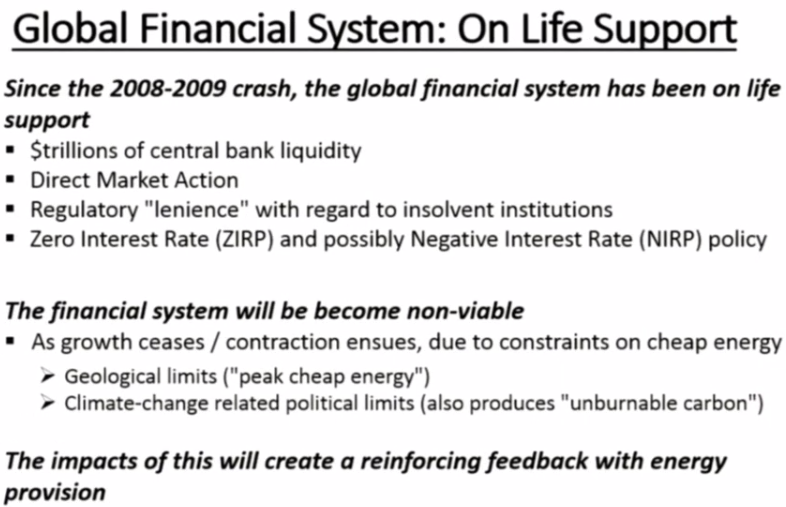

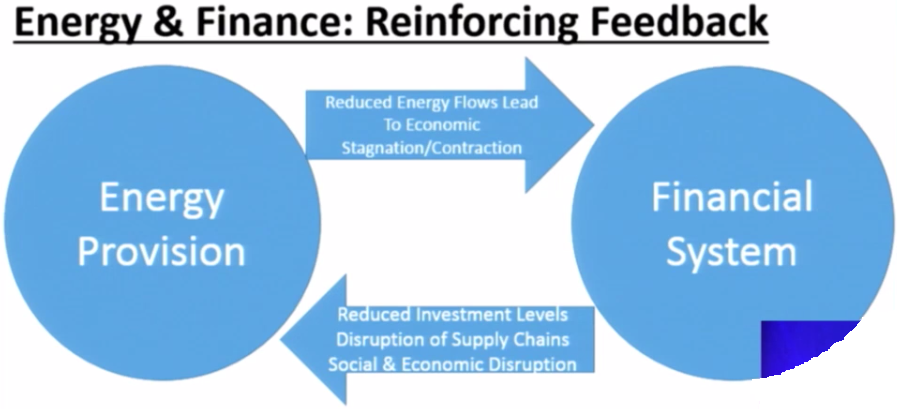

Yesterday I watched a short web video that blew me away: Global Financial System: On Life Support. Then I watched it again, and again… It is only 12 minutes long. The crux of the presentation was not only that the global financial system is on life support but also that the financial system is dependent on energy flows into the economy and energy flows are dependent on a healthy financial system. That is they are co-dependent upon each other.

About two centuries ago, a new financial system was required:

To concentrate and direct the vast amounts of capital needed to exploit fossil fuel resources.

To fund the exponential growth that these energy resources facilitated.

The crux is a vast amount of capital is needed to fund the fossil fuel industry and…

Vast amounts of fossil fuels are needed to feed economic growth of the economy.

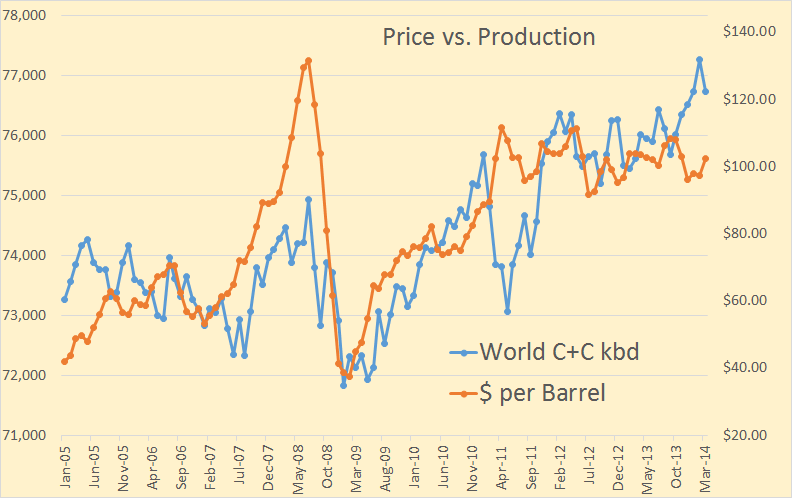

Economic growth is driven by cheap fossil fuel, primarily cheap crude oil. If the price gets too high the economy suffers. Less oil is consumed at this price so the price collapses. When the price collapses a production decline inevitably follows. And when the price rises again, a production increase will follow… if there is more oil to produce at that price.

But with oil at $100 a barrel the economy is still very sick. Doctor Fed is on the job. QE1 was followed by QE2 and then QE3 but still the US economy shrank by 1% in the first quarter of 2014. The economy needs another transfusion of Quantitative Easing blood money to keep it alive.

For those who are not sure what Quantitative Easing is, The Economist explains:

To carry out QE central banks create money by buying securities, such as government bonds, from banks, with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased—hence “quantitative” easing.

That helps but lowering the interest rates is supposed to help also. But with interest rates near zero and the economy flooded with QE money, the economy is still on life support. More money, and I mean a lot more money, is needed to coax more fossil fuel from the ground.

World needs $48 trillion in investment to meet its energy needs to 2035

Meeting the world’s growing need for energy will require more than $48 trillion in investment over the period to 2035, according to a special report on investment released today by the International Energy Agency (IEA) as part of the World Energy Outlook series. Today’s annual investment in energy supply of $1.6 trillion needs to rise steadily over the coming decades towards $2 trillion. Annual spending on energy efficiency, measured against a 2012 baseline, needs to rise from $130 billion today to more than $550 billion by 2035.

Two points, that kind of investment is highly unlikely to happen and even if if it does it is highly unlikely to have the desired effed. Steve Kopits, in a new video explains. The video is divided up into two parts of about 20 minutes each.

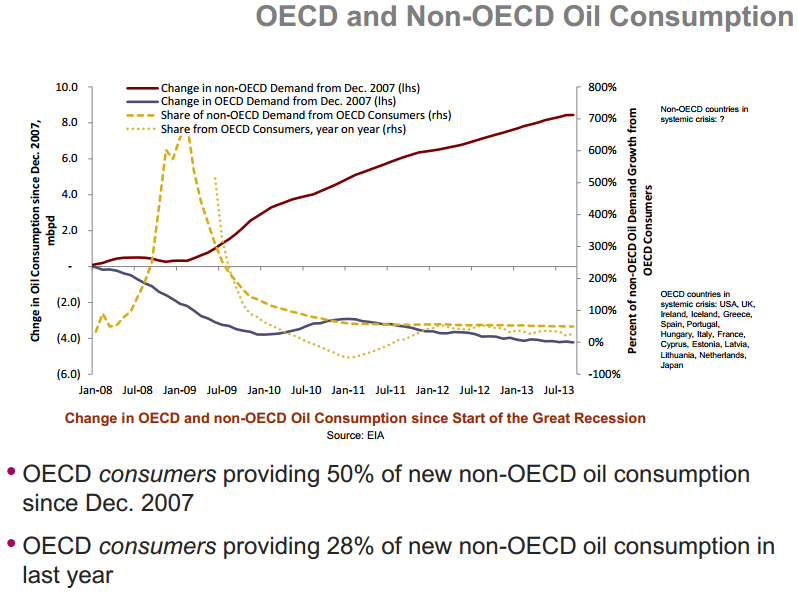

But what countries are on life support and which are not? Steve Kopits does not use the term “life support” but would rather describe it as “experiencing a crisis”

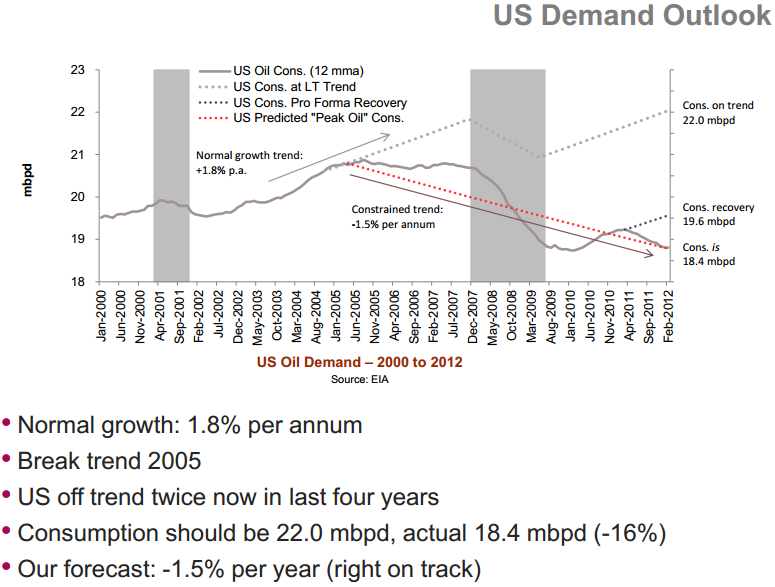

The above chart shows the change in oil consumption, since 2008, of all OECD countries versus Non-OECD countries. Every country that experienced a crisis, beginning in 2008 was an OECD country. None of the Non-OECD countries experienced a crisis in 2008.

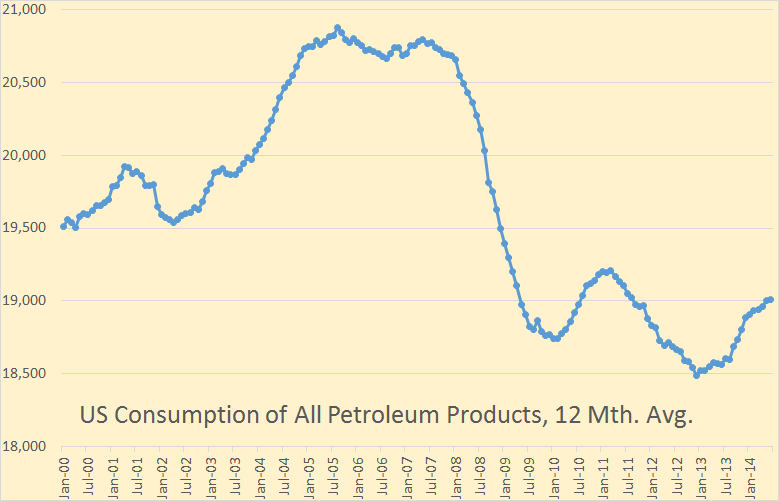

The above chart is the US version of the previous chart. US consumption of petroleum products peaked in 2005. The blue dotted line shows the trend US consumption should have taken, and would have taken had not oil prices started to rise. There would have been a correction in 2008 then consumption should have continued upward beginning in 2009. But that is not what happened.

US consumption has turned up in the last year and a half. Kopits cannot explain this but says the same upturn is not found in European nations. They are all still right on the red line on the chart above this one.

Beginning at about 6 minutes into part 2 Kopits disucsses Manifa, Saudi deep water oil and the marginal cost of oil production in Saudi. This is extremely interesting and confirms what I have been saying about Saudi for years now.

Incidentally almost everyone mispronounces Manifa. It is pronounced Ma-nee’-fa. The emphesis is on the middle syllable, not the first and last.

Steve Kopits’ presentation is pretty much an updated and abbreviated version of his previous “Oil Is A Binding Constraint On Economic Growth” presentation with a bit about Saudi Arabia added. It is nevertheless a worthwhile effort to watch it. But the first video link up top, Global Financial System: On Life Support, is a must watch. One can deny it but the logic presented is extremely hard to argue with.

Howard and Elizabeth Odum wrote of “A Prosperous Way Down” and their heart was was in the right place. But there will not even be a kind or gentle way down and it most definitely will not be prosperous. The reason, or one of the many reasons, is that we have an economy that depends on growth. We have a debt based economy and a debt based economy must grow or collapse. The end of growth is the beginning of collapse.

This gives good support to the various ‘shark fin’ oil production predictions some of us have.

Fuser…. BINGO.

Ron…. great post. I haven’t had the opportunity to watch Steve Kopit’s video as I have the worst internet service on the planet. I have to wait until I go into town to watch long videos.

Anyhow, I made reference to this in your prior post. Not only is the United States being propped up by the Fed’s EASY MONEY POLICY, but the massive derivatives market was designed (probably ignorantly) to siphon funds away from the physical-productive sector and into the FINANCIAL LEECH SYSTEM.

Thus, we have to idea how much goods and services really cost in a free market… because derivatives destroyed the FREE MAKRET altogether.

I know some pretty high up people in the precious metal industry and let me tell you, the end of 2014 looks to be quite explosive. I am not saying this as it pertains to gold and silver, but rather due to geopolitical and market events.

I just had a three hour conversation with an individual who was right in the THICK OF IT when the derivatives credit default-interest rate swap market began. Let me tell you, things today are orders of magnitude worse than 2007-2009.

The Ironic thing we both agreed on is the amazing ability for most people to SHUT THEM EARS when the discussion of gold and silver arises. Now, I can see someone saying that about me as I am just an independent researcher, but this chap GOTS THE WALL STREET KNOW-HOW.

I will end this SOAP BOX diatribe by saying…. at some point in time the Financial System will CRACK, and when this occurs, it will be too late to GET OUT OF DODGE. Again, the irony of it all is watching it happen to friends and family.

I won’t repeat this again… MARK ME WORDS.

steve

Ron….Jesus Christ, when are you going to get an EDIT FUNCTION…LOL. I would gladly throw in a few bucks.

steve

Aaaaha….the Angel of Doom appears on his red-eyed fire-breathing stead.

Hi Steve. Actually I concur with the negative sentiments being expressed except ones purporting to predict how things will play out: Since I’m a fan of Chaos Theory and negative feedback loops.

My sharp accountant insisted many years ago that economic stability is impossible without growth, endless never ending growth. Obviously that’s impossible, so the best (actually all) you can hope for is growth within your family’s lifespan; a forlorn hope I suppose.

Trouble is, there are just so many things, really big things, going wrong (being done to) with our planet.

Doug,

Yeah, I realize I am a walking Encyclopedia of Contradictions. However, I believe the Financial System will probably collapse well before Mother Nature & Uncle Climate Change do us in.

Which brings me to the silly conclusion:

That either an individual has REAL ASSETS that can make better choices for his family in the future even as the climate system continues to worsen, or he will have to deal with all of this… WITH A HELL OF A LOT LESS.

Maybe I am totally off base thinking this way, but there you have it.

Straight from the HORSES MOUTH & ASS.

steve

You know, I’d take something from a horse’s mouth, but it’s ass? Eh, I think I’ll have to forgo that little gift. Sorry.

You Say….”You know, I’d take something from a horse’s mouth, but it’s ass? Eh, I think I’ll have to forgo that little gift. Sorry.”

…coming from someone called “THE WET ONE”… I’ll take into consideration.. LOL.

steve

Hi Ron, This seems to be the very thing that Gail Tverberg and a few others have been trying to explain to folks for a very long time. This gentleman has done a great job of both simplifying and shortening what are complex and nuanced interactions between finance and energy. You mentioned something a few days ago about an X factor and I agree with you. It would seem to me that it could come from almost anything at any time at this point. In our culture perception is everything and can cause over exuberance or panic…..without prior notice. Perhaps the world truly is held together by nothing more than duct tape. Tic Toc?

Gail Tverberg writing at ‘Ourfiniteworld.com’ has focused on these principles in great and convincing detail. As I understand her thesis, excessive debt rather than geology will bring down the system.

Quantitative Easing, deficit spending at Federal, state, and municipal level, and relaxed accounting rules are all that has prevented total economic collapse. These delaying strategies have exceeded their useful life. I do not know what the trigger (black swan) will be but we are truly on the financial precipice. Will the trigger be Russian invasion of Ukraine, fall of Baghdad to ISIS, ISIS invasion of Saudi Arabia, …

The Mediterranean is rimmed with failed or failing states from Libya to Greece and Spain and Italy are not far behind. Since 1970 the population in the Middle Eastern countries has increased three to six fold depending on country resulting in severely strained resources which lead to civil (tribal) war. Neither Europe nor US are immune to tribalism. Tribalism can be restrained when resources are plentiful but when they become scarce nature will have its way.

This is the first time i’ve seen these wars correctly identified as tribal wars, I have problems with them being called civil wars (you see civil war means war between citizens, citizens is an alternative name for nationals which requires a nation and a nation requires less than 20% of people to marry their first cousins and that describes practically no Muslim country) these countrys are tribal alliances with a tribal chieftain, wipe out (or undermine in the case of Syria) the chieftain and his immediate successors and you guarantee a tribal fight from top to bottom of the society to determine a new pecking order between the tribes, clans & families. As for Europe and America their susceptibility to tribalism is determined by cousin marriage rates, although civil wars or dictatorships are a distinct possibility, when resources run short.

”The end of growth is the beginning of collapse.”

Unfortunately I must agree.

The questions then fall out more or less this way:

How fast ?

How deep?

What can be done to mitigate the worst effects?

How will the pain be distributed? Who aches but lives?Who bleeds to death?Who falls to their economic knees and then eventually recovers? Perhaps not to anything like current day conditions but nevertheless recovers in the sense of experiencing growth again?

Money is necessary so long as we are playing by the current rule book but money and resources are not the same thing. The ancient Egyptians built the pyramids without central bankers and the help of Gold in Sacks. Nazi Germany although flat broke nevertheless built up the most formidable war machine the world had ever seen up until that time in well under a decade.

Most of the debts that are owed by governments these days are never going to be repaid because the resources necessary to both repay them and support necessary current expenditures are do not exist in sufficient quantity.

Governments do the same thing people do in a really bad pinch. They pay the most critical bills with the cash on hand. People in a bad enough bind quit paying the rent and then the electricity bill and water bill and the car payment and everything else until there is no money left for anything but the one truly and absolutely essential short term necessity- food.

Governments are going to basically do the same thing- pay the bills that absolutely must be paid for the government to continue to exist and maintain control of the society which is after all the definition of government- the mechanism that controls a society.

Things are going to get to be very very tough but collapse across the board within the easily foreseeable future is not inevitable in countries such as the US and Canada.Once the fecal matter is well and truly in the fan we Yankees will quit paying what we owe to other countries and if they don’t like they can send their navy to embargo us.There is nothing so far as I can see coming out of China that we can’t and did not formerly make for ourselves. If there is anything of that nature we can do without it.

Ditto the oil we import. I understand we cannot conduct business as usual without the six or seven million barrels we import daily but I said things are going to get to be ”very very tough” and survival is not the same thing as business as usual.The naysayers will insist that we cannot build a fleet of cars that can get double the mileage of our current fleet in less than fifteen or twenty years and we can’t playing by the current rule book.

If we get twice the utility out of a barrel of oil we can afford to pay twice as much and at twice current prices we can probably make a go of coal to liquids.We can divert the money we spend on new highways to renewed and reclaimed rail.We can spend what we spend on leisure travel on improving the energy efficiency of our homes and other buildings.The people employed in leisure travel are going to have to get by on the dole and it is not going to be easy for the ones who can’t handle employment building bike lanes or adding insulation to older houses or raising cabbage and beans on a small scale.Small scale farming is going to make a big comeback partly because we are going to need the food so produced locally without so much expense in transporting and packaging and processing it but more so because it will at least partly offset the expense of supporting the workers on these new small farms who otherwise would be unemployed and on the dole.

We are going to quit building new houses in significant numbers and double and triple up as necessary.

The current rule book is going out the window and a new one that most of us are not going to like very much is going to come out and it is going to be enforced by emergency federal powers at the point of guns as necessary.

Some of the rules are going to be along lines like these. Your pension is halved or quartered. If you don’t have enough to eat you can get a ration card for beans and rice and cabbage and maybe a chicken leg once in a while.It is going to be against the law to drive your big old suv or 4×4 truck except in cases of actual need- if you have six passengers you can pass the roadblock. If you are alone and on personal business it will be confiscated.You will get a gasoline ration- a very small one – even if you don’t own a car because that is going to be fair to the people who don’t.They can use theirs to get that suv filled up for a community trip to the flea market and supermarket.

GM and Ford will design and sell a hundred mpg minicar in twelve months. The engineers at the same companies built new military vehicles from scratch in less time than that in the forties without the aid of computers.

I am still using some apple boxes on our farm ( although retired) that I helped my grandfather make when I was a kid back in the sixties.We logged the trees and milled the lumber with a seven and a half horsepower homemade mill and nailed the crates up with a hammer.These crates are now over fifty years old and about at the end of their usefulness due to decay and plain old wear and tear. But we still deliver in them to the one local supermarket that will buy from us while the big growers and big supermarket chains use throw away cardboard boxes. The throwaway boxes are mostly recycled once or twice on the second hand market and then some of them are returned as waste paper to paper mills but our resource usage for containers is probably less that five percent of that of the big boys.

My point is that we waste a huge part of everything we use and when we no longer have it available to waste it- well then we will quit wasting it.

We Yankees may not pull thru. Most of the world is headed for hell in a handbaskst within the foreseeable future but we are not going down without going on a war footing fight for our survival and we have more than enough resources here in North America at least to pull thru for the foreseeable future.

I don’t think it is going to be easy- I have said before that I am personally prepared to fort up in case of things getting totally out of hand for a while. I am VERY glad that a lot of my relatives and neighbors are veterans and a whole bunch more are Old Testament Baptists who will give you the shirt off their back if you really need it and yet habitually go around with loaded rifles and shotguns in window racks in their pickup trucks.

I have set aside an older full size Ford pickup with a granny gear four speed and real mccoy four wheel drive and I have a hard copy of the plans put out by the feds to convert her to run on wood gas.All the materials needed are on the place as I have been collecting such stuff for decades.Doing the conversion is going to be mostly for the fun of it – but if there comes a time there is simply no gasoline to be had it will get me and a sick neighbor the hospital and back in an emergency.

The kids are mostly worthless these days when it comes to anything tougher than flipping burgers and playing video games but we old guys still remember how our own old folks got by and can teach them- and when their bellies start growling the kids will start listening.They will toughen up in a hurry when they have to.After that I won’t refer to them as worthless any more.

“…but if there comes a time there is simply no gasoline to be had it will get me and a sick neighbor the hospital and back in an emergency…”

-Ah my smart E-I-E-I-O farmer…the classic fault of most of the “bright” minds on this blog. You know endless details about how all this will play out and claim to be prepared for it…yet cannot (are not capable – is more accurate!) comprehend the whole picture!

-Please, do allow me to help:

there will be no hospital and emergency room if there is no gasoline available!

-Oh, and please do spare me (and yourself, too!) the: “medical help and hospitals existed long before gasoline…” comment…it insults the intelligence of the blog! Indeed!

Be well and take my advice to spend your time in a more rational way than building a “wood pickup” which will take you to the ER…you will thank me if you do.

Petro

Hi Petro,

Perhaps you should read some history. I would not for any nameable treasure be caught in a place such as Egypt when the crash finally hits.

But there will be a hospital in most places in the USA for the foreseeable future and whole it probably won’t be doing organ transplants or advanced chemo on patients that are going to die in a few weeks anyway it will still do appendectomies and set broken bones.

And the doctors and nurses may sort of like me a little better than most patients since I may leave a homemade wooden box of green beans or a couple of quarts of honey in the nurses lounge.

Those emergency powers I mentioned will ensure that the hospital staff can get to work easily- people living within walking distance will have leases revoked and the apartments given to nurses and doctors. A little later walking distance homeowners ditto.

Leviathan is not helpless when it comes to dealing with catastrophic change unless the change comes too fast to react.

With a little luck we will have time to react here. Oil production is not going to go to zero overnight and it is not going to stop raining all over the agricultural lands in a country the size of the US.

We had an industrial civilization before we adopted the use of oil in preference to coal and we can- with great difficulty it is true- revert to a substantially more energy efficient coal powered society.

I could get by just fine with intermittent solar power where I live with a modest amount of battery backup just using my mixed bag of tradesman’s skills to modify my home.Intermittent power is a hell of a resource compared to no power.

It is easy to overlook the fact that three or four people can live in a two thousand square foot typical mini mcmansion on the same or less energy consumption for heating and only a little more for lighting. The only real per capita difference per house is water consumption in this case.

Of course people at the far end of the last power line out into the boonies are sooner or later going to see the power go off and never come back on but that is no reason to assume that nearly all of the grid cannot and will not be kept functional.

Apples will again be eaten near where they are grown rather than shipped across the country and across the world of course and airfreighted veggies are going to be a luxury no longer except maybe to a very few superrich folks who can arrange the shipment under the radar of public outrage.Airports will mostlybe converted back into cow pastures because five or ten percent of the jets flying today are at the most going to be flying in twenty or thirty years.If people want to see Grandma they will have to revert to doing what my family has always done-up until recently at least- stick together.The actual truth about air travel is that except for patrolling for a possible invasion by the Chinese ( sarcasm light on!) we don’t really need air travel.

We don’t really need computers that are twice as fast every eighteen months either although they are handy to be sure. We do need Hollywood to help us temporarily forget our troubles but we can see what Hollywood produces on televisions at home and pick up the programming over the air or on little plastic disks locally. We don’t have to drive fifteen or twenty miles to the cinema any more.

We need potatoes but we don’t need potato chips. We will have our beer but it will be brewed locally and served and sold in reusable containers instead of brewed a thousand miles away and shipped in aluminum cans.Hauling water around instead of hops and barley is energy insanity.

An economy based on nuclear and renewable power plus coal can and will work and while it will contract like a toy baloon with a leak it will eventually stabilize and begin to put out some tendrils of new growth.

I have always been and remain a big believer in the good Reverend Malthus and he is going to get the last laugh over most parts of the world for damned sure. But like Hubbert he could only see what could be seen from his own time in history.Both will be proven right in time but not as soon as they would have expected.

The old cultural molds are broken and while some will be repaired many will be permanently discarded.Technology has provided us with some things virtually unimaginable a century ago including vascetomies and tubal ligations and dirt cheap birth control pills.Culture has changed too. In Brazil,one of the most Catholic countries in the world, the women are having hardly more than enough babies to maintain the population over the long run . In Italy there will be population shrinkage within the lifetime of a lot of readers of this blog today. Italy in case anyone has forgotten is the home of the Pope.

In the event anybody reading this blog is interested in the possibilities open to them I have a little farm organized around an efficient low energy low cash low material input lifestyle that will be for sale within twenty years owner financed at the most.Within the next year there will be a decent thousand square foot rental place on it that comes with a couple of acres of fenced prime bottom land garden space with irrigation and a wood lot and storage sheds- the basic survival package. The rent will be about five hundred bucks.

Any body really willing to work at it can grow ten thousand dollars worth of veggies on two acres if they don’t have anything else to consume their time.Another couple of acres can be had long term for another couple of hundred bucks a year. Land outside the fence can be had ten acres for five hundred a year.Water alongside the field.Plenty of it unless it stops raining in the Southeastern US.The stream heads up in a National Park and comes down a steep mountainside and there is no farm upstream of mine and no good farmland upstream of mine and only a half a dozen houses all with domestic water wells. A family willing to work at it could grow eighty percent of their own food including poultry and fruit and nuts.A dairy cow and a beef cow or hog is a distinct possibility. After the first year or two I would be glad to write a long term lease with an inflation clause in it.Also a deflation clause for those who believe prices may come down.I would be happy to teach my tenants how to operate farm machinery and castrate a pig and do rough carpentry and sex their medical marijuana plants once cultivation is legalized in Virginia.

There are plenty of opportunities such as this one for individuals and families that are actually interested in improving the odds of getting thru the next few decades in a dignified and satisfying mode of living.

I AM NOT ADVERTISING – although there are people commenting here who I would dearly love to meet personally and have come for a day or a week for a visit. Ron included!!

Maybe next year I will be but not on Ron’s blog. I am mentioning this just to illustrate the possibilities open to people who are willing to act rather than just feel sorry for themselves.

Now as it happens I remember when we didn’t have running water at our house as a kid and if we wanted to stay warm we chopped wood.I would have given my front teeth for a weenie sometimes but I seldom saw one. But we had plenty of homegrown range raised chickens and potatoes and plenty of corn bread as well as other meat raised on the place and milk from a family cow almost all the time by swapping with a neighbor when our cow was ”dry”. We had three channels on the tv only one of which came in well enough to see any detail but we had the whole outdoor universe to entertain us.My Dad built the farm house we live in yet without a mortgage while working a ”slave labor ” job in a small southern textile town.You can still buy ten acres of excellent land in my neighborhood for the price of just one nice new car and the tax bill is no more than the tax on the car.

We were looked on by the kids in the one traffic light town – the county seat- as poor of course. But we actually lived as well or better in real terms as the kids in town although we had fewer toys and fewer new clothes.

OFM, I have not been posting for a long time but have been reading posts on and off. I am working in the manufacturing line. Presently, our supply chain is way too long and too globalized. Everything is not done locally anymore, be it a tooth pick, surgeon’s scapel or any electronic parts. The machine has makes these rely on parts that are also made somewhere else. It is a very complex web of manufacturing system. Our high tech semiconductor company, which is based in South East Asia nearly went belly up in 2009 when banks did not trust each other and suppliers are demanding upfront payment. Our machines went down just because of a single part from Japan did not arrive. Our customers could not pay us as they could not give us money and we cannot our Japanese supplier cash as they never trusted our letter of credit issued by a bank. The entire chain froze. Were it not for the money printing, we would probably have collaped. Now, the effects of QE has diminished to a point where it is not useful anymore. Pray tell what will happen when 2008 repeats.

A lot of people do not understand that unlike 1950s or even 1990s, everything is globalized. T-shirts, tooth picks and everything under the sun is not locally produced anymore. Your hospital’s flourescent tubes, alcohol, antiseptic, antibiotics, bed, sheets are not locally sourced. When the collapse happen, everything will go at the same time.

Companies want to make money and whatever they make is proprietary. Different car manufacturer has different toolsets to open up their engine. Your Philips or fla screw driver is of no use. Tools for opening Toyata engines are different from BMWs. The machines used in the hospitals are not repairable anymore. If you send them back for repairs, those guys will just swap a circuit board out and plug in a new one. The circuit board is designed in US, drawn out by their Indian subsidiary, the layout was sent to China for manufacturing. The chips are made in China, Japan and US. The capacitors are made in Taiwan. The final product was sent to Singapore for testing.

Your wind turbine and solar panel are too complex to be maintained. The controller board in the solar panel will not last long and the semiconductor chips inside will not last long as it was not made up to the quality standard that people used to call “military spec” that is suppose to last for years. The chips require exotic materials like Indium, Gallium that is probably unobtainable due to high extraction cost (for it is a very low quality ore). These are not available in an event of a collapse. The miners can only mine when there is enough financial capital. Without the capital, there will be no mining, there will no exotic materials; there will no seminconductors and there will be no turbines or solar panels. Neodynium is used in powerful magnets in wind turbines. These are not easily replace.

Due to cost cutting (like it is observed in the semiconductor field), experts are scattered everywhere. The expert in your wind turbine or solar panel may be in India or Japan or UK or somewhere on the other side of the world. When you call in, you are connected to him via telephone. In an event of a collapse, his skills are not available anymore.

Liebig’s Law of Mininum is very important in our modern civilization. One small item like a spoilt chip or a broken screw. Example: if your wind turbine requires a high vanadium high strength stainless steel nut/bolt, do you think you can get it easily? The manufacturer of the bolt/nut may be bankrupt and all the nuts/bolts are manufacturered in China. Is it easy to get a replacement? Globalized supply chain. If you find a substitute nut that is not high tensile, it will work, but probably for a short while only and the whole wind turbine will collapse. Similarly, a high performance cooling oil in a heavy duty transformer may be made in Japan. It is the best for the transformer and the manufacturer wants everyone to use it. When Japan goes down the drain (high debt), the company may collapse. It is a proprietary mixture and you cannot get it from someone else. Do you think you have a substitute?

We are actually experiencing this in our factory and that is the reason why I feel that ultimately, it will be our supply chain that will bring down our civilization. I am “in” the supply chain and I know how fragile it is.

Think about it, food and medicine needs to be transport into towns. If the trucks break down due to inavailability of parts, then you have a serious problem. If the water pumps fail or the power generating plants fail, then your grid is down and you are really really in deep trouble. Remember that there was report by the US government (I am not a US citizen) stating that if an EMP attack happens or if a Carrington event happens, a lot of electric transformers in US will be damaged. These transformers have long lead time and it is not possible to get them up within 1-2 years.

Bottom line is that, when the supply chain goes, every one goes. It does not matter if you are in US or in Brazil or China. Just do a mental exercise, what product is made locally. Do you have a shoe factory or a fabric factory that can provide you with clothes or shoes? Is your cotton or leather imported? Even if the cotton is obtained in Georgia, are they planted organically and harvest by hand and transport to the weaver in horse cart? Fertilizers require refinery that require millions of parts(valves, meters, etc) that is sourced world wide. Combined harvesters and trucks is also assembled by parts sourced worldwide. Software is coded in India or Europe. Are all these available in an event of a collapse?

Lastly, due to profit pressure, companies employ “just in time” inventory. So, your solar panel controller that is availabe in US may be stored in China and it is shipped over only when it is required in US. In a collapse, do you think you can get it. Food, shoes, car parts, etc are not stocked to the brim. They are only delivered when ordered. There is no buffer and this will accelerate any collapse.

Just do a mental exercise and think about what I have written. I know that many people in this blog think that there will be uneven collapse with US, Canada, Australia and other advanced country having smaller collapse. This is true if we are in 1950s but definately not true in this extremely globalized 2014.

A few more items : China controls >90% of the worlds rare earth that is required in all high tech electronic stuff. Asia (especiall Taiwan and China) makes practically all the seminconductors in the world. Bearings, nuts, bolts and fasteners are bascially monopolized by Asian countries. It also goes for fabric, fibers (natural and synthetic). Developed countries are more towards design (however, the software that they use are probably coded in India).

List down all the things that are produced in your country and see what else you need in order for your country’s economy to continue.

Fishing nets – the simplest form of harvesting food – can you make it in your country?

“Bearings, nuts, bolts and fasteners are bascially monopolized by Asian countries”

Man’s first mechanical invention was the wheel and the second was the bearing to support the wheel. Makes me think of all those classic WWII movies showing Allied bombers. Seems they were always targeting German ball-bearing factories. Making steel balls that are spherical to the micrometer level takes some real technology. Take out the bearings and you take out the most basic technological infrastructure. Our machines literally grind to a halt. Even bicycles won’t roll without ball bearings.

CTG,

Excellent comment. Excellent. I may not agree with everything you say, but I fear you are right. A slower event may alleviate the situation and allow adjustment time, though. I sure hope so.

Paulo

OFM, I fear that you have overlooked the social aspects of response to economic depression or more likely collapse. The vast majority of the US population will be surprised. Their great expectations will be disappointed. Most lack the experience and skills that come from a life of self reliance such as yours. A person can make small changes in response to events and over time adjust quite well to a new paradigm. However, a sudden drastic change is beyond most people’s ability. The government provided ‘social safety net’ programs have undoubtedly relieved much hard ship over the past sixty years but they have stolen much of the self reliance that is going to be needed in the near future.

Surprise, disappointment and near helplessness in the new environment result in a ‘deer in the headlights’ response.

Just on a point of history,

I am fairy sure that the great pyramids were built with the aid of both money and (food) banks – the unreliable floods of the Nile resulted in feast or famine, and the Pharaoh won power by organising food taxes in the good years to build up huge reserves in state granaries, to tide over the bad years. The entire priest caste and the pharaoh as god on earth thing work well for a millenium. The pyramids required large numbers of skilled artisans, and a thriving economy with standardised rates of pay and rates of exchange for different goods. They even had a good sized middle class. This is money without the abstract tokens. Very few slaves involved, excepting captured foreigners.

Yes-if you want to describe the process by which the Pyramids got built this way it is ok with me. Taxes can be collected in kind. Wages and salaries can be paid in kind. You can call resources money if you please.A middle class and an upper class is certainly possible without money as such .

I have never claimed otherwise.

I prefer to separate the concepts of money and actual physical resources since so many people think they are interchangeable and that money can be created by magic just by wishing it into existence.

The magical creation by wishing part is true but the equivalency to resources part is unfortunately a generally fatal mistake sooner or later.

Magical money can bring resources together in one place and enable the managers of the money and resources to do things that are hard to do otherwise of course. It would be damned hard to build a nuclear power plant on the barter system.

But usable money in the here and now does not require the payment of past debts when the powers that be decree otherwise.

When the time comes UNCLE SAM will renege on most of his debt but he will issue checks to pay for what he wants to pay for and the checks will be accepted and the money they represent will be spendable because anybody who refuses to take it will wind up as an example in the federal pokey.

There will be chain gangs and prison farms as needed. Interment camps are such a waste of useful potential labor!!!!!

I am very glad this is a country armed to the teeth but not so naive as to think anybody is going to defy the feds very long when the fecal matter hits the fan.

Old cash green dollars in circulation may be collected and new ones issued in their place. This process has been repeated several times in countries that went bust.

At different periods barter was refined to what would now be considered a fiat money system.

http://www.touregypt.net/featurestories/prices.htm

Money was counted in loaves of bread and jugs of beer, etc., but standard exchange rates were set to other commodities including copper and gold.

A wage economy was widespread, with a basic wage being paid in food only. Weights and measures were closely controlled and ceramic loaf tokens have been discovered. Higher wages were paid in multiples of the basic, but these would have been delivered in more convenient forms. Written accounts of personal wealth have been found.

It was not a debt economy based on interest and growth. You paid your taxes and the Pharoah would repay the debt in the famine years from the grain stores. Growth was only possible when the land was productive.

Yes. Tokens are a precursor of fiat money. Tokens can be counterfeited just like cash incidentally.Nothing you have said disproves anything I have said. Values enabling the exchange of goods and services can be established in gold or gems or a standardized measure of coal or wheat or lumber.

But money is only an abstract tool that enables governments to do all the things governments do with greater convenience. And when the abstract money we call a dollar eventually becomes worthless it will be discarded and a new currency put into its place.

In the controlled economy that is coming your old cash and bank accounts will be either worthless or you will get a severe haircut as the saying goes these days. The new currency will enable you as an individual to function without resorting mostly to barter like a mediaeval peasant with maybe a couple of very small coins and a sack of turnips on market day.More important it will allow big business such as electric utilities to replace items such as trucks and generators and transformers and fertilizer companies to provide fertilizer to farmers and take care of other ESSENTIAL business.

I have spent many a long evening reading and studying about such matters. There is plenty of history to examine.

Now of course it is ( for now anyway) still a free country and we are each still entitled to our own interpretation of that history.

I was once convinced that we have no real hope except maybe for a savage dog eat dog collapse back to a horrible preindustrial society and still believe that is going to be the fate of most of the world.

But this is not necessarily the fate of well developed countries powerful enough to defend themselves and endowed with enough resources to make a go of it without the rest of the world economy.

Now I readily admit that a bad enough and fast enough crash might mean mad max. I have often remarked that I am prepared to fort up and hope for the best.If it comes to that my chances of survival long term are not very good but a hell of a lot better than most peoples’.Some body will probably eventually murder me for my material goods if things go mad max but if it comes to that … Southern mountain hillbillies are famous for our violent tendencies and we just might collectively go proactive.

But I just cannot see any reason to think the coming crash will NECESSARILY be that fast.

Hi OFM,

“What could be more superstitious than the idea that money brings forth food?” – Wendell Berry

One of my favorite quotes. A lot more people would do well to read Berry’s work.

If I wasn’t so dead set on staying in the Northwest–or if I knew for a fact that the next Cascadia subduction quake was going to hit in my lifetime–I’d be pretty tempted to come down and see your land. Sounds like a hell of a nice set up for $500/month. I could grow quite a bit of food there. And we could bicker over the details of collapse the next couple decades while it happens around us.

But I like it up here too much. Though we’ll see what’s left of the north coast of Oregon once the tourism industry fully crashes. Of course, there are still a hell of a lot of dairy farms and old farmers around here, so it’ll be interesting to see what the next phase is.

Hope you eventually find some good people for that land. Bet you’ll have a hell of a lot of takers within ten years.

“If we get twice the utility out of a barrel of oil we can afford to pay twice as much…” Really? pay with what? Credit/debt?

“We can divert the money we spend on new highways to renewed and reclaimed rail.” Really? We can divert money we no longer have?

“We can spend what we spend on leisure travel on improving the energy efficiency of our homes and other buildings.” I don’t think what we spend on leisure will exist – unless you mean the debt people use in order to “spend.”

If my renters can no longer pay, then I have no money to divert and no money to spend. Seems to me you are bargaining with make believe. All my real assets become useless the moment they stop producing. It’s so hard to imagine things changing without loss and pain.

No man is an island and that will become quite evident going forward. There are too many people chasing too few [fill in the blank.] And when it becomes obvious to the masses – well, look out. You’ll soon discover that your island only existed in fantasy land along with retirement, pensions, insurance of any kind and good will.

Knowing what we know, who can say they look forward to the future? I can’t. My entire “future” is based on BAU. My income from rental property is dependent on tenants being able to pay. Which means they must have some income too. Oh sure, we can all adjust. Until you can’t any more. Even with no mortgages on my properties, at the minimum I still owe property taxes. What happens when the tax bill doesn’t “adjust” to my ability to pay?

When you start connecting the dots you quickly figure out that ALL dots are connected. And when a dot becomes disconnected, it disappears. There are +7billion dots (and the number is growing) that all exist because they are connected. Watching them disconnect will be hell.

If you are absolutely determined to believe an utter and absolute crash is inevitable then there is nothing anybody will ever do to convince you and people like you otherwise.

But that does not mean that all natural resources and all productive work are going to cease to exist overnight some day within the next few years unless maybe we get hit by an asteroid.

I will point out one last time that this belief is based not on actual physical resources becoming unavailable in enough quantity for us to survive ok in countries such as the US but rather a belief that the current economic rule book is based on actual physical laws such as the laws of physics and geology.

This is patently untrue.The current economic rule book is composed of arbitrary rules that have come to be accepted as gospel. Those of us who are scientifically literate know about how much truth is contained in ” the Gospels”.

There is such a thing as a managed economy.

It ain’t going to be any fun but it ain’t going to result in very many people starving in the USA any time within the foreseeable future. If you want to move up in the managed economy that is coming you better be really good at personal politics and a team player par excellence and lucky enough to get into one of the new bureaucracies that will control the distribution of resources ranging from gasoline to garbage.

Garbage will be a resource instead of a problem in the future and there won’t be much of it anyway.The throwaway economy is a dead man walking.

I have solid wood furniture made by my old ( dead ) folks that will last five hundred years if kept dry. It was never boxed and never shipped and never sold in a store and it has no nonrenewable components except nails and screws which are incidentally easily recycled.

I am not predicting the end of stores and shipping but I am predicting the demise of throw away goods.

When it is finally more or less worn out my furniture will go into somebody’s stove to keep them warm and cook their supper a few centuries down the road unless maybe a museum or collector wants it.

I have rental property myself. Mine is decent with well and septic and ample garden space and located well outside of any major city and very close at a small town. It is near the bottom of the cost scale on a national basis.. People who are losing income can move down.Hardly anybody is going to be moving up very far and they are going to be in the most advantageous buyers market in history given all the upscale rentals built over the last few decades.

Big old houses that are hard to heat and cool and located far from jobs are going to sell for pennies on the dollar if a buyer can be found at all.Tight little houses are going to be occupied especially if located near potential employment.

If your property is upscale and dependent on finding and retaining tenants with plenty of income I suggest you sell it NOW.Upscale rentals are going to sit empty when the crash hits. People with nothing but a social security check can afford mine if absolutely necessary and if I am still around when the fecal matter hits the fan I will cut rents as necessary.Taxes here consume less than a months rent per year per unit.There are things to be said for living in the boonies.

Taxes will not be collected except in relation to government expenditures and except for a bare bones safety net which will necessarily be hugely expanded expenditures will be cut to the bone and well into the bone. Half the jobs that exist today working for government will be eliminated. Maybe way more than half.Teachers who are making fifty or sixty grand with a dozen kids are going to be out of work and collecting ten grand in welfare or looking at forty kids and a fifty percent pay cut.

The music program if one is retained will be taught by a volunteer. Ditto foreign languages.The student parking lot will cease to exist by decree or by legislation.

But in the USA and Canada and other rich countries with remaining substantial endowments of natural resources the grid will stay up and the schools will stay open.There will be food in the supermarkets but no airfreighted grapes from Central America. There will still be bananas if the blight doesn’t’ wipe them out because there will still be banana boats.

Property is going to be my pension and I take a very similar approach to you. In the UK there is a growing ‘but to let’ market where a property speculator buys houses with a large mortgage and uses the rental income to pay the mortgage and a bit extra. Save the extra to be the down payment on the next mortgage and in a decade you can own a dozen properties. The market is skewed in their favour right now as banks see the speculators as a better bet than people buying their own home with an insecure job. As the property bubble expands the speculator can cash out by selling some of the houses to pay the remaining debt on the rest. Of course they never do.

My property is houses I have lived in, paid for, then bought the next one to live in whilst keeping the old one as rental income. Each house is bought and maintained as a home to live in. I cannot be caught out by collapsing house prices, and as people will always need somewhere to live (and I live in an academic city that has been prime real estate for 800 years) I do not expect rental income to collapse completely in my lifetime, although it may well decline sharply in line with the national economy.

The UK has rental advantages the US does not.

The UK renter is required to pay the property tax for the property they are renting, not the owner.

The UK is much less litigious than the US. The US renter who climbs up on a roof and falls off will likely sue the landlord for not having railings on the rooftop. And if he is expected to mow the grass and gets hurt doing so, he will sue for medical expenses as performing paid labor for the landlord (perhaps a rent decrease).

In the UK, your odds as a landlord are pretty good.

I will point out one last time that this belief is based not on actual physical resources becoming unavailable in enough quantity for us to survive ok in countries such as the US but rather a belief that the current economic rule book is based on actual physical laws such as the laws of physics and geology.

This is patently untrue.

Yes it is untrue. But so is your belief that we doomers think the current rule book is based on laws of physics and geology. No it is not and never was. Current economics is a very complicated thing but it is based mostly of faith and emotions. Faith that fiat currency will always have value. (All currencies are fiat by the way, not just the dollar.) It is based on faith that the government will always be there to bail us out of trouble and keep sending us our bennies such as health care and Social Security.

It is based on faith that law and order will always be there to protect us, faith that the grocery store will always be there and stocked with food, faith that anything we need to survive will be available with the money we earn from our jobs or from our retirement check.

Our economy is based on faith, not on geology or any laws of physics.

And faith is something you seem to have plenty of Mac.

Hi Ron ,

You generally read more carefully than you are today. lol. I am not saying that we ARE going to pull thru but rather that there is a strong possibility and maybe even a likelihood that we can and will.

Your old handle is Darwinian and if you hadn’t had it first it would have been mine when I discovered TOD.

The world is very much a Darwinian place. I have repeatedly said that I would not be caught in Egypt for example in a few years for all the treasure in the world.

But you will remember the tale of Little Red Riding Hood and what she had to say : ”What big teeth you have Grandma!!” We have both the teeth and a resource base adequate for us to pull thru on a wartime footing planned economy for the easily foreseeable future- BARRING BAD LUCK.

Bad luck can arrive from many directions of course. But Leviathan is not going to just lie down quietly and die without a struggle.

And while I am as afraid of our UNCLE SAM as a naive backwoods Baptist is the Wrath of God I do not think our government is all powerful or even close to it.

But it has the power to compel us to do what we will have to do to survive peak oil and over population within it’s own borders and will not hesitate to do so when it becomes necessary.The people will riot and strike at first and then when they have no choice they will cooperate.

A wartime effort at maintaining a stable society may fail but it will absolutely be attempted.

It seems to me that most of the people commenting here today are unable to grasp that idea. It seems so likely to me that I will just go ahead and call this response a fact to be rather than just a possibility.

I have a good sound grasp of resource depletion and have posted many comments here and at the TOD predicting dire troubles and MAYBE the end of life as we know it.

If we lose faith in all our institutions we will eventually evolve new ones. It won’t take more than a generation or maybe two at the most for things to settle down. Mad max scenarios burn themselves out like wild fires. There is only so much fuel and once the victims are all used up by roving gangs the gangs are used up too. After that stability. In between chaos.

It is very easy to find examples of old soviet citizens who revered Stalin because he brought certainty to their lives even though they were very hard lives.IF you kept your mouth shut and were not a member of an ethnic or cultural group targeted by the state you got your beans and potatoes and cabbage.

BTW tax revs for H1 2014 are sharply below estimates. The deficit will be above estimates.

Not even the Sequester could stop this.

Good writing Ron.

-Sadly, most of the comments related to your articles (not just this one, all of them) show a feverish/anxious way in trying to detail as much as possible and as “accurately” as possible how all this will unfold… almost to the point in which the commentators seem to “bite their nails” waiting for “the future” to become “the present”, so that they can say: “I was right! I predicted the black swan and/or the X factor! It really did unfold exactly as I thought it would and I am prepared!”

-I strongly suspect that when “the future” really becomes “the present”, it will so overwhelm all the commenting “smart ones” on this blog that, they (indeed,all of us!) wished they new nothing about it!

When one is powerless and past the point of no return in changing the certain outcome with ALL its consequences, ignorance is indeed bliss…

Be well,

Petro

“We have a debt based economy and a debt based economy must grow or collapse. The end of growth is the beginning of collapse.”

It’s unfortunate there isn’t a middle ground. It seems that if so much capitol and labor was expended developing a complex civilization it could just level off at some point or even slowly contract to some degree, but apparently that not being possible. One of the black swan factors Gail suggests is rising interest rates. The Fed has accumulated approx. 4.5 trillion in bonds but so far have not sold them. My understanding is once they begin selling them interest rates will rise. The Dow which breached 17,000 is now down to approx. 16,500 and some say it’s because investors are wary of getting too close to the point when interest rates begin rising. Stocks tend to move ahead of news, so we have most likely seen the zenith of this most recent rise in stocks. But it also begs the question of what will happen to the US economy when interest rates begin rising? Is there anything left in the fancy fiscal Fed bag?

I’m perplexed by how the first qtr. could come in at -2.9% GDP but the 2nd qtr. at +4.0%. That’s a difference of +6.9% and suggests some part of our economy took off like a rocket. But what part was it? Real estate, autos, exports, manuf., tourism? In any case, regardless of miracle quarterly expansions it seems as if the writing is on the wall for another step down similar to 08/09.

“I’m perplexed by how the first qtr. could come in at -2.9% GDP but the 2nd qtr. at +4.0%. That’s a difference of +6.9% and suggests some part of our economy took off like a rocket. But what part was it? ”

… the lying sector …

Ha….

…you certainly do have my vote as the best answer/comment…gave me a laugh, thanks!

Be well,

Petro

Steve, here’s a video link of someone emphatically saying the 4% GDP number is fake, no way possible. http://www.warriorforum.com/off-topic-forum/974548-us-economy-back-track-2nd-quarter.html

He says the government is playing a high stakes game of poker, trying to fake people out about the real numbers. Gets real good at about the 4 min. 30 sec.

Forgot to add, at that 4:30 mark he says one way we know it was fake is because when the news came out the stock market tanked 90 points on the Dow (so investors knew it was a lie), and if it really had been as much as 4%, then we would have seen a move into commodities, which did not happen.

Heads up. CPI, inflation, has evolved or devolved into two categories — core and non core. Exclude food and energy and you get a ‘core measurement’. Food and energy are volatile so a resultant core CPI is more stable.

In the GDP measurement the similar parameter is inventories. They were sharply down in Q1, and even more sharply up in Q2. Exclude them and core GDP was/is about 0.

The one thing important about this is Fed QE didn’t help.

I’m not sure you can add quarterly numbers like that..

Nice talk by Nicole Foss there.

Just a few quibbles: central banks cannot ‘print money’ (because they are collateral constrained). What this means is they cannot create ‘new money’ that is, they cannot make unsecured loans. If they try (Argentina) they are instantly insolvent; this is non-negotiable but rather a condition, like gravity. All banks become insolvent by way of lending. Indeed, banks’ loans are their own losses distributed to others as ‘investment capital’ (the gains are kept by the banks). Quantitative Easing offers an market strategy to hold down interest rates (that are likely to be low, anyway). It IS likely that interest rate repression is a technique to contain energy extraction costs (that is already failing).

Also, returns from fuel use are phantoms. Driving a car does not pay for the car. What provides returns are loans. What this means is that ‘investments’ in alternative energy can’t produce returns, rather it is the alt-energy customers borrowing in the place of the firms; that is what represents ‘cash flow’. The source of the funds for the customers is the same source for the firms! Of course, the firms have more borrowing capacity than do mere customers, particularly when these customers are saddled with repayment obligations, that is, ‘system’ debts amounting to hundreds of trillions of dollars.

What is occurring now is the tapped out customers cannot borrow any more; this inability is starving the drillers for funds along with the alt-energy crew. Too bad, they could have been given some funding starting with the 1973 oil crisis but …

http://www.economic-undertow.com/2014/07/25/the-great-question-mark/

Steve, what does it mean for a Central Bank to become insolvent? Does overpaying for worthless collateral count?

A central bank can’t be insolvent. By definition. It is the source of money.

When a CB buys government securities, it does not do so as collateral. It’s not a loan. It’s a purchase.

Look, folks, you have to understand this is the great evil of QE. Before QE people went through life thinking money was rationally created or destroyed (CBs can SELL their inventory of securities (draining money from The System), they don’t just buy (injecting money into the system).

QE exists because interest rates globally are zero. CBs are in uncharted territory. Before they could pretend there was rationale to it all. Now, no. Even Richard Fischer of the Dallas Fed and a voting member of the Board has said this. The Fed, it’s econometric models, it’s staff of economists, do not know what happens with interest rates 0 for almost a decade and QE rampantly injecting “liquidity” aka money from nothingness.

It Doesn’t Make Sense Anymore. It Has All Come Apart.

And it’s no one’s “fault”. It just is, and probably . . . it’s oil scarcity dependent.

Oil scarcity may have been part of the trigger but the ponzi debt pyramid has been 40 years in the making. Plenty of people in power have been well aware of where this would ultimately go. They were just to busy profiting from it personally to care about what would come after.

The point that I think summed up the whole presentation nicely was the definition of wealth around 9:30 into the presentation. It is all an illusion based on perceptions of future returns, when the perceptions change the wealth disappears.

Having read the first two paragraphs of the report and then crunched some numbers I am surprised not by how large the numbers are but how SMALL they are.

The summary says that investment in energy has doubled since 2000 in real terms, i.e a 5% per annum increase but is going from $1.6T to $2T in 2035 which works out at exactly 1% compound.

So they see the world slowing down the rate of increase in energy investment to what is basically a steady state.

Even if you add in the numbers for energy efficiency $.13T to $.55T in 2035 the annual increase in total investment ( energy + energy efficiency) is only 1.75% compound.

As I read through the report I’ll see if I can make some more sense out of this.

Demand for Sand Takes Off Thanks to Fracking (Google headline for a link to bypass paywall)

[Excerpt from article]

Frackers are expected to use nearly 95 billion pounds of sand this year, up nearly 30% from 2013 and up 50% from forecasts made by energy-consulting firm PacWest Consulting Partners a year ago….

That’s great news for sand miners, but it’s heating up competition between energy buyers and other big industrial users.

U.S. Silica Holdings Inc., one of the largest industrial-sand companies, has already raised prices for some frack sand, and it said recently that it would also start charging 10% to 20% more for the finer grades of sand typically used to make glass and various industrial products as it diverts some of this supply to oil producers….

Preferred Sands…plans to increase sand production by next summer with new and expanded mines in places like Wisconsin and Minnesota, said Chief Executive Michael O’Neill, though he added that it’s becoming tough to find available railcars to move the sand from mines to oil fields….

[There are also] growing restraints on sand supplies. By the end of this year, new and expanded mines capable of producing 10 million pounds of sand annually will be up and running, but future projects could face delays, Cowen & Co. analyst Marc Bianchi said.

Dozens of new sand-mine permits were issued over the last three to four years in places like Wisconsin, Minnesota and Illinois, triggering a massive public backlash about the truck traffic, dust and breathing problems these operations can create. Now many state and county-level health officials are trying to slow the sector’s expansion.

A few companies are skirting those efforts by teaming up with towns hungry for jobs and tax dollars, as well as more regulatory control. In Wisconsin, the cities of Independence and White Hall last year annexed land in Trempealeau County so that Hi-Crush could move ahead with its new mine. Those cities’ zoning rules governing sand operations supersede the county’s regulations, including its temporary ban on permits, so Hi- Crush’s site can go into service later this year. Local officials in Minnesota and Illinois are taking similar steps.

As the good sand becomes increasingly difficult to find, one company is turning next door to South Dakota. Pat Galvin is chief executive of South Dakota Proppants LLC, which aims to resurrect a 1950s-era mine on federal lands about 40 miles from Mount Rushmore. Located in the Black Hills National Forest, the abandoned mine is filled with the same type of high-quality sand frackers have come to count on, and it could generate up to one million tons annually, he said.

The company is getting ready to pull together an environmental-impact statement to present to the federal government, which controls the site. But oil companies are already asking about supply contracts, Mr. Galvin said. The proximity to fracking operations in North Dakota’s Bakken formation and Colorado’s Niobrara Shale could trim delivery costs by as much as $50 a ton, he said.

The South Dakota site has another key advantage: no neighbors. And shipments can be routed to avoid tourists bustling around Mount Rushmore.

“We’re in the middle of nowhere compared to Wisconsin, where you’ve got farming and everything else going on,” Mr. Galvin said.

[End of excerpt]

Proppant is everything, and this has constraints on oil output written all over it.

Note, however, that ceramics would improve production a great deal over sand, but the price stops that. This means those oil wells are absolutely not producing optimally, and never will.

Just going by the geologic map in my head, the sands mentioned are early-Palaeozoic in age and actually nearly-pure quartz sandstones. The grains are spherical and have been through two generations of erosion, transport, and deposition. They are often beautifully bedded, frequently cross-bedded (meaning that they were deposited as dune sand, either subaerial or subaqueous) and produce beautiful landscapes. It’s heartbreaking to think of what the quarries (“mines”) are doing to the areas where the quarrying is going on.

When the Palaeozoic stuff runs out we can start on Zion Canyon in Utah, similar stuff of Jurassic age. There’s always some landscape of some sort to look at elsewhere, after all.

Round is not good enough. Round and large diameter are required. Given how round happens, this is not ubiquitous stuff. The rounding mechanism is also a mechanism to make it smaller.

Hi Watcher.

That’s what’s found in the regions the article describes; Corning has used it for years for glass.

Dune sands aren’t particularly fine-grained–that is, the grains aren’t very small. The grains have to be large enough so they aren’t carried away by wind, but hop instead; they’re very well sorted (by size) as a result, which I’d expect to be a bonus for a proppant.

Cool.

Hi Ron,

Chris Martenson also linked oil and money supply in his crash course. Of course it is a very long series of video to watch.

I think the real link with global money supply is “global energy supply + energy efficiency” instead of crude oil supply or fossil fuel supply. If you increase energy efficiency and decrease fossil fuel (carbon, not nuclear) or replace it with other sources (nuclear, hydro, solar, wind, geothermal), you may still have growth.

If you look to fossil fuel dependency of economies, you will note that EU has a dependency on fossil fuel of 76.7%, US 86.4%, China, 90.4%, Japan 93.4%, Russia 88.5%, Middle East 99.1%, Africa 92.5%, S& Central America 73.1%. Not all economies have the same fossil fuel dependency. EU and S&Central America seem better prepared against peak fossil fuel (but still highly dependent). EU have stressed on better energy efficiency since about 20 years now. They also increased renewable production dramatically albeit it is still marginal (11.5%) comparing to fossil fuel consumption. US is at 5.3% of renewable currently.

New cars sold in EU have a better fuel efficiency than those sold in US. In top of regulation, the explanation is coming from higher gasoline price (due to tax): here in Belgium, gasoline price is above 8$/gallon, more than twice as much as in the US. This favors buying smaller cars and efficient cars. Motors above 2 liters are only found in luxury cars.

Here’S a few remarks.

His chart showing the correlation between economic growth and energy consumption since 1980 proves nothing. I predict energy will decrease significantly as a percentage of the world economy in coming years.

How does he know how high interest rates “should” be? The massive influx of Asian labor in global labor markets driving deflation. The only way to counter deflation is to cut interest rates. So maybe this is a sign of weak banks, but maybe it reflects the fact that manufactured good are getting so cheap.

He complains that the money injected into the system in 2008/2009 is not being taken back out, but ignores the sudden disappearance of a similar amount of money in 2007/2008.

His chart showing the correlation between economic growth and energy consumption since 1980 proves nothing.

All it proves is that there is a correlation between energy consumption and economic growth. Economic growth has always been tied to energy. All forms of growth require more energy. If an employer hires more employees they require energy to drive to work. New products must be delivered. etc.

I predict energy will decrease significantly as a percentage of the world economy in coming years.

It is not enough just to make a prediction. All predictions should have some logic or reasoning behind it. So my question is just how are you going to pull this off? How are you going to produce more with less energy? Sure there is greater efficiency but that can only go so far. And people forget one very important thing about greater efficiency. Greater efficiency in manufacturing means less labor is needed. Greater efficiency, in many cases, means less employment. That’s what the Luddites were all upset about.

It sounds great, growth without more energy being needed. But the world runs on energy. If energy stops growing then sooner or later the economy must also stop growing.

>All it proves is that there is a correlation between energy consumption and economic growth.

It proves there WAS a correlation in the time period he picked for to make his claim.

I agree that the economy must stop growing sooner or later, but I seriously doubt we are anywhere close to an energy-driven limit now. The American economy, one of the world’s biggest, could increase by half without using more energy. You can tell by comparing it to Japan or Germany. And that doesn’t even include new things like LED lighting.

Your example of driving to work illustrates this well. America’s transportation system is a joke. We’ve been importing a billion dollars a day of oil for a generation to support it. It has to change. It will be the end of civilization as Dick “The American way of life is non-negotiable” Cheney sees it, but not the end of civilization. And zero net energy housing is already feasible.

I think doomsters tend to see the economy too much as things that come out of nowhere and get used, instead of a set of arrangements of atoms. A CPU built in 2014 is worth a lot more and cost a lot less energy to produce than a CPU built in 1994. Not only that, most of the consumer products they sold at Radio Shack in the 90s have been replace by apps. My son’s sound system consists of a smartphone that fits in his pocket and a thing about the size and shape of a coke can, but it sounds a lot better than the record player, receiver etc (and huge record collection) I had at that age.

Of course arranging atoms costs energy as well. But keep in mind that all manufactured goods are absurdly crude and primitive compared to a potato. Smart phones won’t start growing on trees next week, but all manufacturing processes have vast room for improvement, and they are rapidly improving.

In take the peak oil arguments very seriously. But I think there is a decent chance of a relatively soft landing, at least on a global scale. I think oil consumption should be heavily taxed now to soften the landing. But other ecological issues like global warming, and lack of topsoil and water seem more threatening.

As to where the jobs will come from, that’s a tough question. Bill Gates claims there will be no poor countries by 2035. Productivity keeps going up. John Maynard Keynes suggested that mankind would solve its economic problem, meaning work would no longer be needed. That’s a stretch, but I do think that ecological problems will loom larger than economic problems in the coming decades.

I’m a bit behind the curve on semiconductor production technology, but certainly up to 1994 the embedded energy of computer chips was rising exponentially, just less exponentially than the processing speed. Clearly chips consume dramatically less energy than they used to in operation, but purchase price is no direct indication of net energy content – hardware is now a loss leader for many manufacturers to sell their apps and in-app purchases. The technology is breath-taking , and without the internet and the GPS satellite system, telcomms satellites , etc, largely useless.

At the same time it gets harder and harder to buy basic tools that are made of sufficient physical material to survive more than a few months of real world use without disintegrating beyond repair, because it is not economic to build in repairability when everybody just throws it away and buys a new one.

Wait a minute. Ya can’t say stuff like the economy can grow 50% without knowing what the measurement is.

GDP = C(onsumption) + I(nvestment, private) + G(ovt Spending) + (exports – imports)

There is handwaving about income based GDP measures vs the above production/expenditure measure, but the above equation is the long term standard.

(Inventories are embedded in the Consumption number btw)

Now you’ll notice that CPU speed isn’t anywhere explicit in that equation.

But oil burning is. It’s the purest form of Consumption. Taking your car out and driving in circles is economically stimulative. How cool is that?

Building tanks is G. So is paying people to dig holes and then fill them up. All G.

Foreign aid is usually military, with the obvious string attached that the recipient must buy American tanks. All part of G.

Taxes reduce Investment. Destimulative. But where could the G come from if you don’t tax? Shrug. The Fed, of course. Or the public. This is why God gave us perpetual deficits.

Want to really see why the measurements are insane? Think about software and “inventories”. Or digital movies and “inventories”.

Actually I think the quickest way to grow the American economy would be to tax gas at the pump, because it would increase net exports.

The problem with your idea about driving around in circles is that about half the money would flow out of the country, so the economy would grow less than expected.

Also far from reducing investment, taxing gas at the pump would stimulate investment in gas saving technology.

You don’t understand the equation. “Investment” is not buying stock or R&D. It’s buying machinery with which to make more widgets.

If you counted R&D or buying stock, you’d double count. The company takes that money and buys things — or in the new normal would do share buybacks.

Sorry, it just doesn’t work the utopian way. And never will. It can’t.

I understand the equation quite well as a matter of fact. By investment I meant companies buying fuel efficient equipment, or governments taking the revenue from the gas tax and putting it into mass transit.

No. I is private investment. Not government inves– spending. No such thing as government investment.

>No such thing as government investment.

That’s just some bizarre ideology.

Be that as it may, there is one error in your equation — G should be net government outlays (outlays -tax take), not spending.

Hi Watcher,

The government spending to build the mass transit is not investment spending.

The spending by all the companies who build the mass transit system on new factories and equipment is indeed private investment.

I assume you have heard of the multiplier effect.

There’s no ideology in this. It’s definition. I don’t make the definitions.

Taxes are not in the GDP measurement. If they were there would be a T, not a subset of G.

“G (government spending) is the sum of government expenditures on final goods and services. ”

There is no mention of multiplier effect in the equation.

Can’T seem to figure out how to reply to watcher but NET government spending is the number you are looking for and it is what the government gives out minus what it takes in, so it mentions taxes, because that is what it takes in.

Your equation is based on the circular flow model. Here are examples of what that looks like.

Basic (no gov or exports)

http://wiki.ubc.ca/File:Circular_Flow_Simple.jpg

More complicated

http://www.tutorsonnet.com/images/uses_of_prpbility_curve_1.jpg

These lump government expenditures but there is no reason not to split them into covering operating costs vs investment. Claiming this is somehow impossible is quasi-religious ideology.

Hi Watcher,

I am not sure how much economics you have studied, but the multiplier effect is simply that an increase in government spending will increase GDP by more than the increase in government spending.

The basic idea is that when there is considerable unemployment the government spending creates jobs, leading to higher income and consumption. The higher consumption will lead to more jobs etc.

See http://en.wikipedia.org/wiki/Fiscal_multiplier

for a better explanation.