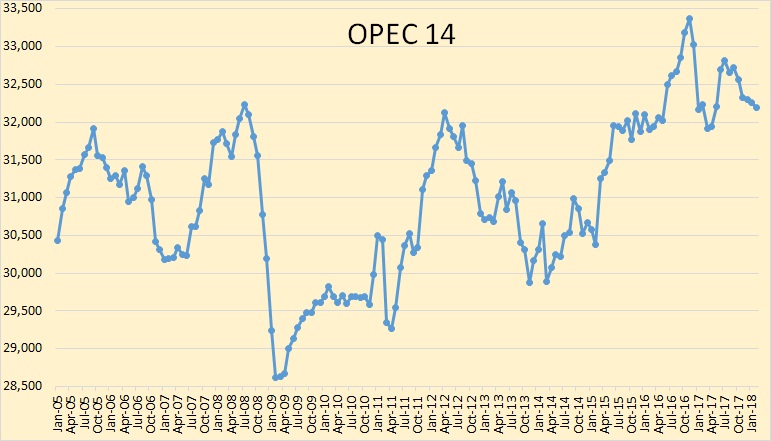

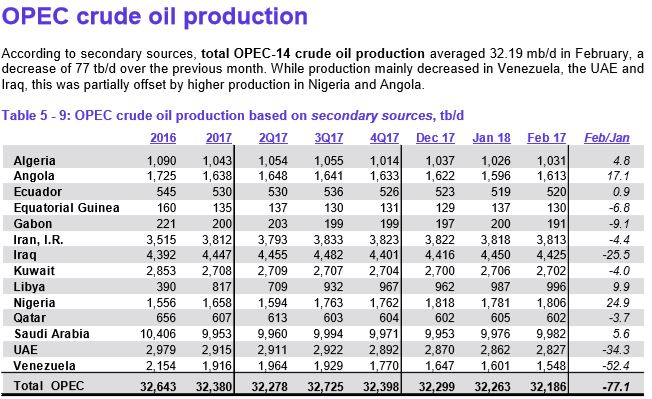

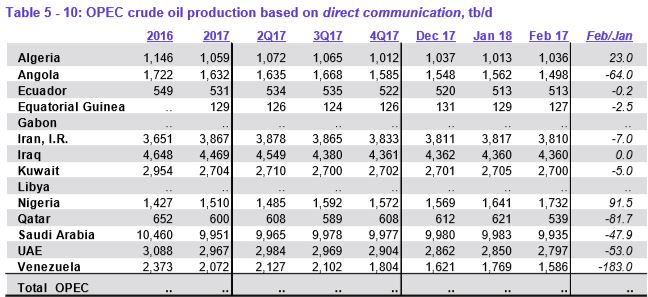

The March OPEC Monthly Oil Market Report is out with the February production data. All data is through February 2o18 and is in thousand barrels per day,

C

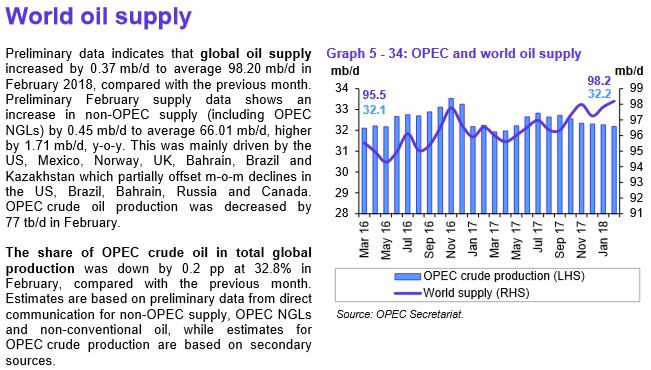

OPEC crude only production was down 77,000 barrels per day in February but that was after January production had been revised downward 40,000 barrels per day.

It seems most OPEC countries want to say they are producing less than what “secondary sources” say they are producing. Either they are correct or they are cheating on their quota.

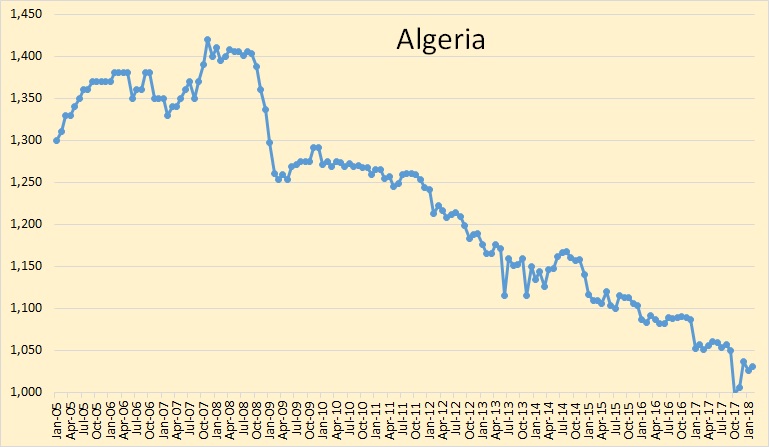

Not much happening in Algeria. They just continue their slow decline.

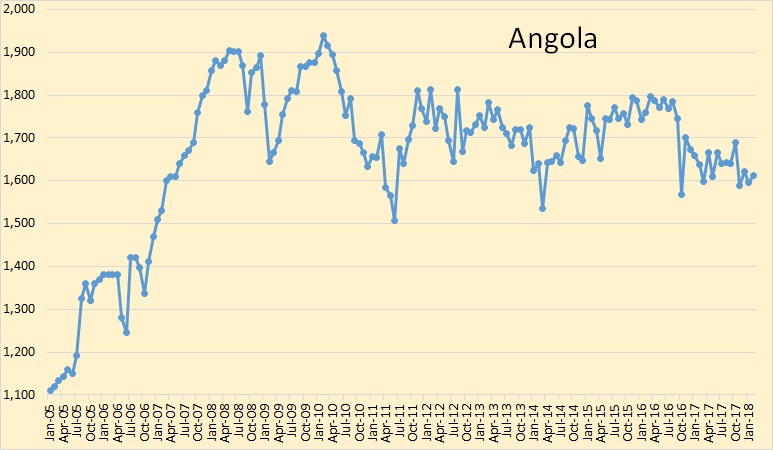

Angola seems to be holding steady.

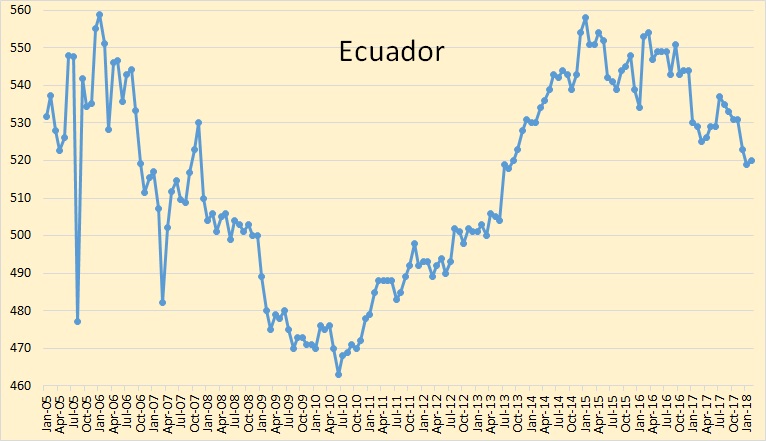

Ecuador was up less than a thousand bpd in February but their decline continues since their 2015 peak.

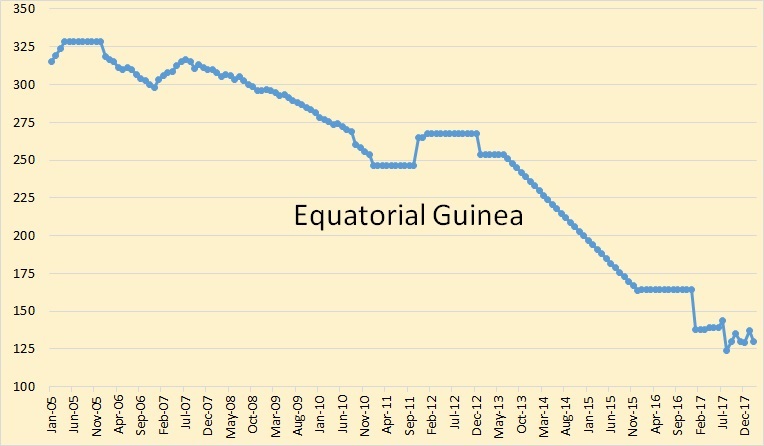

Nothing much is happening in Equatorial Guinea.

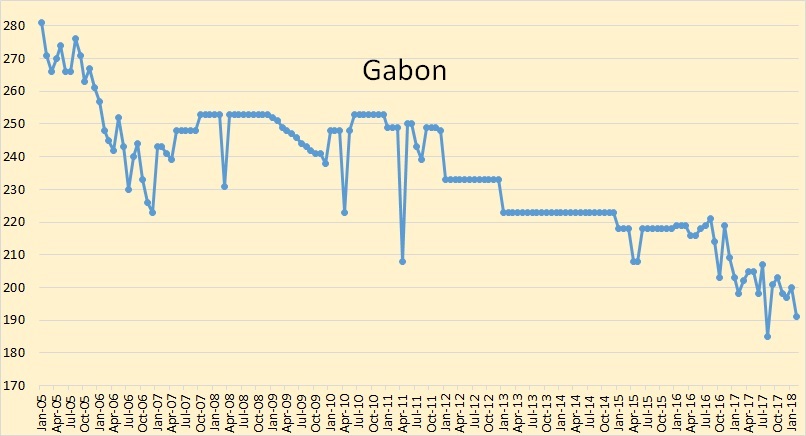

Gabon is another of those low producers where not much is happening. Don’t know why they joined OPEC. For the prestige I suppose.

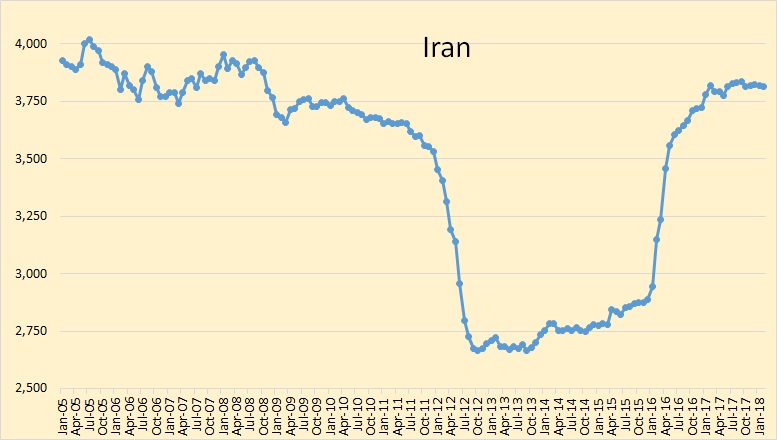

Iran is obviously producing flat out since they recovered from sanctions.

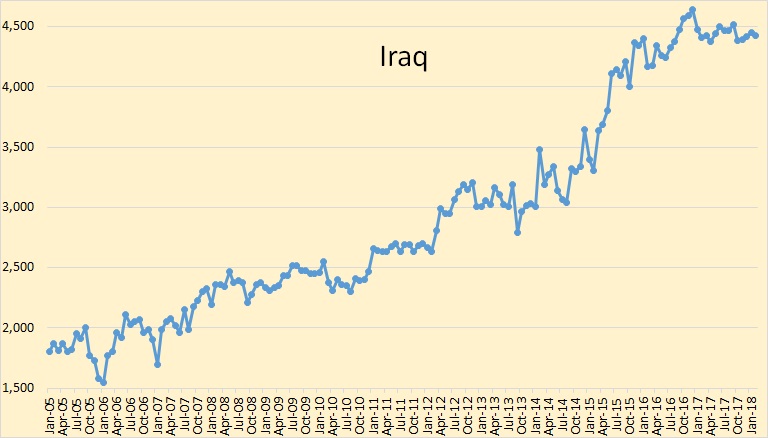

Iraq is another country that appears to be producing flat out. their average in 2017 was 4,441 thousand barrels per day. Their February production was only 16,000 barrels per day below that figure.

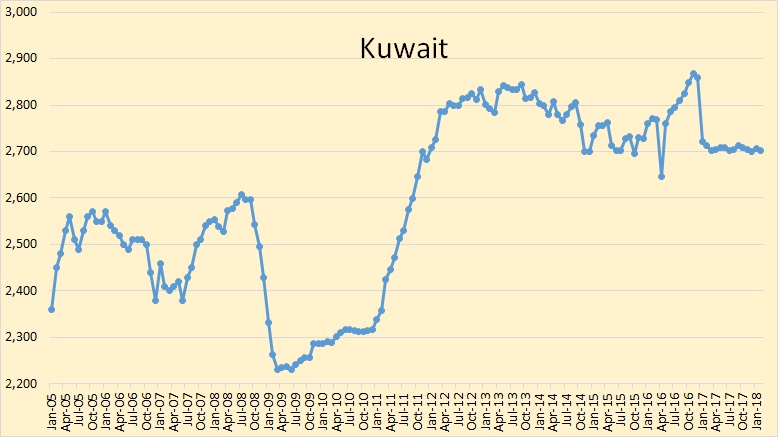

Kuwait has been holding almost flat since January 2017.

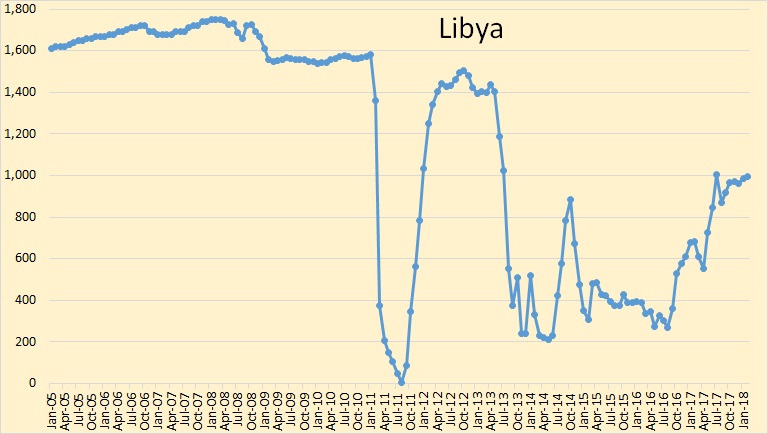

Libya is holding at just under one million barrels per day.

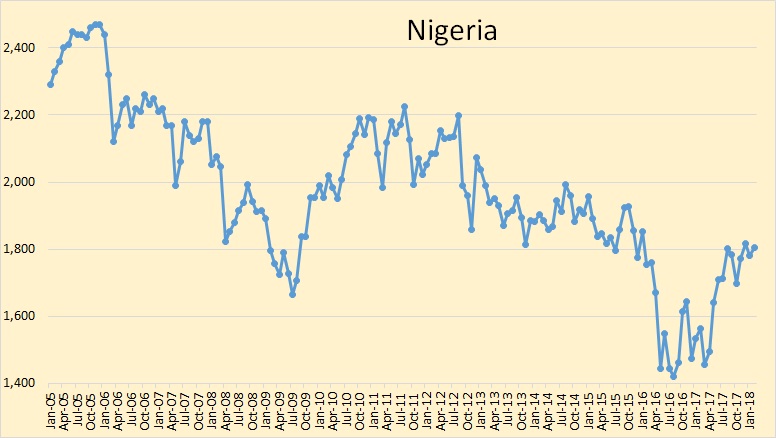

Things seem to be settling down in Nigeria. Their political problems continue but their oil production is holding steady at around 1,800,000 barrels per day.

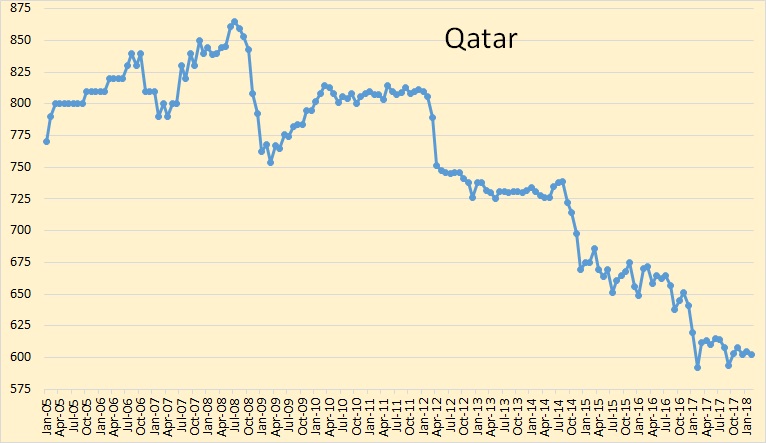

Qatar peaked in 2008 and has been in a slow decline ever since.

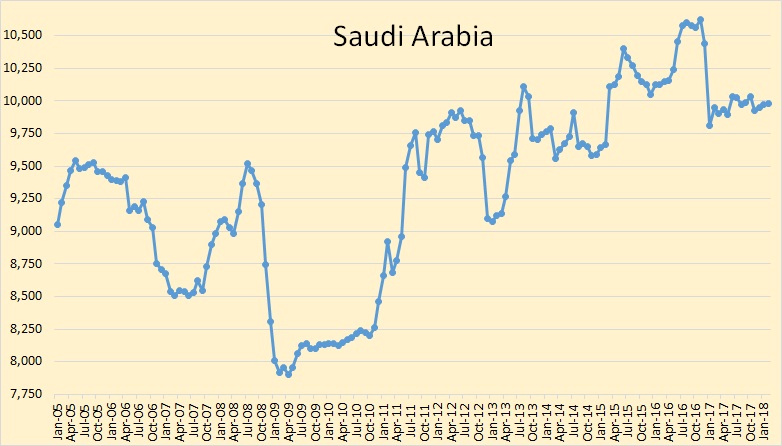

Saudi Arabia is holding steady at about 400,000 barrels per day below their 2017 average.

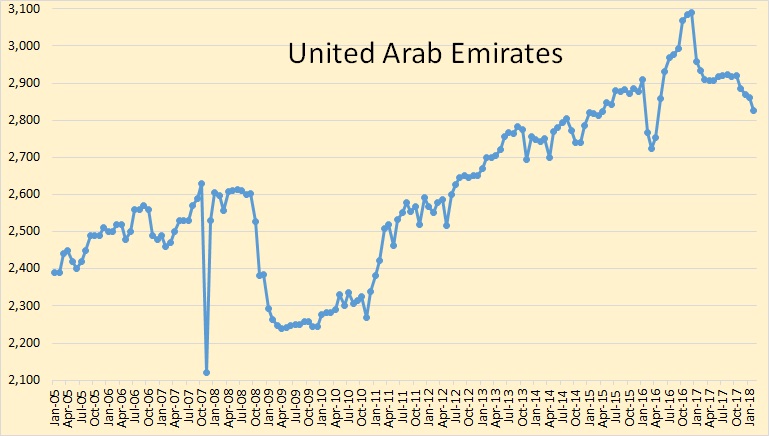

The UAE increased production in the last quarter of 2016, positioning themselves for the quota cut. Then they cut but they seem to be still cutting. That don’t look good.

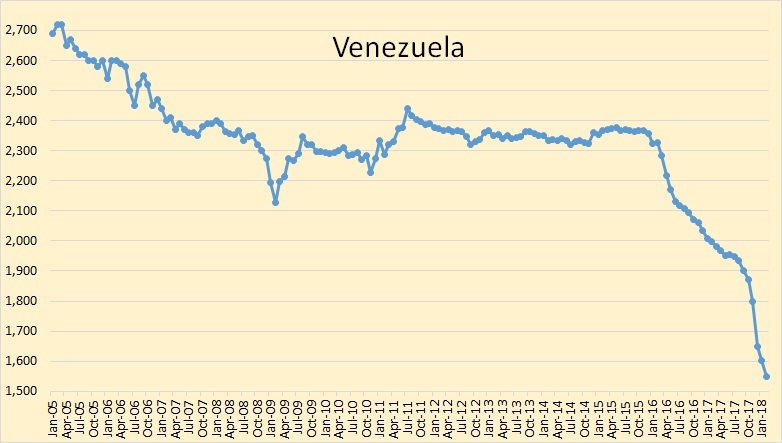

Venezuela is still collapsing, politically as well as oil production wise. I see no hope for them.

World oil supply continues to increase slightly. This is all liquids of course.

Russia, currently the world’s leading oil producer, leveled out in May 2017 and has been holding relatively steady since.

The UN refugee commissioner requested that all nations accept Venezuelans as refugees under applicable treaties. This means Venezuelans can flee even without passports and get help.

Good policy.

Nations are quite obsolete.

On a side note:

Trump’s prospective new Secretary of State Mike Pompeo is a drastic improvement on his predecessor .

https://vvattsupwiththat.blogspot.com/

Tillerson, like so many Big Oil men, has bought heavily into the climate alarmist narrative. Perhaps it’s cynicism: part of the “greenwashing” strategy companies like Exxon, Shell, and BP used to try to buy off their environmentalist critics…

Tillerson, in other words, embodies the crony capitalist mentality of the swamp Trump promised to drain. He was never a good pick—as he demonstrated by opposing Trump’s perfectly sensible plan to pull out of the Paris Climate Accord.

Pompeo, we can be sure, is the right man for the job.

Pity the man whose career trajectory carries him from being the legislative right hand of two shrewd Witchita MIT alumni to playing diplomatic secretary to someone unable to deal with Rex Tillerson.

https://oilprice.com/Alternative-Energy/Renewable-Energy/Audi-Unveils-Its-Flying-Smart-Car.html

I’m waiting for the flying semi tractor. You guys in high rises just thought you were safe.

I’m waiting for the flying semi tractor.

You mean something like this? https://www.solarship.com/product/

PRODUCT

Solar Ship Inc. builds aircraft called solarships to service remote areas, most of which have no roads. The solarship is a hybrid aircraft, gaining lift from both buoyant gas and aerodynamics. Its wing-ship design allows for extreme short takeoff and landing (XSTOL), such as in a soccer field. Its design provides a large surface area for solar electric power, allowing long, self- sufficient range. A solarship does not need to be solar powered and can be powered by traditional combustion. However, the goal is to develop a new mode of transportation that does not depend on fossil fuels, roads, or runways. The solarship can access areas where planes, trucks, ships and airships cannot, delivering cargo to the places that are currently cut off from the benefits of the connected world. Each aircraft is designed and built to the requirements of a mission. Currently, there are three initial missions with specific requirements.

https://rbnenergy.com/taxonomy/term/565

Link to some articles regarding oil and gas pipeline take away capacity. I don’t see this hyped up oil production explosion in 2018. If we do, they will be hawking their oil on the side of I20.

The way I think they would do it. Would be to increase production as fast as the could based upon the contracted amount of pipeline space. Then back off until the new pipelines were close to completion. I remember reading one of the larger E&P show and tells, where they stated that some of the increase in rigs would be allocated to only drilling DUCs that would come online in 2019.

If I were a royalty owner in this area, I would be highly ticked off, if they overproduced early resulting in a $20 discount. Surely, they are not that stupid to complete guaranteed losses.

Ron, do you know which countries are responsible for those downward revisions? Amazing by the way that you seemingly are the only one noticing this – mainstream media seems to be overlooking this

Here is the amount each country’s January production was revised. The dots after the numbers were necessary for formatting. So you can see the big downward revisions were Nigeria, Angola and Iran. Iraq was revised upward by 15,000 bpd.

Algeria Angola Ecuador E.Guinea Gabon Iran Iraq

-3 ……. -19 ….. -4 …….. 3 …………. 2 ……….. -11 ….. 15

Kuwait1 Libya Nigeria Qatar Arabia Emirates Venezuela OPEC 14

-1 ……….. 9 … -38 ……..9 …….. -1 ……. -2 …………….. 1 ……..-40

I imagine Iraq and Iran have some undeveloped or underdeveloped fields that could still be invested in eventually. But the rest, flat out producing. Only Venezuela has real enduring potential. But it won’t be decided with until China and the western world fight over the control of Orinoco heavy oil. Its looking like the Permian is the last holdout before oil declines take over again.

I think SA has some undeveloped fields, too. But they are in reserve when Ghawar finally declines. SA has longer oil plans than some fracking companies trying to pump as fast as they can.

With the fracking mindset SA could go to 25 mb/day – by heavy overinvesting and overpumping all fields. But what would be the profit from this? Crashing the oil price, earning no money and after the boom sitting on lots of dept with not much oil left? Great plan.

To get another 15 mmbpd would cost $1 trillion at least, would take five times the current EPIC oil sector capacity and they wouldn’t see any returns for about ten years (assuming they do have that oil to develop, which is doubtful). It’s nothing like US LTO.

George Kaplan –

The useful energy needed to build up for that SA new 15 mmbpd exceeds the total raw energy in the reserve. This might sound untrue and extreme, but read the case of 1905 Britain with easy coal, below, if you have a minute:

In just one year, 1905, 236,128,936 tonnes of coal have been produced in Britain. That volume weighs no less than 4514 Titanic ships, each weigh 52,310 tonne. Over 15% of all that coal went into empowering steam engines draining water and the coal itself from an average depth of 300 feet (heat-joule-vs-gravity @ 2% efficiency lifting for a period of one year).

Another portion of that amount was utilised in propelling ships bringing lubrication-oil necessary to sustain domestic steam engines in motion, from the overseas Nigeria and elsewhere, where palm oil slavery farms have been organised. Another was consumed in animating transportation of the coal produced. The other major field of consumption was the manufacturing of supporting machinery, such as steam engines and the industrial base making them. Given there was around 1 million workers and several tens of thousands of horses directly involved in mining – a strong assumption materialises that no less than 3/4 of the coal produced in 1905 was in fact burned for energy feeding back into the process of mining for that same amount of coal.

Knowing that the 1 million workers and animals were created, sustained, trained and tooled, consuming energies extracted prior to 1905, as well as big part of the infrastructure of water canals and sites – one may safely conclude that most of the energy-surplus out of that amount of 236,128,936 tonnes of coal mined in 1905 has been offset by external energies coming from the energy-saturated eco-system built-up over the decades and centuries earlier, prior to 1905, in the form of science and engineering knowledge and know-how and a social order enforced by a stable and experienced political-economic system.

In 1914 Churchill successfully switched the Royal Navy from coal to oil were not a drop of oil has then been discovered in the country, also Britain has invaded Iraq.

By 1925, the exchange rate of the Sterling against other European currencies has practically stopped any coal exports from Britain.

But has there been any coal left in the country to export after the discussion above has revealed how little the energy returned on the energy invested in mining for ‘easy’ coal: 1 to <=1?

The little energy-return explained has also been demonstrating itself when mining workers in Britain have suffered systemic wage’s decline, the more they mine the poorer they became. How that reconciles with the Terajoules of energy they produced every day, which should’ve been found no less than ‘money-printers’?

If crude oil is analysed by the same method above, one can safely conclude what left of Crude is barely enough to keep the semantics of the show going. If maintaining and repairing the massive legacy world, built to date by fossil fuels, against wear and tear (Entropy) is thought to be done and sustained consuming any remaining reserves, this might be a false assumption.

This far, the severely-depleting crude oil cannot be given, from now on, high-enough market value – it should only be looted.

Somebody has made Churchill & Co knowing about these startling facts about fossil fuels real story – all along – from the long and bitter experience in Britain with Coal: Earth is not an energy playground for humans. Physics rules!

The oil majors would blow up tomorrow if PO was properly understood by the markets, and immediately after that the whole system would implode. Hence USG is content if things keep going for another week, even with no long term Great Plan.

There is no solution, other than starting WW3 and putting the US onto a war economy – this allows the government to direct industry and the labour force into whatever production keeps them in control, and crack down on dissent/disloyalty – FEMA camps, no fuel for cars, no protest movements, etc.

That is why this last few months there has been a massive increase in sabre-rattling and war talk against Russia, China, North Korea, Iran, and the arming of Ukraine and everybody.

Here are the Bakken updates. January is usually a time when there is weather related problems. The number of new wells was only 61 compared to 104 in December. Average number of production days were down a bit for the pre 2015 wells (except 2012) but not as much as last year. For 2015-2017 average number of production days instead increased from December. They were however unusually low in December so its more like they normalized. Overall though for all years together, average number of production days did not change much at all compared to December.

And here is the GOR graph.

Ron, assume you meant Saudi Arabia below their 2016 average, and not 2107.

No, I meant 2017 average. I just transposed the zero and the one. Thanks for the heads up.

Hi Ron,

Also Kuwait 2917 instead of 2017.

Cheers,

Iron

Seeing the chart for Iraq’s exponential increase in oil production since the 2003 War, it comes to mind that without wood and horse supplies, the coal industry in Britain wouldn’t be taking off into its advanced stages where steam engines have taken over horses, steel, rubber and coal over wood.

In just one year, 1905, 236,128,936 tonnes of coal have been produced in Britain. That volume weighs no less than 4514 Titanic ships, each weighs 52,310 tonne.

A recently circulating thesis in thermodynamics inspires that most of that coal have gone to mine for more less accessible coal, or where then all those Titanics have gone? – a demonstration of the fact that most of the coal consumed was burned for energy feeding back into the process of deeper mining for more coal.

https://the-fifth-law.com/pages/press-release

When the world will stop burning easy crude to produce less easy crude? Hope that moment will be comming very soon.

Entropyn

At first pumps used a great deal of the coal that was mined as more efficient mine pumps like this were produced they enabled the access of more difficult coal.

https://www.youtube.com/watch?v=YGoQQCM4SMU

With electric pumps and large cutting machinery most coal did go to homes and power stations.

If you are hoping that cheap oil will run out and therefore the expensive oil will stay in the ground, you will have to wail some time.

http://markets.businessinsider.com/commodities/news/how-much-it-costs-both-saudi-arabia-and-the-us-to-produce-oil-2017-3-1001868041

There is a great deal of easy oil in Saudi Arabia, Russia, Iran, Iraq, U.A.E and other places.

As with coal in the past, technology is making difficult oil cheaper to produce.

We have been burning coal for over 200 years and burn vast amounts now compared to 100 years ago with no end in sight.

https://www.aps.org/units/fps/newsletters/201407/letters.cfm

Too many jobs and products are tired up in oil, it will take a long time to shift to other things.

Peter –

Javon Paradox: Gaps in Energy Audit:

Javon Paradox, when efficiency increases, higher energy consumption materialises, might be resulted from the fact that James Watt’s improvement has practically increased the weight, complexity and size of earlier Newcommon’s steam engine by more than one-fold. That has required significantly more energy expended to produce each engine to the new design.

Each sub-process involved in the mass production of the new engine required substantial embodied coal energies for extending the industrial, social eco-system and platforms involved.

Maintaining all those energy-intensive components against wear and tear required no less energy than building more of them.

Therefore, run-time efficiency is always offset to zero or less by the total energy expended at design and construction time building for that efficiency.

Atmospheric CO2

February 2018

408.35

Up, up, and away!

Entropyn

If you were right no coal would have been delivered to millions of homes over decades.

http://www.oldhouseweb.com/blog/the-history-of-coal-heating/

https://www.azosensors.com/article.aspx?ArticleID=496

and billions of tonnes would not be burned in power stations.

Digging up the coal does NOT take more energy than it contains that is why it is possible to produce millions of tonnes of steal just from coal.

Coal, oil and gas contain vast amounts of energy which enable us to build houses and fly planes. Obviously none of these processes of 100% efficient and much energy is wasted. But there is still a huge net energy gain from extracting oil, coal and gas for other uses.

Peter –

Millions of years of solar and colossal planetary forces stored in fossil fuels are almost now depleted in just 300 years?!

Knowing there is 23000 man/hour in a barrel of crude, and we are consuming 100m barrel a day; That is: 2,300,000,000,000 man/hour a day at our service just from crude (two and a half trillion man/hour a day). That is 328 man/hour per capita of 7 billion population. Add Coal and N. Gas and you understand that no matter how fossil fuels are dense in energy, we burn most of the energy stored in them in the process of extracting and converting fossil fuels into useful energy.

Given the majority on Earth today are hardly consuming any fossil fuels (Africa, many nations in the ME including Iraq, Syria, Yemen, Libya), Central Asia (Afghanistan et al) , many nations in S. America, great deal of Russia, 270 million in India don’t even have electricity, yet alone cars, rural population in West China are hardly using any fossil fuels or private cars) – where all the oil, gas and coal are going everyday?

Britain’s massive coal reserve has been consumed largely to keep the process of mining coal continuous. This far, all what has been built using coal in the country doesn’t come in weight and size to match the weight and size of the total weight of the coal extracted. That includes all machinery, bridges, ships, locomotives, tracks, even if most of these objects were built with the heaviest of metals.

In just one year, 1905, 236,128,936 tonnes of coal have been produced in Britain. That volume weighs no less than 4514 Titanic ships, each weigh 52,310 tonne. Over 15% of all that coal went into empowering steam engines draining water and the coal itself from an average depth of 300 feet (heat-joule-vs-gravity @ 2% efficiency lifting for a period of one year).

Another portion of that amount was utilised in propelling ships bringing lubrication-oil necessary to sustain domestic steam engines in motion, from the overseas Nigeria and elsewhere, where palm oil slavery farms have been organised. Another was consumed in animating transportation of the coal produced. The other major field of consumption was the manufacturing of supporting machinery, such as steam engines and the industrial base making them. Given there was around 1 million workers and several tens of thousands of horses directly involved in mining – a strong assumption materialises that no less than 3/4 of the coal produced in 1905 was in fact burned for energy feeding back into the process of mining for that same amount of coal.

Or, why there were no bridges, machinery and structures built in that year that match in mass (at least) the mass of that coal, even if they were built with the heaviest of metals?

Coal: Unit: Million t/Year. Total: 6,753 million metric tonne/year. Greater than Britain’s 1905 production 28 folds.

China 3,210 (some of the Chinese mines use diesel trucks to move coal to the mine surface driving for 30+ minutes each way)

India 708

United States 683

Australia 509

Indonesia 459

Russia 359

South Africa 250

Germany 177

Poland 131

Kazakhstan 102

Colombia 94

Turkey 71

It is very sad how humans have wasted all the finite and irreplaceable fossil fuels this way – all along!

Which fields do you consider to be easy oil in those named places, and what are the other places that you think have easy oil? What is your definition of “easy oil” – is it a development cost? Why do you think western oil companies are pulling out of Iran and Iraq, and why is there still exploration activity in both countries if there is known easy oil there. Why is Russia active in the Arctic if it has other oil potential? Why is Saudi trying so hard for shale gas and before that pre-salt oil in the Red Sea, and are gradually adding ESPs to all their offshore wells if they have easier oil? I think the cost for security in Iraq is about half the production cost for a barrel of oil – how is that easy?

George Kaplan –

There never was an easy oil in Saudi, Iraq or even in 1850s Pennsylvania!

What happened with each of those is that the surrounding eco-system has accumulated a saturated embodied energy in roads, woods, horses, steel furnaces, robs, knowledge, supporting political and commercial system over hundreds and hundreds of years earlier. That ‘saturated’ embodied energies were expended in digging for the first crude well. When that resulted in coal/oil discovery and production, the extracted crude fed back into the process, taking over and building on past saturated-energy system.

No easy oil was in Saudi if rigs, tractors, pipes, expertise, ships and many others were not brought from overseas to dig for the first 1930s well. All what was brought into the process has been built with colossal amount of overseas biomass, coal, hydro, solar, time and crude oil. Clearing land in North America was systemic and extensive since Columbus. That has built the seed-capacity to explore crude oil in Pennsylvania later (see archive photos where horses and wood were extensively utilised in crude and coal operations).

Astronomical energies expended in WW I’s war-machine has also contributed into the process, when Britain has accomplished the invasion and control of the Middle East for the Americans to take over later and start produce Saudi oil, peacefully.

In Britain, people were extracting and burning coal since the 1500s and earlier. Newcommons engine came only in 1712. The 200 years in between was a period of energy-saturation build-up. By mid 1800s, forest logging has nearly cleared Europe of all of its forests that have taken ages to create and self-sustain with solar.

There is no such thing as EROI of 1 energy consumed, >1 energy extracted.

It is always 1 energy consumed, much-less than 1 energy-extracted.

Why Russia and others go to the Arctic and even to the moon for fossil fuels?

Oil is found there, saturated energies have earlier been built up, and the will to sacrifice it for negative-value fossil fuels – is dominant.

However, wear and tear (Entropy) will always degrade the eco-system of saturated-energies to the point it loses its effect and advantage (like when roads are destroyed after extensive use. See abandoned oil rigs in Venezuela, Azerbaijan and elsewhere).

The best of our Diesel engines today don’t last for few tens of thousands of hours running continuously unattended, and they cease if not massive fresh energies are poured into maintaining and repairing them. Diesel engine are ones of the most robust and enduring pieces of technologies man has ever made.

The concept of easy and cheap fossil fuels is flawed.

Entropy internal to matter rules.

Very sloppy language.

“No device can generate energy in excess of the total energy put into constructing it”.

Devices do not generate energy, they merely capture it and transform it, any physicist knows that.

Simply explain how a PV panel can transform as much energy in one year as it took to produce it, yet the panel might last 30 to 50 years.

GoneFishing –

According to your belief, if we convert all fossil fuels into PV panels, they will double the energy from those fossil fuels every year over 50 years in the future.

Nature has taken millions of years of colossal sunshine and planetary forces to create fossil fuels.

Do you really think PV panels can double those millions-of-years’ worth of energy every year, even if the sun shines forever?

Your opinion is not that extreme as those who say ‘PV panels double the total energy put into constructing them by 2-15 times every year’, though!

“According to your belief” Not a belief, simple calculations and values from real devices that exist now in the real world.

“According to your belief, if we convert all fossil fuels into PV panels, they will double the energy from those fossil fuels every year over 50 years in the future.”

I said nothing of the kind, that is a completely false representation. I merely asked you to explain the energetics of current PV devices, which you apparently cannot so you make up irrational and erroneous statements.

“Nature has taken millions of years of colossal sunshine and planetary forces to create fossil fuels.

Do you really think PV panels can double those millions-of-years’ worth of energy every year, even if the sun shines forever?”

First of all, fossil fuels only contain an infinitesimally small amount of the energy input to the planet during those many millions of years to create them. They are probably the most inefficient way to store energy that exists, taken in that context.

“PV panels can double the energy of fossil fuels every year? “That one is too irrational to attempt a response.

Since you can’t explain the energetics of a complex device such as a PV panel in terms of the “5th Law”, maybe you can explain simpler devices.

Explain how the energy that goes into making a water wheel is less than the output of energy from that water wheel during it’s lifetime.

Explain a match, a simple chemical device. How does it unleash tremendous amounts of energy, far more than was used to make it? You know, the energy of a burning long, burning coal pile, burning forest? How does that simple device break the “5th Law of Thermodynamics”?

If you can understand a match, you can understand the energetics of PV and other renewable energy devices.

GoneFishing –

Water Wheel: The sum of all the solar energy falling on trees’ leaves added to all planetary energies that pushed water and nutrients into the tree, energies put earlier in making the tools cutting the trees, transporting them, energy in sustaining humans in the process, energy expended in gathering knowledge and design know-how, energies put into the host platform the water wheel is installed and energy it produces converted into useful work – are all ages-taking energies.

The water wheel will fail and disintegrate well before it would endure with a material integrity to match that very long trail of expended energies put earlier into constructing it. If the trees used to make the wheel have taken 30 years to grow, the wheel will well be gone much earlier than that if it set at work continuously without any maintenance and repairs.

This is regardless of the efficiency of the wheel and the energy that set up it in motion is free of charge.

Chemical: The energy generated wouldn’t match all the energies expended in making the vessel/device used to host the reaction, the energy put in knowledge and design, energies in efforts and sustainability of humans including shelters, lights, etc. Then transform the energy produced by that chemical reaction and transfer it to useful energy.

The sum of all this useful energy will never match the total energy put earlier into making the device and harnessing the chemical energy into useful work.

Fossil Fuels are “probably the most inefficient way to store energy that exists“: That’s why all our jumbo jets today are flying with Tesla batteries!

This is no matter how batteries were attempted since 2nd half of the 1800s in coal mines!

Do you think another 100 of burning fossil fuels as there is no tomorrow would improve batteries a bit better?

Humans cannot cheat physics: Nature is a one energy vessel.

Gee, why not follow your line of thinking and go back to the Big Bang. Look how much energy was expended to make all those materials in the universe. How are we ever going to get all that energy out of our devices or even use them to transform energy.

Nothing can be done because the universe is a giant energy sink and most of the energy goes out to empty space.

Have fun getting a following for your pseudo-science. Have fun re-defining the language of science also.

BTW, why do you make fossil fuels a special case?

GoneFishing –

“Nothing can be done because the universe is a giant energy sink… . How are we ever going to get all that energy out of our devices or even use them to transform energy?”

Sunshine-assisted human slavery as never seen before, maybe?

Devices do not generate energy, they merely capture it and transform it, any physicist knows that.

Of course they do! Watch this, it is absolutely amazing… Next time you get a Nigerian email offering you millions of dollars, take the money and invest it in this! You can’t go wrong…

https://www.youtube.com/watch?v=OzOhM4HsIeg

New for 2018 Free Energy Generator 100% Self Runing By Eng Noman Shah Afridi

But if you count all the energy in the creation of the universe and the energy released by all the stars since we are in a huge energy deficit according to some, and can never make any positive energy. That is why civilization has ground to a halt and PV panels are really batteries that suck in energy. Soon time will run backwards and we will get all that energy back as we get reduced to cosmic plasma.

sarc

During the Depression, my mother’s cousins live in Kansas City. In the winter it gets cold there, and they couldn’t afford coal, so the kids went down to the railroad to steal coal from the trains at the depot.

There were guards on the trains to keep the thieves off, so the kids threw rocks at them. The guards responded by throwing lumps of coal at the kids.

It was definitely an exception to this new law of thermodynamics. The rocks just magically turned into lumps f coal.

Mr EntropynEnergy is either just having some fun trolling or else he is so stupid there’s no point in trying to prove him wrong.

He’s like Caelan. Facts mean less than nothing to him, and he understands less than nothing about energy, in theory or as a practical matter.

Talking to him about energy is about as productive as talking to a backwoods Baptist about evolution.

(Note that making fun of the Baptist in public forums is a serious mistake, because he DOES have the right to vote, and nothing pisses him off worse than being ridiculed. Making fun of him is a sure a method of getting him to vote for Trump type politicians. There ARE ways to communicate and work with him, but that’s a subject for the other thread. )

If you can’t dazzle them with your brilliance, you still have a shot at baffling them with your bullshit,right Mr E’n E?

Unfortunately for you, there are no more than a couple of regulars here who are so ill informed as to take you seriously.

The problem, for society as a whole, is that about half of us are so ignorant that any scam artist or huckster who can easily spout big words with confidence is about as apt to be believed as a real expert.

Yeah, he’ll end up on my ignore lists like others who come to this forum with elaborate ideas with a tenuous connection to reality.

There was one guy who I think has been banned at least once here who I believe is bi-polar. He posts in a flurry of mania.

George

Dr Colin Campbell, Matt Simmons and others made it clear that there are various qualities of oil in locations that raise a variety of practical problems.

Orinoco heavy oil is expensive because it is poor in quality. Brazil pre-salt in expensive to produce because it is far offshore and so deep.

onshore and high quality oil such as in Saudi Arabia and Iraq are geologically and practically easy in comparison.

http://graphics.wsj.com/oil-barrel-breakdown/

That is why the costs are so different, easy to produce oil costs a lot less than difficult. Most people understand that, because it is rather basic.

That chart is based on existing production not new greenfield development. Most people understand the difference and recognise they may not know everything instead of trying to be a superior prick all the time.

It’s simply a choice. As a society we can choose to stay (temporarily) with fossil fuel, we could go to nuclear, or we could go with renewables.

Renewables appear to be the cheapest and fastest option. But, fossil fuel investors and employees are fighting desperately to maintain the status quo.

https://wattsupwiththat.com/2018/03/15/mit-report-it-will-take-400-years-to-transform-to-clean-energy/

Two thoughts:

1st, as Caldeira notes, much of the problem goes away when you electrify thermal processes. You don’t need to replace 15 terawatts of ICE transportation power or space heating, with 15TW of electricity – you need about 1/3 of that.

2nd, as he notes: “There’s simply little financial incentive for the energy industry to build at that scale and speed while it has tens of trillions of dollars of sunk costs in the existing system.”

In other words, fossil fuel investors don’t want to lose the money they’ve invested in the current system.

That’s not surprising.

Nick G –

Efficiency and Scale are chicken-and-egg in relation to energy expended in achieving them;

The time has come for humans to understand their size to what they build in relation to scarce finite fossil fuels energy resources.

Ants don’t build host structures that take them to climb very high consuming an amount of energy beyond their capacity to gather food and beyond the endurance of their biological body to life-span (try climbing the stairs of Khalifa’s Tower everyday for few years and all the lower body joints will require replacement).

“…the problem goes away when you electrify thermal processes. You don’t need to replace 15 terawatts of ICE transportation power or space heating, with 15TW of electricity – you need about 1/3 of that…;

Energy required for building devices that are claimed to produce useful energy equal to 15TW but consuming 1/3 of what current 15TW-platforms consume in transportation and heating – is an order of magnitude more than the 2/3 of the energy saved.

James Watt wouldn’t have built a steam turbine first even if he knew how to do it, because the energy needed for building the turbines is so greater than what was needed to build a steam engine.

Has he elected building a turbine anyway, he needed a mountain of James Watt’s steam engines to empower the manufacturing process with.

Building, running and repairing the steam engine at 1% or 2% efficiency to build the turbine, would have consumed much more energy than the useful energy ever produced by the turbine –

before it dies owning to wear and tear (Entropy internal to matter).

Therefore, we went from Newcommon’s engine to Watt’s to high pressure steams and then to steam turbines – in that exact order – low energy to bigger.

Steam turbines have started to emerge only after all vast coal reserves of Britain have already gone!

Nature is a single entangled-energy vessel!

This is it – the time for dreaming of replacing entire transportation, heating systems or others with more efficient platforms is over. The scarce fossil fuels still in the ground are barely enough to run and do repairs against wear and tear of the massive existing legacy system we have built and run with fossil fuels up to this stage in civilisation.

Soon, it’s most likely what goes broken stays broken, never replaced with a new – an observation that has strongly been materlising before the eyes of people since the 1980’s in the war-torn Middle East.

Do you think the US doesn’t have the know-how, desire and capacity to churn Tesla3s in the millions every year replacing ICEs when China has learned how to produce millions of cars annually in record few years – if that saves 2/3 on transportation and heating and refreshes the market with new investments, training, retooling, hope in community and nation revitalisation?

Energy, or the lack it is the hurdle that prevents that dream coming true, even as the ‘last’ big success-story of the outgoing fossil fuel age, sadly and unfortunately.

Nick G –

Consider Nuclear reactor is the boiler driving a steam turbine no different from coal-driven steam turbine. The turbine will fail faster than in coal plants owing to radiation and others.

That’s why Nuclear is no better than coal. In fact, N. plants go offline for maintenance, repairs, which some of them are capital, and refueling – for weeks and months every two years or earlier.

Repairs and refueling, not to mention enrichment, mining, storage and handling – take substantial amount of fossil fuels energy. This far, it exceeds all the useful energy produced by the N. plant since last repair!

The report below clearly demonstrates that ALL energy-generation on Earth is fossil fuel-driven, with no exception – by physics!

According to analysts from Energy Research & Social Science (ERSS), there is an 80% probability of a “serious accident” at one of Ukraine’s nuclear power plants before the year 2020. This is due both to the increased burden on the nuclear plants caused by the widespread shutdowns of Ukraine’s thermal power plants (the raw material they consumed – coal from the Donbass – is in critically short supply) and also because of the severe physical deterioration of their Soviet-era nuclear equipment and the catastrophic underfunding of this industry. link here

Why would radiation reach the turbine?

A large portion of our world energy is in the form of sunlight to plants, renewable energy (solar driven directly and indirectly), and some nuclear and geothermal. There is no law of physics stating that energy must come from fossil fuels. That is by choice and design, not physics.

You forgot sunlight driven wind and moon driven tidal… 😉

Wind was included in solar driven indirectly. The rest is covered by “A large portion of our world energy …” which gives me a pass from listing ever possible energy source.

The point was not to make a list of all possible sources but that ” There is no law of physics stating that energy must come from fossil fuels. That is by choice and design, not physics.”

I know that contravenes the”third law of entrapping a populace” but maybe that law is flawed.

I’m sure you are aware that I’m not a big fan of those that incorrectly equate fossil fuels with energy. Combusting fossil hydrocarbons to produce heat energy, has always struck me as a rather primitive, inefficient and dirty way of doing work…

Only economists and politicians believe that energy independence can be achieved by extracting, refining and burning fossil fuels, I think of them as a form of addictive enslavement.

Fred, how do you like our latest energy villager?

How do I like our latest energy villager?

Wheeeal, dunno quite what to make of him/her…

I’m certainly no nuclear energy expert but I’m pretty sure that the turbine blades are not subjected to exposure of radioactive steam under normal operating conditions.

Someone please correct me if I’m wrong.

And while I’m a big fan of Li-ion batteries and know of some limited applications of electrified small prop planes I gotta admit I wasn’t quite prepared for this comment:

Fossil Fuels are “probably the most inefficient way to store energy that exists“: That’s why all our jumbo jets today are flying with Tesla batteries!

Would love to see how battery powered jets work…

Boomer II –

Because it is nuclear radiation (see documentaries on how workers repairing nuclear turbines take strict measures to reduce the impact on their health from exposure to radiation while inside the nuclear turbine’s room, although the reactor is put idle).

I still don’t see the connection. The reactor heats water into steam that turns the turbine. The water itself shouldn’t be radioactive.

Workers are prudent to take precautions against radiation exposure, but turbines in nuclear power plants shouldn’t have a shortened lifespan because of radiation since they shouldn’t be exposed to radiation.

Boomer II –

What connection you don’t see? The steam coming from the heart of reactor into the turbine and the two installed back to back?

Scrap metals from those turbines are not welcomed into recycling furnaces for re-use, unlike locomotives, say, being radioactive (see relevant documentaries in the public domain).

Boomer II –

Oh! And radioactivity turns any metal brittle over time. Major repairs to the level of replacing N. turbine cases after just few months in operation (quite capital) is not uncommon.

Such an operation is involving massive cranes and supporting gears, sensitive alignment and others, not to mention the workforce involved and shutdown time.

Where are you getting your information?

You realize, don’t you, that aircraft carriers and submarine are powered by nuclear reactors. Their turbines aren’t breaking down after months.

Boomer II –

This is the sort of information off the public domain, I think. In the old Soviet Union, it was very well spread between the commons how N. Subs crews have inhumane working conditions.

The US Navy has nuclear subs and carriers. Not the same working conditions that the Soviets might have had.

Properly built nuclear power plants should be good for at least 40 years according to info I have seen.

Boomer II –

Bravo, well said;

This brings us to square-one:

What has made the US power-machines different from the old Soviet Union’s poor ones?

Energy!

More energy, probably in many orders of magnitude, has been put in the US’s machines which allowed them durability, endurance and robustness: Energy in design, advanced material, precision, logic, complexity, procedures, control, monitoring and so on…

All above are an indication on the tight relation between the useful energy out of an energy-producing device to the total energy put into constructing it!

Has more energy put Fukushima behind barriers that would survive the strongest of tsunamis (which means significantly more energy expended in constructing Fukushima), the machine wouldn’t be that venerable to Entropy turning it in a matter of hours to a waste that requires now incredible fresh energy to clean the mess. This far, fresh energies that exceed all the useful energy generated by the wrecked device since commissioning.

Because 99% of all above are fossil fuels-driven, one understands why fossil fuels are critical and where all the Terra-joules we are getting from them by the hour are dissipating and vanishing in waste:

Also see: “The Entropy Law and the Economic Process“

Radiation reaches the turbine only in the case of leaks in the steam lines inside the steam generator. If such leaks occur to the extent they threaten to cause problems with any other equipment, the reactor is shut down for maintenance work, and the leaks are fixed.

I fixed some myself…… personally, back when I worked maintenance in the biz. Paid about six or seven times, on an annual basis, what I earned as a teacher, which had a hell of a lot to do with my giving up teaching, lol.

E’nE is full of shit up to his nose.

He does get something right at least once, apparently by accident. Nukes in countries that are in desperate economic condition are apt to be poorly maintained, and maintenance delayed too long, and so the risk of an accident is greatly increased.

OFM –

Once a turbine is contaminated, it may continue in service until entirely replaced. It may get some repairs prior to a full replacement, which leaves the turbine radioactive for the period.

“..Paid about six or seven times, on an annual basis..” – also owning to very likely risks of excess exposure to radioactivity.

This is a public knowledge, everywhere, I think.

I will donate ten bucks to the charity of his choice to anybody who can point out a case of a turbine being replaced because it was contaminated.

As has often been pointed out, just about anything and every thing on this planet is radioactive to some extent……. as you will find if you subject it to testing to the limits of sensitivity.

It’s true that people who do hot work pick up some exposure. So do the people who fly a lot at high altitudes, or live where there’s radon, or work in the medical imaging field.

The standards are tightened up for allowable exposure from time to time. So

And your personal records follow you from job to job in the industry….. forever.

A friend of mine had an auto accident in the late eighties, who worked in the industry with me. The hospital shot a bunch of xrays without out even asking him. SOP.

Because he told the Health Physics team about these xrays, the next time he wanted to work, he was not allowed to do any hot work for the next three years, because this would have put him past the established limits of exposure for that length of time.

OFM –

“….anybody who can point out a case of a turbine being replaced because it was contaminated“..

This is what I could understand reading and listening to documentaries: steam turbines at n. plants are expected to run contaminated.

There are more references that mention radiation makes the strongest of metals and materials more susceptible to failure. Add to that heat and rotation, a turbine wouldn’t have easier service life in n. plants than in coal power plants.

Add all the extra energy expended in handling n. plant potentially radiated components, and one can calculate the net useful energy out of any n. machine.

Taming n. power to be convertible to useful electricity seems quite different from detonating n. devices in a split second done for destruction – where all the universe comes to help with gravity bringing everything to waste (Hiroshima) – an objective that a bikies group-size force has managed to achieve recently turning cities to ruins in the Middle East in the last few years, using no more than light weapons and RPGs(Riqqa, Mosul).

See any structure that is control-demolished coming down in seconds. Now, rebuild that structure again – and all the gravity in the universe comes against you asking for Energy!

Wärtsilä has built for Jordan a power plant of more then 500MW put in a cluster of ICEs using heavy fuel oil in the desert. Bringing up and shutting down the plant claimed to take minutes. The system is quite modular and it can be scaled up to >1G in a matter of weeks. A 20% out of the waste heat can be converted to useful energy using ORC, potentially.

Countless similar power stations can be found everywhere.

One wishes Wärtsilä customise their flagship heavy duty ICEs to run with the light-oil out of shale oil fracked wells, without the need to get the new fuel processed any further blending it with other crudes, avoiding a host of costly energy processes that may erode the net energy in the extracted liquid.

It’s over 40 years since I worked on nuclear power but I think they had two or even three barriers between the core and the turbines: there’s primary cooling, which has up to four redundant circuits, then maybe a secondary heat transfer circuit, and then the steam circuit. Maybe different for boiling water reactors?

OFM –

http://www.natgeotv.com/in/worlds-toughest-fixes/videos/going-nuclear

Also, the full-length of the documentary allows more information on how readings on radioactivity inside the turbine room is being done…

Technology costs energy just to exist. So it may be cheaper to extract oil , but there is additional hidden energy cost in the system. That’s why, despite more technology, today’s civilization consumes more energy, than in the past. And when civilization’s energy dissipation rate slows, technology will disappear accordingly.

ktos said “That’s why, despite more technology, today’s civilization consumes more energy, than in the past”

Consider that we have a much larger population now and that much of the “more technology” actually is intended to use energy to gain a desired change or effect that society needs or wants.

“And when civilization’s energy dissipation rate slows, technology will disappear accordingly.” When civilizations energy dissipation rate gets lower it will have transitioned to more efficient and sustainable technology and systems. We are seeing this change now, with the advent of cars that are four to five times more efficient than ICE cars and need no fossil fuels to travel. PV and wind produce energy directly from the source (sunlight and sunlight driven wind) with no need for fossil fuel or any local energy source.

GoneFishing –

“…When civilizations energy dissipation rate gets lower it will have transitioned to more efficient and sustainable technology and systems….”;

Here you may watch a community that transitions to more efficient and sustainable technology and systems (Iraq has lost its power grid to the 2003 War, never recovered since. Shortages in natural gas supplies, price rising, are severe and chronic. Iraq exports 5+ mbpd of crude, consumes as much as what mainly keeps the oil drilling, pumping stations and export port hub running).

PV panels hardly work under this intense solar radiation, if at all. They become deeply ‘grilled’ down to their core matter, and useless after few summer seasons – although many claim they last for 50 years working just as fine.

Good transition! God forbid it comes close to where one lives…

https://www.youtube.com/watch?v=92i6KtPto7U

What is that, an electric heat grid under the pan? Very funny.

You saying that the ground temperature is 300C and boils oil?

Maybe you should inform the Saudi’s who are installing solar or all those people in Arizona (same latitude as Iran), quick run around warning them that their panels melted down already.

https://en.wikipedia.org/wiki/Solar_power_in_Arizona

You are full of shit. God forbid anyone listen to you.

GoneFishing-

There is a plethora of these cooking-under-the-sun demonstration videos (below few more samples).

See videos on grid-size solar panel projects in the ME: they do exist but try and also watch documentaries on how energy-intensive cleaning them every morning is. Given the lowered efficiency due to extreme heat, cleaning will consume the rest of the power generated, likely.

Grid-size solar panel projects are Money transactions, too, not just about energy, mind you!

Whether they work or cost more energy than what they produce, there is ‘always’ fossil fuels to offset, thankfully!

Cleaning:

https://www.youtube.com/watch?v=rWtukrV1xNQ

https://www.youtube.com/watch?v=y8rIXjOPZ8w

Cooking:

https://www.youtube.com/watch?v=wbZa0y6QTFA

https://www.youtube.com/watch?v=odV6bRZdaD0

https://www.youtube.com/watch?v=lz85G5XzuAc

UAE had some major planned maintenance, but why didn’t they just turn on their “spare capacity”?

4 months of maintenance culminating in January?

No, just the most recent drop, so it should come back. We shall see.

The drop was quite small. So that suggests that they did turn on spare capacity if it was major maintenance. The months before that looks more like natural decline.

https://www.chron.com/business/energy/article/Chevron-Phillips-Chemical-launches-Baytown-ethane-12746845.php

There was some discussion on ethane in the previous post. The first new cracker for many years actually started up on Monday (1.5 million tons of ethylene per year).

(article doesn’t say if all that is in US.)

https://www.energyvoice.com/oilandgas/166231/no-room-oil-statoils-new-name-equinor/

Statoil is becoming Equinor (no state or oil in name, Norway’s in there, don’t know about Equi).

IEA OMR: https://www.iea.org/oilmarketreport/omrpublic/

Supply is forecasted to grow but demand grows even more. Comparing the demand/supply chart with previous month it looks as they assume lower surplus (stock build) in 1Q and greater deficit in 2Q, 3Q and 4Q.

Some quotes:

“OECD commercial stocks rose in January for the first time in seven months to reach 2 871 mb. However, the 18 mb increase was only half the usual level. The surplus to the five-year averaged fell to 53 mb. Cushing crude stocks reached their lowest level in three years.”

“Global refining throughput in 1Q18 slowed from 4Q17’s record levels by 0.9 mb/d. It will ramp up to a new record in 2Q18 at 81.8 mb/d. We assume refining throughput will only partially meet the seasonal demand increase, with inventories filling the gap.”

“…we highlighted how in 2017 discoveries of new resources fell to a record low of only 4 bn barrels while 36 bn barrels were actually produced. We also pointed out that in 2018 investment spending is likely to grow only by 6% having barely increased at all in 2017. To 2020, production increases from non-OPEC countries are by themselves enough to meet demand growth. After that time, the pace of growth from these countries is less certain, and the market might well need the supplies currently being held off the market by leading producers.”

Lights starting a little, although it is nowhere near twilight illumination, yet. At $60 up til now, the growth in the US will almost all have to come from the Permian. With pipeline constraints capping that near 800k, or less, for 2018. Or less, is because the 800k is oil pipelines, there already there with gas pipeline constraints. May get another 200k bpd from the Bakken and Eagle Ford if prices will support it. 2019 will remove a lot of the constraints, but that’s next year. I can’t figure where they expect the other half million barrels per day to come from, worldwide? Canada is facing what the Permian will, if they overproduce. Discounts of $30 for transportation problems. Brazil better start humping to get that oil out. Much more than 3k bpd that came in January. This report is going to become more amusing as the year progresses.

Next year shale oil has to deliver 2 mb/day more oil than now to keep in the timeline – can the pipelines then deliver this? And 2020 3 mb/day to stay at the forecasts. When they stall now, they have to be even faster next year.

They have about 3 million barrels of pipeline capacity in the hopper, even now. Whether it gets to that point, or not, is the unanswered question. They won’t be built until they have sufficient contracts already in place. They are just in the planning stage, yet. Speeding it up, as they go. For instance, one 450k pipeline project originally expected to go online by early 2019, is now expected by the beginning of the fourth quarter 2018. There are still limits on how fast they can build. Texas is huge, so the distances are very long.

When they say “We assume refining throughput will only partially meet the seasonal demand increase, with inventories filling the gap.” what does that mean? Aren’t they supposed to analyse the figures, not just assume? And are they assuming both insufficient seasonal refining and sufficient stocks (presumably of product)?

Storage is low and falling faster (or filling slower) than before and with no floating reserve – SPR to be released?

I still can’t see where the 2019 production comes from, if not the Permian (and I can’t see how exponential growth from a high starting point is possible there), and the downside risk from any geopolitical upset or major lost time incidents are growing. Venezuela could easily go to nearly zero in 2019, and UK, Norway, Mexico, most of Asia-Pacific (especially China) will likely lose more combined in 2019 than this year. Something that no-one has even properly considered is going to happen.

Norway will probably be flat to slight increase going forward. Sverdrup start up plus fairly aggressive growth plans by smaller operators… but it won’t be enough

“Aggressive growth plans by smaller operators” – yes (AkerBP, Lundin comes to my mind) but plans are not by themselves enough to grow production. Limited success in Barents Sea, so far. Do you know of projects that will enable growth from now on?

Equinor (Statoil) are involved in most of the projects that matters. Including Johan Sverdrup ph1 (440kbd) which is expected to start production in 4Q 2019 – ramping up in 4Q will not compensate for decline and enable growth in 2019. The other projects that I know of are much smaller Martin Linge ~40kbd (Equinor) has experienced major delays and is currently expected to come on line in the first half of 2019, Trestakk (Equinor main operator, Åsgard tieback) ~20kbd, Oda ~35kbd?.

Many years until Johan Sverdrup ph2 and Johan Castberg will ramp up.

There are some redevelopments planned – Snorre, Heidrun, Njord, Ekofisk – which will likely hold up some decline. On the other side the biggest oil producer at the moment is Troll and that will come of line pretty fast from 2020, as they are going to start production from the gas cap soon after.

My point was that those countries combined will decline faster (UK is growing at the moment and will then be declining, possibly quickly because Buzzard can’t keep on plateau for ever and there are definite signs of rapid water breakthrough for it and Golden Eagle now).

Yes, but Njord is the biggest of the four and is scheduled late 2020 (I think), Snorre the year after. My interpretation (perhaps I have mistaken) is remaining projects will mainly compensate for legacy decline, not grow production (I expect Norway’s production to decline gently until late 2019/early 2020).

An overview of projects can be found at: http://www.npd.no/en/news/News/2018/The-Shelf-2017/3-Development-and-operations/

That is why it is entertaining to follow this story while it unfolds. Our high point of exports has been right around 2 million barrels a day. Probably pretty close to max, right now. Some say 3 million, but if that was so, I am sure we would have seen it climb close to that, at some week, surely. Corpus is planning on expansion, but that is a while to go. 2020, maybe? It does not compute. Nothing the EIA or IEA makes sense. They even underestimated demand last year, I don’t see the drop in floating inventory covered in any of the “analysis”. They are beginning to point the finger more at Venezuela. So when the fit hits the shan, they will blame all the problems on them, and not extremely faulty logic?

when the fit hits the shan

I saw that used nicely in a Zelazny novel.

US SPR has only been used as a respond to short term problems. I think the decision is up to the president (and the current one is a bit unpredictable…) but I can´t see what good it would make to use it when the problem is long term and structural. There is also a free rider problem too, it would benefit other countries as much as the US.

Btw. I´m starting to feel a bit worry. I though that we would either be in a recession by now (reducing demand) or see higher prices that reduce demand and incentive efficiency and more upstream investment. Instead we face a sleep walking situation with low prices, high demand and stock drawdowns. It´s insane!

Good observation regarding the “sleep walking situation” where there seems to be no notice or concern of low prices, high demand and inventory draw downs.

Almost a mirror-image of what we saw from 2013 up to the price crash when we had HIGH prices, INCREASING production and BUILDING inventories.

No one took notice until the numbers were grossly out of hand and then the market woke up and crashed.

I wonder how far down the rabbit hole we will go this time until the market takes notice and prices go ballistic….again….

Nobody was that fearful, at first, when prices plunged. Everyone was talking about a rebound for about a year. So, I suspect that will happen on the uptick, also. Denial will reign when it’s starts going up for, at least, a year. Everyone has been listening to nothing, except the Permian for two years. Gonna be hard to shut that song out.

In 2014 the market thought that OPEC will cut. Now, maybe the market thinks, that in case, OPEC will increase extraction rate?

Yes, that is part of the thinking. Do the charts above indicate they have 1.8 million to dump back into the market? At this point, there should no longer be any more “cuts”. Super spikes will not be beneficial to users or producers. The longer they delay in announcing their exit, the longer the expectation will be that the supply will exceed demand, even if the rest of the worlds inventories are circling the drain. It’s having the opposite end effect of what the Saudis want. Announce it now, and the market will have sufficient time to adjust when they float their IPO. Wait, and the market will go down expecting them to flood the market. Maybe.

Jeff

I can only agree with your post and I feel exactly the same way. I think the consequences of peak oil are so sobering that denial is a big part of keeping the party go on until it can not continue. And that, in my view, would not last past 2019. The US shale production would hit the wall figuratively speaking, and I suspect some major countries in the Middle East are not up to the challenge to increase oil production (no evidence, who knows anything about the black box SA by the way).

That does not mean that oil production will fall steeply in the future if enough investments in unstable countries by western standards can be scaled up, and investments probably will be scaled up. But I do think peak oil finally may have arrived in 2019-2020, and the argument why not enough investments will be made in oil is that many enough of key people realise that a transition to renewables is needed, even if it will be painful. And that the lower EROI of oil investments is part of the reason (and also why the focus for IOCs turn toward natural gas going forward).

I happen by coincidence to live in a country that can actually cope with a renewable transition, due to an aboundance of hydro power and wind power potential compared to population (Norway). I am still uncomfortable with the signals in the market; the realisation of peak oil is all too clear (just look at what the IOCs are doing). A major transition must happen, and since political leaders want to keep the party going too long, a major crisis will come and it will be very uncomfortable and ignite the needed changes in energy policies.

I am actually concerned that there will be winners and losers among countries in this transition and that it will breed major conflicts in parts of the world; more than we have been used to in the recent peaceful period. Reducing standard of living will not be a quiet process.

“Reducing standard of living will not be a quiet process.”

Indeed.

I believe the fear of this is why so-called president trump was elected. A large portion of his vote was cast by those who are fairly ignorant and think this schmuck might help them stave off the decline they are experiencing.

“Something that no-one has even properly considered is going to happen.” Yup. That usually upsets all of my speculation.

Well, 2019 increases to equate demand, I can’t even begin to imagine where it comes from. Still trying to figure out how supply will come within one million barrels of demand for 2018.

Hi Guym,

If supply is short, oil prices will rise until the level of oil falls until they are equal.

For the past couple of years oil prices have risen at about $12/year (slope of trend line of average 5 week Brent oil price over the Feb 2016 to Feb 2018 period.) The recent 5 week average was about $63/b in Feb 2018 so perhaps we might see $75/b by the end of 2018 to balance supply and demand for oil on World markets. At that oil price several LTO plays might be profitable on a cash forward basis and might see increased investment and completion rates.

Since one of the major uses of oil is transportation, demand for oil could fall over the next decade due to increasing efficiency and replacement by EV vehicles.

I think a price surge in oil now will be it’s death knell as far as consumers are concerned. It will be extremely tough to get rid of older SUV’s in five years and real giveaways in ten unless the price of oil stays low. Americans may be slow to take on change now, but when it comes to their pocketbooks many will smarten up fast and think of reasons other than “green” ones to buy into the renewable/EV sectors.

How about the crazy idea that cheaper Chinese EV’s will enter the US market within five years? It happened with Germany, Japan, Korea so why not China?

gone fishing,

I agree eventually (maybe 2040 or so) EVs may reduce oil demand and cause an over supply of oil, but between 2018 and 2040 oil supply may be short and oil prices may rise, the higher prices will have two effects, it will accelerate the move to EVs and it may reduce the rate of decline of oil output after the peak until demand for oil starts to decline faster than the decline in oil supply, at that point oil prices will fall (my guess around 2040-2050).

I was thinking of all EV’s plus additional increased efficiency in ICE’s. All EV’s will include two wheelers which are popular in much of the densely populated world, three wheelers, cars, trucks, buses and trains.

The big markets are going to be in China, India and the developing countries. Many will not look like or be conventional cars as westerners view them, but they will use little or no liquid fuel unless that country has access to a lot of it’s own.

gone fishing,

Agree 100%, it will be hybrids, plugin hybrids, smaller vehicles, and expanded public transport in densely populated areas, also ride sharing, and better urban design allowing more walking and biking. Higher oil prices will accelerate the transition and those high prices will arrive within 2 to 5 years ($100/b or more).

Hello

How are you?

Mr Ron Patterson or Someone else

When will the peak of natural gas of Bolivia?

Which was the gas production in Bolivia in 2016 and 2017?

Hi Cecilia,

In 2016 Bolivia produced 19.7 billion cubic meters (BCM) of natural gas, peak so far was 2014 at 21 BCM. Cumulative production from 1972 to 2016 was 294 BCM, proved reserves at the end of 2016 were 280 BCM, that’s all the information I have, data from

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

There is this in the news, but I don’t know anything about it…

LA PAZ, March 15, 2018 – Bolivia is preparing to announce that it has major shale resources, international media reported on Thursday.

No further details were provided in the report, though Sanchez also cited recent studies according to which the Madre de Dios River Basin holds 340 bcm-3.4 tcm (12-120 tcf) of gas and up to 40 billion barrels of oil.

https://www.theoilandgasyear.com/news/bolivia-eyes-own-vaca-muerta-report/

The Madre de Dios basin is located in Peru, Bolivia and Brazil. My guess is the Permian may have a viable “shale”, it has gas and oil shows, and in Peru it has a high carbonate content (what I call a hot lime).

is the 40 Gb estimate in the right ballpark? Say within 10

Gb or 30-50 Gb.

Assume your July 2016 oil price forecast is roughly correct.

Who the hell makes your headlines on oil price?

Outstanding. RRC in changeup mode. Checked statewide to see if it was posted early. Surprise, a few of the operators are posted. No way to tell now, on final preliminary numbers on the statewide query for awhile. Might have to wait until they post the summary on the main site. Instead of them posting everything at one time, now it just dribbles in.

For folks who keep an eye on the natgas world, the just-released (March 13, 2018) presentation from CNX – formerly Consol – contains some potentially bombshell information.

As one of the few operators continuing to drill Deep Utica wells in Pennsylvania, their results are being watched by many.

They are now claiming over 1,000 Utica wells will be drilled east and northeast of Pittsburgh with expected EURs of 3.5 Bcf/1,000′ lateral … essentially 25 Bcf for a 7,000 foot well.

What this means, if their projections are correct, is that the Utica is, indeed, as big as the Marcellus.

“Moving lower for the 3rd day in a row, CNX finished Tuesday at 16.25 tanking $0.87 (-5.08%) on high volume. This is the biggest single day loss in over a month. Today’s closing price of 16.25 marks the lowest close since February 28th. The bears were in full control today, moving the market lower throughout the whole session. Closing below Monday’s low at 17.06, the share confirms its breakout through the previous session’s low having traded $0.89 below it intraday. Ending with a weak close near the low of the day sets a bearish note for the next session.”

https://techniquant.com/reports/stock-cnx-daily-technical-report-for-2018-03-13/

Pretty tough to sell buckets of sea water down at the beach.

Day after EQT announced IP results of the most successful shale well of all time – the Scotts Run – their stock dropped 7%.

Speculation was that the enormous amount of new gas (from the Utica) would hurt suppliers due to the abundance.

And that was the point of my posting.

If people think the Marcellus is huge, Appalachian Basin potential just skyrocketed.

In a PS, XTO just drilled/completed 2 Deep Utica wells in this general area – east/northeast of Pittsburgh in Indiana and Jefferson counties.

Should they prove successful, it will further expand the footprint of this already massive (Utica) formation.

Reserves are a function of price. The majority of shale gas wells at these prices LOSE money. And I am not basing this on their company presentations. I have seen the AFE’s, JIB’s and LOE’s.

The production results of the Shale producers is NOT an engineering miracle or technology driven, it is a function of their creditors suspending the laws of economics.

ETA: anytime you see the phrases IRR or EBITDA in one of these companies presentation, just realize they are losing money. At some point, ANY company that has as many rigs running as these companies do, should be able to drill their wells out of cash flow. They can’t, because they LOSE money.

Now, now, Reno; you are an actual oily person, you cannot say those sorts of things. Perception is far more fun that realization; it makes for never ending speculation. Shale (oil and gas) exists, therefore it is: 1P to 4P Power Point reserves will all come out of the ground, somehow, someway. Debt, costs, lack of profitability, market constraints, water, Mother Nature etc. etc….none of that is important. Its a all just a miracle.

I’d like to hear from you now and then, sir: https://twitter.com/oilystuffblog/status/974083737112793088

Debt, costs, lack of profitability, market constraints, water, Mother Nature etc. etc….none of that is important. Its a all just a miracle.

That sure seems to be the way a lot of people navigate through life in general at this particular juncture in human history. And to be clear, I’m not just talking about USians. I have traveled far and wide in this world and have found that much like fish being unaware of water, most humans are unaware of the economic and political operating systems within which they live out their lives. Though that would be a separate dissertation.

First a short disclaimer, while I still read the petroleum section posts and comments, I very rarely comment myself these days. The main reason being that much of the discussion seems to completely ignore the main points of the excerpt that I have italicized at the begining of this comment. There seems to be very little understanding of what I like to characterize as a fundamental truth, that all economic and political systems are subsidiaries of ‘Ecosystems Inc.’ That would be another dissertation on the profound logical flaws and blind spots of classical neoliberal economic theory, it’s origins and how we got to where we are today.

The fact of the matter is that the entire global economic system basically operates on the premise that ecosystem services are an externality that can be safely ignored. Personally I think that is a dangerous delusion, witness the ample scientific evidence that we are currently in the throes of a quickly accelerating mass extinction event. The underlying causes of which are complex and multifaceted but have a large component caused by anthropogenic release of CO2 from buring fossil fuels. You can not argue with the logarithmic scale of pH.

What for example is the cost of destroying the world’s coral reef ecosystems? Well the brilliant economists at Deloitte Access Economics have recently valued the Great Barrier Reef at A$56 billion, with an economic contribution of A$6.4 billion per year. Forgive me for finding that assesment, laughable. Another dissertation would be in order here.

The bottom line here is that that most in the oil industry still takes ecosystem services for granted. This is a massive subsidy and bailout that society can ill afford to continue funding. The bill is fast coming due and it is way past time to start doing full cost accounting.

Perhaps a starting point for the necessary discussion might be educating the public at large as to what ecosystem services are and how they impact the well being of all of humanity.

https://www.sciencedirect.com/science/article/pii/S0959378017303540

Since the Millennium Ecosystem Assessment, ecosystem service science has made much progress in framing core concepts and approaches, but there is still debate around the notion of cultural services, and a growing consensus that ecosystem use and ecosystem service use should be clearly differentiated. Part of the debate resides in the fact that the most significant sources of conflict around natural resource management arise from the multiple managements (uses) of ecosystems, rather than from the multiple uses of ecosystem services.

If the ecosystem approach or the ecosystem service paradigm are to be implemented at national levels, there is an urgent need to disentangle what are often semantic issues, revise the notion of cultural services, and more broadly, practically define the less tangible ecosystem services on which we depend. This is a critical step to identifying suitable ways to manage trade-offs and promote adaptive management.

Cheers!

I am troubled by policy from the White House that doesn’t even meet the level of short term business sense. Some of what the administration is doing is even hurting the industries it is supposedly trying to help.

So the global ecosystem is WAY beyond their capacity to grasp.

So the global ecosystem is WAY beyond their capacity to grasp.

Oh, I fully agree! My point doesn’t include the total clusterfuck that is the current administration. I have never seen a group of such incompetent clowns. By comparison, a three stooges skit comes across as an erudite professorial presentation. I fully expect them to be a only a very short lived blip in the pages of history… Though the damage they wreak on the reputation of our country may take quite a while to mend.

Thanks! I’ll file that in the drawer of excellent comments. I think one of the reasons we’ll have a hard time nurturing the ecosystems is the inertia. Will Mother nature care if we manage to shut down 500 coal plants? Not much is my guess. She will be very grim at the negotiating table – not saying much at all – or if anything – I’d like more – What have you done for me lately?

You gentlemen are correct regarding the economic realities of these plays.

At $21 million+ for some of the Deep Utica wells, the returns may never be there.

CNX is hoping for $14 million per as it co-develops with the shallower Marcellus, a striking departure from all the other AB operators.

Again, the economics are not the salient point in my posting.

What CNX and, possibly, XTO with their 2 Deep Uticas coming online in Central Pennsylvania shortly, are showing the world is that there is recoverable gas in Pennsylvania that may be measurable in the thousands of trillions of cubic feet.

Furthermore, the physics – along with the massive size – of gas recovery versus oil greatly favors gas over oil in the coming decades.

If the economics are not there as you say, then the gas is not recoverable. That is the whole point of reserves. Reserves are not what you can book on a piece of paper. Or what you can produce without regard to profit. They are what actually comes out of the ground and can make a return. End of story. If the wells can not make money, then they should not be drilled. And I am talking about all costs. Acreage, LOE, overhead, interest costs, etc. Apply to that well and give me a date at which payout occurs. Actually, I think that one metric would clear everything up. All a company need provide is a date that each of their wells payout, after allocating EVERY cost associated with that well. Give me that number and I can tell you if these wells have the reserves they claim.

There is undoubtedly lots of gas in place. I am as sure of this as I am sure that it can not be recovered at these prices. These companies need to manage their production better or sell out now. Quit drilling alternate unit wells. Drill on appropriate spacing as opposed to touting PUDs and reserves. Drill wells like you are using your money. These simple steps would make these companies profitable, and might ultimately prove your thoughts on these shale plays correct.

Mike,

Love your sight and check in daily.

RT

My thoughts are as significant as yours in these matters … not particularly important as it is neither you nor I spending the hundreds of billions of dollars in the finding and extracting of these unconventional hydrocarbons.

Your concerns regarding the economics, especially profitability, are greatly warranted, yet the fact remains that production – especially in the HIGHLY impactful matter of Utica recoverability – continues apace.

The present 27 Bcfd output from the AB will be 35 +/- Bcfd this time next year regardless of HH, regardless if Exco is bankrupt or Travis Peak just sold out.

The fact that the Appalachian Basin is on the cusp of being recognized as the largest source of recoverable natgas on the planet is a momentous event.

People, especially those in the oil and gas industry who decline to accept this do so to their own detriment.

interest doesnt sleep. And what can’t go on forever will not.

People who refuse to account for profitability and economics of these wells do so to their own detriment. I am not telling you what to believe or not to believe, but if you want to discuss reserves, and not include the economics, that is wrong.

I gave you real easy benchmarks for discussing profitability of these wells. Which will tell you if the reserves mean anything. Dismissing it is your blind spot. It has gone beyond ignorance of the subject to willful misrepresentation.