David Archibald has recently revised his peak date for shale oil. The below was contained in a recent post I received from him:

Ron,

For what it is worth, just to let you know that I have recanted on my estimate of US LTO production.

This is from reading the presentations put out in September by the US independents. I started with the EOG presentation and then worked through the others that EOG referred to. If Hubbert-type analysis works for LTO, it may be too early to apply it.

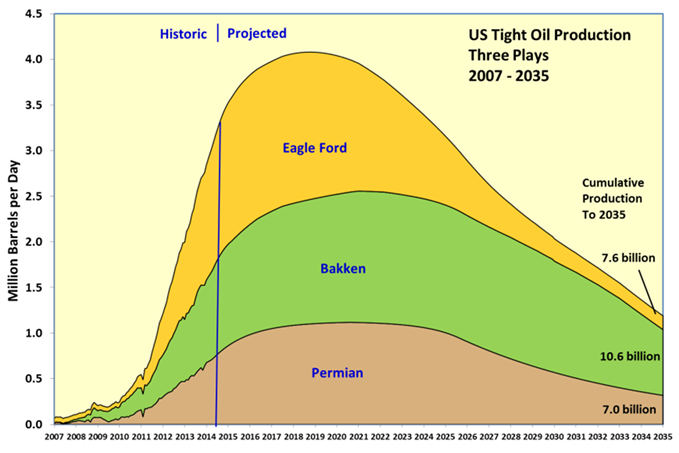

The rig count for the Bakken etc may be down to flat but the fraccing units are pumping a lot more sand and the economics of fraccing have improved a lot over the last two years. That in turn means that the resource is larger at a given IRR cutoff. This is currently my best guess of the three major plays:

Others are appearing such as SCOOP in Oklahoma.

I tried to make the graph useful by putting in the cumulative production to 2035 so that people can mentally adjust it for what they think EUR might be. The Permian has a lot of NGLs and natural gas which means that the energy produced is about twice as large as the oil component. The reason I didn’t make the Permian as peaky as the Eagle Ford for example is that there at lot of stacked plays in the Permian. Once companies have got acreage and got one horizon working, they don’t have to be in a rush to develop the others.

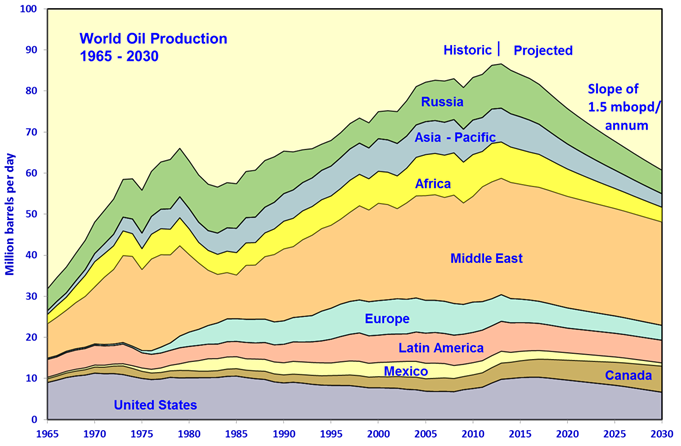

The US LTO boom is worth about two to three years of conventional oil decline:

With further demand destruction, the US will become energy independent.

David revised his opinion on LTO after reading presentations by LTO drillers. I am not so sure this is a reliable source… However, eyeballing his first chart, he has LTO increasing from about 3.35 mbd today to about 4.1 mbd in 2019. That is an increase of only about .75 mbd over the next 4 to 5 years or so.

Looking at his second chart it looks like he is predicting the peak of world oil production to be this year, 2014. That falls within my prediction of a peak in 2015, give or take one year.

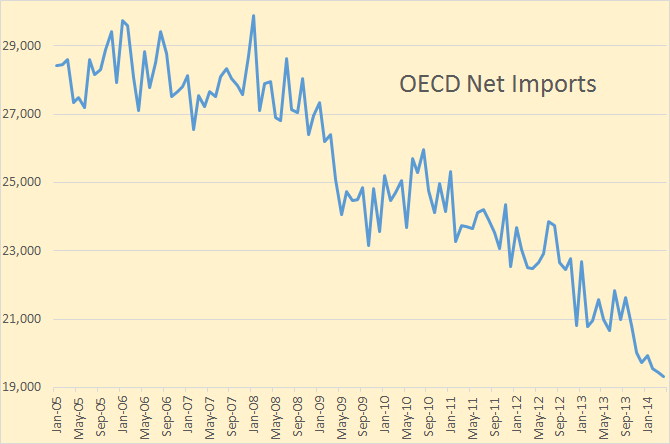

The EIA’s International Energy Statistics export data is pretty poor, with data only through 2010. But their data on imports is much better, updated through April 2014. The data used to make the charts below are in thousand barrels per day through April 2014. Unfortunately they only give import data for OECD nations. We have no data for India, China, Brazil or many other World nations. The OECD members are the following countries:

Australia Hungry Norway

Austria Iceland Poland

Belgium Ireland Portugal

Canada Israel Slovakia

Chile Italy Slovenia

Czech Republic Japan Spain

Denmark South Korea Sweden

Estonia Luxembourg Switzerland

Finland Mexico Turkey

France Netherlands United Kingdom

Germany New Zealand United States

Greece

Net OECD imports are down about 9 million barrels per day since 2005

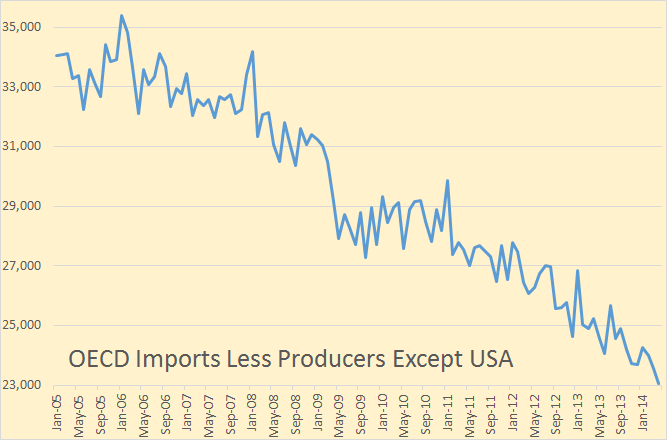

But the chart is misleading. It includes not just producers but net exporters as well. Exports are subtracted from imports to get net imports. Sometimes it is a negative number. So the below chart excludes all major producers except the USA. That is the chart includes USA’s imports.

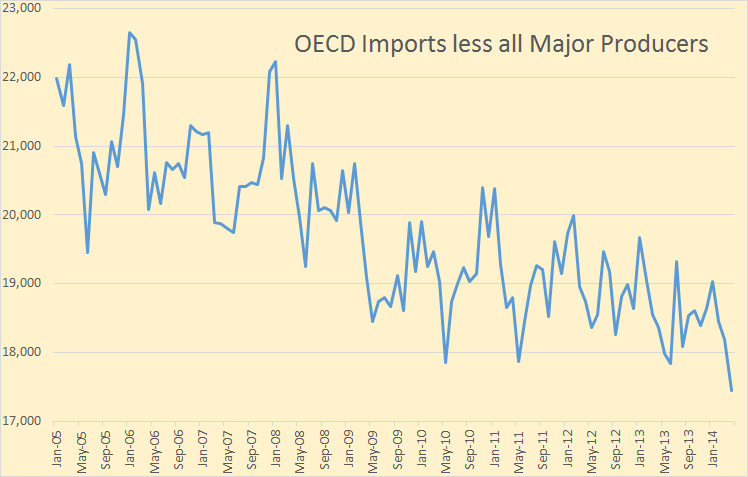

So OECD net imports, excluding major producers but including the USA, are down about 10 million barrels per day since 2005. But what if we exclude the USA also?

Major OECD producers are the USA, Norway, United Kingdom, Mexico and Denmark.

OECD imports less all major OECD producers are down about 3 million barrels per day since 2005.

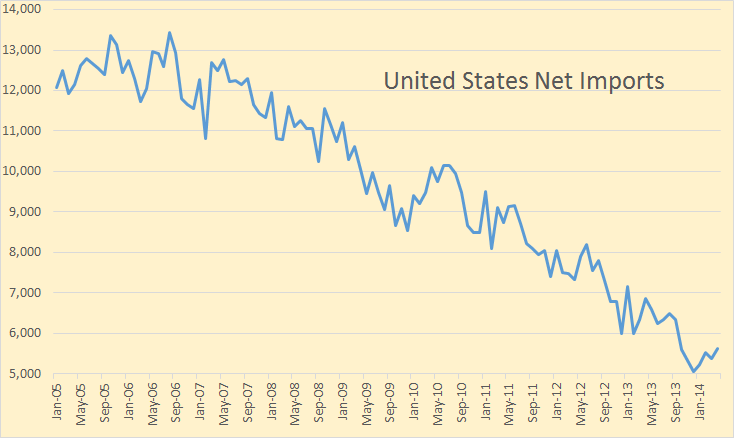

That means that USA net imports are down about 7 million barrels per day since 2005 and 2006.

This is important: Were the USA still importing what we did in 2005 and 2006 the world would be short another 7 million barrels per day. About half this reduction in imports has come from new shale oil and the other half from demand destruction due to high prices. At any rate the USA’s effect on World oil supply and demand is very significant.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com

“With further demand destruction, the US will become energy independent.”

With further credit destruction the US will become … like, totally bankrupt, dude! LOL!

So by 2020 the US will be experiencing peak oil and the ROW will already be several years into it. I assume efforts of increased efficiency and transforming other fossil fuels to liquids will be the first response to the crises. Increased pricing will probably put a tailspin to the world economy which will then decrease further drilling and exploration. Not going to be a happy time if you depend on outside resources and a job for income.

US already experienced peak in 70’s

And it is happening again when the continuous fields tap out.

That first graph shows a descent of 1.5 million bpd/yr, that means that in 12 years the total US consumption of oil will be missing from the world. Basically 1/5 of production gone.

To which graph do you refer? 1st graph shows LTO dropping from 4 to 2.5 mpd over about ten years. Don’t see 1.5 mpd/yr drop in another graph…?

The 1.5mbpd/year decline is in the second chart, world production. This is broadly in line with what other experts have presented as how much decline one needs to make up annually to stay even.

Meant the second graph, didn’t scroll up far enough.

Distillate fuels are required for modern Life both Global and Local. Wonder if it’s possible to estimate percentage of US diesel requirements met with imported vs domestic streams. Gov reporting liquids such as LTO and moonshine as crude really confuses the situation.

Distillate fuels are required for modern Life

Not really. EVs of various sorts work for passenger transportation. Rail works for ground freight. Synthetic fuels will work for aviation and long-distance water shipping.

Rail is dirty, dangerous and expensive. It’s time to kick our addiction.

Rail is the cleanest, safest form of mechanised land transport when measuring CO2 emissions, and fatalities per mile traveled. High speed rail is less efficient than sub-100mph. It uses a tiny faction of the energy of aviation and kills fewer people. For moving bulk freight containerised shipping is by far the most efficient, but slow. The slower it goes, the more efficient it is.

Passenger ferries are, worldwide, by far the most dangerous public transport method. They sink with monotonous regularity, they have inadequate life rafts, badly trained and reckless crews, are often unseaworthy and almost always dangerously overloaded.

Oops, my bad.

I meant to say *oil* is dirty, dangerous and expensive.

Siri…

never mnd

EV are dirty, dangerous, and expensive, unless one wears blinkers in some sheltered urban environment and ignores the crumbing roads and industrial insanity and strip mines and hey is that a coal plant that the “green” whale-road Danes are certainly not phasing out? But, slumped out over some wheelwell (merely a lost opportunity to exercise) paying orders of magnitude greater costs than walking (my transportation costs this year to date are $0, what are yours?) for the privilege of being stuck in traffic with all those other traffic drivers is how some y’all seem to want to try to roll, so best of luck with that. An alcoholic switching to less dirty hooch does not impress.

Wow.

Well, 1st, wind and solar can certainly power EVs. Wind tends to be a bit stronger at night, which is a nice synergy with charging. Both wind and nuclear tend to have surplus power at night. Works nicely.

If you want to walk and bike, more power to you. But it’s misleading to suggest that they’re *necessary*.

While walking or biking to the local farmer’s market or to the local drug store is admirable, food still has to be transported from farm to table or from train depot to food store. Powering an EV to provide that service is one way to go.

I suspect the Rockefeller Fund sees this happening. GM announced a breakthrough with Lithium Sulphur batteries with 5 to 8 times the energy density of Lithium Ion batteries. Instead of a 100 mile pack, this would be a 500 to 800 mile pack. With the Tesla, this could be over 1300 to over 2000 miles on a charge.

The other shoe to drop are solar photovoltaic cells with efficiencies in the greater than 45% range. There are a number of companies working on solutions.

The idea is to replace our usage of FF with these type of renewables. My array generates an average of about 22 kwhrs/day. This is enough to power an EV 66 miles a day. More than enough to visit a local farm and return.

A 45% array would supply about 70% of my needs in the coldest month of the year. By adding solar thermal to our home, we could get by quite nicely using solar and have some surplus left over.

My angst is due to my “Saudi-America” acquaintances, who are like the grasshopper of the ant and the grasshopper parable fame. The catch to all of this is the ability of our fellow countrymen and women to accept our predicament and all of us do a triage on what is essential, what is nice to have, and what should be discarded.

I suspect that some faux news outlets will steer them into a Rockefeller Store of Renewables. It’s their patriotic thing to do.

22 kwhrs/day. This is enough to power an EV 66 miles a day.

3 miles per kWh used to be a standard assumption. OTOH, someone who owns both a Leaf and a Volt posted the other day that they’ve been measuring their consumption at 4 miles per kWh. I haven’t seen more general numbers lately – it would be interesting.

EV range and energy is highly dependent on driving conditions – air temperature, hills, speed. I have a 2013 Volt and average 12 kWh of charging energy to drive 40 miles electric in “average” weather and driving conditions and not hypermiling. In ideal weather and easy country road driving, I can get 45 miles on a charge, or closer to 4 miles/kWh. Hyper mile it and it can get 4.5 miles/kWh. In the winter, I get 2.5-3 miles/kWh, as I have to run the heater and the battery isn’t as efficient. So it all depends….

Interesting, thanks.

So, in the worst of conditions you still get an electric range of 30 miles?

for what it is worth department from insidecarnews…best 2014 cars for value #4 is the Volt and #6 is the Tesla. bad news Dodge Challenger is #1.

http://www.insidercarnews.com/7-of-the-best-2014-cars-for-the-money/

The +45% efficiency is for concentrator photovoltaics. Although it is good news, you should currently have a solar tracker to obtain the best efficiency and optimise the cost. In the future, with reduced price and/or greater efficiency, this solution will be a key player for electricity production.

You do realize that every alternative form of energy still has hydrocarbon inputs, right?

No, none that are essential.

EVs may be delivered by diesel trucks today, but they can go by electric rail.

The first oil wells were served by horse transportation. The first coal mines were served by biomass: wood and grass-fed horses.

But surely you realize that all this horse stuff served us when we were but a small fraction of the population we have today. But in a way you are correct, none will be essential after the population crashes back to about one billion people. That is about all the earth can support without fossil fuels.

The horse stuff illustrates that each energy source builds the infrastructure for the next energy source. Wood built coal mines. Horses built oil wells. Oil builds wind turbines, and then eventually wind turbines are manufactured, transported and installed with wind-generated electricity.

There’s more than enough affordable wind, solar and nuclear (if needed) to power whatever we might do. Of course, we’re mostly talking about oil here: EVs can be powered by coal and gas, if desired. And, sadly, peak coal and gas is nowhere in sight.

“peak coal … nowhere in sight”

Citi says “[China power sector] … possible flattening or peaking before 2020”

https://ir.citi.com/z5yk080HEXZtoIax1EnHssv%2Bzm4Pc8GALpLbF2Ysb%2Fl21vGjprPCVQ%3D%3D

US ENERGY from coal PEAKED in 1998, at 598 million toe.

http://en.wikipedia.org/wiki/Peak_coal

German hard coal peaked in 1958,

British coal peaked in 1913.

A good discussion of coal reserve downgrading is found in:

http://energywatchgroup.org/wp-content/uploads/2014/02/EWG_Report_Coal_10-07-2007ms1.pdf

Note that specific productivity per miner has been decreasing in the US and elsewhere for a while.

http://www.platts.com/latest-news/coal/washington/power-river-basin-producers-finding-it-more-costly-21402408

A lot of powder river basin coal is likely too deep to be strip mined, and most of the coal is in seams too soft and thick to do underground mining anywhere near cost-effectively. It’s SUB-bituminous coal, meaning we’re run low on higher grades. (Sound familiar? How much light sweet Brent is actually on the market these days?)

There’s a zillion tons of kerogen shale in the world,

but how much will ever be turned into syncrude, due to lack of water, energy, capital, etc.?

Remember the “thousand years of natural gas” the shale bonanza was to give us?

Then the DOE cut reserve estimates in the Marcellus by 2/3rds…

Same kind of reality check is going on with coal.

This paper by David Rutledge gives a good history of the historical overestimation of coal reserves and his 90% depletion date of 2070. (It’s open access).

http://www.sciencedirect.com/science/article/pii/S0166516210002144

I think this is a big issue – among economists and policy wonks, and even among some peak oil cognoscente, the feeling is “well, we can always go to CTL or GTL – sure it may cost more, but…”,

but many reasonable people think the (excess) coal (for CTL) just won’t be there in 10 – 20 years. Opps!

I don’t agree with Patzek and Croft that peak coal is so soon that it constrains climate change significantly (though I think the IPCC does overestimate coal’s ultimate contribution), but the “200 years of coal” crowd is even further off base.

http://www.sciencedirect.com/science/article/pii/S0360544210000617

I was wondering if anyone would raise that issue – it’s an important one.

I’d like to think that Peak Coal is close – it would be far better for the world, including humanity – sadly, I don’t think that it’s the case. I’d say that we have far more coal than is needed to cook the planet, and we as a species will have to make a conscious choice to limit it’s use.

I’ve written two discussions of the issue – I’ll just link to them, because copying them seems excessive. Please take a look:

http://energyfaq.blogspot.com/2008/06/are-we-running-out-of-coal.html

http://energyfaq.blogspot.com/2009/02/are-we-running-out-of-coal-part-2.html

1 billion may be optimistic.

The last time we were fossil fuel energy free was around 1700, and the population was 700 million, and we had oceans and continents to plunder, intact ecosystems.

None of that is available today.

Since then, we’ve developed cheap and effective ways to harvest the vast amounts of wind, solar and nuclear energy around us.

The 2nd century Romans didn’t know how to use the coal in the ground. The 19th century Britons didn’t know how to use wind, solar and nuclear.

Things change.

The problem here is someone doesn’t understand what 745 watts per horsepower means in a cold, harsh mathematical way.

That’s a mighty cryptic comment.

Don’t forget that some of the very largest “engines” in the world are electric. Diesel locomotives are electric. Diesel submarines are extended-range EVs, just like the Chevy Volt.

EVs are very well tested in the real world. They’re better than ICEs: higher torque, cheaper, smaller, etc.

Technology is not energy.

And each new energy gain has been to more concentrated forms.

Wind and solar is going back down to the bottom of the list.

Humans have never done this before.

While nuclear is good idea, humans build and run them– with the observable results.

Plus we still haven’t solved the “waste” problem.

Technology is not energy.

No, but electricity is. That’s what wind turbines and solar panels produce, and quite a lot of it, too. I”m puzzled that’s not clear: lot’s of people, companies and utilities are installing them, and are quite happy with the power they produce.

And each new energy gain has been to more concentrated forms.

Electricity is as concentrated as it gets.

PV panels at the point of production recover the energy put into manufacturing them in 2-8 years.

Now if you put the externalities in (rare earth minerals, extruded aluminum, transportation, etc) one may never recover the energy invested.

This is going backward (I’m all in favor of PV, don’t get me wrong, lets turn that energy into something useful, rather than just burning it).

But basic thermodynamics says we will be going backward to get that electricity.

If we could replace 20% of out needs, that would be a bonus.

>And each new energy gain has been to more concentrated forms.

I think that this is the big change that is coming in the 21st century. You hear a lot of talk about baseload power and the need for a stable energy supply, but maybe that may be an artifact of 20th century technology.

Maybe we are getting better at exploiting marginal energy sources. It is certainly true that we are getting better at exploiting non-marginal energy sources.

Of course the same logic could apply to the oil industry.

Dave,

That EROEI ratio is out-dated. Think about it: panels cost about $.70 per watt (and falling fast), and Germany is installing it for $2 per watt. Over the 30 year life of an average US installation with 15% capacity factor that panel will produce about 40 kWhs (costing about $4.50 at retail utility prices in the US). Given that labor is always the largest component of cost for any manufactured or built item, how could there not be a good EROEI (aka net energy gain)?

Nick-

You are confusing price with energy.

The price has nothing to do with energy invested, it is a function of the market.

The cost of panels, and the overall installation, are closely related to the cost of the inputs. In turn, the cost of the inputs gives us pretty good guidance about the volume of the inputs.

Generally, labor accounts for most of the cost of manufactured items: energy (both electricity to power equipment, and process heat) is around 5%. If we make an outrageously high assumption of 25% for PV panels, then we’re looking at $.15 of energy input: that can’t be more than 3 kWhs.

You might ask, why estimate in this way? Well, the kind of detailed, academic analyses that we might want for PV are out of date. Roughly 10 years ago PV achieved around and EROIE of 5-10 to one, and everyone recognized that was good enough. No one was interested in publishing such work – it wasn’t needed. Now, PV costs, and energy inputs, have fallen by about 75% since then, but proprietary protection of IP and the lack of need for such studies means no one is looking at the changes.

You are still confusing money and energy.

You are not alone, it is hard to shake the idea that money is energy.

Not at all. Did you read my comment??

I’m using prices to *estimate* actual energy inputs. Actually, to demonstrate upper limits.

Price and energy are not linked by return on energy invested.

You are mixing two different things.

*sigh*

Well, would academic studies help? If so, I’ll dig them up.

Ummm, FYI – the Romans in Britain, the Rhineland and a few isolated sites in Northern Italy used coal. Transport was so poor it had to be used locally.

http://history.alberta.ca/energyheritage/coal/early-coal-history-to-1900/unearthing-ancient-mysteries/ancient-romans-in-britain.aspx

If you have access to a university library, the following seems to be the big study of Roman coal usage in Roman Britain:

http://journals.cambridge.org/action/displayAbstract?fromPage=online&aid=7868617

There’s a bit here on Google books:

http://books.google.com/books?id=N6Y3AAAAIAAJ&pg=PA28&lpg=PA28&dq=webster+coal+use+by+romans&source=bl&ots=UPBkMtSELI&sig=rYyAXweAgLPl_OR1owrJwJS5vH0&hl=en&sa=X&ei=cE8mVK6VC8ivoQTtyIKYAQ&ved=0CEIQ6AEwBg#v=onepage&q=webster%20coal%20use%20by%20romans&f=false

Yeah, Britons (and others) used coal they found lying about. That’s why I mentioned that they didn’t know how to use coal in the ground. It was there, in vast quantities, but they had no idea how to make use of it.

The English early on called it “sea coal” because it was commonly found on the beach.

Hi Nick,

I think he was referring to the fact that EVs are made from steel and plastics that have their base formation due to fossil fuels.

There is a fellow who has built EVs out of wood. The idea is to figure out what needs to be done with the remaining FFs and to devise plans to build what is essential. Hopefully, we will make the adjustments necessary to what we can use and how we live with each other.

Coal is handy for reducing iron oxide, but it’s not essential. And, of course, once you’ve smelted iron once, it can be recycled without using coal at all: almost all US steel consumption is recycled.

Plastic can be replaced with other things, recycled, or produced from biomass. The first car license plates were made from soy – they stopped that when cows ate them!

Really? Link? That’s funny. I wish they had eaten the cars.

I’m not sure where I saw that. Here’s what I found with a little googling:

“During the Second World War, license plates in several states were manufactured using soybeans, but the cardboard-like material was so flimsy that few survive. ”

http://www.macsmotorcitygarage.com/2013/04/24/henry-fords-soybean-car/

“In 1943 several of these jokes were dusted off when a goat actually ate an Illinois license plate made of soybean-derived fiberboard.”

http://www.soyinfocenter.com/HSS/henry_ford_and_employees.php

The World’s Most Eco-Friendly Car: Made From Hemp!

The Cannabis plant often gets a bad rap for its extra-curricular uses, but people may be shocked to discover that the hemp plant has over 50,000 uses, from clothes, to medicine, to fabrics, to fuel… to… well, even cars.

http://www.greenerideal.com/vehicles/0926-worlds-eco-friendly-car-made-hemp/

There are many chemical processes able to transform wood or biomass to petrol(like). So plastics as we know today can be made from biomass.

Houses, furniture and a lot of other things can also be made from wood. All paper products are made from wood. Wood is the most versatile product on earth. It is also becoming the most scarce products on earth.

We are cutting down all the trees. We are destroying the habitat for all wild animals. We are destroying the watershed and allowing the washing away of our topsoil. And the water runs off instead of being soaked into the ground allowing the water tables to drop even faster.

Wood, or rather the lack of wood, is the problem not the solution.

Ron, it depends where you are in the world. Most of the developed world has been accumulating wood on the stump for the last 50 years or so. There is a reason that wood prices have been depressed since the 90s. Demand has been depressed. A lot of timber and biomass in the US isn’t worth enough to pay its way to the mill so just accumulates in the woods.

Ron,

I wouldn’t get distracted by the wood problem. This discussion started about plastic in cars: cars are 99% recycled, so that plastic can be re-used about 100 times. Biomass isn’t all that scalable, but it doesn’t need to be for plastics: this is a pretty small scale problem.

Ron, you are of course right. As stated by Nick G, the discussion started from plastics. Plastics represent only 2% of the oil consumption and can be recycled.

Personnally, I prefer wood than plastics.

Woody, I do believe you completely miss the point. I am not remotely concerned with the price of wood or its availability for lumber in the US. My concern was the destruction of rain forest, boreal forest and dry forest around the world. Do you realize that the Amazon is being cleared? Do you realize that Sub-Saharan Africa is being cleared? Do you realize that Borneo is being cleared for palm oil plantations?

Do you realize that we are destroying the fucking plant and driving into extinction every wild animal that lives in the forests of the world?

Ron,

There’s no question that destruction of old-growth forests and animal habitat are disastrously bad.

That’s not what we’re talking about here. We’re talking about farmed tree plantations – they’re reasonably renewable.

Nick, I know all about tree farms. They are all over the south, right where the real forest used to be. They are mostly loblolly pine farms. They are good for making paper, nothing else. The old growth forest, in the US and elsewhere around the world, are being cut for timber. Africa is being cleared for timber. Central america is being cleared for timber. None of these forests are, as you put it, “reasonably renewable”.

This conversation isn’t about timber, it’s about sources of hydrocarbons for plastic & plastic substitutes. Those pine farms, along with lots of other “low quality” ag products would work just fine.

Now, to start a different conversation: I had the impression that most lumber in the US was farmed. Have you seen stats?

something ….

http://www.treecycler.com/home/

Now, to start a different conversation: I had the impression that most lumber in the US was farmed. Have you seen stats?

Nick, reply below where the space is wider.

A little googling suggests that the total value of wood & paper consumption in the US is about $238B, with lumber consumption at about $67B: , roughly 90% comes from domestic production.

http://www.statista.com/topics/1316/forest-products-industry/

Nick, please take it below to where things are a bit wider.

You do realize that all forms of hydrocarbon energy still has hydrocarbon inputs, right?

And furthermore the EROEI of hydrocarbon energy is starting to look rather worrisome.

But the point is moot, the only thing we can be 100% sure of is that in the future we will not be living as we have been in the past. If humanity is still able to maintain some form of industrial civilization post peak oil our wants will very likely not be supplied by hydrocarbon based energy. Perhaps it is time to start adjusting our expectations to come more in line with the energy budgets that will be available to us. My guess is that at some point, solar, wind and hydro will no longer be thought of as alternatives…

They aren’t now. Fossil fuels are poison, and we are dead unless we get offa them. I simply can’t believe all these obviously smart guys here still go on about ff’s as if that was a real option. It isn’t.

All this BS about relative costs, EROEI and all that is empty air when we add the little footnote about all dead.

Fortunately, a VERY high fraction of energy use today is for totally silly non-essentials. My favorite infuriating example is laws, lawn mowers, lawn feeders and all that. Another one is all and every soft drink, another one is burning 3000 miles of kerosene to visit the grandkids, in the process assuring their unhappy life. And so on.

And, last lash, Need New Law. Nobody says anything about a Nissan Leaf unless they have driven one a while. What a crock of crap has been blatted about here, like for example, range of 35 miles! When I see 90 miles on the meter, I have no problem, never, winter or summer, driving nearly that far. Scares the hell out of wife, she never goes more that 60 miles anyhow.

I think the 35 miles was the electric range for a volt not a leaf.

“The question is: Do we make this transition from

fossil resources to RE on our own terms, in ways that

maximize the benefits to us today and to future

generations, or do we turn our heads away and suffer

the economic and social shocks that rising prices and

market volatility will create — as it has done so often

in the past?”

http://worldfuturecouncil.org/fileadmin/user_upload/Climate_and_Energy/Cities/Policy_Handbook_Online_Version.pdf

This is a common confusion when it comes to renewables — confusing the operation with the creation of the plant. For example nuclear power requires a great deal of cement to make it work, and cement production produces a lot of carbon dioxide.

I recently read an article saying that in 1016 there wold be record installation of solar panels, but then the subsidy would be lower and the solar industry would “collapse”. In fact if there are record installations in 2016, output from solar panels will hit a new record in 2017 — hardly a collapse.

It is so easy to get muddled about whether you are talking about increase in output or increase in increase in output. but the bottom line is renewables do not use fuel.

The US actually exports diesel to Europe and they in turn export gasoline to us.

The US has been exporting diesel to Europe for years and importing gasoline from there. I wonder if that’s begun changing. Anyone know?

What is the decline rate used in this stuff for non-LTO US oil fields, and then what is the rate of reduced output from non-LTO US oil fields including supportive drilling in those fields?

Good Question

Distillate fuels are required for modern Life -… no Diesel, no barge or train = no grid power , Got to have the JIT Coal at the hundreds of plants. Loose coal stream at 2% of sites, Grid collapse without major load shedding. The Diesel exported to Europe is high perecentage ( ?% ) from imported crude. US exported massive amounts of Texas crude during WWI&II and before the US Peak. Hence the Seaway pipeline from Oklahoma fields to buttress the flows.

1st, let’s be clear about the volumes and timeframes involved.

Rail & barge freight use a small percentage of overall distillates, and will easily out-bid other uses, such as passenger transportation. Overall oil production will continue to be large enough to supply rail & barge consumption for many decades. Right?

Second, rail can be electrified. Yes?

3rd, small volume, high value uses such as aviation and long distance shipping can afford to pay twice as much for fuel, and liquid fuel can be synthesized at roughly 2x the current cost of fuel.

“Rail & barge freight use a small percentage of overall distillates” OK. Compared to Trucking/Air the case at $100 bbl, but at $150+ ? . With LTO lacking in high SG components, One wonders about the slope of % of US domestic essential consumption of distillates fulfilled by imported crude? The US is still the Petro hungriest economy on the planet. Perhaps a ball to keep an eye on may be PODD ” Peak Oil Distillates Dynamics” in addition to Rockman’s POD for All Liquids/Crude. The price drop for liquids and Mexico having little demand for the Light stuff come into play.

The important thing is to compare the volume of “essential” demand vs production. If prices rose that would reduce consumption by passenger vehicles and trucks, leaving more than enough for rail and barges.

In the longterm, rail can electrify: how much do barges use??

Also, refiners can shift their balance of diesel vs other products.

It will be a long time before “essential” consumption like aviation and long-distance water shipping don’t have enough fuel.

Power plants and food freight both have huge pricing power because they are involved with inelastic goods, and will be prioritized by the government if necessary because otherwise you have massive unrest.

The diesel users that will be clubbed over the head are the pickup drivers and freight that moves elastic consumer goods.

Power plants will be the first to phase out oil.

Surprisingly, quite a lot of oil & diesel is still used to generate power, in Japan, Saudi Arabia, Hawaii, China, India, Iraq, etc. Solar and wind are far cheaper (a gallon of diesel costs about $3.60, and generates about 12kWs, so that’s about $.30 per kWh – solar and wind are far cheaper than that).

US military bases are a good example: they’re installing wind and solar fast. Guantanamo installed a single wind turbine that reduced their diesel consumption by a third.

Most oil used for electricity is either in OPEC nations who get the oil for lifting costs, or small diesel generators where they are covering power cuts or are the only available power. Both these are inelastic demands, for different reasons.

I’ve seen estimates that 8M bpd are used for power generation, counting everything worldwide (which is hard).

Just as a start, have you looked at Japan?

Other thoughts: OPEC nations are quite clear on the concept that they’re losing $100 per barrel of oil they use for power. They’re all planning to ramp up solar to replace it, though they’re being remarkably slow about it.

Power generation isn’t inelastic: solar is clearly cheaper. Replacing diesel generation is a big reason solar power is growing so fast.

Diesel generation is everywhere, and is big. Look at Chinese and Indian manufacturing: they’re very dependent on generators because the grid is unreliable and inadequate. Look at almost all of the non-OECD world: Iraq, Jamaica, Chile. Much of the generation is at the consumer side, so it doesn’t show up in national grid statistics, but it’s there, and its big.

Heck, think outside the box. What percentage of passenger fuel is used to generate “house” electricity for AC, radio, lights, etc? Australian RVs are using PV to generate power – it’s becoming standard. How soon until other transportation does the same? Diesel locomotives use electric motors, powered by onboard diesel generators. Trains are outside all of the time – the containers could be covered with PV, and hooked together to power the train. With oil above $100 for the longterm, it will happen eventually…

Ransquawk:

http://headlines.ransquawk.com/headlines/saudi-arabia-s-august-crude-oil-output-drops-to-9-579mln-bpd-from-10mln-bpd-in-july-according-to-an-industry-sources-24-09-2014

Hopefully Continental Resources’ Investor and Analyst Day presentation posted last week was one of the presentations he looked at.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NTU1MzUwfENoaWxkSUQ9MjUyMDcyfFR5cGU9MQ==&t=1

One of the most information-rich corporate presentations in some time and highly recommended viewing. And there should be a little of something for everyone in there–no matter if you are an LTO skeptic or optimist.

I haven’t read that yet, but if the intention is to be so aggressively informative, why present it at an investor and analyst meeting. Why not call in university professors from Petroleum Engineering depts and provide it to them a priori and then make themselves available for questions. If the intention is to be aggressively informative . . . .

In my experience, Professional Engineer (retired) 35 years experience, the WORST possible source of “real” information is Corporate Investor Presentations. Its sort of like choosing a toothpaste by looking at TV ads, but much worse of course.

Okay I went thru it. When you are not a stock pimp and don’t care about CLR or EOG, you have to go thru these things to find technical details that the company hypesters were not sufficiently up to petroleum engineering speed to know that they should not let it appear. Some such matters for the 4 counties’ geology as a whole, which is what we care about here.

Slide 13 quotes porosity higher than any other source I’ve seen, including wiki. 20% higher, from 5 to 6%. Not an outrage, but a tad surprising this late in the game.

Slide 18 is profoundly absurd in such low permeability rock.

Slide 20 IS an outrage laying out recovery for P10 numbers.

Slide 26 suggests 1320′ spacing is to be standard, and my recall is that will chop down well total. The slide is not altogether clear.

Slide 29 is then curious, claiming measured frack distances of 340′ “in each direction” which somewhat points at 3D. But hmm, why 1320′ spacing if that’s all the distance the fracturing happens.

Slide 34 then supports 1320′ is as packed as you can go.

Slide 40 is deceptive. A celebration of more proppant used per well (stage count ramping up) and then a declining graph that is price PER POUND. This does not say what is implied — that proppant costs are falling. The extra proppant reqd is eating up the price decline per pound. But we aren’t focused on money here, geology/logistics is more important.

Slide 45 raised my eyebrows. Artificial lift has NOT been on my radar screen at all. Have we seen this spoken of before?

Slide 48 . . . ominous. CLR is going to drill more of their own disposal wells. Or “HAS” to drill its own disposal wells. Hope NoDak has inspectors there.

In the entire Bakken presentation, not a single word about flaring management.

Watcher,

It’s exactly as you say, DECEPTIVE; that’s the key word. But, as long as you realize Corporate Investor Presentations are really just elaborate ads, you won’t go too far astray.

Yes it was. And I commend it.

The second chart does seem to support a peak this year.

Now the question if David and Ron are right is how fast production will decline and how fast we can adapt to the decline. My personal guess is that countries such as the US which have either credit or good stuff to export will get by ok for a few more years and that countries with little or nothing to export are soon going to be up Sxxt Creek without a paddle if not there already..( Sxxt Creek is a legendary stream in the southern mountains that is highly enriched with um doo doo and pee pee.Corn grows well on bottom land irrigated with Sxxt Creek water without much additional fertilizer.)

But it seems very unlikely to me that we can adapt to lower consumption fast enough to keep prices from rising sharply and staying up. This will for sure lead to demand destruction and then the question becomes how fast the economy goes down hill.

This would be a good time to remember the classical joke wherein the boss is addressing the rest of management and saying that there is both good news and bad news. The bad news is that the world is coming to an end in a few months .

The good news is that there are unprecedented opportunities to be taken advantage of for the months remaining.

This would be a good time to invest in any established company that has plans to build and sell motor scooters and electric bicycles in this country.They ought to sell like ice water in hell for as long as plenty of people who still have jobs are silmantaneously trying to cut back by getting rid of one or two cars.

But a lot of people who are dependent on their cars and trucks for work are adapting a whole lot faster than might be expected. When I advertise for help occasionally most of the skilled trades men who are younger guys insist that they have to have an extra five bucks an hour to cover gas these days because they have to travel so far. I just laugh and tell them that they are free to get rid of the four by four v8 gas hog and get a car like mine that gets upwards of forty mpg on a good road.

A surprising number of these young guys have gotten the message already. I know of half a dozen or so who are driving compact four cylinder five speed pickups today that were driving full size trucks with big engines two or three years ago.At least one of them admits or to put it differently brags that he is saving almost enough on gasoline alone to make the payment on his new truck after trading in his old one.It is not uncommon for young guys to have to drive forty thousand miles a year to stay at work in construction.

For what it is worth

The Mustangs and Camaros that are driven to work by younger people these days are almost all v6 versions that get better mileage than a lot of yesterdays compacts.I do not know a single young person who has bought a NEW hot rod car in the last few years. They have gotten so expensive as to be beyond the reach of most young people and that is a good thing imo.

The question of adaptation is crucial in this context. Choosing smaller and economic cars (or motor scooters) is easy and would cause a drop in fuel used for transportation. But even if it will work during the first years of decline, the trend is not sustainable. Demand destruction can also come from the use of public transportation systems.

However if we consider a transfer from fuel to electricity, there is currently no plan/project to build the electric power necessary for the transition. These nuclear power plants or gaz turbine needs at least 10 years to be on line. Solar panels and wind turbines are not enough to provide enough power (but are part of the solution) and needs energy storage.

The best is a smooth transition. I would like to think this is still possible as people will chose the most economical solutions. Higher oil price, better the trend to choose greener solutions and higher the chance to start the necessary changes in the Society.

Solar panels and wind turbines are not enough to provide enough power

Actually, they do. To power EVs the US only needs to expand power generation by about 15% over 20 years. Wind and solar can do that easily.

To expand on what Nick has said, my 5 kw array delivers 4.38 kw to my utility meter. This is because the DC power produced is converted to AC. I live in an area where each kw of electricity generated produces 5 kwhrs of electricity on average per day. Thus, my array produces and average of about 22 kwhrs a day.

An EV sedan uses 1 kwhr of electricity to go about 3 miles. A pickup truck goes about 2 miles.

My array cost me $28K. Without taking into any of the tax incentives, and using the difference between gasoline and electricity, I expect to pay off my array in about 25 years. I expect to pay for my next battery pack for the most part by not having to pay for fan belts, oil changes, antifreeze, spark plugs (or fuel injectors), etc.

If my next pack is made from the Lithium Sulphur batteries that GM has been working on, the pack should be very cheaper than oil changes and last a lot longer (600K miles vs warranties of 100K today).

Will there be gasoline in 25 years? probably.

Will it be cheaper than today’s price adjusted for inflation? Only if a lot of us switch to electric.

And solar has gotten cheaper. That array cost about $5.60 per kWp, and newer residential installations are averaging around $4 (commercial is closer to $3). Heck, the panels only cost about $.70 – the rest is planning, inverter, wiring, installation, etc. In Germany with standardization they’ve gotten the whole thing down to $2!

I agree for transportation (my estimation for Belgium is an increase of 40-50% of the production which could be reached easily by PV, wind, biomass, hydro and geothermal. Indeed this increase in production represents about 15-20% of the current installed production capacity (well, if the 3 nuclear power plants shutdown for sabotage or problems are online again). If we add other usages of fossil fuels (essentially eating), the current electricity production should be increased by 450% except if we increase insulation.

For the US, the numbers are apparently about the same, with an increase in production of 400-450%.

There is no plan/project nowhere to build this extra capacity.

Of course, we have time for this increase of capacity (a world withour fossil fuel). But about half of this goal should be reached by 2030-2035 (after peak oil, peak gas and maybe peal coal).

The US would need to increase power generation by about 25% to handle passenger transportation (2.9T miles / 3 miles per kWh = about 1,000 TwH vs US average consumption of about 4,000TwH).

The other uses of oil won’t need as much from the grid to replace: rail is far more efficient than trucking, and electric rail uses little power; petrochemical feedstock and road building materials won’t come from electricity, probably.

Insulation is the best way to reduce space heating needs, and heat pumps are very efficient.

I doubt the grid would have to increase output more than 50% to dramatically reduce oil and gas consumption.

The next stage will have to be shortening the distances traveled. Urban design people point out that a lot of fuel is used traveling around the “great triangle” between a suburb, an industrial park and a shopping mall. This is caused by zoning laws. I live in a German suburb and I often walk to the grocery store. Building a grocery store that close is illegal in most American suburbs. There simply aren’t any corner stores.

Another issue is subsidies for building commuter roads and suburban sewers.

Also American cities allow car traffic to have a huge footprint. Go almost anywhere but Manhattan in America and you see wide high speed roads with no sound barriers and huge surface parking areas. These reduce the land value and population density of the cities, making it harder for them to provide the amenities to make urban life more pleasant, so it is a vicious circle.

Those are great ideas, but they’re not *necessary*.

Redesigning cities and roads is good, but very slow. It’s much, much faster to replace ICE usage with HEV/PHEV/EREV/EV usage. Vehicles less than 6 years old provide 50% of vehicle miles traveled (in an environment where new vehicles aren’t much different from the old ones). Switching to better vehicles is fast and effective.

City patterns can change in a hurry when something literally isn’t economically viable. Many suburbs don’t have very good incomes to start with; there have been entire books written about how poverty has moved out into the ‘burbs. Really wealthy areas won’t care of course, they have large disposable income and more ability to request pay hikes at work. But your $40k/year suburb dweller with nigh-zero disposable income and two cars rapidly runs out of options – and takes a big hit on the marketability of his house.

Well, hybrids and EVs are cheaper than traditional gas powered cars. Gas prices aren’t going to make poor suburbs poorer, if they’re at all smart about what they buy.

Ilam guy, scope up a few minithreads. The frack distance for our cylinders or boxes have been throttled down.

Yes, and they are flatter too, I think. There seems to be a clear distinction between Bakken and Three Forks wells. That means you usually cannot assume that it’s going to be the whole 308 ft thick.

Still waiting for definitive sizes, but these EUR numbers are getting up towards out calculations of absolute max volume, which of course cannot happen physically.

The country that has the single biggest problem, bar none, is India. Japan and South Korea are much more mature and efficient and they along with China have very strong ability to buy what they need. India has poor (and peaked) oil reserves, no captive supplier and not a whole lot of financial firepower relative to what they would need to develop the way they want to.

Which is largely why these bizarre discussions about imposing behavior on Americans are pointless.

The oil is not conserved. It’s just sent to China, who will soon become “the enemy”. Or India, who will try to stay off the radar screen while they get their per capita consumption up to civilized levels..

US consumption is not growing. Theirs is exploding. Why on earth do you want to cause American upheaval when you could spend this wasted time on the enemy.

BTW India just injected its first planetary probe into Mars orbit. Price tag of the mission is about 75 million bux. They used mostly Indian components aboard.

Some months back we looked at US per capita oil consumption and the fact that China and India are woefully behind — but when they catch up total global consumption will be well north of 100 mbpd, or would be if it existed.

India is clearly well on their way to raising their technology and if they want a good life for their people they’ll be raising their per capita oil consumption to civilized levels — at which point we get the scarcity show and nuke lobbing underway quickly.

The prices went up and that didn’t stop Chinese demand from increasing, but it cut US demand. In effect the chinese are outbidding the Americans in the oil market.

There is a simple explanation for this — oil is worth more to the Chinese than to Americans. The reason for that is that Americans do not use oil to grow their economy, they use it for status displays and to prop up a hopelessly inefficient transportation system.

Of course the Chinese waste oil as well, but not on as grand a scale as America.

US per capita consumption: 19ish million bpd / 320 million people = 0.059 barrels per person per day

China per capita consumption (using the mazama graph, I remember Ron noted BP (on which it’s based) may not be consistent liquids vs crude in their count, but it’s convenient) : 10.5 mbpd / 1.36 billion people = 0.007 barrels per person per day

India per capita consumption: about 4 mbpd / 1.29 billlion people =

0.003 barrels per person per day

http://mazamascience.com/OilExport/ select the country dropdowns for the quick graph

Bottom line here is China needs to do a X8 on their consumption to get up to civilized US standards of consumption. That will be 80 million bpd, just about the whole world’s total — and they need to do it fast because every day they delay is a day their people spend at a lower level of civilized living.

India has to do a X 20, which also will get them to 80 mbpd, for a Chindia sum of 160 mbpd, which doesn’t exist, and they must do this as fast as they can to stop abusing their people with the life lower consumption condemns them to.

And so, they MUST ramp up as quickly, or MORE quickly, than those graphs show or they are being immoral towards their own society. The nuke lobbing can’t be far off.

China and India would shoot themselves in the foot by raising oil consumption. They need to install solar to reduce their diesel consumption for power generation, and move to HEV/PHEV/EREV/EVs for transportation.

Oil is expensive, dirty and dangerous: every country is better off reducing their consumption ASAP.

This is the path to misery for the people in question. It’s a profoundly immoral position to deny them the sort of Social Security funded by oil driven GDP that the US has. There is no Soc Sec in India. GDP is the path to it. There is no choice.

That’s the point: imported oil reduces GDP, while HEV/PHEV/EREV/EVs are cheaper and better. They free up more income for other useful consumption.

India is going bankrupt paying for imported oil. It’s a curse.

US consumption has been dropping because of intense US policy of demanding better vehicle standards combined with changes in living habits. We drive our cars less and they don’t burn as much gas per mile.

Now, growth in oil consumption is more *essential* to China than the US since the US simply does not need to consume anymore than it currently does, and in fact could consume a lot less. Not really an option for China and India.

Which . . . makes the point? 160 million bpd reqd for them to get up to US standards.

It doesn’t exist.

Their choice is to accept inferior life for their people . . . forever . . . or do the moral thing and attack wherever they must to increase their consumption and achieve parity.

We’ve already done this. The miracle seekers decide that the US in a gesture of community will hold a vote and decide to degrade themselves for the benefit of Chinese housewives.

The somewhat higher probability is for the Chinese to go after that juicy 5 mbpd importer target called Japan.

Next you’ll suggest they need to smoke and drink more, to emulate our way of life.

Oil is dirty, expensive and risky. The Chinese will be far better off if they take a different path of industrialization. Kind’ve like countries that go with cell phones, and skip the expensive step of installing landlines.

Oh this isn’t about should.

This is about likely.

Humans will not accept subordination. Japan is right there and oil is the path to dominance. It must be sought.

That’s the thing — oil is the path to failure, and economic inferiority.

Oil is expensive, and imports make your country dependent, poor and vulnerable.

In Western terms India is not looking good. They have only recently elevated their middle class into the consumer model of lifestyle, and they are beginning to find it slipping from their grasp already.

However, that is also their strength. India has always been poor (with a tiny elite). It still has a strong culture and caste system, at least in cultural memory. They lived through many famines and survived.

100 years from now India will be very much like the India of 300 years ago, but with fewer people. They will have the same gods, same jobs, the same happiness and misery.

The above “World Oil Production” graph, reminds me of the graphs put out by “ACE” of The Oil Drum.

Then he would have to constantly put out revised graphs over time, when the production declines predicted never materialized.

http://4.bp.blogspot.com/_fl4GqRfOC9Q/Sl3jhaEHhLI/AAAAAAAAAgI/EtlXEFR0mXQ/s1600-h/WorldCC200704.jpg

An ethical prognosticator admits their mistakes and corrects them as appropriate. Don’t pay attention to people that can’t.

Wait a minute.

What is an ethical prognosticator? How does what you just laid out differ from a palm reader that predicts the future, discovers that he or she was wrong, and offers up a new prediction (maybe for pay)?

Wouldn’t it be better to just crawl under a rock and stay there for the duration?

Hi Watcher,

It looks like I was getting too cute with my wording. What I was trying to convey was that that it is a good quality for someone to make adjustments to their predictions as better data comes in. At first glance, John B. seems to be criticizing ACE for adjusting his charts.

He was criticizing ACE for always being wrong.

ACE’s charts always showed a sharp decline, starting at the date of the chart.

Well, when wrong there are three choices.

1) Wave hands and point out blah blah blah blah this parameter was different for reasons . . . altogether now . . . No One Could Have Foreseen and it caused the overall prediction to slew slightly blah blah blah.

2) Re-interpret data and say you were actually right and the bad guys changed the definitions. This presumes the definition change would have moved the result in the direction of the prediction.

3) Stand up and say “I was completely wrong and have no idea about any of this stuff and you’ll never hear from me again in any way.”

We don’t see too much of #3.

We should see it almost all of the time.

Less cynically, guys like Nate Silver and Sam Wang say, “Here is my model, and here is what it predicts with the following probabilities”. When they are wrong they tweak the model and try again. Nate Silver even likes to point out that the fact that his prediction is correct is not even solid evidence that the model is correct.

That’s like buying a stock after performing intricate analysis of 80 different parameters, and then it goes up because the president of the primary competing company is killed along with his senior staff.

Your model meant nada.

Exactly

I have a book, “Oil in the 21st century,” published 2006, edited by Robert Mabro. It’s a collection of essays on the topic; there are no entries in the index for “tight oil” or “shale oil.” I don’t think anyone has any real clue how things will unfold; my take is that what can be done on a smaller scale with private capital can expand to have greater gains, while macro scale megaprojects (CTL for instance) are more dubious propositions. The ROI is too up in the air for investors to dirty their hands, while the tight oil phenomenon proves that what you want is to get Ma and Pa on something they can bankroll.

As always I don’t think anyone has any real grasp on how the public at large will handle a bona fide shortfall in supply.

What is the reaction of a shortfall in supply?

Blame someone. That’s always the path walked, because politicians NEED to have someone or something blamed that absolves policy from blame.

China is out there with that steep consumption curve. Odds look high they are the target.

Ron/David – In the 2nd graph, what is counted toward “World Oil Production”, as the peak of about 88mbd comes in well above C+C’s 73 or so, yet below the 92 or so typically seen for ‘All Liquids’?

Thanks for any clarification.

It looks a lot closer to 86 million barrels per day to me. That would mean it includes natural gas liquids.

In 2014 the EIA will have “Total Liquids” averaging somewhere around 91.4 mbd but that includes refinery process gain. No one in the world counts refinery process gain except the EIA. They will have “Crude Oil, NGPL and Other Liquids” averaging between 88 and 89 million barrels per day. That is all liquids except refinery process gain. But if you only count crude oil and NGLs then the average for 2014 will be somewhere around 86 million barrels per day in 2014.

Thanks for the explanation. And I agree completely that RPG shouldn’t be counted. And of course a barrel of NGL counts less than a barrel of crude, but the EIA isn’t in the business of providing that sort of meaningful Information. Perhaps they should change their middle name to Obfuscation…

Sorry, I can never take anything that Tiny Archibald writes seriously after reading his crank theories on climate change. YMMV.

Thanks for the heads up. Archibald does seem to push pseudo ideas (won’t call it science). Probably needs to re-read his physics texts. Global warming appears complicated but it is actually quite simple. Decreased emitted radiation from the atmosphere/ocean into space pushes it to a higher temperature equilibrium. Not a lot of discussion needed there. The side effects are where the discussion lies.

Allan,

Actually, you have to wonder if wacko global climate change theories are really more bizarre that projecting US Tight Oil Production numbers twenty years into the future, based largely on Corporate Investor Presentations. Ah “Pseudo Ideas”: yes, that sounds about right.

Doug,

I do wonder about the ice age promoters.

Right now tight oil production is rising so downward predictions are dependent upon known parameters such as field size, number of total wells possible, inhomogeneity of fields, production drop off rate of known wells, etc.

All parameters show a limit to growth that is not far in the future. Unlike major climate change, long term oil production descent, ocean rise, possible collapse of world civilization and such; most of us will live to see the tight oil fields peak and descend in production. Maybe that will stir some realization that building a civilization upon a finite limited resource is about as smart as Russian roulette. Then again, maybe it will just push people to depend on other limited resources until they run out of all options.

I would hope that “most of us” would live until 12-24 months from now (i.e. when even the industry promo material in the OP is saying they will functionally peak; don’t really care about what the last 200k look like with what the rest of North America looks like…). I guess unless Iceland blows up or something.

Hi WHT,

I take it that David and Tiny Archibald are the same person ? In your opinion at least?

We should not say anything much about people who are right about any given subject that is still controversial in the eyes of the public and wrong about another such subject for a very practical reason.

This involves the nature of the evolved monkey mind that bosses our bodies around. We tend to believe what we want to believe for the most part, rather than what the evidence indicates, no matter how clear that evidence may be.

We consciously and unconsciously divide the world into ” us ” and ” them”.Any individual is far from likely to listen to anything contrary to his world view coming from a member of his perceived ”them ” camp.

There is a strong correlation between climate denial and peak oil denial.You will not find too many people who understand peak oil in the climate change denial camp.

On the other hand a climate change skeptic has the ” us ” credibility to spread the peak oil news within the climate change denial camp.

This unfortunate aspect of human nature makes it damned near impossible for us to deal with a great many extremely serious problems.

Liberal democrats for instance just about feel compelled to deny that tea party conservative republicans are right about our country spending itself into a hole that may well swallow us someday.

Conservative republicans are unable to admit that having millions of people bankrupted and condemned to unproductive lives and early graves because they cannot afford medical care is a grave public policy mistake.

( This goes deeper than just paying your own bills. If a person is once disabled or addicted to pain killers etc the public winds up paying to support him ;it would be cheaper to pay for treatment initially. People who are mad with pain and broke self medicate with alcohol and worse and are apt to mug and murder and burgle to make ends meet.This sets up a vicious feed back loop requiring more cops more prison guards more emergency room services on the dole etc.)

We need to remember the words of not quite so foolish as often assumed RR. If a person is your friend on a truly important issue it is best to ignore his other mistakes to the extent you safely can.

I call him Tiny because by coincidence, many of the more infamous climate deniers on the blogs share names with well-known NBA players. Judy “Dell” Curry, Bob “Wayman” Tisdale, Rob “Pervis” Ellison, Anthony “Slick” Watts, Willis “Reed” Eshenbach, Tony “Downtown” Brown, and others.

Archibald has the honor of sharing the last name as the great Nate “Tiny” Archibald.

That’s about the only interesting thing in all this. I never forget their names because I was always a hoops fan.

“the economics of fraccing have improved a lot over the last two years.”

Can someone please show the numbers that prove this, and not that the infrastructure guys are making more and more money with more and more wells, but that a barrel getting delivered by train to some refinery is now cheaper produced and delivered than it was two years ago? Also not talking about the spot prices, but the “economics.”

JC, like you I doubt that the cost per barrel to produce has declined over the past two years because the cost of the marginal barrel has certainly gone up during the past two years. But what David is likely talking about is the fact that the barrels per rig has improved over the last two years. That is verified by the EIA’s Drilling Productivity Report

I am pretty sure Ron is right and that the cost per marginal barrel of fracked oil has been going up for the last two years.

But as I see it this would be because the drillers are always working the sweetest spots first and so the production of given wells of a given size ( depth amount of fracking etc length of laterals etc) is constantly falling.

BUT unless the cost of rigs crews and chemicals is going up noticeably the cost of drilling wells must be coming down noticeably.There is no doubt the drillers are getting more done with a given rig these days.

Of course the question could boil down to increased drilling efficiency versus increased costs of rig rental crew wages and purchased materials from pipe to sand to diesel fuel.This could be a wash or play out either way.

But if the drillers could find enough new sweet spots then the cost of producing fracked oil MIGHT actually decline .

I am personally highly skeptical about very many such new sweet spots being found but a few lucky companies will find and get control of some good unexploited ground and thus make excellent profits..

In any case not enough tight oil is going to be brought to market to offset the decline of conventional crude and if the price goes down it will be because the world economy is desperately sick with the high energy cost flu.

If I have got it wrong I am always ready to learn why.

Mac, I think there is a misunderstanding about the term “sweet spots”. Sweet spots is actually a misnomer, it should be “sweet spot”, singular not plural, or that is the case for the Bakken anyway.

There is actually only one big sweet spot in the Bakken and it occupies most of four counties in North Dakota. Production from wells drop off considerably as drillers move further and further away from that one big sweet spot.

When I say that the marginal cost per barrel is going up I mean around the world, not just fracked wells. Fracked wells, especially in the Bakken are a different animal altogether. That is because as “downspacing” is now the order of the day in the Bakken, they are drilling more and more wells from the same pad. That is the primary reason production per well has been increasing, they don’t have to break the rig down, move it, and set up again. They just start drilling again immediately after the well is complete. Well, in many cases anyway.

..they are drilling more and more wells from the same pad. That is the primary reason production per well has been increasing, they don’t have to break the rig down, move it, and set up again

This doesn’t make sense to me. Maybe I am a little confused about the distinction between well, pad and rig.

I imagine a rig sits on a pad and creates a well. Multiple wells per pad would increase rig productivity, but how would it affect well productivity? The only thing I can imagine is that more wells are drilled on pads that already have successful wells on them, making them more likely to be successful themselves.

Sorry, my mistake. I meant to say “production per rig” not production per well. Obviously downspacing will reduce production per well but not enough to offset what they gain from multiple wells per pad/

The rigs walk . . . on the bad . . . from wellsite to well site.

But too much is being made of this whole rig issue — because it was a traditionally important metric — and should not be.

The equivalent or analagous count now is proppant carrying trucks and water carrying trucks. The fracking process is far far more definitive of well spud-to-first-oil duration than the drill count.

There are holes stacked up in inventory waiting for proppant and water and big pumps.

Hi Ron

With this clarification I am with you all the way.

And on my part I should have said good new tight oil fields rather than sweet spots.

It seems likely that if there are going to be more new highly productive tight oil fields found in the US at least we would have heard about them by now.

Right, but saying the “economics” is implying the costs, as its repeated in all the financial press. It was like Ed Crooks in FT piece a couple weeks ago, with some cherry picked report that shale was going to be profitable next year, without naming companies and basically concluding loss per piece would be made up in volume.

Anyway, Im opened at this point into what they may still get out of various places, but the real mover that’s undeniable at this point is cost, as even the old majors cant hide it in their quarterly reports. And just as importantly, debt has become the major pillar of the entire economic status quo, no more so than with shale, and this becomes especially important if it wasn’t making money at 100, whats happening at 90 or 80?

Thanks for the work, from long time old TODer.

If my name were CROOK I believe I might write puff pieces under an alias.LoL and no offense intended of course.

One caveat to all this additional production is the cost of transportation. Railroads are handling around 75% of Bakken production and will handle all future increases in production, even if Keystone XL is built up north. Capital investment by the RR’s to handle this oil, including in the Permian basin is $$billions per year, especially after having to build 10,000 or more new tank cars that meet current DOT regulations. They are putting in double track, building more transload facilities, upgrading their signals systems (including new PTC mandated by Congress).

All these improvements cost money and the RR’s will get a return on this investment which most aim for about 15 to 20% per year. Since no easy or cheap alternatives exist for rail transport of this oil, the railroads enjoy “pricing power”. Rail haulage rates will climb from current $10 to $14 ber barrel to $15 to $20 per barrel within a year or two, IMO. DOT has also mandated that oil train speeds be reduced, thus further adding to cost (labor paid by the hour and track occupancy costs are by the hour). Unless oil prices can rise much faster than inflation I don’t see these production predictions reaching these levels as cost to the consumer (high prices) will limit demand.

Buy sell or Hold … BRK, etc. http://www.thestreet.com/topic/25823/top-rated-equity-road-rail.html

The natives are getting a little restless about financing this however:

http://daily.sightline.org/2014/09/17/how-state-public-money-pays-for-coal-exports-and-oil-trains/

As has been mentioned before, Buffett bought BNSF for a reason, and don’t know if it’s still true, but it was recently . . . Bill Gates largest non MSFT holding is Canadian National Railroad.

Gates and Buffett… and the Shock Doctrine.

I have a hard time taking them seriously as philanthropists.

They will get burned.

It is only a matter of time.

FWIW the US Net imports of crude and products this week were 4.783 mmbod. That is the first time I’ve seen it under 5. Let the bon temps roulee.

Maybe. It’s 97 degs in Williston. Rain due again this weekend, and 45 degs.

Wonderful, what a webpage it is! This website presents useful information to us, keep it up.

I am generally not as cynical as Watcher and a few others about government interventions and management and MISMANAGEMENT of problems but the ones of us who believe that we cannot count on government for a rational and vigorous response to peak energy and other resource problems do have some very strong arguments on their side.

We have gotten to the point that crooks own the Gxxxxxxxd justice department.Had any of the regular authors or commenters here pulled the tricks pulled tens of thousands of times by the big banks involving mortgages we would have gotten a long sentence and pulled most of it.

http://www.theguardian.com/money/us-money-blog/2014/sep/25/eric-holder-resign-mortgage-abuses-americans

It is hard to imagine that when the fecal matter hits the fan in terms of energy that big time crooks and market manipulators will fare any worse than the bosses at these big banks.

Farmer guy, here’s the thing.

Had anyone of us, those of us who have some understanding of swaps and excess reserves, been in charge in 2008, we would have done the same thing. Remember, this was GW Bush who advocated TARP and huge government intervention. The “bailout” bill was rejected by the House once and then passed. It was Bush that pushed that absolutely non conservative option, and the GOP in the House signed on because There Was No Choice.

The entire system teetered on oblivion because Lehman was the swap central player. Bernanke . . . if we want to go back and find who was to blame for it all . . . it was Bernanke. I don’t mean vague questions about his rate management and whatever. I mean the specific decision he made as regards Lehman. If he had essentially backstopped Lehman, the swaps would not have frozen everything with fear about counter parties not fulfilling obligations. Banks and finance houses would have still traded. The mortgage problem wasn’t even addressed until the next year — by Bernanke, finally. The problem was Bernanke misjudged the systemic effect of Lehman and all the swaps they triggered.

And so, we would have done the same thing because there was no choice.

Next time, even that choice won’t be available.

As for what happens when oil scarcity asserts itself, let’s watch Ukraine and gas over the next several months. The Russian energy minister today said that gas to Europe will be restricted if gas sold to various countries is then transshipped somehow to Ukraine.

I’m pretty sure the back flow capacity of the pipelines that usually go east to west will not come close to providing Ukraine what they have to have this winter.

And so one would expect to see Kiev make defiant noises about resisting Russian aggression while cutting a deal under the table. That would be what to expect when oil scarcity arrives. Someone must be blamed and someone will be blamed, and then whatever must be done to make food roll on trucks will be done. Then when spare parts are denied transport fuel because of food priority, things will start to break fast.

The internet uses spare parts, btw.

If the authorities just stay out of it, then things will work ok. If, when oil is a problem, prices are just allowed to raise a bit, less-valuable consumption will decline, and food trucks will keep rolling.

Now, we’re talking about gas, here, right? If Russia stops natural gas that will probably affect power generation first?

They should be installing local supply, like wind, but instead they’re futzing around insisting that wind farm developers buy their turbines within Ukraine!

hahah ZH commenter:

What’s the most endangered thing in Ukraine?

Forests.

Run, Forest! Run!

My opinion of the ethics of the Bush administration is no higher than my opinion of the Obama administration.

But I think maybe Bush would have put at least one or two big wheels in jail simply as a matter of good politics next election time. Obama is about the worst as far as actually ignoring the law during my lifetime.

Bush was out before the time came to prosecute and my comment is not about swaps and derivatives but about mortgage fraud pure and simple. If your or I had done just one of those robosignings we would have gotten five years and been sold out to make our victim good.

AND I am not deliberately focusing on Obama and Holder except that they happen to be the latest in power. The next administration is highly likely imo to be republican and I expect as bad or worse but to throw more sops thrown to the public in such affairs to save face among old time conservatives most of whom would gladly lock up the robosigning bankers and throw away the keys.

Obama and Holder have so much contempt for us that they did not throw even one of their own under the bus to make it at least appear that they are ethical.

Our political system has always been corrupt. Politics are always corrupt at any level above the local village or township where things are decided by people who all know each other face to face and even then the petty cash has a way of getting spent on beer and pizza.

The corruption seems to be running noticeably deeper from one administration to the next since back about Carter. Before that I was not paying as much attention to politics and have no firm personal opinion but government was smaller back then and there were fewer opportunities for corruption with the smaller size.

http://headlines.ransquawk.com/headlines/rosneft-and-exxonmobil-said-to-strike-oil-in-arctic-well-26-09-2014

That would be the Kara Sea.

Fleshing out:

http://news.investors.com/092614-719185-exxonmobil-said-to-strike-oil-in-sanctioned-well.htm?ven=schf&src=aurlhdz

The primary source is FT, behind a paywall.

Bottom line, results not definitive and there is talk of condensate. The announcement was supposed to address presumptions it would all be natgas.

Hi Mac,

I am not sure if government has really grown in recent decades. I don’t know much about business insider, but the charts source the St. Louis Fed.

http://www.businessinsider.com/percentage-of-americans-work-for-the-government-2012-7

Best,

Tom

Government has been growing at least all my adult life as a percentage of the population of the country and the number of people dependent on it. Medicare alone for instance is a simply mindboogling program in terms of size and cost. There have been extremely few programs of any size done away with but there are new departments of one sort or another one after another such as the federal dept of education.

The bigger it gets the harder it is too keep an eye on it and government is like every other human endeavor. If you don’t keep a close eye on the people involved they will be sleeping on the job in short order and stealing soon after that in one way or another.

The revolving door between the banking industry and the govt for instance is a super duper opportunity for people to steal without actually breaking any laws in ways that can be proven in criminal court.

Farmer band together and steal from each other and the public by getting marketing laws passed that keep out competition from other farmers- I could never have raised any tobacco legally and sold it for instance for lack of an ”allotment”.Such laws increase the cost of food .

Barbers and hairdressers in my state have gotten a law passed that requires a student barber to spend the same amount of money and time in class as is required to get an associate degree in nursing -two academic years- and a registered nurses license in this state. In nursing school you learn about infection control and clean instruments in a few hours and you get two hours of practice shaving and cutting hair which the instructors consider more than ample time in terms of the health and welfare of a patient.