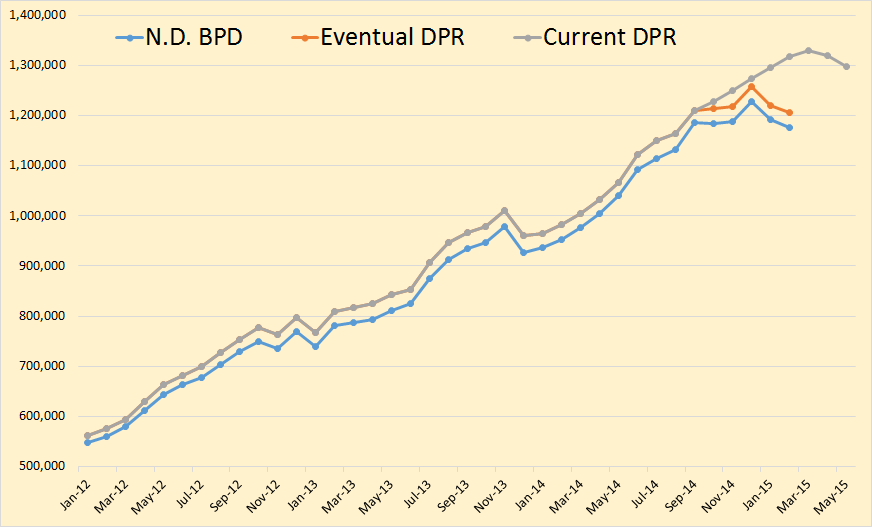

The NDIC Bakken Production Data and the NDIC North Dakota Production Data is in. Production in the Bakken was down 11,941 barrels per day and production in all North Dakota was down 14,104 bpd. The numbers for January were revised slightly. January Bakken was down 35,064 from December and all North Dakota was down 36,331 bpd from December.

As I have pointed out before, the EIA’s Drilling Productivity Report, for some unknown reason, estimates the last six or seven months, when the actual data is available. In the above chart they estimate from October on. This throws their current numbers way off. The DPR data includes the Montana Bakken therefore their numbers will naturally be higher than the North Dakota data.

Of course the EIA DPR will eventually bring their numbers into what North Dakota is reporting. The above is what the eventual Drilling Productivity Report will look like. (In Orange). Here is the amount the historical DPR is off.

Month Amount in BPD that the DPR is too High

Oct-14 15,085

Nov-14 32,514

Dec-14 16,096

Jan-15 76,031

Feb-15 112,075

From the Director’s Cut

Jan Producing Wells = 12,197

Feb Producing Wells = 12,198 (preliminary)(NEW all-time high)

9,208 wells or 75% are now unconventional Bakken – Three forks wells

2,990 wells or 24% produce from legacy conventional pools

Jan Permitting: 246 drilling and 0 seismic

Feb Permitting: 197 drilling and 0 seismic

Mar Permitting: 190 drilling and 0 seismic (all time high was 370 in 10/2012)

Jan Sweet Crude Price = $31.41/barrel

Feb Sweet Crude Price = $34.11/barrel

Mar Sweet Crude Price = $31.47/barrel

Today Sweet Crude Price = $36.25/barrel (lowest since Feb 2009) (all-time high was $136.29 7/3/2008)

Jan rig count 160

Feb rig count 133

Mar rig count 108

Today’s rig count is 91

The drilling rig count dropped 27 from January to February, 25 more from February to March, and has since fallen 17 more from March to today. The number of well completions dropped from 63(final) in January to 42(preliminary) in February. Oil price is by far the biggest driver behind the slow-down, with operators reporting postponed completion work to avoid high initial oil production at very low prices and to achieve NDIC gas capture goals. There were no major precipitation events, 7 days with wind speeds in excess of 35 mph (too high for completion work), and 9 days with temperatures below -10F.

At the end of February there were an estimated 900 wells waiting on completion services1, an increase of 75. Comparing December, January, and February completions and production increases results in a requirement of 110-120 completions per month to maintain production near 1.2 million barrels per day.

Notice Helms says wells producing increased by only 1 while well completions were 42. A lot of wells were shut in. And now there are 900 wells waiting completion. The fracking crews are not even working as fast as the drilling crews. And the rig count is down by over 50 percent.

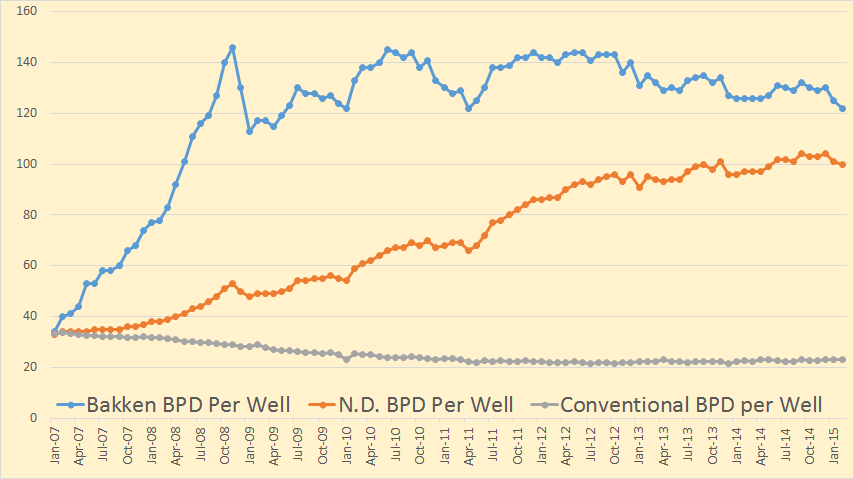

Bakken barrels per day per well dropped to 122. That is the lowest since April 2011. All North Dakota bpd per well is at 100.

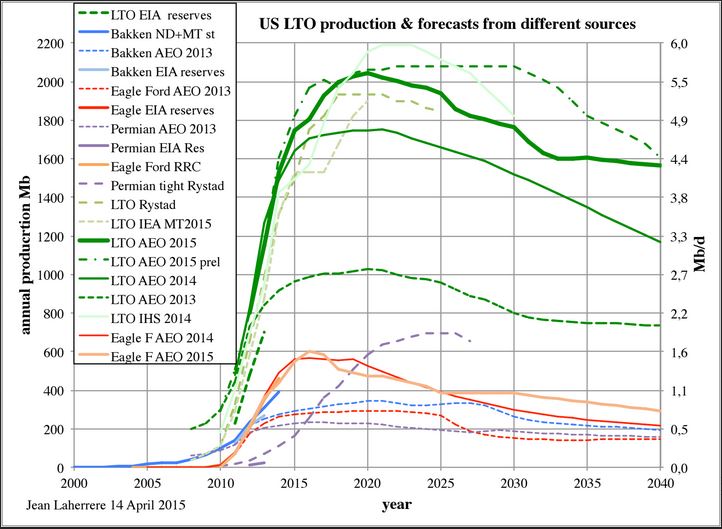

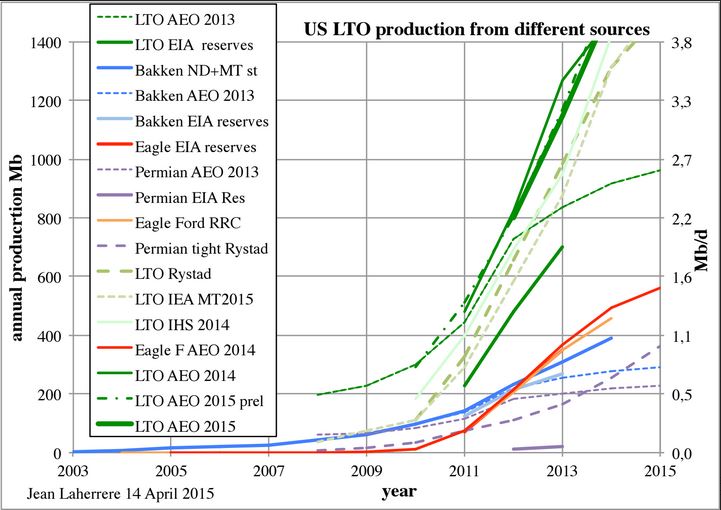

Jean Laherrere sent this and the below chart today. I found them interesting in light of the latest data from the LTO basins. The big one up top, LTO AEO 2015 preliminary, is interesting.

AEO 2015 just came out and both these charts have been updated with the latest data.

I am at a loss to explain the EIA’s overestimation of US LTO production. The data for January was in from Texas and North Dakota yet they still have LTO production increasing through February and flat for March. They have to know that data is way off.

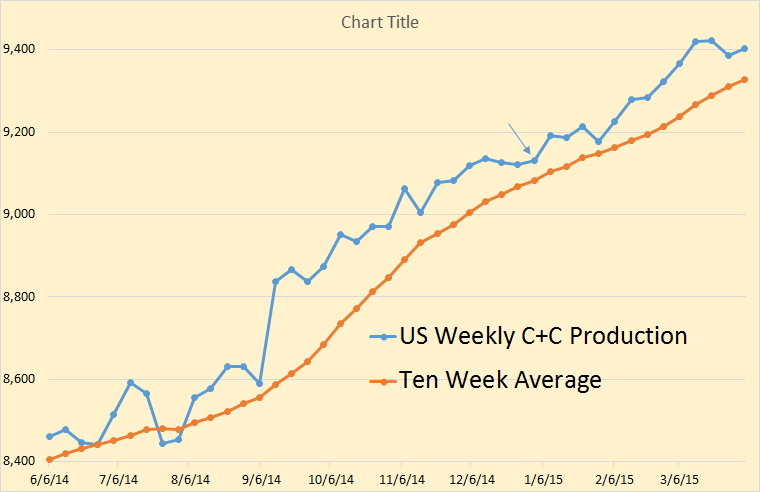

Here is the weekly C+C production data as published by the EIA. The arrow marks January 2nd. And as you can see the weekly data has production increasing right through January and February. It did not and the EIA had to know that fact. The latest weekly data is at least 100,000 bpd too high and perhaps 200,000 bpd too high.

_______________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

There was a lot of geographical examination done when production was percolating along.

There could be a lot of information to be had now based on where companies are choosing to complete, at least in the context of where they either must complete for lease holding or where they think they can make money at $31.

Yo Ron

Notice Helms says wells producing increased by only 1 while well completions were 42. A lot of wells were shut in. And now there are 900 wells waiting completion. The fracking crews are not even working as fast as the drilling crews.

How can this result in only an 11K bpd fall. Why didn’t the decline rate eat up that 1 lousy additional well?

Well wait, okay the wells shut in to get down to 1 additional were producing very little anyway, so shutting them in cost not much flow. But still, 42 new completions only dropped output 11K bpd? Isn’t there a 70ish K bpd decline rate per month going on?

Edit, or wait rev 2.0, maybe the decline rate is crashing as the number of new wells with their steep decline is also crashing.

Nevertheless, hmmm, 11K bpd is less fall than those numbers would suggest.

There was a brief exchange with Mike about rework rigs. Rigs that don’t drill new wells, they open or fix or whatever, old wells. They are in the count?

Is it true that completion is the last process for a well before it is contributing to the production numbers, or is there another step to tie oil and/or gas into some kind of collection systems.

Substantially trucks in the Bakken. Takes a long time to lay pipeline and the wells are dead by then. Some is collected that way, as pipe is routed to nodes and drilling happens to occur nearby, but latest numbers seemed to be > 50% trucks.

I suspect they have a requirement to collect gas. This requires a separator, and a gas dehydrator, sometimes they have to add a compressor.

I don’t like to criticize too much but the North Dakota industry practices seem like something out of the 1930’s. This appears to be getting fixed.

So, assuming they use a more rational approach they would have to lay a well flowline to a gathering manifold, feed the collected production to a separator, take the gas into a dehydrator and then feed the dry gas into a gathering line. If they haven’t been thinking thus way they’ll have to learn the ropes. I’ve managed projects done to have the wells flowing within 72 hours after we nipples up the tree valves. The delay was mostly associated with getting the rig to move out. But this process can also take months if the people doing it are rookies.

Fernando, the ND regulators are tightening the gas capturing parameters on an incremental basis.

One of the many challenges facing the operators is the size area over which 10,000 wells have been drilled in little over a half dozen years. The flush early oil production, followed by rapid decline holds true for the gas output also. An operator had little incentive to spend large capital only to have small gas output in a year’s time.

One approach in ND has been the creation of ‘energy corridors’ where pads are linearly laid out enabling service roads, water pipelines, and gas gathering lines to all be all efficiently emplaced. There is a great photo of this on slide #11 in ND’s Aug. 6, 2014 presentation ‘Update Spotlight on Oil/Gas’.

The 10 minute read of that presentation, BTW, is enormously informative about the Bakken.

Vendors are coming out of the woodwork trying to interest the operators in a whole array of gas compressing/liquifying hardware.

coffeeguyzz, I have worked in large scale operations where we shared a similar problem. However, this was in another country, and we were expected to capture all produced gas. We had about 800-900 producing wells, drilled about 50 per year, recycled the pumps and and tubing to keep costs down, so it wasn´t exactly a very high margin operation.

The best solution was to flow multiphase (oil, gas, and water) to a gathering manifold, then connect several manifolds to a satellite station where we separated and dehydrated the gas, and shipped the oil and water in a single line to a plant, with gas being fed to the fuel gas system. From the fuel gas system we took the surplus, compressed, and transferred (we gave it away).

Later I worked in other areas, the approach changes a little bit in multiwell pads. The way I see it, it´s more sensible to put up to 30 wells in a single pad (they don´t have to be drilled at the same time). The well spacing is dictated by the WORKOVER rig needs, the drilling rig skids on top of the well row, and the wells offset to, or under the rig, are protected by very sturdy steel cages.

The multiwell pads allow the manifold to be on location with a test separator. If feasible the pad flows multiphase to a gathering point where the fluids are treated.

I think the problem in ND is the utterly chaotic nature of the development coupled to a fairly lax and hands off attitude by the regulatory authorities. Evidently a more organized and better paced development would have reduced the total rate, but it would also have improved the enviromental footprint and allowed the state to keep its income optimized. I think now its a bit too late other than to slap a patch on what they already have.

Well it’s a lot worse than you would think from looking at Helms’ data. Check the actual “Wells Producing” from the Bakken and North Dakota data.

Wells Prod. Bakken N.D. Non-Bakken Jan-15 9,053 11,801 2,748 Feb-15 9,166 11,794 2,628 113 -7 -120The Bakken gained 113 wells while all North Dakota lost 7 wells. That means that 120 Non-Bakken wells had to be shut in. Get your head around that one.

Those non Bakken wells were strippers. Shutting them in didn’t deduct much, would be the theory.

Oooh here’s another idea.

Let’s say companies report a completion and some flow in order to pay royalty to the owner and taxes to NoDak and hold the lease, even though they didn’t complete the well and get any actual flow. Who would complain? Only the proppant vendor and the workers not working.

Hmmm, this would result in a lower flow per completion, not higher as we seem to have. Nevermind.

They can be severely punished if they send a fake Completion report. In some countries this can be a criminal penalty.

Hi Fernando,

Is it possible that a smaller choke is being used on the wells (lower flow rate) due to the low oil price environment? Would choking back wells do any damage to the overall estimated ultimate recovery for the well or would it be ok as long as it is not overdone(choke not too small or flow rate not too low)?

Do shale oil wells flow very long? How do you choke back a well on rod pump?

That´s fairly easy. To choke back a well on pump one slows down the pump. This increases back pressure and reduces rate.

Will someone tell me how a rod pump works on a horizontal well? Does the rod bend into the horizontal section or does the rod only go down to where the bend begins?

Ron, the maximum inclination from vertical to economically pump a horizontal well is about 10 degrees, IMO; so the tubing is anchored just at the top of radius. There is a seating nipple in the tubing string to which the the insert pump (attached to the rod string) is landed. The rods go up and down, the pump plunger in the now stationary pump barrel goes up and down and fluid is “staged” up the hole. At the bottom of the insert pump are a series of valves, so to speak, that open on the upstroke, and close on the down stroke.

Setting the insert pump deeper into the radius, causes excessive rod and tubing wear. Its sometimes done, but is very problematic.

Its actually quite possible to choke a well on rod lift other than by slowing the unit down; its done all the time, along with back pressure regulators on the casing, to regulate the static producing fluid level in the well above the seating nipple and GOR/to bubble point management.

I think there can be ultimate recovery issues when choking shale wells back. Proppant embedment and corresponding fracture closure comes to mind, for one reason.

Mike

Thanks Mike.

Mike, if the well flowing bottom hole pressure goes UP the closing stresses are reduced. pulling the well pressure down, or what I call “letting it rip” can be profitable but in most cases it reduces recovery factor in primary producing wells. This can change if we are dealing with very heavy oil wells and other cases.

So what is Exxon doing in the Bakken?

Mike: I have no experience with horizontal wells. Over time, do they require a lot of work over? I am envisioning problems with a 10,000′ lateral clogging up. Admit I know little about this.

Shallow, rod lift at 8,000 feet is a headache. Rod lift from horizontal laterals is a double headache that requires 800 mg of Advil 3 times daily. Remember all those laterals have production casing or liners in them; in the Bakken I think the lateral liner is tacked back to an intermediate string or hung in a hanger. In the EF, one string, top to toe. I don’t think solids is much of an issue, yet. Paraffin is, as is corrosion, etc. A “rod job” where the pump is pulled is typically 25K, if the tubing has to be pulled, etc., 40K. Hopefully that only needs to be done twice a year. Maybe. Hopefully. If you have to fish the tubing anchor, or something fairly normal (Murphy lives in the oilfield), hold on to your knickers.

This shale stuff is new and nobody, I repeat nobody, has all the answers yet. Its complicated. Most 5 year old EF wells I am familiar with produce 125-140 BTFPD on rod lift with varying OWR. Same would be true for the Bakken. Rod lift has its limits.

Mike

Hi Mike and Fernando,

Would the artificial lift be installed from the start and just not turned on until the natural pressure drive starts to deplete, or do you run the well based on the pressure in the system and when the flow rate falls to less than 200 bopd (or some number based on experience) the well is shut down and the artificial lift is then installed?

In case this is not obvious, I know much less than Shallow Sand about oil wells of any sort.

Ron et al, here´s a sketch and a discussion about horizontal well artificial lift. I started to write an answer and decided it was simpler to draw you a sketch. It´s just a brief discussion, the subject can get really complicated, but I think it will give you a pretty good idea.

http://21stcenturysocialcritic.blogspot.com.es/p/typical-horizontal-well-tubular-design.html

Thanks Fernando.

Fernando, Nice, informative article. Thanks for the time/effort.

Your recommendation to monitor Exxon’s horizontals is a good one and I will check that out, time permitting.

FYI, their subsidiary, XTO, is seeking permits for over 550 wells on 46 pads at June’s North Dakota DMR hearing. Apparently they feel the Bakken is a worthwhile venture.

Fernando. Thank you for the information.

Any time you want me to doodle something, just let me know. I notice the Exxoners are designing 12 well pads? That could be a three tine double forks, 6 wells, one pattern placed in an upper zone, the other located offset in a lower zone? They tend to be very careful. If they froze this type of design it bears watching.

Hi Shallow sand,

The flow rate for the first 6 to 12 months probably does not require rod pumps, it is the new wells with higher flow rates that I was referring to. I do not think these wells are put on artificial lift immediately, but I am not a petroleum engineer and don’t know. The average Bakken/Three Forks well flows at about 500 b/d for the first month and at maybe 230 b/d on average for the first year (very roughly), but I don’t know the flow rate at which rod pumps are used, basically when the pressure in the well cannot push the fluid to the surface, artificial lift is needed. Maybe the wells are on artificial lift from the start?

The subject is not straightforward at all.

I guess that is my real question from above, and thank you for all of the answers.

I just question how economic and/or effective it would be to choke back wells on rod pump.

We try very hard to find the optimum stroke length and strokes per minute with regard to each well. In particular, we need to make sure they are set up so they do not pump off, but on the other hand we do not want to slow them down to where they are not pounding fluid.

Many times we are required to speed up or slow down wells as the water flood usually changes over time. We have issues with channeling, and so adjustments are made to injection rate from time to time.

On wells where there is no injected water pressuring the producing formation, we many times place the wells on time clocks, or pump them on set days of the week. These wells, of course, produce little total fluid. Failure to keep an eye on this results in down hole pump failures.

I will agree my field knowledge pales in comparison to many of our posters, and I appreciate all of the information. I would like to see some more technical specifics on choking back non-flowing wells, if anyone has any links I am having a hard time envisioning this, I guess.

Hey, shallow, your curiosity about the time frame of Bakken wells going on AL prompted me to do some checking, to no avail. I just signed up (long overdue) to get the basic subscription for the ND DMR site which will offer WAY more info than I’ll ever need on every ND well going back to the 50’s. Good deal for 50 bucks, I suppose. All wells’ status – including F (flowing) or AL (artificial lift) will be viewable and I’ll let you know what I find.

The other day, a Bak well was described as still flowing after two years production … the implication being it was highly unusual. As the pressure varies considerably over the Bakken and – especially – the Three Forks formations, individual wells show varying timelines before AL kicks in, but six months or so has been considered somewhat the norm.

Dennis, choking an oil well back doesn´t usually reduce recovery. Choking a horizontal well completed with multiple fractures in a tight formation ought to increase recovery.

Why does recovery increase? Because the pressure drop within the low permeability matrix is reduced. These tight zones have very large pressure drops in the tight rock surrounding the fractures. The large pressure drops cause gas to come out of solution, which in turn can coalesce and form gas channels, and these cause a preferential path for natural gas, which in turn leads to faster pressure depletion (it´s the fractional flow issue, I just described it without using equations).

I´m familiar with lab work which proves the fractional flow equations for oil and gas break down. But I´m not sure how these particular rocks perform. The best answer would be obtained by choking wells back and observing their performance.

Let me ask you guys, do you see a tendency for ExxonMobil wells to produce at lower initial rates and also have lower decline rates? EM engineers are super sharp, they are probably working this problem and trying to figure out the optimum path. One thing I learned in my career was to snoop and see what they were doing so I could copy it.

Thanks Fernando.

I dug up some info on XTO vs a few other Bakken producers down the thread.

It does look like XTO does not push production too hard for the first couple of months.

I do not know if EOG is doing something great or just owns some very nice leases, maybe you should check out their 10k, they might be worth a look.

Dennis, those are great charts you posted, as usual. EOG is recognized as not only doing something great, consistently, they purchased virtually their entire Parshall acreage in one fell swoop by buying out the original operator back in ’06, ’07. The Parshall is considered the best area in the Bakken.

You may be interested to know those high production numbers from EOG are coming primarily from ‘short laterals’ – 5,000’/7,000′ long … significantly shorter than their peers.

Better yet, compare the number of Bakken wells producing in 12/14 v 2/15. Looks like a substantial drop in production per well over a two month period, 8 barrels per day per well on average over a 60 day period. Expect that to continue as fewer wells are completed in the next few months. Taking away flush 0-90 day production makes a big difference in production per well.

Watcher – Did you consider that the average well completed in January probably produced for 15 days in January. While those same January completions probably produced for all 28 days in February?

Well okay, but all the December and November completions are crashing their output per the steep decline. Deducts from Jan/Feb.

These are not the first Directors Cut tidbits that are not consistent. Won’t be the last.

The operators are choking back a great deal of output from new wells (November, 2014 and later) in order to NOT sell their product at these low prices.

The monthly production numbers from several wells show a dramatic dropoff … way higher than the norm.

Several CEOs have emphatically, repeatedly stated that they will hold production back as long as viable until better pricing occurs.

And with what money will they pay the loans?

And btw, your theory makes the numbers even more wrong. The fall in production should be even more steep.

Watcher, you probably follow the financial side way more than I, esp since I skim through that end of it, but where are the feared bankruptcies? The ‘redeterminations’ as per the reserve value writedowns pertaining to loan covenants seems to be cookie cutter routine from what I’m seeing.

If the 12,000 ND wells average 100bpd one has over a million barrels. Immediately stop new output and you would still have near MMbpd for some time. Hypothetically, simultaneously frac/produce 900 pending wells at, say, 1,000 barrel 24 hr IP and you have another near million barrels right there.

This game is hard core economics where most operators would rather wait before selling new production for less than cheap bottled water.

Coffee. I think Enno Peters has posted some pretty good information about Bakken production. I think you will find about half of the production in the month of 12/14 came from wells placed into production in 2014. So no new wells for one year would result in a substantial decrease in production, probably drop to 600-700,000 barrels per day by the end of 2015. I think EFS and much of the Permian unconventional has a steeper decline.

As for financing, as long as the companies can keep getting investors to buy more bond and stock issues, they will keep drilling. The model is to pay off the line with these issuances and then borrow from the lines again. The banks are never very exposed, they have the first lien on the assets.

Will be interesting to see how investors react to terrible first quarter earnings, to be released next month.

Or more accurately, first quarter losses.

Good one! Only hedges will avoid losses, and most are

not hedged very well. None of us saw $ dropping below $70 WTI.

The game is what Hyman Minsky defined as ponzi finance. Nothing more.

Hi Ron. Great site. Keep up the good work

MORGAN STANLEY: The plunge in rig counts will end in 12 weeks

And even with 12 weeks till we possibly see the bottom, the decline in rig counts has not dented production yet as less efficient units have been taken offline first, as we recently highlighted via Deutsche Bank’s Torsten Sløk.

How can they keep publishing this bullshit? Production has clearly been dented and dented severely.

Slorer also wrote that now is a good time to buy or increase holdings of oil services stocks.

If Slorer really believes production hasn’t been dented I would be reluctant to take his word about this being a good time to buy oil service stocks.

It is annoying, isn’t it.

OTOH, that which is inevitable is inevitable and it doesn’t really matter what Morgan Stanley says.

Hell Ron I bought oil service stocks in late January based on what you were writing (I focused on the numbers and graphs). I realize you don’t like to brag, but taking the plunge seemed like a good idea. Now I am waiting for the Guardian campaign to drive oil stocks down to buy me some more.

Hi Ron,

If we focus on ND Bakken/Three Forks only (which is where we have the best data):

Output in kb/d (three significant digits)

Sept 1120

Oct- 1120

Nov- 1120

Dec- 1160

Jan- 1130

Feb- 1120

If Dec 2014 is treated as an anomaly Bakken/Three Forks output has basically been flat since Sept 2014, if not production is down 40 kb/d over the past two months or by 3.5%. That is not a big drop in production considering that the rig count has been cut in half.

Fernando has suggested that many of these companies will wait as long as they can to complete the wells that have been drilled due to low oil prices. Perhaps they believe Steve Kopits oil market analysis and think oil prices will rebound in the fourth quarter. If so they may be completing the wells that they expect will have the lowest output (of those that have already been drilled) rather than their best areas which is the reverse of what I expected, or they might be choking back their new wells.

The way Fernando would play this is to weather the storm and try to get as many wells drilled and waiting on completion services as possible financially so that when oil prices rise, wells can quickly be completed. Unfortunately this may just drive prices back down if it happens too quickly.

And the bullshit keeps getting deeper and deeper.

EIA: US Crude Oil Output To Soar Till 2020 Despite Price Rout

The U.S. government on Tuesday forecast domestic crude production will rise even more than expected a year ago, undeterred by the worst price rout since the financial crisis.

U.S. crude oil production will peak at 10.6 million barrels per day in 2020, a million barrels more than the high forecast a year earlier, according to the annual energy outlook by the Energy Information Administration, the statistical arm of the U.S. Energy Department.

Crude production will then moderate to 9.4 million bpd in 2040, 26 percent more than expected a year ago, the agency said.

I just figured out this prediction is from AEO 2015. I will have a post out on that in a few days.

Art Berman sent out some highlights:

Jeff,

At first, I thought those were Berman’s highlights. But, I figured he was highlighting the INSANE EIA Report. We must remember, the EIA is now providing POLITICAL FORECASTS, not actual production forecasts due to the fact that if the world realized peak oil was here, it would destroy the already weak highly leveraged financial system. And, who wants to go down in history for ruining the last great financial orgy?

If we go by Jean Laherrere’s recent chart, the U.S. will be producing about 2.7 mbd by 2030 and a measly 1 mbd of oil by 2040.

Ever think about how we are going to run Dallas, Chicago, Manhattan or whatever large metropolis on 1 mbd of domestic oil production?

LOL.

steve

How does one reach these conclusions? I find it hard to reconcile these kinds of statements when comparing to opinions and modeling done by members on websites such as this.

One of these two differing camps will be eating some serious humble pie. I wonder which way production will end up going?

Don’t worry the EIA will eventually revise their projections to reflect what has actually happened… GRIN!

Fred, what quantity is being plotted there?

Problem with old eia reports is that they seem to be inconsistent with what they’re measuring from report to report. Bit annoying. Are there any in depth comparisons out there of how well their various predictions stack up to reality?

Sam that graph is based on a real one from the EIA and the quantity is in millions of barrels per day… now as to WHAT is being plotted I deliberately omitted that information >;-)

You are therefore free to interpret it any way you like…

You know that Dolly Parton movie, ‘The Best Little Whore House in Texas where the Gov, does the Sidestep? Kinda like that.

[Verse 1]

Fellow Texans, I am proudly standing here to humbly see

I assure you, and I mean it- Now, who says I don’t speak out as plain as day?

And, fellow Texans, I’m for progress and the flag- long may it fly

I’m a poor boy, come to greatness. So, it follows that I cannot tell a lie

[Chorus]

Ooh I love to dance a little sidestep, now they see me now they don’t

I’ve come and gone and, ooh I love to sweep around the wide step

Cut a little swathe and lead the people on…

Sam that graph is based on a real one from the EIA, of course some of the later projections are lines that were added by yours truly. The quantity is in millions of barrels per day… now as to WHAT is being plotted I deliberately omitted that information >;-)

You are therefore free to interpret it any way you like…

You know that Dolly Parton movie, ‘The Best Little Whore House in Texas where the Gov, does the Sidestep? Kinda like that.

[Verse 1]

Fellow Texans, I am proudly standing here to humbly see

I assure you, and I mean it- Now, who says I don’t speak out as plain as day?

And, fellow Texans, I’m for progress and the flag- long may it fly

I’m a poor boy, come to greatness. So, it follows that I cannot tell a lie

[Chorus]

Ooh I love to dance a little sidestep, now they see me now they don’t

I’ve come and gone and, ooh I love to sweep around the wide step

Cut a little swathe and lead the people on…

Oh come on, don’t leave me hanging

Coincidentally, the graph and everything stops at 2030, which is roughly where Guy McPherson predicts our extinction will happen.

But, nice haircut anyway. Perfectly flush with 2030. All you have to do now is add some fracking fluid and comb it down.

delete please

Hi Dave P,

Jean Laherrere’s forecasts are excellent, but he may be a bit conservative on LTO potential. The EIA’s forecasts are much too high. David Hughes forecasts in drilling deeper are quite good in my opinion and are between the forecast of Jean Laherrere and that of the EIA, my guesses, which are based on USGS estimates are fairly close to the scenarios created by david Hughes in Drilling Deeper.

http://www.postcarbon.org/publications/drillingdeeper/

The LTO story is not really that big in the long term picture. The URR will be 30-40 Gb at most from all LTO plays in the US, for the World the URR of C+C less extra heavy oil (oil sands in Canada and Venezuela) will be between 2500 Gb and 3100 Gb (my guess is 2800 Gb) so 30 Gb would be about 1% of this total, there are another 600 Gb of extra heavy oil resources, but these take much longer to develop and the overall contribution to World output will be no more than 13 Mb/d before 2100 (peak in 2060).

About 1200 Gb of C+C have been produced, so if the 2800 Gb estimate for C+C less extra heavy oil is correct then we have roughly 1600 Gb plus 500 Gb of oil sands resources or 2100 Gb left to produce. One possible scenario in chart below.

Dennis,

While Jean’s forecasts may be a bit conservative, I would like to bring up once again the subject of RESERVE QUALITY. Who cares if we have say 25-50% more LTO reserves than Jean uses in his charts. I rather suspect those REMAINING CRUMBS of LTO reserves will be a much lower EROI and profitability.

Furthermore, few in here focus on the financial aspect of the global system… of course Watcher is one of them. With countries fleeing the U.S. Dollar Swift system for international trade and heading over to the BRICS & AIIB, you can rest assured that the value of the almighty Dollar will be worth much less in the coming years.

Sure, maybe Russia might be able to bring on some decent shale oil production as detailed by Doug here, but that’s THEIR OIL not OURS. Well, on second thought if the U.S. and NATO are successful in Ukraine and also with the unseating of Putin with another Western bend-over Ruler such as Yeltsin, then maybe the Russian Shale oil could be OURS.

Regardless, I see a collapse of CAPITAL coming in the next 2-5 years. Without available capital, I would imagine a good bit of that remaining LOW EROI CRAP LTO Reserves may stay where they lay.

steve

Steve,

I read your blog and enjoy the work you do in regards to the EROI factor.

BRICS alternative doesn’t matter though. Neither does all the gold China and Russia have been importing.

Currently 65% of all debt that exists is denominated in US dollars another 20% in Euro’s. the other 15% is denominated in all other currencies combined. So 85% of the worlds loans you need either dollars or euro’s to pay. Not Gold not silver not Chinese yuan or Russian rubles.

If the US and the dollar collapse so does the rest of the worlds currencies and economies.

I have yet to see ANY well reasoned argument indicating that when it becomes necessary the USA cannot print as many dollars as Uncle Sam pleases.

A banking crisis and or a confidence crisis could leave people and countries without dollars as things are organized NOW.

The dollar may well become worthless at some point due to inflation but it will NEVER collapse like a man having a heart attack. It will die a long slow death by inflation most likely, barring black swan events.

People who possess great expertise in banking and the present day banking and money creation system of loaning it into existence are blinded by their own expertise into thinking that institutions such as the Fed are absolutely essential and that such institutions CANNOT be replaced with something new.

Essential they are – as things are organized today- but if and when the situation demands it the entire current day banking system rule book can and will be tossed out the window by Congress and the Executive branch if necessary.

Look for worthless dollars- eventually. But there will ALWAYS be plenty of dollars around except maybe for a short while if the current set up fails to keep them plentiful.

A new system will supply them as needed.

MONEY is not the fundamental problem. Resources and overpopulation are the fundamental problems.

Hi Steve,

Only the EROEI of the entire economic system is important.

At the individual product level only profits matter.

I believe it was Rockman who said something to the effect that oil companies are in business to make money. The EROEI of the barrels they produce do not matter, only the profit they make when they sell their oil.

Perhaps the oil guys can correct me here, does an oil company typically calculate the EROEI of the oil they produce? My guess is that they have no idea what the EROEI of their oil is, nor do they care.

Also Steve, I specifically said the LTO is really not a game changer for World oil. The countries that export oil will sell to the highest bidder, oil prices will increase and other types of energy (natural gas coal, nuclear, wind, solar, hydro, geothermal, and biofuels will be substituted for oil. Oil will also be used more efficiently as prices increase, much less will be wasted driving around in F150s to go to the grocery store or mall.

In round numbers, and to simplify somewhat, they are forecasting that we are looking at around 10 mbpd of C+C production for 25 years.

Let’s assume three scenarios for the decline rates from existing production–10%/year, 15%/year & 20%/year.

In order to maintain about 10 mbpd for 25 years:

At a decline rate of 10%/year from existing wells, we would need to put on line 25 mbpd of new production.

At a decline rate of 15%/year from existing wells, we would need to put on line 37.5 mbpd of new production.

At a decline rate of 20%/year from existing wells, we would need to put on line 50 mbpd of new production.

My comment on the previous thread about US natural gas decline rates and the observed decline in Louisiana’s natural gas production:

http://peakoilbarrel.com/eias-april-drilling-productivity-report/comment-page-1/#comment-511869

“Crude production will then moderate to 9.4 million bpd in 2040, 26 percent more than expected a year ago, the agency said”

Lol.

You can get that production with a big price rise.

Or you can get it with a big cost cut (like a Fed subsidy of loans).

If you HAVE to have the oil, you WILL get it, regardless of price or cost.

Watcher,

QE 4 is just a few quarters of bad news away. That ought to fix things at least for a little while.

I think they will buy more bonds this time around. But instead of MBS they will buy student loan debt this time around.

The majors starting cutting projects in 2014, before the price crash. I think they’d need to see consistently high prices with no risk of OPEC doing again what they did last year and no major volatility risks for a couple of years before they really started winding up again. To develop known resources could take 5 years more; to explore, find and develop new resources (Arctic, deep water etc.) might take 15+. The speech the other day from Rex Tillerson about Arctic access might indicate they see the issues coming.

If that green curve is accurate then the early 20’s looks like a wars all over (maybe civil) because there won’t be enough exports to fill he gap – of those available China has been doing all it can to get guaranteed long term supply agreements, you have to think Putin will be gloating, the Middle East doesn’t look in any way likely to de-escalate the problems (it looks more and more like the 30 years war scenario).

At some point the oil industry will effectively be nationalized so that there is direct government funding to avoid cycles like we have now – even if it is couched in different terms and is designed to ensure the 1% keep their rents (maybe closer to fascism than socialism).

That’s the spirit!!

Your first sentence was the best. Amazing how few are focusing on how that happened.

The majors are currently going about reserve replacement through either acquisition of other companies, or things like production sharing deals with national oil companies (see bp in Iraq). While I’m sure shareholders appreciate this, it’s not exploration and it’s not finding new oil.

Hi Sam,

There can be quite a lot of reserve growth. In the US if we take proven reserves in 1970 an 2013 and multiply by 1.25 as a rough estimate of proved plus probable(2P) reserves and subtract cumulative C+C production from 1970 2P reserves and then add 2013 2P reserves to estimate discoveries plus reserve growth we find that it is roughly 220% of 1970 2P reserves. There have not been many new discoveries of “new oil” in the US, it has been almost all reserve growth.

Let’ s say that the US had been well explored in 1970 and that the World as a whole had been equally well explored by 2010.

Jean Laherrere has estimated about 850 Gb of 2P reserves for the World in 2010(excluding extra heavy oil). If we deduct 30 Gb of US 2P reserves in 2010, we get about 820 Gb of 2P reserves for the World excluding the US. If we assume reserve growth for the rest of the World is only half of the US level, 100% rather than 200%, then we get 820 Gb of reserve growth, cumulative C+C production through 2010 was about 1100 Gb, if we assume about 30 Gb of new oil discoveries we would have a URR= 1100+850+820+30= 2800 Gb of C+C less extra heavy oil.

Probably the reality will be 250 Gb of discoveries and 600 Gb reserve growth

Sam,

At the time the majors were cutting back their capex, the several of the OPEC companies were ordering numerous drilling rigs. Both and Qatar an Abu Dhabi have several Jack ups coming out and we know Saudi and Kuwait have been contracting as many land rigs as they can get their hands on?

So OPEC is either losing production capacity and they need to catch up, or they are trying to ensure they maintain control of the market.

Tool,

Does it have to be either or? Maybe there’s a little of both?

However the middle East rig count has been on roughly the same trajectory since 2011, as this chart from euan mearns shows.

http://www.euanmearns.com/wp-content/uploads/2015/04/opec-count-mar15.png

I don’t see their output rising accordingly, though, and there’s been plenty of time for the increase in rig count to feed through.

Sam,

I feel we will have to wait, to see how it pans out. I feel they are playing catch up and need the extra rigs to stand still. Hopefully I will have better information a month or two.

If I were the owner of a brand new tight oil well I would postpone producing it if I could on a bet that the longer I put off production the higher the price I would get.

The conversation seems to indicate that there are numerous wells being held back from production for this very reason.

This in turn leads me to think that maybe the owners of such wells are not in as much trouble with the bank as you might expect. Or maybe they are – and they are selling out.

If a lot of wells that have been drilled but not Fracked are changing hands – being sold by near bankrupt operators unable to make payments – to other operators with deeper pockets- Would we know about it?

In other words are there regulations involving changes of well and lease ownership that require these changes to be made public within a short time frame? Is any government agency publishing this data? If so would it be even more out of date than current reported production data which seems to be lagging anywhere from a month to three months or more ?

I suppose the better investment advice outfits collect this sort of info but they aren’t going to give it away.

This is all well and good, but for most countries and companies, the oil must flow. Debt has to be serviced. Loans must be repaid. The plebs have to be subsidized, lest they take up arms.

The problem with the idea that the best wells are being held off until later is that the best wells are the only ones that can make you money these days. The wells at the margins are being taken offline and won’t go back on until the price is right.

Pretty much that.

That is the rebuttal to all the “we’ll hold production off and wait for better price” quotes. The loans never sleep. You have to pay them and only production will fund that.

Or not, if someone bails it out.

Most don’t have to pay principal till 2020 or beyond.

That sort of doesn’t make sense.

If they have an avg maturity of 5 yrs, then that was so in 2012 too. Beyond the maturity and more compelling overall are the covenants, which can mandate total debt load not exceed blah blah. Which translates into amortizing the full maturity into a year by year retirement.

Banks are waiving covenants. Before crash most paid off earlier maturing bonds with ones that do not mature until 2020 and beyond.

Clueless made a good point re bank borrowing base covenants. Banks don’t want to put their customers out of business. They are going to hold their nose and see how its going in October.

I am sure some bank (maybe singular) waived covenants. I am not so sure all banks went into their board room and explained how waiving the covenants was good for the bank and posed no risk. I am also sure no HY ETF fund managers were receptive to such an explanation to waive the covenants on the bonds in their portfolios.

I think this covenant waiving story is hype. We’ll know soon.

Mac, it’s a mix of wells. The usual approach is not to mess with high water cut wells. This means some dogs are kept on producing. The best way to save money is to avoid expensive well repairs. Suspend fishing jobs. Don’t change ESPs. Don’t frac new wells, leave them shut in. It may be a good idea to shut in a well with a very low water cut and watch the pressures.

All of this requires a dedicated team of engineers grinding a lot of numbers to optimize the asset PV and deliver the cash needed to survive. And we get into a lot of debates over individual wells. It’s stressful but it’s also fun, sort of like being in Stalingrad in 1942.

As I told you 3 months ago: here I am with an update, 15 months after the model was built. It is now more clear then ever I underestimated the so called “Ultimate Recoverable Resource” in the Hubbert-model a little bit. But… The last datapoint is – altough not exactly on the predicted production curve – pointing significantly downward on the curve of the Hubbert linearisation, more or less matching last years curve.

Since the Bakken economy has changed dramatically the last 6 months all bets are off. That’s the way it looks. On the other hand: Reality is coming back to the model again. 🙂 I will keep my model, without changing the initial parameters, as a reference. It basically says: Bakken will struggle and keep production more or less flat for another half a year, before staring to decline in earnest. We will see.

Edited a typo and lost the graph. So here is the graph again.

Hi Ovi,

Great job on that model, can you remind us of the underlying URR for that model?

The USGS estimates a URR of 10 Gb and Proved reserves plus cumulative production at the end of 2013 for North Dakota Bakken/Three Forks is about 6 Gb, 2P reserves plus cumulative output is about 7.3 Gb, reserve growth is likely to get us close to 10 Gb for URR.

Based on Steve Kopits analysis, I assume new wells added in the ND Bakken/Three Forks falls to about 110 new wells per month from May 2015 to Sept 2015 and then gradually rises to 145 new wells per month by May 2016 and remains at that level until Jan 2030.

New well estimated ultimate recovery(EUR) starts to decrease in June 2016 and the rate of decrease in new well EUR gradually increases to a maximum of 10%/year in June 2017. Economically Recoverable Resources(ERR) are about 9.4 Gb by 2040, peak of 1300 kb/d in 2019. Chart below.

Dennis, My model starts from a Hubbert linearisation, that pointed out an URR of something in the range of only 1.8 Gb to 2.2 Gb. I thought that was a little bit too low, so I made a “best fit”, with the then available data, calculated the other way around and built the final model, which you see here every 3 months now since 15 months, with an URR of 2.77 Gb. I know that is WAY beneath the USGS-data and all that. It’s an educated guess. Nothing more, nothing less. But the total amount of oil from Bakken ND in the last 15 months was predicted to be 463 Mb and it turned out to be 466 Mb. That is a 0.6% deviation. So still: My model is spot on.

(Please notice: The proof of the pudding is the eating: The days of truth are yet to come. Will the ultimate inflection point to the downslope be right? We will see.)

Hi Verwimp,

Sorry I got your name wrong.

I agree your model looks very good so far. I do not think Hubbert Linearization works well for such a short period of data. Cumulative Bakken/ Three Forks Production through Feb 2015 is about 1.3 Gb and if output followed the derivative of the logistic function we would be near peak output, assuming the URR is 2.8 Gb.

It would also mean that proved reserves in the Bakken/Three Forks were overstated at the end of 2013 by about 3 Gb, about a factor of 2.5 too high based on your estimate of URR. Depending on oil prices and the number of new wells completed, a reasonable scenario would be flat output at 1100 kb/d until 2020 if oil prices remain around $50/b, or output rising to about 1300 kb/d if oil prices gradually rise to $80/b or higher by 2020, if the URR is 10 Gb as the USGS predicts (mean estimate).

Your model predicts about 1000 kb/d in March 2016 and 800 kb/d in July 2017, I doubt we will see 800 kb/d or lower before 2026, and expect we will remain above 1000 kb/d for North Dakota Bakken/Three Forks output until at least 2021.

A more conservative scenario is presented below, with 100 new wells per month added from August 2015 to Sept 2031, about 30,000 total wells, and an ERR of 7.9 Gb through Jan 2040. I expect actual output will higher than shown in this scenario as the 2P reserves plus cumulative production were over 7 Gb at the end of 2013 and I expect there will be some reserve growth as oil prices rise in the future.

I will have a new post tomorrow, Friday April 17th, that will give Jean Laherrere’s take on Bakken reserves and likely peak.

Hi Ron,

I look forward to it, thanks.

Why would there be a steady amount of 100 new wells per month for a 15 year period? Especially when they lose money. There may be 8Gb remaining now, but it will stay in the ground. That’s my estimation. We will see.

Hi Verwimp,

They will only drill in the best areas, not all companies are losing money, the companies with poorly performing leases are losing money. Oil prices will rise, if they stay at this level fewer wells will be drilled and the 100 new wells per month will not be drilled.

At $80/b a lot of the companies will be doing fine. At some point oil prices will rise to that level or higher. I expect by mid 2016 at the latest. The 100 new wells per month is a conservative estimate, it may be higher than that.

Today, talked to a relative who lives in the heart of the Bakken not too far from Tioga. He said that things are slowing down some, but the wells have to be serviced, there are a few people leaving but the core workers remain. In other words, the trains with petroleum cars keep on rolling.

Those with tattoos on their necks and arms are gone. har

From fool.com:

Oil from the Bakken shale has increasingly become the preferred oil over West Texas Intermediate, or WTI, by refineries all over the world. And, because there is so much explosive growth in production in the Bakken and the midstream oil transport capacity can’t keep up, the oil is selling at a premium. In this video, Motley Fool energy analyst Joel South talks about what this means for WTI, and why he thinks Bakken oil will soon be the U.S. standard.

I was wondering for a minute there if your clock was off a couple of weeks and it was April one and the piece a parody from the Onion.

But it is three years old and sure is good evidence of how much attention we ought to pay to pundits such as the ones at fool.com.

Three years used to seem like a long time back when I was young. Now it seems like three months back then.

Yeah, I know it is as old as the hills, but I believe it remains still the same.

10,000 rail cars each week of petroleum cars pulled by the BNSF is the proof in the pudding. Doesn’t seem to let up that much and not much decline in production.

But back here in present time and in the real world, Reuters reports that US refiners are increasingly rejecting “Imitation WTI” blends of heavy crude oil and condensate:

http://peakoilbarrel.com/eias-april-drilling-productivity-report/comment-page-1/#comment-511864

Not really sure what to make of this article. It’s premise appears to be: If the refiners like it, the Bakken production will stay up. Does that make sense to anyone here? If so explain.

http://eaglefordtexas.com/news/id/150140/from-the-east-coast-bakken-oils-outlook-not-so-bad/

I know nothing about what refiners need in the way of crude, be it Williston Light Sweet, etc. I do know if I am in the refinery business, I would be clamoring for drill baby drill to continue. Refiners love $30 crack spreads and growing demand, neither of which occur at $90+ oil prices.

KSA seems very perplexed as to why US independents would keep drilling wells in the current environment. They must assume the managemt of the US independents are playing with their own $$. How wrong they are.

There will not be many BK with regard to US independents until 2020, if ever. That is when most

of the bonds start coming due. Until then, US independents will forge ahead, paying the 5% interest, borrowing more if they can, in hopes that oil prices return to 2011-14 levels.

To KSA it seems simple, US independents should save themselves by stopping all drilling and dropping US production by 1.5 million bopd this year. They just don’t understand that, unlike Saudi Aramco, US Independents are playing mostly with other people’s money, such as pension funds, etc.

By US having less of an energy policy than in pre 1971 Texas RRC, we will surely burn up the shale reserves as quickly as possible for the lowest price possible. Oh well, maybe we will convert the fleet by then to natural gas and electric.

Thanks sand, it makes some sense now. With capacity factor of over 40 percent in ND, maybe some of these drillers will move into wind power before they go down the tubes. Got to run the next investment scheme.

A drilling company, or a small independent, is as likely to invest in wind power as Coca Cola and Unilever. Most companies have management and a work force with a particular set of skills. Oil company skills don´t transfer well to putting up wind turbines. This is something that REALLY needs to sink in, because I read these remarks and articles about forcing oil companies to invest in renewables, which completely ignore reality.

IF oil companies can´t access commercial opportunities in their field they will disappear. The employees get laid off and the stockholders invest in OTHER ASSETS, which don´t necessarily have to have anything related to energy.

Yeah.

It’s all about the staff inside the company – they know where their skills fit, and they’ll resist moving into things where their professional expertise isn’t relevant.

The same thing is true of car companies, which helps explain why some car companies have been slow to transition to EV/hybrids, and why some companies have been schizophrenic – actively rolling out new products in one division, but seeing passive resistance in management, other divisions, or in the dealerships, where salespeople actively move buyers away from these newfangled things they don’t understand.

You can tell a car company doesn’t understand EVs when their television ads try to tell you that EVs are almost as good as ICEs. Obviously, the execs feel they need to apologize for these weird new things, rather than selling them as better than ICEs – which they are.

You could tell that a car company “got it”, when their commercials started out showing people in the bathroom shaving with noise, smoky gas-powered shavers, then moved to show their clean, quiet EV.

The Strib’s take…

N.D. sees second consecutive monthly drop in oil output

[Excerpt from article]

North Dakota’s oil output declined for the second consecutive month as just one new well was completed in February and some producers pumped less oil and gas to meet flaring rules, state officials said Tuesday.

“It was an unusual event,” Lynn Helms, director of the North Dakota Mineral Resources Department, said of the back-to-back monthly decline in production, which last happened in 2011.

Oil production in the state likely will fall through May because of the drop in the number of drilling rigs to 91 this month, less than half the number operating a year ago, he added.

Output was just under 1.18 million barrels per day in February, a drop of 50,435 daily barrels since December, when the state hit a 1.2-million-barrel-per-day record high.

Helms said the falloff in drilling has happened faster than projected, driven by low oil prices that have cut capital investment by oil companies. The output of newly completed oil wells always declines, so new ones must be drilled constantly or an oil field’s production steadily drops.

After North Dakota’s news, light sweet crude oil futures for May closed the day up 3.2 percent at $53.55 per barrel on the New York Mercantile Exchange.

Helms attributed most of February’s drop of 14,000 barrels per day to producers cutting back production to meet new regulations on flaring, or burning of natural gas at wells that are not connected to pipelines. Under regulations that gradually get stricter, producers are allowed to burn no more than 23 percent of gas output or face state-ordered cuts in production.

The number of uncompleted wells in North Dakota rose to an estimated 900 at the end of February, Helms said, as drillers decided to hold off on the final step — hydraulic fracturing, or injecting water, sand and chemicals to free gas and oil in shale layers. Helms added that he expects a surge of fracking in June if sustained low prices trigger a state law that cuts oil production taxes.

“I think we are going to see continued production declines through May and then we’ll see a big catch up in June that will take us back up pretty close to the 1.2 million-barrels-per-day-mark,” Helms said on his monthly conference call with reporters.

For reasons that are not yet clear, a smaller share of North Dakota’s oil — 55 percent — ended up on oil trains in February, said Justin Kringstad, director of the North Dakota Pipeline Authority. That compares with 58 percent in January, he said.

[End of excerpt]

Interesting energy statistics from China.

In the first quarter of 2015, China’s electricity generation fell by 0.1 percent compared to the same quarter last year. Official statistics say that China’s GDP grew by 7 percent in the first quarter from the same quarter last year (and industrial production grew by 6.4 percent).

In the past, China’s electricity generation growth generally matched the overall economic growth. But in years of economic slowdown, China’s electricity generation often decelerated much more sharply than the overall economic growth.

China’s hydro electricity generation continues to surge and grew by 17% in the first quarter from the same quarterly last year. As a result, fossil fuels electricity generation fell by 3.7% from a year ago.

Separately, China’s coal production fell by 3.5% in the first quarter from the same quarter last year. China’s coal industrya asssociation now plans to reduce the annual production in 2015 by 5% from last year.

Given these trends, it is highly likely that in 2015, both China’s coal consumtion and carbon dioxide emissions will decline.

This will certainly help the world by some time from climate stabilization. Although I do not expect the trend to be sustained.

I think China (and the world) is in for a major economic crisis in the next 5 years.

I agree

In the first quarter, China’s crude oil imports reached 80.34 million tons, an increase by 7.5% from the same quarter last year

Ya, and why is coal production meaningful when they can just import more of it and keep theirs for their grandchildren.

This will certainly help the world by some time from climate stabilization. Although I do not expect the trend to be sustained.

Given that based on the information you cited it is highly likely that China’s economy is not growing at the roughly 7% that is supposedly their official growth rate. (Actually I personally believe that number is a complete fiction), Taken together with your cite that their electricity generation might even indicate a significant slow down. Plus the fact that you agree with Anonymous’ statement below that China and the world are likely are heading for a major economic crisis in the next five years, why, pray, do you not expect this trend to continue?!

Sounds like there may be a bit of a contradiction in there. No?

There is no contradiction between the expectation that the Chinese economy may enter into a major crisis in the next five years and the expectation that China’s coal consumption and CO2 emissions will resume growth in the long run.

If you read my post carefully, you may realize that a big factor that contributes to the decline of fossil fuels power generation has to do with the near 20% growth of hydro electricity

PE,

Could you provide the raw numbers? Number of GWhs for coal, hydro, etc?

If you read my post carefully, you may realize that a big factor that contributes to the decline of fossil fuels power generation has to do with the near 20% growth of hydro electricity

My bad I had read your post as saying that coal use would continue to increase…

The invisible hand at work.

http://www.reuters.com/article/2015/04/14/us-markets-oil-idUSKBN0N502O20150414

It looks like the Bakken is not the only place where the oil companies do not see the merit of completing their wells. The Eagles Ford, is also leaving wells uncompleted. With fast decline rate, dropping rig count and the lack of interest in completing wells, it is hard to believe that current production levels can be held. But read the article and you will see how it can be done.

http://press.ihs.com/press-release/uncompleted-wells-eagle-ford-shale/large-inventory-drilled-uncompleted-wells-pose-oppo

Large Inventory of Drilled but Uncompleted Wells Pose Opportunities for Handful of U.S. E&P Operators with Quality Assets; Challenges for Those Without, IHS Says

BHP Billiton, Chesapeake, Anadarko, EOG Resources, ConocoPhillips and Pioneer Resources Own Nearly 40 Percent of Optimal DUC Wells in Eagle Ford

It seems for the companies that have the cash, they do not need to bother completing their wells.

Of course the other reason, they are not completing, is because the refiners don’t like their flavour of near oil?

Warning: IHS article. Please remove rose tinted glasses after reading!

So, how long can they leave wells uncompleted for, isn’t it a year? So either prices stay low for a year, and many of these wells will have to be completed and will keep oversupplying the market, or prices edge back up and suddenly there’s a boom in completions in response, and production could potentially surge again, keeping the price suppressed.

There seems to be an assumption by the MSM that all the frack log wells can be completed on the same day, which of course, is impossible.

For starters, I wonder what the frack companies did with their personnel?

Watcher would like that IHS article, which makes the claim that break even is now under $30 for frack log wells. Why is it so low? Because of course we no longer have to consider how much the well cost to drill, that money has already been spent.

But what about payment of the interest and principal on each of those $3-4 million dollar holes that are generating no revenue. Until completed, they are the economic equivalent of a duster.

Heck, we can break even at under $10 I guess. We can just apparently ignore whatever expenses we like.

I usually don’t equate a partially completed building with financial success. That is what frack log looks like to me.

Sam,

Certainly in ND, it is a year before they need to complete a well. Not sure of the regs are in Texas, but this doesn’t mean that at the end of the year they all need to be completed in a rush.

The completions can be rotated around, until the point is reached where the only wells that are completed are one year old. It would be at that point where the panic to complete may set. By this time, and at the rate the drilling count is dropping, the only wells to complete will be older ones.

Maybe a slight exaggeration, but I hope you get my point.

I did an analysis a few weeks ago, concluded it´s feasible to wait three years. The IHS report states:

“””“In this low oil-price environment, operators in the Eagle Ford and other U.S. shale plays are focused on optimizing the value of their assets and managing their costs, and these drilled, but uncompleted wells enable them to do that more effectively for several reasons,” said Raoul LeBlanc, senior director of research at IHS Energy, and the lead author of the DUC analysis. “First, the drilling costs of these wells were already incurred by operators prior to 2015, and the completion costs–which comprise the majority of well costs–can be negotiated at a cheaper rate since completion crews are now both available and available at cheaper rates. Second, if completion costs are fairly consistent in the play, then it stands to reason that wells with higher production will yield better returns on capital.””””

When I wrote here my conclusion, I met a little bit of resistance, but the numbers are fairly easy to work out, you just have to take the time to put it in a spreadsheet.

Fernando. I agree with you, if you can predict with some certainty the future oil prices. I don’t think it works based merely on current contango. You will need a substantial increase.

Do you know the life assigned to tangible leasehold equipment and depreciation method utilized by public oil companies? Is this standard across the industry, or does this vary?

Also, do you know how public oil companies calculate cost depletion?

I wonder how frack log wells are handled for tax purposes?

I guess my concern if I were building up an inventory of drilled but not completed wells is the cash crunch that would result not only from the lack of income from those wells but the income tax ramifications.

It is my understanding that the well cannot be considered to be placed in service for depreciation and depletion purposes until it has been completed and placed into production.

It would seem to me an oil producer would require a significant amount of cash on hand to keep drilling wells but not complete them. Not only would there be $0 revenue from them, but the money expended on them could not be taken as a deduction either.

As I look at shale drillers like WLL, CLR, etc, I find that most do not have significant cash.

It seems to be a questionable lending practice to loan funds to drill wells that will only be completed at a date when hopefully the oil price rises, and that cannot even be expensed until completed.

Also, what category do the reserves of these types of wells fall under?

No wonder KSA is perplexed. They under estimated the ability of Americans to continue to dodge the financial day of reckoning. They should have learned something from the 2008-2009 financial crisis.

I’m not sure about current U.S. Tax rules, but overseas we lump all drilling and completion CAPEX in an account (it’s not on a per well basis). If the well is considered good enough to case and put on a schedule to eventually be completed, we book it as CAPEX. If eventually we complete and it doesn’t produce we write it off.

I don’t think the tax implications are that important. The gain in present value from waiting is pretty big. Remember, what I think about prices doesn’t matter. What matters is whether somebody is willing to offer to buy the oil at a higher price.

Fernando. I took a look at the IRS rules for when an oil and/or gas well is considered to be placed in service. It appears to me to be placed into service, the well must be completed.

I understand you experience is in planning for well capitalized IOC’s. Many US unconventional independents are not in the same cash situation.

From what I can tell, the US companies write off tangible leasehold equipment using MACRS with a seven year life. However, this cannot commence until the well is completed. Further, no cost depletion may commence until the well is placed into service.

So, if your company borrows the money to drill the wells, as has been the situation with a large percentage of US lower 48 onshore, your company would go three years with a. Interest expense on the sums borrowed to drill; b. Would have no revenue to offset the interest expense; and c. Would have no depreciation deduction from the uncompleted wells to offset against net income from other producing wells or other income generated.

In my view, only a well capitalized company with substantial income from other assets could pull this off on a large scale, or even moderate basis.

This is notwithstanding issues with the oil and gas lease terms and/or state regulations.

Most of the frack log companies will not wait long, and are praying for a significant price increase this year, IMO.

Or they will farm out acreage to companies with cash. Don’t forget many oil companies are buying their own stock.

Returning to the tax issue, let’s say I borrow $4 million at 10 %. I pay $400k in interest, net cost is $256k per year after taxes. Say I hold the well for TWO years, but arrange to drop the remaining $4 mm completion and other costs by 20 %, that saves me $800k.

If I complete the well today I have to pay the same $7.2 million (I assume the costs will drop) but the well PV10 is much lower. The key to the whole issue becomes staying power. But a company which lacks the financing will sell to those who have cash.

I think this is the argument companies use to issue stock. And it wouldn’t surprise me if some banks may not be carrying them through this period.

I guess we will just have to wait. But the more contango we see the more oil will be stored, and the more we will see delayed completions.

Hi Shallow sands,

When a company has no profits, it pays no taxes, so the tax write off issue is not that big a deal. A lot of these companies are just weathering the storm and trying to keep their losses to a minimum, their tax bills will not be large. The depreciation issue may not be a problem, though I am not an accountant and am probably missing some major points.

Dennis. Good point! As I have stated before, IMO shale company earnings are overstated because I believe their depreciation and depletion deductions are taken at a rate which is much less than the decline their wells experience. As they cut CAPEX, this effect will eventually wear away and may even understate earnings, depending on the level if future CAPEX.

However, crude prices were so low in the first quarter that there would be no taxable income for most of the companies. That may very well be the case in future quarters too, although there may be a significant price rally in the works.

However, crude prices were so low in the first quarter that there would be no taxable income for most of the companies.

Sometimes they even find ways to reclaim taxes they have already paid.

Noble gets a $7.8 million reduction in its 2012 Weld County tax bill – The Denver Post

Here’s a better article about the tax payback.

Weld commissioners approve $7.8M tax abatement for Noble Energy – BizWest

The Greeley Tribune reports that the approval was unanimous. Noble had originally paid $73,307,779.47, but received an abatement of $7,783,166.32. The request came after the company revised its 2012 tax filing and found more expenses that could have been deducted.

The county government will be on the hook to pay back more than $2.3 million, while Aims Community College will have to repay more than $854,000 and the school district in Kersey nearly $510,000.

The abatement comes just a week after the company announced it was cutting 20 workers in Greeley and another 80 in Denver.

Gooood morning, slaves…

And welcome to a fresh sedition of ‘It’s The End Of The World As We Know It And I Feel Fine‘. Which focuses on my old stomping grounds (Montreal).

Always the perfect little show to watch over one’s morning coffee/tea. Or juice. So go grab one, sit back, relax and enjoy!

Oh, yes, almost forgot… Fred, there are distinct differences between ‘literary devices’ and internal states, tabarnak! Which is not to suggest that the two are mutually exclusive, but nor should they necessarily be. Because, for three, there is energy, passion and conviction. And sedition. Vive les differences! ‘u^

Bonne journee!

Caelan, “capitalism” has evolved into something like hyper-financialized rentier-socialism for the top 0.001-1%, most of whom in the upper strata of that lofty lot are invisible, unreachable, unaccountable, and untouchable.

In the US, total annual net flows to the financial sector now absorb virtually 100% of annual value-added output of the economy. The vast majority of the associated rentier claims go to the top 0.001-1% and to a lesser extent, and indirectly, to the next 5-9%.

I suspect we’re going to have to see a growing majority of those beneath the top 0.001% in the technocratic and political castes get the glitter treatment that Draghi received earlier today before there is recognition among the Power Elite top 0.001% and their facilitator technocrats and politicians that the bottom 90% are suffering, only so far in relative silence.

I’m waiting for a protester to fling bats$&t on someone to prove the larger point.

Then again, public acts of disobedience and glittering high-profile gov’t, corporate, and media types will probably only permit the top 0.001% and the state to rationalize violence against the masses.

Looks like oil prices will continue to fall for a while yet, with this massive oil field found just off England. We should use the lower cost of construction to invest heavily in alternatives. There will be a place in the worlds economy for a long time to come, but we should work now to lessen our dependence on it.

Which huge field found off England?

No massive oil field found “off” England. A modest sized oil field possibly has been found in England, not off, that will take years to develop if it proves to be worth exploiting. Only 10% to 15% of the oil that may be there can be got out of the ground. There is no salvation for the world from oil scarcity offered by the “massive oil field found off England”.

Got it, the Kimmeridge shale play by Heathrow. The good thing about it is the ability to go downtown by train once we finish fracking at 5 pm.

Many are expecting the same ‘bats#&t crazy’ system that got us into this mess to get them out. Secondly, that system are we. But who are we?

There may be a wild card, and I have been falling behind in making the effort at helping to create it and/or move it along. It is one thing to describe a system, and yet another to transcend it.

A reformist solution is far in the rear view mirror at this point.

But the feedback loops are immense.

I presume when you say ‘reformist’ that you are talking about reforming a system that I think is unreformable and that you understand that that’s not what I am advocating at all. And I am inclined to agree if that’s what you mean– that it’s too late to do what the likes of Nick or Dennis seem to think. Even if it does reform, if the ethics are not reformed as well, then it’s new incarnation will likely be at best, just a kinder, gentler, more polite and diplomatic version of unethical.

And we do appreciate folks who are polite and diplomatic, but fundamental @%#holes, don’t we.

Correct.

Thinking that reforming a system that is not reformable is pure delusion, sort of like the Austrians in 1914 arguing who their next Habsburg Ruler is going to be.

A alternative social construct that would work and that people agree on would be nice. Then we know what we are aiming for.

Do you agree that there have been times when radically altering the social system has had relatively poor results?

This has not always been the case, but is the reason that some prefer incremental change rather than revolutionary change.

Oil futures are hoovering at 54.00 this morning. Close at 55.00 opens the door to 67.00 If you want to be precisely technical, oil need to close above 54.25. I say 55.00 cause that shows a clear break in resistance. Still possibility of pullback still remains until this resistance is broken.

I should add that once this resistance is overcome. 55.00 will become strong support going forward.

That’s probably how it is going to unfold, (save for one or more wild cards, like the world’s first global tribe rising up to challenge the world’s last global state system).

Because it’s ‘what we know’. It’s comfortable in a way and too inconvenient to leave. Like a bad relationship that you tweak to cope with (ya, I am being cheated on, but I’ll look the other way, maybe take a new hobby; ya, I’m being abused, but maybe if I be even more accommodating, I’ll get less of it), until it destroys you in the end by a death of a thousand cuts.

Doesn’t matter that it’s violent/coercive/undemocratic, and is what makes it fundamentally self-defeating. Because it’s an outgrowth or emergent property of us, maybe with lots of cheap energy thrown in.

Of course I keep talking about pure democracy and ethics, but that doesn’t seem to matter; what seems to count is the ‘grand illusion’, the overriding unethical/undemocratic politic-uneconomic prison system, that we’re all embedded in from birth, and its self-reinforcing/self-relevant political/etc. narratives/memes, such as of statistics like the GDP; organizations like The World Bank and International Monetary Fund; borders arbitrarily carving up the planet, like the US or Russia, and their government/operational structures, and industrials, like solar panels and electric vehicles. So that’s what we’re going to get, not just until collapse, but collapse precisely because of it. Unless the wild card, but it might come too late.

Time to refill the meds, Tribe. It is getting beyond the pale.

Stick it, Paulo. And your nanny bonnet. My comment is highly relevant to peak oil and you know it. How about this one of yours? Nothing. This whole culture is a giant med-in-need and we uphold it and suck up to it and I’ll call it out. And ya, it will piss a lot of people off. Like the ones in the oil field or advocating EV’s and PV’s. Like on this blog. But that’s expected. Some changes don’t happen otherwise. If you want to talk about this sick joke of a culture in your way, I can talk about it in mine. I think it’s called freedom. Like that image I posted that you liked and commented on. My med to it.

Good morning Caelan,

Lots of days I am as doomerish as you are but today the indescribable new green is climbing the mountain sides and the ( scarce ) bees are in the apple tree blossoms. The grass is a foot tall already. Maybe things will hold together for a while yet.

Mother Nature will take care of her own by taking care of the problem – We have met the enemy and they is us. For damned sure this is one of the truest things ever said.