The EIA has apparently stopped publishing its International Energy Statistics. Instead they are now publishing an abbreviated version on their Total Energy web page titled: Tabel 11.1b World Crude Oil Production. Here they publish crude + condensate production numbers for Persian Gulf Nations, Selected Non-OPEC Countries, Total Non-OPEC and World. The “Selected Non-OPEC Producers are Canada, China, Egypt, Mexico, Norway, Russia, United Kingdom and the United States. They have just released their latest data through February 2016.

All the data below is in thousand barrels per day and through February 2016 unless otherwise noted.

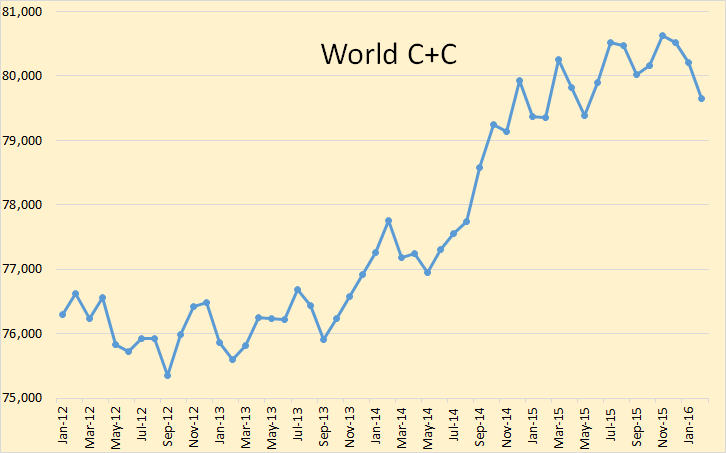

They have world C+C peaking, so far, in November 2015 at 80,630,000 bpd. February production was 79,653,000 bpd, or 977,000 bpd below the peak. World C+C production, they say, averaged 80,035,000 in 2015. Average for the first two months of 2016 was 79,933.000 or 102,000 bpd below the average for 2015.

So with world production continuing to decline, there is little doubt that 2016 production will be well below 2015 production.

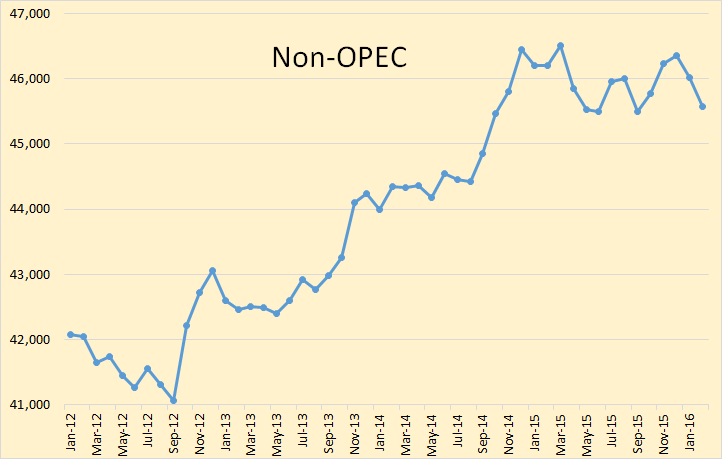

They have Non-OPEC peaking in March 2015 at 46,504,000 bpd and down by 925,000 bpd in February to 45,579,000 bpd.

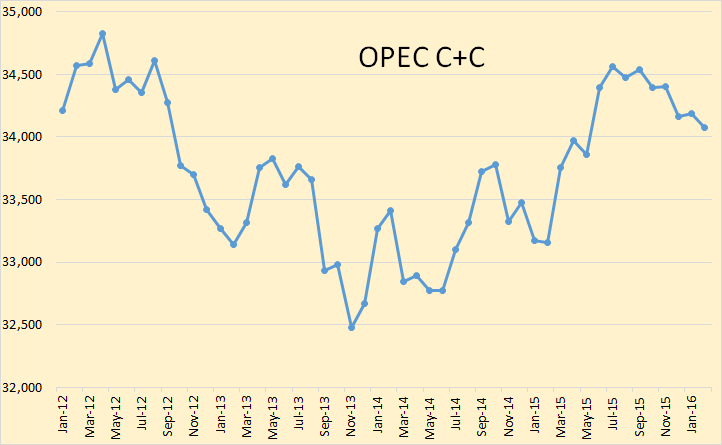

They also publish OPEC members data, Table 11.1a. OPEC C+C failed to breach its 2012 peak but did reach 34,562,000 bpd in July 2015 but by February 2016 it was down 488,000 bpd to 34,074,000 bpd.

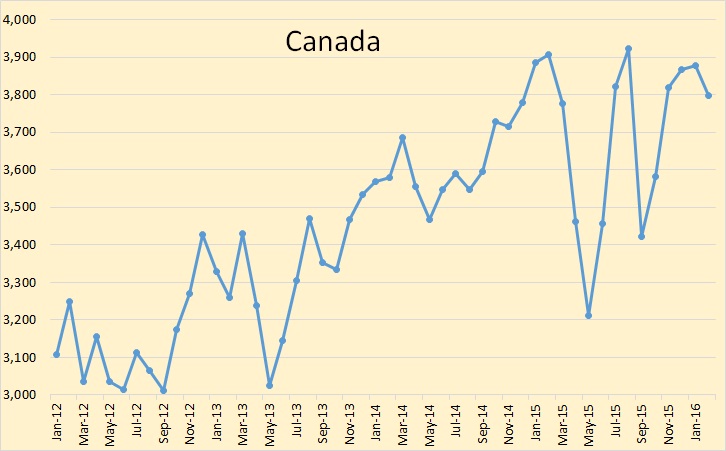

This is the EIA’s version of Canadian production. It looks exactly like Canada’s National Energy Board data except the EIA’s data is about 150,000 bpd less than Canada’s NEB shows. Obviously Canada is counting something that the EIA is not. Look for Canada’s production to decline substantially in 2016. And those May wildfires will not help at all.

China has peaked. The only question left to be answered is how fast will she decline? There are several articles on the web about China’s decline, but they all say about the same thing.

*China April crude oil output lowest since July 2013

Data from the National Bureau of Statistics released on Saturday showed China produced 16.59 million tonnes of crude oil last month, or about 4.04 million barrels per day (bpd), the lowest rate since July 2013 on a daily basis.

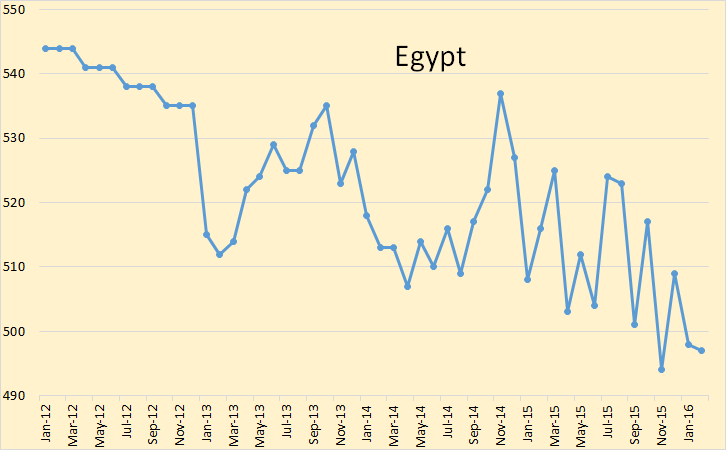

Egypt is in a slow decline. But we have been knowing that for years.

Mexico managed to stem their decline for a few months but their production has begun to decline again.

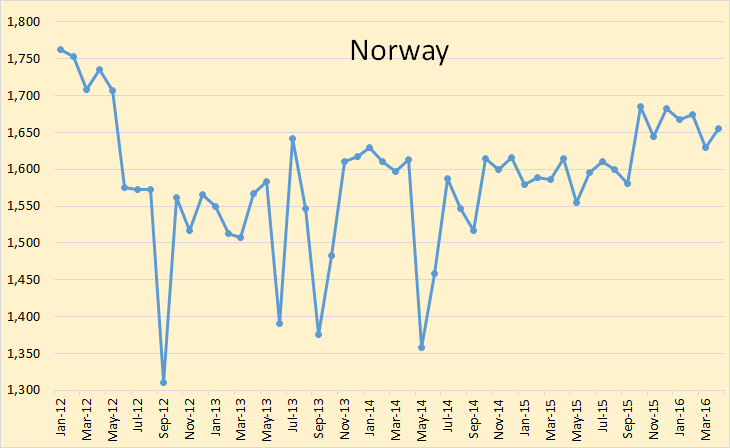

Norway, which produced around 3 million barrels per day from 1996 to 2004, has now dropped to almost half that amount. But they have managed halt the decline in 2012 and have since even increased their production slightly. It is likely they will continue to hold this production for at least another year. They are managing to buck the trend.

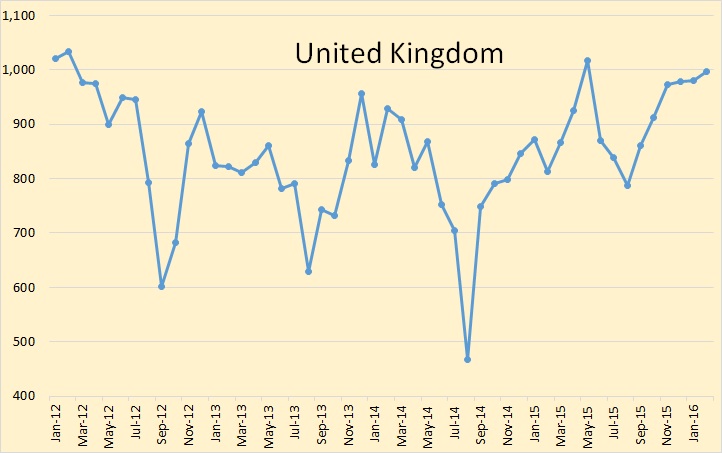

The UK peaked at just under 3 million barrels per day in 1998 and for the last three years or so has averaged about one third that amount. But the UK has also managed to stem their decline. For how long, I have no idea.

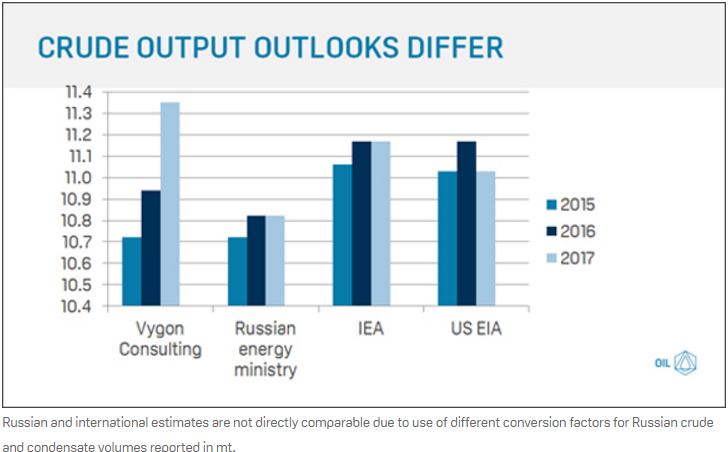

Russia has been a real shocker. No one, inside or outside Russia, expected them to increase production by over 200,000 bpd over the last few months. *Production declined by .7 percent in April according to the Russian Energy Ministry: *Russian daily oil production down in April. My above projection was made using average change in production of the Energy Ministry’s data.

Everyone has a different opinion on what to expect from Russia next year. Everyone now expects their production to increase slightly this year. I say now because everyone had a different opinion a few months ago. But…

Will Russia’s crude output levels surprise again?

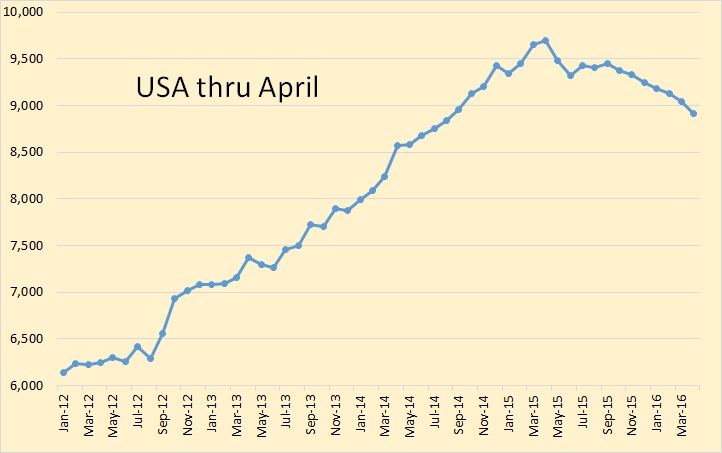

The USA is, of course a big part of what is happening to world oil production, and will continue to play a big part. I think US production will continue to decline for another year or so. After that? I think production will flatten out then increase slightly. But the boom times very expensive shale oil brought are over.

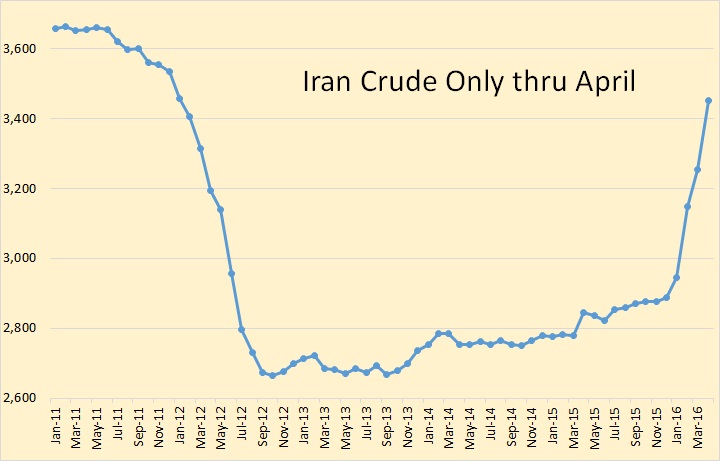

Iran is the main reason the the price induced decline has not become obvious.

In conclusion: In spite of the recent increase in Russian production as well as the slight increase from the North Sea, in spite of the dramatic production increase from Iran due to the lifting of sanctions, world crude oil production is in decline. And while it is true that most of this decline is due to the price crash it remains to be seen just how much production will recover when the price returns to… to… wherever it returns to before it stops.

But… the decline has only just begun. The price collapse caused the plateau in world oil production that begun about March 2015. However the decline did not actually begin until January 2016. The dramatic rise in production from Iran has kept the decline from becoming obvious to everyone. However when the May production numbers come in, I think it will then become obvious to everyone.

IEA has world demand at 95 and climbing this year. EIA has world production at 80, however, we have a world oil glut. Guess EIA is not counting oil production from Uranus. Can’t get this durn calculator to work right.

95 mb/d is total liquids consumption, including crude, condensate, NGLs, biofuels, synthetic fuel from coal and natural gas, refinery processing gains, etc.

80 mb/d is crude+condensate only.

Thanks

Ron: I see world production declining for more than just a year or two. All the major oil cos. have reduced capital spending on exploration and production by large percentages, with many decreasing by more than 50%. The small producers here in the US have also scaled back, some permanently as they went bankrupt. Even those that are still staying afloat cannot get financing for projects that are viable because of so much bad paper held by major banks that financed the boom of the last seven years and some of the borrowers have gone under and leases are worth far less at resale.

I know first hand these obstacle to getting our oil producers back to drilling because I lost big time. My one remaining investment, though very promising based on other wells in the field, may never be drilled because of unwillingness of banks to lend. The prospect had 60% of capital raised and still can’t get a loan for the balance. This is being repeated hundreds of times over.

Then look at offshore, where no drilling is likely to occur north of Alaska as the majors have spent billions and then gave up (Shell even drilled some test wells that found some oil), largely because they could not produce at a profit even ten years out. Gulf of Mexico is nearly the same story, as majors are backing away from PEMEX deals they signed onto just two or three years ago.

All this spells a downturn for the US/North America production from here on out. And the world will follow as Saudi Arabia is keeping production elevated mainly by its many recent projects involving EOR and no new fields coming on stream. Although EOR (enhanced oil recovery) boosts production from a benchmark level, decline comes even quicker for nearly every method.

Sure, the world has a lot of oil remaining, but those that can drill (or mine as in Canada) are finding that much is not now nor ever will be profitable. Thus we have past peak oil, IMO.

I can confirm the story about the unavailability of lending to the oil and gas sector here in Alberta. A close relative used to lend to the sector at one of our major banks. When things fell apart, he was lucky to be moved to the team that…evaluates the status of existing loans. For the last year-and-a-half, he has summed up the lending situation as follows: “Our bank no longer lends to the oil-and-gas sector. Talk to a venture capitalist.”

It is a weird situation to start to see the peak as being in the past. Partly, I feel some vindication, but it is dwarfed by a sense of foreboding.

Hi Mbnewtrain,

Oil prices will rise and profits will improve. You may be correct that the 2015 peak will not be surpassed, but I think we might see a slight increase in output to 81 or 82 Mb/d in 2018 to 2020 or a plateau at around 79-80 Mb/d until 2022 at minimum. The more we produce over the near to medium term, the steeper the decline on the other side once decline begins. High oil prices may lead to the expansion of EVs, plug-in hybrids, and hybrids along with more light rail and better urban and suburban design. So the end result may be a decline in demand matching the decline in supply with occasional shortages and price spikes.

No doubt oil price volatility will be an issue unless an oil cartel tries to control the volatility.

“All the major oil cos. have reduced capital spending on exploration and production by large percentages, with many decreasing by more than 50%. ”

Sportsfans should recall this happened Jan/Feb 2014 timeframe.

Before the price started down.

Possibly we may be heading towards some kind of price correction. 🙂

Why do you assume Iran raised their oil production post sanctions? How do you know they are not just shipping from storage, especially condensate few want?

Russia has shocked many Peak Oilers as well as her NATO-GCC enemies. The same applies to Iraq and Iran. Anyone who has glanced at my posts on this blog would know that one of the two main reasons for the current geopolitical conflict are the vast reserves of the three aforementioned countries. NATO-GCC has not gone crazy all of a sudden, they are just trying their best to prevent a different power block from challenging them. Russia, Iran and Iraq will be able to exert significant leverage in world affairs, unless NATO-GCC manage to either break them to pieces or at least circumvent them through new pipeline routes, or both.

What we read in the mainstream media about these countries is a combination of deliberate misinformation and wishful thinking. I have been reading mainstream sources claim that Russian oil production is about to enter terminal decline for well over a decade now. The sanctions on the financing of Russia’s oil firms, the banning of Western firms from investing there as well as the embargo on the sale of oil equipment to Russia were all designed to suppress Russia’s oil production. Until now at least, they have utterly failed.

Remember also all those articles from so called experts that claimed that Iran would require years, along with tens of billions in investment and Western technology in order to reach its pre-sanctions volume of oil production.

All of that was utter nonsense.

When it comes to energy issues, I think that we can safely say that the media and so called experts are either completely clueless or on a clear mission to mislead the public.

Regarding Iran, I read several posts on energy boards theorizing that their production never dropped, and they were smuggling the sanctioned oil through Azerbaijan (if I remember correctly). It could explain how they were able to “ramp up” so quickly.

“Regarding Iran, I read several posts on energy boards theorizing that their production never dropped, and they were smuggling the sanctioned oil through Azerbaijan”

Unlikely, as:

1) Azerbaijan does not have direct access to global markets. Its oil is supplied by pipelines via Russia (CPC to Novorossiisk) and Turkey (Baku-Ceyhan).

2) The volumes of Azeri oil production are well known (given the participation of BP and other oil majors) and it would be difficult to explain significant additional export volumes.

Maybe they had 20-30 mmbo in storage? Or maybe they had wells shut in for a while and they are getting a bit of flush production. Or both. It’s going to be interesting to see if they can reach 3.6 to 3.8 Mmbopd crude oil within the next 24 months.

They had some 35-45 mmbo in storage, more than half of it condensate.

They have sold most of crude from storage, but most of condensate remains there.

Oil production has already reached 3.6 mb/d.

the charts below are from the IEA OMR May 2016:

Yes Alex, but that supply can be in part from storage and flush wells. I’ve been in situations where we had to shut in groups of fields and wells for a long period of time, and we stored oil in every nook we could find. We also used that period to do maintenance, and kept on injecting water while monitoring pressure in the shut in wells. This gave us a pretty nice surge when we got the go ahead to open up.

What I also found was that wells producing very thick heterogeneous pay (say over 50 meters thick) could self inject and would produce 100 % water for a few weeks, until they cleaned up and went back to a more normal performance. I assume the Iranians could avoid this problem by producing high water cut wells with a low drawdown.

Time will tell if they can stabilize in the range 3.6 to 3.8 mmbopd, or we are seeing a mix of storage, flush production, and a few new wells?

Fernando,

In this context, supply means production, loadings mean exports.

So what do think is coming down the line from this part of the world (Rus-Iraq-Iran)?

As a unified bloc they would be dominant, but I doubt that will come about. Unless perhaps they get China to buy into a longterm arrangement of shorts.

Worries about this whole area is why Europe is making peace with the authoritarian government of Turkey. Europe and far eastern Asia are massively dependent on the imported energy from these three (and the other gulf states).

Energy Imports (as a % of total energy consumption-2013)-

S. Korea 83%, Singapore 98%, Japan 94%, Belgium 74%, Germany 62%, Spain 70%

(US 14%, China 14%)

Utter Nonsense or not…

The fossils are worthless because of cheap solar cells and batteries…true or false

Egypt got a loan from Russia for a nuclear reactor because they want to glow…true or false

China has a CDO clone (Wealth Management Products) ponzi scam going on…true or false

The whole world is down the crapper because EROI does matter at some point…true or false

Russia’s nuclear industry is thriving because natural gas is not abundant and cheap…true or false

America is a vassal of Israel…true or false

Thorium molten salt reactors are a money sink hole…true or false

Neoliberalism Globalisation is the biggest ponzi system in mankind history…true or false

“Cheap solar panels and batteries”

Hahaha hahaha…

If any of that “green energy” mumbo jumbo was remotely true, then nobody, absolutely nobody, would care about the Middle East or Russia…

Luís de Sousa has a good post about Peak Oil being reached in 2015 here – http://attheedgeoftime.blogspot.com/2016/05/this-is-peak-oil.html

“…. a long term decline is settling in. Understanding the present petroleum market as a feature of the supply destruction – demand destruction cycle makes this case clear. ”

“The present supply destruction cycle dates back to the beginning of 2014…” and “… this supply destruction cycle is coming to an end sooner rather than later.”

“The coming demand destruction cycle is therefore likely to be a long one too. And at some point it can invert the extraction trend upwards. In such a scenario, can extraction return to the 80 Mb/d rate of 2015? That is the big question, which I will abstain from answering definitively. Looking at it from the other side of the equation, for such a scenario to ever materialise, demand must withstand again a good number of years at high prices without undershooting.”

Sorry if this is a repost but I didn’t see it mentioned here earlier.

“The EIA has apparently stopped publishing its International Energy Statistics. ”

Weird. Ominous? What are they hiding? What was in the old stats which isn’t in the new abbreviated report?

The EIA international energy statistics were detailed, but of low quality.

I always preferred using alternative sources, if available.

Hi AlexS,

What source do you recommend for World C+C? OPEC and IEA report total liquids,so it is hard to determine C+C. JODI data is woefully incomplete for an estimate of World output, though it is more timely than EIA data, I like the idea of using EIA data for most of the World but substituting better data sets, where they exist (Russian Energy Ministry of Canada’s NEB, and Dean’s estimate for Texas.)

Dennis,

For OPEC countries you can use:

1) data from secondary sources published in OPEC MOMR;

2) data from the IEA OMR

Both include crude only and exclude condensate and NGLs

For Brazil, the key source is ANP.

Very good and detailed annual and monthly data can be found here:

http://www.anp.gov.br/?pg=73222&m=&t1=&t2=&t3=&t4=&ar=&ps=&1435195042069

http://www.anp.gov.br/?pg=76362&m=&t1=&t2=&t3=&t4=&ar=&ps=&1436539557465

For Mexico: http://www.pemex.com/ri/Publicaciones/Paginas/IndicadoresPetroleros.aspx

There are official sources for China

Hi Alex,

Are the EIA estimates for those sources much different from the sources you cite? For the NEB and Russia they are, but I would think the EIA uses those same secondary sources for OPEC estimates, they might also get the data from Mexico and Brazil from those sources.

We could try to reproduce what the EIA already does, by pulling together estimates from many different nations, but if it seems they are already doing that, there would not be much point, too much work and a waste of time.

Hi AlexS,

Trying to get a consistent estimate is very difficult, how much condensate does OPEC produce, how much “non-conventional” oil, how much NGL?

Using OPEC estimates for quarter 3, they match with the EIA C+C+NGL estimate within 0.7% (about a 264 kb/d difference). The IEA estimate for OPEC is higher, but is it more accurate? Hard to know, the only place we have an NGPL estimate is from the EIA (only through Oct 2015). The international data is just not very good, either we use C+C+NGL (from BP) all liquids (OPEC or IEA) or we have to rely on EIA estimates (which for OPEC are pretty close to OPEC estimates with secondary sources) for C+C. The data for Mexico is very close to the EIA data (30 kb/d too high for EIA relative to Mexican data, about 1.6%) and insignificant at the World level.

Dennis,

Brazil’s ANP C+C data is the same as until recently was released by the EIA.

I don’t understand why the EIA is using data from national sources for some countries and own estimates for others. As I have noticed in the past, these estimates may be quite unreliable.

I don’t understand why they stopped publishing International Energy Statistics with country data, but continue to release the numbers for world total.

The source of this data is the same: “EIA, International Energy Statistics Database”.

I don’t understand why they have data on Egypt (a secondary producer), but do not release data for Brazil, which is much bigger producer.

The IEA database is definitely better the that of the EIA, but unfortunately C+C statistics are not available in free access.

Hi Alex S,

I disagree, I find the EIA data much easier to use. Note that the full IEA report is released after two weeks. There is no IEA C+C data, so I find it less than useful. Also, not providing the data in a spreadsheet is kind of 20th century.

The EIA data is not perfect, but is better than most other data out there.

I agree they should use data from other nations where it is reliable. Some nations do not provide reliable statistics, but Mexico, Russia, Canada, and Brazil do not belong to that group.

Perhaps the EIA uses “secondary sources” in cases where they believe they are more reliable. My access to proprietary data is not good, no doubt the EIA has access to more information.

Dennis,

The EIA data is much easier to use, but when you need data for individual countries, 1) it is less accurate; 2) it is now non-available for most of the countries.

Therefore, when I need oil statistics for large non-OPEC producers, such as Canada, Mexico, Brazil, Russia, Norway, UK, China I prefer using national statistics. They are more detailed, more accurate and more up-to-date.

I m sure it is possible to find statistics for some other non-OPEC countries, such as India, Australia.

For OPEC countries, I am using the numbers from the IEA or OPEC. They have separate statistics for crude and NGLs.

After the EIA discontinued statistics for of all countries, the only remaining advantage of its international energy statistics is the aggregate data for the world. But given inaccuracy of the EIA data for individual countries its numbers for the world should be viewed with a caution.

BTW, the IEA has a good database in excel format. Unfortunately, it is not available for free users.

Hi AlexS,

I didn’t realize that. Thanks.

The EIA was definitely better for international statistics in the past, for World C+C, it is the best we have and BP is best for C+C+NGL (in tonnes).

There was something like that before:

1/5/2011

EIA terminates updates of International Energy Statistics

http://crudeoilpeak.info/eia-terminates-updates-to-international-energy-statistics

There were 28 Non-OPEC nations and 12 OPEC nations in the old International Energy Statistics. In the new abbreviated version there are 8 Non-OPEC nations plus one called “Persian Gulf Producers”.

I don’t think they are hiding anything, they just don’t have the budget to keep the old survey going. But it is interesting to note that, or it seems to me that, all the cuts came in the international survey sector, not in the domestic sector.

“they just don’t have the budget”

I watched an interesting interview with John Stewart today where he mentioned that one of our political parties had a great “tautology” going: Keep the government from doing things and then blame it for being incompetent. This may be an example of that.

“However when the May production numbers come in, I think it will then become obvious to everyone.”

Nah. It won’t be obvious to some people for *years*. It’s amazing how long people can ignore evidence.

You mean like Exxon ignore their own climate scientists for 40 years? Yup.

Exxon never ignored the evidence. They simply chose to act in a way that maximized the profits to their shareholders despite the fact that they knew what they were doing was detrimental to the entire planet.

well now if Exxon had “climate scientists” on their pay roll 40 years ago that would surprise me. However as I recall the consensus forty years ago in 1976 was that the world was entering into new ice age. So perhaps we all should thank the “exxon climate scientists”, for ignoring that evidence and saving humanity from that catastrophe. Har. you guys are great for a smile.

To keep this post on topic AlxeS did you see the map on the MRO presentation where the highest well density in the SCOOP Woodford is in a narrow ban identified as “condensate” and to the east and covering a much larger area is a area identified as “oil”. You are absolutely correct in presenting the facts of the recent past, I am just pointing out that the future may well be something different.

well now if Exxon had “climate scientists” on their pay roll 40 years ago that would surprise me.

Well, guess what, I hope you are sitting down, SURPRISE!! 🙂

They apparently did, at least according to this article in Sciam.

http://www.scientificamerican.com/article/exxon-knew-about-climate-change-almost-40-years-ago/

Exxon didn’t just understand the science, the company actively engaged with it. In the 1970s and 1980s it employed top scientists to look into the issue and launched its own ambitious research program that empirically sampled carbon dioxide and built rigorous climate models. Exxon even spent more than $1 million on a tanker project that would tackle how much CO2 is absorbed by the oceans. It was one of the biggest scientific questions of the time, meaning that Exxon was truly conducting unprecedented research.

FredM,

I wouldn’t be surprised at Exxon backing climate research back then, but it’s worth keeping in mind, I think, that it was after about 1970 that global temperature began an upward trend and then it was a while before it began to look for real, and not just part of the variation that always occurs. It takes a while in such research before confidence builds.

I’m not talking about what Exxon did with the research, only about how those doing it might have been viewing their results.

Actually, global temperature has risen for well over one hundred years. The slowdown in the 60’s was mostly caused by long term extreme atmospheric pollution. If you were around then, you could see the air. As the air cleared somewhat and CO2 concentration rose, there was no holding back global temperature rise.

They had climate scientists. The company I worked for had them too. At one point in the early 90s I worked with this group (I supervised their former team leader and eventually he moved past me to be my bosses boss).

Anyway, we used to exchange notes with other outfits, and we could see faint signals in the data that we had seen some warming in the previous 30 years. But nobody thought it was statistically significant enough to change our design basis requirements.

Based on what I see the claims that “Exxon knew” are bullshit. If they had known they would have made more Arctic plays, set up to hold the Mackenzie delta fields, etc.

Fernando, would you mind taking the time to explain who exactly the climate scientist were in terms of their science background and mission. I have a great deal of respect for what meteorologist of the time were able to do with the tools at their disposal, but I was under the impression it was only with the advancement in satellite imagery that we have come any where close to establishing a baseline from which any “change” can measured from.

As for what people “know” we have local experts here who can’t agree what peal oil is or if peak oil has occurred or when it might occur and this subject is clearly of less scope and easier to model with less variables than the earth’s climate. This does not take aways from the good work Ron, Dennis et al are doing.

Texas, we had a mixture of people. Some were geophysicists and engineers who had evolved into climate wonks. We had a couple of ex USA military who had worked in their cold regions programs. And Canadians who had worked in the Beaufort projects. It was a mixed bag.

Back in the early 90s we had acquired the USA Arctic ice coverage data. As it turns out the USA did have satellite acquisition over the Arctic to see where Russian subs could pop up to shoot their missiles. The data went back to the early 60’s.

We also had information such as temperature records in lots of stations north of 60 degrees North.

Our emphasis was to try to figure out the climate trends to define the design basis for ice capable tankers, platforms, etc.

We also could take sea floor cores, and those have lots of information. They had people checking bugs, pollen, sand grains, and of course sea floor permafrost.

Anyhow, I sat in quite a few discussions as to what exactly were we supposed to use as a design basis, in the end we decided the trend was too short, and we just couldn’t be sure it would turn around and get colder. We took the data and used it without extrapolating it into a theoretical warmer climate.

So, the way I see it, a company which really thought it was going to get warmer would start buying up rights for Arctic projects all over the place. As far as I know Exxon only had a share of Prudhoe, a share of Sakhalin I, and were dabbling a bit in the Pechora onshore. I think they would have gone for the Mackenzie delta and the Beaufort properties if they were convinced it was going to get warmer.

Fernando,

Thanks, that makes sense. In other words, you had some very talented oil and gas people (geophysicists and engineers) who were ask to research “weather patterns” to help the company make decisions about how to design facilities to extract oil and gas. That makes sense. What does not make sense is to call them “climate scientist”.

Question for you texas tea-

Assuming you are in texas and have a bunch of friends/colleagues, in general do the people you know feel that wind/solar are asset to the states economy, or do they see it more as a nuisance or threat to their particularly industry, or as an imposed (incentivized) burden?

Here in Calif (amongst people I have heard discussing it) I sense a mixed bag, but overall cautiously positive. I say cautiously because so far it hasn’t been cheap, and the benefits aren’t perceived to be widely shared among the populace.

Texas, some of these guys studied the subject for over 20 years. Most had gradúate degrees. Many climatologists and met-ocean experts began careers as physicists and atmospheric physicists in the 1970s. I studied quite a bit of oceanography, and my professors had a mixed background.

I don’t think we had a particularly exceptional team, but neither did I find other outfits with more muscle, even in the Russian institutes or in Canada, Finland, Denmark and other centers it was still a subject people were groping simply because the satellite and buoy data was pretty scarce.

Texas tea,

“You are absolutely correct in presenting the facts of the recent past, I am just pointing out that the future may well be something different.”

I am sure that the future will be different.

I have no doubt that:

– there are some very good wells in the Oklahoma resource plays;

– there are liquid-rich zones in some of these plays;

– some of shale companies operating in these plays can significantly grow output volumes;

– although LTO production in OK has remained relatively stable around 50 kb/d in the past 2 years, it can start to increase after a further recovery in oil prices.

But I doubt that:

– OK shale plays are a new Bakken or a new Eagle Ford;

– they can be a game-changer in terms of overall US oil production.

Ok, I think I now understand your view point, hard to argue with that.

Do you guys have any opinion about the HRZ on the north slope of Alaska. First few test wells look promising and flow tests (fraccing) being planned.

Too expensive. Maybe they can elect somebody who will cut taxes to the bone to keep the pipeline working.

By the way, are Todd and Sarah back in Wasilla?

Exxon: The Road Not Taken

Inside Climate News

The reality is most of us ignored climate change/energy for decades. Great fun to rant at Exxon I guess. Kind of like a bunch of kids yelling “I didn’t do it”. Course if you’re a person who believes anything an “expert” says, guess it all makes sense.

The point I was trying to make was simply that Exxon did indeed have climate scientists on board who told them that climate change was a problem.

Exxon took that into consideration and made a decision to ignore their advice and move forwards with their development of fossil fuels as did many other oil companies and the rest of industrial civilization for that matter.

I’m not suggesting I’m any holier than Exxon, given the circumstances and the huge profits to be made had I been in a position of power to do so I might just as easily have succumbed to the temptation and found any number of perfectly sensible rationalizations to proceed exactly as they did.

That was then, now we are here and we know a lot more. We have lost our collective innocence and it’s time to accept that we have a problem and find ways to get beyond it, assuming we still can.

I agree that blaming people for doing what they did back then is not very useful. Heck, back then I sometimes drove 4oo miles to get my helicopter flight out to an offshore oil rig…

Fred maybe we can make it very simple. The article you cited compares what exxon “climate scientist” knew and then compares the handling of that information with what tobacco scientist and tobacco companies did with that information. Now aside from the absurdity of that comparison which only serves to throw red meat to the unthinking alarmist, lets put some perspective around this. Lets assume that Fernando and the author are correct and that indeed, Exxon and other “oil”companies did have “climate scientist” on the payroll and they had some idea that Co2 or methane or some other product of fossil fuel use was a contributing factor climate change. Now what would you have them do. There were no alternatives at the time, nationally we were in the middle of regional hot wars, the cold war and as always in economic competition.

This is where I believe Peak Oil and “Clean Renewable Energy” meet. We are now closer to the time where Alternative Energy as a growing part of our energy mix may well be a distinct economic advantage providing US citizens a higher level of national security and economic security relative to our military and economic competitors. But for that to happen we need all forms of energy to continue to be developed, evolve and compete in the market place. We don’t need a few brilliant as they maybe know-it alls, stifling competition, declaring some forms “bad” and others “good”. The idea that the biggest economy on the planet should economically “disarm” in the name of “saving our planet” and by banning certain sources from our energy mix is beyond dangerous. Now lets get to making America great again;)

What did we want them to do??

Tell the truth.

Everyone is angry at Exxon because they lied for decades. Not because they produced oil.

They financed a campaign of disinformation that denied there was a problem…that’s the problem.

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

995 more wells added from Dec of 2014 to March of 2016, monthly production fell about ten percent from the highest production reached in Dec of 2014.

2014 12 38096604 1228923 11744 3244 105

2016 3 34386634 1109246 12739 2699 87

The decline in production is not due to the price crash, the oil isn’t there in copious quantities.

995 more wells must have an investment cost of some six billion dollars or so at six million dollars per well and still the production decreases.

If it is true across the board, in all oil producing regions, a steady decline will happen and the price of oil won’t be to blame.

“995 more wells added from Dec of 2014 to March of 2016”

“The decline in production is not due to the price crash”

Much more wells should have been added to offset output decline from older wells.

They were not added due to price crash.

The latest Monthly Oil Market report from the IEA

https://www.iea.org/media/omrreports/fullissues/2016-05-12.pdf

has a graph on drilled and uncompleted wells in the US (page 23). Peaked at around 4,700 end 2014 and is now down to 3,800

Russia’s economic issues basically necessitate that they double down on oil production. Their economy is heavily reliant on it and they haven’t got time to do a u-turn on that. Plus, it makes for a great PR blast.

WAY OFF TOPIC but too good a pun to pass up, this headline is from my Google News bookmark.

“Tesla Model S Mounts a Toyota Camry in Florida, Damages Two More Cars”

Can TESLA actually screw TOYOTA, and by implication the rest of the auto industry? Not likely, but still funny as hell from a farmers pov. We are used to seeing such things, you city slickers only know about dogs humping your leg. 😉

Probably see the day soon when Toyota has the better battery. Then the race is on and we will see who comes out on top.

Tesla and Panasonic have a huge head start but Toyota has the muscle. My guess is that within ten years or so, EVERY body will have a satisfactory battery, by either building it in house or buying it.

Of course, production is somewhat related to demand. Right now demand is high, but will it continue to be high in the future?

In 1960, passenger cars got about 14 miles to the gallon, traveled 587 billion miles all for 180 million people. They used 41.1 billion gallons of gasoline to do that.

In 2010, passenger cars got about 23 mpg, traveled 2025 billion miles to service 309 million people. They used 86.8 billion gallons of gasoline.

More than three times the number of cars registered and a little more than twice the use of fuel.

Looks like America went on a car buying spree, added a lot of people but forgot to raise the mpg far enough to cover the increase in travel.

For EV’s to go as far as the 2010 cars, it would cost 73 billion dollars in electricity.

US drivers spent $348 billion on gasoline in 2010 and $448 billion on gasoline in 2011. $337 billion was spent on gasoline in 2015.

Seems to me that the savings on gasoline would pay for a full replacement of cars with EV’s, especially since it will go up in price again. So it would pay for the American public to shift to EV’s over the next 12 years or so. Better than eventually paying $6 to $10 a gallon, while your neighbor pays next to nothing to go just as far. With falling production and increasing cost for oil production, best to be out of the demand end of that business.

Clearly we have a few years (15-20?) before gasoline prices reach $6/gal. In that time, hopefully we will see several generations and dramatic improvement in electric car cost and performance as well improvements in the power distribution such as grid level storage….Oh, and by the way, we would need our utilities to increase the number of power plans by what 40%? Additionally, most of them would run on natural gas? That means a lot more natural gas wells would need to be drilled, and the capital estimates should include these new power plants, distribution networks, etc.

It is not clear to me. Prices have hit over $4 a gallon in the near past, taxes will have to increase for road maintenance and expect a carbon tax this decade. I expect US gasoline to hit $6 within this decade.

The shale fields will play out within that 15 to 20 year span, reducing output as they go. We need to have alternatives in place and EV’s at least to the 50% level by or before 2040 to avoid extreme prices for gasoline as the world demand outstrips supply.

The diesel locomotive and automobile had large advantages over coal fired locomotives, so coal faded as a transport fuel without the huge price rise.

EV’s have advantages and large potential advantages over gasoline engines, especially since we are at the peak production time and gasoline will only become harder to get as time goes on.

With coal there was time for an easy transistion, with gasoline we are edging into the downhill slide so prices could wander quite a bit, until they just go up or gasoline becomes unnecessary for most transport.

As far as utilities go, a properly designed EV will not use much external energy at all. The current ones we have do use some but I could run one from just a few PV panels on my house, so in the long run, no need for added power plants. In the short run, there will be some extra demand, but nowhere near what people think.

Unlike ICE’s the power for EV’s can be easily locally generated.

Check back with me around 202o, that should be an inflection point.

Hi Brad B,

Costs for solar and wind have been falling so a lot of the new supply will come from those sources. Eventually natural gas will peak and decline (2030 or so), so using natural gas is a poor future bet for low electricity cost.

Wind and Solar widely distributed and interconnected with the grid and some natural gas backup takes care of intermittency and is probably the lowest cost option going forward.

See

http://web.stanford.edu/group/efmh/jacobson/Articles/I/WWS-50-USState-plans.html

excerpt from above

The transformation reduces 2050 power demand relative to a business-as-usual (BAU) scenario by ~31.4% due to the higher work to energy ratio of WWS electricity over combustion and the elimination of energy for mining, transporting, and processing fuels, and another ~6.9% due to end-use efficiency beyond that already occurring in the BAU case.

About a 38% reduction in energy use relative to BAU by converting to Wind, Water, and Solar.

And

http://www.sciencedirect.com/science/article/pii/S0378775312014759

Excerpt from above

At 2030 technology costs and with excess electricity displacing natural gas, we find that the electric system can be powered 90%–99.9% of hours entirely on renewable electricity, at costs comparable to today’s—but only if we optimize the mix of generation and storage technologies.

They look for lowest cost option which entails excess capacity, about 3 times that needed to meet average load. Note that the existing grid also needs excess capacity to meet peak loads.

Dennis, I doubt the wind/solar/natural gas will be the lowest cost option even by 2030. Certainly 90-99.9% of hours being powered by renewable electricity will be out of question, at least in the United States and China (unless it means for a few hours or a few days).

Practical, on the field experience (not from theoretical models/simulations) from China seems to indicate that it takes at least 1 GW of fossil fuel power plant to back up 1 GW of wind/solar. In the Chinese case, this has to be done for the most part by coal (unless hydro is available).

I’ll contribute another post here in a few weeks once the latest BP Statistical Review becomes available and will comment more on this.

Hi Political economist,

The excess wind and solar backs up itself, did you read the paper?

It is a simulation based on real weather data over a four year period and actual electric demand over that same period for about 25% of the US.

Also are you including externalities in your cost estimate?

At “2030 technology costs” they cover 90 to 99.9 % of load for 25 % of the country.

Denis, my analysis shows that, any time a study extrapolates to a supposed lower cost scenario, it fails to pass the smell test.

There must be hundreds of cuddly lets do renewables articles like this (I don’t think it merits being called a paper). This in turn drives amateurs and energy populists to back extremely stupid actions.

I have yet to see a serious engineering and economic project study on this theme, published and posted for download.

Read the work by Mark z Jacobson that I linked. Costs for wind and solar in optimal locationso are already competitive.

Do you believe fossil fuel prices will remain low after the Peak?

Nuclear is also expensive. Wind, water, solar and geothermal along with energy efficiency makes sense going forward.

If not we will need to use less energy.

In optimal locations. With incomplete records. Don’t forget my job was to run down errors in engineering studies, and I simply can’t find anything I would grade as fit for purpose. There’s a huge amount of bullshit running around.

Hi Fernando,

The better locations are where most of the power is being installed in the US for Wind and solar. Current costs in the better areas (Midwest and Texas for wind and southwest for solar) are currently very competitive with coal and natural gas. The cost of solar in particular has been coming down quite rapidly and utility scale PV solar with tracking has a capacity factor of 32% for 2014 projects in the US.

The studies may not meet the level of perfection you require. The transition will be gradual and widely dispersed interconnected wind and solar will over come most intermittency problems if overbuilt by a factor of 3 (capacity of 3 times average load). Very little backup or storage will be needed up to 90% of average load. Existing plant can easily supply backup for the remaining 10%.

Do you agree that fossil fuels will peak?

Nuclear is not cheap, and is probably not needed, an expansion of hydro and geothermal where it makes economic sense is a good option. Finding the lowest cost option accounting for externalities is the best way forward.

After the fossil fuel peak in 2030, fossil fuels will no longer be the cheapest option.

OECD nations should start the transition and drive down costs and in 20 years the developing World will find wind, water, and solar are the cheapest option.

The studies may not meet the level of perfection you require.

That’s very polite, but…there’s no evidence for it.

I would very much like to see Fernando make a specific objection to a study like this, rather than present a “hand waving” argument. We shouldn’t assume that he actually has evidence for his argument, in the absence of any kind of specific facts or arguments.

Fernando: please provide evidence.

Hi Dennis. Just to point out here that just because an academic paper assumes a scenario where “wind/solar will back up themselves” doesn’t mean that it works in the real world.

In Calif currently the wind/ solar electrical peak output has turned out to not match peak demand all that well, leaving a fairly big management problem. Either other sources of generation are needed vs huge storage capacity vs some sort of enforced alteration of the demand (punitive pricing structure- beyond what we already have).

Not saying I am against a big wind/solar buildout, but I’m just saying I wouldn’t so readily discount the need for other sources of supply for decades- be it coal, Ngas, nuc’s, or whatever regions can come up with as time goes by, to help with the load.

In Calif currently the wind/ solar electrical peak output has turned out to not match peak demand all that well…

Well, no, solar peak output matched peak demand quite well. The current challenge is that CA has shaved off the peak quite thoroughly, and so now we’re looking at a secondary peak in the evening. This is normal, and quite expected by everyone concerned.

some sort of enforced alteration of the demand (punitive pricing structure

There’s nothing punitive about time-of-day pricing. Home owners can adapt with inexpensive programmable thermostats: the obvious strategy is to turn on the the A/C during the daytime when solar power is at it’s peak, and then turn it down for a couple hours in the evening peak. This is, of course, a reversal of the traditional strategy of leaving the A/C off during the day when you were at work, but people are smart – they’ll figure it out.

Hi Hickory,

Did you read the paper?

It looked at load data and wind data over a four year period (actual data for about 25% of the US). The wind, and solar (mostly onshore wind) could provide 90% of load at competitive prices with conservative assumptions about 2030 costs (assumed costs continued to decline, but no big technological breakthroughs). In order to achieve this excess capacity (about 3 times average load) is needed and the wind turbines and solar panels need to be widely dispersed.

Note that the existing grid can provide backup as wind and solar ramp up and that existing power plant already have excess capacity, that is how the grid handles peak load. To get to 99% renewables, batteries, fuel cells, and vehicle to grid provide some of the backup and costs are higher, but this is more likely to be achieved in 2060 than in 2030. My guess is that California does not have enough wind and solar capacity to provide its own backup, but as more is installed in more places it can eventually be achieved. Not likely by 2030, but maybe 2040.

This is actually a very conservative study: due to limitations on computer processing power, they didn’t look at “wind-gas” as a backup for seasonal renewable production lulls.

Therefore their proposed system is sub-optimized and a bit more expensive than necessary. You wouldn’t need to over-build quite as much as they project: I’d estimate a need for 50-75% overbuilding, which is very similar to current levels.

Hi Dennis, so basically it depends on assumptions of about future storage technologies. I suppose it is fair to say that these assumptions are controversial.

Alternatively, we can find peer-reviewed articles that hold pessimistic views about renewable energy, especially solar. Have you seen those articles posted recently on Energy Matters about EROEI on solar. One of them claims solar has less than one EROEI. That I suspect is not reliable and involves some double counting in energy inputs. But there were also studies by Hall et al that found solar EROEI to be in low single digits. I think that’s more credible.

When we study the “costs”, I think it is useful to separate economic costs from externalities. Just to clarify the economic cost itself is not always easy. If we also count externalities, it requires many additional assumptions. For example, how to compare the carbon price (what carbon price we should use) and the poisonous materials used for solar cell manufacturing.

When we compare the current wind/solar cost with coal/gas cost, it is important to compare them on as equal a basis as possible. Because in the end we want to see large-scale application of renewables, not just as supplemental energy sources. For this reason, I do not find it particularly encouraging that, say, solar in certain “best sites” have become competitive.

Normally I do not take media reports on this at face value. For example, some days ago, there were reports saying in Dubai the solar price has fallen to 2 cents per kwh. I did some research and found that in fact the project was at a cost of about $2000 per kw, implying a unit cost of 15 cents per kwh (assuming annual fixed cost 10% (interest and depreciation) and capacity factor 15%).

One should also pay attention to the differences between countries. For example, China’s solar cost is cheap compared to the US. The current cost is about 8000 Yuan/kw (or $1300/kw). But coal power plant is even cheaper in China. The current construction cost is about 4000 Yuan/kw (or $700/kw, like the US gas turbine price; by comparison, the US coal plant construction cost is about $3000/kw).

Coal consumption has fallen in China over the last two years. Growth of wind/solar has been a factor. But the most important factors are decline of heavy industry and the surge of hydro (partly because of El Nino).

However, the Chinese electric power business has rushed to build coal-fired power plants. Over the first four months of this year, China built 22 GW of conventional thermal power (there is no data about how many of these are coal-fired or gas-fired, but normally coal accounts for more than 90%); 2 gigawatts of hydro, 2 gigawatts of nuclear, and 4 gigawatts of wind.

When I write my updated annual report on world energy, I will report my own calculations of electricity generating cost using EIA data. I will of course make the underlying assumptions transparent.

All of these are just dollar-to-dollar comparisons without taking into account intermittency, back up, storage et al. Perhaps, by 2030, we will see the materialization of cheap large-scale electricity storage but perhaps not.

At this point (without demonstration of viability of large-scale electricity storage on a, say, TWH basis), it is safe to assume that wind/solar will continue to be troubled by intermittency.

Hi Political economist,

The backup requirements are only needed when going from 90 to 99 %, very little backup is needed.

My comment on optimal sites is for today, in 2030 under reasonable assumptions wind and solar will be cheaper than fossil fuel power generation in all advanced economies due the coming peak in fossil fuels, even without accounting for externalities.

I understand very well that externalities are difficult to estimate, but it is very clear to me that the externalities of power generation by coal (especially without pollution control, as is the case in many developing nations) is far higher than the externalities from wind and solar power.

Have you read the work by Jacobson and Delucchi?

http://www.nasonline.org/news-and-multimedia/news/2015-cozzarelli-prize-recipients.html

http://www.pnas.org/content/112/49/15060

Other works at

http://web.stanford.edu/group/efmh/jacobson/Articles/I/WWS-50-USState-plans.html

Normally I do not take media reports on this at face value. For example, some days ago, there were reports saying in Dubai the solar price has fallen to 2 cents per kwh. I did some research and found that in fact the project was at a cost of about $2000 per kw, implying a unit cost of 15 cents per kwh (assuming annual fixed cost 10% (interest and depreciation) and capacity factor 15%).

With due respect PE, you have fallen for the oldest marketing trick in the book. The price was 2.99 cents so, that’s 3 cents not 2. The solar map for the UAE below shows that the average annual resource in Dubai is between 2100 and 2200 kWh/m2. That works out to a figure of 5.89 Peak Sun Hours per day which would indicate a capacity factor of 24.5 %.

Maybe the following article might point to a different perspective..

2 cent solar?

There may be a touch of the middle eastern tendency to brag and exaggerate in that price nonetheless.

Your claim about “field experience” is nonsense.

The evidence is that solar acts as its own backup during the daytime, once it’s in high enough volume; the sun is always shining somewhere. The same is true of sufficiently distributed wind; the wind is blowing somewhere.

Is this a reply to my post? Since you have not done research yourself and obviously you do not read Chinese, therefore, it is safe to say that you have no idea about Chinese “field experience”.

For this reason, your reply can only considered to be wishful thinking and nonsensical

Fernando and Political Economist,

A nice paper by Jacobson, DeLucchi, et al addresses intermittency.

http://web.stanford.edu/group/efmh/jacobson/Articles/I/CombiningRenew/CONUSGridIntegration.pdf

For the US 100% of energy needs can be provided by wind, water and solar (WWS) system by 2050 at an electric cost of 10.6 cents/kWhr (2013$).

Estimated future electricity cost under a business as usual scenario is 27.6 cents per kWhr in 2050 (including externalities) and 17 cents per kWhr if externalities are ignored.

Bottom line, transitioning to a WWS system will be cheaper in the long run. We should get started on the transition, 34 years to go!

Hi Dennis, thanks for sharing the articles. I am interested in your opinion on the following:

http://euanmearns.com/the-energy-return-of-solar-pv/#more-13773

http://www.resilience.org/stories/2016-05-27/the-real-eroi-of-photovoltaic-systems-professor-hall-weighs-in

The first one is not very credible but I think it has some interesting insights (but it’s peer reviewed and published on Energy Policy nonetheless). The second one (Hall) is probably serious research.

About falling costs of wind/solar, I think, just like any commodity, eventually they will run into space/resources/labor limits and at that point their cost curve will begin to turn up. We do not know how soon this turning point will arrive, but it may not be too far away. The following article has some assessment about the long-term limit of solar:

http://www.eis.uva.es/energiasostenible/wp-content/uploads/2011/11/solar-energy-draft.pdf

(a revised version of this was published in Energy Policy)

It should also be noted that as wind/solar expand, they will first substitute the more expensive fossil fuels. This will lower the cost of fossil fuels that stay on the market, creating barrier to further expansion of wind/solar.

In this sense, if we would really like to have a 100% renewable world, the renewables need to be competitive against not the most expensive fossil fuels, not the average fossil fuels, but the cheapest, best quality fossil fuels.

Hi Political Economist,

PV Solar power in particular is similar to computers in that it is a high tech industry with a potential for very large cost savings as scale increases.

If that is correct the cost of PV modules will fall below even the cheapest fossil fuels, there are also cost savings with distributed power as transmission and distribution costs are reduced.

I doubt that the transition to renewables will happen as fast as optimists like Tony Seba and others predict.

I think it likely that demand for fossil fuels will keep fossil fuel prices at least as high or higher than wind and solar but that falling costs of these technologies (especially solar) will eventually drive fossil fuel prices lower,but there is a limit to how much fossil fuel can be produces at these lower prices so if energy demand is to be met energy prices will need to rise. As technological development in solar and wind continue to push costs lower.

The price of performing one GFLOPS (one billion floating point operations per second) using a computer system in chart below. Note the log base 10 scale on the left axis, so the cost was reduced by a factor of 10^13 from 1960 to 2012 in constant 2013 US dollars. So it was 10 trillion times cheaper after 50 years for a billion FLOPS.

I don’t think PV will progress that fast, but think there is a lot of room to reduce the cost of PV modules.

Isn’t it true that much of those cheap fossil fuels are running on debt and not making profit?

We’ve actually already reached the point where the LCOE of solar and wind is cheaper than any other new construction for producing electricity — at least if you’re south of the Snowbelt.

In the US the main problem with solar panel prices isn’t even the panels any more. The rooftop installers are charging huge markups to cover, basically, marketing costs; these are something like a quarter of the total cost, with panels being less than half the cost. This is aberrant, since installation prices are much lower in Germany and in Australia. In Germany and Spain the governments are trying to tax solar panels to prevent them from being installed, which is unlikely to be an effective tactic; it’ll just make people mad.

Predatory business operators and schizophrenic governments. Sounds like the same old song. In fact someone should write a song about this.

Long time lurker first post.

As an Australian electrician and installer of solar panels and wind turbines I can tell you they don’t come close to being as cost efficient as the old cool fired power station’s. It would be great if they did but they are not in the same league some times reality is a bi$&ch.

Hi Political economist,

I have read the piece by Hall and Bardi, I agree more with Bardi than with Hall. The piece by Prieto and Hall extends the EROEI concept so far that it is not comparable to most other common EROEI measures.

A fundamental problem with the EROEI analysis is where to draw the boundries is never very clear. Possibly a detailed input output analysis would give a clear result.

An example of the problems with the Prieto analysis is that things such as roads, fences, and such were included and the output was considered at the distribution point near a customer’s home or business.

For marginal fossil fuels like LTO or oil sands, would an analysis that looks at EROEI find that at the gas pump the EROEI extended for these types of energy is more than Solar?

Also note that the cost of solar was considerably higher in 2008 than it is today so that study is quite out of date.

As far as your first link, I would say the study is not well done, see

http://cassandralegacy.blogspot.com/2016/05/but-whats-real-energy-return-of.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+CassandrasLegacy+%28Cassandra%27s+legacy%29

Should have read link first. Some good comments by Prieto. Does not address that first paper.

My recollection is that the paper focuses on Germany, where sunshine is not all that abundant. As costs fall for solar EROI will improve.

Also the general piece by Murphy at the oil drum suggests a minimum of 10:1 would translate to about 3:1 for extended EROI.

If Solar is 11:1 using standard EROI measures that would suggest a little higher EROI than Prieto calculates, as Solar gets integrated into society on a wider scale the energy will be utilized more efficiently and EROI extended will improve.

Another point sometimes missed for energy use in transportation is that the greater efficiency of EVs vs ICEV will reduce energy needs (due to a reduction of thermal losses).

I have posted here before about developments that will drive down costs that are yet to hit the market. The first factory to use a “kerfless” process to produce wafers is currently under construction in New York state. It is expected that this will reduce wafer costs by up to %40. Premium module efficiences are now pushing past 21%, up significantly from just a few years ago. Going from 14% to 21% efficient modules means 30% less area (modules, mounting hardware, etc.) is needed to harvest the same amount of energy.

PV is already competitive with the most expensive FF and it is well on the way to competing with lower cost options. I make it a point of duty to try and keep up to date with the latest news on PV technology. Things are improving really quickly, making five year old studies useless if they didn’t include realistic projections of reduced costs.

Hi Political Economist,

The third paper, makes very conservative assumptions about solar potential and also makes unreasonable assumptions about energy needs.

Essentially it assumes the lowest possible area for solar PV and the highest possible growth in energy use, both assumptions are likely to be proven false.

For example most primary energy at present is used very inefficiently.

The use of Solar PV that existed in 2010 to estimate the future, is interesting, but is likely to underestimate future potential by a large measure.

The capacity factors for US projects are reaching about 32% in 2014 (for US southwest with tracking) and 28% for lower solar areas with tracking, without tracking it is 22% to 28% (measured in AC to be comparable with Wind and other power generation).

See

https://emp.lbl.gov/sites/all/files/lbnl-1000917.pdf

Let’s assume the World average is close to the US average and that tracking is used, this would increase the capacity factors to 30% from the 15% used in that older paper.

Also see

http://physics.ucsd.edu/do-the-math/2011/12/wind-fights-solar/

It’s bullshit.

Hi Fernando,

If you are referring to the work of Jacobson and Delucchi, the US National Academy of Sciences, disagrees.

From

http://www.nasonline.org/news-and-multimedia/news/2015-cozzarelli-prize-recipients.html

The Editorial Board of the Proceedings of the National Academy of Sciences (PNAS) has selected six papers published by PNAS in 2015 to receive the Cozzarelli Prize, an award that recognizes outstanding contributions to the scientific disciplines represented by the National Academy of Sciences (NAS). Papers were chosen from the more than 3,000 research articles that appeared in the journal last year and represent the six broadly defined classes under which the NAS is organized.

The annual Cozzarelli Prize acknowledges papers that reflect scientific excellence and originality. …

Class VI (Applied Biological, Agricultural, and Environmental Sciences):

“Low-cost solution to the grid reliability problem with 100% penetration of intermittent wind, water, and solar for all purposes,” by Mark Z. Jacobson, Mark A. Delucchi, Mary A. Cameron, and Bethany A. Frew

Link: http://www.pnas.org/content/112/49/15060

…

Hi Political economist,

As far as I know China does not have 3 times the capacity of average electrical load in wind and solar capacity. That is what it takes for 90% of average load hours to be covered by a widely dispersed interconnected wind and solar power network. The 99% number requires a fair amount of battery and/or fuel cell backup and is more expensive. The more capacity that is installed, the less that backup is needed. Also the backup becomes more expensive over time and costs are lowered by replacing as much backup as possible with excess capacity in wind and solar. For now China should aim for 90%, as costs come down in the future for batteries and fuel cells, excess power can be used during high wind times (or mid day for solar) to charge batteries or produce hydrogen to use in fuel cells for backup.

“Oh, and by the way, we would need our utilities to increase the number of power plans by what 40%”

I posted some back of the envelope calculations a while back Basically, I looked at the VMT for a recent year (2014?) and worked out how much electricity would be needed to supply a fleet of EVs with similar electricity consumption to Tesla Model S (not particularly frugal). Ignoring charging losses (10%?) it would have required 18% more electricity than was produced for the year. I also ignored the reduction in electricity use from not having to refine any petroleum into motor fuels to cover the VMT used in the calculation.

I think we can safely say that increased electricity consumption by EVs is unlikely to be a show-stopper.

Any comments from investors and hands on guys about stronger companies not previously invested in tight oil buying into distressed tight oil properties would throw some light on what the buyers think about future prices. There is plenty of news about bankruptcies, but not much about buyouts and mergers between tight oil and conventional oil companies.

So- are some conventional companies picking thru the carcasses of dead tight oil companies?

Very few of the Bankruptcies are liquidations – most are pre packaged restructurings. This is of course because the financial backers of the companies are confident the assets have value and that $40/bbl oil will not be the future price. The value of prime shale acreage has dropped very little and M&A activity for quality properties has been strong. The problem areas where economics were challenged to begin with such as the Tuscaloosa Marine Shale are having problems attracting buyers. (see GDP) Permian acreage is at a premium, note the recent Callon acquisition.

Rockman over at Peakoil.com has mentioned several times that the owner of his company (who has no debt and a boat load of cash to put into oil/gas opportunities) is still waiting on the sidelines…but is salivating for the tight oil bargain basement to arrive soon, as there isn’t anything around in the conventional arena that comes close to meeting his ROI standards. Like smart players, though, they holding their cards very close to their vests.

HVACman,

Has Rockman said that they are going to be looking at LTO possibilities? They’ve always avoided such, as I recall.

In May of 2014, Stone Energy’s stock price (SGY) was 48.54 usd, today it is at 65 cents, the 52 week low is 27 cents.

http://www.marketwatch.com/investing/stock/sgy

Looks like a fall of more than 99 percent, not quite 100 percent, but close. Not until the vultures start circling, then you can worry.

Probably can’t get any worse, but it might.

Unfortunately, the U.S. Energy Sector is in a lot more trouble than falling oil production. In 2015, the U.S. Energy Sector paid 48% of their operating profits just to pay the interest on their debt. However, it was even worse during the first quarter of 2016.

Here is a link to the chart. I can’t post it here for some reason: https://srsroccoreport.com/wp-content/uploads/2016/05/U.S.-Energy-Sector-Interest-Payments-On-Debt-.png

The U.S. Energy Sector paid a whopping 86% of their operating profits just to pay the interest on the debts in Q1 2016. Their total debts are $370 billion.

What’s even more alarming is that $5.1 billion of debt matures this year, but it balloons to $25 billion next year. It will be interesting to see how this plays out.

steve

Just wait till they start rolling that debt over to higher interest rates.

Hi Satan’s best friend,

Interest rates rise when the economy is doing well for a nation that has control over its own monetary policy (Greece does not apply). So the GDP rises, tax revenue rises, government spending falls (less welfare and unemployment payments) and debt can be paid down. If we want to pay down debt faster, raise taxes or cut government spending or both. Just need some compromise from better politicians to do it.

Dennis,

I have learned much from your posts and I am a fan of the work u do here.

I am pointing that out because, as we all know, thing can be misunderstood on Internet.

I think being in massive debt is risky. I just don’t agree with u here.

Ultimately, the markets determine interest rates. When people don’t think they will get paid back interest rates will go up.

I don’t think the fed can play money games forever. If they could we should have never seen financial problems in the past. But we consistently do.

There is no free lunch.

Hi Satan’s Best Friend,

I think we actually agree on the principle. The question is how much debt is too much? Do you really think and advanced economy with control over its own money supply is in trouble with central government debt of 100%?

If so, then yes we disagree. Do I think debt can be expanded without limit? Absolutely not. I think economies that approach Japanese levels of debt will be in trouble.

The low interest rates are indeed determined by the market to a degree, but the supply of money also has an influence on interest rates.

Also note that many are worried about private debt, this is a new problem that economists did not worry about in the past. The problem of government debt crowding out private debt seems to have been pushed aside and now the focus is on total debt, (public plus private).

Yes there is no free lunch, without proper monetary and fiscal policy there may be no lunch. 🙂

When inflation rises the Fed will tighten the money supply so that interest rates will rise. So far monetary policy has been appropriate and the reason for the slow recovery is too little debt, not too much.

Why did the Great Depression end? What happened to debt levels?

Hi All,

Russian C+C output from the Russian Energy Ministry, the data is reported in metric tonnes, I converted to barrels at 7.3 b/tonne. The last data point is March 2016.

http://minenergo.gov.ru/en/activity/statistic

An alternative estimate of World C+C that substitutes the Russian Energy Ministry estimate for Russia, the NEB estimate for Canada, and Dean’s Texas C+C estimate for Texas.

The decline from Nov 2015 to February 2016 is similar (about 930 kb/d). Also shown is the centered 11 month moving average (in red). I expect decline will flatten and output will stabilize around 79 to 80 Mb/d and as inventories are drawn, prices will rise, possibly dramatically, by the end of 2017.

It takes some time for supply to react to higher oil prices, so $135/b (2016$) in 2018 seems possible if decline continues and ramp up in oil supply is as slow as I expect.

I expect decline will flatten and output will stabilize around 79 to 80 Mb/d and as inventories are drawn, prices will rise,

Errr… the decline will flatten and stabilize around 79 to 80 million bpd? That’s exactly where they were in February, 79,653,000 bpd. You expect them to stabilize at exactly where they are right now.

Naw, I don’t think so.

And eventually you are going to have to start using the EIA numbers for C+C. They are the only numbers we’ve got. You can continue to make up your own numbers but they will not mean much. Eventually you will have to start using official numbers.

I know, I know, some of the EIA’s numbers I don’t like either. But they are the only numbers we have. JODI numbers are incomplete and totally crap. For OPEC they use the “direct communication” numbers from the MOMR, not the far more reliable “secondary sources” data.

Hi Ron,

I do use the EIA’s numbers for everywhere except Russia, Canada, and Texas where we have better estimates from Russia, Canada, and Dean (for Texas).

You have already shown what the EIA’s numbers are, not much point in repeating them. Those are the best C+C estimates, except for the estimate that I have shown above, which is better, imo.

Hi Ron,

The difference between the OPEC numbers and the EIA’s numbers are that OPEC’s numbers do not include extra heavy oil or condensate (these are in the NGL plus non-conventional estimate). To compare OPEC and EIA data for OPEC one has to use C+C+NGL data from the EIA and compare to OPEC secondary sources plus NGL and non-conventional. The last data point we have for OPEC NGPL from the EIA is Oct 2015, so if we look at third quarter 2015 the EIA and OPEC estimates fro OPEC C+C+NGL are very similar.

The EIA estimate is about 210 kb/d less than the OPEC estimate (or about 0.55% too low) for the third quarter of 2015.

Also note that my claim is that the EIA’s estimate is too low and Feb 2016 output is about 80,300 kb/d, if we add the OPEC underestimate it would be 80,500 kb/d (assuming the low estimate of the third quarter continued through Feb 2016, hard to know without an NGPL estimate for OPEC).

Dennis,

The Russian Energy Ministry has a final number for April, which is 88 kb/d , or 0,8% below January 2016 peak.

My very rough preliminary estimate for May, based on incomplete daily data from CDU TEK, indicates a slight increase vs. April levels.

Thanks AlexS,

Russia gets its data out very early. Are there usually revisions for the most recent month reported or are the estimates usually pretty close?

Dennis,

Preliminary monthly estimates are reported on the 2nd or 3rd day of next month.

Final numbers are reported about 3 weeks later.

Here are revisions for the last 6 months:

Hi AlexS,

Wow, that is excellent data. After 6 months I am assuming the revisions would be negligible, is that a good assumption?

Thanks.

Dennis,

As I said, revised numbers are released by the end of next month and they are final. The revised numbers for January-April in the table above will not be revised further.

Hi AlexS,

That actually makes me wonder if they are accurate if they are never revised. Russia has a big oil industry and there is a lot of data to process, maybe people don’t make errors in Russia? Isn’t there a yearly review of the data where perhaps there are revisions?

Dennis,

This is the legacy of the old central planning system, when all state oil producing enterprises had to report to the Oil ministry on the daily basis.

The numbers can be easily checked as all produced volumes are transported via state-owned pipeline system and/or export terminals. Therefore it is not a big problem to get the final number by the end of next month.

In fact many other countries release final oil production numbers with about a month delay. So it is not Russia, but the U.S. is an exception. And the biggest problem is Texas. There are thousands of small companies, which transport oil by pipelines, rail, river tankers and trucks, and are not required to report production numbers soon after the month-end. And each state regulator has its own rules of reporting.

BTW, statistics for Alaska and the GoM, where oil and gas fields are operated by big companies, are much more reliable and are rarily revised.

As you know, NDIC production statistics for North Dakota are also quite good.

Hi AlexS,

Yes the NDIC data is very good (though not as good as Russia’s), there are some small revisions but they are not significant.

A simple solution to Texas poor reporting would be to include the “pending well” file in the RRC data reported online, then revise each month if there are some wells incorrectly reported.

My guess is that stiff penalties for delinquent reports ($10,000 per well each month for every well not reported on time) would improve the data quite a bit.

In the South they like to take their time, so we will all just have to wait 12 or 18 months to see what’s happening.

My very rough preliminary estimate for May, based on incomplete daily data from CDU TEK, indicates a slight increase vs. April levels.

The Russian energy ministry has slightly different figures.

Russian oil output falls slightly in May to 10.83 million bpd

Russian oil output stood at 10.83 million barrels per day (bpd) in May, slightly down for a second straight month but still close to a record high reached earlier this year…

Preliminary data from the Russian energy ministry showed on Thursday that Russia produced 45.79 million tonnes of oil last month – or 10.83 million bpd as an average, down from 10.84 million bpd in April.

As I said, my estimate was based on incomplete daily data from CDU TEK.

The free data from CDU TEK was for only 24 days of May. For the 7 missing days I was using average numbers between the previous and the next day.

The resulting number was 45,855 thousand tons, or 10,798 kb/d (7.3 ratio) or 10,842 kb/d (7.33 ratio).

The preliminary number published today by the Energy Ministry is 45,790 thousand tons, or 10,783 kb/d (7.3 ratio) or 10,827 kb/d (7.33 ratio).

This is still slightly above the final number for April: 10,778 kb/d (7.3 ratio) or 10,822 kb/d (7.33 ratio).

Hi AlexS,

My understanding is that 7.3 b/t matches the average crude plus condensate density in Russia better than 7.33 b/t. Is that correct?

Dennis,

I was always using 7.3 ratio, although some western sources, including Energy Intelligence, use 7.33.

Rosneft is using 7.41 for its oil.

In any case, all official statistics are still in tons.

BTW, Russian oil mix is becoming lighter, as most of new oil from eastern Siberia, Far East (Sakhalin) and the north of western Siberia is light.

Hi AlexS,

Due to the lighter oil, 7.33 b/t would be a better estimate then? Are there any official Russian statistics on average C+C density in Russia?

Dennis,

I don’t have average numbers.

Here is a table comparing Urals export blend with the new Russian crudes:

Hi all. This is my usual end of the month update for Texas with the latest EIA data: as you can see this is the first major divergence between my data and EIA. Honestly, since the dynamics of the RRC data does not show any particular jump/change in their revision over time (see a comment of mine in the Texas post), I cannot anything about it, since my method is fully data-dependent.