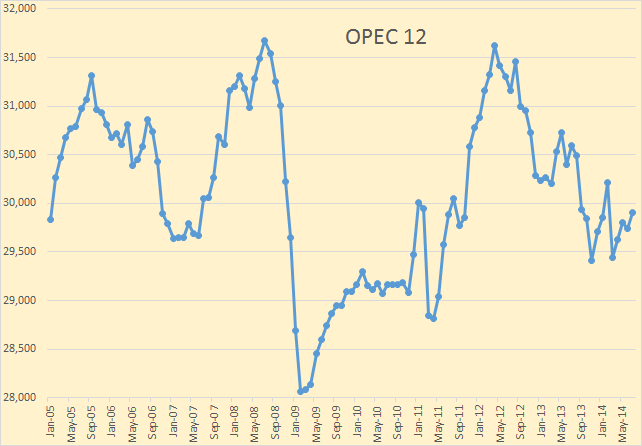

The August OPEC Monthly Oil Market Report is out with the OPEC production numbers for July 2014. There were no big surprises and only small revisions in the June data.

The OPEC 12 was up 166,000 barrels per day. The increase was due to some Libyan oil coming back on line.

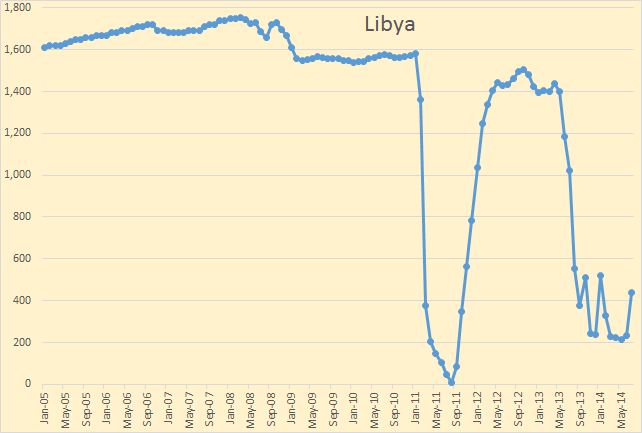

Libyan crude only was up 206 kbd to 438 kbd. Libya was up and down all the month of July and is now down again. From the Wall Street Journal: Risks Remain to Libya’s Oil Supply Despite Reopening of Ports, Fields Behind a pay wall but accessible via Google.

Following an end to protests by a local ethnic group at the country’s largest oil field, called Sharara, Libya’s oil production surged to a five-month high in mid-July to about 600,000 barrels a day—one third of which came from Sharara…

A week after the fighting broke out Libya’s state-owned National Oil Co. acknowledged the country’s output had fallen back by around 100,000 barrels a day.

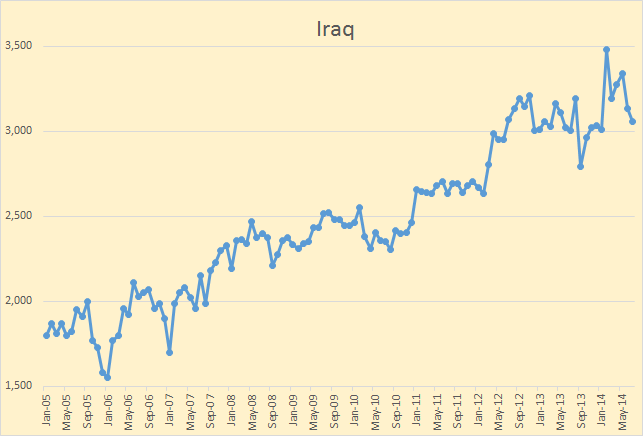

Iraq is right back where it has been for the past two years, dropping to 3,058 kbd. Going in the wrong direction since hitting a new all time high of 3,477 kbd in February.

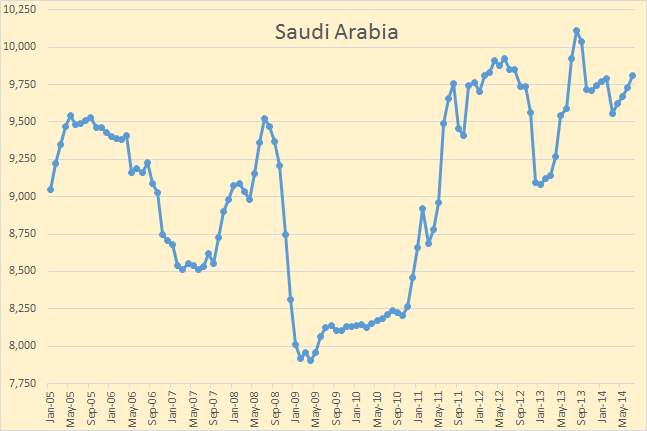

Saudi Arabia is not doing much of anything, moving sideways for the past 10 months. Saudi’s crude only production now stands at 9,813 kd/d.

Updated charts of all 12 OPEC nations can be found on the OPEC Charts page.

OPEC came out with their Annual Statistical Bulletin a few weeks ago. Here are a few stats and charts from that report.

Proven reserves below are in million barrels. (Add 6 zeros to all numbers.)

| Proven Reserves | 2013 | Drilling Rigs | 2013 |

| N. America | 37,893 | N. America | 2,143 |

| Canada | 4,893 | Canada | 372 |

| USA | 33,000 | USA | 1,771 |

| Latin America | 338,289 | Latin Amer. | 550 |

| Argentina | 2,820 | Argentina | 94 |

| Brazil | 13,219 | Bolivia | 11 |

| Colombia | 2,377 | Brazil | 54 |

| Ecuador | 8,832 | Colombia | 45 |

| Mexico | 10,070 | Ecuador | 50 |

| Venezuela | 298,350 | Mexico | 98 |

| Others | 2,621 | Trinidad & Tobago | 3 |

| E. Europe & Eurasia | 119,877 | Venezuela | 186 |

| Azerbaijan | 7,000 | Others | 9 |

| Belarus | 198 | E. Europe & Eurasia | 410 |

| Kazakhstan | 30,000 | Azerbaijan | 14 |

| Russia | 80,000 | Kazakhstan | 59 |

| Turkmenistan | 600 | Poland | 12 |

| Ukraine | 395 | Romania | 12 |

| Uzbekistan | 594 | Russia | 304 |

| Others | 1,090 | Turkmenistan | 9 |

| W. Europe | 12,267 | Others | 0 |

| Denmark | 805 | W. Europe | 126 |

| Norway | 5,825 | Germany | 4 |

| UK | 2,979 | Italy | 4 |

| Others | 2,658 | Netherlands | 5 |

| Middle East | 803,182 | Norway | 14 |

| Iran | 157,800 | UK | 12 |

| Iraq | 144,211 | Others | 87 |

| Kuwait | 101,500 | Middle East | 553 |

| Oman | 5,500 | Iran | 138 |

| Qatar | 25,244 | Iraq | 83 |

| Saudi Arabia | 265,789 | Kuwait | 49 |

| Syria | 2,500 | Oman | 65 |

| UAE | 97,800 | Qatar | 5 |

| Others | 2,838 | Saudi Arabia | 148 |

| Africa | 128,149 | Syrai | 22 |

| Algeria | 12,200 | UAE | 30 |

| Angola | 9,011 | Yemen | 6 |

| Egypt | 4,400 | Others | 7 |

| Gabon | 2,000 | Africa | 265 |

| Libya | 48,363 | Algeria | 49 |

| Nigeria | 37,070 | Angola | 28 |

| Sudans | 5,000 | Egypt | 52 |

| Others | 10,105 | Gabon | 6 |

| Asia & Pac. | 50,208 | Libya | 31 |

| Brunei | 1,100 | Nigeria | 59 |

| China | 24,428 | Others | 40 |

| India | 5,654 | Asia & Pa. | 1,076 |

| Indonesia | 3,590 | Australia | 18 |

| Malaysia | 5,850 | China | 827 |

| Vietnam | 4,400 | India | 121 |

| Australia | 3,872 | Indonesia | 38 |

| Others | 1,314 | Malaysia | 12 |

| Total World | 1,489,865 | New | 8 |

| OPEC | 1,206,170 | Pakistan | 21 |

| Non-OPEC | 283,695 | Others | 31 |

| % OPEC | 81 | Total | 5,123 |

| OECD | 64,448 | OPEC | 856 |

| . | . | Non-OPEC | 4,267 |

| . | . | % OPEC | 16.7 |

| . | . | OECD | 2,364 |

Saudi Arabia drilling rigs were 98 in 2010 and 148 in 2013, an increase of 50.

All so-called “proven” reserves should be taken with a grain of salt. They are just guesses at best and blatant lies at worst. Proven reserves, because they are mostly fiction, cannot and should not be used as any kind of indication of any nation’s future production potential.

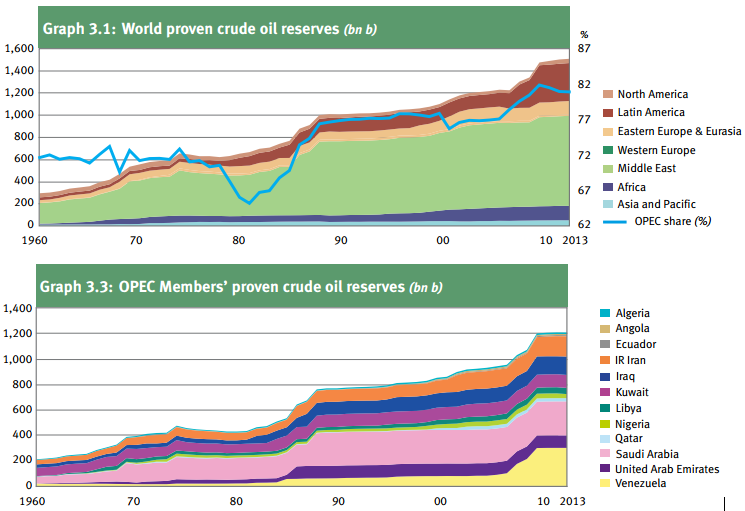

The above charts make my case. Discoveries peaked in the 1960’s and have been falling ever since. Yet proven reserves have grown by leaps and bounds since then with less and less oil being found every year.

The above charts make my case. Discoveries peaked in the 1960’s and have been falling ever since. Yet proven reserves have grown by leaps and bounds since then with less and less oil being found every year.

OPEC chose to include the Venezuela Bitumen in as part of world proven reserves but not the Canadian Tar Sands. This only proves that they select what they wish to count or not to count.

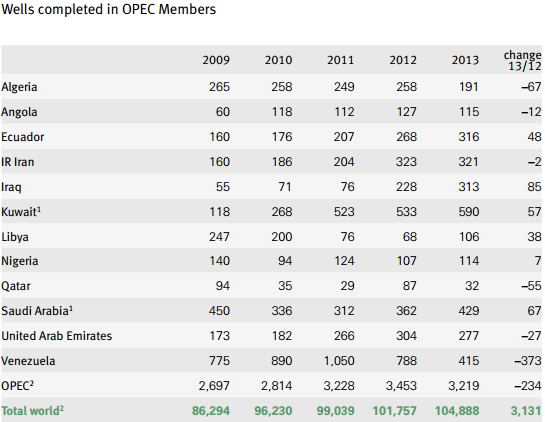

This is OPEC new wells completed by year. Kuwait had the most last year. “Project Kuwait” which had been on the books for over a decade finally got underway in earnest in 2010. It is interesting to note that Venezuela, last year, completed way less than half the wells they completed in 2011.

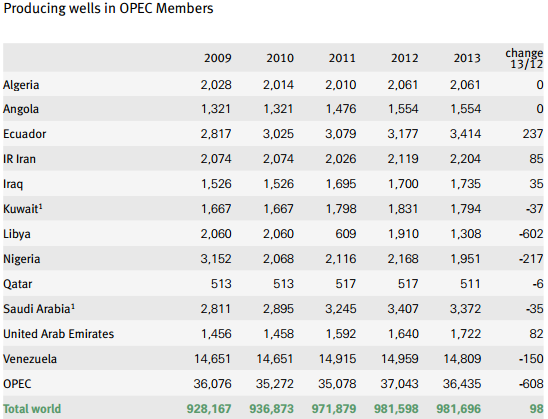

Venezuela has by far the most producing wells and Ecuador, OPEC’s smallest producer, has the second most producing wells. Saudi comes in a close third.

This is cumulative production of all OPEC countries in thousand barrels. Between 2000 and 2013 Saudi produced 41.6 billion barrels and their proven reserves increased slightly. OPEC Middle East nations have magic oil. For every barrel they pump out of the ground another magically takes its place.

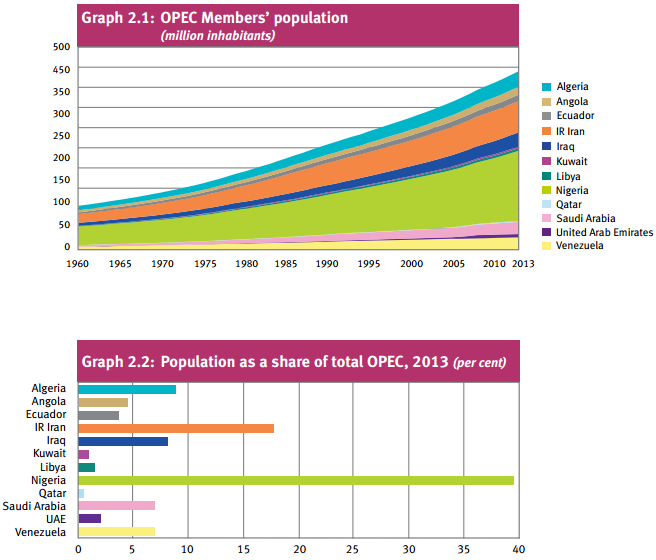

Combined OPEC nations have a population of 438 million. Algeria 38.3 million, Angola 19.2 million, Ecuador 15.8 million, Iran 77.1 million, Iraq 35.1 million, Kuwait 4 million, Libya 6.3 million, Nigeria 172.3 million, Qatar 2 million, Saudi 30 million, UAE 8.5 million and Venezuela 30 million.

Combined OPEC nations have a population of 438 million. Algeria 38.3 million, Angola 19.2 million, Ecuador 15.8 million, Iran 77.1 million, Iraq 35.1 million, Kuwait 4 million, Libya 6.3 million, Nigeria 172.3 million, Qatar 2 million, Saudi 30 million, UAE 8.5 million and Venezuela 30 million.

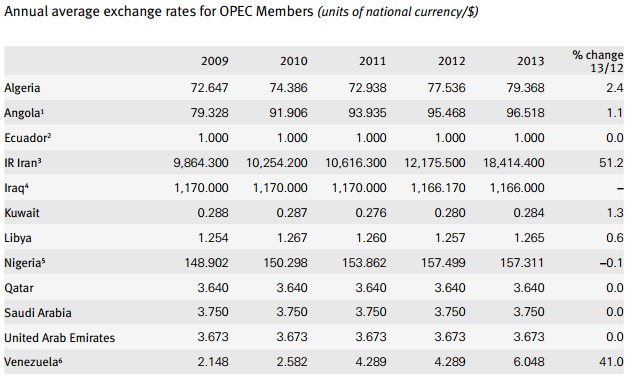

And lastly the exchange rate versus the US dollar. We can see that Iran has a runaway inflation rate as does Venezuela. Qatar, Saudi Arabia and the UAE have their currencies pegged to the dollar and Ecuador does not bother with any pegs, they just use the US dollar as their national currency. In 2000, in order to stabilize the economy, the Ecuadorian government voted to adopt the U.S. dollar as the official currency.

I post an email list that I send to folks when I publish a new post. If you would like to be on that notification list post me at DarwinianOne at Gmail.com.

The EIA has posted their preliminary consumption numbers:

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=5&aid=2&cid=regions&syid=2005&eyid=2013&unit=TBPD

Based on prior years, there will be ongoing revisions. In any case, no surprises so far.

Saudi net oil exports fell from 8.9 mbpd in 2012 to 8.7 mbpd in 2013 (total petroleum liquids + other liquids), versus 9.1 mbpd in 2005.

Russian net exports remained flat at 7.2 mbpd. Russian net exports have been at or below 7.2 mbpd since 2007.

I first introduced the Export Land Model (ELM) concept, as a way to understand explain “Net Export Math,” in early 2006, focusing on the top three net oil exporters at the time, Saudi Arabia, Russia and Norway, and I suggested (in January, 2006) that “These factors could interact this year produce to an unprecedented–and probably permanent–net oil export crisis.”

Saudi and Russian production has been higher than I anticipated, but as noted Saudi net oil exports have been below their 2005 rate for eight straight years, while Russian net oil exports stopped increasing in 2007. Combined net exports from Saudi Arabia, Russia and Norway fell from 18.6 mbpd in 2005 to 17.5 mbpd in 2013–versus the very rapid combined rate of increase that they showed from 2002 to 2005.

Media phrasing has become a little odd with respect to Libya.

They still call it “geopolitical supply risk”. Operative word risk.

It’s not a risk when it’s already happened. A risk is a probability of a negative occurrence — the potential of losing something of value.

It’s already lost. That’s not a risk. That’s just loss of supply.

The two countries that catch my attention are from the table of wells producing.

Kuwait and Qatar. They have no above ground constraints on drilling, but they still have a reduction in wells producing — though only from 2012 to 2013. That number rose 2011 to 2012.

And for amusement we see Iran increased its wells producing the past two years, and increased wells completed by over 100 over the past two years — all this amid “choking sanctions”. That’s funny. There are vested EU and US interests in sanctions being effective. If they aren’t, the reaction is . . . no, yes they are.

Watcher,

I have a friend, petroleum engineer, who works in Kuwait from time-to-time. Apparently any reduced number of producing well would likely stem from outside edges of fields becoming exhausted leaving production concentrated from the more central core anticline regions. Something similar could be happening in Oman.

Doug

Hmmm. Well, down is down. Ron’s OPEC charts page shows Kuwait in output decline, along with fewer wells producing. Down about 75K bpd over the past year. About 2.6%.

Qatar down 1.6% over the same period, but they took an 8% drop in the first quarter of 2012. One wonders what hit then because they have not recovered. The decline has continued.

This decline in drilling and wells producing there is attention getting.

A DEBATE CHALLENGE,

While this is a bit off topic, I believe it’s an important subject to debate. Why, because it has to do in part with controlling natural resources such as oil and gas.

Ron and I had a small exchange at the end of the last post on the subject of Putin and Russia. I believe Americans have been misinformed by the corporate controlled media. In my understanding, this is not conspiracy but fact.

Which is why I PRESENT A CHALLENGE to some of the readers here. Paul Craig Roberts who was the ex-secretary of the Treasure during the Reagan’s Administration, has been outspoken about what is taking place in the U.S. economy and foreign policy.

I have listened to more than 2 dozen of his interviews and deem Paul Craig Roberts to be very intelligent, even-keel and honest. Roberts (as well as many other individuals) paints a much different picture of what is currently taking place than most Americans who receive their information from CNN, CNBC, FOX, MSN and etc.

Here is Paul Craig Roberts most recent interview about Ukraine and Russia:

http://kkrn.org/broadcasts/view/590

You can also read or listen to more of what Paul Craig Roberts has to say at his site: http://www.paulcraigroberts.org/

Anyone in this blog that spends some time listening to Roberts interviews…. it would be interesting to see if I am OFF BASE here. It would be interesting to hear comments on this topic.

steve

Steve, Paul Craig Roberts is a 9/11 truther. Paul Craig Roberts: Truther as Patriot

Roberts became convinced that the United States government was implicated in the attacks and that the government and media were involved in a massive cover-up.

Got that, Roberts not only believes the US government was responsible for the 9/11 attacks but also that the media was involved in a massive cover-up of what really happened.

He is a conspiracy theory nutcase of the first order. He thinks the whole 9/11 thing was planned and carried out by Washington. He also thinks the government in Kiev is entirely controlled by Washington. He is a nut case first class.

No, I will not debate a truther or any other conspiracy theorists. I have no patience with conspiracy theorists. Sorry.

Why Rational People Buy Into Conspiracy Theories

“The best predictor of belief in a conspiracy theory is belief in other conspiracy theories,” says Viren Swami, a psychology professor who studies conspiracy belief at the University of Westminster in England. Psychologists say that’s because a conspiracy theory isn’t so much a response to a single event as it is an expression of an overarching worldview.

Notice: This is not a conspiracy theory website. If you have a conspiracy theory, be it 9/11, the Kennedy assassination or whatever, this is not the place to argue your case. There are hundreds of conspiracy theory web sites, take it to one of them.

“He also thinks the government in Kiev is entirely controlled by Washington”

It’s guided by Washington. Controlled by local oligarchs. I live in a country bordering on Ukraine and I can assure you there’s nothing “conspirational” about the machinations of the US government in Ukraine and elsewhere. The history of US involvement in various government removals and coups throughout the 20the century all over the world is well documented, I’m not sure why that should be even up to a debate.

As to the Crimea, do you have any idea about its history? Do you even know what the Crimea and Sevastopol are? How many wars have been fought for it and how much is it worth to Russia? The threat of the Crimea (which should never have been part of Ukraine in the first place) becoming part of NATO and the eventual expiration of the Sevastopol lease was pure geopolitical madness by the US administration and Russia’s response after the illegitimate ukrainian coup was the only logical reaction. Ronald Reagan must be turning in his grave over such stupidity, he would have never allowed it to get this far (and neither would Bush Sr., but in the recent years it seems that the US foreign policy is being controlled by kindergartners).

Strummer,

I appreciate your insight.

Steve

Kiev was the original capital of the Russian State.

The Rurik Dynasty ( http://en.wikipedia.org/wiki/Rurik_dynasty ) was founded in Kiev when Moscow was still a hunting camp.

Hello Ron,

Next time you have a conversation with someone who blows you off for being a nutcase about Peak Oil and Finite Resources. Remember this:

“No, I will not debate a truther or any other conspiracy theorists. I have no patience with conspiracy theorists. Sorry.”

Hello Dots. Peak oil is not a conspiracy theory.

Conspiracy Theory: a theory that explains an event or set of circumstances as the result of a secret plot by usually powerful conspirators.

But if someone does argue that Peak Oil is a conspiracy by powerful men who have some ulterior motive, like increasing the price of oil, then I will just laugh them off and be on my way.

What would you do?

“an event or set of circumstances as the result of a secret plot by usually powerful conspirators”

There are hundreds of (hugely influential) events in recent history that fit this description, where the “secret plot” was real, and wa later confirmed and documented with solid evidence. The 1953 Iran coup, the 1973 Chile coup, I guess you consider the US involvement a “conspiracy theory” too? And what about the 1973 “oil crisis”? Was that just a random sequence of events, nothing to do with the US peak oil two years before?

Sometimes people have trouble seeing things, especially when they are ‘inside the empire’. The US has been dabbling in foreign politics for decades. Anyway, here is a transcript leaked from the Nuland-Pyatt call talking about who the US wants in government in Ukraine.

http://www.bbc.com/news/world-europe-26079957

‘Her strong statement of preference for how Ukraine’s government should be formed – and apparent confidence that the US has major influence over that – is a reminder of the disconnect between US government assurances that it doesn’t meddle in nations’ internal politics and its actual behavior (White House spokesman Jay Carney repeats this canard in his comment on the tape.) This was not a conversation analyzing unfolding events and how to respond to what comes next. This was about molding a situation according to US interests.’

I read through some of the stuff on those sites. The strident rhetoric only serves to convince me that the author does not have much to say.

You talk about problems with American media. One of the biggest ones is the urge to overdramatize and focus on “lessons learned” instead of on reporting what is going on. This web site is worse than most in this regard.

Another major problem in the American media is the narcissism in reporting. It’s all about America when it comes to reporting foreign events. Claiming that Ukrainians fighting to end corruption and improve democracy must be pawns of the American “regime” is a particularly egregious example of this. Some foreign events just don’t have much to do with America.

Ron

So Roberts is a nutcase. Okay… that’s one opinion. Anyone else?

Steve

How is this oil relevant?

Watcher

If you don’t understand how geopolitical events shape the world oil markets.. there’s not much I can say…lol

Steve

Because the Bush Administration invaded Iraq for oil under the pretense of 911

ConnecttheDots

LOL… .When are you going to learn you can’t continue down that rabbit hole. You might want to try discussing Ukraine and the current situation.

I don’t think Ron will delete that.

LOL…Steve

Good old ‘Operation Iraqi Liberation’ (O.I.L).

At least they were up-front with the title!

Your’s is the inigllteent approach to this issue.

Bill Maher has a good line on that one:

If it was all about oil, Where’s the oil?

Rachel Maddow has done some very good work on this topic:

http://www.youtube.com/watch?v=Sbey4hPlrX0

Thanks CaveBio, this is really great. I guess it was really all about oil great. I would encourage everyone to watch this video. However the one above is partly off the page, or screen. You can watch it on Youtube here:

Rachel Maddow, Why We Did It

Hi Ron,

I agree with you–Maddow does a brilliant job weaving the evidence together. I have yet to hear a coherent, convincing rebuttal to the evidence presented in the documentary. The response from the the body politic, including the liberal media, never mind the rest of the MSM, to the evidence presented has been deafening in its silence.

Best,

Tom

Bremer and the CPA were profoundly incompetent so little oil was produced even though the oil ministry was one of the few infrastructure assets to be secured after “shock and awe” was over. Even munitions stockpiles went unsecured.

I suspect OIF was about oil, empire, and defense contractor profits but I can’t be sure since I wasn’t invited to sit on Cheney’s energy task force.

Here’s a story I read in that book “Fiasco”:

Bremer hired a team from former East Germany to develop a privatization plan for Iraqi state owned companies. The team flew in, assessed the situation, and drew up a plan involving 1500 people, mostly Arabic speaking.

They submitted the plan. Bremer said he only had 200 people for the whole government, and almost none spoke Arabic. The team left a few days later. The End.

Well I listened to about 15 minutes and stopped as my impression was that Roberts might have some kind of cognitive issue.

That said there’s little question in my mind about Iraq. Never bought the war argument and I have read “A Project For a New American Century”. Iraq War Two was and continues to be a tragedy. But Roberts Ukraine story doesn’t pass my sniff test. I’d continue but I’m typing this on my #@% phone… Not fun,,.

I’d continue but I’m typing this on my #@% phone… Not fun,,.

Byron, and everyone else. You do not have to put symbols when you want to say a cuss word. Just say the goddamn word. I will not delete it. I don’t buy into this crap about libraries or schools filtering sites by words. Even if they do then I don’t really give a shit.

You are dead right about cussing Ron.

The kids who happen to hear about peak oil etc and want to read about it will actually seek out the sites with a few cuss words.

A few kids will not find this site because they are using school computers to just more or less randomly click on links.

So far after reading a lot of sites such as this one I have yet to identify a comment that I think was posted by a kid although I see a lot posted by ignorant adults.I doubt any one kid out of ten thousand except maybe one assigned to do a project on oil or natural resources in general will ever even glance at this site.

Having said this much I try to keep from cussing too much myself because it is a habit frowned on in my part of the world and I tend to forget sometimes.

The more you do it the more you tend to forget.

Forgetting tends to irritate nice older ladies who feel sorry for you baching it with your elderly Daddy and hence occasionally bring you something good to eat such as a homemade cake.;-)

Ron,

Gotcha, and as always I appreciate this site and everyone’s efforts (but you do the heavy lifting).

I agree in general with your attitude towards profanity, but profanity can easily get out of control. In the comments at some websites, every other word is profane. Such language then loses all descriptive power and just becomes ugly clutter.

Expletives also tend to become attached to descriptions of persons, enhancing the tendency of disagreements to degenerate into increasingly coarse ad hominem attacks.

I’m not a prude, but I doubt that profane language is ever really needed to make an important point. In fact, understatement is often more effective in getting people to realize the importance of a particular message.

Your site is very informative, with mostly very astute comments. I can only hope that your readers, with your assistance, can keep their language under control.

Byron

I appreciate you at least listening to sone of the interview. Actually… that is not the best one to start off with.

However.. I would just like to state, Roberts was one of the driving forces in Reagans economic policy with the Soviet Union during the 1980’s.

Steve

Steve,

Roberts does have an impressive CV and I would agree with him on some issues but I think he has left the ranch when it comes to the Ukraine. I also read some of his stuff on 9/11, in which case I think he’s left the universe 🙂

Anyhow it’s always good to check out other positions and see what they can offer. I do check out the doomer site ZeroHedge but blow off better than 99% of the crap I read there. Yet every so often I find something good at ZH.

I’m an active investor and if I believed the stuff there, I’d be down in a bunker eating MREs.

But my main interest is energy, especially peak oil, as like many on this site I know that the economic engine of the world runs on (primarily) oil. We have leveraged up our lifestyle via this cheap, easily portable energy source and oddly the world at large doesn’t seem to get this. I’m always amazed when people carp about gas prices, knowing just how much energy there is in a gallon of gas. I just hope that the decline in global oil production is slow and gentle rather than cliff like.

It will be interesting to see what happens with Russian production. I was amazed that TASS reported the eminent peak in production and that the story got nearly zero coverage. If true, it’s a game changer. I’ll be watching Ron’s reports on their production over the coming months.

Later,

Byron

911 has distracted part of the left.

Could this be a conspiracy?

Lets put it in the rear view mirror.

Dave,

Agreed. Actually, the subject I brought up was PUTIN-UKRAINE. I don’t see how that has anything to do with past conspiracies.

steve

SRS,

Thanks for the interview link. I actually found it well balanced and in line with my own assessment of geopolitical events taken place in the last 13 years. He did get a bit emotional towards the end, but that might be comprehensible if one reflects about how much human blood has already been shed and how much more is at stake.

One thing that really intrigues me is the fact that many on boards like this are very much aware of the falsehood of almost everything related to oil depletion that is emitted by the MSM, and yet let themselves be brainwashed when it comes to “world news”.

Yep, it’s amazing to read the western vs eastern news sources for an event as they both paint very different pictures of an event. I don’t think either are any less bias so the truth is probably in the middle.

To assume that western media is balanced and completely honest is extremely naive.

Yes, everyone has its own bias that’s for sure, but sometimes the truth is not in the middle. If A is accusing Z and Z is accusing A, in many cases the culprit is really either A or Z, not M or N.

And this battle of biases is not equilibrated, since Reuters and Associated Press manage to be reverberated in most countries, even those who are not aligned with the US.

Here in Brazil, for example, even though our current government basically diverges from the US foreign policy, most main media outlets look a lot more like, say, CNN, than like, say, RT. To find the reason for this, one would just need to follow the money (cause it’s definitely not because of own-source real journalism performed on conflict zones oceans away).

Rather than suggesting that the truth may lie in the middle, I prefer to suggest it lies else where. There is little evidence that it is between these two arbitrary points.

Your final point is pertinent to Ron.

If the lay public get their energy / oil news purely from the MSM then as far as they know America is:

1) Energy independent

2) Has more Oil and will produce more than Saudi Arabia

3) Has 100+ years of cheap natural gas

4) Will not run out of oil due to ‘new’ technology like fracking

Now, on your own account if they took the media at face value then of course they would think that peak oil is a big conspiracy and obviously false. In fact, Forbes and other outlets are telling them this regularly. If we are to believe everything that the MSM says as ‘truthful’ then your website technically would be seen as a ‘peakers (oil) conspiracy site’.

Do you not see the irony at all? The question to you: If we don’t get truthful reporting / news on the energy situation, then why do you assume we are getting truthful news on other topics?!

Especially geopolitics.

Well I don’t get my news from the American press, and I still think this guy is wacky. Not only that, I think his presentation style should make this wackiness obvious to anyone with critical media analysis skills.

Dave, MSM is reporting what they think is truth about peak oil. And they are reporting what they think is truth about everything else. Do you actually believe that MSM is a big conspiracy to lie about peak oil? No I am sure you don’t believe something as silly as that. They are reporting what they hear from Yergin, Lynch, the oil company CEOs and other so-called experts.

Remember Halon’s razor: Never attribute to malice that which is adequately explained by stupidity.

And almost no one thinks peak oil is a big conspiracy. A few do but there is no accounting for the few. The cornucopians just think we are ignorant, the same opinion we have of them.

Ron,

I would like to add a words about MSM and peak oil. I finally got to see the videos you posted on your previous article. The first one was the most interesting as Steve Kopits was rehashing a lot of what he already stated in his earlier presentation this year.

However, Roger Boyd’s presentation on the Financial & Energy System Feedback loops was outstanding. At the end of his presentation he spoke about “PERCEPTIONS” about assets. He stated that if the world knew that the energy supply would not grow, but contract, it would change quite quickly the PERCEPTIONS of these assets.

Thus, it is my contention that MSM (which is run by 5-6 large corporations) will focus on NEWS that continues BAU- Business As Usual. Which means PEAK OIL is not good for their bottom line, stock prices or shareholder sentiment.

This is not a conspiracy, but COMMON LOGIC when your business model is built on continued growth. This is also why we see continued bullish analysis in MSM by the twits Yergin-Lynch et al for oil supply growth for the next several decades.

steve

Steve, you are correct. It is not a conspiracy but what they all wish to believe. But I have a crow to pick with this line:

Thus, it is my contention that MSM (which is run by 5-6 large corporations)…

By which you are implying that those 5 or 6 large corporations must screen and approve every article published. No, they do not. Every publication, radio and TV network has editors and of course they are going hire writers who reflect their point of view. But many, not all, also allow Op-Ed pieces that are opposed to the editors point of view. New York Times and The Washington Post are good examples.

But the point is the editors, some left, some right and a few right in the middle of the road, print and broadcast what they truly believe is true. They may be brainwashed, ignorant, or whatever but they are not lying. Never attribute to malice that which is adequately explained by stupidity.

Steve, people in general, rely on experts for information outside their field. But the problem is there are experts on both side of the fence. So people pick, and believe, the expert that tells them what they want to hear. So if you want to believe peak oil is in the distant future, if ever, you will believe Lynch, Yergin and all those other so-called experts who tells them that peak oil is a myth and that oil will be available in sufficient quantities until we find “something else” that is much cheaper.

Well that’s kinda what you said. So you are correct.

Hi Ron,

As evidence for this, all one has to do is Google Dan Dicker, author of “Oil’s Endless Bid” and MSNBC. Much of the liberal media wants to believe the idea that the price of oil is about trader manipulation. I am myself an unabashed liberal; however, the continued reporting by many members of the liberal media of the idea that oil price is largely or completely a function of greedy traders is very frustrating. I continuously find otherwise thoughtful liberals ignoring evidence that would rebut this belief. I have sent a number of emails to the Rachel Maddow show about the evidence of peak oil after she interviewed Dan Dicker. I never received a response. As you may guess from our conversation above, I generally have a very favorable opinion of the work Maddow does.

Best,

Tom

lobodomar,

Couldn’t agree more with what you said… especially your last sentence.

steve

lobodomar,

Unfortunately, my reply was meant for your first comment and your sentence:

“One thing that really intrigues me is the fact that many on boards like this are very much aware of the falsehood of almost everything related to oil depletion that is emitted by the MSM, and yet let themselves be brainwashed when it comes to “world news”

Bravo…

steve

I am interested in what the Hillsgroup guy said some weeks ago about shut in fields being irreparably damaged. And this has my attention in the context of Libya — derived from a story this week from Egypt’s former foreign minister suggesting Egyptian military involvement in Libya, aka, invasion was the way to . . . get oil flowing. Of course, they have to fund that and their American aid package is how that happens so this trial balloon probably got its helium blessed from Washington.

Now here’s the problem.

The rebels have said they have no incentive to damage the fields. The oil belongs to Libya, all of Libya, and they have no wish to damage their own oil. But . . . if said rebels see Egyptian tanks coming over the sand dunes it doesn’t take much of a logical recognition to realize that oil is about to become Egypt’s, not Libya’s.

So one wonders how quickly they can irreparably damage the fields. Irreparably being the key. What can be done quickly to drive the oil down deeper where it heats up and becomes nat gas? This is the sort of knowledge that should propagate through the terrorist communities. THIS is yet another category of weapon of mass destruction and you’d think it would be a significant chapter in the jihadist playbook. It’s quite a threat if it can be done quickly.

As regards damaged fields — surfing around I found damn little mention of mechanism for damage, but I happened across this article that is astonishing by virtue of its date:

http://www.greencarcongress.com/2004/04/the_shadow_of_y.html

It’s about the Yibal field in Oman and how RDS used a technique to increase output and failed to get maximum total barrels vs immediate flow rate, with that field’s output in freefall ever since.

In the article, dated 2004, is extensive description of horizontal drilling which took place in 1990(!) in Yibal.

Also in the article is careful discussion of the choices unfolding (then, and now) to voluntarily restrict output and drive the price up. When you are a producer and seek advantage, how can you not do this when your customer is extremely dependent. It is an obvious direction to walk for Canada, who cannot get a pipeline to the coast.

Watcher,

A bit of information I picked up about the Yidel Field from a directional driller I worked with. Not sure how much it affected the final amount of oil extracted, but shows the conflicts that go on in large oil companies between departments.

Apparently the Yidel field had a hard layer at the top of the reservoir which was hard to drill, but still held good oil and permeability. The big plan was to drill new horizontal well that was going to increase recoverable reserves and increase flow rates. This was back in the 1990’s, so a while a go. Anyway to help things along it was agreed to give good incentive bonuses to the drilling people to get the wells on line as quickly as possible. So the options were basically drill the hard rock and maximize the reserves but miss the bonus, or drill a little deeper, sterilize reserves, as any oil above the horizontal section will not be produced, complete the wells ahead of time and clean up with the bonuses. I will leave it to your imagination which avenue was chosen. I believe there other issues involved as well, close well spacing, water break through with over flooding etc, but the thing that struck me was how short term thinking always seems to over ride the long term advantage.

Your description is largely consistent with that article.

As for short term vs long term, business-wise you must choose the short term. There are only about 90 million unknown variables about the future that could render your careful long term thinking utterly wrong, and turn into a case study for all future business schools in how not do run a business. That’s why there is an epidemic of share buybacks going on. Invest the cheap money where it will produce earnings and make glowing entries on every executive’s resume.

Yes, the companies are “getting smaller”, not growing, even though EPS grows, but the board won’t fire anyone for EPS growth. They plan to retire before those chickens come home to roost, too.

Now, one does wonder about your point as regards “keeping it for our grandchildren”. A really big producer must know he can force the price up by cutting back production, but does he do better producing more at the lower price? Someone noted that there is prestige in big thousands of bpd’s. Maybe, or maybe there’s more prestige in barrels still in possession.

BTW do you know how to irreparably damage an oil field?

Watcher,

I have left that one alone as I am no reservoir engineer. But I believe what is being said when the vertical well is being produced a cone is formed by the water for below the oil. If the well gets shut in that water wet cone will not allow the flow of oil as it did before.

On the other hand the Saudi’s rest their fields all the time to allow those cones to equalize out.

Don’t ask me what the correct answer is, but you will need someone like Rockman on PO to give you a more definitive answer.

Good luck in your quest.

Ron

Did you delete comments on 9/11 after you brought up the allegation and topic? I didn’t feel the need to go down that rabbit hole.. but you brought it up first.

I was focusing on Roberts views on the Ukraine. If you don’t want 9/11 duscussed on your site… then don’t bring up the allegation and then deleting comments in response.

Steve

I brought up the subject of conspiracy theories and posted an explanation of why people believe in conspiracy theories. The 9/11 case is just one of the favorite conspiracy theories people have.

Steve, if I brought up the case of genocide and talked about what a crime it is. That would not give someone the right to argue, on my site, the case that genocide is sometimes justified. You might say: “But you brought up the case of genocide so you should not delete posts by people who think it is sometimes justified”.

The only reason I brought up 9/11 was to point out that Roberts was a 9/11 truther. That means he is a conspiracy theory nutcase. That in no way infers that I must give conspiracy theory nutcases a platform to argue their case.

Ron

You’re 100% right. As it is you’re site. That being ssid, it would be nice to see comments on the Ukraine-Putin subject and how it impacts the world energy markets.

Steve

There are conspiracy theories and conspiracy theories. The ones to steer well clear of are the over-arching ones that seek to explain every significant political development. The ones that don’t trace themselves back to the Protocols of the Elders of Zion trace them back instead to the British Royal Family. Most people who believe them are nutters, but some of the people pushing them are more sinister.

On the other hand, conspiracy theories to explain certain limited facts and/or situations can be credible. For a while I entertained one or two 9/11 conspiracy theories, until I decided that they required having too many people in on it in some fashion and would result, if they actually existed, in a whistle-blower coming forward.

There is one conspiracy theory which most Peak Oilers believe to be true – myself included. This is the story that says the OPEC proven reserves are fiction. We have no proof of this, since no whistle-blower has come forward and it has not been revealed any other way, but it remains by far the most coherent explanation of the publicly known facts:

(a) Oil discoveries in OPEC nations peaked in the 1960s and comparatively little has been discovered since;

(b) OPEC adopted production quotas in the 1980s and based the allocation of quotas on proven reserves;

(c) After the adoption of reserve based quotas, OPEC countries increased their estimates of reserves; and

(d) OPEC reserves never go down by the amount produced the previous year. Instead, they mostly stay stable.

The best explanation of this is that individual OPEC countries lied about their reserves to boost their production quotas and that, since then, OPEC has conspired to keep real reserves secret in order to save face and prevent massive internal in-fighting.

This is a credible theory, in that:

(a) Not many people need to be in on it – for individual country reserves, just the upper echelons of the oil ministry in individual OPEC members and, for the total, the OPEC Secretariat; and

(b) The people who are in on the conspiracy theory have good reason to keep their traps shut.

People engage in political conspiracies over limited objectives all the time. The reasoning generally goes “If we tried to do X openly, it wouldn’t work. Either we’re breaking the rules, or the people who would lose out from it would have a credible chance of stopping us, or it wouldn’t be good for our reputations. Therefore, we’ll keep this under cover, at least for the time being.” Limited numbers of people are involved and they have common interests which act to ensure solidarity.

The further away from this type of conspiracy you get, however, the greater the chance of some whistle-blower coming forward and the less credible the conspiracy allegation is.

Most people who believe them are nutters, but some of the people pushing them are more sinister.

Who’s law was it, posted here a couple of days ago: Never attribute to malice what can be explained by ignorance.

There is one conspiracy theory which most Peak Oilers believe to be true – myself included. This is the story that says the OPEC proven reserves are fiction.

No, no, no… This is not a conspiracy It started out as a lie, or multiple lies. But the lies were by OPEC nations to each other, not to the outside world. There were some talk about setting OPEC quotas by proven reserves, so one by one they all started increasing their proven reserves… with a pencil. Now it has gone on so long that they, themselves, are starting to believe it.

But the point is a lie is not necessarily a conspiracy. And because it’s a secret does not mean it’s a conspiracy either.

And there can be no whistle blower to OPEC reserves because it just becomes a shouting match between those who say they are real and those who say they are not real. An example: The publication “Petroleum Intelligence Weekly” tried to blow the whistle on Kuwait: Oil Reserves Accounting: The Case Of Kuwait (From Petroleum Intelligence Weekly) Then the people, and many in the government, demanded to know the truth. So Kuwait said they would do a survey and find out the truth. So they did. And when they were asked for the results they simply stated, something to the effect: “We are not going to tell you simply because we don’t have to.”

No conspiracy, just lies and secrets.

Why does OPEC lie about its oil reserves?

I have considered the OPEC situation, particularly KSA, and my suspicion is if I were head of the House of Saud and running the show, and I was told that I’ll be empty in 5 years, no way in hell I will tell anyone.

Yes, that news would explode the price of oil and make me a LOT of money on the remainder to be pumped (assuming I think money matters in what would be coming), but the danger is the concept of fair share.

Nobody with a significant military will allow someone else to dole out “fair distribution” of the liquid which suddenly costs $500/barrel. Yes, all economies are destroyed by this price, but empty is empty and that price won’t fall. So it will be doled out, almost like charity, because death will sweep the world if it’s not doled out.

And so, as head of the royal family, I know damn well what comes next. I’ll be invaded and occupied by whoever isn’t going to accept an arbiter’s fair share ruling. My people will be killed, my government will lose all power.

I avoid all this by keeping my mouth shut, and so shut it shall be.

Yeah there is nothing conspiratorial about disbelieving NOC statements on reserves. They are fundamentally different from what ExxonMobil or Total means when they talk their reserves.

The constant rise in proven reserves while production is flat-to-dropping and the companies that *do* have to report results report bad ones with exploration and slash budgets accordingly…fiction.

This post pertains more to the use of NG than oil, but it might be interesting to the readers here:

http://www.rawstory.com/rs/2014/08/10/now-water-and-air-are-all-you-need-to-make-one-of-worlds-most-important-chemicals/

So, if this process can cross the ‘Valley of Death’ and be widely implemented, it would produce NH3 for about 1/3 less energy and without NG as an input.

The article mentions an idea to use wind energy in Iowa…I seem to recall a posted with the handle ‘Stranded Wind’ on TOD. Perhaps this technology, if scalable, could make a small contribution towards a post-FF transition.

the real intriguing possibility is offhandedly/obliquely alluded to in the article…the idea of using advances in Biotechnology to modify more crops to fix atmospheric nitrogen. That would really help with energy efficiency and runoff issue…if the trick could be pulled off. But…but…as many people correctly would point out, there will always be another Limit to Growth (or to BAU for that matter)…in the case of agriculture, Phosphorus comes to mind.

Cheers

That URL is in itself a lie and the key problem with any such process. All you need is not water and air. These are relatively plentiful and cheap. You also need lots of energy, and that is far from cheap.

Dear Oil industry: do you want me to buy more gas for my cars? You know you do! Then lower your damn price, especially when you have a GLUT from your new wonder technology of fracking.

You know, as we are seeing, the free market “rules” are not working with regard to the gasoline market in this country. The prices are up and will stay up, completely artificially, for as long as the petro cartels rule our government.

What we really have to do is just say NO to the cartel’s fraudulent increase of gas prices. That’s why I am circulating this appeal to NOT buy any gas this Thursday, August 14. If we, the customers, on this day stand up to the high crimes being committed each and every day gas is above its fair market value of $2.50/gallon, the oil companies might just regain their sanity and realize that they will not be able to keep on bleeding the Middle Class of this country dry every time we fill up our tanks with their product.

Okay, everybody buy their gas on Wednesday, August 13th, not on Thursday the 14th. Will that work?

Really Lawless, oil is fungible and priced according to world demand. US refineries must pay the world price, except for some Midwestern states where they get the WTI price. But the price at the pump is based on the price they must pay for crude. The few you persuade not to buy oil on Thursday will not make one whit of difference.

Ron

LOLOL… I totally agree with you on this issue.

Steve

Is this garbage still going around? I remember whisperings like this after the (so-called) Arab Oil Embargo in 1973! Since then, there have been many variations on this theme. Don’t buy gas on a certain date, a certain day of the week, from such-and-such gas stations … If you really and sincerely think that “high” gas prices (which, here in the US, are remarkably low) are the result of a conspiracy, then stop driving. I mean it. Stop driving. That, and only that, will send a signal. Otherwise you are playing “their” game every time you drive. This sort of thing reminds me of hearing someone complain about the cost of parking, while they were shoving quarters into the parking meter!

Wanna save money on gas? Take a bus.

Ride a bike or take a hike >;-)

Buy gas on the 14th!

Lawless, I remember reading awhile back that some Christian fundamentalists were praying at gas stations for God to lower the price. It rose in price. Perhaps your strategy too, while likely sincere, may have the same boomerang like repercussions?

Disclaimer: I do not poke fun at anyone’s sincere religious beliefs however I do not find praying for material advancement for one’s self to be in any way sincere but merely a way to help sooth one’s anxiety.

Actually, one needs to poke fun at religious beliefs, as this is just meme protection.

As Lenny Bruce pointed out:

“If you can’t say f#ck, you can’t say f#ck the government”

Unless you are Chinese. They don’t seem to have any problem worshipping Caishen, the money god. Refreshingly honest.

Military coup in Iraq. How very quaint.

Speaking of conspiracies…. They say if it quacks like a duck and waddles like a duck and swims like a duck and looks like a duck— it is almost for sure a duck.

And in the cases of things that look and waddle and swim and quack just like a duck….. I am always of the opinion that it IS a duck unless maybe it is a hologram with sound.

But in the real world there are things that really do look a lot like ducks- or in the current discussion – conspiracies which are not really either ducks or conspiracies.

Sometimes things just play out this way.

Now my intent in making this remark is to find out if anybody knows of a word -it will be a German word no doubt- that names this class of things that look in many ways like a ducks or conspiracies but are NOT in reality.

I have been searching for this word for a long time- assuming it exists.

Old farmer mac,

Es tut mir leid, aber ich habe kein Verständnis für Ihre Verschwörungstheorie. May be what you are looking for but I have no idea why. It means (sort of) you`ll have to look elsewhere for a conspiracy theory. Verschwörungstheorie equals conspiracy theory: Twas a popular idea before WW II.

Doug

Thanks but not exactly what I want. I want a NAME for a class of events that are not actually the results of conspiracies but are prone to being mistaken for being the result of conspiracies.

If I were fluent in Latin I could probably coin such a word.

The Germans have so many great word that put a name to highly abstract concepts that I think they probably have one for this concept too.

Unfortunately I don’t know any Germans these days.

Can`t really help. Actually my wife typed the German since I don`t pretend to know how to put umlauts (the two dots) above vowels. She said her German is pretty rusty formal university kind of stuff that does not include Ducks mixed up with conspiracy theories. There may be such a phrase as you are looking for but not likely in Hochdeutsche Dialekte (High German).

I surfed around in German websites to look for you (I’m an American living in Germany and speak the language) and my conclusion is that Germans don’t think there is any need of a particular constellation of unlikely events: All you need is a Feindbild, I nice word meaning “Image of the enemy”.

In other words conspiracy theories are an expression of hate towards a particular group or organization, not a way of interpreting current events.

Thanks this is getting closer and the precise word may still be found maybe in some other language.

The word I am looking for has implications of accidental or unintentional camouflage or false colors. A lot of flies for instance have evolved to look like bees which gives of course confers considerable protection against some predators that avoid bees. The bees advertise their stingers with their bright colors.

But an accidental confluence of events that makes these events look like a conspiracy is in effect like a fly putting a sign on its back saying ” Eat me I have no defenses”.

Jim Hansen in his latest and unfortunately last Master Resource Report looks at U.S. and Canadian Natural gas storage…

The dark side of the renovation boom

Canadians spend billions a year on renovations. But our love affair with fix-ups has put households–and the economy–at risk.

Chris Sorensen, Maclean’s, July 28, 2014

Folks think they have been building wealth into their homes… unfortunately it was cosmetic and not the investment in resiliency that was actually needed. Jim Hansen’s Canadian natural gas storage chart above and this article reminded me of the shallowness of our wealth… ‘bling’ and house porn.

Here’s my take on the Ukraine – Russia war. It’s all about Peak Oil.

I will counter an interesting essay by Ambrose Evans-Pritchard who takes the position that the war is

“Vladimir Putin’s pointless conflict” see http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/11017413/Vladimir-Putins-pointless-conflict-with-Europe-leaves-it-a-vassal-of-China.html

Russia has already reached peak and everyone knows it. “The International Energy Agency says Russia needs to invest $100bn a year for two decades just to stop its oil and gas output declining. ” Yet the current sanctions “shut Russia’s banks out of global finance, and block technology needed to open up Russia’s oil and gas fields in the Arctic or the shale reserves of the Bazhenov Basin. ”

Globally Peak Oil is likely to arrive this year or next. And I am sure that the major governments are also fully aware of this. The single statement by Ambrose Evans-Pritchard “Oil can be obtained anywhere.” is the clear Achilles heel of his entire argument. It is not true. There is no possible replacement.

It is only within the perspective of a continuation of the current economic status quo that this war seems purely irrational. Russia will lose therefore Putin must be an insane dictator. Europe will be hit hard by the closure of Russian gas supplies. Surely they should try to end this war.

If however we believe that the arrival of Peak Oil in the very near future will fundamentally alter the global economy then this war begins to make more sense. An example I think it is highly likely that the process of globalization will be abruptly reversed. It makes sense for Russia to abandon trade agreements and end the importation of Western food now. Better to nurture their own domestic food supplies than be caught out later.

“Vladimir Putin has perhaps 72 hours to decide whether to launch a full invasion.” was written more than 72 hours ago. It did not happen. Ambrose Evans-Pritchard is misreading the situation and is misunderstanding Putin. The war is likely to remain a proxy war for now. What changes the situation is not the actions of a madman but the coming arrival of Peak Oil.

Jeju-islander, thanks for posting this. It makes far more sense than anything I have read or heard anywhere so far. I am reserving judgement for right now however. We shall see.

“The International Energy Agency says Russia needs to invest $100bn a year for two decades just to stop its oil and gas output declining. ”

This is either misquoted or just wrong. Putin recently said he had to invest $24 billion between now and 2020 to just hold production, and he expected that money to be fronted by the companies who would get the contracts. Maybe what you read was $100 billion for the entire 2 decades in question. That would be at least in the same ballpark.

We have from another source Russia drilling 6000 wells/year. 100 billion per year would be 16 million dollars per well, onshore, in-filling conventional fields with no proppant costs. No way.

“Surely they should try to end this war.”

What war? There is no Russia vs anybody war. They drain $500 billion per year from their enemies (7 million bpd plus gas exported), assuming we think QE’ed money will continue to matter. That’s a crushing burden he places on those enemies. Why would he want it to change? He’s enroute to overwhelming victory. Ask yourself why Super Mario Draghi hasn’t printed with the EU at negative GDP.

Apparently Russia is drilling 5000-6000 infill wells a year with 304 drill rigs. I asked Ron a while back how many rigs would be required to drill that number and he estimated 450–same ballpark.

Mild Wow about those drilling crews.

Here’s an interesting observation:

“Before Ukraine’s government was overthrown, energy companies like Chevron, Exxon Mobil, Repsol, and Shell were on the verge of signing a deal with now-fugitive President Viktor Yanukovych to develop the offshore deposits of the Black Sea. Trans Euro Energy has even found enormous gas reserves under the Crimean mainland. These regions lie on the seabed within 200 nautical miles of the Crimean shoreline and are said to contain 45 trillion cubic meters of gas.”

Source: http://www.americanthinker.com/2014/04/the_crimea_criss__cui_bono.html

The article also quotes John McCain saying that that Russia “is a gas station masquerading as a country”, which made me smile. Personally I’d call Russia a natural resource based kleptocracy.

In any case, if correct, that’s an absolutely mind boggling amount of nat gas (1 cubic meter is 35.3 cubic feet).

If it’s mind boggling, then why imagine it is true? Maybe there’s nothing there at all.

“Every body fill up on Wednesday”! Assuming every body took this advice, the gas station at 5th and Pine runs out at 11:00 am and that makes the noon news. All the rest panic and not only fill up but fill two gasoline cans in addition. By 10:00 pm all the stations run out of gaso0line and the next shipment is priced higher to capitalize on the panic.

Further more if you fill up on Wednesday or Friday, the impact is zero.

These people vote! No wonder…

The ‘Telegraph is running a story about how oil and gas companies are running out of cash:

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

So how much cash is on the balance sheets? And by how much did cash on the balance sheets increase?

From the source document:

This shortfall was filled through a $106 billion net increase in debt and $73 billion from sales of assets, which increased the overall cash balance

Analyzing cash flows without considering cash stocks seems like an exercise in futility.

This Telegraph story about the EIA report of major oil companies running up massive debt and selling assets has been published by other news sources but is very important. I have stated before, what is happening to the publically owned oil companies is also happening to most national oil companies. Rosneft, majority owned by the Government of Russia has similar problems:

US sanctions not mere ‘trifles’ for Russia’s oil industry

Take Rosneft. The Kremlin-controlled oil group took on huge amounts of debt to finance its $55bn acquisition of TNK-BP, BP’s Russian joint-venture, and much of that is short term. It has to repay $20bn of loans by the end of the first quarter of 2015, according to Moody’s.

Nobody is going to sell any Russian oil asset debts located inside the borders of Russian territory on the courthouse steps in Podunk America or even in Beijing or London.

If they do the new owners of the debt- not the actual assets- are going to have a hell of a time of foreclosing.

Russia will survive these confrontations in far better shape than her adversaries and or customers. I never learned to play chess but checkers work basically the same way.Who ever is the last player on the board is the winner.

Russia can get along a damned sight easier without our consumer goods than the West can get along without her energy exports and Putin and his staff are well aware of this fact.

He is in the last analysis holding nearly all the high cards including the worlds second most potent military establishment and one we are absolutely not going to Fxxx with nose to nose in his own backyard.

I guess twenty billion would take a noticeable chunk out of Russia’s foreign exchange reserves but if Putin wants it paid on time it will be paid.

The Russians probably have enough gold stockpiled to raise that much in a couple of days in the gold market without even missing it.

Times are not what they used to be.

Come to think about it a crisis is always a good time to unload a bunch of gold because gold always spikes during a crisis.Putin could probably engineer such a crisis if he wants to risk doing so.

Russia’s foreign exchange reserves stand at $470bn including 1100 tonnes of gold. Central Bank of Russia buys 10-20 tonnes of gold every month since April.

This money analysis does not have potential. Rosneft is state owned. And the debt may have been borrowed from the Russian central bank.

If so . . . . .

People just do not realize the horror of the precedent that QE set. Money doesn’t have to mean anything anymore. My God, look at Japan. They are desperate to trash their own currency so their exports will dominate, and they can’t do it. It’s mired at 102 yen to the dollar. They have QEed trillions upon trillions upon trillions and the other CBs of the world just shrug and buy yen. They won’t let it fall. Japan imports every drop of their 5ish mbpd priced at Brent and the Yen Doesn’t Move.

Lotsa conspiracy talk above. What do you call it when Central Banks around the world communicate and cooperate with coordinated QE so that no one’s currency can move?

You evaded the question. How much cash is and how much did cash increase on the balance sheets?

Ambrose-Pritchard is clueless. There is not a scintilla of evidence from the EIA source document that the oil/gas biz is running out of cash. Furthermore, aggregate debt is never extinguished, it is rolled.

As you are a former stock broker, I will not give you the benefit to choose equity or debt proceeds for acquisition. Rosneft’s debt became TNK-BP’s cash.

In Ron’s post he said:

All so-called “proven” reserves should be taken with a grain of salt. They are just guesses at best and blatant lies at worst. Proven reserves, because they are mostly fiction, cannot and should not be used as any kind of indication of any nation’s future production potential.

I think this statement is true of OPEC reserves, but non-OPEC reserves though we do not know them with certainty, can and should be used to indicate those nation’s future potential, any other types of guesses about the future amount to hand waving.

One can claim that decline rates will be 10% in 2020, but without any estimate of reserves, there is very little basis for any such prediction except a person’s “gut feel”. A different person could claim that decline rates will be 2%, how do we decide which claim is more realistic?

We could use previous research by knowledgeable people (such as Jean Laherrere) about proved plus probable reserves (850 Gb at the end of 2012) and backdated oil discoveries and then use a model (such as Webhubbletelescope’s Oil Shock Model) to estimate future output.

As oil fields get developed the estimates of previous discoveries constantly are updated. As more knowledge is gained from further drilling and production reserves tend to grow. The estimates are imprecise, but ignoring such estimates means that we must rely on the assumption that past trends in production will continue in the future to make any estimate of future output.

Better estimates of future output will result if we use all available information.

Dennis,

Regardless of what Ron meant there are too many large variables to enable sensible oil production predictions very far into the future. OPEC reserves are a REALY big one. As you well know, some claims suggest OPEC “reserves” have been overstated by 70% and Wikileaks are saying there is a 40% reserve exaggeration for Saudi Arabia. Now we have new uncertainty owing to developments in Russia. How can you model Russia’s contribution to world oil supplies right now even though their reserve figures seem pretty solid? You can’t, not without huge error boxes. The Middle East, Iraq, in particular, is a disaster which might spread. Of course US Tight Oil supplies depend largely on price and we keep getting wildly different predictions there (I doubt low ones are creditable). And, what new wrench-in-the-gears will emerge next week: Ebola in Nigeria, economic collapse in China (or Europe or America)? If China goes haywire, for example, or Ukraine becomes a regional war or, more likely, something big happens that no one actually thought of, it will suddenly change the dynamics of a lot of things currently preoccupying semi-intelligent minds. The Real World at work!

Doug

Hi Doug,

I agree that long term predictions of oil output are impossible to get correct.

The model simply gives a starting point for how thing might turn out if the future resembles the past. There has been a lot of stuff going on in the World since 1960, the model matches up with output very well with actual data over the 1960 to 2013 period.

Now if we assume the future will be much different than the past, the model will clearly be incorrect, but if we specify how depletion rates might change in the future, we can create a model that shows what would happen if that specification is correct.

I have asked you before what you thought depletion rates might look like in the future,

you did not bite, probably because nobody knows. I have shown a number of models that specify a low future depletion rate and others which show what output will look like if depletion rates remain constant at current levels.

As I understand it, you think that depletion rates will rise over time, let’s assume we know what the current world average depletion rate is (we don’t), would you expect it to double over the next 20 years (or what ever time frame you deem to be sensible)?

Dennis,

Depletion is somewhat of a red herring. The real issue is cost(s). As someone once said: “It doesn’t matter how much oil comes out of the ground when it’s priced too high for us to keep using it the way we’re used to.”

Therein lies the rub. As I’ve said ad nauseam, production at prices required by shale oil and deep sea oil, for example, is not comparable to conventional oil. Conventional oil is increasingly being replaced expensive hard to get oil. To me, this is more important that depletion rates, whatever they are. Of course I have no idea what average world depletion rates are.

Doug

Doug, economically recoverable reserves go up and down with the price of oil. Therefore the depletion of economically recoverable reserves would fluctuate with the price of oil also.

True.

Hi Doug and Ron,

The oil shock model does not have any economic inputs, it assumes the price of oil will be adequate to satisfy the producers of oil or they will not invest in new wells.

The model uses oil discovery data, assumes an average time that it takes to bring oil wells online from the time that the oil is discovered and then uses actual oil output data to determine the extraction rate (aka depletion rate) from proved producing reserves. The model matches oil output from 1960 to 2013 with fairly good precision.

I have recently modified the model by changing the fallow, build, and maturation times to 12 years (for each of the three).

Earlier I used 10 years. I made this change because I noticed that Jean Laherrere’s estimate for 2P reserves was about 850 Gb in 2010, proved reserves would be about 2/3 of this or 510 Gb and proved producing reserves would be about 2/3 of this or roughly 380 Gb. Mature reserves in the oil shock model are pretty similar to proved producing reserves and using this new model the 2010 mature reserves are about 379 Gb, so a good match to Jean Laherrere’s 2P estimate ( if the 4/9 estimate of proved producing reserves to 2P reserves is roughly correct).

The extraction rates in this new model are higher because mature reserves are lower by about 45% compared to my previous model. Chart below showing 1960 to 2013.

Oil shock model described above from 1960 to 2040, extraction rates remain at 2013 levels until 2040. JL Model is Jean Laherrere’s C+C model from Jan 2013 with URR= 2700 Gb. The URR for my model is 10% higher (3000 Gb).

Hi Ron,

Oil output is not very responsive to price in the short term. Long term prices (averaged over 3 years or so) and more importantly the expected future price of oil is what determines investment in development of reserves. Once the reserves have made it to the proved producing reserve category, they will be produced regardless of price (assuming the oil price covers operating costs which is a very low bar.)

As an example in the United States over the 2009 to 2012 period the depletion rate from proved producing reserves (C+C reserves) was quite stable at about 11% despite large swings in oil prices.

Oil output is not very responsive to price in the short term. Long term prices (averaged over 3 years or so)

Of course this is true, but the price of oil is very responsive to oil output, even in the very short term. If you doubt that just watch what happens every at 9:30, central time, when the oil storage report comes out. If it comes out as expected nothing much will happen. But if it is way above the expected prices will spike down. And vise versa, if the storage numbers are below what was expected, prices will spike up. And they will normally stay up or down until further supply news comes in.

This is the short term swings I have talked about. In the only slighter longer term, (still short term though), prices will follow the actual supply of oil on the world market.

The big risk with Russia – other than them starting a war and getting kicked out of SWIFT – is what they’ve been doing to maintain this plateau of theirs as long as they have on no substantial new fields. That’s not normally how that goes.

What’s their decline rate over the next five years? What does the curve look like? No one has any idea. They say ~ 6% over the next two years, but they’ve already done a good job of dropping towards that so far *this* year.

Dennis, just curious but what is your outlook for Russian production? I know you don’t know just as I don’t know but what is your best guess? I think you said a few posts back that you expected a decline of about 1.5% per year but I am too lazy to go back and try to find that post. Is that correct? Or do you think there is a chance that they will not peak for a number of years yet?

You will remember that I called Russian peak in November-December of 2013 and the 12 months July 2013 through June 2014 will be the peak 12 month average for Russia. And I expect a decline, beginning July 2014, of between 3.5% to 5% per year. What is your opinion of my prognosis?

Hi Ron,

I think that your call for the Russian peak may be correct, I have not followed that data nearly as closely as you have. I do not have any discovery data for Russia so I cannot do a model like I have attempted for Norway or the World using the oil shock model.

Using BP Statistics the Russian depletion rate from proved reserves in 2013 was 4.2% and over the 1998 to 2013 period they have been adding more reserves each year than annual production. In 2013 about 4.8 Gb were added to reserves (2013 production plus the increase in reserves from 2012 to 2013), but only 3.9 Gb of oil was produced, unless there is a fall in depletion rates I think Russia could remain on a plateau for a few more years.

I doubt that the decline rate will be as high as 3.5% in the near term, when decline begins I would think it would be under 2%.

Note that the depletion rate from proved reserves has been pretty steady at about 4.2% since 2007 and I see no reason (except possibly Western sanctions) why this would change sharply. Also over the past 5 years there has been more reserves added than oil produced. If both of these remain true then we would expect an small increase in output over time, if the reserves added fall to the level of output then the decline will begin unless depletion rates rise.

Chart below for post above

Hi Ron,

From the EIA data I get 10.1 for April 2013 to March 2014, so a 3.5% decline would be about 9.7 Mb/d for July 2014 to Jun 2015 (if the July 2013 to June 2014 data ends up at 10.1 Mb/d). Unless there is a big drop in reserves added or depletion rate, I think Russia is more likely to remain at 10.1 Mb/d +/- 0.1 Mb/d.

Okay, you are saying that a year from now, using EIA data, russia will be between 10.2 and 10 million barrels per day. I believe they will be around 9.7 to 9.8 mbd, EIA data.

If I take Russia DCU TEK data in tons and multiply it by 7.27, the multiplier the EIA says they are using, I come up with about 400 thousand barrels per day more than the EIA is reporting.

But we will see in a year from now who is closest. And by the way I pay no attention to depletion rates, decline rates are the only thing that counts on the final data sheet.

I am saying that the 12 month average for April 2014 to March 2015 will be about 10.1 Mb/d (as reported by the EIA), a 3.5% decline would be 9.75 Mb/d, but a 5% decline rate would give us 9.6 Mb/d, so I would think that you expect 9.6 to 9.75 Mb/d we could call it 9.6 to 9.8, I would expect 10 to 10.2.

I know you only care about decline rates, but I prefer not to just pull numbers from thin air. The depletion rates are important and tend to change slowly over time unless there is a major disruption (political turmoil as in Libya or Iraq or a major war as in the Iran Iraq war during 1980 to 1982).

We have reserve data and output data, the depletion rate for Russia is easily calculated unless you do not trust the reserve data. Do you also distrust the EIA’s proved reserve data for the US? I agree we know little about OPEC reserves, but as far as I know the Russian data is pretty good.

As I said before it makes no sense not to use all available data.

Depletion rates have either been stable (since 2006) or increasing (from 1998 to 2005). Unless either reserve additions decrease or the depletion rate decreases (or both) output will either remain steady or rise over time.

For example if reserve additions fall by 0.9 Gb (almost 20%) and the depletion rate remains the same then output will be unchanged. If reserve additions remain at 4.84 Gb, then the depletion rate can fall to 4.2% (from 4.24%) and output will be unchanged.

I looked over a bunch of forecasts for Russia, all of them indicate the peak should already have occurred. So my guess may be wrong. Also the Russian reserves reported by BP are not very reliable (they include NGL reserves along with C+C).

We also lack an estimate of proved producing reserves, using an estimate by Colin Campbell (Dec 2004) of 120 Gb Russian reserves and deducting production from 2005 to 2013 leads to an 89 Gb reserve estimate with 2013 depletion at about 4.1 %, if we assume no new reserves are added to these 89 Gb of reserves (a highly pessimistic assumption), and assumed a slow increase in the rate of depletion, then decline rates would be 3 to 4%.

I have seen USGS estimates of 60 Gb of undiscovered resources in Russia, if some of these resources get added to reserves, the decline rate will be lower than 3.5%. That is all the information I could find, perhaps Jean Laherrere has some insight.

Hi Ron,

What has the decline rate for the 12 month trailing average been so far?

We don’t have 12 months to measure but from November thru June the decline was about 1.5%. July was way down due to a lot of downtime somewhere. Production is back up now but it will be several days to weeks before we know where production is going to settle out.

In general, the biggest adds to reserves each year are from within existing fields, not new field discoveries. As the fields are better engineered, knowledge on productive intervals is gained, and secondary and tertiary production is carried out the reserve numbers will go up. Take the following example as a case in which reserves can be updated to add barrels:

A field is under primary production on 40 acre spacing. Based on this spacing, geology and the estimated drainage radius of the wells, there is an reserves number given that is 7% of the OOIP (original oil in place). After some time, it is determined that the wells are not efficiently moving hydrocarbons on the edges of the draining radius so an infill drilling program is completed, moving the field to 20 acre spacing. Based on the reservoir qualities, it is estimated that an additional 5% of OOIP can be recovered, to a now total 12%. Then more time passes, and it is decided that the field is a good candidate for secondary waterflood. A small-scale pilot is done and based on the results it is determined that a field-wide waterflood on the current spacing will add an additional 12% reserves, bringing the total to 24%. Then more infill drilling is done, bringing overall well spacing down to 10 acres and again adding more reserves, lets say 3%, bringing the total to 27%. Then a tertiary CO2 flood pilot is done, and it is determined that a full field flood would be economic. Based on the pilot results, as well as waterflood performance, an additional 14% OOIP is added to the reserves for a grand total of 41%. Obviously as production is ongoing the existing reserves numbers are depleted from production, but from initial reserves estimate to the final number given there was an increase from 7% OOIP to 41% OOIP.

Hi Manbearpig,

Thanks for that explanation, in addition to the changes in recovery factor, as more drilling is done and there is more production data, the OOIP estimate will change over time as well. Usually the initial estimates will be conservative, as more knowledge is gained the OOIP estimates often increase over time, along with the recovery factor.

I would note that the recovery can increase in some specific cases, but often this argument is taken to ridiculous lengths, such as all resources have a recovery factor of say 30% on average, so we will just apply technology to raise the average recovery factor to 60% and double the reserves.

There are limits to what is technically possible and we may have reached those limits or if not we are quickly approaching them.

Maliki (may have) been forced out as Iraqi prime minister. President names one of his deputies as his replacement. Maliki refuses to go and puts loyal troops onto the streets

http://www.theguardian.com/world/2014/aug/11/nouri-al-maliki-iraq-forced-out-prime-minister

Maliki is responsible for a lot of the problems in Iraq today.

Although I dabble in conspiracy theories myself, I certainly don’t believe that there is a shadowy elite anywhere in the world that controls all things.

To the extent that conspiracy theorists at least make a go at trying to establish patterns of power in this world, and ask the crucial question of who benefits, I think they are useful. More so than say, reflexively nationalist people who believe anything the media and government tells them.