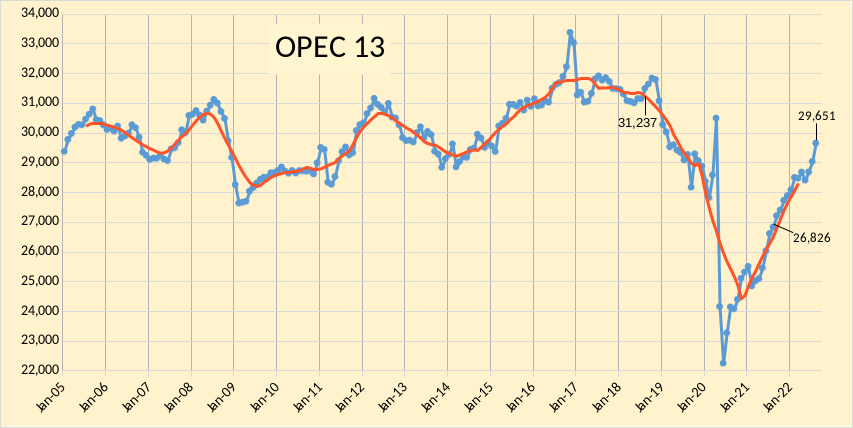

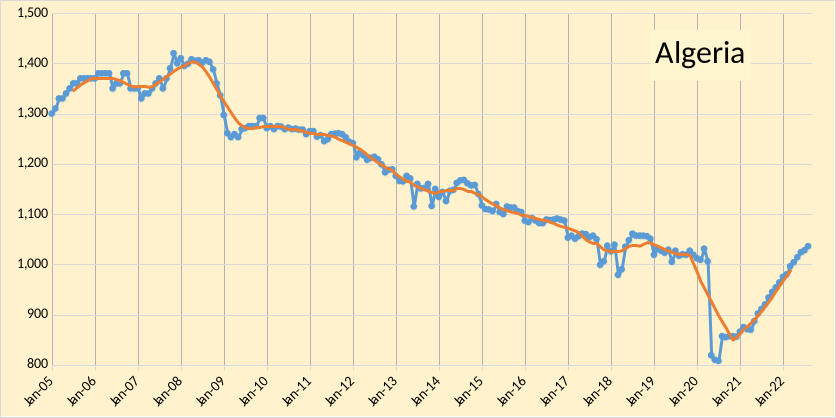

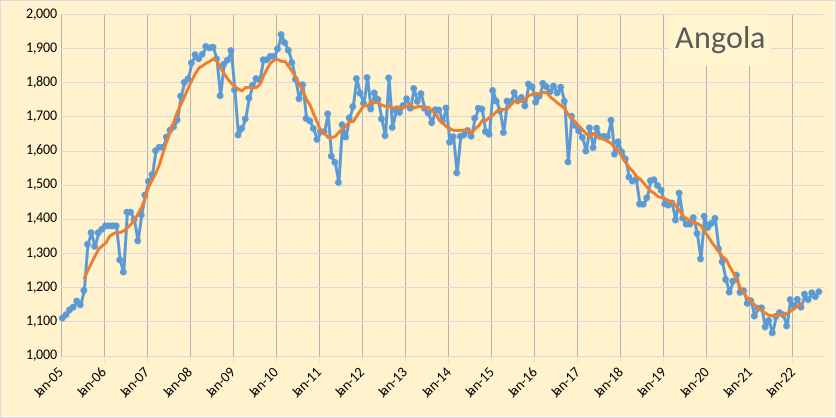

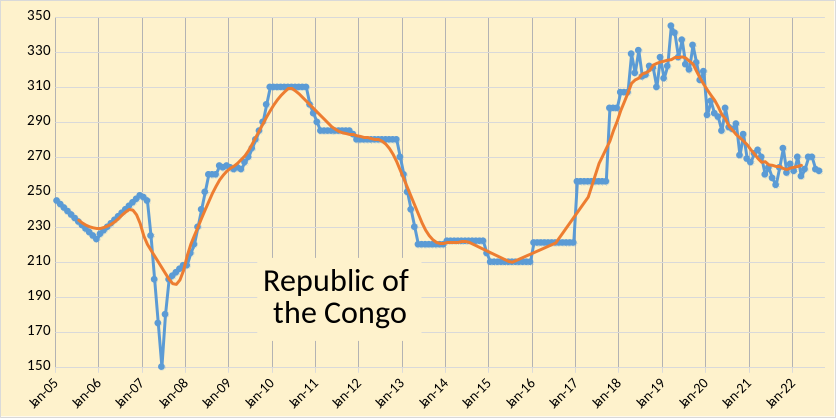

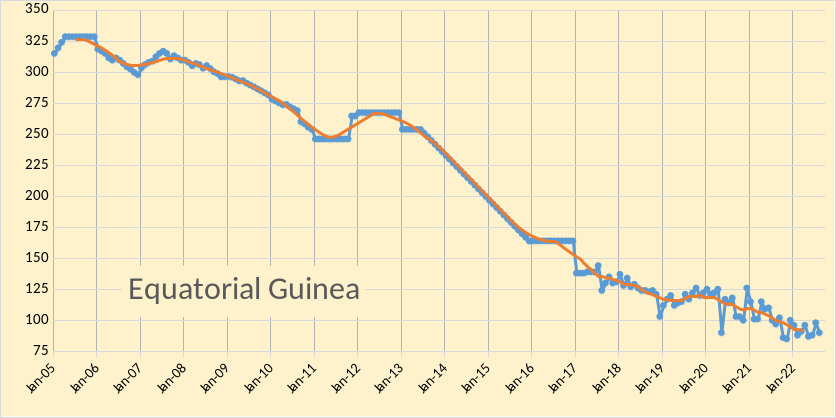

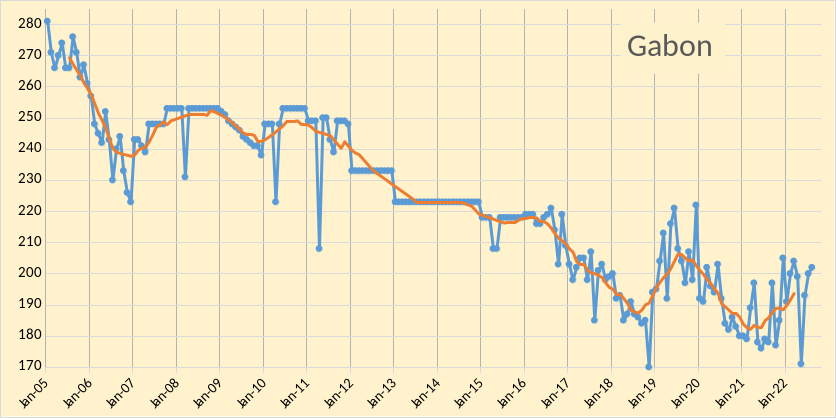

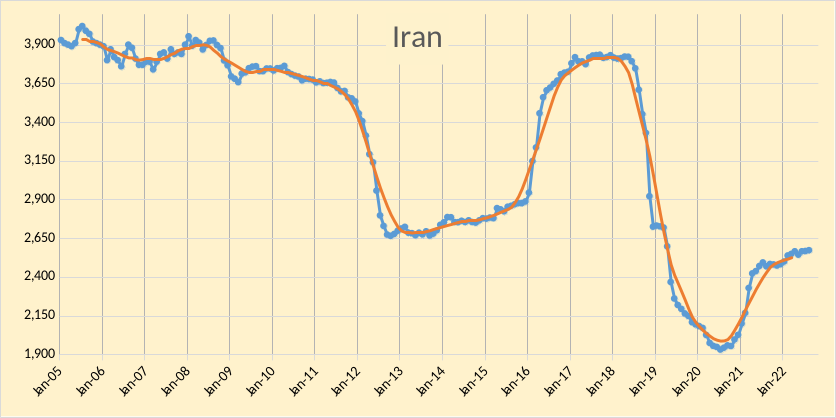

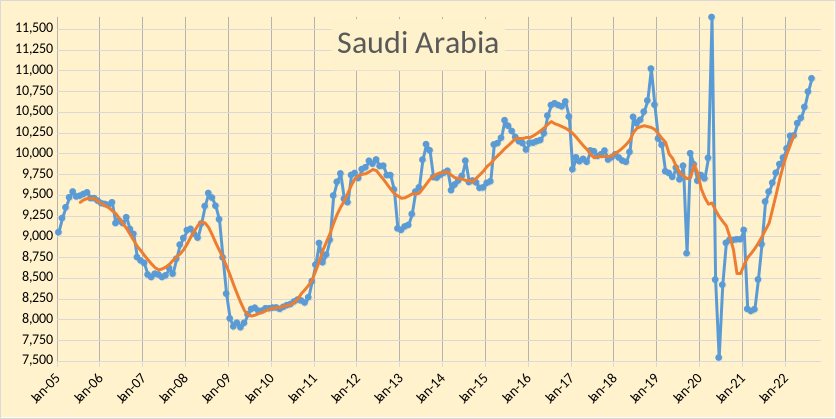

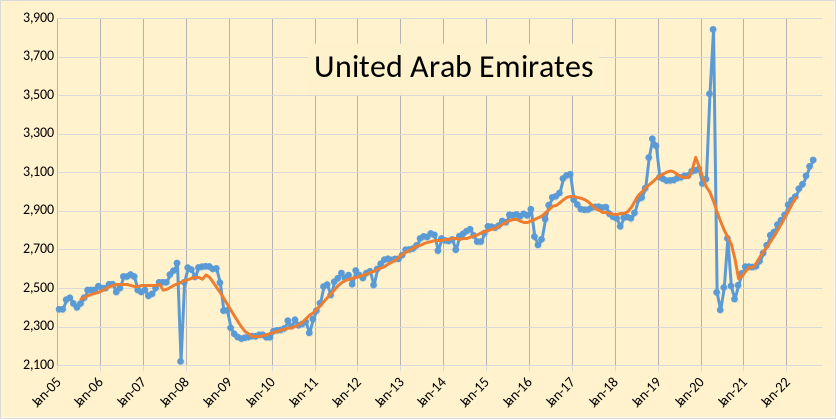

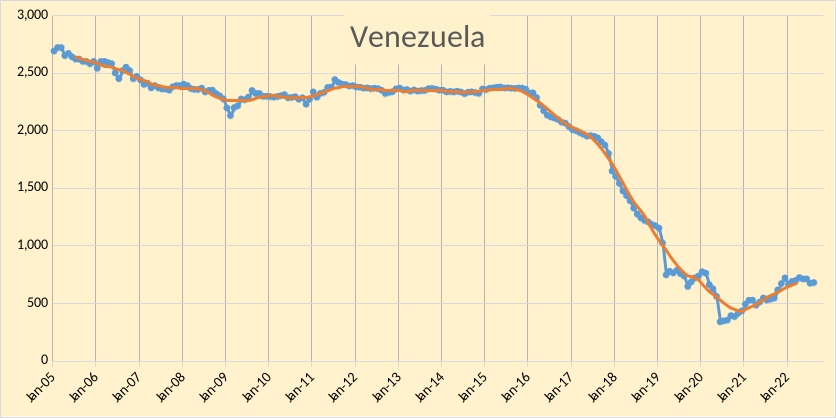

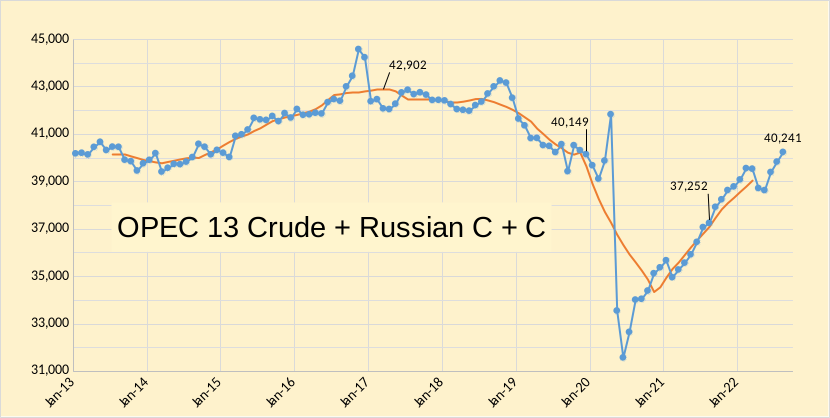

The OPEC Monthly Oil Market Report (MOMR) for September 2022 was published recently. The last month reported in most of the OPEC charts that follow is August 2022 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the OPEC charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

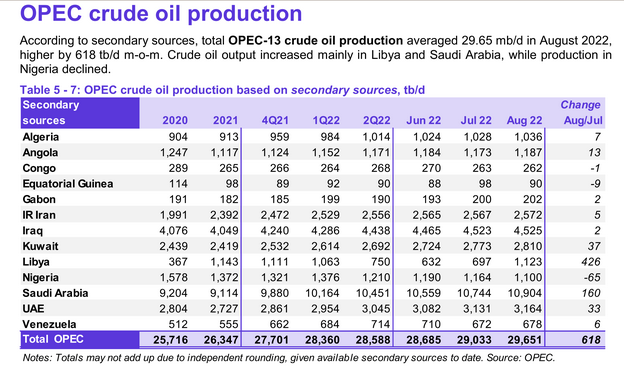

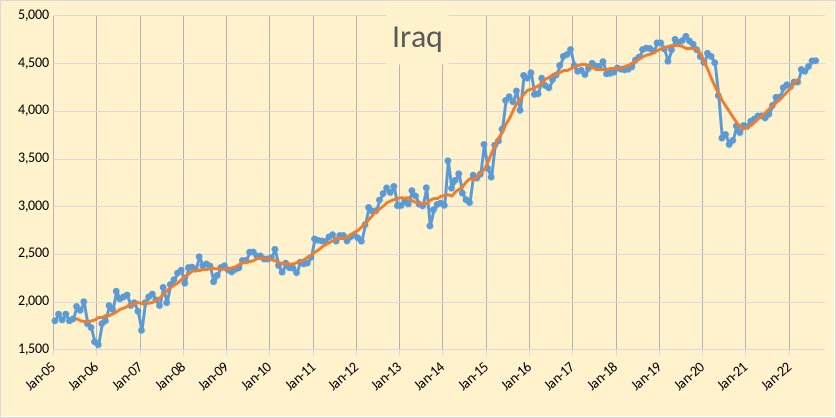

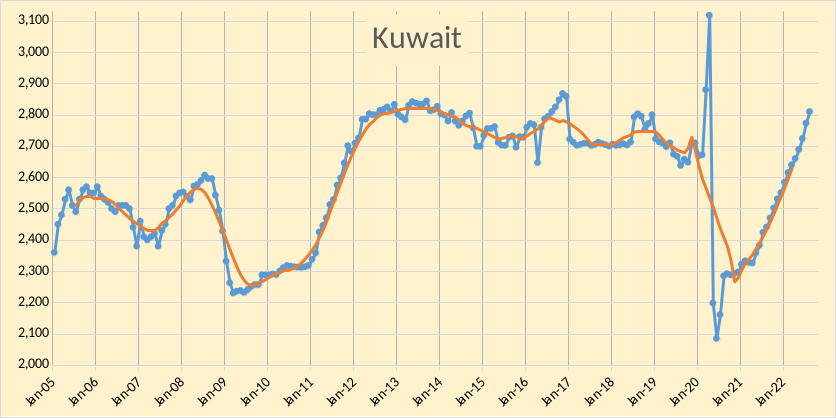

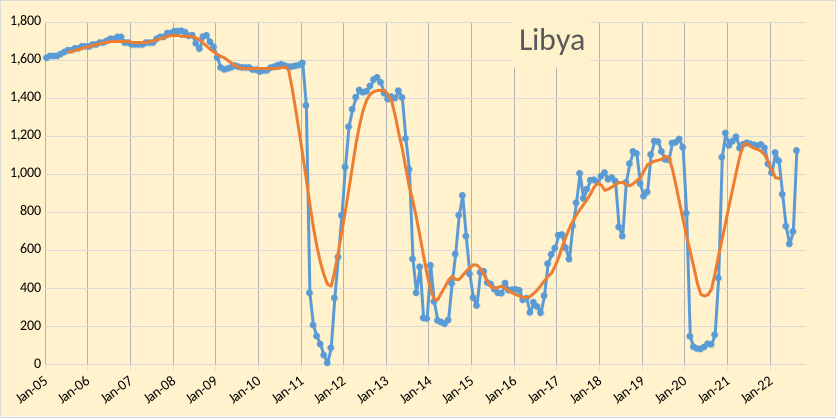

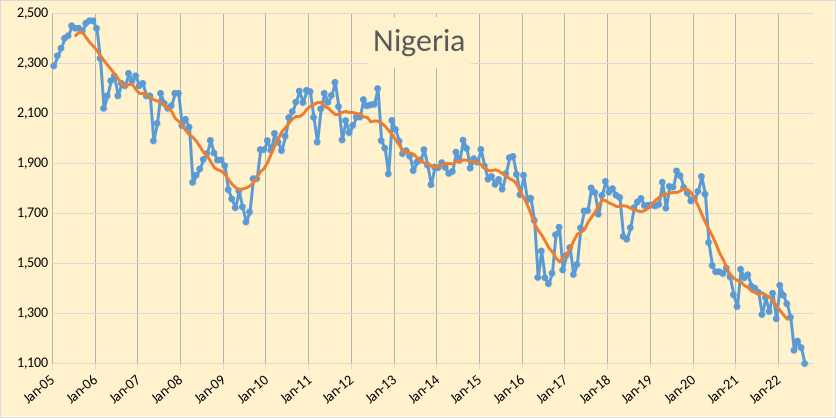

OPEC output increased by 618 kb/d in August after being revised higher in July 2022 by 37 kb/d and June 2022 output was revised up by 5 kb/d compared to last month’s MOMR. The bulk of the August increase in OPEC output (69%) was from Libya(426), with smaller increases from Saudi Arabia(160), Kuwait(37), and UAE(33). Nigeria had a decrease of 65 kb/d. The rest of the OPEC producers had small increases or decreases of less than 20 kb/d with a total increase of 25 kb/d for all 8 nations.

In the chart below we have Russian C + C and OPEC crude oil output. Output in August 2022 was 2192 kb/d below the centered 12 month average (CTMA) in August 2018 of 42,433 kb/d (when the World CTMA of C+C output was at its peak.)

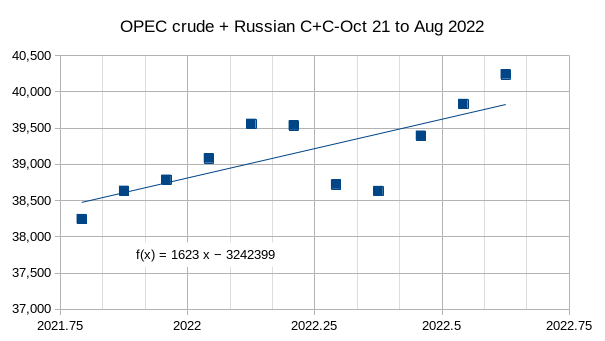

The chart below shows the ordinary least squares trend for the October 2021 to August 2022 period for OPEC crude oil plus Russian C+C output, the average annual rate of increase has been 1623 kb/d over this period. I expect future growth rate will be far slower, possibly close to zero in the near term (next 3 years).

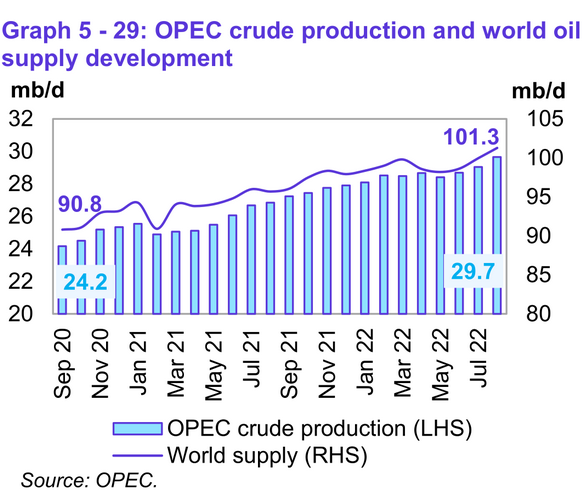

World Liquids supply increased to 101.3 Mb/d in August 2022, about 10.5 Mb/d higher than 2 years ago.

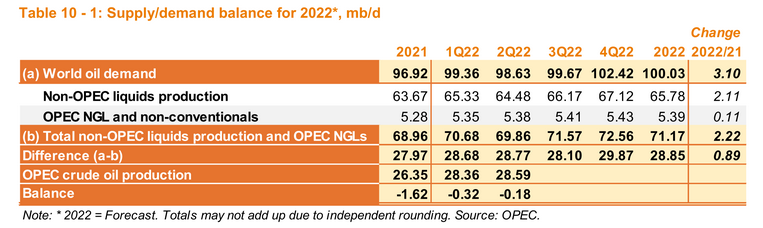

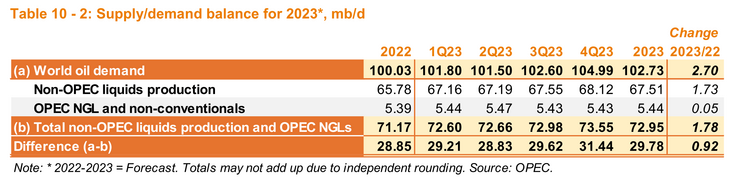

At present it looks like OPEC will be able to meet the call on OPEC in 2022 (if we assume OPEC forecasts for non-OPEC supply and World demand for oil are correct). Without higher output from Iran and with a nuclear compromise seemingly out of reach, it may be difficult for OPEC to meet the call on OPEC for the last quarter of 2023.

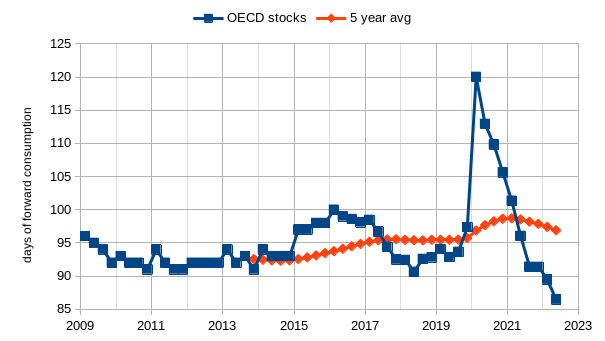

OECD stock levels have fallen to very low levels for the second quarter of 2022 in days of forward consumption at 86.5 days. This is far below the lowest level of 2010 to 2014 (91 days) and well below the trailing 5 year average at its lowest point in 2014 which was 92.3 days. This suggests future oil prices are likely to be high in the future unless we see a robust stock build in the future.

Saudi Arabia looks to be skyrocketing. Any explaination for this? Are they drawing from strocks? O do they really pump it out of the ground? And how long can they hold that level?

We will find out in a couple of months. My bet is OPEC 13 will be down, from their August production level, by almost one million barrels per day by January. The big jump in OPEC was Libya which apparently had some success in defeating the rebels. They are back to their level of November-December of 2021. That is their maximum production level. But a rebel insurgence could come at any time.

Saudi Arabia is now producing every barrel they possibly can. They have already said they will start cutting in September.

Yes, this was a happy month, all the big ones going up, with the exception of Nigeria. So from now on at best a plateau but probably with an underlying slow but steady downward trend.

Westexasfanclub

Attached is a table that shows the August OPEC production estimates for their member countries along with the official data submitted to the JODI database through direct communication and the OPEC targets for August.

As can be seen, SA and Iraq have higher production numbers that they have submitted to JODI. Typically this means that OPEC revises the Iraq and SA numbers the next month. I expect that these are the only two countries that will show an increase in the order of 100 kb/d in October and will meet their target and that have the capacity. So I think we can expect a combined increase of 200 kb/d from Iraq and SA in the October report. The other two big suppliers UAE and Kuwait are right on target and at max.

The August targets are slightly below the highest ones. There will be a small increase for September for most countries. SA will increase to 11,030 kb/d and Iraq 4,663 kb/d. For October they drop back to the August levels and will probably stay there for the rest of the year.

After October, the question becomes for how long can these four major producers stay at these levels. Looking at their previous history, the longest has been about six months to a year. So OPEC is very close to its current maximum capacity. After October there will probably be a plateau for close to six months and then slow drift down.

Thank you Ovi for these much appreciated details. So when the EU sanctions against Russian oil start in December, things will become really tight.

Westexasfanclub

I don’t think that the sanctions will have any effect on Russian production immediately. I am excluding the effects of sanctions on spare parts and removal of US personnel and technology.

I think the supply lines will change and become longer. Instead of Russian oil going to Germany, it will go to China and India plus a few others. China and India will buy it for a discount from Russia and then turn around and sell it back to Europe and make a nice profit for their troubles. Europe will be happy then to say they don’t need Russian oil.

Not sure what happens six months from now.

Yes, I think the same Ovi. Though the embargo will kick in in various steps. So not too far off from 6 months:

From a German TV channel:

„However, the EU has provided for a bridging period of six months (at the time the article was published) for the import of crude oil and eight months (same as above) for oil products such as gasoline or diesel. This means that the sanctions will not apply until December 5, 2022, and February 5, 2023, respectively.“

So lots of time left to move things through the back door. But certainly it won‘t make oil cheaper …

Westexasfanclub

Forgot to include this reference in the response above.

“Russian oil shipments hit their highest ever August level this month, according to data from the Institute of International Finance, in the latest sign that the country’s energy exports are holding up much better than expected.

The IIF also found that Greek-owned tankers were playing the biggest role in helping Russia’s oil get to international markets, after digging into the shell companies that own ships.

The capacity of oil tankers departing Russian ports — a proxy for exports — came in at just under 160 million barrels in August, IIF chief economist Robin Brooks said on Twitter on Tuesday. That was more than in any August in any prior year, he said.

https://markets.businessinsider.com/news/commodities/russian-oil-exports-august-record-china-india-sanctions-ukraine-energy-2022-8

Russia’s economy is cratering, and so is its domestic oil consumption. They must export it because they have nowhere to store the oil. Point is, that more exports do not mean more production.

Thanks Ovi,

If the direct communication data is accurate, then most of the shortfall (98%) from OPEC10 vs quota is from Nigeria (-854) and Angola (-346) for a total of 1200 kb/d less from these two nations out of a total shortfall of 1229 kb/d for all of the OPEC 10 producers based on direct communication. Total output in August for OPEC10 was 25460 kb/d and the August target was 26689, OPEC10 refers to the 10 OPEC nations that have a quota, Iran, Venezuela, and Libya do not have a quota at present.

Thanks for the work Dennis.

Oh yes, Dennis, thank you very much!

Schinzy, WestTexasfanclub, Kengeo, and Someguy,

You’re welcome.

I appreciate everyone who reads and comments here at peakoilbarrel.com.

It is all of you (especially those willing to comment) that makes this blog worth visiting, along with the great work from Ovi, Ron, George Kaplan, Bob Meltz, Islandboy, and others.

Thanks.

Interesting charts, peak production from 2015-2019, doesn’t look like any challenge expected any time soon. Nice works on the update, thank you for spending the time and effort on it.

Great charts, as always.

Makes it clear how the big guns (Saudi, Kuwait, UAE) are really pumping hard, I wonder how long they will/can keep it up for?

Will the impending economic downturn mean that they don’t end up having to answer that question (for now), or will their production fall off before the slowdown really hits, causing one last price spike before the recession really hits home, and giving us some insight into their ability to sustain these production levels.

I guess there is no need to speculate (unless you like betting on energy markets, of course), we can sit back and see what happens over the next 12 months.

OPEC plus drilling is still pretty constant with maybe a very slow rise discernible. BH does not record Iran or ex-USSR countries. My guess is that the sanctions are about now starting to have real impact on Russian drilling as any new wells now would have to be designed and executed without western expertise. It will be another couple of months before the poorer drilling results will show up as reduced production.

As another indicator that the Bakken is getting exhausted this shows the undeveloped and developed acreage for the top three producers. There is very little left undeveloped so new wells have to be fitted in between existing wells.

I was surprised that the proportion of reserves that are undeveloped has not fallen more (even as the total reserves has been falling). There are signs that the ratio is starting to drop in recent years and the growing amount of negative revisions will mostly be coming from the undeveloped reserves. Proved undeveloped reserves (PUD) means there are clear plans in place for development over the next five or so years, undeveloped acreage does not contain PUDs, at best there may be probable reserves but really it is just resources..

For the Permian it is more difficult to find companies that are localised, most own acreage and reserves in various basins, mostly around Texas. Pioneer and, to a lesser extent, Diamondback, look similar to the Bakken companies in losing undeveloped acreage, but Devon and EOG are retaining a lot of undeveloped leases (these two companies are prominent in EagleFord as well). The pictPure is further complicated by the amount of sales and acquisitions that have been happening. The Texas side of the Permian is a year or more younger than the Bakken and the New Mexico side over two years so it may be that undeveloped acreage starts to be allowed to expire in the near future. There is some sign that the ratio is starting to decline faster recently but, again, sales and acquisitions complicate things.

The picture for undeveloped reserves is similar to that for the Bakken companies with a decline in the ratio maybe being seen in recent years (however here the overall amount of reserves has been rising because of acquisitions and ‘discoveries’ – i.e. approved FIDs for drilling the leases).

George,

Great stuff, though my color perception is not great, is the EOG line the one that drops to under 10% from 2016 to 2020? Trying to determine which is EOG and which is Pioneer.

Thanks for sharing.

Yes Dennis- it is the EOG ‘developed’ that you described.

Hickory,

I realized my confusion was where the EOG and Pioneer lines cross in 2010, I thought my eyes were playing tricks as the colors seemed to change, then I realized the colors do change and I was assuming the line went in a different direction than was the case, the two dark colors was making it difficult to distinguish for my eyes.

Chart below has OPEC 13 crude plus Russian C plus C plus US C plus C output in kb/d. The centered twelve month average (CTMA) in August 2018 (peak for World C plus C CTMA was August 2018) is noted on the chart (53580 kb/d) as well as the level in June 2022 (last data point available for US).

If we assume US C plus C remains at the June 2022 level in August 2022, then the OPEC13 plus US plus Russian output level would be 52057 kb/d in August 2022, about 1523 kb/d below the CTMA for these nations at the World peak in August 2018.

I expect OPEC13 plus Russia may remain close to the August 2022 level, but expect we will see US, Canada, Brazil, Norway, Guyana, and Argentina increase output over the next few years, likely by far more than decreases elsewhere in the World especially if oil prices remain high (over $90/bo for Brent crude on average in 2022 $). Perhaps 2 to 3 years from August 2022 before we see a new World peak for the C plus C CTMA.

I expect OPEC13 plus Russia may remain close to the August 2022 level,

Not a snowball’s chance in hell of that happening. OPEC less the big five will continue to decline. The big five will also decline. They have already announced that. Russia dropped 220,000 barrels per day in August and will be down another one million barrels per day by January.

August will likely be the high post-pandemic high…. forever.

Ron,

Perhaps you will be correct, the South pole has hellish weather and snowballs might last a while there, though it is dry and they might sublimate relatively quickly. If there is decline for OPEC 13 plus Russia, I expect it to be modest. The steep decline of the past few years has mostly been Iran, Venezuela, and Nigeria, they may stabilize at this lower level, though there may be ups and downs due to instability in Libya and Nigeria.

Forever is a long time, I won’t be around to confirm.

If there is decline for OPEC 13 plus Russia, I expect it to be modest.

Dennis, do you really believe that the Russian decline will be modest? I find that presumption astonishing.

Ron,

I expect the sum of Opec crude plus Russian crude plus condensate will decline modestly and perhaps not at all.

Dennis, your predictions get funnier every day.

😀 😃 😄😁 😆 😅 😂 🤣😀 😃 😄😁 😆 😅 😂 🤣

Russian oil output will crater by 1.9 million barrels a day after fresh EU sanctions kick in, IEA says

Russia’s oil output will fall by 1.9 million barrels a day after EU sanctions kick in, the IEA said.

By February 2023, the group expects Russia’s oil production to drop to 9.5 million barrels a day.

Ron

Some how I think the IEA doesn’t believe that Russia will ship their oil out of Russia to China and others using other means. I think we are going to have to wait to see what happens. I don’t believe the IEA forecast. We will have to wait to see who is right, IEA or POB. Recall this article I posted earlier.

https://markets.businessinsider.com/news/commodities/russian-oil-exports-august-record-china-india-sanctions-ukraine-energy-2022-8

The other crazy thing I read the other day was that Saudi Arabia is buying Russian fuel oil for their power plants so they don’t have to use theirs.

https://www.nytimes.com/2022/09/14/business/energy-environment/russia-saudi-oil-putin-mbs.html

As Russia massed troops on its border with Ukraine and invaded the country at the start of the year, Saudi Arabia’s Kingdom Holding Company quietly invested more than $600 million in Russia’s three dominant energy companies.

Then, over the summer, as the United States, Canada and several European countries cut oil imports from Russia, Saudi Arabia doubled the amount of fuel oil it was buying from Russia for its power plants, freeing up its own crude for export.

And, this month, Russia and Saudi Arabia steered the Organization of the Petroleum Exporting Countries and its allied producers to reduce output targets in an effort to prop up global oil prices, which were falling, a decision that should increase the oil profits of both nations.

A lot of unforeseen twists and turns are happening

Ron,

The IEA is wrong about as often as I am on their predictions of the future. In April the IEA said by now that Russian output would have decreased by 3 Mb/d.

A good overview of potential future scenarios ar covered in the following publication from August 2022.

https://www.oxfordenergy.org/publications/oil-market-volatility-assessing-the-bullish-and-bearish-narratives/

I expect Russia to follow something closer to their bearish case, but do not expect Iranian oil to come back any time soon (seems the JCPOA is dead), and also do not think the odds of a severe global recession are high, I expect a mild World recession with only a small impact on World oil demand.

Ovi, you greatly oversimplify the embargo. China is in no position to flagrantly ignore the sanctions. And every ship carrying Russian oil will be doing it without insurance. Anyway, the price cap that is being worked on would help Russia ship more oil. But Russia says they will not sell any oil under the price cap.

However, it really doesn’t matter all that much as Russian oil production is now in sharp decline. All their new greenfield plans are either completely stopped or their progress is slowed tremendously. They had planned on these new greenfield operations to replace oil from their Ural and Western Siberia brownfields which are all in serious decline. Russian oil production is headed for a serious decline. Nothing could be more obvious than that.

Ron,

I will believe that Russia is in serious decline when I see it in the data. What I see now is that after sanctions were first imposed, Russian output dropped by 1000 kb/d, then Russia adapted and output recovered almost to the post pandemic peak (just 260 kb/d shy of that peak in July 2022, in August output dropped by 200 kb/d to 460 kb/d below the post pandemic peak (11060 kb/d). My expectation is that most of this decrease is due to difficulty exporting oil, but some of it may be supply disruption due to sanctions.

Difficult to know what will happen.

Ovi, here is what virtually everyone was expecting to happen. Notice that their brownfields are obviously in sharp decline. However, they fully expected those new greenfields to come online and replace the brownfield decline.That will now not happen due to all the sanctions on parts, companies leaving, and personnel. Also, the brownfield decline will be increased due to the dropoff in infill drilling.

The chart below dates from several years ago, around 2015 I think.

Ovi, it’s set in stone. Russian production will most definitely decline rather sharply. Dennis’s rather strange predictions, I believe, is affecting your judgment. 🤣

Click on graph to enlarge.

Ron,

A paper from Sept 2019 at link below

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/09/The-Future-of-Russian-Oil-Production-in-the-Short-Medium-and-Long-Term-Insight-57.pdf

See figure 18 on page 22 and figure 17 on page 21. My guess is that reality may fall between these two figures with output at about 10.5 Mb/d in 2026 and falling to 9.75 Mb/d in 2030.

Ron

Attached is the STEO forecast for Russia. They figure that Russian production will drop from October 2022 at 10.97 Mb/d to 8.98 Mb/d in March 2023, a drop of 2 Mb/d. I assume this is All liquids oil data.

I just don’t see why Europe and the US and others putting buying sanctions on Russian oil will affect their production and ability to sell/export to other willing buyers.

Let’s just sit back and watch.

Dennis, this paper, as pessimistic as it is, was produced long before the invasion of Ukraine. Do you really believe that the invasion, the sanctions, and the companies pulling out, and the countries no longer willing to sell Russia parts and technology will have no effect? Really Dennis? I have no further comment. I am speechless!

Ovi, I really don’t think you understand sanctions. This is not just American sanctions, this is European sanctions as well. And sanctions simply cannot be ignored if you can find a country that is willing to ignore them. Sanctions affect shipping and the insurance of tankers doing the shipping. They cannot get insurance if they ignore the sanctions. They would not dare to take that chance.

Also, China depends on exports to Europe and America. Do you really believe they will thumb their nose at both and say, “Screw you, we will import and ship Russian oil if we damn well please”? No, China knows they depend on exports to Europe and the USA. They would not dare do such a thing.

Ron

You and I are not going to agree on this business of avoiding sanctions. Let’s agree on that.

Politicians will be willing to shut their eyes to get the right headline. If China tells Germany that they are prepared to sell Germany Chinese oil, Scholz will say thank you! Do you really think that he will ask Xi to guarantee that the oil is not re-routed Russian oil.

The headline will be “Germany now buying oil from China” and China German trade will continue unhindered.

Remember these is too much money to be made by rebranding Russian oil.

Ovi, okay, I agree with almost every analyst in the world, and you don’t. I have quoted them and posted their articles and charts, but still, you disagree. Okay, let’s just agree to disagree.

But I must post my main point once more. That point is not that China, a country that consumes 12.8 million barrels per day but produces less than 4.2 million barrels per day, will not import Russian oil and then resell it, but that makes damn little difference. The point is that Russian oil production will dramatically decline in the next few years anyway, even if they do manage to sell every barrel they can possibly produce.

Ron

I am discussing the next six months where technology and people sanctions will have minimal impact on Russian production. At some point, sanctions on people and technology will start to have an impact,

Ovi,

I think you are correct. As to whether the sanctions will have much affect, Russia can probably get help from nations who don’t care about US sanctions such as Venezuela, and Iran. I imagine they will find a way to keep oil production up, especially if oil prices remain high and they find places where they can sell their oil (India, China, Saudi Arabia, Iran, Venezuela, etc).

Ron,

I think the most likely outcome is a decline of about 1to 1.2 Mb/d (Russian C plus C of 9.8 to 10 Mb/d). The wide range would be 0 to 2.1 Mb/d. Perhaps means low likelihood as in perhaps there will be no decline and perhaps there will be 2.1 Mb/d of decline.

Ovi,

On the STEO, I would consider that a reasonable lower bound (worst case scenario). My guess is that the decline will be about half as large as the STEO currently predicts.

Dennis wrote: I think the most likely outcome is a decline of about 1to 1.2 Mb/d (Russian C plus C of 9.8 to 10 Mb/d).

Dennis, please read, and comment on, My post below: “Russia’s central bank says oil production goals proposed by the nation’s finance ministry are too optimistic” The link is in that post.

You say 9.8 million bp/d. The Russian finance minister says 9.5 million bp/d. The Russian bank says that is too optimistic.

Question: What do you know that neither the Russian finance minister nor Russia’s central bank does not know? 🤣

Dennis

New production plans from the UAE. The plan is to increase production from the current 3,150 kb/d to 5,000 kb/d bu 2025.

UAE accelerates plan to increase its oil production capacity

The United Arab Emirates has accelerated a plan to raise its oil production capacity, according to people familiar with the matter, as it tries to cash in on its crude reserves before the world transitions to cleaner energy.

Abu Dhabi National Oil Co., which pumps almost all the UAE’s oil, wants to be able to produce 5 million barrels of crude a day by 2025, according to the people. That’s sooner than a previously disclosed aim of 2030.

The new target will be difficult to achieve and may increase the expense of a project that was already set to cost billions of dollars, the people said. Adnoc and the UAE government initially planned to bring the objective forward to 2027, before deciding on 2025, they said.

The UAE is pushing to sell more oil and natural gas while fossil fuel prices stay high. Oil soared to US$120 barrel following Russia’s invasion of Ukraine. While it’s slumped since June to around US$90, it’s still far above the UAE’s production costs.

https://www.bnnbloomberg.ca/uae-accelerates-plan-to-increase-its-oil-production-capacity-1.1820653

Thanks Ovi,

Sometimes these nations talk a big game (remember the Iraq plan to increase output to 6 Mb/d?) and it does not amount to much, perhaps the UAE can accomplish this by 2025, but 2027 to 2030 is likely more realistic or it may not happen at all.

Time will tell.

Ovi,

At link below is a claim that Iraq will raise capacity to 8 Mb/d by 2027, from Oct 2021, supposedly they are aiming for 6 Mb/d by 2024.

https://www.thenationalnews.com/business/energy/2021/10/06/iraq-aims-to-boost-crude-output-to-8-million-bpd-by-2027/

Back in 2011 Iraq claimed it would expand its capacity to 12 Mb/d by 2017, see link below to an article from 2011. This is what I was thinking of, but remembered the total incorrectly (the number was so large in my head, I divided it in half, I actually thought it was something ridiculous, but even 6 Mb/d sounds absurd to me.)

https://english.alarabiya.net/articles/2010/09/28/120623

Dennis

I have more faith in the UAE than Iraq, Also the increase is in a reasonable range and they already have started on the project. It does appear to be behind schedule. The first test will be to see if they can sustain the current production level for six months.

Ovi,

I agree UAE seems more likely to accomplish this as they seem more politically stable. My point was that sometimes these projects are exaggerated, or that was certainly the case for Iraq in 2011, UAE may be different, we will see.

An older article on Permian from March 2022, but worth a read imo.

https://www.bloomberg.com/graphics/2022-global-oil-permian-basin/

Sorry about paywall.

A slightly more recent article (June 2022) that quotes a Rystad article from May 31, 2022.

https://www.currentargus.com/story/news/2022/06/07/permian-basin-expected-lead-u-s-oil-production-through-fossil-fuel-new-mexico-texas-delaware/7489330001/

Rystad piece at link below

https://oilprice.com/Energy/Crude-Oil/Permian-Leaves-Rivals-Behind-As-Production-Continues-To-Grow.html

Dennis/Anybody

I don’t get it

Energy companies continued to invest in the Permian Basin of southeast New Mexico and West Texas, an area believed to be among the most lucrative oil and gas regions in the world, as fuel demand surged, and fossil fuel producers sought to increase production.

If this is the “most lucrative oil and gas region”, why is Oxy selling and Orion buying. They can’t be both right.

Ovi,

The Permian basin is not homogeneous, there are some areas that are far more productive than others. Mr Shellman has documented this quite well at his blog. I am not familiar with the acreage held by these various firms, but I would speculate that areas being sold might be less productive or that those selling have found this to be the case. It is also possible that operators are trying to consolidate holdings so that they can drill longer laterals which might have better economics in some cases. There is no doubt that it is much more complex than I realize as I do not have practical experience in the industry.

Oxy has a $28 billion debt and $17 billion interest payment obligations which get worse every time the FED meets. Orion has money to spend.

Thanks George,

A much better explanation.

The Rystad analysis from May 31, 2022 forecasts Permian basin growth of about 900 kb/d in 2022 and 2023 (annual average increase in output each year). My best guess scenario is shown below with the centered twelve month average (CTMA) Permian tight oil output plotted and annual average for 2021, 2022, and 2023 shown on chart. The increased output for my scenario is about 589 kb/d for 2022 and 624 kb/d for 2023 (annual average output).

Some people think my scenarios are ridiculous, but they are more conservative than many respected mainstream analysts such as Rystad. In 2023 my best guess scenario is about 1000 kb/d less than the Rystad scenario, if we assume conventional Permian output of about 500 kb/d in 2023. The Rystad estimate for conventional and unconventional Permian C plus C output is 6.5 Mb/d in 2023.

The Oil Production Story: Pre- and Post-Peak Nations – Updated July 2022 with 2021 data

Table and comments prepared by Steve Andrews, The Energy Bulletin

Spreadsheet of top 50 nations here, organized by top 10, then 11-20 etc:

– https://bit.ly/3BPAFBY

Thanks! Only 7 of the top 50 haven’t peaked yet.

And every one of those 7 is very near their peak.

OPEC+ Is Now 3.6 Million Bpd Below Its Oil Production Target

OPEC+ fell a whopping 3.6 million bpd below its oil production target in August, with the gap widening from 2.9 million bpd in July.

While OPEC members were 1.399 million bpd behind the quota, non-OPEC producers were more than two million bpd below their quota.

Russia and Nigeria were the two biggest laggards of their respective groups, and OPEC+ will likely fall even further behind its production quotas in September.

OPEC+ was widely expected to continue to underperform by a lot compared to its production targets for July and August after the group decided to accelerate the rollback of the cuts and have them completely unwound by the end of August.

The underperformance in September will be even higher because the group lifted its collective target by 100,000 bpd for the month of September. This increase will be reversed in October, OPEC+ decided at a meeting earlier this month.

Ovi, it seems that everyone in the world realizes Russian oil production is about to crash except you and Dennis. 🤣

Russia’s Oil Exports Are Set To Plunge Next Year

Russia’s oil exports have been resilient since it invaded Ukraine, falling just 400,000 bpd below pre-war levels despite international sanctions.

The EU’s embargo on crude oil this December and its embargo on oil products in February will displace 2.4 million bpd of oil.

While Russia may be able to find buyers for roughly half of that supply, it seems inevitable that its exports will fall dramatically.

Nearly seven months after Russia’s invasion of Ukraine, Russian oil exports have been quite resilient and just 400,000 barrels per day (bpd) below pre-war levels.

But come December, Russian oil supply could plunge by more than one million bpd after the EU embargo on Russian oil imports by sea enters into force. In February, another one million bpd could then come offline due to the EU’s fuel embargo.

So far this year, Russia has managed to divert a lot of cargoes previously sent to Europe to buyers in Asia, predominantly China and India. As of December – and two months later when the EU oil product embargo kicks in – Russia will have to find a home for 2.4 million bpd of its oil if it is to keep its oil exports at current levels, the International Energy Agency (IEA) said in its Oil Market Report last week.

The global oil market will have to prepare itself for a loss of 2.4 million bpd supply when the EU embargo kicks in; an additional 1 million bpd of products and 1.4 million bpd of crude will have to find new homes. This could result in deeper declines in Russian oil exports and production, the IEA said. The Paris-based agency expects oil production in Russia to fall to 9.5 million bpd by February 2023, which would be a plunge of 1.9 million bpd compared to February 2022.

Ron, these are valid observations. I just disagree in one point: I think behind this war on both sides (NATO vs Russia/China) is a long term strategy. When the Russians invaded Ucraine, this might not have been ethically correct, but it sure as hell was well planned and the consequences were factored in. IF there is a harsh decline in production, it most probably will go hand in hand with a demand decline in the west, especially Europe, which is on the brink of a severe recession. So why Russia shouldn‘t keep that oil in the ground? Until now they are making a great profit with what they are producing. They have no need to overproduce and ruin the price of their oil and they might be just fine producing 8 mb/d selling it to China or India with a decent profit. This is a conflict of attrition, designed to last very long and I think the Russians know very well what they are doing.

When the Russians invaded Ukraine, this might not have been ethically correct, but it sure as hell was well planned and the consequences were factored in.

Oh dear god, you have to be kidding. Do you really believe Putin planned on getting thousands of his soldiers killed? Do you really think he planned on getting hundreds of tanks and helicopters destroyed and his largest ship sank? Do you really think he planned on the latest defeat and embarrassment of the Russian army? Do you really believe he planned for the economy of Russia to be trashed?

NO, hell no. Putin thought the war would be over in a week or less. He never planned on any of this shit. Damn WTFC, nothing could be more obvious than the fact that Putin never planned on any of this destruction and embarrassment.

Russia will never recover from this debacle, and every Russian knows that. Now they are just trying to figure out how they can get rid of Putin before he does even more damage to the economy if that is possible.

There are words that there has been attempts on Putin’s life recently. He went to a summit with Xi in uzbekistan. As usual, several routes have been established and a for each route a safety officer designated. In facts, the person in charge of the route security finally taken by Putin and its escort disapeared.

Ron

POB is replete with independent thinkers. That means we don’t go along with the crowd and their opinions.

The world cannot sustain a 2 Mb/d loss of Russian oil next year. Those sanctioned barrels will find a way to see the light of day.

We will revisit this discussion every month as we get the new Russian production numbers.

At some point we will find out which opinion was closer to what happened.

Ovi, everyone is entitled to their own opinion. But they are not entitled to their own facts.

It is a hard fact that sanctions devastated Venezuela’s oil production.

It is a hard fact that sanctions deeply cut into Iran’s oil production.

What happened to Sakhalin Island oil production is a hard fact.

It just blows my mind that some people just believe sanctions have little to no effect. There seems to be the belief that Russia will somehow find its way around them. However, that opinion does not seem to be shared by anyone inside Russia. After all, they are the ones who know the facts.

Ovi,

I am sure Russia would like to sell as much oil as possible. I think what you may be forgetting is that many of the world’s largest service companies have exited Russia and it may be a long time before they return. Without these service companies, just as in Venezuela, the impact on the Russian Oil Production will be very negative and long lasting. By the way, Putin has eliminated at least 4 Oligarchs (who spoke out against the war) running the Russian Oil companies which will also impact the industry moving forward. It isn’t only about reserves but also about the health of the producing infrastructure in keeping these wells going.

LTO Survivor,

I imagine Ovi is aware of that fact, I believe he thinks this will have more of an effect over the medium term rather than in the short term. In chart below is the OPEC forecast for Russia from the September MOMR. Basically a Russian decrease of about 1 Mb/d is expected from 2022Q1 to 2023Q4 by OPEC.

Ovi-

“The world cannot sustain a 2 Mb/d loss of Russian oil next year”

I bring up the idea that world will have to learn to handle a 2 Mb/d loss of oil from Russia or some other collection of producing countries

each and every year being perhaps this year, or at least in this decade.

In fact, it will be fortunate if the drop is only 2 Mbpd.

We need to get used to that eventuality…quickly.

The world can sustain a multi-million barrel a day deficit if the Fed continues to use interest rates to crash the economy. I don’t think the effect of higher interest rates will reduce inflation. So much of the inflation we are seeing is supply chain driven. Since Covid, followed by the Russia/Ukraine war, the supply chain for most staples seem to be very wobbly and strained. Not to beat a dead horse, but production casing is in very short supply and it will take our company at least four months to receive our next shipment. We also have many wells to re-complete and cannot get a frac crew for at least several months. Part of this due to the fact of the Pressure Pumping companie are not expanding 1. in order to maintain profits 2. Cannot find enough labor.

Ron ,

Read the piece from the Oxford Institute for Energy Studies, the Russian energy experts there see a number of different scenarios.

https://www.oxfordenergy.org/publications/oil-market-volatility-assessing-the-bullish-and-bearish-narratives/

From slide 24 of the presentation is the Russian low disruption case shown below from the bearish oil price scenario. I expect this will be a little high and reality will fall somewhere between this case and the EIA’s STEO case for Russia which Ovi presented in another comment (see link below).

https://peakoilbarrel.com/opec-update-september-18-2022/#comment-746285

Sorry chart didn’t post see next comment.

Dennis, the first page the link lead to said this, and nothing else about sanctions:

Eventually as the dominant elements become clearer (i.e. the impact of sanctions on Russian production, macro-outlook and demand impacts), price volatility will start to ease and move away from the recent extremes.

The PDF did not mention sanctions or anything about the invasion. It completely ignored them. If you really believe the sanctions are a non event, then I am at a loss for words. But just let me exit by showing you exactly the effect sanctions are having on Sakhalin Island. Before the invasion this was what they were producing.This was posted in 2019:

https://www.reuters.com/article/us-russia-oil-sakhalin-idUSKCN1M017K

The government of Sakhalin said that oil and gas condensate output this year is expected to reach 17.4 million tonnes, equating to 348,000 barrels per day (bpd), with production of natural gas at 32.2 billion cubic metres (bcm).

This is what sanctions has done to Sakhalin Island:

https://www.upstreamonline.com/production/exxonmobil-closer-to-completing-sakhalin-1-exit/2-1-1272625

The project has suffered serious setbacks following the international sanctions imposed in response to Russia’s invasion of Ukraine, including reports of an almost threefold drop in oil output to just over 60,000 barrels per day between 1 and 15 May, compared with the April average.

Okay, from 348,000 barrels per day to 60,000 barrels per day. That is what sanctions did to just one greenfield project. But you, and the paper you posted, choose to ignore sanctions totally. But that is your choice, but I am afraid your choice will not affect Russian oil production at all.

Just one more point. For every paper you can find that totally ignores the effect of sanctions, I can find a hundred that doesn’t ignore sanctions. You cannot make them go away by ignoring them.

Ron,

Russian disruptions means Russian supply is affected by Russian sanctions. The presentation assumes that people are aware of the sanctions on Russia and sees no need to mention the fact. The presentation was given to other experts, knowledge is assumed in this case.

The high disruption case has Russian output falling by 2.1 Mb/d by the end of 2023, the low disruption case has no impact on Russian C plus C supply (output returns to about 11 Mb/d). My guess is that a middle case is most realistic with Russian output falling to 10 Mb/d by the end of 2023.

This is not “no impact”, it is simply a smaller impact than you foresee.

The experts at the Oxford Institute for Energy Studies are quite good. The presentation is excellent in my opinion.

Ron,

The following paper from Oxford Institute for Energy Studies gives an assessment in March 2022 and covers sanctions and Western companies leaving Russia and likely impacts.

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/03/Insight-112-Thoughts-on-the-impact-of-foreign-companies-exiting-the-Russian-oil-and-gas-industry.pdf

Chart is here.

Ron,

The article essentially claims that none of the 2.4 Mb/d of Russian oil exports to the EU will find buyers elsewhere in the World. Doesn’t sound very realistic. Perhaps 1.2 Mb/d may not find buyers, but if oil prices rise to $120/bo when the EU embargo kicks in, there may be many buyers of oil on the World market that will be happy to buy the barrels that the EU does not buy.

Holy crap, am I misunderstanding Westexas’ statement:

“ When the Russians invaded Ucraine, this might not have been ethically correct, but it sure as hell was well planned and the consequences were factored in.”

There must be some context missing…?

Kengo, what I mean is, you can condemn Russia for what they did, but they are certainly not stupid. This war was years in the making and they calculated its consequences on all levels: the military, the economic and the institutional one. So did their adversary (NATO). What we are actually seeing, is just the tip of the iceberg.

Westtexasfanclub,

I think the Russian’s underestimated the Ukrainian resistance and the Western willingness to aid Ukraine. I think if they gamed this out it, the reality has turned out close to their worse case scenario (the scenario just short of all out nuclear war).

The Russian people may eventually turn on Putin.

Westexas,

Couple points around “planning the consequences” by the Russians:

1. You have a hallucinating Putin believing he is uniting Russia’s former empire – he is not a Genghis Khan-

hence there is no cohesive plan (I’m from E. Europe, every communist party had a 5 yr. plan, you know the results of that planning)

2. When you have so much power (Russians were just learning how to self govern- never before in their history- in many localities and Putin put a stop on this in the last 11yrs. ) planning does not work, you only left “Yes” people around and no facts are factored in- how can you plan.

3. Human intelligence is acquired not inherent.

Ron is right about conspiracy theories.

“You have a hallucinating Putin believing he is uniting Russia’s former empire – he is not a Genghis Khan”

Ukraine is the hardest one. The rest only have NATO support to stand a chance.

NATO is in a pickle, because it needs Russia’s resources.

Ukraine wasn’t supposed to be this hard, as they laid down when Russia took Crimea.

Also, don’t forget Peak Oil. Putin knows it’s now or never.

“Human intelligence is acquired not inherent”

Human intelligence is largely if not entirely genetic. Yes, the enivronment plays a role, but it is how your genes respond to an environment you don’t control that matters.

That’s why animals with pig genes become pigs and animals with cow genes become cows. Yet they are largely in the same environment, a farm.

That’s exactly what I meant, Putin could not have planned (“calculated”) for the consequences – “Ukraine wasn’t supposed to be this hard” , partially because he did not have all of the intelligence (as in knowledge)

Kengeo, no, you did not misunderstand Westxas, he actually believes that crap. Poor guy, he deserves our pity. 😫

Dennis and Ron (thank you for your pitty), is it really that difficult for you, being energy experts, to see what Russia is playing by dragging this war? Did you ever bother to read European news to see what‘s going on there? The economy in fact is TANKING. But its not Russia‘s.

When this really should become a military conflict and not a slightly hotter wargame, have in mind that Russia until now is only using 10% of its armed forces. And Europe already burned a good part of its arm stocks. Saying this, keep an eye on the next weeks, things could become increasingly serious.

Westtexasfanclub,

For some objective forecasting see table 1 on page 7 at link below

https://www.imf.org/en/Publications/WEO/Issues/2022/07/26/world-economic-outlook-update-july-2022

Russia’s economy is doing much worse than the EU.

As to how the war will go in the future, I am not an expert on war, no idea. Perhaps Russia will do fine supplying India and China rather than Europe with energy, though perhaps India and China will be wary of relying on Russia as a supplier, as they have now proven to be unreliable.

Who owns IMF?

The Secretary of the Treasury serves as the U.S. Governor to the IMF, and the U.S. Executive Director of the IMF is one of 24 directors who exercise voting rights over the strategic direction of the institution. The U.S. is the largest shareholder in the Fund.

So, it might be a bit tainted?

I’m just an elder in Central Oregon.

But, be wary comrades.

Hightrekker,

Then try

https://openknowledge.worldbank.org/handle/10986/37224

there is also an economic outlook from OPEC

https://www.opec.org/opec_web/en/publications/338.htm

In every case the data and forecasts show a very poor economy in Russia relative to the EU in 2022.

If you dispute this back it up.

Hint:

The organizations that make up the World Bank Group are owned by the governments of member nations, which have the ultimate decision-making power within the organizations on all matters, including policy, financial or membership issues.

See any problems here?

I have no insider knowledge, but the University of CA has made me inquisitive.

They could be fine, upstanding policy makers, with no ideology or ambitions.

Unfortunately, they are human.

OPEC?

Surely you must be kidding

EU?

They have done quite well, and I’m a fan.

We will see how this winter unravels, when reality hits.

Hightrekker,

OPEC has no ax to grind with Russia, they are cooperating on oil output and OPEC nations have had very little negative to say about the invasion of Ukraine. Perrhaps it is coincidence that all of these three groups (IMF, World Bank, and OPEC) have similar estimates for 2022 real GDP growth forecasts for the EU and Russia.

It could be a grand conspiracy or it might be an accurate assessment, we will know more in the future.

Dennis, you could be right.

As you stated, we shall see,

Dennis wrote: It could be a grand conspiracy or it might be an accurate assessment, we will know more in the future.

That is a false dichotomy. It doesn’t have to be either one. It could very well be an inaccurate assessment. In fact, the vast majority of future predictions are inaccurate. So that is most likely the case here also.

Ron,

Yes that is correct, any forecast of the future will likely be wrong. It seems when 3 different agencies have similar expectations of the future, they are likely looking at a similar set of facts and reach similar conclusions about what might happen in the future based on history. It is always difficult (impossible really) to accurately predict how the future will unfold.

On that we might agree.

Dennis, what are they smoking at the IMF? Just some quotes from Tuesday focussing on the German economy from the British Express, certainly not a platform for conspiracy theorists:

“The Bundesbank said: “Economic activity may pull back somewhat this quarter and shrink markedly in the autumn and winter months.”

Experts are also sounding the alarm. Carsten Brzeski of the Dutch bank ING recently warned that Germany will need a “miracle” to avoid recession.

As quoted by the Guardian, he said: “It will need an economic miracle for Germany not to fall into recession in the second half of the year.

“The fact that the entire German economic business model is currently up for renovation will also weigh on growth prospects in the coming years.””

While Reuters reports the understandably different Russian view on their own economy:

“Sept 6 (Reuters) – Russia’s economy will post a shallower economic contraction than expected over the coming years and could return to growth on a quarterly basis from as early as the end of 2022, a top government official said on Tuesday.

Economy Minister Maxim Reshetnikov said the government was now forecasting a 2.9% contraction in Russia’s GDP for 2022, Russian news agencies reported – an improvement on its August prediction of a 4.2% annual decline.

The Russian economy is set to return to growth on a quarterly basis in late 2022 or 2023, Reshetnikov said.”

I personally see an even bigger downturn in the German – and European – economy, a real existencial thread, while Russia will just shrug and go ahead.

WestTexas- “When this really should become a military conflict and not a slightly hotter war game, have in mind that Russia until now is only using 10% of its armed forces.”

I, among many others, expected Russia to handle Ukraine easily in the first couple weeks.

It does seem like either they severely underestimated Ukrainian military strength and determination, or severely overestimated their own.

Either way the failure has been very surprising.

Attrition… yes and as I had said at the outset, Putin went in expecting that his people would handle hardship longer than all others. He may be right, especially since he is the head of an autocracy where disagreement with policy or leadership cult is not given a very long leash.

There’s a good several centuries worth of very interesting literature featuring Ukrainians fighting, killing and dying fanatically, and bravely, for their homeland.

https://en.m.wikipedia.org/wiki/The_White_Guard

I’m not sure what victory for Russia was supposed to look like in Ukraine; The Troubles, but the size of France?

https://en.m.wikipedia.org/wiki/The_Troubles

Everything since ’99 is on Putin’s authority.

https://en.m.wikipedia.org/wiki/List_of_wars_involving_Russia

Much of Russias Tier 1 and high speed-low drag Gucci units are decimated. It’s gonna be a multi decade rebuild to get airborne, special ops units and anything with premium combat initiative put back together with experienced officers.

Putin stepped on his dick; reach exceeding grasp, that sorta thing. Real 7D chess shit.

Cue some uppity types in the Caucasus.

Right Hickory, we all misinterpreted some moves and learned two or three things (for example, that for a full scale invasion, they had needed at least three times more soldiers). Russia has been moving so far with the least destructive potential possible, just climbing up the escalation ladder as much as necessary, even now, with the annexation and mobilization. Attrition has alsways been part of the game, like a plan B kicking in automatically when the lower intensity solutions were failing. If this was a baseball game, this weekend we just have entered the third inning. There’s still a long way to go.

Ovi,

Can you test to see if you can post charts in comments? I am having problems for some reason.

Dennis.

Upthread you commented that Venezuela and Iran could help Russia. I took that to mean with upstream technology?

Could you expand on that?

Shallow Sand,

Iran and Venezuela have been under sanctions for a while (as is also the case for Russia, though previously the energy industry was not targeted in Russia to the current degree). My guess is that they have devised creative ways to avoid the sanctions to keep their oil industry going. Perhaps the World can live with 2 Mb/d less crude plus condensate output, my guess is that Russian output may suffer, but I doubt it will crash as quickly as some believe and the level of output will likely drop about half as much as may are predicting.

If I am wrong, we will likely see oil prices rise to $130 to $140 per barrel unless we have a severe Worldwide recession which reduces demand for oil.

Note that if Russia’s output drops by a similar level to Iran’s (about 34% from 3.8 Mb/d to 2.5 Mb/d), then Russia’s output would fall by about 3.7 Mb/d, a tight oil market would become very tight.

One argument against the idea that Russian oil will find a home is why hasn’t this been the case for Iran? Though perhaps the Iranian sanctions has made it impossible for Iran to produce more than 2.5 Mb/d, and perhaps for Russia they might also see their output drop to 66% of their post pandemic high (C plus C output of about 11 Mb/d).

Both Iran and Venezuela are considerably below peak production. Both are believed to have much greater reserves than most other countries in the world.

Sanctions really do matter based upon Iran and Venezuela production data.

If Russian oil production drops as Iran and Venezuela, the world will have a big problem regarding oil supply.

There are allegations that Iran produces and sells more oil than is reported.

Admittedly I know very little about this topic. I was just surprised that you gave Iran and Venezuela as examples of maintaining production in the face of sanctions and/or that these countries could somehow help Russia maintain its production. Venezuela is a failed state and it seems many of its residents are trying to leave. I don’t see how Venezuela could help any country.

Iran doesn’t exactly have a strong economy either, due largely to sanctions it has faced for many years.

Shallow sand,

The idea was that Iran and Venezuela have not doubt tried to devise ways around sanctions, I agree neither nation is doing very well, but I imagine they would try to work with the Russians as they are already under sanctions. Probably would be of little help. It is possible that India and China will also try to help Russia, those would be very large markets for the US and EU to try to sanction, might be shooting ourselves in the foot to do so.

Venezuela is basically a failed state, their production had already fallen quite a lot before sanctions on their oil industry. The government of Venezuela alienated the IOCs and PVDSA did a very poor job reinvesting in the oil industry and was run exceedingly poorly.

Iran does show that sanctions can bite, if we see a similar rate of fall in Russia’s output (34% decrease) the price of oil will be very high. Some experts are predicting about a 19% drop in Russian output by the end of 2023 (about 2.1 Mb/d or 9.9 Mb/d). It is not clear the World will be able to replace that oil and currently the SPR in many nations is being depleted, eventually that will need to stop as it cannot continue when they fall to zero.

We will be back to more than $100/bo unless there is a severe World recession due to tightening of money supply to rein in inflation.

Dennis.

The EIA has some very good information about Iranian oil production, field, etc. Part of it deals with the effects of sanctions.

When sanctions were lifted in 2015, Total entered into an agreement to increase production. Russian firms entered into a separate agreement to increase production. All of those pulled out when sanctions were reinstated in 2018.

Iran clearly has more domestic oil and gas production capability than Venezuela. However it does appear it needs foreign investment and technology to maximize production.

My guess is the same is true for Russia. I’m in the camp that Russian production will slowly decline, but given its large base, even a 3-5% annual drop will be a big deal.

Shallow sand,

You may be right, though Russia may get help from China and might have more ability to manufacture goods than Iran. A 4% annual decline sounds reasonable, that would be about 440 kb/d per year. At some point the situation in Ukraine may get resolved, when that happens nobody knows as well as if sanctions will remain after an armistice is reached.

Russia’s Finance Minister says Russian oil production will fall to 9.5 million barrels per day. Russia’s central bank says that is too optimistic. I agree with Russia’s central bank. I expect Russian oil production to fall to 8.5 million barrels per day by the end of 2023.

Russia’s central bank says oil production goals proposed by the nation’s finance ministry are too optimistic

Russia’s central bank said that new oil price and production goals proposed by the nation’s finance ministry are too optimistic.

In a new budget, the ministry sets the price of Russia’s Urals crude at $60 a barrel and an output of 9.5 million barrels per day.

Why do a few people, though not many for sure, ignore the effects of sanctions on the Russian oil industry? Russia will never return to its glory days of producing over 11 million barrels per day. Once they fall below 9 million barrels per day, and they will, they will never return to that level.

A shift to Asia won’t solve Russia’s economic woes

Russia’s oil and gas industry will not recover. Many of Russia’s most important fields have declining production and were looking at partnerships with major Western oil companies and service providers to introduce new technologies for lateral drilling to extend their lives. Those partnerships have now dissolved. Western technology would also be crucial for the construction of LNG plants capable of turning a meaningful share of the gas Russia used to pipe to Europe into liquids that could be shipped to global markets.

Although Russia already pipes gas to China and has another pipeline under construction, its capacity is only a small share of the gas it used to send to Europe.

Sanction regimes are never watertight, particularly for commodities that account for about two-thirds of Russia’s exports. Russia will continue to earn export revenue. However, the loss of access to Western technology will hobble the development of Russia’s more advanced industries over the medium term.

Test for Dennis

The chart appears in a flash and then disappears.

Thanks Ovi,

I will contact Bluehost.

Ovi and Ron,

Problem with attaching images to comments has been resolved.

BRS Group, a Paris shipowner, has looked pretty hard at the transshipment of Russian oil. They think 220 ships are involved, many of which have long been involved in transshipment of Iranian and Venezuelan oil. The International Maritime Organization is studying this too, but in typical UN fashion will have a report out in 2026–a bit late but highly reflective of a worldwide need to turn a blind eye to a subterfuge that may be necessary to keep the world spinning. At any rate, it is estimated that the transshipment fleet will grow to 400, which would represent about 10% of international tankers. Apparently it is no big deal to “launder” the identity code that is supposed to stay with a ship–any ship–from cradle to grave, no matter which flag it flies. Turning off a transponder or using a laundered Maritime Mobile Service Identity number (a nine-digit number assigned to a particular ship’s radio) is also as common as changing a SIM card.

Just as there are well-recognized transshipment anchorages for Iranian and Venezuelan oil, there are developing anchorages for Russian oil. Malta, Ceuta (the Spanish autonomous city on the Moroccan side of the Strait of Gibraltar), Kalamata off Greece, Kavkaz, and Alexandria. Many Baltic ports yawn at this.

The future is speculative, of course, but the world is clearly experiencing extremes in temperatures and climatic related weather events. Over 8-billion of us need temperature attenuation. No matter the cost of electricity, data storage is growing like a cancer that hogs energy. The population is aging and needs its pharmacy. Automobile bodies–even if powered by lithium-ion batteries–are manufactured by using fossil fuels. Air travel is increasing. Manufacturing runs on electricity from oil and gas. Can the world do without Russian oil? I don’t know. Europe is the test laboratory. If the coming recession is hard enough that the economy tanks, or the winter is severe enough that people suffer mightily or even die, then the answer is no. But then there’s world opinion, morality, ethics, honor among nations.

World opinion isn’t worth much–judging by the lethargic response to these well-identified clandestine anchorage ports and vessels involved in transshipments. Additionally, using the long arm of history, I’m not sure that Russia has violated anyone’s moral standards any more than have many OPEC nations (including KSA), yet no one has much trouble buying from them. Many English and American families became wealthy on the backs of slavery, yet we haven’t asked their descendants for reparations and some of them have even become presidents or senators. Commerce must go on.

The logical question, then, is whether Russian oil should be sanctioned at all. If it is, and by some miracle of maritime divine intervention transshipment is curtailed, then the price of oil will go up dramatically and Putin makes the same amount of money by pumping less oil. More likely, Putin is going to subterfuge the system by transshipment (to China and India, then to Europe) as a wary world diverts its eyes. It’s game on, same way oil has always flowed. It has been said that H.L. Hunt, the world’s richest Baptist, bootlegged oil in the dead of night during the second war. If that is true, it was used–right along with the more Christian daylight oil–to win the war. Like Trump’s tariffs on Chinese steel, which resulted in tariffs on U.S. soybeans, this “moralistic” sanction on Russian oil is going to run smack into the hard, cold reality of practicality.

Gerry Maddoux,

I believe the argument is not that the oil cannot be shipped, it is that the oil cannot be produced without European or North American oil industry expertise and technology. My guess is that despite the clandestine shipments of Iranian oil, the their output has indeed decreased from about 3.8 Mb/d to 2.6 Mb/d due the lack of support from Europe and North America in their oil fields. The same might be true in Russia unless they get help from China or are able to continue to produce by using their own oil experts. I expect there will be some decrease, but perhaps not as much as the Russians are claiming. Russians might be overstating the case to make it difficult to reach consensus in the European Union on how to implement the sanctions.

Dennis

Let me clarify. My discussion of sanctions and Russian production only considered the next six months over which the EIA and IEA forecast a drop of 2 Mb/d. I don’t think that will happen. Beyond six months the expertise and technology impacts will begin to be felt.

Ovi,

See

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/03/Insight-112-Thoughts-on-the-impact-of-foreign-companies-exiting-the-Russian-oil-and-gas-industry.pdf

especially last 3 or 4 pages (of 18 total).

Dennis, that article is dated March 2022. That was after the invasion but before the collapse of Russian oil production. However, that chart on page 17 is a lot older. I know I saw that chart over a year ago. That data is not valid. It was not valid when it was posted in March.

Yes the article was from March 2022. The author tries to predict what may happen to Russian output, read it to put the charts in context. Also read the September MOMR and note their predictions for future Russian output, basically similar to what I predict, a drop of about 1 Mb/d from 2022Q1 to 2023Q4. My guess is 1.2 Mb/d (from 11 Mb/d to 9.8 Mb/d). Note this is a slight revision to my earlier eatimate, high case of -200 kb/d and low case of -2100 kb/d with the average being -1150 kb/d and I round down to -1200 kb/d.

From the conclusion:

This leads to the conclusion that short-term Russian oil production is not at risk from a technical perspective, but the medium-term prospects may be. Figure 7 is reproduced from an analysis in 2019 that compared a forecast of future Russian oil production at the time from the Ministry of Energy with a possible outcome if Russia did not meet key technical challenges in its new fields. The Ministry of Energy forecast was for production to stay flat at 550 million tonnes per annum, equivalent to just over 11 million b/d, while the analysis showed that production from existing fields in production, condensate, and approved new fields could see output fall to around 8.5 million b/d in 2030 if hard-to-recover, offshore, enhanced oil recovery, and other more complex reserves were not developed.

Stability of production over the medium term remains a key Russian government objective, but the risks on the downside would now appear to have increased as the availability of complex software and hardware is limited by the withdrawal of western oil companies and service contractors. Production is probably secure to 2024/25, and domestic and Asian companies and contractors can fill some of the void left by western companies, but as Russian companies need to develop a greater share of remote and complex fields the chance of overall oil production going into decline will increase and picture shown in Figure 7 will become more likely. A collapse in output is not forecast and a short-term decline will be driven more by market forces then technical issues, but the risk of Russian oil production being markedly lower by 2030 has increased as a result of the reaction to the current war in Ukraine.

There is a lot of supporting evidence in the first 15 pages of the paper.

Ron,

Also from

https://www.oxfordenergy.org/publications/oies-oil-monthly-issue-17/

The resilience of Russian production so far and ability of Russian producers to divert large volumes of crude from Europe to other markets have led us to revise down the size of the expected disruptions in Russian oil production by 240,000 b/d to 630,000 b/d in 2022 and by 500,000 b/d to 1.5 mb/d in 2023. On the lower bound, Russian disruptions are expected to reach near the previous high of 900,000 b/d by year-end and peak at 1.2 mb/d in February 2023, to average 1 mb/d for the year. Considering the confirmation by G7 to review and finalize a price cap measure on Russian oil, this month we also consider a high case scenario under which a price cap is hypothetically imposed in early-December and Russia responds by cutting its production by 3 mb/d compared to pre-invasion levels close to 8.1 mb/d. Both high/low Russian disruption scenarios are included in our balance of risks for this month.

Another look at Russia from June (this has Russian output falling by 2.6 Mb/d by the end of 2022.) Note that they have revised their expectations inAugust based on the resilience of Russian output though July.

https://www.oxfordenergy.org/publications/russias-invasion-of-ukraine-and-oil-market-dynamics/

Dennis, this sentence from your post just blows my mind.

Production is probably secure to 2024/25, and domestic and Asian companies and contractors can fill some of the void left by western companies, but as Russian companies need to develop a greater share of remote and complex fields the chance of overall oil production going into decline will increase and picture shown in Figure 7 will become more likely.

Figure 7 was the best case scenario, with no effect from sanctions. And to say that production is secure through 2024/2025 shows they are not living in the real world.

Ron,

There are several forecasts from March, June, and August 2022. The estimates evolve over time as they get new information.

Does anyone know of a website or a spreadsheet that will complete a Hubert linearization for you as long as you provide the data? Thank you so much.

just plot cumulative production on x axis vs ratio of annual to cumulative production.

For an example see spreadsheet linked below using World EIA C plus C data and cumulative World C plus C of 981.2 Gb at the end of 2004.

https://peakoilbarrel.com/wp-content/uploads/2022/09/worldhl4.xls

Same can be done for individual nations etc.

In a previous thread LTO Survivor did not think my Permian scenario with 650 completions at maximum from 2026-2028 was realistic (ridiculous in his opinion). Several scenarios with different maximum rates of completion are presented below, perhaps he thinks all of them are ridiculous. Recent completion rates in the Permian basin have been around 430 to 435 wells per month.

The 650 completion rate scenario uses separate well profiles for the 4 major formations in the Permian (Wolfcamp Midland, Wolfcamp Delaware, Spraberry, and Bonespring) after 2018. The other scenarios use a single well profile for the entire Permian basin.

Hard to know about Russian production. Like you said in your note, “My guess is that . . . Iranian . . . output has indeed decreased,” there’s no way to know.

Lots of out-of-the-way places use sophisticated western oilfield equipment and technology. Kazakhstan, for example. Foreign companies have dumped billions into their Kashagan field; they must have learned something. They don’t want to be invaded and they share borders with China and Russia. I’ll bet they’d put a piece of equipment in the back of a truck and send it over to Russia.

I don’t know. When I first learned of this I thought there goes Russian oil–they can’t cut it without western knowhow. But man, the Russians know machinery, and if the price is right you can always get a replacement part or a guy to solve a problem.

Like I noted, the maritime oversight agency that reports directly to the UN doesn’t seem in a big hurry to make a thing out of oil transshipment, whether it originates from Iran, Venezuela or Russia. I have to believe that that’s due to the reasoning that the world needs the oil. I think Europe is going to get into big trouble, if not this winter, then at some point. The name of this blog is still peak oil, right? Well, if we’re nearing peak oil (which most people seem to roughly agree about), and knowing that life was rough as a cob before electricity (life expectancy 46), and then running up against the realization that renewables aren’t going to run manufacturing, serve as feedstock for manufacture of hundreds of thousands of things, including ammonium nitrate fertilizer responsible for food production, then I figure the world is going to be quick enough to supply expertise and spare parts to Russian oil endeavors.

Putin is an evil son of a bitch, no doubts about it. But I have to wonder which population has suffered the greatest humanitarian insult, the Uyghurs under Xi or the Ukrainians because of Putin. Last I checked, China still made about 95% of the precursors that go into pharmaceuticals for the world, and put together our iPhones. If the world becomes overly moralistic about commerce, well then, commerce will stop. Of course, I grew up thinking that nationalism was bad and the way to hold the world together was through trade. I still feel that way. As Lyndon Johnson said, don’t spit in the soup, we all gotta eat.

Gerry,

I agree difficult to predict what will happen.

Russia’s surging oil exports to China in August fail to keep Saudis down

* August Russian crude imports 1.96 mln bpd, 28% yr/yr

* August Saudi crude imports nearly 2 mln bpd, 5% yr/yr

* Imports from Malaysia doubled to record 794,000 bpd

* Imports from Angola, Brazil hit

SINGAPORE, Sept 20 (Reuters) – China’s crude oil imports from Russia in August surged 28% from a year earlier, official data showed on Tuesday, but it handed back its top supplier ranking to Saudi Arabia for the first time in four months.

Imports of Russian oil, including supplies pumped via the East Siberia Pacific Ocean pipeline and seaborne shipments from Russia’s European and Far Eastern ports, totalled 8.342 million tonnes, data from the Chinese General Administration of Customs showed.

Russian imports rose as Chinese independent refiners extended purchases of discounted Russian supplies that elbowed out rival cargoes from West Africa and Brazil.

Emma Li, China analyst with Vortexa Analytics, said actual Russian supplies are likely on par with Saudi shipments at close to 8.5 million tonnes. Several cargoes of Russian Urals crude were reported as originating in Malaysia, according to ship-tracking data she has compiled.

https://www.reuters.com/world/middle-east/russias-surging-oil-exports-china-aug-fail-keep-saudis-down-data-2022-09-20/

Getting around sanctions will be an increasing business for the next year. The table shows imports by country into China. Look at the big increase from Malaysia. Iraq, Angola, Brazil and Oman are all negative. They can now find new buyers in Europe.

https://market-ticker.org/akcs-www?post=246994

+75 – 100 bips

When do those shale companies roll over their debt?

And if those Shale Companies don’t want to roll over to higher interest rates..

They can pay it all back from their cash reserves as it matures!!!

https://www.oilystuffblog.com/forumstuff/forum-stuff/whazzup-in-west-texas

I am huge fan of Mike Shellman’s work. Just like I am huge fan of Dennis, Ron, Ovi and the Peak Oil crew.

I am a believer that as historians, eating their acorns, reflect on Peak Oil…

The value of these sites will grow..

The comments section of this post deserves another look.

@PeterDuprey absolutely demolishes Harold Hamm

Peak Avocado,

I am also a fan of Mike Shellman. Interesting that he seems to now agree that a lot of tight oil in the Permian basin is quite profitable to produce at current oil prices. Novi labs has a piece that shows tight oil well productivity over time normalized for lateral length at 12 months at link below

https://novilabs.com/blog/can-unconventional-well-productivity-predict-peak-oil-production/

Chart below is from that piece. Based on this chart the decrease in well productivity that many of us expect in the future is not yet evident. In my view the basinwide average is more important than results from individual operators or individual counties. For those not aware, Novilabs bought shaleprofile.com so the data from shaleprofile is now found at Novilabs. See for example the following Permian update by Enno Peters

https://novilabs.com/blog/permian-update-through-may-2022/

To be fair and to keep the dialogue light, Harold Hamm did have a billion-dollar divorce settlement check to write. I suspect that he was more afraid of the former Mrs. Hamm than of Mr. Duprey.

And not to take sides (because I too admire Mr.Shellman), but to ask a serious question, what would be the status of the world today if shale oil had not made its contribution? Seriously.

As an American who lived through the Saudi oil embargo, I can easily envision OPEC using oil supply as a cudgel. Perhaps the deal that President Roosevelt hammered out with the old king in 1945 while sitting on board a ship in the Bitter Lake area of the Suez Canal (modern equipment and protection in exchange for “favored nation customer” status) would have protected us. But maybe not. Perhaps we’d be paying $200/bll for oil (or invading another country that hadn’t actually done anything to us).

No matter when we reach the end of oil, the oil coaxed out of tombstone rock has helped delay that dreaded time for a good ten to fifteen years. And to be perfectly honest, shale basins haven’t been hyped much more than any other oilfield that I’m aware of. Nor has shale been more corrupt. Dad Joiner hyped the hell out of the east Texas field. Too many subscriptions were sold. Slant drilling took oil out from under another man’s land–a few people did jail time. Corrupt stuff goes on all the time in any oilfield.

I’m not a big fan of shale oil. I’m not even sure we should be doing it, mainly because the process removes prodigious amounts of fresh water from the planetary water life cycle and the wastewater is forever sequestered away in an expensive disposal well. Secondly, the amount of methane gas vented and flared by shale wells that outstripped pipeline takeaway would measure in the billions (or trillions?) of BTU, and methane (CH4) has a greenhouse gas number that is 19 times that of CO2.

However, I am a believer that we’ve actually seen peak oil and that it’s now like a roll of toilet paper: the closer you get to the end the faster it disappears. In other words, I strongly suspect that shale oil and Saudi oil are going to Peter out at just about the same time. And because oil is a commodity priced by an inelastic algorithm, we’ll pay up for those last few barrels. At that point, I imagine that Mr. Putin’s sins will rapidly be overlooked and Europe will once again be vying for Siberian oil and gas.

“but to ask a serious question, what would be the status of the world today if shale oil had not made its contribution? Seriously.”

A few observations on this

-Most countries would be deep into petrol rationing by now.

-The price of nat gas in the US would be at higher levels than was the case before before fracking- well over the prior $14/ MBtu seen in 2007. Probably closer to $20, or higher, and there would be no exportation of LNG from the USA.

-The great Terminal Deforestation Event [TDE] would have begun by now in most countries.

https://www.bnnbloomberg.ca/video/supply-won-t-rebound-as-fast-as-demand-mike-rothman-on-oil-markets~2366296

Mike Rothman from Cornerstone Analytics

Vitol’s Muller on Russia’s 7+ mmbd Oil/Products Exports “It is Impossible, Let Me Repeat, It is Impossible for the World to Get By Without All of That”

September 4, 2022

On oil exports from Russia- ““It is Impossible, Let Me Repeat, It is Impossible for the World to Get By Without All of That”

That can mean different things, such as it is impossible

-to continue with the assumption of perpetual growth in oil supply, and therefore global economic growth and the wide distribution of prosperity

-to continue on with perpetual internal combustion engine economy transport on land sea and air

-to assume that economically fragile states will avoid a severe collapse in economic and political function (failed state status) when they can no longer afford oil for general purposes