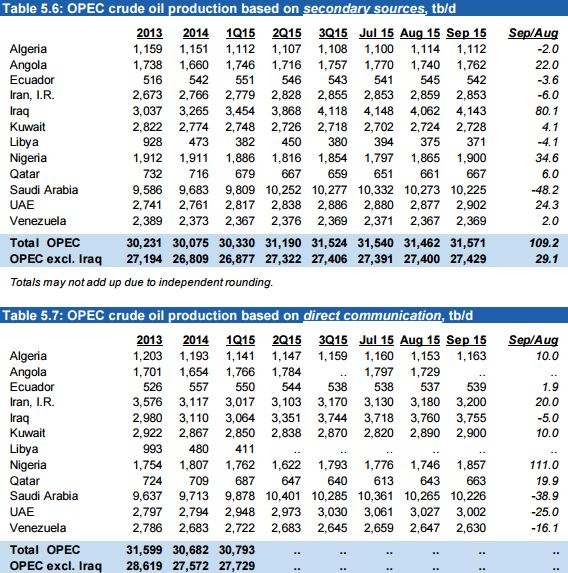

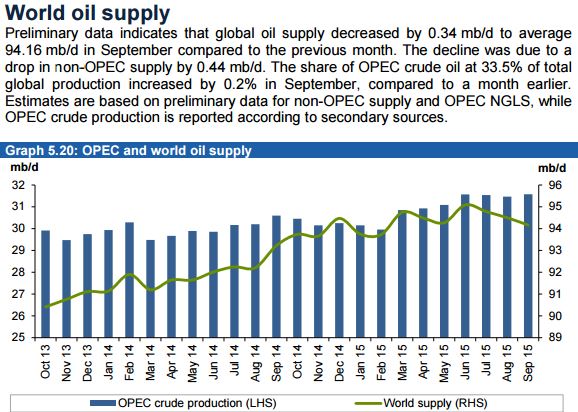

The OPEC Monthly Oil Market Report is just out with the crude only production numbers for the 12 OPEC countries. The data below is in thousand barrels per day and the last data point is September 2015.

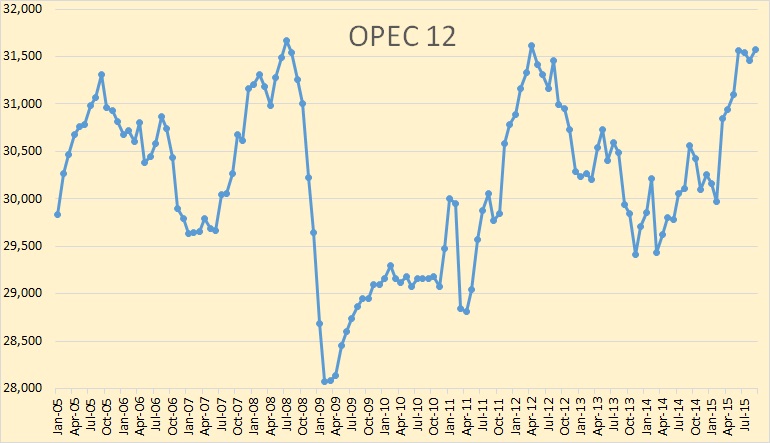

OPEC 12 crude only production was up 109,000 barrels per day in September but that was after the August production numbers were revised down by 82,000 bpd. OPEC crude only production now stands at 31,571,000 pbd. That is just 12,000 bpd above June production but still 100,000 bpd below their peak in July of 2008.

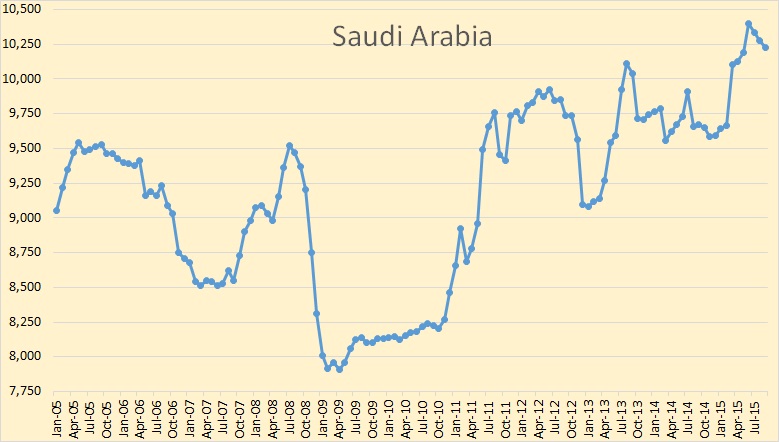

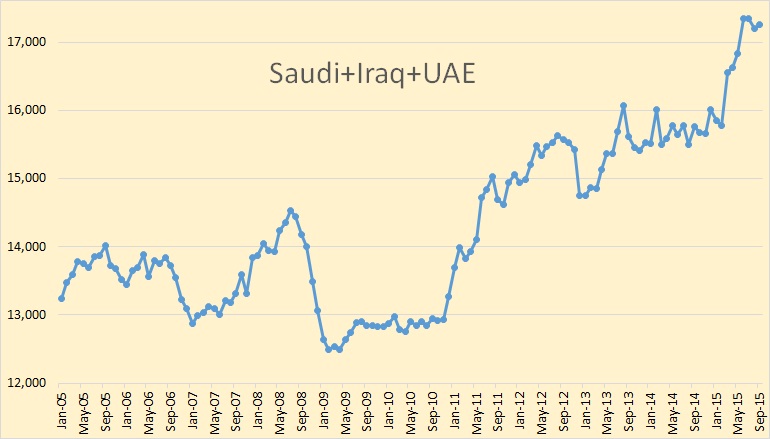

Saudi Arabia was down 48,000 bpd in September to 10,225,000 bpd. That is 174,000 bpd below their latest peak in June.

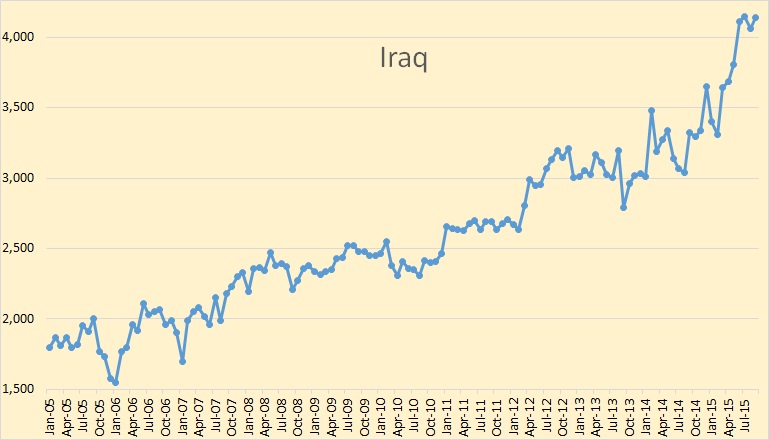

The big gainer in September was Iraq, up 80,100 bpd in September. That is still 5,000 bpd below their latest peak in July.

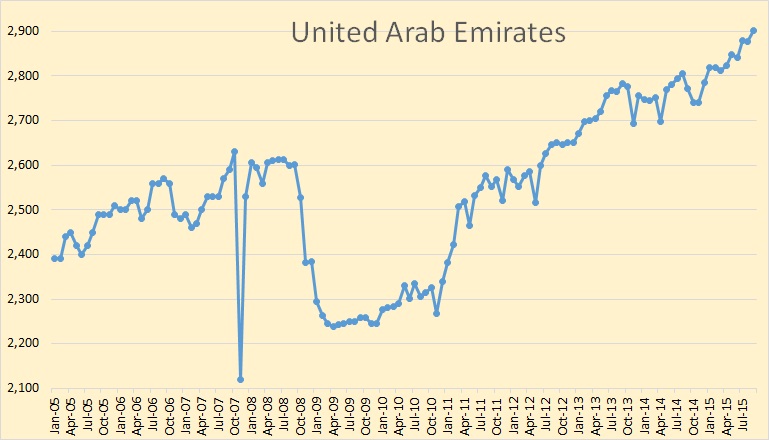

The UAE hit a new high in September, up 24,300 bpd in September to 2,902,000 bpd.

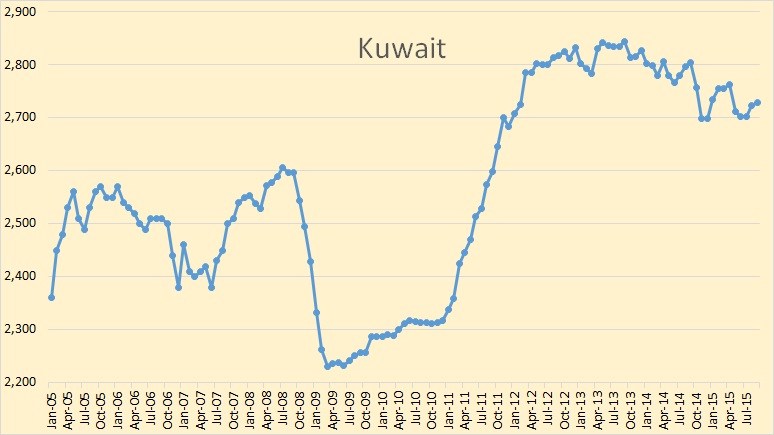

Kuwait, one of the big four that is responsible for all the increase in OPEC production since 2011, Kuwait seems to have peaked in 2013.

All the OPEC increase in 2015 has come from Saudi, Iraq and the UAE.

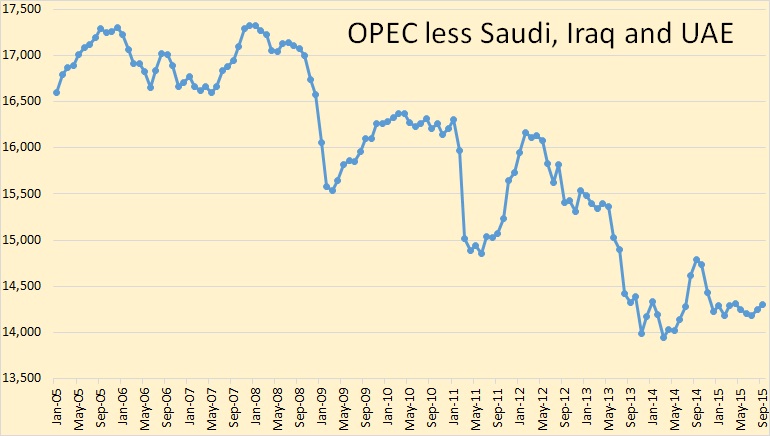

The other nine OPEC countries, when combined, have been flat in 2015.

Here are the numbers for all 12 OPEC countries. I always use “secondary sources” for my charts. Notice the difference between what they say they produced when called and what the secondary sources say they produced. Iran and Venezuela always say they produced a lot more than they actually produced. This month secondary sources matches Saudi’s “direct communication” almost exact.

OPEC says world total liquids declined 34,000 bpd in September. Non-OPEC production, they say, declined 440,000 bpd in September. Eyeballing the chart Non-OPEC production looks to be down over 1,000,000 barrels per day since June.

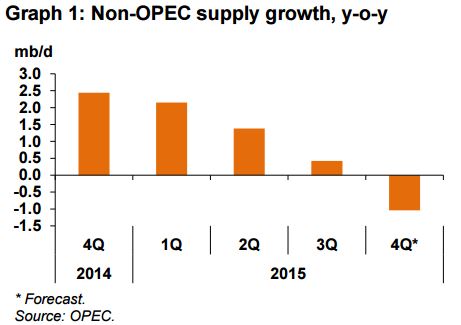

This chart does not contradict the chart above. This is year over year growth change. Although third quarter Non-OPEC production was down it was still slightly higher than third quarter 2014 production. Fourth quarter 2015 Non-OPEC production is predicted to be down versus fourth quarter of 2014.

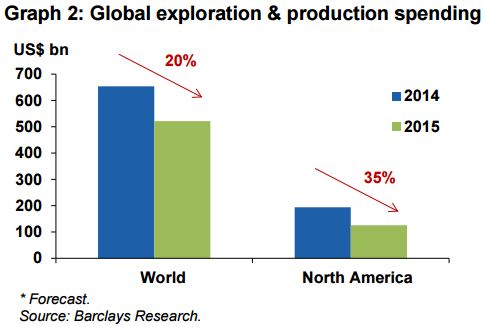

OPEC says world upstream spending will be down only 20% in 2015 but North American upstream spending will drop by 35%. I guess that is because of the big drop in shale spending.

3Q15–4Q15–1Q16–2Q16–3Q16–4Q16

-13.5—13.4—13.4—13.5—-13.5—13.7

Above is the OPEC projection for US production out to Q4-16.

Looks optimistic to me. For the above to be true, there must be some underlining assumption regarding increasing oil prices to restart drilling.

Yes those numbers are totally unrealistic, just as unrealistic as the US Short Term Energy Outlook numbers. In the chart below US Total Liquids are the left axis while C+C numbers are the right axis.

Total liquids for the US STEO includes refinery process gain. And they even count refinery process gain on imported oil. So it looks like the OPEC MOMR numbers do not include refinery process gain.

The above chart is just total liquids less C+C. It shows US “other liquids” growing by 1,180,000 barrels per day from the first quarter 2014 to the fourth quarter 2016. I don’t believe that either. But it shows why the OPEC numbers are growing. They are counting all those “other liquids.”

The EIA expects U.S. non-C+C liquids supply to increase by 1.17mb/d between January 2014 and December 2016, of which 1.03 mb/d – NGPLs.

BNSF completing huge double tracking project, Chicago to LA, to take container market share. Means less trucks on the road. Lower diesel fuel use and less wear and tear on highway system.

“The Los Angeles-to-Chicago route links the busiest U.S. container port to the biggest mid-continent rail hub, giving Fort Worth-based BNSF a leg up in the race to find alternatives to those dwindling coal cars.”

http://www.dallasnews.com/business/headlines/20151011-bnsf-builds-rail-superhighway-to-grab-truck-freight.ece

‘God-trader’ Andy Hall’s fund loses $500M

http://www.cnbc.com/2015/08/06/god-trader-andy-halls-fund-loses-500m.html

Was he trading based on IEA, EIA or OPEC forecast numbers? 🙂

Nah! He just forgot to read his own disclaimer:

“past performance is no guarantee of future results”

http://www.cnbc.com/2015/10/12/us-shale-firms-snap-up-50-oil-hedges-risking-rally-reversal.html

“In addition to creating immediate headwinds by selling into the rally, drillers whose future profits are insured with new hedges will be better able to keep on pumping oil, adding to a global oversupply, the thinking goes. “

Ron’s excellent charts are telling me that Opec is not going to be producing as much or MORE oil on a daily basis, if any, very much longer.

With only three countries carrying the load, and all the others combined just holding steady over the last few years, DEPLETION is sure to take a bite out of those other smaller countries production pretty soon.

It looks as if the only countries with any REAL hope of increasing production enough to really matter on the world stage, near term, are Iran and Iraq and the USA. The USA is out of the running until prices go up and then, according to what I read here, it will take a year or maybe two to ramp up again.

Am I right about this? Are there any other countries that have any real hope of substantially increasing production near term?

I am thinking about buying a LOT (for an individual) of diesel fuel as soon as I think the price is starting up again. I know, predicting IS HARD , but a bigger stash of diesel is as good as silver and gold in a jar buried in the back yard. Will probably stock up on lime and fertilizer as well, these inputs are extremely sensitive to and correlate with oil and gas prices.

Hi Old Farmer Mac,

Just take my price predictions and assume the opposite will be true, or flip a coin 🙂

Nobody can predict when oil prices will rise with any accuracy. I will suggest it will be in the future, maybe late 2016, maybe not.

…there will be no price rise, just the volatility of: “…a bomb went off here…”, “…a war started there…” and “…a russian jet was shot down over there…somewhere…”.

be well,

Petro

P.S: the “hoard” of diesel is not a bad idea, OFM

..a russian jet was shot down over there..

Not true. Already 252850 jet shot down in Syria 🙂

Dennis,

Good to see that you have revised your forecast towards a more cautious approach that nobody can predict oil prices. However, I think it is possible to see a trend and the underlying forces, which make the trend. As I think that the oil price will stay low over the next few months, the chances that oil will be going up have actually grown very much. The US trade deficit soared in September (over 15% higher than in 2014) and reached nearly 50 bn per month. If the deficit goes over 60bn per month the dollar will fall substantially and this will drive oil prices up again. This may be sooner the case as it looked like a few weeks ago.

Hi Heinrich,

I agree a trend can be discerned, what cannot be discerned is that present trends will continue. I certainly have been wrong on oil prices in the past, that trend will probably continue, or not.

I once had a teacher with a straight face write on the chalk board, back when I was in elementary school, that bad weather is ALWAYS followed by good weather. I have never been able to decide if he was joking or not, I was a little kid then but later when I was older on I realized he had no sense of humor.

Oil WILL go up again. I don’t see it going down very much or very long, although an economic crash might depress the price a little more, for a while.

Now just to prove that PREDICTING IS HARD, here is the news about PLAYBOY magazine this morning.

xxxx

The news is nearly unthinkable — but it is true.

Playboy is covering up.”

xxxx

From the Washington Post, Hef started the war and the internet finished it for him.

Nudity will no longer sell magazines , it’s basically free these days.

Hi Old Farmer Mac,

Eventually the bad weather ends, if “better weather” is good weather, I would say your teacher was correct. It depends on how one defines good or bad weather.

He may not of had a sense of humour, but at least he was an optimist. As most everyone here knows perfectly well, bad weather always follows the good.

Hi Old Farmer Mac,

If OPEC maintains Sept 2015 output levels (no increase), the OPEC forecast suggests the “call on OPEC” (World demand minus non-OPEC World output) for crude will be less than OPEC output until the third quarter of 2016. The OPEC forecast for supply and/or demand for crude may be wrong, but non-OPEC supply has been surprisingly resilient in the face of low oil prices. Whether this can continue at the supply levels that OPEC believes and if the forecasted level of World economic output (which determines World demand for Oil) is also correct is a guessing game.

This new SEC regulation might help people interested in peak oil and oil prices come by more and better data.

It will probably go into force second half next year from the looks of things.

http://thehill.com/blogs/congress-blog/economy-budget/256535-wind-at-secs-back-on-long-overdue-oil-transparency-rule

You never know how good numbers put out by financial analysts are, or what they might be trying to sell.

Never heard of this outfit TPH myself but this link has some numbers in it you number crunchers will be interested in looking at.

http://fuelfix.com/blog/2015/10/12/tph-many-oil-companies-virtually-abandoning-exploration/#34823101=0

OPEC has reached a plateau, oscillating between 28 mbpd to 31.6 mbpd since 10 years now.

World production peaked so far in June.

Saudi Arabia production in decline since June, US production in decline since several months.

Peak oil in 2015?

I am curious to see the December production…

More energy reduction.

QM Power Introduces the Highest Efficiency Fan Motor on the Market: the Q-Sync™ Smart Synchronous Motor

http://www.businesswire.com/news/home/20150928005235/en/QM-Power-Introduces-Highest-Efficiency-Fan-Motor#.VhwfBssQW1s

If an electric motor is running at less than about eighty percent efficiency, something is most likely wrong.

https://www1.eere.energy.gov/manufacturing/tech_assistance/pdfs/10097517.pdf

Cost of ownership of single phase induction motors can be many times of a 3 ( or more ) phase motor. There is no rotating magnetic field in a a stator of single phase motor. All kinds of gimmicks are used to get them rotating. Think about how many times the AC repair man is called out to replace blown starting capacitors in the life of an AC condensing fan. A simple 3 phase induction can high efficiencies in the high 90’s, as long as identical sinusoidal RMS voltage on all 3 phases – 120 degrees apart. Any motor over 1/3 hp ( 250w) should be poly phase if efficiency or reliability is a consideration. Solutions for high efficiency small motors is long overdue ( At Least in North America where you find lots of single phase fractional horse motors ). Energy pigs

Yet another example of how easy it would be for US to cut energy usage by very large amounts very quickly, just by doing what we already know full well how to do.

How many motors are you talking about and how much energy savings?

Millions in many Counties. Fans, HVAC, Conveyors, Pumps .. just for starters.

—–

New Q-Sync Smart Synchronous Motor Shatters Industry Standards by Reducing Energy Consumption up to 80%

—-

70% would not be unrealistic in many applications.

Google – Fujtsu 12RLS Series3 – upto 33 SEER.

No numbers though, just hand waving guesses?

As Paul pointed out, … your really focusing on fractional horse, but they are everywhere in North America. Majority smaller than 1-2HP like you see on small shop air compressors. The Biggest single phase motor I ever swapped out was a 7.5HP Booster pump for a water system. The rural electric co asked to remove it since many customers were complaining. 3 phase VFD ( Variable Freq Drives ) that runs from single phase are available from Granger and elsewhere. Ive retro’d Air compressors with them. When you start any “dumb” induction motor across the line, it’s similar to a short till the rotor rotates upto speed. If the motor has to cycle often, it’s hell on the motor and the feed equipment.

But how many “dumb induction” motors are there and how many kwh will be saved by converting to more efficient motors. Percentage efficiency change is not an actual value nor does it state the actual scope of the problem. If you are so adamant about this, do some research and get some actual numbers. Otherwise it’s just wind.

The cost and trouble of converting residential and businesses to all three phase wiring would be absolutely horrendous and will not get done to run a computer fan or a refrigerator fan. Realism has to enter the picture.

ECM’s have been around since the 1960’s. Now there is the Q-sync.

As Paul said, all the high energy applications already run on three phase.

DOE has lots of info on ROI on energy efficiency upgrades. Each facility will have a different ROI depending on existing load profiles, equipment age and energy costs.. I can say that Lighting upgrades ROI is often less than 24 months if the existing facility has magnetic ballasts.

Zep,

I specified a Wilo circulator with an ECM motor for a hydronic system in 2008. ECM circulators were pretty novel in North America then, and I had some resistance. In hindsight it was the obvious choice. ECMs may have been around since the sixties but overcoming institutional inertia, as well as a higher first cost, took more then a few decades.

Btw, fan and pump motors are everywhere. The fan on my fridge is droning away in the background as I type this.

The QM motor looks like it might be the real deal. Every bit helps.

T

Industry and commerce have been using efficient three-phase motors for many decades, with a trend toward premium efficiency motors in the last couple of decades. Many of these motors run 24 hours per day, often without stopping for many days at a time. They work in all sorts of manufacturing such as pulp and paper, refining and chemicals, materials handling and processing, pumps, compressors, etc. 1000 hp motors are not uncommon in pulp and paper mills.

The inefficient motors are on household appliances, which tend to be small and seldom run. Refrigerator and HVAC motors have gotten more efficient in recent years.

“ECM” type variable-speed high efficiency fractional HP motors are becoming real big in furnace fans, small residential high efficiency AC’s exhaust fans, an small pumps. ECM is “electronically-commutated motor” basically, brushless permanent magnet rotor type DC motors with electronic “commutation” – they create 3-phase variable-frequency power for the stator from single-phase DC. The electronics take single-phase AC input, rectify to DC, then via inverters create 3 phase AC power. The electronics are built into the motors now.

If you get one of those Panasonic super-quiet exhaust fans that sets the exhaust cfm based on a DIP switch setting, that fan has a miniature ECM motor.

The article says ECM was invented back in the 1960’s and is less efficient than the new Q-Sync motors.

OK, so does that mean that us PV enthusiasts can go to DC to power all the present appliances, and forget the inverter?

And come out ahead in battery life?

I would like to forget that inverter. And extend the battery life.

Actually Mean-well AC-DC drivers run fine on HVDC input. The HLG series is a good one. They are Universal world supplies. Listed only for AC in North America – but the German spec sheets for the same supply show HVDC input. Isolated Low Voltage ( 8-60V ) from a 250V Array .

Universal AC Input 90-305VAC — 127-431Vdc… Make sure you have local switch/disconnect rated for proper HVDC Voltage. As always voltage Warning Labels. Danger on the high side. High side not accessible. You don’t get second chances. http://www.mouser.com/ds/2/260/HLG-240H-spec-43068.pdf …

uh chris US for the production did you watch Ron posts the data of the main producing states (Bakken and Texas) and you just recite the speech EIA

This may be pretty far off topic, but we hear about Apple electric cars quite often these days.

So far as I know, Apple as a company has close to ZERO actual manufacturing expertise and farms out virtually all actual production.

No doubt the company has money enough to easily fund an automobile start up, and enough loyal customers to sell a lot of cars early on.

But HOW long would it take APPLE to actually get cars to market, in significant numbers, with the bugs mostly worked out, starting with nothing but DRAWINGS?

Could they get away with having a KNOWN auto manufacturer build their car?

That might result in some brand dilution. The average person who uses an Apple product doesn’t have the faintest idea who actually BUILDS that product.

Perhaps BYD will Build the Apple car. They could become the Flextronics or Foxcon of Autos. Apple could get slaughtered if they mis step.

Old Farmer Mac, the Apple car launch is rumored to be at the end of 2019.

Hey OFM,

This is the most comprehensive page I’ve found on Apple’s electric vehicle project (Project Titan): http://www.macrumors.com/roundup/apple-car/

As of late-September the project went from an exploratory project to a committed project, so it will definitely happen. No reveal until 2019, then product release in 2020.

They met with Elon Musk to discuss acquiring Tesla, but Musk is committed to Tesla until after the release of the Model 3. Musk often says he’s only dedicated to Tesla until the Model 3 and Model Y release; those two vehicles will be unveiled at the same time.

My hunch is that Musk will sell the vehicle portion of Tesla around 2017-2020, and become a battery company thus allowing Tesla to focus on battery tech R&D as well as production. The Gigafactory is called GF1 for a reason after all. Musk would like to focus more on SpaceX and has said he won’t be running 2 companies forever.

Long story short, I’d predict that Apple will either acquire the electric car portion of Tesla and the Freemont Vehicle Production Factory, or they will partner with a major auto-maker for production. Ford, GM, and Chrysler are way behind the game on EVs and smart tech software, so it’d be a win for both Apple and lagging auto-makers who will need to play serious catch up once the superiority of EVs becomes self-evident to the masses.

Lower battery prices, more efficient batteries, and the build out of Super Charging infrastructure will make ICEs obsolete by 2020. Auto-makers are already having a very tough time meeting ever increasing CAFE standards for mpg, so the change to EVs will crunch from both directions as EVs become cheaper and ICEs become more expensive to engineer and build with ever increasing CAFE standards… Look at VW for the evidence that tighter CAFE standards are slowly but surely beginning to impact the viability of ICEs.

Apart from that I feel that Apple’s ultimate goal is a service you’ll order – think Uber – and not a vehicle a person can purchase like a Tesla. Apple wants an autonomous EV. If you look at the CVs of the people they’ve hired for the project (over 800 now with a stated goal of 1,800 employees in the near future) it’s clear that autonomy is a central pillar of Project Titan.

The head of Google’s autonomous vehicle project has stated that his kid will be 16 in 5 years. His goal is for his son to never have to purchase a vehicle, and he’s confident they’ll meet that goal.

Elon Musk and the head of the venture capital firm Y Combinator had a great discussion led by Andy Sorkin recently, and they talked about how the public seems to think autonomous vehicles are 10, 20, 30 years away, but every Silicon Valley insider is 100% confident that by 2020 autonomous vehicles will begin taking over. Here’s the video:

https://www.youtube.com/watch?v=SqEo107j-uw&index=13&list=PLSkchylZvKEZrmKHebNQZiyjW3IpftidK

Apple knows this and is trying to catch up. It will be a HUGE market with enough room for several large players dominating different niches. Exciting times!

Just was reading about a new low cost advanced LIDAR system that does not need communication with other cars to operate. Resolution to 1 cm, can detect road stripes, signs, objects at 300 meters, potholes, you name it. The technology is here now.

http://viodi.com/2015/02/17/better-eyesight-than-humans-the-advent-of-low-cost-lidar/

We should all chip in and get Old Farmer an autonomous tractor. 🙂

I really appreciate the suggestion, but get me an autonomous truck instead.

I am getting to age I will soon be DANGEROUS on the highway. 😉

But the odds of running over anybody out in the field are pretty close to zero and I LIKE driving my old tractors.It’s hard for me to imagine a more pleasant way to spend a nice day than mowing hay. You can do a lot of thinking while enjoying being out side, enjoying nature, getting something done that is useful and necessary.

They are like old friends, part of the family so to speak, and I think of them the way older urban types might think of a favorite easy chair or other piece of furniture that has been around for forty years or more. The NEWEST one is a seventy two Model 30 Ferguson Industrial- basically the same as the one thirty five farm but with a reverse shuttle shift and an extra heavy front axle so it can support a really big front loader. It’s fifty three years old now, and except for a starter rebuild, a water pump, a low pressure fuel pump,muffler and tires and batteries and belts etc it has NEVER needed ANY repairs. The new ones are all computerized and they change all the parts every four or five years so you can only get parts from the DEALER.

In thirty years the only way one of them will run will be to rob ” no longer available” parts off another one of the same make and model and even the same YEAR model.

Any old farmer will tell you the two things that MATTER that are the least likely to let you down are your hound and your old diesel tractor. Four generations of the family have used it, or will use it, assuming the kids coming on want to visit and learn how.

Some of them are old enough now but the youngsters are all wrapped up in fantasy games on their phones these days and have forgotten there is a REAL world out there.

Sky Daddy help them, the shit will hit the fan within their lifetime. None of them are going to know how to do anything except fill out tax documents or program computers or run some sort of business that will probably cease to exist.

IF I leave the farm to them, they will most likely sell it pronto and spend the money on more toys or maybe a house in town someplace.

Speaking of Tesla and energy. They have big solar manufacturing plans.

They recently purchased a bay area company- Silevo who has pioneered a high efficiency cell at about 22-23% (very high). Tesla plans to mass produce these and has secured manufacturing space in Buffalo. This may be another significant step in the long march towards competitive solar electricity.

Silevo has an amazing video of their manufacturing process. If you haven’t seen state of the art manufacturing in motion, then enjoy this one-

http://silevosolar.com/

Hickory,

Just a small clarification, the company you’re thinking of is Solar City, not Tesla. Elon Musk is “only” a board member of Solar City. I believe his cousin runs the company and Musk was a co-founder.

Everything else you mentioned is accurate though.

True indeed, Thanks.

It looks like the latest OPEC Monthly Oil Market Report predicts that World Oil Supply and Demand will be in balance by 3Q16, if OPEC output remains at 3Q15 levels. There will still be a supply overhang which may require another quarter or two of either decreased supply or increased demand (or both) to bring oil stocks back to normal levels.

As always, these forecasts are notoriously inaccurate so oil prices could remain low until 2018 if demand is lower or supply is higher than OPEC forecasts, or they might rise in early 2016 if the opposite is true. It’s a coin flip.

Wouldn’t most oil producers go out of business if prices stayed low until 2018?

Hi Greenbub,

As oil producers go out of business supply goes down and prices go up. By low prices I mean less than $65/b. I have no idea what oil price will have what effect, and anyone who claims to know with any precision is blowing smoke, any forecasts are guesses pure and simple.

A couple of days ago somebody posted that coal fumes are killing a half a million people a year in China.

This link, based on materials from the LANCET, which is reputed to be one of the very best medical journals, says cigarettes were killing a million Chinese men five years ago and that within a decade the annual toll will be two million.

http://www.sciencedaily.com/releases/2015/10/151008191048.htm

The article points out that only a few women in China smoke. I guess that proves they are either smarter than men, or that they have less money.

Hi OFM,

I checked with my wife, women are smarter. 🙂

I just ran across this at WIRED.. It’s about Arctic climate and MAPS newly available free on line from a government operated website which is part of NGA- a government outfit that does mostly secret mapping, apparently, for the Pentagon.

It seems they have decided to put a lot of stuff together in one spot where it is easy to find. Regulars here who are into the Arctic issues will probably want to bookmark this. The actual site where you can see the declassified and consolidated maps is linked inside the WIRED article.

I haven’t yet tried to use that site- it looks like it would take a few minutes or maybe a few hours to learn to navigate it and find what you want.

http://www.wired.com/2015/10/arctic-maps/

Good find OFM.

Apparently the caribou herds are not doing very well, way down in population.

http://www.canadiangeographic.ca/magazine/nd07/indepth/decline.asp

I just read this link about the AMOC which was written by somebody for TECH TIMES- a site that is apparently sort of short of editorial oversight, to put it mildly. I have NOT read the research it is supposedly based on.

BUT it appears that either the researcher or the author of this piece is pretty much an idiot. The researcher would probably like to strangle the author of this piece.

http://www.techtimes.com/articles/93987/20151012/the-earth-could-see-average-temperatures-dropping-and-giant-tsunamis-in-20-years-amoc-study.htm

I can believe that if the AMOC stalled ( which appears to be possible ) the climate would be severely disrupted with Western Europe getting a lot colder, no question.

But saying the whole WORLD would cool off appears to be insanity. Without the Gulf Stream to carry the heat north for instance , the tropical western Atlantic would heat up like crazy- unless I am having a super senior moment.

I’m not familiar with Tech Times . Maybe the site is for idiots.

OFM,

From what I’ve gathered the AMOC is likely to slow down, but would be unlikely to fully shut down.

The way it’s been playing out lately is that it doesn’t run as far North as it used to due to non-saline meltwater running off of Greenland. If it continues to be pushed south Northern Europe will be cooler, but no European Ice Age.

Two primary drivers of the AMOC will keep it chugging along regardless of freshwater inundation: Trade winds pushing water to the the Caribbean/Southern U.S. and the thermodynamics of hot water mixing with cold water. Basically, a big component of the AMOC is the unbreakable physics of water flowing downhill; in a river gravity does it, for the AMOC it’s about heat diffusion as well as a means of dispersing the excess water pushed west by trade winds.

After the last Ice Age global sea levels rose 220 feet… and the AMOC didn’t shut down. Greenland only has enough water to raise sea levels by, what, 20 feet or so? So if it didn’t shut down when New York went from a mile high ice sheet to forest, then it’s unlikely to shut down even under a rapid melt scenario.

Hi Brian,

What you have to say is consistent with what I have read at better sites and with my own limited understanding of this sort of thing. I do know BASIC physics and chemistry and have spent a good bit of time reading about climate.

Maybe the woman who wrote this article gets paid by the word at a very low rate and there is NO EDITOR at TECH TIMES.

Or maybe “she” is a bot as Fred suggested about one of our commenters a couple of days back.

From here on out I will not read anything posted at the TECH TIMES site.

From a the caption under the top picture :

A new study found that average temperatures globally may drop to about 1.3 degrees Fahrenheit or -17 degrees Celsius in 20 years. A researcher discovered that the effects of global warming now may affect ocean currents and completely reverse the condition.

Well the Tech Times at the very least could use a good editor. 1.3 degrees Fahrenheit certainly doesn’t equal -17 degrees Celsius… If they didn’t even catch that glaring mistake right at the top of the page then you really can’t expect much from the rest of the article, can you?

I did skim read the paper in Nature and also a comment about the paper from the University of South Hampton where Professor Sybren Drijfhout is a researcher.

Long story short, what the paper concludes does not in any way support climate denialists if they would like to claim this study portends a global cooling. Global Warming might have slowed for a short period but it will return with a vengeance. There is certainly not going to be any long term global cooling trend!

Professor Sybren said: “It can be excluded, however, that this hiatus period was solely caused by changes in atmospheric forcing, either due to volcanic eruptions, more aerosols emissions in Asia, or reduced greenhouse gas emissions. Changes in ocean circulation must have played an important role. Natural variations have counteracted the greenhouse effect for a decade or so, but I expect this period is over now.”

It is always best to read the actual paper!

Fred said “Well the Tech Times at the very least could use a good editor. 1.3 degrees Fahrenheit certainly doesn’t equal -17 degrees Celsius… If they didn’t even catch that glaring mistake right at the top of the page then you really can’t expect much from the rest of the article, can you? ”

Fred, -17 Celsius equals 1.4 degrees Fahrenheit. I wouldn’t call a tenth of a degree a glaring mistake.

Yep! My bad, I had a brain fart for sure!

I thought they were saying that average global temps were going to fall by 1.3 degrees Fahrenheit to -17 Celsius…

What they were saying is that global temps would fall TO to 1.3 degrees Fahrenheit. Which would be one hell of a lot colder than even the coldest witches tit. 🙂

Anyways I still think it beyond absurd that someone could, with a straight face, claim that in twenty years the average global temperature which today is roughly 16 degrees Celsius, would fall to -17 degrees Celsius. BTW I went back an read the TECH TIMES article and here is the paragraph that caused me to misread the caption of the photo. I knew I wasn’t completely crazy!

As per the study results, Drijfhout said that if the planet persists to warm, ocean currents such as AMOC may weaken, creating giant tsunamis. In 20 years, if AMOC and global warming happens simultaneously, the planet would begin to cool rather than warm. As per estimates, a drop of about 1.3 degrees Fahrenheit or -17 degrees Celsius would transpire, after which, the recovery phase would start.

I got to thinking about oil and gas (forget coal for the moment).

Dead organisms piling up in conditions that were not favorable to immediate oxidation of their “reduced” carbon (which got reduced, or energized, from solar energy), over time accumulated in deposits.

And some of these deposits got buried and matured over the eons to become the juice that powers us 7.2 billion.

How much reduced carbon was deposited each day in the best years? And how many years did this go on for?

Today, each day, we consume what- 90 millions barrels? Add to that the natural gas.

So, how many hundreds of thousands of years of fossil fuel accumulation do we burn through each day?

Another American nuke will bite the dust within the next five years.

http://www.bostonglobe.com/metro/2015/10/13/entergy-close-pilgrim-nuclear-power-station-nuclear-power-plant-that-opened/fNeR4RT1BowMrFApb7DqQO/story.html

I wonder if some of the plant can be salvaged. The roads, security system, generators and turbines etc, are all probably in good condition. It ought to be possible to salvage the steam turbines and move them some place where a coal fired plant is being built.

Maybe some shuttered nukes could be converted to gas fired?

Everything REALLY expensive (except the necessary new gas turbines and gas line) is already in place.

There should be plenty of space and I can’t see any reason why all the transmission lines, transformers, right of ways etc should go to waste.

This particular nuke appears to be well located to use it as a peaker plant site if there is a gas pipe line nearby. .

Personally I am sort of agnostic on nuclear power.

The arguments the holier than thou types keep making about the cost of shuttering a nuke strike me as the utmost in a combination naivette, ignorance, and hypocrisy, given the cost of continuing to burn coal and dumping the toxic by products into the air and water NOW.

A containment building American style could be poured full of stone with a little cement mixed in, the doors welded shut, reinforced, and concreted over military bunker style, and it would most likely be many thousands of years before any significant amount of hot particles escaped- and even then the escape would probably be a very slow small plume.

OF course this would still leave us with the spent fuel problem.

Hopefully some new design can be perfected that will solve both the weapons proliferation and the spent fuel problem.

Such a design might even be proof against meltdown.

The crowning touch would be to sentence every engineer and bureaucrat who signs off on any thing especially the LOCATION of a new nuke to life imprisonment without parole in the event it suffers a major accident due to earthquake , tsunami, rising sea level, or any other natural occurrence except getting hit by a giant space rock.

Soon Watts Bar 2 will come on line, the only nuclear power plant to come on line this century in the US. Cost is estimated at 6.1 billion.

http://www.latimes.com/business/hiltzik/la-fi-mh-america-s-newest-nuke-plant-20151011-column.html

OFM,

“The company that owns Pilgrim Nuclear Power Station said Tuesday that it plans to close the 43-year-old plant in Plymouth.”

I find it interesting on how quickly things change. 43 years!! so only 3 years after its original design life, and 3 years into the 20 year extension, that many of the US nuclear plants have been granted, the operators have found it uneconomical to operate? These are suppose to be the most economical years to operate. Construction, supposedly paid off, the bulk if not all of the trust fund in place to pay for decommissioning in place. Now they can’t afford a small amount of U 235, and wages for 600 men?

Maybe the Nuclear industry is not always fully forth coming with all the facts.

Possibly similar to the shale plays?

Interesting there will be no federal cost of living adjustment this year, which pundits say is directly the result of lower oil prices.

Unfortunately for social security recipients and federal retirees, the cost of Medicare premiums and part B deductibles are headed up quite a bit. Lower incomes are exempt, therefore higher income earners will pay much higher Medicare premiums. All share in the deductible increase, which appears will triple.

Funny what some risk taking shale drillers and middle eastern sheiks are able to influence. Article indicates about 70 million Americans are affected. Article argues CPI calculation is not accurate as seniors/retirees tend to spend much more on healthcare and much less on fuel than each are weighted in the CPI calculation.

Bakken August production numbers just released.

Just under 1,200,000 bbl/d.

Fraclog almost 1,000 wells.

Coffee,

Amazing maths?

115 completions

79 well increase in fraclog.

equals 194 new wells

74 rigs working, = 2.6 wells per rig per month.

Therefore the average time to drill a well = 11.9 days!

Now this is the average. What is the best time?

Wow that is an increase rig in productivity? (sarc)

Sorry I don’t believe it. There has to be something else in the numbers. I look forward to Enno’s numbers for an explaination.

Maybe some of the completions are re-completions? Something is wrong.

Not much of a decline. Chokes opening.

Watcher,

August in previous years has surprised to the up side due to good weather. I suspect there will not be too many takers, when heating is required to keep the frac water from freezing?

coffee, toolpush

The drilling report came just out and indicated 3.6 bcf/d less production than last year for November. The number is also confirmed by bentekenergy.com which released a 71,1 bcf/d production rate, which is the lowest for a long time (December 2014 was at 74 bcf/d). There has been no flood of production during the summer as promised. Although prices are still low, it is in my view the anticipation of a new ‘flood’ of production during December. However yearly growth rates for December 2014 until February 2015 have been around 14% and this will be difficult to match this year. In my view production will be down until February to 67 bcf/d which is a yearly decline of over 10%. Depending on how the winter weather will turn out, prices will respond accordingly. 7bcf/d less production means around 1000 bcf less inventory during the heating season and inventory could go below working storage by next year.

Heinrich,

I had been thinking about you, with the decreasing Henry Hub price of Nat gas. I feel the declining LNG price, will upset industries plans. How this pans out, we will see shortly, with the first LNG plant due online next month.

Obviously, the current nat gas market is well supplied, though with a decreasing production. Whether the Marcellus and Utica, can respond and fill the up coming pipe capacity increases remains to be seen. I suppose we will all have to keep a close eye to the EIA storage report and at what price achieves an adequate supply response.

PS As per the EiA weekly report, New England price of Nat Gas, is closer to Marcellus price of sub $1 mcf, than HH at approx $2.50.

Late next year, or at the beginning of 2017, the Rover pipeline should start up. Twin 42″ pipelines, 3 bcf capacity, going to all points north of the Ohio. Will it be full of gas, or running on vacuum? The gas will have have to come from somewhere, unless the vacuum wins out of course!

Also,NE is still exporting gas to Canada, with a couple of small additions to come on line later this year.

Push, Mr. Leopold

I do not track the rig/well/completion numbers too closely, but I’m inclined to think that there is a simple explanation for the numbers put forth by the DMR.

I would think most every well in the Bakken by now is started with a small rig and the laterals drilled by the big boys. That may explain some of the timing and numbers.

I gotta tell ya, Mr. Leopold, I’m getting mighty weary walking around all day wearing this stupid life preserver … waitin’ on the ‘flood’. But, in actuality, there are now about 2,600 wells in Pennsylvania alone, that are drilled but not producing (7,000 producers).

Ohio has 400 drilled but not online (1,000 producing).

There is ongoing pipeline conversions and reversals, but the biggies should be operational by the end of 2016/2017.

Somewhat surprisingly to me, about 300,000 barrels of condensate were sourced from Ohio and shipped out of New Jersey last month. It appears this will slowly increase as more infrastructure is built out.

The flood may arrive before $20mmbtu … we’ll see …

In Wake Of Dieselgate Scandal, Volkswagen Announces Strong Commitment To Plug-In Electric Cars

“There are several strategies laid out today by Volkswagen board of management. Among those strategies, we see an intense future focus on electrification.

Perhaps most importantly, Volkswagen will push electrification across its MQB (basis for current VW Golf and Audi A3) platform:”

Just a little tit-bit from the demand side 🙂

islandboy,

By vastly overpromising, they make the same mistake all over again. It is typical for VW that people promote themselves with unrealistic ideas and then just retire with high pensions when the whole house of cards collapses. VW should introduce stock options as salary, then this would not happen. Managers have everything to gain and nothing to loose by lying through the bank.