North Dakota published their Bakken Production Data yesterday along with their North Dakota Production Data. This all happened the same day the EIA’s Drilling Productivity Report came out. This has resulted in two post in two days.

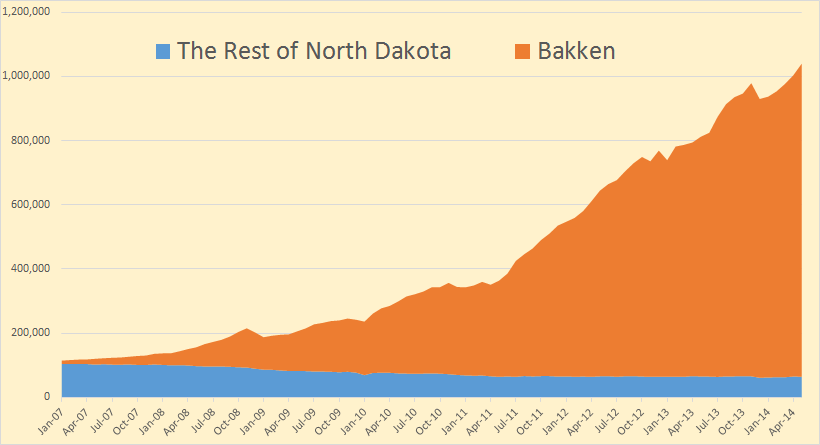

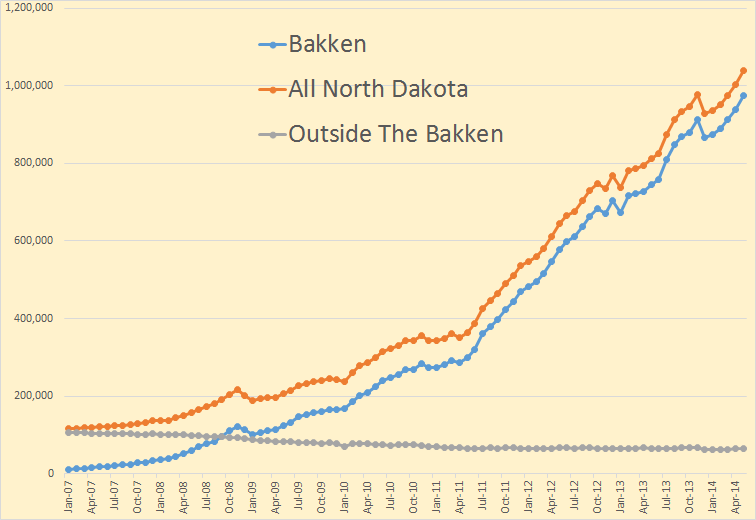

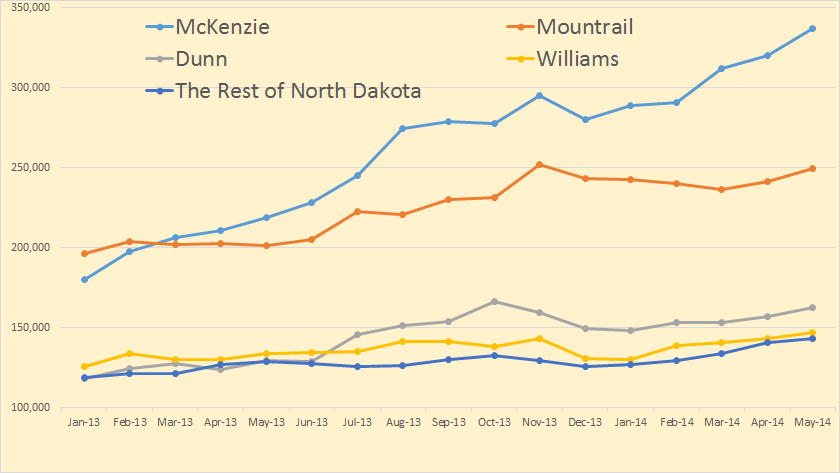

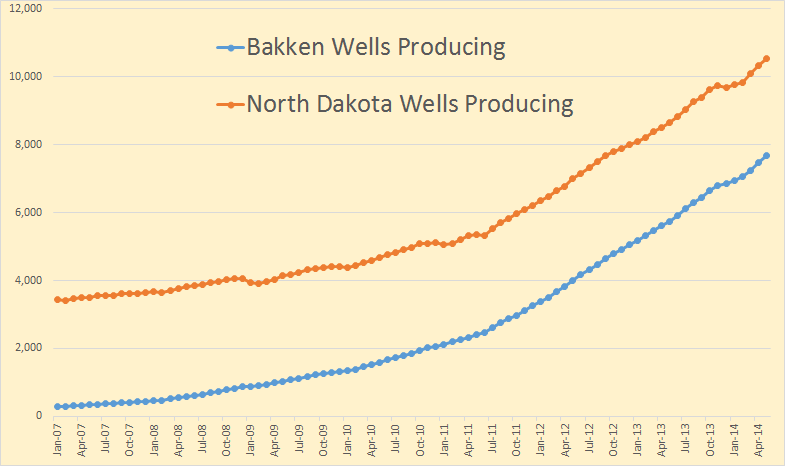

All charts below are in barrels per day with the last data point May 2014 even though the horizontal axis may only go through April 2014.

What type of chart is preferable to most folks, the below type?

Or this type?

This was a good month for the Bakken. Production was up 36,653 bp/d to 974,695 bp/d. All North Dakota was up 36,379 bp/d to 1,039,635 bp/d. This meant that North Dakota production outside the Bakken was down 274 bp/d to 64,940 bp/d.

From the Director’s Cut, bold mine:

The drilling rig count was up slightly from April to May, and from May to June the rig

count increased by one. The number of well completions increased 14% to 227, but weather continued to impact activity in May with 2 days of heavy rain near Dickinson and 5 to 6 days with wind speeds in excess of 35 mph (too high for completion work).

At the end of May there were about 610 wells waiting on completion services, an

increase of 10.

227 new wells is a lot of wells in one month. I think that is a record. New wells were up by 200 in both March and April. Additional wells producing were up slightly less, 219 in the Bakken and 222 in all North Dakota. That simply means a few wells were shut in.

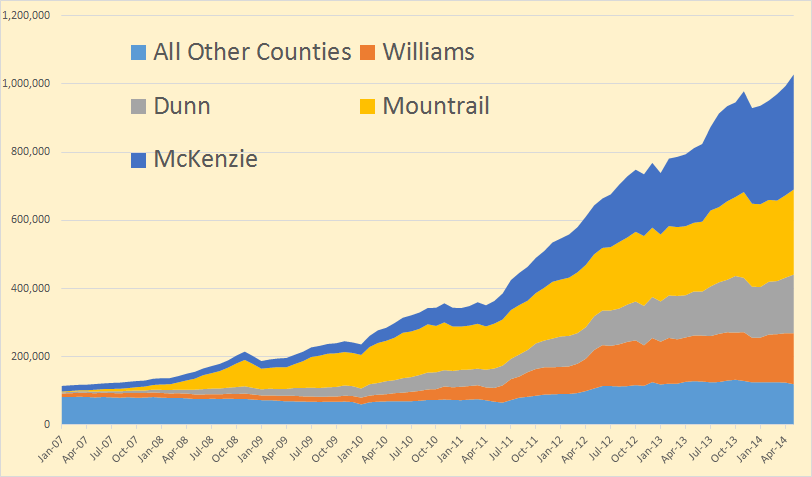

North Dakota’t top four counties are all in the Bakken. This is a stacked chart. I prefer a line chart like the one below. But others may differ.

All county data is after correction for confidential wells has been added.

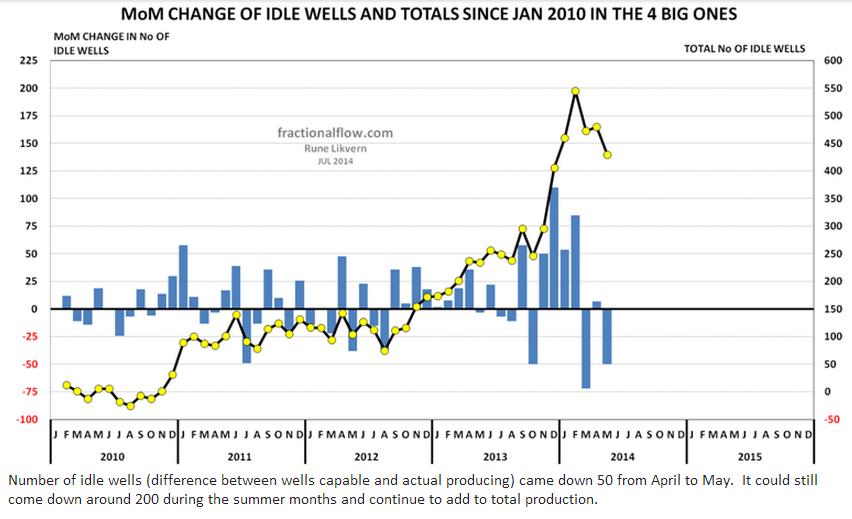

Rune Likvern posted me this idle wells chart.

Rune Likvern posted me this idle wells chart.

Wells producing number 7,687 in the Bakken, up 219 in May. In all North Dakota wells producing number 10,539, up 222 in May. 227 new wells were actually completed in May.

There was some discussion about declining world oil output and increasing population (by Watcher) in the OPEC Update post and I created an interesting chart using Enno’s observation that it is per capita oil output that is most important.

The chart combines an oil shock model with 2500 Gb of crude les extra heavy oil with depletion rates of this type of output (which does not include Canadian oil sands or Orinoco belt oil from Venezuela) remaining at present levels of 3.9% of proved producing reserves (excluding extra heavy reserves). Extra heavy oil is modelled separately and is somewhat more conservative than Jean Laherrere’s estimates (peak output is lower) but used the same URR of 500 Gb. My World C+C scenario has a URR of 3000 Gb (300 Gb higher than Jean Laherrere’s 2013 scenario).

For World population I use UN estimates from 1950 through 2010 and the low fertility scenario out to 2050.

Per capita C+C falls to 1962 levels by 2030 and to 1957 levels by 2050.

Chart below

Thanks Dennis, that is a very informative chart, and in my opinion one of the most important world oil charts available.

Seems like we all need to get used to a little less oil per person, in an increasingly quicker (percentual) pace. The chart makes clear however that this process has already started 35 years ago. Would be nice to add to this a chart with the $ amount paid for this oil, per capita, to demonstrate that the drop is due to supply constraints, and not demand, as Steven Kopits also has argued very well.

“Seems like we all need to get used to a little less oil per person, in an increasingly quicker (percentual) pace.”

Nope. Not the probable mechanism.

The probable mechanism is some will have to get used to less oil per person.

And this chart doesn’t even contain EROI / energy cost of energy adjustment right? Adjusted for that I imagine that it would be even a more doomy chart.

Hi BAU,

Yes you are correct that the chart makes no attempt to adjust for reduced EROEI, I am not sure where one would get year by year data on what this has been in the past and would be unsure of how it would progress in the future. It would look worse if this were included.

Hi BAU,

On the EROEI (energy return on energy invested), the problem is that these EROEI calculations include all energy (from coal, nuclear, natural gas, and oil).

For the near term, it is primarily oil that is likely to become scarce so it is the oil return on oil invested that is of importance, but as far as I know that is not what EROEI measures.

For both this reason and the boundry line problem of how many processes should be included in the EROEI calculations, I don’t think the EROEI concept is all that useful in the context of peak oil.

Hi Enno,

Another excellent idea! Rather than just dollars spent on oil consumption per capita, I thought it better to look at per capita oil spending (in constant dollars) per real GDP per capita.

I believe this metric is more important as there is some literature suggesting that if spending on oil rises above 4% of GDP that a recession is likely, the World was above this level from 1980 to 1984 and came close to this level in 2008 (3.7%) and also in 2011.

As before I have used the UN’s Low Fertility scenario and I have needed to make assumptions about future real oil prices and future real GDP. I have assumed that the peak in oil output will be fully recognized by the world by 2020 and that around that time real oil prices will begin to rise more rapidly (3% per year) and that the growth rate in real GDP will gradually slow from 3% in 2013 to 0.5% in 2034 and remain at that low growth rate until 2050. Oil prices reach $259/barrel in 2013 $ by 2050.

Chart below with Real GDP and Oil Price assumptions with log scales on vertical axes:

On a per capita basis (and using a linear scale) the real GDP per capita per year (left axis) and real Oil Spending per capita per year (right axis) are shown below in 2013 dollars.

And finally the chart that I think is most useful based on Enno’s excellent ideas.

Note that real oil spending as a percentage of real GDP remains below 4% through 2050,

and that a higher real GDP growth rate (if it is possible as oil output declines) would make the % oil spending even lower because the denominator would be bigger. Real GDP growth could fall to zero by 2040 and with the price assumptions above the % oil spending per $GDP would remain below 3.4% until 2050. Chart below.

http://the100metreline.blogspot.co.nz/2012/11/the-cost-of-oil.html

This 2012 effort shows the same idea : Cost of oil to the world per day. Its not going to cost the world any less, until it costs us nothing.

Great charts Dennis. Interesting that you don’t see a rising % oil spend/gdp. It would be very positive if that trend indeed is reverted.

Of course the world is made of many parts with large individual differences, and it would be interesting to analyze all of these separately, but I do think these average values are still very useful to get an overall picture on where we are coming from and going to.

I don’t agree with the criticisms on the modelling efforts. Models in my mind are the only things that allow people to make rational decisions in the face of uncertainty (esp the future). Many people don’t realize that they’re using models themselves when they make decisions, they just don’t verbalize them. Sure, they will never be (close to) perfect, and just by themselves they also may not be enough, but they are just so much better than the alternative (no models, e.g. using emotions and feelings).

Thanks Enno,

I agree with your comment.

At some point I might try to tackle the regional differences, but would not attempt to forecast how those would play out so I would just show the trends from 1980 to 2013 (if I am showing spending on oil), if I did only per capita oil consumption, I could use BP data and cover 1965 to 2013.

Enno,

Thanks for your comments on models. It took me a long time to understand the abstract concept that is a ‘model’ as I was hung up on my teenage experience of a model being composed of plastic parts that I glued together with some high VOC glue, and which usually ended up looking like a poorly painted version of a world war II fighter plane.

In a way the collective contributions of the POB community in the aggregate is one of my models… some inputs I value more than others though!

This chart points out why mankind went to the moon only in 1969-1972. I doubt real further relevance. The world is such a big place, with huge differences among people. Those differences are all leveled out in a world-per-capita-chart. This chart suggests mankind is in crisis mode since 1975. Now we all see that we still made some progress since then.

Thanks to charts like this one, one may recognise that this progress was made because other people were cut off from making progress. (The decolonisation of Africa, the collapse of the Eastern Bloc, the downturn in the PIIGS and the US Middle class, The Arab Spring.) So one can imagine what the next decade will bring: further progress in some areas (South East Asia?), further downturn in a growing number of areas: We? When will it be our turn?

Hi Verwimp,

Yes there are lots of regional differences in consumption. A better chart would indicate these. This was the easy chart to do. Predicting what these future differences will be is beyond what I am capable of. Looking at the past differences could be easily done though.

Peak per capita oil oil supply is actually in my opinion considerably more important than peak and it seems we are well past peak per capita availability already.

Predicting what will happen as supplies grow tighter is difficult indeed. On the one hand people in truly backward but developing countries may be able to make better use of more oil than anybody else in the world if they use it to produce more food and run a basic transportation system such as buses.Draft animals eat a hell of a lot compared to expense of buying fuel once a farmer has a tractor.Freeing up the land for human food production is the way to go in the short to medium term at least.

But what will such a country export to pay for oil?

And in the case of a country such as Vietnam or China both of which are still backward for the most part but developing rapidly-who knows?

So long as they can export consumer junk or even top quality industrial goods they will be able to pay for imported oil.But what happens if their primary buyers go busted or decide to bring the jobs back home?

As times inevitably get tougher with the further depletion of one time gifts of nature many countries are going to turn protectionist.

I for one would far rather pay twice as much for better quality longer lasting American made stuff from companies that have native English speaker to answer the phone than to support a continuous expansion of the welfare state.Every time we bring a job back we move one person from the bail out end of the balance scale to the tax paying end of it.

I am not at all opposed to foreign companies operating in this country if they have extensive manufacturing and distribution facilities here.

But as things stand now we are soon going to be economic cripples. Fire – finance insurance and real estate economics are not sustainable.

Hi OFM,

I was riding a chairlift last year with a total stranger and complained that very little manufacturing is done in the US. He was involved in the manufacturing sector (machine shop as I recall) and told me that there was plenty of manufacturing in the US, and that my misconception was a common one.

Your comment about US manufacturing and this previous conversation prompted me to research this a little further.

One thing I quickly learned is that there are two ways to view output, the gross value of output (total units produced times sales price per unit) or on a value added basis (gross value minus the value of inputs to the manufacturing process).

The gross value is roughly double the value added for the US in 2010. I chose to do the analysis in gross value because the only long term data set I could find did the analysis in this way.

The chart below gives the percentage of gross manufacturing output divided by GDP for the US from 1972 to 2010. It fell from 32% in 1972 to 28% by 1990, remained about that level until 2000 and then fell to 24% by 2010.

So basically you are correct there is a lot less manufacturing as a percentage of GDP today than 40 years ago, but it is also true that there is still quite a lot of US manufacturing output.

Gross real value of manufacturing output at link below (download spredsheet)

http://mercatus.org/publication/us-manufacturing-output-vs-jobs-1975

Real GDP at link below

http://research.stlouisfed.org/fred2/search?st=real+gdp

Data needed to convert from 2005$ to 2009 $ at EIA Real prices viewer, basically just multiply values in 2005$ (manufacturing output is in 2005$) by 1.0988 to convert to 2009$ (GDP data is in 2009$).

Of course there is still a lot of manufacturing in this country in total number of people employed and in the value of the manufactured goods.

But this does not change the fact that we have lost millions of manufacturing jobs that have been shipped overseas.

In my area we used to have tens of thousands of jobs associated with textiles and furniture.Nearly all of them are gone now and the people who formerly worked in these industries are for the most part in pretty bad circumstances.

A few of them managed to get into some sort of retraining program but most of them are making half what they used to make flipping burgers or stocking shelves in a supermarket.

The rest are on welfare one way or another.

When a young man with no skills and no education to amount to anything can get a job that pays enough to live in a factory he will usually take it.

When he can’t he often leaves his wife and kids or turns to crime to make ends meet. A man making peanuts can live ok on those peanuts and have a beer or a meal out occasionally if he is not supporting a family.

Welfare destroys families.At this very minute I can name three women who live within a couple of miles of me in this rural area who are getting rental assistance and food stamps and free school lunches and medical care for their kids.

There are probably a couple more I don’t know about. This info is readily available to any body who has rental property and screens prospective tenants.

All three of them have boyfriends – long term boyfriends – who have jobs and maintain an address elsewhere.

But the male friends’ cars are generally parked at their respective girlfriends house at three or four am almost every night.

I am not condemning these people. They didn’t write the rule book. They are just playing by it.

Incidentally it seem to be against the law for a social worker to even ask about such a boyfriend – but if he marries the woman they haul his ass off to jail if he doesn’t support the kids.

Every job that goes overseas that paid a good wage means one more person on the wrong end of the social safety net balance beam scale.

We can’t just abandon these people to starve but on the other hand there is no way in hell to get them to go back to work at jobs that pay only a hair more than their welfare benefits.

If you can earn three hundred after taxes a week and have to commute and actually work it is far more satisfactory to stay home and collect two fifty.If you have to have the other fifty you can get it by doing a few odd jobs or peddling a little pot or whatever.

We are damned if we do and damned if we don’t.I can’t see any workable solutions that are politically viable.

BUT it sure would help if we had those furniture and textiles jobs back with the wages and bennies they used to pay.

Changes of this nature are never static in effect but rather always dynamic. If there were to be a new plant opened – or an old one reopened- in the town next to me or any town that put a thousand people to work that would mean one thousand less on welfare or trying to get on at a fast food place. Wages at the fast food place would probably go up a bit too when there are less applicants per opening.

There would be a little less money needed for cops and social workers and a little more for essential maintenance of the town’s publicly owned infrastructure.

Hi OFM,

I suppose one possible strategy would be to cut corporate tax rates to levels similar to other nations. This might result in fewer businesses moving overseas.

Businesses that are not profitable even if their tax rate is reduced to zero will shut down in a capitalist system.

The lack of manufacturing jobs is in part because of the rise in labor productivity.

Based on the Wikepedia writeup on TANF, it is limited to 60 months and there is a work requirement after 2 years.

By no means a perfect system.

http://en.wikipedia.org/wiki/Temporary_Assistance_for_Needy_Families

I think that you probably know all this, but I learned much by reading it (I am far from an expert on the welfare system.)

http://www.ogj.com/articles/2014/07/north-dakota-flaring-reduction-policy-may-impact-january-production.html

Good find, and I’d say boom except for two things:

It all happens after November’s election.

“Selected wells” will be selected in the dead of winter. The ones not producing anyway will be selected.

http://hosted.ap.org/dynamic/stories/U/US_NORTH_DAKOTA_SALTWATER_SPILL?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT

Wastewater spills. Legislature proposed regs. Companies said too expensive and bought off legislators.

Being re-introduced.

I prefer chart 2 where you raise the question.

I also prefer chart 2.

So do I.

so do I.

Stacked vs Line charts. We need both. So thank you for providing 2 graphs

Properly stacked graphs always show that subsystems are flat or have peaked in what looks like an eternally growing total. You have rightly stacked by starting with flat production followed by peaking and then still growing on top.

The line graph shows that your focus should be on McKenzie because if that peaks, the whole Bakken will peak

You need to use the same colors in both stacked and line graphs

Check on all other counties as they appear in the line graph to go up slightly while in the stacked chart they seem to go down. It always helps to add data labels (value)

In stacked graphs add a total line (change series chart type) to be sure the stack adds up properly

Stacked graph goes to April 2014 while the line graph goes to May 2014

This is very important work you are doing

Stacked charts are great so long as they are readable. A whole lot of the ones I run across have so many layers pictured in such narrow bands as to be virtually unreadable.

There is seldom enough color contrast on top of that.

Now a stacked chart showing only say ten or less functions each of which is easily visible is great.

Nobody is going to bother to take a magnifying glass and pore over a chart on a small screen and even if they did the resolution probably would be inadequate.

Not everybody has a three foot monitor handy.

Beyond that using little squares and triangles and circles as well as colors is helpful in easily seeing the data in line charts.

Stacked graph goes to April 2014 while the line graph goes to May 2014,

No, they all go to May 2014. The horizontal axis only shows every three months, January through April. But the data extends beyond that one month. That is a problem with all graphs that cannot show every month. But I assure you the data is through May. Both charts were made with the exact same data.

I have got the monthly production data by county and am plotting it up for logistic decline plot analysis. Where did you get the confidential production data by county and how significant is it?

It can be found here: https://www.dmr.nd.gov/oilgas/mprindex.asp

And it is very significant and relatively accurate.

This proposed Bakken pipeline has been big news in Iowa over the last week. A lot of Iowans, politicians included, seem to have been caught off guard regarding how big of a project is being proposed for their state.

Oil pipeline across Iowa proposed

Should also mention this pipeline is now on the North Dakota Pipeline Authority’s table of existing and proposed North Dakota crude oil export options. They anticipate nearly 3 million bpd of export capacity by the end of 2016! https://ndpipelines.files.wordpress.com/2012/04/oil-table-6-26-20141.jpg

Serious question here, how many of you in july 2011 – three years ago – believed the ND Bakken would ever produce 1 million barrels of oil per day? If you had not heard of the Bakken or North Dakota back then you can say that too.

For the record i thought it would happen but not this soon. The “experts” back then were saying it would take several more years to get to a million, like by the year 2020 or something.

The standard answer has become classic:

In 2009 I didn’t think it would amount to much. And if the price of oil was now what it was then, I would have been dead on correct. The price is $100 now. Hard to make a case for abundance.

But we must put this into perspective.

That is 1/19th of our daily use in the USA.

And that is why it has had minimal impact on $100 oil.

In 2011, I was skeptical but my first modelling attempt based on work by Rune Likvern and Webhubbletelescope can be found at the link below (October 2012).

http://oilpeakclimate.blogspot.com/2012/10/using-dispersive-diffusion-model-for.html

A comment posted by Steven Kopits on the Econbrowser blog:

Two recent items follow. I somehow don’t find if very comforting when the US Secretary of State describes armed conflict between China and the US as “Not inevitable.”

China tells U.S. to stay out of South China Seas dispute

http://www.reuters.com/article/2014/07/15/us-china-usa-asean-idUSKBN0FK0CM20140715

Beijing’s Appetite for Engagement Ebbs

http://online.wsj.com/articles/beijings-appetite-for-engagement-ebbs-chinas-world-1405397472?tesla=y&mod=WSJ_World_RIGHTTopCarousel_1&mg=reno64-wsj

The GNE/CNI Chart follows. I estimate that the GNE/CNI value for 2013 will be down to between 4.6 and 4.7. At an GNE/CNI Ratio of 1.0, China & India (China & India’s Net Imports = CNI) alone would theoretically consume 100% of Global Net Exports of oil (GNE). ANE (Available Net Exports) = GNE less CNI.

Absolutely key point: Given an inevitable ongoing decline in GNE, unless China & India cut their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the rate of decline in ANE will exceed the rate of decline in GNE, and the rate of decline in ANE will accelerate with time (on a year over year basis).

At the observed 2005 to 2012 rate of decline in the GNE/CNI Ratio, it would be down to about 2.0 in 2022, which would imply that China and India would be consuming 50% of Global Net Exports of oil. And at the observed 2005 to 2012 rate of decline in the GNE/CNI Ratio, it would be down to 4.6 in 2013.

I’ve described what happens to the GNE/CNI Ratio from 2012 to 2022, and in subsequent years, as the $64 Trillion question.

The world is a Darwinian place.

China is on an expansionist roll. The state controlled media there are stoking the fires and the other countries in the immediate are not big enough to stand up to China.

It is extremely doubtful that they will be able to cooperate well enough to present a united front and even if they could they cannot hope to match Chinese industrial power.

Mark these words.

Japan will be a nuclear power in a decade. I know it sounds crazy but the generation of pacifists spawned by WWII is just about gone and she has no choice if she expects to survive as China grows.

Little kids in Chinese schools are taught about the Rape of Nanking the way kids in this country are taught about Paul Revere and George Washington crossing the Delaware.

The US is still the top dog in the military arena but we are the old dog in economic decline and China is the up and coming dog.

We will never be able to put troops on the ground in Asia in sufficient numbers to matter now that China is industrialized.Our European allies are not going to help to any significant extent in the event of a confrontation in Asia.

I can’t see whoever is in control in Washington a few years down the road going nose to nose with China and actually using nukes.

The Philippines has had landing strips in the Spratley Islands for a long time.

See Thitu Island.

And so has Malaysia. See Layang Layang island.

And so has Taiwan. see Itu Aba Island

Seems like the Permian is gonna pick up the baton once the EF and Bakken start to decline…Dunno how accurate this prediction is, but according to the article below, the potential seems to be there.

https://oilprice.com/Energy/Crude-Oil/Back-to-Permian-U.S.-Oil-Comes-Full-Circle.html

Much larger than Eagle Ford and once thought to have reached peak production, new technology has brought us full circle back to the Permian Basin in Texas and New Mexico, where the recent shift to horizontal well drilling has rendered this play the unconventional ground zero.

Determining where the next real oil boom will be depends largely on following the technology, and while the Permian Basin has been slower than others to switch from vertical well drilling to horizontal drilling, horizontal has now outpaced vertical, and investors are lining up to get in on the game.

Until about 12 years ago, virtually all wells in the Permian were vertical. As of last fall, however, horizontal and directional rig counts—meaning, non-vertical drilling rigs—have now begun to exceed vertical, according to RBN Energy.

But what they’re also looking for are developers who are seeing strong economics in both vertical and horizontal wells. It’s all about balance, and this co-mingling of multiple zones, with the ability to complete both horizontal and vertical wells economically is the best bet for investors.

The Permian Basin now boasts the top rig count in the US. Just this week, the number of rigs exploring for oil and natural gas in the Permian Basin increased by to 560, according to the weekly rig count report released Thursday by Houston-based oilfield services company Baker Hughes.

What’s more, according to Bernstein Research, the Permian Basin will top the charts for North American spending growth in 2014, with an amazing 21% increase. And 2013 was already a stellar year for the Permian.

Permian production last year increased by 280,000 boe/d to 2.3 million boe/d, comprised of 1.4 million b/d of oil and 5.3 bcfd of gas, according to the US Energy Information Administration.

This technology has changed the way we think about the Permian Basin, once the darling of American oil production and then lost in the shadow of Eagle Ford and Bakken. While Eagle Ford and Bakken were viewed as the “bigger plays” at the start of the unconventional boom in the US due to the fact that new technology debuted here harder and faster, the Permian is back and it’s bigger than ever.

“The Permian Basin is much larger than the Eagle Ford play, and it also contains over 20 potentially productive zones, while Eagle Ford has only one zone,” Parker Hallam, CEO of Crude Energy—a small-cap company, not publicly traded, operating in the Permian, told Oilprice.com.

Hallam particularly noted the “excellent quality rock” in the Wolfcamp, Fusselman, Cline, Mississippian and Strawn zones.

“The Wolfcamp is one of the better producers in the Permian. It can be up to 1000 feet thick and is composed of multiple individual zones, several which could be production. Wolfcamp is attracting a lot of attention right now because of the horizontal drilling through the normally tight limestone,” he said.

Hallam also noted that while horizontal drilling is changing the future of the Permian Basin, “vertical completions using new technology like fracking and co-mingling multiple zones are turning out top results and drillers are seeing strong economics in these wells.”

Leading the pack in the Permian are Devon Energy Corp., Concho Resources, Pioneer Natural Resources and Chevron, with Wolfcamp probably the key focus of development activities, and the leading formation in terms of production increases. Devon in particular is being singled out by analysts for its large acreage in the Permian, couple with its transformative turnaround that could render it one of the largest crude oil producers in the US.

The only challenge with the Permian—which is on trend to see continual increases in production—is the pipeline takeaway capacity, according to RBN Energy. “The bottom line is that crude oil production in the Permian is growing rapidly, and today there is not enough pipeline takeaway capacity to efficiently handle the volume”, but that should correct itself soon with new pipelines coming online.

Bloomberg quoted Bruce Carswell, West Texas operations manager for Iowa Pacific Holdings, as saying that the forecast through July is that volumes are going to continue to move out of the region by rail.

The Permian Basin Petroleum Index, put out by Amarillo economist Karr Ingham, which examines several industry metrics to measure the health of the oil and gas business in the region, was almost 10 percent higher in May than a year earlier.

Regardless of pipeline capacity, Permian Basin crude is shaping up to be the next big oil boom thanks to new technology. Eagle Ford and Bakken became economical only after being drilled horizontally, so with the final shift to dominate horizontal drilling in the Permian, the game has only just begun.

The EIA – i.e. someone who isn’t trying to talk book in a bubbly investment climate – doesn’t think much of massive new gains in Permian shale.

The Permian basin is not some unexploited area. They’ve had 500+ rigs there since the end of 2011 and already have a legacy decline of 53,000 bpd.

http://www.eia.gov/petroleum/drilling/pdf/permian.pdf

“Permian production last year increased by 280,000 boe/d to 2.3 million boe/d, comprised of 1.4 million b/d of oil and 5.3 bcfd of gas, according to the US Energy Information Administration. ”

This doesn’t say how much of the 280K increase was oil vs gas. It just says the present mix, which Ron has noted includes legacy verticals.

Additionally, as we’ve seen in the NoDak data, drill rig count is not the decision parameter. Proppant and pumping trucks decide things as to has fast wells come online. The drilling of the hole goes fast. It’s the fracking completion that takes time.

By having verticals relevant, the issue of water scarcity that Mike mentions can be obfuscated. Talk about the verticals when you don’t want to talk about how few horizontals can be fracked (though clearly some are). And then talk about the horizontals when chasing investors.

The graphs look great, but I think there’s about zero chance they will reflect reality. Why? Finance. Any model that doesn’t take finance into account is missing a big piece of the puzzle. For instance, what would those graphs look like if drillers always had to show positive cash flow?

Mr. Barrows, I could not agree with you more, sir. I think that the majority for unconventional LTO wells, at least in the Eagle Ford, will end up going thru their middle age crisis before, if, they show positive cash flow. I would be interested in knowing how many folks out there would risk 9 million borrowed dollars to earn 75% rate of return…over 25 years? Maybe, hopefully, keep your fingers and toes crossed, 75% internal rate of return? If you think a well like that is like a government bond, you are nuts.

Modeling the future of oil and natural gas production is like modeling life; it never, ever works out quite the way you think it will. It is difficult for people outside my industry to understand the impact that extenuating circumstances has on the development of an oilfield. I actually know of no other business in the world that has to cope with so much risk and uncertainty. To assume that 80,000 more stinkin’ shale wells are going to get drilled in the Eagle Ford and the Bakken without major hiccups, is ludicrous.

In 2007-08 the price of crude oil declined nearly 90 dollars per barrel in a matter of months. That would be the big dirt sandwich for LTO. I don’t know why, to this day, oil prices fell that much. Do not tell me it will never happen again. As you correctly point out, the financial tightrope these shale fellas walk already has them listing to starboard. An angry American public buys into the ridiculous notion of “subsidies” paid to the oil and gas industry, intangible drilling deductions get lost in some obscure Senate bill…adios shale business. Those Saudi boys will be laughing their arses off.

Or how about this: https://rbnenergy.com/daily-energy-post/ or this: http://fuelfix.com/blog/2014/07/14/states-regulator-weighs-in-on-dentons-proposed-fracking-ban/ or this:

http://local.msn.com/strongest-link-wastewater-wells-triggered-oklahoma-earthquake-surge?gt1=24000,

or the link I posted earlier about flaring regulations in North Dakota. How about 8.5 million gallons of fresh water, potable water fit for human consumption, and food, required per LTO well? In West Texas, in the Permian? Gimme a break. Water usage is going to slow down frac’ing like four flat tires on a tractor. One more groundwater contamination lawsuit against a public company that the plaintiff wins, or a pipeline rupture, or a BP lookalike on land?

Modeling the outcome of LTO resources in this county relies far too heavily on the uninterrupted use of land, water, steel, money and public support for an industry that is loathed to begin with. It relies too heavily on logic, and rational regulatory thought. That is not the world we live in today. Modeling assumes all those tens of thousands of wells will just magically get drilled on a predictable time table. That is not the way the oilfield works, trust me.

Mike

Hi Mike,

Keep in mind that when someone does a model they need to make assumptions and everyone knows that these assumptions about the future will not be correct.

To account for this I create multiple scenarios, using different assumptions in an attempt to cover a range of possibilities.

Oil prices can fluctuate a lot, interest rates can change, rules and regulations can change, and I am sure that you could come up with many others. Any of these will cause the rate that new wells are completed to change.

My most recent scenarios suggest that if well costs remain about where they are in real terms and oil prices follow the EIA’s latest reference scenario, about 30,000 wells will be completed in the Bakken/ Three Forks with a URR of about 10 Gb and about 20,000 wells in the Eagle Ford with a URR of about 5 Gb. If real well costs increase or real oil prices decrease or both then these scenarios will be too optimistic.

Note that these assumptions can easily be changed to more realistic guesses with input from those in the field who actually know the oil business.

Note that David Hughes forecasts about 7 Gb for the Eagle Ford and the USGS mean estimate for the TRR for the North Dakota Bakken/Three Forks is about 10 Gb, so my Eagle Ford scenario might be too pessimistic and the Bakken scenario is likely too optimistic, I have lower scenarios with Bakken URR at 6 Gb and about 20,000 wells drilled and the most realistic scenario is about 8 Gb and around 25,000 wells.

So the total wells should be about 45,000 wells for the ND Bakken/ Three Forks and Eagle Ford Combined with a URR from both plays about 14 Gb (8Gb for Bakken and 6 Gb for Eagle Ford).

I believe you may have suggested rising real well costs, could you suggest a realistic guess based on your experience? Thanks.

Hola, Dennis: I cannot say that I understand modeling when the modeler knows in the end the model won’t be correct. And I am plumb baffled how anyone can estimate URR in a tight oil play without knowing the number of wells that will be drilled…or that can pick a URR out of blue sky and use EUR to back into the number of wells that WILL be drilled.

I think people can guess all they want; its probably important somehow, though in my opinion most Americans can’t think past next month and will tune that out completely. Folks will only know something is wrong with the oil abundance picture when oil is clearly not abundant anymore. $4.89 a gallon should do it.

I don’t recall stating that drilling and completion costs will rise over time but indeed they probably will. What doesn’t? What I do recall saying is that incremental lift costs per barrel will definitely increase over time. That of course will shorten the life span of marginal wells and whack off all those long tails in decline curve analysis. The E in EUR stands for estimated.

Mike

“Folks will only know something is wrong with the oil abundance picture when oil is clearly not abundant anymore. $4.89 a gallon should do it. ”

I’d say no. Only when the convenience store underground tanks are dry will they decide this is serious. Price motion can be pontificated into an optimistic picture. Somehow.

Hi Mike,

On models being incorrect. This is simply because we cannot predict the future accurately. As I said before a range of scenarios with reasonable assumptions about possible future numbers of wells, well costs, discount rates, royalties and taxes, oil prices, OPEX, transport costs to the refinery, and a reasonable well profile (EUR) are used to find the net present value of future oil output from a new well, if the net present value of future output is greater than the well cost, then the well will be drilled. I also assume that new well EUR will decrease as the sweet spots get drilled up. The TRR from the USGS is used initially along with a well profile developed from Eagle ford wells in the RRC database. The EUR decrease is chosen so that the TRR matches up with the USGS estimate, then the economic assumptions are applied to see how many wells can be drilled profitably.

The model will only be as correct as the assumptions, if reality falls within the bounds of the assumptions of the high and low scenarios the the real path of oil output will be bounded by the high and low scenarios. I think it is pretty useful, time will tell how far off I am.

Dennis, I did not say models were incorrect, thought often they are; I said they are a waste of human endeavor. I am sure there is grass to mow, or wood to cut for the winter, that would be time much better spent. But I am a practical sort who instead of talking, or blogging, about oil production must actually get the nasty stuff out the ground or not feed my family. I do respect your science, however, and I know you respect the practical component I occasionally try to offer.

Modeling is qualitative; you make certain assumptions, and your model changes. Are your assumptions based on fact, or experience, or conjecture? What I want to suggest, very respectfully, is that you not, for instance in your post above, rely on the internet for your data. This is an old argument…the EIA, or IEA, or the USGS or whomever, says this and you take that on face value and make your models work by backing into the internet poop. It is more complicated than that, Dennis; the oil business is very, very complicated. Its very dark down there and we cannot see down that tiny little hole.

People, especially young people, believe there should be answers for everything…that there are no unknowns and uncertainties in life, period. They want answers. They want immediate answers. They google the answers and they have what they need in the way of answers, all at their finger tips. Immediate gratification. Life is not like that and I can assure you, the oil business is not like that. The shale industry would have you believe that it knows all the answers, just google it.

We are 7 years into unconventional LTO resource plays and I can almost guarantee you that all this long, fat tail EUR stuff the tight oil industry wants you to model off, will be an OMG moment about 12 years from now. Everyone of those stinkin’ shale wells is going to be a stripper well and marginally profitable, even at 150 dollar oil. Then all these big time shale companies will be bailing on banks and leaving tax payers holding the bill, and having to plug and abandon 57,756.35 of these shale wells at 100 K a pop. It will make the mortgage bailout look like it was a tick on a long hair dog.

Again, the message of peak oil is in the immediate past, not in modeling the future. But hey, I am just an oil guy; all my Sunday go to church clothes have oil spots on them, what do I know?

Well, I know that oil prices fell in 2007 for lots of reasons and everybody who thinks they know exactly why, doesn’t. And if they do, they would know the same thing could happen in October and the shale business would be on its ear. Which is the point I was trying to make about assumptions in modeling.

Mike

Mike, I agree with you everywhere except…. Oil prices did not fall in 2007, they rose steadily throughout the year. They fell in 2008. And there is no “exactly why” but the fact that they shot up to $147 a barrel and contributing to the recession far more than anything else, is a pretty damn good guess.

Hi Mike,

I forgot to mention that I find your contributions and criticisms invaluable, thanks!

Hi Mike,

I agree with everything except the part about models being a waste of time.

Note that the well profiles that I use are based on data for the forst 6 years for the Bakken well profile and for only about 2 years for the Eagle Ford. I do not believe the oil forecasts from the EIA and IEA, but I do trust the work of the USGS and Jean Laherrere (though Laherrere does not like the recent work by the USGS very much).

I agree that the oil business is very complex and my models come no where near capturing this complexity.

One thing about models that I like is that we take what we know and assume and make it very explicit. Sometimes the result is not what we expect.

We all use mental models all the time, it is how we plan for the future or make business decisions. Creating the model and testing various what-if scenarios can help us to make better plans for the future.

On the fat tails, I only assume the well profile will be hyperbolic out to about 15 years and then assume decline will be exponential at about 7% per year, I also do not use a high b value and tend to keep it close to 1 so the tail is not the very fat variety seen in some investor presentations (Bakken EUR30 about 350kb and Eagle Ford EUR30 about 210 kb).

The Eagle Ford average well in my model will be a stripper in 9 years where I define stripper at 10 b/d or less. If the average well gets capped when it gets to 5 b/d or less then cumulative output is 203 kb at that point (my recollection is you previously said 5 would be the cut off but I may be remembering incorrectly).

This does not speak to the water issue which might be solved with recycling the water (with filtering), but this would raise well costs and may be impractical.

What caused the 2008-09 collapse in oil prices was an accelerating economic collapse. Massive hits to demand combined with people frantically selling speculative contracts first for cash, and then to avoid further losses as the price crashed.

It had nothing to do with the “real” price of oil, since it plunged to the point that most of world production either was unprofitable and/or below what national budgets require. As it was, it severely harmed the Russian economy on both fronts and they have never quite recovered from it.

Anon is right.

I think of the temporary price decline as being like the movement of traffic during a major storm or after a really bad accident. All that money tied up in all those contracts scared the hell out of everybody since nobody could say how long or how deep the crisis would get and hardly anybody had a way to take delivery of actual physical oil and put it in storage.

In the future we may experience another such crash in the price of oil or other commodities but such low prices can only last until the situation stabilizes.

The price will be determined over any extended period of time – a few months at the longest- by the marginal production cost of the last couple of million barrels.

If it costs a hundred bucks to bring new production to market the price will not go below a hundred bucks very long unless the economy gets to be in such poor shape that the end users can’t afford oil.IF the world can only pay eighty bucks a barrel production at higher cost will eventually be shut in pretty quick.

There is still some oil out there that is cheap to produce but the good folks who own it are not much into charity.

What caused the 2008-09 collapse in oil prices was an accelerating economic collapse.

Okay, but what caused the accelerating economic collapse? Could $140 a barrel oil price have anything to do with it?

Massive hits to demand combined with people frantically selling speculative contracts first for cash, and then to avoid further losses as the price crashed.

The selling of speculative contracts did not start until after the price of oil started to crash. You’ve got the cart before the horse.

Economic collapse, or the recession, caused a huge drop in oil demand. The drop in demand was what caused the price to crash. In fact either a drop in demand or an oversupply of oil is all that can cause the price of oil to drop. Since there was no sudden oversupply of oil then it had to be the drop in demand that caused the price to crash.

It had nothing to do with the “real” price of oil, since it plunged to the point that most of world production either was unprofitable and/or below what national budgets require.

It was the “real” price of oil that crashed. So it had everything to do with the “real” price of oil. If the “real” price had never reached such astronomical heights then the price would would never have crashed.

Hi Ron,

I think the contribution of the $140/barrel oil was a rather small part of the economic story. For anyone who thinks oil prices were the main cause of the recession, why didn’t the economy quickly recover when oil prices dropped to $40/barrel and then stayed under $80/ barrel until late 2010? The speculative bubble in real estate and poor banking practices were the main story, along with a government response to the crisis which was much too timid.

Dennis, of course it was not the only cause of the recession. The subprime mortgage crash happened almost simultaneous with the crash of oil prices. And the subprime crash deeply affected the economy, hundreds of billions was lost. The economy could not possibly recover quickly under such conditions.

I will not go so far as to say that the price of oil caused the mortgage crisis because the mortgage crisis was actually a bubble bursting, a bubble that had to burst.

But it was the oil supply that simply stopped growing that kept the economy from recovering. And in much of the world it has not yet recovered. And the long term price of oil is currently at an all time high. The economy cannot get to healthy under such conditions. And it won’t.

The title is misleading but the concept is interesting.

http://www.sciencedaily.com/releases/2014/07/140715165819.htm

Best,

Tom

Hi Tom,

Thanks. Very interesting 59% thermal efficiency in a diesel/gasoline mix, very cool.

Note that gasoline engines are typically in the 38% thermal efficiency range at best, but those are production engines, and this diesel is a research engine, but it looks promising.

The Bakken continues to impress me. Say what you will about the causes or limitations or future, what has been done up to now is quite an accomplishment. Of course, I would prefer more of the resource be left in the ground for my son and his friends to enjoy, I would also prefer the huge investment in drilling be directed to more sustainable efforts and decaying infrastructure. It’s kind of like those huge body builders — impressive in a way that they can do that to their bodies, but not my idea of what a person should do.

I found this page linked from a cnbc story:

http://oilprice.com/Energy/Crude-Oil/Back-to-Permian-U.S.-Oil-Comes-Full-Circle.html

I don’t know anything about this oilprice.com website, but my working assumption is that the data here may have an intentional bias intended to promote sales in some way. In any event, there is one comment in the article that caught my eye and I was hoping that one of the experts here may be able to provide more data or context.

“The Permian Basin is much larger than the Eagle Ford play, and it also contains over 20 potentially productive zones, while Eagle Ford has only one zone,” Parker Hallam, CEO of Crude Energy—a small-cap company, not publicly traded, operating in the Permian, told Oilprice.com.

The wording suggests these 20 potential zones are shale plays. The Permian has been discussed here before, and the recent rise in New Mexico production has also been discussed; however, I am curious to hear feedback regarding this specific assertion.

Best,

Tom

oilprice.com has developed a hate subculture on zerohedge. Whenever they publish something, the commenters find a lot of errors. Not just opinion things. Outright errors.

But OTOH, they have published some Gail the Actuary pieces. None of late. Their advertisers may not see the value in doing so.

Watcher,

Articles at oilprice.com are written by a number of authors; some I’ve found to be poor but the author of the piece on the Permian Basin, Nick Cunningham, has done well as far as I can judge.

One Dave Forest is a hoot–a commodities specialist I believe, and he lacks all belief in dependent clauses. His information is good. But he only writes in short bursts. Unlike the others who write for the company.

Tom, there are a lot of people who read this blog that know a lot more about the Permian than I do. But I can give you my 2 cents worth. The article in OilPrice.com is relatively accurate as near as I can tell.

The Permian is a mixture of all kinds of reservoirs, on several levels and in several different areas. Somewhere around half of the Permian’s wells are vertical. There is a lot of fracking going on, even in some of the vertical wells.

Mineral rights on different levels of the Permian, even on the same acreage, is owned by different oil companies. But the Texas RRC now allows different companies to consolidate their holdings and therefore one vertical well can penetrate more than one level of the Permian and collect oil from more than one level.

The EIA’s Drilling Productivity Report treats the entire Permian as if it were shale, or light tight oil. But actually much of the Permian is conventional oil. That is why the decline rate is lower than the Bakken or Eagle ford. Still it is quite high.

OilPrice.com supports itself with advertising and as far as I know has no ax to grind by promoting anything. The story you linked to was posted on many sites on the web. I am not sure who posted it first however.

Thanks for the information Ron. It will be interesting to watch this play and see if the water issues TechGuy mentions hinder potential production.

I believe a big reason why the Permian Basin hasn’t taken off like Eagle Ford is because lack of water and infrastructure. Unless the drought breaks I doubt frack drilling can expand there. In Texas, they are already starting to use treated sewage water:

http://www.scientificamerican.com/article/parched-texas-town-turns-to-treated-sewage-as-emergency-drinking-water-source/

There is a poster here named “Mike” who is directly involved in Texas drilling who make several posts in the past about Texas’s dire water shortage problems that was impacting fracking in Texas.

FWIW: I think future frack drilling make be dependent on how Bakken plays out. Once Bakken Drillers can no longer show strong growth, I believe investors will stop throwing money at them. If fraud is found (ie drillers mis-representing profits) its going to kill off the industry as no investor likes getting scammed twice.

I also believe that we are heading into another market correction and labor force downsizing in the USA which I think will begin this fall. China’s economy make also take a swan dive soon. This would probably send oil prices lower for a period.

FYI: More Russian sanctions in the works (potentially further weaking the global economy)

http://online.wsj.com/articles/european-leaders-expected-expand-russian-sanctions-over-ukraine-1405449448

Using Texas RRC data to find the % of total Texas C+C output from the Permian basin and then using EIA Texas C+C data multiplied by this % of Permian to Statewide C+C, I estimated Texas Permian basin output from Jan 2007 to April 2014. Chart below April output is approximately 1300 kb/d (using only 2 significant figures). Note that the EIA’s DPR includes Permian basin output from both Texas and New Mexico (I could not find any data for Permian basin output in New Mexico).

Sanctions on Russia are bans on long term commercial finance for major companies. List includes Rosneft.

So JP Morgan cannot fund in field Russia drilling.

But BNP Paribas can. Or Barclays can. Or Deutschbank can. The Europeans refused to sign on.

The point is not clear.

I am not sure exactly which point you are referring to as not clear but it is clear enough to me that the Europeans are not willing to risk seriously irritating the Russians.

Making speeches is one thing.The Russians don’t have to listen to them anyway. Actually imposing sanctions with teeth is another.

Western Europe is almost totally dependent on imported oil and the Russians have it to export.

We don’t and never will.

Beyond that the Russians are probably able to raise enough money out of the cash sale of oil to do what they need to do. Most of Russia is not yet well developed but nobody should forget that they have superb engineers. What they can’t buy they can no doubt duplicate.

And they almost for sure have ” academicians” at the oligarchs elbows pointing out just how short oil is going to be on the world market in a few more years.

It is a mistake to think a country such as Russia or and industry such as the Russian oil industry is dependent on borrowed money the way smaller oil companies are in the US.

The Russians are not going to go broke trying to hold onto leases that must be drilled or surrendered. They are not going to go broke in a cutthroat competition to be the first company to get land rights and the first company to market with oil.

Russia is another world in business terms.

This is not to say however that there are not lots of Russians with money now who would like to get some or most of it out of Russia and into ( supposedly ) safer western countries.

Russia has all that geography. Simply that. If oil is evenly distributed (it isn’t), then they have the overwhelming advantage.

Odds are post 2020 they will not be able to hold 10 mbpd even with infield drilling. Odds are post 2020 the US oil output will have resumed its normal, natural decline.

And I’d say odds are they will fall slower than the US. If they stop caring about LCD TVs and just worry about food, they don’t have to export much at all.

They are going to win. This MAY be clear to US and EU thinkers and that will be inducement to bring the fight to the battlefield now, before the weakening asserts itself.

The Big One: Russia’s Bazhenov shale

Just for argument’s sake let’s say the 75 billion barrels of recoverable oil is correct (I doubt it, but in the past I have been too pessimistic).

In 2013 the World produced 28 billion barrels of crude plus condensate, so 75 billion barrels would not be enough for 3 years of consumption at 2013 levels.

Most oil and gas companies that are operating in the US LTO plays are small to mid-size companies. All the bigger international companies like Shell or Exxon have found the LTO plays unprofitable. In Russia there are no small or mid-size oil companies of any consequence so it is quite unlikely that LTO will be developed in Russia at present oil price levels. Now if oil prices rise by 20% or so, I might be proven incorrect, but such a price level is likely to cause a World recession and drive oil prices lower.

In 10 to 20 years, if the World economy has not collapsed, the Russian LTO might be developed, but it will not be enough to maintain BAU.

“All the bigger international companies like Shell or Exxon have found the LTO plays unprofitable.”

This isn’t necessarily true. Subsidiaries can make LTO work out for the big international companies. ExxonMobile is in LTO through its subsidiary XTO Energy. So is ConocoPhillips by way of Burlington Resources.

These smaller companies have been bought by larger firms for their reserves which had been proved before the purchase.

Can you name the small Russian firms that the big IOCs can purchase?

At present oil prices, it is not going to happen. Maybe at $200/barrel it will.

Didn’t Tillerson say that they were losing their shirts in the shale plays?

http://online.wsj.com/news/articles/SB10001424052702303561504577492501026260464

From the article linked above (June 27, 2012):

“We are all losing our shirts today.” Mr. Tillerson said in a talk before the Council on Foreign Relations in New York. “We’re making no money. It’s all in the red.”

With Western oil companies still largely shut out or heavily restricted from producing oil in Saudi Arabia, Iran and Venezuela, and struggling to find low-cost projects in other areas, Bazhenov is simply too important to lose

If they are struggling to find low-cost projects they are out of luck. There will be nothing low-cost about the Bazhenov shale. I saw an estimate a couple of months ago that estimated the per-well cost there would be twice what it is in the Bakken, and in the Bakken it is 7 to 10 million dollars per well.

In the below PDF article, for some reason I cannot copy and paste from, but says it is doubtful that well development in Russia would be cheaper than in the USA. And it contained the below well profile which looks worse than even the Bakken. At ten to fifteen million dollars per well and that kind of production, are you kidding me?

Tight Oil Developments in Russia

The costs of fracking in the middle of Siberia would be astronomical. Probably not profitable without global prices ~ $200 in constant 201x dollars.

Doesn’t do any good if economic growth can’t occur at those levels.

Substantially higher oil prices certainly stop growth or at the very least slow it to a crawl.

But nobody should doubt that oil cannot eventually go to 200 bucks in present day money.

There would certainly be much less used here and everywhere else it total but 200 dollar oil is still a lot cheaper than the consequences of not having oil.

That would put gasoline and diesel at upwards of nine to ten bucks I suppose here in the states everything else held equal.

I can pay it and so can hospitals and police departments and trucking companies delivering food. Ditto most essential industry.

But tens of millions of commuters can’t and tens of millions of service jobs will disappear with reduced driving.

So -oil can’t go to 200 bucks in the short term due to demand destruction. But we will eventually adapt to higher and higher prices and we will pay the two hundred.

My guess is that we will be paying it within ten years in current day money.

Volts and Leafs are going to sell for unheard of prices as second hand vehicles.

But nobody should doubt that oil cannot eventually go to 200 bucks in present day money.

That’s a double negative and I am not at all sure what you mean. But I do doubt that oil can go to $200 in present day money. If that’s what you mean then I agree with you. $200 oil would throw the economy into a serious and deep recession, immediately causing the price of oil to drop.

But the recession would hit well before oil got to $200. So yes I do doubt that oil can go to $200. Is that what you meant?

Hi Ron,

I believe he agrees with you in the short term (less than 10 years), but disagrees with you in the long term.

If you ignore the double negative (which I agree is confusing), it is pretty clear from the rest of the comment that OFM agrees in the short term a real oil price of $200 will cause a recession and then reduce demand and price.

In the long term he believes the economy will adjust (with great difficulty) to higher prices.

If I have interpreted his comment correctly, I agree with OFM.

Hopefully OFM will correct me if I have misinterpreted his comment.

Sorry about the poor grammar. I should quit rewriting a comment on the fly and let it sit for a minute or two before posting it.

It would be nice if there was an edit function.

Dennis is right. I believe with Ron that oil cannot go much higher than it is already in the short term without a resulting depression and consequent demand destruction holding the price down.

I don’t know how long the time frame is that Ron is using when he says the economy cannot support two hundred dollar oil. If the time frame is long enough term he may agree that two hundred dollar oil is possible.

Personally I think it very likely that prices in a decade will be up to 200 bucks in 2014 money.

Whether the economy will be larger or smaller then is something I am loathe to predict.But oil consumption per capita will be much lower than at present and it will be far more efficiently used.

Between forced efficiency gains thru mandated mileage standards for new cars and trucks;

more efficient use of oil as fuel in construction and farm machinery and as industrial feed stock; and changing lifestyles- meaning mainly less driving per capita–I think the economy can adapt to 200 dollar oil in a decade or so.

But the economy has more problems that just more expensive oil. We are running short on all sort of one time gifts of nature as well as looking at some substantial demographic problems.

I am not predicting that it will happen but the economy could go to hell in a hand basket by 2024.

I am sure the world economy is going to suffer a very bad collapse within a few decades and within the lifetime of any young people reading this blog today.People are going to be starving and dieing of exposure and violence in many parts of the world.

BUT resources are unequally distributed world wide and the big dogs are going to be able to hold onto a big dogs share of whatever is left.

I expect a terrific depression MUCH WORSE that the thirties in the US eventually because of resource depletion especially including oil depletion.

But barring totally inept leadership and bad luck we Yankees are not necessarily going to collapse back into a preindustrial society .

There is no reason in principle why we can’t run the USA on coal and nukes and wind and solar power more or less indefinitely- or at least for the next hundred years.Oil is not going to run out overnight and we can economize if we are forced to do so.

We are going to be forced by circumstances no question.

Barring runaway climate change or WWIII etc of course.

Hi OFM,

I agree with you as usual and am glad I got something right as I often misinterpret (or over interpret what Ron has to say).

My understanding of the Great Depression was that is was very bad with US unemployment rate estimated at 25%.

In terms of unemployment (and assuming that you believe the government will attempt some measures to alleviate suffering if possible), I was wondering how much worse you think Great Depression 2 will be in terms of unemployment rate.

I think it could be worse, but unless the government collapses, I am not so sure about much worse (in the US) for all the reasons you give in your comment above.

From Ron’s link:

“As with many tight reservoirs the [Bazhenov] oil tends to be light (34-43 degrees API, with an average of 38 degrees compared to the Urals blend figure of 32-33 degrees) and has a relatively low sulphur content of 0.6%.”

This ain’t gonna have Libya quality Diesel content. I believe Jeff says if you ain’t south of 35, you ain’t oil.

That this guy thinks shale is low cost kind of discredits the rest of his article. Has he even talked to anyone involved in the Bakken?

http://ir.eia.gov/ngs/ngs.html

The recent upslope looks steeper than previous years. It’s got a chance of catching up in 4 mos.

If they’re looking to peak on November 7th this year, that allows for 17 more weeks of injections before start of draw down, including today.

Currently at 2,129 Bcf with an early November top out generally around 3,800 Bcf.

Over the last ten weeks, they’ve averaged a weekly injection of 107 Bcf.

If they maintained that average over the next 17 weeks, that would be an additional 1,819 Bcf and total would top out at 3,948 Bcf.

We’ll see if they can maintain, but they’re currently on pace for a full rebound.

Between mild temperatures in Eastern North America that has reduced fuel burn for electricity and lots of associated gas coming out of the Eagle Ford it is quite possible that storage will be at normal levels by the end of the injection season.

That said temperatures have been anomalously hot, and dry, in western North America which is possibly increasing fuel burn and may reduce hydro-electric potential future generation.

We’ll have to wait and see…

‘Terrifying’ oil skills shortage delays projects and raises risks

By Guy Chazan, Energy Editor, FT.com, July 16, 2014 11:58 pm

In a low EROI petroleum extraction world it takes a lot of resources to get oil and gas out of the ground, including human resources.

I don’t see any resolution to the staffing problem facing the industry. A student choosing a university program in the sciences might stay away from anything petroleum related for a variety of reasons; ethical, environmental and economic reasons. Economic, because if the student was half aware of what the implication of meeting the international obligation of keeping warming under two degrees means for fossil fuel usage by the time that student was ten years into a career, the student would realize that his skills would no longer be needed by then.

As well engineering wise, solar and wind are more glamorous, and likely staffed with far more engineers of a similar age as a recently graduated engineer.

Of course the fossil fuel industry has the capacity to offer more generous pay packets, but that would make already expensive projects even more expensive.

Staffing of highly skilled workers are likely another aspect that will factor into turning the more expensive petroleum extraction projects into stranded assets

Typical corporate culture abuse writ large. No investment in the younger generation because…your workers are going to live forever??

Another one from FT…

Global oil giants face a fight to lure local talent

By Michael Kavanagh, FT, July 16, 2014 11:58 pm

Google’s Cars Sniff Out Natural Gas Leaks to Deliver Cleaner Air

By David Biello | July 16, 2014 | Scientific American

Is global warming causing extreme weather via jet stream waves?

A new study investigates how changes to atmospheric winds are making weather more extreme

John Abraham, Guardian, Thursday 17 July 2014

There is a mix of perception and reality that makes people wonder why local weather is wandering so much. I sit here in NJ and had a morning temp of 51 F, a bit below average. The normal average range is 80F high to a low of 60F. Yesterday was mostly sunny, it started at 60F and might have hit 80 by late afternoon. Still it felt cool out on the lake, cooler than usual.

The truncated Jetstream has been playing havoc with temps here for about a year here. Last summer, late July -early August temps often did not break 70 as a high. The winter on the east coast was colder than normal by 10 to 20 degrees F. Summer 2014 has been average to below average. No extreme heat at all. Essentially due to the jet stream not reaching south and bringing up warmer air, it reaches as far south as the mid-Atlantic or mid-Central areas and heads north again. It used to reach down toward the Gulf.

Still when one looks at the range of temps in an area, no records are really broken. I have a range from 107 F down to about minus 25F. One way to really track it is the number of days that are below average or above average. If those are increasing, then the trend becomes clear. Perception may be correct but having some data to compare against gives credence to the subjective.

Weatherspark has some very nice graphs for easy comparison of weather in an area. Here is one for Harrisburg, Pa

http://weatherspark.com/averages/30007/Harrisburg-Pennsylvania-United-States

Um, what happened to my comment? I thought this place was into free speech and not censorship the way the government is when it says certain science is settled.

Maybe it was moved to a climate blog.

Hi Watcher,

I know that you don’t like the climate comments, but Ron thinks these comments are worth having and I agree.

Hi Drkhorse,

I did not see your comment. Did it appear and then disappear?

Typically only comments with really outlandish stuff or outright insults would get removed.

Many of my comments have gotten lost because the site goes down or something. I usually put my longer comments in an editor so if this happens I don’t have to retype.

Probably the site owner. He responded to a comment about climate nonsense and used extreme profanity even though that just feeds into the belief that the extreme far-left can’t win arguments about climate paranoia using actual science but must resort to name calling and covering up aspects of truth that don’t fit the narrative they are tying to sell. Now there’s like five or six comments missing.

I am not trying to sell anything but peak oil. I very seldom, if ever, post climate stuff. But others are welcome to post them. But posting crap without explanation or proof is not what we do here.

But you do prove my point, climate change denial is almost entirely a right wing thing. That is driven by politics and not science.

It accidently got deleted along with some other comments. Sorry. Post it again.

Hi Ron,

I think you can take comments out of the trash can.

These forest fires line up nicely with the above average temperatures in the temperature anomaly chart above.

Wildfires force more evacuations in Western Canada

QMI Agency, First posted: Wednesday, July 16, 2014 11:10 AM EDT | Updated: Thursday, July 17, 2014 12:15 AM EDT

As an adjunct to your post aws, is the following linked article regarding more forest fires in the Arctic than any time in the previous 10,000 years.

http://www.smithsonianmag.com/smart-news/arctic-forests-are-on-fire-now-more-than-at-any-point-in-the-past-10000-years-17175680/

Oregon, Washington Declare States Of Emergency As Wildfires Spread

By Joanna M. Foster, Climate Progress, on July 17, 2014 at 9:57 am

I have noticed that denial of science almost always comes from the political right wing. Not 100 percent of course but at least 95 percent of all science denial, in the United States I am talking about, almost always comes from the far right Republican party.

Be it evolution, stem cell research or climate science, the right wing, in general, doesn’t believe a damn word of it. Now I know there are one or two right wingers out there who would dearly love to pull the Republican party into the 20th century. Of course there is no hope of ever getting them into the 21st century, the 20th is the best they can hope for.

Galileo battled superstitious ignorance during most of his life. Science has always been opposed by those who would have their religious beliefs have the force of law. And that battle is still going on today.

I must agree that climate nonsense is mostly a right wing thing.

But ignorance is not the primary culprit.

This is a cultural thing more than anything else.

I have many acquaintances on both ends of the spectrum and virtually every last one of them toes the line on party politics. The democrats -if they will talk about abortion- are always in favor of it being legal. They are virtually always against people owning and carrying personal firearms.

The republicans almost always automatically take the opposite positions not because they believe in them but because of the perceived need to maintain group solidarity.

I know many black people and it is I believe a well established fact that black people are among the most devoted and conventional of Christians. HARDLY a single one I know personally is in favor of abortions.

BUT I never hear any of them say anything against it even though they are almost invariably opposed to it and often see it as a white sponsored form of genocide.

WHY ? Because ninety percent plus of them are democrats( I would be too if I were black) and speaking against abortion is contrary to party solidarity.

I do not know what percentage of right wingers actually believe that forced climate change is a hoax but I am dead sure of one thing. A whole lot that do believe in forced climate change are never going to say so out loud in public.Doing so would be contrary to group solidarity.

I am not a republican but hold to my own definition of conservatism Humpty Dumpty fashion and thus continue to think of myself as a conservative.

I am technically and scientifically literate but a larger portion of self identified conservatives are poorly educated than self identified liberals.

But ignorance rules the roost on both wings.

You can graduate from an Ivy League university with only one so called survey course in a hard science on your transcript. That means no lab usually no homework no outside reading just showing up and parroting back whatever is lectured in elementary terms and promptly forgotten.

Such courses are just fig leaves at best.There are tons of lawyers and CPA’s out there who have no more training in the hard sciences that that one survey course.

So- the liberals believe in climate change not because it is real (it is) and because they understand the science (Generally they don’t because both liberals and conservatives and middle of the roaders are usually woefully ignorant of the sciences.) but because believing or at least professing belief is consistent with identity politics and culture.

There is one good reason somebody ignorant of the sciences should believe in climate change. That reason is that anybody who understands that all of modern life from a to z is based on science should understand that when just about all scientists believe in something it is almost for dead sure real.

Believing that all the scientists who profess belief in warming are doing so for money betrays a certain lack of sophistication.

Everybody is going to believe in warming in another decade or so because reality is fixing to smack the naysayers upside the head with a brick.

The fact is, the norm in the US is still respect for the Bible and its teachings. The Bible makes pretty clear that God will deliver judgment on our nation if we turn away from Him. Just see what happened to Sodom and Gomorrah. Now I don`t hate anyone, but, it would seem senseless to allow a small minority of our population consisting of scientists funded with lavish taxpayer supported grant to bring down God`s wrath on the rest of us because these people choose to believe that humans, rather than God and God alone, can alter the earth`s climate system. You might think I`m crazy now, but what are you going to think when God`s judgment gets poured out on us?

gimmie that old time religion,

gimmie that old time religion,

gimmie that old time religion,

its good enough for me

Thanks Suthernsoul, you make my point is spades. In fact you said it so well that I’ll bet some folks will accuse me of posting the reply myself under another name that I just made up.

But your reply is just perfect. Ted Cruz, Michele Bachmann or Mike Huckabee could not have put it better. But I am sure they would try.

You make great points Ron. But many on the left also have issues with science, it’s just in different ways. For example, belief in astrology, or UFOs, or ghosts is often true of people on the left.

As for you Southersoul, that isn’t mana from heaven you use to run your pick-up truck you know. Maybe just maybe the Amish were right and burning dirty, sulfur smelling oil pumped out of the ground is yielding to temptation to take the easy way and the real sin. If we had all listened to them we wouldn’t need to worry about global warming.

For example, belief in astrology, or UFOs, or ghosts is often true of people on the left.

Not the same thing at all. Science doesn’t enter the realm religion or superstition. These are beliefs that people have “outside” of science. What I am talking about is “disbelief” in the very foundations of science like evolution.

Of course a lot of people on the left believe in silly stuff. But it is the right wing that “disbelieves” in stuff like evolution, global warming, climate change, the age of the earth and universe and stuff like that.

Most, but not all of course, on the left will blend science in with their religion. They will find a way to believe science and their religion at the same time. While those on the right will do no such thing. If science disagrees with what the Bible teaches then by God they will absolutely disbelieve science.

Yep, the Psychopathic Space Daddy is going to get you unless you behave according to a Bronze/Iron age book of bad fiction.