was in 2018 at about 1% and that the peak will be after 2030 at about 1%.

2018 or earlier 1%

2021 25%

2026 75%

2030 99%

2031 or later 100%

These are also wags.

Thanks Dennis I appreciate your thoughts on it. But just because events are hard to predict does not mean they are not likely to occur. Although any one event happening is small, the system is complex enough that there are a multitude of black swans that could occur, and the likelihood of something disruptive happening is likely high. And of course the potential for disruptions only increases after peak oil leads to massive political instability.

Hear hear.

A peak, even in a predictable and regular system like the sea ice is almost impossible to predict with precision.

You know when insolation is lowest and you can calculate latency until the expansion of the ice cap stops – but you can only guess a broader timeframe, never something less than a week or even a day.

Stephen,

Probabilities are difficult to assign when a new reality presents itself. It is possible that a peak in fossil fuels might be catastrophic, or the World might adjust as fossil fuel prices rise and a transition to other forms of energy occur.

My best guess is that a GFC2 occurs roughly in 2030, a poor policy response to this crisis (similar to the European response to the GFC) might result in a world war, if it is a nuclear war, I imagine oil production would see a Seneca cliff, but this would be minor compared to other problems. I think the likelihood of this worse case scenario is rather low (less than 5% probability). The 2030+/-2 GFC2 scenario is much higher in my opinion at perhaps 50% or more. I think it doubtful the World will repeat the mistakes of 2008-2010 period that were made by European Union policy makers.

In any case, assigning probabilities to future scenarios will always be problematic as there are an infinite number of potential future scenarios.

For that reason I should probably not speculate.

The future will be different from the past, of that I am certain.

Also consider the assumption that peak oil will lead to massive political instability, oil output crashed from 1979 to 1982 and did not surpass the 1979 level until 1996. For the most part there was not a spike in the level of political instability worldwide over that 17 year period. This time may or may not be different, but one needs to be careful not to assume something is true in order to prove it. It seems far more likely that oil output will gradually decrease after the peak with potential periods of sharper decreases due to economic recessions (highly likely) or depressions (less likely, 2 in last 150 years so roughly one every 75 years, though we are due for one, if GFC is ignored). If the GFC was a depression level economic event avoided by good policy in non-European nations), then we might not see a depression until 2085.

“…we might not see a depression until 2085.”

Sure thing, Bud.

Stephen Hren,

I would suggest that since 1880 there has been one depression in the past 139 years.

The Great Depression from 1929-1939 was severe and perhaps we will see another such economic crisis, I suppose one could argue that we are overdue for another depression. One possibility is that the GFC could easily have caused another Worldwide Depression if the policies that were followed from 1929-1933 were repeated. In that case, if we consider the 2008-2010 GFC to be similar to the Great Depression, then we would see a severe economic crisis about every 65 years (2 crises in the past 130 years) with spacing of about 50 and 70 years, so we could suggest 60+/-10 as a rough estimate based on past history and we might see another severe economic crisis starting in either 2060 (50 years) or 2080 (70 years) and lasting from 2 to 10 years. I have already suggested that my expectation is that it will be sooner, perhaps as early as 2030, though I think a GFC type event is more likely than a 1929-1939 type economic catastrophe.

Your crystal ball may be better, we will have to wait and see. 🙂

Technically WTI price on the monthly chart is still underneath the trendline that originates off the lows of 02/01/16 and touches lows of 06/01/17. Price has been consolidating Underneath this trendline for 9 straight trading days. Price really hasn’t gone anywhere up or down in 9 straight trading days.

This market wants to sell off but just hasn’t yet. S@P 500 has been rubbing the underside of it’s monthly chart long term trendline from 2016. For three week straight. Can’t get above it but yet won’t sell off.

Dollar index is fixing to breakout to the upside. 10year treasury bond yields are on the rise. Which is a problem. If all is well. If US and China come to a trade agreement. Then bond yields are going to rise a lot more. Market is so screwed up because of CB intervention that market would view a trade deal as a negative and sell off. Because a deal would mean all is ok. Higher bond yield will take oil price down.

Think about that for second.

Fascinating look into human behavior in which assumptions about the future can change so quickly. Peak oilers were right, then suddenly presumed wrong by a temporary addition of new, mostly unconventional sources, then after a 10 year period realize that after all that peak oilers were in fact right. How quickly all that happened.

Some of you may find this talk about the oil and gas industry in Canada by Chris Slubicki of interest.

https://youtu.be/raMwTUjB224

Howdy, neighbors, just a heads-up regarding this little bit next door and a ‘What do you think?’ addition from myself:

Perhaps the most important reality about oil scarcity is that geology doesn’t care about opinions, particularly the opinions of people who will all probably die in the same year.

It’s not about money. It’s about death.

Die in the same year?! Are you expecting some kind of apocalypse that plays out that fast?

If you want informed commentary on the oil industry, you’re going to get some contributors who are in the oil industry. I believe there is enough push back to super bullish posts to keep things balanced.

Ron make sure of that!

SouthLaGeo,

I would add that without some insight from those in the oil industry we would be flying blind. Comments by you, Mike Shellman, Fernando, Shallow sand, George Kaplan, GuyM, and others that either are a part of the industry or follow it closely because they collect royalties are worth their weight in gold, in my opinion.

This site is going to be very interesting in the next few years. Yeah, I can get some things close like a monkey at a typewriter can eventually spell a word, but there are more than monkeys who post, here. And many are very good.

GuyM,

I agree. I hope the oil producers who contribute on this site will not be alienated by those who believe that we need to eventually (time unknown) transition to other forms of energy besides fossil fuel as these resources deplete over time. There is no moral imperative for this to happen, it just is. We need to conserve resources and utilize those resources as efficiently as possible to enable the transition to be somewhat less painful.

That is how I see it. Such a transition might not be possible, but try we must.

Thanks for the responses, guys, which make sense. Agreed that it’s going to get interesting.

Looks like a slowdown to me. March is likely to be revised.

The rate of increase looks pretty similar to Jan 2017 to Sept 2017 which was a 887 kb/d annual rate of increase vs a 1555 kb/d annual rate of increase from Sept 2017 to Sept 2018. For Oct 2018 to March 2019 the annual rate of increase is about 775 kb/d. So a big slow down relative to Sept 2017 to Sept 2018, but only a slight decrease from the Jan to Sept 2017 rate of increase. Revisions sometimes result in an increase rather than a decrease in output, it is impossible to predict in advance.

Warfare tidbits, Japan WWII

1942 Japan crude needs were a total of 35.9 million barrels — annual. That’s 99K bpd

1942 US crude consumption was 1 billion barrels — annual. That’s 2.7 mbpd

Note this ratio is what happens when you have oil vs have to get oil

US pop that year 135M. Japan pop 72M

Japan divided up the 1942 35.9 of oil as 12.6 million civilian, 17.6 Navy and 5.7 Army. Japan had 870 ships.

US Navy 400 ships and the count grew.

The war journals generally concentrate on battles and ships sunk, because that’s what gets promotions. But the Pacific war was won by the US submarine fleet that sank 50% of the total ships sunk in the war, with the vast majority of those oil tankers from Indonesia. By the end of the war, bombing missions targeting Japanese refineries were scrubbed because the refineries had no crude to refine. Japan was in starvation in 1945.

Japan’s vast submarine fleet in contrast targeted warships. The US was oil self sufficient.

US military presently uses about 300K bpd. Air Force 151K bpd. Navy 100K bpd Army 21K bpd

BTW the price of US oil in 1942 was $1.20 / barrel. It remained that price through 1945. By decree. As if supply and demand matter.

Watcher.

Google Big Inch and Little Big Inch.

Nice read. My Dad was piloting over Europe at the time, while his Dad was providing drilling to supply Big Inch to supply fuel for his airplane. History is cool. When you can connect the dots to your own family history, its really interesting. By researching handwritten deeds, I’ve traced direct descendancy to land owning shootists post Civil War, a signer of the declaration of Texas Independence, and to a soldier with the Swamp Fox in the American Revolution. I’m not interested before that as good luck may run out.

My contribution was meager, Four years of providing communications as an E5 in Japan during Vietnam. Although, the Navcommsta I was stationed at was bombed twice.

But, my grandfather was the Bull. 5’8 inches of Bull. Ran his own fold down rig company. At 65, he knocked a 6’2″ guy over the hood of car with the flat of his hand for insulting his family They don’t make them like that, anymore.

Was vaguely familiar.

I once sat in on a seminar about “Combat of the Future”. Some middle rank Navy officer offered up this . . . combat of the present and future will not optimally be conducted attacking enemy troops and ships. That is what wins medals and promotions, but warfare is an instrument of national policy. The intent is to force the enemy to adopt policies of your choosing. You don’t do that effectively now by killing population. You do it by keeping that population alive — forcing them to consume oil storage while you prevent more from arriving to storage.

Once the storage is gone, starvation begins. It takes nearly no time at all then for the enemy to agree to policies of your choosing. In other words, war will be best fought by NOT killing the enemy. This will not win medals or promotions, but it will win the war.

The US submarine fleet has been noticed by history, but it is the great battles that get most of the attention.

This will change, slightly. There will be nearly no one left to read the histories so it mostly doesn’t matter.

Peak oil is not dead and will never die in the sense that as long as some geologists, scientists, intellectuals, etc. want to discuss it, they will. Heck, if we have descendants and they are smart enough, they will discuss it all the way down the slide. Just like as long there are some humans around, we will debate religion, science, politics, and all manner of subjects.

But peak oil is dead in the sense that it will never be an animating force for most people – it will never really change our innate behavior. There’s a part of us, our biological tendencies formed over millions of years of evolution, that will never change short of a different evolutionary stimulus. There’s also a part of us that is cultural and is informed by cultural norms, and what those norms are at any given time. Those norms may very well change due to resource depletion, but it’s the norms themselves, and not resource depletion, which will change behavior (i.e. kids playing video and virtual reality games rather than driving and exploring; here resource depletion is a factor, there’s not enough fuel to power muscle cars for teenagers, but the norms don’t know that, they simply reroute behavior into another area). Same goes for the financial system, etc.

Peak oil will simply never be acknowledged, respected, dealt with, or “blamed”, if you like. It will be republicans vs democrats, foreigners, muslims, jews, blacks, kids, the elderly, doctors, whoever or whatever you like. This will happen all the way down the collapse. We will never actually admit, it was resource depletion all along. Not now, not 10, not 20, not 30, 50, or 100 years from now. It simply doesn’t make for a good enough story.

I know that’s not what you guys want to hear, but it’s the truth. There will never be widespread awareness of peak oil. It will never enter into public schools, into political discussions, or anything else. Mark my words.

And alcoholics say: “I don’t have a problem.” But, they deal with it eventually, or die.

I don’t expect the public will talk about peak oil. But I think the actions within the gas and oil community are already acknowledging it to themselves, if not to the public. If you anticipate that your main product is getting harder to produce, you prepare for it by quietly cashing out while you still can.

“But peak oil is dead in the sense that it will never be an animating force for most people – it will never really change our innate behavior. [. . . ] There will never be widespread awareness of peak oil.”

That is why, about two years ago when I reanimated my own interest in peak oil, I decided I am going to keep my mouth shut this time. Twelve years ago or so, in the midst of the peak oil “boom,” as it were, I wasn’t quiet about it, I wrote about it and lectured about it, to no effect whatsoever, and I’m sure people thought I was some sort of zealot, especially now that we have been “saved” by fraccing.

But let the slide begin, and watch me just look the other way. Fuck ’em.

Couldn’t agree more Dolph.

I know that’s not what you guys want to hear, but it’s the truth.

Damn! Oh well, at least I am relieved that someone knows the truth about the future. And all this time I have just been guessing.

I realize what you are trying to do Dolph, you are trying to show that the whole resource depletion thing will be just blamed on “others”, the Democrats, Republicans, blacks, Jews, Moslems, or whomever. Of course people will be blamed for not planning for resource depletion, but peak oil will be acknowledged, just as it is starting to again appear in the news lately, just as it did before.

People noticed the US peak oil event in 1970. But did not get alarmed because there was still plenty of oil left in the world. But this time it will be the world peak. They will notice.

Of course they will not notice it when it happens. Only a few years after the peak when world oil production has declined by about 10% or more, and oil is well above $100 barrel again, they will notice. They noticed the last time it happened but ramped up production brought the price back down again. And people calmed down again.

But this time there will be no ramp up in production. People will notice. And “peak oil” will be on everyone’s lips. And when oil reaches $200 a barrel???

Like Michael B, I was evangelizing about Peak Oil when I first became aware of it. I put together a DVD with Al Gore’s “Inconvenient Truth” and a few other Peak Oil themed documentaries (Crude Impact, A Crude Awakening and Oil Smoke and Mirrors among them) and had them delivered to one politician each from the two major local political parties. I have reason to believe that at least one of the people I sent the material to looked at it, based on public pronouncements made after I sent it. Now about ten years later I feel a little embarrassed, a bit like Chicken Little discovering that the sky didn’t actually fall.

However I still persist in telling people that Peak Oil has not gone away and that it will be back. I’m just not sure about the timing and whether it will be result of demand destruction, brought on by technological disruption (Tony Seba’s “Clean Disruption”) or not. My hope is that oil production will eventually decline because of competitive pressures from alternatives but, the chances of that are slim to none. Based on the data and discussions from the previous petroleum thread (OPEC March Dat and Saudi Report) and the material in this thread, it would appear that “Slim” is preparing to exit the building! Is Peak Oil back?

Is Peak Oil back?

It is not just back, it never went away. The illusion of “no peak in sight” is what is going away. I am reminded of when I was a stockbroker for a few months and a trader for many years. We had a saying about insider traders. That is about corporate executives who buy or sell stock in the company they help manage. “Insider traders are almost always right, but they are almost always early.” When you see something that is as plain as the nose on your face, something that is obviously going to happen, you usually expect it to happen well before it does happen.

But on the other hand, the proverb, “once burned, twice shy” applies here. Some people are very reluctant to predict or even acknowledge peak oil. And when they do, they put it several years into the future, bracketed by a +/- two or three years.

Well, that’s fine but I must give my opinion. I thought peak oil was in 2005. And I later revised it to a few years later. But I was wrong, my original estimate was off, in my opinion, by thirteen years. OPEC peaked in 2016 and the World peaked in 2018. Well, that’s my opinion anyway. I may be wrong. We will not know for sure this year because production will obviously be down in 2019. So I have about a two year grace period before anyone can call me an idiot.

For the record, the EIA Short-Term Energy Outlook prediction for World Total Liquids in million barrels per day average:

2018…..100.66

2019…..101.52

2020…..103.21

The OPEC MOMR has World Total liquids production at the end of March at 99.26 Million bp/d.

The next economic crash is in the making and will reduce demand considerably. By this upcoming event, Peak Oil will be disguised for a couple of years.

Meanwhile, all those Greta Thunberg of this world will promote to forgo fossil fuel consumption and politicians will cheer with joy while raising taxes on fossil fuels. At the same time, production and sales of autonomous EVs will grow rapidly and end the need to own a car – the promise is cheap transportation for the ever-shrinking middle class. But at the end of the day, there will be millions of happily poor Thunberg fans riding bicycles in the post-crash industrialized world and they all will have bought into PEAK DEMAND. They saved the world with their altruistic reduction in fuel consumption – so please don’t wake them up from their stupor with any peak oil story!

Acknowledging peak oil means to question the basic rules of the economic system – and the elites have other plans than to give up their ruling.

Is there a rule in economic systems that die-off is not possible?

Yes. It’s called hubris.

The World probably will not even use the term “peak oil”. It’s fairly esoteric. But, they will understand high prices, and that it will not be expected to get better.

What is posted on this board will largely be forgotten. Bigger fish to fry. What will that be? Who knows? Mostly, finger pointing, is my bet. Along with panic, and that is a dangerous combination.

I disagree. Peaks are obvious in retrospect on charts and everyone has a phone that can pull up a chart to complain about why gas prices are higher again.

I think you give the average Joe or Jane too much credit. That would include politicians.

Denial is a psychological reality. Maybe, I don’t give them enough credit, We will find out.

I mean, we have not even reached the point, yet, where we realize that exporting this massive amount of oil is a stupid idea.

GuyM,

If it is not profitable to expand refinery capacity that can handle the tight oil, it makes perfect sense from a business perspective to export the oil to where the refineries are. The US consumes about 5.5 Gb of crude oil per year, the total tight oil that will be produced from 2005 to 2050 is about 87 Gb. Maybe about 14 Gb of tight oil has been produced so far, leaving about 73 Gb/5.5=13.3 years of tight oil that could meet US demand. Basically an investment in refinery capacity to handle this oil would not pay out. Some people think exporting oil is a dumb idea, they are wrong in my opinion.

It is actually potentially quite profitable to incorporate light tight oil into a “lets put North America first” refinery plan, Dennis. Exxon must think so. And Chevron.

Your idealism regarding the future of oil in America is beyond macro, it is based entirely on the belief that prices will continue to rise and therefore there will always be abundant shale oil in America. It is theoretical and lacks vision, common sense, and real life experience in oil production economics and the TRUE cost of reserve replacement. You believe every stinking BO the USGS suggests “might” exist, will exist. 2050? Gimme a break.

Over the past decade we have averaged $75 per BO WTI in the US….and the shale oil phenomena has not even paid for itself yet. At $60 gross, $25 net back per BO, the American shale oil phenomena will have to produce MORE oil (10.4G BO) as it has already produced, just to get out of debt. Do your own arithmetic.

Actually, realistically, anybody promoting the exporting of America’s LAST remaining oil resources is VERY wrong. They most likely have an agenda. The shale oil industry’s “agenda” is to cover interest on long term debt and stay afloat. The government’s agenda is to create jobs, tax revenue and use light tight oil as a temporary foreign policy tool, this administration, anyway.

Might yours be to deplete America’s oil as fast as possible to get on with your renewable agenda?

Exporting America’s last remaining oil resources, while its associated gas is wasted up flare stacks, both of which occur on credit, is beyond dumb. If America can only use 6MM BOPD of shale oil, the rest of it needs to stay in the damn ground… until America needs it. Think of it like a social security program, or an IRA, a savings account. Or don’t you believe in saving for the future? What, exactly, does the term “conservation” mean to you, Dennis?

M. King Hubbert said America’s policy seems to be “Drain America First”. That seems to be the current policy also.

Other sayings during an early energy crisis were “Burn America First” and “Strength Through Exhaustion”

The American shale oil barrel is likely one of the most expensive barrels in the world to produce. It most certainly is NOW given the real price of oil necessary to deleverage that faction of the oil industry’s long term debt. In my 50 years in the oil industry I have seen an array of bad energy policies from EVERY administration; this current policy, however, including exporting, is by far the worse. OPEC and Russia, soon to be back in the driver seat with some of the cheapest barrels in the world, must be loving it!

Mike,

I agree the natural gas should not be flared and have said as much repeatedly. That is a problem for Texans to address, I don’t vote in Texas.

I believe in a free market economic system that unless there are externalities associated with the production and distribution of a good that those businesses should be free to sell their product to whoever they choose.

I also think that Chevron and Exxon will be sorry they have invested in refinery upgrades as in my opinion the oil that can be produced will be considerably less than the USGS mean TRR estimates which are about 99 Gb for Permian, Bakken and Eagle Ford and my WAG for the rest of US tight oil for TRR is 13 Gb for a total USGS mean TRR estimate of 112 Gb for US tight oil.

Using a scenario that assumes the EIA’s AEO 2018 reference oil price scenario is correct and standard economic assumptions (I ignore any income from natural gas so the projection is fairly conservative), I get about 86 Gb of US tight oil production by 2052 with a peak in tight oil output in 2025 at about 11 Mb/d.

Even a more conservative scenario with a peak at 7.5 Mb/d would still be unlikely to allow refineries to make money, at a steady 7.5 Mb/d and 86 Gb URR the refineries would have 27 years of input, though it is doubtful output could be maintained at 7.5 Mb/d for that length of time, that capacity would only be maintained for 10 years, not enough time to make a decent return on a long lived asset.

As far as any agenda, I really don’t care if the oil is exported or not, if I were an oil producer I would not be in favor of the government deciding who I should sell my oil to.

My agenda is simply to ensure a successful transition to other forms of energy as fossil fuel depletes, for my children and potential grandchildren my hope is that the energy transition occurs smoothly and quickly so there is less environmental damage to the planet.

Conservation in my mind has to do with good stewardship of the environment while minimizing government interference in individual private decisions. These are fairly standard conservative political principles.

Hi Mike,

You said:

If America can only use 6MM BOPD of shale oil, the rest of it needs to stay in the damn ground… until America needs it.

That would be fine with me, I don’t decide how much oil is produced. Typically in a capitalist system it is up to individual businesses to decide how much product they should produce.

How do you propose that we limit the tight oil that is produced?

Cartels are illegal in the US and generally businesses are not in favor of having government bureaucrats deciding how they should run their business. Generally I would agree with business people with the exception of taxes being applied to limit externalities.

About the only potential solution might be for the RRC to act and perhaps the NDIC could follow the Texas RRC’s lead, though laws allowing this would need to be passed in North Dakota (not sure about that, just a guess.)

Mike Shellman and I are basically on the same path. The majors will limit the increase in shale oil. Not that it won’t increase, but its not likely to increase too much beyond their capacity to refine it. If they (Big Oil) has the majority of the increase, it will cut into imports, not increase exports. If they export it, they don’t get the refining margins, and that is plain stupid. Someone else does. So, if Bubba is in control, we don’t need gov. regulation. It is self regulated. Mike sees a continued effort to export more and more. I no longer see that as the most probable outcome. And I see the offshore export terminals, increased port capability, and massive additions to Permian pipelines as dead ducks. OK, not dead, but severely wounded.

GuyM,

What you say makes a lot of sense to me. My previous scenario simply assumed tight oil output continues to increase at roughly the rate of the past 24 months or so.

I am not saying this is the best possible outcome, simply what could occur if the past rates of increase continue, I also consider the economics and if oil prices rise at the rate proposed in the EIA’s AEO 2018 reference oil price scenario, Permian basin debt can be paid back by about 2030 in that previous scenario.

An alternative more “conservative” scenario where the completion rate in the Permian basin increases relatively slowly, we get the scenario below (I have left other basins aside from the Permian basin the same as the original scenario and have only changed the Permian part of the US LTO scenario in order to minimize my effort).

This results in higher overall output because the higher oil prices in the later period allow more oil to be extracted profitably. URR goes up to 98 Gb from previous 86 Gb estimate for US tight oil. This flatter output profile may allow refinery expansion to be profitable and exports might be minimized.

Oh, who knows how much. But, the tail looks like what I am guessing.

I have posted, previously, the billions in upgrades to new and existing refineries by Exxon and Chevron within the past three months to handle more Permian production. If it is not profitable, why are they doing it???

No, it makes more sense for them to buy up other producers that are exporting it, so they can have it for their more expensive refineries.

Fundamentals change, and it is difficult to project by past history. The majors, even Marathon (they are the largest refinery operation in the US), are not interested in producing enough to export a lot. There will always be some, but overproducing what they cant use, is utterly stupid.

Here is my “pie in the sky” hope. Right now, only 8 to 10% of the oil can be extracted from shale. So far, the efforts of enhanced production have been limited to efforts of independents, and some Universities. With the net result being a lot of theories, and a massive amount of BS. What if you could expand those percentages by 25 to 50% more? The R and D departments of the majors are the yen and yang. Would that delay peak? Nah. But, it could put more money in my pocket.

Would the majors share this info? Yeah, after they have bought up most of the productive areas.

Right now, only 8 to 10% of the oil can be extracted from shale….. What if you could expand those percentages by 25 to 50% more?

Tackling the tight oil recovery challenge

North American shale reservoirs contain billions of barrels of oil but the industry’s average recovery factor is typically well below 10%, compared with an average 30% for conventional reservoirs. Efforts to improve recovery from unconventional reservoirs are well under way….

Consequentially, the development of EOR processes for shale fields will soon impact the unconventional oil industry with at least as much force as did the combination of horizontal drilling and hydraulic fracturing a decade ago.

That was written two years ago and the recovery rate is still well below 10%. The oil is embedded in very tight rock. Water injection will not work in such tight rock. The water just finds a fracture and pours through that fracture rather than sweeping through the tight rock. CO2 injection has the same problem as water. You cannot sweep fractured tight rock with anything.

Okay, back to the drawing board. I don’t think there is anything left on the drawing board. But that’s just my opinion. My point is, the idea that you could expand those percentages by 25 to 50% more is a pipe dream and a very silly pipe dream at that.

It may be silly, but EOG has been reporting those numbers on their enhanced efforts on 150 wells in the Eagle Ford for the past three years. They say it is only good for the EF, now, as it is more contained. The Eagle Ford is where I am, and EOG is my producer. That said, I have not been able to find proof, anywhere. They wouldn’t lie, would they??

Slide 32:

http://investors.eogresources.com/Cache/1500117669.PDF?O=PDF&T=&Y=&D=&FID=1500117669&iid=4075407

Sorry, I could not find those numbers anywhere on slide 32. Below is what it says about EOR. Nowhere in the entire slide show does it mention 25 to 50% EOR.

It just says “Strong Results”, whatever that means. Strong results could mean going from 5% to 7%. Or it could just mean better fracking techniques.

Ron, you would have had to kept up with the presentations and discussions in each report over the past three years. The following on slide 32 from the first quarter 2018 gives a little more info:

http://investors.eogresources.com/Cache/1001238571.PDF?O=PDF&T=&Y=&D=&FID=1001238571&iid=4075407

Basically, they are claiming a 30 to 70% increase in reserves from the program. I discounted it on my own, as we all know investor presentations are horse manure. Yet, there still has to be some increase, or they would not, generally, make these kind of statements without some evidence. Even if it is not close.

Still nothing there about the percentage of recovery. The average recovery rate from conventional wells, that is reservoir rock, sandstone or limestone, not source rock is 30%. To get 25% from shale source rock, so tight that the oil could not escape naturally, would be phenomenal.

And fracking only gets some of the very lightest stuff out. The longer polymers stay embedded forever.

I read it as incremental reserves. Not the percentage of oil that would be extracted. That is, if their expected production was 300k bbls, a 30% increase would yield 390k bbls. What am I missing?

And, I am not attesting to anything EOG says. Just posting it. If I can make it clearer, there is not much of anything that I can trust to say about an oil company, except how much they have paid me.

Okay, what we are talking about is the percentage of the oil that can be recovered form the oil that is in the ground. From normal reservoir rock, that percentage averages about 30%. That is, from all the oil that is in the rock, about 30% can be recovered.

That is an average of course. Sometimes it is higher and sometimes it is less. That is just an average.

But the oil that is in very tight source rock, tha recovery rate is much smaller. The average is somewhere between 5 and 10%. EOR recovery from very tight source rock is much more difficult from recovery porous reservoir rock.

EOR recovery from reservoir rock is an entirely different animal from recovery from very tight oil source rock. Methods that work in the former simply does not work in the latter.

Okay, universities have tried to find ways to use EOR for enhanced recovery from tight oil source rock. So far they have found nothing. They can do better fracking, fine-tune their well spacing, but that’s about all they can do.

My point is, talking about increasing the recovery rate from very tight oil reservoir rock is something that only fine tuning the fracking methods can do. Other than that….. nothing.

No, no, no, they have not found a way to extract 25 to 50% of the oil that is in the very tight reservoir rock. Those are absurd figures.

Can they get to 10 to 11%? I doubt it, but that is the EOR from shale oil should be talking about. Not absurd figures around 25% or higher.

Ok. I went back and read what I posted, originally. It was not worded exactly correct. When I said if you expand those percentages, and I meant to say if you could increase those percentages by a multiple of 25 to 50% more. I did not mean to get them up to 25 to 50%. I meant multiply .25 to .50 times the original production rate of 8 to 10 %. My bad.

No problem Guy, I just wanted to keep things in perspective, and to keep from misleading those who might not understand why we frack at all.

Ron,

In your 7:33 PM post, in the paragraph that begins “Okay, universities…” you begin saying “tight oil reservoir rock” instead of “tight oil source rock.” That’s just a typo, yes?

Yes, of course. I have now corrected the typo. Thanks for the heads up.

Guym,

Agreed on export of refined product, I am talking about exporting crude. I believe Exxon and Chevron might believe some of the hype on tight oil resources which are probably much smaller than projected by the EIA, not sure if the billions of investments in refineries will pay out, as long as it is not overdone it may be ok, but at peak tight oil output, some of it may need to be exported or there will be overinvestment because eventually output will decline and refineries will not be able to run at optimal capacity and profits will be low.

That is exactly my point. They buy up the independents suffering from self inflicted wounds, moderate the production to match their capacity, and production lasts longer. And, that is just a guess, but the direction looks right.

Exxon, Chevron and close to Majors (Conoco and Oxy) all have moderate increases in production planned when you look at the lion’s share of Permian acreage they hold. As they gain more area, I would expect that trend to continue.

It’s a more fundamental change than what has occurred in the past. Historical projections may be superceded.

I think, based on where the majors are putting their money, they see the future and want to extract money, but without signaling a collapse. They can buy out other companies, which will make it look like they have plans, but it really serves as a cover for their real intentions to quietly liquidate.

https://www.forbes.com/sites/michaellynch/2019/02/06/the-oil-industry-demonstrates-why-limits-on-share-buybacks-are-unwise/#1603021f7582

GuyM,

How much added refinery capacity is planned by majors and near majors to handle the light crude?

From an aging and fragile memory, over a million a day for short term increase (probably close to completion by now) and Chevron bought a big enough area to produce a lot more in the future, but it was not clear of their immediate plans. In and around the Houston area. Enough to take care of their projected increases through 2025. And Marathon, the largest US refinery system, has been adding to their potential to process LTO for several years. They (Marathon) still export some, but only if production outweighs their capability to process it. My guess is that exports will eventually become a smaller piece of the production end point.

This only covers about half of what I have read about for Exxon’s expansion in the past year, still, we are looking at about 2 million future just from this article.

http://www.turnermason.com/index.php/oil-majors-expand-refining-capacity-to-cash-in-on-permian/

Those port and offshore terminal expansions look overdone, to me. Even Motiva has been quietly expanding their capability to process LTO over the past few years.

It’s easy to lose track over time, but if you go back at the August 2011 EIA weekly, you will get an idea of how much LTO we are actually using.

GuyM,

I only see 110 kb/d for Chevron and 250 kb/d for Exxon in that article for a total of 370 kb/d. If we assume this is half of the total, that suggests about 740 kb/d of new capacity or about one tenth of recent US tight oil output. Not sure how much of the tight oil is currently refined in the US.

The most recent 4 week average for net exports of products is about 2900 kb/d and about 2590 kb/d of crude is exported while about 6500 kb/d of crude is imported (net imports of crude of about 3910 kb/d). In a sense we can think of 2900 kb/d of crude being imported, refined and then exported. The other 1000 kb/d we refine and use here, in addition to domestic crude that is not exported.

If we make the simple assumption that all crude exports are tight oil, then we refine about 4900 kb/d of tight oil, but would need another 2600 kb/d of capacity at current levels of tight oil output. So if we see refiners adding a lot more capacity for light oil there would be no need for exports, or if tight oil output falls by 2600 kb/d then no new capacity would be needed.

The question is what is the most profitable way forward for the integrated oil companies? I don’t know the answer. It seems doubtful that an expansion by 8400 kb/d to light oil refining capacity would make sense (this is the amount needed to refine all of the forecast peak in tight oil output in 2025 (11,000-2600).

Perhaps no further increase in tight oil output and an expansion of refinery capacity by 2600 kb/d would be profitable for refiners, but it is not clear how long they need to remain at 90% of capacity for such an investment to payout. I do not know enough about the economics of a refinery to even venture a WAG.

Seems unlikely however that US tight oil output would remain level at 7.5 Mb/d, I expect it will increase to at least 9 Mb/d.

In that case id refineries only can expand profitably by 2600 kb/d, we might expect tight oil exports to continue when tight oil is at its peak. Perhaps much of these tight oil exports will be production from independents.

Exxon has allocated 50 billion to expand refinery capabilities all across the GOM. It just has not got to it all, yet. Note the Chevron purchase has an additional 143 acres available for expansion. Chevron is an exporter. It provides refined products for its operations in Mexico.

I don’t ever recall saying US production will not increase. Just not at the level of some projections. Certainly, not much in the next year. And Independents will still export. Especially, the smaller ones with low IP rates, because Bubba has no interest in their land.

I think governments are well aware of the challenges ahead, and policies should not be underestimated by us observers. New refineries in the US to handle tight oil should give a combination of gasoline and liquid petroleum gases to have a utilisation in another type of energy environment than before. But still useful, LPG and condensate do not necessarily have to go into petrochemicals and plastics, but could be used to fuel electricity production and maybe also electric cars. In Norway quiet steps are taken all the time to enforce the energy transition. A copper mine in the north of Norway to be established with extra cost of 300 mill NOK subsidies to make it an unusual all electric mining operation is a recent example. Also a push to pursue expansion of wind power and tie that to long term contracts to power intensive industries like producing aluminum and silicon. There are thoughts of having hydrogen storages and technology to use this fuel type as a backup to the current energy mix. It would be expensive but could serve as a “war chest” and a backup plan and the thought of this is very much alive in Norway.

The senior politicians in Norway are thinking of “what we are supposed to live of after the oil”, while the junior politicians are trying to block oil and gas exploration of the Lofoten area due to environment concerns. 70% of all new cars in Oslo were battery based in March and a few short distance ferry routes are going full battery based/electric as well as part of a new trend. The goverment majority (senior politicians of the major parties) is fully aware that a combination of hydro and wind power makes a energy transition more realistic in Norway than most other places and that the rapid depletion of hydrocarbon resources (at least in Norway) makes the direction of policy urgent.

In Norway the project with biggest environmental potential is the one related to transport and store CO2 in the Utsira formation. This CO2 will be captured from Cement factories , coal power plants , oil and gaz platforms , prosessing plants. Several oil Companys and the Norwegian Goverment is supporting this and soon first well will be drilled to see how this apear in the formation, learn more.

But Norway does not produce enough food for herself. What Norway is going to offer for sale after hydrocarbons run out?

Very expensive copper? Copper is much more common than oil in Earth crust, it would be more proftable to develop even the deep water oil.

Wind power smelting aluminium? I suppose with minus EROI. Also, windmills do not work well in cold weather.

Moreover, Gulf Stream is weakening, which means colder times are coming to Norway. Hydropower does not work with ice.

I think that developing energy intensive industries is not a good bet for Norway.

You are right. The Gulf Stream will stop tomorrow and the lakes and rivers will freeze from bottom to top, also tomorrow.

I have never said “Tomorrow”.

https://www.theguardian.com/environment/2018/apr/11/critical-gulf-stream-current-weakest-for-1600-years-research-finds

Out of the blue the Gulf current stops and the lakes freeze and all by a sudden Norway has no energy source. The obvious solution to this is to mine copper. Surely the Norwegians will overcome with such ingenious plans.

Study shows continuing impacts of Deepwater Horizon oil spill

https://www.eurekalert.org/pub_releases/2019-04/viom-ssc041919.php

Some people here have predicted low oil prices for along time- $20/barrel recently predicted in these threads.

I suppose anything is possible, but I think the much more likely scenario (and one that I would bank on), is the one where depletion/disruption in oil supply overtakes demand in the coming 5 yrs, and price of crude goes way up.

And the returns that producers take in will be prodigious.

Replacement by other energy sources will be far short and far delayed to dent dent this trend, for a very long time.

IMIO [in my ignorant opinion]-

It would be in the best interest of the country, nonetheless, for domestic energy supplies of renewables to be

built out in a massive effort to provide some domestic resiliency [Go Texas]. Producers shouldn’t fear this- they will have far more customers for oil than they could supply. The biggest threat to crude oil sales is not alternative energy. Not even close. It is economic depression, where customers would like to buy fuel, but they can’t afford to. One certain way to get there is have oil prices get too high, too fast.

Hickory,

Oil prices will increase and more people will see the value of BEVs, plugin hybrids and hybrids, as well as high efficiency ICEV, this will in turn reduce the rate of increase in oil demand and keep oil prices from getting above $150/b, after several years of high oil prices (maybe 5 to 10 years) and the continued fall in the cost of batteries for electrified transport, demand for oil may start to fall faster than the demand for oil and oil prices will start to fall as there will be an over supply at high oil price, then the high cost oil (tight oil, extra heavy oil, and deep water new projects) will become unprofitable and new development in these areas will cease. World oil supply will fall faster and faster as fewer people will want ICEVs as they will be more expensive to own.

This is how I see the transition occurring, eventually (2060 or so) the number of ICEVs will be less than 1% of total registered vehicles in the World.

I can’t project the number of ICEVs out that far because I foresee some massive changes happening before then.

I think we are due for a significant global economic recession/depression which will affect consumption.

I think the increasing severity of natural disasters will force changes in economic priorities.

The generations in the US that embraced ICEVs are dying off. Younger generations are not nearly as interested in owning them or even driving them.

The nature of global power is changing. Alliances are changing. Trade agreements are changing. I think all of them will upend consumer spending, and with that ICEV use.

It is interesting that cars sales around the world are terrible, but EV sales are booming. For example car sales in the US in March 2019 were down nearly 3% YoY, and 2018 was a bad year too. Manufacturers are cutting production.

https://www.marklines.com/en/statistics/flash_sales/salesfig_usa_2019

https://www.autonews.com/sales/sales-weakest-start-5-years

Meanwhile EV sales are only being held back by production limitations, especially for batteries. It looks like big changes are afoot. There is quite a bit of panic in the car industry. Some are even saying that 2017 was peak ICE sales.

For the last decade or so all worldwide growth has come from China, but that also seems to be changing — the numbers coming out of China are horrible.

https://www.best-selling-cars.com/international/2019-january-february-international-worldwide-car-sales/

But the oil industry should be insulated from these changes for the time being by the huge fleet of ICE vehicles on the road. Furthermore, even as their sales fall, the number on the road is increasing, because new ICE vehicles are still being built faster than old ones are being scrapped.

Perhaps Dennis.

I was commenting about upcoming 5-10 yrs. Beyond that, I’ll defer to you and others.

Hickory,

I expect the process I gave to occur over the next 5 to 10 years and beyond. EV prices will continue to fall while oil prices rise from 2019 to 2029. If peak occurs by 2025 as I expect oil prices will rise sharply until enough EVs are sold to reduce demand, autonomous vehicles might also hit the market and reduce the need for ICEV, by 2035 we might see oil prices start to fall. Much depends on the level of oil prices and how this affects demand for EVs, difficult to predict.

True, a deep recession or depression would hurt the big oil companies and wreck many of the US producers. However, in the longer term the steady erosion of demand will hurt just as much and never cease. Having more economical cars, trucks and a growing EV/hybrid population is a serious limiting factor. Global EV sales have now gone above the total growth of vehicle sales and are doubling every two years. So by 2023 we can expect global EV to be about 8 percent of sales. Since several big companies are planning EV’s for 2022 and 2023 they may soon reach 10 percent of sales. That is 10 percent of new fuel sales knocked off each year against a declining population of ICE.

If trends continue we could see from 50 percent to 100 percent of new vehicles not being ICE by 2030. Of course by then other problems may be so big that we will not care.

This is still not fast enough to nullify oil depletion but instituting cars as a service would drop the demand for the total number of cars needed and making them electric or other alternate energy might at least counter oil descent.

It’s going to be a tough go because few countries or people are really looking ahead at the consequences of peak oil. A lot of belt tightening will happen in countries dependent on transport.

Plus it takes time to convert a giant global system.

BTW, if the price of gasoline goes up over $3 a gallon in the both conservation and EV buying will increase. The US is such a wasteful place that dropping use by 20 to 25% can happen very quickly if price increases and financial problems occur simultaneously.

Addendum to the item above concerning oil scarcity during World War II. Not only was the price of oil fixed by decree in the United States, but pricing was not employed to determine consumption.

One more time. Consumption was not determined by price. There was rationing. By decree. Doesn’t really matter what the price is for something you are not able to get. And that’s a general truism. It doesn’t have to be government rationing that defines something to be unobtainable. Anything unobtainable has a meaningless price.

I have not been able to find the price of gasoline in Japan during those years.

I lived thru the WWII rationing. My father had a B card. The speed limit was 35mph. I walked or rode my light weight “Victory Bike” a lot. The real shortage was rubber. I have read that rubber more than oil was the genesis for rationing. Shoe rationing and a tennis shoe shortage affected me as much as anything

Permian oil pipelines – at least 1 million barrels per day of new oil pipeline capacity by the end of 2019. Pipeline capacity has already increased by 635 Mb/d in the last six months.

2019-04-17 (RBN Energy) Between Plains’ Cactus II, EPIC’s EPIC Crude, and Phillips 66/Enbridge’s Gray Oak pipelines (white rectangles in Figure 1 below), there is upwards of 2 MMb/d of new pipeline capacity that should be completed and in-service by this time next year, with at least 1 MMb/d of that likely to come online by the third or fourth quarter of 2019.

Plains – Cactus II 670 Mb/day Q3-2019

P66/Enbridge – Gray Oak 900 MB/day Q4-2019

RBN Energy map https://pbs.twimg.com/media/D4cFokiXkAAWXlp.jpg

RBN Energy –> https://rbnenergy.com/hard-hat-and-a-hammer-how-does-the-permian-basin-avoid-getting-overbuilt

Interesting. 2 mbpd pipeline addition may be needed in the future, but by the first quarter of 2020, it may be a bit premature. Correct that. It may be a lot premature.

IMHO – “Peak Oil” should be thought of as a continuum. (Based on price and technology, but with clearly different source wedges of production as years go by.) Our resource is not one big barrel of oil being drained over time, but rather a very large oil bearing tree where much Hydrocarbon fruit exists, but some of it is very high up and we don’t have the proper ladders yet.