This is a guest post by Jean Laherrere

BOEM and BSEE have published in 2014 the GOM oil & gas reserves at end 2010 few months ago and at end 2011 lately.

The big change is that they now report proved and probable reserves = 2P (in contrary to SEC rules for operators reporting at the US Stock Exchange, forbidding to report probable reserves), when before they reported only proved reserves = 1P

They argue:

In order to more closely align BOEM GOM reserves definitions with the Petroleum Resources Management System definitions (SPE/AAPG/WPC/SPEE 2007), this report clarifies that Proved Reserves in this and previous reports are Proved plus Probable (2P) estimates.

The difference between original reserves estimates from previous year found little difference for discoveries before 1995

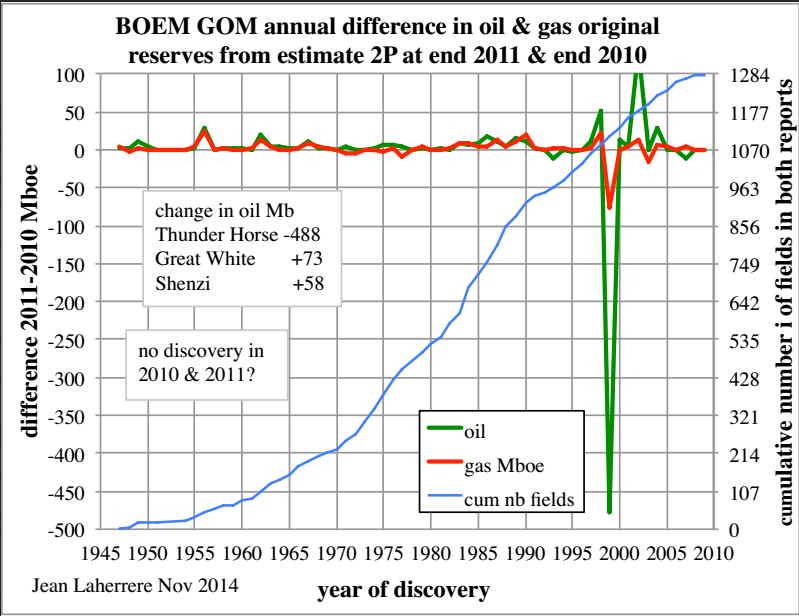

The difference between 2P 2011 and 2P 2010 is a very large decrease for Thunder Horse (-488 Mb or 573 Mboe) and the largest increase is Great White +73 Mb

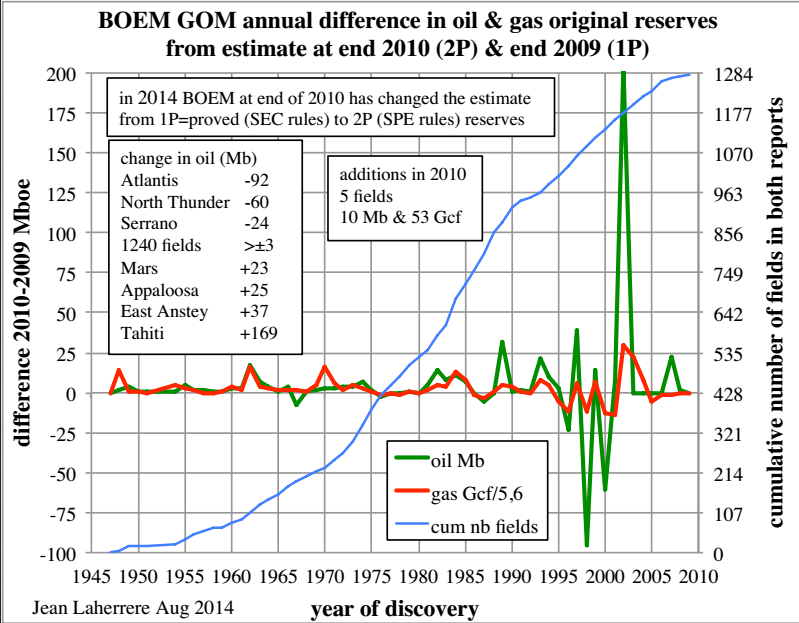

The difference between 2P 2010 and 1P 2009 displays a large increase in Tahiti +169 Gb and large decrease with Atlantis -92 Mb (already in decrease in 2009)

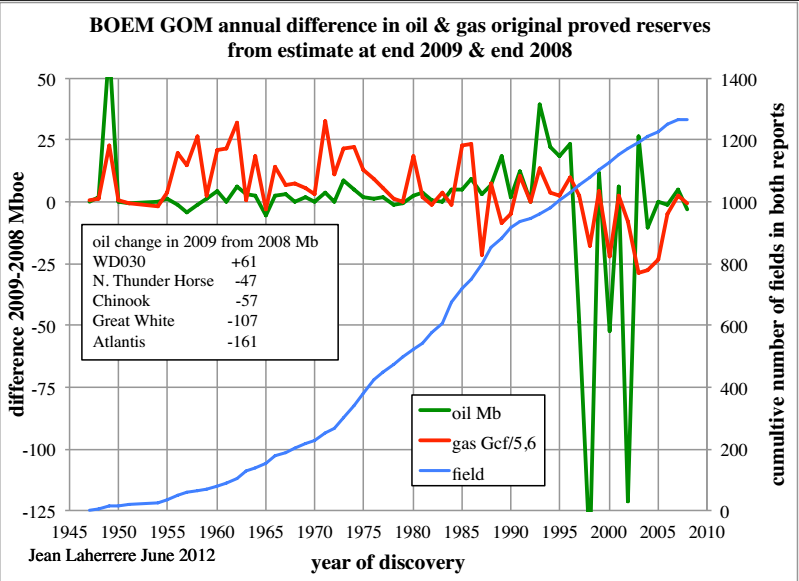

The difference between 1P 2009 and 1P 2008 is as important as the difference between 2P and 1P: large increase with WD 030 +61 Mb and large decrease for Atalntis -161 Mb

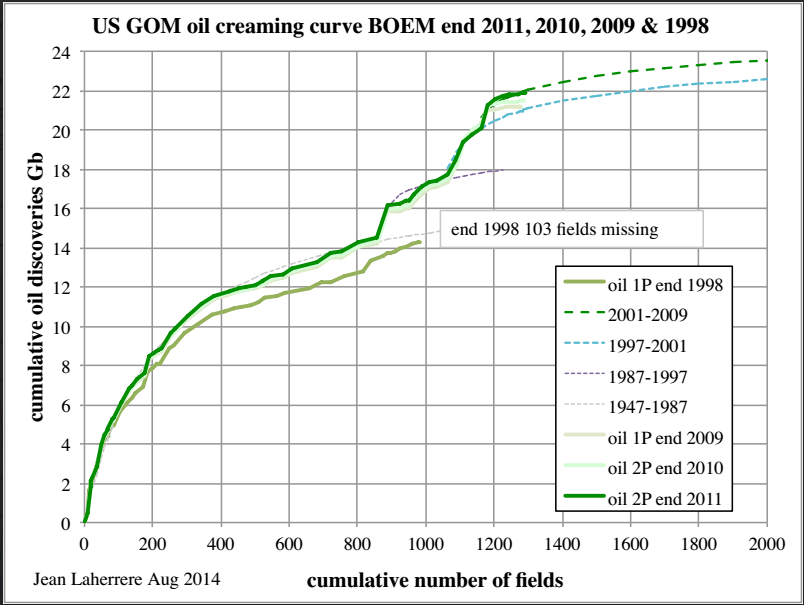

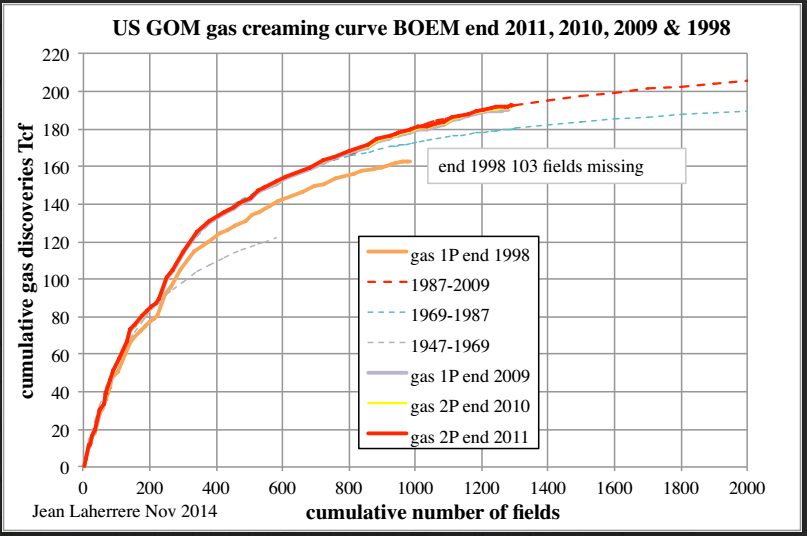

The change in reserves with time and definitions does not change the estimate on GOM ultimates: 24 Gb and 210 Tcf

The modelling for oil is complex because the subsalt and needs 4 cycles, meaning that a fifth one is difficult to guess

The modelling for natural gas is easier with only 3 cycles and one cycle model could be as good.

The increase from 1998 values comes mainly because these government agencies, selling leases to the oil companies, are unable to properly register the number of fields: about 10% missing!

The number of fields at end of 1998 was 984 in the 1998 study (14,3 Gb & 163 Tcf) when it is now in the 2011 study 1087 fields (18,5 Gb & 184 Tcf): 103 fields missing representing about 4 Gb & 20 Tcf: poor reporting!

But the last 2014 report at end of 2011 does not report any discoveries in 2010 and 2011, when it is known that Macondo (200 Mb) found in 2010 (with 6 other discoveries, in particular Appotattox (220 Mb) did produced some undesirable oil during the blow out. These reports are unfortunetly incomplete. Governments are unable to gather in time reports from operators and several years are needed to get them corrected.

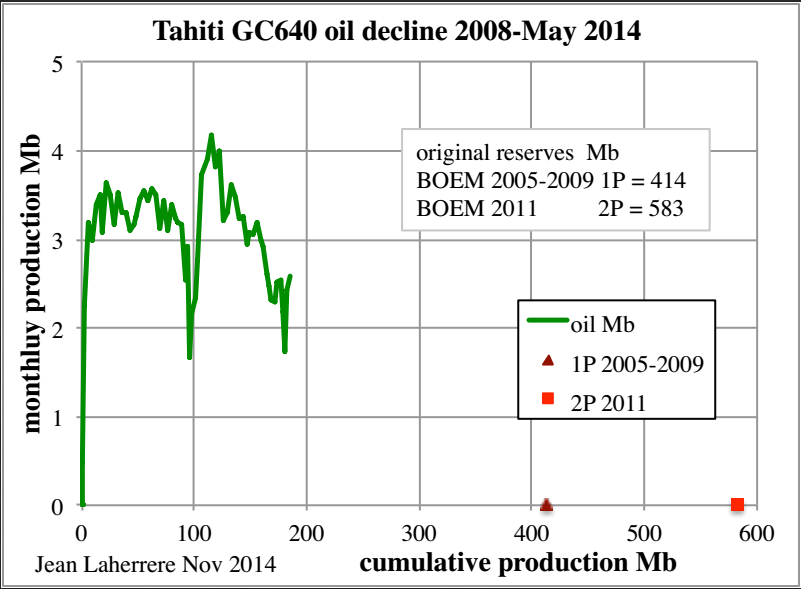

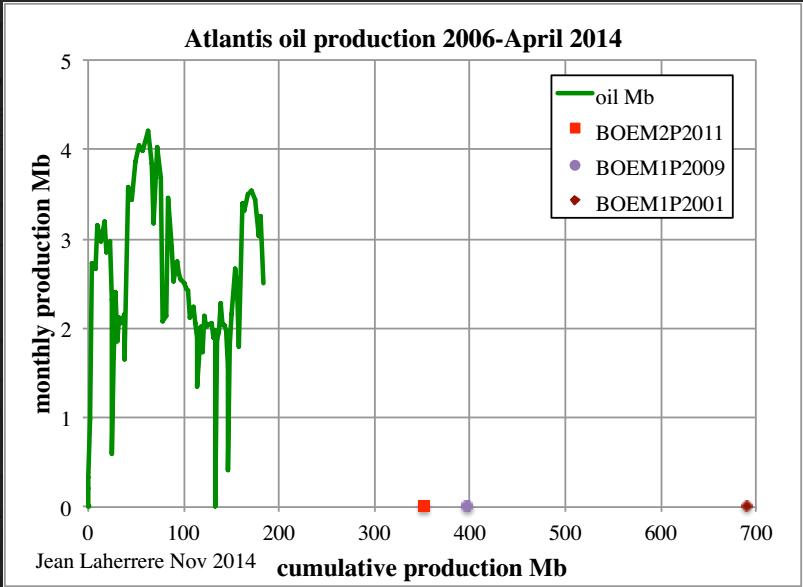

The plot of oil production of the changing fields (p most in deepwater) shows large varitions, meaning that the estimate of reserves in frontier area (subsalt) is difficult

-Tahiti rank 7 deepwater 4320′ subsalt found in 2002: 414 Mb in 2009, 583 Mb in 2011

-Atlantis rank 14 deepwater 6285′ subsalt found in 1998: 689 Mb in 2001, 398 Mb in 2009, 352 Mb in 2011

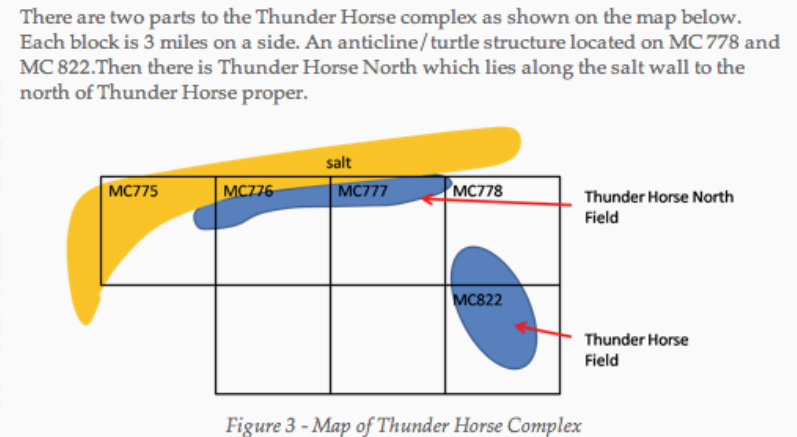

-Thunder Horse (formerly Crazy Horse) MC 778 rank 2 in 2010, rank 41 in 2011 deepwater 6078′ found in 1999 by BP which produced the field with the largest semisubmersible platform as also North Thunder Horse MC 776 deepwater 5668′ found in 2000

BOEM & BSEE reports complete monthly production per lease

BOEM Deepwater Natural Gas and Oil Qualified Fields

but the oil reserves are reported by field.

field lease area block water ‘ operator code discovery

N.Thunder Horse G09866 MC 776 5,668 BP MC776 2000

N.Thunder Horse G09867 MC 777 5,668 BP MC776 2000

N.Thunder Horse G09868 MC 778 5,668 BP MC776 2000

N.Thunder Horse G19997 MC 775 5,668 BP MC776 2000

N.Thunder Horse G21778 MC 734 5,668 Murphy MC776 2000

N.Thunder Horse G27312 MC 819 5,668 Murphy MC776 2000

Thunder Horse G09868 MC 778 6,077 BP MC778 1999

Thunder Horse G14657 MC 821 6,077 BP MC778 1999

Thunder Horse G14658 MC 822 6,077 BP MC778 1999

Unfortunatley lease G09868 belongs both to MC 766 and MC 778.

So to get the data by field it is neccessary to go from each annual report giving the monthly production per field and per lease.

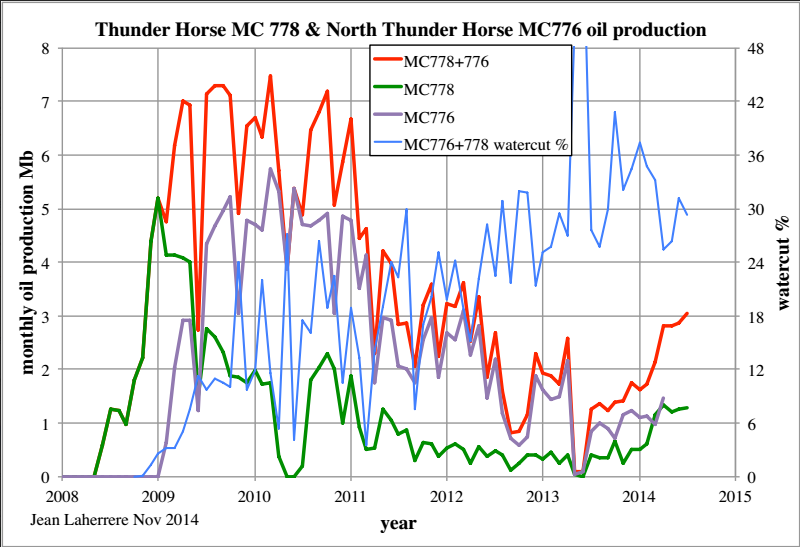

MC 778 (in green) peaked in 2009 and declined sharply and was stopped during Macondi blow out, resume decline, but increases since February 2014.

MC 776 (in purple) peaked in 2010 higher and declined since rather chaotically.

Both fields (in red) dispolays a bumpy plateau in 2009 and 2010, a sharp decline and a new increase in 2014.

The watercut of the combined fields has u increased slowly and in 2014 is about 30% which is much less than most of GOM fields when in decline. Watercut is not the problem of deepwater fields.

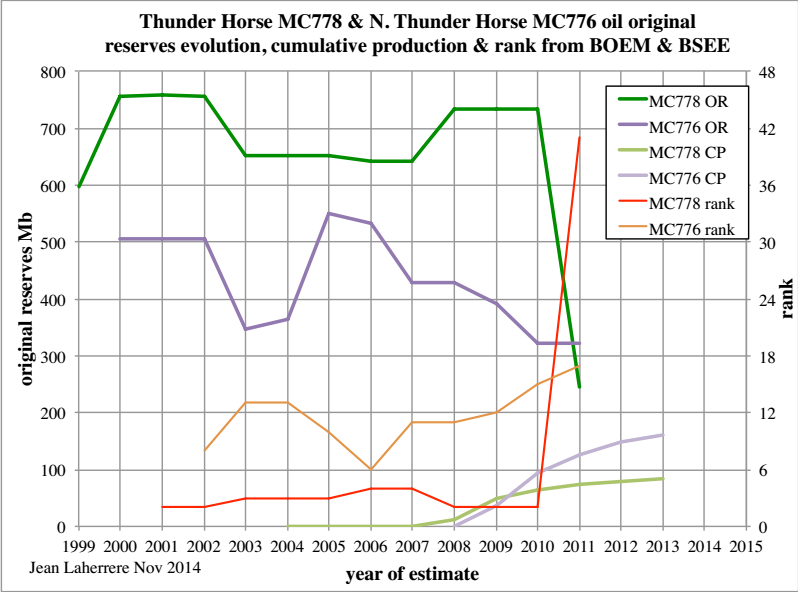

From 2011 reserve report, the next graph shows the oil original estimate since 1999 for both fields, the rank and the cumulative production (up to 2013 from above graphs)

Thunder Horse (MC778) was in 2001 reported as the second largest field in the GOM, was still second in 2010 but in 2011 its rank fell down to 41

Thunder Horse North (MC776) was raked at 6 in 2006 and at 17 in 2011.

The oil and gas reserves of both fields were 1506 Mboe in 2000, 1227 in 2010 and 651 Mboe in 2011: divided by half.

And I guess that the fall can continuei

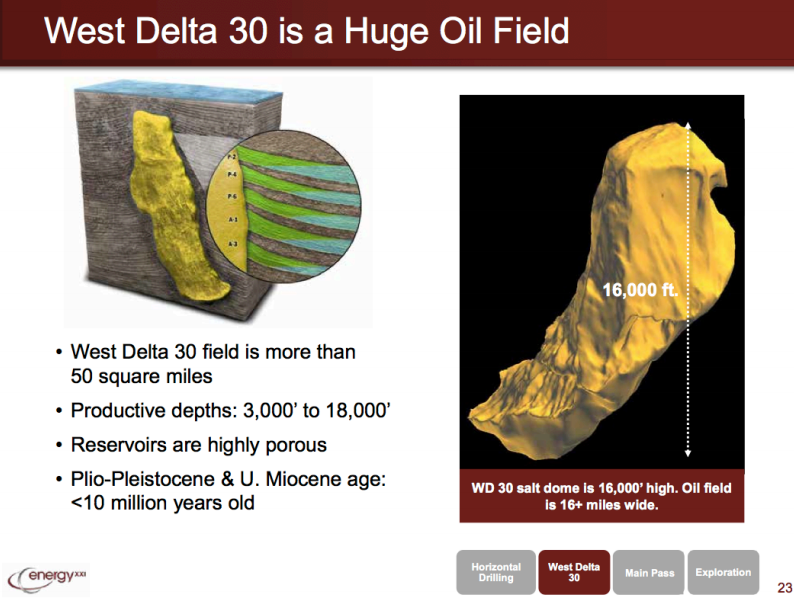

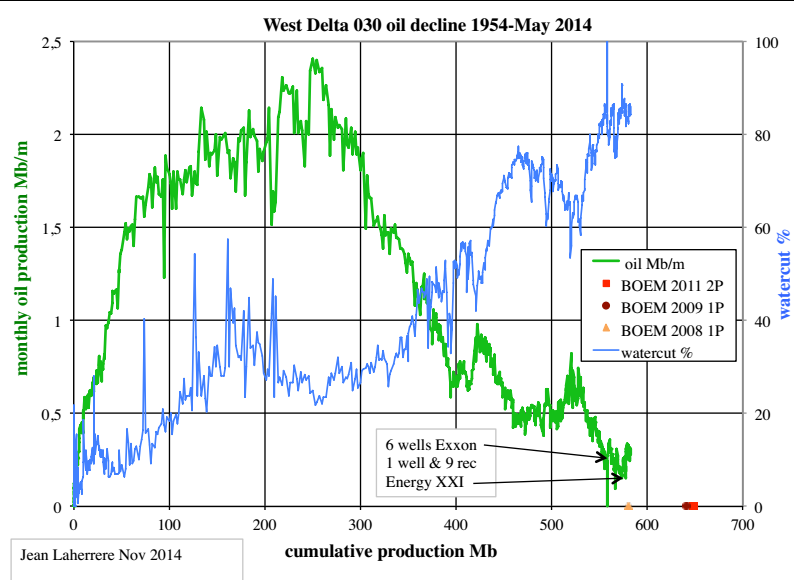

-West Delta 030 shallow water (49′) found in 1953

The fields has many reservoirs against a salt wall over a depth of 16 000 ft: see Energy XXI slide.

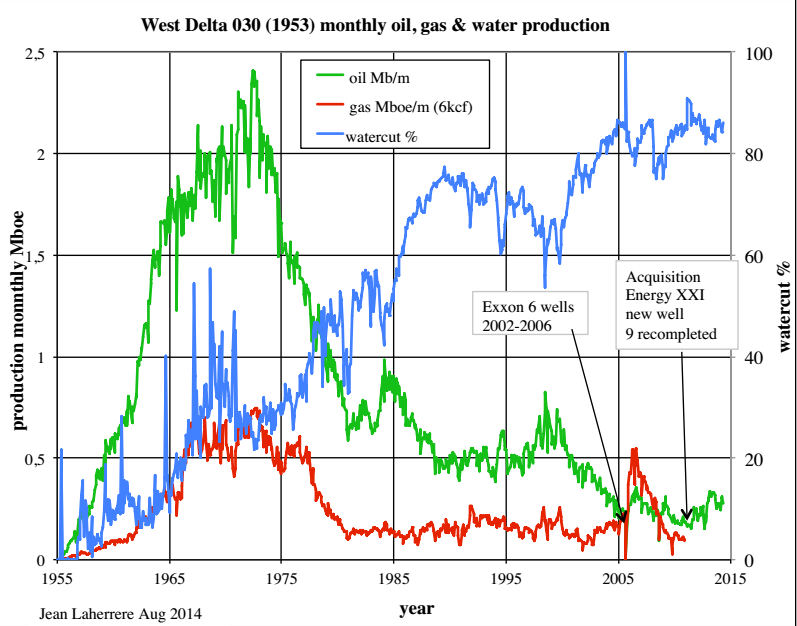

WD 030 peaked in 1973 and declined with bumps, in 2002-2006 the operator Exxon drilled 6 wells, small increase, mainly gas and in 2010 sold the field and 8 other fields to Energy XXI for 1 G$.

Energy XXI has drilled a new well and 9 wells were recompleted. The result is a small increase. Watercut stays around 85%.

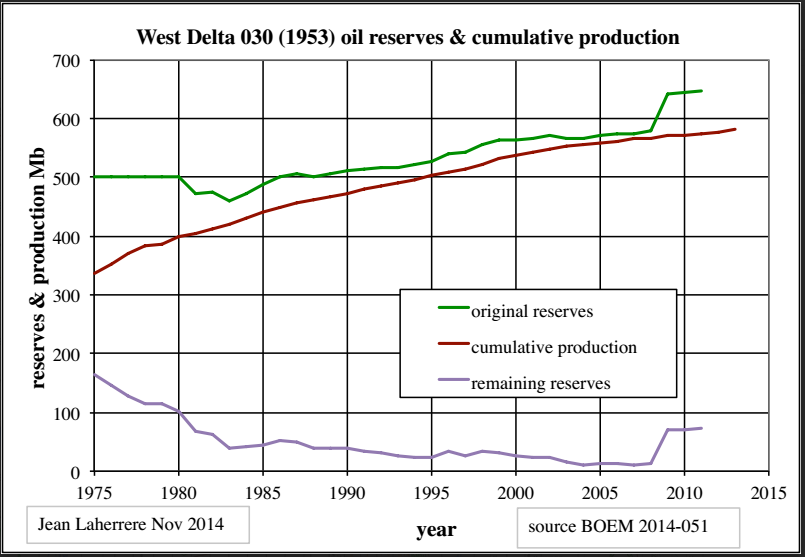

The monthly oil production plot against cumulative discovery shwos that the original reserves went from 580 Mb 1P in 2008 to 641 Mb 1P in 2009 and 648 Mb 2P in 2011

The plot of the 1P reserves and cumulative production displays the usual increase of proved reserves with production and also with oil price. The last increase will take a long time to be produced.

This small increase, which can be described as EOR done by a small operator which has smaller operating costs than a major and can affords more drilling.

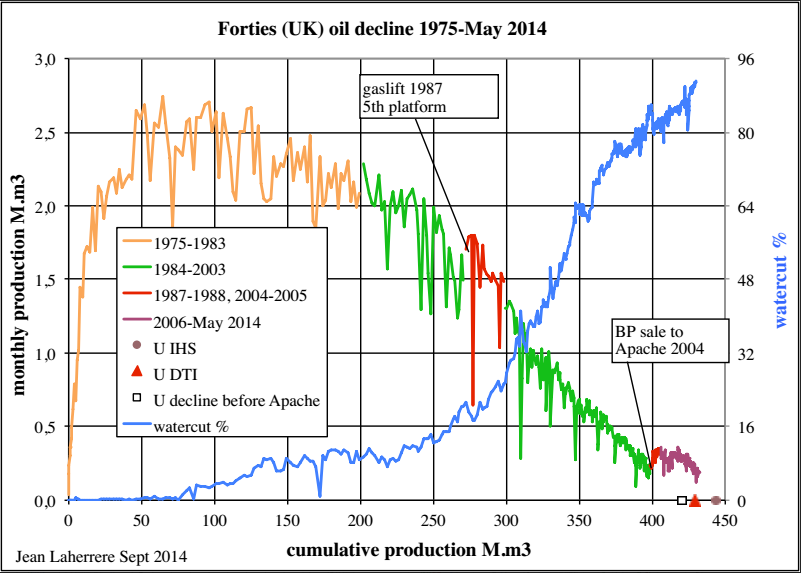

It remind the small increase in the North Sea UK Forties field sold by BP to Apache in 2004.

In conclusion it appears that the deepwater fields were overestimated, BOEM/BSEE are correcting theirs estimates.

In the world there was no giant discovery in 2013, the first time since 1903 and in the GOM the largest deepwater discovery was divided by half losing the volume of a giant field!

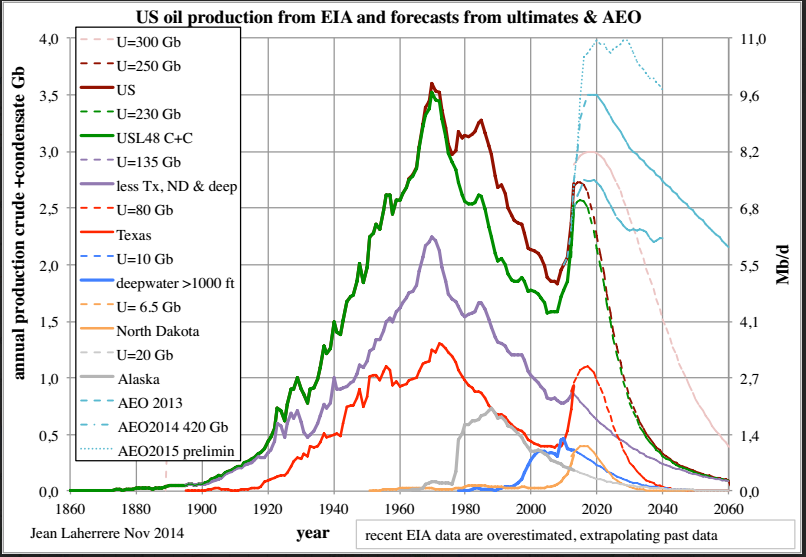

My last forecast on the US oil production is far from the last preliminary AEO 2015 and also from the official AEO 2014 which extrapolated needs an US ultimate over 400 Gb, when my guess is between 250 (adding the different estimates) and 300 Gb (global guess to take care of unknowns)

There was a guy who posted here who was aware of a new field of significant size GOM. Mississippi something. Not a new discovery. Just preparing to come online.

Oil is down 20 cents in Singapore with the dollar largely flat.

Watcher, How about the Deepwater Horizon which is (was) located in the Mississippi Canyon. I think some of the oil caught on fire. 😉

It wasn’t canyon. Something else.

Watcher,

Mississippi lime? It’s a Kansas/Oklahoma LTO unit.

No sorry guys. There was a poster here who was working or about to work what I vaguely recall as a shallow GOM play and he was quoting hundreds of millions of barrels estimated reserves.

I thought it was called Mississippi something, but not canyon. Though maybe it’s in the canyon and shallow. Just don’t recall. Did some searching using search above. Nada.

‘Hundreds of millions of bbls?’

A drop in the bucket.

Well, sorta, but for GOM totals it would matter.

About 17 Gb were produced in the Gulf of Mexico by the end of 2011, so 500 million barrels would be significant (about 3% of cumulative output).

It think Mississippi Canyon is correct.

http://en.wikipedia.org/wiki/Mississippi_Canyon

It being me.

Any body prepared to predict how the senate vote on the keystone will go?

It appears that it will take just one more dimorat to break ranks for the bill to pass. I have not looked into this situation at all closely and thus have no clear idea but it seems pretty likely to me that at least one or two more dimocrats will decide their own chances of getting re elected next time around will be improved by breaking ranks on this one bill.So I think it has a very good chance of passing -greater than fifty percent but this is only a personal seat of the pants guess.

All the pundits say that Obama will veto it if it passes and maybe he will. If so it will please his base but in my estimation hurt the chances of the democrats winning next time around. Their better course would have been to just give up on Landreiu as I see it. I hereby predict she will lose in a landslide either way.

Generally speaking I am of the opinion that the dimocrats while not as politically sharp witted as theyshould be ( hence my calling them dimocrats ) are still much more adept at political maneuvering than the repuglithans. But not this time around. This time the repuglithans win the propaganda battle hands down.

It appears the repugs have allowed the dimorats to maneuver themselves into a damned if they do and damned if they don’t dilemma.

I personally support strong environmental regulations but stopping this pipeline is not going to serve any real purpose other than perhaps as litmus test and as a line in the sand to rally the environmental troops.The tar sands oil is going to get to market no matter what, no matter how many speeches to the contrary are made.

If the democrats were not in this case dimocrats they would have used this issue as a bargaining chip to get some more money for parklands or renewable energy research or any other worthwhile purpose but it is probably too late for that now.

Harold Hamm told the GOP not to bother with it. He had a point. Some Bakken oil may use it, but it will take a long time to build and it’s not going to matter soon, and soon is all that may matter..

The overall bill is mostly trying to save Landrieu’s seat. She has a runoff in 3 weeks. She won Nov 6 by 1% with a third party guy getting 13% and since has been campaigning with the #2 guy, a Republican. She is going for broke sponsoring the bill to try to do SOMETHING to win.

Odds near zero.

I agree that Landreiu has a near zero chance of saving her seat.

But are you referring to her re election or the odds of the bill passing?

“The tar sands oil is going to get to market no matter what” “used this issue as a bargaining chip”

I couldn’t agree more with the statements above. The country already has tens of thousands of miles of pipeline running across it. It’s not like one more is going to make a difference. Controlling the flow of the oil will be much more important in the future for security reasons. Refineries on the gulf coast should be the cleanest in the world to process it. Pipelines are more efficient than rail. Plus, if something goes wrong. It’s in Republican territory. Which is better than in my backyard.

Nothing says fish oil like the GOM

It encourages me to see that at least one other person in this forum has enough raw basic survival instinct to understand that having that oil coming thru the US rather than leaving thru east and west pipelines inside Canada- which will surely get built if the Keystone does not- is critically important to the survival of YANKEES in this Darwinian old world.

There will be energy crisis after energy crisis eventually morphing into one continuous crisis barring miracles.Resource depletion and overshoot are as real as the giant hole in the Titanic and that oil in a sense is going to be a lifeboat for whoever has immediate access to it.

Ya know what they say about such issues in law offices.

Possession is nine tenths of the law.

There is another famous quote about such things in English history sorry I cannot remember the origin of it. But somebody asks somebody else by what right he claims possession of certain property.

The reply is famous .” By right of a strong right arm!!!” while brandishing the sword.

I do not wish to insult the readers and commenters of this forum who may see things differently but the only honest thing I can think of to say in this particular case is that if somebody believes in peak oil and economic and ecological collapse then they either must be terminally naive or just plain stupid if they do not believe there will be hot wars fought over access to oil.

The only thing that just might prevent the major powers from going at it directly is MAD- mutual assured destruction as the result of such wars going nuclear. The threat of MAD is credited by quite a few serious thinkers as being the only real reason the Soviets never invaded the rest of Europe after consolidating their newly gained empire at the end of WWII..

If WE have to have it to stave off collapse HERE and it is on the high seas that means attacking the shipping of other countries and starting WWIII.

If it is flowing thru this country and we have it inside our borders if other countries want it that means attacking the US mainland.

Dogs are always bravest and strongest in their own yards.This includes the dogs of war.

I have little doubt that a number of sleeper terrorists have been infiltrated into this country and that more are arriving but such individuals or small groups can’t do very much except piss us off. Killing a few thousand people means nothing in terms of the strength and security of a country with three hundred million except as a political statement.

Nobody is going to attack the US directly in the usual military sense of the word for the foreseeable future.IF we have that oil we have it and the rest of the world will just have to like it – and suck up to us politically hoping for a share of it.

This is not something that pleases me..I would rather there was plenty of oil for everybody to pull thru the next few decades without fighting over it..

There will not be any fight for the Canadian tar sands oil if it passes thru this country.

Now as to which is worse – collapse due to energy wars or runaway warming due to having fossil fuels- well about that issue I guess we are damned if we do and damned if we don’t .

My guess is that we will adapt on a world wide basis by burning coal and that oil shortages will make things worse rather than better in terms of climate.

Hi OFM,

You are probably correct that it will be better if the pipeline gets built, the oil will be used one way or the other.

One counterargument that I can think of is that the availability of this oil will tend to delay the transition that needs to occur.

I find that argument unconvincing because the price of oil is determined in World markets and the price of oil is the key.

An interesting fossil fuel forecast by Steve Mohr suggests that coal will peak before natural gas, with peak energy from all three fossil fuels (oil, natural gas, and coal) occurring in 2018 at about 260 Mboe/d (in 2013 consumption of fossil fuels was about 232 Mboe/d (boe is barrel of oil equivalent).

A summary of the thesis can be found at the link below, note that an exajoule (EJ) is about 5.73 Gboe, so for Mohr’s best guess scenario (case 2)

the URR of oil is 4200 Gb (including about 1000 Gb of shale oil, Green River shale mostly), for coal URR is 3400 Gboe, and for natural gas URR is 3000 Gboe (including 430 Gboe of coalbed methane).

http://www.theoildrum.com/node/6782

The full thesis can be downloaded at the link below:

http://ogma.newcastle.edu.au:8080/vital/access/manager/Repository/uon:6530

I place great weight on the argument that we need to transition away from fossil fuels as soon as possible for both economic and environmental reasons. Fossil fuels will not last forever and unfortunately runaway global warming is a near to medium term threat that may already be baked in.

BUT in order to survive the long term we must first get thru the short term and every five or ten years more of business as usual means the built base of renewable wind and solar power will be doubled even as the price of the technology continues to fall.

So as I the big picture we are in a race for the survival of life as we know it today in rich countries such as the US. I advocate keeping the pedal to the metal on all sorts of renewable investments plus building a new fleet of nukes as well as tough legislation involving the conservation and efficient use of all natural resources.

If we are very very lucky some of us will skinny thru but an outright collapse of modern industrial civilization world wide is a very real possibility. I think countries such as the US are likely to survive more or less whole while maintaining a basically civilized industrially based life style but there are so many possible things might go wrong that the odds of our pulling thru are impossible to estimate in my opinion.

But if I could lay a bet on it and live long enough to collect if I won I would bet three to two or maybe even two to one that the larger part of the US will have running water and grid juice and sewers and food in the stores and cops -maybe in military uniform- on the streets fifty years from now and a hundred years from now.

Cars running on oil or biofuels will be extremely scarce but there might be a lot of electrics. There will be oil enough real or synthetic and biofuels enough to maintain food production and distribution and essential infrastructure.Airports and resorts are not essential. Football stadiums are not essential.

Beer will be brewed locally unless it is hauled on trains. Food will come in returnable jars and boxes but hey we have to go back to the store anyway right?

I would also bet that desperately overpopulated countries such as Egypt will have suffered a major die off under Somalian like circumstances.

It is imo speaking as a real hands on plus professionally educated farmer than it is utterly impossible to transition back to any previous agricultural system and support the billions of people alive today. It is going to be industrial farming or starvation given the amount of land and water available and the unimaginable difficulties that would be involved in any attempt to put urban people back on the land by the tens and hundreds of millions.

Most of them would gladly starve fighting first in my opinion and the ones who would move would have no relevant skills no housing no transportation no machinery no capital and very little hope.

A time is coming when countries that import vast amounts of food are not going to have anything to exchange in payment for it and I don’tt think the rest of the world is going to be able to pay or even if able willing to do so.

Young Man At Heart (OFM),

We are on the same page here. The answers to the worlds energy and co2 problems are on the demand sided, not the supply side. The first step we need to do is transition to a near sustainable low energy transportation system(renewable). Personal expectations and old money fossil fuel industries are the biggest obstacles, not technology.

This is one time we can’t do the American thing and wait for the problem to become catastrophic before we fix it.

We are destroying our only mother earth. Population growth has to be addressed. It’s the root of the problem.

Right, it is the root.

And that gets addressed in China and India. Now explain how you will do that without using force.

And then when you realize you can’t, the correct conclusion is not that you have to think some more.

Population growth is at not the root, and even if it were, it’s already been addressed in China and mostly addressed in India: China has a very low fertility rate, and India’s fertility is dropping like a rock.

The problem is per capita consumption of fossil fuels. That’s pretty easy to fix, if we only choose to.

Nick, fixed your typo but I cannot fix your very obvious misunderstanding about world population. World overpopulation is the root of all our environmental problems. We are at about four or five times the long term carrying capacity of the earth. We are now well above the short term carrying capacity of the earth. A short term, in this instance, is defined as less than a century. And we are already well into that last century of exuberance.

In both India and China the water tables are dropping by meters per year. Land previously irrigated can now no longer being irrigated.

About every 30 minutes in India, a farmer commits suicide. In China the topsoil is blowing away and the Yellow River only reaches the sea in the rainy season.

I could write a book with stories about how our massive overpopulation is killing the planet. But some people just insist that there is no overpopulation problem. I will never understand that mindset. And just one more point. You wrote:

That’s pretty easy to fix, if we only choose to.

Do you actually believed the world is in its current condition because seven billion people chose its current condition? Or that they could change things if they simply “chose to”?

Hi Ron,

I agree there is an overpopulation problem at present, there are places such as Japan where population is declining, eventually this will happen everywhere. It may not happen as fast as is necessary, if not death rates will increase due to war, famine, and/or disease.

Chart below with Japanese population projection. Total Fertility ratio is less than 1.5 births per woman in Japan.

First, I was responding to the idea that something needs to be done in China and India. Fact is that they have done or are doing what needs to be done to stop population growth. The places that need intervention are in Africa and the Middle East: primarily, freeing women from forced child bearing.

Yes, we do have a choice. Our primary problem with sustainability is fossil fuels: both because they are limited and because they pollute. There are better and cheaper alternatives, which we don’t use for social reasons, primarily the resistance by minorities who would be harmed by change in the short term.

I place great weight on the argument that we need to transition away from fossil fuels as soon as possible for both economic and environmental reasons. Fossil fuels will not last forever and unfortunately runaway global warming is a near to medium term threat that may already be baked in.

BUT in order to survive the long term we must first get thru the short term and every five or ten years more of business as usual means the built base of renewable wind and solar power will be doubled even as the price of the technology continues to fall.

So as I the big picture we are in a race for the survival of life as we know it today in rich countries such as the US. I advocate keeping the pedal to the metal on all sorts of renewable investments plus building a new fleet of nukes as well as tough legislation involving the conservation and efficient use of all natural resources.

If we are very very lucky some of us will skinny thru but an outright collapse of modern industrial civilization world wide is a very real possibility. I think countries such as the US are likely to survive more or less whole while maintaining a basically civilized industrially based life style but there are so many possible things might go wrong that the odds of our pulling thru are impossible to estimate in my opinion.

But if I could lay a bet on it and live long enough to collect if I won I would bet three to two or maybe even two to one that the larger part of the US will have running water and grid juice and sewers and food in the stores and cops -maybe in military uniform- on the streets fifty years from now and a hundred years from now.

Cars running on oil or biofuels will be extremely scarce but there might be a lot of electrics. There will be oil enough real or synthetic and biofuels enough to maintain food production and distribution and essential infrastructure.Airports and resorts are not essential. Football stadiums are not essential.

Beer will be brewed locally unless it is hauled on trains. Food will come in returnable jars and boxes but hey we have to go back to the store anyway right?

I would also bet that desperately overpopulated countries such as Egypt will have suffered a major die off under Somalian like circumstances.

It is imo speaking as a real hands on plus professionally educated farmer than it is utterly impossible to transition back to any previous agricultural system and support the billions of people alive today. It is going to be industrial farming or starvation given the amount of land and water available and the unimaginable difficulties that would be involved in any attempt to put urban people back on the land by the tens and hundreds of millions.

Most of them would gladly starve fighting first in my opinion and the ones who would move would have no relevant skills no housing no transportation no machinery no capital and very little hope.

A time is coming when countries that import vast amounts of food are not going to have anything to exchange in payment for it and I don’tt think the rest of the world is going to be able to pay or even if able willing to do so.

Mac….re: XL

You will have the oil but will still have to pay close to world price for it. Remember, the shutoff/diversion valves will be on the Canadian side of the border. If US plays dirty with price (as they did with softwood lumber) I am sure the Chinese or someone else would be pleased to finance an eastern pipeline (Northern Gateway is dead in the water). New canal options being built, at least engineering is being done, as this is written. By the Chinese.

Before any of this is an issue Kinder Morgan is increasing pipeline capacity with transit through Vancouver up to an estimated 900 k bbl/day. Contentious, but I would think it will happen as First nations have mostly signed on who live along the route.

I do agree XL is important as decline and unrest sets in. However, that does not mean refinery export bans to landlock supplies in order to keep the SUVs on the road with lower than world gas prices. Everyone will have to change their consumption habits going forward.

paulo

Hi Paulo,

I do not think crude imported to the US from Canada is under any export restriction, in most cases the oil sands oil will be sold to refineries and there is no export ban on refined products, only on crude. The current make up of Congress may result in the elimination of any restriction on crude exports.

For now, there would be no problem with shipping Crude to the US from Canada.

As far as “owning” the oil, if the price is not right the oil sands can be sent elsewhere, by rail or other pipelines.

The US imports about 7 Mb/d of crude, it might as well be from our friendly neighbors to the North. The peak will arrive soon, then oil prices will increase and the transition can begin.

Even in Steve Mohr’s optimistic (case 3) scenario all fossil fuels peak in combined energy annual output by 2030, the realistic (case 2) scenario is 2018 (I think maybe 2020).

We really need to get cracking on wind, solar, and nuclear now, the sooner fossil fuel prices start to rise, the better, as it will push the transition forward.

I hope I have not given the impression we would get the oil at a discount or try to cheat the Canadians although hard ball politics are hard ball politics.

Having that oil coming thru the US means that when the shit hits the fan we have physical control of it- and oil is the single most important strategic material in the entire world given that food is produced in significant quantities just about every where there are people.

Navies run on oil. Armies run on oil. Economies for now and for the easily foreseeable future run on oil.Hitler invaded other countries as much for oil as for any other reason.

Who ever controls it when the shit hits the fan is in a substantially better strategic position. Of course the Canadians could cut it off and deny it to us but they aren’t going to build pipelines on short notice in time to change the strategic situation in a time of crisis.

And by the time they could build them we would probably be upset enough to say something along the line of ”you go ahead and load that Chinese tanker- but as soon as it is out of Canadian waters we are going to sink it since we are at war with China.”

A country dealing from a position of great strength can often avoid going to war at all. Of course I hope we will never get into another hot war with another major power but history isn’t over.

A lot has changed since WWII. The U.S. has hurt itself enormously by focusing on controlling all supplies, instead of becoming independent of it. Fortunately the U.S. Navy didn’t make the same mistake, and is much less reliant on oil in it used to be.

The US produces more than enough oil to proceed on a war footing.

Yes, like a junky robbing a liquor store to buy more heroin. Sounds like a good plan, but it has its down sides.

No Mac, you did not give that impression and I mistakenly gave Dennis the idea that I said/thought refined products are export restricted. I understand that they are not. Now. But, I was cautioning or expressing distaste about the idea of political forces controlling exports to keep prices low for political gain, (continued wasteful use of resources).

We pay far higher prices here due to our tax regime (my local price =$ 4.61 per US gallon)….in Canadian funds of course, which adjusted would still be roughly $4.05/US gal. Our tax rates help pay for our transit and infrastructure. In general revenue it helps pay for our socialized medicine program and other safety nets. Our Province has a balanced budget and Canadian budget is very close to being balanced after the recent debt crisis and recession.

There is much crowing in media about dropping gas prices. This is a mistake as far as I am concerned. I think the price should be doubled to restrict waste and promote alternatives to FF powered personal transport. If gas was $8.00 per US gallon we would have simple 100 mpg made in America cars that consumers could afford to buy and operate.

regards, paulo

Definitely with you on higher gas prices in the US.

I misunderstood both Glen with the “possession is nine tenths of the law” in his comment (or something to that effect), and you on the keeping prices export prices low (and you are correct that laws can change.)

I apologize to you both, I seem to be reading very poorly.

and writing poorly as well!

“and you on the keeping prices export prices low” should have been

“and you on keeping export prices low”

In the short term, the pipeline benefits Canada, not the US.

The US has far more oil than it needs to fight a war.

In the longer term, it would be far cheaper and better for the US to ramp up production of vehicles that use less fuel.

Reliance on oil is a bad idea. It’s promoted in the US primarily to benefit oil investors.

Let there be no mistake about it, Keystone will do nothing more than further erode WTI prices in the US and make it harder for domestic producers to maintain production levels. A number of pipeline projects recently completed have been able to mover more oil out of the Permian Basin and are draining Cushing like somebody pulled the plug in the bottom of a bathtub. All of that is going to Houston and Pt. Arthur and there is no more room for another stinkin’ barrel of oil, anywhere. Shale oil from the Eagle Ford once commanded an 8-12 dollar premium to WTI based on a posting called LLS (Louisiana Light Sweet); because of the surplus that is down to

< 3.00 dollars and falling.

Keystone, in spite the rhetoric, will get more Bakken barrels to the Gulf Coast, EF LTO will get blended with nasty Canadian bitumen and limited refinery capacity will be dedicated to Canadian oil and Canadian exports, not US oil.

Nobody in the oil business in the Texas or Louisiana wants this thing, I assure you.

Hi Mike,

The project will only allow an extra 100 kb/d to be shipped by pipeline from the Bakken, the bulk of the oil will be oil sands oil diluted with condensate (700 kb/d of the 800 kb/d capacity of the Keystone XL).

Wouldn’t the extra heavy oil from Canada just replace imports from Saudi Arabia and Venezuela?

Despite what the average American thinks, I am sure that you are well aware that the US still imports 6 Mb/d of crude, seems like it doesn’t matter much whether it comes from Canada or some other country.

The Bakken and Eagle Ford are unlikely to increase output much more (maybe another 500 kb/d combined). The Permian basin might grow a little (300 kb/d) as well, but within a few years the Eagle Ford and Bakken will be declining at 10% per year (probably 2015 to 2017 depending on oil prices). It is doubtful that other LTO plays will be able to keep US output at 9 Mb/d.

Also current oil prices will lead to reduced drilling in all the LTO plays, output will level off or decline and oil prices will go up, probably within 6 months, even if OPEC does not cut output.

Dennis, why do I always feel like you are lecturing me? Look, I don’t have the time to post 65 times a day, fortunately. When I do I am not trying to pick a fight, or prove to someone what I know, I am just trying to give some insight into the real oilfield. Not the oilfield people read about on the internet all day long; the real one, with real people and real problems.

I wrote that we are full up down here along the Gulf Coast, flooded, awash, floating in oil, sometimes we can’t even get oil out of the field anymore into pipelines at the end of the month because there is no more places to store the stuff along the Coast. Premiums to WTI are dropping like a rock. That is a detriment to the ability to sustain domestic production. If you think that there won’t be more than 100K BO per day ultimately stuffed in Keystone from the Bakken, instead of on rail cars, simply because Trans Canada says there won’t on the internet, you are wrong. We’re worried about it.

I am aware of current import levels to the US, thank you. I am also very much aware of the “give it to Texas, Texas will eat anything” mentality other Americans have. The infrastructure to move oil around this country sucks; it sucks because nobody else in the country wants refineries in their own yard. Keystone will just create more bottlenecks down here. If we have to keep that nasty bitumen crap in the North American family, build Keystone east, erect some refineries in Maine, or Vermont.

As an aside, your mention of Vermont in that context reminds me of what I’ve been hearing about with regard to some states, perhaps especially Vermont, that seem to be getting increasingly radical when it comes to local versus what corporations and national governpimps think they can get away with.

Thomas Linzey seems to be spearheading much of this, though I imagine it’s catching on quite a bit. I noticed his site highlights some (banned) fracking, but perhaps he’s nevertheless aware that, given its ‘numbers’, the current price of oil, recent climate-change alarm, etc., it seems kind of self-banning anyway.

Mike, here are some things about which you are right.

US refinery capacity 18 million bpd. Portion of that around TX/Louisiana/Mississippi — looks like 45%. That means one helluva lot of oil is being refined elsewhere and if that elsewhere is shipped to Texas, the capacity isn’t there to refine it.

One supposes the almost 1 million bpd refinery capacity of Illinois somehow can’t deal with Bakken oil, because that’s enough capacity to handle all of it — and it’s rather a lot closer to NoDak than Texas. That’s interesting on about 6 different levels.

Hi Watcher,

I will assume your refinery capacity numbers are correct.

PADD 3 (mostly Texas, Louisiana, New Mexico, and Gulf of Mexico) produced about 60% of US C+C output in August 2014, so having a fair amount of refineries (45% of capacity) near to where the oil production occurs, makes sense.

I don’t know why the Bakken oil doesn’t go to Illinois refineries, some goes to the east and west coasts. Perhaps the refinery in Illinois is set up for heavier grades of crude.

In fact the Midwest refineries take about 2000 kb/d of imported crude, probably from Canada, there is an excess of Canadian crude of about 700 kb/d that is probably already going to the Gulf coast refineries.

I am not sure that Keystone XL will change the amount of crude getting to the Gulf Coast, it may only make it cheaper to get it there.

In the short term the Gulf coast pipeline system may be swamped, longer term the LTO plays will start to decline and we will be happy to have the crude flowing to the Gulf coast from a stable neighbor.

My understanding is that the input to the Keystone XL near the Bakken can handle no more than 100 kb/d, 700 kb/d will be coming from the oil sands.

Currently we get about 2700 kb/d from Canada, and another roughly 2400 kb/d split in thirds from Saudi Arabia, Mexico and Venezuela (August 2014 4 week average data from the EIA).

The rest of the imported crude comes from Iraq, Ecuador, Columbia, Angola, and Kuwait. In August about 6600 kb/d of crude was imported.

Also some Canadian oil goes to all 5 PADDs, but almost all goes to the Midwest with smaller amounts going to the other 4 PADDs. Excluding Canadian imports, 3300 kb/d is imported to the gulf Coast refineries (with 700 kb/d from Mexico).

So I was wrong about 700 kb/d of Canadian oil already going to the Gulf coast, in August it was only 200 kb/d.

Sorry Mike,

I didn’t mean to offend. I am actually trying to learn. I do that by asking questions.

In the future, I will just listen.

Thanks.

“Nobody in the oil business in the Texas or Louisiana wants this thing, I assure you.”

Phillips 66 and Valero would love to see discounted dirty oil via pipeline from the Tar Sands connected to their refineries. They already have the means to process it.

Not everybody

Hi DTLC,

I think the oil producers are not keen on Keystone.

Dennis, we’re cool; you certainly don’t have to listen to me. I just try and keep it real. When I say oil people I was, of course, referring to producers, not the downstream folks, particularly high cost LTO producers, who are now loosing the WTI premium they once enjoyed…along with the 25% hit in NYMEX WTI. We (producers) all whine about oil prices but there have been a number of different circumstances over the years when just selling the stuff was problematic. Its getting that way now.

I take stock in Watcher’s 45% total refinery capacity in the 3 states he mentioned, and your 60% C+C for the states you mentioned. But everything in OK, and AK, Kansas, drains toward Houston as well, and then everything from Mexico, Venezuela, and from where else? to what total volume? gets floated into TX and LA from afar. The only point I wished to make was that though it may be in the long term best interest of America, Keystone is going to put more pressure on prices in the US. I believe that. It seems this subject is relevant to Mr. Laherrere’s fine work in the GOM.

I have seen heavy oil production in Venezuela, and tar sand stuff in Alberta… I love Canada but that is some nasty, ugly stuff they are doing up there.

Mike

I’m sure local American producers aren’t interested in a pipeline that could drive the price of oil down, but that’s not what the original statement said. There is a reason why we are all not businessmen. In free market capitalism, some of us get hurt and don’t recover. But for the big boys, it’s who has congress in their back pocket. Elections have consequences. The Irony of President Obama protecting Oilmen of the South from themselves.

Cookie

Well, the only thing I have in my back pocket is a rag to wipe my hands on, but I get your point, sir. The irony is that the Prez might axe the Keystone in the name of climate change, and in a small way, for a short period, help prop up domestic oil prices. I was just making an observation about how oily folks think about Keystone; in the long run, however, if it is the best thing for American, let ‘er rip.

But you gotta also admit how equally ironic it is that for the first time in oil history we have this big potential hydrocarbon resource (Bakken and Canadian bitumen) flat dab in the middle of North America, a lot closer to major concentrations of homo sapiens than Houston, but where is all going? Houston.

DTTLC,

D C–what he said. The producers are dead set against it. Rockman goes on and on and ON about it, and he’s an inside source, like Mike.

It always looked about politics to me, and jobs. You can win a lot of elections opposing that which everyone hates, and which the party in power has to embrace because it’s their policy — but eventually you have to govern and thus you need to present an alternative.

The general populace knows there are jobs in NoDak from the “boom”. The boom was the jobs, not the oil. Ditto the pipeline. Lots of jobs.

But again, nobody was elected with the pipeline as the centerpiece of their campaign. It is quite curious that this became issue numero uno for the GOP. Though . . . maybe Landrieu pushed the topic on the floor and the GOP decided to try to ridicule her for embracing a GOP issue.

Hi Synapsid,

Part of what I didn’t understand initially when I read Mike’s comment was how stressed the oil transport system has become in Texas, in the future I will try to read more carefully so I don’t say dumb stuff that comes across as offensive.

I have also heard Rockman say on several occasions that no oil producers in Texas were happy about the Keystone XL pipeline.

I think they like the idea in North Dakota and definitely in Alberta. 😉

Hi DC.

KXL would be helpful in N Dakota though, if memory serves, one of the proposed Bakken/Cushing pipelines did get some interest and might go; not sure.

A simplification I read today, of what Mike told us about oversupply in Houston, was “Let LTO be exported to get it out of the way, so the refineries on the Gulf Coast can concentrate on Canadian heavy.” I always fall for simple things that make sense to me, though I’m not successful at picking the winners. It’s a good thing I’m not in charge of anything.

Hi Synapsid,

I agree on allowing crude exports (if I am reading you correctly), we don’t really have the refineries and pipelines to handle it, the Gulf coast refineries (and possibly those in the Midwest) have been set up to handle heavy and extra heavy crude inputs. Send the light stuff to Europe where they have the proper refineries to handle light sweet crude.

No doubt I am missing something, but let the free market decide what makes sense, if it doesn’t work out, change the rules again.

Bottom line, there will be much less LTO than the EIA thinks, about 11 Gb combined URR from Bakken/Three Forks and Eagle Ford at $100/b (2014$), possibly up to 20 Gb if oil prices rise enough, probably another 5 to 10 Gb of LTO from the Permian Basin and maybe another 5 Gb tops from other US LTO plays (Niobrara and others).

The most realistic scenario at oil prices that the economy can deal with is about 20 Gb from all US LTO plays give or take a couple of Gb.

Exporting some of the LTO and importing heavier crude that our refineries can handle would seem to make sense, let the market decide.

Might new safety studies influence pipeline decision?

http://imarketreports.com/fight-brews-over-crude-rail-rules.html

“The regulator’s decision will be based at least in part on the testimony of a half dozen oil executives who urged the state to consider the conclusions of a study by the North Dakota Petroleum Council, a lobbying group for energy producers. That study found Bakken crude was no more volatile than other “light” crudes commonplace in Texas and elsewhere.”

“Concern about the reliability of those results prompted Canadian federal authorities to commission new tests, to be carried out later this year and in early 2015, that will use newer methods designed to prevent light ends from escaping.”

Perhaps some of what gets shipped by rail may not actually be “crude” . API < 45 or 50 ?

Looks like many Volatiles get stripped out before pipeline shipping.

Longtimber,

Pipelines can handle much higher vapour pressure than rail cars. As long as the high vapour gases can stay liquid in the pipeline, then they cause no problem. In fact a pipeline allows a greater quantity well bore products to be transported via one form of transport. The alternative, is to have a gas pipeline or rail/truck the NGLs out of the area.

They have the same issue offshore. A pipeline can take the high vapour pressure products, but if the oil needs to be transported by ship, then these high vapour pressure products to be stripped out, and flared, unless they have a gas pipeline in place.

From a safety point of view, the Bakken oil should be shipped by pipe, and the Tar sands by train. The heavy oil in a train crash, would be much less likely to burn, especially if the dilutent was stripped out, and would not flow on rupture of the tank car.

All true, but I’m intrigued that the Canadians noticed how the assay changed when it looked like the previous numbers would force the industry to fund rail car upgrades.

This Canadian assay upcoming will be very interesting. Gates and Buffett (as major rail owners) will be interested (and maybe involved).

Has this piece been highlighted? Some rather juicy bits:

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11231383/Oil-price-slump-to-trigger-new-US-debt-default-crisis-as-Opec-waits.html

”This rush to pump more oil in the US has created a dangerous debt bubble in a notoriously volatile segment of corporate credit markets, which could pose a wider systemic risk in the world’s biggest economy. By encouraging ever more drilling in pursuit of lower oil prices, the US Department of Energy has unleashed a potential economic monster and pitched these heavily debt-laden shale oil drilling companies into an impossible battle for market share against some of the world’s most powerful low-cost producers in the Organisation of Petroleum Exporting Countries (Opec).

It’s a battle the US oil fracking companies won’t win. ”

It has been highlighted. Later in the thread too.

Pretty much all it takes is to threaten the world with swap trigger and you get a bailout.

The Bakken is located in a place where it is strategic for military use. Air Force bases in North Dakota, South Dakota, Montana and Wyoming are going to benefit from an oil formation near their locations. The wells can be seized and guarded for military use, i.e. nationalization, if worse gets worse.

The oil is dynamite for producing jet fuel, 65,000 barrels per day are moved to a refinery that Delta Airlines is funding.

http://www.upi.com/Business_News/Energy-Resources/2014/07/21/Delta-sources-Bakken-crude-for-Pa-refinery/5281405951764/

The Air Force uses jet fuel, it is a no brainer that the oil will possibly be subsidized by the US gov, they are going to need it in the future and the future of the Bakken is a 100 year plan for oil and production.

It is there to stay and the producers will be subsidized.

The US gov benefits the most of all, a well-kept secret.

Anyone have a handle of actual yields for kerosene/Jet Fuel from LTO. It’s similar to diesel .. 6-12 C’s. I was under the impression that yield of such distillates was poor for LTO.

It is relatively poor compared to that which is relatively good (Libya). Further, Bakkan and Eagle Ford yields aren’t the same. And further, there is variance within the Bakken.

Of course, there is variance within Libya, too.

The question, and the overall API rating, and vapor pressure in the rail cars, and metal content, seems to be so delicate that obfuscation is all over it.

Bakken crude assay and comparison on page 21.

http://inside.mines.edu/~jjechura/Refining/02_Feedstocks_&_Products.pdf

If you look at the bottom of that page, it’s dated 2011, pre serious fracking.

I’ve seen a lot of these. They vary and there is disquiet in that the Marathon assay, which is somewhat definitive, showed problems with vapor pressure in a 2013 result, but Congressional hearings were scheduled for early this year (this was about the train explosions) and Marathon changed their page to show a 2014 result with less vapor pressure difficulty.

Europe has spiked the dollar and smacked oil down, just under 75.

Additive effect, Japan has re-entered recession, but no consumption data yet.

BRENT FALLS TO NEAR $78 AS JAPAN ENTERS RECESSION

http://www.cnbc.com/id/102189175#.

“Brent crude fell by more than $1 towards $78 a barrel on Monday after Japan, the world’s fourth-biggest crude importer, slipped into recession and as Saudi Arabia reiterated the oil price should be left to supply and demand.”

The BoJ is buying JGBs and even Nikkei ETFs. They’ll next have to buy the GDP declaring organization.

Okay, someone tell me what they think of Jean’s post?

Ron,

I really enjoyed it . I plan on emaiing Jean with a few questions. I do have one though.

Jean’s graph shows about 250 Mb total production to date. Is this correct? If so… looks like thunder horse was a big DUD.

steve

Excellent. I have been enjoying Jean Laherrere’s posts for many years. During the 90’s we had a connection through a mutual friend, L. F. Buz Ivanhoe. I do not speak or read French but I recall looking at some of the articles Jean published in French, just to see the graphs. Three years ago I had the opportunity at an ASPO meeting to sit at a table with Jean for two days. I can attest to the fact that in person, Jean is a charismatic gentleman. http://www.theoildrum.com/node/8397

My impression was delving into what happens if 1P becomes 2P as the decisive parameter for reserves determination is like delving into what happens when any definition on anything is changed.

You do it for a reason and the reason is usually to get a desirable headline. One shrugs and one also applauds the outrage — when is occurs, and one hopes it can be maintained.

There was no such thing as non GAAP financial reports 50 years ago. Now it’s harder to get the pure Generally Accepted Accounting Principles quote of earnings than it is to get the “ex items” quote.

Hi watcher,

That’s what the annual and quarterly reports are for, they always give you the GAAP financials. On the 1P vs 2P reserves, the BOEM has been calling 2P reserves “proved reserves” for years, so they have finally made this explicit, but the numbers were unchanged. Note that reporting of proved plus probable makes the most sense because this is the “best guess” estimate.

I am wrong on the 1P being called 2P in past BOEM reports,it is clear from Jean Laherrrere’s post that this change caused reserves to increase in the 2011 report relative to earlier reports.

I might be correct that Jean prefers 2P reserves over 1P, I think I have read that in the past, though I do not think he said that in this post.

“I might be correct that Jean prefers 2P reserves over 1P”

I doubt that Dennis. As Watcher might say: Just window dressing. I’ve yet to meet a geologist/engineer who would prefer to see the combined figure because P2 adds ambiguity to reserve numbers. What’s wrong with using two numbers and making your own decisions based to these?

Hi Doug,

Perhaps we have read different pieces of Laherrere’s work (I have not read all that he has written, and I do not understand French very well so I have only read what he has written in English).

My understanding is that Jean Laherrere believes that proved plus probable is closest to the mean estimate and it is what most of the world uses, besides the United States, for reserve reporting. The problem with using only proved reserves is that there tends to be a lot of “reserve growth” in the US because reserves are under reported by using proved rather than proved plus probable. In fact when the USGS did its World Petroleum assessment in 2000, it took the supposed reserve growth in the US, which was base on proved reserves and applied that rate of reserve growth to the rest of the World where proved plus probable reserves is the norm.

To my knowledge when Jean Laherrere reports “technical reserves”, they are based on the scout databases plus adjustments for OPEC “phantom reserves” (about 300 Gb) and deducting oil sands (175 Gb) and Orinoco belt (200 GB?) reserves and are closest to 2P reserves (such as those reported by Norway and the UK).

There is a huge difference between the political/financial proved reserves in brown, which has always increased since 1947, and the confidential technical 2P reserves in green, which has been decreasing since 1980. This graph explains why most economists do not believe in peak oil. They rely only on the proved reserves coming from OGJ, EIA, BP and OPEC data, which are wrong; they have no access to the confidential technical data. Economists ignoring peak oil do not think wrong, they thing on wrong data!

Quote is from http://www.theoildrum.com/node/10009

Chart referred to is below.

I also admire Jean’s work, and enjoyed taking to him at an ASPO meeting, However, I struggle finding a conclusion in his long posts with multiple complicated graphs. When I finished this one I thought – so what does all of this data mean. I wish he would wrap it up with his conclusions.

Yes, I came to exactly the same conclusion.

I was going to say the same thing but chickened out 🙂

Isn’t that last chart, with the rather rapid near term decline, the conclusion?

Hi Patrick,

I thought he wrapped it up so nicely, I was at a loss for what to say.

Which is usually a good thing. 🙂

Hi Ron,

Jean’s post was excellent as always.

I read up a little on the Gulf of Mexico, so I could comment semi-intelligently.

Jean’s analysis follows the BOEM’s reserve outlook fairly closely where 2P total reserves (cumulative production plus remaining reserves) are 22 Gb at the end of 2011, his analysis anticipates future discoveries of about 2 Gb.

When we look at how the total reserves have changed over time they roughly doubled from 1985 to 2008, but since 2008 total reserves have been flat (a slight increase of 1 Gb over the 2008 to 2011 period). From that perspective Jean’s URR of 24 Gb makes perfect sense.

Link to reserve report below:

http://www.boem.gov/BOEM-2014-656/

A second report from the BOEM considers resources and what might discovered in the future as well as potential reserve growth.

I will focus only on the central Gulf of Mexico, where most of the cumulative production has occurred so far in the US. The undiscovered technically recoverable resources (UTRR) in the central Gulf of Mexico are expected to be between 23 Gb and 41 Gb at the 95% and 5% probability levels, with a mean of 31 Gb. The report also considers undiscovered economically recoverable resources (UERR) at various oil price levels, for the central Gulf of Mexico at an oil price of $30/b (and a gas price of $2/MCF) the UERR is 21 Gb. In table 3 of the resource assessment 9.5 Gb of reserve growth is expected (this is most likely the mean value), at the 95% probability level the reserve growth would be about 6 Gb. A fairly conservative estimate of future discoveries (including reserve growth) based on this report would be about 27 Gb in the central Gulf of Mexico, quite a bit larger than Jean’s estimate. Report at link below:

http://www.boem.gov/2011-National-Assessment-Factsheet/

A more detailed report for the geologists at the link below:

http://www.boem.gov/uploadedFiles/BOEM/Oil_and_Gas_Energy_Program/Resource_Evaluation/Resource_Assessment/GOM-2011-NationalAssessment.pdf

From the last link in the appendix are detailed tables with total reserves of 32 Gb for the central gulf of mexico (including 9.5 Gb of reserve growth) and a UERR at the 95% probability level of 15 Gb @ $30/b and 18 Gb @ $60/b for a total endowment of 47 to 50 Gb at conservative oil price levels and a 95% probability level.

My guess is that Jean does not trust the probabilistic methodology used in these types of assessments.

Wood Mac: Gulf of Mexico oil production fades

Energy consultant group Wood Mackenzie said it expects U.S. Gulf of Mexico oil production to enter a period of decline after peak output is reached in 2016.

New fields — Heidelberg and Jack/St. Malo — should boost output from the Gulf of Mexico with 115,000 barrels of oil equivalent in new production by 2016. Overall production, including the expansion of older fields, means output from the Gulf of Mexico will pass a peak first set in 2009.

“We expect production from 2014 to 2016 to grow 18 percent annually,” analyst Imran Khan said in a Thursday statement.

After that, the analyst group said a steady level of investment will be needed to sustain production from the gulf basin. Several new discoveries have been made in deeper waters, where development can cost as much as three times higher than elsewhere in the region.

Following on from the idea that some have on this forum that the US government will intervene (via the Fed etc) to prop up shale production as it crashes due to low oil prices it seems Knustler is also of similar opinion. See the end of the following article: http://kunstler.com/clusterfuck-nation/the-instability-express/

Ya Deutsche Bank has been beating this drum. If systemic risk exists then the Fed would move. Congress and the Prez aren’t going to do anything for a minimum of months on something like this.

Speculating on mechanism, the shale industry isn’t going to receive directly printed dollars from the Fed. The bonds already issued by the industry would be bought by the Fed, and if those bonds default the Fed won’t declare default. Any other bondholders who DO want to declare default (a declaration of default triggers swaps) would also have THEIR bonds bought by the Fed, at probably whatever premium the bondholder wants to gouge out.

When systemic destruction looms, you do not quibble over price. They may get paid triple face amount just to get it out of their hands and into the hands of an entity who won’t declare default.

So then we would have the bizarre situation where the bond issuers try to buy back their own bonds in order to sell them to the Fed at triple price. And . . . the Fed would do it to avoid the default swaps triggering.

There are supposed to be swap regulating agencies around, but there’s no international coordination. A swap can be written in Malaysia for Continental Resources.

Reiterating from days ago . . . junk isn’t usually swapped and shale is funded with HY (aka junk) bonds. But . . . who knows.

Or to expand upon Knustler the Fed just buys high yield junk bonds (of various types) to disguise the fact that its specifically a shale crash intervention.

Ya, but the point is . . . from whom do they buy?

Present lenders about to be defaulted on will be delighted to sell. But the whole field only grows production and the whole operation only works if they can sell more bonds (borrow more money). So . . . then you are faced with the question, will private lenders continue to lend because they have faith in the Fed’s backstop?

Or will the Fed have to be the buyer of future bond issuance?

Like I said, from whom will the Fed buy.

Oddly easy to become anonymous, maybe not, just a cookie clear.

The one sentence that stands out:

In the world there was no giant discovery in 2013, the first time since 1903 and in the GOM the largest deepwater discovery was divided by half losing the volume of a giant field!

PEAK CHOCOLATE?

Comment from my wife: “Well Doug, if you’re going to waste three hours every day commiserating with your Peak Oil buddies maybe I’ll be forced start a Peak Chocolate Blog.”

WORLD’S LARGEST CHOCOLATE MANUFACTURER ADDS VOICE TO WARNINGS OF ‘POTENTIAL COCOA SHORTAGE BY 2020’

http://www.independent.co.uk/life-style/food-and-drink/news/worlds-largest-chocolate-manufacturer-adds-voice-to-warnings-of-potential-cocoa-shortage-by-2020-9864437.html

“The Switzerland-based Barry Callebaut Group has joined a host of industry experts in expressing concerns about “a potential cocoa shortage by 2020”, which has contributed to cocoa prices rising a staggering 25 per cent in the past year.”

Don’t worry – higher prices will just help the chocolate industry to refine their technology. Any day now, I expect to here on Fox that Hershey’s has started some horizontal growing and cocao bean fracking in the “Bakking” region of ND. There might be a problem with excessive aroma flaring, though. Not sure if the RR’s will start stocking up on more cocoa butter tank cars, nor if the current cars are rated for the more-volatile LTC that is produced with this new technology.

Food forest gardens. Vertical argiculture. Permaculture.

Cocobutter to that, I say, cocobutter to that. ^u^

As seen from space…

The style-shift of the font looks suspiciously like an effect (on a particular local) of some of the aroma-flaring.

It’s hard to write with a mouse… and my handwriting is cryptic at the best of times. : )

Now time for more chocolate.

Wonder if that Bakking chocolate is organic and fair trade?

It’s hard to write with a mouse… and my handwriting is cryptic at the best of times. : ) ~ aws.

Really? I mean, take a look at your inability to even close your html

tag at your other comment… Nice try, aws, but the other explanation seems the more plausible. ;>Pipeline Alert From Federal Regulator Is First of Its Kind

Reversing oil and gas pipelines or changing the product they’re carrying can have a ‘significant impact’ on the line’s safety and integrity.

By Elizabeth Douglass, InsideClimate News

Kinder Morgan is adept at socializing costs and capitalizing profits. Nothing in the Trans Mountain expansion that’s good for B.C., or the nation as a whole.

Trans Mountain Pipeline: Big Bucks for US Investors, Peanuts for Us

Thanks to clever US owner, firm pays minimal taxes here, sometimes none.

By Robyn Allan, Today, TheTyee.ca

Is there some reason the Canadian government cannot put a some additional Canadian taxes on the pipelines located in Canada? If the companies that own them are making big profits they can easily afford to pay more to Canada.

Hi Old Farmer Mac,

The Canadians may feel that it is not fair to change the rules of the game.

I am not familiar with these particular pipeline deals, but there are cases where tax breaks are given in order to sweeten the deal. Pipelines are expensive to build and profits are not assured, the Canadian (and provincial) government may want to wait until all the pipelines they need have been built, then the rules can be changed.

The Japanese are reacting to their recession (2nd consec neg quarter announced last night). The relevance is future consumption. Here are the gems:

Japan PM Abe plans to scrap the condition linking sales tax increase to the economy. Finance minister agrees.

[Phase 1 of that fired off about 10 months ago and clearly has gently attenuated (aka smashed) retail sales. Phase 2 was to begin mid next year as I recall. A condition allowing that only if GDP were X% is going to be scrapped. They gotta have the money fiscally. This obviously means they are going to tolerate further weakening (induced) in the economy, which should smack oil consumption, price and North Dakota. (The really ugly news in this ideologically is the somewhat outright proof that a tax increase eroded economic activity, to which some will say duh, and austerity, in that order.]

Nomura has halved its 2015 Japan growth forecast — and that Ransquawk was pulled a few minutes ago. Someone was off the narrative reservation.

Helicopter Abe has ordered the cabinet to follow-up on Oct 31’s monumental BOJ QE (remember that, all of 2 weeks ago) with plans to hand out BOJ printed-money gift cards to the poor in order to stimulate retail sales. And the thing is, 9 years ago this would have been grist for undergraduate comedy sketches. But hey, maybe the gift cardage will get spent on gasoline, to save the Bakken.

Oh cool, Ransquawk restored.

Nomura reducing previous estimate of 2015 growth of 1.7% down to 0.8% and . . . hahahah . . . they see further BoJ easing coming. Ink is infinite.

Hi Watcher,

The sales tax (if it is structured in a similar way to US sales taxes on a simple % of the sale)is a regressive tax. So what this shows is that when you shift the tax burden to the poor, you reduce economic growth. When taxes are progressive (where the burden is shifted to the wealthy), there is much less of an economic effect to a tax increase.

Generally speaking a tax shared equally (say a flat income tax) would probably be fairest and would certainly gave the effect that it would reduce spending and growth, unless any tax increase was matched by an equal increase in government spending where the increased tax revenue is simply spent by the government.

Part of Japan’s problem is declining population and an aging population so the size of the workforce is smaller. They should probably change their GDP metric to GDP per capita or even GDP per working age person (15-64).

This may also be somewhat of a problem in Europe where population growth is low, but there is more immigration to Europe than Japan so population is still growing for Europe as a whole.

The sales tax is not evenly applied across income. The stages of imposition are two fold, 8% since hmm 2012 as I recall and 10% Oct of next year. The 10% has been suspended in the recent move — and given that and recent cabinet scandals Abe is calling a snap election to reset the parliamentary democracy clock on elections. His personal popularity is around 50% and falling. Now is the time to have elections before it gets worse.

These are not stupid people. They know taxation withdraws money from GDP. The BoJ doesn’tt buy JGBs because it’s fashionable. They buy them because they run enormous deficits from spending on all sorts of projects already authorized. They don’t lack for spending.

They lack for oil. Period. There is no fix for this.

http://www.businessweek.com/articles/2014-11-17/halliburton-merger-with-baker-hughes-driven-by-cheap-oil-fear

“So Halliburton needs a dance partner. Combining with Baker Hughes makes a lot of sense. It will insulate both companies from a pullback in drilling and potentially allow them to keep prices higher than they would’ve been if they were forced to compete for declining demand.”

“there is real concern that at some point soon, oil will become too cheap for many companies to drill for it profitably.” Hello , SOP in the Patch… But but in the petro pre bubble age, few gave a flip. So Drill Baby Drill now shall be .. Merge Baby Merge

Big Big Deal if the DOJ goes along… Who you going to call? HAL, SLB

Upside down…

http://cci-reanalyzer.org/DailySummary/index_ds.php#

aws,

Thanks for this. Cold air moves out of Canada, hm, air from somewhere has to replace it…how ’bout from the North Pacific?

Gross simplification (using that word a lot lately) but maybe gives the idea. Maybe.

When Eastern North America was so cold last winter there was a heatwave in Europe. I live on the 51st parallel and it didn’t freeze all winter at my house.

Simplification it may be but it satisfies me and anyway everything in the world need not have a complicated explanation.

The ” why” may be pretty complicated of course.If this pattern becomes common in the spring or fall it will probably contribute enormously to the overall warming trend by reducing snow cover and encouraging earlier and later vegetative growth up north.. There will be more open water earlier and later and less ice in the spring and fall..

These changes will almost for sure overwhelm any increase in ice and snow cover and longer winters down south in the forty eight.

Explaining this sort of thing to somebody freezing in Chicago is not going to be easy.

Synapsid,

You have it about right. From Dr. Jeff Master’s blog…

Sorry Ron, I didn’t close the <a> properly.

What is actually happening is the Jetstream over the US (and other places) has changed. Very similar to last year, the Jetstream is both slower and truncated so it does not move south far enough to warm the east coast. The southernmost position is mid US generally under these conditions.

The artic is getting streaming off the warmer Pacific and Atlantic oceans.

In the meantime the stream coming off North America heads east across the Atlantic and bends south as far as North Africa where lately it seems to shed streamers due north up the Euro coast and GB. Thus giving them some warming.

All this could shift but if the current trend continues through the winter, that will be over two years that this pattern has held in North America.

Reminds me of that “chaos pendulum” swinging erratically…

Two winters ago, there was warmth and hardly any snow in the Eastern States/Canada, with a few summer days in March, and when the ‘pendulum’ starts its erratic swings “back”, I wonder if the upcoming hurricane season, or the following one, is going to be the 100 or 1000-yearer.

I now live on the coast, if in Nova Scotia, but if everything’s shifty, what was once the normal epicenters or touchdowns, might shift here… not that that’s not like trying to make sense of or predict chaos…

Which also reminds me a little of some of the dialogue about the “market”…

Maybe ‘we’ could borrow some of the energy of the upcoming years’ hypothetical hurricanes to offset their fury, or at least make it look that way…

Two news for your information:

Russian gov’t vows to support oil producers

Iraq and Kurds Reach Deal on Oil Exports and Budget Payments

Other point: Are current efforts to sign an agreement with Iran a sign of imminent peak oil? Or a way to put pressure on Saudi Arabia?

Final effort in US-Iran nuclear talks could settle 35 years of enmity and help defuse Middle East

An agreement with Iran can probably postpone peak oil by one, maybe two years.

Redundancies appear to be picking up steam in the exploration industry. In getting whispers that western geco are shedding 10% of UK staff, and possibly US to. I wouldn’t count on there being quite as much exploration in gulf of Mexico as there has been the last decade or so.

Personally I’m not sure right oil will be where the big declines come from. Lot of marginal conventional products are being hit hard at the moment.

Regardless, maybe time for a career change!

”Lot of marginal conventional products are being hit hard at the moment.”

I am not a number cruncher but I do read a lot of stuff written by the numbers guys and it is for sure my impression that some conventional oil producers are in the red zone at eighty bucks- especially the ones in deep water.Producing deep water wells will no doubt be kept in production – but if it really costs eighty bucks or more to get new deep water oil to market- new wells are going to be put on hold for some indefinite period of time until the bean counters get over being afraid the price will go down on them .

I have no real idea how long that might be but I am guessing that it will take at least a year of steady or rising prices for them to get comfortable with spending the money again.

Depletion never sleeps.

I’m at petex today, the UK’s largest industry conference of the year. The keynote speakers this morning were somewhat downbeat

Hi Sam,

Does the $80/b estimate for a new deepwater project to breakeven sound right?

I assume you work in the North Sea, but would think the prices would be similar in the Gulf of Mexico. When I say deep I am thinking 800-1600 m of water rather than the ultradeep (>2400 m) projects which might require higher prices. You’re an exploration guy (I think) so I thought you might have some idea.

Dennis,

I’m mostly involved in seismic, so don’t really get that involved with project economics. However given what I’m heading from various people the smaller deep north sea deep prospects would really rather struggle at 80 I think.

However petroleum tax here varies from 60-80% so differing tax regimes might come into it somewhere, as well as protect size of course. I certainly think lots of the more marginal stuff that people were looking at 2-3 years ago is probably being put on hold.

Thanks Sam.

I am not in the industry, so I was pretty sure that you would know more than me, and I was correct. Hey, it happens from time to time. 🙂

Anybody still talking UK shale?

There were a few technical posters up about shale but there was nothing really of note. There’s a 2 1/2 hour debate on the technical feasibility of shale in the UK on Thursday but unfortunately I won’t be there for that. However I exist I’ll be able to pick the brains of someone who goes at some point.

Should be good to hear how that flows. British shale drilling was supposed to be their jobs boom.

If we do get any shale drilling here I reckon it’ll be more on the scale of Poland than the USA. Population density is just too high, and there’s not the mineral rights, nor the experience or available rigs. Anyway the odds of it coming close to offsetting north sea decline seems minimal.

And Poland is pretty much as bust, by most accounts.

The salt dome is massive. Millions of years of accumulation of deposits at a hundred feet for every million years, the salt dome possibly reflects 160 million years of duration to make it all the way it is. Count 40 million years of ice ages, the seas will wax and wane in levels. You’ll have die-off of marine life. You’ll have a new continent with no Bering Strait. The water frozen in ice caps thousands of feet thick will make the world a much different place. Ice ages contribute directly to the formation of oil.

Another ice age, more oil.

Check your timelines.

Well then, up to ten million years old, 1600 feet for every one million years. Those ten million years include one ice age for two million of those ten million years.

I just like fiddlin’ with numbers and see what they do, not that they’re at all accurate, which they’re not, but it’s still fun.

Interesting item about Saudi Arabia that someone posted on Peakoil.com:

http://www.bbc.com/news/blogs-trending-30047096

Maybe one or two percent of the little people in places such as Saudia Arabia will have the good sense to get out while the getting is good as the oil starts running short. The other ninety eight or ninety nine percent will wait until it is too late and getting into another country is going to be very hard to impossible.

The ruling class – that part of it with brains and cunning at least- will make it out having already taken care to buy property and get the necessary paperwork started and make business and political contributions and friends in the countries they will be moving to. But if I were to guess at how many have brains enough to have done so- I would say not over ten percent of them.

Interesting 60 Minutes story on US and global groundwater depletion:

http://www.cbsnews.com/news/depleting-the-water/

This old farmer has a lot to say about oil but I have never claimed any expertise.I only know what I read on sites such as this one and from reading a few books specifically about the subject when it comes to oil.

But I will never have anything to say about agriculture than you can’t take to the bank.

We are collectively in one hell of a fix when it comes to water for irrigation and so far as I can see there is essentially zero hope the aquifers that are being pumped dry will refill within any meaningful time frame. Some of them will take tens of thousands of years to fill again once pumping stops and hardly any of them will regain any water even in a somewhat wetter than average year for a couple of easily understood reasons.

First , once farmers in a general geographical area are equipped to irrigate some of them are going to find it profitable to do so even when the rainfall is adequate or even somewhat above normal because there are usually some dry spells during the course of a year – and putting the pumps on during that dry spell- once the pumps are in place- costs very little in comparison to the value of the extra yield.So a crop that would have done ok even though there was a three week dry spell will not be allowed to go without water for more than maybe a week to ten days- at that point unless the weather forecast is for a good rain at close to a hundred percent probability the farmer will fire up his pumps because a gallon of diesel that costs three or four bucks will bring in five or ten dollars of extra yield.

Second the land area under cultivation is constantly increasing just about every where except close in to cities where farmland is being lost to development or to desertification. The more land is put into cultivation the more water is pumped. A county in the American mid west that had ten thousand acres under cultivation a decade ago is almost for sure to have more than that in crops now.This hold true just about anyplace where farming is practiced on a commercial basis. The only likely exceptions are places where there simply isn’t any land left to put to the plow that is not protected by being part of a nature reserve of some sort. And even such land that is theoretically protected is in actuality quite often being converted to farmland on an ongoing daily basis.