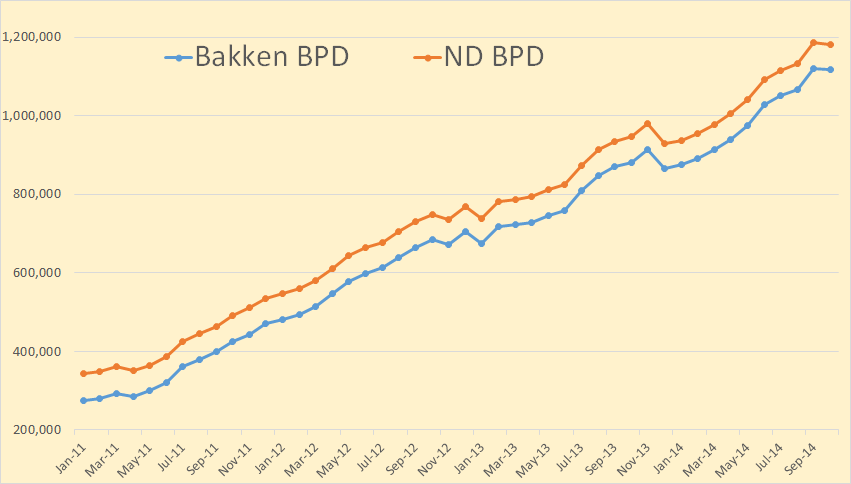

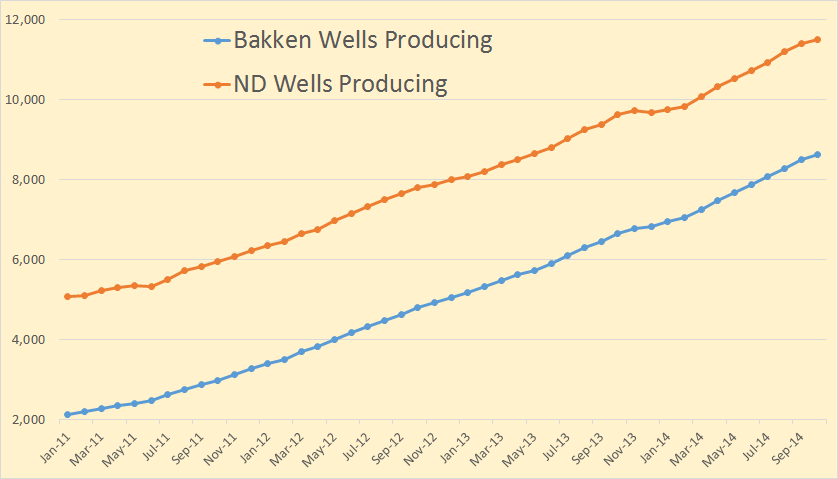

The North Dakota Industrial Commission just published their Bakken Monthly Oil Production Statistics and also their ND Monthly Oil Production Statistics.

Bakken production was down 1,598 barrels per day to 1,118,010 bpd. All North Dakota production was down 4,054 bpd to 1,182,174 bpd.

From the Director’s Cut, bold mine:

The drilling rig count dropped 2 from September to October, an additional 3 from October to November, and has since fallen 5 more from November to today. The number of well completions decreased from 193(final) in September to 134(preliminary) in October. Three significant forces are driving the slow-down: oil price, flaring reduction, and oil conditioning. Several operators have reported postponing completion work to achieve the NDIC gas capture goals. There were no major precipitation events, but there were 9 days with wind speeds in excess of 35 mph (too high for completion work).

The drillers outpaced completion crews in October. At the end of October there were about 650 wells waiting on completion services, an increase of 40.

Crude oil take away capacity is expected to remain adequate as long as rail deliveries to coastal refineries keep growing.

Rig count in the Williston Basin is set to fall rapidly during the first quarter of 2015. Utilization rate for rigs capable of 20,000+ feet is currently about 90%, and for shallow well rigs (7,000 feet or less) about 60%.

Sep rig count 193

Oct rig count 191

Nov rig count 188

Today’s rig count is 183

Sep Sweet Crude Price = $74.85/barrel

Oct Sweet Crude Price = $68.94/barrel

Nov Sweet Crude Price = $60.61/barrel

Today Sweet Crude Price = $41.75/barrel (lowest since March 2009)

I just checked Rig Count. It now stands at 181 but one of them is drilling a salt water disposal well. So they have 180 rigs drilling for oil right now.

Bakken wells producing increased by 118 to 8,602 while North Dakota wells producing increased by 92 to 11,507. Since Bakken wells are included in the North Dakota count this means at least 26 wells outside the Bakken had to be shut down.

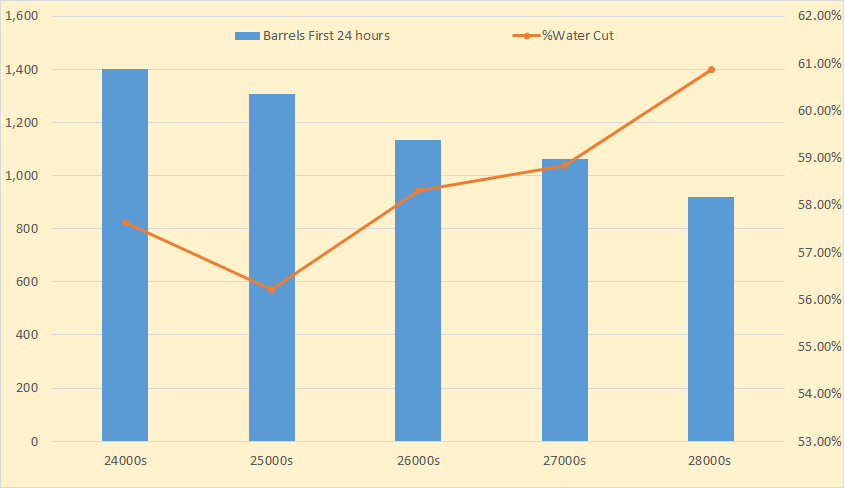

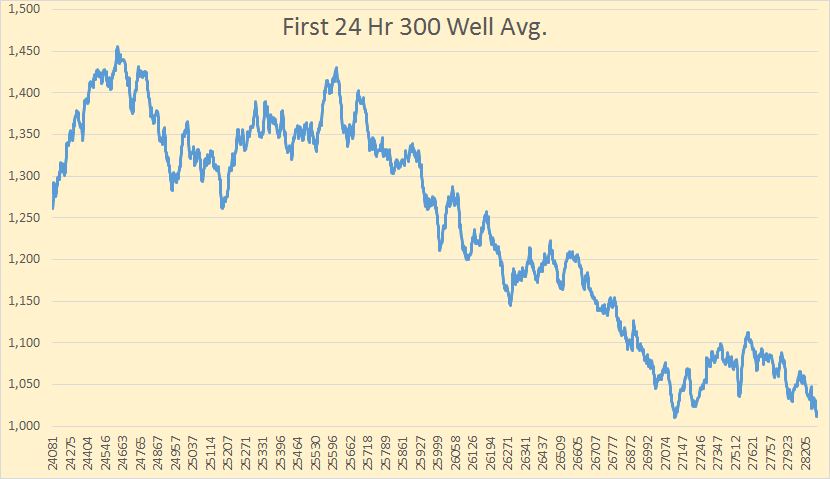

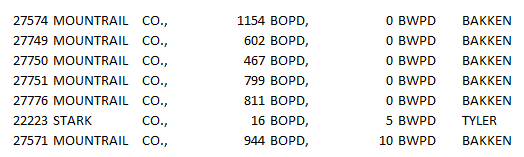

I am still tracking first 24 hours production by well numbers. I am now more convinced than ever that the first 24 hours production is a significant indicator of future production of that well. So far there are only 73 wells in the 28000s however.

Using a 300 well average and sorting by well number you can see how the BOPD falls off as the well number gets higher. The 27000s seems to have leveled out but I believe it will keep falling as more higher well numbers come on line.

I have 2 weeks worth of data for December. There are 121 wells brought on line so far in December. But concerning the first 24 hours of water cut.

Everyone is telling me the first 24 hours is all fracking water so it means nothing. Welllll… I think the drillers have some way of accounting for that. I sorted the 121 wells I have so far for December by barrels of water per day. Above you see the seven wells with the lowest water cut. If the water that comes up the first 24 hours is all fracking water then there is a problem here. I am willing to hear opinions of what that problem is because I haven’t a clue.

Incidentally at the other end of the sort, the seven wells with the highest water in the first 24 hours, averaged 5,396 barrels of water per well and 1,898 barrels of oil per well.

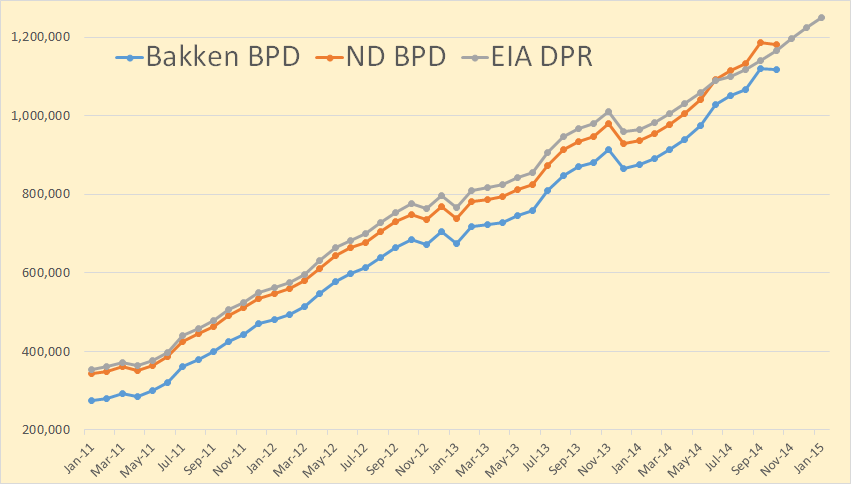

I have included the the Bakken data from the EIA’s Drilling Productivity Report here. Their data is for all the Bakken, including the Montana part, but not the non Bakken part of North Dakota. Their data goes through January 2015. The last six months of the DPR data is nothing but a wild guess.

I wanted to show the DPR data because people and the media keep pointing to it as if it were gospel as to what will be produced from all shale fields within the next two months. For instance this article: EIA: Despite lower crude oil prices, U.S. crude oil production expected to grow in 2015.

The recent decline in crude oil prices has created the potential for weaker crude oil production. EIA’s Drilling Productivity Report (DPR) includes indicators that provide details on the effect low prices may have on tight oil production, which accounts for 56% of total U.S. oil production. Analyzing these indicators and the changes in oil production following the drop in crude oil prices during the 2008-09 recession may offer some insight into possible near-term oil production trends.

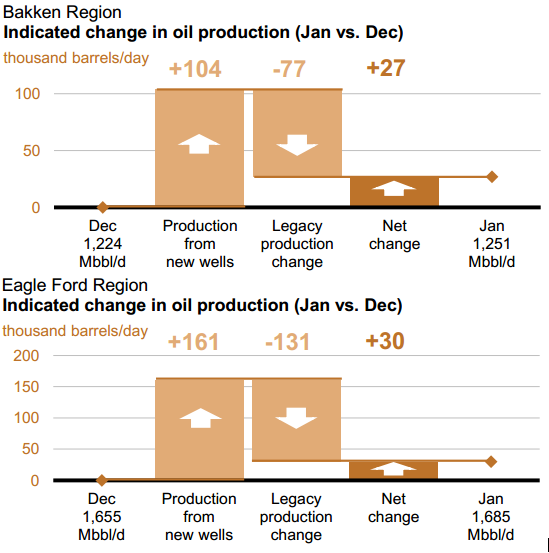

They are expecting great things, at least through January 2015. From their report:

They are expecting light tight oil to be up 116,000 barrels per day in January. They think the Bakken will be up 27,000 bpd in January and Texas’ Eagle Ford and the Permian to be up a whopping 76,000 barrels per day.

I did the math. If these decline rates are right, then in January, these two fields will decline by 208,000 barrels per day. That is they will have to produce 208,000 barrels of new oil in January just to break even. Or if production declines by just 21.5% they will just break even. I expect new well production from these two fields, for most months next year, to be well below 208,000 barrels per day

The IEA has lowered their expectations for 2015 but only slightly.

Oil Market Report

Global production fell by 340 kb/d in November to 94.1 mb/d on lower OPEC supplies. Annual gains of 2.1 mb/d were split evenly between OPEC and non-OPEC. Surging US light tight oil supply looks set to push total non-OPEC production to record growth of 1.9 mb/d this year, but the pace is expected to slow to 1.3 mb/d in 2015.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

A good main stream media article on the economics of extracting oil at current prices.

The Saudi standoff: Oil-rich nation takes on world’s high-cost producers

Hard to believe that the recent tumbling oil price is already having an affect on tight oil production. And 134 new wells isn’t enough to keep the Bakken Red Queen at bay. Unless I’m missing something crucial, I’m flabbergasted how quickly things are happening.

These numbers are for October. The price crater process was just warming up and Bakken oil was still nearly $70 (which means WTI was still $86). And even then, production started to fall.

The price is down about 60% (!!!) from then. (41/68)

This is like a bomb going off.

ack down 40%, to 60% OF then.

I would imagine the severe winter weather in November will have had an impact as well, so it’s entirely possible the next data series will confirm your suspicions, but for entirely different reasons.

In general we’re heading into the slower months for Bakken production, so we likely won’t know for certain until late-Spring 2015. That time period will be incredibly revealing though. If well completions, wells waiting to be completed, and rig count don’t do their usual Spring upswing it’ll be very meaningful.

Depending on what happens with Greece in the next few weeks we could see prices fall further, and at the very least stabilize near this current price for a few months. I think a lot of traders are staying sidelined until a clear bottom is in. Everyone knows oil will go back up, so once that bottom is in it’ll have a sharp correction to the upside.

Fascinating stuff unfolding at the moment!

If events in Greece move the world market price of oil, I would take it as proof positive that the prices are pure speculation, unrelated to the fundamentals (that is the cost on the supply side and the pain point on the demand side).

Greece affects the price of oil by the amount of oil they consume. A change in Greek consumption would have only a tiny effect on the world price of oil. Only by the effect they have on the Euro and therefore the Euro’s value to the dollar can Greece affect the price of oil. But that would be a change in the fundamentals.

To say that the price of oil is unrelated to the fundamentals is something a only totally uninformed person would say.

The quoted price of $41 and change is confirmation of the previous month . . . today’s WTI was $57 and change. The delta is $16, and it was last month, too. No dodging that.

$41 has no chance of working out.

Tidbits:

A recent study commissioned by the state Department of Commerce calculated North Dakota’s effective tax rate on oil production at 9.8 percent, making it the fourth-lowest rate among the top eight oil-producing states in the fiscal year ending in June 2010, the most recent year for which comparable data was available.

That was from an article in early 2013 right after the legislature voted to reduce extraction tax to 4.5% (where it is now cuz > 1 million bpd for 3 consecutive months, per the law). But that 9.8 is a tad higher than our estimates. We know royalties are a bit north of 15% so the sum is 25ish%.

The extraction tax item is price related.

“The tax breaks for oil production are invoked when the price per barrel of West Texas Intermediate Cushing crude oil (minus $2.5o per barrel) falls below the trigger price. What’s interesting is that the WTI per-barrel price is not always very indicative of actual oil prices in North Dakota.” The trigger for 2014 is $52 for 5 months. So it has a ways yet to fall before there is a tax break to the bankrupts doing oil in NoDak.

Note that is extraction tax, not income. HY interest expense doesn’t spare the producer from paying the govt.

http://sayanythingblog.com/entry/oil-tax-trigger/

“I am willing to hear opinions of what that problem is because I haven’t a clue.”

Are those wells fracked? Maybe they are verticals or horizontals with money not spent on sand and thus no frack water?

Aren’t these supposed to be producing wells?

They are producing wells.

I don’t think so. Most of them are in Mountrail County, the heart of the Bakken. And the water cut goes up gradually from these wells. It’s not like there were just a few wells with a low water count. The next well up from these seven had 44 barrels of water the first 24 hours and 1,309 barrels of oil. That had to be a fracked well to produce that much oil.

And one of those with zero barrels of water produces 1,154 barrels of oil the first 24 hours. That is a fracked well.

I see the EIA has the Permian posting the largest expected gains of 46,000 bpd, as I posted on the last thread, the Permian has dropped 20 rigs this week. It seems as though the Permian maybe in the vanguard for the slow down.

Sorry Dennis, I used to scoff at all your graphs where drilling came to a complete halt, and production dropped away a very fast rate. The way things are stating to look, you maybe able to dust them off, and look brilliant with your foresight, lol.

With all these fast declining wells that will not be replaced by new capacity, we could be in for a sharp bump in about 12 months, once all these actions start taking effect.

Russia should be an interesting place to watch, as they also have some very fast declining wells. The question will be, will they continue to drill new wells at a fast enough pace with such a low oil price. I know Ron will be our man to supply the good oil on that one.

Hi Toolpush,

Thanks. I think I overreacted when prices went down so low. The point of those charts was that if prices stay at low levels that production would decline rapidly, but I believe I overstated how quickly the rate that new wells would be added would decrease, note that my model suggests that at 120 new wells per month and new well EUR starting to decrease in June 2016 that output would be relatively flat for a couple of years and then slowly decline if prices rise by about 1% per year from 2015 to 2030.

The problem with all of these scenarios is that there are three crucial pieces of information that are unknown and we can only guess at:

1. Future oil prices

2. Future rate that new wells are added to the Bakken/Three Forks (and Eagle Ford)

3. Future decrease of new well EUR as sweet spots become fully drilled, both when this occurs and the rate of decrease once it begins.

Even Ron does not know the answers to these, nor has he ever claimed to know. Sometimes people do not realize that picking a peak date implies knowledge of these factors (though there are many different possibilities for the combination of these factors which will determine the output path.)

Scenario below has two guesses for oil price (low and medium) and both scenarios assume 120 new wells per month starting in June 2015 (falling from 200 wells/month in Oct by 10 each month), the decrease in new well EUR is assumed to begin in June 2016 and reach a maximum rate of decrease of 4% per year 6 months later. In the medium price case (ERR=8 Gb) new wells added decrease in Jan 2020 to 60 new wells per month by June 2020 (decrease of 10 per month) and remain at this level until 2029 when they fall further to 48 new wells per month.

Higher prices or more new wells added per month would result in very different scenarios, also a change in when new well EUR begins to decrease would change things. I do not know what future oil output will be, there are a huge number of variables, the future values of which are unknown.

Another set of variables ids the abandonment rate of production and the exponential decline rate of the tail (in this case I used 15% annual decline rate after 6 years and a low value for well abandonment, these have a relatively small effect through 2020, but influence output from 2020 to 2030 where the guesses become highly speculative.

Dennis, why would you assume the price of crude oil will follow a linear trend? To large degree oil prices have always corresponded to energy investment cycles and obviously wide price swings have occurred in times of shortage/oversupply with cycles extending over several years responding to changes in demand (as well as OPEC/non-OPEC supply). Geopolitical events have also represented a major effect on prices throughout oil’s history. A glance at any oil price chart spanning 1850 to the present looks more like a saw tooth design with no significant intervals containing even approximate linear trends.

Hi Doug,

It is an exponential trend, which oil prices roughly followed between 1998 and 2011 (prices rose at about a 13% annual rate rising from about $20/b to $100/b in 2014$ over a 13 year period).

Just a guess at a rough trendline for oil prices. nobody knows what they will be or where the noise above and below trend will be.

I have not seen your predictions, though I would be happy to use them.

I have on many occasions suggested that people tell me what they think will happen. Ron and Fernando have done so, and Mike as well, I think a rough trendline like the EIA does in the AEO makes sense.

In the few feasibility studies that I have been involved with the main economic metric employed was the average total production costs of competing producers versus the one under consideration: the rational here being, if production costs applicable to a given reserve were lower than most competing production that entity would remain viable during negative price cycles. That’s the main reason small reservoirs were often rejected because their life cycle could be easily trapped within a low oil price cycle. I have no idea how shale operators think. Perhaps they are akin to speculative stock players (where small investors absorb most of the risk). Anyway, I think predicting future oil prices is a mug’s game – too many variables.

Obviously anyone can define different parameterizations of production curves but looking at the graphs of oil production over the past 100 years I fail to see evidence of trends that conform to simplistic defined-curves, linear, geometric, exponential or otherwise (across meaningful time intervals). And, believe me, I’ve studied differential geometry of curves in painstaking detail in my past life. As stated above, there are too many variables affecting oil production. If anything, the lesson from history should be you simply cannot predict oil production across years, even approximately.

“If anything, the lesson from history should be you simply cannot predict oil production across years, even approximately.”

Marvy.

Hi Doug,

You are absolutely correct that oil prices do not follow any trend over long periods. I would think that when oil companies make investment decisions some kind of low and high oil price scenarios would be used.

The financial guys at the oil companies have to use some future guess about oil prices, possibly a window that they expect will define the upper and lower bounds of the oil price. For example in the chart below, I show a low, medium, and high price scenario (low matches the price scenario you didn’t like), we could think of prices fluctuating between a low and high price scenario, they could be anything, but to make a business decision oil companies nees to make some assumption about expected future oil prices.

Doug said:

You are absolutely correct that oil prices do not follow any trend over long periods.

Here is a 47 year price trend curve with a correlation coefficient of 0.965 (first graph). We’ll have to wait for Arch Angel Gabriel to come down with the whole thing engraved on a gold platter to do much better. Quit to the contrary, we know exactly where oil prices are going on a yearly bases with a predictable margin of error. It is only the short term variation that is not possible to predict.

http://www.thehillsgroup.org/depletion2_022.htm

No sir, you do not know “exactly” where oil prices are going, long or short term. I have seen the link to this graph so many times I want to hurl.

Pretty easy to control oil prices.

Bomb KSA pipelines for a nice uptick.

Bomb Shanghai for a downtick.

Precisely, Mr. Margerie; merci. By the way, I hope you are well. The internet works well up (down?) there; how is the red wine?

These same guys also like to say oil prices will never be above 100 dollars again. The world is one little ‘ol brain fart away from total chaos; one of them giant tankers 4 football fields long sunk in the Strait of Hormuz would just about guarantee 150 dollar oil overnight.

Bon chance, mon ami.

Mike

Hi BW Hill,

I said that, not Doug, I doubt that long term oil prices can be predicted. A fit to past data is no guarantee that the future oil price will follow the fit. Numerical fits without a decent theory to explain the fit, tells us very little.

Mike said:

No sir, you do not know “exactly” where oil prices are going, long or short term. I have seen the link to this graph so many times I want to hurl.

The equation of that graph is:

$/barrel = exp(5.4*10^-5(1.4*10^5 / (1+ 361.44e^(-0.053*yr))) + 0.6877)

You are very mistaken, you have never seen that graph before, or anything even close to it. You can not demonstrate a function that can reproduce the last 47 years of petroleum prices with a correlation coefficient of 0.965. Such a statement as the one above need to be substantiated, or they have no creditability.

http://www.thehillsgroup.org/

Dennis Coyne said:

“Numerical fits without a decent theory to explain the fit, tells us very little.”

Sorry Dennis, yes you did say that – not Doug. The derivation of the Etp model is published in a 57 page report that is available at our web site. It is directed toward the professional energy analyst, and is a commercial product. We do supply copies free of charge to individuals for non commercial use if they can show that they possess the necessary mathematical skills to understand it. If you would like to inquire into obtaining a copy contact us at our site. Thanks.

We have now distributed over 500 copies world wide.

http://www.thehillsgroup.org/

If i had such a great oil price predicción tool i would keep it súper dooper triple lock top secret. I would hock myself to my eyebrows, and play the futures market, and gradually take over the world. When I got to my first $500 billion I would buy me a large island, and fund my own army. The rest of it is up to your imagination.

I know it is winter, but with all the slow down about to take effect, do you think we are looking at a production peak for the Bakken?

Hi Toolpush,

If prices stay low, yes. if they rise there may be a secondary peak, it also depends on how quickly oil prices rise, they would need to increase by 2% or more annually.

Re-posted from end of last thread:

I thought this graph from ZH was pretty revealing – yields on junk bonds from the energy companies shooting up through the roof, and starting to take the rest of the high yield market with it:

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2014/12/20141212_EOD3.jpg

Yep, it certainly does look scary. Things are getting bent so fast, that something is going to break, and I don’t think we have long to wait!

Tidbit maybe not clear to the oil people here. That graph shows a spike to 988 bps. That’s basis points, not barrels per second. And so 9.88%.

That doesn’t mean the bonds already issued by the companies and bought by the lenders are now going to yield 9.88%. That paper doesn’t change. It was probably issued at 5% and that’s what the lender gets.

BUT.

This paper has its own market. It gets traded, just like any other bond. Quick little lesson. Yield = Coupon / Price. The coupon is the text on the piece of paper that says “the bearer of this paper gets $50 every year”. The paper was issued (bought) for $1000, and so that’s 50/1000 or 5%.

It’s not still priced at $1000. It’s an asset. Its price moves with the prevailing yield (interest rate) and at 9.88% the price has to adjust to make $50 (which is fixed for the life of the bond) equal 9.88%. So that piece of paper, bought for $1000, is now worth $50 / 0.0988 = $506. The owner of that bond, the guy who bought it — who loaned that money to the driller — has lost $494 of his $1000. Already. Before default. He can sell it on the open market and that’s all he’ll get — $494.

He can hold to maturity and get the full $1000 back, assuming no default, but that’s years in the future and all that matters is NOW. What is it worth now. The future is dice rolling.

Point being, the lenders have ALREADY BEEN SCREWED. Hard to see how they are going to anxious to buy more issuance (which is what 9.88% indicates).

“He can sell it on the open market and that’s all he’ll get — $494.”

errr $506.

BTW, in this overall context, a Fed decision to begin buying these bonds, at par value (the original $1000), takes the yield right back to 5%, even with oil price in the Bakken at $41.

The drillers could keep operating because they can still borrow at 5%. Hell, the may ask the Fed to pay more than par value, taking the rate down to 2% and even cooler, do what the Fed does with Treasuries. They never have to be paid back.

The price of oil could sit there at $41 in NoDak, and the drillers can borrow $10 million for each well, drill and pump oil because the well is free. It costs nothing. They won’t pay back the loan because the Fed will just let the paper mature and trash it, as they do with Treasuries.

Behold, what started when QE started.

What a tangled web we weave?

Thanks Watcher for the making the ridiculous simple, it must be all that spook training you had as Big Mac flipper trainee!

I know Watcher annoys people, but that’s a very snobbish comment, Toolpusher.

Bill,

I know humour can be hard on these boards, but there was no snobbery intended. In the last few days a few of the regulars were taking shots at Watchers true occupation. being a spook was suggested due to his broad knowledge of all things. In which he replied he worked at a failed McDonalds.

I am sure everyone has there opinions about our Watcher, but I do not believe anybody would judge that to be a true statement about his back ground.

Anyway, knowing Watcher, if he had any grips I am sure he would let me know. As he is certainly not a shrinking violet, lol

WATCHER could be anybody from an old fat guy mostly stuck in the house like me to a bond trader or a middle man of some sort in the oil business.

There would be some real insights into the way the market is headed to be gleaned from a site such as this one.

And while I caught him out on chainsaws a couple of days ago- that proves nothing because he could have deliberately written his comment in such a way as to conceal a knowledge of loggers tools.

There are at least two sides to spook theory – desk jockey spooks keep an eye on websites and newspapers for any relevant info.He may be writing a tight little report twice a day on what is posted here and forwarding it to his employer who might be anybody from a paper trader to an assistant to the director of Homeland Security.

Or the personal secretary of the ceo of Exon or BP.

I am the dead CEO of Total.

Thanks, toolpusher, I withdraw my comment unreservedly!!

With qe government buys government bonds not junk.

I read somewhere that venezuelan bonds are paying very attractive interest rates, near 20 %. And a birdie told me their oil exports are down.

The way you calculate the yield to maturity is wrong. It is not that simple and depends on the time to maturity. For example, if the bond has a face value of 1000, yields 5%, the current price is 500 and matures in a year, the YTM is 101% (and not 10%). If it matures in 2 years, the YTM is something a little north of 40%. This is simply because the bond issuer has to pay the face value on maturity.

– Lurker and a bond investor.

Sorry 110% (not 101%)

We ain’t adding it up to maturity. The bondholder cares about NOW. He’s down a ton.

Of course, more to the point, what’s the yield to maturity for the Fed, who may buy such things, bearing in mind that they refund all interest Treasury pays them.

When they are saying a bond yields 9.88%, that is what it means. Its yield to maturity. If you are issuing a bond for a period of time, you are obliged to pay the face value on maturity provided you are solvent. Hence the yield which is stated is what is your return per annum compounded if you hold it till maturity. So yield is not coupon/price like you have stated. That is simply false and misleading to guys who are uninitiated. The bond holder is down a lot depending upon when the bond matures but he is not down 494 bucks as you have calculated. And it is applicable for FED too.

Well, I took 9.88 from the posted graph.

I don’t even know what we’re arguing about. I didn’t calculate 9.88%. That was the posted rate from Bloomberg? Actually I didn’t go look at where the quote came from, but it was a quote, not a calculation.

Ahhh, wait — you are typing very clearly yield to maturity and I was reading a different blog talking about future annuities. You’re right. YTM is a more accurate evaluation when looking at a comparison of various instruments with different coupons and maturities — but . . . we’re somewhat not, really. The point was the bond the bondholder bought (from the issuer, at par), when prevailing rates were 5%, and now they are 9.88% (not calculated, quoted) and that means the price of his asset has declined and he’s got a big loss.

To be clear … and if there is not bankruptcy:

1) If several years ago you issued a bond at $1000 with yield 5%, whatever happens on the bond market, you have to pay $50 every years until maturity.

2) If you are the lender, you will receive $50 every year until maturity and $1000 at maturity. However, the mark-to-market reporting will increase your assets if hield is below 5% and decrease you assets if yield is above 5%. In the initial Watcher example, (not sure about his computation), the assets will be evaluated at $506, so the lender would book a loss of $494.

3) The market yield will be important for new issuers or lenders, or to people involved in the secondary market. So a company wanting to issue a new bond should pay 9.88%, an investor buying a the bond on the secondary market would get an return of 9.88%.

The equation to compute the new asset value is the following: $1000 * ( 1 + N * 5%) = MV * (1 + N * YTM) where N is the number of year to maturity, MV, the market asset value and YTM, the new market yield to maturity.

In summary, higher yields are important for lenders (lower asset value in balance sheet) and NEW issuers (they will have to pay that yield).

the lenders have ALREADY BEEN SCREWED.

That’s very unlikely. The original lenders will have sold the commercial paper on the secondary market and become liquid, ready to lend to someone else.

They’ve lost nothing.

It’s weird, and hard for people outside the financial world to believe, but there are always lenders ready to give money to bad risks – they just ask for higher interest rates, and other sweeteners.

Look at Greece – they’ve been going bankrupt for every 25 years, for the last 200 years. Someone always lends to them the next time.

Yeah it’s funny reading this stuff given after the OPEC decision a lot of the further falls have come on the back of what someone said or some report of how much production will grow and not once was it questioned.

TAKE IT FROM THE FARMER.

Commodity prices in the real day to day world are determined almost solely by what the end user is willing and able to pay.

When you get away from day to day and start talking month to month and year to year then the producers cost come into play. Hardly any producers are able to make significant changes in their production on a day to day basis especially in a business as complicated as oil.

Even in a relatively simple business such as farming it takes a year for the producers to change their production schedules to any noticeable extent and farming is dominated by small independent operators.

The people in the oil industry are well started on cutting back production- but production will not actually fall off to amount to anything for months yet and more likely closer to a year.

The FUTURE PRICE of oil has to do with expectations. TODAY’s price has to do with reality on the ground TODAY.Next year and five years from now have almost nothing to do with the price of oil TODAY.

When the end user just doesn’t want ( can’t afford) your product anymore he quits buying it and the price goes down.The wholesalers orders fall off and he quits ordering and the factory starts laying off.

The thing about the ” oil factory” is that it takes a while for the high cost producers to shut down.

The high cost producers will shut down because reality forces them to. The low cost producers will continue to produce because they are still making a profit and want the money.

They will be making a LOT more when the price goes back up of course which gives them some incentive to maintain production now in hops of crippling the high cost competition and keeping it on the disabled list for a good while.

Some people even think the competition in the form of tight oil won’t EVER come back but I think they are badly mistaken.There is obviously a price at which tight oil IS profitable and oil will most likely go up to that price if not next year or the next then the year after that or the next one.Depletion never sleeps.

It is true that a lot of hedging may have been done meaning a lot of end point sellers may be OBLIGATED to take what they contracted for- in that case it just drives the short term price – the spot price even lower as they do what they can to get rid of unwanted inventory- generally by running a losing money sale price on it.

Ron, can you do a little statistical analysis and see if there is a correlation between first 24 hour production and first year production? I think that could help prove one way or the other whether you’re right.

I will see what I can find out. I can only do a few wells because each well would have to be searched seperately but I will try to pick out a few very low first 24 hour producers and a few very high ones and see what comes up.

One can get an idea of the correlation between the first day production and the annual number by using the Bakken decline curve presented by D. Hughes in his recent report, “Drilling Deeper”.

Using the Arps Hyperbolic function to model the monthly data provided to me by Mr. Hughes shows that the flow rate at time zero is 667 b/d. Note that at the end of the first day, the rate is down to 657 b/d. The initial and month 12 rates provided are

Mth Rate (b/d)

1 548

2 423

6 243

12 157

Doing the detailed analysis provides the following results. First year production is 41% of the initial production rate. Second year production is 19% of the initial rate.

To put some perspective on these numbers, below is a back of the envelope estimate.

Adding up the first 12 months of the Hughes production rate data gives an average rate 3252 b/d. Multiplying by 30.416 gives 98,912 bbls for the first year, close to the Arps cumulative number of 99,115.

The problem is, how to estimate the first day rate from the monthly rate. The rate drop between months 1 and 2 is 548 – 423, 125 b/d. Since the 548 b/d rate occurs around mid month and assuming linearity, adding 1/2 of the 125 to 548 to gives an approximate first day rate of 611 b/d. This is 56 b/d lower than the Arps value of 662 b/d, about 8%.

Using the approximate initial rate of 611 b/d gives an annualized production of 223,015 bbls. Dividing the estimated first year production of 98,912 bbls, obtained from the Hughes data, by 223,015 yields 44%, which is 7% higher the more accurate estimate of 41%.

It would be interesting to see how close some actual data comes to this approximate estimate of say 40%.

That looks interesting, but you are at the mercy of variable choke.

The well reserves over 15 years won’t change that much. raising flowing bottom hole pressure helps manage gas, should reduce water production. I wonder if they considered using a higher gathering system pressure? That ought to cut back compression costs. Do any of these operators optimize their systems?

Falling Oil Price slows US Fracking

http://oil-price.net/en/articles/falling-oil-price-slows-us-fracking.php

From my website:

11/12/2014

World on drip of unconventional oil

http://crudeoilpeak.info/world-on-drip-of-unconventional-oil

3/12/2014

US crude imports from Non-OPEC countries peaked 10 years before tight oil boom

http://crudeoilpeak.info/us-crude-imports-from-non-opec-countries-peaked-10-years-before-tight-oil-boom

US Peak Oil II is here and soon will be gone. Print it. Peak Oil is history, i.e., in the rear view mirror.

The energy junk debt bubble is bursting, which will precipitate defaults on US and Canadian C&I bank loans and bust the offshore shadow banking’s carry trade that is levered 50-80:1, increasingly via emerging market (EM) debt, US Treasuries and MBS, and equity index futures.

The current debt bubble is global in scale and now larger than that which preceded 2008-09. The coming debt-deflationary collapse will be unprecedented in history, making 2008-09, 1929-33, and 1893-98 look like an amateur-hour rehearsal.

This is what the collapse in oil and $2 or lower gasoline in 2015 is signaling.

Japan’s monetary base now exceeds the value of loans of the largest Japanese banks. At the current rate of growth of the Japanese monetary base, the base will reach par with total loans by late 2016. The US is on the same course, implying that the Fed will eventually be directed by the TBTE banks to print another $2-$4 trillion in bank reserves to liquefy banks’ balance sheets and to provide sufficient liquidity to clear (monetize) US Treasury issuances to run the necessary fiscal deficits to prevent nominal GDP from contracting hereafter.

This implies the 10-year Treasury yield at 1% (like Japan and the EZ) and, by extension, wages, CPI, and nominal GDP decelerating to 1-1.5% in the years ahead.

The shale boom/bubble was not economically justified given the level and no growth of US consumption and the uneconomic energy costs of extracting costly, lower-quality crude oil substitutes.

Some argue that the price of oil is collapsing because of a glut of oil, but the glut is a result of Peak Oil pushing up the price of oil that we cannot afford to burn and grow real GDP per capita. We will have a permanent glut of costly crude oil substitutes that we cannot afford in terms of energy costs to extract that permits a sufficient supply of affordable costly oil in order to grow the economy.

Peak Oil, LTG, the end of growth, population overshoot, the onset of the post-Oil Age epoch, over the Seneca Cliff, and back to Olduvai we go.

BC- very well said, and that’s just about how I see the whole deal as well.

I especially think that population overshoot is the root cause, and low and behold you have billions of poor young, and now a growing hoard of poor old who can’t afford to live “the consumer dream” in a world with expensive fuel. All the QE, and yen printing in the world won’t fix that.

Most of all the others problems stem from this population overshoot, which was enabled by 100 million years of crude accumulation being tapped and burned in just about 100 yrs.

Ouch.

BC,

You are severely misguided. There is going to be no debt deflation. I will repost my response that I wrote on the clueless Raul Ilargi Meijer’s Debt deflation nonsense website.

“The total Debt in the world depending what all you count in it, is around 200-235 Trillion. This is the basic amount that is used for fear mongering. Comparing it to GDP it looks high. That would show a high Debt to Ebitda ratio if the world were a corporation.

But focusing on income ignores a very important side of the equation.

Which side you ask? I am glad you asked Raul Numbskull Ilargi.

The question is what is the value of the world Equity? I know this may be foreign concept to you so I will elaborate. The world total assets is the sum of the World Equity (not equity like stocks, but equity like residual value after Debt is paid off) + World Debt. So what is the value of world total assets?

That is incredibly hard to figure out as values for a lot of things simply do not exist or are unknown.

But we do know values of a lot of things. For example World Financial assets (stocks, bonds, money market funds, excluding all derivatives) is close to 300 Trillion, and total world Residential and Commercial Real estate is 250 Trillion or so. There are many, many, other assets which are owned by Governments which do produce revenue (for example roads and bridges which are toll taxed) that are not included in this count. Gold and other precious metals are also excluded. The value of all of those would conservatively be 150 Trillion and probably a lot higher. So total assets would be 700 Trillion. Subtracting out the Debt gives you between 465 and 500 Trillion as world Equity. For a Debt to equity ratio of around 0.4 to -0.5. Now most single companies have rarely gotten into trouble until Debt to equity exceeds 4. So at 1/10th those levels only a retard like you could think that. That is why you and Nicole Foss have repeatedly missed the big picture and got everything wrong. And every now and then when after years of fear mongering something remotely goes your way you have orgasmic debt rattles. Actually I have left out the Net value of all private corps. That data is not easily available but most people believe it is between 1X-2X public corps. So between 300 Trillion to 600 Trillion.

That Means your total world assets are 1.0 to.1.3 Quadrillion giving a debt to equity ratio of around 0.2 to 0.15.

You think these numbers are made up?

How about this? This is actually Statistics Canada’s graph.

http://www.statcan.gc.ca/pub/11-008-x/2011001/c-g/11430/c-g003-eng.htm

Showing Canada’s debt to Assets of 0.2! That would imply a Debt to Equity of 0.25! So fucking scary. That chart actually says that it is at the highest level in 35 years and it is still so incredibly low. I actually pointed this out to you in early 2009 as to the reason stocks would rise big time and you made fun of me. Sorry for being like you.

And BTW the average Return on Assets by companies is around 6-8%. So 1000 trillion producing a world GDP (income of 60-70 Trillion would make perfect sense). “

Pretty sure that in that amorphous financial gobbledygook there was a personal attack.

You are correct. I agree it is hard to work out in view of Huck’s poor punctuation skills. Had he inserted a comma before the word “Raul” in line 7 the personal attack would have been much clearer.

As it is, he makes”Raul Ilargi Meijer” the object of the verb “asked”, making a nonsense of the sentence. The ensuing sentences are in the same nonsensical vein.

This character has been trolling over at theautomaticearth for some time.

I have been trolling there. We chose different ways to do our battle. I believe his deflationist view is extremely damaging to people. While I find my own methods crude (haha) I have yet to find one person show that my numbers are even remotely off. That includes Prechter’s family of idiots too.

I won’t troll here as Ron Patterson even on his worst day could not think as 1/10th as stupidly as those two nutcases.

I’m pretty sure your total debt calculations are just government debt, not total debt.

Statscan link confirms that at an individual level Debt to asset ratio is 0.2.

“I’m pretty sure your total debt calculations are just government debt, not total debt.”

You would be pretty wrong.

http://blogs.wsj.com/economics/2013/05/11/number-of-the-week-total-world-debt-load-at-313-of-gdp/

Sounds clumpy… Does it come in a lotion?

But seriously, this is yet another example of complexity and, say, the ‘oligarchy’ or ‘high priesthood’ of information/knowledge. Like legalese.

It’s a trap.

Knowledge is power, status, with power comes responsibility. Or not.

…POB could have a status-o-meter… maybe using something like WordPress’ voting widget.

You forgot to add in the value of all of the ocean’s water, that resource, the value added for ships to be able to sail, the value of the ice cap covering Antarctica, the ice covering Greenland, the coal, the oil, photovolts, wind production, the value added from electricity production, enhanced manufacturing from the available electricity, all of the icebergs in the North Atlantic, the fresh water there, etc.

The totals become astronomical.

The US Treasury should issue a check to everybody on planet earth for 100,000 dollars.

What’s 7,000,000,000 times 100,000?

700,000,000,000,000 that’s seven hundred trillion dollars.

Subtract a 3 percent tax for administrative fees, raise 21 trillion dollars instantly, pay off the national debt in seconds, everybody can afford to live for a few years, buy groceries, the banks can do bail ins, charge fees to keep the hundred grand in everybody’s accounts, they’ll be able to pay off their debts, the world has 700 trillion dollars in cash. The price of oil would become expensive and gone in hours.

What could go wrong?

Good points Ron, and don’t forget the value of all the data in the cloud- just imagine its auction value in the future. And how do you value the productivity of soil microbes, and the work of insects on your sovereign territory?

And I had thought Huck Finn was supposed to be a likeable character.

You are confusing two issues which TAE does quite often.

1) Is debt enough to cause massive deflation…and the answer is no. Would someone who has $60,000 loan on a $300,000 house be considered insolvent? That is virtually impossible. Yeah shit happens occasionally but that is not the average.

2) Is resource depletion and environmental destruction a problem? Yes.

It is. Ron Patterson and everyone around who has worried about this stuff is correct.

But bringing them together to spew a complete garbage of madness? What is the point?

Yo Huck, have a try at this one.

Is eroding EROEI the sort of reality that biases all systems towards deflation entropically.

EROEI only matters if the energy which is the input is non-renewable. if the energy input is for example solar EROEI becomes merely a measure of efficiency.

If you make (m) ethanol from water and CO2 using electricity from a solar or hydro (both energy capturing methods which relatively quickly pay back their own energy input), what is the EROEI?

Rgds

WP

Exceptional answer WP.

You know Watcher your answer reminds me of Robert Prechter and Raul Meijer’s thought process. You know RP spent over 2 decades trying to find a wave count that would create DOW 1000, because he had to see Deflation. Even with oil, that genius saw that $20 would be the peak and we would go to $4!. He was wrong in 2008 by a factor of 35. But hey he still continues to talk about deflation.

If we create an Electric Car Fleet and with the improvements we see in battery efficiency, we improve our EROEI by a factor of 5 as we are using Coal and not oil anymore. I don’t see that happening within 10 years but when it does deflationists will point to the fact that we will reaching Peak Solar power in 40 years and eventually things will all go downhill. Yeah eventually everything will go, but unlikely in our lifetimes.

Does Prechter have anything to say about oil production and how effort to get it rises? I thought he just looked at squiggly lines.

He predicts constantly lower prices, constant imploding deflation and hence was relevant to the topic I thought.

EROEI is only eroding for fossil fuels. For renewables, it’s rising (even though it’s already high enough).

Renewables don’t exist in a vacuum. They require or make assumptions about certain questionable (ethically and otherwise) sociopolitical and infrastructural forms and commitments.

At the same time, I am unsure what is factored into EROEI calculations, since some energies invested don’t always seem to factor in (energy investments in) such things as manufacturing, shipping, maintenance, land-use, pollution, health effects, cleanup, affordability (haves/have-nots), and even social unrest that might come from any of the above.

And then there’re cost-benefit analyses.

There are well known standards and procedures for developing EROEI calculations.

They certainly include energy related to manufacturing, shipping, maintenance, and land-use. The rest are not energy, and therefore not part of an EROEI calculation.

Affordability, of course, is part of a cost analysis.

Any standards/procedures that neglect various energy inputs over the course of a form of energy’s lifecycle seem questionable. I cite nuclear energy’s waste disposal and accident management as two simple examples.

But then, this is like some forms of so-called economics as well, such as with regard to the neglected costs of externalities.

Many cost-benefit analyses are a joke.

EROEI analysis isn’t expected to handle everything, you have to expect your analysis to be a little more complex than one simple quantitative measure.

Heck, if you’re going to try to boil everything down into one simple measure, why not use dollar cost?

No kidding.

Even so, all the measurements in the world, all the uneconomic mumbo-jumbo (that few really seem to understand, even those who are supposed to) are not going to make a better difference without real, pure direct democracy/lateral hierarchy, which includes Earth and the living beings on it.

Pure democracy– control/input over/into your own life– seems to plug, inextricably, into climate change, for example.

That seems to imply doing away with cops, military and governpimps.

If we care about climate change, we care more about democracy/hierarchy than, say, EV’s, PVs or EROEI, and make it more of our narrative or discourse; more about who we are and what we need as priorities.

BTW, over here in so-called Canada, a hint, the secret, to much of our ecosociopoliticultural problems might be found on its 20-dollar bill. In your face, in your pocket, in your food, in your life: Oligarchy; undemocracy.

I don’t think you understand this subject very well. If a companies assets exceed its liabilities it is technically insolvent, you wont be able to borrow very much if your debt is equal to 80% of your assets, let alone 400% which is the point you claim companies start to get into trouble. Your total debt seems very low, US govt unfunded liabilities alone are calculated at around $100T and growing, which is half your total world debt, seems unlikely. Unless of course you are assuming that promises to corporations should be honoured and promises to voters should be defaulted on.

I’m not getting into inflation v deflation debate, but if you are going to rant and rave, and post an ad-hom you should do a bit more thinking first. You have raised some interesting points, but I suggest you use a more constructive approach instead of launching into ad-homs.

If a companies assets exceed its liabilities it is technically insolvent,

Don’t you have that backwards?

“If a companies assets exceed its liabilities it is technically insolvent”.

I think as Ron mentioned above you meant Liabilities exceed Assets.

But you are misunderstanding what I am saying which is quite common among people who confuse Equity with Assets.

I spoke about a Debt to Equity ratio of 4:1. NOT debt to asset Ratio of 4:1.

So If you buy a $250,000 house and put done $50,000, you have $50,000 Equity, $200,000 Debt and your Assets are $250,000. Your Debt to Equity Ratio is 4:1 and your Debt to Asset ratio is 0.8.

Now in the example above most people might think that is a fantastically large downpayment and the borrower would rarely get into trouble. I am saying that, that level described above is the minimum level at which a corp would get into trouble.

Now the Current ratio for the world is as if the World bought the same $250,000 house and paid for it with $200,000 Cash and $50,000 debt.

So Debt to equity ratio is 0.25 and Debt to asset ratio is 0.2.

As the benefits of shale (lower trade deficit, higher economic growth) existed mostly for the US economy, the damage is also now for the US economy. Emerging markets are multiple times outperforming the DOW (Shanghai and Mumbai are up more than 50% during the last three months) and the bond market (EMB outperforms HYLD by 30 % during the last months). The US economy provides the world with cheap oil at its own high costs. This is an huge economic advantage for the rest of the world. China oil and copper imports are at seven months high, India metals and ore imports up 100% yoy, Indonesia production up 10% yoy…. The world is already booming at the expense of the US economy. Furthermore the dollar has already shown a significant reversal (long down candle followed by a long up candle). So, things are very likely getting much better for the world economy) when the dollar starts falling. The US economy has painted itself into the shale corner, which would be only a good position if oil prices would be very high. At low oil prices this is just a fantastic opportunity for the world economy to grow and create jobs and bring many people out of poverty worldwide. The US economy does here a fantastic charity job. Thank you.

The US economy provides the world with cheap oil at its own high costs.

Isn’t the US the second largest importer after China?

ok. It provides also cheap oil and gas to its own economy. However, the net benefit is important. The US imports around 6 mill bpd, the rest of the world around 25 mill bpd. On the other side the US has 10 mill bpd (inclusive natural gas) high cost energy production and the rest of the world close to none. So the balance has shifted significantly towards the rest of the world. At the current level of oil prices, shale is a significant burden for the US economy. This may change over time as I am sure oil will go up again.

There’s been some discussion as to whether lifestyle and income are depressing the demand for oil, especially in the US. This seems relevant. Some have argued that this is only temporary, and as soon as incomes rise, people will go back to their old spending ways. But what on the horizon is going to make incomes rise?

http://op-talk.blogs.nytimes.com/2014/12/11/for-millennials-home-might-be-a-moving-target/?partner=rssnyt&emc=rss

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WRPUPUS2&f=W

Some argue stuff that’s wrong. This ain’t much of a decline and what there is of decline is from the 2008 global Apocalypse that continues.

The reduction in demand meme is bogus. Looks like 20 mbpd of everything, but even though it’s not pure crude consumption, hard to see how it would vary a lot from that graph. mazama’s graph looks the same. This “US is reducing demand” stuff is delusional.

Now that I squint at that it looks clear that every week above 2014 is above 2009. Looks like demand is increasing, don’t it?

Watcher,

The claim for the falling oil price is the lower demand. I don’t believe the lower demand is from the US, but other counties. Since the oil price recovered form the 2008-09 thing, Brent has been over $100 and Tapis a SE Asia oil has been $120. It has been these prices that have fallen the most, and have basically forced WTI lower. Tapis was $20 to $30 more expensive than WTI, is now $66, just $8 difference.

As you note, US oil demand is actually increasing, after the 2009 dramatic drop in consumption. You will need to look out of the US for the so called drop in demand.

Currently, I think many people explain oil price crash by falling demand. This is not correct at all… It should be stated “demand is GROWING lower than expected”. It is incredible how the mainstream media are washing the brain of anybody. So don’t try to find which country has demand falling to explain the “lower demand”. Moreover growth in LTO production was so high that supply is now higher than consumption. The difference is stored, but storage has also limits. I saw recently an article stating that if this oversupply continues, oil sill be stored on sea (in tankers)…

You can get a much better view of what’s going on by looking at the monthly data and then shortening the time base. Of course you will have to make your own graphs, but this is quite easy. The last data point in the chart below is October 2014.

Monthly Energy Review

On that scale it looks pretty flat post 2009, so a meme of US oil consumption dropping because unicorns and flowers have arrived and people gently and in a sense of namby pamby community are all gathering together to not consume oil . . . is crap.

There is no down ramp. There is the 2008 Lehman Apocalypse event and there is nothing else. A GOP Congress will quickly see to it waivers are granted for all CAFE silliness and mazama/BP will show no decline in Chinese consumption this year, nor anywhere else than maybe Greece.

There are no unicorns. Never have been. Never will be. The only significant drop in consumption we will ever see will be imposed by military force.

In fact, now that I notice it, even an Apocalyptic event of Lehman magnitude only got 10% off the US consumption . . . because there is no wastage. What came off was economic activity.

Looking even closer, the Bear Stearns preparatory even to Lehman is also visible. All that upheaval, and all you get is 10, maybe 15%. hahahaha What a disaster.

”The only significant drop in consumption we will ever see will be imposed by military force.”

I assume you mean short to medium term and no unforeseen economic heart attack.

For damned sure consumption will eventually drop due to geological factors and or an economic shift to other energy sources.

I am agnostic about renewables EVENTUALLY being scalable to the extent they can shoulder the load but only because of the ambulance on the way to the hospital aspect of bottleneck and overshoot.

The current remaining stocks of fossil fuels are in my estimation certainly adequate to build out enough renewables to give up fossil fuels- IF we were to get started on the job in a determined way and simply stay after it.

Unfortunately seven billion naked apes aren’t going to get after ANY job except each other and making more apes in a determined way and keep after in.

The reason I believe it is possible though is the snowballing effect of economies of scale. The more you build the cheaper it gets until you run out of raw materials and the two utterly essential materials are sand and an energy source. There is coal enough and sand enough to spare several times over if we were to go for renewables and efficiency the way we go for destroyers and tanks and icbms and mindless entertainment and junk food.

The ” positive ” positive feedbacks would be simply astounding if the decision to go for renewables on a war time footing is ever made and implemented.

I really do have enormous respect for the Wonderful Wonderful Market and the Invincible Invisible Hand.

If the supply of fossil fuels were large enough that the downside of the supply curve would be long and gentle and we were not faced with economic and ecological collapse due to overshoot the market would take care of the ff depletion job for us.Renewables , conservation and efficiency would come into their own about as fast as fossil fuels depleted.

Unfortunately the Market and the Hand are not really on the job and aren’t going to be SUMMONSED to the job by price signals until even the efforts of THE MARKET AND THE HAND are going to be too little too late.

The meme most journalists and economists seem centered on is that changing habits – like people moving to urban areas, using mass transit, buying higher mpg vehicles, driving less in general – led to lower demand for oil in the U.S.

To me they put the cart before the horse. Global net exports were shrinking, less oil was available, so demand by importing countries HAD to fall. Prices rose until import demand shrank to match available export supply on the global market. The result? Involuntary changes in behavior that lowered oil consumption.

The fundamental premise that is wrong is that U.S. oil consumption is lower due to voluntary changes. We chose to use less! Yay!

In reality, lower consumption was forced upon importing countries and people rearranged their lives to cope. When “voluntary” changes don’t drop demand fast enough to reach equilibrium with declining supply we get recessions.

A recession is basically when small, elastic reductions in consumer demand aren’t large enough to equal reduced supply. What then occurs is that more inelastic demand from commercial and industrial consumers must ALSO decline. That commercial/industrial decline IS a recession, and is usually heralded by a rapid rise in oil prices.

It all comes down to elasticity, and which sectors have elastic or inelastic demand curves. Markets had been driven by the demand curve over the last decade, but the inelastic supply curve is, at the moment, dominating the price trend. OPECs decision to not cut supplies changed the equation – economists assumed the supply curve is elastic since OPEC can (presumably) raise or cut supply at a moments notice, thus assuring large price changes aren’t possible on the supply side. Turns out that supply is inelastic (large price change had little effect on supply).

Basically, at any given moment you just need to figure out if the market is being driven by the supply curve or the demand curve, and from there discover if the driver is inelastic or elastic. You can predict the magnitude of price changes with these two pieces of info.

http://www.ritholtz.com/blog/2014/12/awesome-oilenergy-infographic/

” Markets had been driven by the demand curve over the last decade, but the inelastic supply curve is, at the moment, dominating the price trend. OPECs decision to not cut supplies changed the equation – economists assumed the supply curve is elastic since OPEC can (presumably) raise or cut supply at a moments notice, thus assuring large price changes aren’t possible on the supply side. Turns out that supply is inelastic (large price change had little effect on supply). ”

I agree that it is not pure market supply/demand per se since there was a conscious decision not to cut supply. So can you speculate why supply side said “No more”? I guess I am asking for icing on torte and that is hard to get 🙂

Turns out that supply is inelastic (large price change had little effect on supply).

Are you joking? The large drop in prices is having a dramatic effect on supply. Of course there is a lag time. When the price drops drillers just don’t stop drilling on projects already underway. That capex has mostly already been spent so these projects will be completed.

But projects are already being cancelled, rig counts are already dropping. And they are projected to drop a lot further.

Just wait until the second quarter of 2015 and see what kind of effects the price drop is having on supply.

Hey, supply, demand affects price. But price also affects both demand and supply. High prices drive demand down and supply up, low prices drive supply down and demand up. But the economy is a major player in this game. If the economy is in the doldrums then low prices will have a much less effect on demand. In fact it was very likely the state of the economy that started the drop in prices, even more so than higher supply.

During the great depression everything was dirt cheap but the people simply had very little money, so demand stayed low also.

Hi Ron,

To make things clearer you need to distinguish between shifts of the demand or supply curve and movements along a demand or supply curve. Some are arguing that at $100/b and everyone producing “flat out”, that the supply curve was relatively steep (inelastic). Under those conditions, slower economic growth worldwide led to a shift of the oil demand curve to the left, in order for supply and demand to balance oil prices had to fall as prices fall, the quantity of oil supplied will fall and the quantity of oil demanded will rise (both are movements along the supply and demand curve) until they are equal at the market clearing oil price.

It seems we’re in agreement, but simply discussing short-term versus medium-term.

I commented above saying that late spring/early summer 2015 will be very interesting since not much can be gleaned by the slow winter months as well as the lag effect. These prices combined with a depletion of sweet spots could make the summer of 2015 quite interesting.

In either case traditional elasticity curves don’t fit shale production. Due to how quickly wells can be completed and fast depletion, shale supply has more of a “graduated equilibrium” stairs type graph. Outside a narrow range of prices future production plummets. We may very well get to see this occur in the near future.

The longer the lag time for a project the more the average price over long periods of time matters, as opposed to the current price. That’s a large part of what makes shale oil so precarious. The lag time compared to, say, a deep water or oil sand project is quite short, and is much more easily impacted by temporary price changes that take it outside of its price window.

Hi Brian,

Your analysis may be correct, but oil prices are determined by the World oil market, so I was talking about the World oil supply curve, of which LTO is only a small part, as well as World oil demand.

The Bakken Supply curve in the short term is steep, output will not be affected by changes in price for 3 to 6 months.

Mr. Patterson. Really like this site. Thank you for all of the effort you put into it.

I question how much US and Canadian oil exploration is viable at sub $60 WTI. I suspect almost none, and what is occurring now is due strictly to lag time, or major projects that take years of planning. I note there has been almost no growth recently outside of those two countries at much higher prices. Do you think a shortage is in the cards in the next couple years or so?

Noticed every gas station was busy today. Good weather and Christmas shopping going on. Asked cashier where I always buy gas how busy they were. He said thinks they will sell more gas this weekend than they ever have this time of year. Only cost me $48 to fill up. Early summer was $80+. Don’t know about how much demand will increase but doubt it will fall at $2 gas, which will be here soon.

I think it is accurate to say the oil supply is more or less set in concrete over a period of weeks to a few months-barring war or cartel action.. Supply will not start dropping noticeably for a few more months yet in response to a the current price crash unless OPEC or Russia decides to cut production.

We will know how long the time frame is for oil supply to respond to falling prices due to REAL market forces pretty soon -my guess is within a year at the most. By REAL market forces I mean ” other than by cartel manipulation of supply”.

While the price decline looks likely to have an effect on LTO, it isn’t really clear that conventional won’t pick up the slack, at least for a while.

Without commenting on the long term supply (which may fall off a cliff one fine day) in the short term that might not happen, at least for high margin producers.

Profits are very high for the cheapest conventional producers. I think some may be incline to increase production as a reaction to falling prices in order to make up for lost revenues. Standard market theory says supply decreases when the price falls, but the vast “rent taking” in the oil markets may change the calculations of the producers.

For example the Saudis need $85 oil to balance their budget.

http://www.platts.com/latest-news/oil/dubai/saudi-arabia-needs-85b-brent-to-balance-budget-21992779

They now have three options: Cut spending, increase exports or go into debt.

Ironically the falling oil price is an automatic spending cut for the Saudis, since a lot of their spending is oil subsidies. but I doubt that will be enough.

Maybe they’ll just go into deficit spending. They have a lot of cash, and interest rates are low.

But maybe they think their best bet is to simply increase production, assuming they can.

Hi Illambiquated,

The fact that Saudi Arabia was not producing more oil at higher prices suggests that they may have been at their limit, I doubt their C+C output will ever rise as high as 10 Mb/d in the future. Iraq may increase output in the future, but I think this is several years away due to political turmoil for Iraq to reach 4 Mb/d.

Offshore oil production is likely to decrease in this price environment, so I doubt conventional oil will be able to fill the gap left by LTO declines which will occur at oil prices under $75/b.

I do think the reduced output will lead to higher oil prices and that a higher quantity of oil will be demanded at lower oil prices, which will also tend move oil prices higher (as the market moves along the demand curve.) In addition lower oil prices will lead to greater spending on other goods as the cost to fill up the gas tank goes down.

This in turn spurs greater economic growth and a shift of the oil demand curve to the right as income increases, this also will drive up oil prices. The whole process will take 3 to 9 months before we see oil prices start to move higher.

Involuntary changes in behavior that lowered oil consumption.

The fundamental premise that is wrong is that U.S. oil consumption is lower due to voluntary changes. We chose to use less! Yay!

Oh, I agree that many people in the US are downsizing out of necessity. But whether they live in a smaller house by choice or economics, the result is the same. If they drive less because of choice or economics, the result is the same.

The big debate, I think, is whether people would consume more energy if they could afford to. But if the economy doesn’t raise more incomes, they don’t get that choice anyway.

For most of the US population, incomes are not rising. And many younger people are saddled with college debt that they will be paying off for years.

re: ” and as soon as incomes rise, people will go back to their old spending ways. But what on the horizon is going to make incomes rise?”

Excellent comment and point. It seems like there is a lot of money around because people have a lot of fluff stuff like electronics, nice furniture, etc. The sweatshop-made toys are cheap. But look at the faces of people at the grocery store till. They look sick. A $200 lightly filled cart is the norm. I saw one guy with two huge carts (blended family with 7 kids) and his bill was $1200 freaking dollars. I just wondered where he worked?

Locally, pubs are few and far between with very skimpy hours. When I was in my early twenties we would go to a beer parlour and drink all night on $5.00 and I made $7.00/hr as an apprentice. Cost wasn’t even a consideration. Nowadays, there aren’t even any beer parlours, they have trendy little pubs trying to catch those with a few bucks. And pub numbers are declining and going broke because except for an after-work blitz, they have few patrons to justify staying open. When I was still working (two years ago) I would stop in at a local watering hole for a few pints with my buddies. Two pints and a few wings and tip set me back $25. I thought, “hmmmm, $25/wk….$100/month….$1200/yr, I’ll just buy a case and go home. Screw the hockey pool”. It’s like that all over in BC.

I think the decline has set in and you can price equity and assets re: debt all you want, but if you don’t have the cash in hand you have nothing. “it’s not what you own, it’s what you have paid for”.

regards, Paulo

Saudi Arabian Oil Minister Ali Al-Naimi assures us that “the market will correct itself”. That is hardly reassuring. If I’m not mistaken, the whole intent of three rounds of QE, bank bailouts preceding that and a host of financial tricks since 2008 were specifically intended to prevent the market from correcting itself. The market correcting itself is exactly what central banks and governments have been trying desperately to prevent, but exactly what they never stood a chance of preventing for any more than a temporary period of time. There are real physical and incontrovertible forces that are and have been pushing for a market correction. The longer those forces are pushed forward by desperate temporary measures, the harder those forces fight to snap back to a corrected state. It was only a matter of time. Watching all this unfold and having a decent understanding of what is at stake and where this is going and what the consequences are leaves me feeling a little nervous, and it seems that it has only just begun. The unwind is inevitable. Mother Nature always wins in the end. This certainly looks and feels like that moment has finally arrived.

There is the little bugaboo that there is an issue of slope vs level, flow vs supply.

Meaning, if the magical supply and demand parameters were out of balance, that doesn’t define a price. It would define a price increase or decrease, and said increases or decreases would continue to increase or decrease. The level is not defined by imbalance. The rate of change is.

It’s like pushing the stick to the right in an airplane. The ailerons deflect and as long as they are deflected the aircraft rolls. It doesn’t roll to say 30 degrees and stop. It keeps rolling. That’s what imbalance does.

So . . . this theory of imbalance is a tad more complicated. If you want the aircraft to stop rolling, you neutralize the stick. It won’t return to straight and level unless you imbalance the ailerons in the other direction and then re-neutralize at straight and level.

So, hell, this says we can tune the price to whatever we want.

Many expected the OPEC to continue controlling (high) oil prices by adjusting their production taking the growth of US oil production into account. This time they decided to let other players adjust their production. As you said Watcher, by deciding to do nothing (really they lowered sligthly oil production), they appear to be the root cause of oil fall. If one look to the recent evolution of oil production, only shale oil is the cause of oil crash!

Actually I don’t think supply / demand did it. I am in the dollar appreciation cause camp. Too much coincidence that it did its spike in the same months.

The dollar isn’t THAT strong, though. Unless you’re comparing it to the Rouble – but there you’re not looking at a strong dollar, but a Rouble that is weak compared to just about every other currency…

@Watcher

Do you know how much $ appreciated since June?

Is this correlated with start of the chatter of End of QE around the same time?

The dollar / oil thing doesn’t have to be linear. That’s a copout. It’s also true.

There was a proposal that Yellen in June giving October as the end of QE date started the dollar’s rise, but that simply can’t hold water because QE taper started in January and the rate of taper held essentially constant Jan to June, and projecting it forward would have reached zero right around October. So she said nothing not already known.

The aileron example above just addresses the reality of 1st derivatives resulting from imbalance. As has been mentioned, if Shale really is a huge part of US GDP, we’re looking at death spiral in that Shale’s destruction would smack GDP, which lowers demand and maintains the aileron deflation causing continued price lowering. It’s a very dangerous scenario.

And thus, in the New Normal of zero weight for moral hazard government or the Fed will

Simply

Not

Allow

It

aileron deflection

Would you characterize QE as subsidies for lower and lower EROEI with some serious side effects (market imbalances like we are seeing in shale oil boondoggle) ?

Nah, that’s too esoteric.

QE initially was to avoid Apocalypse. There was no thought of EROEI involved.

The September 2012 QE3 is the most curious one because subsequent economic data did not show any cliff dive, yet Bernanke embarked on a monumentally huge injection of liquidity . . . just weeks before a presidential election — hugely risking Fed independence. He risked destroying the Fed. A GOP win may have dissolved it if that maneuver by him had not secured an Obama victory — assuming it did.

And so . . . why QE3? We don’t know, but odds seem very high there was no discussion of EROEI in the FOMC.

I agree. I think there was a bit of oversupply because demand was a little weaker than expected, but what really started things rolling was the strong dollar, which raised the price of dollar denominated oil outside the US. People weren’t willing to pay that, so the prices fell, decreasing america’s import bill, and further strengthening the dollar, creating a positive feedback loop.

That is one possible explanation anyway.

I also continue to believe that the oil rent is huge — that the price is still higher than the cost for most oil (not for new fracked wells, but elsewhere). I think world markets can bear prices much higher than the cost of producing most oil , which the gradual increases in demand at $100+ demonstrated. On average oil costs a lot less to produce than $100, and the difference is pure rent taking, but the demand side didn’t really react negatively.

As a result there is a certain amount of randomness in the prices, and it is set by the futures market aka speculators. That is why I think the vagaries of the forex markets were able to trigger such a dramatic change in price.

As suggested above, the Fed can essentially drill for oil if it chooses too.

It is astonishing to me that in the same breath that people note that a government bailout for shale could happen, they then continue their thoughts presuming that low oil price can destroy Russia.

Russia has a central bank, too.

I agree with your jist, but want to point out that many people misconceive the goal of QE and all the other financial maneuvering (“tricks”) of central banks and governments.

The goal is/was to prevent a chaotic fail, one where store shelves are empty, the economy goes black market, and the standard unemployment rates get above 20%. The gains in the equity market and real estate are a welcome sideshow or secondary goal compared to the prevention of severe unrest.

I agree that these measures are just an attempt at orderly retreat, from the excesses of population overshoot and resource gluttony I would add.

Chapter 2 comes next.

I semi sign onto that. The Fed was forced into things, but in a profoundly imperfect way because future historians (there won’t be any in a destroyed civilization, but just imagining that there could be any) will look back at 2008 and declare that Bernanke blundered in a society destroying way when he did not save Lehman.

If Lehman had been bailed out, the Apocalypse would not have happened. There would have been no TARP. There would possibly have been no Obama. There would have been no GM bailout. There would have been no BoA or GS or GE bailout. AIG . . . maybe they would have followed Lehman, but Lehman was the central focal point for the swap disintegration. Saving Lehman would have changed everything, and if we imagine that the Fed prevented people dying in the street (which they did), they could have kept people out of the street entirely.

Correct, there doesn’t have to be a linear relationship. Small changes are enough to trigger sudden moves in the market if the fundamentals aren’t very tight.

Paulson

He and Bernanke certainly sold the salvation.