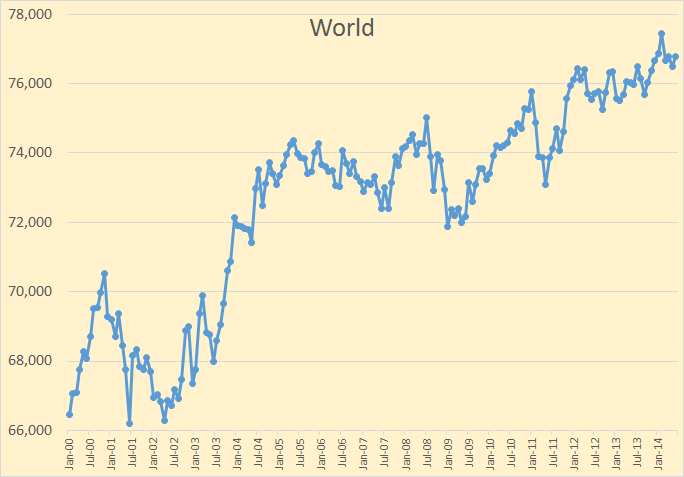

The EIA has finally published its International Energy Statistics. The last one had July data. This one is has two months updates, August and September. All the data I publish comes is Crude+Condensate from January 2000 through September 2013.

Again, all data is C+C in thousand barrels per day with the last data point September 2013.

As you can see from the chart World C+C production has leveled out in the last year and one half. September 2013 is slightly lower than February 2012.

There were a couple of major revisions in the July data. Canada was revised down by 269 kb/d while Non-OPEC was revised down by 228 kb/d. There were other small revisions upward. OPEC C+C had no revisions so that left World C+C for July revised down by 228 kb/d.

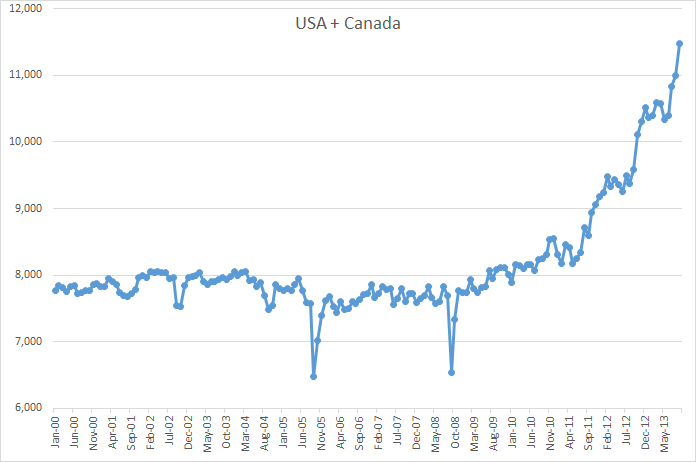

Both the USA and Canada are on a real tear, owing of course to Light Tight Oil and the Oil Sands. Their combined production is up about 1.9 mb/d since in one year, since last September.

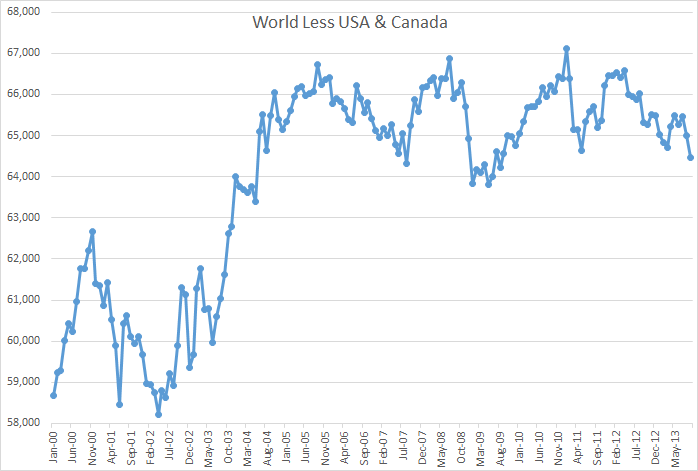

But they are the only ones on a tear. Almost everyone else is flat to down with a few small producers up slightly.

World less USA and Canada is actually below where it was in June 2004 and is swiftly approaching the bottom it hit after the crash of 2008. The peak was in January 11 and they are down 2.65 mb/d since that point.

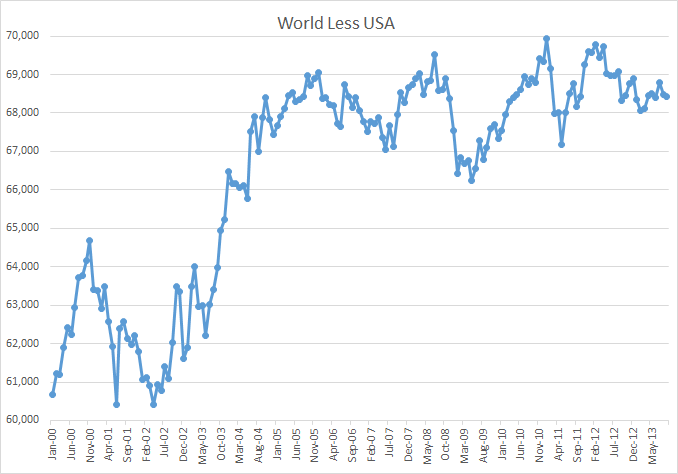

Actually only Light Tight Oil is keeping the world from declaring peak.

World less USA is down over 1.5 mb/d since the peak of January 2011.

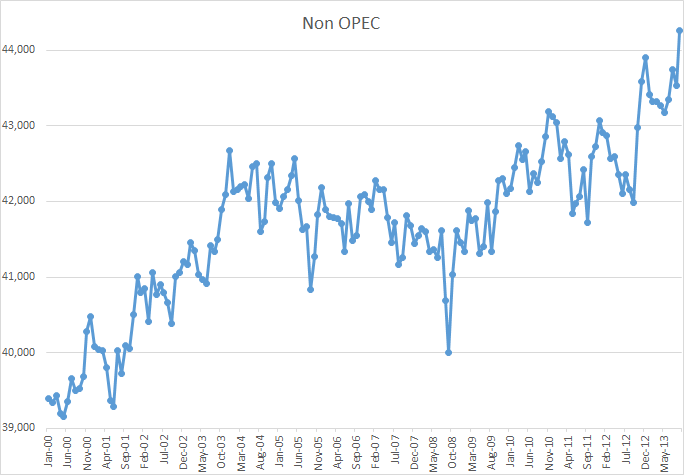

Non-OPEC is up on the strength of the USA and Canada.

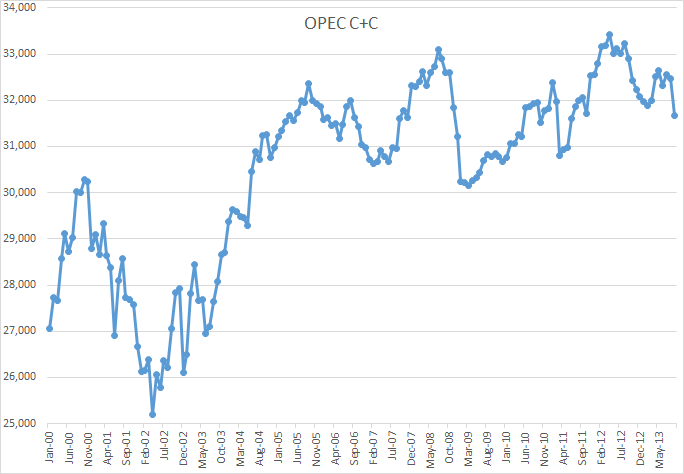

However the EIA has OPEC C+C down considerably.

Charts of all Non-OPEC producers are now up on the Non-OPEC Charts page.

Also a new page has been added, World Crude Oil Production by Geographical Area

Maybe God really does watch out for Americans, and other Drunks, and Fools.

Maybe so!

Here’s a link to a piece that goes into some detail about the Mexican reforms currently being implemented.

If they succeed then Mexican production will likely at least stabilize within a few years for perhaps as long as decade or two.They might even get back up to their former output !

http://www.brookings.edu/research/opinions/2013/12/23-mexican-energy-reform-opportunities-historic-change-negroponte

My guess however is that peak oil will necessarily be recognized as reality by the mainstream before Mexican production achieves any major rebound and than their glory days are behind them.

Hi Mac,

You state:

“My guess however is that peak oil will necessarily be recognized as reality by the mainstream before Mexican production achieves any major rebound and than their glory days are behind them.”

I have been thinking on this point for the past couple of months. The question of whether or not the public, through the media, will accept the reality of peak oil is a very interesting one. I have numerous Ph.D. colleagues–physicists, chemists, biologists–from multiple institutions who refuse to believe in peak oil–at least as a near term (within the next decade) problem. These folks are supposed to be empiricists; however, they have made a choice to ignore the data. It is not that they do not understand the data, they simply refuse to peruse it–or even take a cursory look. I have heard numerous people state something dismissively like, they have been predicting peak oil for 50 years.

Beyond that, I think the data may become obfuscated as we move forward. It would not take a clairvoyant to predict that the Middle East will likely see instability increasing over the next decade. This fact, I believe, will greatly hamper the media’s ability to understand the underlying geological constraints of oil production. Especially when combined with a general mindset that is seemingly unwilling to accept near term production limits.

Here is another variable that may cloud the issue–the demand side. The demand side, at least in the United States, is, in my opinion, set to decline. Why? The most consumptive generation in the history of the world, the baby boom generation, is on the precipice of powering down. Additionally, technologies are changing. The combination of increasing CAFE standards with the aging of our population could set the stage to significantly dampen domestic demand. This will likely make it more difficult to accept or even understand peak oil. In other words, as we move forward, I think it will be more difficult, not less difficult, for people to understand what is occurring.

Best,

Tom

Hi Tom

Yes this is the interesting thing to ponder, as a non-insider [and not being trapped in the US news bubble], I have found the Shale boom incredibly frustrating as it has disrupted the price signal that our societies need in order to get on with the urgent transition away from the world cheap oil built. And in general I think you may be right; there could be enough of a mix of replacement production, demand destruction and actual transition [two different things IMO], to hold the price on its current plateau for longer and allow the deluded to stay deluded.

However, the other possibility is that things could be just about to get interesting again. Check out Euan Mearn’s post linked to below, especially the additional chart in the comments which shows net oil use by a significant group of countries. The three year $100 oil plateau has been amazing, an example of the self righting quality of complex systems, but it looks to me to be increasingly unsustainable. What happens with US Shale is very important because of the way the emotional state of the average american really does drive the discourse.

There really are only two options: a lucky [for BAU] knife-edge continuation of just enough balance to keep price on the ledge, or one outage, decline, or failure to grow by important producers and the inevitable reflection in new higher prices.

The later is surely more likely so then the next questions are will this re-pricing be a sudden leap, or a volatile see-saw, or gradual and relentless? And will it happen before, as, or, after, LTO peaks in the US?

Interesting times:

http://euanmearns.com/brick-oil-production-update-sep-2013/

Hi,Pat and Tom

You bring up good points and I’ll be the first to admit that I’m merely a front row spectator rather than a player in the peak oil games.

But I do have lifetime season ticket! I know something about the history of the oil game, and a few things about the nature of our species and the nature of big businesses.

The nature of the oil industry is such that it takes it a long time to change very much; we constantly hear that nuclear power is no good in part because it takes a decade or more to permit and build a nuke- but it takes a decade or more to bring a new major oil field into production too, even when circumstances are favorable .

Now in Mexico the basic infrastructure at least is already in place and it only needs modernizing and expanding in order for Mexican oil production to expand considerably.But I’ve been observing politics for a long time, and I’ll be extremely surprised if the country can increase it’s marketable production at all within the next to or three years.

If they do succeed in bringing in privately owned oil companies as working partners, just working out the agreements and getting some new drilling projects organized will take the first two or there years if history is any guide to such affairs.

And while tight oil producers are running wild in a couple of plays here in the US, those plays are entirely atypical in that the regulatory environment, the ownership, the availability of rigs , and financing have come together in a way that isn’t likely to be repeated on a large scale anywhere else; and the production from the the lot fields is just barely enough to off set current declines elsewhere and keep the current production plateau more or less flat.

In the meantime, the population of the world keeps growing, and the appetites of the developing world for oil appears to be insatiable at almost any conceivable price because the utility of oil in a developing country is extremely high, compared to a rich mature country.

Ten gallons of gasoline or diesel fuel burnt in a farm tractor adds a meaningful increment of production to the food supply in a poor country just moving to industrialized agriculture, whereas the same ten gallons burnt here in the US is mostly wasted in getting a commuter to work a couple of days and doing some unnecessary shopping.

I used to remark at TOD that twenty dollar a gallon diesel fuel would be cheaper than hay and corn to feed a plow horse.

I’m open to the possibility that more efficient vehicles, a stagnant economy, and changing life styles may actually lower demand for oil in the US and other rich countries -as a matter of fact I believe this is happening already and that the process is accelerating, although it may not yet be adequate to offset an increase in demand from our growing population if the economy picks up.

But just as the lot coming online is only adequate to offset the decline in production from older conventional oil fields, the falloff in demand in richer countries- in my opinion- will hardly be enough to more than offset demand growth in developing countries.

I’m personally just convinced that the depletion of conventional oil will soon outrun any possible new increased production of light tight oil, other unconventional oil, natural gas liquids, and biofuels , and that the world will have to face up to the reality of peak oil.

My gut feeling is that anybody willing to take an honest look at the numbers will recognize peak oil as a reality within the next four or five years at the longest, and that even Joe Sixpack will understand this reality within a decade or so.

Humans are really strange creatures in that when we want to think, we are capable of serious rational thinking; but when we don’t, we just don’t, and this holds true no matter how well educated we are 99.9 percent of the time.

I”m no longer surprised that your acquaintances with advanced degrees are blind to existentially critical facts that would be perfectly obvious to them if they were to take the time to truly study these facts and put them into the “big picture ” context necessary to understand not only the facts themselves but also the inescapable implications of these facts.

No matter how smart we are, we remain creatures of habit, and our behavior is controlled not by our outer layer of folded gray matter where involved thinking takes place but rather in the older , lower buried brain centers; this is and remains the case whether we’re illiterate peasants or rocket scientists.

As a matter of fact, I strongly suspect that the better educated we are, the less we see, on the average, because we are somewhat like blundered mules.When I was a kid, we still had a couple in the family, and I harnessed them up and worked them a little occasionally myself.

Blinders keep a mule from seeing anything except what’s directly in front of him making him easier to control by preventing him from being distracted by his surroundings.

It seems that experts inadvertently blind themselves by getting to be so immersed in their own field of expertise that they habitually shy away from anything outside that field and refuse to even look at it seriously if they can avoid doing so.

It’s always takes a few bricks upside the collective head of the public to get its attention. Unless I miss my guess the peak oil bricks are going to be flying one after another before another five to ten years are gone.

The French used to have an artillery piece known affectionately by as the “French 75″ . The 75 gunners were fond of saying when they got into action

” one in the gun and six in the air”.

The peak oil bricks are going to fly that way someday when it’s just not possible any longer for the msm media to pretend that oil is still plentiful.

” I have found the Shale boom incredibly frustrating as it has disrupted the price signal that our societies need in order to get on with the urgent transition away from the world cheap oil built.”

Most of the World has begun some transitioning, but by switching to coal. Only the US is moving away from coal. Despite all the discussions about moving to renewable power, its just not going to happen. When we breach the tipping point the industrialize world will collapse. Consider that the industrial world has spent 150 years building infrastructure specific to fossil fuels its going to take nearly as long as to transition to something else, and unfortunately the technology that exists to day is insufficient to replace fossil fuels. The only real way to maintain an industrial civilization without fossil fuel is with nuclear energy. Fission nuclear power is nothing more than playing Russian roulette and Fusion power is not possible because the containment input power costs will exceed the power output. Stars use gravity for containment which does not require an energy input.

Arcticals about worldwide expansion of coal plants:

http://dailycaller.com/2014/01/08/epa-moves-to-ban-coal-power-while-china-europe-embrace-it/

http://www.bloomberg.com/news/2013-11-15/steag-starts-germany-s-first-coal-fired-power-plant-in-8-years.html

http://www.theguardian.com/environment/2012/nov/20/coal-plants-world-resources-institute (1000 new plants planned worldwide)

On top of this crisis we have a debt crisis and a population crisis and the majority of the leaders in power of the industrialized world, either deliberately ignore the imminent threat, or are completely incompetent.

There is no way the world can make a transition with the price of oil near $100. Every industrialized nation is using debt and credit just to stay afloat and they are barely doing just that. In the US the push for renewables has been a disaster as every company that was subsidized turned out to be a fraud (Solyndra, Corn Enthanol, Fisker Karma, etc). In the US and the EU unemployment or under-employment is skyrocketing. Asia has been able to stay positive only by pouring tens of trillions in new credit and sooner or later that bubble is going to burst. Higher Oil prices will not bring about the change you are hoping for.

“The later is surely more likely so then the next questions are will this re-pricing be a sudden leap, or a volatile see-saw, or gradual and relentless? ”

In my opinion the price will become very volatile as price increases cause demand destruction and renewed interest in developing more expensive oil projects. We will probably see asymmetric prices swings as the prices slowly rises over a long period, followed by a dramatic price crash as the economy crashes. Prices will undershoot and then begin rising again until the next wave of demand destruction begins. We will also see price spikes as geo-political events occur, ie another major oil producer falls pray to the Arab spring, or Iran and Israel go to war.

Do not expect renaissance that will usher in another era of prosperity. Expect new dark ages as nations go bankrupt, go to war, or collapse into a civil war. The poorest nations fall prey to collapse and civil war first which has already begun. But this will eventual work its way up to major industrialize nations.

The best advice I can offer, is not to rely on society and the gov’t to meet your basic needs (food, shelter, energy), and begin working on becoming self-reliant. Do not wait for society to come to build it for you. If you believe in moving to a renewable energy economy, then start by implementing it for yourself and your family.

FWIW: I am glad that we did have a shale boom as it provide me additional time to become better self-reliant.

Fusion power is not possible because the containment input power costs will exceed the power output. Stars use gravity for containment which does not require an energy input.

I also believe that fusion power will not come to the rescue or even be viable before collapse.

As a note of interest to those who want to investigate and review some of the hard core fusion research that has been accomplished so far – The University of Wisconsin of Madison has conducted a great deal of research into fusion.

Established in the early 1960’s, the plasma and fusion research program at UW is one of the broadest university research and graduate education programs in these areas in the US. It includes several high-performance plasma confinement experiments, collaborations in national and international experiments, a cross-disciplinary theory and computation effort, a comprehensive fusion engineering program, a center for plasma-aided manufacturing, and a Physics Frontier Center on Magnetic Organization. Research is conducted under the departments of Engineering Physics, Physics, and Electrical and Computer Engineering.

http://fusion.wisc.edu/

Also be sure to check out: (just because it’s fascinating)

Space and Lunar He3: The UW FTI first identified the existence of the lunar helium-3 fusion fuel in 1986. Adjunct Prof. Harrison H. Schmitt was the Moon’s most recent visitor; he last co-taught Resources in Space in Spring 2004.

http://fti.neep.wisc.edu/

This column is getting narrow so I’l try to be brief.

The transition is from liquid fuels to electricity.

We will generate that electricity in every way.

Existing nuclear [but not new nuclear- it doesn’t stack up], new coal, gas, and increasingly renewables [which increasingly do stack up, and are growing fast and will need structural changes in distribution to accommodate]. Big picture: Oil->Grid. Or grids plural.

Because the transition is from liquid fuels the biggest problem is transportation. And is, therefore, also an urban form problem. The peak of the age of auto-dependency is already in the rearview mirror [and the world it built- Yes Atlanta I’m looking at you].

Yes there will be electric cars, but these will only prolong highly dispersed social orders for so long, certainly without profound breakthroughs in the economics of mobile electricity storage. They will be part of the mix of electrified Transit; Streetcars are returning, Metros, electric buses, but also of the profound [and already observable rise in cycling and walking as transport modes, in cities]. This mix makes us happier, healthier and makes urban economies much more productive and competitive. Oh, and, almost as a byproduct, much much greener and therefore viable than countryside living.

Humans are amazingly adaptive but also incredibly stubborn: We will cling to the old ways long past their use by date- look at how long the habits of the British Empire persisted way way after the fact!

I do not delight in the Shale boom, it has allowed the bullshit of oil abundance to deepen just as the urgency for new thinking needs wider acceptance [and it is further frying the planet and doing god knows what to the local environment].

Yes new technology will be vital, but almost certainly at the incremental level [smart phones not fusion plants]. This is a revolution in social, spatial, and movement orders, and is therefore, a horrifying prospect for many. Especially the unimaginative and those who believe all their happiness is founded on the trappings of the oil age.

Our world by say 2030 will be as profoundly different as was 1950 from 1935, and energy source and supply now, as then, is at the heart of this. And no I don’t believe there needs to be any kind of world war to achieve it. Unless we are complete idiots and fail to grasp the opportunities offered by this inevitable change. Power different.

I have pondered this many times myself: Will living in an urban environment be better than a semi-rural or rural arrangement? It’s one that I struggle to find a definitive answer for as I can see advantages and disadvantages for both arrangements.

Certainly central / urban living would reduce commuting costs, however I have no idea whether many of the current jobs required in cities will remain viable. Rural living obviously exposes yourself to more transport costs but then you have the advantage or having more access to solar energy (land) and producing your own food.

At the moment I am leaning towards semi-rural (so not the boon-docks) so that I can try and remain somewhat close but will still be able to have a large garden and some animals. I know this is not a viable solution for everyone given our population levels however.

I’d be interested to know what peoples thoughts are in regards to urban vs non-urban living once energy decline sets in.

Hi John

A much confused discussion in which I find myself frequently. I reside on five acres close to a very large city, with easy access to express train service.

I moved, for a short time, to the rural countryside of Oregon – too much so, I suspect. I was five hours from the city, three hours from a town, and still twelve miles from a very small village. It wS just too far out. Sure, I might have been surrounded by food, sometime in the future, but everything else and everybody else was just too far away.

Good example KC. Sounds like you may have hit a sweet spot! Each to their own, but as transportation is actually the key problem I would weight this more heavily than other considerations. But every case is specific. My key point is simply that the countryside is neither as ‘green’ nor as viable as it first seems once looked at carefully. And good walkable transit rich cities can support a lot of people using very low quantities of liquid fuels making very low emissions.

Hi Patrick,

You can attempt to conserve comment levels by clicking one level up. In this case although I am replying to you I clicked on the reply above your comment as it will appear right below your comment and will still be readable.

DC

Patrick Reynolds Wrote:

“The transition is from liquid fuels to electricity.”

Here is why I don’t think this is going to happen:

1. The US National grid cannot handle even double the load and to transition from liquid fuels to electricity will probably need a 4 to 5 times the existing load. Building new transmission lines is extremely expensive had has to cope with the “Not in my back yard” syndrome

2. We need to replace all of our nuke plants. Before considering expanding the grid we will need to first replace about 105 Gigawatts provided by Nuclear power since all of the operating reactors have serious issues. With an average costs of $15 Billion to build a new plant we need about $1.5 Trillion. We probably also lack sufficient technical workers need to build them since most of the original tech workers are retired or near retirement.

FWIW: The only reason why major US nuclear plants haven’t been retired is because their is no money to decommision them. The only option for power companies is to get the NRC to extend their licenses so they can use the operating cash flow to maintain them. After Decommission a reactor there is no more revenue and the power company has to pay for the decommission using revenue from other sources.

3. We need find an alternative replacement for 450 Gigawatts which is currently being generated using natural gas. We are also suffering from natgas depletion. To replace this with renewables (Solar and Wind) we would need to build about 6 times the nameplate capacity since the wind does always blow and solar plants can’t operate at 100% 24/7/365 and there are no viable storage systems except for pumped hydroelectric which required lots of land in the right locations and lots and lots of water. The cost to build 2700 Gigawatts of wind turbines would Assuming the cost per nameplate megawatt is about $1.6 Million would costs about $4.3 Trillion. then include the costs of land purchases, grid connection infrastucture, and switch controlling systems add in another conservative estimate of about $1 Trillion.

So just to break even by fixing our existing nuclear plants and replace our natgas power with renewables we need to find a spare $7 Trillion, Now consider the costs of doubling, tripling the grid capacity. We are probably need about $30 to $40 Trillion. That said, it still does not address domestic heating which also uses natgas and oil. At best if we just switched the majority of transportation to electricity we could buy a few decades before facing a second energy crisis. Plus it would take at-least two to three decades to build $30 to $40 Trillion of electrical grid infrastructure using fossil fuels. By the time we made any major dent in this project we will be deep in liquid fuel depletion.

I see no way this goal can be achieved in time.

Patrick Reynolds Wrote:

“Our world by say 2030 will be as profoundly different as was 1950 from 1935”

I am thinking more like 1950 versus 1350. This crisis is unlike any crisis we faced since the beginning of civilization. No time in the past has the entire global been completely dependent on a non-renewable energy source. It is not just a matter of mobilizing to a WW2 economy to make the transition. Its far, far more difficult!

Tim E. Wrote:

“http://fusion.wisc.edu/”

Yes, I am very familiar with their work as well as probably a half dozen of other university and gov’t research fusion programs. You can also check out the amateur fusion research at http://fusor.net which has several very interesting projects too. Unfortunately the physics doesn’t work because for deuterium to fuse, the two nuclei need to hit dead on, and only a very tiny number of instances of dead on collisions occur. when a pair of nuclei strike off-center, they do not fuse and spend their kinetic energy as waste heat, forcing more input energy to raise their kinetic energy again. Low density plasma reactions will never be successive unless they figure out a way to dramatically improve the fusion cross-section so that the nuclei do not have to hit dead on to fuse. This may not be possible because of the physics, and I have not seen any research on this effort. The last effort was in the 1980’s with Muon catalyzed fusion which didn’t pan out because of the enormous energy required to produce Muons and their short life before decaying. The majority of fusion research has been to build a bigger, more expensive boat that sinks faster, not a boat the works more efficiently and floats.

“Space and Lunar He3: ”

We can’t even get Deutrium fusion working yet. Fusing He3 is much harder. Getting He3 off the moon the least challenging issue. Its getting Fusion working period!

Tech Guy only sees big Tech solution. Hammer, nail, etc

As opposed to Ron who sees no solution whatsoever.

Pat Reynolds Wrote:

“Tech Guy only sees big Tech solution”

No, quite the opposite. I see no realistic solution. I was pointing out why its not possible by providing some estimates on what it would cost and how long it would take.

My only agenda is to get people to become self-reliant and not wait for society to work out a solution which will never happen. The only thing I can do is try to get people to critically think about depletion why there is solution to solve this.

Hi Patrick,

I think Techguy is jus looking at potential problems and don’t think he is far off. He kind of agrees with Ron that there is no realistic solution.

I agree with him that it will be difficult, but there will certainly be demand for electricity and if there is not enough supply then prices will rise and that will lead to investment in grid upgrades, nuclear, wind, and maybe even coal (though I hope not). There is a lot of idle capacity in the US and these resources (people and their skills mainly) can be put to use to accomplish this transition. If there is a crisis then the government will step in as in WW2 and much can be accomplished when the country works together with a purpose. As far as electricity demand and moving to electricity in transit, a small portion will be electric cars which can be met at night when demand is currently low. The rest can be met with rail, light rail and other electric public transit which is much more efficient from an energy standpoint than IC transport. Again a rise in the cost of transport will reduce demand and increase supply of public transport.

DC

I agree there is no solution if by solution we mean something that means nothing changes. I see huge change, and change not being made by choice. However I just don’t believe that this will be as bad as most seem to think on these fora. Perhaps contributors tend to be from the doomy side of life, or perhaps the people with the time to respond are older and therefore often less able to see a different future. Or perhaps because so many of you are from a technical or engineering background which tends [please forgive me- we need you guys] by definition to attract people with great skills in analytical thinking rather than in more creative approaches [again no insult intended; we need all types].

What do I think? Read Richard Florida’s short book: The Great Reset. That describes what’s happening, and it’s more than a few years old now:

Change, all change, change in movement, change in employment, change in education, change in habitation, change in urban form.

Change is always disruptive, and we have not changed like this since the last Great Reset that was precipitated by The Great Depression. Always has winners and losers. And for some it will feel like ‘the end of the world’ because worlds are ending.

In particular auto-dependent sprawl is ending. Believe me it is. And this should not be mourned.

I agree with Tech Guy that we should prepare. But I’m not advising running to the hills; I advise getting to a walkable, transit rich metro, buy a bike, and watch your life improve. There’s plenty of oil to run the farms and the bulk deliveries. Just not for everyone to drive huge SUVs around curly cul-de-sacs delivering kids who have never walked or got on a bike to power centres on the dreary edge of town.

You could also read Green Metropolis, Happy City, and Walkable City on this.

Change is happening here: http://www.peakfish.com/north-america-installed-solar-capacity-in-mw-2002-2012/

And the US will get by on a lot less oil than it currently uses next decade and its electricity will come from many different sources with a mix distributed and grid delivery, but society won’t look like it does now.

And a whole lot of things will be better.

Hi Patrick,

I guess my position is somewhere between yours and techguy’s. He makes a number of points about why a transition will either be very difficult or nearly impossible. You recognize that change will be difficult, but think these problems can be overcome fairly easily. I have simplified both positions and probably not gotten them exactly right. I agree with Techguy that there are big problems and that they will be very difficult to overcome, I also agree with you that humans will find a way to overcome these obstacles (through social changes which may have already begun), but I don’t think it will be quite as easy as you seem to envision. Hopefully you are correct, I am less optimistic.

DC

Hi Ron, How about something that helps us follow price. I am no expert so I don’t much care what, but just something easy to bounce the production graph off of. Thanks for this site. Anyone ever wants info on farming with horses and mules, that is my game. Donn

Donn, I will try to do a left-scale, right-scale chart with production and price on my next update. There has not been much correlation in the last three years however. Up to the minute prices can be found here: http://www.bloomberg.com/energy/, delayed by about 15 minutes or so. Historical Brent prices can be found here:

http://www.eia.gov/dnav/pet/hist/leafhandler.ashx?n=pet&s=rbrte&f=d

Or WTI: http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=rwtc&f=D

http://www.investing.com/commodities/energies without delay.

Hi Donn,

I have a chart with a longer view and prices (Brent from 1987, EIA data). Hope it helps.

Dennis

The Keystone is like Schroedinger’s cat”, nobody is sure if it’s alive.

But either way , it probably matters quite a bit to the question of peak oil in the near term.

http://www.bloomberg.com/news/2014-01-09/keystone-s-deepening-fight-spurs-move-to-oil-by-rail.html

Hi Mac,

Had to have a chuckle, I doubt if many in Government or even the oil industry have even heard of Shroedinger let alone his bloody cat.

Regards

Yorkshire Miner,

Nobody is really sure if the cat is bloody or not 😉

DC

Deffeyes (and I think Campbell also) predicted that unconventional crude would peak around 2005 and according to these graphs, they are correct. Take out oil sands and lto (also deepwater which isn’t broken out) and it looks to my eye that 2005 was the peak. Yet due to misinterpretation of their predictions (and outright distortion) many claim their predictions were wrong.

The unconventional oil is keeping our nose just above the water at the moment. The real question is when will production rates of the major conventional overwhelm those efforts. Looking at the World Less USA & Canada graph, it seems like the time is not far off. Maybe three years?

Once again, thanks Ron for all your great and valuable work.

Thanks for this service. Very useful for showing sceptics that PO is upon us . One thing: with the y axis on the Non OPEC graph not zero based, the effect is to suggest, until you pay heed to the scaling, that there is nothing to worry about and US and Canada are saving the world.

Apologies if this has already been highlighted but this Financial Times article (previously I think behind a paywall) has only just come my way (published about 6 weeks ago). It is a doozy:

http://www.ft.com/cms/s/0/5e923e3a-51d3-11e3-8c42-00144feabdc0.html#axzz2pwIL13Dc

Hi all,

I did drop a few comments from time to time over TOD, from France. (I was far more a learner than a teacher !) Thanks to you Ron, for carrying on your work of breaking down oil production numbers, and glad to see that a handful of former TODers seem to have gathered around in the last weeks – it is a pleasure to read your words again !

I have a question (or an angst ?), anyone cares to give insight ? Since this summer, I have a stronger and stronger feeling that when the shale oil bubble burts, this will be a very bad signal to investors, and that this will be the definitive trigger of relentless decline in global financial ability to bring on stream enough new productive capacity, even to stay flat. So, US LTO scheme revealed as a Ponzish fraud = TEOTWAWKI.

Is that a correct feeling ?

“Since this summer, I have a stronger and stronger feeling that when the shale oil bubble bursts, this will be a very bad signal to investors”

In my opinion its likely that other economical factors may sideline Oil production issues in 2014. The US is likely to double dip in 2014 because of the gov’t regulation changes to health care. 16% of the US economy is from health care. Corporate earnings and sales have had a dismal Quarter for Q4 2013 and inventories of unsold goods are piling up.

China may also suffer a recession as businesses that need to borrow are forced to pay interest rates of 30% to 50% (http://online.wsj.com/news/articles/SB10001424052702304579404579236001885224902). Unless China is able loosen up credit its boom is probably going to bust in 2014.

There does not appear to any chance of an economic turn around in the EU. From the articles I’ve read, it appears that unemployment in the EU continues to rise. Its also probable that Portugal will collapse like Greece did, as Portugal has run out of options to save itself.

There are also geo-political issues that may get ugly, such as the Iran-Israel showdown (http://kleinonline.wnd.com/2013/11/24/officals-israelis-in-secret-trip-to-inspect-saudi-bases-could-be-used-as-staging-ground-for-strikes-against-iran/), and further destabilizing in the Middle East as radicals continue to spread civil wars in the region.

If I am even 25% right on any of these issues, demand of oil will decline and prices will remain in the $85 to $105 range (except perhaps if Israel and Iran go to war). If China falls into recession we might see prices dive into the $50-$70 range.

I don’t think Peak Oil concerns will return until 2016 or perhaps as late as 2018. Even when the Shale busts it will probably take a few years before investors wise up. Consider that the housing subprime crisis began in early 2007, but it did spike into a full economic crisis until late 2008.

The degree to which the Bakken, even more than the Eagleford, has become the poster child for the abundance narrative should not be underestimated.

The day the rollover is clear . . . perhaps a no special factors decline in summer production . . . the underpinning of the abundance narrative gets smashed. There are a lot more people watching this than you might think.

There will certainly be denial out, and demands for investment, but the smart money will understand the game is over.

@TechGuy and Watcher

Thanks,

I have come across some articles recently about military escalation between Japan and China of course, and very worried concerns about ME (a recent special thread opened about ME on peakoil.com where someone states about a coming open conflagration sunni vs. shia, spreading from Syria – even if Syria is a Saudi arabia/Iran proxy war, etc, and that will be some real tough shit).

But I was rather thinking strictly of all liquids production, and by TETOTWAWKI, I meant not really an flash dive into the abyss, but rather the fact that, once triggered, the decline shall never be reverted. All the madness going on all over the globe has obviously consequences on oil price dynamics for sure, but what if a sharp drop in oil price happens when the LTO narrative blows out ?

Who will then have the financial capacity and will to develop additional unconventional plays, let’s say off shore (Brazil’s current turmoil). I imagine a staircase scenario in which each stair down (less volume, higher price) kills demand a little more, and discourages a little more investors to back up new production (a sort of descending ondulating plateau, if you prefer)

As Watcher said it, I wonder wether the TRUST (be it misplaced, irrationnal, or anything else) will survive and if big money will have any means to elicit the same acceptance of either new narrative to come about oil production.

And if the smart investors give it a fuck… that’s what I meant. Official recognition of shale oil fallacy, and then a massive financial storm that spreads across (perhaps) still recovering western economies and less dynamic, more endebted emergent economies ?

There are already massive disappointment about recently acclaimed developments (brazilian offshore, Kashagan giant shit swamp). I fear that when the last eldorado of the still superpower blows out, it will be the end of trust and then the inexorable decline.

Plus, if you combine the net loss of 1.5 Mbps at home, ELM in action in Araby, and fast growing difficulty in maintaining naval trading routes…

I wanted to post the below email from Jeremy Leggett. I found it most interesting. And be sure to check out the link to his blog he posts, (and I post again just below this message). There are links to three very interesting articles at the very bottom of his blog. The first is a Word document that I could not bring up. One of the others is also by Mark Lewis, author of the article that Andy Hamilton posted above. It is a slide presentation that that is extremely interesting. The third is a Power Point presentation by David Hughes on “The Shale Revolution, Myths and Realities.

http://www.jeremyleggett.net/2014/01/9876/

———————————————————–

Jeremy Leggett

3:48 PM (2 hours ago)

Folks

If I and my confederates are correct in what follows, huge implications arise for national economies, businesses, communities, households and individuals all.

Recently, Lt Col Davis of the US Army and I convened video-linked gatherings of experts in Washington and London to discuss the risks of a global oil crisis, and the related potential for a shale gas “surprise”. The multiple reasons for concern, and the discussion of them by analysts, security experts, and politicians of all species including ex ministers, can now be viewed here

We who worry about the uncomfortable narrative are a minority. But it should not be forgotten that only a very few people warned that the financial incumbency had their particular comforting narrative catastrophically wrong, until the proof came along in the shape of the financial crash.

I have also recently published a book to ventilate this warning, and other warnings about systemic-risk-taking by the energy incumbency, (plus my prescrption for a road to recovery beyond), as everyone on this bcc list will know. Literally hundreds of you have kindly helped me – that’s just the ones I know about – with my unseemly “zero-overhead, tactical-egotism no-shame” strategy to get the word out: asking folk to send e-mails to friends and colleagues pointing to the good reviews the book has been lucky enough to attract. I want to take this opportunity to thank everyone who did that, or something like it. My thanks are all the more heartfelt because it is showing signs of working. The book has yet to be reviewed in any mainstream paper anywhere in the world. But Routledge tell me no energy title of theirs has sold faster in its first few months, ever. So gratitude, sincerely. This is genuine, bottom-up, digital people power at work, and anything anyone else can quickly do to keep the momentum going will be equally appreciated.

And now, on with the drama. As it unfolds in 2014, and intersects with other dramas such as climate change and the continuing lack of fitness-for-purpose of the capital markets, I shall cover it all as best as I can on http://www.jeremyleggett.net. I am among those who now think the crisis won’t erupt fully until 2015 at the earliest. Of course, we may be wrong, either way. Either way, we need to start winning on climate change in the interim. More on that in a month or so, (Unless you care to drop me a two word e-mail “drop me”, in which case no worries, I know how busy everyone is).

A successful and fun 2014 to all. It is sure to be interesting.

Jeremy

An excerpt from the discussio…

John Miles:

I understand that, Dave, but why don’t we just go back and refrack that original well?

David Hughes:

Refracking: I guess the jury is out on that. A University of Texas in Austin study just published has suggested that refracking may add 2 to 3% to the ultimate recoverable gas. The fracking part of drilling is generally 50% or more of the total well cost, so you really have to look at the economics of doing that.

John Miles:Sure, but my point is refracking seems like the obvious thing to do. Thesimple explanations of fracking suggest that you create these fractures and then they sort of close up, despite the fact that you put proppants down there, and the logical solution to that would be just to do it again, and yes, it pushes the price up, but this is not the most expensive form of oil, so even if you push the price up it’s not as difficult as getting a presalt oil off Brazil. I’m struggling to understand why we are so confident that these curves are going to go down so swiftly.

David Hughes:

Well, I don’t think the fractures close up. I think the reason the declines go down so fast is because you’re producing the oil from very close to those fractures, and it’s gone. Refracking is maybe further breaking up rock that’s already been broken up, and so the question is how much additional oil can you get? The jury is still out on that,but I think it would be a lot less than the initial frack job.

Pingbacks: A pingback is a notice that someone has posted a link to your blog in another blog or news article posted on the net. I have gotten several pingbacks from the same article by Michael Klare. They are all from the same article but the article was picked up and re-posted by another blog or news article. Everytime it is re-posted I get another pingback. I have deleted some of them because they all point to the same place. Here is the article published here by the Arab News:

Peak or no Peak, Oil is Unsafe at any Price

I have not located the link because Michael buries it in the text. You only know it is a link because it is blue and a little finger appears when you mouse over it. And there are many links in this article. But anyway, Thanks Michael for linking to my blog.

Some of the pingbacks appear in the comments section of this article:

Bakken Update, Is Production Slowing Down?

Actually they appear to be coming from two different articles.

Ron , you’re obviously doing the same great job here that you did at TOD and it’s obvious that the people following you here appreciate you as much as ever but it sure is a SHAME that TOD didn’t last a little longer!

The larger audience sure would be a big help in getting the message out about how close we must be to another oil shock!

Ron,

With respect, and acknowledging the great job you are doing, I would encourage you to strive to balance emphasis away from tight oil toward other issues. To my mind these include: global depletion, decreasing “oil quality” and capital expenditure topics. By any reasonable criteria peak oil is upon us, the super giants and giants are shadows and what matters is where we go now — not when Bakken rolls over. At best, endlessly harvesting tar sands (I’m a Canadian) and coal will leave my grandchildren a planet that looks like Namibia. This really matters!

I’m sure Ron would if he could but he’s only one man and there’s a limit to his time and energy.

And for the moment, the action in terms of peak oil and the public mind is right where the focus is, namely tight oil.

Nobody with a shred of credibility can deny depletion; they can only ignore it.

But for now any body who wants to can still talk tight oil and gas to the sky and get away with it by cherry picking his facts.There are literally millions of people doing so on a daily basis.

Ron is one of the handful of people making the case for the early decline of tight oil and doing the hard work involved in getting the facts together.

Doug, my last post, the one above is not about Light Tight Oil. I do post about other things like OPEC production. And my pages are about Non-OPEC Charts, OPEC Charts and other things. Not one of them is about Tight Oil.

However you must understand, as I have explained before, I am a data hog. I post graphs of data that I can gather on the net. In addition to the graphs that I post from the data I gather I also post graphs that I gather from agencies like the EIA and IEA as well as graphs that I find on other sites. That is what I do, I post data and graphs and comments about those data and graphs. I invite others from time to time to post their comments and theories. For instance Jeffery Brown has an open invitation to post anything he wishes to at any time. Dennis Coyne also post whatever whenever he wishes. But I post about data, graphs and comments on World Oil Production and that includes Light Tight Oil, Tar Sands, Orinoco Bitumen, OPEC, Non-OPEC and anything else that concerns world oil production.

Ron,

Yes, and you’re very good at what you do. Please don’t take offense, it’s just that it is frustrating to helplessly watch a perfectly good planet being trashed by an overrated species that should know better.

And Dennis, thanks for the posting offer. In fact, I do have a pair of contacts (old geo-buddies) working on the North Slope, that have provided me with some scary unpublished depletion information which might be worth insinuating into your web page – assuming it’s possible without putting someone’s job at risk. Hang tough on that.

Doug, I agree 100% with you on the species trashing the planet. I am planning an essay on that very subject but it will be a month or two before I have it ready. I think I will call it “The Savanna Ape”.

In the meantime if you really want to get depressed, try this blog:

Desdemona Despair

hi Doug if you are interested in posting something just contact me at dcoyne78atgeemaildotcom

DC

Dennis,

Please note above response to your posting offer.

Duke Fracking Tests Reveal Dangers Driller’s Data Missed

By Mark Drajem, Bloomberg, Jan 10, 2014 12:01 AM ET

When the U.S. Environmental Protection Agency declared that a group of Texas homes near a gas-drilling operation didn’t have dangerous levels of methane in their water, it relied on tests conducted by the driller itself.

Now, independent tests from Duke University researchers have found potentially explosive levels of methane in some of the wells, and homeowners want the EPA to re-open the case.

The following picture was the lead picture on Bloomberg.com at lunch time today. Meant to get a screen grab but missed it before Bloomberg revised their main page.

There was a recent funny episode of Alpha House where the pro-fracking senator from Pennsylvania burns downs a bathroom when he attempts to put out his cigarette in the sink. (He was at the house of the leader of a pro-fracking group in the state.) I thought they were pushing the joke a little hard, but evidently I was wrong. Maybe we have entered an era where there will be burning bathrooms popping up all over the place. I’m now wondering what it will take for people to actually get upset about this stuff.

Thanks, Ron, for this blog. Great charts, graphs, and insights. It is turning into at least a partial way to fill the void left by TOD.

Secret Memo Casts Doubt on Feds’ Claims for Science Library Closures

Goal stated is ‘culling’ research, not preserving and sharing through digitization.

By Andrew Nikiforuk, 30 Dec 2013, TheTyee.ca

Eric Marshall ‘Disturbed’ by Dismantling of Namesake Science Library

‘I don’t want to have my name associated with empty shelves,’ biologist says.

By Andrew Nikiforuk, Today, TheTyee.ca

quote…

Marshall argues that the reduction of the federal science libraries is purely ideological.

“It seems to me that the Harper government has its own agenda. They want to export our natural resources here and now. And they want to ship this stuff off to China and elsewhere, and they don’t want scientists pointing out that there might be repercussions to these activities. And that’s why they’ve cut back on research and support for environmental research by cutting libraries.”

This link is to an article in today’s Washington Post.It seems awfully familiar;I think I’ve read to before someplace else but links don’t cost anything.

http://www.washingtonpost.com/world/brazils-oil-euphoria-hits-reality-hard/2014/01/05/0d213790-4d4b-11e3-bf60-c1ca136ae14a_story.html?hpid=z11

Here’s a link to a press release or speech by the governor of Alaska. I suppose that it is as self serving as most speeches by governors but it nevertheless indicates that an Alaskan ng pipeline is probably going to get built and maybe sooner than expected.

http://juneauempire.com/opinion/2014-01-12/gasline-alaskas-terms-alaskans-interests#.UtKeG6V8Fz8

Hi oldfarmermac,

It is a little more work for you, but I think if you pull a nice quote out of the articles that you link to, more people would click on the links, don’t quote the entire article just pull out a paragraph that gives a flavor of the article. Just a thought.

DC

Your linked article about Petrobras and Brazil’s oil production has some choice quotes:

Some oil experts say Brazilian energy planners, who spoke of unproven reserves that could rival those of some of the biggest oil powers, may have vastly oversold the deep-sea bounties, which are called “the pre-salt” because the oil is under a shifting cap of salt.

“There were a lot of government authorities saying the reserves of Brazil were 50 billion barrels, 100 billion barrels, even 240 billion barrels, more than Saudi Arabia,” said Wagner Freire, an oil geologist who worked for 35 years at Petrobras, where he oversaw exploration and production. “Lots of wells have been drilled in the pre-salt area, and the well comes up dry.”

After the discoveries in 2007, then-President Luiz Inácio Lula da Silva famously said God had given Brazil bounties that would propel the country’s modernization. Petrobras was among the world’s 10 biggest companies, admired by investors such as George Soros, and a Wall Street darling.

“Brazil drew a winning lottery ticket,” an overjoyed Lula said.

Petrobras officials envisioned a plan that would give Brazil elite status among the world’s energy producers, with production rising from 2 million barrels a day to 5.3 million in 2020, said the company’s president at the time, José Sergio Gabrielli.

Some oil experts say that forecast is unrealistically optimistic.

“Forget about that data,” said a high-ranking official with an international financial institution who has discussed the issue with Brazilian energy officials and advised oil companies.

The official, who spoke on the condition of anonymity because of the delicate nature of relations with energy officials here, said Brazil has found no new basins since 2008 and faces the overwhelming challenge of developing the pre-salt area at a cost of $237 billion.

Fracked oil is headed by rail to California.

http://sanfrancisco.cbslocal.com/2014/01/11/trains-carrying-fracked-oil-may-pose-dangers-to-bay-area/

Old Farmer Mac,

Pikers trying for attention, that’s what they are. Here in the Puget Lowland of western Washington we have five refineries, from Tacoma in the south to Cherry Point just south of the Canadian border, and two of them receive Bakken oil by rail with the remaining three gearing up to do the same.

Sad to say.

We’re no one-trick pony though. The four northernmost refineries (I don’t know about Tacoma) also receive Alberta oil-sands oil via the TransMountain pipeline into the Vancouver area–we divert 44% of it before it reaches Canadian facilities. (Don’t tell the Canadians, eh?)

Oh, and there’s that Alaska stuff, down from Valdez. Don’t see so much of that anymore.

/chauvinism off

Chief spy watchdog working for Enbridge since 2011

Matthew Millar, Vancouver Observer, Posted: Jan 6th, 2014

Canada’s top spy watchdog and former Conservative cabinet minister Chuck Strahl, who registered last month as a paid lobbyist for Enbridge Northern Gateway Pipelines L.P., has in fact been contracted with the company since 2011, the Vancouver Observer has found.

DNR nixes pier repairs for Great Lakes oil terminal in Superior

Superior-based Elkhorn Industries wants to rehabilitate the harborfront pier to make it usable again for Great Lakes vessels, including a possible terminal for a new Calumet Oil facility to fill tankers and barges with crude oil for shipping to eastern oil refineries. The oil would come into Superior from western states and Canada via pipeline. But the ships could be a low-cost option to keep it moving east because there is more pipeline capacity running into Superior from the west than out to the south and east.

http://www.duluthnewstribune.com/event/article/id/288283/

Tar Sands Crude Shipping Meets Great Lakes? Report cites gaps in region’s oil-spill prevention, response.

As tar sands extraction continues and proposals for expanded pipelines from Canada into the U.S. form a backdrop, the Great Lakes themselves could become the next frontier for moving crude oil to a vast Midwest refinery network.

http://www.greatlakes.org/tar-sands/report

Also of note: In a new report, the Wisconsin Department of Natural Resources has identified potential pollution problems with iron mining in the northern part of the state, including the loss of surface and groundwater and the threats to water from a process known as acid mine drainage.

http://www.duluthnewstribune.com/event/article/id/288336/

This link is bit off topic but it is illustrative of the possibility that technology can come up with some solutions fast enough to take the edge off of the peak oil axe.

http://www.bbc.com/future/story/20130714-hole-new-design-for-scooters

Ironically, this UK based web page is not accessible within the UK. What does it say?

Neil Young blasts oilsands expansion, launches fundraising tour

4 concerts to fund First Nations legal fight against oilsands projects

CBC News Posted: Jan 12, 2014 12:49 PM ET

Singer Neil Young has launched a blistering attack on the Harper government and Alberta’s oil sands.

Young told a news conference on Sunday as far as the governing Conservatives are concerned, “money is number one, integrity isn’t even on the map.”

—-

Young, who said he recently visited one of the oil sands sites, compared the pollution to Hiroshima, the Japanese city where the first atomic bomb was dropped during the Second World War.

Young says Canada’s leaders are killing the people of the First Nations and their blood will be on “modern Canada’s hands.”

Of course, that ignores the fact that some First Nations are working with industry to advance their societies. They have trained to become welders, equipment operators, managers, lawyers and teachers. These jobs help them to become a nation that can be proud of their heritage.

Other First nation groups have chosen another road: complain, complain, get drunk, and complain some more.

It is better to work towards a middle-ground solution, rather than fight and die for a cause that will never happen.

The oilsands will be developed in a sound economy like Canada. If you want Canada to become like Venezuela, then they may not be developed.

If you want Canada to become like Venezuela, then they may not be developed.

That line may well be more accurate written this way…

If you want Canada to become like Venezuela, then they must be developed.

I suspect in the end all petro-states will look the same.

Anyway, it’s worth reminding ourselves what “Responsible Resource Development” looks like with respect to protecting First Nations traditional food sources.

Canabuck:

For a different way of looking at Native Americans you might like to try:

The Way of the Human Being: Calvin Luther Martin

http://www.amazon.com/Human-Being-Calvin-Luther-Martin/dp/0300085524

Nominal price of asphalt cement is trending up.

Some selected Eastern Canada and U.S. North East price indexes.

Ministry of Transport Ontario

DOT New York

DOT New Jersey

Argus Assphalt Report, December 2013 (pdf)