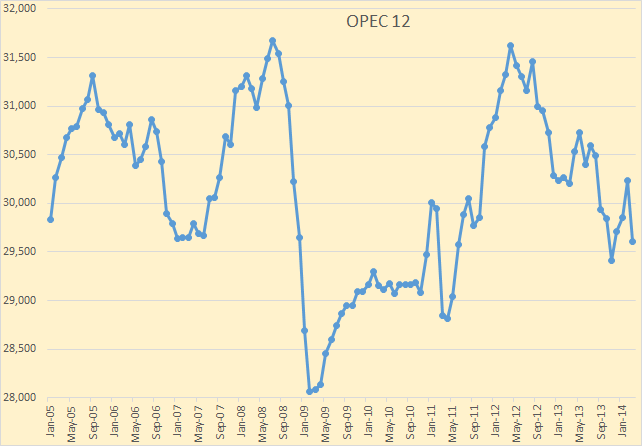

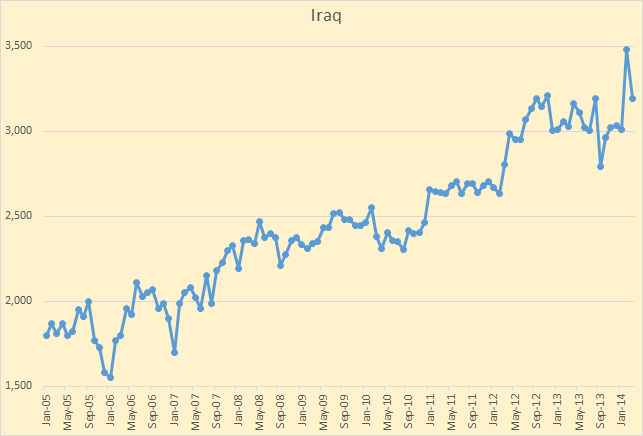

The new Opec Monthly Oil Market Report is out with the March OPEC crude only production data. OPEC crude only fell by 626 kb/d and that was after February production was revised up by 121 kb/d. Big changes were Iraq, down 288 kb/d after February was revised up by 84 kb/d. Angola was down 154 kb/d.

Iraq is back to the same levels it reached in September of 2012. But Iraq is scheduled to increase production. West Qurna-2 is starting to ramp up. It is supposed to be producing 400 kb/d by the end of the year. I really doubt that it will get to those levels by then but it will definitely add to Iraqi production.

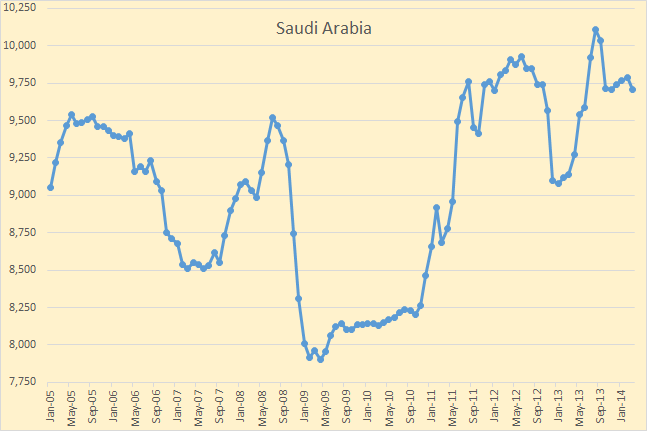

Saudi Arabia was down 81 kb/d but that was after February production had been revised up by 165 kb/d. Saudi Arabia production has been pretty flat for the last for the last six months. They are currently producing 9,709 kb/d, that is 401 kb/d below their peak last august.

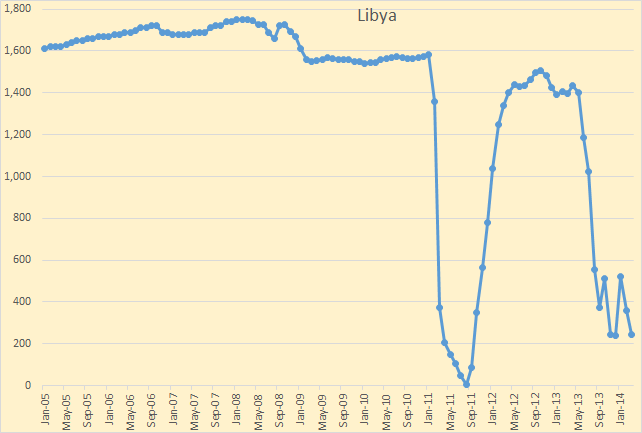

Libya was down 118 kb/d after February had been revised down by 98 kb/d.

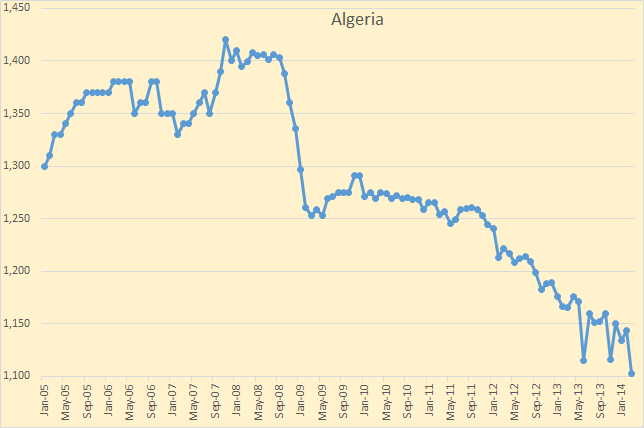

Algeria is obviously in steep decline. Algeria produces a lot of condensate so the EIA report of Algeria production is quite a bit above the OPEC MOMR reported Algeria production.

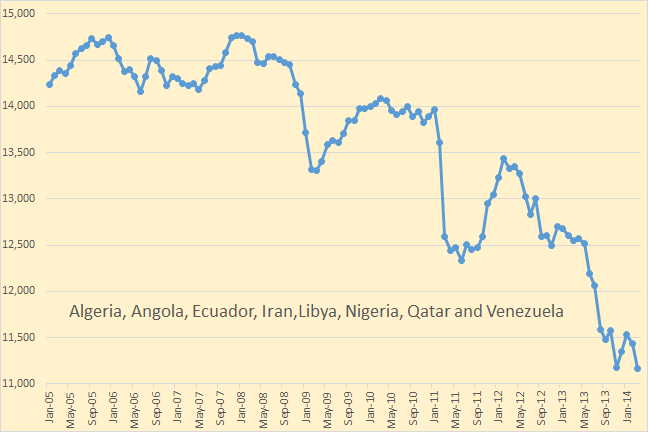

Of course Algeria is one of the Eight OPEC losers. They all have been losing production while Saudi, Kuwait, UAE and Iraq have been increasing production. Yet some in the MSM actually believe these eight have spare capacity. That is a joke in my opinion.

The page OPEC Charts has been updated with the charts of all 12 OPEC nations.

Ron, this side of the pond focus is on Russia and Ukraine. A few of my recent posts…

Ukrainian Death Spiral

Turkey – on its way to a mature economy

The Fantasy of European Gas Independence

I still wonder if and where Iraqi Kurdistan production is being recorded.

Pretty big Iraqi election April 30.

A deal will be announced in that timeframe.

And it will then fall apart.

Oh sorry left out the number.

Iraqi Kurds are pumping 200K/day thru Turkey as of now. Fully counted as best anyone knows.

Yes, but is that production being allocated to Iraq? If you deduct 200 kbpd from the Iraqi numbers then production there remains flat for the last year.

The fight is the Kurds produce and the money goes to Baghdad, and then allocates a flow back to the autonomous region out of the national budget. The Baghdad govt is unhappy that the Kurds often do not hit their production quota but demand that same budget allocation. The Kurds don’t like sending money from THEIR oil to Baghdad and then have the govt not send the agreed upon allocation.

There is no Kurds category of production that I know of so . . .gotta be Iraq?

One thing that Ukraine has going for it is arable land, some of the best in the word. For some reason Ukraine has been unable to translate food production into GDP. On the other hand, post peak they may become the envy of the world.

Why?

Cattle become oxen and pull harvesters. They are less effective oxen and require more food than they used to be 200 yrs ago. Used to be 1 acre of hay for every 2 acres of human food in order to get them thru the winter. Now it would be 1:1.

How do they ship that food?

Are they using potash? Is the land what it was 80 years ago? Is the climate what it was 80 yrs ago (i.e. enough rain?) Irrigation is oil powered.

Ron, here’s a question — at what point is a barrel of oil counted in production? Is it when it comes out of the ground or at some later point?

It is counted as production when it is reported by the oil company to the government as being produced. Sometimes the companies are late reporting their production. That is why we have revisions. That is the case for non-OPEC nations anyway.

Of course OPEC production is a whole different story. OPEC production is estimated by independent reporting agencies such as Platts, BP or whomever. They all take a wild ass guess at what OPEC each OPEC nation is producing and report that. There is some science behind their guesses however as they count tankers and import data from non-OPEC nations. But they still must guess as they don’t know for sure what each nation consumes internally.

OPEC nations fall, occasionally, fall under a quota. Though that quota is often a joke like right now when OPEC just says they want to “cap” production at 30 million barrels per day but tells no one what their share of that 30 million really is.

So until recently no OPEC nation reported their production numbers to anyone. But about a year ago the OPEC MOMR started calling each OPEC producer and asking them what they produced this past month. Then of course they all lie. That’t why the OPEC MOMR publishes two sets of production numbers, numbers gathered from “secondary sources” and numbers from “direct communication”. Amazingly the “direct communication” numbers are usually way higher than the “secondary sources” numbers. They want to brag about their production ability way more than they fear overshooting their share of the 30 million barrel quota.

That, of course, is why the term “production capacity” is a joke. They are all producing flat out and bragging that they are producing even more than they actually are.

The reason I asked is that I observed the big jump and subsequent fall back in Iraq production and wondered if that jump was oil being released from storage once transmission became available. In other words, the big jump was the result of oil that had been extracted from the ground some time earlier and was only counted as production once sent off to the oil terminal. If so, then the current rate of production is probably a better indication of what they can sustainably produce at this time and is certainly in line with what they have been producing for the last year.

One thing is crystal clear — OPEC is in decline. There is no way that any of them is producing less than they could. That is not to say that KSA couldn’t produce more for a limited period of time — I think they could, but the result would be to potentially damage their aging fields by pushing them too hard. I don’t think we will see KSA raise production at the risk of that damage.

So, where’s the good news? Manifa isn’t a game changer. West Qurna 2 won’t be a game changer. And those are the two best hopes at present, I believe. (Kashagan is a joke, LTO was never a game changer on the world level). Perhaps the only good news is that you will be able to say “I told you so”.

Fracking has made the U.S. “the envy of the world”

Fracking has transformed the U.S. energy industry. One hundred new wells are drilled daily, creating so much supply that the U.S. is now the single largest producer of oil and gas combined, according to Russell Gold, author of The Boom: How Fracking Ignited the American Energy Revolution and Changed the World. He tells The Daily Ticker that fracking…”has redrawn the global energy landscape.”…

Bottom line, says Gold, fracking is “creating jobs.” North Dakota, home to the Bakken Formation, has the lowest unemployment rate in the country at 2.6%.

“We’re the envy of the world,” Gold adds. “Europe would love to have the energy prices that we do.”

Once the people in the industry get their way on exporting gas the Europeans will get it at the same price we do, after allowing for the cost of transportation across the pond.Unfortunately for us as American consumers that price will be the very high world price minus transportation costs if we are lucky.

Of course there is always a possibility that we will not allow any significant amount of gas or oil to be exported so as to maintain a partisan advantage for whichever politicians are able to stop or slow exports.

Insofar as oil is concerned we will be extraordinarily lucky if we are able to ramp up tar sands and tight oil fast enough to continue to offset the decline of conventional production.

Has it ever occurred to you that all the supposed oil we are supposedly ” drowning in” or ”awash in” has not resulted in any decline in the price of oil on world markets even though we are importing much less than formerly?

There are two explanations. If the world economy were strong and and production flat prices should be going up.They aren’t.

A weak world economy should be pushing prices down if production were constant or rising.

It seems pretty clear to me at least that our increasing domestic production with consequently lower imports is allowing our former imported oil to make up for declining production elsewhere.

Otherwise prices would be falling on the world market.They aren’t.

Rust and depletion never sleep —oil banker Matt Simons.

The last time I checked those hundred new wells per day are depleting so fast that it takes seventy-five of them to hold production flat from one month to the next.

Why don’t you post the number of wells drilled every day in countries such as Saudi Arabia which produces about as much oil as we do?

Insofar as oil is concerned the Europeans are actually getting it about the same price we do taken all around except for the fact of a lot of Canadian production being landlocked out of the world market – for now. That won’t last. But the oil we import from Mexico and Venezuela and other places we pay the world price same as every body else.

Europeans can buy a barrel of Suadi crude for the same price we do. The difference is taxes.

The ENI guy says no LNG from the US is going to Europe in any forseeable future.

Russia will always be able to undercut the price. They will inform the boards of this. The LNG plant won’t get built.

I don’t think there will be any NatGas availble for export anyway:

http://www.weather.com/news/science/environment/flurry-coal-power-plant-shutdowns-expected-2016-20140220

http://johnhanger.blogspot.com/2012/03/wsj-reports-258-natural-gas-plants.html

Although, not all these new NatGas plants maye get built:

http://www.post-gazette.com/news/state/2012/11/24/Gas-fired-plants-planned-as-coal-facilities-retired/stories/201211240204

Power companies will be forced to decommission coal plants and replace them with NatGas Plants. But I have no doubt we will see electricity prices double to quadruple over the next 5 years, to pay for the new plants and as NatGas demand will out pace cheap supplies. Any bets that NatGas prices will breach double digits again this summer?

The article says, if you dig into the numbers, about 20% of coal fired gigawatts will shut down . . . and thereafter no further reduction, in fact, coal plants will then resume growth as nat gas prices rise.

20% is not much if it’s going to head back up.

Hi Watcher,

Aren’t their claims that in the US new wind is cheaper than new coal? You are no doubt skeptical of such claims, if coal plants are forced to burn cleanly (as clean as technologically possible, holding aside carbon emissions), they are pretty expensive.

You may claim that clean air standards will be ignored to keep electricity prices low. Where I live electricity is about 16 cents per kilowatt hour (without time of use).

Higher electricity prices may lead to more use of smart meters and people shifting there electricity use to lower use periods to save money.

When natural gas prices go up, a lot more wind power will be built.

“The article says, if you dig into the numbers, about 20% of coal fired gigawatts will shut down . . . and thereafter no further reduction, in fact, coal plants will then resume growth as nat gas prices rise.”

They can’t build any new plants. The new regulations for Power plants is limited to 1100 lb of CO2 per MW. Coal plants emit about 1700 lb, and NatGas is 1000 lb CO2. There is no way Coal fire plants can meet that target.

http://thinkprogress.org/climate/2014/01/09/3139921/epa-carbon-rule-power-plants/

Basically by 2024, all US coal fired plants will need to be shutdown (about 43% of all US electricity production) with the pending rule changes. None of the current Coal fire plants will or can meet the newer regulations, or would simply be too costly.

Never happen.

I tend to agree with Tech Guy about electricity prices increases although I don’t think they will go up much over ten percent a year because the politicians will cut the coal fired generating industry some slack to tone down the outrage and keep from getting voted out of office.

I will bet my often mentioned last can of beans that Watcher is right about the gas fired targets not being met.

There just doesn’t seem to be any way to ramp up wind and solar fast enough and I don’t think the gas will be avail able at a price the consumer will pay without successful rebellion at the ballot box.

My own personal guess is that we will be burning a good bit of coal for domestic electricity two or three decades from now and doing it without ccs.

Most of the world will be burning as much coal as can be paid for or bought on the never never.

The Democrats are already on track to lose a Senate seat in West Virginia because of coal hatred.

This comes back to how you measure boomage. You don’t measure it with BTUs, or watts. You measure it with jobs. Coal is a lot of jobs and they don’t end when the coal plant is built.

They also vote.

Already happening:

http://www.sourcewatch.org/index.php/Coal_plant_retirements

RBOB Gasoline now above 3.00 USd/gal. This should translate into higher pump prices in the near future.

http://portal.ransquawk.com/headlines/north-dakota-regulator-says-expects-to-hit-1mln-bpd-in-oil-production-in-march-april-despite-winter-slowdown-11-04-2014