The US Petroleum Supply Monthly just came out with production data for every state and territory. US supply was up 168,000 bpd to 8,864,000 bpd in September. The biggest gainers were North Dakota, up 53,000 bpd to 1,185,000 bpd and Alaska up 79,000 to 477,000 bpd. Alaska was way down in both July and August and are just recovering from that. There was only one big loser, New Mexico, down 18,000 bpd. Texas was up only 9,000 barrels per day which was surprising. The Gulf of Mexico was down 3,000 bpd.

The Choke theory and why I ain’t buying it.

North Dakota publishes a Daily Activity Report Index of all permits and other well activity in the Bakken as well as the rest of North Dakota. In this report is a list of all producing wells completed as well as wells released from confidential (tight hole) status. Wells usually stay on this list from a few days to a few months, but the average is only a few weeks.

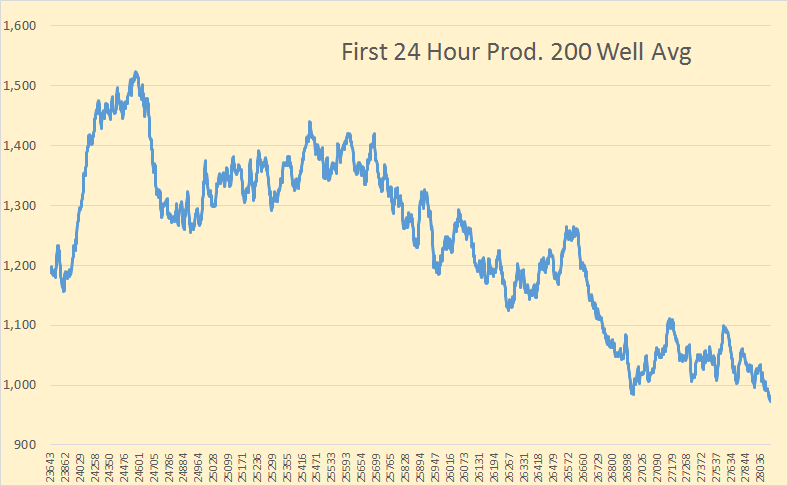

I have collected this data from October 2013 to present and found some startling results. But some have said this data means nothing, that wells are usually choked off by the driller so therefore we can gain nothing from the data. But looking at the individual wells that just doesn’t make any sense. No, I agree that the driller chokes but that he would not gradually choke more according to increasing well number.

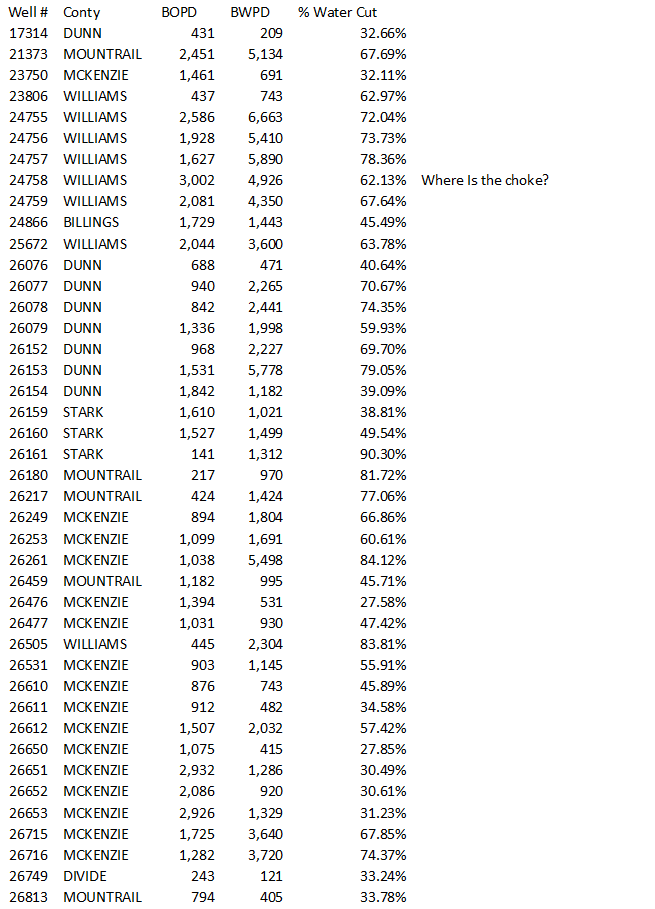

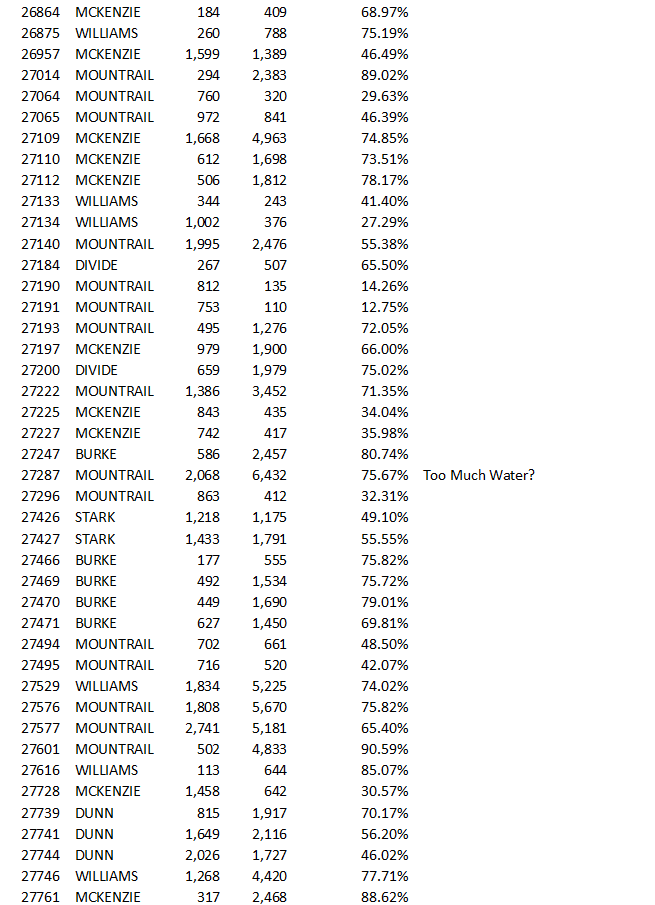

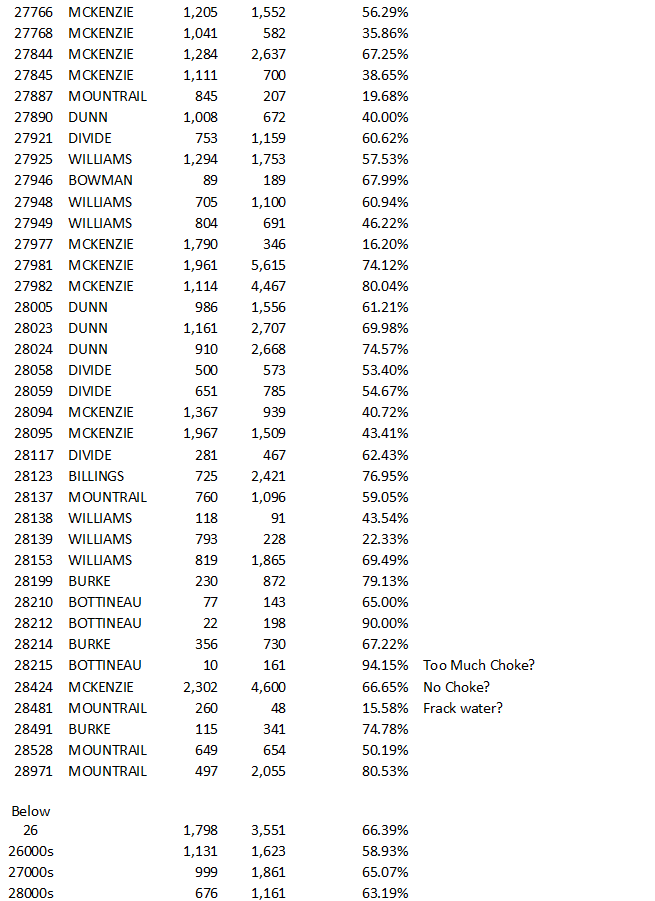

Below I have posted the first 24 hour data for all 122 wells reported by North Dakota for the first 25 days of November. The first 24 hour production ranges from over 3000 barrels of oil per day to a low of only 10 barrels of oil per day. Barrels of water range from a high of 6663 bwpd to a low of 48 bwpd. And the percent water cut ranges form a high of 94.15% water to a low of 12.75% water.

It just seems incredible to me to claim that these numbers are meaningless. Throughout all the almost 14 months of data I have gathered there are lots of very large producing wells and a lot of small producing wells. The point is as the well number increases the number of very large producing wells seems to decrease while the number of small producing wells seems to increase. And I just don’t believe this is due to the many drillers, after checking their well number, decides what size choke to apply.

Just below the list of all wells I have averaged the production according to well number. The sample however is not large enough to really mean a lot. The number of wells in the sample are: Below 26000, 11 wells – 26000s 35 wellw – 27000s 54 wells – 28000s 23 wells.

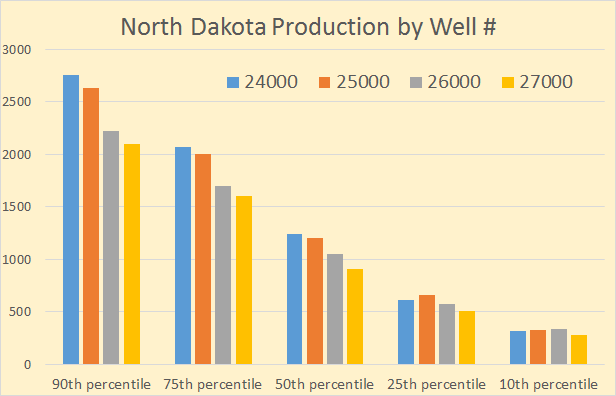

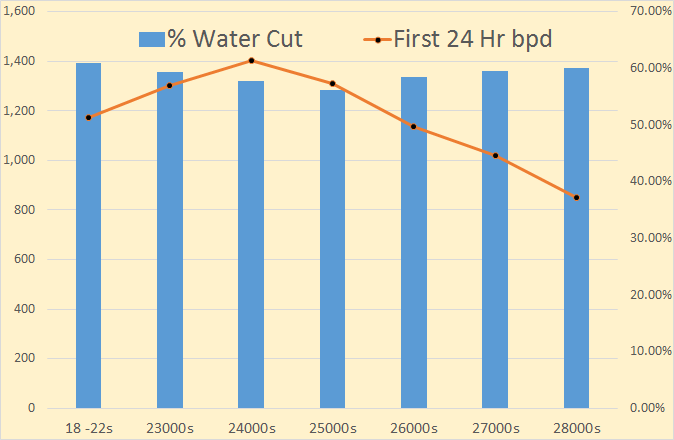

But over the last 14 months we get a trend. Phil Scanlon has analyzed the data and sorted it into percentiles. This is his chart. He did not think he had enough 28000s to get a representative sample.

The gradual drop off in production is more pronounced at the higher production numbers than below the 25th percentile.

Here is my updated chart after adding October 2013 and a couple of days this week to the data. I have made it zero based in order to get a truer look at what the data shows. There are 2,390 wells in the sample but only 46 are above 28000 so that might not be a good representative sample.

And here is my updated 24 hour chart with the October 2013 data. Do you see a trend?

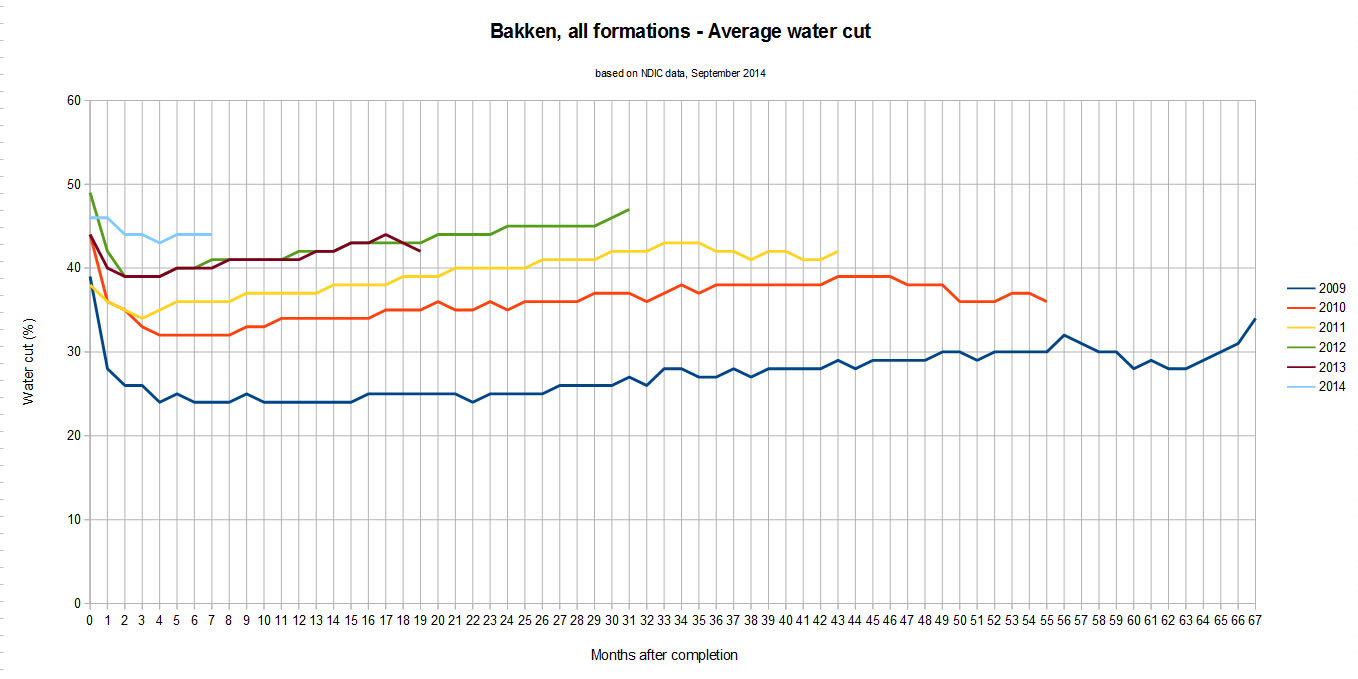

Thanks to Freddy W. for this chart. I consider this chart to be very important because it shows that the early water production, though clearly higher due to the frack water coming back, is nevertheless proportional to the total water cut later after the frack water is gone.

The water cut in all wells is clearly increasing as the well ages. Some have said this would not happen in a LTO reservoir but this chart clearly shows they are wrong. But more importantly it shows the water cut increasing in new wells each year with 2014 the highest at about 44% after 7 months and 2009 the lowest at about 24% after 7 months. This leaves no doubt that the water cut is increasing as they move further from the earliest drilled sweetest of the sweet spots.

Rockman on the first 24 hours of well production, in response to my last post.

The first 24 hours of production is far from being the average first years production. And though all wells are different I am relatively sure there is an average conversion rate but I have no idea what it is. I would guess it is somewhere between one quarter to one third of the first 24 hours of production.” Very nice data gathering. But I suspect you won’t like hearing my answer. First, I drill in Texas and La but I suspect procedures aren’t much different in the Bakken.

So I drill, complete and test a well in Texas. Conventional or frac’d unconventional…doesn’t matter. A simple but common example: the oil flows out of the well head. Within the head is the assembly that holds the “choke”. The choke is a small plate with a hole thru which all the oil flows. The chokes are designated by the diameter of that hole expressed in inches: an 8/64″ choke, a 12/64″ choke, etc. Yes: might be difficult to imagine but wells with flow

Now I test the well by flowing it for maybe several hours thru different chokes. Maybe 900 bopd thru a 14/64″ choke. And then 750 bopd thru a 12/64″ choke. And then 500 bopd thru an 8/64″ choke. And in addition to those rate changes the flowing pressure changes with choke changes. I flow it thru different chokes because the variations help me to better understand the completion quality.

Now what rate do I report that the well testing at: 900 bopd,750 bopd, 500 bopd? I can report any one of those numbers I choose. There is no public reporting standard required by the Texas Rail Road Commission. The state does get all the engineering details and the are available to the public: all you have to do is go find them in the massive data base.

So here’s a simple question: how many times have you seen someone post an oil flow rate AND included the choke size and the flowing pressure? There’s a huge difference between two wells flowing 700 bopd if one is on a 16/64″ choke and the other on an 8/64″ choke…a hole half the diameter.

If that’s not bad enough I can flow a well on a 12/64″ choke at 900 bopd and see that rate slowly drop or increase. I can stop the test at anytime and report a rate that hasn’t stabilized.

You want more complications? It’s not uncommon to let a frac’d well (hz or very) flow at a lower initial rate for weeks: you don’t want to “pull the well too hard” initially for fear of damaging the frac job.

Now here’s the real killer: the initial flow rate of a well in a pressure depletion drive reservoir, as all the shale plays are, has no implication of how much it will be flowing in 12 months. I can test two EFS wells at 900 bopd…same choke and same pressure. And 12 months later one is producing 600 bopd and the other 100 bopd. The rates will be determined by the volume of the reservoir being drained. Simple analogy: you have two steel tanks with one containing 20,000 gallons of water and the other 50,000 gallons. Both are at 9,000 psi. You punch a 12/64″ hole in each tank and they shoot out water at the same rate. But as time passes the pressure in both tanks declines and thus the flow rate decreases in the smaller tank faster. That rate decreases faster in the smaller tank faster because the pressure decreases faster. I’ll skip the physics but this is part of the science behind hyperbolic decline.

Essentially ever EFS well at the same depth has roughly the same reservoir pressure. But how quickly that pressure (and flow) declines will depend upon the volume of the pore spaces being drained. Which is why there are EFS wells that initially produced at 500+ bopd with some ultimately producing 300,000+ bbls and others less than 100,000 bbls.

And if that isn’t confusing enough there are a variety of logistical issues that can prevent a well from flowing at the higher it might be producing several months later. After 3 or 4 years of producing an EFS you can make a pretty good guess of the URR. But doing so during the first few months (let alone from the initial tent rate) of production? Not so much. LOL.

This is all very well but It clearly does not explain the gradual decrease in production as the well number increases. Also there are always outliers. That is there will always be wells that produce little the first 24 hours and will be found to be producing even more one year later. But these are the rare exceptions rather than the rule.

What Rockman is talking about here is something random, or should be random. The driller decides to choke and how much to choke. And there are many drillers with many companies. There should be no discernable trend in their choking actions. If we do see a trend then there has to be some cause and that cause must have some meaning.

Other News of note:

The story of a marginal producer:

SandRidge Energy: You Don’t Know What You Don’t Know

And this is BIG NEWS: Russia says will keep oil output steady in 2015

Russia is hoping to keep output stable by exploiting new areas such as the Bazhenov oil formation and Arctic offshore.

Got that? Russia hopes to keep production from falling next year by exploiting the Bazhenov Shale and the Arctic Ocean. Lotsa luck with that one.

Active drilling rigs in North Dakota stands at 183. 182 if you don’t count the one drilling a salt water disposal well.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

The 2014 Oil Price Crash Explained

Ron, way off topic I’m afraid and I know Mac already posted a link here. But its been the rounds of TAE and Zero Hedge and maybe 20 other blogs. Based on Oil Drum heritage analysis from Phil Hart.

The big news this week must come from OPEC tomorrow ….. what do the bookies say?

The sophisticated Daniel Yergin was interviewed on CNBC this afternoon. He answered one meaningless question partially and his phone link started squealing and he was never recovered. The hosts covered it up by quoting anyone they could find who would say shale in the US operates just fine at $40. Mostly they wanted to celebrate shale output as the cause of price decline, despite nothing special happening with it starting July.

The US boom narrative is essentially 99% dependent on shale. When it is smashed, either the boom narrative changes, or the smash is changed by Federal Reserve intervention, justified by claims that HY bond default would threaten swap trigger and global disaster.

The big Gulf states already leaked that they have consensus NOT to cut. The other OPEC producers are not relevant if that’s those guys’ position.

http://www.businessinsider.com/opec-announcement-preview-2014-11

Saudi is banking on their low actual cost of production and the amount of money they hoard/waste to tide them over until they drive the frackers out of business.

They have no reason not to do precisely that, but there is too much attention on them. They didn’t drive the price down. They are just taking advantage of it.

No one commented on the implication of that graph.

If there is no hysteresis — which is a very big IF — then a lowering of price will lead to a demand destruction as the crude oil production drops down the curve.

But there is no reason to expect that hysteresis won’t appear and the production level maintains as the price drops. And they can always make up numbers 🙂

Hi Paul,

I am not sure if I understand your comment. Euan argues that the supply curve is likely to be steep and that a small decrease in World demand could cause the fall in oil prices we have seen. I believe that analysis is correct.

I would also expect that a fall in oil prices would tend to increase World economic growth causing the oil demand curve to shift to the right and drive oil prices back up.

That may have been what you meant, but I didn’t get that from your comment.

DC,

Well, Euan being one of those AGW deniers, it’s always hard to figure out what he is getting at. He posts a figure of supply & demand curve and expects someone to fill it in?

Legitimate point.

The big flow numbers . . . may be megafracks. 50 stage semi-experimental and no way you choke an experimental. You want unfettered measurement.

I’m gonna need a lecture on how choke increases EUR for shale. With water driven, okay, or with conventional, okay. You slow the hell down to let water flow from somewhere and hold field pressure up. But there’s no water drive here. So how does getting it out slower get you more in total? Dunno. Here’s why:

Essentially ever EFS well at the same depth has roughly the same reservoir pressure. But how quickly that pressure (and flow) declines will depend upon the volume of the pore spaces being drained. Which is why there are EFS wells that initially produced at 500+ bopd with some ultimately producing 300,000+ bbls and others less than 100,000 bbls.

But the Bakken is different because of the salt. You’re pouring water back down into the well now and then, and I would guess under pressure. It can refill pores. Pressure decline won’t be the same as in other fields.

Good call tho on 28481. Don’t matter if there ain’t much oil. Where the hell is the frack water? Maybe it was 1 stage of frack?

I have yet to see him, but it is said there is a major company executive (CLR or EOG) from the Bakken who posts on Bakken discussion boards. His username is “Open Choke”.

I know of whom you speak. He might be an executive with Drilling Info rather than an oil company which would give him access to a lot of data I. all the unconventional plays. If he is with an E&P company, I would bet he is with EOG and is working the EFS.

Hi Watcher,

Maybe in some cases they see how the well will flow before fracking and if it is below a certain level they don’t bother with the frack, I doubt that because a lot of money was spent drilling the well.

Or maybe they want to test the difference before and after fracking, or maybe the frack water flowed to a nearby well and got pumped out by that well. It is difficult to know.

Your discussion is missing the associated gas production, gas/oil ratio, flaring regulations, ability to market the gas, and such very relevant topics. I don’t want to get people upset, but north dakota gas flaring regulations remind me of what prevails in the third world. It’s downright primitive.

Mike says:

November 22, 2014 at 2:05 pm (Edit)

Thank you, Ron; clearly a lot of time was spent on this study.

I am aware of a new consciousness in the S. Texas shale play regarding choke management during flow back procedures. There was even a seminar in San Antonio about that very thing recently; the theory of restricting flow back rates has to do with preservation of gas to oil ratios and ultimate EUR. Reported 24 hour flow back rates in North Dakota, which I assume is also initial production (IP) rates (?), would be related directly to flow back practices anywhere in a tight oil play. So my first reaction to this data is that what we are seeing is operators restricting flow back rates intentionally as they have gotten further down the learning curve.

But that theory gets tossed in Graph 3 where percentage of produced water is brought into the picture. Within the first few days of the wells life the water to oil ratio would, in my opinion, be pretty stable; if anything WOR would be going down, not up, as the well unloaded more and more frac water and cleaned up. Restricting flow back rates thru choke management would not cause water cuts to go up, I don’t think. Increased WOR is a function of something going on in the shale itself. That something is probably not too good.

Mike

Ron, I guess some of this new thread is directed at me. For the record, however, I found the IP data interesting from a number of standpoints, most of which have to do with declining IP’s coupled with what appears to be increasing water production. If the data was presented as a means of gauging a decline in well productivity in mature areas, I buy it. I would like to understand if the combination of declining IP’s and increase WOR is a function of depletion or well interference due to downspacing. Either way, as I said, it is not good.

Mike

Talk to us about flowback procedures, pls.

I am tired and wanna go home but basically it is all about energy preservation; induced energy from the frac and natural energy from the ratio between gas and oil. The more conservative the flow back procedure the more gas stays in solution, for lack of a better term, and helps lift the oil out of the wellbore. There is a relationship between pressure depletion and increased water production. The actual flow back process begins with no choke, no restrictions, then as the oil to frac water ratio begins to climb the well is regulated with chokes to preserve gas energy. There is a direct correlation between GOR and EUR . The size of the frac, or number of frac stages has nothing to do with flow back methods and choke management. The drive mechanism in lots of conventional reservoirs is not water, but solution gas.

The best Eagle Ford shale wells in the entire play are along the dry gas to condensate liquids contact. They refer to it as the condensate “window.” They are a little deeper, are a little hotter, have a little more bottom hole pressure, have a little higher nanoporosity, but the liquids are very high gravity (condensate) and they all have high gas to oil ratio. All these are traits you want in a shale well in the EF, and I believe also in the Bakken. In the EF these wells typically recover only 20% of the frac fluid and that’s it. They make no water, not yet anyway, not after 5-6 years. Many wells along the condensate window in the EF will ultimately make a million barrels or more. Up dip in the oil window, things are not so peachy sometimes, mainly for lack of GOR. Not so sweet spots I believe have higher water saturations. Not all things in life are created equal, same for shale.

In short, flow backs are now being managed better to preserve energy, GOR, with the belief that will ultimately make a better well in the long term.

I’ll leave you with this photo, from drillinginfo.com; this is nanopore in dense shale. It is in this tiny little puppy that all the good stuff exists, oil, gas, and not so good water, I think. When I say tiny, please look how tiny. In a square inch there are 25,000,000 nm. Its only when these little nanopores are linked up with a frac do they give up the goods. Amazing, uh?

Very cool, but . . . what you’ve described is why rail cars were blowing up. The new reg probably has to insist on gas extraction (and flaring).

No, no, no, Watcher. You are talking about high end volatiles in the hydrocarbon chain. Solution gas is blown down, separated, gone by the time it gets on a rail car. Rail cars combust when they run off the rails and hit stuff, like the ground, or other rail cars, whatever. Sparks do that sometimes.

Dennis, thank you; I am no expert on anything. Any data is good data and I am not ready to say Ron’s IP data was irrelevant at all. I leave that up to you.

Patience is kind of hard to come round these parts, it seems, everyone wants precise answers, real time. Life ain’t like that. Happy Thanksgiving, y’all.

Mike

Hi Mike,

It seemed that you explained that there might be a change in how the oil producers were choking their wells and that there is a learning curve that might account for some of the change in 24 hour IP. You assuredly did not say the data was irrelevant, but I think you might have been questioning if it in fact the data showed that Bakken wells were petering out. I interpreted it as an alternative hypothesis for the 24 hour IP data, I may have misunderstood your meaning.

I don’t think I have said the data is irrelevant, but I find your explanation and Rockman’s and the other production data at 1 month, 2 months and 6 months to cause some hesitation about the “petering out” hypothesis. The other data seems to suggest at least much slower decline or possibly no decline at all (through August 2014).

Happy Thanksgiving

Pay attention to what mike writes.

I like playing with scales and orders of magnitude and I know for a fact that most people have no sense of how to relate to a nano meter scale. Maybe my graphic below will drive home how tiny that pore really is. It’s almost mind boggling.

Cheers!

In other words or pictures, the black circle below represents the cross section of a human hair and that yellow dot in it is 2000 nm.

So bald guys are not hired to work the Bakken because oil flow is lower from the well they drill.

I guess my point kinda went over your head, no pun intended.

Which, btw, was that not only are the pores really really tiny but the GOODSTUFF is really hard to economically get out of the shale because most of it isn’t good stuff.

So basically the whole US shale energy panacea is actually another smoke and mirrors boondoogle.

Not to worry though, just party on dudes because the smart people are back to being able to buy those big SUVs and PUs they want without ever having to worry about paying the Piper, another pun not intended…

The only ones who have to worry about what the Piper will do are those who have children but that is far in the future.

Cheers!

Thanks for this perspective on nanoporosity in dense shale. My hope in showing the photograph was that it would not go over anybody’s head, but I think you are right; folks are willing to talk about the dynamics and future of declining oil reserves in very abstract terms, quite content with not understanding much of any it other than sentence here or there on the internet.

To me, however, a tiny nanopore full of oil and gas in dense shale truly is scraping the last dregs from the bottom of the barrel.

Thank you, Mike!

To me, however, a tiny nanopore full of oil and gas in dense shale truly is scraping the last dregs from the bottom of the barrel.

Funny you should mention that, I actually was going to use that metaphor myself but thought it would be one pun too many >;-)

To me, however, a tiny nanopore full of oil and gas in dense shale truly is scraping the last dregs from the bottom of the barrel.

That’s what I don’t understand about media coverage. They have been so willing to write about the fracking miracle, but it doesn’t take much research or intelligence to realize that if we are trying to get oil from shale and tar sands, we’re running out of the easier, cheaper oil.

I’ve seen the “death to peak oil” articles, but fracking and tar sands confirm to me the reality of peak oil.

Here’s an article about estimated break even prices for various oil plays.

http://www.businessinsider.com/citi-breakeven-oil-production-prices-2014-11

Mike, no it was primarily directed at Rockman. And there were others who posted comments when it was posted on PeakOil.com. I have loved your posts and still do. Also…

A lot of people disagree with me on a lot of things. I love such comments as long as they are not insulting and/or silly.

Anybody that might have missed Mike’s highly informative reply to one of my questions in the previous post – this reply being mostly about the way rigs are leased or rented , for how long, how old most of them are, etc.should definitely go back and read it.

I mention this because it went up sort of late and the old post was getting a little stale.

There is insight to be gained from it in terms of how long it takes drillers and other operators in the oil fields to speed up or slow down in response to market signals.

We are lucky to have him posting here.

Wow, thank you, sir. Really. Happy Thanksgiving to you.

Mike

OFM – did you mean two posts ago (RRC numbers)?

this post?

http://peakoilbarrel.com/texas-rrc-november-production-report/comment-page-1/#comment-449877

That reply yes.

It throws a lot of light on how far ahead a driller may be committed so that proceeding to drill is the only real option.

ONCE you have spent megabucks hiring the machinery -which for all I know may come with crew members as part of the rental or lease deal- you might as well run it..The additional costs are almost for sure going to be minor compared to the money already sunk into the deal.

Ron, it seems from a graph on the previous post that Bakken per well day one production is falling at 300 bopd/annum. Is this about correct? Is there a correlation between first 24 hour production and production rate at, say, six months? From there a stab could be made at the rate that EUR per well is falling and the month that Bakken drilling, on average, ceases to be economic.

David, I have no idea if Bakken production is falling or not. All I know is that the first 24 hours of well production is dropping as the permit/well number increases. In the past that could not be directly tied to a time base because so many smaller permit numbers were still being completed. But that has started to change now. October saw a lot of higher numbers being completed and even more so in November. We will know early next year if this correlates into an actual production drop. I am expecting that it will but I am just not sure how much.

I have been trying to find out if there is an average correlation between the first 24 hours of production and first years production but I have not come up with much of an answer yet.

Hi David,

There seems to be no linear correlation between 24 hour IP and production at 1 month, 2 months, 3 months or 6 months. When Rockman and Mike say it is complicated, they are undoubtedly correct.

Thankyou to all. I do appreciate the work behind the data presented. The Bakken rig count has been steady for two years now. So at $100 per barrel it wasn’t attractive enough to attract more rigs to the play. WES453 posted a graph of sand and gravel carried on BNSF on the previous post. Sand carried over the last two years is up 50%. With the rig count flat, it would seem that wells are now accessing a lot more rock than they did two years ago.

Good observation, and it aligns with the new semi standard of increasing frack stages from about 20 to about 30. 50%.

Ron, yes, I saw those posts on Peakoil; I even commented about “offsite” comments. A lot of comments around here are pretty damn silly; somedays’ it must make you want to go pull trees out by their roots.

Its very complicated all this shale stuff; it can’t be googled on the internet, for sure. After 50 years of making my living in the oil business I still get stumped all the time. It would be grand if some smart shale engineers would lead us around a little, but for some odd reason they don’t seem to hang out too much on peak oil blogs. Weannies.

Keep up the good work, sir.

Mike

Well they may start having time on their hands soon and we’ll see them then.

I’m retired now, and I can’t get around much for a while. I’m not an expert in Bakken well behavior, but it seems to me Mike has a pretty good handle on this subject. If anybody has general questions and I see them I’ll try to answer.

Hi Ron,

My understanding of Mike’s comments in your previous post and Rockman’s above, in combination with David Hughes comment is that 24 hour IP is not a very useful measure. Rockman explains why it can change, and Mike commented that there was likely a learning curve where older wells (lower well ID #s) may have been choked differently than newer wells (higher well ID #s). So three experts, Rockman, Mike, and David Hughes question if the trend in 24 hour IP with well ID is significant.

In addition FreddyW and I have presented charts which suggest that at 1 month, 3 months, 6 months, and 12 months there is no apparent trend in cumulative output by date, and I also presented several charts by well # which showed very little trend for 2 month cumulative output.

Chart below shows first month output vs well ID #, not much trend is evident.

Dennis, we haven’t gotten there yet. Just be patient, we will know in the next two or three months.

Hi Ron,

I think we will know eventually, but I think it will be more like 12 months (at the earliest) until we can detect a statistically significant decline in new well output and think using at least the 3 month cumulative (but better would be the 6 month cumulative that Davis Hughes pointed to) is more definitive than 1 or 2 month cumulative output.

Chart with 201 well centered moving average of Bakken/Three Forks 1st month output. Mean output is 8682 b, median is 7238 b and standard deviation is 7173 b. Note that not all wells start producing on the first day of the month so first month output can vary from 1 to 31 days of production. On average over long periods there is likely to be an average output of roughly 15 days in the first month.

This adds variability to first month output on top of normal statistical variability due to geology.

In fact the high output in September might be explained by a higher than average number of producing days for new wells in September.

For example the average number of days of production for new wells in August might have been 7 and for September it might have been 21, if so much of the variability from August to September would be explained. I was hoping FreddyW or Enno could look at this, I don’t have the average days of production for the first month of output in August and September, but they have better access to the data (better computer skills than me). Chart below for first month centered moving average.

In the previous post I showed 6 month cumulative output vs. month,

the following chart shows 6 month cumulative output vs well ID# (horizontal axis).

The linear regression is on the raw data which is not all displayed on the chart. The vertical scale is limited to better show the variation of the 301 well centered moving average.

It is clear that from well 20000 to well 26000 there has been substantial variation in the 301 well moving average, it has moved up and down by about 7000 b or more on three occasions. Will the recent downward trend continue or will it turn up as it has several times already? Time will tell.

Just eyeballing it, that sudden rise between 24000 and 25000 seems to correlate with Ron’s original “First 24 Prod 200 Well Avg” chart.

It would be interesting to overlay the charts, or calculate the ratios of first day to first 6 months.

Hi ilambiquated

I sent enno Peter’s data to Ron. Perhaps he will send the iPhone data to me.

part of the problem may be the limited time of the ip data.

IPhone was supposed to be ip.

You should expect output to decline eventually. However, this depends on a series of variables. For example, let’s say the reservoir quality is decaying as they move to develop lower quality spots…this can be offset by more intensive completions (more fracs). I have been shocked by how shoddy are the gas flaring regulations (I spent the last few years working outside the USA, I would have thought they would try to regulate gas a lot smarter). The gas conservation practices can be really important. Other issues can be as simple as having more experienced personnel, or knowing where to spot a horizontal wellbore. I’m also surprised they aren’t using more well clusters. As they start learning to cluster wells they should improve.

Cousin Klem sea if we want answers to all these questions to email’em to the NSA since they probably have copied every speck of data the industry possesses already..

And although they may have missed some the Chinese have probably managed to steal most of it as well.So it is probably for sale if you know the right person to ask..

Speaking on a more serious not I expect that given a finer grained knowledge of where each well is located and exactly how it was drilled that individual companies may be able to find patterns in THEIR OWN data that indicate that choking in some particular and deliberate fashion increases the ultimate recovery ON AVERAGE- IF IF IF of course such a pattern exists.

But IF they were to find such a pattern doesn’t it seem likely that they would keep such info to themselves?

This sort of knowledge would be power in the hands of a company that has it in negotiating with other companies, landowners, etc, when buying and selling oil field assets.

For a very long time, NASA paid 10s of thousands of dollars each year to rent warehouse space in which mag tapes of Viking and Voyager data were stored. No one ever looked at it. Weren’t funded to.

Same is true of the NSA.

Klem sez the payoff fer stealing it out of warehouses wouldn’t have been worthwhile. Lotta trouble to get trucks and big crews to do than sort of work even when you are have the cooperation of the owners.

According to Klem ”Yer gittin bahin the times. They kin steal all that stuff now with jus a handful o’ guys drinking tea with the office girls nowadays.”

I must admit that I am not the MAN Snowden is .

If I had a job like his I would have been extraordinarily tempted to set up a secret organization of my own and spend my coffee break time on the job searching out data useful in making money- not by selling it to enemies but by buying and selling stocks.

Snowden would get a statue on the mall in every town in this country if I had my way.

Anybody anywhere who thinks any data stored on any machine that may EVER be connected to the net who thinks it is safe from the feds nowadays has another think coming.Of course nickel and dime crooks and scammers are probably safe enough for now even if the feds have the goods on them due to their being too busy to bother- concerned with bigger fish – and not wanting the crooks to realize just how much they know.

He has essentially destroyed IBM. They were banking hard on Chinese growth.

China told them they were probably an NSA conduit and would award them no new contracts.

Yes, the NSA has done *enormous* damage to US exports, and companies like Google.

Not Snowden, of course. It’s the NSA (and the security establishment behind it) that did the damage.

Singapore is saying $72.80.

Baker Hughes’ YouTube channel has some highly produced videos of their fracking technologies. This one mentions choking to hold back water in order to extend the life of the well.

https://www.youtube.com/watch?v=2WO9FDMaArU

“With real-time control and monitoring, you can quickly identify and choke back production from high-water cut zones in order to optimize well performance and delay water breakthrough … increasing ultimate oil recovery.”

For more information:

http://public.bakerhughes.com/multinode/

I like the remote control nature of this technology. No need to brave the harsh Siberian winters. Now you can remotely manage your shale wells from the comfort of a jacuzzi in Moscow. 🙂

That’s a banya in Surgut.

Asia continues at $72.xx.

There is a lot of potential here for the disaster to unfold before the relevant people realize this is not like some other “market” where a central bank can move it at will. This is an industry, and if people are laid off en masse and defaults are declared, it’s going to be a Lehman redux where Bernanke COULD have stopped it, didn’t realize the danger, and did not act.

The Fed COULD pay off all those HY bonds, but there is so much crap about $40 breakevens floating around that this whole thing could catch them by surprise. Come March, it may all be abandoned, shale production could be 250K down from 3 million bpd and the Russians would pick then to let the dollar crash and take oil to $200/b.

And announce to the world that they are ready to supply the oil needs of its customers.

If oil plunges low enough long enough to start causing significant fracker defaults, Russia isn’t doing anything other than imploding. That would be a major current account crisis over there. And I mean major.

A country able to supply all its own critical needs domestically which is politically stable and militarily invincible need not REALLY worry about ANYTHING that depends on banking and accounting procedures.

Money is not wealth but rather only a way of keeping track of wealth.

The Russians will pay a heavy price in slow or negative growth and austerity at the consumer level but they just aren’t going to collapse – not unless Putin and Company misplays the cards in their hand.

Of course at some point all players current hands must be played and the cards dealt again.

BUT that next dealing of the cards is probably a good way off yet.

The Russians are not in any position to have to kiss anybody’s ass.NOT YET. And probably not anytime soon.They can pass while the rest of us play out this deal which might take a year or longer.

If they default on a debt just who is going to send the sheriff around to attach their assets? Such assets as they have outside the military reach of their own territory are basically nothing more than pieces of paper.In terms of the BIG PICTURE of countries and empires any such assets amount to about as much as a few dozen infantry men to a general in command of an army of a million men.

My guess is that the country is remembering how tough the old timers there were and how they pulled thru WWII and times since and that nationalism and patriotism are running at flood stage. If so then they will hang in there until they get tired of this new game of twisting the nose of the west.

That might take a while.

The people running Russia are mostly big time cold war type spooks used to thinking in military terms. Chess terms if you will.

Sacrifices of men and material in the thinking of such men is perfectly acceptable to them if they think such sacrifices are justified in the game of empire.

Now some people think they are currently engaged in a naked grab for territory and resources. Others say they are engaging in a preemptive or proactive defensive maneuver it order to keep the West from encircling them in a way dangerous to their own security.

I say it does not matter which motive is uppermost. Both are no doubt real in my own estimation.

Putin and Company think that they are going to win out in the current power game or they would not have started the game.

I am not sure they WILL or WILL NOT win but I am sure they aren’t going to fold anytime soon.

Pretty much that. Anything they absolutely have to have they can get from China, just like the US does.

http://online.wsj.com/articles/should-you-buy-an-electric-car-1416777176

For those interested in electric cars. Subscription not needed to read this.

From This Week in Petroleum EIA report, shale producers increased their capex in 2014 and their revenues. However they need new debt or capital increase to continue investment.

For me there is something contradictory in this sentence “This group of companies, while profitable, still spent more on capital expenditures than they generated from operations.”

So how to be really long term profitable while loosing money???

It’s the new accounting, its all the rage across not only oil industry, but all corporate America.

Well, let’s not go overboard. Companies do sometimes invest more than they generate. Capex is one of those bastardized terms that can deceive.

A utility building a nuke can easily eat up profits with capex. The real bogosity of the term in this context is the implication that one of these wells is going to flow as long as a nuke makes power.

Sort of funny you can go on and no about the end of things and still believe in corporate accounting.

That’s a good point.

It will be stages of scarcity sourced dissolution. Normalcy. A pretense of normalcy. Declaration of emergency and print money in cooperation with other central banks so that no one’s currency is destroyed. Then print some more. Then have someone else print some more. Then see the effect of yardstick vulnerability. Then — mostly — lose the ability to maintain the facade and have it become clear oil trumps central banks.

There will be no recovery from that stage. That’s the stage when China starts diverting oil from Tokyo to Shanghai.

A company can be profitable if its assets are increasing in value even if it is cash flow negative. The assets in this case are mostly mineral rights, I guess.

Drilling an oil well is an investment. You will always lose money in the short term.

so whats the short term – 3 years lets say, how long are these debts for?

The debts can be rolled over. In addition to the time question banks will wonder how much oil is going to come out of those wells and at what price.

At one time, if you believed that the earth revolved around the sun, you were declared a heretic, grounds to be burned at the stake. Galileo recanted, he was scared the Pope would make his life miserable even more. Breathing is better than not, even if all you can do is fog a mirror.

The Dark Ages had an origin and it involved climate change. The mini ice age made those Dark Ages all happen. The Devil cursed the people of Europe, religion rules and rules are enforced, bider God. The Church decided that the newly formed glaciers in the Alps must go, they were making life intolerable for the devout devotees of the Catholic Church. 50,000 poor souls met their maker simply for the reason they were suspected of doing anything and everything to cause Europe to descend into a 400 year long cold spell. Zero tolerance for heresy, no room for reasonable debate, once found guilty, your future was grim. There was hell to pay.

The mini ice age changed the way people behaved in all of Europe. They really did go mad.

Makes global warming a welcome prospect.

You don’t make this stuff up.

Now we’ve got oil madness going on. The markets, the numbers, the supply, the costs, the sale price, the production, the water, the drilling until hell won’t have it, the stats, the charts, the graphs, the linear growth, the continued unbridled use of the oil, the competition for the oil dollar, the millions of barrels used each day, the industries involved, all combined, drives you mad.

RIG found a brand new 52 week low yesterday, Seadrill lost 4.50 per share or something like that yesterday.

The outlook is indeed grim for the oil market and the price. More of it for sale, increased supply, will lower the price

Let the madness continue.

The permit number/well number plotted against the ip rate did indeed raise awareness. Information like that can possibly influence the price of oil. Imo, it does.

”You don’t make this stuff up.”

AT LEAST NOT WITHOUT being equipped with very fertile imagination and (I strongly suspect) a ready supply of mind altering substances.

But as some serious scientist guy used to say , reality is not only stranger than you think, it is stronger than you CAN think. I believe he used the word imagine rather than think though.

This brings a thought to mind. Occam’s razor is a very very useful tool but I think we rely on it to too great an extent sometimes when analyzing events that have to do with monkey minds and monkey behaviors- especially the behaviors of large groups of monkeys.

The simplest explanation is NOT always the best explanation.Lots of things happen or do not happen because one or two people or a small group of people throw a monkey wrench into the gears of larger events or drop a match into a huge pile of tinder ready to light off a bigger fire –a war or a boom or a depression.

Thorvald Thorvaldson farmed up in Norway around 950 CE, something like that. One day, he was angered by a neighbor, and he ended up killing his neighbor. Thorvald was shipped off to Iceland, the punishment at the time. Banished to live no longer in Norway, you can live, but not here. Lo and behold, Thorvald had a son named Eric, Eric the Red. Eric grew up in Iceland, became a farmer too. Eric was approached by a neighboring farmer and asked Eric to loan him a shovel, which Eric kindly did. Turned out, the neighbor wouldn’t return the shovel, Eric took the matter into his own hands, wrestled the shovel away from the neighbor, hit him over the head with the shovel and his neighbor died. Enter the justice system once again, this time for Eric.

Eric had to stop fishing and farming in Iceland. Forced to sail to Greenland, he built a new farm, had more settlers move to Greenland, and life was once again just fine and dandy for Eric. His son, Lief, drifted for a while in his formative years and found Newfoundland. The Vikings made it to North America all because a group of farmers in Norway banished Thorvald Thorvaldson to Iceland.

Leave it to the Norwegians to throw a monkey wrench into the gearbox and change history, but they did.

Watcher,

Perhaps this isn’t a reasonable question but what is the relative size of the LTO industry? Please answer in language someone (me) who can’t understand the difference between a credit and a debit might be able to understand or relate to. For example, Bakken is x/y where x= Ford Motor Company and y equals Bakken (cumulative).

Thanks, Doug

Doug,

Short answer, much less significant than watcher believes. Remember that Bakken and eagle ford combined is 2.4 mb/d of 76 mb/d c+c output.

At current production and price level, LTO sales should be around 1% of US GDP (~$170 billion). If you want to compare to a company, this is Apple, with worldwide revenues of ~($170 billion), the 15th largest company in the world…

Perfect, thanks Chris.

Bakken + Eagle Ford should be around 60% of Ford Motor Company (~$147 billion revenues, 26th largest company in the world).

This is an incorrect computation. The quantity of liquid multiplied by the price does not define GDP contribution.

If a hurricane smashes a lot of windows and you fund the repairs with a gov’t deficit uptick, the GDP added is not how much silicon is required to make the glass, and you don’t subtract the silicon value in the busted windows.

I did not mention GDP contribution 🙂 but compared LTO sales to US GDP. The contribution of LTO to US GDP is much higher, probably up to 5% if you count drilling, machinery, transportation… Also to compare LTO producers to a company I compared revenues, with estimation for this year from the EIA Short-Term Energy Outlook. Of course this 2014 estimated average price is going to be lower than $95.

I would not venture a number, but 5% would be a HUGE drag on growth — which of course could be blamed on winter.

More important, GDP is a measure of income. So you have to subtract out the costs, which are $70, I guess.

Yes and no because LTO producers need transportation, drilling and many other services. These subcontractors / providers need also different services and machinery. All these LTO expenses are also contributing to the GDP.

I guess that the contribution is around 5% BUT these 5% will not disappear suddently. So in case of problems with high cost LTO would be around 1% GDP in 2015 and in 2016. These are only guesses.

The drillers income is interesting when you look at articles like this:

http://www.businessinsider.com/the-problem-with-high-yield-energy-bonds-2014-11

15% of the high yield (“junk”) bonds issued this year were to energy companies. Their income (not their revenues) is about zero.

WTI at $71.xx after the decision of OPEC to leave output ceiling unchanged at 30 million barrels, and entered briefly in $70.xx.

Breaking news. OPEC says no oil cut. Brent down $2.84 at $74.91. WTI at $71.36.

Saudis win case for no OPEC output cut

Gulf oil producers led by Saudi Arabia on Thursday won the case for keeping OPEC output unchanged, overriding calls from poorer members of the exporters’ group for action to halt a slide in crude prices.

Benchmark Brent crude oil fell $3 to its lowest since September 2010, at under $75 a barrel, on expectations that huge global oversupply will build up in coming months. OPEC also decided to meet next on June 5, 2015. [O/R]

“It was a great decision,” Saudi Oil Minister Ali al-Naimi said as he emerged smiling after around five hours of talks.

Asked whether OPEC had decided not to cut production and to roll over existing output policies, he replied: “That is right”.

Venezuelan Foreign Minister Rafael Ramirez left the meeting visibly angry and declined to comment on the outcome.

The supply problem should last until Q3 2015. Unless production decreases by choice or by geology. The main question could be: what is the remaining storage capacity? Once storage capacity is filled nobody would buy oil surplus. Am I wrong?

Hi Chris,

It is possible that low oil prices may cause the demand curve for oil to shift to the right if World GDP growth increases in response to lower oil prices. In addition there will be less investment in new drilling which will cause the oil producers to move down the supply curve and reduce output as existing wells decline. It is a dynamic response, with shifts in demand and changes in supply in response to changes in oil price.

WTI just went to sub $70. Looks like the tide might be going out. Let’s see who was swimming naked!

It did. And gasp, look at the GBP and Euro in complete freefall this morning, driving the dollar thru the stratosphere.

What a coincidence!

I gotta call this piling on.

I believe this pegs NoDak price at $53.xxx? Hell, that’s still a $13 cushion above $40.

The OPEC “decision” today is a major hit to financial markets.

Here’s an interesting perspective:

Junk Bond Carnage, One Company at a Time

http://wolfstreet.com/2014/11/27/junk-bond-carnage-one-company-at-a-time/

The thing is, all CLR and EOG have to do is start writing massive amounts of credit default swaps on HY bonds and get the word out to the Fed that there are trillions of such derivatives outstanding.

The Fed will backstop all of them.

So, you think the FED will push off the day of reckoning a little further into the future? That’s what they’ve been doing all along, at least since 2008. Can they do it forever? Probably not.

There are politics in this. It gets complex. Fiscally, a GOP Congress will ideologically oppose a subsidy to the uber capitalist industry of oil. But then their own members from deep red states will start asking for it. This will take a lot of time to unravel.

So the Fed is there, able to do something. But sooooo many senior banking people listening to their own analysts have been told shale is good at $40/barrel (who were speaking to investors they were trying to fleece). So if the Fed asks them, the Fed will be told there’s no need to act.

This equates to time passing. Add to it the fact that winter will camouflage everything happening in NoDak and you have further reason for delay.

There is yet another aspect to it all. The boom narrative . . . the facade of economic normalcy would be greatly damaged if the uber capitalist industry of shale gets a Fed or govt bailout. This will create some further reluctance and delay.

Wind and corn ethanol gets subsidized because they are popular in Iowa, and that’s where the primaries start.

But ND is much less important.

Oooh, maybe the biggest part of the announcement is the June schedule. There had been talk of . . . okay, no cut, but we revisit the situation in Feb.

KSA is taking a VERY hard line. Things do not look good for shale.

Huge drop in natural gas storage this week, week ending November 21st. Down 162 BCF. That is 400 BCF below the 5 year average and 346 BCF below the same week last year.

Drawdown starts a couple weeks early..

http://americanoilman.homestead.com/GasStorageGraph.html

7 days behind

Hi all,

Great comment by FreddyW near end of previous post comments at link below, I also had a question that I am hoping he might of seen, but it may be too much work to find the answer.

http://peakoilbarrel.com/bakken-sweet-spots-petering/comment-page-1/#comment-455910

Thanks for mentioning it Dennis. I gave you the data for first month producing days there also. I just temporarily changed one of my methods to run calculations on days instead of oil production. So it did not take much effort at all. It shows that the number of wells are large enough for the data to be quite stable.

Hi FreddyW,

Thanks! You did a chart with 1 month output in barrels per day, did you use actual days of production for that chart or did you assume 30 days (or maybe 31 days) for each month? I don’t have the monthly data for September so I was going to estimate with your chart (I only have data through August).

I consider all sorts of pause in production as part of a wells life. So I have always divided monthly production with the number of days in that month. I was to lazy to take leap year into account though. Shouldn´t matter to much anyway. If I would have divided by number of producing days instead I would have been forced to compress the x-axis also. Otherwise it would have been as if the well could produce without depleting the well the days it is offline. Better to keep it simple and I also think is closer to reality the way I calculate it.

By the way the 1 month data is 1 month after completion. Here is the data for completion month (bopd):

1/2014 309

2/2014 267

3/2014 325

4/2014 290

5/2014 286

6/2014 342

7/2014 321

8/2014 244

9/2014 349

That is at least true for the production profile. But thats a good point. Divide by production days instead for days in month makes more sence for the x month after completion production. It shows more how the quality of the wells have changed rather than how much they have contributed to overall production. But for newer wells it would give a higher value if they have produced for fewer days as the decline rate is very high. So it may not exacly show what you want to see. Anyways here is the data divided by production days instead. Zero days wells have been excluded.

1 month after completion:

1/2014 514

2/2014 564

3/2014 442

4/2014 526

5/2014 580

6/2014 479

7/2014 514

8/2014 530

9/2014 482

Completion month:

1/2014 687

2/2014 578

3/2014 603

4/2014 595

5/2014 606

6/2014 663

7/2014 713

8/2014 630

9/2014 655

Hi Freddy,

Thank you. I was not trying to suggest that one way of doing it was better than the other, I just wasn’t sure how you were presenting the data. I just give total monthly output. Thanks for that data.

On the data set without adjusting for days of production, do you adjust for February having 28 days, April having 30 days etc?

Your data shows why Sept was very different from August.

First month output from new wells in September was 38% higher than new wells in August, primarily because the average new well in Sept produced for an average of 21 days compared with about 14 days in August (using your data and assuming 31 days for August and 30 days for Sept in your data not adjusted for days of production).

Using my Bakken model I estimate that ND Bakken legacy decline in August and September was about 79 kb/d, NDIC data shows Bakken output increased by 16 kb/d in August and 53 kb/d in Sept.

Thus new wells in August produced 79+16=95 kb/d and new wells in Sept produced 79+53=132 kb/d. So Sept new wells produced 132/95=1.39 or 39% more oil than new wells from August. A big part of the explanation is that September wells produced for 22 days vs 14 days in August and 22/14=1.5 or 57% more days of production, the actual productivity per day of production in September was a little lower than August (by about 9%).

Below is a table of days of production for new wells in their first month based on FreddyW’s data:

Jan-14 18.6

Feb-14 13.3

Mar-14 22.8

Apr-14 16.5

May-14 15.3

Jun-14 21.4

Jul-14 19.4

Aug-14 14.3

Sep-14 21.7

Freddy please correct this if I have not understood your data correctly. The above table takes the monthly output in b/d and multiplies by days in the month (31, 30, or 28) and then divides by the monthly output adjusted for days of production to find the days of output for each month.

For August 2014 =244*31/530=14.3 days of output.

Hola, Dennis:

I hope that Freddy can correct me if need be; I think completion techniques have changed a little in the past 18 months since I have witnessed any shale operations but let me walk you from birth of a shale well to the maternity ward, to maturity, so to speak.

Its rare a shale well would flow prior to frac’ing. In high carbonate wells, like MBP suggests, sometimes operators will pump acid ahead of a frac to open and clean perforations but most wells are not going to make anything until all the frac stages are pumped, the plugs are drilled out between stages, or “donuts” between stages pumped out, or sleeves open, whatever they are doing at the moment, and then the well is opened up and flowback commences up the production casing. At some point the well loads up on its own (poops out from declining GOR), or is intentionally killed (loaded with water) to facilitate running production tubing, which is much smaller OD than casing. The well then might flow some more, on it’s own, up production tubing. Then the well will die again, on its own, or is killed, and often gas lift mandrels are run in the production tubing to assist in lifting liquids out of the wellbore, or even ESP’s (electric submersible pumps). Both of those artificial lift methods work for awhile but ultimately most shale wells everywhere go on rod lift and that requires taking out and putting back in other down hole stuff. It is quite possible that a lot of the gas lift, ESP intermediate steps are now eliminated and wells in the Bakken go straight to rod lift, I don’t know. Once the well goes on rod lift all kinds of things go wrong sometimes and I think it is rare that any operator with a large well inventory in shale would have 80% of its wells producing at any one time. Pumping deep wells on rod lift is a royal pain in the ass. You can imagine the wait period for rigs and services in the Bakken when a well goes down. Each step in the life of the well, from birth to maturity, would result in periods of production decline, no production at all, followed by periods of production increase. Even production from rod lift wells can be altered for numerous reasons, and often are. My point is that trying to interpret well performance without full knowledge of day to day operations of that well is not very productive. That is not to say that changes in IP’s and the first few months of production are not as a result of sweet spot depletion and interference from other wells drilled on close spacing. You gotta be there babysitting to really know, I think.

In Texas we do not have to report the number of days a well is on line, or down; the reported production for the month is what it is.

Mike

Thanks Mike,

I am just trying to get a rough idea of what is going on. When we take a fairly large group of wells we can get a rough idea of what the average well is doing.

There was a similar change in the number of producing wells in the Bakken from july to August and from August to September. We do not know how many new wells actually were brought online because we don’t know how many were down for maintenance, but we can estimate.

In August there were about 210 new wells and in September about 213 new wells, but production increased by only 16 kb/d in August, but by 53 kb/d in September. I am offering one possible explanation given the data I have, there is variability in both well start dates from month to month as well as variability in well productivity from month to month so we would expect there to be variability in total output each month even if the number of new wells added was the same every month (which it is not, that varies also).

It is no surprise to me that these numbers bounce around each month, though sometimes people attach significance to normal statistical variation. Bottom line my “explanation” of this variation from August to September is one possibility out of many.

Thanks for the explanation of some of the complexity of the life of an oil well.

Quick question on rod lift. The Bakken wells go roughly 10,000 feet deep with 10,000 foot horizontal sections (laterals?), is it mostly the vertical depth which is important as far as estimating the cost of pumping oil to the surface or is the length of the lateral also important?

Are the laterals drilled slightly up hill so that the oil will flow to a low point near the end of the radius and can just be “lifted” from that point?

Well, it use to be wells were drilled up hill, or up regional dip, but I think not so much anymore. It makes sense that gravity would assist in some way to draining the lateral but now days it seems lateral orientation is more related to stress fractures in the rock and even where, and in what direction, you can cram them into remaining space.

A horizontal well cannot be pumped from the lateral or even too far into the radius; the down hole pump is usually set in the vertical section of the well. So the length of the lateral is not important in rod lift implementation.

Hi FreddyW,

In your last comment there were two sets of numbers.

I assume the first is output per day where you take monthly production and divide by the days of production, but the numbers don’t match the numbers you gave in an earlier comment for days of production.

The second set of numbers I don’t understand at all and have simply ignored. They must be important or you would not have bothered to post them. Can you explain those numbers? Thanks. (The data under “completion month” is the data I do not understand.)

I start to get confused by all the numbers flying around :). Completion month is the month the well was completed and in most cases is the month it started production. I think it was those numbers you were actually looking for.

I divided each well´s monthly production with its days number, then summed all those and divided by number of wells.

Hi Dennis,

I think you have missunderstood my data. As I showed you in Ron´s other post the average number of production days are

8/2014 14

9/2014 16

So you don´t have to calculate that. Also 530 is from 1 month after completion. So wrong table used. I did not divide each well by the average number of days. I divided by number of days each individual well had produced. So your formula will not really work.

The reason September is higher for new wells is both that they have produced for 2 more days, but also because the average well produced more. But why total production was up alot in September more complicated than that. About 50% of the wells are confidential when they start to produce. I don´t know if they try to guess their production or they just don´t include those in the data. If they don´t then it takes about 5 month for all wells to be public. So for any month there are in that case new contributions from wells as far back as 5 month (although with lower production because they are older). Because 1/2 of the new wells are confidential and they produce only 1/2 month the first calender month, their contribution is only 1/4 of what it could have been. Lastly because the average well in August only produced for 14 days, they have declined less when their contributions are summed up for September. I don´t think the effect is that great, but at least some effect.

And yes I used 28 days for February, 30 for April and so on. Actually I think I will continue to divide by days in month and not days in production. If for example a well produced only for one day the first month, dividing by production days would be as if the well produced with 24 IP the whole month.

Hi Freddy,

the NDIC knows what the confidential wells produce, they just don’t report it.

You can get an estimate of what the average well produces from the wells that are not confidential and it is probably a pretty good bet that about 99% of the confidential wells are in the Bakken/Three Forks so that gives you a well count. Then you can assume all wells are average wells to get an estimate of monthly output.

Good call on that second month, that is very true.

I don’t have access to your data, but Enno Peters lists from the month of first output, I call that first month of production and assume it is the same as the completion month (which may not be the case).

So what I was hoping for was the average days of production for the first month for wells in Jan, Feb, etc. (only wells producing), then if we have the average monthly output for Jan, Feb, etc.

Most of the difference from Aug to Sept is due to lower output in b/d in Aug relative to Sept.

Thanks for your help, I think with the 37 kb/d legacy decline and about 212 wells added in August and September, the 16 kb/d increase in July vs 53 kb/d increase in Sept is accounted for in part (about 60% of the difference is accounted for by the difference in first month output). The model predicts an increase in output of about 28 kb/d for August and September, the actual average increase for the two months was about 35 kb/d. It is likely that the actual wells have been performing better than the model “average well” over the past several months.

I don’t have access to your data, but Enno Peters lists from the month of first output, I call that first month of production and assume it is the same as the completion month (which may not be the case).

I don’t understand why the first month’s production would be a full month. Wouldn’t it be from the first day of production to the end of the month? That would seldom be a full month. Or do they start from the first day of the first full month following the well completion?

Hi Ron,

I was trying to clarify Freddy’s use of the term “completion month”, and whether that is the same as what I call “first month of production”. You are correct that a well can start producing on the 1st of the month or on the 31st day of the month and in both cases I would call it the first month of production. If the two wells were wells with similar EUR, the first month of production for a well which starts producing near the end of the month will be lower than a well that starts production near the 1st day of the month.

As Freddy pointed out, the second month of output would be higher for the “late in the month start” well than the other well.

Ok yes that makes sense.

Yes the average for the not confidential wells is good enough. But the data is noisy, so more wells would have been good. And if they decide to make a certain type of wells confidential (the good ones for example) the data will be wrong. But it does not currently seem to be the case. Anyway, I encountered problems. I use https://www.dmr.nd.gov/oilgas/bakkenwells.asp to see which wells are Bakken wells. And confindential wells are added there when they become public. So it will not work on new wells.

Yes completion month is in most cases the same month as production start. But I will actually change and use first production month instead as it will be a bit more accurate.

I think you are correct in your analysis. It looks like the average well has performed better recently.

Hi FreddyW,

I think it is safe to assume that most of the confidential wells are Bakken Wells, you could also look at the ratio of Bakken to non-Bakken for the month and if 95% of wells that month were Bakken wells, just assume 95% of the confidential wells are Bakken wells, also if all of the non-Bakken wells are from certain counties, you could eliminate confidential wells from those counties. Not a prefect system, but it is the best we can do.

By the way, does anyone know what the column “Runs” in the reports here mean?

https://www.dmr.nd.gov/oilgas/mprindex.asp

Sales. Stock tank production is reported, then the numbers of barrels sold must also be reported. The difference in production and sales is “inventory” that stays on location, in tanks, and gets carried over to the next months business. Barrels produced must eventually jive with barrels sold on the “books” so to speak. All barrels must be accounted for; mineral owners for one demand it. Can’t report barrels produced then have them mysteriously disappear.

I see. Thank you Mike.

Mike can correct me here, but runs will roughly coincide with barrels produced, when you have no info on output because a well is confidential, it might be a fairly good estimate (closer than assuming zero, or I have no idea).

Yes interesting. There are actually figures for Runs for confidential wells and they are very similar to production. Perfect then I can include that for wells that are confidential and get better numbers for the last months. I think I will have one version with and one without. Thanks Dennis for the great idea.

One negative thing. I´m drowning in data :P.

Yes, almost always any way. Oil can be held over from one month to the next but in the end, production and sales should always balance. Missing barrels are a big no-no.

Which brings me, again, to this issue of “confidential wells” in the Bakken. I have no idea what that means. It is impossible to withhold production data from mineral ownership and sometimes there might be 400 different mineral owners in a producing unit. What earthly purpose would it serve a Bakken operator to withhold production data on any well, or ask a regulatory agency to not publish production data? There are thousands of Bakken wells up there and no secrets on the boulevard, I assure you. Please explain that to me. Folks have always said production data can be withheld in ND; I find that hard to fathom.

In Texas a well that is “confidential” only refers to regulatory allowances for withholding well logs and certain geological evaluation data from that well for a limited period of time. It has nothing to do with production. Every barrel of oil produced and sold must be reported as soon as it comes out of the ground, or is moved off the lease.

“Folks have always said production data can be withheld in ND; I find that hard to fathom.”

That is exactly the case though. North Dakota law and administrative code states that nobody outside of the North Dakota Industrial Commission is allowed to see production data for confidential wells, not even mineral owners.

There’s a FAQ section about this on the NDIC website…

What does the term confidential mean?

When an operator requests and is granted confidential (tight hole) status for a well, it restricts our ability to release information about the well. Section 43-02-03-31 of the North Dakota Administrative Code states in part:

All information furnished to the director on new permits, except the operator name, well name, location, spacing or drilling unit description, spud date, rig contractor, and any production runs, shall be kept confidential for not more than six months if requested by the operator in writing. The six-month period shall commence on the date the well is completed or the date the written request is received, whichever is earlier. If the written request accompanies the application for permit to drill or is filed after permitting but prior to spudding, the six-month period shall commence on the date the well is spudded.

All information furnished to the director on recompletions or reentries, except the operator name, well name, location, spacing or drilling unit description, spud date, rig contractor, and any production runs, shall be kept confidential for not more than six months if requested by the operator in writing. The six-month period shall commence on the date the well is completed or the date the well was approved for recompletion or reentry, whichever is earlier. Any information furnished to the director prior to approval of the recompletion or reentry shall remain public.

This means that the only information the agency may release during the confidential period is the name the operator, the well name and location, the spacing or drilling unit description, spud date (when they commenced drilling), the rig contractor, and any production runs (oil sold) from the well.

Why can’t I get any information on a confidential well even if I own the mineral/surface rights?

Section 38-08-04 of the North Dakota Century Code states in part that the commission has the authority:

To provide for the confidentiality of well data reported to the commission if requested in writing by those reporting the data for a period not to exceed six months.

And Section 43-02-03-14 of the North Dakota Administrative Code states in part:

The confidentiality of any data submitted which is confidential pursuant to subsection 6 of North Dakota Century Code section 38-08-04 and section 43-02-03-31 must be maintained.

Section 38-08-16 Part 2 makes willful violation by releasing information a Class C felony. The date when information can be released for a well may be found in the confidential well list once the well has been spud.

This is primarily a response to Mike’s observations regarding the confidential listing for North Dakota wells. The DMR website has a FAQ button that defines and – I believe – addresses Mike’s observations as per the conditions for ND well confidentiality. Essentially, the two states are the same in having all production (sales) publicly known, while keeping the specific geology info proprietary for six months.

“All information furnished to the director on new permits, except the operator name, well name, location, spacing or drilling unit description, spud date, rig contractor, and any production runs, shall be kept confidential for not more than six months if requested by the operator in writing.” .

Mr. Wald, thank you. As I stated then, confidentiality only pertains to very specific well information, not production. “Runs” are sales and sales must correspond to production. Production from Bakken wells has always been an open book, as it should be.

Thank you, anonymous.

Mike

365×2,500,000×70=63,875,000,000

.6×147,000,000,000=88,200,000,000

Either the price of cars is too high or the price of oil is too low.

Electric cars have it all beat, you do not have to buy gas. To repeat moss: you don’t have to buy gas, you won’t need any.

Leaf sales are at an all time high for September.

Electric and hybrid car sales are sharply down in 2014. Go back a Ronpost or two for the article laying it out. American buyers have returned to SUVs and trucks. That’s what they want. Period.

Paid $2.31 per gallon for regular yesterday.

Happy motoring folks!

The smart people are buying Priuses other high mpg vehicles…time to strike a good deal so you wave at the folks in the PuTs and SUVs and smile when fuel gets more expensive again…

The smart people are buying what they want, with sub prime loans they won’t repay.

We have different definitions of smart people!

Not true. Electric car sales are up substantially in 2014.

http://insideevs.com/monthly-plug-in-sales-scorecard/

Sorry there fella, don’t know what insideeevs is, but I think we all know what cbsnews is:

http://www.cbsnews.com/news/are-americans-switching-back-to-big-cars-and-suvs/

“During the recession, consumers didn’t buy much of anything but certainly not discretionary-type vehicles like big utilities and sports cars. Yet they still wanted them,” Michelle Krebs, senior analyst at AutoTrader.com, told CBS MoneyWatch.

Krebs noted that the new versions of large SUVs and trucks are selling extremely well, thanks to lower gas prices, better mileage and some new offerings.

**Drum Roll**

“Almost all of the sales growth seen this year has come from the utility segments,” Ibara told CBS MoneyWatch, “while the sedan segments have been flat (note that overall auto sales are up 5.5 percent through the end of October). Hybrid and other alternative energy vehicle sales are down almost 12 percent.”

” Eric Ibara, director of residual value consulting for Kelley Blue Book”

Right. Why should we doubt “the director of residual value consulting for Kelley Blue Book”

http://en.wikipedia.org/wiki/Plug-in_electric_vehicles_in_the_United_States#mediaviewer/File:US_PEV_Sales_2010_2013.png

Why should you believe it?

Because CBS News has some semblance of a fact checking budget and whatever insideeevs is . . . doesn’t.

I think you’ll find that Wards Auto, the industry standard for tracking sales, concurs with his quote. All of it, including the falling hybrid and electric sales.

The wacko green true believers always fall afoul of actual data. It’s best to address reality. You’ll serve your cause better.

The wacko green true believers always fall afoul of actual data.

The sad thing is, this is considered civil discourse in America.

The sad thing is, this is considered civil discourse in America.

Well, not every one in America would necessarily agree with that. Then again, some great apes like to jump up and down, beat their chests and throw feces at other apes that are not members of their own clan in order to show their disapproval of enroachment on their territories… With human apes interacting on the internet, this occasionally can manifest as name calling to mark ideological turf and to let other members of their tribe more easily identify them. It’s probably still a bit better than urinating on the furniture, welcome to America >;-)

Like the way they fact checked Dan Rather’s phony “Bush memos” before he was fired for making things up?

Any thinking person takes what they hear from the MSM with a large grain of salt.

And since your bogus “Wards Auto” data is behind a pay wall, you post it.

**Drum Roll**

http://www.statista.com/statistics/199981/us-car-and-truck-sales-since-1951/

US car sales peaked in 1985 and US Truck sales peaked in 2005 and while there has been some recovery it might also be interesting to note that The US population in 1985 was 237.92 million and currently it stands at 316.98 million.

Here’s a chart