North Dakota has published the latest production numbers.

ND Monthly Oil Production Statistics (All North Dakota)

ND Monthly Bakken* Oil Production Statistics (Bakken Only)

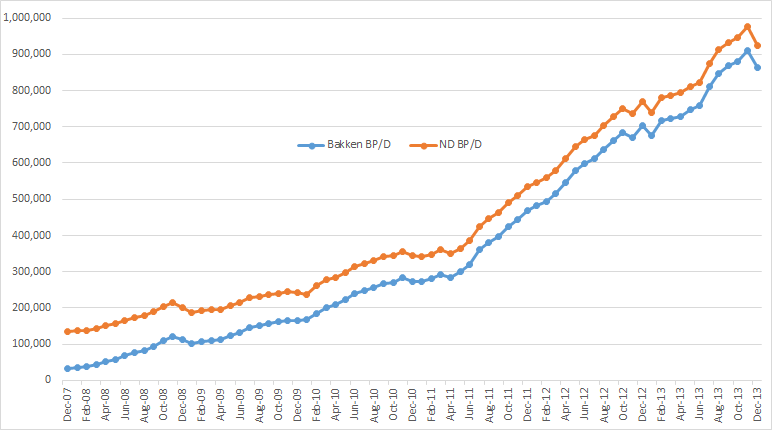

Bakken production fell 48,395 bp/d to 862,389 bp/d and all North Dakota production fell 53,226 bp/d to 923,227 bp/d. That was after Bakken November production had been revised up by 2,908 bp/d and North Dakota November production was revised up by 3,173 bp/d.

From the Director’s Cut

<i>The drilling rig count was up from Nov to Dec, but the number of well completions dropped from 138 to 119. Days from spud to initial production increased 18 days to 132. Investor confidence appears to be growing, but there is still some concerns about the uncertainty surrounding federal policies on taxation and hydraulic fracturing regulation, but the big story is the December weather. Low temperatures of 21 to 31 degrees below zero, 4 major snow events, and 5 major wind events. Dickinson had the 4th coldest December on record and from Williston to Bismarck it was the 9th snowiest December since 1890.</i>

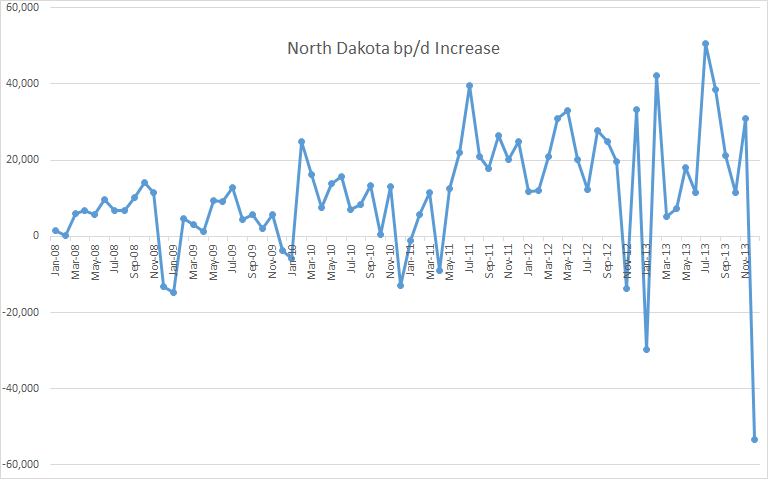

The December decline in North Dakota production was the highest in the history of the state. Total North Dakota increased production in 2012 by 233,349 barrels per day. However the increase in 2013 was only 154,317 bp/d. Their production increase was 34 percent less in 2013 than it was in 2012.

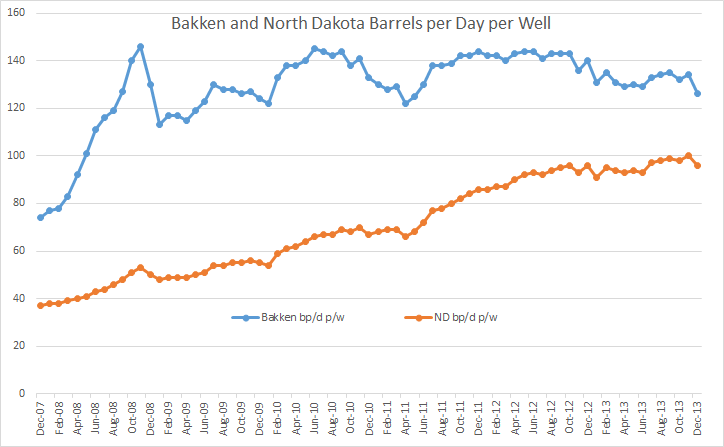

Bakken barrels per day per well dropped by 8 from 134 to 126. That is the lowest number since May of 2011, when the surge in the rig count was just beginning.

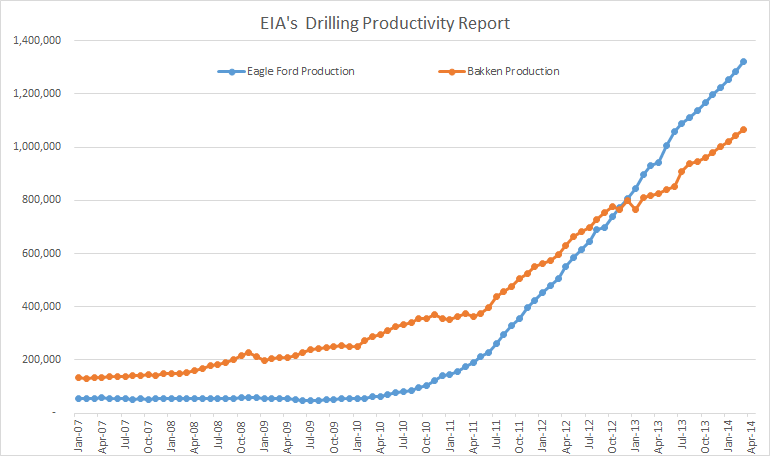

The EIA’s Drilling Productivity Report came out a few days ago. Their Bakken figures look totally different from North Dakotas. The EIA had the Bakken up 247,717 barrels per day in 2012 and up 203,613 bp/d in 2013. There is a bit of apples vs. oranges here however. The ND figures are for all North Dakota while the EIA’s figures are for all the Bakken including Montana’s small share. But still the figures should be pretty close as the EIA has ND Bakken plus Montana Bakken while ND has ND Bakken plus ND non-Bakken.

They are miles apart however as the EIA had all Bakken production in December at 1,001,062 bp/d while ND had all North Dakota production at 862,389 bp/d.

The Data here is through March 2012. I believe the last six months here are just estimates. There is very little variation in the numbers. They have Eagle Ford increasing production by about 30,000 bp/d each month and the Bakken increasing by about 20,000 bp/d each month, but increasing their gain a little each month. They have the Bakken starting out increasing production by 17,500 bp/d in October 13 and rising to 22,650 bp/d in March. They have Eagle Ford having an increase of about 29,000 in October rising to just over 34,000 in March. They are just Guessing. They have the Bakken up over 20,000 bp/d in December while North Dakota had them down by about 50,000 kb/d.

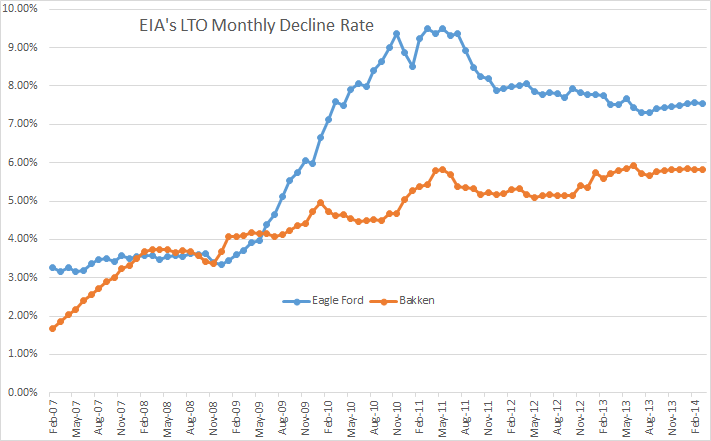

But I think they have the decline rate pretty close. I calculated their decline rate for each month for both the Bakken and Eagle Ford, plotted below.

I posted this link in the comments of the last post but I want to make sure no one misses it.

‘Big oil’ getting smaller as production keeps falling

* Top seven western majors all seeing liquids output fall

* Supermajors’ share of global market dropping every year

* BP reports fastest decline of 30% from 2009-13

* Production becoming more evenly split between oil and gas

Combined output of crude and other liquids by the seven biggest western majors — ExxonMobil, Shell, BP, Chevron, Total, ConocoPhillips and Eni — amounted to 9.517 million b/d last year, down 2.2% from 2012 and marking the fourth consecutive year of decline.

And This Steven Kopits video presentation is just over one hour long but worth every second of it:

Global Oil Market Forecasting: Main Approaches & Key Drivers

These are some significant fireworks. That is a huge drop, and funny thing about winter. It happens about this time each year.

About a year ago we were trying to find a point where well completion count would yield breakeven on production growth, and clearly that was pointless — and it’s useful to note Helms had it wrong, too, and was quoting his own numbers on completion count required to grow production. He had a tiny number and the numbers discussed here were much larger — and it now appears it’s meaningless. If the trucks can’t roll, it’s trucks pre production AND post production that can’t roll.

Meaning if the tankers can’t roll it doesn’t really matter how many completions you complete. The onsite tank fills up and the tanker trucks can’t get to it to offload it, and the well has to stop producing.

This link alludes to a factor none of us have mentioned. There is a paragraph in this North Dakota site that talks about diesel scarcity for the trucks. An Indiana refinery had a shut down and uh oh:

http://www.commerce.nd.gov/news/detail.asp?newsID=1048

>>Hundreds of diesel-fueled trucks are needed to accommodate such growth in a largely remote state, hauling crude to the nearest pipeline or rail head, hauling refined products to the drilling site or trucking in sand and water. These are key ingredients to hydraulic fracturing, or fracking, which involves injecting a mix of water, sand and chemicals into shale formations at high pressures to extract oil and gas.

That is on top of diesel used in the fracking process as well as the trains that transport Bakken crude to other states in the absence of sufficient pipeline capacity.

Local diesel terminals were sucked dry this month — some for hours, others for days — as a major Indiana refinery underwent planned maintenance while fuel demand rose due to seasonal demand from farmers and shippers at the tail end of the autumn harvest and the Bakken shale oil plays. Some truckers had to drive hundreds of miles to fill up.

“Trucks arrive at the loading station and some wait three to four hours and others in excess of eight hours,” said Bud Kerr, operations manager at J5, a hauling company in North Dakota. “The problem appears to be worse than what it was last year.”

>>

Wow. Almost 50K decline in one month, and guess what. It is cold in January, too.

Ron,

This has to be one of the most interesting parts of the post:

The December decline in North Dakota production was the highest in the history of the state. Total North Dakota increased production in 2012 by 233,349 barrels per day. However the increase in 2013 was only 154,317 bp/d. Their production increase was 34 percent less in 2013 than it was in 2012.

———————-

It is very difficult to see what is going on in a month to month basis when the weather is so much of a variable. However, the overall average oil production from one year to the next speaks volumes. Of course the big decline in oil production in Dec had some impact, but if we look at your chart, many of monthly 2013 data points were lower than 2012 — and that was during the spring-summer-fall.

I really think 2014 is going to be an interesting year as it pertains to oil & gas production in the U.S. As mentioned in the prior post, U.S. natgas storage is 5-year lows and may fall close to 800-1,000 Bcf by the end of March.

If the U.S. shale gas industry unable to keep production at current rates, we may see a whole different Natural Gas Market by the end of the year.

steve

FWIIW

The 4 counties with the biggest production, Dunn, McKenzie, Mountrail and Williams had the following changes in wells producing and wells capable of producing from November to December -13.

Wells producing: A decrease of 22 to a total of 6.730 wells.

Wells capable of producing: An increase of 111 wells to a total of 7.432.

(Total well completions during December was 119 according to Directors cut.)

Production from Bakken/Three Forks was reported from 6.824 wells, an increase of 40 from November to December.

With 40 new wells adding about 16000 barrels per day and Bakken production declining 48 kb/d, this indicates a legacy decline of about 64 kb/d for Dec, which if correct would suggest 160 new wells would be needed each month just to keep production flat. This assumes first month production of 400 barrels per month.

Dennis, a lot of the decline could well have been trucks simply not being able to empty the tanks because of bad road conditions. The pumps wold cut off when the tanks were full. We will need several months of good weather production before we can make any definite predictions here.

I wonder if bad road conditions are really the main factor for the decline? Cold winter temperatures would have kept the roads frozen solid, which should have been great for moving heavy trucks.

Heavy snow fall or wind driven snow could of course make it impossible for the trucks to reach the storage tanks. But with all that money (oil) sitting in the tanks, what about just plowing the roads? Or maybe there’s shortage of snow plows or diesel (EROEI at work).

Or maybe the oil becomes too thick and can’t be pumped out of the tanks?

Ron,

I agree, up to a point. The comparison should probably be made with other severe winter months in the past. I would think that the poor weather would mostly effect fracking operations and that’s why only 40 new wells were added to production (actually producing wells). Generally the cold temperatures have little effect on plowing roads and I am not from North Dakota, but in Maine we are pretty good at clearing snow from the roads, I would think they would be even more adept in North Dakota.

To me the idea that trucks would not be able to move on the roads in North Dakota in winter for any extended period sounds pretty ridiculous. It would be interesting to hear from folks who live in the upper plains states (Minnesota, North Dakota, South Dakota and Wisconsin) to see if the winter has been so severe that they have not been able to clear the roads of snow.

At 900K bpd, it only takes a day . . . or half a day . . . or 1/4 day, or maybe an hour or two arriving late to see choppage from trucks not going places easily.

Wow, I just shocked myself. 900K bpd. Trucks carry typically 220 barrels. The trip to a pipeline node or railhead may be 15 miles. (just researched that 220 number here:

http://www.petroleumnews.com/pntruncate/476508249.shtml

900K /220 = 4090 truck trips of avg 15 miles (each way) per day.

A 4 county fleet of 200 trucks would still be making 20 trips a day, each way (20 round trips, 40 segments). 40 X 20 mins = 800 minutes about 13 hour days. Maybe more than 200 trucks are running.

Point being, it really doesn’t take many hours of snowplow waiting to stop the flow.

This from the link:

True explained that in order to get one well into production approximately 2,000 to 2,200 truckloads are needed to the well site in the first year for everything from rig components and water tanks coming to the site, to crude oil leaving the site.

Of that estimated 2,000 to 2,200 truckloads in the first year of operation, True said 37 percent would be for transporting crude oil out.

It’s a big drop agreed. That said, there have been drops in the winter in previous years (look at the graph). Are there any indications that the drop was related to downspacing, running out of sweet spots, etc. rather than weather?

(Not arguing, just curious if there are any other metrics.) I guess if number of wells producing tracks with the drop (it actually dropped) than that would argue it was weather. On the other hand if 90-day IPs from summer 2013 were lower than 90-day IPs from summer 2012, that would argue “running out of sweet spots, downspacing less beneficial, etc.”

When the weather clears, you get a double whammy plus. The trucks can come empty your tank, take it to the railhead and then go back to your well to get today’s 400 barrels worth. Meaning, you can have the trucks make more trips, and have more trucks even for that post snow surge.

Also, with the big increase in wells awaiting completion, you get a surge there, too. The trucks may have shorter distances to travel between wells because there are more of them awaiting completion. Hmm, I’m gonna withdraw that. It takes too long to complete a well for the issue of distance to matter. That might chop an hour or two off travel time to the next well, but if they take multiple days to complete that new well that travel time becomes insignif.

So the post snow surge would seem to be the extra trips hauling oil, not proppant.

I had the impression that they can drill (or even produce), but that the real hard thing in cold weather is fracking because of the water freezing. So, would think that there will be a backlog of drilled, but unfracked wells.

I don’t know if the backlog will lead to more efficient truck trips or the opposite (congestion). Also, how easy it is to add/reduce trucks.

I have never worked a job as big as major oil play and never been around an oil field at all but I have done a little trucking being a rolling stone type and I know some life long truckers and a little bit about how the business works.

In or near a major city in normal times if you want to hire a hundred trucks for a month you run an ad or two in the trade papers and make a call or two to some brokers and you can have your trucks and drivers in short order, maybe in as little as a day or two.

(All the trucking I ever did after learning on the farm as a kid was that sort–short term very long hours big paycheck but no long term obligation. This used to be a super backup way of making a living in case of a layoff or making ends meet if you had a bad year on the farm. A conventional career is the last thing I ever wanted.If I were young and footloose I would spend a year or two in a hot oil play knowing what I know now about the possibilities of making some money in a hurry.)

But a job in the boonies that is not going to last is a different matter altogether especially in a place so waaay out there as North Dakota where there is a known shortage of hotel rooms and so forth.

I doubt it is possible to get many new faces and trucks up there for just a month or two of work given the conditions.

For hire companies won’t give up existing customers for such short term work. The drivers will go if they have to but they will quit at the first opportunity if they are uprooted and sent to such an undesirable location and their employers are altogether aware of this.

It only takes couple of months from scratch to train a novice driver but drivers who are dependable over the long term are in very short supply and replacing them is hard to impossible except by poaching and paying more.

Trucking sucks as lifestyle unless you run local or unless you have no life as such and just love to ride and hardly anybody sticks with over the road trucking any longer than it takes to find another decent paycheck.The usual desired career move is to a local company running local deliveries and thus home most nights.

Independents who aren’t broke and one step in front of the bank’s repo man aren’t much interested in North Dakota winters and the problems associated with them such as getting snowed in and not getting paid for a month.

Momma gets lonely after about a week or ten days,Daddy likewise.North Dakota is a looong way from home from almost anywhere .

And there aren’t many paying loads to and from the home turf to cover the trip there and back. The oil goes to a rail siding somewhere not too far from the wells and the materials needed in the field likewise go by rail except for the last few hundred miles if there is no more rail because that’s the way it always works hauling sand and steel and other such stuff in quantity over the long term.

So far as equipment goes there probably aren’t more than a handful of tank trailers around anyway that are suitable for hauling crude that aren’t already in the oil fields and spoke for. People don’t often buy such expensive equipment unless they have steady work lined up in advance.

Catching up after the cold weather breaks won’t take very long maybe a month or two at the most for a wild axx guess.

So they will probably have to just get by mainly with the trucks and drivers already on hand.

Counting trucks might be a really good way sure enough to understand precisely why and how production fluctuates in oil plays where the winters are rough enough to close the roads.

Now as to whether such fine grained knowledge is useful I have no real idea but it might be useful to somebody speculating in oil.

Watche, the trucks don’t empty the tanks and take it to the rail head. What they collect from the tanks has an awful lot of water mixed with the oil. The water must be removed before they take it to the rail head.

Anyway, go here: Bakken-Three Forks Oil Play Then click on “ND drilling permits issued week ending February 14 » That will take you here: Week 7: February 10-14

And here you will find the number of producing wells completed. I guess dry holes are not listed. Anyway they give you the oil production and water production for the first 24 hours of operation, not the first month’s production which would be a whole lot less. Anyway as you can see from my copy and paste below, a lot of wells produce more water than oil, others more oil.

But I could not help but notice there were only 16 wells completed this past week. That is the lowest number I can remember since I have been following this blog.

Just saying…

Producing wells completed

McKenzie ~ #23927 – True Oil LLC, Liberty Federal 13-36 36-31H Tf1, NWSW 36-148N-101W, 558 bopd, 1641 bwpd – Bakken

McKenzie ~ McKenzie ~ #25891 – Burlington Resources Oil & Gas Co. LP, Blue Ridge 44-31Mbh, SESE 31-153N-95W, 2805 bopd, 204 bwpd – Bakken/Three Forks

McKenzie ~ McKenzie ~ #25962 – Burlington Resources Oil & Gas Co. LP, Archer 34-25Tfh, SESE 25-153N-95W, 2592 bopd, 816 bwpd – Bakken

McKenzie ~ #25679 – Burlington Resources Oil & Gas Co. LP, Washburn 41-36Mbh, NENE 36-153N-95W, 2800 bopd, 287 bwpd – Bakken

McKenzie ~ #25680 – Burlington Resources Oil & Gas Co. LP, Washburn 42-36Tfh, SENE 36-153N-95W, 2544 bopd, 198 bwpd – Bakken

McKenzie ~ #25665 – Burlington Resources Oil & Gas Co. LP, Washburn 44-36Tfh, SESE 36-153N-95W, 2952 bopd, 134 bwpd – Bakken

McKenzie ~ #25960 – Burlington Resources Oil & Gas Co. LP, Archer 44-25Tfh, SESE 25-153N-95W, 2312 bopd, 193 bwpd – Bakken

McKenzie ~ #25678 – Burlington Resources Oil & Gas Co. LP, Washburn 41-36Tfh, NENE 36-153N-95W, 2976 bopd, 103 bwpd – Bakken

McKenzie ~ #26202 – True Oil LLC, True Federal 33-35 2-11Mb1, NWSE 35-148N-101W, 665 bopd, 587 bwpd – Bakken

Williams ~ McKenzie ~ #24634 – Statoil Oil & Gas LP, Blanche 27-22 #7H, NENE 34-154N-102W, 2533 bopd, 6295 bwpd – Bakken

Williams ~ #23746 – Statoil Oil & Gas LP, Mark 4-9 2Tfh, Lot 1 4-154N-100W, 2145 bopd, 4420 bwpd – Bakken

McKenzie ~ #25551 – XTO Energy Inc., Marlene 42X-20H, SENE 20-150N-95W, 4434 bopd, 1165 bwpd – Bakken

Mountrail ~ #25548 – Hess Bakken Investments II, LLC, En-Ruud 154-93-2734H-2, SWSE 22-154N-93W, 554 bopd, 440 bwpd – Bakken

Dunn ~ #24835 – Continental Resources, Inc., Bice Federal 3-32H, SESW 32-146N-95W, 1473 bopd, 887 bwpd – Bakken

Mountrail ~ #25425 – Hess Bakken Investments II, LLC, En-Nelson 155-94-3328H-2, SESW 33-155N-94W, 879 bopd, 520 bwpd – Bakken

Mountrail ~ #26215 – Whiting Oil & Gas Corp., Uran 21-24Tfh, NENW 24-153N-92W, 1280 bopd, 1579 bwpd – Bakken

Good find. No idea where the separator is. I vaguely recall pictures of hoses in the Marcellus labeled water heading into the ground. Doubt they just seperate the water and spray it on the surface.

But . . . if the separator is at the well pad, maybe the tank gets only oil and the truck only carries oil. If the separator is at the railhead . . . then you’re carrying a lot of water and burning diesel to do it. Hmm, would be nice to hear from someone who knows where the gizmo Ron has found is located.

I don’t know how the water is separated from the oil but simply allowing the crude to stand in a tank sounds pretty likely the cheapest and easiest way. A big centrifuge would work too and a lot faster.

In any case water freezes very quickly at sub zero Fahrenheit temperatures and even quicker if the tank is sitting out on an open field exposed to high winds.

Does any body know how much insulation if any is used on the storage tanks?

It is my understanding that crude is fairly hot when it comes up the well bore but at subzero F. temperatures the water in it would still freeze pretty quick.

But then maybe that water has a lot of minerals in it. Brine can have a very low freezing point, down close to zero F I think but not sure .

I think it would take a couple of weeks at least for a solidly frozen large tank to thaw out ambient temperatures only a little above freezing.

And sky daddy alone knows how many mechanics it takes and how long to fix the busted pipes and valves if they are not properly drained or kept ice free thru maintaining a steady flow of warm water and oil.

Well, hell, this is good reason to shut down wells in the cold even before the onsite tank fills. Of course hmmm it would happen regardless of snow. All it would need is cold.

I found this short video on the web. It looks like there is a separator right at the wellhead.

Oil Production Numbers Decrease

I just spent a couple of hours looking for good pics and video and there is not much to be found that actually shows close up detail of wells and other infrastructure.

This link has some good pics but only one or two of any given site and next to nothing in the line of useful commentary.

But it is the best I found.

There are few mind boggling facts included such as the fact that one well involves over 1200 trips by a ten wheeler or larger truck.

http://www.ndoil.org/image/cache/Bakken_Basics_-_Helms_and_Dokkens.pdf

Another good find. That gizmo will freeze. **ANOTHER** reason to shut down.

Mac, for your information, I’ve modified and simplified this using my Oil and Gas Production Handbook as a guide.

…Once a gas/oil well has been verified commercially viable the well must be “completed”. This includes strengthening the well hole with casing, evaluating the pressure and temperature of the formation, and then installing the equipment to ensure an efficient flow out of the well. Flow is controlled with a choke.

Individual well streams are typically fed into facilities over a network of gathering pipes and manifold systems to allow a set up of production “well sets” for optimal production levels. Reservoir utilization, well flow composition (gas, oil, waster) etc. can be selected from the available wells. It is common to meter individual lines into the manifold. For heavy crude and in arctic areas, diluents and heating are frequently needed to reduce viscosity; sometimes pure gas production can be taken directly to gas treatment and/or compression. More often, the well gives a combination of gas, oil and water (and various contaminants) which must be separated and processed. Separators come in many forms and designs, the classical variant being the gravity separator. These are reliable under essentially all weather/temperature conditions!

In gravity separation well flow is fed into a horizontal vessel; the retention period is just a few minutes, allowing gas to bubble out, water to settle at the bottom and oil to be taken out from the middle. Pressure is often reduced in stages (high pressure separator, low pressure separator etc.) to allow controlled separation of volatile components. If you really want to see what these things look like check out: “well head water–oil separation” on the web…

Thanks Doug,

I will hazard a guess that since the crude passes thru a horizontal separator in a very short time there is a still a significant a mount of water mixed with the oil maybe one or two percent but not enough to be a real problem and that this residual water is removed at the refinery.

Of course with as much money on the line as is involved with a producing oil well it makes sense that there would be heaters installed to protect the any exposed pipes and so forth and that these heaters would take care of business so long as they do not fail during a period when the well is temporarily shut down for some reason such as extremely bad weather.

Given that most or a lot of these wells are out in the boonies I suppose they are powered up by an on site diesel generator and that the necessary heat is provided by burning either some diesel or maybe some of the gas produced by the well.

So-so long as the heater system stays up the well and all the pipes and plumbing will be safe from freezing up.But if that generator goes down in a blizzard……

What happens if for some reason a the flow thru a pipeline is interrupted during extremely cold weather? Nothing too serious in the Bakken probably because Bakken crude is very light and probably will not become so viscous that it can’t be pumped once the problem is fixed.

When the crude is heavy is enough diluent added that it can be pumped if it cools to ambient temperatures which may be well below zero F?

I can easily imagine a crude pipeline that for all practical purposes is full of cement at twenty below and having to wait until summer to get the crude flowing again.

Mac,

I’m not suggesting the concerns you bring up do not occur. After all: “The best-laid schemes o’ mice an’ men…”. But, around the world, oil production comes from thousands of operations in every environment imaginable; it’s an enormously mature business.

If you’re looking for issues likely to cause problems in a place like North Dakota I expect they would more likely revolve around things the engineers have least control over such as moving heavy products and materials on iffy rural roads, rail-head delays, Mother Nature, that kind of stuff.

Thanks Doug

Now I have one more question –how about the trucks themselves?

A truck loaded with water in an uninsulated metal tank would freeze in only a few hours max at below zero fahrenheit and one loaded with crude would chill out to the point it would be hard to unload it in a few hours unless the tanks are well insulated.

I presume they are indeed insulated but I can’t tell from such pics as I have seen.

Anyone know why the blowout preventer failed on that one well that was in the news. Was there improper operations or assembly or a material failure? Weather a contributing factor?

I don’t think the BOP failed, I believe they diverted.

When a formation is too shallow, that if the BOP is shut in it would fracture the formation, the proper procedure is to divert. Usually they bridge over and seal themselves off in short period of time.

Rockman on Peakoil.com covered it pretty well

http://peakoil.com/forums/viewtopic.php?f=7&t=69211

On Energy Matters: my fairly neutral take on prospects for UK shale gas….

UK Shale Gas Potential and Perspectives

The Kopits video would be good to discuss in a separate post (very different content than a one month Bakken report).

On that, (admitting that I skimmed the ppt and did not listen to more than first 5 minutes of video) I don’t like the either/or of predicting based on supply or demand. Freshman econ tells us that both supply and demand curves determine the price/volume (by their intersection). Considering time changes in demand (recession, growth, regulations driving switching, etc.) as well as time changes in supply (depletion, new finds) makes more sense. Also, it is much more interesting to graph the curves and to have some understanding of what are the different segments of supply and demand. how big are they and what is the cost (supply) or willingness to pay (demand).

This is of course, not exact, just like an NPV is not exact. But it’s the right way to think about the problem (and is not some geeky thing…have seen it done in lots of commodity industries, paper, chemicals, etc.)

Personally, I am well on my way to ignoring things economic in the world of oil — primarily because of money printing. If, as the cratering of steep output declines unfold, a President and Congress got together and see the price rising — and talk to the industry who informs them that drilling for smaller bubbles of porosity requires that price — and declare that the Federal govt will subsidize production. They will borrow the money to do so via deficit and the lender for that borrowing will be the Federal Reserve.

And thus money becomes meaningless in this, and all things. Track the joules to get it out of the ground. That’s the only thing that can’t be declared this number or that.

“On that, (admitting that I skimmed the ppt and did not listen to more than first 5 minutes of video) I don’t like the either/or of predicting based on supply or demand.”

You skimmed the Power Point and listened to 5 minutes of the one hour presentation. And yet you criticize it because you think it was “either-or”. Just how would you know that? However I can understand why you got that impression from just the first five minutes. BP and the EIA clearly, in their presentations, imply that it is all about demand. Therefore you just assumed that Kopits takes the opposite position, that it’s all about supply. He does not.

They, BP and the EIA, say it is all demand and whatever the world demands the world’s oil producers will deliver. And what non-OPEC cannot deliver, they say, a “call on OPEC” will bring about the necessary oil. or the necessary cuts if there is too much oil.

Kopits, on the other hand, argues that the world is producing every barrel it can at the current world price.

But the presentation is a whole lot more than that. It is about what is going on in the world and why. I have watched the presentation twice and will watch it again. It is a lot to digest and I need to watch it more than once to take it all in.

It could make up a post, using several slides from the PPT. Don’t know, I may do that later.

I looked through the ppt a little more. It’s a bit better than what I said, but I still would like to see crossed supply and demand curves.

I tend to agree with him that OPEC is not dictating price (by withholding production) and that we essentially have a free competition price.

Intrinsically depletion drives supply curves to the left (higher costs, since cheaper stuff exhausted first). Knowledge drives them to the right. The question is which factor wins. Right now, one could argue the futures market is pricing in a little bit of supply increase (since future prices are lower than current).

I would like to see a little more demand analysis. He has a cost curve. Why not a demand curve?

There’s other stuff, if we want to really discuss it.

Maybe there was no man on the grassy knoll. Price just ended up where it did and tight oil development was a response.

“I would like to see a little more demand analysis. He has a cost curve. Why not a demand curve?”

Nony, you are now the one who is forgetting Economy 101. Demand equals supply as arbitrated by price. So I will give you what the EIA, in 2005 thought demand would be. The EIA, in 2005, looked at past demand and saw it had been rising at about 2% per year. So they assumed that demand would continue to increase at 2% per year. The chart here is their demand curve:

The problem was, of course, that supply did not cooperate. Plot a supply curve, or what you think the future supply will look like, and you will have your demand curve.

A demand curve is volume versus price, not volume versus time.

Then a supply curve would be supply versus price because supply always equals demand. Of course the price will always determine supply within what is possible to produce and within what consumers are willing to pay.

There are several demand curves in the Kopits Power Point and they are all plotted over time. Page 21,23 and 24 are three of them.

Not “would be”, but IS. A supply curve shows how much volume is supplied at each price. Page 47 is an example.

A demand curve shows how much volume is bought at each price. Those pages in the presentation are not demand curves. I just went and looked at them.

The intersection defines the price-volume of the market. Changes to either curve will generate a new intersection. This really is Econ 101.

https://en.wikipedia.org/wiki/Supply_demand_curve

The key problem with Econ 101 is that it does not consider physical limits. This is why you sometimes hear economist say that there are no limits to growth. The assumption is that physical laws are subsets of economic laws, which in turn leads to the belief that human ingenuity can overcome physical laws and that economic growth can continue indefinitely.

My believe that the economists have got it backwards, i.e., that economic laws are subsets of physical laws , not the other way around.

Econ 101 is well able to handle physical limits. Realize we are talking about microeconomics, not macro. It’s a very, very basic framework: the supply and demand curves. For instance, you can still make a very doomer forecast and look at supply and demand. the most obvious insight is that depletion drives exhaustion of cheap oil (shifting the supply curve “up” or “to the left”.

http://3.bp.blogspot.com/-8hH95QJAWhQ/ToE-gASq8yI/AAAAAAAAAOQ/LO_UWdUU_Vo/s1600/coffee%2Bmarket%2Ba.png

So what justification do economist use when they say that the word economy can grow forever? Are they talking about colonizing space?

1. You’re putting words in people’s mouths, frug. Who are “economists” and how can you speak for them?

2. Also confusing micro versus macro. How can we discuss the relation of micro to macro (e.g. Koppits remarks about oil as a factor of GDP) when you don’t even understand basic micro itself?

Here’s a couple of examples infinite growth proponents:

http://www.progressive-economics.ca/2008/04/03/is-infinite-economic-growth-possible/

http://andrewleach.ca/uncategorized/finite-resources-and-infinite-growth/

And what’s the fundamental difference between micro and macro economics.

like this…?

http://www.freeimagehosting.net/newuploads/g94yk.jpg

Here is the 2002 to 2012 annual Brent crude oil price, as the GNE/CNI Ratio* fell from about 12 to 5, or as China and India’s net imports, as a percentage of Global Net Exports of oil, rose from about 8% to 20%. The volume of GNE available to importers other than China & India fell from 40 mbpd in 2005 to 35 mbpd in 2012.

*GNE/CNI = Global Net Exports of oil divided Chindia’s Net Imports (Top 33 net exporters in 2005, EIA data, Total petroleum liquids + other liquids)

I agree, the Kopits presentation was very worthwhile watching for any energy geek. (I realize this is not a fascination everyone shares.) He said stuff that bloggers and TODers have been whispering around the edges for years. In so many words he basically summed up Jeffrey Brown’s net export land model (China is mining for oil in OECD dropping consumer consumption) and Steve from Virginia’s triangle of doom (the cost of producing a marginal barrel of oil is very close to more than the marginal consumer is willing to pay, limiting prices increases and eventually shutting in production.) And the info about the falling capex of the majors and that they’re selling assets in order to fund dividends was eye-opening, at least to me.

Of course the marginal barrel supplied matches the marginal barrel bought. That’s the basic definition of the intersection of supply and demand curves! Econ 101.

The one chart I saw for the “triangle of doom” was pretty goofy.

http://www.economic-undertow.com/wp-content/uploads/2013/12/Triangle-of-Doom-1201131.png

Showed someone drawing up and down lines off of stochastic variations of price versus time (like some sort of candlestick-loving technical analyst). These are NOT supply and demand curves. They’re not volume versus price. For that matter, they’re just arbitrary lines on a price versus time chart. I could make them slant the other way. And then the left part of the “triangle” is just the end of the chart (completely arbitrary). The whole thing is silly. If you really believe in the “triangle of doom”, then you believe oil prices will have no volatility in the future. However, the markets (puts and calls) show future price is uncertain.

http://www.eia.gov/forecasts/steo/images/Fig1.png

Of course supply in the end supply always magically meets demand through price (or shortages!) and we can graph that out quite nicely. But this concept is not about supply matching demand, but rather about the point at which the cost of production exceeds the marginal utility to the consumer in the context of our current oil-based cultural norms and infrastructure. It is at that point we will see demand destruct and supply shut in at ever-increasing rates as the cheap oil is pumped and gone for ever, leaving only the more and more expensive stuff that fewer and fewer can afford to use. Companies will not produce oil that costs them $110/barrel if they can only sell it at $105. And if the next year the consumer can only afford $103/barrel, then even more oil gets shut in.

Whether marginal production costs have to get to $105, $110 or even $118 before the self-reinforcing demand-destruction/supply-shut-in cycle occurs is up for grabs, but given the resistance to oil price increases the last year, I don’t see how it goes much above $120. In any event, we are close, perhaps within a year of it. The only way to escape the cycle is for the world consumer to become wealthier and able to afford more expensive oil even in the face of declining oil use. Otherwise, once the resistance point is reached, the supply of oil must necessarily decline. (And this is not even taking into account net export math, increasing oil consumption in emerging economies, political instability of oil producing regions, etc.)

In theory higher prices can be supported by lower volumes used more efficiently (increasing the marginal utility of the oil consumed), but since in reality the US has a lot of oil-based fat, so to speak, our wasteful uses of oil will be burned off at rates that will counteract the upward price support of efficiency for quite a while. We are seeing and will continue to see demand destruction via substitutions such as public transit, young people ceasing to get driver’s licenses, telecommuting, people choosing to walk or live closer to jobs, goods and services, or–what I think is the next wave–people just becoming poorer in real terms and having to make do anyway they can.

So what will necessarily happen as demand destruction sets in is both our societal hardware and software (physical infrastructure and way of life) will adapt and change. This is an issue that goes far beyond the basic supply and demand curve for, say, a pair of shoes. How painful this transition will turn out to be will be based largely (in my opinion) on how tightly we cling to an infrastructure and way of life clearly unsuited to the future we face. (I realize many peak oil observers believe no transition is possible at all. I am not quite that big a doomer.)

Since in the US we arguably waste a good half of the oil we consume (via remarkably heavy cars, long commutes, poor driving habits, etc) because we still live within a physical infrastructure and under cultural norms that were developed when oil was $20/barrel (or less), perhaps we will have to wait and see what happens after half of our demand has dropped in order to figure out what the marginal barrel of oil is truly worth to us. After all, European countries where gasoline is three times the price of the US still do somehow afford to buy some oil.

Karen I couldn’t agree more.

“…in the US we arguably waste a good half of the oil we consume (via remarkably heavy cars, long commutes, poor driving habits, etc) because we still live within a physical infrastructure and under cultural norms that were developed when oil was $20/barrel (or less)”

And my intuition matches yours about demand elasticity [usually held to be zero for oil]: I believe the US [and similar anglophone western economies like Australasia] can and will learn to function on roughly half the oil it has been consuming this last decade. But will only get there because it will have no choice. Rationing by price.

The question is how this will unravel, Some like Gregor MacDonald argue that oil will begin another repricing [he is calling beginning Q4 14] which will really begin to force the destruction of low value demand.

This surely has the possibility to lead to the return of volatility to oil markets as price rises causing -> demand collapse -> price collapse -> and so on. Perhaps like 2008?

Places and economies that are already better suited to lower oil use or that have used the last six years to repurpose as much of their fixed infrastructure to lower oil dependency will survive this better. And not just survive it but will attract more investment and are likely to thrive if not boom.

This is exactly Survival of the Fittest. A phrase that has been commonly misunderstood ever since Darwin [especially by people in nations with large militaries]. It properly means survival of the organism that has the best ‘fit’ to its niche, not of the strongest; fittest in that sense. The US is clearly the fittest in the second sense, and parts of it are fairly fit in the more important first sense, but it also has great swathes that really do/will not fit the new economic environment, [as do the mini-me economies of Canada and Australasia]. These places and ways of living and working will change. Under duress.

We all need Canadian levels [at least!] of Transit service, and will really want European ones next.

Just ride the bus. I always laugh at all the yuppies who want to blather about how the USA doesn’t live up toe Europe and we should have more trains. But ride the bus? Sorry…that’s too ghetto for the average white liberal.

No Nony not ‘just ride the bus’ you currently have, you are going to have to actually build and run real Transit services that currently are absent form most US metros, and while you are being priced out of your SUVs. Gonna regret leaving it so late. At least even LA has started. And baby streps in DFW! Portland and SF will continue to do well, Vancouver even better.

Boomers of course have a snobbery issue with sharing space while moving [except in airplanes!], luckily their children mostly don’t. Amazing though how things can change… necessity the mother etc

A bunch of really autodependent places will just be abandoned. We saw this begin on the edges of hyper sprawled metros in the subprime crash.

Or what’s your picture of the US on 10 mmbpd?

Hi Nony,

Ride the bus is a good idea. In a city, there is generally a congestion problem that light rail would avoid. Also as oil prices rise, which economics suggests will happen as most economists recognize that technological innovation is subject to physical laws so that real oil prices will eventually rise. At that point the bus becomes more expensive. It is possible in cities to run overhead electic cables for the buses to get around that problem, and one could argue that high oil prices may reduce congestion in metropolitan areas, but dedicated tracks, (or roadways) for public transit makes for shorter trips (in time for a given distance) and thus higher utility for consumers of public transportation.

I do agree with ride the bus. Eventually oil prices will rise enough that citizens will demand spending on public transit by their elected representatives. Prices need to rise, and I hope that they will, the sooner the better so we start making the necessary transition sooner rather than later.

Thanks Karen, those are my sentiments exactly. This video was perhaps the most informative I have ever seen. He puts it in clear and concise terms that anyone can understand. And that is very important.

Ron-

What video?

I can’t find it in the thread.

Dave

http://energypolicy.columbia.edu/events-calendar/global-oil-market-forecasting-main-approaches-key-drivers

Thanks

Here is the video by itself:

http://youtu.be/dLCsMRr7hAg

There is an article in New Scientist about the possibility of the underground coal gasification industry taking off in a very big way in the near future but it is behind a paywall.

I have read it and it is hair-raising in terms of the warming potential but on the other hand in also promises to provide cheap energy for most of the world almost indefinitely given the size of the deeply buried coal deposits.

Every body who can should read it. This highly reputable magazine is available in most larger libraries and bookstores.

Hey just wanted to add that I thought that Kopits’ talk was superb – I also think it is worth a seperate discussion thread. I was aware of the individual components of his thesis but he put the whole thing together very well – there are a lot of very data rich slides there and I have watched it twice to make sure I followed everything. His last section on the oil majors was particularly excellent – they are in effect cannibalising themselves to maintain dividend payments. Clearly that cannot go on for very long. The way they are slashing capex has clear implications in terms of future falling production. If they could not maintain production by throwing massive amounts of capex at the problem in the past 8 years, then clearly their production must fall (even faster) now their capex budgets are shrinking. How will this ‘missing’ oil be replaced?

There’s a lot of tantalizing discussion this evening of this Kopit presentation but no link to it that I see although I do have some problems with the old peepers these days.

Please somebody post a link to it and as usual thanks in advance.

http://energypolicy.columbia.edu/events-calendar/global-oil-market-forecasting-main-approaches-key-drivers

Oh btw, in the category of Mr. Obvious . . . that water separation at the well before shipping the oil (only) . . . there’s no water disposal problem, of course. Now that we have a bunch of water sitting there, guess what we use it for.

Fracking the next well on that pad, of course.

Oops. I’m told this doesn’t work. That water may not be adequately fresh. It’s a big issue in proposals for the California Monterrey. They are out of fresh water and suggestions of using sea water for fracking have yielded statements that sea water wont’ mix with the fracking material somehow. Gotta be fresh.

http://www.latimes.com/nation/la-na-texas-oil-boom-20140216,0,7621618.story?page=2#axzz2tS8OpE4x

Funny how these articles always mention fracking / horizontal drilling as the main driver (and saviour) and forget all about the oil price 🙂

Price was important…but the ability of American production to generate an extra 3 million bpd, rapidly, was much more of a cornie attitude, not a doomer one. Show me the chart where you TOD doomsters were adding 3 million bpd of American production as part of a natural price response. None of you people predicted it…and you shaded your predictions low on the Bakken as it was going up.

“Show me the chart where you TOD doomsters were adding 3 million bpd of American production as part of a natural price response. “

What the hell are you talking about? With all that added American oil the bottom should have dropped out of the price of oil. It did not. Brent is $109 and WTI is at $100.80 this morning.

You cornucopians were all predicting a steep price drop as a American oil flooded the market. And you are still predicting a big glut:

Automakers, Motorists Seek Benefits of U.S. Oil Glut

The U.S. Energy Information Administration says the average price for a gallon of regular unleaded gasoline should decline steadily for the next two years.

Just a glut of oil flooding the market. Oil prices plunge as a result of glut? Show me that chart!

We’re obviously in neither a cornie 20/bbl wet dream nor a Simmons 500/bbl nightmare.

Point remains that flexibility of American production to add 3 MM bpd was NOT in any TOD charts. If everything was so well known, why was it not shown?

Give me 3 MM bpd MORE and we WILL crater the freaking price. Drill, baby, drill.

Bottom line:

My point is not to say “cornie is right, doomer is wrong”. Since obviously, both y’all were wrong. 🙂

And I really do have a point with saying that TOD had a buttload of predictions with increasing price in mid-2000s…and none showed the 3 MM bpd US response. Maybe they showed the sands growing a bit. But they didn’t show the dramatic EF and Bakken development. So it is a little rich to say “we knew it was coming”. Why not SHOW it then?

And yes, I completely GET that tight oil is incapable of taking the price of oil sub-50 since it’s not profitable to make it there. How often do I have to kill this strawman? The point of the TO is stopping oil from being 150. 100 is still better than 150.

“And I really do have a point with saying that TOD had a buttload of predictions with increasing price in mid-2000s…and none showed the 3 MM bpd US response.”

No you have no point at all. For starters this is not TOD. And second TOD was a whole lot of people including a few cornucopians. Different people made different kinds of predictions. There was no “TOD” predictions because there was no TOD organization that made any predictions whatsoever.

You are really scraping the bottom of the barrel when you criticize someone for not predicting some event in the future. A whole things will happen later this year and next year and the next. Should I predict them? How about you, can you do that? Do you know anyone who can?

I have never quite understood the terminology re “doomer”.

If you’re not on the receiving end of the nuclear attack to suppress consumption, then why is it doom? It’s doom for the enemy, not you.

Hi Nony,

I used to comment at the Oil Drum and you are correct that as the Bakken initially ramped up in 2008 to 2010 I was skeptical about the more enthusiastic projections. Rune Likvern’s famous Red Queen post ( http://www.theoildrum.com/node/9506 ) got me thinking about the Bakken and Eagle Ford and I commented about it on Oct 6, 2012

http://peakoilbarrel.com/bakken-update-big-drop-december/comment-page-1/#comments

and see chart below.

Granted this was 4 years too late, note the following from The EIA’s AEO 2009: “Total onshore production of crude oil increases from 2.9 million barrels per day in 2007 to 4.1 million barrels per day in 2030 (Figure 70).”

In fact by 2013 only 80 kb/d of extra onshore US Production was expected by the EIA (in early 2009). I do agree there were many overly pessimistic projections at the Oil Drum, my guess for the end of 2013 was about 860 kb/d. I made an incorrect assumption that well productivity (EUR) would decrease starting in Jan 2013, which has proven incorrect.

I agree that so far the doomers and cornucopians have both been incorrect. See my original blog post in Oct 2012

http://oilpeakclimate.blogspot.com/2012/10/using-dispersive-diffusion-model-for.html

Hi Nony,

”Give me 3 MM bpd MORE and we WILL crater the freaking price. Drill, baby, drill.”

I can interpret this comment in different ways.

If you mean three more million barrels per day from the tight oil producers and the time frame is short enough, then you are probably right that oil prices would come down some, maybe a lot, at least for a little while.

But my seat of the pants estimate is that tight oil production is only going up fast enough to keep oil prices from going thru the roof and that by the time another three million barrels of additional tight oil can be brought to market depletion of old legacy fields will have resulted in that same three million vanishing so that the new tight oil will only maintain supply at best.

Given any improvement in the world economy , the price might actually go up substantially even with another three million daily barrels of tight oil.I am not a numbers guy but it is my understanding that even the tight oil optimists think it will take four or five years to increase their production by that much.

Personally I think Ron nailed it as far tight oil and prices are concerned for now at least.

I don’t know what he thinks the price of oil will be in a few years but my own opinion is that it will be up substantially in terms of constant money, probably ten to twenty bucks in constant money and perhaps as much as forty or even fifty bucks in nominal or inflated money.

OFM – First, I agree with your analysis here. But I hope you won’t take it as criticism if I use a part of your post to make a point. By ‘improvement’ in the economy, surely you meant growth, for that is the paradigm in which we live. Unfortunately, as far as the long term survival of our species and many others, we need anything but such improvement. Now, I’m with Ron & others who believe it is far too late to turn this juggernaut around such that a smaller population of humans could live in a sustainable fashion in some ecotechnic or permaculture future. So my point is academic at best. But in memory of Al Bartlett, and with reference to such alt. economists as Herman Daly, Robert Costanza, Charles Eisenstein, Steve Keen etc., it was at some point theoretically possible for us to get off the infinite growth jag, but we told ourselves stories to the contrary, so we didn’t, and now it doesn’t matter. But in any reasonably objective look at the situation, economic growth, such as we measure it by GDP, is not at this point improvement in any sense of the word.

I am with you all the way Clifman.

Growth may be possible for a little longer but we are in overshoot and a crash is inevitable. The question is when not if and how fast and how deep at any given place on the globe.

I used to think the whole global economy would collapse more or less silmantaneously but not any more.

That’s still possible.

But now I think it is more likely that the downside of the overshoot crash will play out very quickly in some places and that most or nearly all the people that live in those places will perish.

Most of the kids alive today in places such as the US and Canada imo have a pretty good shot at making it to the cemetery as the end result of old age but happy go lucky business as usual is a dead man walking. Times are going to be tough for almost everybody in a few more decades.

The Kopits video is brilliant. The killer chart was the one that showed, on a company by company basis, the oil price required to generate free cash flow. If that chart is accurate, almost every company on it is eating itself alive just to keep producing oil. And that explains the divestitures that are making headlines.

The price constraint is a fascinating concept and one has to wonder how firm that constraint will be. Clearly, investment in oil production is not going to continue as it has in the face of stagnant oil prices. Just as clearly, people are not going to stop using oil completely. As Kopits’ video shows, people have cut back on other things so that they can continue to drive. Eventually price has to go up. And if Kopits is right, it has to go up a lot to get companies to go after it. My guess is we are not far from that time.

Calhoun,

“price constraint is a fascinating concept and one has to wonder how firm that constraint will be”.

You mean, producers get harpooned if the price goes down (or stays the same) and the economy tanks if the price goes up (or stays the same).

So, what’s the problem?

You can never tell when politics may add or subtract a few barrels or maybe even half a million barrels a dy to the world oil supply.

I can see how the US has been able to strong arm most of the world into joining along with sanctions but when it suits the Russians and the Chinese to ignore them I think they will be able to do so with near impunity.

http://www.reuters.com/article/2014/02/17/us-russia-iran-oil-idUSBREA1G0DM20140217

This is puzzling because Russia is the world’s second largest exporter of oil. Do they want Iranian oil to resell on the world market?

Lots of nations are, right now, willing to buy Iranian oil but shippers will not haul it because they cannot get insurance. Sanctions would not work at all Western insurance companies were willing to insure the carriers. That is the hump they must get over before they an export oil.

Pretty sure I saw a recent report of Iran exporting oil to Russia. Russia took it via Iranian tanker? Regardless, they then resold it, took a cut, and passed the rest of the money to Iran.

The sanctions have always seemed to me porous. The Iranians have never seemed desperate.

I think that part of it is that what’s his name the Boss enjoys thumbing his nose at Uncle Sam.

But this would be a minor consideration, the icing on the cake so to speak.

In the never ending geopolitical power game Russia is making friends with long memories in a place where we have none— a place that will be critically important as oil supplies eventually shrink. The plateau cannot last too much longer, at least not in my opinion nor yours.

I am sure too that there is a good fat profit involved for the Russian businesses involved above and beyond what would normally be the case because so far as I have been able to determine Iran is selling or trading oil at a discount to the world market price in order to sell it at all.

Now Uncle Sam can buffalo Iran and most other countries due the being the ”more or less only” remaining superpower and controlling most of the international banking industry indirectly when it comes to preventing other countries from buying and paying for Iranian oil.

But I think Russia is in a position to do pretty much as she pleases in this situation.

I can’t see the Obama administration threatening Russia in any significant way– nor any other country being able to do so.

If he were to want to do so Putin is arguably powerful enough to cut off Russian oil exports for a while to any extent he pleases -for a little while at least.

He is probably even capable of ordering a few nukes dropped on American territory but I have my doubts as to whether his generals would actually obey such an order except in the throes of a truly desperate existential crisis.At any rate I don’t believe he is a mad man and only a mad man would even contemplate starting a nuclear war.

I am merely pointing out that nobody at all is in a position to push the Russians around. They have plenty and to spare of wherewithal to push back and the Russian leadership does not appear to be in the least testosterone deficient.

They don’t really need us nearly as much as we need them considering who imports oil to the tune of six (or seven???) million barrels a day. I don’t have a good memory for specific numbers that change frequently.

They do not depend on us for anything at all that really matters that I can think of right off the bat.

But they have us by the family jewels when it comes to our economy if they choose to squeeze.

This is one of those obvious truths that generally escape notice except by generals a and hopefully senior state department personnel.

I don’t like sanctions. Let the oil flow. Helps lower world price.

I actually think engagement with countries instead of isolating them tends to have a more liberalizing influence.

No, I do not want to bomb Iran.

Doesn’t it make more sense to bomb consumption nodes rather than production nodes?

Yes; Atlanta, Phoenix, and Houston. Wipeout the sprawliest most auto-dependent places and delay the oil crunch by decades…..

Well, that would certainly be China’s perspective. And from that perspective they’d be right. OTOH, Shanghai.

Reductio ad absurdum, Watcher.

I posted a link to an article in The Economist a few days back that goes into aspects of future oil supply problems in such a way that the way they avoid saying the dirty words ”peak oil ” is almost comical if one happens to be a peak oil believer.

Here’s another link that dances around the coming peak like an old time drunk cowboy in a western tv when the black hat is emptying his six shooter between his feet.

http://www.foxbusiness.com/industries/2014/02/17/global-oil-firms-seen-cutting-exploration-spending/

It is noteworthy that this is Faux news talking since they are one of the most ardent advocates of a cornucopian BAU future if only somebody will ” round up alla them there com’nist ‘vironment loonies” as a good neighbor of mine puts it and deport them all to Russia or Cuba or China , whichever country comes to his mind first.

I’m sure there are a lot of peak oil observers who will disagree with me but I think that the investment community is coming around faster than most of us anticipated it would although the process can only be said to be in the earliest stages for now.

But I think there will be lead articles in the business and investment sections of some major publications within the next two or three years —articles that focus seriously on peak oil rather than ridicule the concept.

Of course the vested interests that control the mass media for the most part will do all they can to keep the world ignorant and happy in the interest of short term profits even as they reposition themselves to take advantage of the new reality as best they can.

Those who deny the science of global warming are able to get away with their propaganda to a very large extent because warming is a slow process in terms of the day to life affairs of industrial man.

But if peak oil hits with a vengeance and the supply declines sharply within a short period of time such as two to five years there will be no way to keep the people of the world from knowing that something is very ,very wrong.

Scapegoats will be looked for , and found and in most cases they will be completely innocent of course.

Things are apt to get interesting indeed once we fall of the current production plateau.

It is probably possible to eek out a little very slow growth with a steady supply of oil due to increasing energy efficiency and a few more card tricks on the part of the central banks.

But growth or even stasis in the face of an oil supply that is declining at even one or two percent annually is almost for sure an impossibility.

The economy just won’t be able to adapt that fast.

I don’t think things will go all the way to hell in a hand basket in the US and other rich countries still well endowed with natural resources but the downside still looks very bad indeed.VERY BAD!

Millions of people in the US are dependent on jobs that are in turn dependent on cheap and dependable supplies of oil as Ron has pointed out often and the loss of those jobs will bring the economy to it’s knees.

From your link:

Global oil firms, hit by one of the worst years for discovery in two decades, are about to cut exploration spending, pulling back from frontier areas and jeopardising their future reserves, industry insiders say.

They looked, they didn’t find anything, so now they are just going to stop looking. Is that something we might expect if peak oil is upon us?

Just asking.

Yes.

”Just asking” sort of implies that I can answer yes or no but I can’t do that without painting myself in a corner .

There is certainly a case to be made for saying yes with caveats or reservations attached.

I have been seeing short pieces in the press for some time now to the effect that this or the other oil company has been selling assets in order to maintain current profitability and or cash flow and to support current stock prices.

I have posted links to at least a few of them here.

This is the sort of corporate behavior often seen when a large corporation is in deep doo doo but the typical investor has not yet realized it.

Sometimes this works as a turn around strategy by putting the focus back on core businesses but the core business of an oil company is to produce oil and thus selling assets in the ground implies self cannibalization.

My layman’s opinion is that this practice stinks like last last weeks leftover bait when you consider it as a long term indicator of company health.

But it does enable top management to keep on being top management for some indefinite longer period than otherwise,maybe for years.

So -maybe the companies selling are ”back to the wall” in reality but hardly anybody and especially the average uninformed investor and the average fund manager doesn’t realizes it.SO FAR at least.

If this is the case then the way I see the process working out is that management in company X has realized that the company’s prospects of actually increasing production or of even holding production steady are poor to possibly even non existent given current estimated costs of new production and estimated future prices.

Of course any corporate manager who might be reckless enough or honest enough to actually say something along these lines in public is almost for sure going to be looking for a job unless he is in a very strong position vis a vis the corporate board and shareholders.I can’t remember his name but the only one I can remember going public in plain language is or was the CEO of Total iIrc.

This being the case the X management team will probably slap whatever patches on the trouble spots they can and hope to keep the business afloat and apparently profitable and viable as long as possible while preparing for their own eventual exit while the exiting is still good.

Now a stripped down oil company that owes little or nothing and has some good wells in some good oil fields might actually turn a spectacular annual profit for a good long while, being free of the humongous expenses associated with exploration and development of new fields.

With a field that is declining at say four percent cash flow could probably be held steady or close to steady with a four percent annual average increase in selling prices for five or even ten years.

SO— if this scenario is correct– then the decision to give up on exploration could be interpreted as tacit acknowledgement of peak oil by the management of any company that takes this route.

Of course there i s another possibility which is that industry management thinks that there is still plenty of oil to be discovered and extracted but that looking for it and securing drilling rights and actually developing it is a sure losing bet.FOR NOW.

This in turn implies that industry expects a substantial long term run up of the price of crude and that when that happens then it will be time to get back into the exploration game.

But there is not yet an end to this line of speculation because substantially higher prices means substantially less effective demand. The only way substantially higher prices can come about is EITHER that the world economy resumes robust growth and can therefore pay the new higher price; OR that the new price is made possible by the simple fact of a shortfall in supply.

Any farmer will tell you that the gross market value of any annual crop is inversely proportional to the production that year. In other words I used make good money when apples were very scarce even though I had only half a normal crop. Other years when I had a bumper crop I actually lost money because the price collapsed.

I would gladly pay a truly exorbitant price for diesel fuel to run a farm confident that I would still make a profit by passing along the cost of it,assuming I were to have no choice in the matter.Ten or twenty bucks a gallon would be a bargain compared to going back to a horse or mule but of course at that price I could run off some moonshine or go in with some neighbors and start producing some biodiesel.

An airline would be in a truly desperate position. It might be possible to charge enough to keep a few planes in the air but filling up a jumbo with tourists would be impossible.Bankruptcy would be as sure as sunrise tomorrow.

Ron is fond of pointing out that the world economy cannot support a substantially higher oil price and I must agree that he is right at least it the short and medium term.

There are many substitutes for apples or any other food but there are few substitutes for oil even on a small scale and none at all that are capable of taking its place on the grand scale or even on a small scale in the very short term.

So maybe the economy will languish to such an extent that oil known to be in the ground that can only be extracted at say one hundred fifty bucks a barrel will simply be left there forever.

OR maybe as existing fields peter out and production declines there will sooner or later be buyers at one fifty but there won’t be many of them .

I am sure that the only reason the price of oil could approach one fifty in constant money anytime soon and stay there would be that the supply has fallen off sharply. THAT by definition is or would be peak oil.

But there is no sure way to know how all these factors will interact or what conclusions have been reached by the key managers who are making the decisions about exploration.

My opinion for what it is worth is that when a major oil company cuts back on exploration that this can and probably should be interpreted as an early indicator of peak oil.

When a company quits looking it is admitting that it is eventually going to quit producing—-unless it is hoarding cash hoping to buy up other companies assets at firesale prices.

But this still implies peak oil because a change of ownership of an oil field doesn’t change the amount of recoverable oil in it one iota.

I am doing the best I can in a hurry to reduce a lot of stuff I have read to a few paragraphs here. I hope this ramble isn’t too disjointed to make sense.

Ron,

After seeing Gail Tverberg’s Peak Oil Forecast graph, and considering all the new data on the oil majors and Steve Kopit’s work… it sure looks like Gail’s chart may turn out to be the future reality.

People have this strange idea that oil companies are in the business to find and produce oil, they are not. They are in the business to make profits. As Art Berman stated in his 1 hour presentation on Shale Gas in America, “The Majors have to show profits after deducting full cycle costs.”

Shale oil and gas are promoted based on a “Point Forward Basis.” Majors can’t do that so that is why we are seeing the big exodus out of shale.

And look at NatGas today… up another $0.34 at $5.55. What happened to the EIA’s forecast last summer for $3.50 for 2014-2015?

Looks like the weather might speed up the bursting of the SHALE GAS BUBBLE.

steve

“Shale oil and gas are promoted based on a “Point Forward Basis.” Majors can’t do that so that is why we are seeing the big exodus out of shale.”

Hi Steve,

Would you mind explaining what “point forward basis” means to those of us who aren’t familiar with all the financial terms that get used?

I’m still unclear as to why so few of the oil majors are investing as heavily in shale oil or gas as many of the smaller oil companies, so I’d be interested to understand what you are saying here.

Coilin, listen to the first ten minutes of the Art Berman video and he explains “Point Forward” very well.

Art Berman-Reflections on a Decade of Shale Gas

Basically it means writing off all costs that have already been paid like lease costs, overhead costs and interest you are paying on the money you borrowed to finance the play. In other words you only include the cost from the moment you sink the drill bit forward. That is if you figure only the cost of drilling the well, fracking and transportation to the refinery then they are making money. But if you extract all their other expenses then they are losing their shirts.

Thanks very much, Ron.

Just more bubble economics at play I suppose. I wonder when it will all really go pop?

Steve, I agree. Gail’s chart, and the text of her message can be found here:

A Forecast of Our Energy Future; Why Common Solutions Don’t Work

Art Berman’s video can be found here:

Art Berman-Reflections on a Decade of Shale Gas

And Steve Kopits’ video can be found here:

Global Oil Market Forecasting: Main Approaches & Key Drivers

The majors are exiting the shale plays and leaving it to the minors. They are all heavily leveraged. They are losing money, big time, in their gas plays. I think perhaps they are making money with their oil plays but not a lot.

A Texas company just finished drilling for oil off the east coast of New Zealand. Cost $240,000,000. No oil found. I think i heard the news say the oil drilling company was bankrupt. But, someone ask the same question here in NZ if the latest failure to find oil would stop/discontinue the search for oil and i think (not sure) prime minister John Key said search for oil could continue, but i haven’t heard any more about it.

My take on Steven Kopits’ excellent work.

The cumulative increase in global crude oil (Crude + Condensate) production, in the seven year period from 1998 to 2005, in excess of what we would have produced at the 1998 production rate of 67.0 mbpd (million barrels per day, EIA), was 6.3 Gb (billion barrels).

Steven Kopits estimated that cumulative global upstream (oil exploration and production) capital costs were $1.5 Trillion in the seven year period from 1998 to 2005.

Of course, the total upstream capital expenditures were used to both offset declines from existing production and to show a net increase in production, but I am primarily interested in the difference between the 1998 to 2005 increase in global crude oil production versus the 2005 to 2012 increase in global crude oil production.

The cumulative increase in global crude oil production, in the seven year period from 2005 to 2012, in excess of what we would have produced at the 2005 production rate of 73.6 mbpd (million barrels per day, EIA), was 0.3 Gb.

Steven Kopits estimated that cumulative global upstream capital costs were $3.5 Trillion in the seven year period from 2005 to 2012.

Note that cumulative upstream capital costs increased by 133% from the 1998 to 2005 time period to the 2005 to 2012 time period, but the corresponding increase in cumulative production (relative to 1998 and 2005 respectively) fell by 95%.

Therefore the global upstream capital costs necessary to offset production declines from existing wells and to add one new barrel of cumulative production in the 2005 to 2012 time period was 39 times what was necessary to offset production declines from existing wells and to add one new barrel of cumulative production in the 1998 to 2005 time period–in terms of capital costs per barrel of new cumulative production (relative to 1998 and 2005).

In terms of barrels per day (bpd), the industry had to spend 58 times as much money from 2005 to 2012 as they did from 1998 to 2005, in order to add one new bpd of average incremental production (relative to 1998 and 2005), in terms of capital cost per average bpd increase in production.

Note that as the incremental increase in production approaches zero, the capital costs necessary to show one bpd of increased production approaches infinity.

For example, let’s assume that the industry continues to spend about $0.5 Trillion per year on upstream costs, and let’s assume that global production increases by only 100,000 bpd. The capital costs spent (to offset to declines and add new production) would be about $5 million per bpd of increased production. At a global increase of 50,000 bpd, the cost would be $10 million per bpd of increased production.

JJB, appriciate you work and comments!

Do you have a blog or site as well where everything you have mentioned regarding GNE etc. is aggregated? Would be nice to bookmark 🙂

I’m working (slowly) on finally updating my Export Capacity Index paper. As I do annual updates, I plan to leave Export Capacity Index in the title, so you cold presumably find the updates by searching for Export Capacity Index.

I plan to emphasize the CNE (Cumulative Net Exports) depletion rate, i.e, the rate at which we consume our remaining supply of net exports of oil.

Note that one of the implications of “Net Export Math” is that not only does the net export decline rate tend to accelerate with time, the CNE depletion rate also tends to accelerate with time.

For example, combined production from the Six Countries* virtually stopped increasing in 1995 (showing a very slight increase in production from 1995 to 1999, and then declining). Their initial (exponential) remaining CNE depletion rate was 15%/year from 1995 to 1996. Their remaining CNE depletion rate accelerated to 46%/year from 2001 to 2002. Note that based on the 1995 to 2002 rate of decline in the ECI ratio (ratio of production to consumption), estimated post-1995 CNE were 9 Gb. Actual post-1995 CNE were 7.3 Gb.

Based on the 2005 to 2012 rate of decline in the (2005) Top 33 Net Exporters’ ECI ratio, I estimate that post-2005 Global CNE were about 530 Gb (based on the 2005 to 2012 rate of decline in the Top 33 ECI ratio). The estimated Global CNE depletion rate from 2005 to 2006 was 3%/year. The estimated Global CNE depletion rate from 2011 to 2012 accelerated to 3.7%/year. I estimate that remaining Global CNE fell from about 530 GB at the end of 2005 to about 419 Gb at the end of 2012. As noted above, this approach to estimating CNE was too optimistic for the Six Country Case History.

*Six Countries that hit or approached zero net exports from 1980 to 2010:

Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia

Hi OFM. You stated:

“It is noteworthy that this is Faux news talking since they are one of the most ardent advocates of a cornucopian BAU future if only somebody will ” round up alla them there com’nist ‘vironment loonies” as a good neighbor of mine puts it and deport them all to Russia or Cuba or China , whichever country comes to his mind first.”