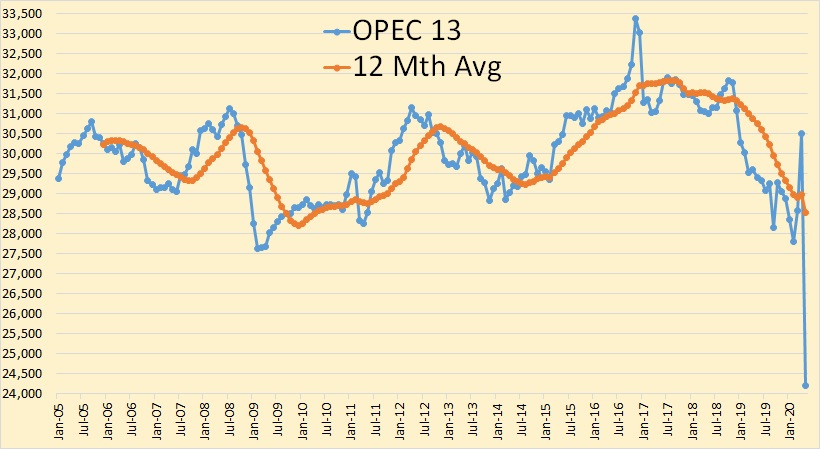

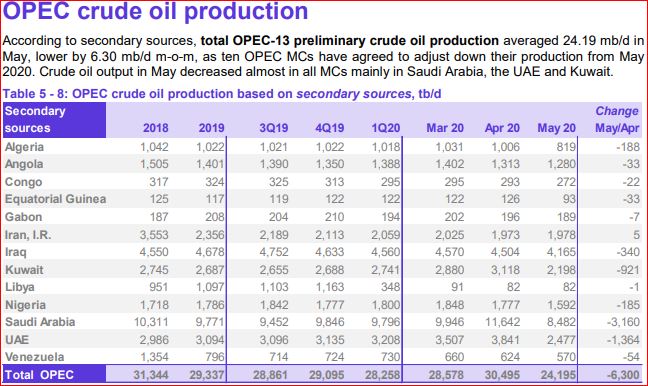

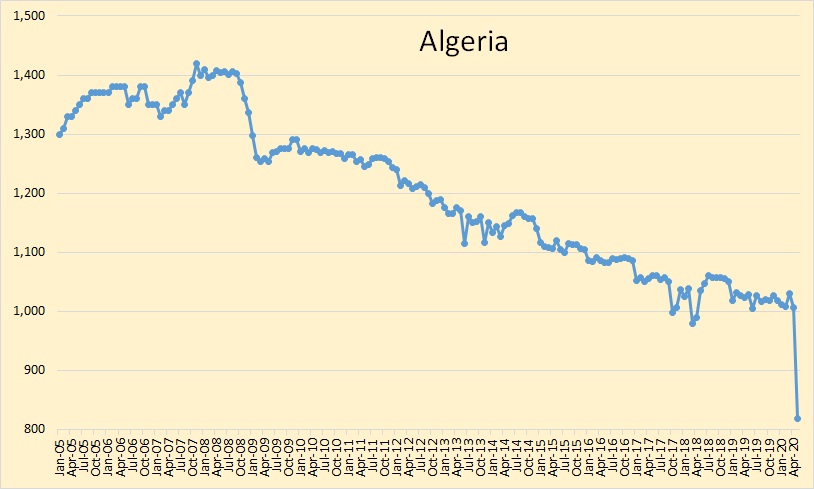

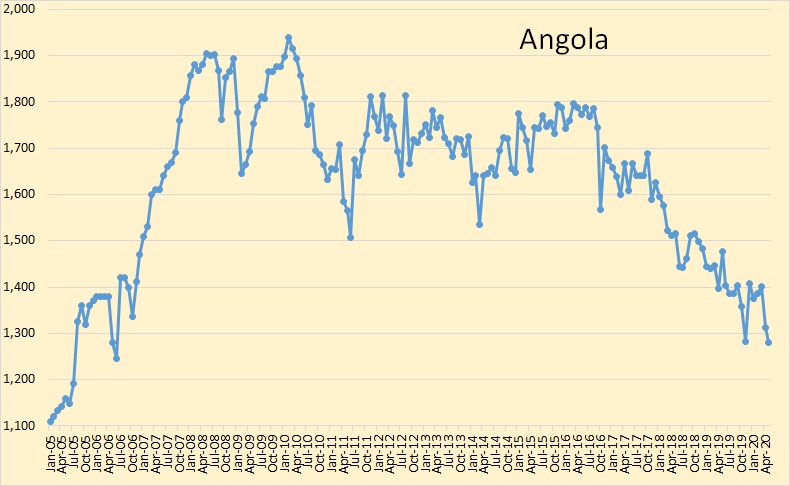

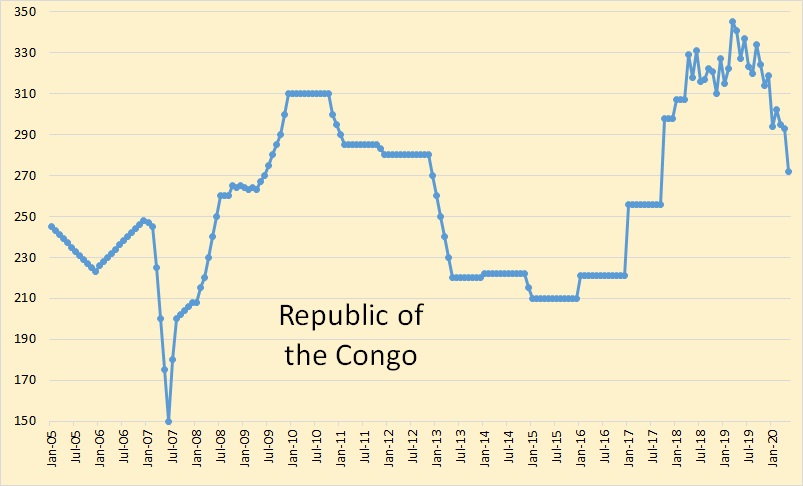

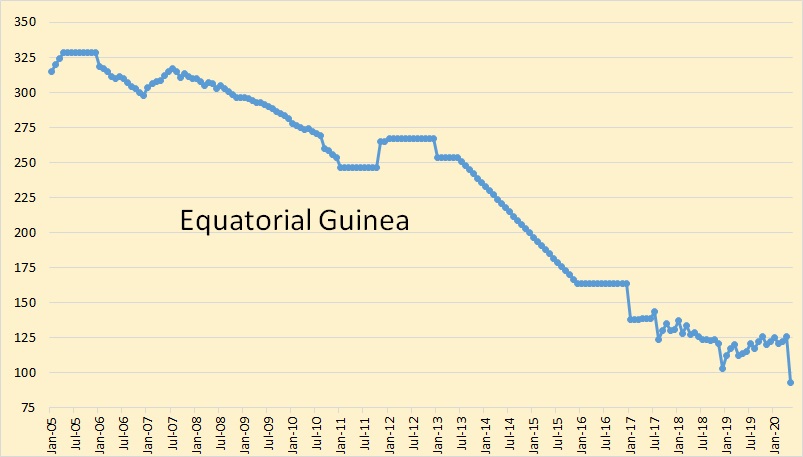

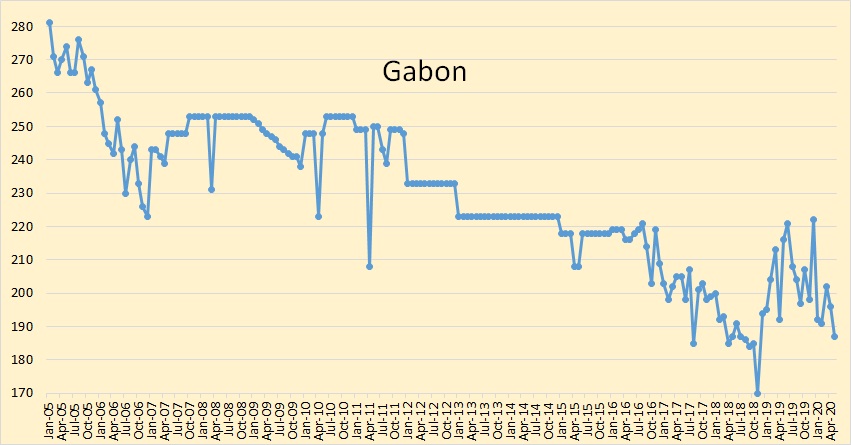

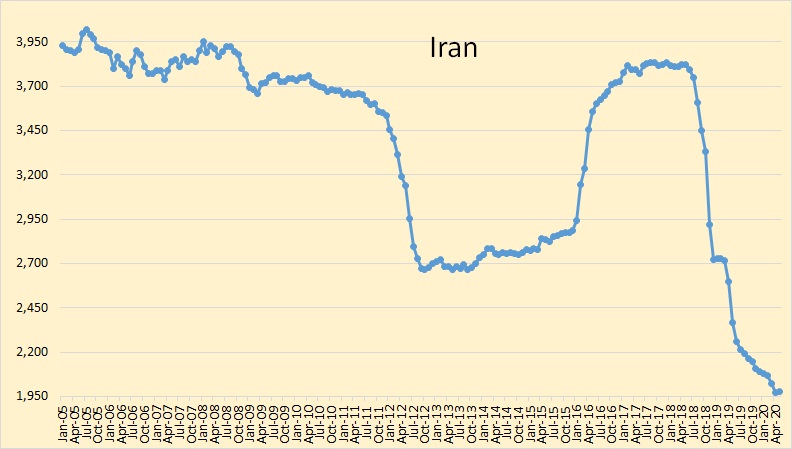

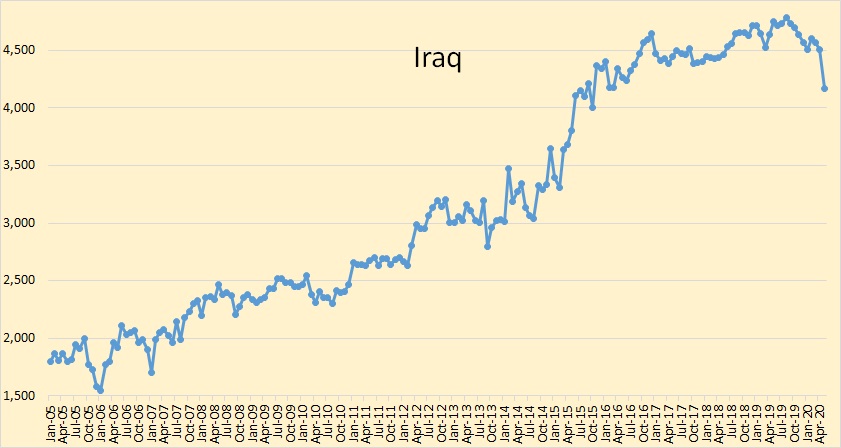

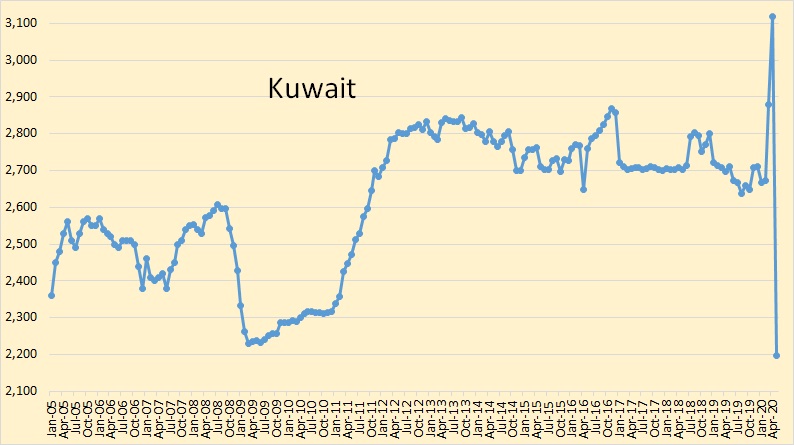

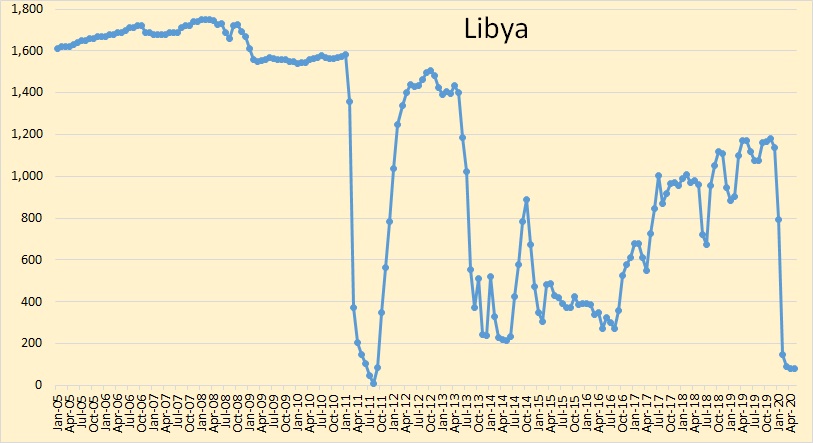

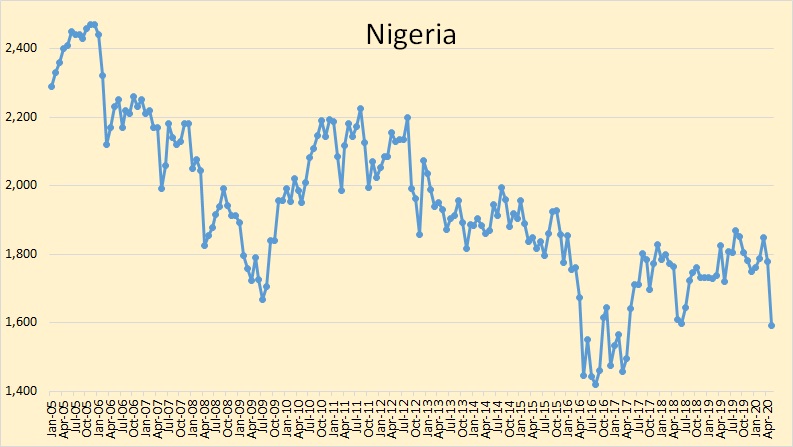

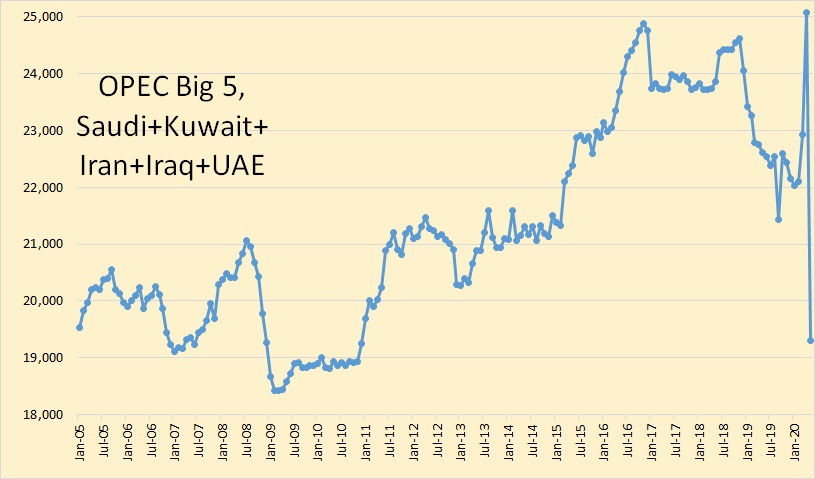

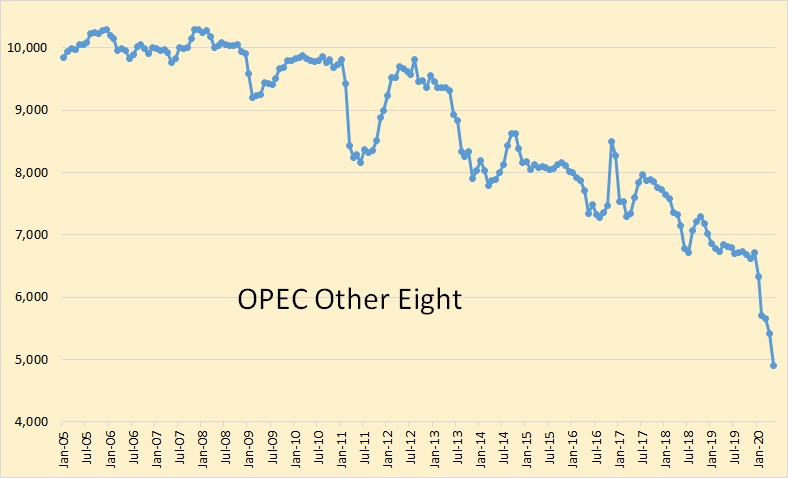

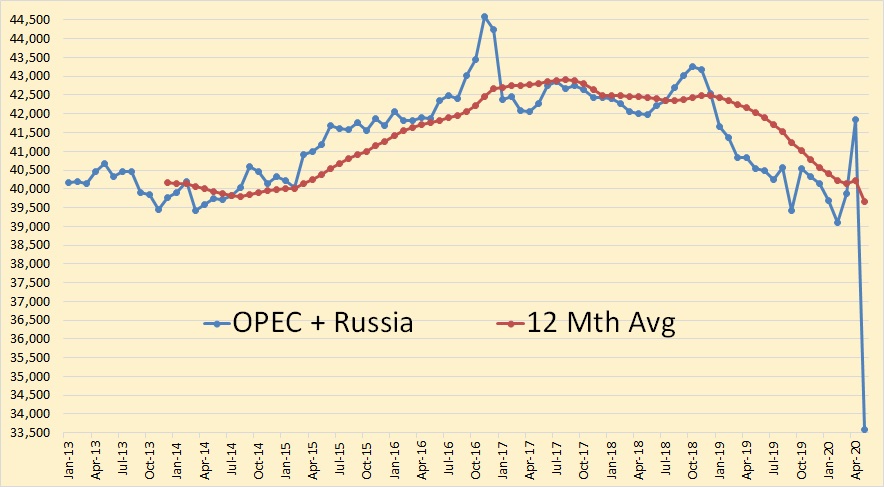

All OPEC charts below were taken from the latest OPEC Monthly Oil Market Report.

All data is through May 2020 and is in thousand barrels per day.

OPEC crude only production was down 6,300,000 barrels per day in May.

Oil production in every OPEC Nation except Iran was down in May.

Algeria down 188,000 barrels per day in May. That was quite a surprise.

Iran is holding steady at just under 2 million barrels per day.

Iraq finally cut by 330,000 barrels per day but this is still way below what they were expected to do.

Kuwait was down 921,000 barrels per day in May. This is not nearly as impressive as it may seem since they were up about half that much over the previous two months.

Libya, exempt from cuts, hardly moved production in May.

Nigeria cut production by 185,000 barrels per day in May.

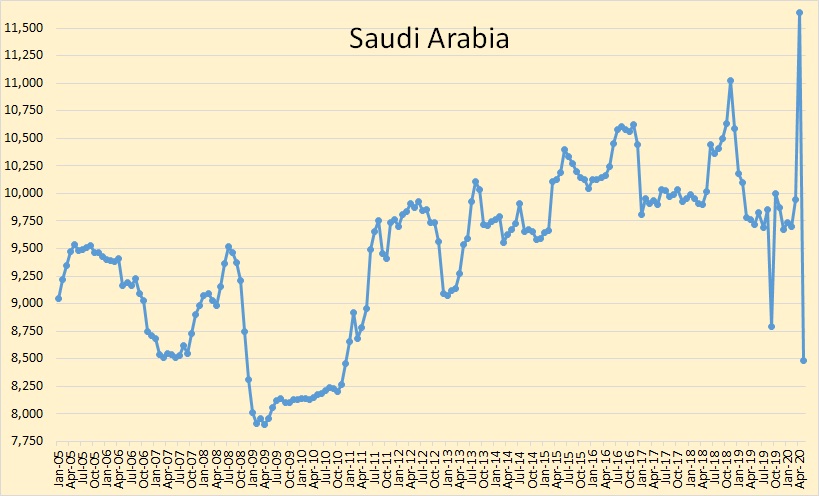

Saudi cut production by 3,160,000 barrels per day in May but that was after being up 1,944,000 barrels per day over the previous two months.

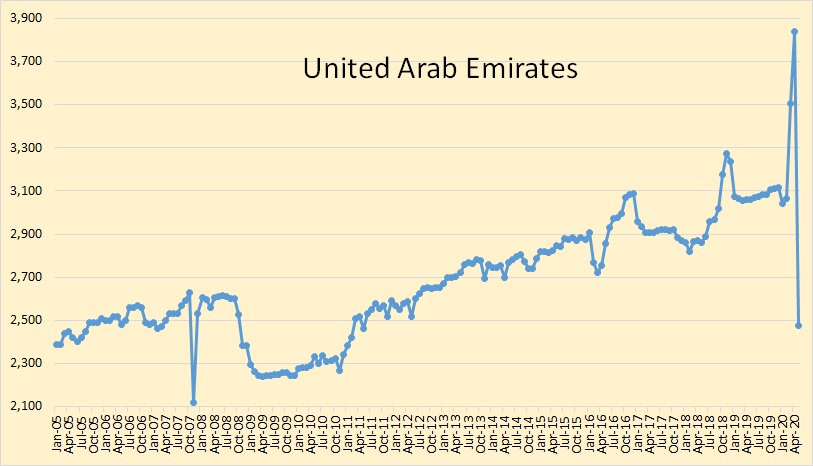

The UAE was down 1,364 barrels per day in May but that was after being up by 744,000 barrels per day over the previous two months.

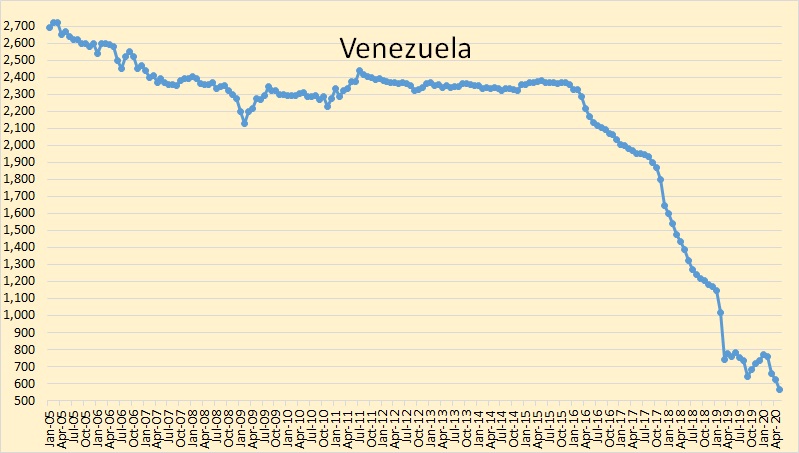

Venezuela reached a new low of 570,000 barrels per day in May. They are exempt from cuts.

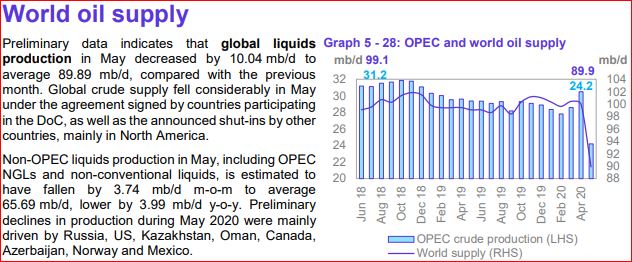

World total petroleum liquids were down by 10,040,000 barrels per day in May to 89,900,000 barrels per day.

OPEC Big 5 were down 5,778,000 barrels per day but that was after being up 2,969,000 over the previous two months.

The other eight OPEC producers were down 522,000 barrels per day in May. They have declined every month this year.

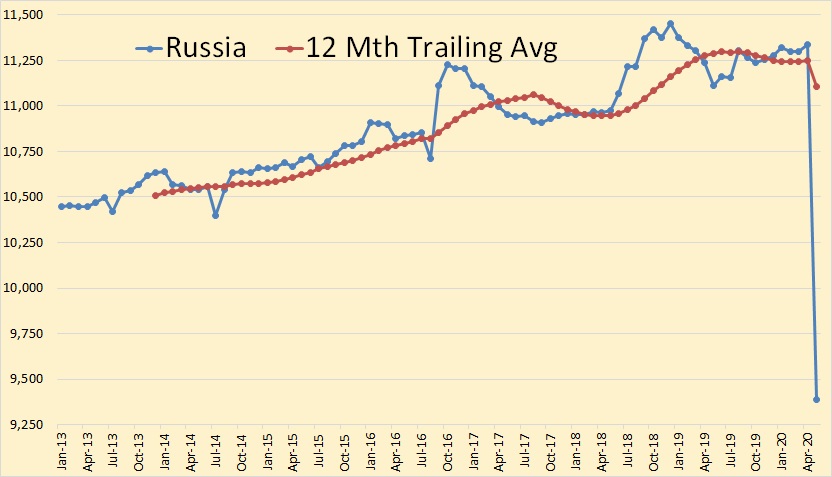

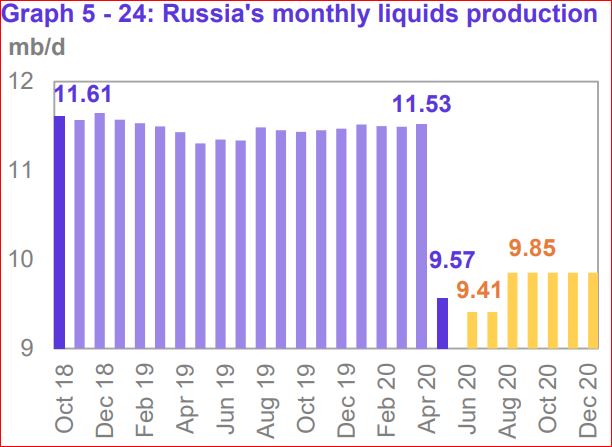

The only other country I have May data for is Russia. The Russian Minister of Energy. I had to convert tons to barrels using 7.33 barrels per ton. They finally decided to cooperate with OPEC and cut production by 1,951,000 barrels per day in May.

OPEC + Russia was down by 8,251,000 barrels per day. That is OPEC crude only plus Russian crude plus condensate.

The above chart is from the OPEC MOMR and is OPEC’s projection of Russian production through December 2020.

Ron,

Excellent post. With so much oil production taken offline, in the U.S. and globally, how is that going to impact the oil companies in Q2 2020?

While I saw several oil companies post impairments during Q1 2020, I had no idea how much.

https://srsroccoreport.com/the-destruction-of-the-shale-oil-industry-begins-massive-impairment-write-offs/

steve

Worse says Deloitte- Shale industry to be rocked by 0.3 $T (for trillion) losses…in the 2nd quarter

https://www.cnbc.com/2020/06/22/shale-industry-will-be-rocked-by-300-billion-in-losses-and-a-wave-of-bankruptcies-deloitte-says.html

er , no

a planet swinging in from the outskirts of our solar system that is going to crash into Earth and wipe out humanity in 2012 or, in some opinions, 2011

still waiting

Nancy Lieder, a self-described “contactee.” Lieder claims she has the ability to receive messages through an implant in her brain from aliens in the Zeta Reticuli star system.

extraordinary claims require extraordinary evidence, please provide it or I’ll go with Carl Sagan’s

“baloney detection kit” ( a set of tools that skeptical thinkers use to investigate any new concept. )

Forbin

I have deleted that stupid post from OneofEU. It had absolutely nothing to do with oil, gas, or peak oil. It was just stupid shit about another planet called “Nibiru” that was about to mess everything up on earth and the “elites” know all about it and are positioning themselves to take advantage.

Forbin, sorry but when I deleted the post your reply to it disappeared also.

Thanks for the great post Ron. And thanks for deleting that ridiculous comment also. Good call.

I saw that post from OneofEU, and i had a great laugh!

So much to unpack there!!

Where does all this stuff come from??

Originally, i thought it was a joke, but i wonder ….

No, it was no joke. He is actually that stupid.

Keep deleting that shit. It undermines the quality of this website by dilluting the comments section. Like seawater in Ghawar.

Cool. The Raelians had their 15 minutes a few decades ago.

Pretty sure 1/R^2 would perturb objects measurably for a large mass within a few years out. Too many would measure this and talk for a cover up to work.

The entire solar system has been perturbed for 10 years already.

Mars, Venus, Mercury, Uranus, Jupiter, Saturn, Pluto….

All those changes are more or less mysterious, each being explained with a new theory.

Example:

https://www.nasa.gov/feature/jpl/saturns-moon-titan-drifting-away-faster-than-previously-thought

The big moon ‘drifts away’ but no one will even mention the possibility of another mass in the system.

Now time for Earth.

Some claim we have already tilt of 26 degrees.

Also the official obsession with asteroids is telling: what they do not tell, is that either something is pushing these rocks towards us or is a source of them.

But, yes, the cover up is amazing. And a testimony to the seriousness of the problem at the same time.

When i was in high school, one of the science projects assigned was to measure the tilt of the earth. It’s pretty simple, so i suspect it would be big news if it was 26 degrees.

Now time for Earth.

Some claim we have already tilt of 26 degrees.

OneofEU is gone. He had been warned about posting stupid shit on the petroleum only post. And anyway, anyone so dumb as to make a statement like the above is cannot possibly have anything intelligent to add to any conversation here.

BIG TROUBLES IN THE PERMIAN

Over the past three years, the first 3-month decline rate in the Permian has picked up speed. From Dec 2017 to March 2018, the decline rate was 15%. This picked up to 19% from Dec 2018 to March 2019, and even further to 23% Dec-19 to March-20.

The more wells and subsequent production causes a larger decline rate. Here are the three-month production declines for the various years:

Permian Dec-Mar Oil Production Declines:

2015 Dec-Mar = -143,000 bopd

2016 Dec-Mar = -173,000 bopd

2017 Dec-Mar = -323,000 bopd

2018 Dec-Mar = -646,000 bopd

2019 Dec-Mar = -930,000 bopd

In three months, even before the covid impact, the Permian lost 930,000 bopd.

READ MORE: https://srsroccoreport.com/chart-of-the-week-permian-shale-oil-decline-rate-23-in-only-three-months/

I will be putting out a new article comparing Saudi Arabia’s Ghawar Field vs the Permian Region. Talk about a difference in annual Decline rates.

Steve

Is it geology? Or do they use a modified fracking procedure, a more aggressive aproach to boost initial flow at the cost of later flow. Or just cheaper sand, which collapses faster.

Is heare somebody from oil business who knows this?

I heard the russians use ceramics for fracking their old conventional field – it keeps cracks longer open, so longer flow.

Edit: I remember someone wrote here Permian producers changed frack sand to local sources, from better sand with longer transport way. Perhaps this is part of the solution?

OMG, Extraction/production dieoff in Libya as seen in 2011/2013 will be tragic for many, especially considering the crude quality.

“US oil production will be down 50% this time next year”

https://www.forbes.com/sites/arthurberman/20

20/06/17/the-party-is-over-for-shale-and-us-energy-dominance/

Your link ain’t working Donald. This one works:

The Party Is Over For Shale And U.S. Energy Dominance

Here is a tiny fraction of the article. You should click on the link to read it all.

The party is over for shale and U.S. energy dominance.

It has nothing to do with the lack of shale profitability or other silly memes cited by people who don’t understand energy.

It’s because of low rig count.

The U.S. tight oil or shale rig count has fallen 69% this year from 539 in mid-March to 165 last week. Tight oil production will decline 50% by this time next year. As a result, U.S. oil production will fall from to less than 8 mmb/d by mid-2021.

What if the downward trend in rig count increases between now and then? No difference for the next year or so. That’s because of the lag between contracting a drilling rig and first production.

Leads and Lags

There are unavoidable leads and lags with oil price, adding or dropping rigs, and oil production.

I think we just don’t need Nibiru to visit our solar system with these numbers. One of the tiniest of structures had the same impact as a rocky planet. We could call this irony …

The world will have to organise in a just and peaceful non growth economy. It’s in fact easier to believe in giant invisible objects in space.

Art’s article re formatted for oil heads.

https://www.artberman.com/2020/06/18/u-s-energy-dominance-is-over/

Great article by Mr Berman. I note that he expects a 9 to 12 month lag from spud to first production (I think 3 to 4 months may make more sense.) Using Enno Peters supply projection and using the 9 month estimate at link below

https://shaleprofile.com/us-tight-oil-gas-projection/

I get the following projection when changing the “lead time from spud to production” from the default of 2 months (I assume this is Mr Peters best guess) to Mr Berman’s 9 month estimate. Tight oil output falls to 5 Mb/d by early 2025 assuming rig count is unchanged from the most recent June 19 estimate.

Thought you guys would enjoy this =>

https://www.cnn.com/2020/06/18/investing/oil-price-spike-jpmorgan/index.html

“$190 oil sounds crazy. But JPMorgan thinks it’s possible, even after the pandemic:

New York (CNN Business)In a little-noticed report, JPMorgan Chase warned in early March that the oil market could be on the cusp of a “supercycle” that sends Brent crude skyrocketing as high as $190 a barrel in 2025.

Weeks later, the coronavirus pandemic set off an epic collapse in oil prices as demand imploded. And yet the bank is doubling down on its bullish view.

Brent hit a two-decade low of $15.98 a barrel in April. US crude crashed below zero for the first time ever, bottoming at negative $40 a barrel.

The United States, Russia and Saudi Arabia — the three largest producers — have dramatically slashed production in response. The massive supply cuts helped breathe life back into oil prices.

Though demand remains depressed, JPMorgan still thinks a bullish oil supercycle is on the horizon. A huge amount of supply has been taken offline and the industry could have major trouble attracting future capital.

“The reality is the chances of oil going toward $100 at this point are higher than three months ago,” said Christyan Malek, JPMorgan’s head of Europe, Middle East and Africa oil and gas research. …

Looming deficit suggests prices will ‘go through the roof’ …….”

HHH thought this, too.

In my opinion it’s very possible, too. Since depletion and rust never sleeps – what all these state oil companies do now during the voluntary cuts? Maintaining their old capacity by investing billions of $, or cut back on investing and using the money to keep their states afloat in the crisis.

I guess several will do the second – no need to spend billion$ in something not needed now when your economy is in troubles from lockdowns.

And even if oil consumption stays flat – the downforce from not investing will carry over, since it takes a lot of time from increasing drilling budget again and reaching the old capacity. And first increases will only reduce decline, it takes some time to turn around the big ship then.

Not sure how those prices don’t push demand way down or how economies can afford to support those prices. Maybe J.P. Morgan figures central banks will continue to shove $trillions up their economies’ asses and that overall inflation will do the rest. Can’t last for long, IMO. This scheme is going down. Not that the financialization gurus can admit it since their livelihoods depend on them not understanding the big picture,, in a Sinclairesque sort of way.

Too many humans. Not enough Planet.

But why would prices ever get this high?

Somewhat counterintuitively, JPMorgan’s Malek said the BP writedown and gloomy forecast are “one of the most bullish” developments he’s seen.

That’s because oil companies must spend heavily just to maintain production, let alone increase it. If they do nothing, output will naturally decline.

And BP’s weaker outlook suggests even fewer long-term oil projects will make the cut. That in turn will keep supply low — even as demand rises.

What they are implying, if not actually saying, is “Peak Oil”. The price of oil will never get that high if production continues to increase,

Right on, Ron. Now that peak oil isn’t a thing (even peak oil bashing has fallen out of fashion), here it is, sneaking in the back door. This occurred to me sometime in March. Pretty sure my neighbors who used their Trump Bucks for a down payment on a big new truck at ‘lower prices’ will be blaming those wicked liberals when it costs a hundred bucks to fill their tanks.

Ghung.

Assuming the Democrats sweep 2020, I think that sets up a possibility for much higher oil prices in addition to the factors you and Ron have cited.

No more GOM drilling. No more shale on Federal lands (which is a decent share of New Mexico Permian shale).

As an investor in low decline conventional wells, I’m good with that. I am worried about no stripper well exemption for methane emissions rules. Not because we are emitting high levels of methane, but because of the proposed extremely high compliance costs.

There has been an ongoing study of stripper oil well methane emissions through the US EPA and DOE. Hopefully the study results are fully transparent.

Alternatively, if US EPA could come up with a much more cost efficient way to monitor methane emissions that what was proposed under the Obama administration.

Petroleum products will be needed in some form for many decades. Our wells have produced for over 100 years and have a tiny footprint. Minimal methane also. Hope the Democrats have a little nuance when it comes to oil.

Shallow sand,

How did the oil industry do under the Obama administration?

A Biden administration would not be much different.

Even if the Democrats manage a majority in the Senate, the rules of the Senate make it damn near impossible to get much done.

The way the US government is structured makes change almost impossible, it is the reason the US has become so backward compared to the rest of the OECD.

In short, you have very little reason to worry, also Biden’s position is no new drilling on Federal lands, generally the GOM is considered water rather than land, even by Democrats. 🙂

Correction: Biden opposes new drilling on federal land or waters, so that plan would affect the Gulf of Mexico, this may be a position he walks away from and is certainly a change from the Obama administration position.

An alternative hypothesis to the high oil price scenario is continued low oil prices.

The alternative scenario assumes OPEC and Russia are concerned with peak oil demand and the transition to electric transport so they want to keep the World oil price low enough so that deep water offshore oil, extra heavy oil, and tight oil resources remain in the ground and they take most of the World oil market share by developing their resources rapidly enough to maintain a World oil price at under $55/bo.

Such a scenario may or may not imply that the peak in World oil output (12 month centered average World C+C output) will be 2018. That depends on future World demand for oil which may not have peaked yet. If the monthly average Brent oil price can be maintained at relatively low levels (such as less than $75/bo in 2020 US$) then the World peak in demand for oil may occur in the 2025 to 2031 time frame (my best guess is 2028).

Dennis. If Russia and the Gulf States want to destroy competition, they will produce at maximum levels.

They decided instead to cut massively due to COVID.

I know you are highly optimistic about electric vehicles and are not a fan of fossil fuels. I agree with you that there is a transition underway. I disagree with you on how rapidly it will occur.

We had our first EV in my county in 2012. The owner traded it for another EV in 2017. It’s owner has 3 ICE vehicles and has traded all three for other ICE vehicles since 2012.

About two years ago our county had its second EV. The owner didn’t like it so much and traded it for a new ICE vehicle. This owner also had two other ICE vehicles while owning the EV.

Granted, I am in a rural area.

Also, I haven’t been traveling like I used to as a result of COVID. But I have made two driving trips since May 1 to major cities. I didn’t see a Tesla on either trip. Usually I see a few.

I have also made a couple trips to a large university town, where EV are very popular with the faculty. Each time I saw one Tesla.

I know we all hate anecdotal around these parts. I haven’t been to California for a long time. That is where over half the EV are.

Dennis, do you have a breakdown as to male/female ownership/driving miles of EV?

Shallow Sand- its not just Tesla. You will be seeing electric pickup trucks from Nikola, Lordstown, Ford, and Rivian, GM, and more, in the next 2-3 years.

By the end of the decade they will common.

https://www.motortrend.com/news/electric-rodeo-we-round-up-the-upcoming-ev-pickup-trucks/

https://www.digitaltrends.com/cars/future-electric-pickups/

Shallow sand,

Perhaps peak demand will be determined by peak supply, in either case oil output will peak either way before 2030. Note that I am not claiming peak demand will happen soon, I predict peak supply will occur first, in 2028, then we will see oil prices rise to match supply and demand between 2028 and 2037, by 2037 oil demand will likely be less than supply.

Note that there is a lot more driving in metro areas than in rural areas. Also there are not really that many Teslas on the road, outside California. In my very small metro area (under 150k) there are perhaps 5 or 6 Teslas, mostly Model 3. That is in Northern New England, no idea if it is more men or women, in my area of the 5 I know about for sure it is 3 men, and 2 women. A very small sample obviously so of little significance.

Dennis.

I have read some articles which indicate that over 2/3 of EV are registered to men.

I have also read that SUV, cross-overs and mini-vans are more popular vehicle choices among women.

I just don’t hear many men or women discussing EV where I am from. EV need to transform from being a niche product desired mostly by highly educated men with strong environmentalist views to vehicles desired by the masses.

I am sure this transformation will take place, but I have been watching EV since 2012, and the transformation process has been slow. What surprises me is that the major automakers still haven’t seemed to have found a way to make money selling them.

I suppose I am going past oil here, but whether or not EV become widely desired and accepted is a big deal regarding demand. I am just not seeing them being widely accepted yet. It’s coming I assume.

Shallow sand,

The Model Y might change things a bit as its a crossover, prices will need to come down for EVs to become more mainstream. 40k is a bit much for most people, eventually more auto makers will produce them, there are nice models from Hyundai and Kia along with the Tesla 3 and Y.

Hyundai Kona and Kia Niro (both are small SUVs) about 240-260 miles of range.

Note when I say demand is less than supply it imies stock levels will increase, prices will fall and supply will fall to match demand. In the long run supply and demand are equal in a free market.

Hedgeye has been talking about recent moves where stock indices have gone down, and commodities have gone up. This is signaling stagflation. If the printers keep going brrr then that trend will probably continue. in the short and medium term, pressures on the dollar will be more significant.

The US Dept of Energy posts a tool on their website which calculates the cost of ‘fueling’ a vehicle with electricity vs gasoline.

They call the electricity an eGallon for direct comparison to a petrol gallon.

The average cost of gasoline in the USA is $2.25/gallon (as of March 21, 2020). To be equivalent in cost to electricity for propulsion of a similar vehicle, the gasoline would have to be priced at $1.15, or less.

You can use the tool to compare these costs for each individual state as well.

https://www.energy.gov/maps/egallon

Of course, it will take well more than a decade for this price advantage to filter through the vehicle fleet of the world

Hi SS,

I own a Tesla but because I can stay home (I’m retired). During this pandemic, I have put very few miles on our Model 3; about 420 miles in 6 weeks. I assume that other Tesla owners are well heeled and can work from home. If it weren’t for this pandemic, we would have been on a road trip to sights we have longed to see.

On that note there was a 37% drop in Tesla EV sales in California. Not sure of the cause but this economic downturn can’t be helping. Could be waiting for the Model Y to appear in quantity. Basically a Model 3 with heat pump heater and higher siting seats and quality control build issues that will get ironed out.

Hello SS,

Are they not at “maximum” with respect to demand that has been reduced by COVID effects?

I’ve noticed that the Father’s Day shopping filled a number of parking lots. We’re already seeing spikes in infections. This can’t be good news down the road which might cause lock downs again thus decreasing demand.

$147 oil killed the market and economy last time. $200 oil would do the same again. Are there market breakers in place or will those who buy oil at $195 be left “holding the barrel”?

This makes me wonder if Malek from JP Morgan is trying to talk the market up as our economy sinks and he has clients that need to bail.

Dennis, I believe your alternative scenario…

“The alternative scenario assumes OPEC and Russia are concerned with peak oil demand and the transition to electric transport so they want to keep the World oil price low enough so that deep water offshore oil, extra heavy oil, and tight oil resources remain in the ground and they take most of the World oil market share by developing their resources rapidly enough to maintain a World oil price at under $55/bo. ”

…makes perfect sense for OPEC and Russia. If they can pull it off.

I wonder how closely they can actually attain their production/price target goals.

Hickory,

Under my scenario it will be difficult for the cartel to operate, there will be lots of cheating and a tendency for output to be higher, and oil prices lower. Doubtful they will hit their price targets, they never have and never will.

Ron,

I am a bit confused on your position. In comments in other threads you have suggested that you expect that demand will never recover to the 2019 level and that what ever level it recovers to will be a slow process (no V shaped recovery). OPEC and Russia are unlikely to maintain their cuts over the long term in my opinion, so as this output is brought back online it can easily replace declines from deepwater, tight oil, and oil sands that is likely to decrease in response to low oil prices and lack of investment.

All of this adds up to the high oil price scenarios being rather unlikely, at least in the short term (next 5 years).

If there’s one thing the farmer’s perspective has in common with that of the oil man, it’s wild market gyrations. In my field, we have a lot of substitutes, so the effect is not so pronounced, but it’s still obvious.

If the price of beef doubles, people can switch to pork and chicken.

Given that there’s no real short term substitute for oil………Production has and will continue to crash hard because nobody is going to be spending much money on new production to replace depleting legacy oil.

I’ve seen the price of peaches at the farm gate triple and quadruple in three or four years starting with a literally can’t even GIVE them away. Growers just quit planting new and replacing older trees with younger ones.

I think maybe peaches might have gone up to two or even three hundred dollars a bushel, lol, if we had nothing else to make moonshine out of to run cars and trucks, lol.

The electric vehicle industry isn’t going to grow fast enough to have any noticeable effect on the price of oil within the next three or four years.

If the economy comes roaring back within three years or so, and nobody spends any significant money on bringing new oil production online, or properly maintain existing wells, in the meantime………. Rust and depletion never sleep, lol.

Two hundred dollar oil is a VERY real possibility.

But my personal guess is that the economy is not going to recover all that fast.

“my personal guess is that the economy is not going to recover all that fast.”

The big variable is a vaccine that works. If we do get one, things could ramp back up within 6 months or so.

Watching the news on vaccine development, I think there are going to be multiple versions available, but it will take quite a long time to know how efficacious the various ones are.

OFM,

Perhaps oil prices might spike for a couple of days or even a month to that level. Tight oil output can be brought online pretty quickly and demand would also fall.

My expectation is that OPEC fears peak demand and wants to delay that, so they will increase output to keep oil prices at less than $75/bo.

In short, I think the $200/bo price for say a 3 month or longer period (average price over that 3 month period) is highly unlikely over the next 3-4 years. I would put the odds at about 50:1.

Agree we may not recover fast, but I think in 3-4 years World real GDP will be above the 2019 level. And World C C output will be above the 2018 annual average level (about 83 Mb/d) by 2026 to 2030, with peak from 2028-2032 at around 84-85 Mb/d.

Good interview with Lundin ceo Alex.

https://www.linkedin.com/pulse/survival-fittest-johan-trocm%25C3%25A9/

So indirect he says:

– Oil reserves are much smaller – since all high cost fields are too dangerous to invest in.

– An oil price spike in the next years is possible.

– Exploring is down, not much new cheap fields in the near future. Nobody wants to invest now in 40$+ oil, too much risk.

– Investing in alternative energies is slow because of lower capital return rates.

Horizontal Rig count for week ending June 19, 2020 was 234 with horizontal oil rigs at 170, down 12 and 9 respectively from last friday and down from 713 and 620 for week ending March 13, 2020.

Coronavirus will hasten ‘peak oil’ by three years, says research firm Bold mine.

An influential research firm has cut its estimate of potential oil production by an amount that exceeds the reserves of Saudi Arabia, as the coronavirus crisis accelerates longer-term structural changes to the market.In an annual report published on Thursday, Oslo-based Rystad Energy said its estimate of “recoverable” oil resources — the volume that could be extracted from the earth, given constraints of technology and demand — has fallen since 2019 by 282bn barrels to 1.9tn barrels, as consumption habits change and oil companies abandon exploration plans. The proven reserves of Saudi Arabia, the world’s second biggest producer, come to 267bn barrels.

“‘Peak oil’ is now a little closer,” said Per Magnus Nysveen, head of analysis at Rystad, referring to the hypothetical moment of maximum production. “We used to say that peak oil will happen around 2030. Now we say that it could happen in 2027 or 2028.”

Crude consumption dropped as much as one-third at the height of the coronavirus crisis in April, as lockdowns and travel restrictions forced people to stay home. Demand has begun to recover, but there is growing acknowledgment across the industry that the impact of the virus may reverberate for years to come.

People will be reluctant to travel by air for some time, Mr Nysveen said, reducing demand for jet fuel. Meanwhile, he said, the sharp fall in crude prices will cause drilling activity to plunge in the near term, leading to a spike in prices between 2023 and 2025 — just as electric vehicles become competitive with the combustion engine. This should accelerate a switch from petrol and diesel, further hurting demand for crude.

Rystad said this drop-off in demand, coupled with increasing environmental consciousness among investors, would discourage oil producers from pumping money into projects in more remote areas with long lead times, meaning areas previously expected to be explored for oil would be left untouched.

There is a lot more to this article but this is all I will copy and paste. They are saying peak oil will be in 2027 or 2028. I am still saying they are a decade off, peak oil happened in 2018.

In November 2018. But on an annual basis 2019 is very close. Within the accuracy of data. A graph with monthly EIA data Jan 2018 – Jan 2020 with annual averages is here:

http://crudeoilpeak.info/latest-graphs

Production losses in Saudi Arabia after the Abqaiq attack have complicated things. Some of the “production” may have come from inventories

Ron,this gentleman is just saving his butt . What is the difference between 2030 and 2028 ? Could very well be a fat finger . What is the difference between 1 mile and 1 mile 1 inch ? Not important . Agree with you peak oil happened in 2018 .

So far 2018 is in fact the peak. In 2028 we will see if you are correct, I would say the odds are 3 to 1 that you will be incorrect.

Want to bet 300 to 1 that Ron and I are correct ?

Disclaimer : I am already a pensioner + and even if I loose I will win . Take your chance . 🙂

I would bet 10 to 1 that 2018 will be the peak even If I knew I would live another 10 years, which is doubtful. But the main reason why is that I belive all three of the world’s largest oil producers have either peaked or very near their peak. That is Saudi Arabia, Russia, and the USA.

It has only been due to a continued increase in production from Russia and the USA that has kept the world from peaking already. Those days of continued year after year increase are over. The decline from all those declining nations however is not over. They will keep declining and a new nation or two will join their numbers each year.

Yep, I’m with Ron on this one.

But I’m a historian, not into oil, although my father was, and relative worked with Drake.

But I’m a old guy also—

So lets get this straight, you would give me 300 to one odds that the 12 month centered average of World C+C output as reported by the EIA will not be exceeded before 2030? In other words if I bet 100 dollars your side of the bet is $30,000?

Am I understanding you correctly?

If so I would be down for $100 on the bet I just outlined. Payout April 30, 2031 when we have the data for 2030 World C+C output.

Would take Ron’s 10 to one bet also again with the understanding that my side is 100 and his side is 1000 for 12 month World average C+C output.

You’re on Dennis. And if I do make it to 92, I will be $100 richer. 😉

Denise ,you are on .

If it’s a true bet you put your respective wagers in escrow…

Stephen , I would ,but I am ready to place another bet with you . I bet the financial system crashes before Ron ,me or Denise will encash our bets .:-) . Also possible that of the three of us some kick the bucket . By the way ,if you accept my wager than I can say four instead of three .;-)

2028?

Probably trading with the tribe in the next valley for arrowheads.

I meant cowrie shells of course…

Maximum World Crude plus Condensate 12 month average trailing output through Feb 2020 is 83060 kb/d in May 2019 according to the most recent EIA data available. The 12 month trailing average for Feb 2020 was 82324 kb/d, Dec 2019 was 82314 kb/d and Dec 2018 was 82925 kb/d.

My expectation is that the May 2019 peak (based on current data, the data always get revised) will be exceeded by December 2030 with a possibility that the final peak will occur in any month between Dec 2026 and Jan 2034. Best guess is some month in 2030.

Incorrect . Some items are finished or almost finished . They are LTO and off shore oil . Now add to this the natural decline and depletion rates , total these and you will discover that arithmetic prevails .

At current prices many marginal producers are going to be in deep s^^^ and face social unrest just like Venezuela . BP wrote of $ 17.5 billion worth of assets because at current prices those are uneconomical to extract . Reality bites . Last of all ,please no ^ifs^ and ^buts^ ,let us stick to the arithmetic or physics ,no one ever won against these two champions .

hole in head,

We will see. My scenario assumes the average World extraction rate for conventional reserves rises from 5.6% in 2018 to about 6.5% in 2030, note that the US extraction rate from producing reserves was 16% in 2018. I also assume tight oil output falls to 1 Mb/d by 2030 in my scenario, which is a very conservative assumption.

Eventually oil price may rise, in which case offshore oil may be profitable to produce.

The rate of decline is determined in large part by the rate that oil is developed. Eventually (after 3 years is my guess) the World economy recovers demand draws down stocks of oil and either oil prices rise (bring back tight oil and deep water) or OPEC and Russia flood the market to keep market share which keeps World output up and keeps oil prices low.

Not clear which it will be, but either scenario leads to an increase in World C+C output.

A third scenario is a rapid transition to EVs and other forms of electric transport which keeps demand for oil below the 2018/2019 level permanently, that is the only somewhat likely scenario where you win the bet.

A fourth highly unlikely scenario is that the World economy never recovers to the 2019 level of real GDP output, that seems to be Ron’s bet, I think it is a long shot.

I have used the new BP Statistical Review data to update my oil consumption graph for China.

http://crudeoilpeak.info/china-peak-oil

The impact of peak oil in China 2015 on the world oil market is still not reported about, not to mention analyzed.

The border clashes between India and China are near the Pakistan – China energy corridor

A map is in this BBC article:

https://www.bbc.com/news/world-asia-52852509

China can now import the oil the West is “saving” as a result of the Corona virus’ induced recession

Triggered by Australia’s demands for an investigation into the origins of the virus, tensions with China have increased, now in a cyber attack

https://www.abc.net.au/news/2020-06-19/foreign-cyber-hack-targets-australian-government-and-business/12372470

It’s long overdue for your world update. ;]

Wow. First year in many I didn’t jump on the Bible of oil when it came out. The virus has rendered everything historical of little consequence.

From a conservative financial commentator-

“Near-universal mask usage would help the economy more than another multi-trillion-dollar stimulus package would—a lot more, and faster, too. And without adding a penny to the national debt.”

For an indicator of economic activity, and petrol demand the Cass Transportation Index is a good measure-

https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/may-2020

The chart is the Cass Freight Index

There is a new Dynamic pulling markets currently. Not sure how long it will stay this way but for now here is how i see markets trading. Basically it’s a reflation trade. Before Covi-19 we had interest rate differentials pulling markets along. Now everybody is near zero or slightly negative. Not enough differential to cause much capital flows.

If your central bank is doing QE then your seen as supporting asset prices and supporting your economy. So if your doing QE US dollars are flowing to your country because asset prices are bid. Even the Euro as flawed as it is has been bid against the dollar. There is one problem with this which is if your doing QE and your not the FED. Then your currency is appreciating against the dollar. Nobody wants a strong currency. And with everyone at zero interest rates there is not a whole lot anybody can do to stop their currency from appreciating. Well they can stop QE and watch asset prices deflate along with their economy. As the flow of US dollars stops and they start flowing out instead of in.

I don’t view oil much different than just another currency. At least in trading terms i don’t. The same reflation dynamic will reinflate oil. Supply shrinking and demand returning will help. But those two things are brought on by reflation.

This reflation dynamic is totally tied to equity or stock markets continuing to go up. Or i guess a better way of putting is anything that would make stocks go down would also reverse capital flows or reflation.

Now the FED has slowed the rate of balance sheet expansion to a trickle compared to what it was 2 months ago. That might be all it takes to reverse reflation.

My take on $190 oil is it’s possible as long as the CB’s don’t lose control over the market. But what i fear most is a global insolvency event that happens in the real economy not the financial markets. Just because you give someone a new loan to cover the old loan doesn’t mean they have the cash flow to service the loan. I can’t stress how big that is right now.

$190 oil would probably be as short lived as negative oil was.

Watch US treasury yields. If they go negative here soon that means there is no reflation and there is not going to be a reflation. FED will likely do YCC to keep long term bonds from going negative. Which means they will buy less or outright sell bonds to keep yields just above zero.

The very fact that we had 140+$ oil and crawled out the other end of the economic fallout of 2008 is enough indication to me that we’ll probably retest those levels, and maybe soon if demand kicks up.

I’m actually bullish about the early thru mid 2020s due to tech fervor and the presumptive let-out party, post-covid. Long term, I’m expecting doom. Of course, anything is possible now, good or bad

Interesting analysis.

FYI 2019 consumption stuff.

US -0.1%. Flat at 19.4 mbpd

China reaches 14.1 mbpd up 5.1%

India +3.1%

All of Europe -0.3%, essentially flat

The Saudis were up substantially 0.5%. Japan down 1.1%. KSA just 24K bpd from becoming the 4th largest consumer in the world.

Russia up solid 1.1% and Iran up 10%. Sanctions triumph.

No one should use the term economic collapse without defining it precisely. The Watcher definition of Apocalypse requires an 80% loss of global population in 12 months. Economic collapse is an 80% loss of GDP extending 2 fiscal quarters. Btw, world govts and CBs this year have created virus stimulus amounting to 21% of Gross World Product. Capitalism triumphs.

Peak oil will not be defined by price, because if you have to have it, and you do have to have it, then you will get it and price will not stand in your way. Peak oil will be defined by about 80% geology and 20% technology, absent war or plague (!!!).

A reasonably good study was released a few days ago out of China and their conclusion is antibodies in patients who become PCR negative (recovered) decrease in quantity by on average 80% within 8 weeks. Stop and read that again. And fully 40% of patients have undetectable antibody levels at that 8 week point. aka 2 months

No, peak oil is all about price and politics and technology.

Politics -> See Lybia, Venezuala and Iran being out of the game. This list can get shorter or longer.

Price: At 30$, there are round about 2 trillion barrels reserves

At 60$ it are 4 trillion

And at 180$ it will be 40 trillion or more, making Kerogen reachable.

So the question is, how much % of BIP does the world pays for convenient liquid fuels – that’s all about peak oil. Will they build huge nuclear reactors or giant solar farms to bake out Kerogen?

30 Years ago the world would have paid more than today, since electric land transport is in the making now as an alternative, heating oil is phasing out and chemical use is still limited.

Oil is now only about transport, not anymore about energy. So peak oil comes near or is already hear.

My personal guess is, it’s now, with a fat finger over a 10 year periode (spiky). US shale has one more bull run in it before running out of good locations, Offshore can have one more run getting all this deep sea around Africa and Brasil, and some old giant fields can be forced one last time. I don’t believe in a 180$ scenario for a longer time, so it’s done after this.

That antibody study was for 37 patients, so still not very authoritative.

The article also mentions that there are other antibodies that can prevent the infection (are they talking about the IgM?), so i’m not entirely sure what’s going on there.

But this question of how long do the antibodies last had been raised a couple of months ago, so i’m surprised other researchers haven’t reported anything yet. I did see one public health person say they thought the immunity might last a year or two, but that might have just been speculation.

https://www.nytimes.com/2020/06/18/health/coronavirus-antibodies.html

There is further reason to give weight to their 37 samples.

The Swedish public health honcho announced the city of Stockholm, after 5 months of no lockdown, shows indication of merely 8% of the population with antibodies, less than half of what he projected/expected and hoped for.

The Chinese may have just told him why.

I had heard about the Swedish survey.

That’s an interesting take!

And in Belgium, with lockdown starting early in the pandemics and released since about one month, we reach also about 8% about the population having antibodies…

Just because antibodies become undetectable doesn’t necessarily mean that a person won’t mount an effective immune response once re-challenged with an antigen. The system is a little more complicated than on-off.

There are indeed memory T-cells and B-cells that can raise very quickly a strong immune response.

Price: At 30$, there are round about 2 trillion barrels reserves

Total absolute nonsense. Even according to OPEC’s Inflated Data there is less than 1.5 trillion barrels. (OPEC 1,190 billion barrels, Non-OPEC 308 billion barrels in 2018.) They got the Non-OPEC data pretty close but the OPEC numbers are inflated by about a factor of three.

Anyway, you are looking at the number of reserves according to the price of extraction. Of course, this is a factor but not the largest factor. The major factor is demand and demand is largely determined by the people’s ability to pay.

The world economy is in serious decline. That means that demand will continue to decline along with the well being of the world’s population. Given this scenario, only cheap oil will be produced. We have way less than half a trillion barrels of very cheap oil, or less than 15 years worth at current consumption. But of course, we could not consume cheap oil right up until the day it is all gone. Production of the cheap stuff would decline a little each year, just as it is doing right now. Only expensive oil, like shale or deepwater, could increase the production numbers.

It is my firm conviction that the slow collapse of the world’s economy has already begun. This virus thing was the trigger that tipped things over the edge. The economy will wax and wane from here on out, with every dip getting a little lower and each recovery not quite reaching the level it did last time.

Ron, on the US side of things, we were struggling to get 3% GDP growth with $1T in fiscal stimulus (aka annual deficit).

The 65+ segment of the population is headed towards 25% of total. They can’t spend as they did in 2019, and there is no reason to believe that will change any time soon.

You cut spending in half by 22% of the population, you have no chance of organic 3% GDP growth. As far as the eye can see.

and this claim is also utterly bizarre:

I know I am utterly bizzare:

” Consisting of an estimated 10^16 tons of carbon”

https://en.wikipedia.org/wiki/Kerogen

To get it:

https://en.wikipedia.org/wiki/Shale_oil_extraction

It’s more expensive to get as tight oil, so my ballpark number was 180$.

It has already been demonstrated to work technically, read some articles before calling someone an idiot.

( I don’t think the oil price stays long enough that high for this scenario comes true, or all these hydrocarbones should be burned at all. It should describe peak oil is more a political, technic and economical thing than a pure geological)

It’s especially bizarre since it will require more water than is available, so a head of lettuce will cost >$1000.

If that’s how you feel about yourself, so be it. (I searched and found no reference to someone calling you “an idiot”)

it will require more water than is available

If memory serves, retort processing might take as much as 5 barrels of water per barrel of oil produced. If oil is selling for $180 it would be easy to justify transporting water quite a distance from some place where water costs a penny per barrel. Heck, you could even justify something quite expensive, such as desalination at 60 cents per barrel of water – that’s only $3 for the water input.

And in situ processing (such as Shell’s) would require much less water.

See my comment below about oil shale.

Create tiny nanobots that have their own engine that will drill down below the surface and retrieve the kerogen and then come back up and process it so that they can use the fuel to make a second trip to go retrieve the kerogen so they can come back up and process is so they can make a third trip down to go and retrieve the kerogen so they can process it and have the fuel to make a fourth trip down to retrieve the kerogen and process it on returning to the surface so they can make a fourth trip down to retrieve the kerogen and

Paul, the nanobot theory is childish and silly. We will never build tiny robots so small that it will take a microscope just to see them.

That silly theory came and went over a decade ago. Books were written about it. Then critical thinking took over and everyone realized it what an absurd theory this was.

No Paul, nanobots, Santa Clause, and the tooth fairy are not real, and never will be.

So, just as silly and implausible as St. Nick G and his own fairy tales

Hi,

I’m a 27 year old German guy and although i kind of realized the whole peak oil problem 8 years ago, i struggle to find a real perspective for my life. Do you have any advice?

Sorry, Simon, I am having enough trouble finding perspectives for my own life without finding perspectives for others.

Simon,

Energy issues (or any global issue, really), aren’t really the most important thing for you to focus on to find a perspective on life. As a German you’re lucky in the lottery of life: you could have been born in Syria, or Somalia. You’re likely to be ok economically.

Focus more on good relationships, meaningful work and self development (have you tried meditation? Here’s a good book: Why Buddhism is True: The Science and Philosophy of Meditation and Enlightenment by Robert Wright).

Hey Simon,

I am a 28 years old guy from Austria with the same problem:) We can get in contact if you want.

Lg

Michi

Simon,

If concerned, do what you can to make changes in your life that you believe will have a positive impact on the World. If you believe, like many, that individual change has no effect, ignore the problems you see (also like many others). If that is difficult perhaps meditation would help, not sure as it is not my approach.

Simon, I’m a 60 yo dumbass. Known about Hubbert since college in 80s. Clueless about when and effects of peak, still. But…learn to enjoy staying at home and growing food crops. It’s a delightful life. Oh…and throw out your television and your religion. Read your Darwin.

Simon,

It’s not great but it’s what I got: https://old.reddit.com/r/CollapseSupport/

Create an account and subscribe to some self-help, personal growth, art, hobby, what-have-you subreddits to avoid too much doom and gloom.

Lots of work to do. Learn permaculture. If your motivated here’s an article to read:

https://www.math.univ-toulouse.fr/~schindle/articles/2020_oil_cycle_notes.pdf.

Hi Simon, I’m not sure where you’re at, so to speak, but I recommend Reality 101 by Nate Hagens.

It’s free on YouTube.

Ron,

BP estimate for “oil” reserves (they include NGL) at the end of 2019 is 1734 Gb, if one rounds to the nearest billion that is “about 2 trillion”.

Not saying it is a good estimate, it will depend in part on the price of oil, my guess based on assumed lower oil prices (OPEC higher output scenario) is about 1.3 to 1.4 Gb of 2P C+C reserves including unconventional (tight oil and extra heavy oil) resources. URR about 2.7 to 2.8 Trillion barrels.

Dennis, we both know BP uses the reserve numbers published by OPEC. That makes the BP reserve numbers worth as much as a bucket of warm spit.

Ron,

Jean Laherrere has generally reduced OPEC 2P conventional reserves by about 300 Gb. In Mr. Laherrere’s opinion the 2P reserves are the best number to focus on as they represent the best guess by petroleum engineers for reserves.

If we ignore extra heavy oil (about 424 Gb), then we have about 1300 Gb of C C less extra heavy reserves reported by BP( 953 Gb of these are OPEC).

If we deduct 300 Gb we get 653 Gb of 2P OPEC conventional reserves. Non OPEC is about 357 Gb of proved reserves (excluding Canadian oil sands), 2P reserves would be about 40% higher, so about 500 Gb. World 2P C C less extra heavy oil reserves would be about 1153 Gb, Laherrere’s recent estimate for extra heavy 2P C C reserves is about 200 Gb, that would give total World 2P reserves of about 1350 Gb, about 1350 Gb of C C has been produced suggesting a World URR of 2700 Gb, but only if it is assumed there are no new oil discoveries or any reserve growth in the future (probably not a good assumption). One might assume that low oil prices in the future (which would tend to reduce reserves) might offset any discoveries or reserve growth in the future. Under that type of low oil price scenario, the URR estimate of 2700 Gb might prove accurate within /- 4% (about /-100 Gb).

Correction:

Laherrere reduces the reported OPEC “proved” reserves (in fact these reported reserves are likely 3P reserves) by 300 Gb to get a 2P C+C reserve estimate for conventional OPEC reserves.

Eulenspiegel,

It is not likely that the price of oil reaches $180/bo on average for any 12 month period in the future. The Kerogen resource is large, but the proportion that would be profitable at $180/bo is very close to zero.

No Kerogen has ever been profitably produced, technical feasibility does not indicate profitable production.

The economic estimates in the Wikipedia article are obviously wrong, because their has been almost no shale oil produced, there has been a little use of Kerogen in power plants as a substitute for coal, but the quantity of shale oil produced to date is virtually nil. It will never be a viable energy resource.

Dennis,

I think you and Eulenspiegel are actually in full agreement.

Shale oil is very similar to Coal-to-liquids. Both are technically possible, but can’t compete with oil’s historical sustained price levels. Both have large barriers to entry: very large capital costs, very long time to payoff, and use very dirty processes which investors know will not get political support or any kind of loan guarantees or other kind of incentives. Around 2007 CTL was floated by some large investors, but they wanted government guarantees due to their riskiness. Those proposals went absolutely nowhere.

So, they are both technically possible, but can’t compete economically with real world alternatives such as electric transportation.

Yes, that’s right.

I was just making scenarios – and at an 180$ or + scenario oil sources that now nobody will touch will be touched. Just for making money, or at least trying to make.

This scenario will never happen in my opinion – a combination from forcing more electric transport together with a economic crisis and plain and simple driving less and slower will prevent this.

In my initial post I just wantet to show that peak oil is only geological at a fixed oil price and a fixed political setting. There is plenty of this black stuff – there is only not much cheap stuff left. And this is what matters, peak cheap oil.

It would much more sense to plot these different curves, instead of the mix up- producing conventional land based oil, fracking, offshore and tar oil (and Kerogen 😉 ). You could see them all peaking at different times.

Eulenspiegel,

My point was that even at $180/bo, it is not likely that 32 trillion barrels of shale oil will be profitable to produce, perhaps 1 trillion (at most, an optimistic estimate.) It is possible that tight oil, ultra deep water offshore and arctic oil reserves would be higher at $180/bo (2020 US$), how much higher is difficult to say, but we did not see a huge increase in reserves from 2011-2014 when Brent averaged about $110/bo in 2018 US$. My guess is that the increase in oi reserves at $180/bo would be marginal (perhaps 5 to 10% increase).

I do agree that $180/bo (2020 US$) for Brent for any 12 month average price is not very likely, though we might see $120/bo (2020 US$) for some 12 month period from 2027-2037. After that I think it likely that oil prices will start to fall as oil consumption may fall below oil output levels leading to rising stock levels and OPEC nations and Russia competing for market share.

No Kerogen has ever been profitably produced, technical feasibility does not indicate profitable production

The shale bings of the Scottish borders were created by profitable industrial enterprises. (Not serious->)Perhaps with cheap heat from 4g nuclear it could be profitable again.

Yes, if you have dirt cheap energy you could develope kerogene by in-site heating. As done with bitumen oil in Kanada, but with even more energy needed.

Dirt cheap energy could be your reactors when existing, or cheap chinese solar cells in a desert (prices of 1 cent / Kwh already reached in some deserts).

I don’t think it makes sense to touch this stuff, but in a fictive 180$ oil scenario it will be done when the numbers are right.

Dennis, perhaps the same like tight oil: Lots of production and red ink, but the investors are happy.

And for the size of the possibly reserves: I don’t think much money was wasted to explore this stuff in detail, world wide, since nobody has any use for it. It’s all fictive anyway, that high oil prices can’t be sustained long enough to mine this stuff. It has to be a at least 10 years periode.

It’s the same as with lithium: As long as lithium batteries where only driving electronic gadgets, there where only a few known sources of lithium.

Now we have here in Germany a new source: Geothermal power plants in the Rheingraben have discovered high lithium concentrations in their sole. There should be enough of this stuff to supply whole Europe from own sources. This “mining” would even generate electric energy, since the lithium unit can be operated by parts of the generated electricity.

https://www.electrive.net/2020/06/15/lithium-gewinnung-aus-geothermie-anlagen-in-deutschland/

And that’s the way to go anyway – leaving behind the oil age. And when you have dirt cheap energy in a desert far far away, generate hydrogen to transport it to where it is used and not second quality oil.

Lithium Batteries are actually Nickle batteries.

The trouble with geothermal is that it is often not renewable, the rocks cool down over time; the UK hot rock program found fracking necessary to get the necessary heat exchange surface area. They eventually gave up. Geothermal works pretty well in Iceland though! – there was a plan for a high voltage Iceland-UK inter connector a while back.

Actually kerogen shale oil exploitation in southern Scotland was prompted by depletion of the Derbyshire fields. James ‘Parrafin’ Young was significant in developing the refining by distillation of the original Derbyshire oil, and resorted to shale and cannal coal in response to the then ‘peak oil’ problem.

https://tinyurl.com/ydfusosm

Wikipedia has an interesting bit on kerogen shale oil too:

https://en.wikipedia.org/wiki/History_of_the_oil_shale_industry

I conjecture that future commercial kerogen shale oil exploitation (when other sources hit limits) is pretty much inevitable – though this may be many years ahead.

IanH,

As other cheaper forms of energy displace natural gas, coal, and oil, it seems highly unlikely that much shale oil will be used as it will always be the most expensive option.

In related news from Sweden we just fired up one old oil powerplant to support base load as our renewable fails to deliver (wind) and mitigate some of our current import needs and shortfalls. This is in addition to a reactivation of a reactor set to be terminated by year end.

I predict we will fire up more of them oil burners in coming years as we close down more reactors and create a more volatile production profile.

Do you have a link?

IanH,

Correction, since the advent of cheap petroleum in 1859, very little shale oil has been profitably produced. Where it has been used has mostly been in power plants since the advent of the petroleum age in 1860, it cannot compete as a transportation fuel from a privately run enterprise that is profitable. Most shale oil that has been produced since 1900 has been supported by government subsidies, it really is not a viable source of energy today and is unlikely to be in the future.

SS, it is at this point in time, facing a global plague, that XOM could move its dividend yield from over 7% to over 5% by reducing the payout to a level that would actually be covered by earnings.

Not only that, but market reaction to the event would probably take the price down and possibly return the dividend yield back up to 7%.

It’s the perfect time. No one would blame the CEO for having to do things in response to a plague that no one could have anticipated. He could keep his job and no longer need to borrow to pay the dividend.

By the way, assuming you are not aware, capital loss harvesting is a very good thing in accounts outside IRAs. If you want to hold a position, buy CVX with the proceeds.

An Article in today’s Guardian newspaper about a report by a French group called the “Shift Project”.

https://www.theguardian.com/business/2020/jun/23/europe-could-face-oil-shortage-in-a-decade-study-warns

Based on data from Rystad Energy.

Link to the report: https://theshiftproject.org/wp-content/uploads/2020/06/Study_Risk-supply-Europe_TSP-with-Rystad-Data.pdf

“He concluded the forecasts offer “yet another reason” for economies to reduce their reliance on oil.

The countries which invest heavily in electric vehicles, for example, will be able to avoid the economic pain of surging fuel prices while those that do not may be forced to accelerate the shift away from petrol and diesel cars to avoid the higher costs.”

This article quoted in news feeds. The Great Compression …. 300 B Billion loss?

https://www2.deloitte.com/us/en/pages/energy-and-resources/articles/covid-19-implications-for-us-shale-industry.html

“Although US shale is less than 10 percent of global oil and gas production, it accounts for 40 percent of the global drilling activity and explains nearly 100 percent of the growth in US midstream and export-oriented refining and petrochemical sectors over the past 10 years. Thus, any major developments in US shales will likely have a domino effect on the global oil and gas industry,”

https://maritimesky.com/index.php/2020/06/23/shale-industry-will-be-rocked-by-300-billion-in-losses-and-a-wave-of-bankruptcies/

US tight oil estimates for May are out, big revisions from last month.

Output at peak in Nov 2019 was 8279 kb/d, in May output fell to 7102 kb/d, a drop of 1177 kb/d from Nov 2019 and a 1008 kb/d drop from March 2020 to May 2020, 704 kb/d drop from April to May.

Data at “tight oil estimates by play” at page linked below

https://www.eia.gov/petroleum/data.php#crude

Also Frac spread count for W/E June 19 2020 was 78, up from 45 about 4 weeks ago (W/E May 22, 2020).

See https://www.youtube.com/watch?v=oV_ITub-234

Chart below pulled from 3:43 of video, but the information from the video is worth watching in my opinion.

Wow that’s looking a lot different than the 2015-16 slow down. Anyone wanna make a wag at the low? 4.5M/d?

Stephen Hren,

See

https://shaleprofile.com/us-tight-oil-gas-projection/

Assuming no future change in rig count, completion rate per rig or new well productivity,

Mr Peters would project 4.5 Mb/d would be reached in June 2025. I adjusted lead time from spud to production to zero months for this projection. Note the model estimate for May 2020 is 7899 kb/d, about 800 kb/d higher than the EIA estimate for May 2020. If we assume all months from May forward are 800 kb/d too high, the 4500 kb/d would be reached in Nov 2021 (projection is 5300 kb/d for that month).

In my opinion your 4500 kb/d guess might be a little too low, mine is 5000 kb/d for the bottom for tight oil (over next 5 years), the eventual bottom will be 500 kb/d or less (maybe in 2035 to 2040).

Worldwide offshore facing a big setback as well over the next few years…

https://www.reuters.com/article/us-global-oil-offshore-drillers-graphic/with-contracts-canceled-and-debts-mounting-offshore-oil-drillers-face-another-shakeout-idUSKBN23V0J3

Great post by Mr Shellman at link below.

https://www.oilystuffblog.com/single-post/2020/06/23/Why-Are-There-ANY-Rigs-Running-In-the-Permian-Basin-

It is a great post, and is greatly bolstered by the most recent PB blog post on shaleprofile.com.

I come up with the 250K BOPD in 36 month wells netting about $4-4.8 million at that point, assuming a 25% royalty burden, at $40 well head.

So not quite halfway to payout with $40 oil. So consider what March at $25, April at $14, May at $23 and June at about $33 will have done to any well completed from 5/1/19 through 5/1/20.

Freakin’ disaster IMO.

Bet PXD adds at least $2 billion more of NOL in 2020.

shallow sand,

Yes it does not work at $40/bo for WTI, which is only $35/bo for many producers at the wellhead. For the average Permian well to payout at $2/MCF for natural gas, they need $65/bo for WTI (that is for a payout in 60 months, for 42 months they would need $70/bo.)

We may never get there, I have revised my expectations for US tight oil, there will be considerably less extracted at the low oil prices we are likely to see in the future.

I doubt OPEC+ will allow oil prices to ever rise above $65/bo before 2028, from 2028 to 2037 we may see a brief rise to $80/bo in 2020 US$. That’s about it in my opinion.

Tight oil URR less than 50 Gb, perhaps as low as 30 Gb. (note that 15 Gb has already been produced, so we are talking remaining reserves of 15 to 35 Gb.)

Dennis. I didn’t include land and seismic in my math. Nor interest. So truly less than 1/3 of the way to payout at $40 well head.

Dennis.

I am glad you are now predicting lower oil prices.

Maybe they will finally go up!

?

SS,

LOL, yes on prices they tend to do the opposite of what I predict.

Note that by low, I mean $60/bo or less. After the economy recovers and OECD petroleum stocks (crude products) are back to near 10 year average levels, I expect Brent will rise from $35/bo to $65/bo, WTI probably $5/bo lower. In the past this has been around your sweet spot (note these are real oil prices in constant 2020 US$.) I expect conventional onshore producers will be fine, only the very well run companies might make money in tight oil at $60/bo for WTI.

Scenario below assumes no tight oil wells are completed after April 2020, so it is a worst case scenario. If oil prices are as low as I now expect, it may not be far from reality, based on your analysis and that of Mr. Shellman.

Note that the model (done on May 6, 2020) has May 2020 tight oil output at 6934 kb/d, actual EIA estimate for May 2020 (which might be revised lower or higher in the future) US tight oil output is 7102 kb/d. It is doubtful that no new wells were completed in May 2020, and a lot of shut in production may come back online in June and July, so the model is likely an underestimate of future tight oil output.

Dennis.

So much depends on the coronavirus outcome with regard to oil prices in the short-medium term.

Prior to coronavirus hitting, WTI was around $55-60. Even then, shale was slowing as rig count was falling and production was flattening (although it tends to flatten in the winter).

Of course, KSA and Saudi went wild in early March, not realizing how bad COVID would hurt demand.

Saudi and Russia are pretty much flying by the seat of their pants like the rest of us. Their “strategy” changes as things change on the ground, just like the rest of us.

KSA and Russia really want prices higher than $60, despite what they try to push publicly. They also don’t have as much control over prices as the credit they are given.

It’s just like pretty much everything in the future. We can’t predict it easily. And if we are right about something once, we will be wrong the next time. See all the “wizards” who predicted GFC, but haven’t done so well predicting the markets since.

I know you like to predict oil prices because you like to do the math. But there are way too many variables to be accurate on that.

But if it’s fun, keep doing it. No harm.

shallow sand,

I agree any future scenario will be incorrect.

In order to do the discounted cash flow analysis that is a part of my model, some oil price assumption must be made, I just like to make my assumptions plain.

I also agree covid19 will be a big part of how the future unfolds and I am far from expert in epidemiology, though I have close acquaintances in the medical field, they don’t know how this unfolds either.

In any case my best guess is somewhere between my low and high models (28 to 70 Gb for tight oil URR with cumulative output at about 16.4 Gb through May 2020).

So between 12 and 54 Gb left to be produced at Brent oil prices between $40/bo for a high and $80/bo for a high in 2020 US$.)

See comment down thread for higher URR scenario with 70 Gb rather than 28 Gb URR scenario presented above. Perhaps reality will be somewhere between these two scenarios, probably not though. 🙂

Seems last week the US oil production increased 500k bpd , amazing with oil price 40 usd WTI.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

Freddy,

The weekly estimates are not very good, they are best ignored for week to week changes in output.

It is possible output went up a bit as prices went from -$40/bo in April to $30 bo/d recently, but the weekly data is crap, only the monthly data is worth paying attention to imho.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS2&f=M

Production in the Gulf of Mexico that had been shut in due to the tropical storm came back on line is the explanation.

shallow sand,

Scenario below might be a bit more realistic and has tight oil output recovering as Brent oil prices rise to $60/b by 2025 and to a maximum of $80/bo (real prices in 2020 US$) in 2036, then remain at $80/bo until 2039 and then decline to $30/b in 2080. Obviously a wag on oil price.

URR is 70 Gb for tight oil in this scenario.

You do realize that OPEC’s income is US dollar based right? All of them can print as much of their local currencies as they wish to run their local economies. But to operate on an international level they have to have US dollars that they can only get from selling oil.

Heck the Saudi’s have to sell oil for US dollars just to maintain their currency peg to the dollar. Their currency has no value outside of Saudi Arabia. Saudi Arabia’s sovereign wealth fund is US dollar based. It’s denominated in US dollars. I’d think they’d want price of oil as high as they can get it.

HHH,

How has that worked for them so far? They try to raise prices and they lose market share to Iraq, Nigeria, Russia, and the US.

At some point all cartels fail and then it is a battle for market share, they make no money from oil in the ground. They may fear that their oil becomes worthless as the World moves beyond oil, so they may move to a new game where they try to gain as much market share as possible, driving extra heavy oil producers, tight oil producers, and new ultra deep water offshore projects out of the market.

That’s the thesis, it is possible that reality will be different. Time will tell.

“so they may move to a new game where they try to gain as much market share as possible”

That new game may be to sign on to be the preferred provider, with long term arrangement, to the biggest customer- China

chart courtesy of Matt-

http://crudeoilpeak.info/peak-oil-in-asia-where-will-the-oil-come-from-for-the-asian-century

You can’t buy anything from market share.

When keeping output high, your expense is bigger, and price lower.

So it is really better to sell all oil at 50$ with 20-30$ cost, than having high price times of 80$ with 10-20$ costs, leaving some of the stuff in the ground.

Yes, shale companies can go for market share and earn nothing. But for state owned companies financing fancy monarchies and palaces this is no option.

High prices, and an oil price war every now and then to keep competition under control ist perhaps the best for them.

Eulenspiegel,

Every producer wants high prices, reality often intervenes.

What do OPEC producers do to keep members from cheating on their quotas? There is no enforcement mechanism.

As I see it, OPEC sees the potential for peak demand and when it arrives (my guess is that this does not occur until 2035, but there may be concern by 2030) oil prices will start to fall due to oversupply.

The potential for OPEC nations to be stuck with billions of barrels of oil in the ground with little market for that oil (or at least a market where production is profitable) may lead to an all out push to produce and sell as much as possible. It may be the target price to accomplish this is $50 or $60/bo, but another factor is that as the EV transportation accelerates over time the price people are willing to pay for transportation fuel will fall. By some accounts gasoline and diesel cars will only be able to compete with EVs at $25/bo for gasoline vehicles and $35/bo for diesel vehicles, my guess is that we don’t reach that point until 2040 or later as it will take that much time to replace the existing ICEV fleet, even with very optimistic assumptions. It is possible if self driving vehicles used as “robotaxis” becomes a reality, that the transition could be faster, but I am skeptical that will become a reality prior to 2040.

I don’t think OPEC has changed strategy yet, but I anticipate that cooperation between OPEC and some non-OPEC nations will fall apart and some members of OPEC may choose to leave (Iraq, Iran, and Nigeria) the organization and the whole cartel may break apart. Probably 2025-2030 before that occurs, but I think there is a 50/50 chance we will see it in the next 10 years.

As oil becomes less traded in the global market. Less US dollars will circulate in global economy. Depending on how you count it there is anywhere between $13 and $26 trillion dollars of debt that is denominated in USD outside the US currently.

It’s going to be impossible for those who owe US dollars outside the US to earn enough US dollars to service their debts. The currency swap lines between central banks don’t not solve this issue.

and even if they did you have be on the friends list to get a swap line.

When this debt get unwound or defaulted on. The dollar cuts the head off of every other currency.

When the Chinese yuan gets a 50% devalue then it’s no longer pegged to the US dollar and they can also no longer buy oil not like the currently do at least. They just won’t have the dollars to do it. And you can apply that to whatever country you choose.

I think this is exactly how countries will deoil so to speak.

U.S. Shale Has Lost $300 Billion In 15 Years

https://oilprice.com/Energy/Energy-General/US-Shale-Has-Lost-300-Billion-In-15-Years.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+oilpricecom+(Oil+Price.com+Daily+News+Update)

(I thought that was a bit conservative)

And now we have a prediction of 0.3 $ Trillion loss in just this ‘to be famous’ Q2 2020-

Deloitte- Shale industry to be rocked by 0.3 $T (for trillion) losses…in the 2nd quarter

https://www.cnbc.com/2020/06/22/shale-industry-will-be-rocked-by-300-billion-in-losses-and-a-wave-of-bankruptcies-deloitte-says.html

Have probably already mentioned that the 100 Years War largely derived from the bubonic plague. Economies were destroyed. This seem to matter more in England than France but either side would be filled with young men pleased to be provided food. Plague wipes out farming as much as anything else.

And those days they didn’t really have currency exchange. There were pounds and tournois but there was no real mechanism for equating them and so when the plague arrived people had better things to worry about.

For now, the riyal can convert according to what some more or less arbitrary traders choose to say. So KSA can sell its oil and the proceeds convert to Riyals and then they have a look at their daily deaths number and decide they have better things to worry about.

Russia is drilling DUCs to flood the market with oil as soon as they allowed to:

https://www.reuters.com/article/us-oil-global-russia-insight/russia-takes-a-leaf-out-the-u-s-shale-oil-playbook-idUSKBN23V3CQ

$50 cap on Brent for minimum 2-3 years…

Stephen,

Interesting article, thanks. For those who don’t read it, the $50 cap for Brent is nowhere in that piece, it is Mr. Hren’s opinion on the result of expanded Russian output in the future (which is what the article is about.)

I think he is correct that this will tend to keep prices down, but my guess would be $60/bo for Brent in 2020 US$ as a potential price cap once demand recovers to 95 Mb/d (all liquids) in 2022. In the mean time Brent oil prices will probably be stuck in the $30 to $60 per barrel range (2020 US$) from now until May 2022.

While it may be true that 80% or so of Covid-19 cases are mild. The 20% or so that aren’t are going to fill hospital beds until they run out. There are more people on ventilators right now in the US than at any point. I’m expecting shutdowns to be reinstated. I’m expecting rolling shutdowns where states shutdown for a month or two then reopen for a month or two only to be yet again shutdown for a month or two.

You won’t even be able to tell that governments and central banks have pumped $20 or so trillion dollars into the global economy. Shale oil production could go where interest rates are. Close to zero over next 3 years.

Without a vaccine this is the most likely outcome over next 3 years.

A new Non-OPEC production thread has been posted.

http://peakoilbarrel.com/non-opec-w-o-u-s-on-production-plateau/

A new Non-Petroleum thread has been posted.

http://peakoilbarrel.com/open-thread-non-petroleum-june-26-2020/