The EIA, a few days ago posted their International Energy Statistics. They publish lots of statistics here but on monthly basis I only follow their production of world Crude Oil including Lease Condensate.

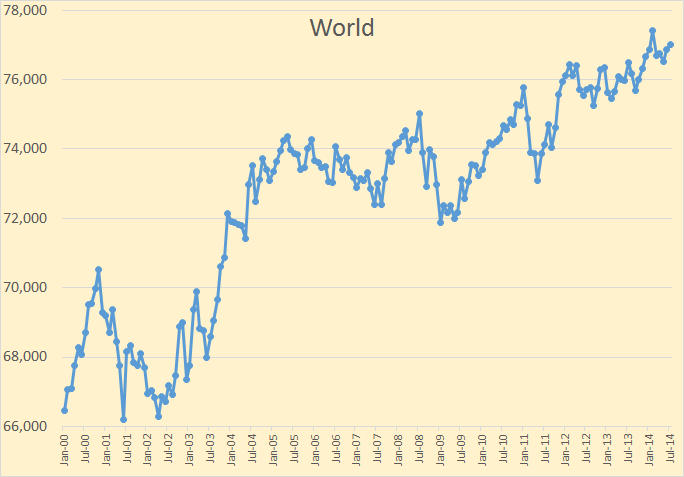

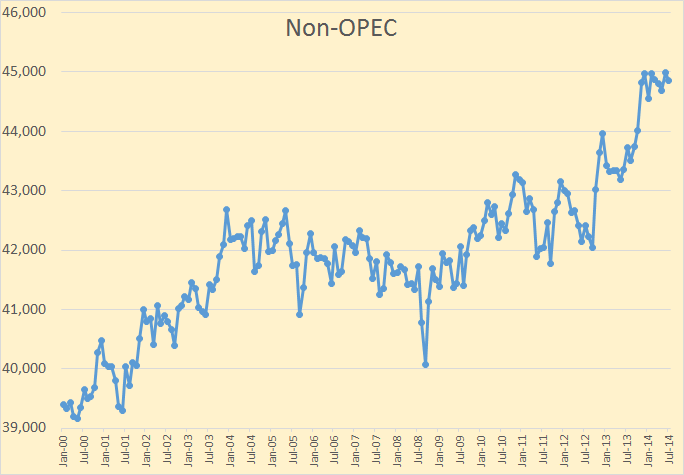

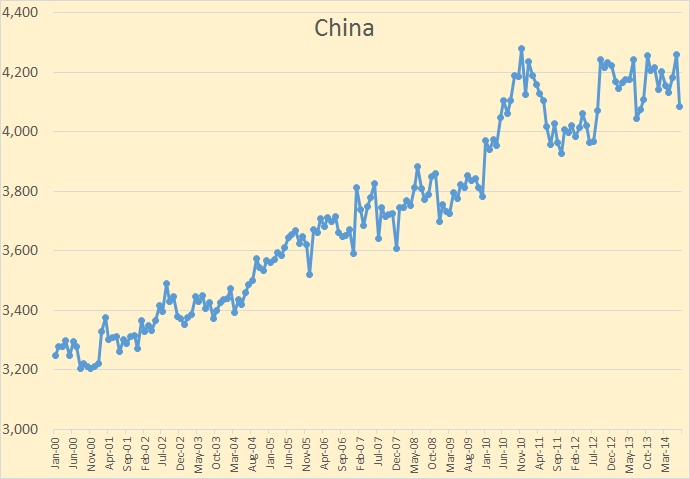

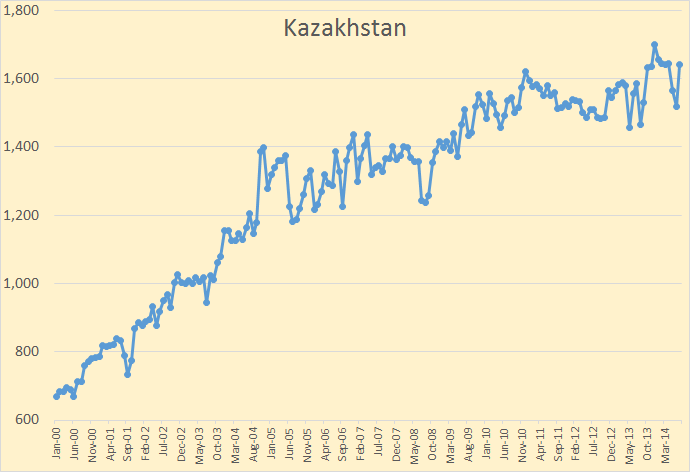

The data on all charts below is Crude + Condensate production through July 2014 and is in thousand barrels per day.

World C+C production was up 168,000 bpd to 77,023,000 bpd. The high, so far, was in February at 77,409,000 bpd.

Non-OPEC C+C was down 135,000 bpd from it high so far. It has been on a 9 month plateau high.

That surge upward in world C+C production was, of course all US production. Without US production Non-OPEC production is 1,365,000 bpd below the peak in November, 2010 and is currently below the level hit on November, 2003. World C+C less US is 2,069,000 bpd below the peak of January 2011.

I believe that Non-OPEC production, less US, is well past its all time high. I think we will see considerable decline in Non-OPEC less US production in 2015. It remains to be seen whether US production will keep Non-OPEC production increasing. But I am predicting that US production will not keep Non-OPEC production increasing past 2015.

The EIA C+C data above is through July while the MOMR Crude Only data is through September. (The MOMR with October data will be out Wednesday.) I have predicted world C+C to peak no later than next year, World peak still depends on what OPEC does. I believe OPEC will decline after 2015 also but that is just my guess.

The biggest loser in July was China, down 175,000 bpd to 4,084,000 bpd.

The biggest gainer, outside OPEC was Kazakhstan, up 124,000 bpd to 1,641,000 bpd. The biggest OPEC C+C gainers in July was Libya, up 200,000 and Saudi Arabia, up 150,000 bpd. I will have the OPEC MOMR post on Wednesday, Nov. 12.

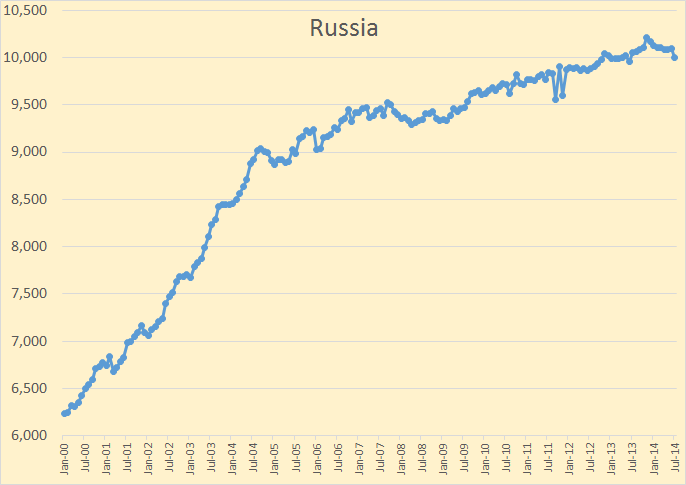

Russia is always of interest. Russia had a bad month in July, down 92,000 bpd to 10,003,000 bpd. Russia has since recovered and are producing around the same amount they produced earlier in the year. The Russian web site CDU TEK always has Russian C+C production about 400,000 bpd higher than the EIA reports. I have no idea why this is the case. Russia list daily production in thousands of tons per day. You must be registered to get their monthly and annual data. Their Registration Page is all in Russian with no translation button so I cannot figure it out.

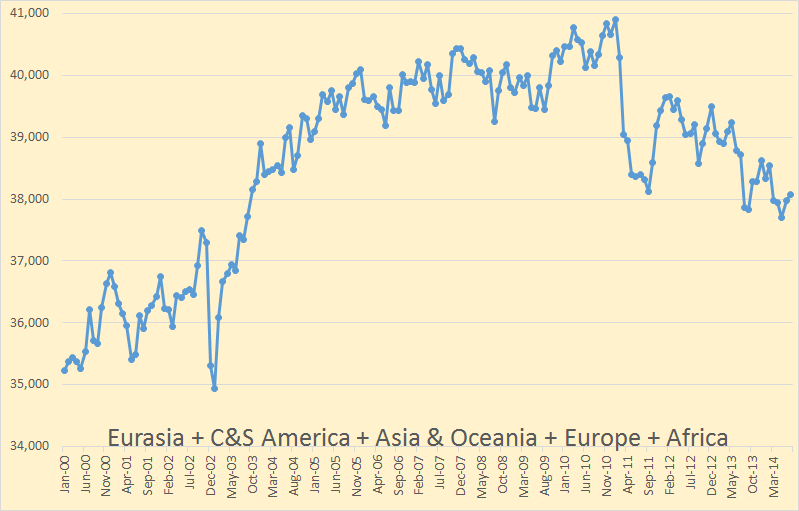

Half the world’s crude oil production is in decline, down 2,834,000 bpd since the peak January 2011. The chart is starting to look like the classic bell curve.

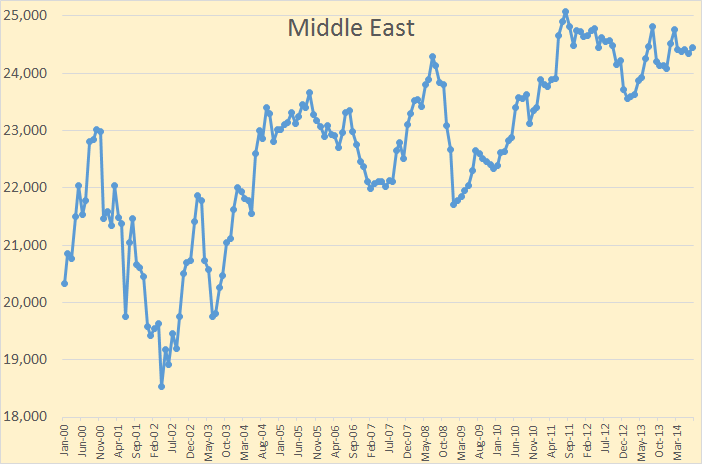

And even the Middle East with 32 percent of world crude + condensate production may also have peaked, down 625,000 bpd since the peak in August 2011.

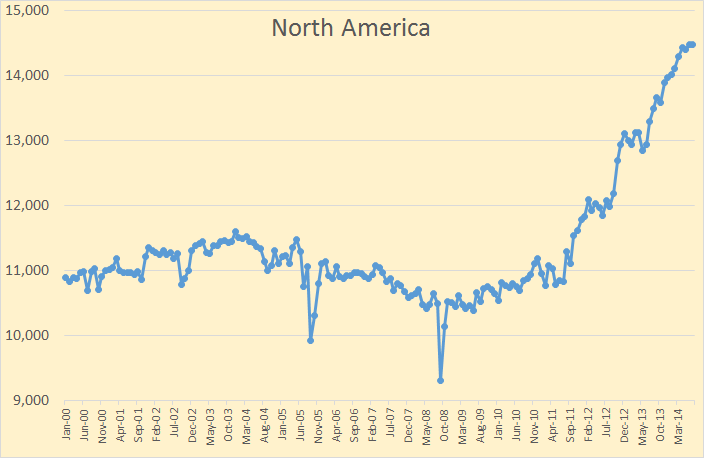

But North America is booming. With about 18 percent of world’s C+C production it is keeping peak oil at bay for perhaps one more year.

Other News:

Harold Hamm says oil prices are headed back up:

Oil Baron’s $433 million Bet that OPEC Blinks First

Harold Hamm called OPEC a “toothless tiger.” Now, he’s backing up that comment by unloading his company’s oil hedges in anticipation that OPEC won’t engage in a price war with American producers. In Wednesday’s earnings release, Hamm said:

We view the recent downdraft in oil prices as unsustainable given the lack of fundamental change in supply and demand. Accordingly, we have elected to monetize nearly all of our outstanding oil hedges, allowing us to fully participate in what we anticipate will be an oil price recovery.

‘Small oil’ could end up with a big debt problem

In order to fund the rapid growth, exploration and production companies have borrowed heavily. The energy sector accounts for 17.4 percent of the high-yield bond market, up from 12 percent in 2002, according to Citi Research.

“A lot of these smaller companies, in particular the smaller frackers, they rely on debt, and the debt markets have been wide and open for them,” Gregory Zuckerman, author of “The Frackers,” told CNBC’s “Power Lunch.” “It not clear it’s going to be (that way) going forward.”

The question is whether companies can keep their balance sheets healthy and continue to grow in the face of falling prices. U.S. oil futures have fallen about 24 percent from a high of $103.66 in June.

The page Non-OPEC Charts and the page World Crude Oil Production by Geographical Area have both been updated with the July production numbers.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Fund managers divided over predictions of oil shortages

Judith Evans, Ft.com – reports – Risk Management, November 9, 2014 8:16 pm

Oooh, here’s the big test.

Darn, I coulda posted that at the end and then claimed it was a reply, just to cause upset.

Missed opportunity.

Dost anyone know where the increased Kazakhstan production came from? Has Kashagan started up?

This is dated June of this year:

A recent report suggests that the giant Kashagan oil field might not produce any oil until at least 2016. The development of the mega oil field located in Kazakhstan’s zone of the Caspian Sea has been plagued by significant delays and cost overruns due to several technical issues.

http://www.dailymail.co.uk/wires/reuters/article-2821925/New-Kashagan-pipes-cost-3-bln-oil-flow-H2-2016-official.html

ASTANA, Nov 5 (Reuters) – The consortium developing Kazakhstan’s giant Kashagan oilfield will have to spend more than $3 billion to replace faulty pipes before output at the deposit resumes in the second half of 2016, a senior Kazakh official said on Wednesday.

No, the July increase in Kazakhstan’s oil production is just an anomaly, or an estimate that will be revised next month. At any rate there has been no fundamental change in Kazakhstan’s ability to produce oil.

Kashagan Oil Field Seen by Total Producing 2017 at Latest

Output will start at the earliest in 2016, Breuillac said in a phone interview yesterday. Total, along with partners Exxon Mobil Corp. (XOM), Eni SpA (ENI) and Royal Dutch Shell Plc (RDSA), stopped output in October last year, a month after production began, due to a natural gas leak.

Oil production may steadily decline in Kazakhstan over the next decade: KazMunaiGas Vice Chairman

“The situation in our country may completely change in the next 10 years if no new fields are discovered. The share of old fields in the total volumes of oil production will steadily decline,” Tiyesov declared.

“In 10-12 years about 80 percent of all the oil production will come from only three projects: Tengiz, Karachaganak and Kashagan. They have fixed contracts. Therefore, there is a question of what to fill our oil refineries with, not only the new one but also the existing ones. We are already beginning to face this issue,” he stressed.

doth anyone… or dost thou…

The figure “Half the world’s crude oil production” has a massive visual impression! Remarkable times, indeed.

Thanks for the good work.

S

Hi Doug,

You have named a couple of oil fields, I think all of them were offshore oil fields. It is very likely that due to the high costs of operating an offshore field that the level of output that results in abandonment is quite a bit higher than onshore oil fields and this will tend to result in steeper decline than an onshore oil field.

Below is a slightly more pessimistic World C+C scenario where extraction rates (aka depletion rates) do not rise as much as my previous scenario (where they rose to 6.2% from 5.9% in 2013 and remained at that level). Ron may like this a little better, but note that we have to assume a lower rate of depletion to cause the decline rate to go up in the near term.

A third scenario that some may like better has extraction rates falling to the 1992 to 2002 level of about 5%, a fall from an extraction rate of 6% in 2020 to 5% in 2027 would need to be explained by some kind of oil shock (such as a war in the Middle East, the start of a World War, or a severe depression), all of these things are possible, but I do not think I can predict such events. If we assume as I do that these severe shocks do not occur, then this scenario is unlikely. The more pessimistic one’s outlook, the more likely one would think this scenario.

Your World average extraction rate of 5 or 6% puts the official Saudi Arabian extraction rate of around 1.3% in perspective. Are they really that bad at extracting oil or are their reserves 4 times lower than stated, or is it a combination of both?

Hi Frugal,

I am not sure the 1.3% extraction rate for Saudi Arabia has the same denominator as the extraction rate definition I am using. In my case the numerator is annual oil output and the denominator is proved producing reserves. I think the 1.3% extraction rate is using 260 Gb of “proved” reserves in Saudi Arabia. I haven’t played around with hubbert linearizations of Saudi Arabia in many years, but in 2008 I estimated a URR of about 210 Gb, so far KSA has produced about 135 Gb and if the URR estimate is correct this would leave 75 Gb of reserves. Note that proved producing reserves would be less than total reserves, lets guess (because I have no idea what they actually are) that 70% of the remaining reserves are producing reserves. That would make the denominator 52.5 Gb and the numerator in 2013 was (EIA data) 3.54 Gb and the extraction rate would be 6.7%, if the 70% guess and the URR estimate from 2008 is correct. If we use URR=250 Gb, and leave the other assumptions unchanged the extraction rate becomes 4.4%, a URR of 220 Gb leads to

an extraction rate of 5.6%, we don’t really know the URR of Saudi Arabia or the World, but smaller URR estimates lead to higher extraction rates and a higher URR to lower extraction rates. I would need to update my Hubbert Linearization of KSA to get a better estimate, for now I would guess the extraction rate is 5.6%+/- 1% for Saudi Arabia.

In other words, you consider the 267 billion barrels of official Saudi proved reserves as fake?

There is no reason to believe any number that is published by Saudi Arabia. It’s an absolute monarchy with production controlled by national oil company and journalism controlled by state censorship. They can say whatever they like.

If someone empirically derives something that disagrees with the Saudi claims, the former should be given more weight.

Hi Frugal,

Yes the Saudis reserves are unaudited, this is covered in Twilight in the Desert. Note that at present a Hubbert Linearization suggests 255 Gb for a Saudi URR, these analyses are not very good however and often underestimate the URR, I would guess around 275 Gb for a Saudi URR.

If the “official” Saudi reserves of 267 Gb was correct then URR would be 402 Gb, I am often accused of being optimistic, I doubt Saudi cumulative output will be higher than 300 Gb. My best guess is URR=275+/-25 Gb.

Frugal, that fact that about two thirds of OPEC reserves are fake is known by everyone who has really seriously looked into claimed OPEC reserves.

It all started in the 80s when OPEC contemplated basing OPEC production quotas on a countries proven reserves. Then almost every OPEC nation began to increase their reserves, with a pencil. And since the 80s billions of barrels of oil have been produced by OPEC nation but their “proven reserves” have only increased, never decreased. That means for every barrel produced from OPEC reserves a new barrel was added to replace it.

Why does OPEC lie about its oil reserves?

OPEC, since the 80’s, began determining production quotas based on the proven oil reserves of its member countries. And, in the same decade there was ridiculously large leaps in numbers: In 1983, Kuwait increased its reserves from 76 billion barrels to 92 billion barrels. Come 1987, Iraq’s reserves went from 47 billion barrels to 100 billion barrels, Iran’s reserves soared from 49 to 93 barrels, and the UAE oil reserves tripled from 31 billion barrels to 92 billion barrels in 85-86. Suspiciously, all the countries had either discovered new oil fields or their existing fields began producing more.

You need to read this whole article to understand it all. The article is five years old this month. Since then OPEC reserves have increased despite the billions of barrels produced since November 2009.

The late Buz Ivanhoe on OPEC reserves (1996 – pages 3-4) http://hubbert.mines.edu/news/Ivanhoe_96-1.pdf

Hi Ron,

Based on Jean Laherrere’s analysis about 300 Gb were added to OPEC proved plus probable reserves in the 1980s quota fights, also 375 Gb of extra heavy oil needs to be deducted from 2P reserves for a 2012 C+C-XH 2P reserve estimate of about 870 to 925 Gb, of these reserves about 650 to 700 Gb are OPEC 2P reserves.

See figure 7 on page 7 of the report at the link below:

http://aspofrance.viabloga.com/files/JL_2013_30Mai_Clarmix.pdf

I haven’t played around with hubbert linearizations of Saudi Arabia in many years, but in 2008 I estimated a URR of about 210 Gb, so far KSA has produced about 135 Gb and if the URR estimate is correct this would leave 75 Gb of reserves.

That was your opinion in 2008? I did not know that. But at any rate, congratulations, I think you got it right.

http://www.theoildrum.com/node/5154/477988

The old estimate was a URR of 200 Gb, now I get 290 Gb, the method tends to underestimate URR in many cases.

Hi Frugal,

The current KSA Hubbert Linearization (1995 to 2013 EIA annual C+C data) leads to a URR of about 255 Gb, I would increase this by 10% because the KSA HL keeps creeping higher over time for a URR of roughly 275 Gb.

For the world in 2013 proved producing reserves (from my model) were 459 Gb and remaining reserves are 1308 Gb so the ratio of producing reserves to reserves is 35%, if we assume this ratio is correct for Saudi Arabia and the URR is 275 Gb, remaining reserves are 140 Gb and producing reserves are 35% of 140 or 49 Gb. The extraction rate for 2013 would be 3.5/49=7% for Saudi Arabia.

….if we assume this ratio is correct for Saudi Arabia and the URR is 275 Gb, remaining reserves are 140 Gb and producing reserves are 35% of 140 or 49 Gb. The extraction rate for 2013 would be 3.5/49=7% for Saudi Arabia.

Wouldn’t that imply that only 35% of Saudi proved reserves are producing oil? But now that Manifa’s online, is there really any significant Saudi fields that aren’t producing oil? So instead of 35%, shouldn’t it be closer to 100%. Or am I missing the definition of producing reserves?

Or am I missing the definition of producing reserves?

I have no idea. I have never heard anyone speak of “producing reserves” before.

Hi Ron,

The EIA gives the data for proved non-producing reserves in the US at the link below:

http://www.eia.gov/dnav/pet/PET_CRD_NPROD_DCU_NUS_A.htm

in 2012 “proved non-producing reserves” were 13.3 Gb for crude plus condensate.

EIA C+C data for “proved reserves” are at the link below

http://www.eia.gov/dnav/pet/pet_crd_cplc_dcu_NUS_a.htm

In 2012 US C+C proved reserves were 33.4 Gb.

You are correct that there is no specific data for the proved C+C reserves that are not “proved non-producing” reserves, I suggest we name them “proved producing reserves” and in 2012 there were about 20.1 Gb of these proved reserves that were producing oil.

Note that the best estimate of future oil output is based not on proved reserves, but on proved plus probable reserves according to Jean Laherrere. Typically proved reserves are about 70% of proved plus probable reserves, so I would estimate for the US in 2012 that proved plus probable(2P) reserves (for C+C) were about 48 Gb so the “proved producing reserves” were about 20.1/48 or 42% of 2P reserves.

My guess would be that the ratio of proved producing reserves to 2P reserves in Saudi Arabia would be similar to the US, where oil fields in general are quite mature, in fact because Saudi Arabia has not been producing oil as long as the US, I would expect the Saudi ratio to be somewhat lower than the US so 35% may not be far off.

Hi Frugal,

I wanted to consider reserves that are in production, the “proved producing reserves”, which are a subcategory of proved developed reserves.

Let’s say a field has begun development and is producing oil, and to simplify we assume all wells have the same estimated ultimate recovery (EUR). When the field is full developed it will have 500 wells, but only 250 wells have been drilled and are producing oil, under my simplifying assumptions only half of the 2P reserves would be “proved producing reserves”.

When Saudi Arabia stops drilling new wells, and all the wells that will produce oil have begun actually producing, at that point 100% of 2P reserves would be “proved producing reserves”.

I found the following which defines several sub categories of proven reserves at the link below:

http://www.spe.org/industry/docs/Petroleum_Reserves_Definitions_1997.pdf

see page 3 of the pdf

Reserve Status Categories

Reserve status categories define the development and producing status of wells and reservoirs.

Developed: Developed reserves are expected to be recovered from existing wells including reserves

behind pipe. Improved recovery reserves are considered developed only after the necessary equipment

has been installed, or when the costs to do so are relatively minor. Developed reserves may be subcategorized

as producing or non-producing.

Producing: Reserves subcategorized as producing are expected to be recovered from completion

intervals which are open and producing at the time of the estimate. Improved recovery reserves are

considered producing only after the improved recovery project is in operation.

Non-producing: Reserves subcategorized as non-producing include shut-in and behind-pipe reserves.

Shut-in reserves are expected to be recovered from (1) completion intervals which are open at the time of

the estimate but which have not started producing, (2) wells which were shut-in for market conditions or

pipeline connections, or (3) wells not capable of production for mechanical reasons. Behind-pipe reserves

are expected to be recovered from zones in existing wells, which will require additional completion work

or future recompletion prior to the start of production.

A final scenario with extraction rates (aka depletion rates) rising from 5.85% in 2014 to 6% in 2020 and falling back to 5.85% in 2028. In 2013 the model estimates an extraction rate of 5.8% for World C+C minus extra heavy oil (oil sands and Orinoco belt oil). It is of course impossible to know what future extraction rates will be, this scenario is my best guess.

Dennis, Ron, et al., adjust world C+C for population, and we’re at the levels of 2000-01 and 2003 per capita.

Total world petroleum production per capita is at the level of 2004.

US C+C per capita peaked in 1970 and is down 46-47% since, and it will achieve a 50% decline by “no later than” 2020-21, with a 50%+ probability of occurring in 2016-17.

Peak Oil is history, i.e., it happened in 2004-05 in per capita terms, which is what matters to real GDP/final sales and net available liquid fossil fuel per person we can afford to burn and avoid contraction of real final sales per capita.

We can’t grow the 5- and 10-year real change rate of real final sales per capita AND have $80-$100 to profitably extract tight and deep oil. Therefore, it follows that we can neither afford to build out the renewable infrastructure to the necessary scale AND maintain the existing liquid fossil fuel infrastructure indefinitely.

Peak Oil + population overshoot + resource depletion per capita = “Limits to Growth” (LTG) = no further growth of world real GDP or final sales per capita hereafter.

The oil-, auto-, debt-, and suburban housing-based economic model is done, but we’re in a Red Queen Race over the Seneca Cliff and don’t know it collectively (or those in positions of authority and power are not telling us, for obvious reasons).

The US shale boom/bubble’s rate of change of acceleration peaked in 2012-13, and the absolute peak is likely to occur “no later than” 2017-19, with increasing evidence that the leading edge of the peak is occurring now and into early 2015.

US-Canada total petroleum production is likely to peak sooner than is now anticipated, as the differential trend rates of growth of production to consumption projects that US and Canada will become “energy independent” by no later than 2017-19, but not in the way proponents of the idea currently envision. The parity of US-Canada production and consumption is more likely to occur as a result of consumption “catching down” to production in the years ahead with production peaking, rather than the converse.

As the rest of the world’s real GDP per capita decelerates further because of Peak Oil, overshoot, and peak Boomer demographic drag effects, the export market for shale and tar sands will not be there as is now assumed, apart from exports for US imperial military needs abroad.

Again, “Peak Oil is history”; it is in the rear view mirror, and we’re on the road off the Seneca Cliff, at the end of the Oil Age epoch, and the beginning of the end of the financial and economic basis for modern, high-tech, high-entropy, mass-consumer society.

The tragedy is that there is no alternative system emerging to permit us to transition seamlessly and successfully to a post-Oil Age epoch. Politicians, eCONomists, CEOs, public intellectuals, and mass-media influentials are not even permitted to admit that Peak Oil has occurred, assuming they are aware and properly informed about the phenomenon, its manifest effects, and the implications hereafter.

Congratulations and many thanks, Ron, for the highly informative site and to the regular contributors here. This site is a worthy successor to the Oil Drum.

Hi BC,

You are correct that per capita peak oil is behind us, but it is interesting how much it has fallen in the US and although things are not great, since 1970 there has been an increase in output, though most of the income increase has gone the the wealthy, middle income wages have been stagnant despite productivity increases.

World GDP per capita has continued to rise (except in 2009) even though per capita oil use (C+C) has peaked.

There will not be a smooth transition, it will be uneven. Fossil energy prices will rise and by fits and starts there will eventually be a transition to other types of energy and greater efficiency in the use of energy.

Anyone who thinks it will be easy is not paying attention. Easy? No. Possible? Maybe.

Dennis, US real final sales per capita are no higher than in 2007-08, and world real GDP per capita is up just 0.4%/year since 2007-08, with a disproportionately large share of the growth being attributable to China’s runaway credit and fixed investment bubble.

The 10-year change of US and EU real GDP per capita is tracking Japan’s rate since 2000-07.

WRT oil production, imports, and growth of total world exports, the world is now where the US was in the mid- to late 1970s, i.e., peak oil production per capita and peak industrialization.

However, the US replaced industrialization and growth of value-added goods-producing employment and rising wages with increasing debt to wages, profits, gov’t receipts, and GDP, and a decline in labor’s share of GDP to a record low. By 2007-08, growth of overall debt to GDP per capita could no longer continue. The same is now occurring for the rest of the world.

The world today does not have the luxury of looking forward to a 25-year US-like debt cycle, financialization, and feminization of the economy (via female employment in gov’t, retail, education, health care, and financial services), and doing it with $10-$20 oil.

As for a transition to a post-Oil Age renewable energy era, see the following:

http://sunweber.blogspot.com/2014/11/prove-this-wrong.html

http://www.rasmussenreports.com/public_content/lifestyle/general_lifestyle/november_2014/americans_overwhelmingly_say_mass_transit_is_not_an_option

I just read the link on mass transit. It seems kind of meaningless. The poll only used 1000 people, and I assume these were people spread across the country rather than concentrated in areas where there is mass transit and the existing mass transit offers a workable option to rival cars.

Where I live, people do vote for mass transit as a solution to traffic. They know they are going to spend money somehow and many would prefer to put the money toward mass transit than to put the money toward ever widening highways which seem to encourage even more cars on the road.

Once you have good mass transit and you are commuting into a city, you have eliminated the need to pay for parking, and you can relax and/or do work on the train or bus rather than driving. If you are looking at an hour to two-hour commute and you can use that time more productively than staring at stop-and-go traffic, it becomes a more appealing option.

Very few Americans would willingly take public transportation over driving their own car somewhere, and most rarely use mass transit at all. A new Rasmussen Reports national survey finds that 70% of American Adults rarely or never use mass transit like buses, trains, subways or ferries, and another 11% only use it every few months. Just 12% use mass transit services at least once a week, with seven percent (7%) who use them every day or nearly every day. Six percent (6%) use mass transit two or three times a month.

The HL for Saudi Arabia is below, URR is 290 Gb when data from 1998 to 2013 is used.

The 95% confidence interval (if the data is normally distributed) for the URR is very wide 185 to 518 Gb.

The 75% confidence interval for the URR is 224 to 393 Gb.

On the Hubbert Linearization for World Crude plus condensate minus extra heavy oil (C+C-XH), I checked the confidence interval, the estimate is 2460 Gb with a 95% confidence interval of 2240 to 2700 Gb and a 75% confidence interval of 2330 to 2590 Gb.

Bottom line, the World C+C-XH HL constrains the URR fairly well, it is likely in the range of 2300 to 2600 Gb, much tighter than the KSA HL.

Jean Laherrere replies:

my graph finds about 2200 Gb for crude oil +condensate less extra-heavy

I am outside the 95% range of Dennis!

I guess that Dennis is not using the same data in particular for XH

you should ask him his graph with the break down with XH

for me XH is less than 10°API = Athabasca and Orinoco

XH ultimate is 500 Gb (always round figure with only 2 significant digits or less)

2200 Gb is used in my modeling fro crude-XH

The other problem is that condensate is badly defined and reported explaining the discrepancy of >2 Mb/d between IEA NGL and EIA NGPL in WEO 2008 and in 2020 the discrepancy is forecasted being 5 Mb/d!

Hi Jean,

I appreciate you taking the time to correct any errors I may have made.

The HL I did does deduct Canadian Oil sands and Orinoco belt extra heavy oil from world C+C output. The difference is the start date, you choose 1985, I use 1993. The chart below shows how the URR result from a Hubbert Linearization varies if we change the start date from 1983 to 1985, 87, 89, 91, and 93. Many analyses I have seen from around 2007 or 2008 used 1992 as a start date to get a 2000 Gb URR for C+C. In the chart it is pretty clear that the HL is not very stable over the period as the result changes from 2100 Gb for 1983 to 2013 to 2500 Gb for 1993 to 2013. Chart below.

A mistake on my part, Jean Laherrere uses 1986 to 2013 for his C+C less extra heavy HL not 1985 as I stated above. A 1986 to 2013 HL would fall between the red and gray dotted lines at a URR of 2200 Gb.

The choice of start year between 1986 and 1993 makes a big difference, about 14% higher after we round to 2 significant digits.

A second chart with Hubbert Linearizations for C+C less extra heavy for 1993-2013, 1995-2013, 1997-2013, and 1999-2013, the URR remains much more stable with URR values between 2400 and 2500 Gb.

Cumulative C+C less extra heavy is 540 Gb in 1985 and 1210 Gb in 2013.

As the stable value for URR is 2400 to 2500 and the longest time period where the stability begins rounds to 2500 Gb and because the URR has tended to increase over time it makes more sense to round up to 2500 than down to 2400 Gb in my judgement.

His second Chart

Hi Jean,

It is interesting that your C+C output in 2040 is about 60 Mb/d ( adding the C+C-XH at 50 Mb/d to the XH at about 10 Mb/d, both in 2040). There are some people that think the decline in C+C output will be considerably steeper than your forecast, but your forecasts are the standard against which any other forecast is measured and is far better than anything else I have seen.

Thank you again for your insight.

Correction 2040 C+C in Jean Laherrere’s forecast looks like it may be 57 Mb/d on closer inspection, but it is tough to read off the chart, definitely somewhere between 55 and 60 Mb/d to my eye.

Here is the chart with C+C, C+C-XH and XH (tar sands and Orinoco oil)

And Jean’s third chart.

Hi Jean,

The NGL forecast as you know is mainly a reflection of natural gas forecasts. It looks as though the IEA is more optimistic than the EIA (which is also quite optimistic in my view) regarding future natural gas output.

There may be a difference between the way the two agencies account for condensate and NGL.

As you have pointed out there are many problems with the statistics. My scenarios are for C+C only and do not include NGL.

If you haven’t already read this Forbes article then I think you’ll find it’s really worth your time:

As Oil Plunges Further, Why It Might Be ‘Game Over’ For The Fracking Boom:

http://www.forbes.com/sites/christopherhelman/2014/11/05/as-oil-plunges-further-why-it-might-be-game-over-for-the-fracking-boom/

The money shot for me:

“At $100 a barrel, the average oil company can generate net income on the order of $15 a barrel (see the comments section for more discussion of this). But as prices fall, this margin evaporates quickly. A decline of $10 to $90 leaves a margin of only $5, that means profits plunge 66%. Thus, at current prices, the average oil company won’t be profitable at all, and the weaker ones, loaded up with debt, are the walking dead.”

Hi Marcus,

Eventually oil supply will drop due to lower profits (this will be more apparent next spring as the Bakken usually has lower output in the winter months, though the Eagle Ford will be interesting to watch), at that point oil prices will rise unless OPEC cuts output before the winter, in that case oil prices will rise sooner.

Dennis, whilst what you propose is logical I’m not brave enough to bet on oil prices in any given time frame. Markets often defy rational process.

Agreed, this is what I expect to happen, I would not bet on it however.

Marcus, Dennis, Watcher, et al., the annual and cyclical real change rates of global real GDP per capita decelerated to the historical stall speed and the rate typical of the onset of recessions as long ago as Q4 2013. That is to say, the global economy is much weaker and subject to all manner of “exogenous shocks” than the Establishment consensus assumes or can be permitted to admit.

The Bank of Japan’s bug-eyed panic move to dramatically expand bank reserves and overtly monetize Japanese gov’t deficits and to buy equities and pension assets in the past week or two is reminiscent of the 2008-09 bank reserve printing party panic.

Global structural deflationary forces continue to build, including in the Middle Kingdom, which has created the largest credit and fixed investment bubble as a share of GDP in world history (with the possible exceptions of the Egyptian pyramids and The Great Wall of China).

Extreme wealth and income inequality in the English-speaking world, Brazil, Mexico, China, the Middle East, most of Africa, and Russia is creating a structural drag on money velocity and growth of money supply less bank reserves and of nominal GDP.

Central banks expanding bank reserves to record levels as a share of GDP only exacerbates the unprecedented leveraged asset bubbles and net flows to the financial sector as a share of wages and GDP, reducing further net real, after-tax wages and profits, resulting in an additional incremental drag on real (un)economic output.

Hi BC,

World GDP per capita was still growing as of 2012 based on IMF Real GDP data (2005 $ using PPP method) from the World Outlook and UN Population data.

The average rate of real GDP per capita increase was about 1.8% from 1980 to 2012 and the growth rate has increased from about 1% in 1981 to 2.5% in 2012.

You, sir, have forgotten 2011.

These things you describe, particularly Q4 2013 and the following quarter, can be entirely accurate and not mean anything at all.

The world changed in 2008. Decisions were made. Actions were taken. And they have been taken over and over since. Three times the Fed has created whimsical money, and the media celebrated the end of each program when it occurred, suggesting “things are back to normal now”. Then the next round of intervention (in capitalism) took place and the media decided this was prudent shepherding of all things money and celebrated that, too, because advertisers fund them and no one will advertise on a media vehicle that depresses consumer sentiment.

And thus, you have forgotten 2011, when the EU rushed into Greece and redefined this instrument and outright threatened the holders of other instruments, all to prevent credit default swaps from triggering. Then when there were a few holdout bondholders, the EU went to the organization whose task it was to declare swap trigger when defaults occurred, and threatened them with jail if they made any such declaration.

This is what you forgot. Money is artificial. If it threatens Apocalypse, governments can redefine things or threaten other things to prevent Apocalypse. If you were in a position of power, you’d probably do the same.

It’s all broken and it’s not fixable. But government won’t let numbers on a screen destroy The System. Only oil scarcity can (and will) do that.

Watcher, if the reply was directed to me, I take your point completely, but I did not imply otherwise. What we are describing is part of the end game of the Fossil Fuel Era and of the once-in-history debt- and oil-fueled mass-consumer model of (un)economic activity and growth.

Effectively, then, the central banks’ liquidity is the stock market, and the stock market is the economy. The central banks cannot raise reserve rates or withdraw reserves from the financial system or risk contraction of nominal GDP and M3, and worse yet a potentially catastrophic disruption to the term structure of outstanding debt and the delevering of trillions of dollars of netted derivatives positions against what is essentially fictitious bank capital guaranteed by central banks’ willingness/obligation to print as many fiat, digital debt-money book entry credits as required to prevent global banking system collapse.

But we are now seeing FDI to China-Asia slow or near reversal, and growth of demand for commodities is decelerating rapidly, not unlike in the manner that precedes recessions.

Dennis, here is the change rate of real GDP per capita in 2005$ for the largest economies:

http://data.worldbank.org/indicator/NY.GDP.PCAP.KD.ZG/countries/1W-US-XC-CN-JP-BR?display=graph

Ex China, there has been virtually no growth since 2011-12.

LTG have arrived. Growth is over. Now it’s just a matter of how the decline trajectory progresses and how, and how soon, the acute effects manifest.

Effectively, then, the central banks’ liquidity is the stock market, and the stock market is the economy.

It is interesting to watch the wealth defined mostly by the very wealthy trading assets back and forth amongst themselves. The stock market, property, art, etc. are deemed at their current valuations because other wealthy people say so.

The rest of us don’t really matter that much to their lives.

It has been amusing to watch all the folks sprint for microphones to present their studies showing lower and lower breakeven prices. But we seem to forget how Shell and the big oil companies divested their shale positions hand over fist over the past year or so. Exxon via XTO retains wet gas property, but in general the guys who actually have to pay dividends to shareholders got to the exit first.

The fact that the majors were so fast to exit proves one or another thing to me to a reasonable degree. They either thought that total production costs were going to prove to be too high to make an economic go of tight oil at close to a hundred bucks-or else they were anticipating the price drop. Maybe both.

After all they do have all the inside data and are in a position ahead of everybody else to know just how much oil is being bought -or not bought- at prevailing prices.

The Chinese are in my estimation thinking oil will go up again pretty soon since they seem to be buying a lot to put into storage.

http://online.wsj.com/articles/china-has-refined-taste-for-oil-heard-on-the-street-1415609441

OFM,

Some of that imported oil is going to the Chinese refineries that have been turning out diesel for export. China has been increasing refining capacity; they have more diesel than they need so they’re exporting it.

Or . . . a government could fund a pipeline to carry NoDak and even Canada oil south thru Nebraska et al and reduce the cost to companies represented by rail cars. Of course Warren is out there fighting that right now, and of all the issues of election night (Obamacare, the economy in general, Middle East incompetence) the Keystone wasn’t really all that prominent, but somehow, some way, it has become very high on the GOP agenda for early passage.

What a coincidence.

The repuglicans need to score some quick legislative successes to drive their message and their victory home and the Keystone is probably one of the easiest and quickest ones they can hope for since the democrats as a group are not united on this and some democrats supported it all along.

My guess is that it will be approved in a hurry with enough democrats breaking ranks on it to make that approval just about veto proof.

In politics the importance of an issue is often greatly magnified by the amount of publicity it has gotten and the Keystone has been in the news constantly for a long time.

Be that as it may be . . . it IS a government subsidy of the Bakken.

It is only a subsidy if the government pays for it, the Keystone XL is a privately owned pipeline, which will help the Canadians mostly, the takeaway capacity from the Bakken in this pipeline is not very large. Bakken producers can now send their output by pipeline to Cushing for $11/b and this makes sense as long as the Brent WTI spread is $5/b or less, according to RBN Energy transport by rail to the East coast is $16/b so if Brent is $5/b more than WTI, it’s a wash as to whether to use pipelines to get the oil to Cushing or rail to get the oil to east coast refineries.

It is a subsidy if anyone other than Bakken oil producing companies pay for it.

You can have some contractor bid the contract for the pipeline, get some tax breaks and other incentives and camouflage the whole reality. Why would you think the gov’t has to have the Army Corps of Engineers build the pipeline for it to be a subsidy.

Ok all private enterprise is a government handout. Is that about right?

Oh and you forgot the part about it helping primarily the Canadian oil sands producers. Maybe the Canadian government is paying for it? I am not from Canada so perhaps the Canadians can chime in.

Of 830 kb/d capacity of the Keystone XL “Northern leg” about 100 kb/d of capacity will serve the Bakken of North Dakota and Montana. So it can help to move one tenth of Bakken crude (assuming 1000 kb/d).

http://www.desmogblog.com/2014/02/05/keystone-xl-northern-leg-fracked-oil-pipeline-tar-sands

Canadian Govt. is not paying for it beyond lobbying for its construction and being friendly to oil business.

Paulo

Wait til it’s built and positioned before you declare takeaway capacity.

You think they will change the plan significantly at this point? There is a specific plan which has to be approved, the plan under consideration has those capacities.

From reading the article, I guess the small highly leveraged drillers may end up getting bought up by their cash rich big brothers. That would bring down their interest rates anyway. So maybe fracking will survive, just not the smaller players.

The big boys are not cash rich. Someone would have to finance the purchase, and they’ll want some say in price paid.

This was another item addressed elsewhere. The price decline also smacks the value of lease holdings. That reduces the book value of the holder. Hard to finance a declining asset.

The fall in asset prices cuts both ways — it makes the tiddlers cheaper to buy. Anyway, we’ll see.

Probably old news to the sharpshooters here, and yes, this doesn’t change PO, but I found it noteworthy nonetheless:

http://theweek.com/speedreads/index/271742/speedreads-ford-is-making-aluminum-pickup-trucks

http://www.greencarreports.com/news/1093609_2015-ford-f-150-sfe-highest-gas-mileage-model-for-aluminum-pickup

http://www.ford.com/trucks/f150/

I did not find the fuel efficiency estimates, but Ford states a 20% increase over 2014 F-150 gas mileage ratings…so 20% better than 18 combined MPG would be about 21-22 combined MPG.

Now I want to see an all-aluminum body and the most efficient ICE-Hybrid engine (Lithium batteries under the PU bed) in a Chevy LUV/Light Datsun-type PU truck…could such a vehicle possibly achieve 30 MPG combined? Maybe more? Not a off-road, big payload, towing machine, but suitable for folks wanting to haul modest loads in an open bed. Aluminum bodies /should/ offer better corrosion resistance than steel bodies…better use of aluminum than for gazillions of beverage cans…

Or an electrick pickup:

http://www.viamotors.com/vehicles/electric-truck/

This, of course, can be deleted. Apparently this is what happens when you edit a comment while it’s saving.

Generally we won’t delete stuff because the thread sometimes gets messed up if we do.

It is deleting messages that have existing replies that really messes things up. That’s why I ask people not to reply to spam messages.

If there is no reply to a message it can be safely deleted. However it takes about 30 seconds or so to delete a comment. If someone replies during those 30 seconds, while I am in the process but before I get it deleted, then things get messed up.

Hi Ron,

Perhaps it would be better to just edit the posts rather than delete them altogether?

Or an electric pickup:

http://www.viamotors.com/vehicles/electric-truck/

Nick,

thank you, I learned something…I had not heard about VIA before.

http://en.wikipedia.org/wiki/VIA_Motors

They don’t state their prices (one has to ask for a quote)…

I also did not see anything talking about a warranty.

The truck shown as the flagship display for their web site is not all-electric, it is a hybrid that can go ~~ 40 miles in all electric mode, and about 400 miles in combined mode. The company claims drivers will get an average of 100MPG equivalent.

The company buys GM trucks (and certain vans and SUVs I think) and retrofits them with a new hybrid drive train.

There…urban cowboys (and real ones) can have their big truck and be fuel thrifty as well,,,hell, no warp drive required!

Bob Lutz seems to run this outfit..the guy who had a lot to do with the Chevy Volt.

Make’em outta Aluminum so they don’t rust…

My mind reels if every consumer light truck could be made with these efficiency specs..and all the cars too…I imagine consumer light car/truck gas/diesel consumption could easily be cut in half…maybe by two-thirds…even with some Jevon’s Paradox thrown in…hey, there is only 24 hours in a day, and the elasticity of individual VMT is not very significant, I bet.

They claim that the Total Cost of Ownership is substantially less than for a conventional pickup.

I suspect the practical MPG of the average pickup is no better than 10, so if they can get 100MPG overall, then that’s a 90% reduction. That’s a large enough reduction that you could pay $10 per gallon for your fuel and still be able to afford fuel easily. $10/gallon is the cost of fully synthetic fuel, even with today’s tech.

My experience with a Leaf convinces me that once people get acquainted with real cars powered by PV, they will not want anything else.

My only problem with the Leaf is that they are way too fancy. I like bare bones vehicles, with the money going to make it go -and do something.

Yair . . . Most of the current crop of Japanese diesels around three litres will do 11-12 kilometres per litre . . . what’s that 26-27 miles per US gallon?

Cheers.

More evidence of falls in drilling activity (and not just shale):

http://oilprice.com/Energy/Energy-General/Early-Signs-Of-A-Pullback-In-Drilling-Activity.html

The Transocean quotes are eyebrow raising.

Last night Glen made one of his usual eloquent comments that I didn’t want people to miss.

http://peakoilbarrel.com/eias-international-energy-statistics-3/comment-page-1/#comment-428281

To follow what OFM is talking about, I put up the comment that follows

http://peakoilbarrel.com/eias-international-energy-statistics-3/comment-page-1/#comment-427454

To which Doug Leighton and Ron responded

http://peakoilbarrel.com/eias-international-energy-statistics-3/comment-page-1/#comment-427598

I responded to Ron with some wishful thinking below

http://peakoilbarrel.com/eias-international-energy-statistics-3/comment-page-1/#comment-427807

At the end of that last link at 6:17 was Ron’s response and OFM was responding to that comment by Ron.

I thought it was interesting, but the order got all messed up, this was an attempt to put it back in order.

The short story is that I have somewhat convinced OFM and Doug of my optimistic position(though Doug less so), Ron pretty much thinks I am nuts (though Ron never actually said as much, I am reading between the lines.)

Nuts is extreme. You just need to spam about 800 more scenarios so you can be right.

Only 800? I have passed 1000 already, I’ll have to delete some I guess 😉

Dennis, where I think you are wrong is that you think the decline will be slow and orderly and everyone will adapt to lower liquid fuel supplies and much higher prices. And all this will happen… very gradually.

Yes, that is wishful thinking. Nothing has ever happened that way in the past and, I believe, never will in the future.

The decline will come in spurts and be very chaotic. The economy will respond in up and down swings with each up being a little lower than the last time and each down being a little lower than the last. We will never have an orderly adjustment to lower amounts and higher prices of liquid fuel. That would be like expecting the ever expanding human population to, nevertheless, adjust to a little less food each year.

No, to expect things to be smooth and orderly is… is… well it is just nutty.

Hi Ron,

The scenarios show a smooth line, you can think of it as a trendline, there will definitely be noise, that is even more unpredictable than the trendline, I could add some random wiggles to the trendline if that would make it seem more realistic, I agree that there will be business cycles and I expect peak oil will make them more severe, but I don’t know how severe they will be, when they will begin and so forth.

So when I say that the economy may be able to adjust, I often add that I do not think such a transition will be smooth or easy, so perhaps I am more sane than you realize.

Take a look at the 1984 to 2016 period and imagine we did a 5 year centered moving average of oil output, a lot of the wiggles in the output curve would be smoothed by such an average and the extraction rates would be smoothed as well, in some sense you can think of the scenario after 2013 as being a general trendline which might reflect a 5 year moving average, nobody could possibly predict exactly what is going to happen to future oil output, I am just trying to give a general sense how things will play out if extraction rates are higher or lower than present levels in the future.

Smoothed scenario 9 year centered average 1985 to 2008, then shorter averages (7, 5, and 3 year) to 2011 for both world C+C and extraction rate. Actual future output would fluctuate above and below the trend line shown.

Hi Ron,

I don’t think human population will be ever expanding, the rate of growth in population is slowing down and just like oil it will peak and decline.

It will be chaotic, but I think the capitalist economic system is more adaptable than you do. Oil is not the only form of energy, as oil prices increase due to scarcity less oil will be used.

Google “earth population growth rate” for a good overview. It peaked at about 2.1% in 1963 and has steadily fallen. It’s now at about 1.2%.

The main driver is the fertility rate which has fallen by half. Increased life expectancy is the main growth engine now. The population pyramid is turning into a tower.

Since 1950 most population growth has come from increasing numbers of under twenties. In the coming century it will be increases in population of those over 35.

http://cdn.static-economist.com/sites/default/files/20110514_WOC726.gif

Extremely high death rates in the over 70 group are keeping population under control for the time being. This may change.

The rate of increase in average life expectancy will slow down and probably stop around 80 (or grow very slowly once it reaches 80, probably around 2100, if it ever actually gets there).

It all depends on if the transition to a more sustainable system is ever achieved, the more pessimistic view is that average life expectancy will be decreasing in the near future.

My view is that in the near term under realistic scenarios it might get to 80, but only with optimistic assumptions about a world transition to non-fossil energy sources.

Hi Dennis,

I have reached conclusions that overlap considerably with yours partly by considering your arguments for sure but mostly by following a different route – that of a generalist or renaissance arm chair scholar as opposed to a specialist who crunches a lot of numbers.

My starting point in understanding the nature of human events is to never forget that the world is a Darwinian place and that humans since the beginning of recorded history have mostly been competing with each other as opposed to other species.

From there I move into the (again armchair) study of history with the emphasis on technology and military affairs as much as plain old politics which is where most historians put their energy.

I can envision collapse happening all over the world but see that as very unlikely. Even the most cursory study of history is enough to understand that a place such as North America with an ocean on either side and plenty of indigenous resources is not in any imminent danger of collapse except as the result of the most utterly incompetent leadership. ( At this point I am scaring myself.!!!!)

History isn’t over. War is almost a given on any given day someplace or another.Nukes will either continue to keep the major powers from toe to toe nose to nose conflict or else we will use them and collapse sure enough in the aftermath if we live thru the first few weeks which is in itself doubtful.

I don’t pretend to know how the citizenry of this country would react on a national basis to a really bad emergency resulting in the imposition of martial law but there is no doubt in my mind that we could under martial law continue to eat and have running water and working sewers using less than half the energy we use currently.

And fifty million or more people out of work are certainly going to vote themselves some pretty large scale public works projects. They might only get paid in beans and potatoes but that is better than a Somalian style scenario.

I tend to think when the time comes that Uncle Sam in cooperation with state and local government is going to be able to maintain order and control on the national scale. But I sure wouldn’t want to be in the wrong place such as some of our more messed up cities.

Nobody is going to invade North America except homeless and desperate people arriving a dozen or less at at a time in small boats or on foot but there is a very strong possibility we may be exporting some democracy to Venezuela and that if we do we will not make the mistake ( as in Iraq) of coming home until after we have had our fill of Venezuelan oil.

An empty stomach or gas tank trumps principles in a hurry.

The phrasing is usually (re Ven) “there are barrels there that need liberating.”

“An empty stomach or gas tank trumps principles . . . .”

They are, of course, the same thing.

Oh and btw (looks side to side and whispers) Venezuela territorial waters are within Chinese SLBM range of the US gulf coast refinery complex.

Hi Glen,

I agree very much with your perspective, and despite the impression I give, I believe there are very large risks of a severe recession or depression if the decline rate of world oil output is very high or if oil prices rise very quickly, but high oil prices may spur some changes, and when peak oil becomes mainstream, people may realize that moving most of our energy use to natural gas will lead to a peak in natural gas that much sooner, and the same would apply to coal. So maybe a transition away from fossil fuels can get started, whether it will be too little too late is unknown for now.

The main motivation is not to give up before we have even tried, we may not be able to transition at all to something sustainable, it certainly will not be smooth sailing, there will be many pitfalls, most of which will be unanticipated, but I think it’s worth a shot.

EU MOVES STEP CLOSER TO LAW ON NATIONAL GMO CROP BANS

http://newsdaily.com/2014/11/eu-moves-step-closer-to-law-on-national-gmo-crop-bans/

“EU politicians on Tuesday backed a plan to allow nations to ban genetically modified crops on their soil even if they are given approval to be grown in the European Union, raising the chance their use will remain limited on the continent.”

“So far, EU authorities have approved only two GM crops for commercial cultivation, and one was later blocked by a court.”

“That leaves Monsanto’s GM maize MON810 as the only GM crop grown in Europe, where it has been cultivated in Spain and Portugal for a decade.”

I believe there was some interest in/discussion about GMO stuff a day or two ago, which I didn’t actually read, because I have little interest and even less knowledge in the issue but this may be relevant to those who are?

The overall conclusion of the discussion was :

1) You use GM seeds or you can’t imaginably generate the calorie total 7 billion require. Insects and weeds will destroy it without the anti weed, high yield, and anti bug qualities of the seeds.

2) Heirloom (non GM) seeds are very rare in farming communities, so the year the trucks stop both the cities AND the farms die — because the GM seeds are sterile, no seeds are made for next year.

3) No oil means no bug spray, no tractors etc. Even if you have heirloom seeds and some draft animals, you probably are going to die, even on the farm. Not a well known truth but the brave, hearty souls who moved westward into the American frontier grew some crops and survived a winter, or two or three, but eventually a bad crop year had them pull up stakes and head back east. Only the bulk moves slowly westward, within range of rivers that could haul in emergency food, permitted expansion. The Mormons in Utah had about a decade of good crop years, big western species deer and elk, and snowpack runoff or they would have had no chance.

1) You use GM seeds or you can’t imaginably generate the calorie total 7 billion require. Insects and weeds will destroy it without the anti weed, high yield, and anti bug qualities of the seeds.

Why can’t we eat the insects and weeds?

“Why can’t we eat the insects and weeds?” Obviously we can but what exactly are you saying? We should? We’ll have to? Or perhaps you just forgot the yellow face, right?

It was a legitimate question. If the reason we can’t feed people is because of weeds and insects, maybe we should consider turning the weeds and insects into food. That may be more effective than trying to kill them with lots of chemicals we’re going to run out of anyway.

I used to forage weeds for food; some of the wild weeds, like lambsquarter, were plentiful and more nutritious than the vegetables available in the grocery store.

We have GMO corn which gets turned into ethanol, corn syrup, and livestock food. Do we need those to feed people?

Here. Look at this.

“Although U.S. corn is a highly productive crop, with typical yields between 140 and 160 bushels per acre, the resulting delivery of food by the corn system is far lower. Today’s corn crop is mainly used for biofuels (roughly 40 percent of U.S. corn is used for ethanol) and as animal feed (roughly 36 percent of U.S. corn, plus distillers grains left over from ethanol production, is fed to cattle, pigs and chickens). Much of the rest is exported. Only a tiny fraction of the national corn crop is directly used for food for Americans, much of that for high-fructose corn syrup.”

http://www.scientificamerican.com/article/time-to-rethink-corn/

Another quote from the article.

“The average Iowa cornfield has the potential to deliver more than 15 million calories per acre each year (enough to sustain 14 people per acre, with a 3,000 calorie-per-day diet, if we ate all of the corn ourselves), but with the current allocation of corn to ethanol and animal production, we end up with an estimated 3 million calories of food per acre per year, mainly as dairy and meat products, enough to sustain only three people per acre. That is lower than the average delivery of food calories from farms in Bangladesh, Egypt and Vietnam.”

OK, OK: I get your point; was never really arguing with you. And, for the record, during my youth in New Zealand, I often ate huhu bugs (larval stage) with Maori boys and more recently I’ve often eaten bugs and weeds in Vietnam and China. Though one man’s weed is another man’s crop. Of course my wife thinks I’m an idiot — sometimes (often)!

I know Americans.

Put forth a referendum. Nationally.

Your choice in this vote is:

Eat weeds and insects or bomb China. Please make your selection and drop your ballot in the box by the election judge. Thank you for voting.

Or perhaps you just forgot the yellow face, right?

No smiley face required to answer that question!

http://www.slate.com/articles/technology/future_tense/2012/06/edible_insects_and_seaweed_are_the_perfect_sustainable_foods_.html

We (most humans) have been eating insects for as long as we’ve been around. Eating beef, pork and poultry raised on GMO monocultured corn is what WE shouldn’t be doing!

Many insects are what you might call superfood—rich in protein, low in fat and cholesterol, high in essential vitamins and minerals like calcium and iron. More important, insects are green super-foods. Bugs are cold-blooded (they don’t waste energy to stay warm), so they’re far more efficient at converting feed to meat than cattle or pigs. Ten grams of feed produces one gram of beef or three grams of pork, but it can yield nine grams of edible insect meat, according research from Arnold van Huis, an entomologist at Wageningen University. Yet insects still have virtually the same amount of protein as beef or pork. A 100-gram portion of grasshopper meat contains 20.6 grams of protein, just 7 grams less than an equivalent portion of beef.

If the protein numbers and energy efficiency don’t move you to try a grilled locust, consider this: Insects use a fraction of the water and land of conventional livestock, plus they’re climate-friendly. According to van Huis’ research, breeding edible insects, like locusts and crickets, emits just 10 percent of the methane from livestock and about 0.3 percent of the nitrous oxide. Insects are also natural recyclers that thrive on paper and industrial wastes—stuff that would normally be trashed.

http://halachicadventures.com/wp-content/uploads/2009/09/grasshopper-nutrition-2012.pdf

Good news is crabgrass is edible. The bad news is there isn’t enough crabgrass.

I saw that on the oildrum a few years ago and it always stuck with me. I forget who wrote it.

No interest in nutritious this and that.

Marvelous. Weeds have nutrition.

What calories do they have? Per minute at the meal table.

Potatoes generate serious calories per acre. I’m guessing weeds don’t.

Potatoes taste good no matter how you cook them, and I would assume crab grass on other weeds taste like shit. As for eating insects, probably not much different than prawns in appearance and size, really. Having said that I prefer my cultural biases and would certainly never live in an area that ate dogs. To be honest, I would starve before I would eat my Jack Russell. I hope I would exhibit the same loyality he extends to me. I am at the point in age and attitude where I can accept that I am culturally biased and is content with my disapproval or dislike of how other people might live. Screw it.

Paulo

Excuse the above post ‘bad grammar’. Need more coffee….more.

Good for you. And I feel exactly the same way about my dog.

So I’ll mark you guys down as voting to bomb China.

Well done.

Doug,

Do keep in mind that the dog is very aware that you are meat.

Dogs have cultural biases too.

As for number one-Not necessarily true but GMO crops are definitely a helpful addition to the toolbox. As time passes they will become more important in the near and mid term. The long term is an open question but my guess is that GMO crops and animals will become commonplace as population continues to grow and shortages of land,water, fuel, plus climate change create more problems.

Growing the amount of food we grow today would require somewhat more fertilizer and a great deal more motor fuel. We would be using more pesticides but less herbicides. We would be having more soil erosion.But we could do it – at least for a while.

TWO- Unfortunately true that not much, far too little conventional seed is available in places such as the US but on the other hand there is so far as I can see no reason to think the hybrid and gmo seed almost everybody is using will just vanish from the marketplace.

GM seed and hybrid seed are NOT NECESSARILY sterile although some varieties are deliberately produced that way.But they will not breed true and the results of planting them are usually such that a farmer seldom tries it more than once. I have no data but will hazard a guess that planting triple cross hybrid seed will result in yields on average that are no better than half or so of the usual across the board.

But if you have no money for more seed and you are a very poor farmer -you plant such harvested seed anyway. Half is better than nothing by a long shot.

Nevertheless a few farmers have harvested and replanted GMO crops –and make good enough production to make a habit of it— and gotten caught in violation of the contract— and been hauled into court as a consequence.

Some of my neighbors propagate patented or trademarked varieties of fruit trees. So far they have gotten away with it and so far as I am concerned more power to them.

Draft animals are in such desperately short supply that they might as well not even exist in terms of being a useful resource if needed .Horses can reproduce annually and that is pretty damned fast in one sense but the number that would be needed could not be bred for decades. Even talking about farming in a place such as the US with draft animals is a waste of time for now and for decades to come at the very least. It is never going to happen barring collapse and die off .

Now seed availability is a different subject. A bushel of conventional corn can be turned into a hundred bushels of corn in a year and the second year that hundred can be turned into ten thousand.Furthermore the seed companies themselves are producing and holding substantial stocks of conventional seed which they use to produce hybrids rather than selling them.

We COULD get back to using conventional seed in a rather short period of time if there was a compelling reason for doing so. Three or four years at the most would be plenty of time to produce enough if the job were undertaken on an emergency basis.

THREE – Barring a total collapse of business as usual and a descent into a world wide mad house scenario we are going to have oil enough to farm and to build the machinery farmers and truckers and food processors and retailers must have for this country to eat for the foreseeable future.

Business as usual is a dead man walking in my opinion but Old Man Business As Usual may and probably will stagger along for decades yet. The personal automobile and air travel may be historical curiosities in fifty years but there will be fuel for tractors and combines and delivery trucks even if it is coal to liquids supplemented by biofuels.

I read a great deal of history but I am not aware of any substantial number of western settlers moving back east in any given year compared to the number than stayed put and continued to move west overall.It did happen though and I might have missed it not being a real historian.

Of the individuals I have read about the ones who failed to make a go of the western migration were mostly ones who went too early -before enough farmers were there to support them as merchants or the operators of other businesses.

No doubt it would have been far easier to make it in a place such as Kentucky or Tennessee with plenty of timber and streams almost every where plus plenty of good fertile land and milder weather – compared to making a go of it out in the open plains or western country where water is an iffy proposition and customers were far away.

The ability to ship OUT production has always been vastly more important than the ability to ship IN food and other supplies.Outbound shipments necessarily paid for everything that wasn’t locally made.

Shipping out is many times the work of shipping into farms because the nature of the exchange back then went something along this line: you traded a barrel of apples for pound or two of nails. You shipped out a wagon load of corn and you got money enough for it to buy a couple of small tools you could have toted home on in your hands . You traded five gallon keg of butter for a pound of coffee or tea or sugar.

Modern farmers ship food by the tractor trailer load and buy by the car trunk load in terms of consumer goods.One truck trip brings home two shiny new tractors that costs a hundred grand each. Depending on the market it might take anywhere from fifty to a hundred or more outbound loads of corn to pay for the tractors.

The ( navigable ) rivers without question did play the most important by far role in determining which new areas got settled and built up first. Most of todays major cities were founded as villages along the rivers and at river mouths on the coast.

Tried to work thru that Farmerguy, but I think you vacillate between scenarios.

I would very much like to know prospects in the zero-fuel-for-tractors-and-trucks-don’t-drive-anymore scenario. It’s not “no money to buy seeds”. It’s no seeds can arrive, period, and no way around it.

What happens with zero shipping? And forget about shipping output. That’s not the issue. There won’t be any customers in the die off. The question is . . . can the farm and maybe a handful of neighbors survive? Are there seeds kept about the farm from last year that can be planted to just stay alive (assuming again the right month of event — if it occurred in July, you could only harvest a portion of what is in the field, by hand.

Vegetarianism would be a workable solution as well. Even switching from beef and pork to chicken and fish would vastly improve the food supply.

People’s reactions to new circumstances and products are sometimes controlled to astounding extent by which ever faction manages to achieve early control of the political debate. If aspirin were invented today it would be a tightly regulated prescription drug.

Here in the US we are just now after most of a century finally showing some glimmerings of political sense about cannabis.It is no doubt a drug with potential for abuse but the case for prohibition has been exaggerated a thousand times at least.

GMO foods will eventually be widely accepted.I am not argueing that growing and eating them is without risk but rather that the risks are minuscule to minor in relation to the hype.Nothing whatsoever about this mysterious phenomenon we refer to as ” LIFE ” safe. Hardly anybody ever dies in bed as the result of an accident but staying in bed is a virtually guaranteed way to die earlier than otherwise due to a lack of exercise.

The real dangers involved with GMO’s have a lot more to do with politics and octopus corporations than with the ecology.Anybody who understands the oil depletion question and the soil erosion question can quickly see that gmo’s can contribute mightily to alleviating both these problems.

Growing more food every year in the short term so more people can starve later in the medium term is not exactly an easily solved moral dilemma but personally I am not coming out in favor of halting the growth of agricultural output in the short term.GMO’s will save many times as many people as they will ever kill- and there is no assurance they will ever kill ANYBODY.

Collapse is no doubt baked in for large parts of the world but other parts are on a fast track to sustainability with birth rates falling to levels that back in my youth I would have considered to be a fantasy.A country such as Italy may indeed have some really tough economic problems to solve but if by hook or crook and good luck or bad luck that turns out good Italy is not going to have an overpopulation problem in a few more decades.

Bad short term luck might turn out to be something along the lines of a killer flu epidemic that could take out say ten or fifteen percent of the old and frail. This would be awful in the short term but it sure would create some breathing room in the medium term for a country with a tough demographic profile and an economy staggering under the load of the old age welfare state.

In twenty years the Japanese will have enough housing roads grid water sewer office building capacity they will only need maintain and upgrade what they have and do no more building at all.They can put their energy into efficiency and resilience rather than more construction and consumption by a growing population.

If we can get thru the coming resources and population bottleneck without fighting WWIII it seems pretty obvious to me that the survivors have a decent shot at living dignified and reasonably comfortable lives for quite some time based on remaining stocks of non renewable natural resources plus renewables by adapting to their situation.

Consider roads and railroads for instance. A highway once graded and paved is something that can and will last for a thousand years with maintenance that costs only a few cents per decade compared to the cost of new construction.Ditto a railroad. There is no reason at all why a solid steel rail car cannot be kept in repair and use for centuries. Cross ties are renewable and steel rails can be recycled after a century if worn badly enough.

Renewables may never and probably never will be efficient enough and economic enough to support business as usual in the sense of business as usual today but if the world decides to build out renewables rather than military industrial complexes and six thousand pound beer transporters enough will get built to maintain an industrial civilization that puts a high priority on resource conservation.

The price of just one new car at thirty grand is enough if put into the construction of a modest new house to make that house a net zero energy house if it weren’t for our failure to take advantage of the economies of scale that are possible. When a contractor starts a house today the CONSTRUCTION paper work usually consumes no more than a few hours and the construction is started and finished turn key in a couple of months to four months or so.A roofer shows up and puts on the roof when the framers are finished in anywhere from a day to a week. The electrical contractor usually comes and goes within a week.

All the materials are pretty well standardized and the methods and specifications are standardized and the crews doing the work are fast and efficient if not necessarily always as meticulous as the buyer might wish.

Once renewables and energy conservation and efficiency are thoroughly integrated into the building process another thirty grand will result in a net zero house.

And as for the existing stock of Mcmansions- as times get tougher the number of people living in each one of them will on average grow substantially.I once lived in an apartment carved out of an old antebellum mansion in Richmond Va. Six families resided in a building once occupied by one family and a couple of house servants.

I myself occasionally daydream about the possibility of daydreaming about sexually harassing a couple of rosy cheeked young women who might come live with me someday in exchange for cooking and cleaning and making my coffee and hoeing the veggie garden in exchange for free room and board.

At my age daydreaming about it would be enough given that actually harassing them would be too much bother..LOL)

(In a more serious vein I would love to meet a young couple interested in small farm life who would like to live on my place for a while in an existing rental unit and eventually buy it owner financed or maybe even inherit it. They would have ample opportunity to live cheap while earning a few extra bucks and trying on the lifestyle for long term fit.

Around here, Mac, we see the odd newspaper add offering a chance for a 20-30 something female to crew on a fish boat. I assume picture, required.

I posted this comment at the Resilence Site under an article by Kurt Cobb advocating labeling of GMO foods which is just fine by me since I believe all foods should be honestly and completely labeled if mass marketed.I am not concerned about the ingredients in homemade cookies sold at church and fire department fund raisers.

The greater part of the article was basically an argument against gmo foods. Speaking as a farmer ( retired) myself I want to point out that GMO crops are not money makers for farmers any more than typewriters made money for small businessmen who bought them- or office computers. Such technologies may or may not increase profits temporarily among early adapters but in a truly competitive industry pretty soon everybody adopts them and the increased efficiency gained thru this adoption result in greater production and lower prices. Farmers are the classic example of a group of people who work for economic break even costs over the years on average.Competition as a rule keeps prices at just about the total cost of production and since in a country such as the US farming is both a lifestyle and a culture a lot of us have been so reluctant to give it up we have worked an extra job to support the farm- or gratefully accepted our wives making double what we have made working as teachers in local school systems or as nurses in a nearby hospital- and also driving the tractor or combine on their days off and after getting home from their job.

Technology and economies of scale drive more of us out of business every year..

So_I do not exactly approve of large scale industrial agriculture but nevertheless I do recognize that it is a necessary evil in the short term and medium term and for so far into the future as I can see personally.It may be possible to obtain our food by reversion to the technology and culture of earlier days in another generation or two or three if we avoid collapse – or such a change may be forced us a CONSEQUENCE of collapse.

But anybody with any significant depth of insight into the nature of the economy and the culture of this or any other economically advanced country should have no trouble at all understanding the nature and necessity of the beast.

I forgot to copy the link but will hunt it up and post it in a minute and then my comment as well.Cobb is basically a very decent guy and generally well informed but in this case he is telling one side and one side only of the story. My comment is about the other side.

This is the link to Cobb’s essay at Resilience.org

http://www.resilience.org/stories/2014-11-09/why-gmo-labeling-in-the-u-s-needs-to-win-only-once1

This is my reply.

Between what Cobb has to say and what I have to say just about everything needed to understand the problem of GMO foods is covered at the abc level.

xxxx

I will not argue that Cobb is actually wrong in his arguments. There is no way to prove him wrong.Some of the things he predicts will happen might happen and I am as a matter of principle of the opinion that all foods which are sold in substantial quantities be labeled completely and accurately in any case.

Farming is my profession and I am professionally trained in this field.There is a flip side to the gmo story and unfortunately the author hardly mentions it.

He is aware of some of the very real shortcomings of modern industrially based agriculture but if he understands the advantages of it he certainly does not mention them in this article.

Let us examine a couple of his arguments in order to illustrate my point.